Abstract

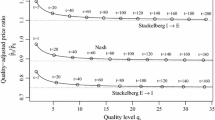

This paper studies the effect of product liability cost on firms’ incentives to conduct R&D when innovation inherently consists a safety dimension and a novelty dimension. We consider a situation where a monopoly firm chooses both product novelty and product safety in an R&D stage followed by a production stage. While firms will invest more in product safety as product liability cost increases, their incentive for product novelty may increase or decrease, depending on the relative strengths of a demand-shifting effect and a cross-R&D effect identified in the model. Consequently, a higher product liability cost may decrease consumer welfare and total welfare. We extend the results to an oligopoly model with differentiated products and study the effects of competition. We find that equilibrium product novelty and safety levels decrease with the number of firms but exhibit non-monotonic relationships with the degree of product substitutability.

Similar content being viewed by others

Change history

04 January 2023

A Correction to this paper has been published: https://doi.org/10.1007/s00712-022-00817-4

Notes

In a survey conducted by Mcguire (1988), more than a third of surveyed CEOs reported that product liability had a major effect on their business, and a small share reported abandoning a new product because of liability fears.

Chen (2001) develops a green product model in which the monopoly firm chooses both traditional and environmental attributes for its products to satisfy different segments of consumers.

Viscusi and Moore also conducted empirical study of how product liability affects firm product safety innovation, using state-level insurance expenses data in the United States.

Note that one can also interpret \(\gamma\) in our model as product quality. As it shall become clear later, all the results will continue to hold under this interpretation.

Here, we assume consumer preference is quasilinear in a numeraire good.

For simplicity and tractability, we assume that product liability cost L does not depend on q. In Appendix 2, we consider the case in which total product liability cost depends on quantity sold and show that main results continue to hold under some specifications.

In many situations, consumers simply bear the damage from unsafe products because it is too costly for them to file lawsuits.

\(\frac{\partial ^{2}x}{\partial \gamma \partial s}\) is in general non-negative though we allow it to be negative. For example, the marginal cost of safety is typically higher for an automobile with higher performance (e.g. sporty cars).

To see this, note that from (2) and (3), \(\frac{1}{2}\frac{ \partial A}{\partial \gamma }=-\frac{\partial p}{\partial \gamma }.\) Thus, the first term in (10) can be rewritten as \(\frac{\partial p}{ \partial \gamma }\frac{\partial \varphi }{\partial s},\) which represents the effect of s on the marginal effect of \(\gamma\) on monopoly price.

Consider the following R&D cost function \(x\left( \gamma ,s\right) =\frac{1 }{2}\alpha \gamma ^{2}+\frac{1}{2}\beta s^{2}+\omega \gamma ^{2}s^{2},\) with \(\alpha>0,\beta>0,\omega >0.\) Note that \(\partial ^{2}x/\partial \gamma \partial s=4\omega \gamma s\) which increases in \(\gamma\) and s. Numerical analysis suggests that for some parameter region, total welfare is an inverted-U shape of L and thus the optimal L occurs at some intermediate value. For example, for \(\gamma _{0}=1,\) \(\delta =0.7,\) \(\alpha =0.9,\) \(\beta =0.6,\) \(\omega =0.3\) and \(c=0.1,\) we can show that total welfare increases with L when \(L<0.78\) and decreases with L when \(L>0.78\). Thus, the optimal L that maximizes total welfare is \(L^{*}=0.78.\)

One can also derive this inverse demand function from a micro-foundation similar to that in the monopoly model in Sect. 2. Moreover, if \(\theta \rightarrow 0,\) the model becomes to a monopoly model as in Sect. 2. If \(\theta \rightarrow 1,\) goods are perfect substitutes and Cournot competition arises.

In fact, if \(n\rightarrow \infty ,\) \(\xi \rightarrow 0\) and demand-shifting effect varnishes.

References

Baumann F, Heine K (2013) Innovation, Tort law, and competition. J Inst Theor Econ 169(4):703–719

Chen C (2001) Design for the environment: a quality-based model for green product development. Manage Sci 47(2):250–263

Chen Y, Hua X (2012) Ex ante investment, ex post remedy, and product liability. Int Econ Rev 53:845–866

Chen Y, Hua X (2017) Competition, product safety, and product liability. J Law Econ Organ 33:237–267

Cooper R, Ross T (1985) Product warranties and double moral hazard. Rand J Econ 16(1):103–113

Daughety A, Reinganum J (1995) Product safety: liability, R&D and signaling. Am Econ Rev 85(5):1187–1206

Daughety A, Reinganum J (2006) Market, torts, and social inefficiency. Rand J Econ 37:300–323

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10(1):20–32

Hua X (2011) Product recall and liability. J Law Econ Organ 27:113–136

Mcguire E (1988) The impact of product liability. In: The conference board research report, New York, vol 908, pp 6–20

Porter M (1990) The competitive advantage of nations. Free Press, New York

Viscusi W, Moore M (1993) Product liability, research and development, and innovation. J Polit Econ 101(1):161–184

Acknowledgements

For helpful comments and suggestions, we thank the editor, two referees, and the participants at Asia-Pacific Industrial Organisation Conference (University of Melbourne) and Hong Kong Economic Association Biennial Conference (Xiamen).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Proof of Proposition 1

Total differentiations of (5) and (6) with respect to L give

and

With rearrangement, we can further show that

and

Thus, applying Cramer’s rule, we can solve \(\frac{\partial \gamma }{\partial L}\) and \(\frac{\partial s}{\partial L},\) and obtain expressions as in (7) and (8).

The second-order conditions, which we assume to hold, are

and

From (25) and (26), we have \(\frac{\partial s}{ \partial L}>0.\) Moreover, \(\frac{\partial \gamma }{\partial L}\gtreqless 0\) if \(\Delta \gtreqless 0.\) Finally, if \(\frac{\partial ^{2}x}{\partial \gamma \partial s}=0,\) \(\Delta >0\) and thus \(\frac{\partial \gamma }{\partial L} >0.\) \(\square\)

Proof of Proposition 2

Note that

Under the linear consumer demand and quadratic R&D cost, we have

Thus, \(\frac{dV}{dL}>(<)0\) if \(\sigma <(>)\alpha \delta .\) Moreover, by envelop theorem, we have

Therefore, total welfare, \(W=V+\pi +\left( 1-s\right) L,\) increases (decreases) with \(\sigma\) if \(\sigma <(>)\alpha \delta .\) \(\square\)

Proof of Proposition 3

We first consider the choice of output quantity, \(q_{i},\) given product novelty, \(\gamma _{i}\) and \(\gamma _{j},\) and safety level, \(s_{i}\) and \(s_{j}\). Firm i maximizes profit,

First order condition, \(\frac{\partial \pi _{i}}{\partial q_{i}}=0,\) implies

Next, we consider the choice of product novelty and safety. Note that the profit can be written as

First order conditions with respect to \(s_{i}\) and \(\gamma _{i},\) respectively, yield

and

We focus on the symmetric equilibrium in which each firm chooses product novelty \(\gamma ,\) safety s and output q. It follows that

Thus,

and

where

Note that second order conditions, which we assume to hold, are

and

Total differentiation of (29) and (30) with respect to L, with rearrangement, yield,

and

Therefore, we have

and

From (31) and (32), we have \(\frac{\partial s}{ \partial L}>0.\) Moreover, \(\frac{\partial \gamma }{\partial L}\gtreqless 0\) if \(\Sigma \gtreqless 0\) where

\(\square\)

Proof of Lemma 1

-

(i)

From (16),

$$\begin{aligned} \frac{\partial \xi }{\partial n}=-\frac{2\theta \left[ \left( n-3\right) \theta +2\right] }{\left( 2-\theta \right) \left[ \left( n-1\right) \theta +2 \right] ^{3}}<0 \end{aligned}$$(35)for \(\theta \in (0,1).\)

-

(ii)

Note that

$$\begin{aligned} \frac{\partial \xi }{\partial \theta }=\frac{4\left( n-1\right) }{\left( \theta -2\right) ^{2}\left[ \left( n-1\right) \theta +2\right] ^{3}}\lambda \left( \theta ,n\right) \end{aligned}$$(36)where \(\lambda \left( \theta ,n\right) =\left( n-2\right) \theta ^{2}+\left( 5-n\right) \theta -2.\) Hence,

$$\begin{aligned} sign\left( \frac{\partial \xi }{\partial \theta }\right) =sign\left( \lambda \left( \theta ,n\right) \right) . \end{aligned}$$Moreover, \(\lambda \left( \theta ,n\right) <0\) if \(\theta =0\) and \(\lambda \left( \theta ,n\right) >0\) if \(\theta =1.\) It follows that there exists a unique \({\hat{\theta }}>0\) such that \(\frac{\partial \xi }{\partial \theta }<0\) for \(\theta \in (0,{\hat{\theta }}]\) and \(\frac{\partial \xi }{\partial \theta } >0\) for \(\theta \in ({\hat{\theta }},1).\) \(\square\)

Proof of Proposition 4

In the symmetric equilibrium, product novelty and safety are given by (29) and (30). Total differentiations of (29) and (30) with respect to \(\xi ,\) with rearrangement, give

and

where

Under the specifications, (37) and (38) become

and

From (32), \(\left( \xi -\alpha \right) \left( \xi \delta ^{2}-\beta \right) -\left( \xi \delta -\sigma \right) ^{2}>0.\) Moreover, from (31), \(\xi <\min \left\{ \beta /\delta ^{2},\alpha \right\} .\) Thus, together with the assumption \(\sigma \le \xi \delta ,\) we have \(\sigma <\min \left\{ \beta /\delta ,\alpha \delta \right\} .\) Hence, by Lemma 1, results in Proposition 4 follow. \(\square\)

Appendix 2

In this appendix, we consider a variant of our main model in which a monopoly firm’s liability cost is linear in quantity sold. Compared to the main model, there will be an additional quantity effect in the variant considered here because product quantity will depend on liability cost. The analysis will become more complicated. Nevertheless, we will show that the main insight that a higher product liability cost may induce a lower product novelty and consequently, lead to a lower consumer welfare will continue to hold under some parameter regions.

The setup is the same as in the main model except that the product liability cost L is equal to lq where l measures the strength of liability. The following analysis is similar to that in the main model. In particular, the firm chooses q to maximize profit,

The resulting profit-maximizing quantity is

and thus we can rewrite the profit function as

The first-order conditions of (39) with respect to \(\gamma\) and s, respectively, yield

and

To conduct tractable analysis, we focus on the case with linear demand and quadratic cost function as considered in Corollary 1. In particular, from the total differentiations of (40) and (41 ) with respect to l, we can obtain that

and

with

Moreover, assuming \(\gamma\) and s are interior solution, we have, from the second-order condition, \(\alpha >\frac{1}{2}\), \(\beta >\frac{1}{2}\left( \delta +l\right) ^{2}\) and \(\Theta >0.\)

Next, we can show that consumer welfare is

Hence,

We have the following result.

Proposition 6

Suppose that \(\left( \gamma ^{*},s^{*}\right) ,\) which is an interior solution to (40) and (41), exists. (i) \(s^{*}\) increases in l and \(\gamma ^{*}\) decreases in l if \(\sigma >\alpha \left( \delta +l\right)\) and \(\beta >\sigma \left( \delta +l\right) .\) Moreover, if \(\beta >2\sigma \left( \delta +l\right) ,\) then consumer surplus decreases in l.

Proof

From (42),

Hence, if \(\sigma >\alpha \left( \delta +l\right) ,\) then \(\frac{\partial s}{ \partial l}>0\) because \(\alpha >\frac{1}{2}.\)

Moreover, from (43),

Thus, if \(\sigma >\alpha \left( \delta +l\right)\) and \(\beta >\sigma \left( \delta +l\right) ,\) then \(\frac{\partial \gamma }{\partial l}<0.\)

Finally,

If \(\sigma >\alpha \left( \delta +l\right)\) and \(\beta >2\sigma \left( \delta +l\right) ,\) then we have \(\frac{dV}{dl}<0.\) \(\square\)

The intuition behind Proposition 6 is similar to that in the main model. Specifically, an increase in l directly increases the marginal benefit of improving product safety. However, when the cross-R&D effect is large (\(\sigma\) is relatively large), an increase product safety induces a decrease in product novelty. When the reduction in product novelty is large it will offset the benefit of an increase in product safety and consequently, consumer welfare will decrease.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lin, P., Zhang, T. Product liability, multidimensional R&D and innovation. J Econ 136, 25–45 (2022). https://doi.org/10.1007/s00712-021-00762-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-021-00762-8