Abstract

This paper discusses the licensing of technology between rival firms in a Cournot duopoly with horizontal and vertical product differentiation. The firms produce products of different qualities (high and low) and incur different costs per unit of output produced. It is shown that technology is transferred from the firm that produces the higher quality product to the firm that produces the lower quality product via a fixed-fee if the quality difference (net of cost) and the horizontal differentiation between the two products are relatively low. Technology is transferred through royalty, for any level of quality difference (net of cost), if the horizontal differentiation between the products is relatively low. A similar result is observed for two-part tariff licensing and quota licensing, which is a combination of output quota set by the licensor coupled with a fixed-fee. It is also shown that the optimal form of contract is either two-part tariff licensing or quota licensing. Technology is never licensed from the firm that produces a lower quality product to its rival that produces a higher quality product. However, the cross-licensing of technology is sometimes possible. After licensing welfare always increases.

Similar content being viewed by others

Notes

In the paper vertical product differentiation refers to the difference in the quality of the products produced by the two firms.

Nguyen et al. (2013) mentions that in many industries where products sold by the firms are highly substitutable (i.e. not very different in quality), Cournot competition rather than Bertrand competition is often observed.

This term captures the vertical product differentiation (quality difference) as well as the unit cost difference between the firms, which is explained in the main text.

Kanellos (2014) points out that Toyota was phasing out its technology licensing deal to get battery packs from Tesla Motors, but the deal was supposed to give the company another dose of good publicity and hold open the promise of eliminating a few potholes in the road. See the link https://www.forbes.com/sites/michaelkanellos/2014/06/13/the-three-ways-to-license-patents/.

Under the terms of the agreement, Microsoft will receive royalties for Samsung’s mobile phones and tablets running the Android mobile platform. Also, the companies agreed to cooperate in the development and marketing of Windows Phone.

See the link: https://news.microsoft.com/2011/09/28/microsoft-and-samsung-broaden-smartphone-partnership/.

“OPPO is one of the leaders in the smartphone industry and we are pleased to welcome them as a Nokia licensee,” said Maria Varsellona, Nokia Chief Legal Officer and President of Nokia Technologies.See the link:

Bagchi and Mukherjee (2014) considers technology licensing by an outside innovator and show that for a certain range of product differentiation, both the innovator and the society prefer royalty licensing compared to the auction (or fixed-fee) if the number of potential licensees is sufficiently large. Nguyen et al. (2013) develops a duopoly model of vertical product differentiation where two domestic firms incur variable costs of quality development, where domestic firms can purchase a superior foreign technology through licensing.

If we assume instead that \(c_{1}<c_{2}\), then also \(0<\theta =\frac{(\alpha _{2}-c_{2})}{(\alpha _{1}-c_{1})}< 1\) may hold.

Market 1: where the higher quality product (good 1) is sold and Market 2: where the lower quality product (good 2) is sold.

In this paper we have used Wolfram Mathematica and Desmos for drawing the diagrams and thereby plotting the regions where the conditions for technology licensing are satisfied.

In all the diagrams we exclude the zone where \(2\theta >\gamma \), as otherwise in the no-licensing stage both firms can’t compete in the market.

This holds as \(2+\gamma ^{2}>3\theta \gamma \).

Market 1: where the higher quality product (good 1) is sold and Market 2: where the lower quality product (good 2) is sold.

It can be easily shown that \(\bar{r}< r^{max}\).

As \((4-\gamma ^{2})^{2}> 9\gamma ^{2}\).

This holds if inequality (22) is satisfied.

Verified in Wolfram Mathematica and Desmos.

Kindly note that in the zone H in Fig. 4 royalty licensing is not possible.

Nagaoka and Kwon (2006) based on a new data set of more than 1100 licensing contracts by Japanese manufacturing firms, examines the determinants of the incidence of cross-licensing among manufacturing firms.

\(q^{F1}_{11}\) is always positive after licensing.

\(q^{R1}_{11}\) is positive after licensing, which is very common in the literature.

\(r^{*}>r^{max}\), if \(\left[ \frac{2(10-\gamma ^{2})(\alpha _{1}-c_{1})- 18\gamma (\alpha _{2}-c_{2})}{4(10-\gamma ^{2})}\right] > \left[ \frac{(2+\gamma ^{2})(\alpha _{1}-c_{1})- 3\gamma (\alpha _{2}-c_{2})}{(4-\gamma ^{2})}\right] \) or \(\left[ 2(4-\gamma ^{2})(10-\gamma ^{2})-4(10-\gamma ^{2})(2+\gamma ^{2})\right] \left[ (\alpha _{1}-c_{1})\right] >\left[ 18\gamma (4-\gamma ^{2})-12\gamma (10-\gamma ^{2})\right] \left[ (\alpha _{2}-c_{2})\right] .\) It has been assumed that \((\alpha _{1}-c_{1})>(\alpha _{2}-c_{2})\) and the coefficient of \((\alpha _{1}-c_{1})\) is greater than coefficient of \((\alpha _{2}-c_{2})\) in the above inequality, as \(Z=\gamma ^{4}+\gamma ^{3}-10\gamma ^{2}+8\gamma>0\Rightarrow r^{*}>r^{max}.\) We find the derivative of Z wrt \(\gamma \) is always negative but the function always takes positive values for all values of \(\gamma \) where \(\gamma \in [0,1]\). This means Z is always positive \(\Rightarrow r^{*}>r^{max}\).

References

Bagchi A, Mukherjee A (2014) Technology licensing in a differentiated oligopoly. Int Rev Econ Finance 29:455–465

Belleflamme P, Peitz M (2015) Industrial organization: markets and strategies. Cambridge University Press, New York

Breton M, Sbragia L (2021) Intra-brand competition in a differentiated oligopoly. J Econ 132:1–40

Buxbaum RM (1965) Restrictions inherent in the patent monopoly: a comparative critique. University of Pennsylvania law review 113:633–667

Eckel C, Iacovone L, Javorcik B, Neary JP (2015) Multi-product firms at home and away: cost-versus quality-based competence. J Int Econ 95:216–232

Fauli-Oller R, Sandonis J (2002) Welfare reducing licensing. Games Econ Behav 41:192–205

Hackner J (2000) A note on price and quantity competition in differentiated oligopolies. J Econ Theory 93:233–239

Kabiraj T, Lee CC (2011) Technology transfer in a duopoly with horizontal and vertical product differentiation. Trade Dev Rev 4:19–40

Kishimoto S (2020) The welfare effect of bargaining power in the licensing of a cost-reducing technology. J Econ 129:173–193

Kitagawa T, Masudab Y, Umezawac M (2014) Patent strength and optimal two-part tariff licensing with a potential rival. Econ Lett 123:227–231

Li C, Ji X (2010) Innovation, licensing, and price versus quantity competition. Econ Model 27:746–754

Li C, Song J (2009) Technology licensing in a vertically differentiated duopoly. Jpn World Econ 21:183–190

Li C, Wang J (2010) Licensing a vertical product innovation. Econ Rec 86:517–527

Marjit S (1990) On a non-cooperative theory of technology transfer. Econ Lett 33:293–298

Mukherjee A, Balasubramanian N (2001) Technology transfer in a horizontally differentiated product market. Res Econ 55(3):257–274

Muto S (1993) On licensing policies in Bertrand competition. Games Econ Behav 5:257–267

Nagaoka S, Kwon HU (2006) The incidence of cross-licensing: a theory and new evidence on the firm and contract level determinants. Res Policy 35:1347–1361

Nguyen X, Sgro P, Nabin M (2013) Licensing under vertical product differentiation: price versus quantity competition. Rev Dev Econ 21:497–510

Niu S (2018) Price and quantity competition in an asymmetric duopoly with licensing. J Public Econ Theory 20:896–913

Priest GL (1977) Cartels and patent license arrangements. J Law Econ 20:309–377

Rostoker M (1984) A survey of corporate licensing. IDEA J Law Technol 24:59–92

San Martin M, Saracho AI (2020) Revenue royalties: comment. J Econ. https://doi.org/10.1007/s00712-020-00721-9

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. Rand J Econ 15:546–554

Stamatopoulos G, Tauman Y (2008) Licensing of a quality-improving innovation. Math Soc Sci 56:410–438

Sutton J (1997) One smart agent. Rand J Econ 28:605–628

Symeonidis G (1999) Cartel stability in advertising-intensive and R&D-intensive industries. Econ Lett 62:121–129

Wang XH (1998) Fee versus royalty licensing in a Cournot duopoly model. Econ Lett 60:55–62

Wang XH (2002) Fee versus royalty licensing in a differentiated Cournot duopoly. J Econ Bus 54:253–266

Zhao D (2017) Choices and impacts of cross-licensing contracts. Int Rev Econ Finance 48:389–405

Acknowledgements

The authors thank Arghya Dutta for helping us in drawing the diagrams. We also thank Uday Bhanu Sinha, Amrita Chatterjee, Debasmita Basu and Priyansh Minocha for their suggestions. We are grateful to the two anonymous referees of this paper as well as to the editor of this journal, Giacomo Corneo, for their valuable comments and suggestions that helped us to upgrade this work. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 Appendix 1.1: Fixed-fee

From the profit functions in the main text (see Sect. 3), we get the following three reaction functions:

After licensing, having access to produce good 1, firm 2 decides whether to stop production in the old market (good 2) or not.

Let us assume that firm 2 produces both the products after licensing (call it as Case 1).Footnote 26 In that case, re-arranging the reaction functions we get

After solving these three equations (43, 44 and 45) simultaneously we get the equilibrium quantities in the post-licensing stage as,

1.1.1 Appendix 1.1.1: Case 1

\( \Pi ^{F1}_{2}=\Bigg [\frac{(\alpha _{1}-c_{1})}{3}\Bigg ] \Bigg [\frac{(2+\gamma ^{2})(\alpha _{1}-c_{1})-3\gamma (\alpha _{2}-c_{2})}{6(1-\gamma ^{2})}\Bigg ] +\Bigg [\frac{3(\alpha _{2}-c_{2})-(\alpha _{1}-c_{1})\gamma }{6}\Bigg ] \Bigg [\frac{(\alpha _{2}-c_{2})-(\alpha _{1}-c_{1})\gamma }{2(1-\gamma ^{2})}\Bigg ]-F =\Bigg [\frac{(\alpha _{1}-c_{1})^{2}(4+5\gamma ^{2})-18\gamma (\alpha _{1}-c_{1})(\alpha _{2}-c_{2})+9(\alpha _{2}-c_{2})^{2}}{36(1-\gamma ^{2})}\Bigg ]-F.\) Therefore, as fixed-fee is charged such that \(\Pi ^{F1}_{2}=\Pi ^{*}_{2}\)

The total industry profit after licensing is,

\(\Pi ^{F1}_{1}+\Pi ^{F1}_{2}= \Bigg [\frac{(\alpha _{1}-c_{1})^{2}(8+\gamma ^{2})-18\gamma (\alpha _{1}-c_{1})(\alpha _{2}-c_{2})+9(\alpha _{2}-c_{2})^{2}}{36(1-\gamma ^{2})}\Bigg ]\).

Therefore, fixed-fee licensing is possible only if \(\Pi ^{F1}_{1}+\Pi ^{F1}_{2} > \Pi ^{*}_{1}+\Pi ^{*}_{2}\), where

\(\Pi ^{*}_{1}+\Pi ^{*}_{2}=\frac{(4+\gamma ^{2})(\alpha _{1}-c_{1})^{2}-8\gamma (\alpha _{1}-c_{1})(\alpha _{2}-c_{2})+(4+\gamma ^{2})(\alpha _{2}-c_{2})^{2}}{(4-\gamma ^{2})^{2}}\). The industry profit increases after licensing, if

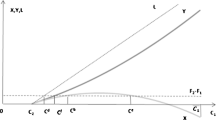

The above inequality (49) holds in the shaded region or zone F as depicted in Fig. 1 of the main text. From the diagram we observe that technology is licensed in the present context through fixed-fee such that \(\theta >{\gamma }\) if \(\gamma \) is slightly lower than \(\theta \), but \(\theta \in [0.7559,1]\).

1.1.2 Appendix 1.1.2: Case 2

Given \(q^{F1}_{12}>0\) and \(q^{F1}_{2}=0\) for \(\gamma \ge \theta \) we find that, \(\Pi ^{F1}_{1} = \frac{(\alpha _{1}-c_{1})^{2}}{9}+F\) and \(\Pi ^{F1}_{2}=\frac{(\alpha _{1}-c_{1})^{2}}{9}-F\) and after licensing total industry profit is \(\Pi ^{F1}_{1}+\Pi ^{F1}_{2}= \frac{2(\alpha _{1}-c_{1})^{2}}{9}\), where \(\Pi ^{F1}_{1}\) and \(\Pi ^{F1}_{2}\) denote the profits of firm 1 and firm 2 respectively, in the post licensing stage.

As in the previous case, fixed-fee licensing is possible only if \(\Pi ^{F1}_{1}+\Pi ^{F1}_{2} > \Pi ^{*}_{1}+\Pi ^{*}_{2}\) or

Therefore, technology is licensed in the present context through fixed-fee such that \(\theta <{\gamma }\), in the shaded region of the Fig. 2 (see the main text), if both \(\gamma \) and \(\theta \) are relatively higher. Technology is never licensed if either \(\theta <0.5619\) or \(\gamma <0.7077\). Moreover, if \(0.5619<\theta <0.6\), then \(\gamma \) should not be too large for licensing to take place. Otherwise, for \(0.6<\theta \), technology is licensed for any \(\theta \), if \(\gamma \) is relatively higher as shown in the diagram.

1.2 Appendix 1.2: Royalty

From the first order conditions of profit maximization (see Sect. 4 of the main text), we obtain the following reaction functions:

The decision to enter the new market (good 1) and/or stop production in the old market (good 2) would be determined by firm 2.

Let us assume that firm 2 produces both the products after licensing (let us call it as Case 1).Footnote 27 In that case, re-arranging the reaction functions we get,

Solving these three equations (51, 52 and 53) simultaneously and assuming that firm 2 operates in both the markets, the equilibrium quantities in the post licensing stage are,

1.2.1 Appendix 1.2.1: Case 1

If \(q^{R1}_{12}>0\) and \(q^{R1}_{2}>0\), then the post-licensing profits of firm 1 and firm 2 are

\(\Pi ^{R1}_{1}=(q^{R1}_{11})^{2}+r(q^{R1}_{12})=\left[ \frac{(\alpha _{1}-c_{1}+r)}{3}\right] ^{2} + r \left[ \frac{(2+\gamma ^{2})(\alpha _{1}-c_{1})- 3\gamma (\alpha _{2}-c_{2})-r(4-\gamma ^{2})}{6(1-\gamma ^{2})}\right] \) and

\(\Pi ^{R1}_{2}= (p_{1}-c_{1}-r)(q^{R1}_{12})+(p_{2}-c_{2})(q^{R1}_{2})\)

\(=\left[ \frac{(\alpha _{1}-c_{1}-2r)}{3}\right] \left[ \frac{(2+\gamma ^{2})(\alpha _{1}-c_{1})- 3\gamma (\alpha _{2}-c_{2})-r(4-\gamma ^{2})}{6(1-\gamma ^{2})}\right] +\left[ \frac{3(\alpha _{2}-c_{2})-\gamma (\alpha _{1}-c_{1}+r)}{6}\right] \left[ \frac{(\alpha _{2}-c_{2})-\gamma (\alpha _{1}-c_{1}-r)}{2(1-\gamma ^{2})}\right] \),

respectively such that \(r\in (\bar{r}, r^{max})\) as discussed in Lemma 3.

To find the optimal royalty rate \(r^{*}\) that firm 1 should charge, we set \(\frac{\partial \Pi ^{R1}_{1}}{\partial r}=0\,\) i.e.

and get \(r^{*}= \left[ \frac{2(10-\gamma ^{2})(\alpha _{1}-c_{1})- 18\gamma (\alpha _{2}-c_{2})}{4(10-\gamma ^{2})}\right] . \) Moreover, \(r^{*}>r^{max}\).Footnote 28 At \(r^{max}\), \(\frac{\partial \Pi ^{R1}_{1}}{\partial r}>0\) and \(\Pi ^{R1}_{1} = \Pi ^{*}_{1}\). However, if firm 1 charges a royalty rate greater than \(r^{max}\), such that \(\Pi ^{R1}_{1} > \Pi ^{*}_{1}\) (because its profit is increasing in the royalty rate r), then licensing cannot take place as \(q^{R1}_{12}=0\). Therefore, licensing is never possible in this scenario as stated in the Lemma 5 of the main text.

1.3 Appendix 1.3: Two-part tariff: Case 1

If \(q^{T1}_{12}>0\) and \(q^{T1}_{2}>0\), then the post-licensing profits of firm 1 and firm 2 are

respectively such that \(r\in (\bar{r}, r^{max})\) as discussed in Lemma 3. Further, firm 1 will set the royalty rate and the fixed-fee in the first stage of the game such that \(\Pi ^{T1}_{2}=\Pi ^{*}_{2}\), as it wants to maximize its profit in the post-licensing stage. Hence, the profit function of firm 1 reduces to

To find the optimal royalty rate \(r^{*}\) that firm 1 should charge coupled with \(F^{*}\), we set \(\frac{\partial \Pi ^{T1}_{1}}{\partial r}=0\,\) and get

Appendix 2: Fixed-fee licensing: Firm 2 to Firm 1

This section studies the possibility of transfer of technology from firm 2 to firm 1 under fixed-fee licensing at a fixed-fee F. After licensing, the profit functions for firm 2 and firm 1 are respectively,

and

where \(q^{F2}_{22}\) and \(q^{F2}_{21}\) are the quantities of the lower quality product produced by firm 2 and firm 1 in the post-licensing stage respectively. The amount of the higher quality product produced by firm 1 after licensing is \(q^{F2}_{1}\).

Let us assume that firm 1 produces both the products after licensing. As in the main text, we get the equilibrium quantities in the post licensing stage as,

From the above expressions it is seen that \( q^{F2}_{22}>0\) and \(q^{F2}_{1}>0\). Secondly,

-

i)

\(q^{F2}_{21}>0\) if \(\theta >\frac{3\gamma }{2+\gamma ^{2}} \) or else

-

ii)

\(q^{F2}_{21}=0\), i.e. technology is not licensed.

Licensing is possible in both these cases if and only if,

If \(F=0\), then \(\Pi ^{F2}_{2} < \Pi ^{*}_{2}\). Thus, firm 2 should set \(F>0\), such that it can offset the loss in profits after licensing with the fixed-fee it receives from the licensee. We consider the case \(q^{F2}_{21}>0\), or \(\theta >\frac{3\gamma }{2+\gamma ^{2}}\), as otherwise licensing is not possible. Firm 2 will set F such that \(\Pi ^{F2}_{21}=\Pi ^{*}_{1}\). Hence, licensing is profitable if

where \(\Pi ^{F2}_{2}=\frac{(\alpha _{2}-c_{2})^{2}}{9}+F\), while firm 1’s total profit includes revenue from the both the higher quality and the lower quality product, and it is equal to

The total industry profit is,

Therefore, fixed-fee licensing is possible only if

where \(\Pi ^{*}_{1}+\Pi ^{*}_{2}=\frac{(4+\gamma ^{2})(\alpha _{1}-c_{1})^{2}-8\gamma (\alpha _{1}-c_{1})(\alpha _{2}-c_{2})+(4+\gamma ^{2})(\alpha _{2}-c_{2})^{2}}{(4-\gamma ^{2})^{2}}\). The above equation holds if \((4-\gamma ^{2})^{2}\bigg ((8+\gamma ^{2}){\gamma ^{*}}^{2}-18\gamma \gamma ^{*}+9\bigg )>36(1-\gamma ^{2})\bigg ((4+\gamma ^{2})-8\gamma \gamma ^{*}+(4+\gamma ^{2}){\gamma ^{*}}^{2}\bigg )\).

However, this is never possible. Hence, technology is never licensed via fixed-fee.

Appendix 3: Royalty Licensing: Firm 2 to Firm 1

This section studies the possibility of transfer of technology from firm 2 to firm 1 under royalty licensing at a rate r. After licensing, the profit functions for firm 2 and firm 1 are respectively,

and

where \(q^{R2}_{22}\) and \(q^{R2}_{21}\) are the quantities of the lower quality product produced by firm 2 and firm 1 in the post-licensing stage, respectively. The amount of the higher quality product produced by firm 1 after licensing is \(q^{R2}_{1}\).

Assuming that firm 1 operates in both the markets, the equilibrium quantities in the post licensing stage are,

As the per unit royalty rate is strictly positive, therefore \(q^{R2}_{22}>0\) and \(q^{R2}_{1}>0.\) From the above expression, it can be said that \(q^{R2}_{21}>0\), if \(r\in (0,r^{max})\), where \(r^{max}= \frac{(2+\gamma ^{2})(\alpha _{2}-c_{2})- 3\gamma (\alpha _{1}-c_{1})}{(4-\gamma ^{2})}\), otherwise technology is not licensed, as \(q^{R2}_{21}\) decreases if r increases.

If \(q^{R2}_{21}>0\), then the post-licensing profits of firm 2 and firm 1 are

respectively such that \(r\in (0, r^{max})\) .

To find the optimal royalty rate \(r^{*}\) that firm 2 should charge, we set \(\frac{\partial \Pi ^{R2}_{2}}{\partial r}=0\,\) i.e.

and get \(r^{*}= \left[ \frac{2(10-\gamma ^{2})(\alpha _{2}-c_{2})- 18\gamma (\alpha _{1}-c_{1})}{4(10-\gamma ^{2})}\right] . \) Moreover, as \(r^{max}<r^{*}\), firm 2 will charge \(r^{max}\), as at \(r=r^{max}\) we have \(\frac{\partial \Pi ^{R2}_{2}}{\partial r}>0\,\). Hence, technology will not be transferred from firm 2 to firm 1, as at \(r=r^{max}\) we get \(q^{R2}_{21}=0.\)

As technology is not transferred from firm 2 to firm 1, either by fixed-fee or by royalty, hence two-part tariff licensing is also not possible in this context.

Rights and permissions

About this article

Cite this article

Sen, N., Kaul, S. & Biswas, R. Technology licensing under product differentiation. J Econ 134, 219–260 (2021). https://doi.org/10.1007/s00712-021-00750-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-021-00750-y