Abstract

We study the sourcing decision of a manufacturer in choosing between sole sourcing and multi-sourcing for a production component, when available sources are under different efficiency levels. In our model, the manufacturer can either produce the component in-house, or outsource to less efficient external suppliers. Without any demand uncertainty or ex-ante capacity constraint with in-house production, we find that the manufacturer may establish only limited in-house production capacity and eventually outsource to less efficient external suppliers. Such partial outsourcing is purely strategic and is due to the existence of single-source components, with which the manufacturer solely relies on key suppliers who possess great market power. Partial outsourcing enables the manufacturer to mitigate the pricing power of key suppliers, which is optimal to the manufacturer so long as the associated efficiency loss of outsourcing is not too pronounced. Moreover, cost increase in outsourcing may lead the manufacturer to outsource even more in order to boost its profitability.

Similar content being viewed by others

Notes

Forbes, Aug 29, 2014. Samsung Shuns Google by Offering Nokia’s Here Maps on Galaxy Phones.

MNET, Jun 12, 2015. Reshoring In-Depth: Ford, Caterpillar, GE, GM Among Top Reshoring Companies.

CNET, Nov. 4, 2013. Apple to Build Made-in-the-USA Manufacturing Plant in Arizona.

Forbes, Dec 6, 2012. Why Apple Is Bringing Manufacturing Back to the United States.

For example, this applies to the case when a manufacturer acquires some parts of the final assembly solely from a single supplier; for other parts, it can either produce in-house or purchase from external sources.

To make in-house production feasible to firm M, F cannot be too big. We assume that the for firm M, his optimal profit net of F when he produces component N fully in-house is no less than his optimal profit when he establishes zero in-house capacity and fully outsources component N .

In Sect. 6, we discuss the robustness of our results if instead a Nash bargaining framework is used to determine the wholesale price.

In our model, the transaction on component SS is conducted before the transaction on component N, which reflexes the flexibility firm M has with his order quantity of component N due to the existence of multiple sources. However, our central results do not rely on this particular timing and will continue to hold if these transactions are conducted in a simultaneous manner.

In our model, we consider capacity decision followed by quantity decision of the manufacturer. Alternatively, we can consider that the manufacturer chooses price of the final good following his capacity decision. Our major result will continue to hold in this alternative setting. In fact, as shown in Kreps and Scheinkman (1983), capacity decision followed by price competition generates Cournot outcome.

Assumption 2 is meant to simplify our analysis; it also applies to a wide variety of demand and cost functions. For example, it is satisfied when both P(q) and C(q) are linear; with quadratic C(q), it is satisfied when P(q) is linear, or when P(q) is constant elastic with elasticity \(\epsilon \le -1\).

In the sequel, we shall use upper bar and asterisk to indicate whether the term is associated with the scenario of partial outsourcing or in-house production.

Note that at \( K= q^{*}({\tilde{w}})\), firm S is indifferent between a low price \( {\bar{w}}\) and a high price \(w_2(K)\) (in this case \(w_2(K)={\tilde{w}}\)). To break the tie, we assume that firm S chooses the low price \({\bar{w}}\). This is for ease of exposition and has no qualitative impact on our analysis.

We can adopt the same assumption as in Dixit (1980), where capacity building has a constant average variable cost. Here we consider that variable cost of capacity increases in capacity scale, which is a more general assumption, so that we can gain more insights regarding the robustness of our central message.

The assumption \(f^{\prime }(K)<m\) is to guarantee that average capacity building cost is not too big such that firm M finds it optimal to give up in-house production and fully rely on outsourcing. This allows us to focus on the strategic aspect of outsourcing.

Instead if price-discrimination is infeasible to firm S, Sect. 6.2 discusses a situation when firm S quotes a uniform price to multiple downstream firms, and shows that our qualitative results are preserved. In fact, adjusting her price w is in the interests of firm S once she deems the in-house capacity installed by firm M sufficiently low.

Corollary 3 shares the spirit of the results in de Fontenay and Gans (2004), as both assert that a downstream monopsonist and consumers’ interests regarding vertical market structure may not be aligned. However, the concrete results of these two works are different due to very different mechanisms. In de Fontenay and Gans (2004), vertically integrating upstream suppliers is a means of a monopsonist to mitigate bargaining power of independent upstream suppliers, which results in less independent upstream suppliers and lower downstream quantity, thus hurting consumers. Instead in our work, it is the vertical disintegration (namely, firm M’s outsourcing) that serves the means of mitigating the market power of the upstream supplier (firm S). The efficiency loss due to outsourcing lowers downstream quantity and thus hurts consumers. The different results stem from the different model setups in the two works. Our work considers multiple production components, and firm S is the unique supplier of one component. Thus the substitutability of upstream suppliers in de Fontenay and Gans (2004) does not apply here. In addition, as shown in Sect. 6.2, although our baseline model studies sourcing decision of a downstream monopsonist, our message does not depend on this market structure and can be extended to downstream competition.

de Fontenay and Gans (2005) provides an analysis about the impact of vertical integration on the supply chain profit, and also on different parties’ bargaining power under upstream monopoly and competition.

These parameters are chosen to be representative; we have tried various combinations of parameters and observe similar patterns.

This implies that firm S cannot discriminate against any manufacturer, presumably due to the fairness concern or the Robinson–Patman Act.

References

Alvarez LHR, Stenbacka R (2007) Partial outsourcing: a real options perspective. Int J Ind Organ 25:91–102

Anton JJ, Yao DA (1989) Split awards, procurement, and innovation. Rand J Econ 20(4):538–552

Babich V (2006) Vulnerable options in supply chains: effects of supplier competition. Naval Res Logist 53(7):656–673

Bulow JI, Geanakoplos JD, Klemperer PD (1985) Multimarket oligopoly: strategic substitutes and complements. J Polit Econ 93(3):488–511

Choi JP, Davison G (2004) Strategic second sourcing by multinationals. Int Econ Rev 45(2):579–600

de Fontenay CC, Gans JS (2004) Can vertical integration by a monopsonist harm consumer welfare? Int J Ind Organ 22:821–834

de Fontenay CC, Gans JS (2005) Vertical integration in the presence of upstream competition. Rand J Econ 36(3):544–572

Dixit A (1980) The role of investment in entry deterrence. Econ J 90(357):95–106

Dong L, Xiao G, Yang N (2016) Supply diversification under price dependent demand and random yield. Working paper, Washington University at St. Louis

Du J, Lu Y, Tao Z (2006) Why do firms conduct bi-sourcing? Econ Lett 92(2):245–249

Farrell J, Gallini N (1988) Second-sourcing as a commitment: monopoly incentives to attract competition. Q J Econ 103(4):673–694

Feng Q, Lu LX (2012) The strategic perils of low cost outsourcing. Manag Sci 58(6):1196–1210

Gao L, Yang N, Zhang R, Luo T (2017) Dynamic supply risk management with signal-based forecast, multi-sourcing, and discretionary selling. Prod Oper Manag 27(7):1399–1415

Gray JV, Tomlin B, Roth AV (2009) Outsourcing to a powerful contract manufacturer: the effect of learning-by-doing. Prod Oper Manag 18(5):487–505

Inderst R (2008) Single sourcing versus multiple sourcing. Rand J Econ 39(1):199–213

Kogut B, Kulatilaka N (1994) Operating flexibility, global manufacturing, and the option value of a multinational network. Manag Sci 40(1):123–139

Kreps D, Scheinkman J (1983) Quantity precommitment and bertrand competition yield cournot outcomes. Bell J Econ 14(2):326–337

Laffont J-J, Tirole J (1988) Repeated auctions of incentive contracts, investment, and bidding parity with an application to takeovers. Rand J Econ 19(4):516–537

Lester T (2002) Making it safe to rely on a single partner. Financ Times

Li C, Debo LG (2009a) Second sourcing vs. sole sourcing with capacity investment and asymmetric information. Manuf Serv Oper Manag 11(3):448–470

Li C, Debo LG (2009b) Strategic dynamic sourcing from competing suppliers with transferable capacity investment. Nav Res Logist 56(6):540–562

Lipsey RG, Lancaster K (1956−1957) The general theory of second best. Rev Econ Stud 24(1):11–32

Quélin B, Duhamel F (2003) Bringing together strategic outsourcing and corporate strategy: outsourcing motives and risks. Eur Manag J 21(5):647–661

Riordan MH, Sappinton DEM (1989) Second sourcing. Rand J Econ 20(1):41–58

Shepard A (1987) Licensing to enhance demand for new technologies. Can J Econ 18(3):360–368

Shy O, Stenbacka R (2005) Partial outsourcing, monitoring cost, and market structure. Can J Econ 38(4):1173–1190

Spencer BJ (2005) International outsourcing and incomplete contracts. Can J Econ 38(4):1107–1135

Stenbacka R, Tombak M (2012) Make and buy: balancing bargaining power. J Econ Behav Organ 81(2):391–402

Tomlin B, Wang Y (2012) Operational strategies for managing supply chain disruption risk. In: Kouvelis P, Boyabatli O, Dong L, Li R (eds) Handbook of integrated risk management in global supply chains. Wiley, Hoboken

Yang Z, Aydin G, Babich V, Beil D (2012) Using a dual-sourcing option in the presence of asymmetric information about supplier reliability: competition vs. diversification. Manuf Serv Oper Manag 14(2):202–217

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

First, we show that \(q^{*}(w)\) and \({\bar{q}}(w)\) decrease in w. By (2), (3) and the implicit function theorem, it holds that

Second, we show that \(q^{*}(w)>{\bar{q}}(w)\). By Assumption 1, \( P^{\prime }(q)q+P(q)-C^{\prime }(q)\) decreases in q. By (2) and (3), \(P^{\prime }( q^*(w))q^{*}(w)+P(q^{*}(w))-C^{\prime }(q^*(w))=w\), and \(P^{\prime }({\bar{q}}(w)){\bar{q}}(w)+P( {\bar{q}}(w))-C^{\prime }({\bar{q}}(w))=w+m>w.\) Thus \(q^{*}(w)>{\bar{q}}(w)\).

Third, note that \(w_{1}(K)\) and \(w_{2}(K)\) are well defined due to the monotonicity of \({\bar{q}}(w)\) and \(q^{*}(w) \). By (4) and (11), it holds that \(w_{1}(K)<w_{2}(K)\).

Forth, we derive firm M’s optimal quantity by discussing different cases. Since \(w_{1}(K)<w_{2}(K)\), there exist three cases: (1) \(w<w_{1}(K)\), (2) \( w\ge w_{2}(K)\), and 3) \(w\in [w_{1}(K),w_{2}(K))\). We discuss each of them below.

- Case 1:

-

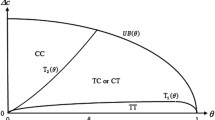

\(w<w_{1}(K)\) By the definition of \(w_{1}(K)\), ( 4) and (11), we have \({\bar{q}}(w)>K\) and \(q^{*}(w)>K\). firm M maximizes \(P(q)q-C(q)-wq-m(q-K)\) subject to \(q>K\), and his equilibrium quantity is \({\bar{q}}(w)\) (given by the heavy part of \({\bar{q}}(w)\) in Fig. 1).

- Case 2:

-

\(w> w_{2}(K)\) By the definition of \(w_{2}(K)\), ( 4) and (11), we have \({\bar{q}}(w)<K\) and \(q^{*}(w)<K\). firm M maximizes \(P(q)q-c(q)-wq\) subject to \(q< K\). His equilibrium quantity is \(q^{*}(w)\) (given by the heavy part of \(q^{*}(w)\) in Fig. 1).

- Case 3:

-

\(w\in [w_{1}(K),w_{2}(K)]\) By the definitions of \(w_{1}(K)\) and \(w_{2}(K)\), (4) and (11), we have \({\bar{q}}(w)\le K\le q^{*}(w)\). The optimal quantity of firm M when he outsources component N shall never exceeds K. Thus, firm M maximizes \(P(q)q-c(q)-wq\) subject to \(q\le K\). The constraint is binding since \(K\le q^{*}(w)\) and firm M’s equilibrium quantity is K. The lemma then follows.

\(\square \)

Proof of Lemma 2

First, note that \({\bar{w}}\) satisfies the first-order condition

and \(w^{*}\) satisfies the first-order condition

Let the optimal quantity produced by firm M by q(w), suppressing \( q(w)=q^{*}(w)\) or \(q(w)={\bar{q}}(w)\). By (12) and (13), the second order condition of firm S’s profit maximization requires that

By (11), we have

with \(H\equiv P^{\prime \prime }(q)q+2P^{\prime }(q)-C^{\prime \prime }\). The above is guaranteed by Assumption 2. Thus (14) is satisfied, showing that \(w^*\) and \({\bar{w}}\) exist and are unique to the profit maximization problem of firm S.

Second, we prove that \(w^{*}>{\bar{w}}\). By (2) and (3), \({\bar{q}}(w)=q^{*}(w)\) at \(m=0\). Therefore, \({\bar{w}}=w^{*}\) at \(m=0 \). To show that \(w^{*}>{\bar{w}}\), it is sufficient to verify that \(\frac{d{\bar{w}}}{dm}<0\) since \(\frac{dw^*}{dm}=0\). Note that by the implicit function theorem, we have

By (12) and the implicit function theorem, we have

by (14) and \(\frac{d^2{\bar{q}}(w)}{dwdm}=0\) (by (11)). The continuity of \({\bar{w}}\) in m suggests that \(w^{*}>{\bar{w}}\). \(\square \)

Proof of Lemma 3

We first establish some structural properties of \(w^*\) and \({\bar{w}}\) before we proceed to prove the lemma.

-

1.

Structural properties of firm S’s wholesale prices

-

(1)

\((w^{*}-v)q^{*}(w^{*})>({\bar{w}}-v){\bar{q}}({\bar{w}}):\) observe that

$$\begin{aligned} \begin{aligned} (w^*-v)q^*(w^*)&\ge ({\bar{w}}-v) q^*({\bar{w}})\qquad \text{ by } \text{ optimality } \text{ of } w^*\\&>({\bar{w}}-v){\bar{q}}({\bar{w}}) \qquad \text{ by } (4). \end{aligned} \end{aligned}$$ -

(2)

\({\tilde{w}}\) exists and is unique: The slope of the iso-profit of firm S is \(\frac{dq}{dw}=-\frac{q}{w-v}<0\) (since \(w-v\ge 0\)), which goes to zero when w goes to infinity. Since \(q^*(w)\) strictly decreases in w, the iso-profit passing point A must intersect \(q^*(w)\) from below, i.e., there exists \({\tilde{w}}>{\bar{w}}\) such that (6) holds. In addition, the iso-profit of firm S is convex since \(\frac{d^2q}{dw^2}= \frac{q}{(w-v)^2}>0\), and \(q^*(w)\) is concave since \(\frac{d^2q^*(w)}{ dw^2}\le 0\) by (15). Thus the intersection of these two at which \( w>{\bar{w}}\) is unique.

-

(3)

\({\tilde{w}}>w^{*}:\) Suppose by negation that \({\tilde{w}}\le w^{*} \). Define \(q^A(w)\) as the solution to \((w-v)q=({\bar{w}}-v){\bar{q}}( {\bar{w}})\) at given w. Thus \((w,q^A(w))\) is on the iso-profit of firm S which passes point A. Since point J is the intersection of this iso-profit and \(q^*(w)\) when the iso-profit is getting flattened, it holds that for \(w\ge {\tilde{w}}\), we have \(q^*(w)\le q^A(w)\). Thus at \( w^*\), \((w^*-v)q^A(w^*)=({\bar{w}}-v){\bar{q}}({\bar{w}})\). Since \( (w^*-v)q^A(w^*)\ge (w^*-v)q^*(w^*)\), it follows that \((\bar{w }-v){\bar{q}}({\bar{w}})\ge (w^*-v)q^*(w^*)\). A contradiction to (i). We conclude that \({\tilde{w}}>w^{*}\).

-

(1)

-

2.

Firm S’s optimal wholesale price decisions

At any given K, in Stage 2 firm S can modify w to induce firm M to produce any quantity along the kinked curve given by q(K, w). Since \( q^{*}({\tilde{w}})<q^{*}(w^{*})\) by (11) and (iii), there can be three cases according to the established capacity K. We discuss each of them in what follows.

- Case 1:

-

\(K\le q^{*}({\tilde{w}})\). In this case, \(w_{2}(K)\ge {\tilde{w}}\) by the definition of \(w_{2}(K)\) and the fact that \(q^{*}(w)\) decreases in w. firm M’s equilibrium quantity q(K, w) passes point A but not point B. Along \({\bar{q}}(w)\), point A maximizes firm S’s profit; it is also achievable for firm S at \(w={\bar{w}}\). Along \(q^{*}(w)\), the optimal point achievable for firm S is point V at \(w=w_{2}(K)\) . Along UV, firm S’s profit is \((w-v)K\), which is maximized at \( w=w_{2}(K)\). Thus, firm S shall compare two prices: \(w_{2}(K)\) and \({\bar{w}} \). Since firm S’s profit along \(q^{*}(w)\), given by \((w-v)q^{*}(w)\) , decreases in w for \(w>w^{*}\), we have \((w_{2}(K)-v)K=(w_{2}(K)-v)q^{ *}(w_{2}(K))\le ({\tilde{w}}-v)q^{*}({\tilde{w}})=({\bar{w}}-v){\bar{q}}( {\bar{w}})\), where equality holds only at \(K= q^{*}({\tilde{w}})\). It follows that \({\bar{w}}\) is optimal for firm S.

- Case 2:

-

\(K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\). It holds that \(w^{*}<w_{2}(K)< {\tilde{w}}\). There are two subcases: (a) \( q^{*}(w^{*})\le {\bar{q}}({\bar{w}})\), and (b) \(q^{*}(w^{*})> {\bar{q}}({\bar{w}})\).

- 2a:

-

\(q^{*}(w^{*})\le {\bar{q}}({\bar{w}})\): When \( q^{*}(w^{*})\le {\bar{q}}({\bar{w}})\), q(K, w) passes point A but not point B. Along \(q^{*}(w)\) and segment UV on q(K, w), point V is optimal for firm S. Thus, firm S again compares two prices: \(w_{2}(K)\) and \({\bar{w}}\). Since \((w-v)q^{*}(w)\) decreases in w for \(w>w^{*}\), we have \((w_{2}(K)-v)K=(w_{2}(K)-v)q^{*}(w_{2}(K))> ({\tilde{w}}-v)q^{*}({\tilde{w}})=({\bar{w}}-v){\bar{q}}({\bar{w}})\). It follows that \(w_{2}(K)\) is optimal for firm S.

- 2b:

-

\(q^{*}(w^{*})>{\bar{q}}({\bar{w}})\): If \(K\le {\bar{q}}({\bar{w}})\), q(K, w) passes point A but not point B. The proof is the same as in 2a). Consider the case when \(K>{\bar{q}}({\bar{w}})\). Now neither point A nor point B is on q(K, w). Along \({\bar{q}}(w)\), it is optimal for firm S to set \(w=w_{1}(K)\) at point U; along \(q^{*}(w)\), setting \(w=w_{2}(K)\) is optimal (at point V). As \(w_{2}(K)>w_{1}(K)\), point V strictly dominates point U for firm S since \((w_{2}(K)-v)K>(w_{1}(K)-v)K\) . Thus, \(w_{2}(K)\) is optimal for firm S.

- Case 3 :

-

\(K\ge q^{*}(w^{*})\): There are again two subcases: (a) \(K\le {\bar{q}}({\bar{w}})\) and (b) \(K>{\bar{q}}({\bar{w}})\).

- 3a:

-

\(K\le {\bar{q}}({\bar{w}})\): Both points A and B are on q(K, w) . Firm S sets \(w={\bar{w}}\) for her profit at point A along \({\bar{q}}(w)\) and \(w=w^{*}\) for her profit at point B along \(q^{*}(w)\). Since \( (w^{*}-v)q^{*}(w^{*})>({\bar{w}}-v){\bar{q}}({\bar{w}})\), \(w=w^{*} \) is optimal for firm S.

- 3b:

-

\(K>{\bar{q}}({\bar{w}})\): Point B is on q(K, w) but not point A. Along \({\bar{q}}(w)\), firm S shall set \(w=w_{1}(K)\) to maximize her profit (at point U); along \(q^{*}(w)\), firm S then sets \(w=w^{*}\) to arrive at point B. Since \((w^{*}-v)q^{*}(w^{*})>({\bar{w}}-v){\bar{q}}({\bar{w}})\), and point A dominates point U along \( {\bar{q}}(w)\), \(w=w^{*}\) is optimal for firm S.

Collectively, the optimal w for firm S is as expressed in the lemma. \(\square \)

Proof of Theorem 1

First, we show that firm M strictly prefers \(K\ge q^{*}(w^{*})\) to \(K\in (q^{*}({\tilde{w}} ),q^{*}(w^{*}))\). By Lemma 3, for \(K\ge q^{*}(w^{*})\), \(w=w^{*}\) in stage 2 and firm M will produce \(q^{*}(w^{*})\) and get profit \(\pi _{m}^{*}-F\). On the other hand, for \( K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\), \(w=w_{2}(K)\) in stage 2 and firm M produces \(q=q^{*}(w_{2}(K))=K \). firm M’s profit is given by \(\pi _m^V-F\), with

In either case, there is no outsourcing in stage 3. We use \(\pi _{m}(w,q^{*}(w))-F\) to denote firm M’s profit when he produces \( q^{*}(w)\) at given w without outsourcing, where

By the envelope theorem, we obtain that

Since \(w^{*}< w_{2}(K)\) for \(K<q^{*}(w^{*})\), it follows that \( \pi _{m}^{*}> \pi _{m}^{V}\). Thus \(K\ge q^{*}(w^{*})\) dominates \(K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\) for firm M.

Second, by Lemma 3, any \(K\le q^{*}({\tilde{w}})\) leads firm M to produce \({\bar{q}}({\bar{w}})\) and firm M engages in partial outsourcing in the production stage. It is optimal for firm M to set \( K=q^{*}({\tilde{w}})\) to minimize his outsourcing cost \(m({\bar{q}}({\bar{w}} )-K)\). Accordingly, firm M’s equilibrium profit under partial outsourcing is at \(K=q^{*}({\tilde{w}})\) and is given by

Therefore, when firm M chooses K, he compares his profit at \(K\ge q^{*}(w^{*})\) (with full in-house production) to his profit at \( K=q^{*}({\tilde{w}})\) (with partial outsourcing). In equilibrium he engages in partial outsourcing whenever (8) is satisfied, which is reduced to

Third, note that \(\pi _{m}^{*}\) does not depend on m and at \(m=0\), \( {\bar{\pi }}_m+mq^{*}({\tilde{w}})=\pi _{m}^{*}\). To prove the theorem, it is sufficient to show that the left-hand-side of (17) strictly increases in m at \(m=0\). We obtain that

We conclude that for m sufficiently close to 0, \(\pi _{m}^{*}<\bar{ \pi }_m+mq^{*}({\tilde{w}})\). The rest of the theorem follows immediately. \(\square \)

Proof of Corollary 1

Under Assumption 3, Lemma 1 through Lemma 3 are preserved since capacity building cost is sunk cost in stage 3 and does not affect the quantity decision of firm M. We need to check the validity of the proof of Theorem 1. First, for \(K\ge q^{*}(w^{*})\), firm M is optimal setting \(K=q^{*}(w^{*})\) when \(f^{\prime }(K)>0\). His profit is \(\pi _{m}^{*}-f(q^{*}(w^{*}))\).

Second, for \(K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\), firm M produces \(q=q^{*}(w_{2}(K))=K \) and his profit is \(\pi _{m}^{V}-f(K)\). Since

the sign is ambiguous and it is not determined whether \(K=q^{*}(w^{*})\) or \(K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\) is optimal for firm M. In either case, firm M does not outsource.

Third, for \(K\le q^{*}({\tilde{w}})\), firm M produces \({\bar{q}}({\bar{w}})\) and his profit is denoted as \({\bar{\pi }}_m+mK-f(K)\). It is still true that firm M is optimal setting \(K=q^{*}({\tilde{w}})\) since \(\frac{d[{\bar{\pi }} _m+mK-f(K)]}{dK}=m-f^{\prime }(K)>0\). Accordingly, firm M’s equilibrium profit under partial outsourcing is

Thus when firm M chooses K, he compares his profit with partial outsourcing to the profit with full in-house production. There can be two cases:

-

Case 1 Firm M is optimal setting \(K=q^{*}(w^{*})\) under full in-house production. If so, condition (8) is rewritten as

$$\begin{aligned} {\bar{\pi }}_{m}+mq^{*}({\tilde{w}})-f(q^{*}({\tilde{w}}))>\pi _{m}^{*}-f(q^{*}(w^{*})). \end{aligned}$$(18)Condition (18) is weaker than condition (8) since \( f(q^{*}({\tilde{w}}))<f(q^{*}(w^{*}))\).

-

Case 2 Firm M is optimal setting \(K\in (q^{*}({\tilde{w}}),q^{*}(w^{*}))\) under full in-house production. If so, condition (8) is rewritten as

$$\begin{aligned} {\bar{\pi }}_{m}+mq^{*}({\tilde{w}})-f(q^{*}({\tilde{w}}))>\pi _{m}^V-f(K). \end{aligned}$$(19)Again, condition (19) is weaker than condition (8) since \(\pi _m^V<\pi _m^{*}\) and \(f(q^{*}({\tilde{w}}))<f(K)\) for \(K> q^{*}({\tilde{w}})\).

We conclude that there is more partial outsourcing in equilibrium under Assumption 3. \(\square \)

Proof of Corollary 2

The corollary directly follows from the proof of Theorem 1. \(\square \)

Proof of Corollary 3

To prove the result, consider

Then \(q^{*}(w^{*})\) solves (20) at \(\theta =w^{*}\) and \( {\bar{q}}({\bar{w}})\) solve (20) at \(\theta ={\bar{w}}+m\). Let \({\tilde{q}}\) solve (20) at \(\theta =v\). Thus \({\tilde{q}}\) is firm M’s monopoly quantity when he vertically integrate with firm S and produces the final good under full capacity. By Assumption 1, the left-hand-side of ( 20) decreases in q. Since \(w^{*}>v,{\bar{w}}+m>v\), we have \( q^{*}(w^{*})<{\tilde{q}},{\bar{q}}({\bar{w}})<{\tilde{q}}\).

At \(m=0\), it holds that \(w^{*}={\bar{w}}+m\). By (16) and \( \frac{d^{2}{\bar{q}}(w)}{dwdm}=0\), we have

Since \(\frac{d{\bar{q}}(w)}{dw}=\frac{d{\bar{q}}(w)}{dm}=\frac{1}{P^{\prime \prime }(q)+2P^{\prime }(q)-C^{\prime \prime }}\), reorganizing gives

By Assumption 2, \(w-v\ge 0\), \(\frac{d{\bar{q}}(w)}{dw}<0\) and \( \frac{d^{2}{\bar{q}}(w)}{dw^{2}}\le 0\), it holds that \(\frac{d({\bar{w}}+m)}{dm} >0\). Thus \({\bar{w}}+m>w^{*}\) for \(m>0\), implying that \({\bar{q}}({\bar{w}} )<q^{*}(w^{*})\). We conclude that firm M produces a lower quantity for the final good under strategic partial outsourcing, leading to lower consumers’ surplus.

In addition, producers’ surplus under strategic partial outsourcing is

and producers’ surplus in status quo is

By Assumption 1 and \({\tilde{q}}>q^{*}(w^{*})>{\bar{q}}({\bar{w}} )>q^{*}({\tilde{w}})\), it follows that \(PS^{*}>{\overline{PS}}\). \(\square \)

Proof of Proposition 1

Since the proof is the same as for Theorem 1, we give only the sketch of the procedure of backward induction.

- (1):

-

The production stage Without partial outsourcing, firm M maximizes his profit \((a-q)q-cq-wq\) and the optimal quantity is

$$\begin{aligned} q^{*}(w)=\frac{1}{2}(a-c-w). \end{aligned}$$(21)Instead, if firm M produces with partial outsourcing, his problem is to maximize profit \((a-q)q-cq-wq-m(q-K)\) and the optimal quantity is

$$\begin{aligned} {\bar{q}}(w)=\frac{1}{2}(a-c-w-m). \end{aligned}$$(22) - (2):

-

The contracting stage In Stage 2, firm S chooses w to maximize her profit. When firm S anticipates that firm M fully uses in-house production for component N, she maximizes \((w-v)q^{*}(w)\) and the optimal wholesale price is

$$\begin{aligned} w^{*}=\frac{1}{2}(a-c+v). \end{aligned}$$On the other hand, when firm S anticipates that firm M will produce with partial outsourcing, firm S maximizes \((w-v){\bar{q}}(w)\) and the optimal wholesale price is

$$\begin{aligned} {\bar{w}}=\frac{1}{2}(a-c-m+v). \end{aligned}$$It is clear that \(w^{*}>{\bar{w}}\). There exists a level of the in-house capacity such that in Stage 2, firm S is indifferent between setting \(\bar{ w}\) while anticipating that firm M outsources his residual demand and setting \({\tilde{w}}\) while anticipating that firm M produces within his in-house capacity. Here, \({\tilde{w}}\) satisfies

$$\begin{aligned} ({\bar{w}}-v){\bar{q}}({\bar{w}})=({\tilde{w}}-v)q^{*}({\tilde{w}}) \end{aligned}$$subject to \({\tilde{w}}>{\bar{w}}\). It is uniquely solved as

$$\begin{aligned} {\tilde{w}}=\frac{1}{2}(a-c+v+\sqrt{m[2(a-c-v)-m]}). \end{aligned}$$The corresponding capacity which makes firm S to be indifferent between \( {\bar{w}}\) and \({\tilde{w}}\) is

$$\begin{aligned} q^{*}({\tilde{w}})=\frac{1}{4}(a-c-v-\sqrt{m[2(a-c-v)-m]}). \end{aligned}$$According to Lemma 3, if and only if \(K\le q^{*}( {\tilde{w}})\), firm S finds it optimal to set \(w={\bar{w}}\), a lower price of component SS.

- (3):

-

The capacity building stage In Stage 1, by establishing \(K\ge q^{*}(w^{*})\), firm M is able to produce without capacity constraint in the production stage and his profit is

$$\begin{aligned} \pi _{m}^{*}=\frac{1}{16}(a-c-v)^{2}. \end{aligned}$$Whereas at \(K=0\), firm M’s profit is

$$\begin{aligned} {\bar{\pi }}_{m}=\frac{1}{16}(a-c-v-m)^{2}. \end{aligned}$$Instead, by establishing \(K=q^{*}({\tilde{w}})\), firm M anticipates that firm S will set \(w={\bar{w}}\) so that in Stage 3, firm M outsources quantity

$$\begin{aligned} {\bar{q}}({\bar{w}})-q^{*}({\tilde{w}})=\frac{1}{4}(\sqrt{m[2(a-c-v)-m]}-m). \end{aligned}$$In this case, firm M’s profit is

$$\begin{aligned} {\bar{\pi }}_{m}+mq^{*}({\tilde{w}})=\frac{1}{16}(a-c-v-m)^{2}+mq^{*}( {\tilde{w}}). \end{aligned}$$firm M’s problem in Stage 1 is to compare \(\pi _{m}^{*}\) to \({\bar{\pi }} _{m}+mq^{*}({\tilde{w}})\) in order to determine the optimal capacity. We find that for \(m<{\bar{m}}\), Condition (8) is satisfied. In this case, firm M finds it optimal setting \(K=q^{*}({\tilde{w}})\) to induce firm S to charge \({\bar{w}}\), then outsourcing quantity \({\bar{q}}({\bar{w}} )-q^{*}({\tilde{w}})\) for component N. The rest of the proposition follows the fact that \({\bar{\pi }}_{m}+mq^{*}({\tilde{w}})\) is maximized at \( m=m^{*}\).

\(\square \)

Proof of Corollaries 4–6

The results follow from straightforward calculations and thus the details are omitted. \(\square \)

Rights and permissions

About this article

Cite this article

Chen, Y., Chen, YJ. Strategic partial outsourcing in the presence of single-source components. J Econ 131, 237–265 (2020). https://doi.org/10.1007/s00712-020-00708-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-020-00708-6