Abstract

We revisit firms’ strategic delegation in a Cournot game. We consider a market comprising two consumer groups, with either a high or low willingness to pay. In this market, we first consider firms’ identical marginal costs and show that either/both firms’ owners may strategically abandon the delegation option to avoid price collapse. We find three types of delegation decisions with either/both/no firm delegating in equilibrium. We further consider firms’ asymmetric marginal costs and show that the asymmetric equilibrium wherein only the less efficient firm delegates will exist in a wider parameter range, compared to that wherein only the more efficient firm delegates. Moreover, delegation may enable the less efficient firm to achieve a higher profit than her rival.

Similar content being viewed by others

Notes

Some parallel studies discuss strategic delegation in the context of firm heterogeneity (Scrimitore 2012), R&D with spillovers (Kopel and Riegler 2008), consumer cooperatives under a mixed oligopoly (Kopel and Marini 2014), network externalities (Lee et al. 2018), and endogenous timing (Fanti and Meccheri 2019).

Bhardwaj (2001) considers Bertrand competition in which each firm endogenously chooses whether to delegate pricing decisions to a manager. The author sheds light on the principal-agent problem and the managers’ demand expansion effort. It is shown that either/both/no firms choosing to delegate may exist in equilibrium.

Firms’ multi-period delegation is also examined in other parallel studies. For example, Barcena-Ruiz and Espinosa (1996) compare a firm’s performance under short-term and long-term contracts. Spagnolo (2000) discusses managers’ collusion incentives by considering their stock-related compensation. Han (2012) considers firms’ short-term contract and shows how it facilitates tacit collusion.

Amaldoss and Shin (2011) extend Ishibashi and Matsushima (2009) by considering a price competition over vertically differentiated products. They show that when facing low-end consumers and when firms sequentially choose their respective quality, the leading firm may decide to sell lower-quality products, but still, obtain a profit higher than the following firm.

Ishibashi and Matsushima (2009) and Pan (2018) consider a similar market structure except that the authors normalize only the size of the high-end segment to 1. Note that all results we present here will still hold if our setting follows the literature, although the mathematical complexity would increase.

For the purposes of identification, we use female pronouns for the owner and male pronouns for the manager.

Kopel and Pezzino (2018) show that managers’ positive outside options may give rise to owners’ asymmetric delegation decisions. We assume \(U_i=0\) to remove this already known logic. All our results hold if assuming \(U_i>0\).

If we follow Vickers (1985) by assuming that the incentive parameter affects the owner’s objective function via \(O_i=\pi _i+\theta _i q_i\), we can reach our findings qualitatively.

For instance, since LG Electronics was founded, most decision-makings have been made by the generations of the founder’s family (Harvard Business School 1985). Similar cases also appear for other Asian enterprises, like Hyundai Motor Company, Hangzhou Wahaha Group Co., Ltd (a food producer), and Hoshi Ryokan (a hotel company).

Notice that this assumption is also technically important in deriving the non-delegation equilibrium. If owner i cannot let her rival know that she will not hire a manager in the future (alternatively, cannot commit to \(\theta _i=1\) in Stage 1), given any of the rival’s incentive rate \(\theta _j\), the best response will always be setting \(\theta _i<1\). This means that the delegation game will always present the equilibrium wherein both owners choose to delegate and set the incentive rate to smaller than 1.

The authors also theoretically discuss this issue by endogenizing firms’ decision-making of whether to disclose their CEO’s compensation schemes in both Cournot and Bertrand competition. They show that both firms choosing to disclose is a unique equilibrium.

Kreps and Scheinkman (1983) show that if firms decide their capacities before competing in price, the market outcome is analogous to that in a quantity competition.

For example, Netflix and Blockbuster always hold an extra stock of copies of latest movies, airline companies need to decide the number of flights for newly established routes (Belleflamme and Peitz 2015, Chapter 3).

Since no costs are involved in the delegation stage, choosing not to hire a manager can also be understood as hiring a manager but to assign the incentive rate \(\theta _i\) to 1 such that the manager’s objective becomes consistent with owner’s.

Notice that the decision-makers’ reaction functions are discontinuous and asymmetric due to the term \(\theta _ic_i\). For this reason, \(R_1(q_2)\) and \(R_2(q_1)\) may not intersect, which means that pure strategy Nash equilibrium may not exist for some parameter ranges. In the following sections, we will focus on the ranges wherein pure strategy Nash equilibrium exists.

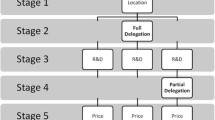

The blank areas denotes the ranges in which no pure strategy Nash equilibrium exists. Notice that the range of asymmetric delegation is relatively narrow compared to the symmetric ones (i.e., nn and dd ). This happens because we have assumed the size of the high-end and low-end markets to be identical for technical simplicity. If we allow the market sizes to be sufficiently asymmetric, the range of dn or nd outcome would be wider.

Notice that for \(c\ge {\tilde{c}}^{ddS}\) and \(c\le {\tilde{c}}^{nnS}\), there exists a unique equilibrium wherein both owners choose to delegate. Notice also that for \({\tilde{c}}^{dnS}\le c\le {\tilde{c}}^{ddI}\), the dn and nd equilibria coexist. We will discuss the dn and nd equilibria in the next section.

References

Amaldoss W, Shin W (2011) Competing for low-end markets. Mark Sci 30(5):776–788

Baik KH, Lee D (2019) Decisions of duopoly firms on sharing information on their delegation contracts. Rev Ind Organ (in press)

Barcena-Ruiz JC, Espinosa MP (1996) Long-term or short-term managerial incentive contracts. J Econ Manag Strategy 5:343–359

Basu K (1995) Stackelberg equilibrium in oligopoly: an explanation based on managerial incentives. Econ Lett 49(4):459–464

Belleflamme P, Peitz M (2015) Industrial organization: markets and strategies. Cambridge University Press, Cambridge

Bhardwaj P (2001) Delegating pricing decisions. Mark Sci 20(2):143–169

Colombo S (2019) Strategic delegation under cost asymmetry revised. Oper Res Lett 47:527–529

Colombo S, Scrimitore M (2018) Managerial delegation under capacity commitment: a tale of two sources. J Econ Behav Organ 150:149–161

Fanti L, Meccheri N (2019) Endogenous timing of managerial delegation contracts in a unionized duopoly. Manag Decis Econ 40(7):845–857

Fershtman C (1985) Managerial incentives as a strategic variable in duopolistic environment. Int J Ind Organ 3(2):245–253

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77:927–940

Han M (2012) Short-term managerial contracts and cartels. SFB discussion paper 2012–057. Humboldt-Universität zu Berlin, Berlin

Harvard Business School (1985) Goldstar Co., Ltd., Case Study 9-385-264. Harvard Business School Case Services, Boston

Hoernig S (2012) Strategic delegation under price competition and network effects. Econ Lett 117:487–489

Ishibashi I, Matsushima N (2009) The existence of low-end firms may help high-end firms. Mark Sci 20(1):136–147

Lambertini L (2017) An economic theory of managerial firms. Routledge Press, London

Lee D, Choi K, Han J (2018) Strategic delegation under fulfilled expectation. Econ Lett 169:80–82

Kreps D, Scheinkman J (1983) Quantity precommitment and bertrand competition yield cournot outcomes. Bell J Econ 14:326–337

Kopel M, Löffler C (2012) Organizational governance, leadership, and the influence of competition. J Inst Theo Econ 168(3):362–392

Kopel M, Riegler C (2008) Delegation in an R&D game with spillovers. Contrib Econ Anal 286:177–213

Kopel M, Marini MA (2014) Strategic delegation in consumer cooperatives under mixed oligopoly. J Econ 113:275–296

Kopel M, Pezzino M (2018) Strategic Delegation in Oligopoly. In: Chapter 10 in handbook of game theory and industrial organization, vol 2, pp 248–285

Macho-Stadler I, Verdier T (1991) Strategic managerial incentives and cross ownership structure: a note. J Econ 53(3):285–297

Miettinen T, Stenbacka R (2018) Strategic short-termism: implications for the management and acquisition of customer relationships. J Econ Behav Organ 153:200–222

Pan C (2018) Firms’ timing of production with heterogeneous consumers. Can J Econ 51(4):1339–1362

Pan C (2020) Competition between branded and nonbranded firms and its impact on welfare. South Econ J (forthcoming)

Scrimitore M (2012) Private and social gains in delegation and sequential games with heterogeneous firms. Manch Sch 81:493–517

Scrimitore M (2018) Endogenizing managerial delegation: a new result under Nash bargaining and network effects. Discussion Paper (siecon3-607788), Società Italiana degli Economisti

Sklivas SD (1987) The strategic choice of managerial incentives. Rand J Econ 18:452–458

Spagnolo G (2000) Stock-related compensation and product-market competition. RAND J Econ 31:22–42

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147

Acknowledgements

We are indebted to editor Giacomo Corneo and two anonymous referees for very insightful comments and suggestions. We would like to thank Akifumi Ishihara, Noriaki Matsushima, and the participants at the seminar in Nanzan University, and 2019 Japanese Economic Association Spring Meeting in Musashi University for their valuable discussions and comments. This work was supported by the Japan Society for the Promotion of Science (Grant Nos. 18K12767, 18K01896, 19H01543). Cong Pan received financial support from Nagoya University of Commerce and Business. DongJoon Lee received financial support from Osaka Sangyo University. Needless to say, all remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1:

By maximizing \(O^k_i\) based on the inverse demand function in Eq. (1), manager i’s reaction function as follows:

The existence of a market separation needs to satisfy \(R^{S}(q_{j})+q_j\le 1-a\), which gives rise to

The existence of a market integration needs to satisfy \(R^{I}(q_j)+q_j>1-a\), which gives rise to

For \((1+a)\theta _ic_i/a-2a<q_j\le 1+\theta _ic_i-2a\), the manager i chooses \(R^{S}(q_j)\) if \(O_i^{S}[q_j,R^{S}(q_j)]\ge O_i^{I}[q_j,R^{I}(q_j)]\) from which

Because \((1+a)\theta _ic_i/a-2a<{\bar{q}}_j\le 1+\theta _ic_i-2a\) for any feasible a, \(c_i\) and \(\theta _i\), Firm i chooses \(R^{S}(q_j)\) for \(q_j\le {\bar{q}}_j\). Thus, we obtain the reaction function as in Eq. (6).

1.2 Proof of Lemma 2, 3 and 4:

Substituting \({\varvec{\theta }}^{nnS}\), \({\varvec{\theta }}^{nnI}\), \({\varvec{\theta }}^{dnS}\), \({\varvec{\theta }}^{dnI}\) , \({\varvec{\theta }}^{ddS}\), \({\varvec{\theta }}^{ddI}\) to Eq. (6), we can derive the threshold values of \({\bar{q}}_j\) that define each firm’s discontinuous reaction function. Substituting these incentive rates to Eq. (7), we can obtain firms’ equilibrium quantities. By further substituting the equilibrium quantities to Eq. (2), we can obtain firms’ equilibrium profits. The equilibrium values are summarized in Table 1.

To prove the first part of Lemma 2, we let \(q_1^{nnS}\le {\bar{q}}_1^{nnS}\) (or \(q_2^{nnS}\le {\bar{q}}_2^{nnS}\)), from which we have

Notice that \({\tilde{c}}^{nnS}>0\) if and only if \(a>4/21\), which is part (ii) of Assumption 1.

To prove the second part of Lemma 2, we let \(q_1^{nnI}\ge {\bar{q}}_1^{nnI}\) (or \(q_2^{nnI}\ge {\bar{q}}_2^{nnI}\)), from which we have

To prove the first part of Lemma 3, we let \(q_1^{dnS}\le {\bar{q}}_1^{dnS}\) and \(q_2^{dnS}\le {\bar{q}}_2^{dnS}\), from which we have

Under Assumption 1, the second inequality is a sufficient condition for the first one. To prove the second part of Lemma 3, we let \(q_1^{dnI}\ge {\bar{q}}_1^{dnI}\) and \(q_2^{dnI}\ge {\bar{q}}_2^{dnI}\), from which we have

Under Assumption 1, the second inequality is a sufficient condition for the first one.

To prove the first part of Lemma 4, we let \(q_1^{ddS}\le {\bar{q}}_1^{ddS}\) (or \(q_2^{ddS}\le {\bar{q}}_2^{ddS}\)), from which we have

To prove the second part of Lemma 4, we let \(q_1^{ddI}\ge {\bar{q}}_1^{ddI}\) (or \(q_2^{ddI}\ge {\bar{q}}_2^{ddI}\)), from which we have

1.3 Proof of Proposition 1

Firms’ equilibrium profits are summarized in Table 1. To guarantee the existence of the asymmetric equilibria (case dn), we let \(a>0.734\) (Remark 2). Then, we have \({\tilde{c}}^{nnI}<{\tilde{c}}^{nnS}<{\tilde{c}}^{dnI}<{\tilde{c}}^{dnS}<{\tilde{c}}^{ddI}<{\tilde{c}}^{ddS}\).

dd We only need to compare \(\pi ^{ddk}_2\) and \(\pi ^{dnl}_2\), where \(k,l=S\) or I. Based on two types of market statuses in the nn and dn subgames, we need to consider the following four cases:

-

(1)

If dd then S, and if dn then S ( \(c\ge \max \{{\tilde{c}}^{ddS},{\tilde{c}}^{dnS}\}={\tilde{c}}^{ddS}\)). If this is the case, \(\pi ^{ddS}_2\ge \pi ^{dnS}_2\) always holds. Therefore, dd is the equilibrium outcome.

-

(2)

If dd then S, if dn then I (\({\tilde{c}}^{ddS}\le c\le {\tilde{c}}^{dnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{dnI}<{\tilde{c}}^{ddS}\) always holds. Therefore, dd cannot be the equilibrium outcome.

-

(3)

If dd then I, and if dn then S (\({\tilde{c}}^{dnS}\le c\le {\tilde{c}}^{ddI}\)). If this is the case, \(\pi ^{dnS}_2>\pi ^{ddI}_2\) always holds. Therefore, dd cannot be the equilibrium outcome.

-

(4)

If dd then I, and if dn then I (\(c\le \min \{{\tilde{c}}^{ddI},{\tilde{c}}^{dnI}\}={\tilde{c}}^{dnI}\)). If this is the case, \(\pi ^{ddI}_2>\pi ^{dnI}_2\) always holds. Therefore, dd is the equilibrium outcome.

To summarize, dd is the equilibrium outcome when the inequality in part (i) of Proposition 1 holds.

dn or nd For symmetry, it suffices to consider only the case of dn. We need to compare \(\pi ^{dnk}_1\) and \(\pi ^{nnl}_1\), and \(\pi ^{dnk}_2\) and \(\pi ^{ddl}_2\) where \(k,l=S\) or I. Based on two types of market statuses in the dn, nn and dd subgames, we need to consider the following eight cases:

-

(1)

If dn then S, if nn then S, and if dd then S (\(c\ge \max \{{\tilde{c}}^{dnS},{\tilde{c}}^{nnS},{\tilde{c}}^{ddS}\} ={\tilde{c}}^{ddS}\)). If this is the case, \(\pi ^{ddS}_2>\pi ^{dnS}_2\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(2)

If dn then S, if nn then S, and if dd then I (\(\max \{{\tilde{c}}^{dnS},{\tilde{c}}^{nnS}\}={\tilde{c}}^{dnS}\le c\le {\tilde{c}}^{ddI}\)). If this is the case, \(\pi ^{dnS}_1\ge \pi ^{nnS}_1\), and \(\pi ^{dnS}_2\ge \pi ^{ddI}_2\). Therefore, dn is the equilibrium outcome.

-

(3)

If dn then S, and if nn then I, if dd then S (\(\max \{{\tilde{c}}^{dnS},{\tilde{c}}^{ddS}\}={\tilde{c}}^{ddS}\le c\le {\tilde{c}}^{nnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{nnI}<{\tilde{c}}^{ddS}\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(4)

If dn then S, and if nn then I, if dd then I (\({\tilde{c}}^{dnS}\le c\le \min \{{\tilde{c}}^{nnI},{\tilde{c}}^{ddI}\}={\tilde{c}}^{nnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{nnI}<{\tilde{c}}^{dnS}\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(5)

If dn then I, if nn then I, and if dd then I (\(c\le \min \{{\tilde{c}}^{dnI},{\tilde{c}}^{nnI},{\tilde{c}}^{ddI}\} ={\tilde{c}}^{nnI}\)). If this is the case, \(\pi ^{ddI}_2>\pi ^{dnI}_2\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(6)

If dn then I, if nn then I, and if dd then S (\({\tilde{c}}^{ddS}\le c\le \min \{{\tilde{c}}^{dnI},{\tilde{c}}^{nnI}\}={\tilde{c}}^{nnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{nnI}<{\tilde{c}}^{ddS}\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(7)

If dn then I, if nn then S, and if dd then I (\({\tilde{c}}^{nnS}\le c\le \min \{{\tilde{c}}^{dnI},{\tilde{c}}^{ddI}\}={\tilde{c}}^{dnI}\)). If this is the case, \(\pi ^{ddI}_2>\pi ^{dnI}_2\) always holds. Therefore, dn cannot be the equilibrium outcome.

-

(8)

If dn then I, if nn then S, and if dd then S (\(\max \{{\tilde{c}}^{nnS},{\tilde{c}}^{ddS}\}={\tilde{c}}^{ddS}\le c\le {\tilde{c}}^{dnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{dnI}<{\tilde{c}}^{ddS}\) always holds. Therefore, dn cannot be the equilibrium outcome.

To summarize, dn and nd are the equilibrium outcomes when the inequality in Proposition 1 (ii) holds.

nn We compare \(\pi ^{nnk}_1\) and \(\pi ^{dnl}_1\), where \(k,l=S\) or I. Based on two types of market statuses in the nn and dn subgames, we need to consider the following four cases:

-

(1)

If nn then S, and if dn then S (\(c\ge \max \{{\tilde{c}}^{nnS},{\tilde{c}}^{dnS}\}={\tilde{c}}^{dnS}\)). If this is the case, \(\pi ^{dnS}_1>\pi ^{nnS}_1\) always holds. Therefore, nn cannot be the equilibrium outcome.

-

(2)

If nn then S, and if dn then I (\({\tilde{c}}^{nnS}\le c\le {\tilde{c}}^{dnI}\)). If this is the case, \(\pi ^{nnS}_1\ge \pi ^{dnI}_1\) always holds. Therefore, nn is the outcome.

-

(3)

If nn then I, and if dn then S (\({\tilde{c}}^{dnS}\le c\le {\tilde{c}}^{nnI}\)). However, from Remark 2, we know that \({\tilde{c}}^{nnI}<{\tilde{c}}^{dnS}\) always holds. Therefore, nn cannot be the equilibrium outcome.

-

(4)

If nn then I, and if dn then I (\(c\le \min \{{\tilde{c}}^{nnI},{\tilde{c}}^{dnI}\}={\tilde{c}}^{nnI}\)). If this is the case, \(\pi ^{dnI}_1>\pi ^{nnI}_1\) always holds. Therefore, nn cannot be the equilibrium outcome.

To summarize, nn is the equilibrium outcome when the inequality in Proposition 1 (iii) holds.

1.4 Proof of Lemma 5, Proposition 2 and 3

We first prove Lemma 5. When both firms choose not to delegate, the incentive rates are \(\hat{{\varvec{\theta }}}^{nn}\equiv (1,1)\). When one firm chooses to delegate, the incentive rates are given in Eqs. (18) and (19). When both firms choose to delegate, we substitute \(c_1=c+\varDelta\) an \(c_2=c\) to Eq. (7) and obtain \({\hat{{\varvec{q}}}}^{dd}(\theta _1,\theta _2)\). In Stage 2, firms’ incentive rates are derived as follow:

We substitute \({\hat{{\varvec{\theta}}}}^{nnS}\), \({\hat{{\varvec{\theta}}}}^{nnI}\), \({\hat{{\varvec{\theta}}}}^{dnS}\), \({\hat{{\varvec{\theta}}}}^{dnI}\), \({\hat{{\varvec{\theta}}}}^{ndS}\), \({\hat{{\varvec{\theta}}}}^{ndI}\), \({\hat{{\varvec{\theta}}}}^{ddS}\), \({\hat{{\varvec{\theta}}}}^{ddI}\) to Eq. (6), we can derive the threshold values of \({\bar{q}}_j\) that define each firm’s discontinuous reaction function. Substituting these incentive rates to Eq. (7), we can obtain firms’ equilibrium quantities. By further substituting the equilibrium quantities to Eq. (2), we can obtain firms’ equilibrium profits. The equilibrium values are summarized in Table 2.

We first need the market to separate under dn and nd, from which we have

We also need the market to integrate under dd, from which we have

It is straightforward that \({\hat{c}}^{dnS}<{\hat{c}}^{ndS}\). Moreover, \({\hat{c}}^{ndS}<{\hat{c}}^{ddI}\) if and only if \(a>0.734\) and

It can also be confirmed that for \({\hat{c}}^{dnS}\le c\le {\hat{c}}^{ddI}\), the market always separates under nn.

Because all equilibrium profits in Table 2 are continuous in \(\varDelta\), all our arguments in the case of firms’ identical marginal costs hold for \(\varDelta \rightarrow 0\). Therefore, for sufficiently small \(\varDelta\) and when \({\hat{c}}^{dnS}\le c\le {\hat{c}}^{ddI}\), \({\hat{\pi }}_1^{dnS}>{\hat{\pi }}_1^{nnS}\) and \({\hat{\pi }}_2^{dnS}>{\hat{\pi }}_2^{ddI}\). Moreover, for sufficiently small \(\varDelta\) and when \({\hat{c}}^{ndS}\le c\le {\hat{c}}^{ddI}\), \({\hat{\pi }}_1^{ndS}>{\hat{\pi }}_1^{ddI}\) and \({\hat{\pi }}_2^{ndS}>{\hat{\pi }}_2^{nnS}\). Therefore, we can confirmed that the dn equilibrium presents when \({\hat{c}}^{dnS}\le c\le {\hat{c}}^{ddI}\), and that the nd equilibrium presents when \({\hat{c}}^{ndS}\le c\le {\hat{c}}^{ddI}\).

Proposition 2 follows straightforwardly from Lemma 5. Regarding Proposition 3, by comparing \({\hat{\pi }}^{dnS}_1\) and \({\hat{\pi }}^{dnS}_2\), we can confirm that Firm 1’s profit is larger when \(\varDelta\) is sufficiently small.

Rights and permissions

About this article

Cite this article

Pan, C., Lee, D. & Choi, K. Firms’ strategic delegation with heterogeneous consumers. J Econ 131, 199–221 (2020). https://doi.org/10.1007/s00712-020-00707-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-020-00707-7