Abstract

An arbitrary number of (ex ante symmetric) firms first choose whether to produce a high-quality or a low-quality product and then, the quantity of product to put on the market. We establish the following results: (1) there exists competition within and across quality segments; (2) firms may be better off producing the low quality if competition within this segment is sufficiently low; (3) a firm’s switch across qualities may benefit all the other firms; (4) there exists a unique partition of the firms between the two quality segments; (5) if high quality has a larger cost-quality ratio, then the equilibrium exhibits vertical differentiation; (6) there may be too much differentiation from the consumers’ point of view.

Similar content being viewed by others

Notes

The certification for organic food, for example, may not be granted if the non-organic variety is produced on the same farm, to avoid fraud.

For instance, in the context of asymmetric information with credence attributes, a firm investing in a quality level higher than the minimum (but not high enough to deserve the certification) would have no means to communicate this quality increase to its consumers; see Besley and Ghatak (2007).

An alternative route would have been to stick to price competition and to introduce horizontal differentiation in each quality segment (in the spirit of Häckner 2000).

The first paper considers free entry, more than two qualities and the possibility for firms to produce several qualities; in the second paper, quality and quantity decisions are simultaneous, and quality levels are endogenous; the third paper is closer to ours in that quality choices precede quantity choices but the analysis is restricted to a duopoly.

To see this, suppose that firms 1 and 2 produce the high quality. Their first-order conditions are, respectively, \(2s_{h}q_{h,1}=s_{h}-c_{h}-s_{h}q_{h,2}-s_{h}q_{h,-1,2}-s_{l}Q_{l}\) and \(2s_{h}q_{h,2}=s_{h}-c_{h}-s_{h}q_{h,1}-s_{h}q_{h,-1,2}-s_{l}Q_{l}\), where \(q_{h,-1,2}\) is the total quantity produced by the high-quality producers but firms 1 and 2. Suppose now, by contradiction, that the equilibrium quantities are such that \(q_2=q_1+x\), with \(x \ne 0\). The previous two equations become: \(3s_{h}q_{h,1}=s_{h}-c_{h}-s_{h}x-s_{h}q_{h,-1,2}-s_{l}Q_{l}\) and \(3s_{h}q_{h,1}=s_{h}-c_{h}-2s_{h}x-s_{h}q_{h,-1,2}-s_{l}Q_{l}\), which are clearly incompatible unless \(x=0\).

It cannot be \(n_l=N\) because at least one firm must be producing the high quality.

The assumption \(v_{k}>0\) guarantees that equilibrium quantities are positive when all firms produce quality k.

For a survey of approaches to coalition formation, see Bloch (2002) Before we characterize the equilibrium partition structure, we want to analyze the externalities among firms.

An exception to the unicity property is when \(n_h\) is an integer at \(U(n_h)=0\): in this case, a firm would be indifferent between switching and there would be two equilibria. However, this is a special case that does not invalidate the results. To rule it out, we could set a cut-off rule by which either \(U(n_h)\le 0\) or \(U(n_h-1)\ge 0\) needs to be a strict inequality.

This is a standard result under Cournot competition, which also applies in our setting.

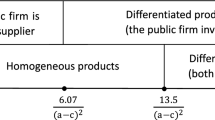

Given that both \(\sigma\) and v are functions of \(s_{h}\) and \(s_{l}\), this simulation is compatible with the following scenario: \(s_{h}=8\), \(s_{l}=2\), \(c_{l}=1\) and \(c_{h}\) ranges from 2.67 to 7.25.

Assuming firms are symmetric.

References

Besley T, Ghatak M (2007) Retailing public goods: the economics of corporate social responsibility. J Public Econ 91(9):1645–1663

Bloch F (2002) Coalition and networks in industrial organization. Manch School 70:36–55

Bonanno G (1986) Vertical differentiation with cournot competition. Econ Notes 15:68–91

Elberfeld W (2003) A note on technology choice, firm heterogeneity and welfare. Int J Ind Organ 2:593–605

Gabszewicz JJ, Thisse JF (1979) Price competition, quality and income disparities. J Econ Theory 20:340–359

Gal-Or E (1983) Quality and quantity competition. Bell J Econ 14:590–600

Gal-Or E (1985) Differentiated industries without entry barriers. J Econ Theory 37:310–339

Gal-Or E (1987) Strategic and non-strategic differentiation. Can J Econ 20:340–356

Häckner J (2000) A note on price and quantity competition in differentiated oligopolies. J Econ Theory 93:233–239

Johnson JP, Myatt DP (2006) Multiproduct Cournot oligopoly. Rand J Econ 13:133–153

Miao Z, Long NV (2017) Multiple-quality Cournot oligopoly and the role of market size. MPRA Paper 82095, University Library of Munich, Germany

Mills DE, Smith W (1996) It pays to be different: endogenous heterogeneity of firms in an oligopoly. Int J Ind Organ 14:317–329

Motta M (1993) Endogenous quality choice: price vs. quantity competition. J Ind Econ 41:113–131

Shaked A, Sutton J (1982) Relaxing price competition through product differentiation. Rev Econ Stud 49:3–13

Turrini A (2000) High-quality bias in vertically differentiated oligopolies: a note on skills. Trade Welf J Econ 71(2):133–147

Acknowledgements

We thank Olivier Bonroy, Estelle Cantillon and Mathieu Parenti for useful comments on an earlier draft.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Own- and cross-competition effect

We first establish that equilibrium profits decrease in the number of firms in any segment. We have:

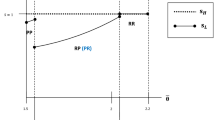

Next, we establish the results regarding the externalities among firms in the first stage of the game. As for the equilibrium profits of firms producing the high quality, we have:

In the low-quality segment, we have:

We compute

We now show that both \(v_{1}\left( n_{h}\right)\) and \(v_{2}\left( n_{h}\right)\) increase in \(n_{h}\). Replacing \(n_{l}\) by \(N-n_{h}\), we have:

both of which are clearly positive.

As a result, \(v_{1}\left( n_{h}\right)\) reaches its smallest value at \(n_{h}=0\) and \(n_{l}=N\), while \(v_{2}\left( n_{h}\right)\) reaches its largest value at \(n_{h}=N-1\) and \(n_{l}=1\); we compute:

which completes the proof (as we consider any switch from the low-quality to the high-quality coalition, which supposes \(1\le n_{l}\le N\)).

1.2 Proof of Proposition 1

Using the definition of \(U\left( n_{h}\right)\), we have that \(U\left( n_{h}\right) \le 0\) if and only if \(\pi _{h}\left( n_{h}+1,n_{l}-1\right) \le \pi _{l}\left( n_{h},n_{l}\right)\), which is equivalent to

Under Assumption (A), all equilibrium quantities are positive; we can thus take the square root on both sides of the inequality. Defining \(\sigma \equiv \sqrt{s_{h}/s_{l}}\), we can then rewrite the previous inequality as

Hence, \(U\left( n_{h}\right) \le 0\) if and only if \(v_{h}/v_{l}\le V\left( n_{h}\right)\). By analogy, \(U\left( n_{h}-1\right) \ge 0\) if and only if \(v_{h}/v_{l}\ge V\left( n_{h}-1\right)\). To establish the existence and unicity of equilibrium, we need thus to prove that \(V\left( n_{h}\right) >V\left( n_{h}-1\right)\), meaning that \(V\left( \cdot \right)\) is an increasing function. It is clear that both \(V_{num}\left( n_{h}\right)\) and \(V_{den}\left( n_{h}\right)\) are positive. The sign of \(V\left( n_{h}\right) -V\left( n_{h}-1\right)\) is thus given by the sign of

A few lines of computations establish that (after substituting \(N-n_{h}\) for \(n_{l}\))

The first three terms on the top line are clearly positive. As for the fourth term on the second line, it is easily seen that it reaches a maximum at \(n_{h}=N/2\). The smallest value is thus obtained for either \(n_{h}=1\) or \(n_{h}=N-1\). Evaluating the fourth term at \(n_{h}=1\) or at \(n_{h}=N-1\), we get

This expression is increasing in \(\sigma\) (its derivative with respect to \(\sigma\) is \(2(N\sigma -1)(N-2)+\sigma ^{2}(N-1)(N+3)+2\sigma [\sigma (N-1)(N+3)-1]\), all terms of which are positive). As, by definition, \(\sigma >1\), this expression is larger than \(\left( N+3\right) \left( N-1\right) +\left( N^{2}-2N-1\right) -2\left( N-2\right) =2N\left( N-1\right) >0\). We have thus proved that \(V\left( n_{h}+1\right) >V\left( n_{h}\right) ,\) which implies that the equilibrium exists and is unique: the function \(V(\cdot )\) partitions the real line in N intervals, corresponding to increasing sizes of the high-quality segment (expressed as increasing values of \(n_h \in {\mathbb {Z}}\)), meaning that the ratio \(v_h/v_l\) must fall in one and only one of these intervals. An exception to the unicity property is when \(n_h\) is an integer at \(U(n_h)=0\) (in which case two equilibria would arise): to rule it out, we could set a cut-off rule by which either \(U(n_h)\le 0\) or \(U(n_h-1)\ge 0\) is a strict inequality.

To complete the proof, let us show that \(V\left( 0\right) >\left( N-1\right) /N\) and \(V\left( N-1\right) <(s_{h}/s_{l})[N/\left( N-1\right) ]\). We have

It follows that

Rights and permissions

About this article

Cite this article

Belleflamme, P., Forlin, V. Endogenous vertical segmentation in a Cournot oligopoly. J Econ 131, 181–195 (2020). https://doi.org/10.1007/s00712-020-00706-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-020-00706-8