Abstract

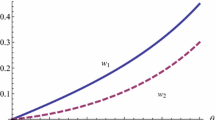

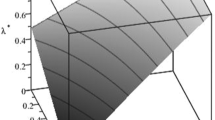

We analyze the effect of downstream competition (or cooperation) in the presence of decentralized bargaining between two downstream firms and an upstream monopolist over a two-part tariff input price. The major findings are as follows: (i) the relationship between the profits of the upstream monopolist (resp. the downstream firms) and the intensity of competition is U-shaped (resp. inverted U-shaped), irrespective of the competition modes in the downstream product market; (ii) if the intensity of competition is sufficiently high, the downstream firms’ profits are higher under Bertrand competition, whereas if the intensity of competition is sufficiently low, the downstream firms’ profits are higher under Cournot competition; and (iii) a market under Cournot competition is more efficient than a market under Bertrand competition, in the sense that both consumer surplus and social welfare are higher in the case of the former.

Similar content being viewed by others

Notes

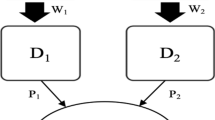

In China, the smartphone market is a competitive market. For example, HUAWEI and XIAOMI are two large smartphone manufacturers that both buy their LCD screens from the BOE Technology Group Co., Ltd. The two smartphone manufacturers are not merely waging a price war—they are also increasing their output and gaining market share (Zhou 2017).

In the existing literature, the effects of competition between downstream rivals have not been considered when the upstream firm is a monopoly. Symeonidis (2008, 2010) analyzed the effects of downstream rivals’ competition where each of the two firms bargains with its respective upstream agent. In reality, there are many upstream monopoly firms providing intermediate products for downstream firms, such as in the chip industry, engine industry, etc. Hence, it is worthwhile to explore the effects of the intensity of downstream competitiveness on the market where the upstream firm is a monopoly.

Ziss (1995) showed that under certain conditions, a downstream merger between duopolists will lead to higher output when upstream suppliers set two-part tariffs. Fershtman and Pakes (2000) showed that the positive effect of collusion on the short-run decision variables of variety and quality more than compensates consumers for the negative effect of collusive prices, so that consumer surplus is larger with collusion.

We would like to thank an anonymous referee for drawing our attention to this issue. Our assumption is different from that of Basak and Mukherjee 2017, who assume that a negative input price is not economically viable. As the per-unit input price is chosen to maximize the joint profits of the upstream and downstream firms, it is reasonable for the upstream firm to subsidize its downstream customers.

It is true that the number of firms is crucial for this type of model because of the intensity of competitiveness. We have also calculated the case of three downstream firms and the basic conclusion of this paper remains valid. However, we only report the equilibrium result for a scenario of two downstream firms in this paper, mainly because the complexity of the analysis increases exponentially with the number of downstream firms.

Escrihuela-Villar (2015) demonstrated the equivalence of the conjectural variations solution and the coefficient of cooperation.

See Symeonidis (2008, p. 261) for more on \( \lambda \in \left[ {0,1} \right] \) and for an explanation of why the unit price decreases and the fixed fee increases in \( \lambda \).

References

Alipranti M, Milliou C, Petrakis E (2014) Price vs. quantity competition in a vertically related market. Econom Lett 124:122–126

Alipranti M, Milliou C, Petrakis E (2015) On vertical relations and the timing of technology adoption. J Econ Behav Organ 120:117–129

Arya A, Mittendorf B, Sappington DE (2008) Outsourcing, vertical integration, and price vs. quantity competition. Int J Ind Organ 26:1–16

Basak D, Mukherjee A (2017) Price vs. quantity competition in a vertically related market revisited. Econom Lett 153:12–14

Basak D, Wang LF (2016) Endogenous choice of price or quantity contract and the implications of two-part-tariff in a vertical structure. Econom Lett 138:53–56

Chen CS (2017) Price discrimination in input markets and quality differentiation. Rev Ind Org 50:367–388

Escrihuela-Villar M (2015) A note on the equivalence of the conjectural variations solution and the coefficient of cooperation. BE J Theor Econ 15:473–480

Fershtman C, Pakes A (2000) A dynamic oligopoly with collusion and price wars. Rand J Econ 31:207–236

Hirose K, Matsumura T (2016) Payoff interdependence and the multi-store paradox. Asia-Pacific J Account Econ 23:256–267

Li Y, Shuai J (2017) Vertical separation with location–price competition. J Econ 121:255–266

Matsumura T, Matsushima N (2012) Competitiveness and stability of collusive behavior. Bull Econ Res 64:s22–s31

Matsumura T, Okamura M (2015) Competition and privatization policies revisited: the payoff interdependence approach. J Econ 116:137–150

Matsumura T, Matsushima N, Cato S (2013) Competitiveness and R&D competition revisited. Econ Model 31:541–547

Miller NH, Pazgal AI (2001) The equivalence of price and quantity competition with delegation. Rand J Econ 32:284–301

Milliou C, Pavlou A (2013) Upstream mergers, downstream competition, and R&D investments. J Econ Manag Strategy 22:787–809

Milliou C, Petrakis E (2007) Upstream horizontal mergers, vertical contracts, and bargaining. Int J Ind Organ 25:963–987

Mukherjee A, Broll U, Mukherjee S (2012) Bertrand versus Cournot competition in a vertical structure: a note. Manch Sch 80:545–559

Pal R (2015) Cournot vs. Bertrand under relative performance delegation: implications of positive and negative network externalities. Math Soc Sci 75:94–101

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. Rand J Econ 15:546–554

Symeonidis G (2008) Downstream competition, bargaining, and welfare. J Econ Manag Strategy 17:247–270

Symeonidis G (2010) Downstream merger and welfare in a bilateral oligopoly. Int J Ind Organ 28:230–243

Vetter H (2017) Pricing and market conduct in a vertical relationship. J Econ 121:239–253

Vives X (1985) On the efficiency of Bertrand and Cournot equilibria with product differentiation. J Econ Theory 36:166–175

Wang X, Li J, Wang L F (2017) Vertical contract and competition intensity in Hotelling’s model. BE J Theoretical Econ. https://doi.org/10.1515/bejte-2017-0048

Zhou ZH (2017) War and peace on the Honor phone. The Financial Times Chinese website, 26 September [Online]. http://www.ftchinese.com/story/001074451?archive. Accessed: 7 October 2018

Ziss S (1995) Vertical separation and horizontal mergers. J Ind Econ 41:63–75

Acknowledgements

We would like to acknowledge financial support from the key project of the National Social Science Foundation of China (17ZDA04), the project of the National Social Science Foundation of China (15BJL087), and the Fundamental Research Funds for the Central Universities (15JNYH001). The authors wish to thank the Editor-in-Chief, Giacomo Corneo, and two anonymous referees for their valuable and constructive comments. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, X., Li, J. Downstream rivals’ competition, bargaining, and welfare. J Econ 131, 61–75 (2020). https://doi.org/10.1007/s00712-018-0644-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-018-0644-y