Abstract

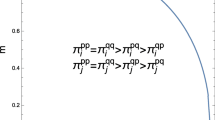

In this paper we endogenize the choice of strategic variables in a mixed duopoly market in which each firm produces a homogeneous product with a strictly increasing convex cost function. This allows us to endogenously determine the type of competition in a mixed duopoly. We get the interesting result that price competition is a dominant strategy for each firm in a mixed duopoly. The firms randomize among the prices belonging to the equilibrium range of price in Bertrand competition. It is different from the outcome in a simple duopoly market where both price competition and quantity competition are pure strategy Nash equilibrium. Thus, this paper establishes that the presence of a public firm influences the kind of competition that takes place in a duopoly market.

Similar content being viewed by others

Notes

‘Ownership is irrelevant’ implies that if the objective of some firm is to maximize profit (as in the case of privately-owned firms) and that of other firms is to maximize social welfare (as in the case of public-sector firms) then in quantity competition in a homogeneous goods market the outcome is the same when all the firms maximize profit.

Haraguchi and Matsumura (2016) also obtain a similar result when goods are substitutes in a mixed oligopoly market.

We impose some further restrictions on the cost function while characterizing the results in Sect. 3.

A mild restriction in the concavity of the demand function or in the convexity of the cost function ensures the negative sign of the second order condition. Therefore, we simply assume it.

We omit the superscript C in the analysis and mention it at the end to denote the case C.

We omit the superscript D here and subsequently in the analysis.

See footnote 6.

References

Bárcena-Ruiz JC (2007) Endogenous timing in a mixed duopoly: price competition. J Econ 91(3):263–272

Chirco A, Colombo C, Scrimitore M (2014) Organizational structure and the choice of price versus quantity in a mixed duopoly. Jpn Econ Rev 65(4):521–542

Corneo G, Jeanne O (1994) Oligopole mixte dans un marche commun. Annales d’Economie et de Statistique 33:73–90

Dastidar KG (1996) Quantity versus price in a homogeneous product duopoly. Bull Econ Res 48(1):83–91

Dastidar KG (2001) Collusive outcomes in price competition. J Econ 73(1):81–93

Dastidar KG, Sinha UB (2011) Price competition in a mixed oligopoly. In: Dastidar MHKG, Sinha UB (eds) Dimensions of economic theory and policy: essays for Anjan Mukherji. Oxford University Press, New Delhi, pp 269–281

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxf Econ Pap 41(2):302–311

De Fraja G, Delbono F (2006) Game theoretic models of mixed oligopoly. J Econ Surv 4(1):1–17

Delbono F, Denicolo V (1993) Regulating innovative activity: the role of a public firm. Int J Ind Organ 11(1):35–48

Din HR, Sun CH (2016) Combining the endogenous choice of timing and competition version in a mixed duopoly. J Econ 118(2):141–166

Fershtman C (1990) The interdependence between ownership status and market structure: the case of privatization. Economica 57(227):319–328

Fjell K, Heywood J (2002) Public Stackelberg leadership in a mixed oligopoly with foreign firms. Aust Econ Pap 41(3):267–281

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29(3):737–743

Han L, Ogawa H (2008) Economic integration and strategic privatization in an international mixed oligopoly. FinanzArchiv Public Finance Anal 64(3):352–363

Haraguchi J, Matsumura T (2014) Price versus quantity in a mixed duopoly with foreign penetration. Res Econ 68(4):338–353

Haraguchi J, Matsumura T (2016) Cournot-bertrand comparison in a mixed oligopoly. J Econ 117(2):117–136

Hoernig SH (2002) Mixed Bertrand equilibria under decreasing returns to scale: an embarrassment of riches. Econ Lett 74(3):359–362

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70(3):473–483

Matsumura T, Matsushima N (2003) Mixed duopoly with product differentiation: sequential choice of location. Aust Econ Pap 42(1):18–34

Matsumura T, Matsushima N (2004) Endogenous cost differentials between public and private enterprises: a mixed duopoly approach. Economica 71(284):671–688

Matsumura T, Ogawa A (2012) Price versus quantity in a mixed duopoly. Econ Lett 116(2):174–177

Matsushima N, Matsumura T (2006) Mixed oligopoly, foreign firms, and location choice. Reg Sci Urban Econ 36(6):753–772

Mujumdar S, Pal D (1998) Effects of indirect taxation in a mixed oligopoly. Econ Lett 58(2):199–204

Myles G (2002) Mixed oligopoly, subsidization and the order of firms’ moves: an irrelevance result for the general case. Econ Bull 12(1):1–6

Nakamura Y (2015) Price versus quantity in a mixed duopoly: the case of relative profit maximization. Econ Model 44:37–43

Nett L (1994) Why private firms are more innovative than public firms. Eur J Polit Econ 10(4):639–653

Ogawa A, Kato K (2006) Price competition in a mixed duopoly. Econ Bull 12(4):1–5

Pal D (1998) Endogenous timing in a mixed oligopoly. Econ Lett 61(2):181–185

Pal D, White M (1998) Mixed oligopoly, privatization, and strategic trade policy. South Econ J 65(2):264–281

Poyago-Theotoky J (2001) Mixed oligopoly, subsidization and the order of firms’ moves: an irrelevance result. Econ Bull 12(3):1–5

Rácz Z, Tasnádi A (2016) A Bertrand–Edgeworth oligopoly with a public firm. J Econ 119(3):253–266

Scrimitore M (2013) Price or quantity? The strategic choice of subsidized firms in a mixed duopoly. Econ Lett 118(2):337–341

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15:546–554

Tomaru Y, Kiyono K (2010) Endogenous timing in mixed duopoly with increasing marginal costs. J Inst Theor Econ 166(4):591–613

White M (1996) Mixed oligopoly, privatization and subsidization. Econ Lett 53(2):189–195

Acknowledgements

I am indebted to Prof. Anjan Mukherji and Prof. Krishnendu Ghosh Dastidar for valuable comments. I would like to express my gratitude to the editor, Prof. Giacomo Corneo and two anonymous referees for giving helpful and detailed comments. I also thank Dr. Debapriya Basu for helpful comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Lemma 1

Suppose \(q_{2}=0\). From Eq. (1) we get, \(f(p_{1})+p_{1}f^{\prime }(p_{1})-c^{\prime }(f(p_{1}))f^{\prime }(p_{1})=0\).

\(p_{1}\) satisfying the Eq. (1) at \(q_{2}=0\) is \(p^{M}\), monopoly price. For \(q_{2}=0\), we get that \(p^{Max}\) satisfies the Eq. (2) i.e. \(f(p^{Max})=0\). We know that \(p^{M}<p^{Max}\). Thus, we get the intercept of the reaction function of firm 1, \(\gamma _{1}(q_{2})=p_{1}\) is less than the intercept of the reaction function of firm 2, \(\gamma _{2}(p_{1})=q_{2}\) at \(q_{2}=0\). Suppose \(p_{1}=0\), Eq. (2) gives us \(f(0)=2q_{2}\). So \( Q^{Max}=2q_{2}~\) at \(~p_{1}=0\). Putting \(p_{1}=0\) and \(q_{2}=\frac{Q^{Max}}{2}~\) in the Eq. (1), we get, \( f(0)-\frac{Q^{Max}}{2}-c^{\prime }(f(0)-\frac{Q^{Max}}{2})f^{\prime }(0)\).

This implies \( \frac{Q^{Max}}{2}-c^{\prime }(\frac{Q^{Max}}{2})f^{\prime }(0)>0~\), since \(~f^{\prime }(0)<0\). For the Eq. (1) to hold at \(q_{2}=\frac{Q^{Max}}{2},~\) we need \(p_{1}>0\) as \(\gamma _{1}^{\prime }(q_{2})<0\). This implies that the reaction function \(~\gamma _{1}(\frac{Q^{Max}}{2})=p_{1}~\) is such that \(p_{1}>0\). But the reaction function of firm 2 at \(q_{2}=\frac{Q^{Max}}{2}~\) is such that \(~\gamma _{2}(0)=\frac{Q^{Max}}{2}\). Therefore, at \((p_{1}=0, q_{2}=\frac{Q^{Max}}{2})\) the reaction function of firm 1 lies above the reaction function of firm 2. The reaction function of firm 1 lies below the reaction function of firm 2 at \(q_{2}=0\) and the reaction function of firm 1 lies above the reaction of firm 2 at \(q_{2}=\frac{Q^{Max}}{2} \). We already know that \(~\gamma _{1}^{\prime }(q_{2})<0,~ \forall q_{2}\ge 0\) and \(\gamma _{2}^{\prime }(p_{1})<0, ~ \forall p_{1}\ge 0\). Therefore, the reaction functions \(~\gamma _{1}(q_{2})=p_{1}\) and \(~\gamma _{2}(p_{1})=q_{2}\) must intersect at a unique point \((p_{1}, q_{2})\) such that \((p_{1}^{A*}, q_{2}^{A*})>0\). \((p_{1}^{A*}, q_{2}^{A*})>0\) maximizes \(\pi _{1}(p^{A}_{1},q_{2}^{A})~\text{ and }~sw_{1}(p^{A}_{1},q_{2}^{A})\), as being a point on the reaction function of each firm. \(\square \)

1.2 Proof of Lemma 2

Suppose \(q_{1}=0\), from Eq. (5), we get, \(p_{2}=c^{\prime }(0)\). From Eq. (6), we get, \(p_{2}=c^{\prime }(f(p_{2}) )\). Thus, we find that the intercept of the reaction function of firm 2 \(\mu _{2}(0)=p_{2}\) lies above the intercept of the reaction function of firm 1. We have already shown that \(\mu ^{\prime }_{1}(p_{2})>0\) and \(\mu ^{\prime }_{2}(q_{1})<0\). Thus, the reaction function of firm 1 \(\mu _{1}(p_{2})=q_{2}\) is going to intersect the reaction function of firm 2 \(\mu _{2}(q_{1})=p_{2}\) at a unique point \((q_{1}^{D*},p_{2}^{D*})>0\). This point lies in both the reaction functions so it maximizes \(\pi _{1}^{D}\) and \(sw_{2}^{D}\). \(\square \)

1.3 Proof of Lemma 3

From Eqs. (1) and (2), we get: \(f(p^{A})-q_{2}+p^{A}f^{\prime }(p^{A})-c^{\prime }(f(p^{A})-q_{2})f^{\prime }(p^{A})=0\), and \(q_{1}^{A}=q_{2}^{A}\), at equilibrium. From Eqs. (3) and (4), we get, \(g(q_{1}+q_{2})+g^{\prime }(q_{1}+q_{2})q_{1}-c^{\prime }(q_{1})=0\), and \(g(q_{1}+q_{2})-c^{\prime }(q_{2})=0\). In equilibrium, the Eq. (3) is \(c^{\prime }(q_{2})+g^{\prime }(q_{1}+q_{2})q_{1}-c^{\prime }(q_{1})=0.\) We insert the equilibrium condition of case A, \(~q_{1}^{A}=q_{2}^{A}~\) in the above equilibrium condition of case C and get, \(g^{\prime }(q_{1}+q_{2})q_{1}=0\), but \(~g^{\prime }(q_{1}+q_{2})q_{1}<0\), for \(q_{1}^{A}>0, q_{2}^{A}>0\). Therefore, the first order condition of firm 1 in case C is negative when we put \(q_{1}=q_{1}^{A}\) and \(q_{2}=q_{2}^{A}\). This implies that at equilibrium, \(q_{1}^{A}>q_{1}^{C}\). Through a similar argument, we can show that \(q_{2}^{A}<q_{2}^{C}\).

In case C, we get \(p=c^{\prime }(q_{2}^{C})\) from Eq. (4). Inserting the above condition in Eq. (1), we get \(f(p^{C})-q_{2}^{A}+f^{\prime }(p)[c^{\prime }(q_{2}^{C})-c^{\prime }(f(p)-q_{2})]=0\). This implies \( f(p^{C})-q_{2}^{A}=0\), since \(c^{\prime }(q_{2}^{C})=c^{\prime }(f(p)-q_{2})\) at equilibrium in case A. But \(q_{1}^{A}>0\). Therefore, Eq. (1) is \(f(p^{C})-q_{2}^{A}>0\), so \(~p=p^{C}~\) is not optimal. \(~p^{A}>p^{C}\) since Eq. (1) is positive at \(p^{C}\). \(\square \)

1.4 Proof of Lemma 4

Suppose \( [c^{\prime }(q_{1}^{A})-\dfrac{c(q_{1}^{A})}{q_{1}^{A}}]q_{1}^{A}-[c^{\prime }(q_{1}^{C})-\dfrac{c(q_{1}^{C})}{q_{1}^{C}}]q_{1}^{C}>0\).

From Eq. (1), we get \(p^{A}_{1}=c^{\prime }(q_{1}^{A})-\frac{q_{1}^{A}}{f^{\prime }(p^{A}_{1})}\). From Eq. (3), we get \(g(q_{1}^{C}+q_{2}^{C})+g^{\prime }(q_{1}^{C}+q_{2}^{C})q_{1}^{C}-c^{\prime }(q_{1}^{C})=0\). Substituting for \(p^{A}\) and \(g(q_{1}^{C}+q_{2}^{C})\) in Eq. (7), we get,

\([c^{\prime }(q_{1}^{A})-\frac{q_{1}^{A}}{f^{\prime }(p^{A}_{1})}]q_{1}^{A}-c(q_{1}^{A})-[c^{\prime }(q_{1}^{C})-g^{\prime }(q_{1}^{C}+q_{2}^{C})q_{1}^{C}]q_{1}^{C}+c(q_{1}^{C})\). We know \(g^{\prime }()=\frac{1}{f^{\prime }()}\), since \(g(Q)=p\) and \(f(p)=Q\). This implies \( [c^{\prime }(q_{1}^{A})-\frac{q_{1}^{A}}{f^{\prime }(p^{A}_{1})}]q_{1}^{A}-c(q_{1}^{A})-[c^{\prime }(q_{1}^{C})-\frac{q_{1}^{C}}{f^{\prime }(p^{C})}]q_{1}^{C}+c(q_{1}^{C})\). We know \(q_{1}^{A}>q_{1}^{C}\) and \(p^{A}>p^{C}, \text{ implying }~ f^{\prime }(p^{A})<f^{\prime }(p^{C})\), since f() is a downward sloping concave function.

This implies \( -\dfrac{(q_{2}^{A})^{2}}{f^{\prime }(p^{A})}+\dfrac{(q_{1}^{C})^{2}}{f^{\prime }(p^{C})}>0\) that gives us \(\pi _{1}^{A}-\pi _{1}^{C}>0\), since \( [c^{\prime }(q_{1}^{A})-\dfrac{c(q_{1}^{A})}{q_{1}^{A}}]q_{1}^{A}-[c^{\prime }(q_{1}^{C})-\dfrac{c(q_{1}^{C})}{q_{1}^{C}}]q_{1}^{C}>0\). \(\square \)

1.5 Proof of Lemma 5

From Eq. 4, we have \(g(q_{1}^{C}+q_{2}^{C})-c^{\prime }(q_{2}^{C})=0\). This implies \( c^{\prime -1}(p)=q_{2}^{C}\).

From Eq. (3), we have \(g(q_{1}^{C}+q_{2}^{C})+g^{\prime }(q_{1}^{C}+q_{2}^{C})q_{1}^{C}=c^{\prime }(q_{1}^{C})\) resulting \( q_{1}^{C}=c^{\prime -1}(p+ g^{\prime }(q_{1}^{C}+q_{2}^{C})q_{1}^{C})\). So \( Q^{C}=q_{1}^{C}+q_{2}^{C}=c^{\prime -1}(p+ g^{\prime }(q_{1}^{C}+q_{2}^{C})q_{1}^{C})+ c^{\prime -1}(p)\).

From Eq. (5), \(p=c^{\prime }(q_{1}^{D})\). This implies \( c^{\prime -1}(p)=q_{1}^{D}\). From Eq. (6),

\(f^{\prime }(p)p-c^{\prime }(f(p)-q_{1}^{D})f^{\prime }(p)=0\) leads to \( p-c^{\prime }(q_{2}^{D})=0\). So \( q_{2}^{D}=c^{\prime -1}(p)\).

Comparing Eqs. (8) and (9), we get, \(c^{\prime -1}(p+g^{\prime }()q_{1}^{C})+c^{\prime -1}(p)<~2c^{\prime -1}(p)\).

\( g^{\prime }()q_{1}^{C}<0~\), because g() is a downward sloping concave function and c() is strictly convex increasing function. \(f^{C}(p)<f^{D}(p)\). \(p^{D}<p^{C}\), since f(p) is a downward sloping concave function. \(\square \)

1.6 Proof of Lemma 6

Suppose \(sw_{2}^{D}-sw_{2}^{C}>0\). This implies

\( \left[ \displaystyle {\int }_{p^{D}}^{p^{Max}}f(x)dx+p^{D}q_{1}^{D}-c(q_{1}^{D})+p^{D}\left[ f(p^{D})-q_{1}^{D}\right] -c(f(p^{D})-q_{1}^{D})\right] -\left[ \displaystyle {\int }_{0}^{Q_{C}}g(x)dx-c(q_{1}^{C})-c(q_{2}^{C})\right] >0\). So \( \displaystyle {\int }_{p^{D}}^{p^{Max}}f(x)dx -c(q_{1}^{D})+p^{D}f(p^{D})-c(f(p^{D})-q_{1}^{D})+\int _{p^{C}}^{p^{Max}}f(x)dx-p^{C}\left[ q_{1}^{C}+q_{2}^{C}\right] +c(q_{1}^{C})+c(q_{2}^{C})>0\). From Lemma 5, we know that \(p^{C}>p^{D}\) and from Lemma 2\(q_{1}^{D}=q_{2}^{D}\), so we get, \(\displaystyle {\int }_{p^{D}}^{p^{C}}f(x)dx + p^{D}f(p^{D})-p^{C}[q_{1}^{C}+q_{2}^{C}]-2c(q_{1}^{D})+c(q_{1}^{C})+c(q_{2}^{C})>0\).

This implies \( \displaystyle {\int }_{Q^{C}}^{Q^{D}}g(x)dx-2c(q_{1}^{D})+c(q_{1}^{C})+c(q_{2}^{C})>0\).

The sufficiency aspect is obvious. \(\square \)

1.7 Proof of Lemma 8

We know that \(\bar{p}\) is such that \(\dfrac{c(f(p)-c(\frac{f(p)}{2})}{\frac{f(p)}{2}}\ge p\). From Lemma 2, we get \(p^{D}_{2}=c^{\prime }(\frac{f(p^{D}_{2})}{2})\). From the convexity of the cost function we get,

\(\dfrac{c(f(p_{2}^{D})-c(\frac{f(p_{2}^{D})}{2}))}{\frac{f(p_{2}^{D})}{2}}>c^{\prime }(\frac{f(p_{2}^{D})}{2})\). Thus, \(p^{D}_{2}<\bar{p}\). The other part is obvious since at \(\underline{p}\), \(\hat{\pi _{1}}(\underline{p})_=-c(0)\). But \(\pi _{1}^{D}>0\), so \(\underline{p}<p_{2}^{D}\). \(\square \)

1.8 Proof of Lemma 9

Suppose \(p^{A}\le \bar{p}\) and suppose \(\dfrac{c(f(p^{A}))-c(\frac{f(p^{A})}{2}))}{\frac{f(p^{A})}{2}}<c^{\prime }(\frac{f(p^{A})}{2})-\dfrac{(q_{1}^{A})^{2}}{f^{\prime }(p^{A})}\).

This implies \(\dfrac{c(f(p^{A}))-c(\frac{f(p^{A})}{2}))}{\frac{f(p^{A})}{2}}<p^{A}\), because from Eq. (1), at equilibrium, we get \(p^{A}=c^{\prime }(\frac{f(p^{A})}{2})-\dfrac{(q_{1}^{A})^{2}}{f^{\prime }(p^{A})}\). This implies \( c(f(p^{A}))-c(\frac{f(p^{A})}{2})<p^{A}\dfrac{f(p^{A})}{2}.\)\( p^{A}\dfrac{f(p^{A})}{2}-c(\frac{f(p^{A})}{2})<p^{A}f(p^{A})-c(f(p^{A}))\). So \( p^{A}>\bar{p}\), from the results on price competition in a mixed duopoly. This results in a contradiction. Therefore,

The sufficiency aspect is obvious from the convexity of the cost function. \(\square \)

1.9 Proof of Lemma 10

\(P_{2}\) lies in [0, 1] because \( \hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})>0 \) and \(\hat{\pi }_{1}(p^{D})>0\). \( \hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})>0 \) is true because \(p^{A} > p^{D}\) and \(p^{A} , p^{D} \in [\underline{p},\bar{p}]\) where \( ~\hat{\pi }_{1}(p)>\pi _{1}(p)~\forall p\in [\underline{p},\bar{p}]\) and \(\hat{\pi }_{1}'(p)>0,\forall p<p^{m}\). \(\hat{\pi }_{1}(p^{D})>0\) because \(p^{D}=c'(\frac{f(p^{D})}{2}) \) and from the strict convexity of cost function, we have \(c'(\frac{f(p)}{2})>\dfrac{c(\frac{f(p)}{2})}{\frac{f(p)}{2}}\).

We need to show that \(0<P_{1}<1\). Using convexity of cost function it is easy to show that \(\hat{sw}(p)>sw(p)\), \(\forall p>0\). This implies \( \hat{sw}(p^{D})-sw(p^{D})+\hat{sw}(p^{A})-sw(p^{A})>0\). For \(\hat{sw}(p^{A})-sw(p^{D})>0\) we need the condition \( c(Q^{A})- \displaystyle {\int }_{Q^{A}}^{Q^{D}}g(x)dx -2c(\frac{Q^{A}}{2})>0\). Suppose \(\hat{sw}(p^{A})-sw(p^{D})>0\). It implies \( \displaystyle {\int }_{p^{A}}^{p^{Max}}f(x)dx+p^{A}f(p^{A})-2c(\frac{f(p^{A})}{2})-\int _{p^{D}}^{p^{Max}}f(x)dx -p^{D}f(p^{D})+c(f(p^{D}))>0.\) Thus, \(c(Q^{D})-\int _{Q^{A}}^{Q^{D}}g(x)dx-2c(\frac{Q_{A}}{2})>0\). This is both a necessary and a sufficient condition. We assume that \( c(Q^{A})- \displaystyle {\int }_{Q^{A}}^{Q^{D}}g(x)dx -2c(\frac{Q^{A}}{2})>0\) is true. So \(P_{1}\) lies in (0, 1). \(\square \)

1.10 Proof of Proposition 11

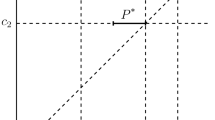

Suppose firm 1 chooses price and randomizes between \(p^{A}\) and \(p^{D}\) with the probability of setting \(p^{D}\) as \(P_{1}=\dfrac{\hat{sw}(p^{A})-sw(p^{D})}{\hat{sw}(p^{D})-sw(p^{D})+\hat{sw}(p^{A})-sw(p^{A})}\). It is not optimal for firm 2 to choose quantity in stage one. If firm 2 chooses quantity then the pay-off of firm 2 is \(sw(p^{A})\times P_{1}+(1-P_{1})\times \hat{sw}(p^{A})\) and \(sw(p^{A})\times P_{1}+(1-P_{1})\times \hat{sw}(p^{A})<Exp(\hat{sw}(P_{1},P_{2}))\). So firm 2 should switch to price in stage one. Therefore, the possibility of case A is ruled out.

Suppose firm 2 chooses price and randomizes between \(p^{A}\) and \(p^{D}\) with the probability of setting \(p^{D}\) as \(P_{2}=\dfrac{\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}{\hat{\pi }_{1}(p^{D})+\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}\). If firm 1 chooses quantity then its pay-off is \(P_{2}\times \hat{\pi }(p^{D})+(1-P_{2})\times \pi _{1}(p^{D})\) and it is less than \(Exp(\hat{\pi }_{1}(P_{1},P_{2})\). So firm 1 should switch to price in stage one. Therefore, the possibility of case D is ruled out.

Suppose firm 1 randomizes between price \(p^{A}\) and \(p^{D}\), and firm 2 randomizes between \(p^{D}\) and \(p^{*}\), \(p^{*}<p^{A}\). The expected pay-off of firm 2 from \(p^{*}\) is \(sw(p^{*})\times P_{1}+(1-P_{1})\times sw(p^{*})\) when firm 1 randomizes between \(p^{D}\) and \(p^{A}\). \(sw(p^{*})\times P_{1}+(1-P_{1})\times sw(p^{*}) < \hat{sw}(p^{A})\times P_{1}+(1-P_{1})\times sw(p^{A})\), since \(\hat{sw}(p)>sw(p), \forall p \in [\underline{p},\bar{p}]\). sw(p) is maximized at \(p^{S}=c'(f(p^{S}))\) and \(p^{S}>p^{A}\) from the convexity of the cost function. Thus, there is no tendency for firm 2 to undercut the price at \(p^{A}\). Firm 2 has no tendency to undercut the price at \(p^{D}\) because \(\hat{sw}(p)=\displaystyle {\int }_{p}^{p^{Max}}f(x)dx +pf(p)-2c(\frac{f(p)}{2})\) is maximized at \(p=p^{D}\). Thus, when firm 1 randomizes between \(p^{A}\) and \(p^{D}\), the optimal strategy of firm 2 is to randomize between the same prices with the probability of setting \(p^{D}\) price as \(P_{2}= \dfrac{\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}{\hat{\pi }_{1}(p^{D})+\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}\).

\(\hat{\pi }_{1}(p)>\pi _{1}(p), \forall ~p\in [\underline{p},\bar{p})\) and \(\hat{\pi }_{1}(p)=\pi _{1}(p)\) at \(p=\bar{p}\). So there is no tendency for firm 1 to undercut at \(p^{D}\) and \(p^{A}\) when firm 2 randomizes between \(p^{A}\) and \(p^{D}\).

Thus, \(\{P_{1},P_{2}\}\) such that \(P_{1}=\dfrac{\hat{sw}(p^{A})-sw(p^{D})}{\hat{sw}(p^{D})-sw(p^{D})+\hat{sw}(p^{A})-sw(p^{A})}\),

\(P_{2}=\dfrac{\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}{\hat{\pi }_{1}(p^{D})+\hat{\pi }_{1}(p^{A})-\pi _{1}(p^{D})}~\) is a non-degenerate asymmetric mixed strategy Nash equilibrium where firm 1 and firm 2 randomize between the prices \(p^{A}\) and \(p^{B}\). \(\square \)

Rights and permissions

About this article

Cite this article

Mahanta, A. Endogenous strategic variable in a mixed duopoly. J Econ 128, 47–65 (2019). https://doi.org/10.1007/s00712-018-0641-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-018-0641-1