Abstract

This paper extends two recent models of duopoly with a joint capacity constraint (Nie and Chen in Econ Model 29:1715–1721, 2012; Nie in J Econ 112(3):283–294, 2014) by relaxing their crucial assumption that the game has an equilibrium which is unique and interior. Instead, this paper tackles a more basic issue on when their assumption applies. Our investigation is undertaken by using the best-response curve analysis. Both standard duopoly and mixed duopoly are considered, and both simultaneous moves and sequential moves are investigated. We find that their assumption applies only when the constraint is sufficiently weak, otherwise the equilibrium is either non-unique or corner.

Similar content being viewed by others

Notes

The literature on oligopolies is vast. For excellent coverages of topics studied in the early literature, one may consult Shapiro (1989) and Vives (1999). Issues related to existence and uniqueness of equilibrium have been extensively investigated. The recent paper by Ewerhart (2014) provides unified conditions applicable to these issues. They are certainly applicable to the linear model setup in the present paper. A classical study of the duopoly model that is most relevant to the present paper is Dixit (1979). Recent relevant studies include Nie and Chen (2012) and references cited therein.

The literature on mixed oligopolies is sizable and covers a large number of topics, including most topics studied for standard oligopolies (equilibrium existence, merger, entry and exit, R&D, etc.) plus other specific topics such as the optimal level of privatization for a public firm. A classical study of mixed duopoly is Merrill and Schneider (1966). De Fraja and Delbono (1989) provided a survey of the early literature. Recent studies include Nie and Chen (2012), Matsumura and Ogawa (2012), Tao et al. (2013), Haraguchi and Matsumura (2016), Rácz and Tasnádi (2016), and references cited therein.

For general \(\theta _1\) and \(\theta _2\), the constraint (4) becomes \(\frac{q_1 }{\theta _1 }+\frac{q_2 }{\theta _2 }\le R\). All results are qualitatively the same as those given in the text with only straightforward changes needed. For example, all corner solutions are determined by the above more general constraint, and whenever the constraint is binding the solution must satisfy the above constraint (including those in Figs. 1 and 2).

We note that the recent paper by Rácz and Tasnádi (2016) has provided a study of a mixed homogenous good oligopoly in which firms engage in Bertrand price competition in the presence of firm-level capacity constraints.

The rules for the simultaneous-move quantity game parallel those of the well-known Divide-the-Dollar (DD) game. In the DD game, two players simultaneously make their demands to divide a dollar; each player receives his or her demand if the sum of the demands does not exceed one, and zero if otherwise. (See Brams and Taylor 1994 for a study of the DD game.) In our Cournot game with a joint capacity constraint, the two firms simultaneously make their demands for the common input; each receives its demand if the sum of their demands does not exceed the constraint, and zero if otherwise. For any generalized Nash equilibrium problem (or pseudo game) such as the DD game or our Cournot game with a joint capacity constraint, outside help by a non-player is needed to implement the rules. In the Arrow–Debreu abstract economy (a pseudo-game), this non-player has been modelled as an auctioneer who steers prices to the equilibrium levels. In the DD game or the game being studied here, another decision maker (who is a non-player) must be involved for implementation.

We will further assume that \(c_1 <\frac{a+c_2 }{2}\) so as to ensure that both firms produce a positive output in the unrestricted Cournot–Nash equilibrium.

In our context of a duopoly with a joint capacity constraint, a generalized Nash equilibrium is a pair of quantity choices satisfying the joint constraint such that no firm can increase its own profit by a unilateral move. Obviously, the Nash equilibrium solution in Proposition 1 satisfies the above definition, since the joint constraint is satisfied and no firm has an incentive to change its quantity choice unilaterally given the joint constraint.

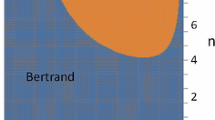

The intuition behind the multiple equilibria under the resource constraint is interesting. Without resource constraint the standard Cournot equilibrium is illustrated by the intersections between the two firms’ response curves. With the resource constraint, when the constraint becomes tight enough, equilibria are also determined by the intersections between the two firms’ restrictive response curves, which are affected by the feasibility condition, i.e., \(q_1 +q_2 \le R\). When R is sufficiently small, the restricted response curves become kinked, partly coinciding with the constraint curve, and finally completely coinciding with the constraint curve as R becomes sufficiently small. The multiple equilibria arise when R is small enough, which makes the constraint binding and hence become the relevant segment in each of the two firm’s restrictive response curve. As the constraint is common and hence symmetric to both firms, the common constraint gives rise to the multiple equilibria. This intuition may also help explain that the main result as given in Proposition 1 should hold if the demand functions are nonlinear, because the multiple equilibria under the tight constraint are on the relevant segment of the constraint, and not on each firm’s unrestricted response curve.

Under the assumption that \(c_1 <\frac{a+c_2 }{2}\) (see footnote 9) both firms produce a positive output in the unrestricted Stackelberg equilibrium.

An example of well-behaved best response curves is when the demand and cost functions satisfy the conditions given in Vives (1999, Section 4.2) that characterize a smooth Cournot game guaranteeing a unique and stable Nash equilibrium in pure strategies.

Actually, there is another solution for z given by \(z=\frac{2-\sqrt{4-2\left( {1-\in } \right) ^{2}}}{4}\). However, this solution is excluded from consideration since the corresponding quantity \({\bar{Q}} \) is smaller than the solution to (14), which would lead to a positive quantity response by the follower firm 2.

For the special case of \(R={\bar{Q}} \), there is another equilibrium in which firm 1 chooses \({\bar{Q}} \) and firm 1 chooses 0, yielding the same level of profit for firm 1 as in the unrestricted Stackelberg equilibrium.

References

Brams S, Taylor A (1994) Divide the dollar: three solutions and extensions. Theor Decis 37(2):211–231

Chen Y, Wan J-Y, Wang C (2015) Agricultural subsidy with capacity constraints and demand elasticity. Agric Econ 61(1):39–49

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxford Econ Pap 41:302–311

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10:20–32

Ewerhart C (2014) Cournot games with biconcave demand. Games Econ Behav 85:37–47

Facchinei F, Kanzow C (2010) Generalized Nash equilibrium problems. Ann Oper Res 175:177–211

Haraguchi J, Matsumura T (2016) Cournot–Bertrand comparison in a mixed oligopoly. J Econ 117:117–136

Hsu J, Wang XH (2005) On welfare under Cournot and Bertrand competition in differentiated oligopolies. Rev Ind Organ 27:185–191

Liu L, Wang XH, Yang B (2012) Strategic choice of channel structure in an oligopoly. Manag Decis Econ 33(7–8):565–574

Matsumura T, Ogawa A (2012) Price versus quantity in a mixed duopoly. Econ Lett 116:174–177

Merrill W, Schneider N (1966) Government firms in oligopoly industries: a short run analysis. Q J Econ 80:400–412

Nie P (2014) Effects of capacity constraints on mixed duopoly. J Econ 112(3):283–294

Nie P, Chen Y (2012) Duopoly competitions with capacity-constrained input. Econ Model 29:1715–1721

Rácz Z, Tasnádi A (2016) A Bertrand–Edgeworth oligopoly with a public firm. J Econ 119:253–266

Shapiro C (1989) Theories of oligopoly behavior. In: Schmalensee R, Willig R (eds) Chapter 6 in handbook of industrial organization, vol 1. Elsevier Science, Amsterdam

Tao A, Zhu Y, Zou, X (2013) Welfare comparison of leader-follower models in a mixed duopoly. J Appl Math 2013, Article ID 320712, 1–7

Vives X (1999) Oligopoly pricing: old ideas and new tools. MIT Press, Cambridge

Wang XH, Yang B (2010) The sunk-cost effect and optimal two-part pricing. J Econ 101(2):133–148

Acknowledgements

We wish to thank two anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

Without any input constraint, firm i’s best responses in quantity is given by (6). Therefore, part (i) of the lemma holds if the joint capacity constraint is never binding. To see this, we check that \(\frac{a-c_i -q_j }{2}+q_j =\frac{a-c_i +q_j }{2}<R\) if \(q_j <a-c_i\) and \(R\ge a-c_i \).

For part (ii) of the lemma, we note that the first line of (7) is obvious. What remains to be shown is that the joint capacity constraint is binding if \(2R-\left( {a-c_i } \right)<q_j <R\). Indeed, \(\frac{a-c_i -q_j }{2}+q_j =\frac{a-c_i +q_j }{2}>R\) if \(2R-\left( {a-c_i } \right) <q_j \). It follows that firm i’s unconstrained optimal choice of \(\frac{a-c_i -q_j }{2}\) is not feasible when \(q_j >2R-\left( {a-c_i } \right) \), but is feasible when \(q_j \le 2R-\left( {a-c_i } \right) \).

Part (iii) follows easily from part (ii) by noting that when \(R\le \left( {a-c_i } \right) /2\), \(2R-\left( {a-c_i } \right) \le 0\), implying that the third line of (7) is vacuous. \(\square \)

Proof of Proposition 1

Results in this proposition are easily obtained by combining the firms’ best-response curves presented in Lemma 1.

If \(R\ge a-c_2 \) then, by part (i) of Lemma 1, both firms’ best-response curves are the same as in the standard model without an input constraint. Therefore, the equilibrium is the same, which is given by (9). If \(\frac{2a-c_1 -c_2 }{3}\le R<a-c_2 \), at least firm 2’s best-response curve will be affected by the joint capacity constraint. However, the outputs in (9) are still on both firms’ best response curves and moreover the two curves intersect only at this point. This proves part (i) of the proposition.

If \(R<\frac{2a-c_1 -c_2 }{3}\), the two firms’ best-response curves always overlap. From Lemma 1, the part of the line \(q_1 +q_2 =R\) that lies in between the standard (unrestricted) best-response curves for the two firms is now always part of both firms’ best-response curves. In fact, the points in this line segment are the only overlap points of the two best-response curves. They represent all of the Cournot–Nash equilibrium points. Depending on the level of R, we have the remaining three parts of the proposition. In part (ii), R is less restrictive so that the above line segment lies entirely inside the first quadrant. The ranges for \(q_1\) and \(q_2\) in (10) are found by finding the intersection points between the line \(q_1 +q_2 =R\) and the two firms’ unrestricted best-response lines. In part (iii), R is more restrictive so that one end of the line segment is on the vertical axis. This case is given by (11). Finally in part (iv), R is most restrictive. In this case, the line segment reaches both axes. This case is given by (12). \(\square \)

Proof of Proposition 2

We first prove that \({\bar{Q}}\) defined by (14) is greater than the total quantity in the unrestricted Stackelberg equilibrium, i.e., \({\bar{Q}} >q_1^S +q_2^S \), where \(q_1^S\) and \(q_2^S\) are given in (13).

Substituting (13) into (14), we have

Denote \(z=\frac{{\bar{Q}} }{a-c_1 }\) and \(\varepsilon =\frac{c_1 -c_2 }{a-c_1 }\). Note that assumptions about the parameters in the main text imply that \(0\le \varepsilon <1\). The above equation can be rewritten as

Solving this equation for z gives \(z=\frac{2+\sqrt{4-2\left( {1-\varepsilon } \right) ^{2}}}{4}\).Footnote 15 It follows that

Applying this and (13), we have

Since \(4-2\left( {1-\varepsilon } \right) ^{2}-\left( {1+\varepsilon } \right) ^{2}=\left( {1+3\varepsilon } \right) \left( {1-\varepsilon } \right) >0\), the last term above is positive, implying that \({\bar{Q}} >q_1^S +q_2^S \).

Now consider part (i) of Proposition 2. If \(R\ge {\bar{Q}} \) then the unrestricted Stackelberg equilibrium point \(\left( {q_1^S ,q_2^S } \right) \) is below the joint capacity constraint (4) since \({\bar{Q}} >q_1^S +q_2^S \). It follows that the unrestricted Stackelberg equilibrium is still feasible under the joint capacity constraint (4). Moreover, the leader firm 1’s iso-profit curve passing the unrestricted Stackelberg equilibrium point lies entirely below the joint capacity constraint. This is because (a) every point on the decreasing portion of firm 1’s inverted U-shaped iso-profit curve (given by the equation \(\left( {a-c_1 -q_1 -q_2 } \right) q_1 =\left( {a-c_1 -{\bar{Q}} } \right) {\bar{Q}} )\) has a slope between 0 and \(-1\), implying that firm 1’s iso-profit curve is always flatter than the joint capacity constraint (which has a constant slope of \(-1\)); and (b) the intersection point of firm 1’s iso-profit curve with the \(q_1\)-axis \(\left( {{\bar{Q}} ,0}\right) \) lies on or below the joint capacity constraint. Hence, in the case of \(R\ge {\bar{Q}} \), firm 1 has no incentive to raise its output (to \({\bar{Q}}\)) to drive firm 2 out of the market.

The facts established above together imply that in the case of \(R\ge {\bar{Q}} \) the Stackelberg equilibrium under the joint capacity constraint (4) is the same as the unrestricted Stackelberg equilibrium.Footnote 16

Consider next part (ii) of Proposition 2. If \(R<{\bar{Q}} \) then firm 1’s iso-profit curve passing the unrestricted Stackelberg equilibrium point always crosses the joint capacity constraint from below. The same argument about comparing slopes presented above easily establishes that firm 1’s best output choice is equal to R, resulting in an output of zero for the follower firm 2. \(\square \)

Proof of Proposition 3

If \(R>a-c_1 \) then firm 1’s best-response curve is the same as in the standard model without a joint constraint, while firm 2’s best-response curve is at most affected on the segment for \(q_1 >R\) which does not affect its intersection point with firm 1’s best-response curve. Hence, the equilibrium is the same as in the unrestricted equilibrium, which is given by (18). This proves part (i) of the proposition.

If \(\left( {a-c_2 } \right) /2<R\le a-c_1 \), the two firms’ best-response curves always overlap. From (17), the while line segment of \(q_1 +q_2 =R\) between the two axes is part of firm 1’s best-response curve. The line segment of \(q_1 +q_2 =R\) between the \(q_1 \) axis and the intersection point between \(q_1 +q_2 =R\) and firm 2’s unrestricted best-response curve is part of firm 2’s best-response curve. These overlapped points represent all of the Nash equilibrium points, as given by (19). This proves part (ii) of the proposition.

Finally, for \(R\le \left( {a-c_2 } \right) /2\), the whole line segment of \(q_1 +q_2 =R\) between the two axes represents the intersection points of both firms’ response curves, resulting in multiple Nash equilibria as given by (20). This proves part (iii) of the proposition. \(\square \)

Rights and permissions

About this article

Cite this article

Tao, A., Wang, X.H. & Yang, B.Z. Duopoly models with a joint capacity constraint. J Econ 125, 159–172 (2018). https://doi.org/10.1007/s00712-018-0597-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-018-0597-1