Abstract

We analyze firms’ location choices in a Hotelling model with two-dimensional consumer heterogeneity, along addresses and transport cost parameters (flexibility). Firms can price discriminate based on perfect data on consumer addresses and (possibly) imperfect data on consumer flexibility. We show that firms’ location choices depend on how strongly consumers differ in flexibility. Precisely, when consumers are relatively homogeneous, equilibrium locations are socially optimal regardless of the quality of customer flexibility data. However, when consumers are relatively differentiated, firms make socially optimal location choices only when customer flexibility data becomes perfect. These results are driven by the optimal strategy of a firm on its turf, monopolization or market-sharing, which in turn depends on consumer heterogeneity in flexibility. Our analysis is motivated by the availability of customer data, which allows firms to practice third-degree price discrimination based on both consumer characteristics relevant in spatial competition, addresses and transport cost parameters.

Similar content being viewed by others

Notes

Jeff Berry, senior director of Knowledge Development and Application at LoyaltyOne Inc., global provider of loyalty solutions in different industries including retailing, said that “For most organizations today, the loyalty program actually becomes the core of the ability to capture consumer data...” (Linkhorn 2013).

Electronic Privacy Information Center (EPIC), public interest research group with a focus on privacy protection, notes that “Online tracking is no longer limited to the installation of the traditional “cookies” that record websites a user visits. Now, new tools can track in real time the data people are accessing or browsing on a web page and combine that with data about that user’s location, income, hobbies, and even medical problems. These new tools include flash cookies and beacons. Flash cookies can be used to re-install cookies that a user has deleted, and beacons can track everything a user does on a web page including what the user types and where the mouse is being moved.” (“Online Tracking and Behavioral Profiling” at http://epic.org/privacy/consumer/online_tracking_and_behavioral.html).

The term “flexibility” captures the intuition that depending on whether transport costs are high or low, consumers are less or more likely to buy from the farther firm, respectively. Consumers with high (low) transport costs can be referred to as less (more) flexible.

According to the forecasts of a mobile advertiser eMarketer, mobile advertising expenditures will overcome print advertising and will account for 20 % of total advertising spendings in the UK in 2015 (see eMarketer 2015).

For instance, mobile advertising companies, such as Factual and YP Marketing Solutions, design personalized advertisements based on the physical locations of consumers and other types of customer data (see https://www.factual.com/products/geopulse-audience; http://national.yp.com/, respectively).

CEO of Safeway Inc., second-largest supermarket chain in the U.S., Steve Burd, said that “There’s going to come a point where our shelf pricing is pretty irrelevant because we can be so personalized in what we offer people.”Ross (2013). Similarly, the spokesman of Rosetta Stone, which sells software for computer-based language learning said that “We are increasingly focused on segmentation and targeting. Every customer is different.” (Valentino-Devries, 2012).

EPIC notes that “Advertisers are no longer limited to buying an ad on a targeted website because they instead pay companies to follow people around on the internet wherever they go. Companies then use this information to decide what credit-card offers or product pricing to show people, potentially leading to price discrimination.” (“Online Tracking and Behavioral Profiling” at http://epic.org/privacy/consumer/online_tracking_and_behavioral.html).

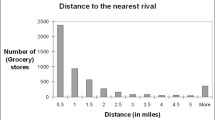

In electronic commerce there is evidence of both discrimination based on consumer locations and flexibility. Mikians (2012) find that some sellers returned different prices to consumers depending on whether a consumer accessed a seller’s website directly or through price aggregators and discount sites (like nextag.com). Those price differences can be explained through differences in price sensitivity (flexibility) of the two types of consumers. Consumers accessing a seller’s website through price aggregators are likely to be more price-sensitive. Similarly, vice president of corporate affairs at Orbitz Worldwide Inc., which operates a website for travel booking, said that “Many hotels have proven willing to provide discounts for mobile sites” Valentino-Devries et al. (2012). The latter can also be explained as price discrimination based on consumer flexibility since smartphone users can be considered as more price-sensitive due to the availability of different mobile applications, which collect special offers depending on a user’s location. The evidence of price discrimination based on consumer locations is provided in Valentino-Devries et al. (2012) who find the strongest correlation between the differences in online prices and the distance to a rival’s store from the center of a ZIP Code of a buyer.

To mention just one of many examples, Waitrose, a British supermarket chain, used services of data analytics company BeyondAnalysis to analyze data on their customers’ Visa card transactions to decide on new store locations (see Ferguson 2013).

This is a standard assumption in Hotelling-type models, where firms can practice perfect discrimination based on consumer addresses, and allows to avoid relying on \(\varepsilon \)-equilibrium concepts (see Lederer and Hurter 1986).

Note that if in the second stage simultaneously with their pricing decisions both firms were deciding whether to acquire flexibility data of an exogenously given quality k, both of them would do that in equilibrium. Following the argument of Liu and Serfes (2007), we can say that by refraining from data acquisition a firm cannot influence the decision of the rival to acquire customer data and only decreases its degrees of freedom in pricing. In the Section “Extensions” we endogenize firms’ decisions to acquire customer flexibility data and consider a different timing, where firms make their location choices after the decision to hold flexibility data.

Note that \(\lim _{k\rightarrow \infty }\overline{t}^{m}(k)=0\), such that when firms can perfectly discriminate based on consumer flexibility, every firm serves in equilibrium all consumers on its turf.

All the derivations of the formulas presented in this section are provided in the Appendix A.

To be more precise, in our case the equilibrium location of a firm minimizes directly the total distance travelled by consumers. In LH the equilibrium location of a firm minimizes directly social transport costs (if production costs are zero). This difference is related to the fact that in our model firms do not know the transport cost parameter of an individual consumer unless \(k\rightarrow \infty \). Then in equilibrium in the version with relatively homogeneous consumers every consumer pays a price equal to the difference in the distances between the consumer and the two firms multiplied by the transport cost parameter of the most flexible consumer on the segment to which consumer belongs, and not consumer’s own transport cost parameter. However, this difference between LH and our model does not change the main result that with relatively homogeneous consumers firms make socially optimal location choices.

LH analyze firms’ location choices in a two-dimensional market region. LH show that in that case equilibrium locations do not necessarily minimize social (transport) costs globally. However, this is always the case in our model (in a version with relatively homogeneous consumers), where firms choose locations on a unit-length Hotelling line over which consumers are distributed uniformly.

Note that \(\int \nolimits _{0}^{1}\max \left\{ D_{A}\left( d_{A};x\right) ,D_{B}\left( d_{B};x\right) \right\} dx=d_{A}-1/2-\left( d_{A}+d_{B}\right) ^{2}/4\). It is straightforward to show that the values \(d_{A}=d_{B}=1/2\) solve the following constrained optimization problem: \(\max _{d_{A},d_{B}} \left[ d_{A}-1/2-\left( d_{A}+d_{B}\right) ^{2}/4\right] \), s.t. \( d_{A}-d_{B}\le 0\), \(-d_{A}\le 0\) and \(d_{B}\le 1\).

In AP the monopolization outcome is not possible, because regardless of the difference in firms’ prices on a given address, some consumers choose the other firm than the majority of consumers. In contrast, in our model one firm gains all consumers on a given address and flexibility segment if firms’ prices there are very different.

This result depends on the assumption of the uniform distribution of consumer transport cost parameters on each location. For example, if there were two large consumer groups with relatively high and low transport cost parameters, it could be optimal for a firm to serve only the former group on its turf, while the latter would switch to the rival. In that case every firm could serve in equilibrium more loyal consumers of the rival than the own loyal consumers.

We are grateful to the two anonymous referees for proposing these extensions.

We follow the literature and assume that in the case of asymmetric information (where one firm has more (accurate) data than the other), firms move sequentially. Precisely, the firm with less (accurate) data moves first and the other firm follows. This assumption can be justified by the observation that prices (discounts) designed for finer consumer groups can be changed easier than prices targeted at larger consumer groups. Moreover, under simultaneous moves a Nash equilibrium may not exist. For articles, which use the same assumption see, for instance, Thisse and Vives (1988), Shaffer and Zhang (1995) Shaffer and Zhang (2002) and Liu and Serfes (2004) Liu and Serfes (2005).

To concentrate on the most important results, in Proposition 2 we omit the equilibrium prices and the allocation of consumers among the firms for any given location choices \(d_{A}\) and \(d_{B}\), which can be found in the proof of Proposition 2 in the online Appendix B, which is available at the webpage of the journal together with the online version of the paper.

As is shown in the Proof of Proposition 2 in the online Appendix B, in the case \( n\,{\ge }\log _{2}\left( \left( l-1\right) /\left( l-3/2\right) \right) \) on its own turf firm B charges the price \(p_{B}(d_{A},d_{B};x,n)\,{=}\,\left( \underline{t}+\left( \overline{t}-\underline{t}\right) /2^{n}\right) \left( \left| d_{A}-x\right| -\left| d_{B}-x\right| \right) \).

We provide the proof of Proposition 3 in the online Appendix B, which is available at the webpage of the journal together with the online version of the paper.

Pitney Bowes Software, a company which provides among others Location Intelligence, mentions in one of its reports that “(t)o identify a profitable store location, acquiring customer and target market data is essential” (see Deakin University Australia Worldly and Pitney Bowes Software 2012).

We provide the proof of Proposition 4 in the online Appendix B, which is available at the webpage of the journal together with the online version of the paper.

To calculate the former we used the equilibrium values \({\small d}_{{\small A }}^{{\small d,As}}\left( {\small n}\right) \) and \({\small d}_{{\small B}}^{ {\small d,As}}\left( {\small n}\right) \) from case (i) of Proposition 3. To calculate the latter we used the equilibrium values \( d_{A}^{d}\left( k\right) \) and \(d_{B}^{d}\left( k\right) \) from Proposition 1 and evaluated them at \(k=0\).

Quite a similar result applies to the sum of firms’ locations.

On the other intervals one should proceed in a similar way.

References

Anderson SP, de Palma A (1988) Spatial price discrimination with heterogeneous products. Rev Econ Stud 55:573–592

Deakin University Australia Worldly and Pitney Bowes Software (2012) New location perspectives in retail: in the zone. Retail White Paper http://www.pitneybowes.com.au/docs/Australia/PBS%20Retail%20Part%202-New%20Location%20Perspectives%202013_print.pdf

eMarketer (2015) Mobile Ad spending to overtake print in the UK. http://www.emarketer.com/Article/Mobile-Ad-Spending-Overtake-Print-UK/1013043. 30 Sept 2015

Ferguson D (2013) How supermarkets get your data- and what they do with it. The Guardian. http://www.theguardian.com/money/2013/jun/08/supermarkets-get-your-data. Accessed date 8 June 2013

Hamilton JH, Thisse J-F (1992) Duopoly with spatial and quantity-dependent price discrimination. Region Sci Urban Econ 22:175–185

Irmen A, Thisse J-F (1998) Competition in multi-characteristic spaces: hotelling was almost right. J Econ Theory 78:76–102

Jentzsch N, Sapi G, Suleymanova I (2013) Targeted pricing and customer data sharing among rivals. Int J Ind Organ 31:131–144

Lederer PJ, Hurter AP (1986) Competition of firms: discriminatory pricing and location. Econometrica 54:623–640

Linkhorn T (2013) Retailers use variety of ways to track consumer habits through loyalty programs: the blade. http://www.toledoblade.com/Retail/2013/08/11/Retailers-use-variety-of-ways-to-track-consumer-habits-through-loyalty-programs.html. 11 Aug 2013

Liu Q, Serfes K (2004) Quality of information and oligopolistic price discrimination. J Econ Manag Strateg 13:671–702

Liu Q, Serfes K (2005) Imperfect price discrimination in a vertical differentiation model. Int J Ind Organ 23:341–354

Liu Q, Serfes K (2007) Market segmentation and collusive behavior. Int J Ind Organ 25:355–378

Mikians J, Gyarmati L, Erramilli V, Laoutaris N (2012) Detecting price and search discrimination on the internet. Hotnets’ 12, Seattle, WA. http://conferences.sigcomm.org/hotnets/2012/papers/hotnets12-final94.pdf. 29–30 Oct 2012

Ross B. (2013) Canned Goods–not Canned Prices With Personalized Pricing. How Grocers Can Implement a Personalized Pricing Strategy in Four Steps. Canadian Grocer, July 24, 2013. http://www.canadiangrocer.com/blog/canned-goods-not-canned-prices-29513

Sapi G, Suleymanova I (2013) Consumer flexibility. Data quality and targeted pricing, DICE Discussion paper no 117

Shaffer G, Zhang ZJ (1995) Competitive coupon targeting. Market Sci 14:395–416

Shaffer G, Zhang ZJ (2002) Competitive one-to-one promotions. Manage Sci 48:1143–1160

Tabuchi T (1994) Two-stage two-dimensional spatial competition between two firms. Region Sci Urban Econ 24:207–227

Thisse J-F, Vives X (1988) On the strategic choice of spatial price policy. Am Econ Rev 78:122–137

Valentino-Devries J, Singer-Vine J, Soltani A (2012) Websites vary prices, deals based on users’ information. The Wall Street Journal. http://online.wsj.com/news/articles/SB10001424127887323777204578189391813881534. 24 Dec 2012

Valletti TM (2002) Location choice and price discrimination in a duopoly. Region Sci Urban Econ 32:339–358

Winterman D (2013) Tesco: how one supermarket came to dominate. BBC news magazine. http://www.bbc.co.uk/news/magazine-23988795. 9 Sept 2013

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank the Editor, the two anonymous reviewers, Gerhard Riener, Alexander Rasch and the participants of the 41st Annual Conference of the EARIE (Milan, 2014) for very valuable comments.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix A

Appendix A

In Appendix A we first provide the derivations of the formulas stated in the Section “Equilibrium Analysis” and then we present the proofs of the Lemmas and Propositions omitted in the text (excluding those from the Section “Extensions,” which are presented in the online Appendix B).

Derivations of the formulas. When consumers are relatively homogeneous, in equilibrium every firm charges on any address on its turf the highest price, which allows to monopolize a given flexibility segment. This price is proportional to the difference in the distances between the consumer and each of the firms. Following Lederer and Hurter (1986, in the following: LH) and using the results of Lemma 2 we can state the equilibrium prices of firm \(i=\left\{ A,B\right\} \) as

where \(D_{i}\left( d_{i};x\right) :=\left| x-d_{i}\right| \). Then the equilibrium profit of firm i for given locations \(d_{i}\) and \(d_{j}\) can be expressed as

where \(i\ne j\) and \(j=\left\{ A,B\right\} \). Similar to Lemma 4 in LH we can rewrite \(\Pi _{i}^{h}(d_{A},d_{B};k)\) as

Second-best locations solve the optimization problem

which is equivalent to the problem

Consider now the case of relatively differentiated consumers. As shown in Lemma 1, given any locations every firm serves on its own turf the more loyal consumers and the less loyal consumers on the rival’s turf. In a similar way as above, following LH and using the results of Lemma 1 we can state the equilibrium prices of firm \(i=\left\{ A,B\right\} \) as

Then the profit of firm i for given locations \(d_{i}\) and \(d_{j}\) can be expressed as

Similar to Lemma 4 in LH we can rewrite \(\Pi _{i}^{d}(d_{A},d_{B};k)\) as

Hence, when firm i chooses location \(d_{i}\), its optimization problem is equivalent to

where \(\alpha \left( k\right) =2/\left[ 9\times 2^{k}\left( 2^{k}-1\right) +8 \right] \).

Second-best locations minimize the transport costs

where \(\beta (k)=1/\left[ 9\times 2^{2k}\right] \).

We now derive the formulas necessary for the comparison of Anderson and de Palma (1988, in the following: AP) and the version of our model with relatively differentiated consumers. In that case the equilibrium prices on segment \(m=1\) (with relatively differentiated consumers) can be derived from Proposition 1 in AP. Consider, for example, the interval \(x\le d_{A}\).Footnote 28 We need to set \( c_{A}=c_{B}=0\) and replace \(F_{1}\) with the demand of firm A on segment \( m=1\):

In AP (in the logit model) equilibrium locations depend on parameter \(\mu \ge 0\), which is interpreted as a measure of consumer/product heterogeneity. In our case it makes sense to define \(\mu \) as \(\mu _{1}\left( k\right) :=\overline{t}\left( d_{B}-d_{A}\right) /2^{k}\). Then from (8) we get that \(\left| \partial d_{i1}\left( \cdot \right) /\partial p_{j1}\left( x\right) \right| =1/\mu _{1}\left( k\right) \) (\(i,j=\left\{ A,B\right\} \)), such that with an increase in \( \mu _{1}\left( k\right) \) firms’ prices become less important in determining their demands. Parameter \(\mu _{1}\left( k\right) \) is inversely related to the quality of customer flexibility data. If \(k=0\), then for any x, \(\mu _{1}\left( k\right) \) gets its highest value of \(\mu _{1}\left( 0\right) = \overline{t}\left( d_{B}-d_{A}\right) \).

Proof of Lemma 1

As firms are symmetric, we will derive equilibrium on the two intervals on the turf of firm A.

-

(i)

Interval 1: \(x\le d_{A}\). Consider some \( x\le d_{A}\) and some m. The transport cost parameter of the indifferent consumer is

$$\begin{aligned}&\widetilde{t}\left( \left. d_{A},d_{B},p_{Am}(x),p_{Bm}(x);x\right| x\le d_{A}\right) :=\tfrac{p_{A}(x)-p_{B}(x)}{d_{B}-d_{A}}, \quad \text {provided}\nonumber \\&\quad \widetilde{t}(\cdot )\in \left[ \underline{t}^{m}(k),\overline{t}^{m}(k) \right] , \end{aligned}$$(9)such that consumers with \(t\ge \widetilde{t}(\cdot )\) buy at firm A. Consider first \(m=1\). Maximization of firms’ expected profits yields the best-response functions

$$\begin{aligned}&p_{A1}\left( \left. d_{A},d_{B},p_{B1}(x);x,k\right| x\le d_{A}\right) \nonumber \\&\quad =\left\{ \begin{array}{lll} \tfrac{\overline{t}^{1}(k)\left( d_{B}-d_{A}\right) +p_{B1}(x)}{2} &{} \text {if } &{} p_{B1}(x)<\overline{t}^{1}(k)\left( d_{B}-d_{A}\right) \\ p_{B1}(x) &{} \text {if} &{} p_{B1}(x)\ge \overline{t}^{1}(k)\left( d_{B}-d_{A}\right) \end{array} \right. \end{aligned}$$(10)and

$$\begin{aligned} p_{B1}\left( \left. d_{A},d_{B},p_{A1}(x);x,k\right| x\le d_{A}\right) = \end{aligned}$$$$\begin{aligned} \left\{ \begin{array}{lll} \tfrac{p_{A1}(x)}{2} &{} \text {if} &{} p_{A1}(x)\le 2\overline{t}^{1}(k)\left( d_{B}-d_{A}\right) \\ p_{A1}(x)-\overline{t}^{1}(k)\left( d_{B}-d_{A}\right) &{} \text {if} &{} p_{A1}(x)>2\overline{t}^{1}(k)\left( d_{B}-d_{A}\right) . \end{array} \right. \end{aligned}$$(11)Given the best-response functions (10) and (11) we conclude that two types of equilibria are possible, where either firm A monopolizes segment m or where both firms serve consumers. Only the latter equilibrium exists where firms charge prices \( p_{A1}^{d}(d_{A},d_{B};x,k)=2\overline{t}\left( d_{B}-d_{A}\right) /\left( 3\times 2^{k}\right) \) and \(p_{B1}^{d}(d_{A},d_{B};x,k)=\overline{t}\left( d_{B}-d_{A}\right) /\left( 3\times 2^{k}\right) \). Firm A serves consumers with \(t\ge \overline{t}^{1}(k)/3\). Consider now segments \(m\ge 2\), where the best-response function of firm A is

$$\begin{aligned} p_{Am}(\left. d_{A},d_{B},p_{Bm}(x);x,k\right| x\le d_{A})=p_{Bm}(x)+ \underline{t}^{m}(k)\left( d_{B}-d_{A}\right) . \end{aligned}$$(12)As \(\overline{t}^{m}(k)-2\underline{t}^{m}(k)\le 0\) for any \(m\ge 2\), there is no \(p_{Bm}(x)\ge 0\) under which it is optimal for firm A to share the market with firm B. (12) yields \( p_{Bm}^{d}(d_{A},d_{B};x,k)=0\). Indeed, assume that in equilibrium \( p_{Bm}^{d}(d_{A},d_{B};x,k)>0\) holds. Firm B gets in equilibrium the profit of zero, because (12) implies that firm B serves no consumers. But firm B can increase its profit through slightly decreasing its price. Hence, \(p_{Bm}^{d}(d_{A},d_{B};x,k)=0\) must hold. Firm A charges the price \(p_{Am}^{d}(d_{A},d_{B};x,k)=\underline{t} ^{m}(k)\left( d_{B}-d_{A}\right) \) and serves all consumers on segment m on address x. On the interval \(x\le d_{A}\) firms realize profits

$$\begin{aligned} \Pi _{A}\left( \left. d_{A},d_{B};k\right| x\le d_{A}\right)= & {} \int \limits _{0}^{d_{A}}f_{t}\left( \left( \tfrac{2\overline{t}}{3\times 2^{k}} \right) ^{2}\left( d_{B}-d_{A}\right) +\tfrac{\overline{t}\left( d_{B}-d_{A}\right) }{2^{k}}\sum \limits _{2}^{2^{k}}\underline{t} ^{m}(k)\right) dx \\= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) d_{A}\left( 9\times 2^{2k}-9\times 2^{k}+8\right) }{9\times 2^{2k+1}} \end{aligned}$$and

$$\begin{aligned} \Pi _{B}(\left. d_{A},d_{B};k\right| x\le d_{A})=\tfrac{\overline{t} \left( d_{B}-d_{A}\right) d_{A}}{9\times 2^{2k}}. \end{aligned}$$Using symmetry we conclude on firms’ profits on the interval \(x\ge d_{B}\):

$$\begin{aligned} \Pi _{A}(\left. d_{A},d_{B};k\right| x\ge & {} d_{B})=\tfrac{\overline{t} \left( d_{B}-d_{A}\right) \left( 1-d_{B}\right) }{9\times 2^{2k}}\text { and} \\ \Pi _{B}(\left. d_{A},d_{B};k\right| x\ge & {} d_{B})=\tfrac{\overline{t} \left( d_{B}-d_{A}\right) \left( 1-d_{B}\right) \left( 9\times 2^{2k}-9\times 2^{k}+8\right) }{9\times 2^{2k+1}} \end{aligned}$$ -

(ii)

Interval 2: \(d_{A}<x\le \left( d_{A}+d_{B}\right) /2\). Consider some \(d_{A}<x\le \left( d_{A}+d_{B}\right) /2\) and segment m. The transport cost parameter of the indifferent consumer is

$$\begin{aligned} \widetilde{t}\left( \left. d_{A},d_{B},p_{Am}(x),p_{Bm}(x);x\right| d_{A}<x\le \tfrac{d_{A}+d_{B}}{2}\right) :=\tfrac{p_{A}(x)-p_{B}(x)}{ d_{A}+d_{B}-2x}, \end{aligned}$$provided \(\widetilde{t}(\cdot )\in \left[ \underline{t}^{m}(k),\overline{t} ^{m}(k)\right] \). Firm A serves consumers with \(t\ge \widetilde{t}(\cdot )\). Consider first \(m=1\). Maximization of firms’ profits yields the best-response functions

$$\begin{aligned} p_{A1}\left( \left. d_{A},d_{B},p_{B1}(x);x,k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right) = \end{aligned}$$$$\begin{aligned} \left\{ \begin{array}{lll} \frac{\overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) +p_{B1}(x)}{2} &{} \text { if} &{} p_{B1}(x)<\overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) \\ p_{B1}(x) &{} \text {if} &{} p_{B1}(x)\ge \overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) \end{array} \right. \end{aligned}$$(13)and

$$\begin{aligned} p_{B1}\left( \left. d_{A},d_{B},p_{A1}(x);x,k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right) = \end{aligned}$$$$\begin{aligned} \left\{ \begin{array}{lll} \frac{p_{A1}(x)}{2} &{} \text {if} &{} p_{A1}(x)\le 2\overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) \\ p_{A1}(x)-\overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) &{} \text {if} &{} p_{A1}(x)>2\overline{t}^{1}(k)\left( d_{A}+d_{B}-2x\right) . \end{array} \right. \end{aligned}$$(14)Given the best-response functions (13) and (14) we conclude that two types of equilibria are possible where either firm A serves all consumers on segment m or shares it with the rival. Only the latter equilibrium exists, where firms charge prices

$$\begin{aligned} p_{A1}^{d}(d_{A},d_{B};x,k)= & {} 2\overline{t}\left( d_{A}+d_{B}-2x\right) /\left( 3\times 2^{k}\right) \text { and} \\ p_{B1}^{d}(d_{A},d_{B};x,k)= & {} \overline{t}\left( d_{A}+d_{B}-2x\right) /\left( 3\times 2^{k}\right) . \end{aligned}$$On \(m=1\) firm A serves consumers with \(t\ge \overline{t}/\left( 3\times 2^{k}\right) \). We now consider \(m\ge 2\), where the best-response function of firm A takes the form

$$\begin{aligned}&p_{Am}\left( \left. d_{A},d_{B},p_{Bm}(x);x,k\right| d_{A}<x\le \frac{ d_{A}+d_{B}}{2}\right) \\&\quad =p_{Bm}(x,k)+\underline{t}^{m}(k)\left( d_{A}+d_{B}-2x\right) , \end{aligned}$$such that firm A never finds it optimal to share segment m with firm B. Applying the logic described in part (i) of the proof, we conclude that \(p_{Bm}^{d}(d_{A},d_{B};x,k)=0\) and \(p_{Am}^{d}(d_{A},d_{B};x,k)= \underline{t}^{m}(k)\left( d_{A}+d_{B}-2x\right) \). Firm A serves all consumers on any segment \(m\ge 2\) on address x. On the interval \(d_{A}<x\le \left( d_{A}+d_{B}\right) /2\) firms realize profits

$$\begin{aligned}&\Pi _{A}\left( \left. d_{A},d_{B};k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right) \\&\quad =\int \limits _{d_{A}}^{\frac{d_{A}+d_{B}}{2}}f_{t}\left[ \left( \tfrac{2 \overline{t}}{3\times 2^{k}}\right) ^{2}\left( d_{A}+d_{B}-2x\right) +\tfrac{ \overline{t}\left( d_{A}+d_{B}-2x\right) }{2^{k}}\sum \limits _{2}^{2^{k}} \underline{t}^{m}(k)\right] dx \\&\quad =\tfrac{\overline{t}\left( d_{B}-d_{A}\right) ^{2}\left( 9\times 2^{2k}-9\times 2^{k}+8\right) }{9\times 2^{2k+3}}\text { and } \end{aligned}$$$$\begin{aligned} \Pi _{B}\left( \left. d_{A},d_{B};k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right) =\tfrac{\overline{t}\left( d_{B}-d_{A}\right) ^{2}}{ 9\times 2^{2k+2}}. \end{aligned}$$Using symmetry, we can conclude on firms’ profits on the interval \(\left( d_{A}+d_{B}\right) /2<x\le d_{B}\):

$$\begin{aligned} \Pi _{A}\left( \left. d_{A},d_{B};k\right| \tfrac{d_{A}+d_{B}}{2}<x\le d_{B}\right)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) ^{2}}{9\times 2^{2k+2}}\text { and} \\ \Pi _{B}\left( \left. d_{A},d_{B};k\right| \tfrac{d_{A}+d_{B}}{2}<x\le d_{B}\right)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) ^{2}\left( 9\times 2^{2k}-9\times 2^{k}+8\right) }{9\times 2^{2k+3}}. \end{aligned}$$Summing up firms’ profits on all the four intervals we get

$$\begin{aligned} \Pi _{A}^{d}(d_{A},d_{B};k)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) \left( 9\times 2^{k}\left( 2^{k}-1\right) (3d_{A}+d_{B})+2\left( 11d_{A}+d_{B}\right) +8\right) }{9\times 2^{2k+3}}\text { and } \\ \Pi _{B}^{d}(d_{A},d_{B};k)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) \left( 32-9\times 2^{k}(2^{k}-1)\left( 3d_{B}+d_{A}-4\right) -2\left( 11d_{B}+d_{A}\right) \right) }{9\times 2^{2k+3}}. \end{aligned}$$

\(\square \)

Proof of Lemma 2

As firms are symmetric, we will only derive equilibrium on the two intervals on the turf of firm A and then conclude on the equilibrium on the turf of firm B.

-

(i)

Interval 1: \(x\le d_{A}\). Consider some \( x\le d_{A}\) and some \(m\ge 1\). The transport cost parameter of the indifferent consumer is

$$\begin{aligned}&\widetilde{t}\left( \left. d_{A},d_{B},p_{Am}(x),p_{Bm}(x);x\right| x\le d_{A}\right) :=\tfrac{p_{A}(x)-p_{B}(x)}{d_{B}-d_{A}}, \quad \text {provided}\\&\quad \widetilde{t}(\cdot )\in \left[ \underline{t}^{m}(k),\overline{t}^{m}(k) \right] . \end{aligned}$$The best-response function of firm A is

$$\begin{aligned} p_{Am}(\left. d_{A},d_{B},p_{Bm}(x);x,k\right| x\le d_{A})=p_{Bm}(x)+ \underline{t}^{m}(k)\left( d_{B}-d_{A}\right) , \end{aligned}$$(15)such that for any price of the rival firm A monopolizes segment m on address x. As \(\overline{t}^{m}(k)-2\underline{t}^{m}(k)\le 0\) for any \( m\ge 2\), there is no \(p_{Bm}(x)\ge 0\) under which it is optimal for firm A to share the market with firm B. (15) yields \(p_{Bm}^{h}(d_{A},d_{B};x,k)=0\). Indeed, assume that in equilibrium \( p_{Bm}^{h}(d_{A},d_{B};x,k)>0\) holds. Firm B gets in equilibrium the profit of zero, because (15) implies that firm B serves no consumers. But firm B can increase its profit through slightly decreasing its price. Hence, \(p_{Bm}^{h}(d_{A},d_{B};x,k)=0\) must hold. Firm A charges the price \(p_{Am}^{h}(d_{A},d_{B};x,k)=\underline{t} ^{m}(k)\left( d_{B}-d_{A}\right) \) and serves all consumers on segment m on address x. Hence, \(\Pi _{B}(\left. d_{A},d_{B};k\right| x\le d_{A})=0\) and the profit of firm A is computed as

$$\begin{aligned} \Pi _{A}\left( \left. d_{A},d_{B};k\right| x\le d_{A}\right) =\sum \limits _{1}^{2^{k}}\underline{t}^{m}(k)\int \limits _{0}^{d_{A}}\left( \tfrac{\left( d_{B}-d_{A}\right) }{2^{k}}\right) dx=\tfrac{d_{A}\left( d_{B}-d_{A}\right) \left( \overline{t}\left( 2^{k}-1\right) +\underline{t} \left( 2^{k}+1\right) \right) }{2^{k+1}}. \end{aligned}$$(16) -

(ii)

Interval 2: \(d_{A}<x\le \left( d_{A}+d_{B}\right) /2\). Consider some \(d_{A}<x\le \left( d_{A}+d_{B}\right) /2\) and some \(m\ge 1\). The transport cost parameter of the indifferent consumer is

$$\begin{aligned} \widetilde{t}\left( \left. d_{A},d_{B},p_{Am}(x),p_{Bm}(x);x\right| d_{A}<x\le \tfrac{d_{A}+d_{B}}{2}\right) :=\tfrac{p_{A}(x)-p_{B}(x)}{ d_{A}+d_{B}-2x}, \end{aligned}$$provided \(\widetilde{t}(\cdot )\in \left[ \underline{t}^{m}(k),\overline{t} ^{m}(k)\right] \). Firm A serves consumers with \(t\ge \widetilde{t}(\cdot ) \). The best-response function of firm A is

$$\begin{aligned}&p_{Am}\left( \left. d_{A},d_{B},p_{Bm}(x);x,k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right) \nonumber \\&\quad =p_{Bm}(x)+\underline{t}^{m}(k)\left( d_{A}+d_{B}-2x\right) . \end{aligned}$$Following the logic applied in part (i) of the proof we conclude that

$$\begin{aligned} p_{Bm}^{h}(x,k)= & {} 0\text { and} \\ p_{Am}^{h}(d_{A},d_{B};x,k)= & {} \underline{t}^{m}(k)\left( d_{A}+d_{B}-2x\right) . \end{aligned}$$Hence, \(\Pi _{B}(\left. d_{A},d_{B};k\right| d_{A}<x\le \left( d_{A}+d_{B}\right) /2)=0\) and the profit of firm A is computed as

$$\begin{aligned} \Pi _{A}\left( \left. d_{A},d_{B};k\right| d_{A}<x\le \tfrac{ d_{A}+d_{B}}{2}\right)= & {} \sum \limits _{1}^{2^{k}}\underline{t}^{m}(k)\int \limits _{d_{A}}^{\left( d_{A}+d_{B}\right) /2}\left( \tfrac{d_{A}+d_{B}-2x}{ 2^{k}}\right) dx \nonumber \\= & {} \tfrac{\left( d_{B}-d_{A}\right) ^{2}\left( \overline{t}\left( 2^{k}-1\right) +\underline{t}\left( 2^{k}+1\right) \right) }{2^{k+3}}. \end{aligned}$$(17)Summing up the profits (16) and (17) we get the profits of firm A as stated in the lemma. The profits of firm B are derived using symmetry.

\(\square \)

Proof of Lemma 3

We first derive first-best locations and prices. We will proceed in two steps. We will first derive first-best prices for any given locations and then will find first-best locations. Assume that firms are located at \(d_{A}\le d_{B}\). Social welfare is maximized when every consumer buys from the closer firm. Prices, which yield such a distribution of consumers between the firms are \(p_{im}^{FB}\left( x\right) ,p_{jm}^{FB}\left( x\right) \ge 0\) such that

Given (18), the first-best locations, \(d_{A}^{FB}\) and \( d_{B}^{FB}\), have to minimize the transport costs

which yields the locations \(d_{A}^{FB}=1/4\) and \(d_{B}^{FB}=3/4\). Note that SOCs are fulfilled.

We now turn to the second-best locations. Here we have to distinguish between the cases of relatively homogeneous and differentiated consumers, because for any locations firms charge different prices in equilibrium depending on the case. We start with the case of relatively homogeneous consumers. Note that the equilibrium prices stated in Lemma 2 satisfy (18). Indeed, in equilibrium every consumer buys from the closer firm. Then second-best locations should also minimize (19 ), which yields \(d_{A}^{SB,h}=1/4\) and \(d_{B}^{SB,h}=3/4\).

We now consider the case of relatively differentiated consumers. According to Lemma 1, on its own turf each firm serves consumers with \(t\ge \overline{ t}/\left( 3\times 2^{k}\right) \), while consumers with \(t<\overline{t} /\left( 3\times 2^{k}\right) \) switch to the rival. Then second-best locations have to minimize the transport costs

which yields

SOCs are fulfilled. Note finally that \(\lim _{k\rightarrow \infty }d_{A}^{SB}\left( k\right) =1/4\) and \(\lim _{k\rightarrow \infty }d_{B}^{SB}\left( k\right) =3/4\). \(\square \)

Proof of Proposition 1

-

(i)

Maximization of the profits

$$\begin{aligned} \Pi _{A}^{h}(d_{A},d_{B};k)= & {} \tfrac{\underline{t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) \left( d_{B}+3d_{A}\right) \left( d_{B}-d_{A}\right) }{2^{k+3}}\quad \text { and } \\ \Pi _{B}^{h}(d_{A},d_{B};k)= & {} \tfrac{\underline{t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) \left( 4-d_{A}-3d_{B}\right) \left( d_{B}-d_{A}\right) }{2^{k+3}} \end{aligned}$$with respect to \(d_{A}\) and \(d_{B}\) yields the FOCs: \(d_{B}-3d_{A}=0\) and \( d_{A}-3d_{B}+2=0\), respectively. Solving them simultaneously we get \( d_{A}^{h}=1/4\) and \(d_{B}^{h}=3/4\), such that the profit of firm \(i=\left\{ A,B\right\} \) is

$$\begin{aligned} \Pi _{i}^{h}\left( k\right) =\tfrac{3\underline{t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) }{2^{k+5}}. \end{aligned}$$(20)Note that SOCs are fulfilled. To prove that these locations constitute indeed the equilibrium, we have to prove that firm A does not have an incentive to choose a location \(d_{A}\ge d_{B}^{h}=3/4\). Due to symmetry, this would also imply that firm B does not have an incentive to choose \( d_{B}\le d_{A}^{h}=1/4\). If firm A locates at \(d_{A}\ge d_{B}^{h}\), then according to Lemma 2 it realizes the profit

$$\begin{aligned} \Pi _{B}\left( d_{B},d_{A};k\right) =\tfrac{\underline{t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) \left( 4-d_{B}-3d_{A}\right) \left( d_{A}-d_{B}\right) }{2^{k+3}}. \end{aligned}$$(21)Maximizing (21) with respect to \(d_{A}\) yields the FOC: \( d_{A}\left( d_{B}^{h}\right) =\left( d_{B}^{h}+2\right) /3=11/12\). Firm A realizes the profit

$$\begin{aligned} \Pi _{B}\left( \tfrac{3}{4},\tfrac{11}{12};k\right) =\tfrac{\underline{t} \left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) \left( 4-d_{B}-3d_{A}\right) \left( d_{A}-d_{B}\right) }{2^{k+3}}=\tfrac{\underline{ t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) }{3\times 2^{k+5}}.\quad \end{aligned}$$(22)Comparing the profits (20) and (22) we conclude that

$$\begin{aligned} \Pi _{i}^{h}\left( k\right) -\Pi _{B}\left( \tfrac{3}{4},\tfrac{11}{12} ;k\right) =\tfrac{\underline{t}\left( \left( 2^{k}+1\right) +l\left( 2^{k}-1\right) \right) }{3\times 2^{k+2}}>0\quad \text {for any} \quad k\ge 0, \end{aligned}$$hence, firm A does not have an incentive to deviate to \(d_{A}\ge d_{B}^{h} \). We conclude that the locations \(d_{A}^{h}=1/4\) and \( d_{B}^{h}=3/4\) constitute indeed the equilibrium.

-

(ii)

Maximization of the profits

$$\begin{aligned} \Pi _{A}^{d}(d_{A},d_{B};k)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) \left( 9\times 2^{k}\left( 2^{k}-1\right) (3d_{A}+d_{B})+2\left( 11d_{A}+d_{B}\right) +8\right) }{9\times 2^{2k+3}}\quad \text { and } \\ \Pi _{B}^{d}(d_{A},d_{B};k)= & {} \tfrac{\overline{t}\left( d_{B}-d_{A}\right) \left( -9\times 2^{k}(2^{k}-1)\left( 3d_{B}+d_{A}-4\right) -2\left( 11d_{B}+d_{A}\right) +32\right) }{9\times 2^{2k+3}} \end{aligned}$$with respect to \(d_{A}\) and \(d_{B}\) yields the FOCs

$$\begin{aligned} d_{A}\left( d_{B};k\right)= & {} \tfrac{9\times 2^{k}d_{B}\left( 2^{k}-1\right) +10d_{B}-4}{27\times 2^{2k}-27\times 2^{k}+22} \quad \text { and} \\ d_{B}\left( d_{A};k\right)= & {} \tfrac{9\times 2^{k}\left( 2^{k}-1\right) \left( d_{A}+2\right) +10d_{A}+16}{27\times 2^{2k}-27\times 2^{k}+22}, \end{aligned}$$respectively. Solving FOCs simultaneously we get the locations

$$\begin{aligned} d_{A}^{d}\left( k\right)= & {} \tfrac{9\times 2^{2k}-9\times 2^{k}+6}{36\times 2^{2k}-36\times 2^{k}+32} \quad \text {and} \nonumber \\ d_{B}^{d}\left( k\right)= & {} \tfrac{27\times 2^{2k}-27\times 2^{k}+26}{ 36\times 2^{2k}-36\times 2^{k}+32}, \end{aligned}$$(23)such that firm \(i=\left\{ A,B\right\} \) realizes the profit

$$\begin{aligned} \Pi _{i}^{d}(k)=\tfrac{\overline{t}\left( 9\times 2^{2k}-9\times 2^{k}+10\right) ^{2}\left( 27\times 2^{2k}-27\times 2^{k}+22\right) }{ 9\times 2^{2k+5}\left( 9\times 2^{2k}-9\times 2^{k}+8\right) ^{2}}. \end{aligned}$$Note that the SOCs are also fulfilled. To prove that the locations \( d_{A}^{d}\left( k\right) \) and \(d_{B}^{d}\left( k\right) \) constitute indeed the equilibrium, we have to show that firm A does not have an incentive to locate at \(d_{A}\ge d_{B}^{d}\left( k\right) \). As firms are symmetric, firm B then does not have an incentive to locate at \(d_{B}\le d_{A}^{d}\left( k\right) \) either. If firm A chooses \(d_{A}\ge d_{B}^{d}\left( k\right) \), then it realizes the profit

$$\begin{aligned}&\Pi _{B}^{d}\left( d_{B}^{d}\left( k\right) ,d_{A};k\right) \nonumber \\= & {} \tfrac{\overline{t}\left( d_{A}-d_{B}^{d}\left( k\right) \right) \left( -9\times 2^{k}(2^{k}-1)\left( 3d_{A}+d_{B}^{d}\left( k\right) -4\right) -2\left( 11d_{A}+d_{B}^{d}\left( k\right) \right) +32\right) }{9\times 2^{2k+3}}. \end{aligned}$$(24)Maximization of (24) with respect to \(d_{A}\) yields

$$\begin{aligned} d_{A}\left( d_{B}^{d}\left( k\right) ;k\right)= & {} \tfrac{9\times 2^{k}\left( 2^{k}-1\right) \left( d_{B}^{d}\left( k\right) +2\right) +10d_{B}^{d}\left( k\right) +16}{27\times 2^{2k}-27\times 2^{k}+22} \\= & {} \tfrac{2547\times 2^{2k}-1782\times 2^{3k}+891\times 2^{4k}-1656\times 2^{k}+772}{\left( 36\times 2^{2k}-36\times 2^{k}+32\right) \left( 27\times 2^{2k}-27\times 2^{k}+22\right) }, \end{aligned}$$such that firm A realizes the profit

$$\begin{aligned} \Pi _{B}\left( d_{B}^{d}\left( k\right) ,d_{A}\left( d_{B}^{d}\left( k\right) ;k\right) ;k\right) =\tfrac{\overline{t}\left( 9\times 2^{2k}-9\times 2^{k}+10\right) ^{4}}{9\times 2^{2k+5}(9\times 2^{2k}-9\times 2^{k}+8)^{2}(27\times 2^{2k}-27\times 2^{k}+22)}\text {. } \end{aligned}$$Comparison of the profits \(\Pi _{i}^{d}(k)\) and \(\Pi _{B}\left( d_{B}^{d}\left( k\right) ,d_{A}\left( d_{B}^{d}\left( k\right) ;k\right) ;k\right) \) yields

$$\begin{aligned}&\Pi _{i}^{d}(k)-\Pi _{B}\left( d_{B}^{d}\left( k\right) ,d_{A}\left( d_{B}^{d}\left( k\right) ;k\right) ;k\right) \\= & {} \tfrac{\left( 3\times 2^{2k}-3\times 2^{k}+2\right) \left( 9\times 2^{2k}-9\times 2^{k}+10\right) ^{2}}{3\times 2^{2k+2}\left( 27\times 2^{2k}-27\times 2^{k}+22\right) (9\times 2^{2k}-9\times 2^{k}+8)}>0\quad \text { for any} \quad k, \end{aligned}$$hence, firm A does not have an incentive to locate at \(d_{A}\ge d_{B}^{d}\left( k\right) \). We conclude that the locations \(d_{A}^{d}\left( k\right) \) and \(d_{B}^{d}\left( k\right) \) in (23) constitute indeed the equilibrium.

\(\square \)

Rights and permissions

About this article

Cite this article

Baye, I., Hasnas, I. Consumer flexibility, data quality and location choice. J Econ 120, 135–169 (2017). https://doi.org/10.1007/s00712-016-0491-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-016-0491-7