Abstract

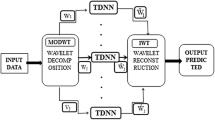

Agricultural product futures are crucial to economic development, and the prediction of agricultural product futures prices has an important impact on the stability of the market economy. In order to improve the accuracy of agricultural product futures price prediction, based on machine learning algorithms, this study mainly uses machine learning methods to predict futures prices based on the analysis of fundamental factors affecting agricultural product futures prices. Moreover, in this study, wavelet analysis method is used to smooth the data and then build a model to process the hierarchical information after signal decomposition. In addition, this study conducts model validity studies through cases to draw comparative statistical diagrams to analyze the accuracy of model prediction data. The research shows that the model proposed in this paper has certain effects and can provide theoretical reference for subsequent related research.

Similar content being viewed by others

References

Inani SK (2017) Price discovery in Indian stock index futures market: new evidence based on intraday data. Int J Indian Cult Bus Manag 14:23–43

Zhang XD, Li A, Pan R (2016) Stock trend prediction based on a new status box method and AdaBoost probabilistic support vector machine. Appl Soft Comput 49:385–398

Chou JS, Nguyen TK (2018) Forward forecast of stock price using sliding-window metaheuristic-optimized machine-learning regression. IEEE Trans Ind Inform 14(7):3132–3142

Indriawan I, Jiao F, Tse Y (2019) The impact of the US stock market opening on price discovery of government bond futures. J Futures Mark 39:779–802

Gao Y, Sun B (2018) Impacts of introducing index futures on stock market volatilities: new evidences from China. RPBFMP 21:1850024

Han Y (2016) Analysis of stock index futures market fluctuation based on wavelet multi resolution. J Comput Theor Nanosci 13(12):10337–10341

Mongi A (2019) The global influence of oil futures-prices on Dow Jones Islamic stock indexes: do energy-volatility’s structural breaks matter? Int J Emerg Mark 14(4):523–549

Ireland P (2018) Efficiency or power? The rise of the shareholder-oriented joint stock corporation. Indiana J Global Legal Stud 25(1):291

Wolf A (2012) Discorsi per Immagini: of political and architectural experimentation. Calif Ital Stud 3(2):1–20

Kumar S, Inani SK (2017) Intraday price discovery in Indian stock index futures market: new evidence from neural network approach. Int J Financ Mark Deriv 6:12–29

Chiang IHE, Hughen WK (2017) Do oil futures prices predict stock returns? J Bank Finance 79:129–141

Eom Y (2018) The opposite disposition effect: evidence from the Korean stock index futures market. Finance Res Lett 26:261–265

Dai J, Zhou H, Zhao S (2017) Determining the multi-scale hedge ratios of stock index futures using the lower partial moments method. Phys A Stat Mech Appl 466(Complete):502–510

Fernandez-Perez A, Frijns B, Gafiatullina I et al (2018) Determinants of intraday price discovery in VIX exchange traded notes. J Futures Mark 38:535–548

Osorio D, Giron L, Sierra L (2017) Es El Mercado De Metales Eficiente? (Is the metals market efficient?). Available at SSRN. https://doi.org/10.2139/ssrn.2956657

Floras C, Salvador E (2016) Volatility, trading volume and open interest in futures markets. Int J Manag Finance 12(5):629–653

Douglas Foster F, Lee AD, Liu WM (2019) CFDs, forwards, futures and the cost-of-carry. Pac Basin Finance J 54:183–198

Zhang J (2019) Is options trading informed? Evidence from credit rating change announcements. J Futures Mark 39:36–41

Jin Z, Yang Y, Liu Y (2019) Stock closing price prediction based on sentiment analysis and LSTM. Neural Comput Appl 3:1–17

An Y, Chan NH (2017) Short-term stock price prediction based on limit order book dynamics. J Forecast 36:541–556

Lahmiri S (2018) A technical analysis information fusion approach for stock price analysis and modeling. Fluct Noise Lett 17(1):1850007

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhao, H. Futures price prediction of agricultural products based on machine learning. Neural Comput & Applic 33, 837–850 (2021). https://doi.org/10.1007/s00521-020-05250-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-020-05250-6