Abstract

Following tfhe seminal paper of Offerman et al. (2009), in this study, adaptations of constructions of continuous-valued logic to prospect theory are presented. Here, we demonstrate that the so-called kappa function and its special cases are viable alternatives to some elements of quadratic scoring rule prospects theory. After, we present the tau-eta scoring rule prospect and show that it may be treated as a generalization of the quadratic scoring rule prospect. Furthermore, we prove that if this new prospect for an uncertain event is evaluated using specific kappa functions as utility functions, then (1) the weighting measure of the event is a function of the optimal value of its reported probability, (2) the inverse of the latter function, and (3) the (risk-) corrected reported probability of the event, also as a function of the optimal value of its reported probability, all have a common formula. The parameters of the common formula are unambiguously determined by four tuning parameters. Lastly, we show that with our approach, by fitting one of the abovementioned functions to corresponding empirical data, we can immediately obtain the other two functions as well.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In many situations, people’s private opinions about the probability of an uncertain event contain subjective beliefs that may greatly influence their decisions and the confidence in their judgments. In cases where appropriate incentives are missing, these subjective beliefs are not sufficiently updated and this may make people more confident about their judgments than they in fact are (Li 2007). Manski (2004) presented a comprehensive overview of belief measurement. The incentive-compatible mechanisms in the form of proper scoring rules are well-known efficient techniques for belief measurement (Brier 1950; Good 1952). There are many areas of science where proper scoring rules have been successfully applied. These include accounting (Wright 1988), analyses of stock markets (Von Holstein 1972), economics (Schotter and Trevino 2014; Andersen et al. 2014; Arieli and Mueller-Frank 2017; Murad et al. 2016; Harrison et al. 2017), education (Echternacht 1972), finance (Shiller et al. 1996; Johnstone 2007b, a), forecasting (Witkowski et al. 2017), mathematical statistics (Savage 1971), medical science (Spiegelhalter 1986), politics (Tetlock 2017), prospect theory (Offerman et al. 2009; Wakker 2010; Armantier and Treich 2013; Hossain and Okui 2013; Schlag et al. 2015) and psychology (McClelland and Bolger 1994).

Traditionally, when applying proper scoring rules, maximization of expected value is assumed, but in practice, many exceptions to this assumption have been identified. Also numerous deviations from the expected utility model have been presented (see, e.g., Allais (1953); Kahneman and Tversky (2013); Ellsberg (1961); Keynes (1921); Knight (1921)). Offerman et al. (2009) extended the proper scoring rules from the expected value model and demonstrated that subjective belief and ambiguity attitudes can be separated from risk attitude by using proper scoring rules.

Our own study may be viewed as a further development to the theoretical results presented in Offerman et al. (2009). The main contribution of our paper is the adaptation of constructions of continuous-valued logic to prospect theory. Our main findings can be summarized as follows. We will demonstrate that some important elements of prospect theory can be derived from probabilistic unary operators of continuous-valued logic. Namely, we will show that:

-

(1)

The functions in the quadratic scoring rule prospect can be generated by the probabilistic unary operators of continuous-valued logic;

-

(2)

The Prelec probability weighting function is a special case of the probabilistic unary operator; and

-

(3)

The widely applied power utility functions can also be generated by the probabilistic unary operators.

Next, we will utilize the kappa function, which is a unary operator of continuous-valued logic that can be induced by the generator functions of the Dombi operators. Here, we will show that the so-called extended kappa function, the kappa function and its special cases, the tau and the eta functions, can be applied in prospect theory as viable alternatives to:

-

(1)

The functions in the quadratic scoring rule prospect

-

(2)

The power utility functions

-

(3)

The Prelec probability weighting function

-

(4)

The Ostaszewski, Green and Myerson probability weighting function and

-

(5)

The (risk-)corrected reported probability function (inverse of Prelec’s probability weighting function).

It should be added that each parameter of the kappa function has a semantic meaning related to the shape of the function curve. This property makes the kappa function suitable for modeling and curve fitting tasks. Also, by making use of the tau and the eta functions, for the uncertain event E, we will introduce the tau-eta scoring rule prospect

as an alternative to the quadratic scoring rule prospect

where \(\nu _s \in (1/2,1)\) and \(r \in (0,1)\). As the main results of this study, in Theorem 4, we will show that if a tau-eta scoring rule prospect in Eq. (1) is evaluated with a tau utility function that has a parameter value \(\nu _u \in (0,1/2]\) and the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\), then

-

(F1)

The weighting measure W(E) of the uncertain event E being a function of the optimal value of the reported probability \(r = r_E\)

-

(F2)

The inverse function of W(E) and

-

(F3)

The (risk-)corrected reported probability measure B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), being a function of the optimal value of the reported probability \(r = r_E\)

can all be written in the following common form:

where

and the variable and parameter values in Eq. (2) and Eq. (3) for the above-listed three functions (F1-F3) are given in Table 1.

In Table 1, the parameters a and b are given by

and

Note that in our approach, four tuning parameters are utilized to model the abovementioned three functions; namely, \(\nu _u\), \(\nu _s\), \(\lambda _w\) and \(\nu _w\). Each of these parameters has a semantic meaning. These are:

- \(\nu _u\)::

-

The value of the parameter \(\nu _u \in (0,1)\) determines the shape of the tau function (a special case of the kappa function), when it is used as a utility function. If \(\nu _u=1/2\), then the tau function coincides with the identity utility function. If \(\nu _u=1/4\), then the tau function approximates the square root utility function quite well. By changing the value of the parameter \(\nu _u\), the tau function can be used to model various utility functions.

- \(\nu _s\)::

-

\(\nu _s \in (0,1)\) is the scoring parameter of the tau-eta scoring rule prospect. If \(\nu _s = 3/4\), then the tau-eta scoring rule is approximately the quadratic scoring rule.

- \(\lambda _w\) and \(\nu _w\)::

-

These are the parameters of the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\), where \(\lambda _w>0\) and \(\nu _w \in (0,1)\). The value of the parameter \(\lambda _w\) determines the slope of \(w^{(\lambda _w)}_{\nu _w}(x)\) at \(x=\nu _w\), while \(\nu _w\) is the unique fixed point of the function, i.e., \(w^{(\lambda _w)}_{\nu _w}(\nu _w)=\nu _w\). If \(\lambda _w = 2/3\) and \(\nu _w = 2/5\), then the kappa probability weighting function approximates the Prelec probability weighting function quite well.

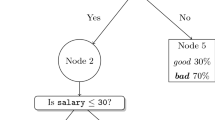

It is worth adding that the values of these four tuning parameters unambiguously determine the values of all the parameters in the common formula in Eq. (2) and Eq. (3). As findings in our study, we will propose particular values for the four tuning parameters. The functions W(E), r(W(E)) and B(E) all have an S-shape or an inverse S-shape (see Fig. 1).

Also, there is an important aspect of our approach that should be mentioned here. Suppose that we have empirical data for one of the abovementioned three functions. Then, the four tuning parameters can be determined by fitting the function to the empirical data, which means that we immediately have the other two functions determined as well.

Regarding the connections between fuzzy logic and the quadratic scoring rules, it is worth mentioning that in fuzzy control, the fuzzy affine models utilize quadratic Lyapunov functions (see, e.g., Ji et al. (2021, 2022)). In our approach, we approximate two particular quadratic functions, \(q_1(r) = 1- (1-r)^{2}\) and \(q_2(r) = (1-r^{2})\), \(r \in [0,1]\), using the tau and eta functions, which are unary operators in fuzzy logic (see Dombi and Jónás (2021)). That is, we apply unary operators of fuzzy logic to approximate quadratic functions. The question of whether the constructions of fuzzy affine models can be adapted to quadratic scoring rules is left for future study.

We should mention that with compared with some prevalent results (see, e.g., Kahneman and Tversky (2013); Knight (1921); Offerman et al. (2009)), the proposed approach has two big advantages. On the one hand, using Eq. (2), we can provide a unified theoretical approach to the three important functions of prospect theory that are described in (F1)-(F3). On the other hand, our approach simplifies the empirical studies. Namely, by fitting one of the abovementioned functions to empirical data, we get the other two functions as well.

This paper is organized as follows. In Sect. 2, the main elements of proper scoring rules are summarized. In Sect. 3, we briefly show how the operators of continuous-valued logic are related to elements of prospect theory. Next, Dombi operators of continuous-valued logic and the kappa function are discussed in Sect. 4. Fitting kappa functions to well-known functions of prospect theory is introduced in Sect. 5. Here, we present the tau-eta scoring rule as an alternative to the quadratic scoring rule. In Sect. 6, we will present our results for the evaluation and analysis of tau-eta scoring rule prospects. Lastly, in Sect. 7, we summarize the key findings of this study and mention some future research plans.

The proofs of lemmas, propositions and theorems presented in this paper can be found in Appendix A.

2 Main elements of proper scoring rules in prospect theory

Here, we will briefly review the most important notions, constructions and results related to proper scoring rule prospects, focusing mainly on the quadratic scoring rule prospects. Following the study of Offerman et al. (2009), we shall assume that judgments related to uncertain events are made by specialized agents. In such cases, if there is a lack of proper incentives, agents may pretend to be more confident about their judgment than they really are.

From now on, let X be an event space, and let \(E \subseteq X\) be an uncertain event. The uncertainty of the agent about the event E depends on the information that the agent possesses about E. In many cases, the objective probability of the event E is unknown, therefore the decisions and judgments related to E need to be made based on beliefs and subjective probabilities. A prospect is generally defined as follows.

Definition 1

(see Offerman et al. (2009)). The prospect \(x \,_E \, y\) is an event-contingent payment such that

This means that the prospect \(x \,_E \, y\) yields the outcome x if event E occurs, and it yields the outcome y if the complement of event E occurs, and the outcomes are financial amounts. From here on, we will use the notation \({\overline{E}}\) for the complement of set (event) E. When the probability p of event E is known, the general notation \(x \,_p \, y\) is used to express the fact that the prospect yields x with probability p and it yields y with probability \(1-p\), where \(p \in [0,1]\).

It is generally agreed that the quadratic scoring rule (QSR) is the most widely used proper scoring rule (see McKelvey and Page (1990); Nyarko and Schotter (2002); Offerman et al. (2009)). Now, we will present an alternative to the well-known quadratic scoring rule prospect, which is given by the following definition.

Definition 2

(see Offerman et al. (2009)). A quadratic scoring rule prospect for event E is

where \(r \in [0,1]\) is a function of event E and it is called the (uncorrected) reported probability of E.

It should be added that the notation \(r_E\) is also used to indicate that the reported probability \(r_E\) is a function of E. Furthermore, it is also assumed that if event E has a probability p, then \(r=r_E\) depends only on p; that is, \(r_E = R(p)\), where R is a function such that \(R: [0,1] \rightarrow [0,1]\). It is worth noting that the QSR prospect in Eq. (5) has an important symmetry property, which is stated in the following lemma.

Lemma 1

Let \((1-(1-r_E)^2)\, _E \, (1-r_E^2)\) be a QSR prospect for the event E and let \((1-(1-r_{{\overline{E}}})^2)\,_{{\overline{E}}} \, (1-r_{{\overline{E}}}^2)\) be a QSR prospect for the event \({\overline{E}}\), where \(r_E, r_{{\overline{E}}} \in [0,1]\). Then,

holds if and only if

Notice that if \(r_E = R(p)\), where R is a function such that \(R:[0,1] \rightarrow [0,1]\), then

follows from Lemma 1. Lemma 1 allows us to state our results only for \(r \ge 1/2\), and the results for \(r<1/2\) follow from Eq. (6) and Eq. (7).

We will now use the concept of monotone measures that are also known as fuzzy measures.

Definition 3

Let \(\Sigma \) be a \(\sigma \)-algebra on the set X. Then the function \(g: \Sigma \rightarrow [0,1]\) is a monotone measure on the measurable space \((X, \Sigma )\) iff g satisfies the following requirements:

-

(1)

\(g(\emptyset ) = 0\), \(g(X) = 1\);

-

(2)

If \(B \subseteq A\), then \(g(B) \le g(A)\) for any \(A, B \in \Sigma \) (monotonicity);

-

(3)

If \(\forall i \in {\mathbb {N}}, A_i \in \Sigma \) and \((A_i) \) is monotonic \((A_1 \subseteq A_2 \subseteq \ldots \subseteq A_n \subseteq \ldots \) or \(A_1 \supseteq A_2 \supseteq \ldots \supseteq A_n \ldots )\), then

$$\begin{aligned} \lim \limits _{i \rightarrow \infty } g(A_i) = g\left( \lim \limits _{i \rightarrow \infty } A_{i} \right) \text {(continuity).} \end{aligned}$$

If X is a finite set, then the continuity requirement in Definition 3 can be disregarded.

In modern decision models, the QSR prospect given in Eq. (5) is evaluated by using the following formula (see, e.g., Wakker (2010)):

where \(V_{QSR}(r)\) is the value of the QSR prospect \((1-(1-r)^2)\, _E \, (1-r^2)\) at r, \(r \in [0,1]\), \(U:[0,1] \rightarrow [0,1]\) is a utility function which is strictly increasing, continuous and \(U(0) = 0\), and W is a monotone measure over the event space X. Offerman et al. (2009) presented the following cases for the measure W, where each case represents a decision model.

-

1.

Expected value. The utility function U is the identity function, and the measure W is a probability measure P on X.

-

2.

Expected utility. The measure W is a probability measure P on X.

-

3.

Probabilistic sophistication (with non-expected utility). There exists a probability measure P and a continuous strictly increasing function \(w: [0,1] \rightarrow [0,1]\), called the probability weighting function, such that \(W (\cdot ) = w(P (\cdot )), w(0) = 0,\) and \(w(1) = 1\).

-

4.

General model. The measure W is a monotone measure on X.

Note that there are two sub-cases for the probability measure P. Namely, it is either an objective probability measure, which is based on statistical data that everyone agrees on, or a subjective probability measure, which can be derived from preferences (Offerman et al. 2009). The preference foundations for subjective probabilities can be found in the publications of De Finetti (1937), Savage (1954) and Machina and Schmeidler (1992). It should be added that the sequence of the presented cases reflects the historical development of decision models. The well-known St. Petersburg paradox presented by Daniel Bernoulli in 1738 (Commentaries of the Imperial Academy of Science of Saint Petersburg, see its translation in Bernoulli (1954)) demonstrates that the expected value model (Case 1) is not suitable for describing people’s decision making under uncertainty. Next, Maurice Allais in 1953 pointed out that the expected utility model (Case 2) is often violated (see the Allais paradox in Allais (1953)), and so the function w and the measure W are non-additive. The well-known Ellsberg paradox, which was published in 1961, shows that the probabilistic sophistication (Case 3) is also often violated (Ellsberg 1961). Therefore, the modern decision making models usually consider the general case (Case 4).

As regards the quadratic scoring rule prospect given in Eq. (5), Offerman et al. (2009) presented the following results for the optimal value of the reported probability \(r_E\).

Theorem 1

(Offerman et al. 2009). In the general model (Case 4), the optimal choice r in Eq. (5) satisfies the following requirement:

If \(r > 1/2\), then

Corollary 1

Under the expected value (Case 1), Eq. (9) holds for all r and \(r = r_E = P(E)\).

This was first presented by author Brier (1950).

In Offerman et al. (2009), the authors stated that if there is a sufficient amount of general decisions under risk without proper scoring rules observable, but with known probabilities, then the whole probability weighting function w can be discovered. Also, the measure W could be found by observing enough decisions under uncertainty. Based on these findings, they introduced the following important measure, which is called the (risk-)corrected reported probability.

Definition 4

The (risk-)corrected reported probability B is given by

for any \(E \subseteq X\), where w is a probability weighting function and W is a monotone measure on the event space X.

It immediately follows from Definition 4 that B is a monotone measure on the event space X. Furthermore, we can see that under the probabilistic sophistication; that is, when \(W(E) = w(P(E))\), from Eq. (10) we get that \(B(E) = P(E)\), where P is a probability measure on X. Based on these results, Offerman et al. concluded that B is a better measure of subjective beliefs than the reported probability r. Utilizing the measure B, they deduced the following results from Theorem 1.

Corollary 2

( Offerman et al. (2009)). For the optimal choice \(r = r_E\), if \(r > 1/2\), then

Corollary 3

(Offerman et al. (2009)). Under probabilistic sophistication, we have for the optimal choice \(r = R(p)\): if \(r > 1/2\), then

Corollary 4

( Offerman et al. (2009)). Assume the general model (Case 4). For an event E with \( r_E= r\), we can find the objective probability p with the same value \(R(p) = r\), and then we may conclude that \(B(E) = p\). That is, if \(r_E= r > 1/2\), then

In our study, by using techniques of continuous-valued logic, we will give viable alternatives to all the main elements of prospect theory that were briefly discussed in this section.

3 Connection of operators of continuous-valued logic with elements of prospect theory

In a study of continuous-valued logic it is necessary to discuss t-norms and t-conorms (Klement et al. 2013), which here correspond to the the conjunctive and disjunctive operators. From an application point of view, the strictly monotonously increasing (or decreasing) operators play an important role. It is well known that any strict conjunction operator \(c:[0,1] \times [0,1] \rightarrow [0,1]\) and any strict disjunction operator \(d:[0,1] \times [0,1] \rightarrow [0,1]\) have the following form (Aczél 1966):

where x and y are continuous-valued logic variables, \(f_c:[0,1] \rightarrow [0,\infty ]\) and \(f_d:[0,1] \rightarrow [0,\infty ]\) are continuous, strictly decreasing and strictly increasing functions, respectively. Here, \(f_c\) and \(f_d\) are called the generator functions of the operators c and d, respectively, with the inverse functions \(f_c^{-1}:[0,\infty ] \rightarrow [0,1]\) and \(f_d^{-1}:[0,\infty ] \rightarrow [0,1]\), respectively (Dombi 1982). Note that the generator functions \(f_c\) and \(f_d\) are determined up to a constant multiplicative factor.

For these conjunctive and disjunctive operators, we can order the unary operators \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}:[0,1] \rightarrow [0,1]\) and \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}:[0,1] \rightarrow [0,1]\), which are given by

where \(\nu , \nu _0 \in (0,1)\) and \(\lambda \in {\mathbb {R}}\) are the parameters of the unary operators (Dombi 2012).

Here, we will utilize two operator families, namely the probabilistic operators (also known as product operators) and the Dombi operators.

The generator functions of the probabilistic operators c and d are given by

Using Eq. (11) and Eq. (12), one can easily see that these generator functions yield the following operators:

Later, we will show that the unary operators in Eq. (13) and in Eq. (14) coincide if the generator functions \(f_c\) and \(f_d\) are \(f_c(x) = \left( \frac{1-x}{x} \right) ^{\alpha }\) with \(\alpha >0\) and \(f_d(x) = \left( \frac{1-x}{x} \right) ^{\alpha }\) with \(\alpha <0\), where \(\alpha \in {\mathbb {R}}\), \(\alpha \ne 0\) and \(x \in (0,1)\).

Now, we will demonstrate that some important elements of prospect theory can be derived from probabilistic unary operators of continuous-valued logic. Namely, we will show that:

-

The functions in the quadratic scoring rule prospect can be generated by the probabilistic unary operators of continuous-valued logic;

-

Prelec’s probability weighting function is a special case of the probabilistic unary operator;

-

The widely applied power utility functions can be generated by the probabilistic unary operators.

3.1 A new interpretation of the quadratic scoring rule prospect using probabilistic unary operators

Here, we will demonstrate that the functions in the quadratic scoring rule prospect can be generated by the unary operators given in Eq. (13) and in Eq. (14).

Proposition 1

If the generator function \(f_d\) of the unary operator \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}\) in Eq. (14) is given by \(f_d(x) = -\ln (1-x)\), \(\lambda =1\) and \(f_d(\nu _0) = 2 f_d(\nu )\), then the QSR prospect

can be written in the form

where \(r \in (0,1)\).

Remark 1

It can be shown that if \(f_c(x) = -\ln (x)\), \(f_d(x) = -\ln (1-x)\) and \(\lambda =1\), then

for any \(x \in (0,1)\). That is, the QSR prospect in Eq. (15) can also be written in the following form:

where \(r \in (0,1)\).

Proposition 1 tells us that the functions in the quadratic scoring rule prospect can be generated by the unary operators given in Eq. (13) and in Eq. (14).

3.2 A new interpretation of Prelec’s probability weighting function using the probabilistic unary operator

The Perlec’s probability weighting function family (Prelec 1998) \(w_{P}\) is given by

where \(0<a<1\), \(b>0\) and \(x \in (0,1]\). The following proposition shows how the Perlec’s probability weighting function family can be generated by the unary operator \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\).

Proposition 2

Let \(0<a<1\), \(b>0\) and let the generator function \(f_c\) of the unary operator \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) in Eq. (13) be given by \(f_c(x) = - \ln (x)\). Then, if

and

then \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}(x) = w_{P}(x)\) for any \(x \in (0,1]\).

3.3 A new interpretation of the power utility functions using the probabilistic unary operator

In prospect theory, a utility function \(U:[0,1] \rightarrow [0,1]\) is commonly represented by a power function (Offerman et al. 2009); that is, \(U(x) = x^{\rho }\). The following proposition shows how the power utility functions can be derived from the unary operators given in Eqs. (13) and (14).

Proposition 3

Let the generator function \(f_c\) of the unary operator \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) in Eq. (13) be given by \(f_c(x) = - \ln (x)\). Then, if \(\lambda =1\), \(\nu , \nu _0 \in (0,1)\) and

then \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}(x) = x^{\rho }\) for any \(x \in (0,1]\).

Notice that by making use of Proposition 3 with \(\rho =1/2\), we get the utility function \(U: [0,1] \rightarrow [0,1]\), \(U(x) = \sqrt{x}\).

4 Dombi operators and the kappa functions

The structure of the continuous-valued logic operators when the fix point \(\nu _*\) of the negation operation can have any value in the interval (0, 1) is discussed in Dombi (2011). In these operator systems, we have infinitely many negation operators. In the following, we will use a system in which the generator function is a parametric function.

Definition 5

The generator function \(f_D: (0,1) \rightarrow (0,\infty ]\) of the Dombi operators in continuous-valued logic is given by

where \(\alpha \in {\mathbb {R}}\), \(\alpha \ne 0\).

Remark 2

It should be noted that

-

(a)

if \(\alpha >0\), then \(f_D\) is a strictly decreasing generator function and so applying Eq. (11) with \(f_c = f_D\) results in a conjunctive operator, which is called the Dombi conjunction operator;

-

(b)

if \(\alpha <0\), then \(f_D\) is a strictly increasing generator function and so applying Eq. (12) with \(f_d = f_D\) results in a disjunctive operator, which is called the Dombi disjunction operator Dombi (2011).

Proposition 4

The unary operators \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) and \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}\) given in Eq. (13) and Eq. (14), respectively, coincide if \(f_c = f_D\) with \(\alpha >0\) and \(f_d=f_D\) with \(\alpha <0\). In this case, \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) and \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}\) are both identical to the kappa function \(\kappa ^{(\lambda )}_{\nu ,\nu _0}:(0,1) \rightarrow (0,1)\), which is given by

where \(\nu ,\nu _0 \in (0,1)\), \(\lambda \in {\mathbb {R}}\).

Notice that the unary operators \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) and \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}\) induced from the generator function \(f_D\) with \(\alpha >0\) and \(\alpha <0\), respectively, are both independent of the parameter \(\alpha \). This is why these two operators coincide if they are both induced from the generator function of the Dombi operator in Eq. (18).

Later, we will use the following extended kappa function.

Definition 6

The extended kappa function \(\kappa _{(a,b), x_{\nu },\nu _{0}}^{(\lambda )}:(a,b) \rightarrow (0,1)\) with the parameters \(a,b, \lambda \in {\mathbb {R}}\), \(a<b\), \(x_{\nu } \in (a,b)\) and \(\nu _0 \in (0,1)\) is given by

Remark 3

Notice that the extended kappa function given in Definition 6 can be obtained by a linear transformation of the kappa function \(\kappa _{\nu , \nu _0}^{(\lambda )}\) from the domain (0, 1) to the domain (a, b). Therefore, the main properties of the extended kappa function \(\kappa _{(a,b), x_{\nu },\nu _{0}}^{(\lambda )}\) can be readily derived from the properties of the kappa function \(\kappa _{\nu , \nu _0}^{(\lambda )}\).

4.1 Properties of the kappa functions

We will use the kappa function, its inverse function, the extended kappa function and the compositions of kappa functions to create an alternative to the quadratic scoring rule prospect and derive new techniques to evaluate it. The elementary properties of the kappa function \(\kappa _{x_{\nu },\nu _{0}}^{(\lambda )}\), namely, continuity, monotonicity, limits, role of the parameters and shape are summarized in Appendix B. Figure 2 shows some example plots of the kappa function \(\kappa _{\nu ,\nu _{0}}^{(\lambda )}(x)\) with various parameter values.

4.1.1 Compositions of kappa functions

Now, we will show that the composition of a kappa function with an extended kappa function is a kappa function as well.

Proposition 5

If \(\kappa _{\nu , \nu _{0_1}}^{(\lambda _1)}\) is a kappa function with the parameters \(\nu , \nu _{0_1} \in (0,1)\), \(\lambda _1 \in {\mathbb {R}}\) and \(\kappa _{(a,b), x_{\nu },\nu _{0_2}}^{(\lambda _2)}\) is an extended kappa function with the parameters \(a,b, \lambda \in {\mathbb {R}}\), \(a<b\), \(x_{\nu } \in (a,b)\), \(\nu _{0_2} \in (0,1)\) and \(\lambda _1, \lambda _2 \ne 0\), then

where \(\kappa _{(a,b), x'_{\nu },\nu '_{0}}^{(\lambda )}\) is an extended kappa function with the parameters

The following corollary immediately follows from Proposition 5.

Corollary 5

If \(\kappa _{\nu _1, \nu _{0_1}}^{(\lambda _1)}\) and \(\kappa _{\nu _2, \nu _{0_2}}^{(\lambda _1)}\) are two kappa functions with the parameters \(\nu _{0_1}, \nu _{0_2}, \nu _1, \nu _2 \in (0,1)\), \(\lambda _1, \lambda _2 \in {\mathbb {R}}\) and \(\lambda _1, \lambda _2 \ne 0\), then

where \(\kappa _{\nu , \nu _0}^{(\lambda )}\) is a kappa function with the parameters

4.1.2 Inverse of the kappa function

Now, we will show that the inverse of a kappa function is a kappa function as well.

Proposition 6

If \(\kappa _{\nu , \nu _0}^{(\lambda )}\) is a kappa function with the parameters \(\nu , \nu _0 \in (0,1)\) and \(\lambda \ne 0\), then

holds for any \(x \in (0,1)\), where \(\left( \kappa _{\nu , \nu _0}^{(\lambda )} \right) ^{-1}\) is the inverse of the function \(\kappa _{\nu , \nu _0}^{(\lambda )}\).

Proposition 6 tells us that a kappa function can be inverted by swapping the \(\nu \) and \(\nu _0\) parameters and inverting the \(\lambda \) parameter.

4.2 The tau and eta functions as special cases of the kappa function

Now, we will define the tau and eta function as a special case of the kappa function.

Definition 7

The tau function \(\tau _{\nu }:(0,1) \rightarrow (0,1)\) is the kappa function \(\kappa _{\nu ,\nu _{0}}^{(\lambda )}\) with the parameter values \(\lambda =1\) and \(\nu _0=1/2\). That is,

where \(\nu , x \in (0,1)\).

Definition 8

The eta function \(\eta _{\nu }:(0,1) \rightarrow (0,1)\) is the kappa function \(\kappa _{\nu ,\nu _{0}}^{(\lambda )}\) with the parameter values \(\lambda =-1\) and \(\nu _0=1/2\). That is,

where \(\nu , x \in (0,1)\).

4.2.1 Some properties of the tau and eta functions

Here, we will describe some important properties of the tau and eta functions that we will use later on.

The following two propositions concern the inverse of tau and eta functions.

Proposition 7

If \(\tau _{\nu }\) is a tau function with the parameter \(\nu \in (0,1)\), then its inverse function \(\tau ^{-1}_{\nu }\) is the tau function \(\tau _{\nu '}\), where \(\nu '=1-\nu \).

Proposition 8

If \(\eta _{\nu }\) is an eta function with the parameter \(\nu \in (0,1)\), then its inverse function \(\eta ^{-1}_{\nu }\) is the eta function \(\eta _{\nu }\).

The following two propositions are about the compositions of tau and eta functions.

Proposition 9

Let \(\tau _{\nu _1}\) and \(\tau _{\nu _2}\) be two tau functions and let \(\eta _{\nu _1}\) and \(\eta _{\nu _2}\) be two eta functions, where \(\nu _1, \nu _2 \in (0,1)\). Then, the following properties hold for the composite functions \(\tau _{\nu _1} \circ \tau _{\nu _2}\) and \(\eta _{\nu _1} \circ \eta _{\nu _2}\):

-

(1)

\(\tau _{\nu _1} \circ \tau _{\nu _2} = \tau _{\nu }\), where

$$\begin{aligned} \nu = \frac{1}{1 + \frac{1-\nu _1}{\nu _1} \frac{1-\nu _2}{\nu _2}}; \end{aligned}$$ -

(2)

\(\eta _{\nu _1} \circ \eta _{\nu _2} = \tau _{\nu }\), where

$$\begin{aligned} \nu = \frac{1}{1 + \frac{\nu _1}{1-\nu _1} \frac{1-\nu _2}{\nu _2}}. \end{aligned}$$

Proposition 10

Let \(\tau _{\nu _{\tau }}\) and \(\eta _{\nu _{\eta }}\) be a tau function and an eta function, respectively, where \(\nu _{\tau }, \nu _{\eta } \in (0,1)\). Then, the following properties hold for the composite functions \(\tau _{\nu _{\tau }} \circ \eta _{\nu _{\eta }}\) and \(\eta _{\nu _{\eta }} \circ \tau _{\nu _{\tau }}\):

-

(1)

\(\tau _{\nu _{\tau }} \circ \eta _{\nu _{\eta }} = \eta _{\nu }\), where

$$\begin{aligned} \nu = \frac{1}{1 + \frac{\nu _{\tau }}{1-\nu _{\tau }} \frac{1-\nu _{\eta }}{\nu _{\eta }}}; \end{aligned}$$ -

(2)

\(\eta _{\nu _{\eta }} \circ \tau _{\nu _{\tau }} = \eta _{\nu }\), where

$$\begin{aligned} \nu = \frac{1}{1 + \frac{1-\nu _{\eta }}{\nu _{\eta }} \frac{1-\nu _{\tau }}{\nu _{\tau }}}. \end{aligned}$$

We will also utilize the following proposition which is about the composition of a tau derivative and a tau function.

Proposition 11

Let \(\tau _{\nu _u}\) and \(\tau _{1-\nu _s}\) be two tau functions and let \(\eta _{\nu _s}\) be an eta function, where \(\nu _u, \nu _s \in (0,1)\). Then,

and

where

5 Kappa functions as alternatives to well-known functions of prospect theory

Here, we will discuss how the kappa function and its special cases, the tau and the eta functions, can be applied in prospect theory as viable alternatives to

-

Functions in the quadratic scoring rule prospect (Sect. 5.1);

-

Power utility functions (Sect. 5.2);

-

Prelec’s probability weighting function (Sect. 5.3);

-

The Ostaszewski, Green and Myerson probability weighting function (Sect. 5.4);

-

The (risk-)corrected reported probability function (inverse of Prelec’s probability weighting function) (Sect. 5.5).

5.1 Tau and eta functions in the quadratic scoring rule prospect

Here, we will show that the functions in a quadratic scoring rule prospect \((1-(1-r)^2)\, _E \, (1-r^2)\) can be approximated by tau and eta functions. Let the functions f and g be given by \(f(r) = 1-(1-r)^2 \) and \(g(r) =1-r^2\), where \(r \in (0,1)\). Notice that function f has a similar shape to that of the tau function with a parameter value of \(\nu <1/2\). Also, function g has a similar shape to that of the eta function with a parameter value of \(\nu >1/2\). Let the scoring parameter \(\nu _s\) be \(\nu _s \in (1/2,1)\). Then, \(1-\nu _s<1/2\) and so the function \(\tau _{1-\nu _s}\) has a similar shape to that of function f and the function \(\eta _{\nu _s}\) has a similar shape to that of function g. That is, we may use the following approximations:

and

where \(r \in (0,1)\). It can also be seen that \(f(r) = g(r) = 3/4\) if and only if \(r=1/2\). Based on these observations, if we require that both the tau function \(\tau _{1-\nu _s}\) and the eta function \(\eta _{\nu _s}\) take the value of 3/4 at \(r=1/2\), then \(\tau _{1-\nu _s}\) and \(\eta _{\nu _s}\) need to fulfill the following requirements:

By solving Eq. (30) and Eq. (31) for \(\nu _s\), we get \(\nu _s = 3/4\) from both equations, which means that 3/4 is an appropriate value for the scoring parameter \(\nu _s\). Hence, we may use the following approximations:

where \(r \in (0,1)\). It can be shown numerically that

and

Therefore, the prospect \(\tau _{\frac{1}{4}}(r) \, _E \, \eta _{\frac{3}{4}}(r)\) may be viewed as an alternative to the quadratic scoring rule prospect \((1-(1-r)^2) \, _E \, (1-r^2)\). Based on these findings, we define the tau-eta scoring rule prospect as follows.

Definition 9

A tau-eta scoring rule prospect for event E is

where \(r \in (0,1)\) is a function of event E and \(\nu _s \in (1/2,1)\).

Note that this definition is general in the sense that the value of the scoring parameter \(\nu _s\) may be arbitrary in the interval (1/2, 1). However, we will use it with the setting \(\nu _s = 3/4\). Notice that for the tau-eta scoring rule prospect the value of the reported probability r is in the open interval (0, 1). It should be added that this does not mean any restriction in practice because the following limit properties of the tau and eta functions hold:

It is worth noting that, similar to the QSR prospect, the tau-eta scoring rule prospect in Eq. (32) has the following important symmetry property.

Lemma 2

Let \(\tau _{1-\nu _s}(r_E) \, _E \, \eta _{\nu _s}(r_E)\) be a tau-eta scoring rule prospect for the event E and let \(\tau _{1-\nu _s}(r_{{\overline{E}}}) \, _{{\overline{E}}} \, \eta _{\nu _s}(r_{{\overline{E}}})\) be a tau-eta scoring rule prospect for the event \({\overline{E}}\), where \(r_E, r_{{\overline{E}}} \in (0,1)\). Then,

holds if and only if

Remark 4

Notice that the tau function \(\tau _{1-\nu _s}\) is symmetric to the line given by \(l(r) = 1-r\) and the eta function \(\eta _{\nu _s}\) is symmetric to the diagonal line \(l(r)=r\), while the functions \(f(r) = 1-(1-r)^2\) and \(g(r) = 1-r^2\) do not have these symmetry properties.

5.2 Tau functions as alternatives to power utility functions

As we pointed out previously in Sect. 3.3, a utility function \(U:[0,1] \rightarrow [0,1]\) is commonly given by a power function (Offerman et al. 2009); that is, \(U(x) = x^{\rho }\). Here, we will demonstrate that tau functions with appropriate parameter values may be viewed as alternatives to the most widely used power utility functions.

Identity utility function (\(\rho =1\))

It immediately follows from the definition for a tau function given in Definition 7 that

where \(x \in (0,1)\).

Square root utility function (\(\rho =1/2\))

Notice that the utility function \(U:[0,1] \rightarrow [0,1]\), \(U(x) = \sqrt{x}\) has a similar shape to that of the tau function \(\tau _{\nu _u}\) with a parameter value of \(\nu _u<1/2\), where \(x \in (0,1)\). If \(\nu _u=\frac{1}{4}\), then \(\tau _{\frac{1}{4}}(1/4) = \frac{1}{2}\); that is,

Furthermore, it can be shown numerically that

Hence, the tau function \(\tau _{\frac{1}{4}}(x)\) may be viewed as an alternative to the square root utility function \(U(x)=\sqrt{x}\), where \(x \in (0,1)\).

Square utility function (\(\rho =2\))

One can also see that the utility function \(U:[0,1] \rightarrow [0,1]\), \(U(x) = x^2\) has a similar shape to that of the tau function \(\tau _{\nu _u}\) with a parameter value of \(\nu _u>1/2\), where \(x \in (0,1)\). It can be shown numerically that if \(\nu =\frac{3}{4}\), then

Therefore, the tau function \(\tau _{\frac{3}{4}}(x)\) approximates the square utility function \(U(x)=x^2\) quite well, where \(x \in (0,1)\).

Table 2 summarizes how the tau function \(\tau _{\nu _u}\) can be used to approximate the most commonly used power utility functions.

Based on the above results, we conclude that the tau function may be treated as an alternative to the most commonly used power utility functions of prospect theory.

5.3 The kappa function as an alternative to Prelec’s probability weighting function

In Proposition 2, we showed that using the unary operator \(u_{c,\nu , \nu _0}^{(\lambda )}\) with the probabilistic generator function \(f_c(p)=-\ln (p)\) results in Prelec’s probability weighting function \(w_P\), which is given by

where \(p \in (0,1]\). Based on empirical studies (see e.g. Prelec (1998); Offerman et al. (2009)) in probabilistic sophistication, the typical values of the parameters a and b are \(a=0.65\), \(b=1\).

In Proposition 4, we demonstrated that using the unary operator \(u_{c,\nu , \nu _0}^{(\lambda )}\) with the generator function \(f_c(p)=\left( \frac{1-p}{p} \right) ^{\alpha }\) and \(\alpha >0\), or using the unary operator \(u_{d,\nu , \nu _0}^{(\lambda )}\) with the generator function \(f_d(p)=\left( \frac{1-p}{p} \right) ^{\alpha }\) and \(\alpha <0\), we get the kappa function

where \(p \in (0,1)\), \(\nu ,\nu _0 \in (0,1)\) and \(\lambda \in {\mathbb {R}}\).

It can be shown numerically that if the parameters of Prelec’s probability weighting function are set to \(a=0.65\), \(b=1\), and the parameters of the kappa function \(\kappa ^{(\lambda )}_{\nu ,\nu _0}\) are \(\nu = \nu _0=2/5\) and \(\lambda = 2/3\), then

Since \(\nu = \nu _0= 2/5\), we will use the notation \(\nu _w\) for both \(\nu _0\) and \(\nu \). Also, we will use the notation \(w^{(\lambda )}_{\nu _w}\) instead of \(\kappa ^{(\lambda )}_{\nu ,\nu _0}\). That is, the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) is given by

where \(p \in (0,1)\), \(\nu _w \in (0,1)\) and \(\lambda _w \in {\mathbb {R}}^{+}\). Figure 3 shows the plots of the functions \(w_{P}(p)\), \(\kappa ^{(\lambda )}_{\nu ,\nu _0}(p)\) and the absolute difference \(\vert w_{P}(p) - \kappa ^{(\lambda )}_{\nu ,\nu _0}(p) \vert \) for the parameter values \(a=0.65\), \(b=1\), \(\nu = \nu _0=2/5\) and \(\lambda = 2/3\).

Based on the above results, we may conclude that in probabilistic sophistication, the probability weighting function \(w^{(\lambda _w)}_{\nu _w}(p)\), which is kappa function, can be used instead of Prelec’s probability weighting function.

5.4 The Ostaszewski, Green and Myerson probability weighting function as a special case of the kappa function

The Ostaszewski, Green and Myerson probability weighting function family (Ostaszewski et al. 1998) \(w_{OGM}\) is given by

where \(0<a<1\), \(b>0\) and \(p \in [0,1]\). Note that this probability weighting function family was introduced independently by Lattimore, Baker and Witte as well in 1992 (see Lattimore et al. (1992)). The following lemma demonstrates that the Ostaszewski, Green and Myerson probability weighting function is a special case of the kappa function \(\kappa ^{(\lambda )}_{\nu ,\nu _0}\) in (35).

Lemma 3

Let \(0<a<1\), \(b>0\). Then, if

then

holds for any \(p \in (0,1]\).

Lemma 3 tells us that the Ostaszewski, Green and Myerson probability weighting function is a special case of the kappa function \(\kappa ^{(\lambda )}_{\nu ,\nu _0}\).

5.5 The kappa function as an alternative to the (risk-)corrected reported probability function

According to Eq. (10), the (risk-)corrected reported probability B is given by

where E is an uncertain event of an event space X, W is a monotone measure on X and \(w^{-1}\) is the inverse of a probability weighting function. As pointed out previously, the most commonly used probability weighting function is Prelec’s probability weighting function given in Eq. (34) with the parameter values \(a=0.65\) and \(b=1\). Next, based on the results of Sect. 5.3, this function can be replaced by the probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) in Eq. (36) with the parameter values \(\nu _w = 2/5\) and \(\lambda =2/3\). Therefore, the inverse of the function \(w^{(\lambda )}_{\nu _w}\) is a suitable (risk-)corrected reported probability function. Noting that \(w^{(\lambda )}_{\nu _w}\) is a kappa function and making the use of Proposition 6, we get that

is a kappa function as well, where \(p \in (0,1)\), \(\nu _w \in (0,1)\), \(\lambda _w \in {\mathbb {R}}\) and \(\lambda _w \ne 0\).

6 Evaluating and analyzing tau-eta scoring rule prospects

Here, we will discuss the evaluation and analysis of tau-eta prospects. Following the approach presented by Offerman et al. (2009), for the tau-eta scoring rule prospect \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\), we will identify the relationship between the optimal value of the reported probability \(r=r_E\) and the measure W(E). Next, we will show that this relationship is given by an extended kappa function when the utility function is the function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\). Furthermore, we will demonstrate that if the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) given in Eq. (36) and the utility function is the tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\), then the (risk-)corrected reported probability B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), is also an extended kappa function of the optimal value of the reported probability r.

Later, we will use the following lemma.

Lemma 4

Let \(f,g:[0,1] \rightarrow [0,1]\) be two twice differentiable functions on the interval [0, 1]. Then, if f is a strictly increasing and concave function on [0, 1], and g is a strictly concave function on [0, 1], then the composite function \(f \circ g\) is strictly concave on [0, 1].

Similar to the evaluation of a QSR prospect given in Eq. (8), the tau-eta scoring rule (TESR) prospect

can be evaluated by

where \(\nu _s \in (1/2, 1]\) and \(r \in (0,1)\). Recall that according to the general model (Case 4 in Sect. 2), E is an uncertain event of an event space X, W is a monotone measure on X and \(U:[0,1] \rightarrow [0,1]\) is a utility function such that \(U(0)=0\). Now, we will investigate the optimal value of the reported probability \(r=r_E\) of the uncertain event E.

Theorem 2

Let \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) be a tau-eta scoring rule prospect with a scoring parameter value \(\nu _s \in (1/2,1)\), \(r \in (0,1)\) and let \(U:(0,1) \rightarrow (0,1)\) be a strictly increasing, twice differentiable, concave utility function such that \(\lim _{r \rightarrow 0} U(r) = 0\). Then, in the general model, if \(r \ge 1/2\) and \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) is evaluated according to Eq. (42), then the optimal value of the reported probability \(r=r_E\) for the tau-eta scoring rule prospect \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) satisfies the equation

Remark 5

It follows from Eq. (42) and Eq. (43) that the optimal value for \(r<1/2\) satisfies the equation:

From now on, we will only discuss the case \(r \ge 1/2\), and the results for \(r<1/2\) can be derived from Eq. (44).

6.1 Analyzing the tau-eta scoring rule prospects when the utility function is a tau function

Now, we will discuss Eq. (43) in cases where the utility function U is the tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\). Here, we will demonstrate that in these cases

-

W(E) is an extended kappa function of the optimal value of the reported probability r;

-

The (risk-)corrected reported probability B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), is also an extended kappa function of the optimal value of the reported probability r if the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) given in Eq. (36).

Theorem 3

Let \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) be a tau-eta scoring rule prospect with a scoring parameter value \(\nu _s \in (1/2,1)\), \(r \in (0,1)\) and let the utility function U be the tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\). Then, in the general model, if \(r \ge 1/2\) and \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) is evaluated according to Eq. (42), then the following hold:

-

(1)

The measure W(E) is an extended kappa function of the optimal value of the reported probability r; namely,

$$\begin{aligned} W(E) = \frac{1}{1 + \frac{1-\nu _0}{\nu _0} \left( \frac{r_\nu - a}{b - r_\nu } \frac{b-r}{r-a} \right) ^{\lambda }}, \end{aligned}$$(45)where

$$\begin{aligned} \begin{aligned}&\lambda = 2, \quad a = \frac{1}{1 - \frac{1-\nu _u}{\nu _u} \frac{\nu _s}{1-\nu _s}}, \quad b = \frac{1}{1 - \frac{\nu _u}{1-\nu _u} \frac{1-\nu _s}{\nu _s}} \\&r_\nu = \nu _0 = \frac{1}{2}. \end{aligned} \end{aligned}$$(46) -

(2)

The optimal value of the reported probability r can be expressed in terms of W(E) by

$$\begin{aligned} \begin{aligned} r \left( W(E)\right)&= \frac{b}{1+\frac{b-r_{\nu }}{r_{\nu }-a} \left( \frac{\nu _0}{1-\nu _0} \frac{1-W(E)}{W(E)}\right) ^{\frac{1}{\lambda }}} \\&\quad + \frac{a}{1+ \left( \frac{b-r_{\nu }}{r_{\nu }-a} \left( \frac{\nu _0}{1-\nu _0} \frac{1-W(E)}{W(E)}\right) ^{\frac{1}{\lambda }} \right) ^{-1}}, \end{aligned} \end{aligned}$$(47)where the values of parameters \(\lambda \), a, b, \(r_\nu \) and \(\nu _0\) are given by Eqs. (46).

-

(3)

The (risk-)corrected reported probability B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), is an extended kappa function of the optimal value of the reported probability r if the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) given in Eq. (36). That is,

$$\begin{aligned} B(E) = \frac{1}{1 + \frac{1-\nu '_0}{\nu '_0} \left( \frac{r'_\nu - a}{b - r'_\nu } \frac{b-r}{r-a} \right) ^{\lambda '}}, \end{aligned}$$(48)where

$$\begin{aligned} \begin{aligned}&\lambda ' = \frac{2}{\lambda _w} \\&a = \frac{1}{1 - \frac{1-\nu _u}{\nu _u} \frac{\nu _s}{1-\nu _s}}, \quad b = \frac{1}{1 - \frac{\nu _u}{1-\nu _u} \frac{1-\nu _s}{\nu _s}} \\&\nu '_0 = \nu _w, \quad r'_{\nu } = \frac{a + b \sqrt{\frac{\nu _w}{1-\nu _w}}}{1+\sqrt{\frac{\nu _w}{1-\nu _w}}}. \end{aligned} \end{aligned}$$(49)

Remark 6

Note that \(r=r_E \in (0,1)\); that is, we interpret functions W(E) and B(E) in the domain (0, 1) despite the fact that the corresponding expressions would allow \(r \in (a,b)\). Accordingly, the inverse function of W(E); that is, r(W(E)) is interpreted in the interval \((W(E) \vert _{r=0},W(E) \vert _{r=1})\). It should be added that \(a=0- \Delta \) and \(b=1+\Delta \), where

Therefore, the equation \(a+b=1\) holds for each of the three statements of Theorem 3.

It is worth mentioning here that the parameters \(\nu _u\), \(\nu _s\), \(\lambda _w\) and \(\nu _w\) unambiguously determine all the parameters of the functions W(E), r(W(E)) and B(E) in Eqs. (46) and Eqs. (49).

Notice that, based on Theorem 3, the measure W(E) as a function of the optimal value of the reported probability r in Eq. (45), the inverse function of W(E) in Eq. (47) and the (risk-)corrected reported probability B(E) as a function of the optimal value of the reported probability r in Eq. (48) can be written in a common form. Therefore, the main results of Theorem 3 can be summarized by using a common form for these three functions.

Theorem 4

Let \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) be a tau-eta scoring rule prospect with a scoring parameter value \(\nu _s \in (1/2,1)\), \(r \in (0,1)\) and let the utility function U be the tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\). Then, in the general model, if \(r \ge 1/2\) and \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) is evaluated according to Eq. (42), then the following functions all have the same form:

-

(1)

The weighting measure W(E) of the uncertain event E as a function of the optimal value of the reported probability \(r=r_E\);

-

(2)

The optimal value of the reported probability \(r=r_E\) as a function of the weighting measure W(E);

-

(3)

In the case where the weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\), the (risk-) corrected reported probability \(B(E) = w^{-1}\left( W(E)\right) \) as a function of the optimal value of the reported probability \(r=r_E\).

The common formula is

where

and the variable and parameter values in Eq. (50) and Eq. (51) for the above-listed three functions are given in Table 3.

In Table 3, the parameters a and b are given by

and

Remark 7

Note that in our approach, there are four tuning parameters used to model the abovementioned three functions; namely, \(\nu _u\), \(\nu _s\), \(\lambda _w\) and \(\nu _w\). It should be added that once the values of these four tuning parameters have been determined, then all the parameters of the common formula in Eq. (50) and Eq. (51) are unambiguously given as well. Also, if \(\alpha =1\), then the second term in Eq. (50) is zero f is an extended kappa function. Recall that \(a+b=1\) (see Remark 6), which implies that if \(\alpha =b\), then \(1-\alpha = a\).

As we previously pointed out in Sect. 5.1, if the parameter values are set as

then

-

The tau-eta scoring rule prospect is approximately the quadratic scoring rule prospect;

-

The kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) in Eq. (36) is approximately the Prelec probability weighting function.

Making use of Theorem 4, we now present a step-by-step method that can be used to compute the following functions:

-

1.

(F1) The weighting measure W(E) of the uncertain event E being a function of the optimal value of the reported probability \(r = r_E\);

-

2.

(F2) The inverse function of W(E) (denoted by r(W(E)));

-

3.

(F3) The (risk-)corrected reported probability measure B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), being a function of the optimal value of the reported probability \(r = r_E\).

Method

Step 1. Set the values of parameters \(\nu _s\), \(\lambda _w\) and \(\nu _w \) to

Step 2.

-

s for the utility function \(U(x)=x\), \(x \in [0,1]\), (i.e., the utility function is the identity function) set the value of parameter \(\nu _u\) to

$$\begin{aligned} \nu _u = 1/2. \end{aligned}$$ -

To compute (F1), (F2) and (F3) for a tau utility function that approximates the square root utility function \(U(x)=\sqrt{x}\), \(x \in [0,1]\), set the value of parameter \(\nu _u\) to

$$\begin{aligned} \nu _u = 1/4. \end{aligned}$$

Step 3. Compute the values of a, b and z using Eq. (52) and Eq. (53).

Step 4. Determine the values of the parameters \(\alpha \), \(a^{*}\), \(b^{*}\), \(x_\nu \), A, B, \(y_\nu \) and \(\lambda \) for (F1), (F2) and (F3), respectively, according to Table 3.

Step 5. Compute the functions (F1), (F2) and (F3) using Eq. (50) and Eq. (51).

Remark 8

Note that Step 3 in the above method gives the following values for parameters a, b and z:

-

When the utility function is the identity function (\(\nu _u=1/2\)), using the parameter values given in Eq. (54) and the condition that \(\nu _u=1/2\), after direct calculation, we get

$$\begin{aligned} \begin{aligned}&a = -\frac{1}{2}, \quad b = \frac{3}{2}, \quad z = \frac{3 \sqrt{2} - \sqrt{3}}{2 \sqrt{3} + 2 \sqrt{2}}; \end{aligned} \end{aligned}$$ -

When the utility function is the tau function \(\tau _{\nu _u}\) with \(\nu _u=1/4\), taking into account the parameter values given in Eq. (54) and the condition that \(\nu _u=1/4\), after direct calculation, we find that

$$\begin{aligned} \begin{aligned}&a = -\frac{1}{8}, \quad b = \frac{9}{8}, \quad z = \frac{9 \sqrt{2} - \sqrt{3}}{8 \sqrt{3} + 8 \sqrt{2}}. \end{aligned} \end{aligned}$$

Figures 4 and 5 show the plots of the functions W(E), r(W(E)) and B(E) for the parameter values \(\nu _u=1/2\) and \(\nu _u=1/4\), respectively, when \(\nu _s = 3/4\), \(\lambda _w = 2/3\) and \(\nu _w = 2/5\).

There is a nice aspect of our approach that should be mentioned here. Suppose that we have empirical data for one of the abovementioned three functions. Then, the four tuning parameters can be determined by fitting the function to the empirical data, which also means that we immediately determine the other two functions as well.

7 Conclusions and future work

The main findings of our study can be summarized as follows. We demonstrated that some important elements of prospect theory can be derived from probabilistic unary operators of continuous-valued logic. Namely, we showed that

-

The functions in the quadratic scoring rule prospect can be generated by the probabilistic unary operators of continuous-valued logic;

-

Prelec’s probability weighting function is a special case of the probabilistic unary operator;

-

The widely applied power utility functions can be generated by the probabilistic unary operators.

Next, we pointed out that the extended kappa function, the kappa function and its special cases, the tau and the eta functions, can be applied in prospect theory as viable alternatives to

-

Functions in the quadratic scoring rule prospect;

-

Power utility functions;

-

Prelec’s probability weighting function;

-

The Ostaszewski, Green and Myerson probability weighting function;

-

The (risk-)corrected reported probability function (inverse of Prelec’s probability weighting function).

Also, by making use of the tau and the eta functions, we introduced the tau-eta scoring rule prospect \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\), where \(\nu _s \in (1/2,1)\), and said that if this is evaluated with a utility function U which is a tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2]\), then

-

W(E) is an extended kappa function of the optimal value of the reported probability r;

-

The (risk-)corrected reported probability measure B, which is given by \(B(E) = w^{-1}\left( W(E)\right) \), is also an extended kappa function of the optimal value of the reported probability r if the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) given in Eq. (36).

Furthermore, we demonstrated that if a tau-eta scoring rule prospect is evaluated with a utility function U which is a tau function \(\tau _{\nu _u}\) with a parameter value \(\nu _u \in (0,1/2])\) and the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) is used in probabilistic sophistication, then

-

The measure W(E) as a function of the optimal value of the reported probability r;

-

The inverse function of W(E);

-

The (risk-)corrected reported probability B(E) being a function of the optimal value of the reported probability r;

can all be written in a common form. In practice, this result can be utilized as follows. If we have empirical data for one of the abovementioned three functions, then the four tuning parameters can be determined by fitting the function to the empirical data, which means that we immediately obtain the other two functions at the same time.

As part of our future research plans, we would like to find how the kappa function and the common formula given in Eq. (50) can be fitted to empirical data. Also, we plan to investigate how the weighting measure W could be modeled by \(\lambda \)-additive or \(\nu \)-additive measures (see Dombi and Jónás (2019)). And, we plan to see whether the constructions of fuzzy affine models (see, e.g., Ji et al. (2021, 2022)) can be adapted to quadratic scoring rules.

Data availability

Data sharing not applicable to this article as no datasets were generated or analyzed during the current study.

References

Aczél J (1966) Lectures on functional equations and their applications, vol 19. Academic press, New York

Allais M (1953) Le comportement de l’homme rationnel devant le risque: critique des postulats et axiomes de l’école américaine. Econometrica: J Econ Soc 21(4):503–546

Andersen S, Fountain J, Harrison GW, Rutström EE (2014) Estimating subjective probabilities. J Risk Uncertain 48(3):207–229

Arieli I, Mueller-Frank M (2017) Inferring beliefs from actions. Games Econ Behav 102:455–461. https://doi.org/10.1016/j.geb.2017.01.014

Armantier O, Treich N (2013) Eliciting beliefs: proper scoring rules, incentives, stakes and hedging. Eur Econ Rev 62:17–40

Bernoulli D (1954) Exposition of a new theory on the measurement of risk. Econometrica 22(1):23–36. https://doi.org/10.2307/1909829

Brier GW (1950) Verification of forecasts expressed in terms of probability. Mon Weather Rev 78(1):1–3

De Finetti B (1937) La prévision: ses lois logiques, ses sources subjectives. Ann de l’institut Henri Poincaré 17:1–68

Dombi J (1982) A general class of fuzzy operators, the De Morgan class of fuzzy operators and fuzziness measures induced by fuzzy operators. Fuzzy Sets Syst 8(2):149–163

Dombi J (2011) Demorgan systems with an infinitely many negations in the strict monotone operator case. Inf Sci 181(8):1440–1453

Dombi J (2012) Modalities. In: Melo-Pinto P, Couto P, Serôdio C, Fodor J, De Baets B (eds) Eurofuse 2011. Springer, Heidelberg, pp 53–65

Dombi J, Jónás T (2019) The general Poincaré formula for \(\lambda \)-additive measures. Inf Sci 490:285–291. https://doi.org/10.1016/j.ins.2019.03.059

Dombi J, Jónás T (2021) A unified approach to four important classes of unary operators. Int J Approx Reason 133:80–94. https://doi.org/10.1016/j.ijar.2021.03.007

Echternacht GJ (1972) The use of confidence testing in objective tests. Rev Educ Res 42(2):217–236

Ellsberg D (1961) Risk, ambiguity, and the savage axioms. Q J Econ 25(4):643–669

Good IJ (1952) Rational decisions. J Roy Stat Soc: Ser B (Methodol) 14(1):107–114

Harrison GW, Martínez-Correa J, Swarthout JT, Ulm ER (2017) Scoring rules for subjective probability distributions. J Econ Behav Organ 134:430–448

Hossain T, Okui R (2013) The binarized scoring rule. Rev Econ Stud 80(3):984–1001. https://doi.org/10.1093/restud/rdt006

Ji W, Qiu J, Wu L, Lam HK (2021) Fuzzy-affine-model-based output feedback dynamic sliding mode controller design of nonlinear systems. IEEE Trans Syst, Man, Cybern: Syst 51(3):1652–1661. https://doi.org/10.1109/TSMC.2019.2900050

Ji W, Qiu J, Lam HK (2022) A new sampled-data output-feedback controller design of nonlinear systems via fuzzy affine models. IEEE Trans Cybern 52(3):1681–1690. https://doi.org/10.1109/TCYB.2020.2984331

Johnstone D (2007) Economic Darwinism: who has the best probabilities? Theor Decis 62(1):47–96

Johnstone DJ (2007) The value of a probability forecast from portfolio theory. Theor Decis 63(2):153–203

Kahneman D, Tversky A (2013) Prospect theory: an analysis of decision under risk. In: Handbook of the fundamentals of financial decision making: Part I, World Scientific, pp 99–127

Keynes JM (1921) Treatise on Probability. Dover Publications, London, England

Klement EP, Mesiar R, Pap E (2013) Triangular norms, vol 8. Springer Science & Business Media, Berlin

Knight FH (1921) Risk, Uncertainty, and Profit. Hart, Schaffner, and Marx Prize Essays, (31):381 Houghton Mifflin, Boston and New York

Lattimore PK, Baker JR, Witte AD (1992) The influence of probability on risky choice: a parametric examination. J Econ Behav Organ 17(3):377–400

Li W (2007) Changing one’s mind when the facts change: incentives of experts and the design of reporting protocols. Rev Econ Stud 74(4):1175–1194

Machina MJ, Schmeidler D (1992) A more robust definition of subjective probability. Econom: J Econ Soc 60(4):745–780

Manski CF (2004) Measuring expectations. Econometrica 72(5):1329–1376

McClelland AGR, Bolger F (1994) The calibration of subjective probability: Theories and models 1980–94. Subjective probability. Wiley, Oxford, England, pp 453–482

McKelvey RD, Page T (1990) Public and private information: an experimental study of information pooling. Econom: J Econom Soc 58(6):1321–1339

Murad Z, Sefton M, Starmer C (2016) How do risk attitudes affect measured confidence? J Risk Uncertain 52(1):21–46. https://doi.org/10.1007/s11166-016-9231-1

Nyarko Y, Schotter A (2002) An experimental study of belief learning using elicited beliefs. Econometrica 70(3):971–1005

Offerman T, Sonnemans J, Van de Kuilen G, Wakker PP (2009) A truth serum for non-Bayesians: correcting proper scoring rules for risk attitudes. Rev Econ Stud 76(4):1461–1489

Ostaszewski P, Green L, Myerson J (1998) Effects of inflation on the subjective value of delayed and probabilistic rewards. Psychon Bull Rev 5(2):324–333

Prelec D (1998) The probability weighting function. Econometrica 66:497–528

Savage LJ (1954) The foundations of statistics. Wiley Publications in Statistics, Berlin

Savage LJ (1971) Elicitation of personal probabilities and expectations. J Am Stat Assoc 66(336):783–801

Schlag KH, Tremewan J, Van der Weele JJ (2015) A penny for your thoughts: a survey of methods for eliciting beliefs. Exp Econ 18(3):457–490

Schotter A, Trevino I (2014) Belief elicitation in the laboratory. Ann Rev Econ 6(1):103–128. https://doi.org/10.1146/annurev-economics-080213-040927

Shiller RJ, Kon-Ya F, Tsutsui Y et al (1996) Why did the Nikkei crash? Expanding the scope of expectations data collection. Rev Econ Stat 78(1):156–164

Spiegelhalter DJ (1986) Probabilistic prediction in patient management and clinical trials. Stat Med 5(5):421–433

Tetlock PE (2017) Expert political judgment: how good is it? How can we know?-New Edition. Princeton University Press, New York

Von Holstein CASS (1972) Probabilistic forecasting: an experiment related to the stock market. Organ Behav Hum Perform 8(1):139-158

Wakker PP (2010) Prospect theory: for risk and ambiguity. Cambridge University Press, New York

Witkowski J, Atanasov P, Ungar LH, Krause A (2017) Proper proxy scoring rules. In: Thirty-First AAAI Conference on Artificial Intelligence, pp 743–749

Wright WF (1988) Empirical comparison of subjective probability elicitation methods. Contemp Account Res 5(1):47–57

Acknowledgements

The study was supported by the Ministry of Innovation and Technology NRDI Office within the framework of the Artificial Intelligence National Laboratory Program. The research was also funded from the National Research, Development and Innovation Fund of Ministry of Innovation and Technology of Hungary under the TKP2021-NVA (Project no. TKP2021-NVA-09) funding scheme.

Funding

Open access funding provided by Eötvös Loránd University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest:

József Dombi (author) declares that he has no conflict of interest. Tamás Jónás (author) declares that he has no conflict of interest.

Ethical approval:

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proofs

Proof

of Lemma 1. Noting the definition of a QSR prospect given in Definition 2 and the fact that \(r_E, r_{{\overline{E}}} \in [0,1]\), if

holds, then \(1-(1-r_E)^2 = 1-r_{{\overline{E}}}^2\) (and \(1-r_E^2 = 1-(1-r_{{\overline{E}}})^2\)), from which \(r_{{\overline{E}}} = 1- r_E\) immediately follows. Conversely, if \(r_{{\overline{E}}} = 1- r_E\), then (55) trivially follows from the definition for a QSR prospect given in Definition 2. \(\square \)

Proof

of Theorem 1. See the proof of Theorem 1 in Offerman et al. (2009). \(\square \)

Proof

of Corollary 1. See the proof of Corollary 1 in Offerman et al. (2009). \(\square \)

Proof

of Corollary 2. See the proof of Corollary 2 in Offerman et al. (2009). \(\square \)

Proof

of Corollary 3. See the proof of Corollary 3 in Offerman et al. (2009). \(\square \)

Proof

of Corollary 4. See the proof of Corollary 4 in Offerman et al. (2009). \(\square \)

Proof

of Proposition 1. By direct calculation, we get

and

Hence, the QSR prospect \((1-(1-r)^2) \, _E \, (1-r)^2\) and the prospect defined in Eq. (15) are identical. \(\square \)

Proof

of Proposition 2. The inverse of the generator function \(f_c\) is \(f_c^{-1}:[0,\infty ] \rightarrow (0,1]\), \(f_c^{-1}(x) = \mathrm {e}^{-x}\). Now, by applying the unary operator in Eq. (13) with \(\nu = \nu _0\), we get

Next, by noting Eq. (16) and Eq. (17), from Eq. (56) we immediately get that \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}(x) = w_{P}(x)\) for any \(x \in (0,1]\). \(\square \)

Proof

of Proposition 3. If \(\lambda =1\), \(\nu , \nu _0 \in (0,1)\) and \(\rho = \frac{f_c(\nu _0)}{f_c(\nu )}\), then from Eq. (13) we have

Now, by using the condition that \(f_c(x) = - \ln (x)\), from the previous equation we get

\(\square \)

Proof

of Proposition 4. Let \(\alpha >0\) and \(f_c = f_D\). Then,

and from Eq. (13) we get

where \(x \in (0,1)\). Next, if \(\alpha <0\) and \(f_d = f_D\), then \(f_d^{-1}\) has the same form as \(f_c^{-1}\) in Eq. (57) and \(\kappa _{d,\nu ,\nu _0}^{(\lambda )}\) has the same form as \(\kappa _{c,\nu ,\nu _0}^{(\lambda )}\) in Eq. (58). \(\square \)

Proof

of Proposition 5. Let \(x \in (0,1)\). By direct calculation, we get

where

and

Next, from Eq. (59), we have

and from Eq. (60), we have

Now, by letting \(\lambda =\lambda _1 \lambda _2\) and noting the definition of the extended kappa function in Eq. (20), we get that

\(\square \)

Proof

of Corollary 5. Noting the definitions for the kappa and extended kappa functions, Eq. (22) is a special case of Eq. (21), where \(\nu =\nu _1\), \(a=0\), \(b=1\), \(x_{\nu }=\nu _2\), \(x'_{\nu }=\nu \) and \(\nu '_0 = \nu _0\). Next, using Proposition 5, we immediately get the parameter values in Eq. (23). \(\square \)

Proof

of Proposition 6. Let \(\lambda \ne 0\). In this case, based on the properties of the kappa function, \(\kappa _{\nu , \nu _0}^{(\lambda )}\) is a bijective function. By a direct calculation, we get that the inverse of function \(\kappa _{\nu , \nu _0}^{(\lambda )}\) can be written as

Now, taking into account the definition of the kappa function in Eq. (19), from Eq. (61), we get that \(\left( \kappa _{\nu , \nu _0}^{(\lambda )} \right) ^{-1}(x) = \kappa _{\nu _0, \nu }^{(\frac{1}{\lambda })}(x)\) holds for any \(x \in (0,1)\). \(\square \)

Proof

of Proposition 7. If \(\tau _{\nu }\) is a tau function with the parameter \(\nu \in (0,1)\), then the identity

holds for any \(x \in (0,1)\), where \(\nu _0=1/2\). Since \(\tau _{\nu }\) is also a kappa function, it immediately follows from Proposition 6 that

holds for any \(x \in (0,1)\). \(\square \)

Proof

of Proposition 8. From the definition for an eta function in Definition 8, we have that

holds for any \(x \in (0,1)\), where \(\nu _0=1/2\). Since \(\eta _{\nu }\) is also a kappa function, it immediately follows from Proposition 6 that

holds for any \(x \in (0,1)\). \(\square \)

Proof

of Proposition 9. Since every tau function and every eta is a kappa function, the proposition immediately follows from Corollary 5. \(\square \)

Proof

of Proposition 10. Noting that the tau function and the eta function are both kappa functions, the proposition immediately follows from Corollary 5. \(\square \)

Proof

of Proposition 11. By noting Proposition 9 and Proposition 10, we have

and

where \(\nu _{*}\) is given in Eq. (29). Here, on the one hand, from Eq. (62), we have

On the other hand, after differentiation, we have

Since the left hand sides of Eq. (64) and Eq. (65) are identical, we have

from which Eq. (27) immediately follows. Similarly, from Eq. (63) we have

and

Noting that the left hand sides of Eq. (66) and Eq. (67) are equal, we get

which implies Eq. (28). \(\square \)

Proof

of Lemma 2. Noting the definition for a tau-eta scoring rule prospect given in Definition 9, the definitions for tau and eta functions given in Definition 7 and Definition 8, respectively, and the fact that \(r_E, r_{{\overline{E}}} \in (0,1)\), if

holds, then

and

From Eq. (69) and Eq. (70), \(r_{{\overline{E}}} = 1- r_E\) immediately follows. Conversely, if \(r_{{\overline{E}}} = 1- r_E\), then Eq. (69) and Eq. (70) hold, and noting the definition for a tau-eta scoring rule prospect given in Definition 9, Eq. (68) follows from Eq. (69) (or from Eq. (70)). \(\square \)

Proof

of Lemma 3. Using the conditions in Eq. (38) and Eq. (39), Eq. (40) immediately follows from Eq. (35). \(\square \)

Proof

of Lemma 4. Let \(x \in [0,1]\). Then,

Now, noting the conditions of this lemma, we have \(f''(g(x))\left( g'(x) \right) ^2 \le 0\) and \(f'(g(x)) g''(x) <0\). That is, \(\left( f(g(x)) \right) '' <0\), which means that the composite function \(h = f \circ g\) is strictly concave on [0, 1]. \(\square \)

Proof

of Theorem 2. Since the utility function U is strictly increasing, twice differentiable and concave, and for any \(\nu _s \in (1/2,1)\), both the \(\tau _{1-\nu _s}\) and \(\eta _{\nu _s}\) functions are strictly concave, it follows from Lemma 4 that the composite functions \(U \circ \tau _{1-\nu _s}\) and \(U \circ \eta _{\nu _s}\) are both strictly concave on (0, 1). This implies that the function

is strictly concave on (0, 1). Therefore, the optimal value of r can be obtained by solving the equation

where \(V'_{TESR}\) is the first derivative function of \(V'_{TESR}\). So, after differentiating \(V_{TESR}(r)\) is Eq. (71), we have

from which Eq. (43) follows.

\(\square \)

Proof

of Theorem 3. Here, we will utilize the result of Theorem 2.

-

(1)

If \(\nu _{u} \in (0,1/2]\) and the utility function U is given by \(U(r) = \tau _{\nu _u}(r)\) for any \(r \in (0,1)\), then applying Theorem 2 means that the optimal value of the reported probability r for the tau-eta scoring rule prospect \(\tau _{1-\nu _s}(r) \, _E \, \eta _{\nu _s}(r)\) satisfies the equation

$$\begin{aligned} W(E) = \frac{1}{1 - \frac{\tau '_{\nu _u} \left( \tau _{1-\nu _s}(r) \right) }{\tau '_{\nu _u} \left( \eta _{\nu _s}(r) \right) } \frac{\tau '_{1-\nu _s}(r) }{\eta '_{\nu _s}(r) }}. \end{aligned}$$(72)Next, from Proposition 11, we have

$$\begin{aligned} \tau '_{\nu _u} \left( \tau _{1-\nu _s}(r) \right) = \frac{\tau '_{1-\nu _{*}}(r)}{\tau '_{1-\nu _s}(r)} \end{aligned}$$(73)and

$$\begin{aligned} \tau '_{\nu _u} \left( \eta _{\nu _s}(r) \right) = \frac{\eta '_{\nu _{*}}(r)}{\eta '_{\nu _s}(r)} \end{aligned}$$(74)for any \(r \in (0,1)\), where \(\nu _{*}\) is given by Eq. (29). Now, by substituting Eq. (73) and Eq. (74) into Eq. (72), we get

$$\begin{aligned} W(E) = \frac{1}{1 - \frac{\tau '_{1-\nu _*}(r) }{\eta '_{\nu _*}(r) }}, \end{aligned}$$(75)where \(\nu _{*}\) is given by Eq. (29). Recall that a tau function is a kappa function as well, and so by using Eq. (78), after direct calculation, we get

$$\begin{aligned} \begin{aligned}&\frac{\tau '_{1-\nu _*}(r) }{\eta '_{\nu _*}(r) } = - \frac{\tau _{1-\nu _*}(r) \left( 1- \tau _{1-\nu _*}(r) \right) }{\eta _{\nu _*}(r) \left( 1- \eta _{\nu _*}(r) \right) } = \\&- \left( \frac{(1-\nu _{*})r + \nu _{*} (1-r)}{\nu _{*} r + (1-\nu _{*}) (1-r)} \right) ^2. \end{aligned} \end{aligned}$$Now, utilizing this result and Eq. (75), we get

$$\begin{aligned} \begin{aligned}&W(E) = \frac{1}{1+ \left( \frac{(1-\nu _{*})r + \nu _{*} (1-r)}{\nu _{*} r + (1-\nu _{*}) (1-r)} \right) ^2} = \\&= \frac{1}{1+ \left( \dfrac{\frac{1}{2}-\frac{\nu _*-1}{2 \nu _* -1}}{\frac{\nu _*}{2 \nu _*-1}-\frac{1}{2}} \dfrac{\frac{\nu _*}{2\nu _*-1}-r}{r-\frac{\nu _*-1}{2\nu _*-1}} \right) ^2} = \\&\frac{1}{1 + \frac{1-\nu _0}{\nu _0} \left( \frac{r_\nu - a}{b - r_\nu } \frac{b-r}{r-a} \right) ^{\lambda }}, \end{aligned} \end{aligned}$$(76)where

$$\begin{aligned} \lambda = 2, \quad a = \frac{\nu _*-1}{2 \nu _* -1}, \quad b = \frac{\nu _*}{ 2 \nu _* -1}, \quad r_\nu = \nu _0 = \frac{1}{2}. \end{aligned}$$Now, taking into account the definition of \(\nu _{*}\) given in Eq. (29), we get that

$$\begin{aligned} a = \frac{1}{1 - \frac{1-\nu _u}{\nu _u} \frac{\nu _s}{1-\nu _s}}, \quad b = \frac{1}{1 - \frac{\nu _u}{1-\nu _u} \frac{1-\nu _s}{\nu _s}}. \end{aligned}$$(77)That is, by noting the definition for an extended kappa function in Definition 6, we may conclude that W(E) is an extended kappa function of the optimal value of the reported probability r; namely, \(W(E) = \kappa _{(a,b), x_{\nu },\nu _{0}}^{(\lambda )}(r)\) with the parameter values given in Eqs. (46).

-

(2)

From Eq. (76), we have

$$\begin{aligned} \begin{gathered} W(E) = \frac{1}{1 + \frac{1-\nu _0}{\nu _0} \left( \frac{r_\nu - a}{b - r_\nu } \frac{b-r}{r-a} \right) ^{\lambda }}, \end{gathered} \end{aligned}$$where the values of parameters \(\lambda \), a, b, \(r_\nu \) and \(\nu _0\) are given by Eqs. (46). Now, from this equation, by expressing r in terms of W(E), we get

$$\begin{aligned} \begin{aligned}&r \left( W(E)\right) = \frac{b}{1+\frac{b-r_{\nu }}{r_{\nu }-a} \left( \frac{\nu _0}{1-\nu _0} \frac{1-W(E)}{W(E)}\right) ^{\frac{1}{\lambda }}} + \\&+ \frac{a}{1+ \left( \frac{b-r_{\nu }}{r_{\nu }-a} \left( \frac{\nu _0}{1-\nu _0} \frac{1-W(E)}{W(E)}\right) ^{\frac{1}{\lambda }} \right) ^{-1}}. \end{aligned} \end{aligned}$$ -

(3)

If the probability weighting function w is the kappa probability weighting function \(w^{(\lambda _w)}_{\nu _w}\) given in Eq. (36), then

$$\begin{aligned} B(E) = w^{-1}\left( W(E)\right) = \left( w^{(\lambda _w)}_{\nu _w} \right) ^{-1} \left( W(E)\right) . \end{aligned}$$Next, based on Eq. (41), we have

$$\begin{aligned} \left( w^{(\lambda _w)}_{\nu _w} \right) ^{-1} = w^{(\frac{1}{\lambda _w})}_{\nu _w}, \end{aligned}$$which, according to Proposition 6, is a kappa function as well. We have shown that W(E) is an extended kappa function of the optimal value of the reported probability r, and so B is a composition of a kappa function and an extended kappa function. That is, B can be written as

$$\begin{aligned} B = \kappa _{\nu , \nu _{0_1}}^{(\lambda _1)} \circ \kappa _{(a,b), x_{\nu },\nu _{0_2}}^{(\lambda _2)}, \end{aligned}$$where

$$\begin{aligned} \begin{aligned}&\lambda _1 = \frac{1}{\lambda _w}; \quad \nu = \nu _{0_1} = \nu _w, \quad \lambda _2 = 2 \\&a = \frac{1}{1 - \frac{1-\nu _u}{\nu _u} \frac{\nu _s}{1-\nu _s}}, \quad b = \frac{1}{1 - \frac{\nu _u}{1-\nu _u} \frac{1-\nu _s}{\nu _s}} \\&r_\nu = \nu _{0_2} = \frac{1}{2}. \end{aligned} \end{aligned}$$Now, by making use of Proposition 5, we get

$$\begin{aligned} B(E) = \kappa _{(a,b), r'_{\nu },\nu '_{0}}^{(\lambda )}(r), \end{aligned}$$where