Abstract

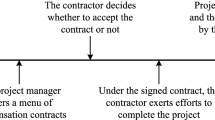

A suitable and attractive contract may bring large profits and lower the risk caused by uncertain information in project management; thus, how to design incentive contracts under uncertainty has been the most pressing demand for the owner. This paper investigates the project incentive contract design problem with random asymmetric information, in which a risk-neutral owner (he) engages a risk-averse contractor (she) to complete a project. The contractor’s construction capacity is private information and characterized as a random variable. Furthermore, two incentive contracts, duration-based contract and deadline-based contract, are designed, where the owner offers a fixed payment and a penalty or bonus factor based on the real project duration and a predetermined deadline for the contractor in these two different contracts. Then, a project duration contract and a deadline-based contract model are developed with the purpose of maximizing the owner’s expected payoff, respectively. The optimal contracts are investigated, and the values of the contractor’s construction capacity information for the owner under these two contracts are quantified. The results show that the owner benefits better from getting more construction capacity information and should commit an information rent to the contractor due to asymmetric information, which distorts the penalty factor under both contracts. Moreover, regardless of contract type, the deadline has no effects on the owner’s incentive term and only affects the fixed payments. Further, the contractor is more likely to keep information private, while the owner benefits more from knowing the contractor’s construction capacity when the deadline-based contract is used.

Similar content being viewed by others

Notes

We have examined the case where the contractor’s minimum net incoming is R > 0, and find that the results will not be changed.

References

Afshar A, Fathi H (2009) Fuzzy multi-objective optimization of finance-based scheduling for construction projects with uncertainties in cost. Eng Optim 41:1063–1080

Ammar MA (2011) Optimization of project time-cost trade-off problem with discounted cash flows. J Constr Eng Manag 137:65–71

Ashfaq RAR, Wang XZ, Huang JZX, Abbas H, He YL (2017) Fuzziness based semi-supervised learning approach for intrusion detection system. Inf Sci 378:484–497

Ayaǧ Z (2014) An integrated approach to concept evaluation in a new product development. J Intell Manuf. doi:10.1007/s10845-014-0930-7

Azariadis C (1983) Employment with asymmetric information. Q J Econ 98:157–172

Baron DP, Myerson RB (1982) Regulating a monopolist with unknown costs. Econometrica 50:911–930

Bayiz M, Corbett CJ (2005) Coordination and incentive contracts in project management under asymmetric information. Working paper, UCLA Anderson School

Cachon GP (2003) Supply chain coordination with contracts. In: Hand-book in operations research and management science: supply chain management. Kluwer, Amsterdam, The Netherlands

Chen YJ (2013) Risk-incentives trade-off and outside options. OR Spectr 35:937–956

Dutta S (2008) Managerial expertise, private information, and pay-performance sensitivity. Manag Sci 54:429–442

Grossman SJ, Hart OD (1983) Implicit contracts under asymmetric information. Q J Econ 98:123–156

Homberger J (2007) A multi-agent system for the decentralized resource-constrained multi-project scheduling problem. Int Trans Oper Res 14:565–589

Kwon H, Lippman S, Tang C (2010) Optimal duration-based and cost-based coordinated project contracts with unobservable work rates. Int J Prod Econ 126:247–254

Kwon H, Lippman S, Tang C (2011) Sourcing decisions of project tasks with exponential completion times: impact on operating profits. Int J Prod Econ 134:138–150

Laffont J, Tirole J (1986) Using cost observation to regulate firms. J Polit Econ 94:614–641

Mirrlees JA (1971) An exploration in the theory of optimum income taxation. Rev Econ Stud 38:175–208

Mirrlees JA (1974) Notes on welfare economics, information and uncertainty. In: Balch M, McFadden D, Wu S (eds) Essays in equilibrium behavior under uncertainty. North-Holland, Amsterdam

Pathak B, Srivastava S (2014) Integrated fuzzy-HMH for project uncertainties in time-cost tradeoff problem. Appl Soft Comput 21:320–329

Paul A, Gutierrez G (2005) Simple probability models for project contracting. Eur J Oper Res 165:329–338

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71:393–410

Wang XZ (2004) Economic analysis: incentive and constraint mechanism for construction project principal-agents. Bus Manag 6:77–82

Wang XZ (2015) Learning from big data with uncertainty–editorial. J Intell Fuzzy Syst 28:2329–2330

Wang XZ, Ashfaq R, Fu A (2015) Fuzziness based sample categorization for classifier performance improvement. J Intell Fuzzy Syst 29:1185–1196

Wu X, Lan Y, Liu H (2014) Optimal revenue-sharing contract based on forecasting effort for uncertain agency problem. Int J Mach Learn Cybern 5:971–979

Xiao W, Xu Y (2012) The impact of royalty contract revision in a multistage strategic R&D alliance. Manag Sci 58:2251–2271

Yang I (2011) Stochastic time-cost tradeoff analysis: a distribution-free approach with focus on correlation and stochastic dominance. Autom Constr 20:916–926

Yang K, Zhao R, Lan Y (2014) The impact of risk attitude in new product development under dual information asymmetry. Comput Ind Eng 76:122–137

Yang K, Zhao R, Lan Y (2016a) Impacts of uncertain project duration and asymmetric risk sensitivity information in project management. Int Trans Oper Res 23:749–774

Yang K, Zhao R, Lan Y (2016b) Incentive contract design in project management with serial tasks and uncertain completion times. Eng Optim 48:629–651

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors have no conflict of interest.

Human participants

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by Y. Ni.

Rights and permissions

About this article

Cite this article

Qi, L. Project duration contract design problem under uncertain information. Soft Comput 22, 5593–5602 (2018). https://doi.org/10.1007/s00500-017-2527-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-017-2527-5