Abstract

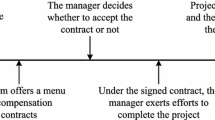

The contractor’s procrastinating behavior owing to the psychology of cost salience exposes the project manager to the risk of time delay, which brings a significant challenge in project manager’s incentive contract design. This paper considers that a project manager pays a contractor over a menu of deadline-based incentive contracts to conduct a project which consists of two sequential tasks. The contractor is endowed with private cost salience information and unobservable efforts. The subjective assessments about the cost salience degree and the project variability are characterized as uncertain variables. Within the framework of uncertainty theory and principal-agent theory, we investigate the impacts of the existence of cost salience and information asymmetry on the incentive contract and the project manager’s profit. We confirm that cost salience can impel the project manager to lower both the fixed payment under full information and the penalty/incentive rate under pure moral hazard. Interestingly, we find that moral hazard can weaken the extent of inverse impact caused by the existence of cost salience for the project manager. Our study also shows that, for mitigating the adverse impacts brought by moral hazard, the project manager is more profitable to provide effort incentive when the contractor’s efforts are more productive or the project risk is in a higher level. Finally, other suggestions for mitigating the detrimental impacts brought by adverse selection are provided by numerical experiments.

Similar content being viewed by others

References

Akerlof, G. A. (1991). Procrastination and obedience. The American Economic Review, 81(2), 1–19.

Ariely, D., & Wertenbroch, K. (2002). Procrastination, deadlines, and performance: Self-control by precommitment. Psychological Science, 13(3), 219–224.

Assaf, S. A., & Al-Hejji, S. (2006). Causes of delay in large construction projects. International Journal of Project Management, 24(4), 349–357.

Boarnet, M. G. (1998). Business losses, transportation damage, and the northridge earthquake. Journal of Transportation and Statistics, 39, 49–63.

Bubshait, A. A. (2003). Incentive/disincentive contracts and its effects on industrial projects. International Journal of Project Management, 21(1), 63–70.

Chen, T., Klastorin, T., & Wagner, M. R. (2015). Incentive contracts in serial stochastic projects. Manufacturing & Service Operations Management, 17(3), 290–301.

Chen, Z., Lan, Y., & Zhao, R. (2018). Impacts of risk attitude and outside option on compensation contracts under different information structures. Fuzzy Optimization and Decision Making, 17(1), 13–47.

Dutta, S. (2008). Managerial expertise, private information, and pay-performance sensitivity. Management Science, 54(3), 429–442.

Ericson, K. M. (2017). On the interaction of memory and procrastination: Implications for reminders, deadlines, and empirical estimation. Journal of the European Economic Association, 15(3), 692–719.

Ferrari, J. R., & Roster, C. A. (2018). Delaying disposing: examining the relationship between procrastination and clutter across generations. Current Psychology, 37(2), 426–431.

Fu, Y., Chen, Z., & Lan, Y. (2018). The impacts of private risk aversion magnitude and moral hazard in R&D project under uncertain environment. Soft Computing, 22(16), 5231–5246.

Gao, J., Yang, X., & Liu, D. (2016). Uncertain shapley value of coalitional game with application to supply chain alliance. Applied Soft Computing,. https://doi.org/10.1016/j.asoc.2016.06.018.

Gibbons, R. (1987). Piece-rate incentive schemes. Journal of Labor Economics, 5(4), 413–429.

Kerkhove, L. P., & Vanhoucke, M. (2016). Incentive contract design for projects: The owner’s perspective. Omega, 62, 93–114.

Kwon, H. D., Lippman, S. A., & Tang, C. S. (2010). Optimal time-based and cost-based coordinated project contracts with unobservable work rates. International Journal of Production Economics, 126(2), 247–254.

Liu, B. (2007). Uncertainty Theory (2nd ed.). Berlin: Springer.

Liu, B. (2013). Extreme value theorems of uncertain process with application to insurance risk model. Soft Computing, 17(4), 549–556.

Liu, Y., Chen, X., & Ralescu, D. A. (2015). Uncertain currency model and currency option pricing. International Journal of Intelligent Systems, 30(1), 40–51.

Mu, R., Lan, Y., & Tang, W. (2013). An uncertain contract model for rural migrant worker’s employment problems. Fuzzy Optimization and Decision Making, 12(1), 29–39.

O’Donoghue, T., & Rabin, M. (1999). Incentives for procrastinators. The Quarterly Journal of Economics, 114(3), 769–816.

Steel, P. (2007). The nature of procrastination: A meta-analytic and theoretical review of quintessential self-regulatory failure. Psychological Bulletin, 133(1), 65–94.

Tang, C. S., Zhang, K., & Zhou, S. X. (2015). Incentive contracts for managing a project with uncertain completion time. Production and Operations Management, 24(12), 1945–1954.

Walker, K. (2010). Prime Contractor Performance Report. Washington State Department of Transportation (WSDOT) Engineering and Regional Operations Division, Olympia, Washington.

Wu, Y., Ramachandran, K., & Krishnan, V. (2014). Managing cost salience and procrastination in projects: Compensation and team composition. Production and Operations Management, 23(8), 1299–1311.

Xiao, W., & Xu, Y. (2012). The impact of royalty contract revision in a multistage strategic R&D alliance. Management Science, 58(12), 2251–2271.

Yang, K., Zhao, R., & Lan, Y. (2016). Incentive contract design in project management with serial tasks and uncertain completion times. Engineering Optimization, 48(4), 629–651.

Zhang, J. (2016). Deadlines in product development. Management Science, 62(11), 3310–3326.

Zhou, C., Peng, J., Liu, Z., & Dong, B. (2018). Optimal incentive contracts under loss aversion and inequity aversion. Fuzzy Optimization and Decision Making,. https://doi.org/10.1007/s10700-018-9288-1.

Acknowledgements

This work was supported by the National Natural Science Foundation of China under Grant Nos. 71771166 and 71771165, Tianjin Natural Science Foundation under Grant No. 18JCQNJC04200, and partly by a S\({\hat{e}}\)r Cymru II COFUND Fellowship, UK.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proofs

Appendix: Proofs

Proof of Proposition 1

Based on the expected value criterion, the project manager’s expected profit can be written as

Because the project manager’s expected profit is decreasing in the fixed payments \(\alpha _1\) and \(\alpha _2\), at optimality, the individual rationality constraints for the contractor should be binding, i.e., \(\text {CE}(1,1)=0\). Thus, we can rewrite the project manager’s problem as

By substituting the fixed payments into the objective function, we obtain the project manager’s expected profit:

which is decreasing in \(\beta _1\) and \(\beta _2\) and concave in \(e_{1}\) and \(e_{2}\). Thus, the project manager would set both \(\beta _1\) and \(\beta _2\) to zero for getting a maximum profit. Besides, we can yield the contractor’s optimal effort levels \(e_1=bt_{11}\) and \(e_2=bt_{12}\) by using the first-order condition. Following the determinate individual rationality constraints which are binding, the corresponding optimal fixed payments \(\alpha _1\) and \(\alpha _2\) for the contractor can be derived immediately. The proof of the proposition is complete. \(\square \)

Proof of Proposition 2

Under moral hazard, the contractor will choose his efforts \(e_{i}\) in task i to maximize his own utility

which is concave in \({\hat{e}}_{i}\), \(i=1,2\). The maximum is completely characterized by the first-order condition and we derive \(e_{1}=t_{11}\beta _1\) and \(e_{1}=t_{12}\beta _2\). Furthermore, because the project manager’s profit is decreasing in the fixed payments, at optimality, the individual rationality constraints should be binding. Therefore, by substituting \(e_{1}\) and \(e_{2}\) into the individual rationality constraints and then substituting the fixed payments (\(\alpha _1\) and \(\alpha _2\)) and the effort levels (\(e_{1}\) and \(e_{2}\)) into the objective function, the project manager’s expected profit can be rewritten as

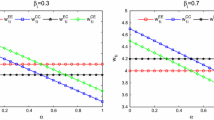

By the first-order condition regarding to \(\beta _1\) and \(\beta _1\), we can obtain \(\beta _1=\frac{bt_{11}^2}{t_{11}^2+\rho \sigma _1^2}\) and \(\beta _2=\frac{bt_{12}^2}{t_{12}^2+\rho \sigma _2^2}\). Based on the binding individual rationality constraints, the optimal fixed payments (\(\alpha _1\) and \(\alpha _2\)) can be obtained immediately. The proof of the proposition is complete. \(\square \)

Proof of Proposition 3

Similar to the Proof of Proposition 1. \(\square \)

Proof of Proposition 4

Similar to the Proof of Proposition 2. \(\square \)

Proof of Proposition 5

Let \(\text {CE}(\theta ,\theta )=\text {CE}_1(\theta ,\theta )+\text {CE}_2(\theta ,\theta )\). The incentive compatibility constraints for adverse selection can be written as

which means that \(\text {CE}(\theta ,{\tilde{\theta }})\) obtains its maximal value at \(\text {CE}(\theta ,\theta )\), i.e., the contractor can obtain his maximal profit \(\text {CE}(\theta ,{\tilde{\theta }})\) if and only if \(\theta ={\tilde{\theta }}\). Thus, \(\text {CE}(\theta ,{\tilde{\theta }})\) satisfies the first-order condition (i.e., local incentive compatibility constraint) \(\frac{\partial \text {CE}(\theta ,{\tilde{\theta }})}{\partial {\tilde{\theta }}}\bigm |_{{\tilde{\theta }}=\theta }=0\) and the second-order condition \(\frac{\partial ^{2} \text {CE}(\theta ,{\tilde{\theta }})}{\partial {\tilde{\theta }}^{2}}\bigm |_{{\tilde{\theta }}=\theta }\leqslant 0\). The local incentive compatibility constraint

Differentiating \(\text {CE}(\theta ,\theta )\) with respect to \(\theta \) yields

Thus, the individual rationality constraint is equivalent to

The constraint is binding under the optimal mechanism because the project manager will reap the redundant profit, so that \(\text {CE}({\overline{\theta }},{\overline{\theta }})=0\). Because \(\text {CE}({\overline{\theta }},{\overline{\theta }})=0\) and \(\frac{\mathrm {d}\text {CE}(\theta ,\theta )}{\mathrm {d}\theta }=-e_1^2/2\), we can derive

Combining the definition of \(\text {CE}(\theta ,\theta )\) yields

By substituting the fixed wages into the objective function, we can derive

which is decreasing in \(\beta _1\) and \(\beta _2\) and concave in \(e_{1}\) and \(e_{2}\). Thus, the project manager would set both \(\beta _1\) and \(\beta _2\) to zero for getting a maximum profit. Besides, we can yield the contractor’s optimal effort levels \(e_1=bt_{11}/{\overline{\theta }}\) and \(e_2=bt_{12}\) by using the first-order condition. Following the determinate individual rationality constraints which are binding, the corresponding optimal fixed payments \(\alpha _1\) and \(\alpha _2\) for the contractor can be derived immediately. The proof of the proposition is complete. \(\square \)

Proof of Proposition 6

Similar to the Proof of Proposition 5. \(\square \)

Proof of Proposition 7

The result is derived directly by comparing the project manager’s profits which are shown in Corollaries 1–4. \(\square \)

Proof of Proposition 8

The result is derived directly by comparing the project manager’s profits which are shown in Corollaries 3–6. \(\square \)

Rights and permissions

About this article

Cite this article

Chen, Z., Lan, Y., Zhao, R. et al. Deadline-based incentive contracts in project management with cost salience. Fuzzy Optim Decis Making 18, 451–473 (2019). https://doi.org/10.1007/s10700-019-09302-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-019-09302-y