Abstract

We examine technology adoption and growth in a political economy framework where two alternative mechanisms of redistribution are on the menu of choice for the economy. One of these is a lump-sum transfer given to agents in the economy. The other is in the form of expenditure directed towards institutional reform aimed at bringing about a reduction in the cost of technology adoption in the presence of uncertainty. The choice over these mechanisms is examined under three alternative approaches to collective decision making, namely a voting mechanism, and social planning with a Benthamite and Rawlsian social welfare function respectively. We find that the extent of uncertainty, and initial inequality, working through the political economy mechanism, have a positive impact on long run average wealth levels in the economy in all settings. All economies converge to the same inequality and growth rates in the long run; however, the speed of transition is fastest with the voting mechanism and slowest in the case of social planning with the Rawlsian social welfare function. Transitional inequality is highest in the Rawlsian framework, suggesting that egalitarian objectives in collective decision making do not necessarily correspond to egalitarian outcomes for the economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Political economy models emphasize the endogenous nature of policies and institutions, and their determination by public opinion and vested interests. This endogeneity is highlighted in models that consider conflict over a policy parameter such as the tax rate on capital (as in Alesina and Rodrik 1994), the inflation rate (as in Huffman 1997; Albanesi 2007; Dolmas et al 2000), or the policy on social security (such as Tabellini 2000). Conflict over the policies arises due to the presence of inequality, which in turn influences economic outcomes through a desire for redistribution. Another strand within this literature focuses on policies that are the key to the process of development, such as those enabling the adoption of modern technologies. In this literature, conflict arises as some agents have vested interests in existing technologies, and suffer economic losses when new technologies are adopted (as in Krusell and Rios-Rull 1996; Acemoglu and Robinson 2000), or losses in political power (as in Acemoglu and Robinson 2002).

Common to the above-mentioned papers is the fact that political conflict arises over a single dimension of policy, such as tax rates, social security, or technology adoption. In this paper, however, we recognize the possibility of conflict arising due to the presence of several competing mechanisms of redistribution and growth on the menu of choice of agents in an economy. Each agent or group of agents is impacted differently, depending on the mechanism in question. For example, these expenditures can be purely redistributive, such as food stamps directly given to the poor, or have redistributive elements such as a public education system which can benefit poor as well as rich individuals. This can lead to conflict over the instrument of policy that is used for redistribution and development.

The existence of such trade-offs is further substantiated by several studies in the empirical political economy literature; see, for example, Busemeyer et al (2018) and Bursztyn (2016) in the context of educational policy and Reeves et al (2014) in the context of health policy. Similar politico-economic influences impact not only on environmental policies, but also on the adoption and diffusion of technologies directed at alleviating environmental problems such as pollution and climate change (Dasgupta et al 2017).

Furthermore, there are several institutional arrangements of collective decision making that may be used to resolve these types of conflicts, which could also lead to different outcomes for an economy (Fumagalli and Narciso 2012; Persson and Tabellini 2001; Besley and Case 2003). Parallel to this literature, which takes a positive approach, one may also view outcomes arising due to policies from the lens of normative social choice theory. As discussed in Sen (2017) this literature uses “social welfare functions” which are constructs that aggregate individual welfare using social norms such as egalitarianism, utilitarianism, economic freedom, or capabilities. Applications of this approach occur in the form of policy evaluation as well as implementation, either through the development of indicators that track the aggregate wellbeing of an economy, or through welfare-based cost-benefit analyses that inform the development of social policies (Kakwani et al 2016).

The focus of this paper is on technology and how the above-mentioned influences on redistributive policy interact to affect technology adoption, inequality and growth. We suggest that other redistributive alternatives compete with reform aimed at facilitating technology adoption and the trade-offs between these choices can lead to different transitional paths to development and the diffusion of technologies. The mechanism of collective choice also impacts on such transitional dynamics, providing a potential explanation for the different rates of technology adoption in the world economy.

To this end, we construct an overlapping-generations economy with inequality in wealth, in which intra-generational redistribution can be achieved through two instruments of policy. One instrument is a direct mechanism of redistribution, achieving it through a lump-sum transfer, which is funded via a linear tax on the wealth/resources of agents. The second instrument is aimed at cost-reducing institutional development that facilitates technology adoption in the presence of risk and uncertainty. This expenditure must also be financed through the taxation system. Conflict arises over the proportion of tax revenues that may be allocated to each of these instruments.

The choice of this proportion is then examined under three different mechanisms of collective decision making. In the first scenario, this proportion is determined through a majority voting process. This scenario is then compared with two other approaches, which, in addition to presenting alternative ways of collective decision making, can serve as normative benchmarks for evaluating the positive political economy implications of the voting model. In the second setting we have a “planned economy” whereby the government in any period chooses this proportion to maximize a ‘Benthamite’ social welfare function, which is the sum of expected lifetime utilities of all agents born in that period. The third setting involves another planned economy in which a government chooses the proportion devoted to institutional development by maximizing a ‘Rawlsian’ ‘maximin’ social welfare function; this entails maximizing the utility of the worst-off agent in the generation born in that period.Footnote 1,Footnote 2

In part, the motivation for considering the above-mentioned paradigms of social choice stems from two strands of empirical literature, one which examines the link between democracy and development, and another which examines the link between redistribution and development. In both strands of literature, the evidence on the link in question is inconclusive.Footnote 3 This is understandable given the wide spectrum of institutional settings and social norms observed in world economies, which renders the measurement of concepts such as ‘democracy’ and ‘redistribution’ a challenging task. The paradigms we consider give us a frame of reference or lens to interpret the literature. For example, the voting model captures a perfectly functioning or idealized notion of a ‘democracy’ while the two planned economies are stylized, idealized versions of real world planned economies with different objectives. World economies may arguably be interpreted as falling “in-between” pairs of these stylized settings in terms of their process of collective decision making and the social norms that inform them. For example, one can have a democracy with an emphasis on social planning, and socialist economies with a decentralized, market based economic policies.Footnote 4 See, also, Agranov and Palfrey (2015), page 46, for a discussion of this point.

The inconclusive nature of the redistribution-and-growth discussion also justifies considering political economy underpinnings stemming from conflict over competing mechanisms of redistribution. Furthermore, this is a more realistic context in which barriers to technology adoption can arise. For example, historically there are relatively few instances in which technological change has been blocked by economic agents (Acemoglu and Robinson 2000). However, as inferred from the voluminous redistribution-and-growth literature, and policy debates in various countries, trade-offs between different mechanisms of redistribution arise frequently in the context of economic reform.

While there are typically many forms of redistributive expenditures that can be made with a government’s revenue, a simple starting point conceptualizing this idea is the case of two competing mechanisms. We therefore consider two types of mechanisms, one which is a direct transfer of resources from the rich to the poor, and another which is indirect, such as revenue spent on institutional development. The latter mechanism eventually achieves redistribution and growth via a reduction of costs incurred in adopting high-return technologies associated with risk. In a dynamic context, both these mechanisms impact on growth, which leads to further redistribution given a larger “size of cake” to be divided among economic agents in subsequent periods of development.

To characterize the idea of technology adoption in our model, we consider two technologies, and both are characterized by risk. However, the second technology offers alleviation of risk at a fixed cost. We interpret this cost as the expense associated with entering a financial intermediary system whereby the pooling of risks allows for a form of insurance in the event an unfavourable shock. Alternatively, and more generally, this could be a “cost of doing business” in an environment with poorly developed institutions. The presence of uncertainty in our model adds another, previously unexplored yet relevant dimension in the political economy literature on technology adoption. There are, for example, several empirical studies that emphasize the presence of risk and uncertainty as a barrier to technological change. See, for example, Dercon and Christiaensen (2011). However, the theoretical literature has devoted limited attention to this issue, particularly in a political economy context. While there are a large number of models that focus on uncertainty and technology adoption in the context of a microeconomic framework (see the survey of Hoppe (2002)) the macroeconomic literature has typically focussed on other barriers to technology adoption, such as institutional or skill-specific fixed costs (Greenwood and Yorukoglu 1997; Parente and Prescott 1994) or politico-economic barriers that arise in the absence of uncertainty (Krusell and Rios-Rull 1996; Acemoglu and Robinson 2000; Desmet and Parente 2014). While the broader implication of institutional barriers is still applicable, our framework puts an additional layer to this interpretation, suggesting that poor institutional development adds to the risk associated with technological adoption.

The results of our model, both analytical and numerical, show that uncertainty interacts with the political economy aspects in interesting ways. We have “uncertainty driven growth” like in Oikawa (2010), although the mechanism of our paper is different. Essentially, uncertainty interacts with the political economy mechanism by creating a desire for redistribution in the form of institutional development. Institutional development, in turn, facilitates the reduction of costs associated with risky technology adoption. In all settings considered we find uncertainty facilitates faster adoption as well as diffusion of technologies. We interpret ‘diffusion’ to have occurred at the point where institutional development has taken place to the extent that no further redistributive revenues are allocated to it, and the economy has converged to the sustained, balanced growth path.

Preferences in our model are not single-peaked, so we are not able to invoke the median voter theorem in its classic form, as discussed in Black (1948) and Downs (1957). However, we analytically derive the optimal plans of the agents, in addition to establishing that, under certain reasonable conditions, the median voter will be pivotal. This enables us to fully characterize the political equilibrium and dynamics of the economy in the case of our baseline model— i.e., the model in which collective choice is through a majority vote. We further explore the features of our model using numerical analysis, which illustrates that while long run outcomes such as inequality and growth are identical in all settings, there are some striking differences in the transitional dynamics and the timing of convergence to the balanced growth path. Typically, the “best” outcomes occur in the democracy, in the sense that technology diffusion and transition to the balanced growth path is at least as fast as or faster than the planned economies, with average long run wealth levels being at least as high or higher than in planned economies. Transitional inequality in the democracy, however, is at least as high, or higher than in the case of the Benthamite economy. Interestingly, the ‘egalitarian’ Rawlsian framework produces the highest transitional inequality and the slowest adoption and diffusion of technology, leading to the slowest transition to the balanced growth path.

The intuition for this seemingly paradoxical result is as follows. In the initial stages of transition, preferences of most agents are in favour of redistribution in the form of the direct lump-sum transfer, since a large proportion of the agents are poor and unable to access the better technology regardless of the redistribution that takes place. The Rawlsian economy typically favours the poorest agent, even when the distribution shifts over time and the majority prefer redistribution via the institutional development expenditure. This slows down the adoption and diffusion process, since wealth levels of richer agents are rising relatively slowly, the “size of the cake” to be redistributed is smaller. This means redistribution on the transition path in the Rawlsian economy is lower than that of the democracy, in which the median agent’s preference is pivotal. The Benthamite economy, on the other hand, either favours the median agent or the richer agents, given its preference for redistribution that maximizes the sum of utilities of agents. This can translate into either lower or equal average wealth levels relative to the democracy.

The remainder of the paper is organized as follows. Section 2 describes the framework and presents analytical results. Section 3 presents a numerical illustration of the theory discussed in the previous section and provides additional insights on issues beyond the scope of theoretical analysis. Section 4 concludes, and proofs of results from Sect. 2 are presented in the Appendix.

2 The economic environment and analytical results

We consider a two-period overlapping-generations economy with N agents whose wealth holdings are heterogeneous. A new generation is born every period and time is discrete, with \(t = 0, 1, 2,\ldots \). Each agent i born in period t also inherits wealth \(W_{it}\) from their parents in the form of bequests. Agents are also endowed with a unit of unskilled labour endowment which earns them a subsistence wage \({\overline{w}}\).

The economy produces output (Y) using capital (K). The production functions G(K) assume a simple “AK” specification, which suggests that capital is a composite good consisting of both human and physical capital. This simple specification represents one of the first-generation approaches to the endogenous growth theory pioneered in Romer (1986, 1987, 1990), and generates endogenous growth through a capital deepening process (Acemoglu 2009; Obstfeld et al 1996).Footnote 5 There are two technologies available to the agents. Specifically, the production functions for Technology B is \(G(K) = BK\) and for Technology F is \(G(K) = FK\), where B and F are stochastic, and denote the respective total factor productivity parameters associated with the two technologies.

In the case of Technology B, \(B=\eta +\varepsilon _{i,t}\), where \(\eta >0\) is a time-invariant and non-stochastic component and \(\varepsilon _{i,t}\) is a shock experienced by agent i at time t. In what follows, however, we suppress the agent-specific subscript in our notation, given that all the variables our analysis below refers to a specific agent, unless otherwise specified. We keep time subscripts intact, with the exception of the economy-wide average level of wealth, which is indicated b \({\overline{W}}\), except in cases where it is evident that we are referring to average wealth within a specific period.

If the agent faces a bad shock, and this occurs with the probability p, then \(\varepsilon _t=\varepsilon _l<0\), while if the agent faces a good shock \(\varepsilon _t=\varepsilon _h>0\). We assume that \(E[\varepsilon _t]=0\) and \(|\varepsilon _l|=|\varepsilon _h|<\eta \). The return on Technology F is similar to that of Technology B when the agent faces a good shock i.e. \(F=\eta +\varepsilon _h\). Furthermore, when the agent faces a bad shock, the return on Technology F is \(\phi \) where \(\eta +\varepsilon _l<\phi <\eta \). However, there is a fixed cost associated with Technology F.Footnote 6

This modelling approach with regard to uncertainty is somewhat similar to that of Townsend and Ueda (2006, 2010). As in those studies, one could interpret the agents’ decision to use Technology F as using a system that involves financial intermediaries. However, we assume that agents cannot borrow to adopt a certain technology. Rather, financial intermediaries invest on behalf of all the agents who deposit funds with them and offer the returns as described above, depending on the type of shock that is experienced. Financial intermediaries charge a once-off fixed entry fee \(\psi >0\). This fee implicitly represents the registration and other fees that financial intermediaries incur including any mark-up they charge on customers.

A more general interpretation would be that this cost is incurred in the “learning-by-doing” process of adopting and adapting the new technology, as in Lahiri et al (2018), although given the presence of uncertainty in this model this “learning-by-doing” could arise from the uncertainty itself. For example, farmers adopting a high-yield variety of seed would take time to understand the appropriate levels of irrigation based on local climate, soil or infrastructural conditions.

There is also a government in the economy. The government raises revenue by levying a constant tax rate of \(\tau \) on the heterogeneous agents’ total wealth endowment. The distribution of the agents’ total endowment is described by a density function f(W) with support \((0,\kappa )\). The total revenue that the government raises in any period \(GR_t\) is described by:

The government can use this revenue in two ways. In its role as facilitator of technology adoption it can undertake expenditures that reduce the cost of technology adoption. To use the specific example of financial intermediaries, the government could use a proportion \(g_t=\alpha \tau {\overline{W}}_t\) of the funds to reduce the cost associated with registering a financial intermediary and to fund its regulatory activities. The latter cost may, for example, include things such as the cost of training a financial regulator, engaging in research and other activities aimed at improving the financial system and setting up insurance schemes for innovative entrepreneurs. More generally, the government could undertake any expenditure that mitigates the uncertainty associated with adopting new technologies. This could entail institutional reform that promotes a more stable environment, which in turn facilitates entrepreneurial activity. Alternatively, the government could directly invest in an education system that leads to a dynamic workforce that adapts quickly to changes in the technological space. For example, it could promote investments in curriculum that are more technology specific, such as initiatives to improve digital literacy of students. This would make them more adaptable to the dynamic changes that occur in the workplace due to digitisation, thereby promoting more rapid adoption of digital technologies.

Thus \(\psi \), the adoption cost, is decreasing in \(g_t\) which in turn depends on \(\alpha \), the proportion of revenues allocated to reducing this cost. The remainder of the revenue \(tr_t=(1-\alpha )\tau {\overline{W}}_t\) is given to all the young agents in the form of a lump-sum transfer.Footnote 7 It is this competing mechanism of re-distribution that underpins the political economy results of our paper.Footnote 8

We assume that the functional form for \(\psi (g)\) satisfies the following properties:

-

(i)

\(\psi ^{\prime }(g)<0\); \(\psi ^{\prime \prime }(g)\ge 0\)

-

(ii)

\(\underset{g\rightarrow \infty }{lim\;\;} \psi (g)=0\)

A form which satisfies the above, and is used to derive our results is given by:

where \(\psi (0)=\overline{\psi }\).

We consider three approaches to collective decision making regarding the value of \(\alpha \). The first case is a ‘democracy’ whereby agents vote on their preferred value of \(\alpha \), and the majority rule is used to decide the value of \(\alpha \) that will be implemented. In the second case, the government uses a Benthamite social welfare function, and the value of \(\alpha \) that maximizes this function is chosen. In the third case the government uses the Rawlsian social welfare function which maximizes the minimum of the utilities across all agents in the economy. We assume that the tax rate \(\tau \) is exogenously determined by the government and is the same across all of the cases considered.

Caveats apply to the above characterizations of collective decision making, and it worthwhile noting them before we proceed with a more formal discussion of the three cases considered here. The characterization of the “democracy” is more consistent with the idea of direct democracy as opposed to representative democracy where policy proposals are voted upon by elected representatives of the people rather than the people themselves. The direct voting approach using the majority rule, however, is commonly used in several papers and is an abstraction that is intended to capture the spirit of what is observed in the democratic process, while having the appeal of tractability. For example, Bhattacharya et al (2005) consider overlapping generation models where agents vote on the inflation rate, an abstraction intended to capture the idea of the lack of central bank independence and the presence of political pressure to use inflation as a means of redistribution. Likewise, Glomm and Ravikumar (1992) consider agents voting directly on the tax rate used to finance the public education system.Footnote 9

Similarly, the “welfarist” approaches to collective decision making can be viewed as normative benchmarks to compare the political economy framework. However, we suggest that all three cases are essentially abstractions, and governance in real economies is informed by a mix of philosophies. Some economies focus on economic freedom and democratic processes regardless of outcomes, while others develop policies informed by egalitarian or utilitarian principles, even though their implementation may occur without consensus. The latter outcome could play out even in countries that are democratic, as legislative processes of many countries do not require legislators to consult their constituents directly for each and every reform that is passed by the government. Similarly, the role of the welfare state could be written into a country’s constitution.Footnote 10 As such, our use of the term “democracy” for the voting model and “planned economy” for the Benthamite and Rawlsian cases is not intended to imply a comparison of democracies and authoritarian states; rather, we see these stylized cases as emphasizing different principles (respectively democratic, utilitarian or egalitarian) in the process of collective decision making.Footnote 11

Of course, there is much greater complexity in real economies relative to what can be captured by the three paradigms we consider here. However, understanding those complexities is difficult without first understanding the outcomes that prevail in an idealized setting that focuses on a specific form of decision making. It is in this spirit that we present and interpret our analysis of these settings.

2.1 Case 1: Majority voting to determine \(\alpha \)

In the “democracy” the agents vote on the proportion \(\alpha \) that they prefer to be allocated towards cost-reducing institutional development expenditure. Voting takes place at the ‘first stage’ of each period t and the political outcome is determined by majority rule. In common with the direct voting models referenced earlier, we essentially look at the median agent’s preference over \(\alpha \) to establish our results. As will be discussed shortly, outcomes in this economy can be characterized by the median voter’s preference even though the conditions of the median voter theorem are not necessarily satisfied.

In the “second stage” of period t, after considering the political outcome, agents decide whether they should adopt Technology F or not. These decisions are made in the presence of uncertainty; the realization of the shock occurs after the voting on \(\alpha \) and technology adoption, consumption and bequest plans are made. The timing of events is as characterised in Fig. 1.

Agents do not consume in the first period of their life. The utilities of the agents using Technologies B and F are respectively described in Eqs. (2) and (3):

In Eqs. (2) and (3), \(c_{t+1}\) and \(b_{t+1}\) denote period 2 household consumption and bequests for the agent. Superscripts B and F simply imply that the agent adopts Technology B and Technology F, respectively, while superscripts l and h denote whether the agent faces a bad or good shock respectively. The parameter \(\theta \) describes the extent of imperfect intergenerational altruism in the model. In every period each generation faces a problem regarding whether to adopt Technology B or F. This decision depends on an agent’s resource endowment and this in turn depends upon the resources inherited from parents in the form of bequests. Agents face different budget constraints depending on whether they use Technology B or F. For those adopting B these are described as follows:

The resource endowment for agents whose parents adopted B is given by \(W_t=W_t^{B,x}=b_t^{B,x}\) while the endowment of agents whose parents adopted F is given by \(W_t=W_t^{F,x}=b_t^{F,x}\), where \(x = h, l\). Note that agents do not consume in the first period of their lives, and as such their entire endowment, net of taxes, is invested into the technology they choose to adopt. The first term on the right-hand-side of (4) and (5) respectively denotes the output resulting from this investment depending on the shock received by the agent. For agents who adopt F, the budget constraints are described as follows:

The agent’s problem is to make choices of \(c_{t+1}, b_{t+1}\) that maximise his/her utility. More specifically, agents who adopt B maximise Eq. (2) subject to constraints (4) and (5). This yields the following optimal state-contingent consumption and bequest plans:

In the above equations \(y_t^{B,x}=(1-\tau )(\eta +\varepsilon _x)({\overline{w}}+W_t)+(1-\alpha )\tau {\overline{W}}_t\), where \(x = l, h\). Alternatively, an agent who adopts F maximises Eq. (3) subject to constraints (6) and (7). This yields the following optimal state-contingent consumption and bequest plans:

In the above equations, \(y_t^{F,l}=(1-\tau )\phi ({\overline{w}}+W_t)+(1-\alpha )\tau {\overline{W}}_t-\frac{\overline{\psi }}{1+\alpha \tau {\overline{W}}_t}\) and \(y_t^{F,h}=(1-\tau )(\eta +\varepsilon _h)({\overline{w}}+W_t)+(1-\alpha )\tau {\overline{W}}_t-\frac{\overline{\psi }}{1+\alpha \tau {\overline{W}}_t}\) Note that an agent will adopt F iff

where and \(V^F\) and \(V^B\) represent the indirect expected utility functions for the agents who adopt F or B respectively and the superscript \(^*\) denotes the optimal choice of the variable in question. It can then be shown that (16) implies the following:

Equation (17) is quite easy to interpret; it essentially suggests that an agent will adopt Technology F if the expected income, net of adoption costs, exceeds the expected income from adopting Technology B. Furthermore, we can show the following result.Footnote 12

Proposition 1

There is a critical level of wealth \(W^{*}\) such that agents with wealth above this level adopt Technology F.

For a proof see the Appendix. It is also possible to gain some insight on how people vote by analysing the total change of \(W^{*}\) with respect to changes in \(\alpha \). At first glance, intuition suggests that agents are likely to prefer a high \(\alpha \) in order to adopt F quickly. However, this decision is not clear-cut because agents also receive a lump-sum transfer payment \((1-\alpha )\tau {\overline{W}}\), which is decreasing in \(\alpha \). However, in the case where bad shocks and good shocks occur with equal probability, we can show the following result.

Proposition 2

Consider the case of symmetric shocks, with \(p = 1-p = 1/2\). Assume further that \({\overline{W}}>\frac{\sqrt{\,\overline{\psi }}-1}{\tau }\) . It can be shown that:

-

(a)

If \(\alpha \in [0,{\tilde{\alpha }}]\) where \({\tilde{\alpha }}=\frac{\sqrt{\overline{\psi }}-1}{\tau {\overline{W}}}\), then \(\frac{dW^{*}}{d\alpha }<0\)

-

(b)

For \(\alpha \in ({\tilde{\alpha }},1]\) there are two possibilities:

-

(i)

\(\frac{dW^{*}}{d\alpha }<0\), (so that, in combination with part (a) \(\frac{dW^{*}}{d\alpha }<0\) for all alpha in [0, 1]).

-

(ii)

There exists \({\hat{\alpha }}\in ({\tilde{\alpha }},1]\) such that \(\frac{dW^{*}}{d\alpha }<0\) for \(\alpha \in ({\tilde{\alpha }},{\hat{\alpha }}]\) and \(\frac{dW^{*}}{d\alpha }\ge 0\) for \(\alpha \in ({\hat{\alpha }},1]\) , (so that in combination with part (a) \(\frac{dW^{*}}{d\alpha }<0\) for \(\alpha \in [0,{\hat{\alpha }}]\) and \(\frac{dW^{*}}{d\alpha }\ge 0\) for \(\alpha \in ({\hat{\alpha }},1]\)).

-

(i)

Before we consider the implications of these results, a few remarks are in order for the assumptions in the statement of Proposition 2. Firstly, we believe the symmetric shocks case to be the most relevant and interesting case to analyse in the context of this model. This is because, to consider the impact of uncertainty, presented in the next section, we look at quantitative experiments based on “mean preserving” distributions of the shock. Furthermore, asymmetric shocks, in addition to being less analytically tractable, rig the model to produce either weaker or stronger versions of the outcomes in the symmetric case, without adding anything qualitatively different.

Secondly, the assumption \({\overline{W}}>\frac{\sqrt{\,\overline{\psi }}-1}{\tau }\) reflects the idea that the economy is in a transitional phase, so that its average wealth is higher than the adoption costs associated with Technology F by a roughly proportional amount. This assumption also ensures an interior solution for the \(\alpha \) that is optimal from the perspective of agents using Technology F.

Regarding the implications of Proposition 2, it is interesting to note that allocating all of the revenue raised by the government to cost-reducing institutional development need not be efficient. Part b(i) of the proposition combined with part (a) essentially reflects this possibility, in that there is a critical proportion of revenue beyond which expenditures allocated to such activity do not reduce the critical wealth \(W^{*}\) required by agents to adopt Technology F. However, this case is only one of the possibilities, so that cost-reducing developmental expenditure is potentially efficient in the entire range of \(\alpha \).

In what follows, we impose this assumption in the remainder of this section. However, numerical simulations conducted in the subsequent section consider experiments which allow for a vote on the entire range of \(\alpha \). These experiments show that political economy outcomes are the same as those implied by the analytical results we are about to discuss. Intuitively, agents do not vote for a value of \(\alpha \) that falls in the inefficient range; not only does this amount to a waste of resources, it also implies a smaller amount of redistribution in the form of the lump-sum transfer. Consider, for example, Fig. 2.

Here, the proportion \(\alpha ^{\prime }\) of government revenues can achieve the same \(W^{*}\) as \(\alpha ^{\prime \prime }\), but \(\alpha ^{\prime }\) entails a smaller sacrifice of revenues received from the government in the form of the lump-sum transfer.

In the case of efficient R&D, we examine the political economy aspects by looking at three subsets of agents within the economy’s distribution of wealth and examining how their indirect utility functions behave with changes in \(\alpha \). Recall that the support of the economy’s distribution is \([0,\kappa ]\). We consider subsets within this range which are diagrammatically illustrated in Fig. 3.

Note that \(W^{*}\), the critical level of wealth that makes it worthwhile to adopt F falls in Subset 3 of the interval \([0, \kappa ]\) shown in Fig. 3. As discussed above we know that \(W^{*}\) can vary with \(\alpha \), and in the case considered is decreasing in \(\alpha \). Without loss of generality, then, we can define the range \([{\hat{W}},{\tilde{W}}]\) such that it covers the variation in \(W^{*}\) as \(\alpha \) varies in the permissible range. This means that as \(\alpha \) increases towards its maximum value, \(W^{*}\) moves to the left, towards \({\hat{W}}\). As \(\alpha \) decreases towards 0, \(W^{*}\) moves to the right towards \({\tilde{W}}\). The three subsets shown in Fig. 3 are then described as follows:

-

(i)

Subset 1: Agents with a level of wealth belonging to the interval \((0, {\hat{W}}]\), which is substantially below W, so that changes in \(\alpha \) do not reduce \(W^{*}\) to the extent that it falls below \({\hat{W}}\) .

-

(ii)

Agents with a level of wealth belonging to the interval \([{\tilde{W}} , \kappa )\) substantially above \(W^{*}\) so that changes in \(\alpha \) do not increase \(W^{*}\) to the extent that it rises above \({\tilde{W}}\).

-

(iii)

Agents in the range \(({\hat{W}}, {\tilde{W}})\), whose technology adoption choice is affected by changes in \(\alpha \) through its impact on \(W^{*}\).

We first consider the cases (i) and (ii), i.e. agents who belong to the bottom and top ends of the wealth distribution, with the bottom end adopting Technology B and the top end adopting Technology F. Preferences for these agents are single peaked with respect to \(\alpha \). The preferred value of \(\alpha \) in these cases is described in the following proposition:Footnote 13

Proposition 3

(i) Agents with initial wealth levels in the interval \((0, {\hat{W}}]\) prefer \(\alpha =0\). (ii) The preferred value of alpha for agents in the interval \([{\tilde{W}}, \kappa )\) is given by:

In the case of the middle group of agents we can show the following:Footnote 14

Proposition 4

Agents with initial wealth levels in the interval \(({\hat{W}},\tilde{W})\) have preferences that are non-single peaked in \(\alpha \). However, it can be shown that there exists a threshold level of wealth \(W^{\prime }\) (which can be distinct from \(W^{*}\)) such that agents above this level have a preferred value of \(\alpha \) which is the same as that of agents in the interval \([{\tilde{W}}, \kappa )\). Agents below this level have the same preferred value of \(\alpha \) as those in the interval \((0, {\hat{W}}]\).

Propositions 3 and 4 essentially imply that the political outcome for \(\alpha \) depends on the distribution of wealth in any given period and various parameters of the model, such as the average level of wealth in the economy, the adoption cost parameter \(\overline{\psi }\) and the tax rate \(\tau \), and the location of the median voter relative to the second threshold level of wealth \(W^{\prime }\) defined in Proposition 4. This threshold level splits the distribution of agents into two groups, one of which prefers \(\alpha = {\tilde{\alpha }}\), while the other prefers \(\alpha =0\). Also note that as the average level of wealth in the economy grows over time, \({\tilde{\alpha }}\) converges to zero as well.

Intuitively, in the early stages of development, when there are a substantial number of agents in the bottom end of the distribution, and the median voter is below \(W^{\prime }\), we would expect a vote for \(\alpha =0\), given agents who prefer this value are in the majority. However, as redistribution through the lump sum transfers takes place the distribution changes over time, making it possible for a vote in favour of a positive value of \(\alpha \), as described by Proposition 3 part (ii). Eventually, however, as development takes place with the number of agents adopting F increasing over time, tax revenues \(\tau {\overline{W}}\) grow and all agents prefer a value of \(\alpha \) equal to 0.

It is also possible to reinforce the intuition regarding the transitional dynamics of the economy by looking at the difference Eqs. (10), (11), (14) and (15) that determine the evolution of wealth over time. To simplify the analysis, we look at the economy’s “average” behaviour by taking expected values of these equations. Further, let \(Z_{t+1}^B=EW_{t+1}^B\), \(Z_{t+1}^F=EW_{t+1}^F\), where E represents the expectation operator, and let \(Z_t=W\); \(Z_t^{*}=W^{*}\).Footnote 15 We can then derive:

In Eq. (18),

As can be seen from (18), the expected bequest/wealth functions that describe the economy’s evolution are non-autonomous difference equations with time-variant ‘forcing terms’ \(a_t\) and \(c_t\) which are also endogenous, given that \(\alpha \) is chosen through a political process. However, we know that \(d > b\) and \(a_t\) and \(c_t\) are positive and increasing in the average level of wealth \({\overline{W}}_t\). Even if we assume that \(b<1\), as long as \(d >1\), we can see that a dynasty starting below the critical level of resources would eventually escape to the group of F adopters, provided the economy’s average level of wealth, which impacts on the forcing terms \(a_t\) and \(c_t\), was growing over time.Footnote 16 The pattern for \(\alpha \) would be roughly similar to what we have conjectured above. That is, in early stages there would be vote for a value of \(\alpha =0\), given that the majority of agents are below the threshold level of wealth \(W^{\prime }_t\). In the transitional stages, with more agents adopting F there would be a vote in favour of higher values of \(\alpha \). However, as the economy develops, the average wealth would grow without bound, particularly once all agents have adopted F. Eventually, then, \(\alpha \) would converge to zero.

Note that the above analysis was based on a given level of uncertainty. If we increase the ‘extent of uncertainty’ by increasing the variance of the shocks, our intuition suggests that the transitional process would be lengthened. However, this need not be the case since the political economy mechanism ensures that the agents in the economy will take into account the extent of uncertainty when voting for \(\alpha \). We attempt to address this issue by examining how the critical level of wealth required for adoption, \(W^{*}\) changes with the negative and positive shocks to the economy. The analytical results capturing this effect are summarized in the proposition below.Footnote 17

Proposition 5

Consider \(W^{*}\) as defined in Proposition 1. We can show that

-

(i)

\(\frac{dW^{*}}{d\varepsilon _l}>0\) and \(\frac{dW^{*}}{d\varepsilon _h}<0\);

-

(ii)

The sign of \(\frac{dW^{*}}{d\varepsilon _l}+\frac{dW^{*}}{d\varepsilon _h}\) is ambiguous. Specifically,

$$\begin{aligned} \frac{dW^{*}}{d\varepsilon _h}+\frac{dW^{*}}{d\varepsilon _l}\ge (\le )\, 0 \quad \text { iff }\quad \frac{p}{y^{B,l}}+\frac{1-p}{y^{B,h}}-\frac{1-p}{y^{F,h}}\ge (\le )\, 0. \end{aligned}$$

Proposition 5 demonstrates that, ceteris paribus, an increase in size of the negative shock increases the critical level of wealth necessary for adopting the superior technology, while the opposite is true for the positive shock. However, part (ii) suggests the magnitude of the total impact is not necessarily symmetric; that is, keeping both shocks equal in absolute value, as assumed earlier, an increase in the absolute size of both shocks could either increase or decrease \(W^{*}\).

2.2 Case 2: The government maximizes a Benthamite social welfare function (BSWF) to determine \(\alpha \)

Here, the timing of the announcement is the same as in the previous model, with agents’ technology adoption, consumption and bequest plans made after \(\alpha \) is announced. Budget constraints and utility functions have an identical form, as do the optimal consumption and bequest plans. Therefore, the form of the indirect utility functions are also identical. The only difference is the determination of \(\alpha \), which is given by

Note that the underlying preferences of agents are the same as in the previous case. This means that, for a given initial distribution, agents’ preferences over \(\alpha \) are described by Propositions 3 and 4 above. However, this economy will not necessarily pick the \(\alpha \) chosen by the median voter. Recall that there are, effectively, two types of agents in the economy—those below \(W^{\prime }\) who prefer \(\alpha =0\), and those above this level of wealth who prefer \(\alpha ={\tilde{\alpha }}\). The problem of the Benthamite economy, in the most likely case, is to choose from one of these two values, rather than a range of values of \(\alpha \).Footnote 18 Since utility is increasing in wealth, the BSWF tends to give a higher weight to the preference of richer individuals. It is therefore possible for this economy to choose an \(\alpha \) that is different from the median agent’s preferred value.

2.3 Case 3: The government maximizes a Rawlsian social welfare function (RSWF) to determine \(\alpha \)

Again, the timing conventions are the same as in the previous model. The proportion of revenues allocated to institutional development is announced first, followed by the technology adoption plans and finally the state-contingent consumption and bequest plans. The RSWF maximizes the minimum of the utilities attained by agents in the economy. Formally,

In contrast to the BSWF, and the voting mechanism, the RSWF favours the preference of the poorest agent in the economy. Depending on the wealth level of the poorest agent in the economy, this will either be \(\alpha =0\) or \(\alpha ={\tilde{\alpha }}\). For a transitional economy this is likely to be \(\alpha =0\) since agents at the bottom end of the distribution are too poor to be able to adopt Technology F, regardless of the redistribution of resources in the economy. Put differently, for a given initial distribution the RSWF is more likely to generate the outcome of \(\alpha =0\).

Intuitively, the \(\alpha \) chosen by a ‘democracy’ is likely to be the same as \(\alpha ^R\) if there is a sufficiently high level of inequality. In that case, the median voter would fall into the group of agents below the wealth level \(W^{\prime }\) as defined in Proposition 4, so that in both economies the preferred \(\alpha \) would equal zero. It is harder to glean what might occur in the Benthamite case, but it is clear that the nature of the distribution would matter. In the Benthamite case, the question is whether the sum of agents’ utilities evaluated at \(\alpha =0\) or \(\alpha ={\tilde{\alpha }}\) is the highest. Nevertheless, given the higher weight that is implicitly attached to the utility of richer agents, there is the possibility that \({\tilde{\alpha }}\) is chosen even in the case when the median agent’s preferred \(\alpha \) is zero.

The above discussion assumes that the initial distribution of wealth is identical in all three economies. Note that the next period’s distribution will be identical across the three cases only if this period’s outcome for \(\alpha \) is identical. If not, the economies will move to a different transitional path, depending on the outcome for \(\alpha \). To get further insight as to what might happen, however, we need to resort to numerical experiments, which are presented in the next section. These experiments also help to analyse the impact of uncertainty, for which we have only a partial characterization based on Proposition 5.

3 Results based on numerical experiments

We first present the analysis of a ‘democracy’ as it serves as a useful benchmark for discussing results in the case of planned economies. This is because the dynamic patterns in the three cases are similar, and differences arise only in the timing of adoption and diffusion of technology, and in the timing of convergence to long-run levels of inequality and growth.

For the purpose of the numerical experiments, we start with a benchmark set of parameters and then vary some of these to glean insights on issues we are interested in, such as the impact of uncertainty and initial inequality on long-run and transitional outcomes for the democratic economy. We then present a comparison of three economies along the same dimensions. The benchmark parameters are: \(\theta =1\); \(\phi =2.5\); \(\eta = 3\); \(p =0.5\); \(\overline{\psi }=50\); \({\overline{w}}=10\) and \(\tau = 0.25\). The number of agents in the economy is 501, with their wealth levels drawn from an initial distribution which is lognormal with mean 2.5 and standard deviation 0.8. We sort this initial distribution so that agents are arranged in ascending order of their wealth levels, with the median agent represented by the \(251^{\mathrm{st}}\) agent.Footnote 19

Given \(\eta = 3\) and \(\phi =2.5\), the assumptions set out in Sect. 2 regarding uncertainty provide some restrictions on the size of shocks we can experiment with. Since \(\eta +\varepsilon _l<\phi \) we must have \(\varepsilon _l < -0.5\). Furthermore, we have assumed symmetric shocks such that \(E\varepsilon _t=0\), and \(|\varepsilon _l|=|\varepsilon _h|<\eta \), so our experiments involving varying the extent of uncertainty amount to varying \(\varepsilon _t\) such that \(0.5<|\varepsilon _t|<3\). At the lower end of the range, a size of shock such that \(|\varepsilon _t|=0.5\) represents a loss of 16.6% of average income if the bad state occurs (and an equivalent gain if the good state is realized), with a standard deviation of shocks equal to 0.7. At the upper end of the range \(|\varepsilon _t|=3\) represents a 100% loss relative to average income in the bad state and a doubling of income in the good state, with a standard deviation of shocks equal to 4.25.

To begin with we consider the pattern of technology adoption over time, which is presented in Fig. 4, for varying levels of uncertainty as represented by the standard deviations of the shocks. The figure shows that \(N_F\), the number of agents adopting technology F is initially zero, followed by a complete and irreversible switch to the technology F. However, a higher extent of uncertainty seems to lead to a quicker timing of complete adoption, although there are some ranges of parameters for which uncertainty does not have any impact. For example, as the standard deviation of shocks increases from 0.7 to 0.75 and then to 0.8, complete adoption occurs in periods 7, 6 and 5 respectively, but a further increase of uncertainty, as represented by a standard deviation of shocks equal to 0.85, does not lead to quicker adoption. Nevertheless, the impact of uncertainty is non-negative.Footnote 20 Broadly speaking, the intuition is as follows: a higher extent of uncertainty creates a desire for re-distribution via the institutional development expenditure, leading to a favourable vote for \(\alpha \), as reflected in Fig. 5, which presents the \(\alpha \) preferred by the majority over time.

However, the proportion of revenue allocated to institutional development falls immediately after the initial spike, which occurs when the transition to full adoption takes place. This decline is consistent with the theory and intuition presented in Sect. 2. Specifically, there is an initial phase in which the majority prefers \(\alpha =0\), since the median voter falls below \(W^{\prime }\), the level of wealth defined in Proposition 4. Subsequent distributional shifts ensure the arrival of a transitional phase in which \({\tilde{\alpha }}=(\sqrt{\,\overline{\psi }}-1)/(\tau {\overline{W}}_t)\) is the preferred proportion of revenues allocated to cost-reducing institutional development expenditure. However, since the average wealth in the economy grows over time, this proportion falls, and eventually converges to zero. We associate this convergence to zero with complete diffusion of technology F.

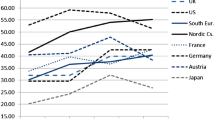

Again, the impact of uncertainty is to increase the proportion of revenue allocated to institutional development in the initial period of the transitional phase. However, the convergence to zero also occurs faster, so that the diffusion of the technology is also facilitated by increases in uncertainty. This is because average wealth, as depicted in Fig. 6, rises faster, the higher the extent of uncertainty in the economy. A larger proportion of revenues allocated to institutional development facilitates a faster transition to the sustained balanced growth path. Average growth (i.e. the average of the growth rates experienced by all agents) following complete adoption and diffusion fluctuates within a band, which is wider and has a higher mean, higher the extent of uncertainty (see Fig. 7). Long run inequality, on the other hand, is higher in economies with a higher extent of uncertainty (see Fig. 8).

The qualitative pattern in other economies—i.e. the Benthamite and Rawlsian - is very similar with a few differences. Specifically, technology adoption in the latter cases need not follow an “all or nothing” pattern we observe in the democracy. There is, instead, an intermediate phase in which some agents adopt B, while others adopt F. See Figs. 9 and 10 which present the Benthamite and Rawlsian cases. For some levels of uncertainty, each of these economies transitions to a partial adoption before full adoption takes place, but the extent of partial adoption in the intermediate phase is much larger in the Benthamite economy.

However, in quantitative terms there are some important differences across the three types of economies. See Fig. 11 in which we present the dynamic pattern of \(\alpha \) for the three cases, for different levels of uncertainty. Note that the pattern for \(\alpha \) can be used to “predict” the patterns for other variables. In our analysis for the democracy the graph for \(\alpha \) could have been used as an “indicator” for patterns observed in other variables - the timing of complete adoption occurred at the same time as the period in which \(\alpha \) was the highest. The fastest convergence to zero was associated with the highest average wealth level. The fastest convergence in \(\alpha \) was also associated with the fastest convergence to the sustained, balanced growth path, and the highest long-run level of inequality. We find that these connections between the graph for \(\alpha \) and other dynamic patterns in the economy are also found in the Benthamite and Rawlsian cases. As such, we are able to present the results more succinctly using only the graphs for \(\alpha \) and comparing them across the economies.

The four panels of Fig. 11 present the dynamic patterns for \(\alpha \), \(\alpha ^B\) and \(\alpha ^R\) for levels of uncertainty associated respectively with \(|\varepsilon _t|=0.7, 0.75, 0.80, 0.85\). The top-left and bottom-right are particularly interesting, in that the proportion allocated to institutional development in the initial period of the transitional phase is the highest in the Benthamite case, followed by the democracy and Rawlsian cases. This suggests a faster timing of complete adoption in the Benthamite case followed by the democracy and Rawlsian cases respectively. In the top-right and bottom-left panels, however, the Benthamite economy and the democracy have identical outcomes. They have a higher level of \(\alpha \) and faster complete adoption relative to the Rawlsian case.

The fastest diffusion of technologies, however, is difficult to read off Fig. 11, given the small size and scale of the individual panels. Figures 12 and 13 therefore present magnified versions of Panel 1 of Fig. 11. These figures show that the fastest convergence to zero occurs in the case of the democracy, followed by the Benthamite and Rawlsian cases. This translates into the fact that the democracy experiences the fastest diffusion of Technology F and the fastest transition to sustained growth, as well as the highest level of long run wealth. To assess the dynamic pattern of long run inequality, the corresponding results are presented in Fig. 14. Here we see that transitional inequality is highest in the Rawlsian case, followed by the democracy and Benthamite cases. Inequality, however, converges to the same level in all three cases.

Magnified version of Fig. 11, top-left panel

Further magnification of Fig. 11 panel (i)

In all of the above cases we assumed a given initial distribution of income. In Figs. 15 and 16 we present experiments to glean the impact of initial inequality on the long run outcomes in the economy. In the three panels of Fig. 15 we present the dynamic pattern for the proportion allocated to institutional development in the democracy. The solid line represents an initial distribution which is lognormal with mean 2.5 and standard deviation 0.8 and a Gini coefficient of 0.43. The underlying distribution for the dashed line is a mean preserving spread of the former distribution with a standard deviation of 1.1 and a Gini coefficient of 0.55. Higher initial inequality leads to a greater initial expenditure on institutional development and faster diffusion of technology, in addition to a faster transition to the balanced growth path. Figure 16 illustrates that long run inequality levels are the same, regardless of the initial distribution of wealth. Results for the Benthamite and Rawlsian cases are analogous to those presented in Figs. 15 and 16.

In summary, uncertainty reacts with the political mechanism in all cases, with higher uncertainty leading to higher long-run average wealth and inequality, and a faster adoption and diffusion of the better technology. In most cases, the democracy and Benthamite mechanisms lead to the same outcomes, while in some cases the democracy leads to the fastest diffusion and highest long run average wealth. In all cases the Rawlsian mechanism leads to the slowest adoption and diffusion of technology and the lowest long run average wealth. For a given level of uncertainty, the Rawlsian mechanism also leads to the highest transitional inequality. For a given set of parameters, and uncertainty levels, however, the long run inequality and growth patterns in all economies are the same.

That the Rawlsian economy produces the highest transitional inequality may seem paradoxical in light of the discussion in the welfare economics literature that highlights the ‘egalitarian’ nature of the Rawlsian social welfare function (see Harsanyi 1975). However, the intuition for why this happens in the context of our model is straightforward. In the initial stages of transition, most agents are in favour of the direct lump-sum transfer, since a large proportion of the agents are poor and unable to access the better technology. The Rawlsian social welfare function gives the highest weight to the poorest agent, even when the distribution shifts over time and the majority prefer redistribution via the institutional development expenditure. Going back to Fig. 11, for example, we see that in all cases, in the initial stages of development, the Rawlsian economy opts for redistribution through the lump sum transfer rather institutional development. While it eventually reaches a stage where the poorest agent prefers some proportion of revenue allocated to institutional development, it lags behind the political and Benthamite cases in this regard.Footnote 21

An immediate implication of this feature is that growth in the Rawlsian economy is slower since the richer agents get fewer benefits in terms of adoption-cost reducing institutional development expenditure. This further implies that revenues available for redistribution in subsequent periods of development are also lower. Since redistribution is lower, inequality goes down at a slower pace as well, relative to the democracy where the median agent’s preference is pivotal. The Benthamite economy, on the other hand, puts more weight on the median and rich agents, given its preference for redistribution that maximizes the sum of utilities of agents. This can translate into lower transitional inequality relative to the democracy as well the Rawlsian economy.

All economies, however, converge to the same level of inequality in the long run. Once the desired reduction in adoption costs takes place all economies favour redistribution in the form of the lump-sum transfer. The tax-transfer system works perfectly as there is no corruption or other revenue losses associated with it. Given this scenario, all economies converge to the same balanced growth path commensurate with the productivity of the F technology. The latter feature is common to the AK class of endogenous growth models discussed earlier.Footnote 22 Also in common with those models, some inequality remains, given that all agents were part of an unequal distribution to begin with and growing at the same rate ensures that the “catch-up” never takes place, despite the redistribution in the economy.

Another reason for the long-run convergence to the same level of inequality relates to the similarity of objectives across the three mechanisms with regard to redistribution. If there is high inequality the median voter is poor, which suggests similarity of preferences relative to the poorest agent, who is emphasized in the Rawlsian case. There is also a similarity with the Benthamite case, even though in that framework the weight on richer agents is higher. This is because with high inequality there are many more agents at the lower end of the distribution and the sum of their utilities could add up to more than that of the richer agents leading to outcomes in line with the median voter’s preference. Differences in short-run outcomes will, of course, exist, as discussed in the theoretical section, and illustrated in our quantitative experiments. However, as development and redistribution take place these differences shrink further since inequality decreases over time.

A caveat to the above discussion pertains to the idea of progressivity in the taxation system. As discussed previously, we have assumed a linear tax rate that is same across all economies. This creates a framework that is tractable but makes a fair comparison of the three different economies somewhat difficult. It could be argued, for example, that the Rawlsian economy would have chosen a different tax system, one that is more progressive relative to other economies. In this paper, however, we do not model choice of a tax system. A parallel extension would entail including progressive taxation in all three economies. Even so, some aspect of the outcomes obtained here would remain; the late adoption that occurs would still remain since agents at the lower end of the distribution would favour the lump-sum transfer, leading to slower growth as a result of the slower adoption of technologies. This could, in turn, lower transitional growth as well as redistribution, as with the linear tax case. Nevertheless, a progressive tax system, particularly in the context of a model that incorporates work-effort in more explicit form could have significantly different outcomes and suggests fruitful directions of future research.

4 Concluding remarks

Empirical literature on inequality and growth suggests a diversity of inequality and wealth patterns, in addition to varied timing of adoption and diffusion of technologies. Furthermore, the literature on the link between uncertainty and is impact on technology adoption also yields mixed evidence. The framework considered in this paper, which examines the link between technology adoption and uncertainty, provides a political economy perspective on both strands of literature, in addition to strands that examine the link between institutions (relating to democracy and redistribution) and their impact on growth and inequality.

Specifically, we examine technology adoption and growth in a political economy framework where two alternative mechanisms of redistribution are on the menu of choice for the economy. One of these is a lump-sum transfer given to agents in the economy. The other is in the form of expenditure directed towards institutional reform aimed at bringing about a reduction in the cost of technology adoption in the presence of uncertainty. The choice over these mechanisms is examined under three alternative approaches to collective decision making. In the first setting, voting takes place to determine the proportion of revenue allocated to adoption-cost-reducing institutional expenditure. In the second setting, the government chooses this proportion to maximize a ‘Benthamite’ social welfare function, i.e. the sum of utilities of agents in the economy. The third setting applies the Rawlsian social welfare function, which is the most “egalitarian” in that this proportion is chosen to maximize the minimum level of utility attained in the heterogeneous agent economy.

A key feature of the framework is that the extent of uncertainty, working through the political economy mechanism, has a positive impact on long run average wealth levels in the economy in all settings. The voting mechanism leads to the fastest transition to sustained balanced growth in all cases, while the slowest transition is experienced in the case of the Rawlsian economy. Expenditures on institutional development are higher in the voting and Benthamite economies relative to the Rawlsian economy. All economies converge to the same inequality and growth rates in the long run. Transitional inequality, however, is highest in the Rawlsian framework. Another interesting aspect is that higher the initial level of inequality, faster the transition to the long run outcome.

In light of these results a further exploration of the mechanisms of collective choice is a potential area of future research, particularly in the context of macroeconomic models. For example, there is a large literature on social choice suggesting alternative voting mechanisms lead to different outcomes, but the implications of these results have not been explored in the context of political economy macroeconomic settings. A deeper exploration of the implications of such mechanisms, as well as alternative social welfare constructs that have been proposed in the welfare economics literature, could lead to further insights into the issues addressed above. Such an exploration could occur in the context institutional choices, such as between taxation systems with different degrees of progression, or alternative mechanisms of redistribution, such as education or health.

Notes

Note that policies chosen in the planned economies described here are not necessarily “optimal policies” in the sense described in the overlapping generations literature. For a discussion of optimality in the context of overlapping generations models, see de la Croix and Michel (2002). Here we borrow social welfare functions from the social choice and welfare literature applied in the context of a government that exists for a two periods and only considers the collective welfare of a single generation of agents over their lifetime.

For a discussion of Benthamite and Rawlsian social welfare functions see d’Aspremont and Gevers (2002) and references therein.

For example, China is not a democracy, and yet has experienced shifts in institutional structure, particularly at the local government level where democratic processes such as elections are in place (Mohanty 2007). India, in early stages of its post-colonial development had, on the other hand, a strong emphasis on social planning.

The linearity in capital makes the AK specification a tractable way of introducing endogenous technical change, but with the caveat that the implied share of capital is 1, an aspect which does not align with empirical evidence. However, this feature is mitigated to an extent if one emphasizes the composite nature of capital. Another way to interpret this specification is to recognize that while there may be diminishing returns to capital accumulation at the level of an individual firm, the “knowledge spillovers” generated cause constant returns at the aggregate level. Capital accumulation and deepening in this model is therefore interpreted as including both physical and human capital accumulation, where the latter occurs through education and learning-by-doing, both viewed as important channels of economic growth in theoretical and empirical literature. See, for example, Benhabib and Spiegel (1994, 2005), Hanushek and Woessmann (2020) and references therein.

The structure of the model has some similarity with that of Lahiri and Ratnasiri (2012), who also discuss the implications of adding an exogenous growth element that shifts the productivities associated with the two technologies. In that model there is no uncertainty, taxation or political economy element, key features of our model that will be discussed shortly. However, the presence of an exogenous growth component does not alter outcomes in a qualitative sense, and we anticipate that this will be true in the context of our model as well. In a nutshell, the process of technology adoption and diffusion will repeat following an exogenous shock to productivities and the process of adjustment will be similar to what is described in the analysis that follows.

Note that the linear tax structure, combined with a lump-sum transfer implies a tax system that is mildly progressive. In the presence of inequality, most agents have a wealth level below the average wealth of the economy, so (depending on the value of \(\alpha \)) they can receive more than they pay in taxes. The opposite is true for richer agents whose wealth is higher than the average level of wealth.pay more relative to what they receive in transfers.

Of course, a competing mechanism of redistribution could be modelled in several ways. For example the government may choose to spend the remaining revenues on health, education or other forms of redistribution. Here we choose the “lump sum transfer” as it is a tractable way of making the point of the paper, in addition to capturing the idea that “direct” mechanisms of redistribution such as transfers compete with “indirect” mechanisms such as those directed towards health, education research and development.

For a deeper discussion of early models using the majority voting approach see Verdier (1994) and references therein. Other paradigms, involving “indirect” voting through representatives have been considered in Besley and Coate (1997) and Persson and Tabellini (1994) have been shown to lead to outcomes that are qualitatively similar to direct voting models.

From a theoretical point of view on could characterize this by incorporating elected representatives who choose to aggregate preferences according to a social welfare function.

Another point to note is that democracies can be characterized by low voter-turnout. Our model abstracts from this issue and assumes that all agents exercise their voting privileges. Alternatively, we can say, consistent with public choice theory that voting is “expressive” as voters value their participation in the electoral process (Riker and Ordeshook 1968). This may occur due to education, as voters become more aware of civic responsibility and assign value to it regardless of whether or not their preferred outcome wins.

Henceforth we drop the time subscript when we are concerned with a distribution at a point in time, as exemplified in the propositions that follow. We use the time subscript again when we discuss the dynamics of the model, i.e. changes in wealth over time.

See Appendix for a proof of this proposition, and the single peakedness of preferences for these agents.

See the Appendix for proofs of these propositions.

Note that in the case of symmetric shocks, we can analytically derive \(W^{*}\), albeit the form it takes is cumbersome to write down. We cannot, however derive an expression when shocks are asymmetric

The only scenarios in which there is a ‘poverty trap’ are as follows: (a) the case in which \(b < 1\) and all agents in the economy have a resource endowment below the critical level, and (b) the case in which there are some agents above the critical level but both b and d are less than 1. However, we are interested in the case of transitional economies, and from that point of view we consider initial wealth distributions in which at least a few agents have resources above the critical level of wealth and \(d >1\).

For a proof see the Appendix.

The indirect utility function of agents below \(W^{\prime }\) is the largest at \(\alpha =0\), while it is the largest at \(\alpha ={\tilde{\alpha }}\) for agents above this level of wealth. The highest “weights” in the social welfare function are therefore associated with these values, making them the most likely candidates for the proportion that is eventually chosen.

A sensitivity analysis with various parameters suggests that results presented above are robust. That is, the results discussed below summarize, in a qualitative sense the long run and transitional outcomes that are typical in the model. Specifically, we conducted experiments for a wide range of initial distributions, standard deviation of the shock, tax rates and other parameters. The results confirm or are intuitively consistent with the theoretical outcomes of the model discussed in the previous section.

We consider experiments in the entire range of \(\varepsilon \) that is permissible given our assumptions and the results parallel those presented here.

This suggests that even with good intentions outcomes of policies could be contrary to what is intended. Note, however, that in our characterization of all three settings there is forward looking behaviour in a limited sense. In the voting model agents care about bequests left to the next generation and this feeds into the Benthamite and Rawlsian settings in a similar way, given that bequests enter the respective social welfare functions as well. However more complex constructs would entail that agents and planners are fully forward looking in that they take into account the impact of any policy on future generations’ welfare. See Krusell et al (1997) for a discussion in the context of voting models. It would be interesting to consider extensions of this type as a future direction of research, particularly in the context of social welfare functions.

Much of the empirical literature on international income differences suggests a lack of convergence in incomes across world economies (Johnson and Papageorgiou 2020). Early endogenous growth models such as the “AK model” due to Romer (1986, 1987) were designed to address this feature, also mentioned in Kaldor (1957) as a “stylized fact” of economic growth. In models of this form there is convergence to a “steady state growth rate” rather than in income levels.

As will become evident from the analysis of the optimal solution for \(\alpha \) in later propositions, a condition for an interior solution requires \(\sqrt{\,\overline{\psi }}-1<\tau {\overline{W}}\). This implies that at \(\alpha =1\), \(\overline{\psi }/(1+\alpha \tau {\overline{W}})^2<1\).

Note that we have drawn the LHS with its value greater that 1 when evaluated at \({\tilde{\alpha }}\). We could just as easily have drawn it differently, with the curve starting at a point below 1. But the possibilities would still remain the same—either the two curves would intersect in the range, or the LHS would always lie above the RHS.

Recall from the result of Proposition 2 that the “efficient” range of \(\alpha \) - in which \(W^{*}\) falls with \(\alpha \) - can be either [0, 1] or \([0,{\hat{\alpha }}]\) where \({\hat{\alpha }}>{\tilde{\alpha }}=\frac{\sqrt{\overline{\psi }}-1}{\tau {\overline{W}}}\). As assumed above, we have restricted the vote on \(\alpha \) to the efficient range so that \(W^{*}\) changes monotonically in this range, towards \({\hat{W}}\) as \(\alpha \) increases and towards \({\tilde{W}}\) as \(\alpha \) decreases.

References

Acemoglu D (2009) Introduction to modern economic growth. Princeton University Press, Princeton

Acemoglu D, Robinson J (2000) Political losers as a barrier to economic development. Am Econ Rev 90(2):126–130

Acemoglu D, Robinson J (2002) The political economy of the Kuznets curve. Rev Dev Econ 6(2):183–203

Agranov M, Palfrey TR (2015) Equilibrium tax rates and income redistribution: a laboratory study. J Public Econ 130:45–58

Albanesi S (2007) Inflation and inequality. J Monet Econ 54:1088–1114

Alesina A, Rodrik D (1994) Distributive politics and economic growth. Q J Econ 109(2):465–490

Benhabib J, Spiegel MM (1994) The role of human capital in economic development evidence from aggregate cross-country data. J Monet Econ 34(2):143–173

Benhabib J, Spiegel MM (2005) Human capital and technology diffusion. Handb Econ Growth 1:935–966

Besley T, Case A (2003) Political institutions and policy choices: evidence from the United States. J Econ Lit 41(1):7–73

Besley T, Coate S (1997) An economic model of representative democracy. Q J Econ 112(1):85–114

Bhattacharya J, Bunzel H, Haslag J (2005) The non-monotonic relationship between seigniorage and inequality. Can J Econ 38(2):500–519

Black D (1948) On the rationale of group decision making. J Polit Econ 65:135–150

Bursztyn L (2016) Poverty and the political economy of public education spending: evidence from Brazil. J Eur Econ Assoc 14(5):1101–1128

Busemeyer MR, Legetporer P, Woessmann L (2018) Public opinion and the political economy of educational reforms: a survey. Eur J Polit Econ 53:161–185

Dasgupta S, De Cian E, Verdolini E (2017) The political economy of energy innovation. In: Arent D, Channing A, Miller M, Tarp F, Zinaman O (eds) The political economy of clean energy transitions, Oxford Scholarship Online, chap 7

d’Aspremont C, Gevers L (2002) Social welfare functionals and interpersonal comparability. In: Arrow KJ, Sen AK, Suzumura K (eds) Handbook of social choice and welfare, vol 1, chap 10. Elsevier, pp 459–541

de la Croix D, Michel P (2002) A theory of economic growth. Cambridge University Press, Cambridge

Dercon S, Christiaensen L (2011) Consumption risk, technology adoption and poverty traps: evidence from Ethiopia. J Dev Econ 96(2):159–173

Desmet K, Parente SL (2014) Resistance to technology adoption: the rise and decline of guilds. Rev Econ Dyn 17(4):437–458

Dolmas J, Huffman GW, Wynne MA (2000) Inequality, inflation, and central bank independence. Can J Econ 33(1):271–87

Downs A (1957) An economic theory of democracy. Harper and Row, New York

Fumagalli E, Narciso G (2012) Political institutions, voter turnout, and policy outcomes. Eur J Polit Econ 28(2):162–173

Glomm G, Ravikumar B (1992) Public versus private investment in human capital: endogenous growth and income inequality. J Polit Econ 100(4):818–834

Greenwood J, Yorukoglu M (1997) 1974. Carnegie-Rochester conference series on public policy, vol 46, pp 49–95

Hanushek EA, Woessmann L (2020) Education, knowledge capital, and economic growth. In: The economics of education, pp 171–182

Harsanyi JC (1975) Nonlinear social welfare functions. Theor Decis 6(3):311–332

Hoppe HC (2002) The timing of new technology adoption: theoretical models and empirical evidence. Manch School 70(1):56–76

Huffman G (1997) An equilibrium analysis of central bank independence and inflation. Can J Econ 30:943–958

Johnson P, Papageorgiou C (2020) What remains of cross-country convergence? J Econ Lit 58(1):129–75

Kakwani N, Son HH et al (2016) Social welfare functions and development. Springer, London

Kaldor N (1957) A model of economic growth. Econ J 67(268):591–624

Krusell P, Rios-Rull J (1996) Vested interests in a positive theory of stagnation and growth. Rev Econ Stud 63:301–329

Krusell P, Quadrini V, Ríos-Rull JV (1997) Politico-economic equilibrium and economic growth. J Econ Dyn Control 21(1):243–272

Lahiri R, Ratnasiri S (2012) Growth patterns and inequality in the presence of costly technology adoption. S Econ J 79(1):203–223

Lahiri R, Ding J, Chinzara Z (2018) Technology adoption, adaptation and growth. Econ Model 70:469–483

Mohanty M (2007) Local governance, local democracy and the right to participate. In: Mohanty M, Baum R, Ma R, Matthew G (eds) Grass-roots democracy in India and China: the right to participate. Sage Publications, New Delhi

Obstfeld M, Rogoff KS, Rogoff K (1996) Foundations of international macroeconomics. MIT Press, Cambridge

Oikawa K (2010) Uncertainty-driven growth. J Econ Dyn Control 34(5):897–912

Parente S, Prescott E (1994) Barriers to technology adoption and development. J Polit Econ 102(2):298–301

Persson T, Tabellini G (1994) Representative democracy and capital taxation. J Public Econ 55(1):53–70

Persson T, Tabellini G (2006) Democracy and development: the devil is in the details. Am Econ Rev 96:319–324