Abstract

This paper defines the single-crossing property for two-agent, two-good exchange economies with classical (i.e., continuous, strictly monotonic, and strictly convex) individual preferences. Within this framework and on a rich single-crossing domain, the paper characterizes the family of continuous, strategy-proof and individually rational social choice functions whose range belongs to the interior of the set of feasible allocations. This family is shown to be the class of generalized trading rules. This result highlights the importance of the concavification argument in the characterization of fixed-price trading rules provided by Barberá and Jackson (Econometrica 63:51–87, 1995), an argument that does not hold under single-crossing. The paper also shows how several features of abstract single-crossing domains, such as the existence of an ordering over the set of preference relations, can be derived endogenously in economic environments by exploiting the additional structure of classical preferences.

Similar content being viewed by others

Notes

These rules have also been shown to be salient in other mechanism design problems. For instance, Hagerty and Rogerson (1987) consider a bilateral trading model with quasi-linear utility functions and show that a strategy-proof, individually rational and budget-balanced SCF is an FPT rule.

For \(x,z \in \mathfrak {R}_{+}^{2}\), by \(x>z\) we mean \(x_{k}\ge z_{k}\) for all \(k=1,2\) and \(x_{k}>z_{k}\) for some \(k\).

We realize that the maximum of \(R_{i}\) on \(B\) does not depend on \(R_{j}\). However as we shall see, this notation helps in defining the tie-breaking rule for FPT rules. Later in the paper while describing our results, we will drop \(R_{j}\) from the notation because tie-breaking is not required in our characterization.

To define the median, an order on the piecewise linear graph needs to be fixed. Let \(a\) and \(b\) be two diagonal allocations that are on the piecewise linear graph. Fix an agent \(i\). We say \(a>_{i}b\) if \(a_{i}^{x}>_{i}b_{i}^{x}\) (or \(a_{i}^{y}<_{i}b_{i}^{y}\)). Let \(\big \{a^{1},a^{2},a^{3}\}\) be a set of diagonal allocations. We define \(\text {median}\big \{a^{1},a^{2},a^{3}\big \}\in \big \{a^{1},a^{2},a^{3}\big \}\) to be the median of \(\big \{a^{1},a^{2},a^{3}\big \}\) if \(\big |\big \{a^{j}|a^{j}\ge _{i} \text {median}\big \{a^{1},a^{2},a^{3}\big \}\big \}\big |\ge 2\) and \(\big |\big \{a^{j}|\text {median}\big \{a^{1},a^{2},a^{3}\}\ge _{i} a^{j} \big \}\big |\ge 2\).

Barberá and Jackson (1995)’s result holds for an arbitrary number of agents, but they impose further assumptions on the SCF.

For any \(a,b \in \Delta , \,aP_{i}b\) means \(a_{i}\) is preferred to \(b_{i}\) by agent \(i\) with preferences \(R_i\), while \(aI_{i}b\) means that agent \(i\) is indifferent between \(a_{i}\) and \(b_{i}\) under \(R_i\)

The notation \(R_{i}|_{\{a,b,c\}}\) refers to \(R_{i}\) restricted to \(\{a,b,c\}\).

The usual definition of single-peaked preferences apply on a diagonal set according to this order. For instance, if a diagonal set is a straight line segment and lies in the interior of \(\Delta \), then all the allocations on it can be sustained as tops for some preference ordering from \(\mathbb {D}^{s}\) (this follows from arguments similar to Proposition 4). Also, on both sides of the top, the allocation nearer (note that under the order, distance between two allocations can be defined in the Euclidean sense) to it are preferred to the one which is further.

An ordered set \(S\) is said to have the least upper bound property if every bounded subset of \(S\) has the supremum in \(S\).

See Munkres (2005), p 169.

Note that such an upper bound need not exist if either the indifference curves are not strictly convex or the allocation that is considered is not in the interior of \(\Delta \).

If \(d\) is not an interior allocations in \(\Delta \), then this may not be true. We will discuss about this later.

For any relevant \(\theta _{1}\) the solution given by \((\frac{3\theta _{1}}{4})^{6}\) indeed corresponds to the maximum. To see this note that the maximization problem can be equivalently written as \(\text {Max}\;\theta _{1}\sqrt{x_{1}}-x_{1}^{\frac{2}{3}}\). The first order condition is \(\frac{\theta _{1}}{2\sqrt{x_{1}^{*}}}=\frac{2}{3}\frac{1}{(x_{1}^{*})^{\frac{1}{3}}}\), which can be equivalently written as \(\frac{3\theta _{1}}{4}=(x_{1}^{*})^ {\frac{1}{6}}\). Since \(\frac{\sqrt{x_{1}}}{x_{1}^{\frac{1}{3}}}=x_{1}^{\frac{1}{6}}\) is an increasing function of \(x_{1}, \,\frac{\theta _{1}}{2\sqrt{x_{1}}}>\frac{2}{3}\frac{1}{x_{1}^{\frac{1}{3}}}\) for \(x_{1}<x_{1}^{*}\) and \(\frac{\theta _{1}}{2\sqrt{x_{1}}}<\frac{2}{3}\frac{1}{x_{1}^{\frac{1}{3}}}\) for \(x_{1}>x_{1}^{*}\). Hence, for the relevant \(\theta _{1}\) the family of functions \(\theta _{1}\sqrt{{x_{1}}}+y_{1}\) concavify \(x_{1}^{\frac{2}{3}}+y\) at the consumption bundles along \(B^{'}\). Therefore, for relevant \(\theta _{1}s\) the solution given by \((\frac{3}{4}\theta _{1})^{6}\) indeed correspond to the maximum.

For \(a,b \in \mathfrak {R}^{2}, \,a>b\) means \(a_{k}\ge b_{k} \) for all \(k \in M\) and \(a_{k}> b_{k}\) for at least one \(k\).

Let \(F_{i}^{x}(R_{i},R_{j})\) and \(F_{i}^{y}(R_{i},R_{j})\) denote the allocation of good \(x\) and \(y\) to agent \(i\) according to the SCF \(F\) at the profile \((R_{i},R_{j})\). Consider the situation \(F_{i}^{x}(\bar{R_{i}},\bar{R_{j}})=F_{i}^{x}(\tilde{R_{i}},\tilde{R_{j}})\) and \(F_{i}^{y}(\bar{R_{i}},\bar{R_{j}})<F_{i}^{y}(\tilde{R_{i}},\tilde{R_{j}})\). By Lemma 4 \(F(\bar{R_{i}},R_{j})\in SEQ_{i}(F(\bar{R_{i}},\bar{R_{j}}))\) for all \(R_{j}\succ \bar{R_{j}}\). By continuity and strategy-proofness there exists \(R_{j}\) such that \(\tilde{R_{j}}\succ R_{j}\succ \bar{R_{j}}\) and \(F(\bar{R_{i}},R_{j})\in int\; THQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))\). Hence, the positions of \(F(\bar{R_{i}},\bar{R_{j}})\) and \(F(\tilde{R_{i}},\tilde{R_{j}})\) are without the loss of generality.

References

Barberá S, Jackson M (1994) A characterization of strategy-proof social choice functions for economies with pure public goods. Soc Choice Welf 11:241–252

Barberá S, Jackson M (1995) Strategy-proof exchange. Econometrica 63:51–87

Barberá S, Jackson M (2004) Choosing how to choose: self-stable majority rules and constitutions. Quart J Econ 119:1011–1048

Barberá S, Moreno B (2011) Top monotonicity: a common root for single peakedness, single-crossing and the median voter result. Games Econ Behav 72:345–359

Bordes G, Campbell DE, Breton ML (1995) Arrow’s theorem for economic domains and Edgeworth hyperboxes. Int Econ Rev 36:441–454

Caroll G (2012) When are local incentive constraints sufficient? Econometrica 2:661–686

Corchón LC, Rueda-Llano J (2008) Differentiable strategy-proof mechanisms for private and public goods in domains that are not necessarily large or quasi-linear. Rev Econ Des 12:279–291

Gans JS, Smart M (1996) Majority voting with single-crossing preferences. J Pub Econ 59:219–237

Gershkov A, Moldovanu B, Shi X (2013) Optimal voting rules. Working Paper, 493, Department of Economics, University of Toronto

Goswami MP, Mitra M, Sen A (2014) Strategy-proofness and Pareto-efficiency in quasi-linear exchange economies. Theor Econ 9:361–381

Hagerty KM, Rogerson WP (1987) Robust trading mechanisms. J Econ Theory 42:94–107

Hashimoto K (2008) Strategy-proofness versus efficiency on the Cobb–Douglas domain of exchange economies. Soc Choice Welf 31:457–473

Hurwicz L (1972) On informationally decentralized systems. In: Hurwicz B, Radner R (eds) Decision and organization. Amsterdam, North-Holland, pp 297–336

Ju B-G (2003) Strategy-proofness versus efficiency in exchange economies:general domain properties and applications. Soc Choice Welf 21:73–93

Ma J (1994) Strategy-proofness and the strict core in a market with indivisibilities. Int J Game Theory 23:75–83

Mirrlees JA (1971) An expoloration in the theory of optimum income taxation. Rev Econ Stud 38:175–208

Momi T (2013) Note on social choice allocation in exchange economies with many agents. J Econ Theory 148:1237–1254

Munkres JR (2005) Topology, 2nd edn. Pearson Education, Singapore

Nicolò A (2004) Efficiency and truthfulness with Leontief preferences. A note on two-agent, two-good economies. Rev Econ Des 8:373–382

Roth A, Postlewaite A (1977) Weak versus strong domination in a market with indivisible goods. J Math Econ 4:131–137

Rothschild M, Stiglitz JE (1976) Equilibrium in competitive insurance markets: an essay in the economics of imperfect information. Quart J Econ 80:629–649

Saporiti A (2009) Strategy-proofness and single-crossing. Theor Econ 4:127–163

Saporiti A, Tohmé F (2006) Single-crossing, strategic voting and the median choice rule. Soc Choice Welf 26:363–383

Schummer J (1997) Strategy-proofness versus efficiency on restricted domain of exchange economies. Soc Choice Welf 14:47–56

Serizawa S (2002) Inefficiency of strategy-proof rules for pure exchange economies. J Econ Theory 106:219–241

Serizawa S (2006) Pairwise strategy-proofness and self-enforcing manipulation. Soc Choice Welf 26:305–331

Serizawa S, Weymark JA (2003) Efficient strategy-proof exchange and minimum consumption guarantees. J Econ Theory 109:246–263

Spence AM (1973) Job market signaling. Quart J Econ 87:355–374

Sprumont Y (1995) A note on strategy-proofness in Edgeworth-box economies. Econ Lett 49:45–50

Zhou L (1991) Inefficiency of strategy-proof allocation mechanisms in pure exchange economies. Soc Choice Welf 8:247–254

Acknowledgments

I am deeply thankful to two anonymous referees, Anirban Kar, Debasis Mishra, Souvik Roy, James Schummer, Arunava Sen, David Wettstein and John Weymark for their valuable suggestions and comments. I am also thankful to Mihir Bhattacharya, Pranabesh Das, Sabyasachi Dutta, Priyanka Grover, Anup Pramanik, Soumendu Sarkar and Bipul Saurabh for many useful discussions on the technical aspects of the paper at various points in time. This paper is based on a chapter of my Ph.D dissertation submitted to the Indian Statistical Institute in 2011. A research scholarship from the Indian Statistical Institute is gratefully acknowledged. I gratefully acknowledge the financial support of the Israel Council for Higher Education for a PBC fellowship.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Appendix Figs. 7, 8, 9 and 10

We prove the sufficient part of Theorem 2. Good \(x\) is measured along the horizontal axis and Good \(y\) is measured along the vertical axis.

Proof

We first show that the endowment is in the range. This result does not require either strategy-proofness or continuity. \(\square \)

Lemma 3

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let \(\omega _{i} \gg (0,0)\) for all \(i\). Let the SCF \(F:[\mathbb {D}^s]^{2}\rightarrow \Delta \) be individually rational. Then \(\omega \in \mathfrak {R}_{F}\).

Proof

Since \(\mathbb {D}^{s}\) is rich, we know from Proposition 4 that there exists a profile \((R_{i},R_{j})\) such that \(\omega \in PE(R_{i},R_{j})\). Note that indifference curves are strictly convex. Therefore, for any allocation other than \(\omega \) at the profile \((R_{i},R_{j}), \,F\) will violate individual-rationality for at least one agent. Hence, \(F(R_{i},R_{j})=\omega \) that is \(\omega \in \mathfrak {R}_{F}\). \(\square \)

We now establish a monotonicity result with reference to the order on \(\mathbb {D}^s\) defined earlier.

Lemma 4

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let \(F:[\mathbb {D}^s]^2\rightarrow \Delta \) be a strategy-proof SCF. If \(R_{i}^{'}\succ R_{i}^{''}\), then \(x_{i}\big (R_{i}^{'},R_{j}\big )\ge x_{i}(R_{i}^{''},R_{j})\).

Proof

By strategy-proofness, \(F_{i}\big (R_{i}^{'},R_{j}\big )\in LC\big (R_{i}^{''},F_{i}\big (R_{i}^{''},R_{j}\big )\big )\cap UC\big (R_{i}^{'},F_{i}\big (R_{i}^{''},R_{j}\big )\big )\). Hence, \(x_{i}\big (R_{i}^{'},R_{j}\big )\ge x_{i}\big (R_{i}^{''},R_{j}\big )\). \(\square \)

Next we show that if an SCF is continuous, strategy-proof and individually rational, then its range is a diagonal subset of \(\Delta \).

Proposition 5

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. If the SCF \(F:[\mathbb {D}^{s}]^{2}\rightarrow \Delta \) is strategy-proof, individually rational and continuous, then \(\mathfrak {R}_{F}\) is diagonal.

Proof

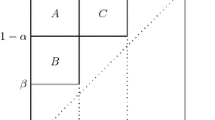

For the sake of contradiction assume that \(F_{i}\big (\tilde{R_{i}},\tilde{R_{j}}\big )> F_{i}\big (\bar{R_{i}},\bar{R_{j}}\big )\) as shown in Fig. 7 Footnote 15 Note that by strategy-proofness \(\bar{R_{k}}\ne \tilde{R_{k}}\) for all \(k\in I\). We prove that if \(\tilde{R_{i}}\succ \bar{R_{i}}\) then \(\tilde{R_{j}}\succ \bar{R_{j}}\). We use Lemma 4 twice. Let \(\tilde{R_{i}}\succ \bar{R_{i}}\). Then by Lemma 4 it follows that \(x_{i}\big (\tilde{R_{i}},\bar{R_{j}}\big )\ge x_{i}\big (\bar{R_{i}},\bar{R_{j}}\big )\). If \(F\big (\tilde{R_{i}},\bar{R_{j}}\big )\in THQ_{i}\big (F\big (\tilde{R_{i}},\tilde{R_{j}}\big )\big )\) then agent \(j\) will manipulate at the profile \(\big (\tilde{R_{i}},\tilde{R_{j}}\big )\) via \(\bar{R_{j}}\). Therefore, \(F\big (\tilde{R_{i}},\bar{R_{j}}\big )\in int\;FOQ_{i}\big (F\big (\tilde{R_{i}},\tilde{R_{j}}\big )\big )\). This means that \(x_{j}\big (\tilde{R_{i}},\tilde{R_{j}}\big )>x_{j}\big (\tilde{R_{i}},\bar{R_{j}}\big )\). Hence by Lemma 4 \(\tilde{R_{j}}\succ \bar{R_{j}}\).

Similarly, if \(\bar{R_{i}}\succ \tilde{R_{i}}\) then \(\bar{R_{j}}\succ \tilde{R_{j}}\). Therefore, without loss of generality we assume that \(\tilde{R_{i}}\succ \bar{R_{i}}\). Also, note by individual-rationality, either \(\omega \in int~FOQ_{i}\big (F\big (\tilde{R_{i}},\tilde{R_{j}}\big )\big )\) or \(\omega \in int~SEQ_{i}\big (F\big (\bar{R_{i}},\bar{R_{j}}\big )\big )\).

Lemma 5 and 6 are important intermediate steps to prove this proposition. \(\square \)

Lemma 5

Let \(F_{i}(\tilde{R_{i}},\tilde{R_{j}})>F_{i}(\bar{R_{i}},\bar{R_{j}})\). There exists a sequence of profiles such that, \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i}^{k+1},R_{j}^{k+1})\succ \succ (R_{i}^{k},R_{j}^{k})\succ \succ (\bar{R_{i}},\bar{R_{j}}), \,(R_{i}^{k},R_{j}^{k})\rightarrow (\tilde{R_{i}},\tilde{R_{j}})\) (resp. \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i}^{k},R_{j}^{k})\succ \succ (R_{i}^{k+1},R_{j}^{k+1})\succ \succ (\bar{R_{i}},\bar{R_{j}}), \,(R_{i}^{k},R_{j}^{k})\rightarrow (\bar{R_{i}},\bar{R_{j}})\)) for any \(k\) (Fig. 7).

Proof

The construction of the sequence in the Lemma follows from Steps 1, 2 and 3.

We show the construction of the increasing sequence. The construction of the decreasing sequence is similar to the construction of the increasing sequence. Consider Fig. 7 and the set \(\mathbb {A}\), where

\(\mathbb {A}=\{ ( R_{i},R_{j})| x_{i} (R_{i},R_{j})=a_{i}^{x},a_{i}^{y}\le y_{i}(R_{i},R_{j})\le y_{i }( \tilde{R_{i}},\tilde{R_{j}} ) ,~\text {and}~(\tilde{R_{i}},\tilde{R_{j}})\succeq (R_{i},R_{j}) \succeq (\bar{R_{i}},\bar{R_{j}})\}\).

Step 1 shows that there exists profiles in \(\mathbb {A}\) other than \((\tilde{R_{i}},\tilde{R_{j}})\).

Step 1: There exists \((R_{i},R_{j})\in \mathbb {A}\) such that \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i},R_{j})\succ \succ (\bar{R_{i}},\bar{R_{j}})\) with \(F(R_{i},R_{j})\ne F(\tilde{R_{i}},\tilde{R_{j}})\) and \(F(R_{i},R_{j})\ne F(\bar{R_{i}},\bar{R_{j}})\).

Proof of Step 1: Since \(F\) is strategy-proof \(F(\tilde{R_{i}},\bar{R_{j}})\in int~FOQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))\). By continuity of \(F\) there exists \(R_{i}^{*}\) such that \(\tilde{R_{i}}\succ R_{i}^{*}\succ \bar{R_{i}}\) and \(F(R_{i}^{*},\bar{R_{j}})\) lies on the line segment joining \(a\) and \(F(\tilde{R_{i}},\tilde{R_{j}})\). Also note that by strategy-proofness of \(i, \,F(R_{i}^{*},\bar{R_{j}})\ne F(\tilde{R_{i}},\tilde{R_{j}})\) Footnote 16. [**]

Since \(F\) is continuous, \(F(R_{i}^{*},R_{j})\ne F(R_{i}^{*},\bar{R_{j}})\) for some \(R_{j}\in (\bar{R_{j}},\tilde{R_{j}})\). If \(F(R_{i}^{*},R_{j})= F(R_{i}^{*},\bar{R_{j}})\) for all \(R_{j}\in (\bar{R_{j}},\tilde{R_{j}})\) then by continuity of \(F, \,F(R_{i}^{*},\tilde{R_{j}})= F(R_{i}^{*},\bar{R_{j}})\). Then agent \(i\) will manipulate \(F\) at \((R_{i}^{*},\tilde{R_{j}})\) via \(\tilde{R_{i}}\) because \(F(\tilde{R_{i}},\tilde{R_{j}})P_{i}^{*}F(R_{i}^{*},\tilde{R_{j}})=F(R_{i}^{*},\bar{R_{j}})\). By Lemma 4 choose \(R_{j}^{**}\in (\bar{R_{j}},\tilde{R_{j}})\) such that \(F(R_{i}^{*},R_{j}^{**})\in int~THQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))\). Note that \(F_{i}(\tilde{R_{i}},\tilde{R_{j}})>F_{i}(R_{i}^{*},R_{j}^{**})\). Therefore, by [**] there exists \(R_{i}^{**}\) such that \(\tilde{R_{i}}\succ R_{i}^{**}\succ R_{i}^{*}\) and \(F(R_{i}^{**},R_{j}^{**})\) lies on the line segment joining \(a\) and \(F(\tilde{R_{i}},\tilde{R_{j}})\). Hence, again by strategy-proofness of \(i, \,F(R_{i}^{**},R_{j}^{**})\ne F(\tilde{R_{i}},\tilde{R_{j}})\). Hence Step 1 is established.

Step 2: Let \((R_{i}^{'}, R_{j}^{'})\) be such that \((\tilde{R_{i}}, \tilde{R_{j}})\succ \succ (R_{i}^{'}, R_{j}^{'})\) and \((R_{i}^{'}, R_{j}^{'})\in \mathbb {A}\) with \(F(R_{i}^{'},R_{j}^{'})\ne F(\tilde{R_{i}},\tilde{R_{j}})\). Then there exists \((R_{i}^{''}, R_{j}^{''})\) such that \((\tilde{R_{i}}, \tilde{R_{j}})\succ \succ (R_{i}^{''}, R_{j}^{''})\succ \succ (R_{i}^{'}, R_{j}^{'})\) and \((R_{i}^{''}, R_{j}^{''})\in \mathbb {A}\) with \(F(R_{i}^{''},R_{j}^{''})\ne F(\tilde{R_{i}},\tilde{R_{j}})\).

Proof of Step 2: The proof follows immediately by repeating the a rguments that has been used to prove Step 1. First increase agent \(j\)’s preference and then increase agent \(i\)’s.

Step 3: Consider a profile \((R_{i}^{*},R_{j}^{*})\) such that \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i}^{*},R_{j}^{*})\succ \succ (\bar{R_{i}},\bar{R_{j}})\). There exists \((R_{i},R_{j})\) such that \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i},R_{j})\succ \succ (R_{i}^{*},R_{j}^{*})\) and \((R_{i},R_{j})\in \mathbb {A}\).

Proof of Step 3: Since \(F\) is continuous \(\mathbb {A}\) is a closed set in the order topology. Therefore set \(\mathbb {A}\) contains all its limit points. Therefore by Step 2 the proof follows.

Now consider any neighborhood around \((\tilde{R_{i}},\tilde{R_{j}})\). By Step 3 there exists \((R_{i},R_{j})\) in this neighborhood such that \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i},R_{j})\) and \((R_{i},R_{j})\in {\mathbb A}\). This proves the existence of the desired increasing sequence. By decreasing \(R_{i}\)s and \(R_{j}\)s we obtain the desired decreasing sequence. \(\square \)

Observe 1

Note that by the construction of the sequence in Lemma 5 for all \(k\,F(R_{i}^{k},R_{j}^{k})\ne F(\tilde{R_{i}},\tilde{R_{j}})\). To show this, let \(F(R_{i}^{k-1},R_{j}^{k-1})\in \mathbb {A}\) and \(F(R_{i}^{k-1},R_{j}^{k-1})\ne F(\tilde{R_{i}},\tilde{R_{j}})\). Note that \(F(R_{i}^{k-1},R_{j}^{k-1})\) and \(F(\tilde{R_{i}},\tilde{R_{j}})\) are non diagonal. Therefore, by Step 1 of Lemma 5 we obtain \((R_{i}^{k},R_{j}^{k})\) such that \(F(R_{i}^{k},R_{j}^{k})\in \mathbb {A}\) and \(F(R_{i}^{k},R_{j}^{k})\ne F(\tilde{R_{i}},\tilde{R_{j}})\).

Lemma 6

Let \(F_{i}(\tilde{R_{i}},\tilde{R_{j}})> F_{i}(\bar{R_{i}},\bar{R_{j}})\). For some \(R_{j}\succ \tilde{R_{j}}\) (resp. \(\bar{R_{j}}\succ R_{j}\)), \(F(\tilde{R_{i}},R_{j})\in int~SEQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))\) (resp. \(F(\bar{R_{i}},R_{j})\in int\; FOQ_{i}(F(\bar{R_{i}},\bar{R_{j}}))\)).

Proof

Assume for the sake of contradiction that this does not happen. Then for all \(R_{j}\succ \tilde{R_{j}}, \,F(\tilde{R_{i}},R_{j})=F(\tilde{R_{i}},\tilde{R_{j}})\). Consider \(\tilde{\tilde{R_{j}}}\succ \tilde{R_{j}}\). Note that \((\tilde{R_{i}},\tilde{\tilde{R_{j}}})\succ \succ (\bar{R_{i}},\bar{R_{j}})\). By Lemma 5, we can construct an increasing sequence of profiles \((R_{i}^{k},R_{j}^{k})\) with \(F(R_{i}^{k},R_{j}^{k})\in T\!HQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))=T\!HQ_{i}(F(\tilde{R_{i}},\tilde{\tilde{R_{j}}})), \,F(\tilde{R_{i}},\tilde{\tilde{R_{j}}})>F(R_{i}^{k},R_{j}^{k})\) and the sequence converges to \((\tilde{R_{i}},\tilde{\tilde{R_{j}}})\). Observe that for \(k\) large enough we can choose \(R_{j}^{k}\) such that \(\tilde{\tilde{R_{j}}}\succ R_{j}^{k}\succ \tilde{R_{j}}\) and \(F(\tilde{R_{i}},\tilde{\tilde{R_{j}}})>F(R_{i}^{k},R_{j}^{k})\). But \(F(\tilde{R_{i}},R_{j}^{k})=F(\tilde{R_{i}},\tilde{R_{j}})P_{i}^{k}F(R_{i}^{k},R_{j}^{k})\). Hence, agent \(i\) will manipulate \(F\) at \((R_{i}^{k},R_{j}^{k})\) via \(\tilde{R_{i}}\).\(\square \)

Back to the proof of the proposition. By \(\overline{F(\bar{R_{i}},\bar{ R_{j}})e}, \,\overline{ec}\) and \(\overline{F(\bar{R_{i}},\bar{ R_{j}})m}\) we denote the straight lines that joins \(F(\bar{R_{i}},\bar{ R_{j}})\) and \(e, \,e\) and \(c\) and \(F(\bar{R_{i}},\bar{ R_{j}})\) and \(m\) respectively. This is an abuse of notation because none of these line segments are diagonal (Fig. 7). We consider two cases.

Case 1: \(\omega \in int\; FOQ_{i}(F(\tilde{R_{i}},\tilde{R_{j}}))\).

By Lemma 6 choose \(R_{j}^{1}\succ \tilde{R_{j}}\) such that \(F(\tilde{R_{i}},R_{j}^{1})\in int\; SEQ_{i}(F({\tilde{R_{i}},\tilde{R_{j}}}))\cap FIQ_{i}(F({\bar{R_{i}},\bar{R_{j}}}))\). By individual-rationality of agent \(i, \,F(R_{i},R_{j}^{1})\in FOQ_{i}(c)\) for some \(R_{i}\) where \(R_{i}\succ \tilde{R_{i}}\). By continuity there exists \(R_{i}^{1}\succ \tilde{R_{i}}\) such that \(F(R_{i}^{1},R_{j}^{1})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}))e}\) or \(F(R_{i}^{1},R_{j}^{1})\in \overline{ec}\). Note that \((R_{i}^{1},R_{j}^{1})\succ \succ (\bar{R_{i}},\bar{R_{j}})\) and \(F_{i}(R_{i}^{1},R_{j}^{1})> F_{i}(\bar{R_{i}},\bar{R_{j}})\). By using Lemma 5 again we find a sequence of increasing profiles that converges to \((R_{i}^{1},R_{j}^{1})\). Then use Lemma 6, individual-rationality and continuity to find \((R_{i}^{2},R_{j}^{2})\succ \succ (R_{i}^{1},R_{j}^{1})\) such that \(F(R_{i}^{2},R_{j}^{2})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}))e}\) or \(F(R_{i}^{2},R_{j}^{2})\in \overline{ec}\). Continuation of this process results in \((R_{i}^{*},R_{j}^{*})\) high enough such that \(F(R_{i}^{*},R_{j}^{*})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}))e}\) or \(F(R_{i}^{*},R_{j}^{*})\in \overline{ec}\) and \(\omega P_{i}^{*} F(R_{i}^{*},R_{j}^{*})\). Hence, individual-rationality of agent \(i\) is violated at \(R_{i}^{*}\).

Case 2: \(\omega \in int\; SEQ_{i}(F(\bar{R_{i}},\bar{R_{j}}))\).

By Lemma 6 choose \(R_{j}^{1}\) such that \(\bar{R_{j}}\succ R_{j}^{1}\) and \(F(\bar{R_{i}},R_{j}^{1})\!\in \!int FOQ_{i}(F(\bar{R_{1}},\bar{R_{2}}))\cap THQ_{i} (F(\tilde{R_{i}},\tilde{R_{j}}))\).

As in Case 1, by continuity and individual-rationality of agent \(i\) there exists \(R_{i}^{1}\) such that \(\bar{R_{i}}\succ R_{i}^{1}\) and \(F(R_{i}^{1},R_{j}^{1})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}))m}\) or \(F(R_{i}^{1},R_{j}^{1})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}) e}\). Note that \((\tilde{R_{i}},\tilde{R_{j}})\succ \succ (R_{i}^{1},R_{j}^{1})\) and \(F(\tilde{R_{i}},\tilde{R_{j}})> F(R_{i}^{1},R_{j}^{1})\). Using Lemma 5, Lemma 6, individual-rationality and continuity repeatedly we find \(R_{i}^{*}\) and \(R_{j}^{*}\) low enough such that \(F(R_{i}^{*},R_{j}^{*})\in \overline{F(\bar{R_{i}},\bar{ R_{j}})m}\) or \(F(R_{i}^{*},R_{j}^{*})\in \overline{F(\bar{R_{i}},\bar{ R_{j}}) e}\) and individual-rationality of agent \(i\) is violated since \(\omega \in int\; SEQ_{i}(F(\bar{R_{i}},\bar{R_{j}}))\).

Hence, by contradiction the proof of the Proposition follows. \(\square \)

Remark 7.1

Since the rich classical single-crossing domain \(\mathbb {D}^{s}\) is connected in the order topology and \(F\) is continuous, \(\mathfrak {R}_{F}\) is connected. Hence, the diagonal property of \(\mathfrak {R}_{F}\) implies that \(\mathfrak {R}_{F}\) can be written as \(\widetilde{d^{'}\omega }\cup \widetilde{\omega d}\) where \(d^{'}\in SEQ_{i}(\omega )\) and \(d\in FOQ_{i}(\omega )\), for some \(i\).

The following Lemma demonstrates that agent preferences are single-peaked on each side of the endowment.

Lemma 7

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let the SCF \(F:[\mathbb {D}^{s}]^{2}\rightarrow \Delta \) be strategy-proof, individually rational and continuous. Let \(\mathfrak {R}_{F}\subseteq int~\Delta \) and let \(\mathfrak {R}_{F}\) be closed. Let \(\mathfrak {R}_{F}=\widetilde{d^{'}\omega }\cup \widetilde{\omega d}\). Then agent preferences are single-peaked on \(\mathfrak {R}_{F}\cap int\;SEQ_{i}(\omega )\) and \(\mathfrak {R}_{F}\cap int\;FOQ_{i}(\omega )\).

Proof

First we show that \(d\) and \(d^{'}\) are attained as tops in \(\widetilde{\omega d}\) and \(\widetilde{d^{'}\omega }\) respectively. Without the loss of generality consider \(d\). Since \(d \in \mathfrak {R}_{F}\) there exists \((R_{i}^{'},R_{j}^{'})\) such that \(F(R_{i}^{'},R_{j}^{'})=d\). Let there exists \(y\in \widetilde{\omega d}\) such that \(y P_{i}^{'} d\). By strategy-proofness of \(i\), there does not exist \(R_{i}\) such that \(F(R_{i},R_{j}^{'})=y\). Hence, by continuity for all \(R_{i}\) such that \(R_{i}^{'}\succ R_{i}, \,F(R_{i},R_{j}^{'})\in \widetilde{y d}\setminus \{y\}\).

Since \(\mathfrak {R}_{F}\) is diagonal by richness there exists \(R_{i}^{''}\) (small according to the order \(\succ \)) such that \(\omega P_{i}^{''} b\) for all \(b \in \widetilde{yd}\). Since \(F(R_{i}^{''},R_{j}^{'})\in \widetilde{y d}\setminus \{y\}\), individual-rationality of agent \(i\) will be violated at \(R_{i}^{''}\).

Hence, we have shown \(d\in Top (R_{i}^{'},\widetilde{\omega d})\). By richness there exists \(R_{i}\succ R_{i}^{'}\) such that \(d=Top (R_{i},\widetilde{\omega d})\).

Now we prove the Lemma in four steps. In the first step we show that any allocation such that \(c\in \widetilde{d^{'}\omega }\setminus \{\omega \}\) or \(c\in \widetilde{\omega d}\setminus \{\omega \}\) can be sustained as a top in \(\widetilde{d^{'}\omega }\) or \(\widetilde{\omega d}\) respectively. In the second step we show that no agent has isolated tops on any side of the endowment. In the third step we show that both agents’ preferences have unique top on both sides of the endowment. In the fourth step we show that preferences are in fact, single-peaked on both sides of the endowment.

Note that both \(\widetilde{d^{'}\omega }\) and \(\widetilde{\omega d}\) are compact. Since, preferences are continuous, on each of these segments a maximum exists under all \(R_{i}\). In Step 1 we show that all the allocations in each side of \(\omega \) can be sustained as a top under some \(R_{i}\).

Step 1: Let \(c\in \widetilde{d^{'} \omega }\setminus \{\omega \}\) or \(c\in \widetilde{\omega d }\setminus \{\omega \}\). Then there exists \(R_{i}\) such that \(c \in Top(R_{i},\widetilde{d^{'} \omega })\) or \(c \in Top(R_{i},\widetilde{ \omega d})\).

Proof of Step 1: Consider \(c\in \widetilde{\omega d}\setminus \{\omega \}\) and \(c\ne d\). We know that \(F(R_{i}^{'},R_{j}^{'})=d\). Since \(\mathfrak {R}_{F}\) is diagonal, by richness there exists \(R_{i}^{*}\) such that \(\omega P_{i}^{*} b\) for all \(b \in \widetilde{cd}\). Therefore, by individual-rationality of \(i\) at \(R_{i}^{*}, \,F(R_{i}^{*},R_{j}^{'})\in SEQ_{i}(c)\). Hence by continuity of \(F\) there exists \(R_{i}^{''}\) such that \(F(R_{i}^{''},R_{j}^{'})=c\). If there exists \(y \in \widetilde{cd}\) such that \(y P_{i}^{''} c\) then agent \(i\) will manipulate \(F\) at \((R_{i}^{''},R_{i}^{'})\) via \(R_{i}^{**}\) where \(F(R_{i}^{**},R_{i}^{'})=y\). Such \(R_{i}^{**}\) exists because \(F(R_{i}^{'},R_{j}^{'})=d, \,F(R_{i}^{''},R_{j}^{'})=c\) and \(F\) is continuous.

Therefore, let \(y\in \widetilde{\omega c}\) such that \(y P_{i}^{''} c\). If \(y=\omega \) then individual-rationality of \(i\) at \(R_{i}^{''}\) is violated. Therefore, let \(y\ne \omega \). By Lemma 4 for all \(R_{i}\) such that \(R_{i}^{''}\succ R_{i}, \,F(R_{i},R_{j}^{'})\in SEQ_{i}(c)\). Since \(\mathfrak {R}_{F}\) is diagonal by richness there exists \(R_{i}^{*}\) (small according to the order \(\succ \)) such that \(\omega P_{i}^{*} b\) for all \(b \in \widetilde{yd} \). But then by continuity, there exists \(R_{i}^{**}\) such that \(F(R_{i}^{**},R_{j}^{'})=y\). Hence, \(i\) will manipulate \(F\) at \((R_{i}^{''},R_{i}^{'})\) via \(R_{i}^{**}\).

Step 2: Consider an agent \(i\) and \(\widetilde{\omega d}\). Let \(a,b\in Top(R_{i}, \widetilde{\omega d})\) such that \(b_{i}^{x}>a_{i}^{x}\) and \(b_{i}^{y}<a_{i}^{y}\). Consider \(x_{i}\in [a_{i}^{x},b_{i}^{x}]\) and \(y_{i}\in [b_{i}^{y},a_{i}^{y}]\) such that \(((x_{i},y_{i}),(\omega -x_{i},\omega -y_{i}))\in \widetilde{\omega d}\). Then, \((x_{i},y_{i})\in Top(R_{i},\widetilde{\omega d})\).

Proof of Step 2: We will prove Step 2 by contradiction. Suppose \(F\) has isolated plateaus on \(\widetilde{\omega d}\) at some \(R_{i}^{*}\) (Fig. 8).

Let \(\widetilde{a^{'}a}\) and \(\widetilde{bb^{'}}\) be two plateaus under \(R_{i}^{*}\). Pick an allocation \(c\) between \(a\) and \(b\) such that \(a\ne c\ne b\). By Step 1 there exists a preference \(R_{i}\) such that \(c\in Top(R_{i},\widetilde{\omega d}\setminus \{\omega \})\). Since \(c\in int\; LC(R_{i}^{*},a), \,R_{i}\) and \(R_{i}^{*}\) cuts twice. This is a contradiction to the single-crossing property.

Step 3: Consider agent \(i, \,R_{i}\) and \(\widetilde{\omega d}\). Then \(Top(R_{i}, \widetilde{\omega d})\) is unique.

Proof of Step 3: It follows from Step 2 that agent preferences have unique plateaus on both sides of \(\omega \). We show that preferences admit unique maximal element on both sides of \(\omega \). Let \(\widetilde{a^{'}a}\) be a plateau for some preference \(R_{i}^{*}\).

Let \(c\in \widetilde{a^{'}a}\) and \(a^{'}\ne c \ne a\). We have \(F(R_{i}^{'},R_{j}^{'})=d\). By richness we can find \(R_{i}^{**}\) such that \(w P_{i}^{**}b\) for all \(b\in \widetilde{cd}\). Hence, by individual-rationality of \(i\) at \(R_{i}^{**}, \,F(R_{i}^{**},R_{j}^{'})\in int\; SEQ_{i}(c)\). Therefore, by continuity, there exists \(R_{i}^{''}\) such that \(F(R_{i}^{''},R_{j}^{'})=c\).

From the single-crossing property it follows that either \(a^{'}P_{i}^{''}c\) or \(aP_{i}^{''}c\). Consider \(a^{'}P_{i}^{''}c\). If \(a^{'}=\omega \) then individual-rationality of \(i\) is violated at \(R_{i}^{''}\). If \(a^{'}\ne \omega \) then we can choose \(R_{i}^{***}\) (small according to the order \(\succ \)) such that \(w P_{i}^{***}b\) for all \(b\in \widetilde{a^{'}d}\). By individual-rationality of agent \(i\) at \(R_{i}^{***}, \,F(R_{i}^{***},R_{j}^{'})\in int \; SEQ_{i}(a^{'})\). By continuity there exists \(R_{i}^{iv}\) such that \(F(R_{i}^{iv},R_{j}^{'})=a^{'}\). Then agent \(i\) will manipulate \(F\) at \((R_{i}^{''},R_{j}^{'})\) via \(R_{i}^{iv}\).

Now let \(aP_{i}^{''}c\). We have \(F(R_{i}^{'},R_{j}^{'})=d\). Hence, by strategy-proofness of \(i\,a\ne d\). Choose \(R_{i}^{***}\) such that \(w P_{i}^{***}b\) for all \(b\in \widetilde{ad}\). By individual-rationality of \(i\) at \(R_{i}^{***}\,F(R_{i}^{***}, R_{j}^{'})\in int SEQ_{i}(a)\). Therefore, by continuity there exists \(R_{i}^{v}\) such that \(F(R_{i}^{v},R_{j}^{'})=a\). Hence, agent \(i\) will manipulate \(F\) at \((R_{i}^{''},R_{j}^{'})\) via \(R_{i}^{v}\).

We have proved that on both sides of the endowment each agent \(i\) has a unique top. However this is not enough to conclude that agent preferences are single-peaked. We now show this.

Step 4: The preferences of any agent \(i\) exhibit single-peakedness over \(\widetilde{d^{'}\omega }\setminus \{\omega \}\) and \(\widetilde{\omega d}\setminus \{\omega \}\).

Suppose \(R_{i}^{*}\) is not single-peaked but has a unique top on \(\widetilde{\omega d}\). Therefore, there exists an indifference curve of the preference \(R_{i}^{*}\) and allocations \(a\) and \(b, \,a\ne b\) in \(\widetilde{\omega d}\) such that \(\widetilde{ab}\subseteq LC(R_{i}^{*},a)=LC(R_{i}^{*},b)\). But by Step 1 this will violate the single-crossing property. \(\square \)

The following Lemma demonstrates a relationship between the end elements of a diagonal set and single-crossing preferences.

Lemma 8

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let \(\mathfrak {R}_{F}\subseteq int~\Delta \) be closed with \(\mathfrak {R}_{F}=\widetilde{d^{'}\omega }\cup \widetilde{\omega d}\). Then there exist profiles \((R_{i}^{*},R_{j}^{*})\) and \((R_{i}^{**},R_{j}^{**})\) such that,

-

1.

\(dP_{i}^{*} b\) and \(dP_{j}^{*}b\) for all \(b\in \mathfrak {R}_{F}, \,d^{'}P_{i}^{**} b\) and \(d^{'}P_{j}^{**}b\) for all \(b\in \mathfrak {R}_{F}\).

-

2.

We can choose \((R_{i}^{*},R_{j}^{*})\) and \((R_{i}^{**},R_{j}^{**})\) in such a way that for all \(i, \,\omega P_{i}^{*} b\) for all \(b\in \widetilde{d^{'}\omega }\setminus \{\omega \}\) and \(\omega P_{i}^{**} b\) for all \(b\in \widetilde{\omega d}\setminus \{\omega \}\).

Proof

Without the loss of generality consider \(d\). We have shown in the proof of Lemma 7 that there exists \(R_{i}\) such that \(d=Top(R_{i},\widetilde{\omega d})\). Since \(\mathfrak {R}_{F}\) is diagonal by richness 1 follows.

However note that the existence of \(R_{i}^{'}\) such that \(d=Top(R_{i}^{'},\mathfrak {R}_{F})\) does not mean that \(\omega P_{i}^{'}b\) for all \(b\in \widetilde{d^{'}\omega }\setminus \{\omega \}\). It is possible that there exists \(b\in \widetilde{d'\omega }\) such that \(bR_{i}^{'}\omega \) as shown in Fig. 9.

By richness there exists \(R_{j}^{*}\) such that \(IC(R_{j}^{*},\omega )=IC(R_{j}^{*},d^{'})\). Now recall from Lemma 7 that for all \(b\in \widetilde{d^{'}\omega }\setminus \{\omega \}, \,b=Top (R_{j},\widetilde{d^{'}\omega })\) for some \(R_{j}\). Hence, by Lemma 7, \(\widetilde{d^{'}\omega }\subseteq UC(R_{j}^{*},\omega )\), otherwise the single-crossing property will be violated. Hence, by applying richness the desired \(R_{i}^{*}\) is obtained. \(\square \)

Remark 7.2

By Lemma 7 all the allocations on \(\widetilde{d^{'}\omega }\setminus \{\omega \}\) are supported as singele-peaked tops. Hence \(R_{i}^{*}\) obtained in Lemma 8 exhibits single-peakedness on \(\widetilde{d^{'}\omega }\) with \(\omega =Top(R_{i}^{*},\widetilde{d^{'}\omega })\). In other words, by Lemma 7 and Lemma 8 both the agents exhibit single-peakedness on \(\widetilde{d^{'}\omega }\) and \(\widetilde{\omega d}\).

The following property of a closed range is useful.

Lemma 9

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let the SCF \(F:[\mathbb {D}^s]^{2}\rightarrow \Delta \) be strategy-proof, individually rational and continuous. Let \(\mathfrak {R}_{F}\subseteq int~\Delta \) be closed and \(\mathfrak {R}_{F}=\widetilde{d^{'}\omega }\cup \widetilde{\omega d}\). If the profiles \((R_{i}^{*},R_{j}^{*})\) and \((R_{i}^{**},R_{j}^{**})\) are such that they satisfy \((1)\) and \((2)\) in Lemma 8, then \(F(R_{i}^{*},R_{j}^{*})=d\) and \(F(R_{i}^{**},R_{j}^{**})=d^{'}\).

Proof

Let \(R_{i}^{*}\) and \(R_{i}^{*}\) satisfy (1) in Lemma 8. Since \(d\) is in the range of \(F\), there exists \((R_{i},R_{j})\) such that \(F(R_{i},R_{j}) = d\). Since \(d\) is the best element on the range of \(F\) at \(R_{i}^{*}\) , by strategy-proofness, \(F(R_{i}^{*},R_{j}) = d\). Similaraly, we have \(F(R_{i}^{*},R_{j}^{*}) = d\). \(\square \)

We now show that at least one agent’s preferences exhibit single-peakednes on \(\mathfrak {R}_{F}\).

Lemma 10

Let the classical single-crossing domain \(\mathbb {D}^s\) be rich. Let the SCF \(F:[\mathbb {D}^{s}]^{2}\rightarrow \Delta \) be strategy-proof, individually rational and continuous. Let \(\mathfrak {R}_{F}\subseteq int~\Delta \) be closed \(\mathfrak {R}_{F}=\widetilde{d^{'}\omega }\cup \widetilde{\omega d}\). Then there exists an agent \(i\) such that his preferences are single-peaked on \(\mathfrak {R}_{F}\).

Proof

By Lemma 7 agent preferences are single-peaked on both sides of the endowment. Suppose agent \(j\) has a preference \(R_{j}^{*}\) such that \(a\in int~\widetilde{\omega d}\) and \(b\in int~\widetilde{d^{'}\omega }\) are tops on \(\widetilde{\omega d}\) and \(\widetilde{d^{'}\omega }\) respectively under \(R_{j}^{*}\) (Fig. 10).

Consider the profiles \((R_{i}^{1},R_{j}^{1})\) and \((R_{i}^{2},R_{j}^{2})\) such that they satisfy \((1)\) and \((2)\) in Lemma 8. By Lemma 9 \(F(R_{i}^{1},R_{j}^{1})=d\) and \(F(R_{i}^{2},R_{j}^{2})=d^{'}\).

By individual-rationality of agent \(i, \,F(R_{i}^{1},R_{j}^{*})\in \widetilde{\omega d}\) and \(F(R_{i}^{2},R_{j}^{*})\in \widetilde{d^{'}\omega }\). By individual-rationality of \(j, \,F(R_{i}^{1},R_{j}^{2})=\omega \) and \(F(R_{i}^{2},R_{j}^{1})=\omega \). Hence now we have, \(F(R_{i}^{1},R_{j}^{1})=d, \,F(R_{i}^{1},R_{j}^{2})=\omega \) and \(F(R_{i}^{1},R_{j}^{*})\in \widetilde{\omega d}\). Since agent \(j\)’s preferences are single-peaked on each side of the endowment, continuity and strategy-proofness imply \(F(R_{i}^{1},R_{j}^{*})=a\). Similarly, \(F(R_{i}^{2},R_{j}^{*})=b\). Note that \(R_{i}^{1}\succ R_{i}^{2}\). By continuity there exists \(R_{i}^{*}\) such that \(F(R_{i}^{*},R_{j}^{*})=\omega \). By strategy-proofness of agent \(i\) at the profile \((R_{i}^{*},R_{j}^{*}), \,\omega \in Top(R_{i}^{*},\widetilde{\omega a})\) and \(\omega \in Top(R_{i}^{*},\widetilde{b\omega })\). But by Lemma 7 and the single-crossing property \(\omega = Top(R_{i}^{*},\widetilde{\omega a})\) and \(\omega = Top(R_{i}^{*},\widetilde{b\omega })\). Again by Lemma 7 and the single-crossing property \(\omega =Top(R_{i}^{*},\widetilde{\omega d})\) and \(\omega =Top(R_{i}^{*},\widetilde{d^{'}\omega })\). Therefore, \(\omega =Top(R_{i}^{*},\mathfrak {R}_{F})\). By Lemma 7 agent \(i\)’s preferences are also single-peaked on both sides of the endowment. Since \(\omega =Top(R_{i}^{*},\mathfrak {R}_{F})\) by the single-crossing property, agent \(i\)’s preferences exhibit single-peakedness on \(\mathfrak {R}_{F}\). \(\square \)

From the preceding Lemma it follows that there exists an agent \(i\) such that for some \(R_{i}^{*}, \,Top(R_{i}^{*},\mathfrak {R}_{F})=\omega \). Hence, \(Top(R_{i},\mathfrak {R}_{F})\in \widetilde{\omega d}\) if \(R_{i}\succ R_{i}^{*}\) and \(Top(R_{i},\mathfrak {R}_{F})\in \widetilde{d^{'}\omega }\) if \(R_{i}^{*}\succ R_{i}\). Therefore, by individual-rationality for all \(R_{j}, \,F(R_{i},R_{j})\in \widetilde{\omega d}\) if \(R_{i}\succ R_{i}^{*}\) and \(F(R_{i},R_{j})\in \widetilde{d^{'}\omega }\) if \(R_{i}^{*}\succ R_{i}\). By individual-rationality, \(F(R_{i}^{*},R_{j})=\omega \) for all \(R_{j}\). Now consider the following partition of \([\mathbb {D}^{s}]^{2}\): \(K(1)=\{(R_{i},R_{j})|R_{i}=R_{i}^{*}\}, \,K(2)=\{(R_{i},R_{j})|R_{i}\succ R_{i}^{*}\}\) and \(K(3)=\{(R_{i},R_{j})|R_{i}^{*}\succ R_{i} \}\). Hence, it follows that if \((R_{i},R_{j})\in K(2)\) then \(F(R_{i},R_{j})\in \widetilde{\omega d}\) and if \((R_{i},R_{j})\in K(3)\) then \(F(R_{i},R_{j})\in \widetilde{d^{'}\omega }\). Now note that in both \(\widetilde{\omega d}\) and \(\widetilde{d^{'}\omega }\) preferences of agent \(j\) are also single-peaked.

Now consider \(K(1)\cup K(2)\). We know by individual-rationality of \(F\) that if \((R_{i},R_{j})\in K(2)\) then \(F(R_{i},R_{j})\in \widetilde{\omega d}\). From Theorem 2 in Barberá and Jackson (1994),

where \(a_{s}\) is an extended real number for all \(s\subseteq \{i,j\}\).

Also if \(s\subset s^{'}\subseteq \{i,j\}\) then \(a_{s}\ge a_{s'}\). [***]

Claim 1: \(a_{\emptyset }\ge d\) and \(a_{\{i,j\}}\le \omega \).

Proof of Claim 1: Let for the sake of contradiction \(a_{\emptyset }< d\). From Lemma 8 and Lemma 9 we can choose a profile such that under \(F\),

By [***], \(\min \Big \{a_{\emptyset },d,d,d\Big \}<d\), which is a contradiction to the above equality.

Now, let for the sake of contradiction \(a_{\{i,j\}}> \omega \). By individual-rationality of \(F\) from our earlier discussion we can choose a profile such that,

By [***] \(\min \Big \{a_{\emptyset },a_{\{i\}},a_{\{j\}},a_{\{i,j\}}\Big \}>\omega \), which is a contradiction to the above equality. This establishes Claim 1.

Since \(F(R_{i},R_{j})\in \widetilde{\omega d}\) for all \((R_{i},R_{j})\in K(1)\cup K(2)\), the definition of min-max function and Claim 1 imply that we can set \(a_{\emptyset }=d\) and \(a_{\{i,j\}}=\omega \).

Claim 2: \(a_{\{i\}}=\omega \) and \(a_{\{j\}}=\omega \).

Proof of Claim 2: Let for the sake of contradiction \(a_{\{i\}}>\omega \). We know that by individual-rationality of \(F, \,\min \Big \{d,\max \{d,a_{\{i\}}\},\max \{\omega ,a_{\{j\}}\}, \max \{d,\omega ,\omega \}\Big \}=\omega \). Hence, \(a_{\{j\}}=\omega \). Again by, individual-rationality of \(F, \,\min \Big \{d,\max \{\omega ,a_{\{i\}}\},\max \{d,\omega \}, \max \{\omega ,d,\omega \}\Big \}=\omega \), i.e. \(\min \Big \{d,\max \{\omega ,a_{\{i\}}\},d,d\Big \}=\omega \), which is a contradiction.

Let for the sake of contradiction \(a_{\{j\}}>\omega \). By individual-rationality of \(F\),

This is a contradiction since, \(\max \{\omega ,a_{\{j\}}\}>\omega \). This establishes the Claim 2.

Hence, from the claims above it follows that \(a_{\emptyset }=d\) and \(a_{s}=\omega \) for \(s\subseteq \{i,j\}\) and \(s\ne \emptyset \). Therefore,

Since none of the tops can be higher than \(d\) so we can write,

Analogously, if \((R_{i},R_{j})\in K(1)\cup K(3)\) then

This completes the proof of Theorem 2.

Rights and permissions

About this article

Cite this article

Goswami, M.P. Non fixed-price trading rules in single-crossing classical exchange economies. Soc Choice Welf 44, 389–422 (2015). https://doi.org/10.1007/s00355-014-0834-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-014-0834-7