Abstract

In this paper we study optimal investment when the investor can peek some time units into the future, but cannot fully take advantage of this knowledge because of quadratic transaction costs. In the Bachelier setting with exponential utility, we give an explicit solution to this control problem with intrinsically infinite-dimensional memory. This is made possible by solving the dual problem where we make use of the theory of Gaussian Volterra integral equations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Optimal investment is a tremendously rich source of mathematical challenges in stochastic control theory. The key driver in this problem is the tradeoff between risk and return. Thus, information on the investment opportunities is playing a role which is as important for the mathematical theory as it is in practice where investors go at great lengths to secure even the slightest advantage in knowledge. So it is no wonder that insider information has been widely studied in the literature; see, for instance, [2, 3, 5, 20, 24] where an investor obtains extra information about the stock price evolution at some fixed point in time. By contrast to these studies, the present paper takes a more dynamic view on information gathering and affords the investor the opportunity to continually peek \(\Delta \) units of time into the future. Closest to such an investor in reality may be high-frequency traders (“frontrunners”) that get access to order flow information earlier or are able process it faster than their competition. To the best of our knowledge, this paper is the first continuous-time stochastic control paper with such a feature, apart from the optimal stopping problem of [9].

Of course, perfect knowledge about future stock prices easily lets optimal investment problems degenerate and so it is of great interest to understand how market mechanisms may curb an investor’s ability to take advantage of this extra information. A most satisfactory approach from an economic point of view is the equilibrium approach due to Kyle [22] where the insider knows the terminal stock price right from the start and internalizes the impact of her orders on market prices. Generalizations of this approach are challenging; see [6, 7, 28] and the references therein. For dynamic information advantages in this context, we refer to [11, 12] who consider an insider receiving a dynamic signal on, respectively, the terminal asset price or the traded firm’s default time. These models, however, do not get close to addressing the intrinsically infinite-dimensional information structure of our peek-ahead setting. Fortunately, also the much simpler market impact model of [1] that just imposes quadratic transaction costs for the investor turns out to be sufficient friction to make the optimal investment problem viable. In an insider model where additional information is obtained just once, [4] use such a friction for optimal portfolio liquidation. A combination between Kyle’s equilibrium setting and quadratic price impact costs is solved in [8]. With peek-ahead information as in the present paper, [14] study super–replication, albeit in a discretized version of the Bachelier model.

It is in the continuous-time Bachelier model that the present paper provides its main result, namely the explicit optimal investment strategy for an exponential utility maximizer who knows about future prices \(\Delta \) time units before they materialize in the market, but cannot freely take advantage of her extra knowledge due to quadratic transaction costs. The optimal policy turns out to be a combination of two trading incentives. On the one hand, there is the urge to trade towards the optimal frictionless position given by the well-known Merton ratio. On the other hand, there is the desire to take advantage of the next stock price moves and this contributes to the optimal turnover rate through an explicitly given average of stock prices over the window of length \(\Delta \) on which our investor has extra information.

Due to its peek-ahead feature, our optimal control problem can be viewed as a contribution to pathwise stochastic control. A closely related work is [10] where the authors studied a hidden stochastic volatility model with a controller who has full information on the extra noise. The theory of delayed or partial information also shares the infinite-dimensional pathwise control issues we need to address here; see the recent papers [25, 26] and the references therein. Finally, our control theoretic setting is also related to models discussed in the monograph [15].

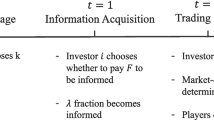

Instead of dynamic programming (which would be challenging in this infinite memory setting; cf. [15]), our methodology is based on duality. For the case of exponential utility and quadratic transaction costs, this theory is developed with flexible information flow in great generality in an essentially self-contained appendix. It shows that the primal optimal control is determined by the conditional expectation of the terminal stock price under the dual optimal probability measure. For the Brownian framework that we focus on in the main body of the paper, we derive a particularly convenient representation of the dual target functional which leads to deterministic variational problems. These problems can be solved explicitly, and results from the theory of Gaussian Volterra integral equations [18, 19] allow us both to construct the solution to the dual problem and to compute the primal optimal strategy. These Gaussian Volterra integral equations also occur in [13] albeit in the rather different context of (no) arbitrage criteria in fractionally perturbed financial models.

In Section 2 we specify our model and formulate and interpret our main result. Section 3 contains the proof of the main result and the appendix A presents the duality results necessary for these developments.

2 Problem Formulation and Main Result

We consider an investor who knows about market movements some time before they happen, but cannot arbitrarily exploit them due to market frictions. Specifically, apart from a riskless savings account bearing zero interest (for simplicity), the investor has the opportunity to trade in a risky asset with Bachelier price dynamics

where \(s_0 \in {\mathbb {R}}\) is the initial asset price, \(\mu \in \mathbb {R}\) is the constant drift, \(\sigma >0\) is the constant volatility and W is a one-dimensional Brownian motion supported on a complete probability space \((\Omega , \mathcal {F}, {\mathbb {P}})\). Rather than having access to just the natural augmented filtration \((\mathcal {F}^S_t)_{t \ge 0}\) for making investment decisions, we assume that our investor can peek \(\Delta \in [0,\infty )\) time units into the future, and so her information flow is given by the filtration

Remark 2.1

As suggested by an anonymous referee, one could more generally consider a non-decreasing time shift \(\tau :[0,\infty ) \rightarrow [0,\infty )\) with \(\tau (t) \ge t\) to model time-varying ability to peek ahead. To keep the exposition here as simple as possible, we leave this extension of our model as a topic for future research.

Taking advantage of the inside information is impeded by the investor’s adverse market impact. Following [1], we model this impact in a temporary linear form and, thus, when at time t the investor turns over her position \(\Phi _t\) at the rate \(\phi _t=\dot{\Phi }_t\) the execution price is \(S_t + \frac{\Lambda }{2} \phi _t\) for some constant \(\Lambda >0\). As a result, the profits and losses from trading are given by

where, for convenience, we assume that the investor marks to market her position \(\Phi _T = \Phi _0+\int _0^T \phi _t dt\) in the risky asset that she has acquired by time \(T>0\).

Fixing a time horizon \(T>0\), the natural class of admissible strategies is then

The investor’s preferences are described by an exponential utility function

with constant absolute risk aversion parameter \(\alpha >0\), and her goal is thus to

The paper’s main result is the following solution to this optimization problem:

Theorem 2.2

In the utility maximization problem (2.2), the investor’s optimal turnover rate \(\hat{\phi }_t\) at time \(t \in [0,T]\) depends on the risk-liquidity ratio

on the position \(\hat{\Phi }_t=\Phi _0+\int _0^t \hat{\phi }_sds\) acquired so far and the privileged information on the next stock prices \((S_{t+s})_{s \in [0,\Delta ]}\) in the feedback form

where \(\bar{S}^\Delta \) is the stock price average given by

with \(\Upsilon ^\Delta (\tau )=\Delta \sqrt{\rho }\tanh (\sqrt{\rho }(\tau -\Delta )^{+})/(1+\Delta \sqrt{\rho }\tanh (\sqrt{\rho }(\tau -\Delta )^+))\). The maximal utility this policy generates is

Our feedback description (2.3) can be interpreted as follows: First, without privileged information, i.e. for \(\Delta =0\), we have \(\bar{S}^\Delta _t=S_t\) and, therefore, the first term in (2.3) vanishes leaving us with the optimal policy

So the uninformed agent will trade towards the optimal position \(\mu /(\alpha \sigma ^2)\) well known from the frictionless Merton problem. Due to the impact costs, she does so with finite urgency \(\sqrt{\rho }\tanh (\sqrt{\rho }(T-t))\). With a long time to go, this urgency is essentially \(\sqrt{\rho }\) and thus dictated by the risk/liquidity ration \(\rho =\alpha \sigma ^2/\Lambda \); as t approaches the time horizon T, the urgency vanishes because, towards the end, position improvements have an ever shorter time to yield risk premia but the investor still has to pay the same impact costs that obtain at the start of trading.Footnote 1

For the informed agent, i.e. for \(\Delta >0\), the desire to be close to the Merton ratio persists, but the urgency reduces to

leaving “some air” to take advantage of the knowledge on future price movements. This is done by averaging out in (2.4) the latest relevant stock price available to the investor, \(S_{(t+\Delta )\wedge T},\) with the mean stock price \(\frac{1}{\Delta } \int _0^{\Delta } S_{t+s}ds\) to be realized over the next \(\Delta \) time units in an effort to assess the earnings potential over today’s stock price \(S_t\). Put into relation with the impact costs \(\Lambda \), this yields the second contribution \((\bar{S}^\Delta _t-S_t)/\Lambda \) to the optimal turnover rate. The weight that this assessment of earnings assigns to the average stock prices is given by \(\Upsilon ^\Delta (T-t) \in [0,1]\); it is about \(\Delta \sqrt{\rho }/(1+\Delta \sqrt{\rho })\) when there is still a lot of time to go, but vanishes completely as soon as \(T-t\le \Delta \), i.e. as soon as full knowledge of stock price movements over the relevant time span [0, T] is attained. In this terminal regime also the ambition to be close to the Merton ratio is wiped out and the investor just chases the earning potential \(S_T-S_t\) from the stock, of course still in a tradeoff against the liquidity costs \(\Lambda \); this latter effect is also immediate from separate, pointwise optimization over \(\phi _t\) in the representation (2.1) of profits and losses (which leads to \(\phi _t^*=(S_T-S_t)/\Lambda \), \(t \in [0,T]\), an admissible strategy as soon as \(S_T\) becomes known). Figure 1 illustrates the different components important for the optimal strategy along a typical trajectory of price fluctuations.

The first of these illustrations shows an evolution of the stock price S (blue), the corresponding average \(S^\Delta \) (orange) along with the underlying weight \(\Upsilon ^\Delta \); the second shows the resulting trading rates due to “frontrunning” (grey) and due to tracking the Merton portfolio (black); the third display shows the ensuing stock position \(\Phi \) (red) together with the Merton ratio \(\mu /(\alpha \sigma ^2\)) (light red). Parameters where chosen as \(s_0=0\), \(\mu =.1\), \(\sigma =.3\), \(T=10\), \(\Delta =1\), \(\alpha =.03\), \(\Phi _0=0\), \(\Lambda = .01\)

The monetary value of being able to peek ahead by \(\Delta \) is best described by the certainty equivalent

determined by comparing the utility attainable for an informed investor (with admissible strategy set \({\mathcal {A}}^\Delta \)) and an uninformed one (who is confined to strategies from the smaller class \({\mathcal {A}}^0\))Footnote 2. Interestingly, the certainty equivalent does not depend on the stock’s risk premium \(\mu \), but is determined by the risk/liquidity ratio \(\rho =\alpha \sigma ^2/\Lambda \), the investor’s time horizon T and the time units \(\Delta \) she can look ahead. Except for a period of length \(\Delta \) and with a lot of time to go, it accrues at about the rate \(\Delta \rho /(2(1+\Delta \sqrt{\rho }))\) which increases with \(\Delta \) to the upper bound \(\sqrt{\rho }/2\), revealing again the curb frictions put on the earning potential of even extreme information advantages.

The proof of Theorem 2.2 is carried out in the next section. It is obtained by solving the dual problem to

The corresponding duality theory holds true beyond the Brownian framework specified here and is developed in a self-contained manner in the Appendix A as a second key contribution of our paper.

3 Proof of Theorem 2.2

Let us first note that it suffices to treat the case

Indeed, by passing from \(\alpha \), \(\Lambda \), \(\mu \) to, respectively, \(\alpha '=\alpha \sigma \), \(\Lambda '=\Lambda /\sigma \), \(\mu '=\mu /\sigma \), the utility with \(\sigma '=1\) obtained from a given strategy will coincide with the one obtained from this strategy under the original parameters. Moreover, rewriting the expected utility under \({\mathbb {P}}' \sim {\mathbb {P}}\) with density

under which \(W'_t=W_t+\mu ' t\), \(t \ge 0\), is a driftless Brownian motion, the expected utilities under \({\mathbb {P}}\) coincide, up to the factor \(\exp \left( \frac{1}{2}\mu '^2 T\right) \), with those under \(\mathbb P'\) if we start with \(\Phi _0'=\Phi _0-{\mu }/({\alpha \sigma ^2})\) rather than \(\Phi _0\) risky assets.

The proof of Theorem 2.2 will be accomplished via the dual problem whose properties are summarized in the following proposition which is an immediate consequence of the general duality results presented in Appendix A.

Proposition 3.1

Denoting by \({\mathcal {Q}}\) the set of all probability measures \({\mathbb {Q}}\sim {\mathbb {P}}\) with finite entropy

relative to \({\mathbb {P}}\), we have

Furthermore, the minimizer \(\hat{{\mathbb {Q}}}\) for the dual problem is unique and yields via

the unique optimal portfolio for the primal problem.

Proof

Follows from Proposition A.2 below with the choice \(\mathcal {G}_{t}:=\mathcal {G}_{t}^{\Delta }\) after noting that \(S_{t}/\sqrt{t}\) is standard Gaussian and so

clearly holds for some small enough \(a>0\). \(\square \)

In order to solve the utility maximization problem it therefore suffices to find the minimizer \(\hat{{\mathbb {Q}}}\) of the dual problem and work out the conditional expectation in (3.3). This is the path we will follow for the rest of this section. In a first step we derive a particularly convenient representation for the target functional of our dual problem:

Lemma 3.2

The dual infimum in (3.2) coincides with the one taken over all \({\mathbb {Q}} \in {\mathcal {Q}}\) whose densities take the form

for some bounded and adapted \(\theta \) changing values only at finitely many deterministic times. For such \({\mathbb {Q}}\) the induced value (2.7) for the dual problem can be written as

where, for \(t\in [0,T]\), \(a_t\) and \(l_{t,.}\) are determined by the Itô-representations

with respect to the \({\mathbb {Q}}\)-Brownian motion \(W^{\mathbb Q}_s=W_s+\int _0^s \theta _r dr\), \(s \ge 0\).

Proof

For any \({\mathbb {Q}} \in {\mathcal {Q}}\) the martingale representation property of Brownian motion gives us a predictable \(\theta \) with \({\mathbb {E}}_{{\mathbb {Q}}}[\log (d{\mathbb {Q}}/d{\mathbb {P}})]=\mathbb E_{{\mathbb {Q}}}[\int _0^T\theta ^2_sds]/2<\infty \) such that the density \(d{\mathbb {Q}}/d{\mathbb {P}}\) takes the form (3.4). Using this density to rewrite the dual target functional as an expectation under \({\mathbb {P}}\), we can follow standard density arguments to see that the infimum over \({\mathbb {Q}} \in {\mathcal {Q}}\) can be realized by considering the \({\mathbb {Q}}\) induced via (3.4) by simple \(\theta \) as described in the lemma’s formulation. As a consequence, the Itô representations of \(\theta _t\) in (3.5) can be chosen in such a way that the resulting \((a_t,l_{t,.})\) are also measurable in t: in fact they only change when \(\theta \) changes its value, i.e., at finitely many deterministic times. This joint measurability will allow us below to freely apply Fubini’s theorem.

Let us rewrite the dual target functional in terms of a and l. In terms of \(\theta \) and the \({\mathbb {Q}}\)-Brownian motion \(W^{{\mathbb {Q}}}\), it reads

From Itô’s isometry and Fubini’s theorem we obtain

Again by Fubini’s theorem it follows that

for any \(t\in [0,T]\), where the last equality follows from the martingale property of stochastic integrals. Thus, another application of Itô’s isometry yields

Plugging this together with (3.7) into (3.6) and using Fubini’s theorem then provides us with the claimed formula for our dual target value:

\(\square \)

The crucial point of the above representation is that by taking the minimum separately over a and over \(l_{.,s}\) for each \(s \in [0,T]\) we obtain deterministic variational problems that can be solved explicitly (see the next Lemma 3.3) and this deterministic minimum yields a lower-bound for the dual target value that, using some Gaussian process theory, will ultimately be shown to actually coincide with it (see Lemma 3.4 below).

Lemma 3.3

Recall our notation \(\rho =\alpha \sigma ^2/\Lambda =\alpha /\Lambda \) (because \(\sigma =1\); cf. (3.1)).

-

(i)

The minimum of the functional

$$\begin{aligned} -\Phi _0\int _{0}^T a_t dt+\frac{1}{2\alpha }\int _{0}^T a^2_t dt+\frac{1}{2\Lambda }\int _{0}^T \left( \int _t^T a_udu\right) ^2 dt \end{aligned}$$over \(a \in L^2([0,T],dt)\) is attained for \(\hat{a}\Phi _0\) where

$$\begin{aligned} \hat{a}_t = \frac{\alpha \cosh (\sqrt{\rho }(T-t))}{\cosh (\sqrt{\rho } T)}, \quad t \in [0,T]. \end{aligned}$$(3.8)The resulting minimum value is \(-\hat{A}_T\Phi _0^2\) where

$$\begin{aligned} \hat{A}_T=\Lambda \sqrt{\rho }\tanh (\sqrt{\rho } T)/2. \end{aligned}$$(3.9) -

(ii)

For any \(s \in [0,T]\), the minimum of the functional

$$\begin{aligned} \frac{1}{2\alpha }\int _{s}^{T} l^2_{t} dt+ \frac{1}{2\Lambda } \int _{s}^{T}\left( \int _t^T l_{u}du\right) ^2dt +\frac{s\wedge \Delta }{2\Lambda }\left( 1-\int _s^Tl_{u}du\right) ^2 \end{aligned}$$over \(l \in L^2([s,T],dt)\) is attained at

$$\begin{aligned} \hat{l}_{t,s} = \frac{ \rho (s \wedge \Delta ) \cosh (\sqrt{\rho }(T-t))}{\cosh (\sqrt{\rho }(T-s))+ \sqrt{\rho } (s \wedge \Delta ) \sinh (\sqrt{\rho }(T-s))}, \quad t\in [s,T]. \end{aligned}$$(3.10)The corresponding minimum value is

$$\begin{aligned} \hat{L}_s=\frac{1}{2\Lambda }\frac{s \wedge \Delta }{1+(s\wedge \Delta )\sqrt{\rho } \tanh (\sqrt{\rho }(T-s))}. \end{aligned}$$(3.11)

Proof

We start with (ii). The uniqueness follows from strict convexity of the functional to be minimized over \(l \in L^2([s,T],dt)\). To write this as a standard variational problem, put \(H(u,v):=\frac{1}{2\Lambda }u^2+ \frac{1}{2\alpha } v^2\) for \( u,v\in {\mathbb {R}}\), reparametrize l via \(g(t) = \int _t^T l_u du\), \(t \in [s,T]\), and consider, for any \(s \in [0,T]\) and any \(\Theta \in {\mathbb {R}}\), the problem to minimize \(\int _{s}^T H(g_t,\dot{g}_t) dt\) over \(g \in C^1[s,T]\) subject to the constraints \(g(s)=\Theta \), \(g(T)=0\).

The optimization problem is convex and so it has a unique solution which has to satisfy the Euler–Lagrange equation (for details see Section 1 in [16])

Thus, the optimizer is the unique solution of the linear ODE

namely

Next, observe that for the function \(g(t):=\int _{t}^T l_u du\), \(t\in [s,T]\) we have \(\dot{g}=-l\) where \(\dot{g}\) is the weak derivative of g, and so,

Thus, from simple density arguments (needed since g is not necessarily smooth) we obtain that

where the last equality follows from simple computations.

Finally, the minimum of the above quadratic pattern (in \(\Theta \)) is attained at

The proof of (i) is almost the same as the of (ii), but slightly simpler. Observe that

The minimum of the above quadratic pattern (in \(\Theta \)) is attained in

This gives (3.8)–(3.9). \(\square \)

The previous two lemmas suggest a way to construct a candidate for the solution to the dual problem: Find \(\hat{{\mathbb {Q}}} \sim {\mathbb {P}}\) whose density is given by

with

For the associated Brownian motion \(\hat{W}=W^{\hat{{\mathbb {Q}}}}=W+\int _0^. \hat{\theta }_r dr\) this implies the Volterra-type integral equation

Integral equations of this type occur in [18, 19]; see also [13]. By considering \(W+\int _0^. \hat{a}_r \Phi _0 dr\) as a Brownian motion with respect to some probability measure which is equivalent to \({\mathbb {P}}\), we can apply the results from Section 6.4 in [18] (in particular see Theorem 6.3 and its proof there). We obtain that (3.14) has a unique solution given by

where \(\hat{k}\) is the associated resolvent kernel characterized by the equation

Moreover, \(\hat{W}\) is a Brownian motion with respect to \(\hat{{\mathbb {Q}}}\) which is well defined by (3.12).

As our \(\hat{l}\) is separable multiplicatively, (3.16) can be reduced to a linear ODE from which we compute the explicit solution

We are now in a position to solve the dual problem:

Lemma 3.4

The dual infimum (3.2) is attained by \(\hat{{\mathbb {Q}}} \sim {\mathbb {P}}\) with density

for \(\hat{\theta }\) constructed in (3.13) with \(\hat{W}\) as given by (3.15); this \(\hat{W}\) coincides with the \(\hat{{\mathbb {Q}}}\)-Brownian motion induced by the \(\mathbb P\)-Brownian motion W via Girsanov’s theorem. The value of the dual problem is

Proof

The construction of \(\hat{{\mathbb {Q}}}\), \(\hat{W}\) and \(\hat{\theta }\) has already been established by the preceding discussion. It is readily checked that \(\hat{{\mathbb {Q}}}\) has finite entropy relative to \({\mathbb {P}}\) and so \(\hat{{\mathbb {Q}}} \in {\mathcal {Q}}\). Note that \(\hat{W}\) and W generate the same filtration because of (3.14) and (3.15) and so we can follow the same reasoning as in the proof of Lemma 3.2 to obtain its representation for the dual target functional also for \(\hat{\mathbb Q}\). Recalling the minimizing properties of \(\hat{a}\) and \(\hat{l}_{.,s}\), \(s \in [0,T]\), it then follows that \(\hat{\mathbb Q}\) solves the dual problem with value (3.18). \(\square \)

By (3.2) the above value (3.18) of the dual problem already yields the claimed value (2.5) for our primal utility maximization problem. For the completion of the proof of Theorem 2.2 it therefore remains to work out the optimal turnover policy \(\hat{\phi }\). Due to its dual description (3.3), it suffices to compute \({\mathbb {E}}_{\hat{{\mathbb {Q}}}}\left[ S_T|{\mathcal {G}}^{\Delta }_t\right] = {\mathbb {E}}_{\hat{{\mathbb {Q}}}}\left[ W_T|\mathcal F_{t+\Delta }\right] \). Recalling the Volterra-type equation (3.14) and using Fubini’s theorem we can write

Thus, for any \(t \in [0,T]\), we find

where in the second step we used (3.15) to get an expression in terms of the original input to our problem W rather than \(\hat{W}\). The structure of this expression suggests to consider for \(X=W\) and \(X=\int _0^. \hat{a}_s ds\) the integral operator

for continuous paths X. Notice that the dX-integrals can be defined through integration by parts which reveals in particular that \({\mathcal {I}}^T_t(X)\) depends continuously on X; notice also that we used the notation \(\hat{l}^T\) and \(\hat{k}^T\) in lieu of l and \(k\) to emphasize that these kernels depend on the time horizon T. In conjunction with (3.3) and \(S_t=W_t\), this provides us with a (somewhat) explicit ‘open loop’ expression of the optimal turnover policy:

where, again, \(\hat{a}^T\) is used to recall that \(\hat{a}\) of (3.8) depends on T.

To establish the policy’s more informative feedback description given in Theorem 2.2, we note next that dynamic programming holds for our problem:

Lemma 3.5

The optimal policy \(\hat{\phi }\) of (3.19) can alternatively be described in the form

where \(\hat{\Phi }_t=\Phi _0+\int _0^t \hat{\phi }_sds\) for \(t \in [0,T]\).

Proof

The righthand side of (3.19) gives us for each time horizon T a continuous functional \(\Psi ^T:{\mathbb {R}}\times C[0,T]\rightarrow C[0,T]\) such that for any initial stock position \(\Phi _0 \in {\mathbb {R}}\) and any stock price evolution W, \(\Psi ^T(\Phi _0,W|_{[0,T]})\) is the correspondingly optimal strategy \(\hat{\phi }\) for the utility maximization problem.

Assume by contradiction that the statement of our lemma does not hold. Then, by continuity of sample paths of \(\hat{\phi }\), there exists \(t_0\in [0,T]\) such that with positive probability \(\hat{\phi }_{t_0}\) does not coincide with the righthand side of (3.20). Now consider the strategy \(\tilde{\phi }\) that coincides with \(\hat{\phi }\) up to time \(t_0\) when it switches to

For any strategy \(\phi \), we can write the contribution over the interval \([t_0,T]\) to the resulting terminal wealth as

where \(\Phi _{t_0}:=\Phi _0+\int _0^{t_0}\phi _t dt\). Of course, \(\tilde{\Phi }_{t_0}:=\Phi _0+\int _0^{t_0}\tilde{\phi }_t dt=\hat{\Phi }_{t_0}\). So, by the Markov property of Brownian motion and choice of \(\tilde{\phi }\) as the unique optimal policy as of time \(t_0\), this allows us to observe that

with “>” holding on \(\{\hat{\phi }_{t_0} \not = \tilde{\phi }_{t_0}\}\) (i.e. where (3.20) is violated) because continuity of \(\hat{\phi }\) and \(\tilde{\phi }\) ensures that they will differ on an open interval once they differ at all. Since by assumption this happens with positive probability, it follows for the unconditional expected utility from \(\tilde{\phi }\) that

contradicting the optimality of \(\hat{\phi }\). \(\square \)

As a consequence of this dynamic programming result, it suffices to verify our feedback policy description (2.3) for time \(t=0\):

Lemma 3.6

The optimal initial turnover rate is

Proof

In view of (3.19), we need to compute for \(X=W\) and \(X=\int _0^.\hat{a}_udu\) the operator

with

where the last equality is due to Fubini’s theorem. For \(t \in [r,\Delta \wedge T]\), the kernel identity (3.16) shows that the second ds-integral in (3.23) gives \(\hat{k}_{t,r}+\hat{l}_{t,r}\). For \(t \in (\Delta \wedge T,T]\), we note that \(\Delta <T\) and we let \(n_t\) denote the numerator in the definition of \(\hat{l}_{t,.}\) in (3.10) to write \(\hat{l}_{t,r}=\hat{l}_{\Delta ,r} n_t/n_{\Delta }\). It follows by another use of the kernel identity (3.16) that for such t the second ds-integral above amounts to

where we used (3.17) in the final step. Plugging all this into (3.23), we see that the contribution to the dt-integral from \([r,\Delta \wedge T]\) is partially cancelled by the first ds-integral there, leaving us with

Inserting this into (3.22), we see a cancellation of integrals over \(\hat{l}\) and arrive at

where in view of (3.10) we have

Now we apply (3.24) to \(X=W\) and \(X=\int _.^T\hat{a}_udu\) to rewrite the open loop description (3.19) of \(\hat{\phi }_0\) as

We conclude the claimed representation for the optimal policy (3.21) by inserting (3.25) and

in the above formula for \(\hat{\phi }_0\).

As a final step, we need to recall the simplifying steps from the beginning of this chapter where we reduced everything to the case \(S=W\) underpinning our calculations so far. Reversing these steps then leads to the formulae given in the present lemma which work for the general case required in our main theorem. \(\square \)

Notes

We will prove this result along the way to our main result with future knowledge \(\Delta >0\). Let us note though that, for \(\Delta =0\), a closely related result is obtained by dynamic programming techniques in [27] who, in contrast to our setting, impose a liquidation constraint \(\hat{\Phi }_T=0\) and assume \(\mu =0\).

The integral in (2.6) can be computed explicitly, but the resulting formulae turn out to be not more informative than the above integral and are therefore omitted.

References

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–39 (2001)

Amendinger, J., Becherer, D., Schweizer, M.: A monetary value for initial information in portfolio optimization. Finance Stochast. 7, 29–46 (2003)

Amendinger, J., Imkeller, P., Schweizer, M.: Additional logarithmic utility of an insider. Stochast. Process. Appl. 75, 263–286 (1998)

Ankirchner, S., Blanchet-Scalliet, C., Eyraud-Loisel, A.: Optimal portfolio liquidation with additional information. Math. Fin. Econ. 10(1), 1–14 (2016)

Ankirchner, S., Dereich, S., Imkeller, P.: The Shannon information of filtrations and the additional logarithmic utility of insiders. Ann. Appl. Probab. 34, 743–778 (2006)

Back, K., Baruch, S.: Information in securities markets: Kyle meets Glosten and Milgrom. Econometrica 72(2), 433–465 (2004)

Back, K., Cocquemas, F., Ekren, I., Lioui, A.: Optimal transport and risk aversion in Kyle’s model of informed trading. arXiv:2006.09518 (2021)

Barger, W., Donnelly, R.: Insider trading with temporary price impact. Int. J. Theoret. Appl. Fin. 24, 02 (2021)

Bayraktar, E., Zhou, Z.: On an optimal stopping problem of an insider. Theory Probab. Appl. 61, 181–186 (2016)

Buckdahn, R., Ma, J.: Pathwise stochastic control problems and stochastic Hjb equations. SIAM J. Control. Optim. 45, 2224–2256 (2007)

Campi, L., Çetin, U., Danilova, A.: Equilibrium model with default and dynamic insider information. Fin. Stoch. 17(3), 565–585 (2013)

Campi, L., Çetin, U., Danilova, A.: Dynamic Markov bridges motivated by models of insider trading. Stoch. Process. Appl. 121(3), 534–567 (2011)

Cheridito, P.: Regularizing fractional Brownian motion with a view towards stock price modelling. ProQuest LLC, Ann Arbor, MI. Thesis (Dr.sc.math.)–Eidgenoessische Technische Hochschule Zuerich (Switzerland) (2001)

Dolinsky, Y., Zouari, J.: The value of insider information for super-replication with quadratic transaction costs. Stochast. Process. Appl. 131, 394–416 (2021)

Fabbri, G., Gozzi, F., Świpolhk ech, A.: Stochastic optimal control in infinite dimension: dynamic programming and HJB equations. Probability Theory and Stochastic Modelling, vol. 82. Springer, Cham (2017). (With a contribution by Marco Fuhrman and Gianmario Tessitore)

Gelfand, I., Fomin, S.: Calculus of Variations. Prentice Hall, Upper Saddle River, NJ (1963)

Guasoni, P., Rásonyi, M.: Hedging, arbitrage and optimality under superlinear friction. Ann. Appl. Probab. 25, 2066–2095 (2015)

Hida, T., Hitsuda, M.: Gaussian Processes. American Mathematical Society, New York (1993)

Hitsuda, M.: Representation of Gaussian processes equivalent to wiener process. Osaka J. Math. 5, 299–312 (1968)

Imkeller, P.: Malliavin’s calculus in insider models: additional utility and free lunches. Math. Fin. 13, 153–169 (2003)

Kabanov, Y.M., Stricker, C.: On the optimal portfolio for the exponential utility maximization: remarks to the six-author paper. Math. Fin. 12, 125–134 (2002)

Kyle, A.S.: Continuous auctions and insider trading. Econometrica 53, 1315–1335 (1985)

Neveu, J.: Discrete-Parameter Martingales. North-Holland, Amsterdam (1975)

Pikovsky, I., Karatzas, I.: Anticipative portfolio optimization. Adv. Appl. Probab. 28, 1095–1122 (1996)

Saporito, Y.F.: Stochastic control and differential games with path-dependent influence of controls on dynamics and running cost. SIAM J. Control. Optim. 57, 1312–1327 (2019)

Saporito, Y.F., Zhang, J.: Stochastic control with delayed information and related nonlinear master equation. SIAM J. Control. Optim. 57, 693–717 (2019)

Schied, A., Schöneborn, T.: Optimal portfolio liquidation for CARA investors. SSRN Electron. J. (2007). https://doi.org/10.2139/ssrn.1018088

Çetin, U.: Financial equilibrium with asymmetric information and random horizon. Fin. Stochast. 22(1), 97–126 (2018)

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

P. Bank is supported in part by the GIF Grant 1489-304.6/2019. Y. Dolinsky is supported in part by the GIF Grant 1489-304.6/2019 and the ISF Grant 230/21. M. Rásonyi thanks for the support of the “Lendület” Grant LP 2015-6 of the Hungarian Academy of Sciences.

Appendix A: Duality

Appendix A: Duality

In this appendix we develop the duality theory for the utility maximization problem (2.2) not just for the Bachelier model discussed in the rest of the paper, but for any càdlàg price process \(S=(S_t)_{t \in [0,T]}\) on a filtered probability space \((\Omega ,\mathcal {F},\mathbb {P})\) equipped with the (completed, right-continuous) filtration \((\mathcal {G}_{t})_{t\in [0,T]}\) to which S is adapted. Expectation of a real-valued random variable X with respect to some probability R on \(\mathcal {F}\) is denoted \(\mathbb {E}_{R}[X]\) where the index is dropped when \(\mathbb {Q}=\mathbb {P}\). Sometimes we also use the shorthand notation \(\mathbb {E}_{{R},t}[X]\) (resp. \(\mathbb {E}_{t}[X]\)) instead of \(\mathbb {E}_{R}[X\vert \mathcal {G}_{t}]\) (resp. \(\mathbb {E}[X\vert \mathcal {G}_{t}]\)).

Define the set of admissible strategies by

and for each \(\phi \in \mathcal {A}\) define the corresponding portfolio value at time T by

where \(\Lambda >0\) is a given constant characterizing the strength of price impact.

Assumption A.1

There is \(a>0\) such that

Proposition A.2

Let Assumption A.1 be in force. Denoting by \(\mathcal Q\) the set of all probability measures \(\mathbb Q\sim \mathbb P\) with finite entropy

relative to \(\mathbb P\), we have

Furthermore, there is a unique minimizer \(\hat{\mathbb Q}\) for the dual problem and the process given by

is the unique optimal portfolio for the primal problem.

We will prove Proposition A.2 at the end of this section, after suitable preparations. In the rest of this section we assume \(\alpha =1\), \(\Lambda =2\), \(\Phi _{0}=0\) for simplicity and will write \(V(\phi )\) instead of \(V^{0,\phi }\). The general case is only notationally more involved.

We first state the “difficult” direction of the superhedging theorem in the present context: it provides a sufficient condition for a claim to be superhedged by a suitable strategy.

Theorem A.3

Let \(\mathbb {Q}\sim \mathbb {P}\) be a probability such that

Let W be a real-valued random variable with \(\mathbb {E}_{\mathbb {Q}}[|W|]<\infty \). If

holds for all probabilities \({R}\ll \mathbb {Q}\) with bounded \(d{R}/d\mathbb {Q}\) then there exists \(\phi \in \mathcal {A}\) such that \(V(\phi )\ge W\) almost surely.

Proof

It follows along the lines of the case treated in Theorem 3.9 of [17], the integrability condition (A.1) being used in the arguments corresponding to those of page 2082 there. \(\square \)

Note that the convex conjugate of the function \(u(x):=-\exp (-x)\), \(x\in \mathbb {R}\) is

By simple calculations \(v(y)=y\ln y-y\), where the convention \(0\ln 0=0\) is used. The Fenchel inequality \(u(x)\le v(y)+xy\) trivially holds for all \(x\in \mathbb {R}\) and \(y\ge 0\).

Let \(\mathcal {Z}\) denote the set of non-negative random variables \(\xi \) such that \(\mathbb {E}[\xi ]=1\). For each \(\xi \), define the probability \(R(\xi )\ll \mathbb {P}\) by \(R(\xi )(A):=\mathbb {E}[\xi 1_{A}]\). Let \(\mathcal {Z}_{e}:=\{\xi \in \mathcal {Z}:\ \mathbb {E}[\xi |\ln \xi |]<\infty \}\).

In the rest of this section, Assumption A.1 will be in force. Since we will follow a standard route, described e.g. in [21], only the main steps of the proofs will be given.

Lemma A.4

For any family \(\mathcal Z_0 \subset \mathcal Z\) with \(\sup _{\xi \in \mathcal Z_0}\mathbb E[\xi \ln \xi ]<\infty \), one has

Proof

Consider the conjugate Orlicz spaces corresponding to the Young functions \(\Phi (x)=e^{x}-x-1\) and \(\Psi (x)=(1+x)\ln (1+x)-x\), their respective norms being denoted by \(||\cdot ||_{\Phi }\), \(||\cdot ||_{\Psi }\), see the Appendix of [23] for definitions. Assumption A.1 then implies \(\sup _{t\in [0,T]}||S_{t}^{2}||_{\Phi }<\infty \). Using Proposition A-2-2 of [23], we get that

with some constant C. The statement follows. \(\square \)

Lemma A.5

The functional

is finite and strictly convex on the convex set \(\mathcal {Z}_{e}\).

Proof

Finiteness of the functional follows from Lemma A.4, convexity of the set \(\mathcal {Z}_{e}\) is easy. Strict convexity of the first summand defining \(\Xi \) is easy to see; convexity of the second part is somewhat more strenuous. The main ingredient is the following: for any random variable \(X\in \cap _{\xi \in \mathcal {Z}_{e}}L^{1}(R(\xi ))\) and sigma-algebra \(\mathcal {H}\) the mapping

is convex. Indeed, for \(s\in [0,1]\) and \(\xi _{1},\xi _{2}\in \mathcal {Z}_{e}\) one should check that

where, for simplicity, we assume \(\xi _{1},\xi _{2}>0\) almost surely, the general case being only notationally more difficult. This is equivalent, by elementary calculations, to checking

which is clearly true. Now applying this observation with the choice \(\mathcal {H}=\mathcal {G}_{t}\) and \(X=S_{T}-S_{t}\) for each t the statement follows easily. \(\square \)

Proposition A.6

There exists a unique minimizer \(\underline{\xi }\) of \(\Xi \) on \(\mathcal {Z}_{e}\) which is positive almost surely. We denote \(\underline{J}:=\inf _{\xi \in \mathcal {Z}_{e}}\Xi (\xi )\).

Proof

Uniqueness of a minimizer is immediate from the strict convexity of \(\Xi \). Let \(\xi _{n}\in \mathcal {Z}_{e}\) be a minimizing sequence for \(\Xi \). By the Komlós theorem, there exist Césaro-means of a subsequence (denoted by \(\tilde{\xi }_{n}\)) converging almost surely to some \(\underline{\xi }\). As \(\mathcal {Z}_{e}\) is convex, \(\tilde{\xi }_{n}\in \mathcal {Z}_{e}\). Convexity of \(\Xi \) implies that

still holds. As \(\sup _{n}\mathbb {E}[\tilde{\xi }_{n}|\ln \tilde{\xi }_{n}|]<\infty \) follows from (A.4), the de la Vallée-Poussin criterion ensures that \(\tilde{\xi }_{n}\) converges in \(L^{1}\), too, hence \(\underline{\xi }\in \mathcal {Z}_{e}\).

We claim that \(\mathbb {E}_{R(\tilde{\xi }_{n}),t}[S_{T}]\rightarrow \mathbb {E}_{R(\underline{\xi }),t}[S_{T}]\) in probability and observe that, by Fatou’s lemma and (A.4), this entails \(\Xi (\underline{\xi })\le \underline{J}\), establishing \(\underline{\xi }\) as a minimizer of \(\Xi \) in \(\mathcal Z_e\). Since \(\tilde{\xi }_{n}S_{T}\rightarrow \underline{\xi }S_{T}\) almost surely, the claimed convergence will follow from the uniform integrability condition

For this we estimate

The first of the above factors is bounded uniformly in n due to Lemma A.4. We will get our assertion (A.5) by showing that the second factor vanishes uniformly in n as \(b \uparrow \infty \). For this we estimate it further:

The first of these last two expectations is bounded uniformly due to (A.4), the second because of this in conjunction with Lemma A.4, and we can conclude.

To prove positivity of \(\underline{\xi }\), let us pick a strictly positive \(\xi _{0}\in \mathcal {Z}_{e}\) (for instance \(\xi _{0}\equiv 1\)) and define

By optimality of \(\underline{\xi }\) the right derivative \(F_{0+}'\) is non-negative. If we had \(P(\underline{\xi }=0)>0\) then we would reach a contradiction just like in Proposition 3.1 of [21]. \(\square \)

Theorem A.7

There exists a strategy \(\phi ^{\dagger }\) such that \(V(\phi ^{\dagger })=\underline{J}-\ln \underline{\xi }\). Moreover,

Proof

Notice that \(V(\phi )\le Q:=\frac{1}{4}\int _{0}^{T}(S_{T}-S_{t})^{2}\, dt\) for all \(\phi \), and Q is \(R(\xi )\)-integrable for all \(\xi \in \mathcal {Z}_{e}\), by the arguments of Lemma A.4. Let us fix now an arbitrary \(\phi \in \mathcal {A}\) and \(\xi \in \mathcal {Z}_{e}\). For each \(s>0\), we apply the Fenchel inequality and Fubini’s theorem, remembering the integrability of the quantity Q:

Optimizing in s we arrive at

Choosing \(\xi :=\underline{\xi }\),

Now we will prove that a suitable strategy \(\phi ^{\dagger }\) attains the bound given in (A.8). Let \(\xi \in \mathcal {Z}\) be such that \(\xi \le C_{0}\underline{\xi }\) for some \(C_{0}>0\). Since \(\underline{\xi }|\ln \underline{\xi }|\le C_{0}\underline{\xi } (|\ln \underline{\xi }|+|\ln C_{0}|)\), we have, in fact, \(\xi \in \mathcal {Z}_{e}\). Consider the function

Since \(\underline{\xi }\) is the minimizer, \(F_{s}\ge F_{0}\) for \(s\in [0,1]\) so the right-hand derivative satisfies

To simplify notation, we will write \(X_{t}:=S_{T}-S_{t}\) henceforth. Let us calculate the latter derivative now. It equals

Grouping the terms inside the integral that do not contain \(\xi \) we obtain

The rest of the integrand is

The first term of the latter expression can be rewritten and estimated by Cauchy’s inequality:

Taking all terms into consideration, condition (A.9) eventually implies

We now use Theorem A.3 with the choice \(Q=R(\underline{\xi })\) and \(R=R(\xi )\). We obtain from (A.2) and (A.3) that \(-\ln \underline{\xi }+\underline{J}\le V(\phi ^{\dagger })\) for some \(\phi ^{\dagger }\in \mathcal {A}\). Since

\(\phi ^{\dagger }\) is indeed an optimal strategy. Note also that, by (A.8), the above inequality must be an a.s. equality so \(\ln \underline{\xi }=\underline{J}-V(\phi ^{\dagger })\). \(\square \)

Corollary A.8

The strategy

is optimal for the problem (A.6).

Proof

Indeed, the arguments of the previous theorem show that, for all \(\phi \in \mathcal {A}\), \(\xi \in \mathcal {Z}_{e}\) and \(s>0\),

with equality for \(\phi =\phi ^{\dagger }\), \(\xi =\underline{\xi }\) and for a suitable \(s=s^{*}\). This implies that \(\hat{\phi }\) is an optimal strategy. \(\square \)

Proof of Proposition A.2

Proposition A.6 and Theorem A.7 establish that the optimal portfolio wealth \(V(\phi ^{\dagger })\) for the (primal) utility maximization problem (A.6) can be found by first finding the (dual) minimizer \(\underline{\xi }\) of the functional (A.3) and then taking \(\phi ^{\dagger }\) satisfying \(V(\phi ^{\dagger })=\underline{J}-\ln \underline{\xi }\). Finally, from the strict concavity of the map \(\phi \rightarrow -\exp (-V(\phi ))\) we conclude that the strategy \(\hat{\phi }\) which is given in Corollary A.8 is the unique optimal strategy. \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bank, P., Dolinsky, Y. & Rásonyi, M. What if We Knew What the Future Brings? Optimal Investment for a Frontrunner with Price Impact. Appl Math Optim 86, 25 (2022). https://doi.org/10.1007/s00245-022-09885-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s00245-022-09885-w

Keywords

- Gaussian Volterra integral equation

- Inside information

- Price impact

- Exponential utility

- Optimal investment