Abstract

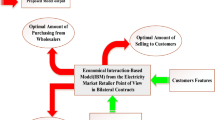

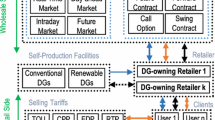

In this paper, a new bi-level model is presented in order to set the interaction between different players in electricity market contracts. The proposed model framework is multi-objective so that the aims of retailer and customers are met simultaneously. In this study, new parameters and indexes for interaction of players will be introduced. In the upper level of this model, the retailer’s profit will be maximized and in the lower level, the customer’s cost will be minimized. Based on the retailer’s interaction with customers in the proposed model, some customers will be selected from the customers group to contract with power retailer. In the proposed model, a robust optimization approach (ROA) is used to manage the retailer’s risk in different conditions due to the uncertainty of energy supply by the wholesaler. The analysis of multi-objective approach in this model is also carried out based on Torabi-Hassini (TH) method. Finally, after the required linearization, the proposed Mixed Integer linear programming (MILP) model in the presence of Karush–Kuhn–Tucker conditions will implement in GAMS software and solved via GUROBI solver.

Similar content being viewed by others

Abbreviations

- \(S=\{\mathrm{1,2},\dots ,s\}\) :

-

Wholesalers' set

- \(B=\{\mathrm{1,2},\dots ,b\}\) :

-

Customers' set

- \(T=\{\mathrm{1,2},\dots ,24\}\) :

-

Set for specific hours or periods of the day

- \(H=\{\mathrm{0,1}\dots ,h\}\) :

-

Set for determining the number of months of the contract with the customers

- \({B}^{\mathrm{^{\prime}}}\subseteq B\) :

-

Customers' subset that retailer has a contract with them at all times and supplies their energy needs

- \({D}_{\mathrm{b}} (\mathrm{kW})\) :

-

Customer's total daily energy consumption

- \({r}_{\mathrm{bt}} (\%)\) :

-

Rate of consumption by customer “b” during period “t”

- \({V}_{\mathrm{b}} (\mathrm{kW})\) :

-

Amount of storage available for the customer “b”

- \({\gamma }_{\mathrm{bh}}(\%)\) :

-

The amount of discount desired by the customer “b” in each energy unit for a contract of length “h”

- \({\theta }_{\mathrm{bh}}(\$)\) :

-

Income resulting from the renewal of the contract with the customer “b” and length “h”

- \({p}_{\mathrm{b}}(\frac{\$}{\mathrm{kWh}})\) :

-

Energy storage system cost of customer “b”

- \(\mu_{\text{t}} \left( {\frac{\$ }{{{\text{kWh}}}}} \right)\) :

-

Energy prices for time “t”

- \(\rho_{{{\text{st}}}} \left( {\frac{\$ }{{{\text{kWh}}}}} \right)\) :

-

Costs of energy supplied by wholesalers “s” for “t”

- \(\overleftrightarrow {{\text{cap}}_{{{\text{st}}}} }\) :

-

Parameter with uncertainty in the model (generation capacity of wholesalers)

- \({x}_{1}\) (g/kWh):

-

Coal consumption

- \({x}_{\mathrm{w}}\) (\({\mathrm{m}}^{3}/\mathrm{kWh}\)):

-

Water consumption

- \({x}_{{\mathrm{Co}}_{2}} \)(g/kWh):

-

Carbon dioxide emissions amount

- \(z\) (g/kWh):

-

Total quantity of pollutants

- \({x}_{{\mathrm{No}}_{\mathrm{x}}}\) (g/kWh):

-

Nitrogen oxide emissions amount

- \({x}_{{\mathrm{So}}_{2}}\) (g/kWh):

-

Sulfur dioxide emissions amount

- \({x}_{\mathrm{APP}}\) (g/kWh):

-

The amount of particulate pollution

- \({x}_{\mathrm{st}} (\mathrm{kWh})\) :

-

The volume of energy purchased from wholesaler “s” in time “t”

- \({m}_{\mathrm{bt}} (\mathrm{kWh})\) :

-

The volume of energy sold by the retailer to customer “b” in time “t”

- \({\alpha }_{\mathrm{bt}} (\%)\) :

-

Amount of discount for customer “b” in time “t”

- \({y}_{\mathrm{bh}}\) :

-

A variable in binary form indicates the presence or absence of a contract between the customer and the retailer

- \({I}_{\mathrm{bt}} (\mathrm{kWh})\) :

-

Volume of energy which stored by customer “b” in time “t”

- \({a}_{\mathrm{bt}}\) :

-

A variable in binary form indicates the accept or reject of a discount from customer “b” by retailer in time “t”

- \(J (\frac{\$}{\mathrm{kWh}})\) :

-

The cost of energy shortages

- \({U}_{\mathrm{t}}(\mathrm{kWh})\) :

-

Volume of energy shortage in time “t

References

Shahidehpour M, Yamin H, Li Z (2002) Market operations in electric power systems. Wiley, New York

Deng SJ, Oren SS (2006) Electricity derivatives and risk management. Energy 3:940–953

Nojavan S, Majidi M, Zare K (2018) Optimal scheduling of heating and power hubs under economic and environment issues in the presence of peak load management. Energy Convers Manage 156:34–44

Nojavan S, Zare K, Mohammadi-Ivatloo B (2017) Risk-based framework for supplying electricity from renewable generation-owning retailers to price-sensitive customers using information gap decision theory. Int J Electr Power Energy Syst 93:156–170

Wu T, Li G, Bie Z (2019) Power procurement strategies of retailer considering demand response program. In: 8th renewable power generation conference (RPG 2019), pp 1–8

Ghazvini MA, Soares J, Horta N, Neves R, Castro R, Vale Z (2015) A multi-objective model for scheduling of short-term incentive-based demand response programs offered by electricity retailers. Appl Energy 151:102–118

Boroumand RH, Goutte S, Guesmi K, Porcher T (2019) Potential benefits of optimal intraday electricity hedging for the environment: the perspective of electricity retailers. Energy Policy 132:1120–1129

Yoon AY, Kim YJ, Zakula T, Moon SI (2020) Retail electricity pricing via online-learning of data-driven demand response of HVAC systems. Appl Energy 265:114771

Guo YM, Shao P, Wang J, Dou X, Zhao WH (2019) Purchase strategies for power retailers considering load deviation and CVaR. Energy Procedia 158:6658–6663

Tom N, Dan M, Riccardo S (2019) Consumer switching in retail electricity markets: Is price all that matters? Energy Econ 83:88–103

Xiao D, do Prado JC, Qiao W (2021) Optimal joint demand and virtual bidding for a strategic retailer in the short-term electricity market. Electric Power Syst Res 190:106855

Wei W, Liu F, Mei S (2015) Offering non-dominated strategies under uncertain market prices. IEEE Trans Power Syst 30:2820–2821

Wei W, Liu F, Mei S (2015) Energy pricing and dispatch for smart grid retailers under demand response and market price uncertainty. IEEE Trans Smart Grid 6:1364–1374

Algarvio H, Lopes F (2022) Agent-based retail competition and portfolio optimization in liberalized electricity markets: A study involving real-world consumers. Int J Electr Power Energy Syst 137:107687

Hu F, Feng X, Cao H (2018) A short-term decision model for electricity retailers: electricity procurement and time-of-use pricing. Energies 11(12):3258

Bruninx K, Pandžić H, Le Cadre H, Delarue E (2020) On the interaction between aggregators, electricity markets and residential demand response providers. IEEE Trans Power Syst 35:840–853

Rezaee Jordehi A, Tabar VS, Mansouri SA, Nasir M, Hakimi SM, Pirouzi S (2022) A risk-averse two-stage stochastic model for planning retailers including self-generation and storage system. J Energy Storage 51:104380

Hosseini Imani M, Zalzar S, Mosavi A, Shamshirband S (2018) Strategic behavior of retailers for risk reduction and profit increment via distributed generators and demand response programs. Energies 11:1602

Deng T, Yan W, Nojavan S, Jermsittiparsert K (2020) Risk evaluation and retail electricity pricing using downside risk constraints method. Energy 192:116672

Grimm V, Orlinskaya G, Schewe L, Schmidt M, Zöttl G (2021) Optimal design of retailer-prosumer electricity tariffs using bilevel optimization. Omega 102:102327

Oveis A et al (2019) Optimal offering and bidding strategies of renewable energy based large consumer using a novel hybrid robust-stochastic approach. J Cleaner Prod 215:878–889

Hou J, Zhang Z, Lin Z, Yang L, Liu X, Jiang Y, He C, Li J, Wang K, Zhang W, Ding Y, Wen F (2019) An energy imbalance settlement mechanism considering decision-making strategy of retailers under renewable portfolio standard. IEEE Access Pr Innov Open Solut 7:118146–118161

Sekizaki S, Nishizaki I, Hayashida T (2019) Decision making of electricity retailer with multiple channels of purchase based on fractile criterion with rational responses of consumers. Int J Electr Power Energy Syst 105:877–893

Feng C, Wang Y, Zheng K, Chen Q (2020) Smart meter data-driven customizing price design for retailers. IEEE Trans Smart Grid 11(3):2043–2054

Sharifi R, Anvari-Moghaddam A, Fathi SH, Vahidinasab V (2020) A bi-level model for strategic bidding of a price-maker retailer with flexible demands in day-ahead electricity market. Int J Electr Power Energy Syst 121:106065

Kleinert T, Labbé M, Ljubić I, Schmidt M (2021) A survey on mixed-integer programming techniques in bilevel optimization. EURO J Comput Optim 9:100007

El Khatib S, Galiana FD (2007) Negotiating bilateral contracts in electricity markets. IEEE Trans Power Syst 22:553–562

Boyd S, Vandenberghe L (2004) Convex optimization”. Cambridge University Press

Boland N, Dey SS, Kalinowski T, Molinaro M, Rigterink F (2017) Bounding the gap between the McCormick relaxation and the convex hull for bilinear functions. Mathem Progr 162:523–535

Castro PM (2015) Tightening piecewise McCormick relaxations for bilinear problems. Comput Chem Eng 72:300–311

Chen S-l (2020) The KKT optimality conditions for optimization problem with interval-valued objective function on Hadamard manifolds. Optimization 71(3):613–632

Sinha A, Soun T, Deb K (2019) Using karush-kuhn-tucker proximity measure for solving bilevel optimization problems. Swarm Evol Comput 44:496–510

Ye Y, Papadaskalopoulos D, Kazempour J, Strbac G (2020) ‘Incorporating non-convex operating characteristics into bi-level optimization electricity market models.’ IEEE Trans Power Syst 35:163–176

Kiani E, Doagou-Mojarrad H, Razmi H (2020) Multi-objective optimal power flow considering voltage stability index and emergency demand response program. Electr Eng 102:2493–2508

Torabi SA, Hassini E (2008) An interactive possibilistic programming approach for multiple objective supply chain master planning. Fuzzy Sets Syst 159(2):193–214

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52(1):35–53

Ben-Tal A, El Ghaoui L, Nemirovski A (2009) Robust optimization. Princeton University Press

Govindan K, Fattahi M, Keyvanshokooh E (2017) Supply chain network design under uncertainty: a comprehensive review and future research directions. Eur J Oper Res 263(1):108–141

Behzadi G, O’Sullivan MJ, Olsen TL, Zhang A (2018) Agribusiness supply chain risk management: a review of quantitative decision models. Omega 79:21–42

Bandi C, Han E, Nohadani O (2019) Sustainable inventory with robust periodic-affine policies and application to medical supply chains. Manag Sci 65(10):4636–4655

The GAMS Software Website, [Online]. https://www.gams.com/archives/presentations/or2010_gmo.pdf

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Apornak, K., Soleymani, S., Faghihi, F. et al. Performance analysis of a robust and multi-approach model in retail electricity market achieving efficient contracts between retailer, end users and wholesalers. Electr Eng 105, 1811–1823 (2023). https://doi.org/10.1007/s00202-023-01747-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00202-023-01747-0