Abstract

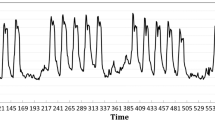

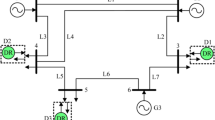

In this paper, a robust optimization approach is proposed to determine selling electricity price for a retailer who procures its obligated energy through two different resources: (1) wholesale market and (2) self-generation facilities. Regarding the self-generation facilities, two different kinds of distributed resources, including gas turbine units (GT) and roof-top photovoltaic sites (RPV) with considering energy storage systems (ESS), are addressed as the deterministic and intermittent power resources. Considering the wholesale market, the retailer can procure some parts of its obligated energy through bilateral contracts and day-ahead market. To overcome the uncertainties associated with power output forecasting of solar sites, a new statistical approach is used considering the dependency of power output to the weather issues, such as irradiation, temperature and wind speed. The problem is formulated by using a robust mixed-integer quadratic program considering a confidence bound for the wholesale electricity price uncertainty. To determine the optimal selling price, a successive algorithm is developed through two iterative optimizations, including inner and outer iterative procedures. Regarding the outer optimization, the confidence bound of wholesale electricity price is portioned into subintervals to evaluate the impacts of each robust subregion of wholesale price on the offered retail selling price. Through the inner optimization, the consumers’ response to the offered price is evaluated using a complete demand function model. Finally, a case study containing the bilateral contracts, wholesale market, RPV units, GT units, ESS, flexible demands and the retailer providing demand response is considered to demonstrate the proficiency of the proposed approach.

Similar content being viewed by others

Abbreviations

- t :

-

Index of time (1, ..., \({N}_\mathrm{T})\)

- i :

-

Index of RPV sites (1, ..., \({N}_\mathrm{S})\)

- j :

-

Index of gas turbine units (1, ..., \({N}_\mathrm{GT})\)

- k :

-

Index of bilateral contracts (1, ..., \({N}_\mathrm{C})\)

- q :

-

Index of subintervals of uncertainty set (1, ..., Q)

- z :

-

Index of iterations for demand response (1, ..., Z)

- l :

-

Index of energy storage system (1, ..., \({N}_\mathrm{ES})\)

- \(\lambda _{t}^\mathrm{D}\) :

-

Selling electricity price ($/MWh)

- \(\lambda _{t}^\mathrm{M} \) :

-

Electricity price of wholesale market ($/MWh)

- \({P}_{t}^\mathrm{D} \) :

-

Demand level at time t (MW)

- \({P}_{t}^\mathrm{M} \) :

-

Traded power in wholesale market (MW)

- \({P}_{{t},{k}}^\mathrm{C} \) :

-

Purchased power from bilateral contract k(MW)

- \({P}_{{t},{i}}^\mathrm{S} \) :

-

Total forecasted power of all RPV sites (MW)

- \({P}_{{t},{j}}^{\mathrm{GT}} \) :

-

Generation power of gas turbine j (MW)

- \({v}_{j}({t})\) :

-

Binary variable of GT units, 1/0 the unit is on/off

- \({C}_{j}^\mathrm{SU}\) :

-

Startup cost of GT units ($)

- \({C}_{j}^\mathrm{SD}\) :

-

Shutdown cost of GT units ($)

- \({\lambda }_{{t,k}}^\mathrm{C}\) :

-

Electricity price of bilateral contract k ($/MWh)

- \({E}_{{l,t}}^{\mathrm{ESS}}\) :

-

Total stored energy at ESS l and hour t (MWh)

- \({P}_{\mathrm{ESS}}^{\mathrm{ch}}\) :

-

Charging power of energy storage system (MW)

- \({P}_{\mathrm{ESS}}^{\mathrm{dis}} \) :

-

Discharging power of energy storage system (MW)

- \({\xi }_{t},\,\beta \) :

-

Dual variables in the duality theorem

- \(\mathrm{DR}_{t}\) :

-

Potential of demand response at time t

- \(\gamma ^{q}\) :

-

Incremental rate of wholesale market price ($/MWh)

- \({C}_{i}^{\mathrm{OM}} \) :

-

Operation, maintenance cost of RPV sites ($/MWh)

- \({C}_{i}^{\mathrm{CI}} \) :

-

Capital investment cost of RPV sites ($/h)

- \(\alpha _{j},\beta _{j},\gamma _{j}\) :

-

Coefficients for cost function of GT units

- \(\overline{{P}_{{t,j}}^{\mathrm{GT}} } \) :

-

Maximum generation capacity of GT units (MW)

- \({{{P}}_{t,j}^\mathrm{GT} }\) :

-

Minimum generation capacity of GT units (MW)

- \(\overline{{S}_{j}^\mathrm{U}} \) :

-

Cost derived from startup of GT units ($)

- \({S}_{j}^\mathrm{D} \) :

-

Cost derived from shutdown of GT units ($)

- \({R}_{j}^\mathrm{U} \) :

-

Maximum ramp-up of GT unit j (MW/h)

- \({R}_{j}^\mathrm{D} \) :

-

Maximum ramp-down of GT unit j (MW/h)

- \(\lambda _{{t,k}}^\mathrm{C,R} \) :

-

Reference price of bilateral contract k ($/MWh)

- \(\eta _\mathrm{ESS}^\mathrm{ch} \) :

-

Charging efficiency of energy storage system

- \(\eta _\mathrm{ESS}^\mathrm{dis} \) :

-

Discharging efficiency of energy storage system

- \({P}_\mathrm{ESS}^\mathrm{nom}\) :

-

Nominal power of energy storage system

- \({E}_\mathrm{ESS}^\mathrm{nom}\) :

-

Nominal capacity of energy storage system

- \({\varGamma }\) :

-

Robustness level

- \(\varepsilon _{X}\) :

-

Elasticity factor of demand function X

- \(\eta \) :

-

Income factor of the retailer

- \(\zeta \) :

-

Stopping criteria of the inner iterative procedure

- N, M :

-

Number of RPV sites including: N as primary and M as reduced numbers

References

Albadi, M. H., & El-Saadany, E. F. (2008). A summary of demand response in electricity markets. Electric Power Systems Research, 78, 1989–1996.

Arya, R. (2016). Determination of customer perceived reliability indices for active distribution systems including omission of tolerable interruption durations employing bootstrapping. IET Generation, Transmission and Distribution, 10(15), 3795–3802.

Bai, X., & Qiao, W. (2015). Robust optimization for bidirectional dispatch coordination of large-scale V2G. IEEE Transactions on Smart Grid, 6(4), 1944–1954.

Bertsimas, D., Brown, D. B., & Caramanis, C. (2011). Theory and applications of robust optimization. SIAM Review, 53(3), 464–501.

Bertsimas, D., & Sim, M. (2003). Robust discrete optimization and network flows. Mathematical Programming, 98, 49–71.

Carvalho, C., & Cuervo, P. (2013). A mixed-integer linear approach for assessing the impact of bilateral contracts in a combined energy market operating under payment minimization. Journal of Control, Automation and Electrical systems, 24(5), 649–660.

Chow, A., & Fung, A. S. (2016). Modeling urban solar energy with high spatiotemporal resolution: A case study in Toronto, Canada. International Journal of Green Energy, 13(1090), 1101.

De Sa Ferreira R., Barroso, L. A., Rochinha Lino, P., Carvalho, M. M., & Valenzuela, P. (2013). Time-of-use tariff design under uncertainty in price-elasticities of electricity demand: A stochastic optimization approach. IEEE Transactions on Smart Grid, 4(3),

Finardi, E. C., Decker, B. U., & de Matos, V. L. (2013). An introductory tutorial on stochastic programming using a long-term hydrothermal scheduling problem. Journal of Control, Automation and Electrical Systems, 24(3), 361–376.

Hatami, A. R., Seifi, H., & Sheikh-El-Eslami, M. K. (2009). Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electric Power Systems Research, 79, 246–254.

Herranz, R., San Roque, A. M., Villar, J., & Campos, F. A. (2012). Optimal demand-side bidding strategies in electricity spot markets. IEEE Transactions on Power Systems, 27(3), 1204–1213.

Holmberg, D. G., Hardin, D. B., & Bushby, S. T. (2014). Facility smart grid interface and a demand response conceptual model. US Department of Commerce: National Institute of Standards.

Jia, L., & Tong, L. (2016). Dynamic pricing and distributed energy management for demand response. IEEE Transactions on Smart Grid, 7(2), 1128–1136.

Karandikar, R., Khaparde, S. A., & Kulkarni, S. V. (2010). Strategic evaluation of bilateral contract for electricity retailer in restructured power market. Electrical Power and Energy Systems, 32, 457–463.

Kazemi, M., Zareipour, H., Ehsan, M., & Rosehart, W. D. (2017). A robust linear approach for offering strategy of a hybrid electric energy company. IEEE Transactions on Power Systems, 32(3), 1949–1959.

Khojasteh, M., & Jadid, S. (2015). A two-stage robust model to determine the optimal selling price for a distributed generation-owning retailer. International Transactions on electrical energy Systems, 25, 3753–3771.

Kirschen, D. S., & Strabac, G. (2004). Fundamentals of power system economics. New York: Wiley.

Luenberger, D., & Ye, Y. (2008). Linear and nonlinear programming. International series in operations research and management science. NewYork: Springer.

Marzband, M., Javadi, M., Garcia, J. D., & Moghaddam, M. (2016). Non-cooperative game theory based energy management systems for energy district in the retail market considering DER uncertainties. IET Generation, Transmission and Distribution, 10(12), 2999–3009.

Mohammadi-Ivatloo, B., Zareipour, H., Amjady, N., & Ehsan, M. (2013). Application of information-gap decision theory to risk-constrained self-scheduling of GenCos. IEEE Transactions on Power Systems, 28, 1093–1102.

Morales, J. M., Conejo, A. J., Madsen, H., Pinson, P., & Zugno, M. (2014). Integrating renewables in electricity markets. Berlin: Springer.

Namerikawa, T., Okubo, N., Sato, R., Okawa, Y., & Ono, M. (2015). Real-time pricing mechanism for electricity market with built-in incentive for participation. IEEE Transactions on Smart Grid, 6, 2714–2724.

Nezhad, A. E., Ahmadi, A., Javadi, M. S., & Janghorbani, M. (2015). Multi-objective decision-making framework for an electricity retailer in energy markets using lexicographic optimization and augmented epsilon-constraint. International Transactions on Electrical Energy Systems, 25(12), 3660–3680.

Nojavan, S., Mohammadi-Ivatloo, B., & Zare, K. (2015). Optimal bidding strategy of electricity retailers using robust optimization approach considering time-of-use rate demand response programs under market price uncertainties. IET Generation, Transmission and Distribution, 9(4), 328–338.

Oliva, S., MacGill, I., & Passeyb, R. (2016). Assessing the short-term revenue impacts of residential PV systems on electricity customers, retailers and network service providers. Renewable and Sustainable Energy Reviews, 54, 1494–1505.

Qiang, C., Xiuli, W., Wang, X., & Zhang, Y. (2016). Residential appliances direct load control in real-time using cooperative game. IEEE Transactions on Power Systems, 31, 226–233.

Shafie-khah, M., & Catalão, J. P. S. (2015). A stochastic multi-layer agent-based model to study electricity market participants behavior. IEEE Transactions on Power Systems, 30(2), 867–881.

Shaker, H., Zareipour, H. R., & Wood, D. (2015). A data driven approach for estimating the power generation of invisible solar sites. IEEE Transactions on Smart Grid, 7, 2466–2476.

Shi, L., Luo, Y., & Tu, G. Y. (2014). Bidding strategy of microgrid with consideration of uncertainty for participating in power market. Electrical Power and Energy Systems, 59, 1–13.

Wei, W., Liu, F., & Mei, S. (2015). Energy pricing and dispatch for smart grid retailers under demand response and market price uncertainty. IEEE Transactions on Smart Grid, 6(3), 1364–1374.

Xavier, S. S., Marangon Lima, J. W., Marangon Lima, L. M., & Lopes, A. L. M. (2015). How efficient are the brazilian electricity distribution companies? Journal of Control, Automation and Electrical Systems, 26(3), 283–296.

Yau, S., Kwon, R. H., Scott Rogers, J., & Wub, D. (2011). Financial and operational decisions in the electricity sector: Contract portfolio optimization with the conditional value-at-risk criterion. International Journal of Production Economics, 134, 67–77.

Zhang, X. (2014). Optimal scheduling of critical peak pricing considering wind commitment. IEEE Transactions on Sustainable Energy, 5(2), 637–645.

Zhang, Y., Beaudin, M., Taheri, R., Zareipour, H., & Wood, D. (2015). Day-ahead power output forecasting for small-scale solar power photovoltaic electricity generators. IEEE Transactions on Smart Grid, 6, 2253–2262.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Golmohamadi, H., Keypour, R. Application of Robust Optimization Approach to Determine Optimal Retail Electricity Price in Presence of Intermittent and Conventional Distributed Generation Considering Demand Response. J Control Autom Electr Syst 28, 664–678 (2017). https://doi.org/10.1007/s40313-017-0328-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40313-017-0328-9