Abstract

In oligopoly models with differentiated products, producers face a market demand function that reflects the preferences of consumers. However, typical assumptions on preferences place only weak restrictions on the shape of aggregate demand. This may result in profit functions that are not strictly quasiconcave, in best-reply correspondences that are not differentiable, and in equilibria that are not robust to perturbations. This paper establishes differentiability and robustness as a generic property: for an open, dense set of economies, best replies are differentiable in a neighborhood of equilibria, which is a precondition for comparative statics. All these economies have a finite number of equilibria in pure strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Comparative statics based on differential calculus is the predominant technique in the study of economic equilibria. It reveals how the outcome of economic activity responds to changes in exogenous variables, and generates testable predictions from economic theory. Yet, it hinges on two preconditions: differentiability and robustness of equilibria. An equilibrium is considered robust if it does not disappear nor multiply after a small change in parameters. In exchange economies neither of the two preconditions is too demanding: In a noted article, Debreu (1970) parameterized economies by endowments and showed that equilibria are generically robust, locally unique, and finite in number.Footnote 1 As a consequence, each equilibrium changes continuously and determinately when parameters are varied, and these changes can be linearly approximated by first-order differentials.

The present paper asks whether these results can be extended to production economies in which producers compete in a differentiated product oligopoly. The parameters of a production economy are the characteristics of its population: Each consumer is represented by an endowment vector and a utility function; each producer is represented by a production set and a profit function. While market demand is differentiable under typical assumptions on consumer characteristics, there are no natural assumptions on producer characteristics that guarantee differentiable best replies. The crux of the problem is that the optimal strategy of each producer depends on the shape of the market demand function. As shown by Sonnenschein (1973), Mantel (1974), and Debreu (1974), consumers may generate market demand of almost any functional form—homogeneity and Walras’ law are the only restrictions.

The consequences are studied in the framework of Cournot–Walras equilibrium, originally introduced by Gabszewicz and Vial (1972). The focus is on two-date finance economies: There is a single input good today, production takes time, and the quantity of future output is uncertain and depends on the state of the world. All producers sell a claim to their output as an asset in the financial market. Assets are differentiated products since the state-dependent output varies across producers. Consumers behave as price-takers, producers choose quantities strategically, and prices are determined by market clearing.Footnote 2

Typical assumptions on consumer characteristics are too weak to rule out set-valued or discontinuous best replies: Set-valued best replies occur when producer payoff functions have flat segments. This case is illustrated in the left panel of Fig. 1. Three sections are shown, each one for a different production level of the other producers. The resulting best-reply correspondence of the producer is depicted in the right panel. At level \(a\), there is a unique profit maximum and the best-reply correspondence is locally differentiable. However, as the other producers increase their output toward level \(b\) and beyond, the profit maximum degenerates and the best-reply correspondence is no longer single-valued. If \(b\) were an equilibrium strategy, differentiability would fail at the equilibrium.

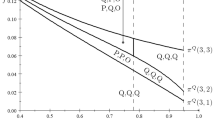

The problem in the preceding example is the lack of strict quasiconcavity. The emphasis is on strict: all sections are quasiconcave and even approach a concave function beyond level \(c\), but at the same time the flat segment grows larger and larger. This problem shall be contrasted with an example that puts the emphasis on quasi: Even if all critical points are nondegenerate, lack of quasiconcavity may entail sections with multiple peaks. This issue is illustrated in Fig. 2. At a low output level of other producers, such as level \(a\) there is a unique maximum at the right peak. At a high output level of other producers, such as level \(c\), the left peak is the higher one. By continuity, there must be an intermediate level, say \(b\), at which the left peak surpasses the right one. At this level, there are two global maxima and the resulting best-reply correspondence exhibits a discontinuity. If \(b\) were an equilibrium strategy, robustness would fail at the equilibrium.

The earliest discussion of this issue goes back to Roberts and Sonnenschein (1977), who stress the implications for the existence of equilibrium in pure strategies. By means of two examples the authors demonstrate that the model lacks an equilibrium for certain parameter ranges.Footnote 3 Sufficient conditions for equilibrium existence are the subject of more recent research: Shirai (2010) shows that if preferences can be aggregated in the form of a representative consumer with a well-behaved, additively separable utility function, equilibria exist generally. Another promising source of existence conditions is the recent literature on non-quasiconcave and discontinuous games, which is surveyed by Reny (2016).

The present paper concentrates on regularity: An equilibrium is regular if it is differentiable and robust. If this were not the case, the model would only have limited predictive power. The following results are obtained:

-

1.

For an open, dense set of economies all equilibria are regular (Theorem 1).

-

2.

Each economy has a finite number of isolated equilibria (Corollary 3).

Contrary to Debreu (1970), who takes \(C^1\) demand functions as the primitive objects, utility functions are used to represent the preferences of consumers. It is known that generic regularity of exchange economies can be obtained for \(C^2\) utility functions that have well-behaved derivatives up to the second order and satisfy a boundary condition. The assumptions necessary to obtain generic regularity in production economies are only slightly stronger: Utility functions must be of class \(C^3\) but restrictions on third-order derivatives are not necessary.

Debreu’s original regularity result has motivated a large number of more or less substantial extensions in exchange economies. The closest one is that of Smale (1974a), who chooses to parameterize economies by utility functions instead of endowments. Utility functions are also used in the parameterization of Dierker (1975), who permits a continuum of consumers. Several variations of the economic environment have been considered: Incomplete markets are covered by Geanakoplos and Polemarchakis (1986). Restrictions on portfolios and consumption are considered by Cass et al. (2001) and Bonnisseau and del Mercato (2008), respectively. Economies with a public good are the subject of Villanacci and Zenginobuz (2005). Nonstandard preferences are the focus of Bonnisseau (2003), who considers consumers without ordered preferences, Biheng and Bonnisseau (2015), who consider ambiguity-averse consumers, and Bonnisseau and del Mercato (2010), who consider consumption externalities.

As regards production economies, most previous results are based on narrow concepts of production. In Fuchs (1974), producers are represented by supply functions, which rules out natural cases such as constant returns to scale technologies. In Fuchs (1977), the setting is generalized to supply correspondences, but the assumptions are still too strong to permit constant returns to scale. By contrast, Mas-Colell (1975) and Kehoe (1980) focus exclusively on technologies with constant returns and the special case of linear activity models, respectively. An extension by Kehoe (1982) permits primary and intermediate goods. First hints of generic regularity with more general production sets are given in Smale (1974b). The necessary arguments for a rigorous proof in general economies with price-taking firms are for the first time presented in Geanakoplos et al. (1990), and proofs of this kind are now part of textbook treatments such as Chapter 9 in Villanacci et al. (2002).

A notable recent contribution is the regularity result of del Mercato and Platino (2017) for production economies with externalities. Conceptually, their equilibrium concept is different from Cournot–Walras equilibrium: All producers are price-takers and do not mind the shape of market demand. Therefore, set-valued or discontinuous best replies, which are the focus of the present paper, do not occur. However, the two models share one technical aspect: The decision problems of all producers are interdependent, and the solution concept is Nash equilibrium in pure strategies. In this case, perturbations of consumers’ endowments, as in Debreu (1970), are not sufficient to restore regularity. To overcome this difficulty, the authors put more structure on producers and introduce perturbations of the supply side of the economy. This additional structure is optional: The present paper shows that regularity can be obtained in two ways. One way is indeed to perturb producers through their cost functions. The other way is to perturb consumers through their utility functions.

The remainder of this paper is structured as follows: Sect. 2 introduces the model, its assumptions, and the concept of regular production economy. In Sect. 3, the main results are derived and discussed. In Sects. 4 and 5, these results are extended to economies with quasilinear utility and unbounded endowments. Section 6 concludes.

2 Model

Consider a two-date finance economy with a finite number of consumers and a finite number of producers. Production takes time: The input is required at the present date (date 0); the output becomes available at the future date (date 1). The future is uncertain and the output quantity depends on the state of the world. At date 0, producers choose their production plans. Each producer sells a claim to his state-dependent output in the form of a financial asset. Consumers trade these assets in the financial market. At date 1, all assets pay off.

The following notation is used throughout: If \(x\) is a vector in Euclidean space, \(x \ge 0\) means all components are nonnegative, \(x > 0\) means at least one component is greater than zero, and \(x \gg 0\) means all components are greater than zero. Moreover, \(\Vert x\Vert \) denotes the Euclidean norm, \(x\cdot y\) is the usual inner product, \({\varvec{I}}\) is the identity matrix, and \({\mathbb {B}}_r(x)\) is the open ball with radius \(r\) and center \(x\). The topological boundary of a set \(X\) is denoted by \(\mathrm{bdry}(X) = \mathrm{cl}(X)\backslash X\). By contrast, if \(X\) is a manifold, its manifold boundary is denoted by \(\partial X\) and its interior by \(\mathrm{int}(X) = X\backslash \partial X\). Prices and gradients are viewed as row vectors while all other variables are viewed as column vectors.

For a \(C^s\) function \(f:X\rightarrow Z\) between two \(C^s\) manifolds \(X,Z\) and \(n\le s\), \(d^n f[x]:\varprod\nolimits_{m=1}^n T_X[x] \rightarrow T_Z[z]\) denotes the \(n{\mathrm{th}}\) order differential of \(f\) at \(x\in X\), which is the symmetric \(n\)-linear map that represents the collection of all \(n{\mathrm{th}}\) order partial derivatives at \(x\), and \(T_X[x]\) is the tangent space to \(X\) at \(x\). Since \(d^n f[x]\) can be represented in \((\mathrm{dim}(X)^n\mathrm{dim}(Z))\)-dimensional Euclidean space, the norm \(\Vert d^n f[x]\Vert \) is well-defined. In the case of \(n=1\), the notation is simplified to \(df[x]\), and the differential can be represented in local coordinates by the Jacobian matrix \(Df[x]\). In the case of \(Z={\mathbb {R}}\), \(d^2 f[x]\) is a symmetric bilinear form, and its local representation is the Hessian matrix \(D^2 f[x]\). Brackets may be omitted whenever the point of evaluation is clear from the context.

2.1 Commodities, uncertainty, and markets

There is a single input good at date 0, which serves as the numéraire. The uncertainty at date 1 is represented by a finite state space \({\varvec{\varOmega }}\). There is one output good for each state of the world. The financial market opens only at date 0: \(K\ge 2\) assets are traded at prices \(p \in {\mathbb {R}}^K\). Their state-dependent payoffs at date 1 are collected in an \(|{\varvec{\varOmega }}|\times K\) payoff matrix \({\varvec{A}}\). It is assumed that \(K\le |{\varvec{\varOmega }}|\); thus, all results hold both for complete and for incomplete markets. There are no short-sale constraints.

2.2 Consumers

There are \(I \ge 1\) consumers, indexed by superscripts \(i\in \{1,\dots ,I\}\). All consumers have identical consumption sets \({\mathcal {C}}^i = {\mathbb {R}}_+^{|{\varvec{\varOmega }}|+1}\). The consumption preferences of consumer \(i\) are represented by a utility function \(U^i:{\mathcal {C}}^i\rightarrow {\mathbb {R}}\). The endowment of the consumer is \(e^i \in {\mathcal {C}}^i\). Whenever consumer-specific variables are joined in a single vector, the superscript is omitted; e.g., \(e = (e^1,\dots ,e^I)\). Whenever consumer-specific variables are aggregated, a bar is put on top; e.g., \(\bar{e} = \sum _{i=1}^I e^i\). Consumers behave as price-takers: Each consumer \(i\) chooses a consumption plan \(c^i \in {\mathcal {C}}^i\) and a portfolio \(\psi ^i \in {\mathbb {R}}^K\) from his budget correspondence \(B^i:{\mathbb {R}}^{|{\varvec{\varOmega }}|\times K}\times {\mathbb {R}}^K \rightrightarrows {\mathcal {C}}^i\times {\mathbb {R}}^K\), which is defined as

The asset demand correspondence \(\varPsi ^{i*}:{\mathbb {R}}^{|{\varvec{\varOmega }}|\times K}\times {\mathbb {R}}^K \rightrightarrows {\mathbb {R}}^K\) maps tuples \(({\varvec{A}},p)\) of payoffs and prices to solutions of the utility maximization problem

Demand of all consumers is joined in the correspondence \(\varPsi ^* =(\varPsi ^{1*},\dots ,\varPsi ^{I*})\).

2.3 Producers

There are \(K \ge 2\) producers, indexed by superscripts \(k\in \{1,\dots ,K\}\). The production set of each producer \(k\) is decomposed into a choice set \({\mathcal {A}}^k\subset {\mathbb {R}}_+^{|{\varvec{\varOmega }}|}\), which contains all feasible output vectors, and a cost function \(\kappa ^k:{\mathcal {A}} \rightarrow {\mathbb {R}}_+\), in which \({\mathcal {A}} = \varprod\nolimits_{k=1}^K {\mathcal {A}}^k\). Producers do not consume at date 1 and their only concern is present profits. Each producer \(k\) sells the entire output as an asset with payoffs \({\varvec{A}}^k \in {\mathcal {A}}^k\). The production preferences of producer \(k\) are represented by a profit function \(\varPi ^k:{\mathcal {A}}\times {\mathbb {R}}_+^K \rightarrow {\mathbb {R}}\), defined as revenue minus costs:

Producers behave strategically: They choose their plans conditional on an inverse demand function \(p^*:{\mathcal {A}}\rightarrow {\mathbb {R}}^K\). The payoff function of producer \(k\) can be written as

and depends on strategy combinations \({\varvec{A}}= ({\varvec{A}}^k,{\varvec{A}}^{{\lnot k}})\). In this tuple, \({\varvec{A}}^k\) represents his own choice, whereas the collection \({\varvec{A}}^{{\lnot k}}\) represents the choices of the other \(K-1\) producers. The best-reply correspondence \(A^{k*}:{\mathcal {A}}\rightrightarrows {\mathcal {A}}^k\) of producer \(k\) associates with each candidate strategy combination \({\varvec{A}}_{\#} \in {\mathcal {A}}\) the solution set to his profit maximization problem

2.4 Economies

The economy is defined by the characteristics of its consumers and producers. Consumers are described by their utility functions and endowments, which satisfy the following assumptions.

Assumption 1

(Preferences) For each consumer \(i\) and \(c^i\in {\mathcal {C}}^i\),

-

1.

\(U^i\) is continuous and of class \(C^3\) on \({\mathbb {R}}_{++}^{|{\varvec{\varOmega }}|+1}\)

-

2.

\(dU^i[c^i](v)\gg 0\;\forall v>0\)

-

3.

\(d^2 U^i[c^i](v,v)<0\;\forall v\ne 0\)

-

4.

\(dU^i[c^i]({\varvec{I}}_{\omega })\rightarrow \infty \) as \(c_{\omega }^i \rightarrow 0\) for any \(\omega \in {\varvec{\varOmega }}\cup \{0\}\).

Assumption 2

(Endowments) Endowments satisfy \(e \gg 0\) and they are contained in an open, bounded set \({\mathbb {E}} \subset {\mathcal {C}}\).

The points of Assumption 1 guarantee that indifference sets are hypersurfaces with convex upper countours that do not intersect the boundary of \({\mathcal {C}}^i\) (in exactly that order). Since endowments are strictly positive under Assumption 2, such preferences result in a unique, interior solution to the utility maximization problem (2). The boundedness assumption ensures that the space of economies can be modeled as Banach manifold and should not be viewed as restrictive since \({\mathbb {E}}\) may be a large set.Footnote 4 Producers are described by their choice sets and cost functions, which satisfy the following assumptions.

Assumption 3

(Production possibilities) For each producer \(k\),

in which \({\varvec{Y}}^k\gg 0\) and \(\mathrm{rank}({\varvec{Y}})=K\).

Assumption 4

(Production costs) For each producer \(k\) and \(v>0\),

-

1.

\(\kappa ^k\) is continuous and of class \(C^2\) on \({\mathbb {R}}_{++}^{|{\varvec{\varOmega }}|\times K}\)

-

2.

\(\kappa ^k(0) = 0\)

-

3.

\(d_{{\varvec{A}}^{{\lnot k}}}\kappa ^k[{\varvec{A}}](v)=0\;\forall {\varvec{A}}\ge 0\)

-

4.

\(d_{{\varvec{A}}^k}\kappa ^k[{\varvec{A}}^k,{\varvec{A}}^{{\lnot k}}](v)>0\;\forall {\varvec{A}}^k>0\)

-

5.

\(d_{{\varvec{A}}^k}\kappa ^k[{\varvec{A}}^k,{\varvec{A}}^{{\lnot k}}](v)\rightarrow 0\) as \({\varvec{A}}^k\rightarrow 0\).

Under Assumption 3, the mapping \(Y(\tau ) =\left( \tau ^1{\varvec{Y}}^1,\dots ,\tau ^K{\varvec{Y}}^K\right) \) from production scales to output combinations is homogeneous of degree 1, each set \({\mathcal {A}}^k\) is a ray in \({\mathbb {R}}_+^{|{\varvec{\varOmega }}|}\), and all \(k\) rays are linearly independent. Such production technologies, originally introduced by Diamond (1967), guarantee that the dimension of the asset span does not change as long as no producer is inactive. This corresponds to Cournot competition in its purest form, in which producers choose a single output quantity. Since output is positive in all states of the world, share prices must be positive under Assumption 1.

In addition to differentiability, Assumption 4 incorporates four properties of cost functions: First, there are no fixed costs of production. Second, costs are independent of the production choices of other producers. This is a natural property in the present setting with a single input good. By contrast, if there were multiple input goods, their relative prices should be affected by the choices of producers. Third, costs are strictly increasing in production scales. As a consequence, profits are bounded from above, and the optimal production scale of any producer \(k\) is finite. Fourth, costs are not prohibitively high. At least for small scales, profits are positive, such that no producer is squeezed out of the market. Like the last condition of Assumption 1 guarantees an interior optimum for consumers, the last condition of Assumption 4 guarantees an interior optimum for producers.

The space of economies is defined as follows: Denote by \({\mathbb {U}}\) the convex cone of functions in \(C^3({\mathcal {C}}^i,{\mathbb {R}})\) that satisfy Assumption 1. In order to equip this space with a topology, consider the semimetric

in which \({\mathcal {X}} \subset {\mathcal {C}}\) is a compact set, yet to be specified. Note that \(\delta _{{\mathbb {U}}}\) controls the distance of utility functions up to the third derivative. It defines equivalence classes of utility functions that ceteris paribus result in the same equilibria and the same comparative statics: Regardless of how small \({\mathcal {X}}\) is, \(\delta _{{\mathbb {U}}}(\tilde{U}^i,U^i) = 0\) implies identical levels and slopes of the consumer’s demand (first and second derivative) as well as identical levels and slopes of producers’ best replies (second and third derivative). For completeness it should be noted that the converse is not true: Demand is invariant to positive affine transformation of utility functions, but \(\delta _{{\mathbb {U}}}(a+bU^i,U^i) \ne 0\) if \(a\ne 0\) or \(b>1\).

Assumptions 1 through 4 ensure that optimal consumption and production plans do not approach infinity. Therefore, the economically relevant range of consumption plans is contained in some open, bounded set. Define \({\mathcal {X}}\) as its closure. In the usual notation, let \({\mathcal {X}}^i\) be the projection of \({\mathcal {X}}\) onto \({\mathcal {C}}^i\). Since there is no need to distinguish elements of \(C^3({\mathcal {C}}^i,{\mathbb {R}})\) that differ only outside \({\mathcal {X}}^i\), the cone \({\mathbb {U}}\) is treated as a subset of \(C^3({\mathcal {X}}^i,{\mathbb {R}})\), which is but the quotient space under \(\delta _{{\mathbb {U}}}\). On this space, \(\delta _{{\mathbb {U}}}\) becomes a metric which induces the \(C^3\) compact-open topology. The family of \(C^s\) compact-open topologies is treated in detail in Hirsch (1994), Chapter 2. The present paper makes use of the following property: By compactness of \({\mathcal {X}}\), it is equivalent to the (strong) \(C^3\) Whitney topology and the resulting space is a Banach space. As an open subset of this space, \({\mathbb {U}}\) is a smooth Banach manifold. The product space \({\mathbb {U}}^I = \varprod\nolimits_{i=1}^I {\mathbb {U}}\), equipped with the metric \(\bar{\delta }_{{\mathbb {U}}}(\tilde{U},U) = \max _i\delta _{{\mathbb {U}}}(\tilde{U}^i,U^i)\), is again a Banach manifold.

The space of cost functions is constructed in a similar fashion. Let \({\mathcal {Y}} \subset {\mathcal {A}}\) be a compact set that contains all affordable production plans. Consider the space \(C^2({\mathcal {Y}},{\mathbb {R}})\), equipped with the metric

which induces the \(C^2\) compact-open topology. Denote by \({\mathbb {K}}\) the convex cone of all functions that satisfy Assumption 4. It is open in the subspace \({\mathbb {K}} - {\mathbb {K}}\) under the induced topology. By compactness of \({\mathcal {Y}}\) and by the same arguments as above, the product space \({\mathbb {K}}^K = \varprod\nolimits_{k=1}^K {\mathbb {K}}\), equipped with the metric \(\bar{\delta }_{{\mathbb {K}}}(\tilde{\kappa },\kappa ) =\max _k\delta _{{\mathbb {K}}}(\tilde{\kappa }^k,\kappa ^k)\), is a smooth Banach manifold. Under Assumption 3, each set \({\mathcal {A}}\) corresponds to one point on a submanifold of the smooth manifold of \(|{\varvec{\varOmega }}|\times K\) matrices with full rank. Let \({\mathbb {A}}\) be the space of all sets as in Assumption 3 equipped with the topology induced by \({\mathcal {A}}\mapsto {\varvec{Y}}\).

Definition 1

An economy is a tuple \((U,e,{\mathcal {A}},\kappa ) \in {\mathbb {U}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) such that Assumptions 1, 2, 3, and 4 are satisfied.

Note that the space of economies is a product of smooth Banach manifolds and thus a smooth Banach manifold itself. It is implicitly understood that all endogenous objects depend on the economy, and in the interest of a compact notation, economies are omitted as arguments; for example, \(\varPsi ^*({\varvec{A}},p)\) is written instead of \(\varPsi ^*({\varvec{A}},p,U,e,{\mathcal {A}},\kappa )\).

2.5 Cournot–Walras equilibrium

The economy is in equilibrium if all consumers choose portfolios and consumption optimally, all producers play best replies, and prices are such that markets clear. For arbitrary choices of \({\varvec{A}}\gg 0\), Assumption 3 ensures that no asset is redundant and \(\mathrm{rank}({\varvec{A}}) = K\). Due to constant rank, Assumptions 1 and 2 guarantee that the demand correspondence \(\varPsi ^{i*}\) is single-valued, and that it can be represented by a \(C^2\) function \(\psi ^{i*}\). Define the \(C^2\) function

then, \(c^{i*}({\varvec{A}},p)\) and \(\psi ^{i*}({\varvec{A}},p)\) solve the utility maximization problem (2). The supply of all assets is normalized to one, such that a price vector \(p\) clears the market whenever it solves

In this case, one speaks of a Walrasian exchange equilibrium. Under the above assumptions, exchange equilibria exist for any choice of \({\varvec{A}}\) (see Magill and Quinzii 1996, p. 87, Theorem 10.5), but they need not be unique. The exchange equilibrium manifold is the set \(\varTheta = (\bar{\psi }^*)^{-1}(\mathbf{1 })\) that consists of all tuples \(({\varvec{A}},p)\) of asset payoffs and corresponding Walrasian equilibrium prices.Footnote 5 The inverse demand function \(p^*\) is a selection from the exchange equilibrium manifold. In general, such a selection need not be continuous. The equilibrium concept is based on an exogenous choice of selection from the set

The regularity condition for local maxima is not too restrictive: The set \(P^*\) is generically nonempty (see Appendix, Proposition 3). In particular, \(P^*\) is a singleton if there exists a unique exchange equilibrium for all strategy combinations. This is the case studied by Gabszewicz and Vial (1972), and it can be ensured by imposing further restrictions on \({\mathbb {U}}^I\times {\mathbb {E}}\). Otherwise, \(P^*\) permits a large variety of selections. One example is the selection introduced by Roberts (1980), which picks the exchange equilibrium closest to a reference point. This selection naturally leads to the equilibrium concept of Bonanno (1988), in which firms have only local knowledge of the market demand function. The following definition of equilibrium is more general, and permits the full variety of price selections.

Definition 2

A Cournot–Walras equilibrium for economy \((U,e,{\mathcal {A}},\kappa )\) and price selection \(p^* \in P^*\) is a tuple \(({\varvec{A}},p,c,\psi )\) such that \({\varvec{A}}= A^*({\varvec{A}})\), \(p = p^*({\varvec{A}})\), \(c = c^*({\varvec{A}},p)\), \(\psi \in \varPsi ^*({\varvec{A}},p)\), and \(\bar{\psi }=\mathbf{1 }\).

Several aspects of Definition 2 are worth noting: Since \(p^*\) is exogenous, the solution concept of the Cournot game boils down to Nash equilibrium in pure strategies. This is in contrast to solution concepts with endogenous selections, in the spirit of Simon and Zame (1990). In particular, \(p^*\) is deterministic, which is in contrast to the solution concept of Allen (1994), in which exchange equilibria are picked at random. A random selection can be constructed provided that the number of critical exchange equilibria is finite, and this is generically the case, as shown by Mas-Colell and Nachbar (1991). An exchange equilibrium is called critical if it is a critical point of the projection \(\mathrm{pr}_{\mathcal {A}}\) of \(\varTheta \) onto \({\mathcal {A}}\). The opposite of critical equilibria are regular equilibria.

2.6 Regularity

An equilibrium is called regular if it is differentiable and robust. While differentiability of prices, consumption, and portfolios is implicitly guaranteed by the above assumptions, differentiability of best replies appears explicitly in the following definition.

Definition 3

A Cournot–Walras equilibrium is regular if

-

1.

\(d_p\bar{\psi }^*[{\varvec{A}},p]\) is surjective

-

2.

\(A^*\) is continuously differentiable at \({\varvec{A}}\)

-

3.

\(dA^*[{\varvec{A}}]-\mathrm{id}_{\mathcal {A}}\) is surjective.

An economy is regular if all its Cournot–Walras equilibria are regular. Consider the properties of regular production economies implied by Definition 3: The first condition ensures, via the implicit function theorem, that the induced exchange economy is regular in the sense of Debreu (1970). The second and third conditions rule out malformations as in Figs. 1 and 2, respectively.

2.7 Reduced-form equilibrium

Strategy combinations \({\varvec{A}}\) are defined as matrices in \({\mathbb {R}}^{|{\varvec{\varOmega }}|\times K}\). However, under Assumption 3, such production plans are completely summarized by the vector \(\tau \in {\mathbb {R}}_+^K\) of production scales. It is analytically convenient to view payoffs \(\varPi ^*\) as a function of \(\tau \) rather than as a function of \({\varvec{A}}\): Since \(\tau \) is a vector, the derivative \(d\varPi ^*[\tau ]\) can be represented by the Jacobian matrix \(D\varPi ^*[\tau ]\). Let \({\mathcal {T}}\) be the preimage of \({\mathcal {Y}}\) under the bijective, linear mapping \(Y\); then, the reduced-form profit maximization problem

gives rise to a best-reply correspondence \(\tau ^{k*}(\tau )\) that is equivalent to \(A^{k*}({\varvec{A}})\) in the sense that \(Y(\tau ^*(\tau )) = A^*(Y(\tau ))\). Therefore, a fixed point of \(\tau ^*\) can always be translated into a fixed point of \(A^*\) and vice versa. Suppose \({\varvec{A}}\) is replaced with \(\tau \) as an argument of \(p^*(\tau )\), \(c^*(\tau ,p)\), and \(\psi ^*(\tau ,p)\); then, equilibrium can be redefined as follows:

Definition 4

A reduced-form equilibrium for economy \((U,e,{\mathcal {A}},\kappa )\) and price selection \(p^* \in P^*\) is a tuple \((\tau ,p,c,\psi )\) such that \(\tau = \tau ^*(\tau )\), \(p = p^*(\tau )\), \(c = c^*(\tau ,p)\), and \(\psi = \psi ^*(\tau ,p)\).

Following Definition 3, a reduced-form equilibrium is called regular if the Jacobian \(D_p\bar{\psi }^*[\tau ,p]\) has full rank, \(\tau ^*\) is continuously differentiable at \(\tau \), and the Jacobian \(D\tau ^*[\tau ]-{\varvec{I}}\) has full rank. By construction, all reduced-form equilibria of an economy are regular if and only if all Cournot–Walras equilibria are regular. Therefore, to verify generic regularity of economies, it is sufficient to study reduced-form equilibria. This strategy is pursued in the following analysis. Payoffs \(\varPi ^*(\tau )\) and thus its components \(\kappa (\tau )\) and \(\varPi (\tau ,p)\) are viewed as having \(\tau \) as an argument. This has the advantage of shorter and more transparent proofs.

3 Results

In order to establish generic regularity, it must be shown that two particular manifolds are generically well-behaved. The first condition of Definition 3 is a property of the exchange equilibrium manifold \(\varTheta \). This manifold can be embedded in \({\mathbb {R}}^{2K}\): each point can be described by a tuple \((\tau ,p)\). The remaining two conditions of Definition 3 are properties of a different manifold, the profit manifold \(\varSigma \), which is defined as the image of \(\varTheta \) under the \(C^2\) function \(h:\varTheta \rightarrow \varSigma \),

This function is a homeomorphism: by Eq. (3), its derivative is everywhere represented by a Jacobian of the form

As a consequence, \(h\) has no critical points and there exists a \(C^2\) inverse. Since \(p^*\) is a selection from \(\varTheta \), it follows from Eq. (4) that \(\varPi ^*\) is a selection from \(\varSigma \). Perturbation of the economy change the shape of \(\varSigma \) and can be used to control the shape of \(\varPi ^*\). It can be shown that \(\mathrm{graph}(\varPi ^*)\) is a manifold with boundary with charts inherited from \(\varSigma \). The boundary can be disregarded because it contains no local profit maxima; otherwise, \(p^*\) would not be a member of \(P^*\). The focus is therefore on the boundaryless manifold \(\mathrm{int}(\mathrm{graph}(\varPi ^*))\), which has a well-behaved atlas. This atlas consists of charts that map open subsets \({\mathcal {O}}_n\) of the manifold to open balls around some strategy combination \(\tau \in {\mathcal {T}}\) in Euclidean space. If \(\tau \in \tau ^*(\tau )\), it is referred to as an equilibrium strategy combination, and in that case \((\tau ,\varPi ^*(\tau ))\) is an equilibrium point on \(\varSigma \). The atlas is constructed as follows.

Lemma 1

For any scalar \(s>0\), there are a finite sequence \(\{\tau _n\}_{n=1}^N\) and \(N\) charts \(\chi ^{-1}:{\mathcal {O}}_n\rightarrow {\mathbb {B}}_r(\tau _n)\) with the following properties:

-

1.

\(0< q< r < s\)

-

2.

any two members of \(\{{\mathbb {B}}_q(\tau _n)\}_{n=1}^N\) are disjoint

-

3.

there is some \(M < N\) such that all of \(\{\tau _m\}_{m=1}^M\) are equilibrium points

-

4.

there are no equilibrium points outside \(\{{\mathbb {B}}_r(\tau _m)\}_{m=1}^M\)

-

5.

\(\{\chi _n^{-1}\}_{n=1}^N\) is a \(C^2\) atlas of \(\mathrm{int}(\mathrm{graph}(\varPi ^*))\).

Proof

Consider the set \({\mathcal {T}}^* = \{\tau \in {\mathcal {T}}\,|\,\tau \in \tau ^*(\tau )\}\) of equilibrium points. Since \(q\) can be chosen arbitrarily small, any finite sequence \(\{\tau _m\}_{m=1}^M\) in \({\mathcal {T}}^*\) has the property that \({\mathbb {B}}_q(\tau _{\ell })\cap {\mathbb {B}}_q(\tau _m)\) is empty \(\forall \ell \ne m\) for some \(q > 0\). Since \({\mathcal {T}}\) is bounded, \(\mathrm{cl}({\mathcal {T}}^*)\) is compact, and there is a finite number \(M\) such that \(\{{\mathbb {B}}_r(\tau _m)\}_{m=1}^M\) is a cover of \({\mathcal {T}}^*\) for any choice of \(r\) such that \(q< r < s\). Now consider the set \({\mathcal {T}}^{**} = \{\tau \in {\mathcal {T}}\,|\,\varPi ^*\text { is } C^2 \text { at }\tau \}\) and the sequence \(\{\tau _n\}_{n=M+1}^N\) in \({\mathcal {T}}^{**}\backslash {\mathcal {T}}^*\) having the property that \({\mathbb {B}}_q(\tau _{\ell })\cap {\mathbb {B}}_q(\tau _n)\) is empty \(\forall \ell \ne n\) and \({\mathbb {B}}_q(\tau _m)\cap {\mathbb {B}}_q(\tau _n)\) is empty \(\forall (m,n)\). Since \(\mathrm{cl}({\mathcal {T}}^*\cap {\mathcal {T}}^{**})\) is compact, there is a finite number \(N\) such that \(\{{\mathbb {B}}_r(\tau _m)\}_{m=1}^N\) is a cover. This collection of open balls satisfies properties 1 through 4.

To construct an atlas, choose \(r\) sufficiently small such that the injective function \(\tau \mapsto (\tau ,\varPi ^*(\tau ))\) is \(C^2\) on \({\mathbb {B}}_r(\tau _n)\) for any \(\tau _n\) in the sequence. Identify \({\mathcal {O}}_n\) with the image of \({\mathbb {B}}_r(\tau _n)\) under this function. Then, the function \(\chi _n:{\mathbb {B}}_r(\tau _n)\rightarrow {\mathcal {O}}_n\) defined as

is a \(C^2\) homeomorphism. It serves as a local parameterization of \(\mathrm{int}(\mathrm{graph}(\varPi ^*))\). The collection of all inverses \(\{\chi _n^{-1}\}_{n=1}^N\) is the desired atlas, which is of class \(C^2\) because all charts are. \(\square \)

Note that the atlas from Lemma 1 varies continuously in an open neighborhood of the reference economy: Since the space of economies is a smooth Banach manifold, the transversality isotopy theorem (see Abraham 1967, p. 51, Theorem 20.2) implies that each nearby economy has an atlas with charts \(\tilde{\chi }_n^{-1}\) isotopic to \(\chi _n^{-1}\). It can be shown that each chart can be controlled independently: It is possible to perturb the reference economy in such a way that the shape of a single chart changes, while all other charts remain the same. These perturbations are so small that the perturbed economy lies in a neighborhood of the reference economy. The following propositions go one step further: For any reference economy, regular or not, there is a perturbation that modifies multiple charts simultaneously in such a way that the perturbed economy is regular.

There are two candidates for perturbations: the producer side and the consumer side of the economy. On the producer side, consider local perturbations of cost functions \(\kappa \). Such perturbations leave \(\varTheta \) as it is, but modify locally the homeomorphism \(h\) by Eqs. (3) and (10). On the consumer side, consider local perturbations of utility functions \(U\). Such perturbations have no effect on \(h\), but transform the exchange equilibrium manifold \(\varTheta \). The purpose of the following two propositions is to show that both types of perturbations of the economy translate into the desired perturbations of the atlas. The producer side is a natural starting point as it lends itself to a simple proof. It is therefore well-suited for the exposition of the perturbation technique employed.

Proposition 1

For any fixed \((U,e,{\mathcal {A}},\kappa )\) there is a set of perturbed cost functions \(\tilde{{\mathbb {K}}}^K(\kappa )\) and an open, dense subset \(\tilde{{\mathbb {K}}}_*^K\subseteq \tilde{{\mathbb {K}}}^K(\kappa )\) such that \((U,e,{\mathcal {A}},\tilde{\kappa })\) is a regular economy for any \(\tilde{\kappa }\in \tilde{{\mathbb {K}}}_*^K\).

The Proof of Proposition 1 follows a simple logic: It defines a subset \({\mathcal {Z}}\subset {\mathbb {U}}^I \times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) that consists of \((U,e,{\mathcal {A}},\kappa )\) and all profit-perturbed economies, and it constructs a function \(f:{\mathcal {Z}}\rightarrow C^1\left(\varprod\nolimits_{n=1}^N {\mathbb {B}}_r(\tau _n), {\mathbb {R}}^{NK}\right) \) that generates for each economy a \(C^1\) test function. This test function is designed in such a way that \(z\in {\mathcal {Z}}\) is a regular economy if \(f(z)\) is transverse to zero, written \(f(z)\pitchfork \{0\}\). By means of the parametric transversality theorem, it is shown that an open, dense subset of \({\mathcal {Z}}\) is indeed regular.

Proof

For the reference economy \((U,e,{\mathcal {A}},\kappa )\), consider an atlas as in Lemma 1. Choose \(s\) small enough such that each ball \({\mathbb {B}}_r(\tau _m)\) does not contain multiple nondegenerate critical points of \(\varPi ^{k*},\;k=1,\dots ,K\). Subscripts \(m\) and \(n\) are normally interchangeable. Only when both appear in the same expression, \(m\) is used for charts that cover an equilibrium point while \(n\) is used for other charts. From each chart \(\chi _m^{-1}\) one can derive a function \(\varPi _m:{\mathbb {B}}_r(\tau _m)\rightarrow {\mathbb {R}}^K\) that is defined as follows: For each producer \(k\), let \(\varPi _m^k(\tau ^k) = \varPi ^{k*}(\tau ^k,\tau _m^{{\lnot k}})\) and join these component functions as \(\varPi _m(\tau ) = (\varPi _m^1(\tau ^1,\tau _m^{\lnot 1}),\dots ,\varPi _m^K(\tau ^K,\tau _m^{\lnot K}))^{\top }\). By construction, \(D\varPi _m\) shares its main diagonal with \(D\varPi ^*\):

This derived function can be used to check whether the reference economy fulfills all three conditions of Definition 3. Note that Condition 1 is fulfilled at any reduced-form equilibrium. Suppose not; then \(p^*\) would not be differentiable at \(\tau \), but then it could not be a member of \(P^*\), which contradicts Definition 4. It remains to be checked whether Conditions 2 and 3 are also satisfied. For an equilibrium strategy combination \(\tau _m\), the following three conditions are jointly sufficient: 1) all best replies to \(\tau _m\) are contained in \({\mathbb {B}}_r(\tau _m)\); 2) \(\tau _m\) is a nondegenerate critical point for all payoff functions; 3) \(\tau ^*\) intersects \(\tau _m\) transversally. To express all three conditions in the language of transversality, three claims are made.

Claim 1

If \((x_m,x_n)\mapsto \varPi _m(x_m)-\varPi _n(x_n) \pitchfork \{0\}\) for any \(m=1,\dots ,M\) and \(n=M+1,\dots ,N\), then \(\tau ^*(\tau _m)\subseteq {\mathbb {B}}_r(\tau _m)\) for any \(m=1,\dots ,M\). To see this, note that by Lemma 1, \(\tau _m\) is an equilibrium strategy combination, and thus, a profit maximum for all producers. The set inclusion can only be violated if some producer has another profit maximum outside \({\mathbb {B}}_r(\tau _m)\); that is to say, there is some strategy combination \(x_n\in {\mathbb {B}}_r(\tau _n)\) with \(\varPi _m(\tau _m)=\varPi _n(x_n)\). But in that case, the first-order condition of the profit maximization problem (5) would imply that \(D\varPi _m[\tau _m]=D\varPi _n[x_n]={\varvec{0}}\). As a consequence, \(d\varPi _m[\tau _m]+d\varPi _n[x_n]\) would not be surjective, which would contradict the transversality condition. Therefore, all best replies must be contained in \({\mathbb {B}}_r(\tau _m)\).

Claim 2

If \(\tau ^*(\tau _m)\subseteq {\mathbb {B}}_r(\tau _m)\) and \(\mathbf{1 }\cdot D\varPi _m \pitchfork \{0\}\), then \(\tau ^*\) is \(C^1\) on \({\mathbb {B}}_r(\tau _m)\). To see this, note that

This matrix is surjective at \(\tau _m\) if and only if the above transversality condition holds. It can only be surjective if \(D^2_{\tau ^k}\varPi ^{k*}[\tau _m]\ne 0\;\forall k\). It follows from the implicit function theorem applied to \(D_{\tau ^k}\varPi ^{k*}[\tau ^k,\tau ^{{\lnot k}}]=0\) that \(\tau ^{k*}\) is \(C^1\) on an open set. Lemma 1 ensures that this open set contains \({\mathbb {B}}_r(\tau _m)\) for a sufficiently small choice of \(s\).

Claim 3

If the matrix in (13) has full rank (and thus \(\tau ^*\) is locally of class \(C^1\)) and \((D_{\tau ^1}\varPi ^{1*},\dots ,D_{\tau ^K}\varPi ^{K*}) \pitchfork \{0\}\), then \(D\tau ^*[\tau _m]-{\varvec{I}}\) has full rank. To see this, note that by the chain rule

in which the division is well-defined since the diagonal elements in (13) are nonzero. Note that \(D(D_{\tau ^1}\varPi ^{1*},\dots ,D_{\tau ^K}\varPi ^{K*})\) has exactly the same main diagonal. By the above transversality condition, the matrix has full rank, and this rank is preserved if each row is divided by minus the diagonal element. After this normalization each row has a form like

and thus the matrix is equal to \(D\tau ^*[\tau _m]-{\varvec{I}}\).

Now consider the subset of economies \({\mathcal {Z}} =\{U\}\times \{e\}\times \{{\mathcal {A}}\}\times \tilde{{\mathbb {K}}}^K(\kappa )\), in which \(\tilde{{\mathbb {K}}}^K(\kappa )\) is the space of parameterized cost functions \(\tilde{\kappa }:{\mathbb {R}}^{K}\times {\mathcal {Z}}\rightarrow {\mathbb {R}}^K\) of the form

in which \(\rho :{\mathbb {R}}\rightarrow [0,1]\) is a smooth function defined as

in which \(q\) and \(r\) are the radii of the open balls from Lemma 1. By Eqs. (3) and (4), a parameterized payoff function \(\tilde{\varPi }^*:{\mathcal {T}}\times {\mathcal {Z}}\rightarrow {\mathbb {R}}^K\) is induced:

Perturbed versions of \(\varPi _m^k\) are defined as \(\tilde{\varPi }_m^k(\tau ,z) = \tilde{\varPi }^{k*}(\tau ^k,\tau _m^{{\lnot k}},z)\). By construction, \(\tilde{{\mathbb {K}}}^K(\kappa )\) can be identified with a neighborhood of zero in \({\mathbb {R}}^{2NK}\) that consists of parameter tuples \((\alpha ,\beta )\), in which \(\alpha _m^k\) and \(\beta _m^k\) are scalars. Since \(\{U\}\), \(\{e\}\), and \(\{{\mathcal {A}}\}\) are smooth manifolds, the entire product space \({\mathcal {Z}}\) is a smooth manifold.

Finally, consider a function \(f:{\mathcal {Z}}\rightarrow C^1\left( \varprod\nolimits_{n=1}^N {\mathbb {B}}_r(\tau _n),{\mathbb {R}}^{NK}\right) \) with the property that \(z\in {\mathcal {Z}}\) is a regular economy if \(f(z) \pitchfork \{0\}\). Such a function can be constructed as follows. Let the components of its evaluation mapping \(f^{ev}\) be defined in the following way: If \(m=n\le M\), i.e., \(\tau _m\) is an equilibrium strategy combination, then

All rows in (17) can be perturbed independently through \(\beta _m^k\). If \(n>M\) and there exists some \(x_n\in {\mathbb {B}}_r(\tau _n)\) such that \(\varPi _m(\tau _m)=\varPi _n(x_n)\) for some \(m\le M\), then

All rows in (18) can be perturbed independently through \(\alpha _n^k\). In all other cases, perturbations of charts are not necessary and the corresponding rows can be defined as

All rows in (19) can be perturbed directly through \(x_n\). Since independent perturbations of all rows are possible, \(df^{ev}\) is surjective and \(f^{ev}\pitchfork \{0\}\). Since \(\mathrm{cl}\left( \varprod\nolimits_{n=1}^N {\mathbb {B}}_r(\tau _n)\right) \) is compact, continuity of \(f\) under the \(C^1\) compact-open topology implies continuity under the \(C^1\) Whitney topology. It follows from the parametric transversality theorem (see Hirsch 1994, pp. 79–80, Theorem 2.7) that \(f(z)\pitchfork \{0\}\) for any \(z\) in an open, dense subset of parameters \({\mathcal {Z}}_{**}\subseteq {\mathcal {Z}}\). The conscious reader will have noticed that \(f(z)\pitchfork \{0\}\) implies only the transversality conditions from Claims 1 and 3 directly. However, perturbations through \(\beta \) that restore the condition from Claim 3 but not the one from Claim 2 are negligible: To see this, replace (17) with

The rows in (20) are jointly perturbed with those in (17). Another application of the parametric transversality theorem shows that there is a different open, dense subset of parameters \({\mathcal {Z}}_*\subseteq {\mathcal {Z}}\) such that the modified \(f(z)\pitchfork \{0\}\) for any \(z\in {\mathcal {Z}}_*\). The intersection \({\mathcal {Z}}_*\cap {\mathcal {Z}}_{**}\) is an open, dense subset of \(\{U\}\times \{e\}\times \{{\mathcal {A}}\}\times \tilde{{\mathbb {K}}}^K(\kappa )\), which concludes the Proof of the Proposition. \(\square \)

Proposition 1 is a local result: It considers a family of subspaces of economies, one for each reference economy, and shows that regular economies are open and dense within each subspace. As regards any of these subspaces, the proposition is read as follows: Market demand may have any shape, but even ill-shaped demand does not translate to an ill-shaped payoff function for the generic producer. The types of malformations discussed in the introduction do not survive small perturbations of the cost function. Half of this local result, namely the density of regular economies, can be translated directly into a global result for the entire space of economies:

Corollary 1

Every open neighborhood of \((U,e,{\mathcal {A}},\kappa )\) in \({\mathbb {U}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) contains a regular economy \((U,e,{\mathcal {A}},\tilde{\kappa })\) with \(\tilde{\kappa }\in \tilde{{\mathbb {K}}}^K(\kappa )\).

Proof

It must be shown that for any \(\varepsilon >0\) there exists a \(\tilde{\kappa }\in \tilde{{\mathbb {K}}}^K(\kappa )\) with \(\bar{\delta }_{{\mathbb {K}}}(\tilde{\kappa },\kappa )<\varepsilon \) such that \((U,e,{\mathcal {A}},\tilde{\kappa })\) is a regular economy. For any \(m\), define \({\mathcal {T}}_m = \mathrm{cl}({\mathbb {B}}_r(\tau _m))\) such that the maximum operator \(\max _{\tau \in {\mathcal {T}}}\) can be equivalently written as \(\max _m\max _{\tau \in {\mathcal {T}}_m}\). Denote by \(\upsilon _m^k(\tau ^k) = \alpha _m^k + (\tau ^k-\tau _m^k)\beta _m^k\) the perturbation term in (14). This function and its differentials \(d\upsilon _m^k[\tau ^k](x) = \beta _m^k x\) and \(d^2\upsilon _m^k[\tau ^k](x,y) = 0\) are linear in \((\alpha ,\beta )\). Written out, with all parentheses and brackets omitted for clarity, the metric is of the form

All maximands are linear in \((\alpha ,\beta )\). Thus, for any \(\varepsilon > 0\), there is some \(\varepsilon ' > 0\) sufficiently small such that all perturbations with \(\Vert (\alpha ,\beta )\Vert <\varepsilon '\) satisfy \(\bar{\delta }(\tilde{\kappa },\kappa ) <\varepsilon \). It remains to be verified, that there exists such a small perturbation that restores regularity, but since \(\Vert (\alpha ,\beta )\Vert < \varepsilon '\) defines an open subset of \(\tilde{{\mathbb {K}}}^K(\kappa )\) this is a direct consequence of the density part of Proposition 1. \(\square \)

Corollary 1 shows that perturbations of production technologies can be used to cancel out the effects of ill-shaped demand. However, it does not answer the question of whether ill-shaped demand is a frequent phenomenon. This question is addressed in the next proposition. Even if producer characteristics are fixed, perturbations of utility functions are sufficient to restore regularity. A precondition for this result is that the mapping from strategy combinations to equilibrium consumption must be injective. The following lemma shows that Assumptions 1 and 3 are jointly sufficient.

Lemma 2

For each consumer \(i\), the function \(\tau \mapsto c^{i*}(\tau ,p^*(\tau ))\) is injective.

Proof

Suppose not; then, \(c^i = c^{i*}(\tau ,p^*(\tau )) =c^{i*}(\hat{\tau },p^*(\hat{\tau }))\) has a solution other than \(\tau = \hat{\tau }\) for some consumer \(i\). Since \(c^{i*}\) satisfies the first-order condition of the utility maximization problem (2), this implies that

Since \(Y\) is homogeneous of degree 1 under Assumption 3, this equation only holds if \(p^{k*}(\tau )\hat{\tau }^k = p^{k*}(\hat{\tau })\tau ^k\) for each producer \(k\). But then (21) holds true for all consumers; that is, each of them consumes the same quantities under the two strategy combinations \(\tau \) and \(\hat{\tau }\). However, \(U^i\) is strictly increasing under Assumption 1, and thus all budget constraints hold with equality. Summing them up over all consumers and substituting the market clearing condition (8) leads to

but the only solution to this equation is \(\tau = \hat{\tau }\) since \(Y\) is homogeneous of degree 1. \(\square \)

Lemma 2 guarantees that the effects of utility perturbations on the exchange equilibrium manifold are local. This leads to the second proposition:

Proposition 2

For any fixed \((U,e,{\mathcal {A}},\kappa )\) there is a set of perturbed utility functions \(\tilde{{\mathbb {U}}}^I(U)\) and an open, dense subset \(\tilde{{\mathbb {U}}}_*^I\subseteq \tilde{{\mathbb {U}}}^I(U)\) such that \((\tilde{U},e,{\mathcal {A}},\kappa )\) is a regular economy for any \(\tilde{U}\in \tilde{{\mathbb {U}}}_*^I\).

The Proof of Proposition 2 follows the same logic as the one of Proposition 1: Instead of cost functions, utility functions are equipped with a finite-dimensional parameterization. This results in a subspace of utility-perturbed economies, for which all charts can be controlled independently. The parametric transversality theorem ensures that an open and dense set of utility perturbations lead to a regular economy. This result can be obtained under great parsimony: To restore regularity it is sufficient to perturb the utility function of a single consumer.

Proof

Many arguments are identical to the ones used in the Proof of Proposition 1. For brevity, these arguments are not repeated, but the focus is on those parts that are different. Again \((U,e,{\mathcal {A}},\kappa )\) is taken as the reference economy, but now utility functions are perturbed instead of cost functions. For this purpose Eq. (16) has to be replaced with

in which \(\tilde{p}^*\) is a parameterized version of \(p^*\). This parameterization is induced by parameterized utility functions. Consider a subset of economies \({\mathcal {Z}} =\tilde{{\mathbb {U}}}^I(U) \times \{e\}\times \{{\mathcal {A}}\}\times \{\kappa \}\), in which \(\tilde{{\mathbb {U}}}(U)\) is the space of utility functions \(\tilde{U}^i:{\mathcal {C}}^i\times {\mathcal {Z}}\rightarrow {\mathbb {R}}\) of the form

in which \(c_m^i = c^{i*}(\tau _m,p^*(\tau _m))\). The smooth function \(\varsigma _m^i\) is constructed with the same properties as \(\rho \) in Eq. (16): Let \(\{{\mathcal {Q}}_m^i\}_{m=1}^N\) and \(\{{\mathcal {R}}_m^i\}_{m=1}^N\) be sequences of open subsets \({\mathcal {Q}}_m^i \subset {\mathcal {R}}_m^i\) of \({\mathcal {C}}^i\) such that \({\mathcal {Q}}_m^i\) and \({\mathcal {R}}_m^i\) contain the images of \({\mathbb {B}}_q(\tau _m)\) and \({\mathbb {B}}_r(\tau _m)\) respectively, under the function \(\tau \mapsto c^{i*}(\tau ,p^*(\tau ))\). Since this function is injective by Lemma 2, the sets \({\mathcal {Q}}_m^i\) and \({\mathcal {R}}_m^i\) can be chosen small enough such that each sequence has disjoint members. There exist smooth functions \(\varsigma _m^i:{\mathcal {C}}^i\rightarrow [0,1]\) that assume 1 on \(\mathrm{cl}({\mathcal {Q}}_m^i)\) and 0 on the complement of \({\mathcal {R}}_m^i\). The set \(\tilde{{\mathbb {U}}}^I(U)\) can be identified with a neighborhood of zero in the space of tuples \((\beta ,{\varvec{\varGamma }})\) that are composed of \((|{\varvec{\varOmega }}|+1)\)-dimensional vectors \(\beta _m^i\) and of \((|{\varvec{\varOmega }}|+1)\times (|{\varvec{\varOmega }}|+1)\) matrices \({\varvec{\varGamma }}_m^i\).

The proposition is proven if all rows in (17) and (18) can be perturbed independently. By Equation (22), a sufficient condition is that \(\tilde{p}^*\) and \(d\tilde{p}^*\) can be perturbed independently. Since \(\tilde{p}^*\) may have discontinuities, consider domain restrictions \(p_m^*:{\mathbb {B}}_r(\tau _m)\times {\mathcal {Z}}\rightarrow {\mathbb {R}}^K\). At \(z={\varvec{0}}\), these functions solve

Since \(h\) and \(\chi _m\) are \(C^2\) homeomorphisms, the differential \(d_{\tau } p_m^*[\tau ,{\varvec{0}}]\) is surjective. As \(p_m^*\) is of class \(C^2\), \(d_{\tau } p_m^*[\tau ,z]\) is surjective for any \(z\) in a neighborhood of zero in \({\mathcal {Z}}\). Prices are connected to utility functions through market demand. Let \(\psi _m^*:{\mathbb {B}}_r(\tau _m)\times {\mathbb {R}}_{++}^K \times {\mathcal {Z}}\rightarrow {\mathbb {R}}^K\) describe demand locally; then, \(p_m^*\) solves the market clearing equation

In order to control prices and their derivatives locally, it is sufficient to perturb the utility function of a single consumer. First, it must be shown that \(p_m^*\) can be perturbed arbitrarily through \(\beta _m^i\). Applying the chain rule to (24) leads to

in which \(d_p\bar{\psi }_m^*\) is bijective since critical exchange equilibria are never optimal by construction of \(P^*\). It remains to be proven that \(d_{\beta _m}\bar{\psi }_m^*(b)\) is surjective. For this purpose, note that individual demand \(\psi _m^{i*}\) solves the equation \(b_m^i(\tau ,p,z,\psi _m^{i*}(\tau ,p,z))=0\) that represents the first-order conditions of the utility maximization problem (2); i.e.,

By the chain rule, \(d_{\beta _m^i}\psi _m^{i*}(b) =-(d_{\psi ^i}b_m^i)^{-1}(d_{\beta _m^i}b_m^i(b))\), and since both of

have full rank \(K\) by Assumptions 1 and 3, \(d_{\beta _m^i}p_m^*\) is indeed surjective.

Second, it must be shown that \(d_{\tau } p_m^*\) can be perturbed independently through \({\varvec{\varGamma }}_m^i\). Note that changes in \({\varvec{\varGamma }}_m^i\) have no first-order effect on \(p_m^*\) at the point of evaluation \((\tau _m,{\varvec{0}})\): It follows from (23) that

To identify the second-order effects, apply the chain rule to (24), which yields

in which the second equality follows from the previously established fact that \(d_{{\varvec{\varGamma }}_m}p_m^*=0\). Thus, a sufficient condition for surjectivity is indeed that \(d_{{\varvec{\varGamma }}_m}d_{\tau }\psi _m^{i*} +d_{{\varvec{\varGamma }}_m}d_p\psi _m^{i*}\circ (d_{\tau } p_m^*,\mathrm{id}))\) is surjective for the perturbed consumer \(i\). One additional application of the chain rule reveals that

in which the last equality is obtained by using the previously established fact that \(d_{{\varvec{\varGamma }}_m^i}\psi _m^{i*}=0\) at the point of evaluation. To see that this term is indeed surjective, note that

and after setting \(v = d_{\tau } p_m^*(t)\) and \(y^i =d_{\tau }\psi _m^{i*}(t)+d_p\psi _m^{i*}(d_{\tau } p_m^*(t))\) one arrives at

As the matrix \({\varvec{G}}\) can be chosen freely, surjectivity could only fail if the differential to the right were zero. But then the mapping \(\tau \mapsto c^{i*}(\tau ,p^*(\tau ))\) could not be injective, which would contradict Lemma 2. As both \(p_m^*\) and \(d_{\tau } p_m^*\) can be perturbed independently, \(f^{ev} \pitchfork \{0\}\) and by the same arguments as in the Proof of Proposition 1, there is an open, dense subset \({\mathcal {Z}}_*\subseteq {\mathcal {Z}}\) of regular economies. \(\square \)

Proposition 2 is, just like Proposition 1, merely a local result. The following corollary extends its density part to the entire space of economies:

Corollary 2

Every open neighborhood of \((U,e,{\mathcal {A}},\kappa )\) in \({\mathbb {U}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) contains a regular economy \((\tilde{U},e,{\mathcal {A}},\kappa )\) with \(\tilde{U}\in \tilde{{\mathbb {U}}}^I(U)\).

Proof

It must be shown that for any \(\varepsilon > 0\), there is some \(\tilde{U} \in \tilde{{\mathbb {U}}}^I(U)\) with \(\bar{\delta }_{{\mathbb {U}}}(\tilde{U},U) < \varepsilon \) such that \((\tilde{U},e,{\mathcal {A}},\kappa )\) is a regular economy. In the Proof of Proposition 1, only the utility function of one consumer, say \(i\), is perturbed. In this case, \(\bar{\delta }_{{\mathbb {U}}}(\tilde{U},U) =\delta _{{\mathbb {U}}}(\tilde{U}^i,U^i)\). The perturbation term from Eq. (23) and its derivatives,

are all linear in \((\beta ,{\varvec{\varGamma }})\). Omitting parentheses and brackets, the metric is of the form

in which all maximands are linear in \((\beta ,{\varvec{\varGamma }})\). Thus, there is always some \(\varepsilon ' > 0\) sufficiently small such that \(\Vert (\beta ,{\varvec{\varGamma }})\Vert < \varepsilon '\) implies \(\bar{\delta }(\tilde{U},U) < \varepsilon \). Since \(\Vert (\beta ,{\varvec{\varGamma }})\Vert < \varepsilon '\) defines an open subset of \(\tilde{{\mathbb {U}}}^I(U)\), the corollary follows from the density part of Proposition 2. \(\square \)

Now that density is established, openness follows in the next step. The generic regularity theorem is the main result.

Theorem 1

\({\mathbb {U}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) has an open and dense subset of regular economies.

Proof

Let \({\mathcal {W}}\) denote the subset of economies with nonempty \(P^*\), which is open and dense by Proposition 3. As an open subset of a smooth Banach manifold, \({\mathcal {W}}\) is itself a smooth Banach manifold. Let \({\mathcal {V}}={\mathcal {T}}\times {\mathbb {R}}^K \times {\mathcal {C}}\times {\mathbb {R}}^{IK}\) denote the domain of the equilibrium variables \((\tau ,p,c,\psi )\). Let \({\mathcal {W}}_* \subseteq {\mathcal {W}}\) be the set of economies regular in the sense of Debreu (1970) (i.e., fulfilling Condition 1 in Definition 3) and let \({\mathcal {W}}_{**} \subseteq {\mathcal {W}}_*\) be the set of regular economies as defined in the present paper (i.e., fulfilling all of Definition 3). It has been shown that \({\mathcal {W}}_{**}\) is dense in \({\mathcal {W}}\) (see Corollary 1 or Corollary 2). It remains to be shown that it is also open. For this purpose, fix some \(w\in {\mathcal {W}}_{**}\) and consider a function \(g_w:{\mathcal {V}}\rightarrow {\mathbb {R}}^{(I+2)K+I(|{\varvec{\varOmega }}|+1)}\) that satisfies \(g_w(\tau ,p,c,\psi )=0\) at any equilibrium, defined as

In general, \(g_w\) need not be \(C^1\) since \(\tau ^*\) may exhibit discontinuities. However, regularity guarantees that \(g_w\) is \(C^1\) on an open, bounded set \({\mathcal {S}}\subset {\mathcal {V}}\) that contains all equilibria (see Condition 2 in Definition 3). On this basis, construct a function \(g:{\mathcal {W}}\rightarrow C^1({\mathcal {S}},{\mathbb {R}}^{(I+2)K+I(|{\varvec{\varOmega }}|+1)})\) with evaluation mapping \(g^{ev}(w,\tau ,p,c,\psi ) = g_w(\tau ,p,c,\psi )\). If \(w\in {\mathcal {W}}_*\), then regularity (i.e., membership in \({\mathcal {W}}_{**}\)) is equivalent to \(g(w) \pitchfork \{0\}\): The Jacobian of \(g_w\) in local coordinates has the form

Conditions 2 and 3 in Definition 3 imply that \(Dg_w\) exists and that the upper left block is invertible. In this case, \(Dg_w\) is a lower triangular matrix with invertible blocks along the main diagonal. As a consequence, \(Dg_w\) is invertible, \(dg_w\) is surjective, and \(g_w \pitchfork \{0\}\). The converse holds as well: If \(g(w) \pitchfork \{0\}\), then \(Dg_w\) exists and the upper left block must be invertible, which implies Conditions 2 and 3 in Definition 3. Note that \(g_w\) and \(dg_w\) are continuous in \(w\): Their components depend only on the market clearing condition (8) and on the first-order conditions of utility maximization (5) and profit maximization (2), which all have the desired continuity properties. Further, note that \(\mathrm{cl}({\mathcal {S}})\) is compact. By the transversality openness theorem for Banach manifolds (see Abraham 1967, p. 47, Theorem 18.2), the set \({\mathcal {W}}_{**}\) of economies that satisfy the transversality condition is open in \({\mathcal {W}}\). As an open, dense subset of \({\mathcal {W}}\), the set \({\mathcal {W}}_{**}\) is also open and dense in the whole space of economies. \(\square \)

Regularity implies that equilibria are locally unique and Theorem 1 leads to a generic determinacy result:

Corollary 3

Generically, equilibria are isolated and finite in number.

Proof

By Theorem 1, the generic economy \(w\) is regular. In a regular economy, each equilibrium \((\tau ,p,c,\psi )\) solves the equation \(g_w(\tau ,p,c,\psi )=0\), as defined in (27), which is locally of class \(C^1\). By the regular value theorem (see Villanacci et al. 2002, p. 84, Theorem 9), the set of equilibria is a 0-dimensional manifold, and thus each equilibrium is isolated. Moreover, under Assumption 3, all assets have positive payoffs. In this case, Assumptions 1 and 2 imply that prices are bounded and contained in some compact set \({\mathcal {P}} \subset {\mathbb {R}}_+^K\). Therefore, when the 0-dimensional manifold is embedded in \({\mathbb {R}}^{2K}\), it is contained in the compact set \({\mathcal {T}}\times {\mathcal {P}}\) and thus has a finite number of elements. \(\square \)

As Theorem 1 can be derived on the basis of both Corollary 1 and Corollary 2, it can be viewed as a statement about the generic producer or as a statement about the generic consumer. Both of these approaches are worth separate discussion. If producer characteristics are fixed, regularity depends on the third-order derivatives of utility functions. This is a parallel to the discussion on strictly concave payoff functions. Regarding their concavity, Roberts and Sonnenschein (1977) assess that, “Short of separability or restrictions on the third-order partial derivatives of the utility function, it is not at all clear it can be assured even in a one consumer world” (p. 105). It should be noted, though, that Assumption 1 places no restrictions on third-order derivatives of utility functions except at the boundary. Nevertheless, these higher-order derivatives are generically well-behaved. This is still true if attention is restricted to economies with a representative consumer since perturbations of a single consumer are sufficient to obtain the result.

It should be noted, however, that even if there is a representative consumer, equilibria need not exist. Contrary to exchange economies, equilibrium existence is a more demanding concept than regularity in the present setting. Assumptions 1 through 4 are not sufficient for (generic) existence of Cournot–Walras equilibrium. Therefore, Corollary 3 should not be misinterpreted as implying a number of equilibria greater than zero. The potential cause of nonexistence is discontinuities: one the one hand, discontinuities in best replies that may arise if payoffs are not concave; on the other hand, discontinuities in the price selection \(p^*\), which are inevitable if there are multiple exchange equilibria.Footnote 6 Stronger assumptions on utility functions are necessary to avoid these problems. For example, Shirai (2010) proves general existence in representative consumer economies with additively separable utility. Even though Corollary 2 is no longer applicable in this case because utility perturbations would destroy additive separability, Theorem 1 continues to hold.

This is where Corollary 1 turns out to be more than a redundant exercise. As long as demand is of class \(C^2\), perturbations of producers are always sufficient to restore regularity. This result is obtained under the strong Assumption 3, under which output sets are independent rays. The critical part of the assumption is not rays: They are convenient because of the equivalence between Cournot–Walras equilibrium and reduced-form equilibrium. If this assumption is relaxed, for example by replacing the family of rays with a family of cones, the equivalence breaks down. This results in more laborious proofs but need not invalidate the regularity result. The critical part of the assumption is independence: If any two cones meet only at the origin, all results go through, provided cost functions are of class \(C^2\) and satisfy a boundary condition that guarantees interior optima. However, if two cones have a larger intersection, Lemma 2 breaks down and Proposition 2 is no longer valid. In this case, perturbations of utility functions are no longer effective, and perturbations of cost functions become the only method of restoring regularity.

It should be emphasized, though, that the meaning of regularity changes when the rank of the asset payoff matrix is not constant. If markets are complete at a Cournot–Walras equilibrium, the concept of regularity is still the same: The equilibrium is differentiable, robust to perturbations, and locally unique. In other word, the main insights from Corollary 3 are still valid. This changes when markets are endogenously incomplete: In this case, the method of comparative statics is still applicable on the basis of directional derivatives, but Cournot–Walras equilibria are no longer locally unique. There is a real indeterminacy that grows with the degree of market incompleteness. Thus, the properties of Cournot–Walras equilibrium are substantially different in a setting with strategic asset structure choice. This setting is studied in a companion paper, Zierhut (2020), and the interested reader is referred to the analysis therein, as well as to Carvajal et al. (2012) for related result. Since those models of Cournot competition with strategic asset choice are based on quasilinear economies, the following section provides a complementary derivation of generic regularity under quasilinear utility as a corollary to Theorem 1.

4 Quasilinear utility

The perturbation technique introduced in Sect. 3 can be modified in order to establish generic regularity in quasilinear economies. Such economies are particularly tractable, and the equilibrium concept becomes independent of price selections because the cardinality of \(P^*\) is at most one. For the purpose of extending Theorem 1 to such economies, replace Assumption 1 with the following variant:

Assumption 1′

For each consumer \(i\),

for some function \(u^i:{\mathbb {R}}_{+}^{|{\varvec{\varOmega }}|}\rightarrow {\mathbb {R}}\) that satisfies for each \(c_{{\varvec{1}}}^i\in {\mathbb {R}}_{++}^{|{\varvec{\varOmega }}|}\),

-

1.

\(u^i\) is continuous and of class \(C^3\) on \({\mathbb {R}}_{++}^{|{\varvec{\varOmega }}|}\)

-

2.

\(du^i[c_{{\varvec{1}}}^i](v)\gg 0\;\forall v>0\)

-

3.

\(d^2 u^i[c_{{\varvec{1}}}^i](v,v)<0\;\forall v\ne 0\)

-

4.

\(du^i[c_{{\varvec{1}}}^i]({\varvec{I}}_{\omega })\rightarrow \infty \) as \(c_{\omega }^i\rightarrow 0\) for any \(\omega \in {\varvec{\varOmega }}\).

Denote by \(\hat{{\mathbb {U}}}\) the space of all utility functions that satisfy Assumption 1′, and let its topology be induced by the same metric \(\delta _{{\mathbb {U}}}\) as on \({\mathbb {U}}\). Under Assumption 1′, consumers always demand strictly positive consumption at date 1. However, at some prices the non-negativity constraint \(c_0^i > 0\) for consumption at date 0 may become binding. At such points, demand \(\psi ^{i*}\), optimal consumption \(c^{i*}\), and prices \(p^*\) fail to be differentiable. This is not a problem per se, unless the constraints become binding simultaneously for all consumers. Therefore, two types of economies must be distinguished: The first type is economies in which all consumers have binding constraints. Such economies do exist: It is possible to construct sequences of economies whose unique equilibria converge to a point where the entire date 0 endowment \(\bar{e}_0\) is used up for production. Such economies are problematic in their own right because \(p^*\) fails to be differentiable in the limit of the equilibrium sequence. As a consequence, \(P^*\) is empty, and no equilibrium exists. At the same time, such economies are trivially regular: If the set of equilibria is empty, all its members are in line with Definition 3. Therefore, the focus must be on the second type of economy, namely economies where \(P^*\) is nonempty. The following lemma verifies that these economies form an open set.

Lemma 3

The subset of \(\hat{{\mathbb {U}}}^I\times {\mathbb {E}} \times {\mathbb {A}}\times {\mathbb {K}}^K\) with nonempty \(P^*\) is open.

Proof

Let \(W:{\mathbb {R}}_{++}^K \rightrightarrows {\mathbb {R}}^K\) be the equilibrium-set correspondence,

which maps production scales to (exchange) equilibrium prices. Under Assumptions 1′ and 2, \(W\) is single-valued (see Hens and Pilgrim 2002, Theorem 6.9, p. 143) and upper hemicontinuous, not only in \(\tau \) but also in \((U,e)\) (see Hildenbrand and Mertens 1972, p. 103, Corollary 2). These two properties jointly imply that \(W\) is continuous. Suppose not; then, there would be two sequences \(\{\tau _n\}_{n=1}^{\infty }\) and \(\{\hat{\tau }_n\}_{n=1}^{\infty }\) that both converge to the same production scale \(\tau \), but \(\lim _{n\rightarrow \infty } W(\tau _n) \ne \lim _{n\rightarrow \infty } W(\hat{\tau }_n)\). By upper hemicontinuity, \(\lim _{n\rightarrow \infty } W(\tau _n) \in W(\tau )\) and \(\lim _{n\rightarrow \infty } W(\hat{\tau }_n) \in W(\tau )\), but then \(W(\tau )\) must have two distinct members, which contradicts single-valuedness. The same arguments work for sequences of consumer characteristics \((U,e)\). Continuity of \(W\) in producer characteristics \(({\mathcal {A}},\kappa )\) is easy to see: Under Assumption 3, \({\mathcal {A}}\) is represented by \({\varvec{Y}}\), which enters (28) only on the right-hand side while \(\kappa \) does not enter at all.

Since \(\varTheta = \mathrm{graph}(W)\), nonemptiness of \(P^*\) implies that \(P^* = \{W\}\). Thus, it follows from the properties of \(P^*\) that \(W\) must be of class \(C^2\) on some open neighborhood \({\mathcal {N}} \subset {\mathbb {R}}_{++}^K\) of the local maxima of (9). Every local maximum is a maximum of the domain restriction of (9) to some compact subset of \({\mathcal {T}}^k\). Since \({\mathcal {T}}^k\) is bounded, the set of local maxima can be covered by a finite number of such compact sets. Moreover, since the payoff functions

are continuous in \((U,e,{\mathcal {A}},\kappa )\) because \(W\) is, all solution mappings to the domain restricted problems are upper hemicontinuous in \((U,e,{\mathcal {A}},\kappa )\) by Berge’s maximum theorem (see Aliprantis and Border 2006, p. 570, Theorem 17.31). The union of all these solution mappings is the correspondence \(L:\hat{{\mathbb {U}}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K \rightrightarrows {\mathcal {T}}\), which maps economies to the set of local maxima of (9). It is upper hemicontinuous as a finite union of upper hemicontinuous correspondences. Thus, given the open neighborhood \({\mathcal {N}} \subset {\mathbb {R}}_{++}^K\), there is an open set of economies \({\mathcal {W}} \subset \hat{{\mathbb {U}}}^I\times {\mathbb {E}} \times {\mathbb {A}}\times {\mathbb {K}}^K\) such that \(L(w) \subset {\mathcal {N}}\) for any \(w \in {\mathcal {W}}\). Since \(W\) is of class \(C^2\) on \({\mathcal {N}}\), the set \(P^*\) is nonempty for each economy in this open set \({\mathcal {W}}\). \(\square \)

In the economies from Lemma 3, there is at least one consumer without a binding constraint at any locally optimal production level. This consumer is the subject of all utility perturbations, and the perturbed consumer may change from level to level. The following result is a weaker version of Lemma 2 that holds in quasilinear economies.

Lemma 4

Under Assumption 1′, the function \(\tau \mapsto c_{{\varvec{1}}}^*(\tau ,p^*(\tau ))\) is injective.

Proof

Suppose not; then, \(c_{{\varvec{1}}} = c_{{\varvec{1}}}^*(\tau ,p^*(\tau )) =c_{{\varvec{1}}}^*(\hat{\tau },p^*(\hat{\tau }))\) for some \(\tau \ne \hat{\tau }\). However, \(U^i\) is strictly increasing under Assumption 1′, and thus all budget constraints hold with equality. Summing the date 1 budget constraints over all consumers and applying the market clearing condition (8) leads to

but since \(Y\) is homogeneous of degree 1, the only solution to this equation is \(\tau = \hat{\tau }\). \(\square \)

By means of Lemma 4, it is possible to construct a family of bump functions \(\varsigma _m^1,\dots ,\varsigma _m^I\) analogous to the ones used in the Proof of Proposition 2, but with \(c_{{\varvec{1}}}^i\) instead of \(c^i\) as the argument, such that \(\varsigma _m^i(c_{{\varvec{1}}}^i) > 0\) for at most one consumer \(i\) at any \(c_{{\varvec{1}}} =(c_{{\varvec{1}}}^1,\dots ,c_{{\varvec{1}}}^I)\). That is to say, perturbations of different consumers do not interfere. The next result is a direct consequence of Lemma 4 and ensures that there is always at least one candidate for perturbations.

Lemma 5

Let \(c_{{\varvec{1}}}^*(\tau ,p^*(\tau ))\) be continuously differentiable at \(\tau \). Under Assumption 1′, \(d_{\tau }(c_{{\varvec{1}}}^{i*}(\tau ,p^*(\tau )))[\tau ]\) is injective for some consumer \(i\).

Proof

Suppose no such consumer exists; then, \(\tau \mapsto c_{{\varvec{1}}}^{i*}(\tau ,p^*(\tau ))\) is not locally injective for any \(i\). Then, however, \(\tau \mapsto c_{{\varvec{1}}}^{*}(\tau ,p^*(\tau ))\) fails to be locally injective, and therefore cannot be (globally) injective, which contradicts Lemma 4. \(\square \)

The following variant of Theorem 1 holds when Assumption 1 is replaced with Assumption 1'. It establishes generic regularity in quasilinear economies.

Corollary 4

\(\hat{{\mathbb {U}}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) has an open and dense subset of regular economies.

Proof

Let \(\{{\mathcal {W}}_0,{\mathcal {W}}\}\) be a partition of \(\hat{{\mathbb {U}}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\) in which \({\mathcal {W}}_0\) consists of all economies where \(P^*\) is empty. All members of \({\mathcal {W}}_0\) are regular economies because the set of equilibria is empty. This set is closed because its complement \({\mathcal {W}}\) is open by Lemma 3. Provided Corollary 2 holds, the remainder of the Proof of Theorem 1 goes through without modification and establishes that a set \({\mathcal {W}}_{**}\), which consists of regular economies, is open and dense in \({\mathcal {W}}\). As a consequence, \({\mathcal {W}}_{**}\) is also open in the entire space \(\hat{{\mathbb {U}}}^I\times {\mathbb {E}}\times {\mathbb {A}}\times {\mathbb {K}}^K\). There are two possible cases.

Case 1: The topological interior of \({\mathcal {W}}_0\) is nonempty. In this case, \(\mathrm{bdry}({\mathcal {W}}_0)\) is closed and nowhere dense in the space of economies. Recall that \({\mathcal {W}}\backslash {\mathcal {W}}_{**}\) is closed and nowhere dense in \({\mathcal {W}}\) and thus closed and nowhere dense in the space of economies. Thus, the union \(\mathrm{bdry}({\mathcal {W}}_0) \cup {\mathcal {W}}\backslash {\mathcal {W}}_{**}\) is closed and nowhere dense. Its complement is an open and dense set that consists of regular economies.

Case 2: The topological interior of \({\mathcal {W}}_0\) is empty. In this case, \({\mathcal {W}}\) is not only open but also dense. Its subset \({\mathcal {W}}_{**}\) is therefore open and dense in the entire space of economies.

As either case results in an open and dense set of regular economies, Corollary 4 is established once Corollary 2 is shown to hold for the alternative space of economies \(\hat{{\mathbb {U}}}^I\times {\mathbb {E}}\times {\mathbb {A}} \times {\mathbb {K}}^K\). Since \(\hat{{\mathbb {U}}}\) and \({\mathbb {U}}\) share the same metric, it is sufficient to consider a modification of Proposition 2. The perturbed utility functions are now of the form

in which \(\beta _m^i\) is a \(|{\varvec{\varOmega }}|\)-dimensional vector and \({\varvec{\varGamma }}_m^i\) is a \(|{\varvec{\varOmega }}|\times |{\varvec{\varOmega }}|\) matrix. Replace (25) with the first-order condition of a consumer \(i\) whose date 0 consumption constraint is not binding:

Consequently, replace (26) with

in which both matrices have full rank \(K\) under Assumptions 1′ and 3, which is sufficient for the surjectivity of \(d_{\beta _m^i} p_m^*\). Regarding the surjectivity of \(d_{{\varvec{\varGamma }}_m^i} d_{\tau } p_m^*\), replace the two final equations in the Proof of Proposition 2 with

and

Recall that \(Y(\tau )\) has full rank, \({\varvec{G}}\) can be chosen freely, and \(\tau \mapsto c_{{\varvec{1}}}^{i*}(\tau ,p^*(\tau ))\) is nonzero for at least one consumer by Lemma 5. This completes the modification of Proposition 2 and thus the entire proof. \(\square \)

5 Larger space of economies

The main result of this paper, Theorem 1, is derived under an upper bound on endowments: Assumption 2 requires that endowments are contained in some open, bounded set. The effect of this assumption is that all attainable consumption and production plans are contained in compact sets \({\mathcal {X}}\) and \({\mathcal {Y}}\), which turns the space of economies \({\mathbb {U}}^I\times {\mathbb {E}} \times {\mathbb {A}}\times {\mathbb {K}}^K\) into a Banach manifold. This is a consequence of the \(C^s\) compact-open topology when functions are restricted to compact sets. However, the \(C^s\) compact-open topology is also well-defined on noncompact domains, and since genericity is defined as a topological property, the upper bound may seem arbitrary or unnecessary. Indeed, if one is willing to give up the structure of a Banach manifold, generic regularity can also be established if Assumption 2 is replaced with a weaker version:Footnote 7

Assumption 2′

Endowments satisfy \(e \gg 0\).