Abstract

How does the central bank influence interbank lending? The central bank’s policy rates determine the attractiveness of the standing facilities compared with the interbank market. Therefore, by choosing the policy rates the central bank affects the number of banks using the standing facilities and the number of banks using the interbank market. There is also a second channel. The policy rates may influence bank liquidity holding and thus the chances that interbank lending occurs. To address both channels, bank liquidity holding is endogenous in the presented model. The results show that liquidity is not held to insure against idiosyncratic risk but to lend to the interbank market in case counterparty risk is not too high. If banks expect interbank lending to be sufficiently likely and profitable, a smooth liquidity transfer at the interbank market is guaranteed. The central bank can create such a situation under the constraint that counterparty risk is moderate and counterparty risk perceptions are not too distorted. If, however, counterparty risk is perceived to be too large, this may result in liquidity hoarding.

Similar content being viewed by others

Notes

Standing facilities or similar operating procedures are provided among others by the following central banks: Bank of England, Bank of Japan, European Central Bank, Reserve Bank of Australia, Reserve Bank of India, Riksbank, Swiss National Bank, and U.S. Federal Reserve. For a more extensive overview, see Bank for International Settlements (2008). We use the terms that are used by the ECB. For example, the U.S. Federal Reserve uses the term “discount window” instead of “lending facility”.

There are observations that banks borrow from the interbank market at a higher interest rate than they could obtain from the central bank. A common explanation is a “stigma” attached to the lending facility—using the central bank’s standing facility is considered as a sign of weakness and financial troubles. For empirical evidence, see Armantier et al. (2015) or Furfine (2003); for a theoretical model see Ennis and Weinberg (2013).

For an extensive review on overnight interbank markets see Green et al. (2016).

Baltensperger (1980) provides a survey on early literature on this topic.

Neyer and Wiemers (2004) also come to the conclusion that an increase in the marginal lending rate may decrease interbank lending activity but for a different reason: In their model heterogeneity in the opportunity cost of holding collateral yields intermediation: Banks with low opportunity cost borrow from the central bank and distribute this liquidity at the unsecured interbank market to banks with high opportunity cost. Hence, an increase in the marginal lending rate decreases the liquidity supply at interbank markets.

Some studies introduce other kinds of frictions such as aggregate liquidity shocks (Allen et al. 2009), Knightian uncertainty (Pritsker 2013), or participation costs at the interbank market (Hauck and Neyer 2014). Peiris and Vardoulakis (2013) allow for the possibility that agents can choose to default on their loan repayments and show that trade fails if the level of reserves is too low.

Note that \(r_{d}\) denotes the return on bank deposits at the central bank. Interest on household deposits at banks is set to zero without loss of generality.

Assuming that the bank invests an amount \(\alpha _{i}\), the expected return from investing equals \(p_{i}R_{i}\alpha _{i}\), while storing \(\alpha _{i}\) at the central bank from \(t=0\) to \(t=2\) yields \(r_{d}\alpha _{i}\).

One can distinguish between idiosyncratic and aggregate liquidity shocks (see for example Allen et al. 2009). Since the model describes the interbank market at normal times, here, only idiosyncratic liquidity shocks are considered.

Here, we assume that a bank receives a return of \(r_{d}\) for every unit that is stored (at the central bank) from \(t=0\) to \(t=2\) and a return of 1 for every unit stored from \(t=0\) to \(t=1\), only. Alternatively, it could be assumed that uninvested units that are stored from \(t=0\) to \(t=1\) are cash holdings, while the bank has the possibility to use the deposit facility only from \(t=1\) to \(t=2\). This yields exactly the same results. Additionally, we also obtain qualitatively the same results when assuming that the bank obtains the return \(r_{d}\) twice, from \(t=0\) to \(t=1\) and from \(t=1\) to \(t=2\). However, in this case the return per unit invested from \(t=0\) to \(t=2\) is then \(r_{d}^{2}\).

By concentrating on unsecured interbank markets, we take into account the role of counterparty risk but neglect the role of availability, cost and quality of collateral. Unsecured interbank markets are particularly vulnerable to changes in the perceived creditworthiness of counterparties. This will be especially important when considering a crisis scenario (see Sect. 5). Heider and Hoerova (2009) analyze the interrelation between secured and unsecured interbank lending.

The possibility of ex ante contracts where the interbank rate is determined already at \(t=0\) is discussed in Appendix H. The results do not depend on the use of the Nash bargaining solution in a qualitative way; see also Appendix H.

Note that (2) can be negative although banks are protected by limited liability. Here, the crucial assumption is that outstanding liabilities \(\left( 1+\lambda _{i}\right) \) are withdrawn at an uncertain time in the future that is not considered. Hence, at \(t=1\) banks maximize expected profit resulting from decisions and payments made at \(t=1\) and \(t=2\). For situation IV, this corresponds to \(p_{i}\left( \alpha _{i}R_{i}-r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) \right) ^{+}\). We still subtract \(\left( 1+\lambda _{i}\right) \) because outstanding liabilities cannot count as profit. This is not crucial for the bank’s behavior because the bank cannot affect \(\left( 1+\lambda _{i}\right) \). If (2) is negative, this means that the bank goes bankrupt at \(t=2\) or will go bankrupt in the future if it does note take out a loan or makes another investment at a later date, say \(t=3\). We assume that banks do not consider these future dates for their decision making. The assumption keeps analysis tractable because several case distinctions can be avoided. It does, however, not qualitatively change the results. Considering \(\left[ p_{i}\left( \alpha _{i}R_{i}-r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) \right) ^{+}-\left( 1+\lambda _{i}\right) \right] ^{+}\) instead of (2) would yield a smaller upper bound on \(r_{l}\) compared to (3). In all other aspects, we do account for this effect by considering \(p_{i}\left( \alpha _{i}R_{i}-r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) \right) ^{+}\) instead of \(p_{i}\left( \alpha _{i}R_{i}-r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) \right) \). This remarks do also apply for expected profits in situations II and III which are considered below.

The condition \(\alpha _{2}^{*}\in \left[ 0,1\right] \) holds and the radicand in the third case is nonnegative. An explanation is provided in the proof.

Policy rates \(r_{d}\),\(r_{l}\) and success probabilities \(p_{1},p_{2}\) are known at \(t=0\).

References

Allen, F., Carletti, E., Gale, D.: Interbank market liquidity and central bank intervention. J. Monet. Econ. 56(5), 639–652 (2009). https://doi.org/10.1016/j.jmoneco.2009.04.003

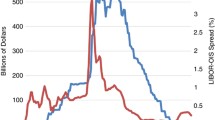

Angelini, P., Nobili, A., Picillo, C.: The interbank market after August 2007: what has changed, and why? J. Money Credit Bank. 43(5), 923–958 (2011). https://doi.org/10.1111/j.1538-4616.2011.00402.x

Armantier, O., Ghysels, E., Sarkar, A., Shrader, J.: Discount window stigma during the 2007–2008 financial crisis. J. Financ. Econ. 118(2), 317–335 (2015). https://doi.org/10.1016/j.jfineco.2015.08.006

Baltensperger, E.: Alternative approaches to the theory of the banking firm. J. Monet. Econ. 6(1), 1–37 (1980). https://doi.org/10.1016/0304-3932(80)90016-1

Bank for International Settlements: MC compendium: monetary policy frameworks and central bank market operations, June 2008. http://www.bis.org/publ/mktc04.htm

Bank of Japan: Functions and operations of the Bank of Japan. Institute for Monetary and Economic Studies (2012). https://www.boj.or.jp/en/about/outline/foboj.htm/

Berentsen, A., Monnet, C.: Monetary policy in a channel system. J. Monet. Econ. 55(6), 1067–1080 (2008). https://doi.org/10.1016/j.jmoneco.2008.07.002

Bindseil, U., Jablecki, J.: The optimal width of the central bank standing facilities corridor and banks’ day-to-day liquidity management. ECB Working Paper, (1350), June 2011. https://ssrn.com/abstract=1852266

Cassola, N., Holthausen, C., Lo Duca, M.: The 2007/2008 turmoil: A challenge for the integration of the Euro area money market? European Central Bank, DG Research, July 2008

Cocco, J.F., Gomes, F.J., Martins, N.C.: Lending relationships in the interbank market. J. Financ. Intermed. 18(1), 24–48 (2009). https://doi.org/10.1016/j.jfi.2008.06.003

Craig, B., von Peter, G.: Interbank tiering and money center banks. J. Financ. Intermed. 23(3), 322–347 (2014). https://doi.org/10.1016/j.jfi.2014.02.003

de Castro, L.I., Chateauneuf, A.: Ambiguity aversion and trade. Econ. Theor. 48(2), 243–273 (2011). https://doi.org/10.1007/s00199-011-0642-6

di Filippo, M., Ranaldo, A., Wrampelmeyer, J.: Unsecured and secured funding. Swiss Institute of Banking and Finance, Working Papers on Finance, (2016/16), August 2016. https://ssrn.com/abstract=2822345

Ennis, H.M., Keister, T.: Optimal bank contracts and financial fragility. Econ. Theor. (2015). https://doi.org/10.1007/s00199-015-0899-2

Ennis, H.M., Weinberg, J.A.: Over-the-counter loans, adverse selection, and stigma in the interbank market. Rev. Econ. Dyn. 16(4), 601–616 (2013). https://doi.org/10.1016/j.red.2012.09.005

European Central Bank: The ECB’s non-standard measures—impact and phasing-out. Monthly Report, pp. 55–70, July 2011a

European Central Bank: The monetary policy of the ECB (2011b)

Federal Reserve Board, U.S.: The Federal Reserve System: Purposes and Functions, 10th edn. Board of Governors of the Federal Reserve System, Washington, DC (2016). https://doi.org/10.17016/0199-9729.10

Freixas, X., Holthausen, C.: Interbank market integration under asymmetric information. Rev. Financ. Stud. 18(2), 459–490 (2004). https://doi.org/10.1093/rfs/hhi001

Freixas, X., Martin, A., Skeie, D.: Bank liquidity, interbank markets, and monetary policy. Rev. Financ. Stud. 24(8), 2656–2692 (2011)

Furfine, C.: Standing facilities and interbank borrowing: evidence from the Federal Reserve’s new discount window. Int. Finance 6(3), 329–347 (2003). https://doi.org/10.1111/j.1367-0271.2003.00121.x

Gabrieli, S., Georg, C.-P.: A network view on interbank liquidity. Working Paper, May 2016. https://ssrn.com/abstract=2797027

Green, C., Bai, Y., Murinde, V., Ngoka, K., Maana, I., Tiriongo, S.: Overnight interbank markets and the determination of the interbank rate: a selective survey. Int. Rev. Financ. Anal. 44, 149–161 (2016). https://doi.org/10.1016/j.irfa.2016.01.014

Hauck, A., Neyer, U.: A model of the Eurosystem’s operational framework and the Euro overnight interbank market. Eur. J. Polit. Econ. 34, 65–82 (2014). https://doi.org/10.1016/j.ejpoleco.2013.06.010

Heider, F., Hoerova, M.: Interbank lending, credit-risk premia and collateral. Int. J. Cent. Bank. 5(4), 5–43 (2009)

Heider, F., Hoerova, M., Holthausen, C.: Liquidity hoarding and interbank market rates: the role of counterparty risk. J. Financ. Econ. 118(2), 336–354 (2015). https://doi.org/10.1016/j.jfineco.2015.07.002

Lagos, R., Rocheteau, G., Weill, P.-O.: Crisis and liquidity in over-the-counter markets. J. Econ. Theory 146(6), 2169–2205 (2011). https://doi.org/10.1016/j.jet.2011.10.001

Martin, A.: Liquidity provision vs. deposit insurance: preventing bank panics without moral hazard. Econ. Theor. 28(1), 197–211 (2006). https://doi.org/10.1007/s00199-005-0613-x

Neyer, U., Wiemers, J.: The influence of a heterogeneous banking sector on the interbank market rate in the Euro area. Swiss J. Econ. Stat. 140(3), 395–428 (2004)

Ozsoylev, H., Werner, J.: Liquidity and asset prices in rational expectations equilibrium with ambiguous information. Econ. Theor. 48(2), 469–491 (2011). https://doi.org/10.1007/s00199-011-0648-0

Peiris, M.U., Vardoulakis, A.P.: Savings and default. Econ. Theor. 54(1), 153–180 (2013). https://doi.org/10.1007/s00199-012-0722-2

Poole, W.: Commercial bank reserve management in a stochastic model: implications for monetary policy. J. Finance 23(5), 769–791 (1968). https://doi.org/10.2307/2325906

Pérez Quirós, G., Rodríguez Mendizábal, H.: Asymmetric standing facilities: an unexploited monetary policy tool. IMF Econ. Rev. 60(1), 43–74 (2012)

Pritsker, M.: Knightian uncertainty and interbank lending. J. Financ. Intermed. 22(1), 85–105 (2013). https://doi.org/10.1016/j.jfi.2012.09.001

Taylor, J.B., Williams, J.C.: A black swan in the money market. Am. Econ. J. Macroecon. 1(1), 58–83 (2009)

Tirole, J.: Overcoming adverse selection: how public intervention can restore market functioning. Am. Econ. Rev. 102(1), 29–59 (2012). https://doi.org/10.1257/aer.102.1.29

Vollmer, U., Wiese, H.: Explaining breakdowns in interbank lending: a bilateral bargaining model. Finance Res. Lett. 11(3), 247–253 (2014). https://doi.org/10.1016/j.frl.2014.02.004

Vollmer, U., Wiese, H.: Central bank standing facilities, counterparty risk and OTC-interbank lending. N. Am. J. Econ. Finance 36, 101–122 (2016). https://doi.org/10.1016/j.najef.2015.12.003

Whitesell, W.: Interest rate corridors and reserves. J. Monet. Econ. 53(6), 1177–1195 (2006). https://doi.org/10.1016/j.jmoneco.2005.03.013

Zappa, P., Zagaglia, P.: Network formation in the Euro interbank market: a longitudinal analysis of the turmoil. Central Bank of Finland seminar series, October 2012

Author information

Authors and Affiliations

Corresponding author

Additional information

The author would like to thank an anonymous referee, Diemo Dietrich, Uwe Vollmer, Harald Wiese, and the participants of the 8th RGS Doctoral Conference in Economics, the Doctoral Seminars at IWH and Leipzig University, and the Annual Congress 2015 of the Swiss Society of Economics and Statistics for helpful comments and suggestions, while retaining responsibility for all errors.

Appendices

Appendix

Proof of Lemma 1

Bank 1 is able to repay the repayment claim in case of a successful investment if

Bank 1 accepts the loan contract if

This yields the condition

Bank 2 accepts the loan contract if

Interbank lending is not taking place if all three conditions (11), (13) and (14) cannot be satisfied at the same time, i.e., if

-

\(\frac{r_{d}}{p_{1}}>\frac{1}{L_{1}}\left( \alpha _{1}R_{1}-r_{l}\left( -1+\alpha _{1}-\lambda _{1}-L_{1}\right) \right) \) and \(r_{l}>\frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}},\) or

-

\(\frac{r_{d}}{p_{1}}>r_{l}\) and \(r_{l}\le \frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}.\)

These conditions are equivalent to

which proves the claim.

Proof of Corollary 1

Denote \(LHS=\frac{r_{d}}{p_{1}}\) and \(RHS=r_{l}-\frac{1}{L_{1}}\left( r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) -\alpha _{1}R_{1}\right) ^{+}\). Note that LHS depends on \(r_{d}\) but not on \(r_{l}\), and RHS depends on \(r_{l}\) but not on \(r_{d}\). LHS is increasing in \(r_{d}\) which proves (a). If \(r_{l}\le \frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}\), then \(RHS=r_{l}\) is increasing in \(r_{l}\) which proves (b1). If \(r_{l}>\frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}\) and \(L_{1}=1-\alpha _{2}+\lambda _{2}\), then \(RHS=r_{l}-r_{l}\frac{-1+\alpha _{1}-\lambda _{1}}{1-\alpha _{2}+\lambda _{2}}+\frac{\alpha _{1}R_{1}}{L_{1}}\) is decreasing in \(r_{l}\) which proves (b2). If \(r_{l}>\frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}\) and \(L_{1}=-1+\alpha _{1}-\lambda _{1}\), then \(RHS=\frac{\alpha _{1}R_{1}}{L_{1}}\) does not depend on \(r_{l}\) which proves (b3).

Proof of Lemma 2

The lemma is proven by case distinction.

-

\(r_{l}\le \frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}:\)

Problem (7) can be described by

$$\begin{aligned} \max _{r_{l}\ge r_{IB}\ge \frac{r_{d}}{p_{1}}}p_{1}L_{1}^{2}\left( r_{l}-r_{IB}\right) \left( p_{1}r_{IB}-r_{d}\right) . \end{aligned}$$Solving this problem yields the interbank rate

$$\begin{aligned} r_{IB}^{*}=\frac{1}{2p_{1}}\left( r_{d}+p_{1}r_{l}\right) . \end{aligned}$$ -

\(r_{l}>\frac{\alpha _{1}R_{1}}{-1+\alpha _{1}-\lambda _{1}}:\)

According to (7), the interbank rate is the solution to

$$\begin{aligned} \max _{r_{IB}}p_{1}\left( \alpha _{1}R_{1}-r_{IB}L_{1}-r_{l}\left( -1+\alpha _{1}-\lambda _{1}-L_{1}\right) \right) \left( p_{1}r_{IB}-r_{d}\right) L_{1} \end{aligned}$$subject to

$$\begin{aligned} \frac{1}{L_{1}}\left( \alpha _{1}R_{1}-r_{l}\left( -1+\alpha _{1}-\lambda _{1}-L_{1}\right) \right) \ge r_{IB}\ge \frac{r_{d}}{p_{1}}. \end{aligned}$$We obtain

$$\begin{aligned} r_{IB}^{*}=\frac{1}{2p_{1}}r_{d}-\frac{1}{2L_{1}}\left( r_{l}\left( -1+\alpha _{1}-\lambda _{1}-L_{1}\right) -\alpha _{1}R_{1}\right) . \end{aligned}$$

Problem (7) is therefore solved by the interbank rate

Proof of Proposition 1

The proof proceeds in the following way: First, banks’ expected profits at \(t=0\) is derived. The second step is the calculation of the best-response functions and liquidity holding in equilibrium.

The expected profit at time \(t=1\) is defined piecewise by

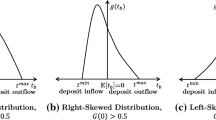

Depending on the liquidity shocks, banks face a different expected profit. The different sections are illustrated in Fig. 2. According to this case distinction, we split the integral

and derive each of the summands separately. Note that \(E^{t=0}\left( \varPi _{i}\wedge II.\right) \) and \(E^{t=0}\left( \varPi _{i}\wedge III.\right) \) can again be split into several summands. For reasons of symmetry, it is sufficient to consider bank 1, only.

-

I.

\(1-\alpha _{i}+\lambda _{i}\ge 0\):

$$\begin{aligned} 4E^{t=0}\left( \varPi _{1}\wedge I.\right) =&\int _{-1+\alpha _{1}}^{1}\int _{-1+\alpha _{2}}^{1}r_{d}\left( 1-\alpha _{1}+\lambda _{1}\right) +p_{1}\alpha _{1}R_{1}\\&-\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1}\\ =&\left( 2-\alpha _{2}\right) \left( 2-\alpha _{1}\right) \left[ r_{d}\left( 1-\frac{1}{2}\alpha _{1}\right) +p_{1}\alpha _{1}R_{1}\right] \\&-\int _{-1+\alpha _{1}}^{1}\int _{-1+\alpha _{2}}^{1}\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1} \end{aligned}$$ -

IV.

\(1-\alpha _{i}+\lambda _{i}<0\):

$$\begin{aligned} 4E^{t=0}\left( \varPi _{1}\wedge IV.\right)= & {} \int _{-1}^{-1+\alpha _{1}}\int _{-1}^{-1+\alpha _{2}}p_{1}\left( \alpha _{1}R_{1}-r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) \right) \\&-\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1}\\= & {} \alpha _{1}^{2}\alpha _{2}p_{1}\left( R_{1}-\frac{r_{l}}{2}\right) -\int _{-1}^{-1+\alpha _{1}}\int _{-1}^{-1+\alpha _{2}}\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1} \end{aligned}$$ -

II.

\(1-\alpha _{1}+\lambda _{1}<0\), \(1-\alpha _{2}+\lambda _{2}\ge 0\):

-

a.

\(r_{l}<\frac{r_{d}}{p_{1}}\):

$$\begin{aligned} 4E^{t=0}\left( \varPi _{1}\wedge II.\wedge a\right)= & {} \int _{-1}^{-1+\alpha _{1}}\int _{-1+\alpha _{2}}^{1}p_{1}\left( \alpha _{1}R_{1}-r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) \right) \\&-\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1}\\= & {} \alpha _{1}^{2}\left( 2-\alpha _{2}\right) p_{1}\left( R_{1}-\frac{r_{l}}{2}\right) \\&-\int _{-1}^{-1+\alpha _{1}}\int _{-1+\alpha _{2}}^{1}\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1} \end{aligned}$$ -

b.

\(r_{l}\ge \frac{r_{d}}{p_{1}}\):

-

II.1.

\(1-\alpha _{2}+\lambda _{2}\ge -1+\alpha _{1}-\lambda _{1}\):

$$\begin{aligned} 4E^{t=0}\left( \varPi _{1}\wedge II.\wedge b\wedge II.1.\right)= & {} \int _{-1}^{-1+\alpha _{1}}\int _{-2+\alpha _{1}+\alpha _{2}-\lambda _{1}}^{1}-\left( 1-\lambda _{1}\right) +p_{1}\left( \alpha _{1}R_{1}\right. \\&\left. -\frac{1}{2p_{1}}\left( r_{d}+p_{1}r_{l}\right) \left( -1+\alpha _{1}-\lambda _{1}\right) \right) \,\,d\lambda _{2}\,d\lambda _{1}\\= & {} p_{1}\alpha _{1}^{2}\left[ R_{1}\left( 2-\frac{1}{2}\alpha _{1}-\alpha _{2}\right) \right. \\&\left. +\frac{1}{2p_{1}}\left( r_{d}+p_{1}r_{l}\right) \left( \frac{1}{3}\alpha _{1}+\frac{1}{2}\alpha _{2}-1\right) \right] \\&-\int _{-1}^{-1+\alpha _{1}}\int _{-2+\alpha _{1}+\alpha _{2}-\lambda _{1}}^{1}\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1} \end{aligned}$$ -

II.2.

\(1-\alpha _{2}+\lambda _{2}<-1+\alpha _{1}-\lambda _{1}\):

$$\begin{aligned}&4E^{t=0}\left( \varPi _{1}\wedge II.\wedge b\wedge II.2.\right) \\&\quad = \int _{-1}^{-1+\alpha _{1}}\int _{-1+\alpha _{2}}^{-2+\alpha _{1}+\alpha _{2}-\lambda _{1}}p_{1}\left( \alpha _{1}R_{1}-r_{l}\left( -2+\alpha _{1}+\alpha _{2}-\lambda _{1}-\lambda _{2}\right) \right. \\&\qquad \left. -\frac{1}{2p_{1}}\left( r_{d}+p_{1}r_{l}\right) \left( 1-\alpha _{2}+\lambda _{2}\right) \right) -\left( 1-\lambda _{1}\right) \,\,d\lambda _{2}\,d\lambda _{1}\\&\quad = \frac{1}{2}p_{1}\alpha _{1}^{3}\left( R_{1}-\frac{1}{6p_{1}}\left( r_{d}+p_{1}r_{l}\right) -\frac{1}{3}r_{l}\right) -\int _{-1}^{-1+\alpha _{1}}\int _{-1+\alpha _{2}}^{-2+\alpha _{1}+\alpha _{2}-\lambda _{1}}\left( 1-\lambda _{1}\right) \text { }d\lambda _{2}\,d\lambda _{1} \end{aligned}$$ -

III.

\(1-\alpha _{1}+\lambda _{1}\ge 0\), \(1-\alpha _{2}+\lambda _{2}<0\):

-

a.

\(r_{l}<\frac{r_{d}}{p_{2}}\):

$$\begin{aligned} 4E^{t=0}\left( \varPi _{1}\wedge III.\wedge a\right)= & {} \int _{-1}^{-1+\alpha _{2}}\int _{-1+\alpha _{1}}^{1}r_{d}\left( 1-\alpha _{1}+\lambda _{1}\right) +p_{1}\alpha _{1}R_{1}\\&-\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2}\\= & {} \alpha _{2}\left( 2-\alpha _{1}\right) \left( r_{d}\left( 1-\frac{1}{2}\alpha _{1}\right) +p_{1}\alpha _{1}R_{1}\right) \\&-\int _{-1}^{-1+\alpha _{2}}\int _{-1+\alpha _{1}}^{1}\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2} \end{aligned}$$ -

b.

\(r_{l}\ge \frac{r_{d}}{p_{2}}\):

-

III.1.

\(1-\alpha _{1}+\lambda _{1}\ge -1+\alpha _{2}-\lambda _{2}\):

$$\begin{aligned}&4E^{t=0}\left( \varPi _{1}\wedge III.\wedge b\wedge III.1.\right) \\&\quad = \int _{-1}^{-1+\alpha _{2}}\int _{-2+\alpha _{1}+\alpha _{2}-\lambda _{2}}^{1}r_{d}\left( 2-\alpha _{1}-\alpha _{2}+\lambda _{1}+\lambda _{2}\right) \\&\qquad +p_{1}\alpha _{1}R_{1}+\frac{1}{2}\left( r_{d}+p_{2}r_{l}\right) \left( -1+\alpha _{2}-\lambda _{2}\right) \\&\qquad -\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2}\\&\quad = \frac{1}{6}r_{d}\alpha _{2}\left( \alpha _{2}^{2}+3\alpha _{1}\alpha _{2}-6\alpha _{2}+3\alpha _{1}^{2}-12\alpha _{1}+12\right) \\&\qquad +p_{1}\alpha _{2}\alpha _{1}R_{1}\left( 2-\frac{1}{2}\alpha _{2}-\alpha _{1}\right) \\&\qquad +\frac{1}{2}\left( r_{d}+p_{2}r_{l}\right) \alpha _{2}^{2}\left( -\frac{1}{3}\alpha _{2}-\frac{1}{2}\alpha _{1}+1\right) \\&\qquad -\int _{-1}^{-1+\alpha _{2}}\int _{-2+\alpha _{1}+\alpha _{2}-\lambda _{2}}^{1}\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2} \end{aligned}$$ -

III.2.

\(1-\alpha _{1}+\lambda _{1}<-1+\alpha _{2}-\lambda _{2}\):

$$\begin{aligned}&4E^{t=0}\left( \varPi _{1}\wedge III.\wedge b\wedge III.2.\right) \\&\quad = \int _{-1}^{-1+\alpha _{2}}\int _{-1+\alpha _{1}}^{-2+\alpha _{1}+\alpha _{2}-\lambda _{2}}\frac{1}{2}\left( r_{d}+p_{2}r_{l}\right) \left( 1-\alpha _{1}+\lambda _{1}\right) \\&\qquad +p_{1}\alpha _{1}R_{1}-\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2}\\&\quad = \frac{1}{2}\alpha _{2}^{2}\left( p_{1}\alpha _{1}R_{1}+\frac{1}{6}\left( r_{d}+p_{2}r_{l}\right) \alpha _{2}\right) \\&\qquad -\int _{-1}^{-1+\alpha _{2}}\int _{-2+\alpha _{1}+\alpha _{2}-\lambda _{2}}^{1}\left( 1-\lambda _{1}\right) \,\,d\lambda _{1}\,d\lambda _{2} \end{aligned}$$

When adding up, four situations need to be distinguished:

-

\(p_{1}r_{l},\,p_{2}r_{l}<r_{d}\):

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} E^{t=0}\left( \varPi _{i}\wedge I.\right) +E^{t=0}\left( \varPi _{i}\wedge II.\wedge a\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge III.\wedge a\right) +E^{t=0}\left( \varPi _{i}\wedge IV.\right) \end{aligned}$$ -

\(p_{1}r_{l}<r_{d}\le p_{2}r_{l}\):

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} E^{t=0}\left( \varPi _{i}\wedge I.\right) +E^{t=0}\left( \varPi _{i}\wedge II.\wedge a\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge III.\wedge b\wedge III.1.\right) +E^{t=0}\left( \varPi _{i}\wedge III.\wedge b\wedge III.2.\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge IV.\right) \end{aligned}$$ -

\(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\):

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} E^{t=0}\left( \varPi _{i}\wedge I.\right) +E^{t=0}\left( \varPi _{i}\wedge II.\wedge b\wedge II.1.\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge II.\wedge b\wedge II.2.\right) +E^{t=0}\left( \varPi _{i}\wedge III.\wedge a\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge IV.\right) \end{aligned}$$ -

\(r_{d}\le p_{1}r_{l},\,p_{2}r_{l}\):

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} E^{t=0}\left( \varPi _{i}\wedge I.\right) +E^{t=0}\left( \varPi _{i}\wedge II.\wedge b\wedge II.1.\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge II.\wedge b\wedge II.2.\right) +E^{t=0}\left( \varPi _{i}\wedge III.\wedge b\wedge III.1.\right) \\&+\,E^{t=0}\left( \varPi _{i}\wedge III.\wedge b\wedge III.2.\right) +E^{t=0}\left( \varPi _{i}\wedge IV.\right) \end{aligned}$$

We obtain expected profit at time \(t=0\):

-

If \(p_{1}r_{l}<r_{d},\,p_{2}r_{l}<r_{d},\)

$$\begin{aligned} E^{t=0}\varPi _{1}=p_{1}\alpha _{1}R_{1}+\frac{1}{4}r_{d}\left( 2-\alpha _{1}\right) ^{2}-\frac{1}{4}p_{1}r_{l}\alpha _{1}^{2}-1. \end{aligned}$$ -

If \(p_{1}r_{l}\ge r_{d}>p_{2}r_{l},\,\)

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) \\&-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{1}^{2}\left( \frac{1}{6}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) . \end{aligned}$$ -

If \(p_{2}r_{l}\ge r_{d}>p_{1}r_{l},\)

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+\frac{1}{4}r_{d}\left( 2-\alpha _{1}\right) ^{2}-\frac{1}{4}p_{1}r_{l}\alpha _{1}^{2}\\&+\left( p_{2}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{2}^{2}\left( 1-\frac{1}{2}\alpha _{1}-\frac{1}{6}\alpha _{2}\right) . \end{aligned}$$ -

If \(p_{1}r_{l}\ge r_{d},p_{2}r_{l}\ge r_{d}\),

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) \\&-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{1}^{2}\left( \frac{1}{6}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) \\&+\left( p_{2}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{2}^{2}\left( 1-\frac{1}{2}\alpha _{1}-\frac{1}{6}\alpha _{2}\right) . \end{aligned}$$A symmetric result holds for bank 2.

Now, the best-response functions and liquidity holding in equilibrium is derived:

-

First, consider \(r_{d}>p_{1}r_{l},\,p_{2}r_{l}\), i.e., there is no interbank lending at \(t=1\). Expected profit at \(t=0\) of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}=p_{1}\alpha _{1}R_{1}+\frac{1}{4}r_{d}\left( 2-\alpha _{1}\right) ^{2}-\frac{1}{4}p_{1}r_{l}\alpha _{1}^{2}-1. \end{aligned}$$To derive the best-response function, we form the derivative with respect to \(\alpha _{1}\)

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}= & {} p_{1}R_{1}-\frac{1}{2}r_{d}\left( 2-\alpha _{1}\right) -\frac{1}{2}p_{1}r_{l}\alpha _{1}\\= & {} p_{1}R_{1}-r_{d}+\frac{1}{2}\alpha _{1}\left( r_{d}-p_{1}r_{l}\right) >0 \end{aligned}$$which yields

$$\begin{aligned} \alpha _{1}^{*}=1. \end{aligned}$$For reasons of symmetry we also get

$$\begin{aligned} \alpha _{2}^{*}=1. \end{aligned}$$ -

Second, consider \(p_{1}r_{l}\ge r_{d}>p_{2}r_{l}\). Expected profit at \(t=0\) of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) \\&-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{1}^{2}\left( \frac{1}{6}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) . \end{aligned}$$Differentiating yields

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}= & {} p_{1}R_{1}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{4}\alpha _{1}\left( \frac{1}{4}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) \\= & {} -\frac{1}{16}\left( p_{1}r_{l}-r_{d}\right) \alpha _{1}^{2}-\frac{1}{4}\left( p_{1}r_{l}-r_{d}\right) \alpha _{1}\left( \frac{1}{2}\alpha _{2}+1\right) \\&+\left( p_{1}R_{1}-r_{d}\right) . \end{aligned}$$If \(p_{1}r_{l}=r_{d},\) the derivative equals \(p_{1}R_{1}-r_{d}>0\), so \(\alpha _{1}^{*}=1\) holds. Otherwise, the derivative describes a quadratic function with two zeros \(\alpha _{1}^{\min }\) and \(\alpha _{1}^{\max }\). Since \(p_{1}r_{l}>r_{d}\), we know from the expected profit function that \(\alpha _{1}^{\min }<\alpha _{1}^{\max }.\) Thus,

$$\begin{aligned} \alpha _{1}^{\min }= & {} -\left( 2+\alpha _{2}\right) -\sqrt{\left( 2+\alpha _{2}\right) ^{2}+16\frac{p_{1}R_{1}-r_{d}}{p_{1}r_{l}-r_{d}}}<0,\\ \alpha _{1}^{\max }= & {} -\left( 2+\alpha _{2}\right) +\sqrt{\left( 2+\alpha _{2}\right) ^{2}+16\frac{p_{1}R_{1}-r_{d}}{p_{1}r_{l}-r_{d}}}. \end{aligned}$$Since \(R_{1}>r_{l}\), we have

$$\begin{aligned} \alpha _{1}^{\max }> & {} -\left( 2+\alpha _{2}\right) +\sqrt{\left( 2+\alpha _{2}\right) ^{2}+16}\\> & {} -\left( 2+\alpha _{2}\right) +\sqrt{\left( 2+\alpha _{2}\right) ^{2}+5+2\alpha _{2}}\\= & {} -\left( 2+\alpha _{2}\right) +\sqrt{\left( 3+\alpha _{2}\right) ^{2}}=1. \end{aligned}$$From the now obtained inequalities \(\alpha _{1}^{\min }<0<1<\alpha _{1}^{\max }\) we know that the expected profit of bank 1 at \(t=0,\ E^{t=0}\varPi _{1},\) must be increasing with respect to \(\alpha _{1}\). Thus,

$$\begin{aligned} \alpha _{1}^{*}=1 \end{aligned}$$holds. For reasons of symmetry we can derive \(\alpha _{2}^{*}\) from the case \(p_{2}r_{l}\ge r_{d}>p_{1}r_{l}\) which is considered next.

-

Consider \(p_{2}r_{l}\ge r_{d}>p_{1}r_{l}\). Expected profit of bank 1 at \(t=0\) is given by

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+\frac{1}{4}r_{d}\left( 2-\alpha _{1}\right) ^{2}-\frac{1}{4}p_{1}r_{l}\alpha _{1}^{2}\\&+\left( p_{2}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{2}^{2}\left( 1-\frac{1}{2}\alpha _{1}-\frac{1}{6}\alpha _{2}\right) \end{aligned}$$which is a quadratic function in \(\alpha _{1}\). Since \(r_{d}>p_{1}r_{l}\), the expected profit is convex in \(\alpha _{1}\) which yields that the share of the funds invested by bank 1 is equal to zero or equal to one. Moreover, for reasons of symmetry we know from the above case that \(\alpha _{2}^{*}=1\). Comparing expected profit at \(\alpha _{1}=0\) and \(\alpha _{1}=1\) yields:

$$\begin{aligned} E^{t=0}\varPi _{1}\left( 0,1\right)= & {} -1+r_{d}+\left( p_{2}r_{l}-r_{d}\right) \frac{5}{48}\\ E^{t=0}\varPi _{1}\left( 1,1\right)= & {} -1+p_{1}R_{1}+\frac{1}{4}\left( r_{d}-p_{1}r_{l}\right) +\frac{1}{24}\left( p_{2}r_{l}-r_{d}\right) . \end{aligned}$$Therefore,

$$\begin{aligned} \alpha _{1}^{*}=\left\{ \begin{array}{cc} 0, &{}\quad 16p_{1}R_{1}-11r_{d}-4p_{1}r_{l}-p_{2}r_{l}<0\\ \left\{ 0,1\right\} , &{}\quad 16p_{1}R_{1}-11r_{d}-4p_{1}r_{l}-p_{2}r_{l}=0\\ 1, &{}\quad 16p_{1}R_{1}-11r_{d}-4p_{1}r_{l}-p_{2}r_{l}>0 \end{array}\right. \end{aligned}$$and

$$\begin{aligned} \alpha _{2}^{*}=1. \end{aligned}$$ -

Last, we have to consider the case \(p_{1}r_{l},\,p_{2}r_{l}\ge r_{d}\). Bank 1 expects the profit

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) \\&-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{1}^{2}\left( \frac{1}{6}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) \\&+\left( p_{2}r_{l}-r_{d}\right) \frac{1}{8}\alpha _{2}^{2}\left( 1-\frac{1}{2}\alpha _{1}-\frac{1}{6}\alpha _{2}\right) . \end{aligned}$$Differentiating with respect to \(\alpha _{1}\) yields

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}= & {} p_{1}R_{1}-r_{d}-\left( p_{2}r_{l}-r_{d}\right) \frac{1}{16}\alpha _{2}^{2}\\&-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{4}\alpha _{1}\left( \frac{1}{4}\alpha _{1}+\frac{1}{2}\alpha _{2}+1\right) . \end{aligned}$$Assume without loss of generality \(p_{1}\ge p_{2}\). Then:

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}\ge & {} p_{1}R_{1}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{4}\left( \frac{1}{4}\alpha _{1}^{2}+\frac{1}{2}\alpha _{1}\alpha _{2}+\alpha _{1}+\frac{1}{4}\alpha _{2}^{2}\right) \\\ge & {} p_{1}R_{1}-r_{d}-\frac{1}{2}\left( p_{1}r_{l}-r_{d}\right) >0 \end{aligned}$$and thus

$$\begin{aligned} \alpha _{1}^{*}=1. \end{aligned}$$Symmetry yields

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{2}}{\partial \alpha _{2}}= & {} p_{2}R_{2}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{16}\alpha _{1}^{2}\\&-\left( p_{2}r_{l}-r_{d}\right) \frac{1}{4}\alpha _{2}\left( \frac{1}{4}\alpha _{2}+\frac{1}{2}\alpha _{1}+1\right) . \end{aligned}$$If \(p_{2}r_{l}=r_{d}\),

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{2}}{\partial \alpha _{2}}=p_{2}R_{2}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{16}\alpha _{1}^{2} \end{aligned}$$and together with \(\alpha _{1}^{*}=1\)

$$\begin{aligned} \alpha _{2}^{*}=\left\{ \begin{array}{cc} 0, &{}\quad 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}<0\\ \left[ 0,1\right] , &{}\quad 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}=0\\ 1, &{}\quad 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}>0. \end{array}\right. \end{aligned}$$Now, consider \(p_{2}r_{l}>r_{d}\). The expected profit of bank 2 at \(t=0\) is a cubical function in \(\alpha _{2}\). We use \(\alpha _{1}^{*}=1\). The first-order condition is equivalent to

$$\begin{aligned} \alpha _{2}^{2}+6\alpha _{2}-16\frac{\left( p_{2}R_{2}-r_{d}\right) }{\left( p_{2}r_{l}-r_{d}\right) }+\frac{\left( p_{1}r_{l}-r_{d}\right) }{\left( p_{2}r_{l}-r_{d}\right) }\overset{!}{=}0. \end{aligned}$$Any solution of the first-order condition is a maximum because

$$\begin{aligned} \frac{\partial ^{2}E^{t=0}\varPi _{2}}{\partial \alpha _{2}^{2}}=-\left( p_{2}r_{l}-r_{d}\right) \frac{1}{4}\left( \frac{1}{2}\alpha _{2}+\frac{3}{2}\right) <0. \end{aligned}$$The profit function has no maximum in \(\left( 0,1\right) \) if

$$\begin{aligned} 9+\frac{1}{p_{2}r_{l}-r_{d}}\left( 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\right) \le 0. \end{aligned}$$In this case the profit function is monotonically decreasing and thus

$$\begin{aligned} \alpha _{2}^{*}=0. \end{aligned}$$Otherwise, the solutions to the first-order condition are given by

$$\begin{aligned} \alpha _{2}^{\min }= & {} -3-\sqrt{9+\frac{1}{p_{2}r_{l}-r_{d}}\left( 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\right) }<0\\ \alpha _{2}^{\max }= & {} -3+\sqrt{9+\frac{1}{p_{2}r_{l}-r_{d}}\left( 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\right) }. \end{aligned}$$We check the conditions for \(\alpha _{2}^{\max }\in \left[ 0,1\right] \) and obtain, with eliminating the redundant inequalities,

$$\begin{aligned} \alpha _{2}^{*}=\left\{ \begin{array}{ll} 0, &{}\quad 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}<0\\ 1, &{}\quad 16p_{2}R_{2}-7p_{2}r_{l}-8r_{d}-p_{1}r_{l}>0\\ \alpha _{2}^{\max }, &{}\quad \text {otherwise} \end{array}\right. \end{aligned}$$which proofs the claim.

Proof of Corollary 2

Since \(\alpha _{2}^{*}=1\) if \(r_{d}>p_{1}r_{l}\), (ii) is clear. Therefore, now concentrate on \(r_{d}\le p_{1}r_{l}\). Note that liquidity holding in equilibrium \(1-\alpha _{2}^{*}\) is increasing and convex in \(r_{l}\) if \(\alpha _{2}^{*}\) is decreasing and concave in \(r_{l}.\)

First, consider the case that liquidity holding of bank 2 in equilibrium is constantly equal to zero if \(r_{d}<p_{2}r_{l}\), i.e.,

A short calculation shows that this condition is equivalent to

Thus, in case equality holds in the above conditions we get

and in case equality does not hold we have \(\alpha _{2}^{*}=1\) if \(p_{2}r_{l}=r_{d}\) which proves the claim.

Second, consider

meaning that liquidity holding is not constantly equal to zero if \(r_{d}<p_{2}r_{l}\). Again the inequality is equivalent to

This immediately yields \(\alpha _{2}^{*}=0\) in case \(r_{d}\ge p_{2}r_{l}\). It remains to be shown that \(\alpha _{2}^{*}\) is decreasing and concave if \(p_{2}r_{l}>r_{d},\,\ 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\ge 0\) and \(16p_{2}R_{2}-8r_{d}-p_{1}r_{l}-7p_{2}r_{l}\le 0\). In this case

The derivative with respect to \(r_{d}\) is given by

The conditions \(16p_{2}R_{2}-8r_{d}-p_{1}r_{l}-7p_{2}r_{l}\le 0\) and \(p_{2}r_{l}>r_{d}\) imply that the numerator and thus the whole derivative is negative. The share of the funds that is invested in equilibrium is monotonically decreasing with respect to \(r_{d}\). We form the second derivative:

and obtain that \(\alpha _{2}^{*}\) is concave with respect to \(r_{d}\).

Proof of Corollary 3

If \(r_{l}\) is small (\(p_{1}r_{l}<r_{d}\)), then \(\alpha _{2}^{*}=1\) and thus liquidity holding is equal to zero. It is therefore sufficient to concentrate on the section \(p_{1}r_{l}\ge r_{d}\).

First, assume that \(\alpha _{2}^{*}\) is constantly equal to zero in case \(p_{2}r_{l}>r_{d},\) i.e.,

A short calculation shows that this condition is equivalent to

Thus, in case equality holds in the above conditions we get

and in case equality does not hold we have \(\alpha _{2}^{*}=0\) if \(p_{2}r_{l}=r_{d}\) which proves the claim.

Second, consider

meaning that liquidity holding is not constantly equal to zero if \(r_{d}<p_{2}r_{l}\). Again the inequality is equivalent to

This immediately yields \(\alpha _{2}^{*}=1\) in case \(r_{d}\ge p_{2}r_{l}\). It remains to be shown that \(\alpha _{2}^{*}\) is decreasing if \(p_{2}r_{l}>r_{d},\,\ 16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\ge 0\) and \(16p_{2}R_{2}-8r_{d}-p_{1}r_{l}-7p_{2}r_{l}\le 0\). In this case we have

The derivative with respect to \(r_{l}\) is given by

The conditions \(16p_{2}R_{2}-15r_{d}-p_{1}r_{l}\ge 0\) and \(p_{2}r_{l}>r_{d}\) imply that the numerator and thus the whole derivative is negative.

Proof of Corollary 4

First, consider changes in \(r_{d}\). If liquidity holding of bank 2 in equilibrium is equal to zero for all \(r_{d}\) satisfying \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\), liquidity holding is constantly equal to zero for all \(r_{d}\) according to Corollary 2. Therefore, it is sufficient to concentrate on the case \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\). A necessary and sufficient condition for liquidity holding being constantly equal to zero for all \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\) is given by

which is equivalent to

Therefore, liquidity holding is constantly equal to zero if \(p_{1}\) and \(p_{2}\) are sufficiently close, meaning that the second summand is not too small.

Second, consider changes in \(r_{l}\). If liquidity holding of bank 2 in equilibrium is equal to zero for all \(r_{l}\) satisfying \(r_{d}<p_{2}r_{l}\le p_{1}r_{l}\), liquidity holding is constantly equal to zero for all \(r_{l}\) according to Corollary 3. Therefore, it is sufficient to concentrate on the case \(r_{d}<p_{2}r_{l}\le p_{1}r_{l}\). A necessary and sufficient condition for liquidity holding being constantly equal to zero is given by

We use \(r_{l}<R_{2}\) and get the condition

Therefore, liquidity holding is constantly equal to zero if \(p_{1}\) and \(p_{2}\) are sufficiently close, meaning that the second summand is not too small.

Robustness check: interbank rate and ex ante contracting

In our model the interbank rate is determined by bilateral bargaining at \(t=1\). More precisely, \(r_{IB}\) is determined by the Nash bargaining solution. While it is consistent with empirical evidence that the interbank rate is determined bilaterally, one may question the use of the Nash bargaining solution. In particular, it is also plausible that the lender makes a “take it or leave it” offer. This yields an interbank rate that maximizes the lender’s expected profit. More generally, the banks’ bargaining power must not necessarily be equal as previously assumed.

Note that Lemma 1 holds also if the Nash bargaining solution is not used. Assume again without loss of generality that bank 1 needs liquidity, \(1-\alpha _{1}+\lambda _{1}<0\), while bank 2 does not, \(1-\alpha _{2}+\lambda _{2}\ge 0\). Any bilateral process that results in an agreement to engage in interbank lending yields an interbank rate satisfying

If \(\frac{r_{d}}{p_{1}}>r_{IB}\) holds, bank 2’s expected return from supplying liquidity at the interbank market, \(p_{1}r_{IB}\), is smaller than bank 2’s expected return from depositing liquidity at the central bank, \(r_{d}\). Hence, bank 2 does not supply liquidity at the interbank market. If \(r_{IB}>r_{l}\) holds, bank 1’s repayment rate for borrowing from the interbank market, \(r_{IB}\), is larger than the repayment rate for borrowing from the central bank, \(r_{l}\), and bank 1 does not demand liquidity from the interbank market. If \(r_{IB}>r_{l}-\frac{1}{L_{1}}\left( r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) -\alpha _{1}R_{1}\right) \) with \(r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) >\alpha _{1}R_{1}\) the de facto interbank rate is still \(r_{l}-\frac{1}{L_{1}}\left( r_{l}\left( -1+\alpha _{1}-\lambda _{1}\right) -\alpha _{1}R_{1}\right) \) because bank 1 is not able to repay a higher amount. Therefore, lending volume on the interbank market between bank 1 and 2 is given by

Assuming that the two banks interact at the interbank market, expected profits are given by (4) and (5), respectively. Hence, the lender’s profit is maximized by the highest possible interbank rate that does not prevent interaction, i.e.,

The borrower’s profit is maximized by the lowest possible interbank rate that does not prevent interaction, \(r_{IB}=\frac{r_{d}}{p_{1}}\). More generally, any interbank rate that does not prevent interaction on the interbank market is given by

for some \(\gamma \in \left[ 0,1\right] \). We show that Proposition 1 and Corollaries 2, 3 and 4 can be transferred to this more general case. The proofs proceed exactly analogous. As before, we assume \(r_{l}<R_{i},i\in \left\{ 1,2\right\} \) which guarantees that bank i’s project can be financed completely through the central bank. Let us start with Proposition 1. If the interbank rate is given by \(\tilde{r}_{IB}\), the equivalent of Proposition 1 is as follows:

Assume\(p_{1}\ge p_{2}\)holds. The bank with the less risky investment holds no liquidity, i.e.,\(\alpha _{1}^{*}=1\). The liquidity holding if the bank with the riskier project can be described in the following way:

- (a):

-

If\(r_{d}>p_{1}r_{l}\ge p_{2}r_{l}\),

$$\begin{aligned} \alpha _{2}^{*}=1. \end{aligned}$$ - (b):

-

If\(p_{1}r_{l}\ge r_{d}>p_{2}r_{l}\),

$$\begin{aligned} \alpha _{2}^{*}={\left\{ \begin{array}{ll} 0, &{} \text {if }8p_{2}R_{2}-\left( 5+\gamma \right) r_{d}-2p_{2}r_{l}-\left( 1-\gamma \right) p_{1}r_{l}<0\\ \left\{ 0,1\right\} , &{} \text {if }8p_{2}R_{2}-\left( 5+\gamma \right) r_{d}-2p_{2}r_{l}-\left( 1-\gamma \right) p_{1}r_{l}=0\\ 1, &{} \text {if }8p_{2}R_{2}-\left( 5+\gamma \right) r_{d}-2p_{2}r_{l}-\left( 1-\gamma \right) p_{1}r_{l}>0 \end{array}\right. } \end{aligned}$$ - (c):

-

If\(p_{1}r_{l}\ge p_{2}r_{l}=r_{d}\),

$$\begin{aligned} \alpha _{2}^{*}={\left\{ \begin{array}{ll} 0, &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}<0,\\ \left[ 0,1\right] , &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}=0,\\ 1, &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}>0. \end{array}\right. } \end{aligned}$$ - (d):

-

If\(p_{1}r_{l}\ge p_{2}r_{l}>r_{d}\),

$$\begin{aligned} \alpha _{2}^{*}={\left\{ \begin{array}{ll} 0, &{} 8p_{2}R_{2}-7r_{d}-p_{1}r_{l}<0,\\ 1, &{} 8p_{2}R_{2}-3r_{d}-p_{1}r_{l}-4p_{2}r_{l}>0,\\ \frac{8p_{2}R_{2}-7r_{d}-p_{1}r_{l}}{4\left( p_{2}r_{l}-r_{d}\right) }, &{} \text {otherwise} \end{array}\right. } \end{aligned}$$for\(\gamma =0\)and

$$\begin{aligned} \alpha _{2}^{*}=\left\{ \begin{array}{l} 0,\qquad \qquad \qquad \ \ 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}<0\\ 1,\qquad \qquad \qquad \ \ 8p_{2}R_{2}-\left( 3+2\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}-\left( 4-\gamma \right) p_{2}r_{l}>0\\ -\frac{2-\gamma }{\gamma }+\sqrt{\frac{\left( 2-\gamma \right) ^{2}}{\gamma ^{2}}+\frac{8}{\gamma }\frac{p_{2}R_{2}-r_{d}}{p_{2}r_{l}-r_{d}}-\frac{1-\gamma }{\gamma }\frac{p_{1}r_{l}-r_{d}}{p_{2}r_{l}-r_{d}}},\,\text {otherwise} \end{array}\right. \end{aligned}$$for\(\gamma \ne 0\).

Proof

We distinguish four different situations

-

1.

\(p_{1}r_{l},p_{2}r_{l}<r_{d}:\) Expected profit of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}=-1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}+\frac{1}{4}\alpha _{1}^{2}\right) -\frac{1}{4}\alpha _{1}^{2}p_{1}r_{l}. \end{aligned}$$Hence, we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}=p_{1}R_{1}-r_{d}+\frac{1}{2}\alpha _{1}\left( r_{d}-p_{1}r_{l}\right) >0 \end{aligned}$$which yields \(\alpha _{1}^{*}=1\) and for reasons of symmetry also \(\alpha _{2}^{*}=1\).

-

2.

\(p_{1}r_{l}\ge r_{d}>p_{2}r_{l}\): Expected profit of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}=-1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) -\left( p_{1}r_{l}-r_{d}\right) \frac{1}{4}\alpha _{1}^{2}\left( \left( 1-\gamma \right) +\gamma \left( \frac{\alpha _{1}}{6}+\frac{\alpha _{2}}{2}\right) \right) . \end{aligned}$$Hence, we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}&=p_{1}R_{1}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \underbrace{\left( \left( 1-\gamma \right) \frac{\alpha _{1}}{2}+\gamma \left( \frac{\alpha _{1}^{2}}{8}+\frac{\alpha _{1}\alpha _{2}}{4}\right) \right) }_{<1}\\&>p_{1}R_{1}-p_{1}r_{l}>0 \end{aligned}$$which yields \(\alpha _{1}^{*}=1\). For reasons of symmetry we can derive \(\alpha _{2}^{*}\) from the case \(p_{2}r_{l}\ge r_{d}>p_{1}r_{l}\) which is considered next.

-

3.

\(p_{2}r_{l}\ge r_{d}>p_{1}r_{l}\): Expected profit of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}= & {} -1+p_{1}\alpha _{1}R_{1}+\frac{r_{d}}{4}\left( 2-\alpha _{1}\right) ^{2}\\&+\,\frac{1-\gamma }{4}\alpha _{2}^{2}\left( \frac{\alpha _{2}}{6}+\frac{\alpha _{1}}{2}-1\right) \left( r_{d}-p_{2}r_{l}\right) -p_{1}r_{l}\frac{\alpha _{1}^{2}}{4}. \end{aligned}$$Hence, we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}=p_{1}R_{1}-\frac{r_{d}}{2}\left( 2-\alpha _{1}\right) +\frac{1-\gamma }{8}\alpha _{2}^{2}\left( r_{d}-p_{2}r_{l}\right) -p_{1}r_{l}\frac{\alpha _{1}}{2} \end{aligned}$$and

$$\begin{aligned} \frac{\partial ^{2}E^{t=0}\varPi _{1}}{\partial \alpha _{1}^{2}}=\frac{1}{2}\left( r_{d}-p_{1}r_{l}\right) >0. \end{aligned}$$The maximum \(\alpha _{1}^{*}\) is either 0 or 1. Using \(\alpha _{2}^{*}=1\) (obtained from the previous case), we get

$$\begin{aligned} E^{t=0}\varPi _{1}\left( 0,1\right)&=-1+r_{d}+\frac{5}{24}\left( 1-\gamma \right) \left( p_{2}r_{l}-r_{d}\right) ,\\ E^{t=0}\varPi _{1}\left( 1,1\right)&=-1+p_{1}R_{1}+\frac{1}{4}\left( r_{d}-p_{1}r_{l}\right) +\frac{1}{12}\left( 1-\gamma \right) \left( p_{2}r_{l}-r_{d}\right) . \end{aligned}$$This yields

$$\begin{aligned} \alpha _{1}^{*}={\left\{ \begin{array}{ll} 0, &{} \text {if }8p_{1}R_{1}-\left( 5+\gamma \right) r_{d}-2p_{1}r_{l}-\left( 1-\gamma \right) p_{2}r_{l}<0,\\ \left\{ 0,1\right\} , &{} \text {if }8p_{1}R_{1}-\left( 5+\gamma \right) r_{d}-2p_{1}r_{l}-\left( 1-\gamma \right) p_{2}r_{l}=0,\\ 1, &{} \text {if }8p_{1}R_{1}-\left( 5+\gamma \right) r_{d}-2p_{1}r_{l}-\left( 1-\gamma \right) p_{2}r_{l}>0. \end{array}\right. } \end{aligned}$$ -

5.

\(p_{1}r_{l},p_{2}r_{l}\ge r_{d}\): Without loss of generality assume \(p_{1}\ge p_{2}\). Expected profit of bank 1 is given by

$$\begin{aligned} E^{t=0}\varPi _{1}=&-1+p_{1}\alpha _{1}R_{1}+r_{d}\left( 1-\alpha _{1}\right) +\left( 1-\gamma \right) \left( r_{d}-p_{1}r_{l}\right) \frac{\alpha _{1}^{2}}{4}\\&+\gamma \left( r_{d}-p_{1}r_{l}\right) \frac{\alpha _{1}^{2}}{4}\left( \frac{\alpha _{1}}{6}+\frac{\alpha _{2}}{2}\right) +\left( p_{2}r_{l}-r_{d}\right) \left( 1-\frac{\alpha _{2}}{6}-\frac{\alpha _{1}}{2}\right) \left( 1-\gamma \right) \frac{\alpha _{2}^{2}}{4}. \end{aligned}$$Hence, we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{1}}{\partial \alpha _{1}}&= p_{1}R_{1}-r_{d}-\left( 1-\gamma \right) \left( p_{1}r_{l}-r_{d}\right) \frac{\alpha _{1}}{2}-\frac{\gamma }{4}\left( \frac{\alpha _{1}^{2}}{2}+\alpha _{1}\alpha _{2}\right) \left( p_{1}r_{l}-r_{d}\right) \\&\quad -\left( p_{2}r_{l}-r_{d}\right) \left( 1-\gamma \right) \frac{\alpha _{2}^{2}}{8}\\&> \left( p_{1}R_{1}-r_{d}\right) -\left( p_{1}r_{l}-r_{d}\right) >0 \end{aligned}$$which yields \(\alpha _{1}^{*}=1\). Using \(\alpha _{1}^{*}=1\), we obtain for bank 2

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{2}}{\partial \alpha _{2}}&= p_{2}R_{2}-r_{d}-\left( 1-\gamma \right) \left( p_{2}r_{l}-r_{d}\right) \frac{\alpha _{2}}{2}-\frac{\gamma }{4}\left( \frac{\alpha _{2}^{2}}{2}+\alpha _{2}\right) \left( p_{2}r_{l}-r_{d}\right) \\&\quad -\left( p_{1}r_{l}-r_{d}\right) \frac{\left( 1-\gamma \right) }{8} \end{aligned}$$and

$$\begin{aligned} \frac{\partial ^{2}E^{t=0}\varPi _{2}}{\partial \alpha _{2}^{2}}=-\frac{\gamma }{4}\left( 1+\alpha _{2}\right) \left( p_{2}r_{l}-r_{d}\right) -\frac{1-\gamma }{2}\left( p_{2}r_{l}-r_{d}\right) <0. \end{aligned}$$If \(p_{2}r_{l}=r_{d}\), we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{2}}{\partial \alpha _{2}}&= p_{2}R_{2}-r_{d}-\left( p_{1}r_{l}-r_{d}\right) \frac{\left( 1-\gamma \right) }{8} \end{aligned}$$and hence

$$\begin{aligned} \alpha _{2}^{*}={\left\{ \begin{array}{ll} 0, &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}<0,\\ \left[ 0,1\right] , &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}=0,\\ 1, &{} 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}>0. \end{array}\right. } \end{aligned}$$If \(p_{2}r_{l}>r_{d}\) and \(\gamma =0\), we have

$$\begin{aligned} \frac{\partial E^{t=0}\varPi _{2}}{\partial \alpha _{2}}=&p_{2}R_{2}-r_{d}-\left( p_{2}r_{l}-r_{d}\right) \frac{\alpha _{2}}{2}-\left( p_{1}r_{l}-r_{d}\right) \frac{1}{8} \end{aligned}$$and hence

$$\begin{aligned} \alpha _{2}^{*}={\left\{ \begin{array}{ll} 0, &{} 8p_{2}R_{2}-7r_{d}-p_{1}r_{l}<0,\\ 1, &{} 8p_{2}R_{2}-3r_{d}-p_{1}r_{l}-4p_{2}r_{l}>0,\\ \frac{8p_{2}R_{2}-7r_{d}-p_{1}r_{l}}{4\left( p_{2}r_{l}-r_{d}\right) }, &{} \text {otherwise}. \end{array}\right. } \end{aligned}$$If otherwise \(p_{2}r_{l}>r_{d}\) and \(\gamma >0\), the first-order condition is given by

$$\begin{aligned} \alpha _{2}^{2}+\alpha _{2}\frac{2\left( 2-\gamma \right) }{\gamma }-\frac{8}{\gamma }\frac{p_{2}R_{2}-r_{d}}{p_{2}r_{l}-r_{d}}+\frac{1-\gamma }{\gamma }\frac{p_{1}r_{l}-r_{d}}{p_{2}r_{l}-r_{d}}=0 \end{aligned}$$This equation has no solution if

$$\begin{aligned} \left( 2-\gamma \right) ^{2}\left( p_{2}r_{l}-r_{d}\right) +\gamma \left[ 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}\right] <0, \end{aligned}$$in this case expected profit is decreasing in \(\alpha _{2}\) and \(\alpha _{2}^{*}=0\). Otherwise, solutions to the first-order condition are given by \(\alpha _{2}^{\min }<\alpha _{2}^{\max }\):

$$\begin{aligned} \alpha _{2}^{\min }&=-\frac{2-\gamma }{\gamma }-\sqrt{\frac{\left( 2-\gamma \right) ^{2}}{\gamma ^{2}}+\frac{8}{\gamma }\frac{p_{2}R_{2}-r_{d}}{p_{2}r_{l}-r_{d}}-\frac{1-\gamma }{\gamma }\frac{p_{1}r_{l}-r_{d}}{p_{2}r_{l}-r_{d}}}<0\\ \alpha _{2}^{\max }&=-\frac{2-\gamma }{\gamma }+\sqrt{\frac{\left( 2-\gamma \right) ^{2}}{\gamma ^{2}}+\frac{8}{\gamma }\frac{p_{2}R_{2}-r_{d}}{p_{2}r_{l}-r_{d}}-\frac{1-\gamma }{\gamma }\frac{p_{1}r_{l}-r_{d}}{p_{2}r_{l}-r_{d}}} \end{aligned}$$We check the conditions for \(\alpha _{2}^{\max }\in \left[ 0,1\right] \) and obtain, with eliminating the redundant inequalities,

$$\begin{aligned} \alpha _{2}^{*}=\left\{ \begin{array}{l} 0,\qquad {\qquad \qquad \ \ }8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}<0\\ 1,\qquad {\qquad \qquad \ \ }8p_{2}R_{2}-\left( 3+2\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}-\left( 4-\gamma \right) p_{2}r_{l}>0\\ -\frac{2-\gamma }{\gamma }-\sqrt{\frac{\left( 2-\gamma \right) ^{2}}{\gamma ^{2}}+\frac{8}{\gamma }\frac{p_{2}R_{2}-r_{d}}{p_{2}r_{l}-r_{d}}-\frac{1-\gamma }{\gamma }\frac{p_{1}r_{l}-r_{d}}{p_{2}r_{l}-r_{d}}},\,\text {otherwise} \end{array}\right. \end{aligned}$$which proves the claim.

\(\square \)

We proceed with proving Corollaries 2, 3 and 4 that can be transferred one to one.

Proof of Corollary 2

Since \(\alpha _{2}^{*}=1\) if \(r_{d}>p_{1}r_{l}\), (ii) is clear. Therefore, concentrate on \(r_{d}\le p_{1}r_{l}\).

First case: \(\alpha _{2}^{*}=1\) for all \(r_{d}<p_{2}r_{l}\), i.e.,

A short calculation shows that this condition is equivalent to

Thus, in case equality holds in the above conditions, we get

and, in case the equality does not hold, we have \(\alpha _{2}^{*}=1\) if \(p_{2}r_{l}=r_{d}\) which proves the claim.

Second case:

Again the inequality is equivalent to

This immediately yields \(\alpha _{2}^{*}=0\) in case \(r_{d}\ge p_{2}r_{l}\). It remains to be shown that \(\alpha _{2}^{*}\) is decreasing and concave if \(p_{2}r_{l}>r_{d},\,\ 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}\ge 0\) and \(8p_{2}R_{2}-\left( 3+2\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}-\left( 4-\gamma \right) p_{2}r_{l}\le 0\). This is easily verified for \(\gamma =0\) as well as for \(\gamma >0\) by considering the first and the second derivative of \(\alpha _{2}^{*}\) with respect to \(r_{d}\). \(\square \)

Proof of Corollary 3

If \(r_{l}\) is small (\(p_{1}r_{l}<r_{d}\)), then \(\alpha _{2}^{*}=1\) and thus liquidity holding is equal to zero. Thus, concentrate on \(p_{1}r_{l}\ge r_{d}\).

First case: \(\alpha _{2}^{*}=0\) for all \(p_{2}r_{l}>r_{d},\) i.e.

This condition is equivalent to

Thus, in case equality holds in the above conditions, we get

and, in case the equality does not hold, we have \(\alpha _{2}^{*}=0\) if \(p_{2}r_{l}=r_{d}\) which proves the claim.

Second case:

Again the inequality is equivalent to

This immediately yields \(\alpha _{2}^{*}=1\) in case \(r_{d}\ge p_{2}r_{l}\). It remains to be shown that \(\alpha _{2}^{*}\) is decreasing if \(p_{2}r_{l}>r_{d},\,\ 8p_{2}R_{2}-\left( 7+\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}\ge 0\) and \(8p_{2}R_{2}-\left( 3+2\gamma \right) r_{d}-\left( 1-\gamma \right) p_{1}r_{l}-\left( 4-\gamma \right) p_{2}r_{l}\le 0\). This is easily verified for \(\gamma =0\) as well as for \(\gamma >0\) by considering the first and the second derivative of \(\alpha _{2}^{*}\) with respect to \(r_{l}\). \(\square \)

Proof of Corollary 4

First, consider changes in \(r_{d}\). If liquidity holding in equilibrium of bank 2 is equal to zero for all \(r_{d}\) satisfying \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\), liquidity holding is constantly equal to zero for all \(r_{d}\) according to Corollary 2. Therefore, it is sufficient to concentrate on the case \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\). A necessary and sufficient condition for liquidity holding being constantly equal to zero for all \(p_{2}r_{l}<r_{d}\le p_{1}r_{l}\) is given by

which is equivalent to

Therefore, liquidity holding is constantly equal to zero if \(p_{1}\) and \(p_{2}\) are sufficiently close, meaning that the second summand is not too small.

Second, consider changes in \(r_{l}\). If liquidity holding in equilibrium of bank 2 is equal to zero for all \(r_{l}\) satisfying \(r_{d}<p_{2}r_{l}\le p_{1}r_{l}\), liquidity holding is constantly equal to zero for all \(r_{l}\) according to Corollary 3. Therefore, it is sufficient to concentrate on the case \(r_{d}<p_{2}r_{l}\le p_{1}r_{l}\). A necessary and sufficient condition for liquidity holding being constantly equal to zero is given by

We use \(r_{l}<R_{2}\) and get the condition

Therefore, liquidity holding is constantly equal to zero if \(p_{1}\) and \(p_{2}\) are sufficiently close, meaning that the second summand is not too small. \(\square \)

Another possibility of extending the model is allowing for ex ante contracts. The idea is that banks agree on an interbank rate at \(t=0\), i.e., before liquidity shocks realize. At \(t=1\) banks decide on interbank lending volumes based on the interbank rate that was fixed at \(t=0\). Note that also ex ante, i.e., at \(t=0\), banks do not agree on an interbank rate larger than \(r_{l}\) or smaller than \(\frac{r_{d}}{p_{i}},i\in \left\{ 1,2\right\} \) because otherwise using the central bank’s lending or deposit facility is more beneficial than using the interbank market.Footnote 17 Since lending volumes are unknown at \(t=0\), banks may ex ante agree on an interbank rate that ex post, i.e., at \(t=1\), is larger than \(r_{l}-\frac{1}{L_{i}}\left( r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) -\alpha _{i}R_{i}\right) ^{+}\) where i denotes the bank that ex post is in need of liquidity and j the bank that ex post has excess liquidity. In this case the lender anticipates that the borrower is not able to repay the full interbank rate and decides on interbank lending at \(t=1\) based on the truncated interbank rate \(r_{l}-\frac{1}{L_{i}}\left( r_{l}\left( -1+\alpha _{i}-\lambda _{i}\right) -\alpha _{i}R_{i}\right) ^{+}\) instead of the interbank rate fixed at \(t=0\). Hence, any interbank rate that banks agree on ex ante is ex post equal to

for some \(\gamma \in \left[ 0,1\right] \). Therefore, introducing ex ante contracts does not change our results. A potential difference between ex ante and ex post interbank contracts is not whether interbank lending takes place or not but the actual value of the interbank rate. For example it could be the case that banks ex ante agree on a lower interbank rate than the interbank rate resulting from ex post bargaining. In this case, the lender is worse off due to the ex ante agreement.

Rights and permissions

About this article

Cite this article

Näther, M. The effect of the central bank’s standing facilities on interbank lending and bank liquidity holding. Econ Theory 68, 537–577 (2019). https://doi.org/10.1007/s00199-018-1134-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-018-1134-8