Abstract

We construct an applied general equilibrium model to account for diverging patterns of the skill premium. Our framework assesses the roles of various factors that affect the demand and supply of skilled and unskilled labor—shifts in the skill composition of the labor supply, changes in the terms of trade and the complementarity between skilled labor and equipment capital in production. We find that increases in relative skilled labor supply due to demographic changes lead to a decline in the skill premium, while equipment capital deepening raises the relative demand for skilled labor, which in turn increases the skill premium. In addition, terms of trade changes lead to the reallocation of resources toward sectors in which countries enjoy comparative advantages. Since our model incorporates multiple factors simultaneously, it can generate either rising or falling skill premium paths. When we parametrize the model to the Baltic states—countries that were similar along many dimensions at the onset of their transition from centrally planned to market-oriented economies—our model can closely account for the diverging patterns of skill premia observed in the Baltics between 1995 and 2008.

Similar content being viewed by others

Notes

Certainly, a dynamic model would be the ideal framework to analyze the effects of physical and capital accumulation on the skill premium. However, as we discuss later, we also want to calibrate our model to conduct numerical simulations to assess the quantitative predictions of our theoretical model. The lack of comparable microdata constrains our analysis to a static one.

The definition of “skill” is not standard in the literature and has been used to denote the occupation, sector, or even tenure of different types of workers. In this article, we follow Goldin and Katz (2008) and Krusell et al. (2000) and use the educational attainment definition of skill: skilled workers are those with tertiary (or college) education, while unskilled workers are those with non-tertiary education.

In Sect. 5.1, we explain in more detail how we construct the capital stock series.

Data are taken from the World Bank’s World Development Indicators database.

The Barro and Lee (2013) database reports statistics in five-year intervals. For the period we analyze, the database provides information for the years 1995, 2000, 2005 and 2010. The values for the year 2008 were calculated by linear interpolation.

A SAM is a record of all the transactions that take place in an economy during a given period of time, typically one year. It provides a snapshot of the structure of production, where the row entries record the receipts of a particular agent and the column entries represent the payments made by the agents. Depending on data availability, it can provide a highly disaggregated level of institutional detail, with different types of firms, various levels of government, households that differ in basic demographic characteristics, and multiple trade partners.

Those data are taken from the WIOD’s SEA, which contain industry-level data on employment, including the number of workers and their educational attainments.

Since the Socio-Economic Accounts only provide the total number of workers, we determine the number of skilled and unskilled workers using the International Labor Organization (ILO) database on employment.

Due to the lack of estimates of sectoral elasticities for the Baltic states, we use the same value for all sectors.

When \(\sigma =\rho \rightarrow 0\), the nested CES component in Eq. (2) becomes a Cobb–Douglas form with no complementarity between capital and skilled labor. We test the implications of that set of values in the sensitivity analysis section.

Auerbach and Kotlikoff (1987) run a robustness check with \(\psi =-\,1.5\), which implies a lower elasticity of substitution of 0.4. We try that case in the sensitivity analysis section, as well as the case of \(\psi \rightarrow 0\), which yields a unit elasticity utility function.

We group “transport equipment,” “ICT equipment” and “other machinery and equipment and weapon system” into a category we call “equipment capital,” and “dwellings” and “other building structures” into a category we label as “structure capital.”

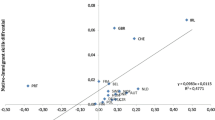

The data suggest that the Baltic states have comparative advantages in sectors that are unskilled intensive. For example, during the 1995–2008 period, sectors such as wood products, textiles, foodstuffs and animal products display values for the revealed comparative advantage (RCA) index that are well in excess of unity, while skill-intensive sectors such as machinery and electrical equipment and transport equipment exhibit RCA values below 1.

References

Auerbach, A., Kotlikoff, L.: Dynamic Fiscal Policy. Cambridge University Press, Cambridge (1987)

Barro, R.J., Lee, J.W.: A new data set of educational attainment in the world, 1950–2010. J. Dev. Econ. 104(C), 184–198 (2013)

Bems, R., Jönsson Hartelius, K.: Trade deficits in the Baltic states: how long will the party last? Rev. Econ. Dyn. 9, 179–209 (2006)

Caselli, F.: Accounting for cross-country income differences. In: Aghion, P., Durlauf, S. (eds.) Handbook of Economic Growth, pp. 679–741. North Holland, Amsterdam (2005)

Eaton, J., Kortum, S.: Technology, geography and trade. Econometrica 70, 1741–1779 (2002)

Ghez, G., Becker, G.: The Allocation of Time and Goods over the Life Cycle. Columbia University Press, New York (1975)

Goldin, C., Katz, L.: The Race Between Education and Technology. The Belknap Press of Harvard University Press, Cambridge (2008)

Griliches, Z.: Capital-skill complementarity. Rev. Econ. Stat. 51, 465–468 (1969)

Hall, R.E., Jones, C.I.: Why do some countries produce so much more output per worker than others? Q. J. Econ. 114, 83–116 (1999)

Katz, L.F., Murphy, K.M.: Changes in relative wages, 1963–1987: supply and demand factors. Q. J. Econ. 107, 35–78 (1992)

Kehoe, T.J., Serra-Puche, J.: A computational general equilibrium model with endogenous unemployment: an analysis of the 1980 fiscal reform in Mexico. J. Public Econ. 22, 1–26 (1983)

Kehoe, T.J.: Social accounting matrices and applied general equilibrium models. Federal Reserve Bank of Minneapolis Working Paper 563 (1996)

Kehoe, T.J., Ruhl, K.J.: Are shocks to the terms of trade shocks to productivity? Rev. Econ. Dyn. 11, 804–819 (2008)

Krusell, P., Ohanian, L., Ríos-Rull, J.V., Violante, G.: Capital-skill complementarity and inequality: a macroeconomic analysis. Econometrica 68, 1029–1053 (2000)

Kurokawa, Y.: A survey of trade and wage inequality: anomalies, resolutions and new trends. J. Econ. Surv. 28, 169–193 (2012)

Parro, F.: Capital-skill complementarity and the skill premium in a quantitative model of trade. Am. Econ. J. Macroecon. 5, 72–117 (2013)

Polgreen, L., Silos, P.: Capital-skill complementarity and inequality: a sensitivity analysis. Rev. Econ. Dyn. 11, 302–313 (2008)

Ripoll, M.: Trade liberalization and the skill premium in developing economies. J. Monet. Econ. 52, 601–619 (2005)

Ruhl, K.J.: The International Elasticity Puzzle. Unpublished Manuscript, University of Texas at Austin (2008)

Simonovska, I., Waugh, M.: The elasticity of trade: estimates and evidence. J. Int. Econ. 92, 34–50 (2014)

Stockman, A.C., Tesar, L.L.: Tastes and technology in a two-country model of the business cycle: explaining international comovements. Am. Econ. Rev. 85, 168–185 (1995)

Toomet, O.: Learn English, not the local language! Ethnic Russians in the Baltic states. Am. Econ. Rev. 101, 526–531 (2011)

Whalley, J.: An evaluation of the Tokyo Round Table Agreement using general equilibrium computational methods. J. Policy Model. 4, 341–361 (1982)

Acknowledgements

We wish to thank the co-editor and two anonymous referees for their thorough revisions and helpful suggestions that significantly improved this article. We also thank seminar participants at the Sydney Macro Reading Group Workshop, the Second World Congress of Comparative Economics, University of Tartu, Stockholm School of Economics in Riga, the Bank of Estonia and the Central Bank of Chile for their comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Sectoral aggregation and skill intensities in 1995

See Table 11.

Appendix 2: Social accounting matrices (1995)

See Fig. 6.

Appendix 3: Calibrated parameters (1995)

Appendix 4: Social accounting matrices (2000)

See Fig. 7.

Appendix 5: Exogenous shocks for numerical experiments

Rights and permissions

About this article

Cite this article

Cho, SW.S., Díaz, J.P. Skill premium divergence: the roles of trade, capital and demographics. Econ Theory 67, 249–283 (2019). https://doi.org/10.1007/s00199-018-1098-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-018-1098-8