Abstract

A large body of literature suggests that consumers derive utility from gains and losses relative to a reference point. This paper shows that such reference dependence can affect savings in opposite directions depending on whether people face liquidity constraints. Existing models for wealth and intertemporal choice predict that reference dependence reduces savings, but these models abstract from liquidity constraints. Introducing a liquidity constraint, I find that reference dependence can increase optimal savings for people without access to credit. Ex post, after reference points have been formed, liquidity constraints force consumers to take part of an income loss in early periods, inducing those who are reference dependent to concentrate the full loss in early periods and save in order to eliminate future losses. Further, anticipating a liquidity constraint raises the expected level of future consumption and thus the expectations-based reference point for future periods, creating an ex-ante savings motive. These findings underscore that it is important to account for financial market imperfections when applying or testing reference-dependent models in low-income settings, and potentially explain heterogeneity in how much the poor save when facing binding liquidity constraints.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Imperfect access to credit hampers the poor’s ability to smooth consumption. Introducing credit can therefore have significant welfare effects (Karlan and Zinman 2011; Banerjee et al. 2015; Angelucci et al. 2015), but quantifying these effects requires a better understanding of the poor’s preferences and behavior (Harrison 2011). Most analyses of intertemporal choice in a context of imperfect credit markets assume that consumption levels determine well-being and that it is optimal to smooth consumption. Violations of consumption smoothing are often explained by reference-dependent behavioral life-cycle models (Shefrin and Thaler 1988), including features of Kahneman and Tversky (1979)’s prospect theory. That is, gains and losses relative to a reference point determine well-being; losses are more painful than gains are pleasant (“loss aversion”); and marginal utility is decreasing in the size of a loss, i.e., utility from losses is convex (“diminishing sensitivity”).Footnote 1

To date, reference-dependent models for wealth and intertemporal choice have largely abstracted from liquidity constraints. It is hence unclear how reference dependence affects savings for the poor, who often do not have access to credit, and how credit impacts their well-being if they indeed do have reference-dependent preferences. This paper fills this gap by introducing a liquidity constraint in existing models for reference-dependent preferences, and I find that reference dependence can have qualitatively different effects depending on whether consumers face liquidity constraints. Compared to the reference-independent optimum, reference dependence reduces savings among those who can borrow, but can increase savings when credit is unavailable. This poses a challenge to applying existing reference-dependent models for wealth and intertemporal choice in low-income settings.

I demonstrate this result using three distinct models that differ in how consumers form their reference points (see Table 1). The first is a standard model for prospect theory in which gains and losses compared to an exogenous reference point determine well-being. In this model, a person compares actual and reference consumption levels, and the reference level can be interpreted in various ways, for instance as a predetermined expectation, a habit, status quo, recent ownership, or consumption level of a social reference group. Although the model is intuitive, it offers the discretion to select any reference point explaining the empirical fact in question. This comes at the cost of many degrees of freedom (Barberis 2013).

The second and third models build on Kőszegi and Rabin (2006, 2009), who postulate that endogenous beliefs held prior to consumption shape the reference point and that updating these beliefs—comparing actual and planned utility in the framework adopted here—influences well-being. By loss aversion, bad news is more painful than good news is pleasant, and by diminishing sensitivity, it is better to receive bad news in one go rather than in bits. A growing literature (e.g., Abeler et al. 2011; Crawford and Meng 2011; Ericson and Fuster 2011) supports these assumptions. Moreover, the model can explain several anomalies in the literature on information preferences and intertemporal choice, in particular why people increase consumption immediately in response to good income news but delay cuts following bad news about their wealth or income (Kőszegi and Rabin 2009).

These models have not been analyzed for consumers with limited access to credit. To assess how missing credit markets and reference dependence interact, I introduce liquidity constraints in each of these models. I consider a setting in which the sole savings motive for reference-independent people is to smooth consumption, meaning that reference-independent consumers save when present income is higher than future income, and either borrow (if unconstrained) or live hand-to-mouth (if liquidity-constrained) when present income is lower.Footnote 2 My main finding is that reference-dependent savings are often higher in the face of liquidity constraints, even though unconstrained savings are unambiguously lower than the reference-independent optimum.

Depending on the model used, this asymmetry is driven by either an ex-post effect of liquidity constraints on feasible savings levels or an ex-ante effect of liquidity constraints on expected consumption. As such, liquidity constraints shape the reference point and indirectly affect behavior.

Ex post, when income is below the reference point in both early and future periods, reference-dependent consumers prefer to borrow and avoid early losses, reducing optimal savings compared to the reference-independent optimum, but this is not viable in the presence of a binding liquidity constraint. By diminishing sensitivity, i.e., convex loss utility, their second-best option is to take the full loss immediately and save to eliminate future losses, increasing optimal savings. Instead of receiving bad news regarding both present and future consumption, the consumer cuts present consumption and receives bad news in one go. Expectations regarding future consumption hence turn into an aspiration to save and maintain future consumption at the planned level. This ex-post mechanism is observed independent of whether the reference point is exogenous or endogenous, as long as diminishing sensitivity is satisfied.

Ex ante, in the model with endogenous reference points, the mere anticipation of a binding liquidity constraint will affect expected consumption and hence the expectations-based reference point. When income is lower in early periods than in future periods, liquidity-constrained people cannot smooth perfectly. They expect higher consumption in future periods, increasing their reference level and thus the marginal utility from future consumption. As a result, when income in early periods turns out not to be too bad, a loss-averse consumer may prefer to save even if reference-independent models predict hand-to-mouth consumption. This aspirations-based savings motive can be observed even when diminishing sensitivity is not satisfied.

This paper contributes by highlighting two novel savings motives from interacting reference dependence and liquidity constraints. The literatures on intertemporal choice in imperfect credit markets and reference dependence have been fairly separated. The finding that liquidity constraints alter how reference dependence influences behavior is relevant for empirical studies aiming to identify such preferences outside the laboratory (see Camerer 2004; Barberis 2013 for reviews). So far, these studies have not considered how missing credit markets may confound estimates of loss aversion and diminishing sensitivity. I show that for people without access to credit markets, reference dependence can affect savings qualitatively different from what we would expect on the basis of existing models. Moreover, if consumers act in line with the framework presented here, introducing credit will have different behavioral effects and welfare implications than previously assumed.

The paper is organized as follows. The next section analyzes the model with exogenous reference points. Section 3 introduces a liquidity constraint into Kőszegi and Rabin (2009), a model with endogenous reference points, loss aversion, and diminishing sensitivity, and examines how savings respond to unanticipated income shocks. Using a similar framework but without diminishing sensitivity, Sect. 4 studies savings for loss-averse consumers who know that income is stochastic when forming their beliefs. Section 5 discusses limitations and economic implications of the models I presented. Section 6 concludes.

2 Case I: Exogenous reference points

2.1 Model for intertemporal choice with exogenous reference points

First consider a framework with exogenous reference points. This tractable model illustrates how reference dependence may increase savings in the presence of a liquidity constraint ex post: When a liquidity constraint prevents consumers from delaying losses to future periods, it is optimal to concentrate losses in the present and eliminate future losses.

The model includes two periods \(t\in \{1,2\}\): the present, \(t=1\), and the future, \(t=2\). In period t, a person earns deterministic income \(w_t\), summarized in a \(2\times 1\)-vector \(\mathbf {w}\equiv \{w_1,w_2\}\). The person chooses how much to consume in the present, \(c_1\), and how much to save, \(w_1 - c_1\). To stay close to the literature on savings and liquidity constraints, the savings technology is a risk-free buffer stock with zero returns, for instance savings in the home, an informal savings group, or a zero-interest rate bank account.Footnote 3 By a regular budget constraint, the person consumes her savings and \(w_2\) in the future, \(c_2 = w_1+w_2 - c_1\). To reflect the stylized fact that the poor often lack access to formal credit and are unable to borrow, the person faces a liquidity constraint, \(c_1 \le w_{1}\).Footnote 4

Preferences are reference dependent, meaning that the person does not derive utility from consumption \(c_t\), but from gains and losses compared to a reference point \(r > 0\).Footnote 5 Consumption \(c_t \ge r\) entails a gain. Lower consumption is considered a loss. Let \(\mu (x)\) be the utility from a gain or loss, \(x = c-r\). A reference-dependent person optimizes lifetime utility \(U(c_1;\mathbf {w}, r)\):

where \(c^D_1(\mathbf {w}, r)\) represents optimal consumption given income \(\mathbf {w}\) and a reference point r, and gain–loss utility \(\mu (x)\) is the standard value function often used in prospect theory. Figure 1 draws an example. Gain–loss utility is defined for all \(x > -r\), continuous for all x, twice differentiable for all \(x\ne 0\), and \(\mu (0)\) is normalized to zero, \(\mu (0)=0\). In addition, drawing on Bowman et al. (1999), I assume that it satisfies the following properties:

(A1) | Monotonicity | \(\mu (x)\) is strictly increasing |

(A2) | Loss aversion over small stakes | \(\lim _{x \downarrow 0} \mu '(-x)/\mu '(x) \equiv \lambda > 1\) |

(A3) | Diminishing sensitivity | \(\mu ''(x) < 0 < \mu ''(-x)\) for all \(x > 0\) |

(A4) | Loss aversion over large stakes | \(\mu '(-r) > \mu '(0^+) \) |

Assumption (A1) says that increasing a gain (or reducing a loss) increases well-being and reducing a gain (increasing a loss) reduces well-being.

Assumption (A2) implies loss aversion over small stakes, meaning that a small loss is more painful than a small gain is pleasant. By loss aversion, gain–loss utility exhibits a kink at the reference point, explaining for instance why people prefer a lottery with an even chance of earning $0 or $50 above a safe option yielding $20 with certainty, while also preferring a safe option yielding $0 with certainty above a lottery in which they either lose $20 or gain $30. The two choices are identical in terms of final outcomes, but the second choice frames the worst outcome as a loss, inducing a preference for the safer option.

Assumption (A3) implies diminishing sensitivity, meaning that an additional gain is less pleasant as more has already been gained, and an additional loss hurts less as more is lost. Intuitively, under diminishing sensitivity, people can be risk averse when choosing between a safe option yielding $25 with certainty and a lottery with an even chance of winning either $0 or $50, but become risk-seeking when choosing between a certain loss of $25 and a gamble with an even chance of losing either $50 or $0. This reflection effect requires the marginal value of gains and losses to decrease in size. In other words, gain–loss utility is convex–concave around the reference point, as in Fig. 1.

Assumption (A3) by itself could imply that a person prefers increasing an already big loss at the benefit of incurring a small gain. Because choice experiments do not always find evidence of convex loss utility (e.g., Levy and Levy 2002) and some of the evidence for convex loss utility results from non-incentivized decisions (Laury and Holt 2008), I specify Assumption (A4), stating that a consumer prefers reducing a loss—which is at most r—above increasing a gain—which is at least \(0^+\). As a result, loss aversion dominates behavior in trade-offs involving both gains and losses, while the convexity of loss utility shapes behavior only in trade-offs involving a sure loss.Footnote 6

On a final note, the model abstracts from discounting. This improves tractability without major implications, but leaves a few cases in which the consumer is indifferent between consuming either \(c_1 = \omega \) and \(c_2 = \nu \), or \(c_1 = \nu \) and \(c_2 = \omega \), whereby \(\omega \ne \nu \). When both these solutions optimize utility, a person prefers the solution that maximizes consumption in the first period, similar to a model in which period 2 consumption is discounted by a factor \(\beta \in (0,1)\):

2.2 Solution of the model with an exogenous reference point

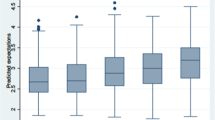

This section analyzes how the reference-dependent optimum and reference-independent optimum differ in a context of missing credit markets. Figure 2 summarizes optimal consumption in the present, \(c^*_1\), as a function of income on hand, \(w_1\). The solid line indicates reference-dependent consumption. As a benchmark, the dashed line indicates the reference-independent optimum, replacing \(\mu (c-r)\) with a strictly increasing concave utility function m(c).

When preferences are reference-independent (“I”), the sole savings motive is to smooth consumption. Consumers prefer to smooth perfectly, \(c_1 = c_2 \). However, when \(w_1 < w_2\), this entails borrowing, which is not possible in the presence of a liquidity constraint. By concavity, the feasible optimum is to consume income on hand, \(w_1\), resulting in piecewise linear consumption:

Reference-dependent (“D”) savings depend on a person’s ability to eliminate losses. When the reference point equals future income, \(r=w_2\), as in Panel (a) in Fig. 2, consuming \(c_1 \le w_1\) in the present and \(c_2 \ge w_2\) in the future is sufficient to avoid a future loss. Substituting \(r = w_2\), Problem (1) reduces to

where \(c_1 - w_2\) entails a present gain or loss, and \(c_2 - w_2 = w_1 - c_1 \ge 0\) a future gain. The solution only depends on income. When present income is relatively low, \(w_1 < w_2\), the liquidity constraint restricts \(c_1\) to a level below the reference point \(w_2\), while \(c_2\) is at or above \(w_2\). The person is forced to take a present loss and a future gain. Due to loss aversion, it is optimal to minimize the present loss and consume present income, \(c_1=w_1\). When present income is relatively high, \(w_1 \ge w_2\), the liquidity constraint does not bind. A loss-averse person avoids a loss in both periods, \(c_1 \in [w_2,w_1]\). In this range, life-cycle utility is concave and it is optimal to smooth gains, \(c_1=\bar{w}\), so that the reference-dependent optimum and reference-independent optimum are observationally equivalent:

This result hinges upon future income being equal to the reference point, \(w_2 = r\), ruling out losses in the future period. In Panel (b), future income is lower, \(w_2 = r - \delta < r\), and the consumer needs to save at least \(\delta > 0\) to avoid a future loss. Problem (1) can now be written as:

In this case, the solution depends on the gap between future income and the reference point, \(\delta \). Panel (b) in Fig. 2 distinguishes four cases differing in whether a person avoids present or future losses. When \(w_1 < \delta \), the consumer cannot avoid a loss in either period so that lifetime utility is convex. The optimum is a corner solution in which the loss is concentrated in one period and minimized in the other period. In other words, it is optimal to consume all wealth in one period and zero in the other, and as the liquidity constraint prevents the person from consuming all wealth in the present, it is optimal to take the full loss in the present, \(c_1 = 0\).Footnote 7 Instead of interpreting this as starvation, the model may apply to a context of narrow bracketing, with consumers making reference-dependent decisions regarding more disposable income sources. When \(w_1 \in [\delta , r)\), the person cannot avoid an early loss, since present income is still below the reference point. However, she can now avoid a future loss by saving at least \(\delta \). Due to loss aversion over large stakes, Assumption (A4), the person will not save more than \(\delta \), as this would entail a future gain at the expense of a present loss. By diminishing sensitivity, Assumption (A3), she will also not save less than \(\delta \), since it is optimal to take the full loss in one period. As a result, the solution is to save \(\delta \) in order to eliminate the future loss and consume \(c_1 = w_1 - \delta \) in the present period.

When present income is at least as high as the reference point, \(w_1 \in [r, r + \delta )\), it is possible to eliminate either the present loss and consume \(c_1 = r\), or the future loss and consume \(c_1 = w_1 - \delta \). Both options yield equal life-cycle utility and optimize the objective function. By Condition (2), the consumer prefers the solution with the highest level and consumption jumps from \(c_1 = w_1 - \delta \) to \(c_1 = r\).Footnote 8 Thus, the liquidity constraint no longer binds.

When present income is even higher and satisfies \(w_1 - \delta \ge w_2 + \delta \), it is possible to avoid losses in both periods. By diminishing sensitivity, utility for gains is concave, and the solution will satisfy a first-order condition such that the present gain, \(c_1 - w_2 - \delta \), equals the future gain, \(w_1 - \delta - c_1\). This means that optimal consumption is equivalent to the reference-independent solution, \(c_1 = \bar{w}\).Footnote 9 Summarizing, if future income is below the reference point, reference-dependent consumption becomes:

To conclude, reference dependence does not affect optimal savings when future income is sufficiently high to avoid future losses, as in Panel (a). By contrast, when future income is insufficient to avoid future losses, as in Panel (b), reference dependence affects decisions differently depending on whether consumers face a binding liquidity constraint. A person with relatively high income, \(w_1 \in [r,r+\delta )\), does not face a binding liquidity constraint and can postpone taking the full loss to the future. Thus, she saves less than reference-independent consumers. A person with low income on hand, \(w_1 < r\), is forced to take part of the loss in the early period, so that it is optimal to concentrate the loss in that period and save more than reference-independent consumers. In this way, liquidity constraints and reference dependence can interact ex post after reference points have been formed.

2.3 Discussion of the model with exogenous reference points

The model with exogenous reference points illustrates an ex-post mechanism through which a binding liquidity constraint affects reference-dependent savings. To interpret this mechanism, it is important to specify how people form their reference point. Previous literature on reference-dependent savings has hypothesized that the reference point is determined by changes in wealth (Kahneman and Tversky 1979), by past consumption levels that lead to habit formation (Bowman et al. 1999), by a comparison with neighbors’ or the society’s consumption, creating a preference for “keeping up with the Joneses,” or by rational expectations of consumption (Kőszegi and Rabin 2006).

The findings presented above can be interpreted in terms of each of these alternative specifications. For instance, if reference points are shaped by average consumption in the society, low income might induce a person to save in the early period in order to catch up with others in the future. Alternatively, in the presence of habit formation, someone may get used to a consumption level that is no longer affordable given her present income. Diminishing sensitivity can motivate this person to reduce present consumption below the reference point, and save to return to her habits in the future. Finally, when expected consumption determines the reference point and present income is lower than anticipated, a person may prefer to cut present consumption and save enough to consume expected levels in the future.

It is nevertheless difficult to empirically test this framework. Without specifying a unique reference point, the model can explain any consumption pattern simply by adjusting the reference point to match observed behaviors. More sophisticated models specify how the reference point is being formed, reducing the degrees of freedom. Another weakness is that consumption levels do not matter at all in this framework. It is plausible that consumers facing extreme losses do pay attention to consumption levels, while consumers facing gains or moderate losses are concerned with changes relative to reference levels. The remainder of this paper addresses these two issues.

3 Case II: Endogenous reference points and deterministic income

3.1 Model for intertemporal choice with expectations-based reference points

The last decade has seen substantial progress in modeling reference dependence, one example being the Kőszegi and Rabin (2009) framework for wealth and intertemporal choice (henceforth KR). This framework builds on Kőszegi and Rabin (2006), a model for reference-dependent preferences that is labeled a “significant attempt to clarify how people think about gains and losses, ... both disciplined and portable across different contexts” (Barberis 2013). KR specify expectations prior to consumption, i.e., consumption plans, as the reference point, and model how consumers make these plans. This yields a unique reference point, eliminating the degrees of freedom that hampered applications of prospect theory outside the laboratory.

This section introduces a liquidity constraint in a deterministic application of the KR framework with two periods. Consumers form beliefs regarding both present and future consumption, assuming they have perfect foresight of income and consumption, and derive gain–loss utility from comparing actual and planned consumption paths. Specifically, the consumer believes her income will be \(\mathbf {w}=(w_1,w_2)\). The anticipated—or planned—consumption path given these income levels, defined as \(\mathbf {b}=(b_1,b_2)\), serves as a reference point for actual consumption, \(\mathbf {c} = (c_1,c_2)\).

The theory makes three key assumptions. To start, not only gains and losses but also consumption levels affect well-being, so that instantaneous utility in period t can be written as follows:

Instantaneous utility includes consumption utility m(c), which is increasing and concave, and \(\mu (x)\), a standard gain–loss utility function satisfying Assumptions (A1)–(A4), with \(\gamma _t\) defined as the weight on period t gain–loss utility. Gain–loss utility is derived from information or news regarding consumption, i.e., from changes between actual and planned consumption utility, \(m(c) - m(b)\). Using a first-order Taylor expansion, small gains and losses reduce to \(m'(b)(c-b)\) and \(m'(c)(b-c)\), respectively. As a result, gains and losses can be interpreted in relative rather than absolute terms. This is an important difference with the previous section.

A second assumption is that rational expectations (or, with deterministic income, anticipated levels) of consumption serve as a reference point. More precise, two mechanisms jointly determine a consumption plan \(\mathbf {b}\): First, consumers only make plans to which they can commit. In other words, given an income path and associated consumption plan, actual consumption \(\mathbf {c}^D(\mathbf {w};\mathbf {b})\) satisfies an equilibrium condition \(\mathbf {c}^D(\mathbf {w};\mathbf {b})=\mathbf {b}\). Plans satisfying these criteria are labeled a “personal equilibrium.” Second, out of all personal equilibria, the consumer chooses the plan that optimizes utility ex-ante. This so-called preferred personal equilibrium provides a unique reference point. “Appendix 1” discusses the formation of plans in more detail.

A final assumption is that news regarding present consumption resonates more than news affecting future consumption. In other words, changing beliefs regarding present consumption carries a higher weight than changing beliefs regarding future consumption:

Normalizing the weight on present gains and losses to one, \(\gamma _1=1\), the weight attached to prospective gains and losses becomes \(\gamma _2=\gamma \).

Using these building blocks, a consumer solves the following problem:

At \(t=1\), the consumer decides how much to consume in both periods, given her income and the associated consumption plan. She optimizes the sum of instantaneous utilities subject to a liquidity constraint, \(c_1 \le w_1\), and a regular budget constraint, \(c_1 + c_2 = w_1+w_2\).

I specify three additional conditions to pose more structure on instantaneous utility \(u(c_t;b_t,\gamma _t)\):

(C1) | Intertemporal loss aversion | \(\gamma \lambda > 1\) |

(C2) | Declining diminishing sensitivity | \(\mu '''(x)\mu '(x) \ge \mu ''(x)^2\) for all \(x < 0\) |

(C3) | Strong decreasing absolute risk aversion | \(A'(c) \le -A(c)^2 < 0\),\(A(c) \equiv -m''(c)/m'(c)\). |

Condition (C1) says that future losses carry a higher marginal utility weight than present gains, \(\gamma \lambda >1\), where \(\lambda \) is the loss aversion parameter defined in Assumption (A2). Such “intertemporal loss aversion” means that future losses are more painful than present gains are pleasant. “Appendix 1” shows that as a result of this condition, the endogenous consumption plan, \(\mathbf {b}\), is equivalent to the reference-independent optimum:

Kőszegi and Rabin (2009) derive a similar result for the case without liquidity constraints. In the absence of intertemporal loss aversion, \(\gamma \lambda < 1\), someone planning to smooth consumption has an incentive to surprise herself with an immediate gain at the expense of a future loss. Without binding liquidity constraint, the endogenous plan is hence to consume more in the present than in the future. Condition (C1) allows analyzing how a reference-dependent consumer who planned for the reference-independent optimum responds to unanticipated income shocks.

Because instantaneous utility now includes concave consumption utility, it is not strictly convex in losses \(c < b\). Conditions (C2) and (C3) help ensure that instantaneous utility is convex only for losses that are small relative to consumption. If gain–loss utility was strictly concave, Condition (C2) would imply non-increasing absolute risk aversion. For convex–concave utility, this condition means that the degree of diminishing sensitivity, \(|\mu ''(x)|/\mu '(x)\), does not increase in the size of a gain or loss |x|. Condition (C3) means that the Arrow–Pratt coefficient of absolute risk aversion for consumption utility decreases at a relatively high rate compared to how risk averse the consumer is. This requires decreasing absolute risk aversion (DARA) from relatively low levels of absolute risk aversion.Footnote 10

As a result, when losses are small and consumption is high, diminishing sensitivity of gain–loss utility is strong relative to the concavity of consumption utility, making instantaneous utility convex. By contrast, when losses are large and consumption is low, instantaneous utility will be concave. The following Lemma formalizes this claim:

Lemma 1

Assume a loss \(L < 0\) exists such that \(DS(L)=A(c)/m'(c)\), where \(DS(x) \equiv \gamma |\mu ''(x)| / (1+\gamma \mu '(x))\) and \(A(c)\equiv -m''(c)/m'(c)\). If Conditions (C2) and (C3) hold, then instantaneous utility is convex for all \(x \in (L,0)\).

For a proof, see “Appendix 2.” Intuitively, instantaneous utility is convex when diminishing sensitivity, i.e., the preference to concentrate losses, dominates absolute risk aversion, i.e., the preference to smooth consumption. This will be the case when losses are sufficiently small, \(x \in (L,0)\). If losses are more extreme, absolute risk aversion A(c) will dominate the reduced degree of diminishing sensitivity DS(x), yielding concave instantaneous utility. As a result, binging consumption into one period is never optimal.

As an example, consider the case with log consumption utility, \(m(c) = \log (c)\), so that we can interpret small gains and losses as the relative change in consumption, with \(m(c)-m(b) \approx (c-b)/b\) for a gain \(c>b\), and \(m(b)-m(c) \approx (b-c)/c\) for a loss \(c<b\). Further, consider the commonly used gain–loss utility function \(\mu (x) = \eta x^{\theta }\) for \(x \ge 0\) and \(\mu (x) = -\eta \lambda (-x)^{\theta }\) for \(x < 0\), where \(\eta \) is the weight of gain–loss utility relative to consumption utility. With parameters \(\eta =10\), \(\gamma =1\), \(\theta = 0.88\), and \(\lambda =2.25\) (the latter two based on estimates from Tversky and Kahneman 1992), utility is convex for all losses such that the planned level is at most 11.5 % above actual consumption, \(-x < L \approx 0.115\).

Alternatively, consider exponential gain–loss utility, \(\mu (x) = \eta (1-e^{-\theta x})/\theta \) for \(x \ge 0\) and \(\mu (x) = -\eta \lambda (1-e^{\theta x})/\theta \) for \(x < 0\). For this specific example, the maximum loss at which utility is convex has an explicit expression:Footnote 11

With parameters \(\eta =10\), \(\gamma =1\), \(\theta = 1.05\), and \(\lambda =2.25\), utility is convex for all losses such that the planned level is at most 11.2 % above actual consumption, \(-x < L \approx 0.112\). Thus, at reasonable parameter values, instantaneous utility is convex for a substantial range of losses.

3.2 Response to unanticipated income shocks

This section analyzes how within this framework exogenous income shocks affect intertemporal choice. By Condition (C1), intertemporal loss aversion is satisfied, and planned consumption equals the reference-independent optimum. Shocks induce consumers to revise their plan. Kőszegi and Rabin (2009) show that they do so in an asymmetric way. Consumers facing income losses prefer not to cut present spending but spend income gains immediately. This reduces savings compared to the reference-independent optimum. However, KR do not consider the existence of a liquidity constraint in their analyses.

To analyze how a liquidity constraint can influence the response to unanticipated income shocks, consider a consumer who plans to earn \(\mathbf {w}=(w_1,w_2)\) but learns that her earnings will be \(\mathbf {w}'=(w'_1,w_2)\), with \(w'_1 \ne w_1\). The reference-independent optimum is to smooth consumption unless the liquidity constraint is binding, \(w'_1 < w_2\), preventing perfect smoothing. In that case, the feasible optimum is \(w'_1\). Thus,

By contrast, the reference-dependent optimum depends on the prior consumption plan, which is the reference-independent optimum given the anticipated income path, \(\mathbf {c}^I(\mathbf {w})\), under Condition (C1). The revised plan does not need to satisfy the personal equilibrium conditions and solves:

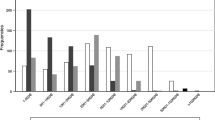

Figure 3 presents the solution to this problem, illustrating revised consumption in the first period as a function of actual income on hand. The figure distinguishes between the reference-independent case—the solid line—and the reference-dependent case, with varying weights attached to prospective gain–loss utility—the dashed and dotted lines.

Consumption and early income after surprise income shocks. a Income believed to be relatively high in the early period: \(w_1 > w_2\). b Income believed to be relatively low in the early period: \(w_1 <w_2 \). The figure draws the solution to Problem (8)–(9) using \(\mu (x)=\eta x^{\theta }\) for utility from gains, \(x\ge 0\); \(\mu (x) = -\eta \lambda (-x)^{\theta }\) for gain–loss utility from losses, \(x < 0\); with \(x=m(c)-m(b)\), \(m(c)= \log (c)\) and \(m(b)=\log (b)\). Income is \(w_1 = 52\) and \(w_2 = 48\) in a, and \(w_1 = 48\) and \(w_2 = 52\) in b. Parameter values are \(\eta =10\), \(\lambda = 2.25\), and \(\theta =0.88\)

The figure distinguishes two mechanisms through which reference dependence may increase savings under liquidity constraints. Panel (a) presents the first mechanism, which occurs due to an ex-post effect of liquidity constraints. Here, consumers anticipate higher income in the first period than in the second period, \(w_1 > w_2\), and plan to consume \(\mathbf {c}^I(\mathbf {w})=(\bar{w},\bar{w})\equiv \bar{\mathbf {w}}\). For income gains and relatively small losses, \(w'_1 \ge \bar{w}\), consumption responds asymmetrically to shocks. This is similar to the asymmetry KR obtained in the case without liquidity constraints: consumers do not cut spending when facing small income losses, but they spend windfall gains immediately. This increases consumption (and reduces savings) compared to the reference-independent optimum. Moreover, if the revised level of income on hand is very small, \(w'_1 \le \underline{w}\), marginal consumption utility in the first period, \(m'(c_1) \ge m'(w'_1)\), will be large enough for life-cycle utility to be increasing in \(c_1\). In that case, it is optimal to spend income on hand as in the reference-independent case.

However, for moderately sized income losses, \(w'_1 \in (\underline{w},\bar{w})\), the optimal response depends on the weight attached to future gains and losses. Consumers need to take a loss in at least one period. By Lemma 1, instantaneous utility is convex if losses are not too large, \(-x > L\). It is then optimal to concentrate losses in one period. The liquidity constraint prevents consumers from taking the full loss in the future period. Instead, if prospective gains and losses carry a sufficiently high weight, it is optimal to take the full loss in the early period and save the amount they planned to set aside for future consumption. The dotted line is therefore strictly below the reference-independent optimum for all \(w'_1 \in (\underline{w},\bar{w})\). By contrast, when a lower weight is attached to future losses, as is true for the dashed line, it is optimal to minimize the early loss by consuming income on hand.

As an example of this ex-post mechanism, Fig. 4 plots lifetime utility if the consumer plans to earn \(\mathbf {w}=(52,48)\) but learns that she earns \(w'_1 = 48\) rather than \(w_1 = 52\). The figure distinguishes again between a high weight and a low weight of prospective gain–loss utility, \(\gamma = 0.9\) and \(\gamma =0.6\), respectively.Footnote 12 A person receiving bad news regarding present income has to give up her plan of consuming \(\bar{w} = 50\) in both periods. Since \(\gamma < 1\), it is optimal to delay the loss and consume \(\mathbf {c} = (50,46)\). But this entails borrowing, which is not feasible. Because utility is convex for a sure loss, \(c_1 \in (46,50)\), the consumer prefers concentrating the loss in one period if \(\gamma \) is sufficiently high, as is the case on the solid line, with \(\gamma = 0.9\). In that case, she takes the full loss immediately, \(c'_1 = 46\), and saves enough to consume \(c'_2 = \bar{w}=50\) in the second period. In other words, the aspiration to carry through future plans enhances savings for the liquidity-constrained consumer.

Life-cycle utility and early income after a surprise income loss. Anticipated and actual income paths are \(\mathbf {w}=(52,48)\) and \(\mathbf {w}'=(48,48)\), respectively. Gain–loss utility satisfies \(\mu (x)=\eta x^{\theta }\) for all \(x \ge 0\) and \(\mu (x) = -\eta \lambda (-x)^{\theta }\) for all \(x < 0\), with \(\eta = 10\), \(\lambda =2.25\), \(\theta = 0.88\), and \(x=m(c)-m(b)\) where \(m(c)=\log (c)\) and \(m(b)=\log (b)\)

Panel (b) in Fig. 3 presents a second mechanism through which reference dependence can increase savings in the presence of an ex-ante liquidity constraint. It draws the optimal revision for consumers who anticipate lower income in the first period than in the second period, \(w_1 < w_2\). They plan to consume \(\mathbf {c}^D(\mathbf {w},\mathbf {c}^I(\mathbf {w}))=\mathbf {w}\). The dashed line is associated with a relatively low weight attached to future gains and losses. As in Panel (a), the liquidity constraint binds and the optimal revision is to take losses and modest income gains immediately, resulting in hand-to-mouth consumption, \(c_1 = w'_1\), even when gains are large enough to raise first-period income above second-period income, \(w'_1 > w_2\). Only when the gain is very large, the consumer saves some of the windfall for future periods. As a result, reference-dependent consumption is strictly larger than reference-independent consumption for all \(w'_1 > w_2\).

This is not the case for the dotted line, with a relatively high weight attached to prospective gains and losses. If \(\gamma \) is high, the income level above which it is optimal to spread the gain over time is lower than it is for reference-independent consumers. Intuitively, because lower consumption was planned for the first period than for the second period, the reference level for first-period consumption is lower as well. It is therefore optimal to save when facing a small windfall, even when the first period is associated with lower consumption than the second period. For larger windfalls, gains are large enough to render differences in gain–loss utility from the two periods negligible. In that case, since \(\gamma < 1\) and gains in the first period have a higher weight than gains in the first period, consumers save less than reference-independent consumers.

The next two propositions formalize these results (see “Appendix 2” for a proof). The first proposition considers a person who anticipates present income to be higher than future income, \(w_1 > w_2\). As illustrated in Panel (a) in Fig. 3, if she faces a moderate income loss, \(w'_1 \in (\underline{w},\bar{w})\), she may save the amount she anticipated to save, increasing savings compared to the reference-independent case:

Proposition 1

Assume that a loss \(L < 0\) exists such that \(DS(L)=A(c)/m'(c)\). Suppose anticipated income in the present period was \(w_1 \in (w_2, \phi w_2)\), with \(\phi >1\) implicitly defined as \(m'((3 - \phi )w_2/2) (\phi - 1) w_2 = -L\), but that actual income is \(w'_1 \ne w_1\). Income levels \(\underline{w} < w_2\) and \(\bar{w}=(w_1+w_2)/2 > w_2\) exist such that the revised plan \(\mathbf {c}^D(\mathbf {w}',\bar{\mathbf {w}})\) solving Problem (8)–(9) satisfies:

This proposition only applies when lifetime utility is convex. This requires a sufficiently high weight, \(\gamma \), attached to prospective gains and losses. Furthermore, the anticipated gap between first- and second-period income should not be too large, \(w_1 \le \phi w_2\). In the example with log consumption utility, \(\phi \) can be expressed explicitly as \(\phi = (2-3L)/(2-L) > 1\) for all \(L<0\). If in addition the maximum loss at which utility is convex is 11 %, as in earlier examples, first-period income can be up to 10 % above second-period income.

The second proposition considers a person who anticipates present income to be lower than future income, \(w_1 < w_2\), and hence plans to consume less in the present. As illustrated in Panel (b) in Fig. 3, if the weight attached to prospective gain–loss utility is sufficiently large, this person prefers to spread income gains over the two periods and save. She will do so at income levels for which reference-independent consumers prefer to live hand-to-mouth, again increasing savings compared to the reference-independent case:

Proposition 2

Suppose that anticipated income in the present period was \(w_1 < w_2\), but that actual income is \(w'_1 \ne w_1\). If \(\gamma > \mu '(m'(w_1)(w_2-w_1))/\mu '(0^+)\), then income levels \(\{w^*,w^{**}\}\) satisfying \(w_1 < w^* < w_2 < w^{**}\) exist such that the revised plan \(\mathbf {c}^D(\mathbf {w}',\mathbf {w})\) solving Problem (8)–(9) satisfies:

In the tractable example with log consumption utility, \(m(c) = \log (c)\), and exponential gain–loss utility, \(\mu (x) = \eta (1-e^{-\theta x})/\theta \) for all \(x \ge 0\), the condition \(\gamma > \mu '(m'(w_1)(w_2-w_1))/\mu '(0^+)\) includes \(\mu '(0^+) = \eta \) and \(\mu '(x) = \eta e^{ -\theta (w_2-w_1)/w_1}\) as the marginal gain–loss utility terms. The condition hence reduces to

When \(w_2\) is sufficiently far above \(w_1\) so that \(w_2 - w_1 > -\log \gamma / \theta \), reference dependence increases savings for all \(w'_1 \in (w^*,w^{**})\). Intuitively, when a consumer anticipated a binding liquidity constraint, but unexpectedly earns more than anticipated and is no longer constrained, she will smooth the gain over time. This makes consumption react gradually in response to unanticipated income shocks.

The results in this section require diminishing sensitivity. The next section relaxes this assumption, replicating the ex-ante mechanism behind Proposition 2 when gain–loss utility is piecewise linear rather than convex–concave.

4 Case III: Endogenous reference points and stochastic income

4.1 Expectations-based reference points when consumption is stochastic

Thus far, consumers did not anticipate the possibility of an income shock when making their plans. This might be somewhat disputable, in part because borrowing restrictions will apply in particular for people with volatile incomes, as banks may fear more defaults among this group. Here, I therefore analyze optimal savings when loss-averse consumers anticipate income risk. Specifically, when making their plans, consumers do not know how much they will earn in the two periods. They find out just prior to the actual consumption-saving decision. Thus, risk present in the planning stage has resolved at the time of actual consumption, eliminating self-insurance motives to save.

For reference-independent consumers, this means that the optimum is equivalent to the reference-independent optimum in previous sections. Their sole savings motive is to spread consumption over time. Assuming perfect financial markets, KR show that loss-averse consumers save less than the reference-independent optimum, since news about immediate consumption carries a higher utility weight. Incorporating liquidity constraints, this section predicts the opposite: Loss-averse consumers may save more than reference-independent consumers because anticipating a liquidity constraint increases expected consumption—and hence the reference point—for future compared to early periods.

Henceforth, consumers’ disposable income in period \(t\in \{1,2\}\), \(W_t\), is IID with a cumulative distribution \(F(\cdot )\) and density \(f(\cdot )\). Upper cases refer to the stochastic variable before the realization of the risk, and lower cases refer to realized values. Income is stochastic due to temporary price shocks, unpredictable expenditures, or income shocks, and these shocks do not affect the marginal productivity of capital. Both buffer-stock models and the KR framework model risk in this way. To stay close to this literature, I do not analyze other types of risk like asset or capital income risk.

The consumer plans without perfect foresight of income during an initial period \(t=0\). At that stage, she only knows the income distribution in periods \(t\in \{1,2\}\). Let \(\mathbf {W}=(W_1,W_2)\) represent income before the realization of risk. The consumption plan made at \(t=0\) is represented by a distribution of beliefs, \(\mathbf {B}(\cdot ) = (B_1(\cdot ),B_2(\cdot ))\), i.e., a contingency plan in which \(B_1(\mathbf {w}) \le w_1\) and \(B_2(\mathbf {w}) = w_1 + w_2 - B(\cdot )\) are defined as the planned consumption level in the first and second period given realized incomes \(\mathbf {w} = (w_1,w_2)\). To isolate the effect of risk at the planning stage, the income risk regarding both periods is resolved prior to consumption at \(t=1\), meaning that there are no precautionary savings in both the reference-dependent and reference-independent cases. The next section discusses the implications of this assumption in more detail.

Once the consumer knows how much she will earn in both periods, she decides to consume \(c_1 \le w_1\) in the first period, save \(w_1 - c_1\) in a risk-free asset with zero returns for the second period, and consume \(c_2 = w_1 + w_2-c_1\) in the second period. Comparing first-period consumption \(c_1\) with the contingency plan \(B_1(\cdot )\) yields contemporaneous gain–loss utility. Comparing second-period consumption \(c_2\) with the contingency plan for future consumption, \(B_2(\cdot )\), yields prospective gain–loss utility. There will be no updating of beliefs and hence no gain–loss utility, in the final period, \(t=2\).

I abstract from diminishing sensitivity because it improves tractability and because the literature is inconclusive as to whether loss utility is convex. Instead, gain–loss utility is piecewise linear, \(\mu (x) = \eta x\) for \(x\ge 0\) and \(\mu (x)=\eta \lambda x\) for \(x < 0\), where \(\eta \) represents the weight attached to gain–loss utility and \(\lambda >1\) the degree of loss aversion. Assuming that the integral below exists, gain–loss utility from changing a plan is defined as:

To illustrate this definition of gain–loss utility, consider a consumer who expects to consume either 50 or 100, both with probability 1/2. The gain or loss from comparing these two outcomes is \(m(100)-m(50)\equiv M\). If she learns in period 1 that she will consume 50, she experiences a loss relative to the good outcome of consuming 100, which would have occurred with probability 1/2, yielding loss utility \(-1/2\eta \lambda M\). If instead she learns that consumption will be 100, she experiences a gain relative to the worst-case scenario of consuming 50, which would have occurred with probability 1/2, yielding gain utility \(1/2\eta M\). Hence, the probability that a gain or loss occurs determines its decision weight.Footnote 13

Regarding the formation of plans, consider two types of consumers. The first is a “naive” consumer planning for the reference-independent optimum, \(c^I_1(\mathbf {w})=\min \{w_1,\bar{w}\}\), where \(\bar{w}\) is average income from the two periods. For this consumer, optimal consumption is defined by the following problem:

For a naive consumer, the optimum \(\mathbf {c}^D(\mathbf {w},c^I(\cdot ))\) is not necessarily equivalent to the planned level of consumption, \(\mathbf {c}^I(\mathbf {w})\). The second type therefore concerns a more “sophisticated” consumer who only makes plans that she is committed to carry through. For her, consumption solves the following problem:

A sophisticated consumer optimizes \(U(c_1;\mathbf {w},\mathbf {B}(\cdot ))\), lifetime utility given the contingency plan to consume \(\mathbf {B}(\cdot )\), and this optimum does not deviate from that contingency plan given realized income \(\mathbf {w}\). KR use this latter condition to define a personal equilibrium (see “Appendix 1” and Kőszegi and Rabin 2006 for a more detailed discussion of this equilibrium concept).

Finally, this section replaces Conditions (C1)–(C3) by two new conditions:

(C1)’ | Intertemporal loss aversion |

\(\;\;\;\;\;\;\;\;\;\; \gamma > (\lambda - (\lambda -1)P_1(\bar{w}))/(\lambda - (\lambda - 1)P_2(\bar{w}))\) | |

(C2)’ | Non-increasing absolute risk aversion |

\(\;\;\;\;\;\;\;\;\;\; A'(c) \le 0\text {, with }A(c) \equiv -m''(c)/m'(c)\) |

The first condition generalizes intertemporal loss aversion by placing a lower bound on \(\gamma \), the weight attached to prospective gains and losses. In this condition, \(\lambda >1\) is the degree of loss aversion; \(\bar{w}=(w_1+w_2)/2\) the reference-independent optimum for \(w_1 > w_2\); and \(P_1(\bar{w})\) and \(P_2(\bar{w})\) the probabilities of consuming less than \(\bar{w}\) in the first and second periods, respectively, given the plan to consume \(c^I_1=\min \{w_1,\bar{w}\}\). Because the consumer is liquidity-constrained, she expects to consume less than \(\bar{w}\) with a higher probability in the first period, \(P_1(\bar{w}) > P_2(\bar{w})\). As a result, the lower bound for \(\gamma \) is strictly below one.Footnote 14 This also implies that the lower bound for \(\gamma \) decreases as the degree of loss aversion, \(\lambda \), increases.

The second condition says that consumption utility exhibits non-increasing absolute risk aversion, including both constant and decreasing absolute risk aversion. This condition is less restrictive than its analog in the previous section, Condition (C3), imposing strong decreasing absolute risk aversion, \(A'(c) \le -A(c)^2\).Footnote 15

4.2 Implications of liquidity constraints for stochastic reference points

This section compares reference-dependent and reference-independent consumption plans. Since the risk is resolved prior to the consumption-saving decision, it does not affect the reference-independent optimum. Without liquidity constraints, a reference-independent consumer prefers perfect smoothing, \(\mathbf {c}^I(\mathbf {w}) = \bar{\mathbf {w}}\), and KR show that reference dependence leads to higher consumption in early periods. Given the plan to consume \(\bar{\mathbf {w}}\) for all \(\mathbf {w} \in \mathbf {W}\), marginal lifetime utility evaluated at \(\mathbf {c} = \bar{\mathbf {w}}\) is:

where we combine the gain–loss utilities from both periods since \(c^I_2(\cdot )=c^I_1(\cdot )\). Thus, when consumers are able to borrow and attach more weight to changes in plans regarding immediate consumption, they have an incentive to increase \(c_1\) above the planned level \(\bar{w}\). Without liquidity constraint, naive consumers hence overconsume relative to the reference-independent case.

Consumption and early income when income risk is anticipated. a Relatively low weight attached to prospective gains and losses, \(\gamma = 0.65\). b Relatively high weight attached to prospective gains and losses, \(\gamma = 0.95\). Income in period t follows a uniform distribution in the interval \(W_t \in [25,75]\). Future income is \(w_2 = 50\), and utility is defined as \(\mu (x) = \eta x\) for \(x > 0\) and \(\mu (x) = -\eta \lambda x\) with \(\eta = 10\) and \(\lambda = 2.25\)

A sophisticated consumer anticipates her incentive to overconsume in the first period and plans for higher consumption, because she will only make plans that she is committed to carry through. Assuming like KR that plans regarding both first-period and second-period consumption, \(B_1(\mathbf {w})\) and \(B_2(\mathbf {w})\), are strictly increasing in total income, the solution is characterized by the following set of first-order conditions:

Because \(\gamma < 1\), it is optimal to consume more in period 1 than in period 2. Thus, without liquidity constraints, also sophisticated reference-dependent consumers will save less than reference-independent consumers.

This result changes when introducing a liquidity constraint. Figure 5 draws optimal consumption in the first period as a function of realized income in the first period, assuming log consumption utility, uniformly distributed income \(W_t \sim U[25,75]\) for \(t\in \{1,2\}\) and realized income for the second period is \(w_2 = 50\). The figure draws the reference-independent optimum (the solid line), the naive reference-dependent optimum (the dashed line), and the sophisticated optimum (the dotted line). Panel (a) attaches a relatively low weight to future gain–loss utility, violating Condition (C1)’, whereas this weight is relatively high in Panel (b), so that Condition (C1)’ is satisfied.

In both panels, the reference-independent optimum is to consume \(c^I_1(\mathbf {w})=\min \{w_1,\bar{w}\}\). At low levels of early income, the reference-dependent optimum is equivalent as both types consume their income \(w_1\). At higher levels of early income, reference-dependent consumption is either higher or lower, depending on the weight attached to future gains and losses. In Panel (a), \(\gamma \) is relatively low, and reference dependence increases consumption, reducing optimal savings. In Panel (b), \(\gamma \) is relatively high, and reference dependence reduces optimal consumption, increasing the optimal level of savings.

Intuitively, in the presence of a liquidity constraint ex ante, a consumer anticipates income realizations for which she cannot smooth consumption since the liquidity constraint will bind. For these income realizations, consumption is higher in the second period than in the first period, raising the expected level of future consumption. This increases consumers’ marginal gain–loss utility for the future period, creating an incentive to consume less in the first period and save more for future consumption if the weight attached to future gain–loss utility, \(\gamma \), is sufficiently high. Differences are more pronounced for sophisticated compared to naive consumers, because they anticipate the deviation from the reference-independent optimum, influencing their expectations and hence optimal consumption. The final proposition generalizes this result to a continuous IID distribution.

Proposition 3

Suppose that income \(\mathbf {W}\) is continuous and IID and that a consumer learns at \(t=1\) she will earn \(\mathbf {w}\). Income levels \(w_N < w_2\) and \(w_S < w_N\) exist such that optimal consumption satisfies

with a strict first inequality for all \(w_1 > w_N\) and a strict second inequality for all \(w_1 > w_S\). Further, \(\partial c^D_1(\mathbf {w},c_1^I(\cdot ))/\partial w_t \le 1/2\) for all \(w_1 \ge w_N\), \(\partial c^D_1(\mathbf {w},B(\cdot ))/\partial w_t \le 1/2\) for all \(w_1 \ge w_S\), and \(\partial c_1^D(\cdot )/\partial w_t < 1/2 \Leftrightarrow A'(c) < 0\).

The proposition sheds light on the joint dynamic behavior of income and consumption. When first-period income is sufficiently high, e.g., \(w_1 \ge w_S\) for the sophisticated consumer type, the marginal propensity to consume in the first period is at most half. Thus, for all \(w_1 \in (w_S,\bar{w})\), they save at least half of their income, while the liquidity constraint binds for reference-independent consumers. When absolute risk aversion is decreasing, the marginal propensity to consume in the first period is strictly less than half also for all \(w_1\ge \bar{w}\), income levels at which reference-independent consumers save half their income. Given that income realizes just prior to the first period, income shocks are unanticipated, and consumption appears excessively smooth to such shocks.

At the same time, the low marginal propensity to consume in the first period together with the budget constraint implies a high marginal propensity to consume in the second period, i.e., \(c^D_2(\mathbf {w},c^I_2(\cdot ))/\partial w_t \ge 1/2\) for all \(w_1 > w_N\), and \(\partial c^D_2(\mathbf {w},B(\cdot ))/\partial w_t \ge 1/2\) for all \(w_1 > w_S\). Given that consumers learn about the level of income shocks already in the first period, income shocks have been anticipated by the time of second-period consumption. Thus, consumption appears excessively sensitive to anticipated income shocks.

5 Discussion

This section reflects on the empirical evidence supporting the KR model, limitations of the applications used, and the economic implications of the analyses presented in the previous two sections.

Kőszegi and Rabin (2006, 2009) address some of the key challenges associated with earlier models of reference dependence, and to my best knowledge, it is the most advanced theory of reference dependence in intertemporal choice. Its key features have been supported by recent experimental and observational studies. To start, reference-independent preferences are nested within this model, which has two benefits (Barberis 2013). First, it is unlikely that absolute levels of consumption do not matter at all with all consumption being concentrated in one period. Second, the nested model allows analyzing whether the additional parameters embedded in reference-dependent models are necessary to describe consumption. Ultimately, the question is not whether we should replace consumption utility by gain–loss utility, but whether adding gain–loss utility significantly improves behavioral predictions.

Further, in KR, beliefs shape the reference point. This unifies stylized facts from laboratory experiments on information preferences, effort provision, and trading decisions. In terms of information preferences, participants bet significantly less in treatments with higher feedback frequency (Gneezy and Potters 1997; Haigh and List 2005; Bellemare et al. 2005), and investors monitor their portfolios more frequently in rising markets than when markets are flat or falling (Karlsson et al. 2009). Regarding effort provision, Abeler et al. (2011) find that manipulating rational expectations of earnings influences effort.Footnote 16 Ericson and Fuster (2011) show that the probability of being allowed to trade or obtain an item affects the valuation of that item, suggesting that beliefs held before the trade drive participants’ decisions. Given this interpretation, changes in wealth affect well-being by creating news about consumption, and expectations are adjusted as soon as the news arrives. In line with this idea, Bronchetti et al. (2013) argue that tax filers rejecting a default savings plan for their income tax refund did so because they already anticipated the refund.

Finally, deriving utility from a comparison of actual and planned consumption can explain why people prefer receiving the same piece of good information sooner rather than later. Combined with loss aversion, this also explains an asymmetry in how people respond to good versus bad income news. Shea (1995) and Bowman et al. (1999) find that union workers receiving bad news regarding future income take the full loss in the future and do not reduce present consumption, while those receiving positive news take the full gain immediately and leave future consumption unaffected.

Nevertheless, the paper made a number of simplifying assumptions to maintain tractability. To start, each model included only two periods, covering the main dynamics of the model. A longer time horizon exponentially increases the dimension of the problem with endogenous reference points and does not substantially affect the results. Consider for instance the model in Sect. 4 in which a naive person plans to consume the reference-independent optimum.Footnote 17 Independent of the number of periods, consumption in future periods will be higher than consumption in early periods when the consumer has less flexibility to prepare for bad income draws. This increases the reference point for future consumption, leading to higher savings in comparison with the reference-independent case.

Another potential limitation is that the model abstracts from precautionary savings motives. In Sect. 4, consumers anticipate risk, but future income risk is resolved already in the early period, before consumers decide how much to save. Thus, the section analyzes whether loss aversion and liquidity constraints create savings motives beyond self-insurance against bad future income draws. I show that even in the absence of such precautionary savings motives, reference-dependent consumers save more than reference-independent consumers, not to self-insure, but because they expect higher consumption in the future, increasing the reference point for future relative to early periods.

Earlier studies have analyzed the impact of reference dependence on precautionary savings. Kőszegi and Rabin (2009), for instance, show that precautionary savings motives are likely to be stronger for loss-averse consumers than for reference-independent consumers. In the reference-independent case, future income risk combined with liquidity constraints gives rise to precautionary savings motives only if marginal utility is convex, i.e., if consumers are prudent (Deaton 1991; Carroll 1997).Footnote 18 Precautionary motives driven by loss aversion and liquidity constraints are first order and do not rely on the curvature of marginal utility, likely increasing reference-dependent savings compared to the reference-independent case. Thus, future income risk will not affect my results.

Further, both the ex-post and ex-ante effects of a binding liquidity constraint will exist in the presence of precautionary savings. When individuals could perfectly self-insure, the liquidity constraint would never bind in a dynamic model, but a large number of studies show that informal insurance is far from perfect and that liquidity constraints often bind (Cochrane 1991; Townsend 1994; Dercon 2008). A consumer with convex loss utility depleting her buffer stock will still have an ex-post incentive to take losses immediately rather than taking both an immediate and a future loss. Further, ex-ante, loss-averse consumers who anticipate having to save and replenish their buffer in early periods expect lower consumption in the short run. Having anticipated this, lower consumption in early periods will not be as painful, further increasing their willingness to save. Reference dependence can hence increase liquidity-constrained savings also when consumers accumulate buffer stocks.

As a final limitation, this paper imposed intertemporal loss aversion. This condition helps ensure observational equivalence of reference-dependent and reference-independent consumption plans in the absence of risk and income shocks. Intertemporal loss aversion requires prospective gains and losses to carry a sufficiently high utility weight. At this stage, it is unclear how much attention consumers in low-income settings pay to future gains and losses while making their financial decisions. A direction for future research is to empirically test the propositions in this paper and measure to what extent financial decisions are characterized by intertemporal loss aversion.

Despite these limitations, predictions are consistent with savings patterns observed in low-income settings. Although formal savings among the poor are low, a series of financial diaries generating detailed data regarding the poor’s cash flows reveal heterogeneity in informal savings rates, with a substantial share of households saving even in times of financial hardship (Collins et al. 2009). Diaries further show that the poor do save not only to self-insure against future shocks, but also for predictable expenditures, even when facing shocks. This can take extreme forms. Dercon (2008, p. ii122–ii123) notes the following: “It is well recorded that during crises, such as the 1984–5 famine in Ethiopia, farmers desperately held on to their livestock, rather than selling in time, even at the expense of many of their household members and their own life.” The possibility of minimizing losses in the future, however remote, may have induced them to keep saving their livestock. A preference for self-insurance and consumption smoothing alone cannot explain such patterns, and other mechanisms—potentially the ones discussed in this paper—may be at play.

Further, the model offers a potential explanation for two puzzles observed in aggregate US consumption data. On the one hand, data exhibit excess smoothness of consumption to current, or unanticipated, labor-income growth (e.g., Campbell and Deaton 1989). On the other hand, the data are excessively sensitive to lagged, or anticipated, labor-income growth (e.g., Flavin 1981). Although liquidity constraints do not easily generate such consumption patterns in the buffer-stock model (Ludvigson and Michaelides 2001), they do in the reference-dependent case presented in the previous section. Specifically, when absolute risk aversion is decreasing, the marginal propensity to consume is strictly lower than half in the first period (consistent with excess smoothness to unanticipated income changes), and strictly higher than half in the second period (consistent with excess sensitivity to anticipated changes), even at relatively low levels of income on hand for which reference-independent consumers live hand-to-mouth.

6 Conclusion

Many laboratory experiments and observational studies provide empirical support of the theory that preferences are reference dependent. These studies are however restricted to settings with high bank penetration, where consumers have more access to credit and other insurance strategies than consumers in low-income countries. The literature on reference-dependent preferences has implicitly assumed perfect access to credit, making it less applicable to millions of consumers with limited access to formal and informal insurance strategies. As a result, it is unclear how reference dependence affects intertemporal choice in settings without well-functioning financial markets, and how improved access to credit affects reference-dependent consumption patterns.

I therefore investigated how reference dependence affects intertemporal choice in a context of liquidity constraints. I analyzed different models of reference-dependent preferences in intertemporal choice, including a model in which gains and losses compared to exogenous reference points influence well-being, and the Kőszegi and Rabin (2009) model with endogenous expectations-based reference points in which utility is derived from both consumption and changes in beliefs. The former has the advantage that it is tractable and easy to interpret, but misses one key ingredient, namely how people form their reference points. The latter model with expectations-based reference points has the advantage that it specifies a unique reference point, thereby unifying a growing literature on prospect theory and other models for reference dependence. Moreover, it integrates some key features of reference-dependent models in a standard framework for intertemporal choice. As such, the framework can be applied and tested for behavior outside the laboratory.

I introduced a liquidity constraint in both models to predict consumption-saving behavior in the presence of missing credit markets. For both models, I showed that reference dependence can increase liquidity-constrained savings, while it has the opposite effect in the absence of liquidity constraints. Two mechanisms explain this asymmetry. First, when ex-post liquidity constraints force consumers to take part of a loss in early periods, they may decide to take the full loss and increase savings compared to the reference-independent case. For instance, if a consumer plans to save and smooth consumption, but faces a moderate income loss in early periods, it is optimal to consume the planned level in early periods and borrow to concentrate the full loss in future periods. However, liquidity constraints prevent the consumer from doing so. By diminishing sensitivity, the best feasible alternative is then to take the full loss in early periods and save the planned amount for future periods.

Second, reference dependence can increase liquidity-constrained savings since anticipating a liquidity constraint may influence expected consumption ex-ante, affecting expectations-based reference points. A person who knows that a binding liquidity constraint will prevent her from smoothing consumption expects lower income in early periods than in future periods. As a result, the planned level—and hence the reference point—is relatively high in future periods. This increases the marginal utility from future consumption, which in turn creates an ex-ante savings motive among consumers without access to credit. Diminishing sensitivity is necessary to obtain this result only in a framework with deterministic income, not when income is stochastic and people anticipate the possibility of income shocks while forming their beliefs.

To conclude, this paper aims to demonstrate that one cannot directly apply existing models for reference dependence to intertemporal choice in low-income settings, where consumers have limited access to credit and other risk-coping strategies. One should account for the finding that reference dependence can affect savings in opposite directions depending on whether consumers face liquidity constraints. The propositions in this study can serve as a first guide toward testing models of reference-dependent preferences outside the laboratory, in settings where such models have rarely been tested.

Notes

I hence analyze whether liquidity constraints create reference-dependent savings motives beyond a self-insurance motive. The final section discusses the implications of reference dependence among consumers with precautionary savings motives in more detail.

Low-income populations face several barriers to obtain higher returns on their savings, including high inflation rates, informal taxation, limited access to banks, and asset risk of assets with higher returns.

A more nuanced model for financial market imperfections would assume endogenous credit rationing, but to stay close to the literature, I follow seminal buffer-stock savings models that have modeled financial market imperfections as an exogenous borrowing constraint (e.g., Deaton 1991; Carroll 1997).

The reference point is time invariant. If the reference point increases over time, future marginal utility will be relatively high, increasing reference-dependent savings, but independent of the existence of liquidity constraints. This section discusses when reference dependence may increase liquidity-constrained savings if it unambiguously reduces unconstrained savings, but Sects. 3 and 4 discuss how liquidity constraints create time variance.

Bowman et al. (1999) adopt a weaker assumption for loss aversion over large stakes, but (A4) comes without too much loss of generality. Take for instance the value function estimated in Tversky and Kahneman (1992), i.e., \(\mu (x)=x^{\theta _G}\) for gains and \(\mu (x)=-\lambda (-x)^{\theta _L}\), with parameters \(\hat{\lambda }=2.25\) and \(\hat{\theta }_L=\hat{\theta }_G=0.88\). Marginal disutility of the largest loss exceeds marginal utility of the smallest gain if the reference point r is at most 860 times the size of the minimum gain. This restricts r only weakly.

The other corner, \(c_1 = w_1\), yields strictly lower utility than \(c_1 = 0\) for all \(0 < w_1 < \delta \):

$$\begin{aligned} U(0;\mathbf {w}, w_2+\delta ) - U(w_1;\mathbf {w}, w_2+\delta )&= \mu (-w_2 - \delta ) + \mu (w_1-\delta ) - \left[ \mu (w_1- w_2 - \delta ) + \mu (-\delta )\right] \\&> 0 \Leftrightarrow w_2 + w_1 > w_2 - w_1\text {, } \text { }w_1 < \delta . \end{aligned}$$This jump could still occur in the presence of discounting, albeit at a lower income level.

Smoothing of gains means that the following first-order condition is satisfied: \(\mu '(c_1 - w_2 - \delta ) = \mu '(w_1- \delta -c)\). Rearranging \(c_1 - w_2 - \delta = w_1 - \delta - c_1\) yields the result that smoothing gains is equivalent to smoothing consumption, \(c_1 = \bar{w}\).

For instance, when consumption utility satisfies constant relative risk aversion (CRRA), the degree of absolute risk aversion is \(A(c) = \rho /c\), where \(\rho > 0\) is defined as the Arrow–Pratt CRRA coefficient. Condition (C3) is satisfied when \(-\rho /c^2 \le -\rho ^2/c^2\), that is, when \(\rho \le 1\). In the more general case where the inverse of absolute risk aversion is a linear function of consumption, \(A(c) = 1/(ac+b)\), this condition is satisfied if and only if \(a \ge 1\).

Using Lemma 1, and log utility’s property that \(-m''(c) = m'(c)^2\), so that \(A(c)/m'(c) = 1\), we obtain this explicit expression for L as follows:

$$\begin{aligned} DS(L) = 1 \Leftrightarrow \gamma \eta \lambda \theta e^{\theta L} = 1 + \gamma \eta \lambda e^{\theta L} \Leftrightarrow \gamma \eta \lambda e^{\theta L} (\theta - 1) =1. \end{aligned}$$Consumption levels \(c_1 > 46\) are associated with bad news regarding future periods. Since the relative disutility from such news is minimized when consumers do not attach much weight to prospective gains and losses, lifetime utility is higher when \(\gamma =0.6\) than when \(\gamma =0.9\).

Gain–loss utility could always include a probability weight \(\pi (p)\). Probability weighting is a core feature of rank-dependent utility and cumulative prospect theory (Tversky and Kahneman 1992). If people overweight the probability that negative events occur, they may become more risk averse, while if they underweight this probability, they may become more risk-seeking. Probability weighting may therefore confound the effects of loss aversion. Therefore, I study the effect of reference dependence, and in particular loss aversion, in isolation of probability weighting.

Notice that \(P_1(\bar{w}) \equiv P(W < \bar{w}) + P(W\ge \bar{w}) P(\bar{W} < \bar{w}| W \ge \bar{w}) \), i.e., the probability that income in the first period is lower than \(\bar{w}\), or if first-period income is higher, the probability that average income \(\bar{W} = (W_1 + W_2)/2\) is lower than \(\bar{w}\) (we can drop time subscripts for income because the income process is assumed to be IID). Further, define \(P_2(\bar{w}) \equiv P(W < \bar{w})P(\bar{W} < \bar{w}| W \ge \bar{w})\) as the probability that both income in the second period and average income are lower than \(\bar{w}\). As a result,

$$\begin{aligned} P_1(\bar{w})-P_2(\bar{w}) = P(W < \bar{w})(1-P(\bar{W} < \bar{w} | W < \bar{w})) + P(W\ge \bar{w}) P(\bar{W} < \bar{w}| W \ge \bar{w}) > 0. \end{aligned}$$Condition (C2) is not applicable in this section because gain–loss utility is piecewise linear. As a result, lifetime utility is strictly concave and there are no cases where diminishing sensitivity toward losses dominates the concavity of consumption utility.

Crawford and Meng (2011) use this theory to explain negative wage elasticities in New York City taxi drivers’ labor supply.

A question is whether individuals are able to solve the problem with endogenous reference points as the time horizon expands. As such, this naive reference point may actually reflect the decision-making process more realistically.

In addition, asset or capital income risk should not dominate the exogenous income risk (Gunning 2010).

To my knowledge, the literature does not document evidence of such pessimism. In fact, consumers are often overconfident (for a review of the literature, see Caliendo and Huang 2008).

Formally, \(\mathbf {\overline{b}} = (\overline{b},w_1+w_2-\overline{b})\) is the plan at which marginal utility is zero when consumption is an infinitesimal amount lower:

$$\begin{aligned} \lim _{c_1 \uparrow \overline{b}} U'(\mathbf {c}; \mathbf {w}, \mathbf {\overline{b}}) = 0 \Leftrightarrow m'(\overline{b})(1 + \eta \lambda ) = m'(w_1+w_2-\overline{b})(1+\gamma \eta ) \end{aligned}$$Consuming less than planned creates a loss in period 1—with weight \(\eta \lambda \)—and an equally sized gain in period 2—with weight \(\gamma \eta \). Likewise, \(\mathbf {\underline{b}} = (\underline{b},w_1+w_2-\underline{b})\) is defined as the planned level at which marginal utility is zero for infinitesimal higher consumption:

$$\begin{aligned} \lim _{c_1 \downarrow \underline{b}} U'(\mathbf {c}; \mathbf {w}, \mathbf {\underline{b}}) = 0 \Leftrightarrow m'(\underline{b})(1 + \eta ) = m'(w_1+w_2-\underline{b})(1+\gamma \eta \lambda ) \end{aligned}$$Consuming more than planned creates a gain in period 1—with weight \(\eta \)—and an equally sized loss in period 2—with weight \(\gamma \eta \lambda \).

If Condition (7) is satisfied, consumers attach relatively high weight to future losses, \(\gamma \ge 1/\lambda \) and \(\overline{b} \ge \bar{w}\). As a result, \(\bar{w}\) is a personal equilibrium. If \(\gamma < 1/\lambda \), then \(\overline{b} < \bar{w}\) and \(\bar{w}\) is not a personal equilibrium.

Because anticipated present income was higher than anticipated future income, the consumer can avoid gains in the future period while incurring a present loss by saving less.

Because \(w_1 > w_2\), revised income will always exceed the left-hand side of this inequality, since \(2\bar{w}' - \bar{w} = w'_1 + w_2 - \bar{w} < w'_1\) if and only if \(w_2 < \bar{w}\), i.e., \(w_2 < w_1\). Thus, the liquidity constraint will not prevent the person from consuming \(c_1 \ge 2\bar{w}'-\bar{w}\).

References

Abeler, J., Falk, A., Goette, L., Huffman, D.: Reference points and effort provision. Am. Econ. Rev. 101(2), 470-492 (2011)

Angelucci, M., Karlan, D., Zinman, J.: Microcredit impacts: evidence from a randomized microcredit program placement experiment by Compartamos Banco. Am. Econ. J. Appl. Econ. 7(1), 151-182 (2015)

Banerjee, A.V., Duflo, E., Glennerster, R., Kinnan, C.: The miracle of microfinance? Evidence from a randomized evaluation. Am. Econ. J. Appl. Econ. 7(1), 22-53 (2015)

Barberis, N.C.: Thirty years of prospect theory in economics: a review and assessment. J. Econ. Perspect. 27(1), 173-196 (2013)

Bellemare, C., Krause, M., Kröger, S., Zhang, C.: Myopic loss aversion: information feedback vs. investment flexibility. Econ. Lett. 87(3), 319-324 (2005)

Bowman, D., Minehart, D., Rabin, M.: Loss aversion in a consumption/savings model. J. Econ. Behav. Organ. 38(2), 155-178 (1999)