Abstract

We develop a model of endogenous growth with automation to study the impact of industrial robots on growth and labour income. We incorporate human capital accumulation into that framework to examine the role of human capital in sustaining growth without displacing low-skilled labour. While automation replaces low-skilled labour with industrial robots in conducting routine tasks, horizontal innovation creates new varieties in which low-skilled labour has an employment advantage. Labour-augmenting technology takes place to improve productivity of low-skilled labour. As such, those latter types of innovation help counterbalance the adverse effect of automation on low-skilled labour. Human capital, the essential production factor that takes part in every economic activity, including conducting non-routine tasks, accumulates over time through education and training. We show that there exists a long-run equilibrium at which either robots or low-skilled workers are employed, together with human capital, to produce varieties. In the fully endogenous model, final output grows at the rate of human capital accumulation. An improvement in the quality of education and training leads to an acceleration of both automation and variety expansion, but not human capital growth. Our numerical exercise indicates that a permanent increase in automation entails a permanent impact on the range of automated varieties, long-run output level and human capital wage. The shock lowers long-run growth and low-skilled workers’ wage and their effective income share. However, it has no effect on the effective income share of human capital.

Similar content being viewed by others

1 Introduction

Automation and its impact on our economy has been a highly debated topic over the past few decades. The debate is getting even more topical these days given that the COVID-19 pandemic has further pushed the global economy towards application of artificial intelligence (AI), automation, and digitalisation. So far, most of the discussion has been focused on the impact of automation on the labour market, since this is the area that sees the most direct effect of this process. On the one hand, there have been concerns over potential job losses as robots will take over many human jobs (Autor et al. 2003; Goos and Manning 2007; Michaels et al. 2014). According to Cortes et al. (2017), the most vulnerable jobs in the US market in the last 35 years have been those of routine nature (i.e., those that can be performed by well-defined instructions and procedures). On the other hand, optimistic economists consider automation as a type of technological change that increases capital inputs and boosts the demand for labour. History has documented the appearance of many new jobs in the verge of each industrial revolution (Autor 2015; Acemoglu and Restrepo 2018a, b). In our modern time of Industry 4.0, while industrial robots replace labour, new jobs like audio-visual specialists, data analysts, meeting planners, and computer support specialists are emerging (Acemoglu and Restrepo 2018b). Thus, no real consensus has emerged and more research is required to gain further insight into the net effect of automation on employment and income.Footnote 1

Many researchers (e.g., Romer 1990; Grossman and Helpman 1991; Aghion and Howitt 1992; Hall and Jones 1999) have documented the essential role of technological progress in driving global output growth and employment over the last few decades. Because automation is a type of innovation, its larger scale impacts will be best understood within a growth context and in conjunction with other types of innovation. The fact that an increasing number of studies (e.g., Acemoglu and Restrepo 2018b; Berg et al. 2018) point out some non-routine occupations or groups of workers as beneficiaries of automation necessitates the need to move beyond the usual assumption that robots and workers are perfect substitutes. In other words, we need to consider two groups of workers: low-skilled workers (performing routine tasks and competing directly with robots) and high-skilled workers (performing non-routine tasks and complementing either robots or low-skilled workers). The following questions come to our attention: (i) Can long-run growth be sustained in an economy where there is automation mingled with other types of technological innovation and workers’ skill levels? (ii) If so, what is the impact of skill accumulation on this balanced growth path? (iii) What are the long-run consequences of an improvement in the quality of education and training activities? (iv) In what way do income shares and wages of workers of different skill levels vary following a permanent automation shock? These questions arise both from the strong modelling need as mentioned above and a number of motivating facts as the following. According to Karabarbounis and Neiman (2014), the share of income accruing to labour has declined significantly since the early 1980s in a large number of countries and industries due to advancement in information and computerised technologies. Chen (2020) points out that the employment share of the goods sector in the US, containing around 70% of workers performing in low-skilled or manual jobs, declined from 53.3 to 19.3% over 1947–2018. Meanwhile, the service sector, with approximately 60% of workers being high-skilled, even experienced some increase in its employment share. A similar pattern is also observed in many other OECD countries as noted by Angelini et al. (2020). This implies that structural transformation has different effects on workers possessing different skill levels.

In an attempt to answer these questions and take possible account of the above-mentioned stylised facts, we develop an endogenous growth model characterised by technological change in various forms, such as automation, new variety creation, labour-augmenting enhancement, and human capital accumulation. There is a unique final consumption good that is produced from a combination of a large range of intermediate varieties. Automation occurs in the production of some intermediate goods where robots take over the role of low-skilled workers in performing routine tasks.Footnote 2 There exists a line of technology that aims at creating new varieties, which in turn generate new employment opportunities for low-skilled labour. In the competition with robots, low-skilled workers improve their productivityFootnote 3 through advancement in labour-augmenting technology.Footnote 4 These technologies, besides competing with each other, are the forces that drive the competition between robots and low-skilled workers through determining the relative profitability of intermediate firms. Unlike low-skilled workers that are under threat of being replaced by robots, human capital or high-skilled labourFootnote 5 is the essential production factor that takes part in every activity of the economy, ranging from production of varieties (e.g., provision of managing or monitoring service) to doing R &D in research labs (for developing new technologies) and education. Within this framework, we show the existence of a long-run dynamic equilibrium. We differentiate our results in two cases. When labour-augmenting technology is entirely exogenous, its rate of growth will dictate that of output, consumption, physical capital, and human capital. However, when this technical process is fully endogenous, all important economic variables will grow at the rate of growth of human capital. While an improvement in the effectiveness of education and training activities has no effect on this growth rate, it induces a higher rate of both variety expansion and automation. Because the rate of growth of human capital is mainly determined by demand and supply factors, a more efficient education and training sector will foster a higher allocation of human capital towards research aiming at either variety expansion or automation.

Upon conducting a quantitative analysis using parameter values that closely match numerous industrialised countries including the US, we find that a permanent positive automation shock reduces the effective income share of low-skilled labour but has no effect on the income share of human capital. This is because robots directly compete with low-skilled labour and replaces it in performing routine tasks in the production of varieties. Meanwhile, robots complement human capital that performs non-routine tasks in this production process. As such, on aggregate, the share of income that goes to total labour force declines. This result resembles the issue of global decline of the labour share since the early 1980s as described in Karabarbounis and Neiman (2014). The same automation shock is found to enhance high-skilled wages but to reduce low-skilled wages. The widening gap between the wage of high-skilled labour relative to that of low-skilled labour well captures the picture of the US labour market over the last 40 years, as documented in Autor et al. (2003). It also reflects the rise in polarisation by skill level, both in terms of wages and employment, due to job losses in the manufacturing sector and employment increases in high-tech service sector observed in a large number of OECD countries as per (Angelini et al. 2020).Footnote 6 While the shock always increases long-run output level, it has no effect on long-run output growth when labour-augmenting technology is exogenous and reduces this growth when labour-augmenting technology is fully endogenous.Footnote 7

So far, there has been relatively little research on the question of how automation impacts growth. Zeira (1998) is probably the first paper in this research line that models exogenous increases in total factor productivity (TFP) as the key factor that encourages the substitution of capital for labour. More recently, Berg et al. (2018) examine how automation affects economic growth. However, the evolution of robots in Berg et al. (2018) is totally exogenous as in Zeira (1998) (see Hanley (2018) for further discussion on this exogeneity of technology). Another study by Aghion et al. (2017) provides a detailed discussion on how to incorporate automation into an endogenous growth setting. Nevertheless, the authors do not consider variety expansion as our paper does. In that respect, perhaps, the work by Acemoglu and Restrepo (2018b) is the one (among the very few of this kind) that has close modelling features to our theoretical work, as it also studies automation in an endogenous growth setting with variety expansion (as per (Romer 1990; Grossman and Helpman 1991; Peretto 1998; Le 2008)).Footnote 8 Despite this fact, our analysis differs to theirs along several dimensions, with notable distinction in modelling framework. First, while labour productivity is either improved exogenously or as a result of a learning-by-doing process in their paper, this factor evolves endogenously thanking to purposeful research lab investment using high-skilled labour input in our paper. In this respect, our assumption is in line with a large literature emphasizing the role of human capital in conducting purposeful R &D investment (Romer 1990; Grossman and Helpman 1991; Le 2022; Le et al. 2022). Second, in our model, human capital is the key production factor that takes part in all activities including R &D activities in research labs, education and training, and production of intermediate products (complementing either low-skilled labour or robots). By doing so, we aim to capture two faces of technological change, namely, the competition between low-skilled workers and robots (as per Autor et al. 2003) and the capital-skill complementarity for high-skilled labour (as per (Krusell et al. 2000) and Chen (2020)). The capital-skill complementarity for high-skilled labour is a missing feature of Acemoglu and Restrepo (2018b). Third, human capital evolves continuously here while it is fixed in Acemoglu and Restrepo (2018b). This new modelling feature allows us to capture the important issue on the ’race between education and technology’ as per (Goldin and Katz 2008). It also helps eliminate the scale effect of human capital present in Acemoglu and Restrepo (2018b), an effect that is refuted by empirical data (Jones 1995).

In another recent study, Hemous and Olsen (2018) also considers automation and horizontal innovation in an economy with low- and high-skilled workers. While that paper has the same goal of examining how skill premium is affected by automation, its economic environment is different from ours in a few aspects: (i) there is no labour-augmenting technology; and (ii) there is no human capital accumulation. By incorporating these two important features, our modelling framework is more general, can better accommodate the real-world economy, and convey far-reaching implications for policy and practice.

In addition to the theoretical literature on task-based growth models discussed above, our paper is also related to an emerging empirical literature on the effects of automation and robotics on growth and welfare. For instance, Autor and Salomons (2018) consider channels through which automation impacts labour share in total output and productivity growth in 18 OECD countries. They show that automation is not labour-displacing although it reduces the share of labour in value added. Eden and Gaggl (2018) estimate the potential distributional implications of information and communication technology (ICT) as a proxy for automation and its growth impact. They find a substantial reallocation of income from routine labour, which is relatively more substitutable with ICT, to non-routine labour, which is relatively less substitutable with ICT. They have also identified some growth gains associated with the increased use of ICT. Graetz and Michaels (2018) find that higher robot use leads to faster TFP growth. Interestingly, an increase in robot utilisation does not reduce total employment, although it does reduce low-skilled workers’ employment share. Although the motivation of this paper is largely theoretical, with the aim of providing a trajectory about the future, our model has the potential to offer an in-depth explanation to these empirical results. It also suggests important solutions to maintain a positive labour share over the long run.

This paper proceeds as follows. Section 2 provides basic setting of the model. Section 3 is devoted to characterising a dynamic equilibrium of the economy, first when labour-augmenting technology is exogenous and then when the technology is endogenous. Each time, we prove the existence of a balanced growth path before examining its main features as well as its influential factors (such as education efficiency). After that, we consider the long-run implications of automation on output growth and effective income share of labour. To that aim, we provide different numerical examples, which calibrate aggregate data of industrialised countries such as the USA, to illustrate some of the theoretical predictions and compare different outcomes obtained under alternative assumptions on labour-augmenting technology. Section 4 provides further discussion on obtained results in conjunction with the modelling of human capital accumulation in a setting with automation. Section 5 ends the paper with some concluding remarks.

2 The environment

Consider an economy with a representative infinitely-lived consumer having the following constant relative risk aversion (CRRA) preferences:

where \(C_{t}\) is consumption, \(\rho >0\) is the rate of time preference and \(\theta \ge 1\) is the coefficient of relative risk aversion (or the inverse intertemporal elasticity of substitution). The budget constraint of the consumer is:

where \(\dot{K_{t}}\) denotes investment and \(Y_{t}\) denotes the final consumption good whose price is chosen as numeraire. We assume no capital depreciation for simplicity. The final consumption good is produced by a large number of competitive firms using a bundle of many varieties (or intermediate products) such that:

where \(y_{it}\) denotes the quantity of a particular production variety i used in production at time t and \(\alpha \in (0,1)\).Footnote 9 Varieties are ordered according to their levels of complexity so that a higher index i indicates a more sophisticated variety that is more difficult to produce. In this formulation, with \(N_{t}\) and \(N_t - Z\) denoting the most and the least complex variety, respectively, the set of varieties available for production of final consumption good is always of a constant mass Z. This also means that each time a new variety is created, it will replace the lowest indexed variety in the final consumption good production.Footnote 10

Varieties are produced by monopolists. Assume that this production process involves two sets of tasks: while non-routine tasks require human capital, routine tasksFootnote 11 can be performed by either low-skilled labour or robots.Footnote 12 By human capital, we refer to workers having the skill level that allows them to perform different types of work. By contrast, low-skilled workers are those that can only implement routine tasks. Assume that there exists \(I_{t} \in [N_t-Z,N_{t}]\) that divides varieties into two different groups. Specifically, if \(i \le I_{t}\), routine tasks are technologically automated so production of each variety is conducted by robots (made up of capital, i.e., k), alongside human capital (i.e., h). For \(i > I_{t}\), routine tasks remain the domain of low-skilled labour (i.e., l) and varieties are produced by combining low-skilled labour with human capital. In each case, human capital is essential for carrying non-routine professional service such as monitoring, management or coordination. This service complements the work of either low-skilled labour or robots in production. The production of varieties, hence, can be described as follows:

where \(\beta \in (0,1)\) and \(A_{it}>0\) denotes labour-augmenting technology used in producing a variety that is strictly increasing in i.Footnote 13 Embedded in this equation is the notion that once a variety is automated, the routine task performed by low-skilled labour in producing this variety will be totally replaced by the work of robots. This specification describes different ways robots interact with different types of labour in the production technology: displacing low-skilled labour but complementing high-skilled labour. The issue of capital–skill complementarity has been previously suggested by Krusell et al. (2000) and Chen (2020): the elasticity of substitution between capital and low-skilled labour is higher than that between capital and high-skilled labour.

3 Dynamic equilibrium

Assume that the size of low-skilled labour is fixed so that \(L_{t}=L, \forall t\).Footnote 14 However, besides capital that evolves over time as a result of households’ optimisation problem, there is a dynamic process associated with each of the following activities: the development of automation technology, the expansion of variety set, the evolution of labour-augmenting technology, and the accumulation of human capital.Footnote 15 Because human capital is employed in all activities of the economy, we have:

where \(H_{yt}, H_{Ht}, H_{Nt}\) and \(H_{It}\) denote the amount of human capital devoted to producing varieties, accumulating human capital itself, introducing new varieties and developing automating technologies respectively. This is the market-clearing condition for human capital.Footnote 16

As specified above, automation and variety expansion both require human capital. The rate of introducing new automation is:

where \(\mu _{I}>0\) is the productivity of this activity. Because \(I_t\) is the cut-off level between automated and non-automated varieties, \(A_{It}\) will be the technological content of the most complex automated variety within the range. The deflation of \(A_{It}\) is to capture the notion that automating the next higher variety will be harder and require more resources (i.e., human capital).

Similarly, the rate of introducing new varieties is:

where \(\mu _{N}>0\) is productivity of this innovation type. Since \(N_t\) is the index of the variety at the top of the range, \(A_{Nt}\) will be the highest technological content attached to a (non-automated) variety. As such, with the deflation of \(A_{Nt}\) in this equation, we mean that research cost increases each time we attempt to create a more sophisticated variety.

At each point in time, high-skilled workers who possess human capital will have to devote a fraction \(u_{t}\) of their time to improve their skill level. The evolution of human capital is of the following form:

where \(\lambda >0\) is the productivity of human capital production. Here, \(H_{Ht}=u_t H_t\) is amount of human capital devoted to its own production (e.g., through attaining education or on the job training). This is important for high-skilled workers to keep themselves updated with recent changes in technology so that they can be able to work in research labs or in production. In this formulation, \(u_{t}\) is the fraction of human capital employed for human capital accumulating purpose that will be determined endogenously within the model.

Now we define \(\tilde{y_{t}}=\frac{Y_{t}}{m_{t}A_{t}}\), \(\tilde{k_{t}}=\frac{K_{t}}{m_{t}A_{t}}\), \(\tilde{c_{t}}=\frac{C_{t}}{m_{t}A_{t}}\) and \(\tilde{h_{yt}}= \frac{H_{yt}}{m_{t}A_{t}}\) as normalised output, capital, consumption, and human capital, respectively, where \(A_{t}^{\frac{\alpha \beta }{1-\alpha }}=\int _{I_{t}}^{N_{t}} A_{it}^{{\frac{\alpha \beta }{1-\alpha }}}di\) denotes the aggregate level of labour-augmenting technology and \(m_t=I_t-(N_t-Z)\) denotes the range of varieties that are produced with robots.Footnote 17. Here, the product \(A_{t}m_{t}\) is used as a measurement of technology in the intermediate good sector. While \(m_{t}\) reflects the level of technology for automated varieties, \(A_{t}\) captures that for non-automated ones as well as the creation of new varieties (note that the appearance of \(N_{t}\) is captured by \(A_{t}\)). Using these normalised variables, from the profit maximisation conditions for variety producers, we can derive the following:Footnote 18

where \(W_{Ht}\), \(W_{Lt}\) and \(R_{t}\) denote factor prices for human capital, \(H_t\), low-skilled labour, \(L_t\), and capital, \(K_t\), respectively.

Let us consider the variety that lies in the borderline between automation and non-automation (i.e., variety I). A firm that automates variety I will incur an opportunity cost that is equal to the present discounted value of the profit that would otherwise be earned by the monopolist currently using low-skilled labour if not replaced by robots.Footnote 19 Let \(V_{It}\) denote the value of automating and becoming a monopolist at time t then:

Now let \(V_{Nt}\) capture the value of creating a new variety and becoming a monopolist then:

Embedded in this formula is the notion that a firm that creates the highest indexed (i.e., the most complex) variety will need to cover its opportunity cost as if it compensates the existing technology monopolist who is producing the lowest indexed (i.e., the least complex) variety (that has been automated) by paying them the present discounted value of profit.

Under the assumption of free entry in the research activities, new research firms will enter the market until all profit opportunities are exhausted. This means that the levels of human capital in each research activity will be determined by the arbitrage condition which equates the marginal cost of an extra unit of human capital to its expected marginal benefit:

As a result, the technology market will be cleared when:

An equilibrium in this economy is defined by the time paths of output, consumption, capital, human capital, number of automated varieties, number of available varieties \(\{Y_t, C_t, K_t, H_t, m_t, N_t\}\), factor prices \(\{p_{it}, W_{Lt}, W_{Ht}\}\), value functions of technology monopolists \(\{V_{It}, V_{Nt}\}\) and allocation of human capital \(\{H_{yt}, H_{Ht}, H_{It}, H_{Nt}\}\) such that all markets clear, all firms maximise their profits, the evolution of each \(I_{t}\) and \(N_{t}\) is determined by free entry, and the representative household maximises its utility. Within this definition of equilibrium, we define the balanced growth path (BGP) equilibrium as one in which the normalised variables \(\tilde{c_{t}}, \tilde{k_{t}}, \tilde{y_{t}}, \tilde{h_{t}}\) are constant. In addition, all other variables grow at a constant rate. Along this BGP, final output grows at a constant rate g as consumption; \(m_{t}\) is constant so that both robots and low-skilled labour produce a fixed number of varieties within the mass of available varieties. This means that \(W_{Ht}\) is constant along the BGP as per (11). From Eqs. 6 and 7, m is constant so \(\dot{N_{t}}=\dot{I_{t}}\). This implies:

We will now suppress the time arguments for those that do not vary with time to simplify the notations.

From utility function defined in Eq. 1, the Euler equation for the rate of growth of consumption is \(g=\frac{R_{t}-\rho }{\theta }\). This implies that the rental rate is also constant and is equal to:

Using this to recalculate the value functions and further simplify the results yields:

where \(\omega _{LIt}=\frac{W_{Lt}}{A_{It}}\) and \(\omega _{LNt}=\frac{W_{Lt}}{A_{Nt}}\) denote productivity-adjusted wages at the margin of either automation or variety expansion respectively and \(g_{\omega _{LI}}\) and \(g_{\omega _{LN}}\) are their corresponding growth rates.

3.1 Exogenous labour-augmenting technical change

3.1.1 Balanced growth path

We first start with the case of an exogenous process of labour productivity improvement. Assume that labour-augmenting technology takes the following form:

Assumption 1

Labour-augmenting technology in each variety line evolves exogenously according to:

where \(\Delta = \left( N_t^2-I_t^2\right) ^{\frac{1-\alpha }{\alpha \beta }}\).

Embedded in this assumption is the notion that each line of labour-augmenting technology grows at the same exogenous constant rate a relative to the economy-wide state of technology (partly captured by \(\Delta \)). In addition, each next variety in the line is a step up in terms of technology from its previous counterpart. This assumption allows us to calculate \(A_{t}=A_{0}.e^{at}\) where \(A_{0}^{\frac{\alpha \beta }{1-\alpha }} = \int _{I_{t}}^{N_{t}} A_{i0}^{\frac{\alpha \beta }{1-\alpha }} di\). This means that \(A_{t}\) will grow at rate a as well. From this and Eq. 10, we can work out that \(g_{\omega LI} = g_{\omega LN} = 0\) and \(g=a\) or \(W_{Lt}\) and \(H_t\) will both grow at rate a.

From Eqs. 14, 17 and 18, we have:

in which \(R=(\rho +\theta a)\) as per (16). In working out this equation, we make use of Assumption 1 to obtain \(\frac{A_{Nt}}{A_{It}} = \frac{A_{N0}}{A_{I0}} = \left( \frac{Z}{m}\right) ^{\frac{1-\alpha }{\alpha \beta }}\).

Note that for \(\omega _{LI} \le R\), there will be no automation at all as it will be more profitable to produce with low-skilled labour instead of robots. By contrast, for \(\omega _{LN} \ge R\), there will be full automation as varieties are cheaper to be produced with robots. This means that partial automation, the case that we are more interested in, can only occur if \(\omega _{LI} \ge R \ge \omega _{LN}\). Upon expressing \(\omega _{LN}= \left( \frac{m}{Z}\right) ^{\frac{1-\alpha }{\alpha \beta }} \omega _{LI}\) to substitute into the above equation, we get:

Now we use (A37) and (A38) to get \(W_{Ht}\). After substituting the results into (12) and making use of Eqs. 17 and 20, we obtain:

This equation allows us to solve for m. This variable will help us determine \(\omega _{LI}\) from Eq. 20 and \(W_{H}\) from Eq. A37. From Eqs. 10 and 11, we can then figure out \(\tilde{k}\) and \(\tilde{h_{y}}\) as well as \(K_t\) and \(H_{yt}\). To make sure that Eq. 21 yields a solution over its defined domain of [0, Z], we make the following assumption:

Assumption 2

Parameters satisfy the following:

-

(i)

\(\frac{\alpha \beta }{1-\alpha } \ge 1\),

-

(ii)

\(\frac{2\mu _{I}(1-\alpha )L\left( \rho +\theta a\right) ^{\frac{1}{1-\beta }}}{\beta [\rho +(\theta -1)a]}.\left( \frac{1-\alpha }{\varOmega }\right) ^{\frac{1-\alpha }{\alpha (1-\beta )}}.\frac{\mu _{N}}{(\mu _{I}+\mu _{N})(2Z+1)Z^{\frac{1-\alpha }{\alpha (1-\beta )}}} >1\),

where \(\varOmega = (1-\alpha )\alpha ^{\frac{\alpha }{1-\alpha }} \left[ \left( \frac{\beta }{1-\beta }\right) ^{1-\beta } + \left( \frac{1-\beta }{\beta }\right) ^{\beta }\right] ^{-\frac{\alpha }{1-\alpha }}\)

The first condition of this assumption is needed to make sure that the productivity-adjusted wage paid to low-skilled labour, as given in Eq. 20, is a decreasing function of m. Indeed, if this condition does not hold, full automation will definitely occur and low-skilled labour can never compete with machines due to its cost disadvantage. Meanwhile, the second condition is required so that there exists a solution to Eq. 21. Clearly, this condition will be automatically satisfied when L is very large. Thus, Assumption 2 restricts the analysis to the interesting part of parameter space where the equilibrium is interior. This is also empirically reasonable given that in practice only a fraction of intermediate producers have made the transition to automating technology.

Under Assumption 2, we can state the following lemma on the existence (and also the uniqueness) of the solution:

Lemma 1

As soon as Assumption 2 holds, there exists a unique \(m^* \in (0, Z)\) that solves Eq. (21).

Proof

See Appendix.\(\square \)

From the above analysis, we can now summarise our main results in the proposition below:

Proposition 1

Suppose that Assumptions 1 and 2 hold. Then there exists a unique interior BGP in which robots and low-skilled labour are each employed to produce a fixed range of varieties alongside human capital. Along this BGP, output, consumption, stock of machines and human capital all grow at the same exogenous rate of labour productivity improvement.

The first noteworthy result of this proposition is the uniqueness of an interior equilibrium. The reason why the equilibrium is interior and only a fraction of intermediate firms switch to employing robots for their production relates to the three main on-going forces that affect the system, particularly, the employment of low-skilled labour and its productivity-adjusted wage. While automation replaces low-skilled labour with robots, new variety creation generates demand for low-skilled labour in newly created product lines. Acemoglu and Restrepo (2018a, 2019) refer to these effects as displacement effect and reinstatement effect on low-skilled labour respectively. In this context, the displacement effect works opposite the reinstatement effect. There is also a productivity effect triggered by the dynamics of labour-augmenting technology. This productivity effect somewhat offsets the displacement effect of automation and strengthens the reinstatement effect of new variety creation. At \(m^*\), all these effects balance out each other leading to a long-run equilibrium for the whole economy. This equilibrium will only change when there is an exogenous shock to the system.

Another important result highlighted in this proposition is that the exogenous rate of growth of labour-augmenting technology dictates that of output, consumption, physical capital and human capital. In that respect, the result reiterates what is present in neoclassical models such as Solow (1956) and Swan (1956) among others. This is mainly due to the timing of events. At the time when firms make decisions on employment and production, the labour-augmenting technology has already been shaped (outside the model) and in operation. Without an influence on this technology, firms have no choice but to take this process into account in determining their action. The dynamics of this factor also determine the rental rate as well as the adjusted wages paid to low-skilled and high-skilled labour.

Upon obtaining the unique interior BGP, we move on to the comparative statics. Here, we pay particular attention to the impact of a change in some important parameters either capturing the human capital accumulation process or the degree of automation on the economy. The main content of these exercises is put in the propositions below:

Proposition 2

Along the interior BGP, other things equal, an improvement in the quality of education and training activities will proportionately accelerate the rate of variety expansion and the rate of automation.

Proof

See Appendix.\(\square \)

The intuition for this result is as follows. Along the BGP, the sector allocates a constant fraction of human capital to final goods production. Meanwhile, because human capital accumulates at the rate of change of the labour-augmenting technology, there is a constant proportion of human capital devoted to human capital accumulation as well. An increase in the effectiveness of education and training activities will lower this proportion. This will in turn make more human capital available and ready to be allocated to either variety expansion or automation activity. Since these allocations are proportionate to each other, both activities will benefit from this resource allocation. However, there will be no change in the range of automated varieties.

Proposition 3

Along the interior BGP, while an increase in the productivity of automation technology increases the range of automated varieties, an increase in the productivity of variety expansion technology does the opposite. An increase in either the rate of time preference or the rate of growth of labour-augmenting technology discourages automation.

Proof

See Appendix.\(\square \)

The results in this proposition can be explained through market mechanism. Obviously, an increase in productivity of automation technology, \(\mu _{I}\), will increase the expected benefit of investing in this line of research so more resources will be pulled towards automation. As a result, the range of automated varieties will be expanded. However, an increase in productivity of variety expansion technology, \(\mu _{N}\), makes variety creation relatively more attractive to human capital than automation and, hence, reduces the range of products to be produced with robots.

An increase in the rate of time preference, \(\rho \), means consumers relatively prefer present consumption to future consumption so they will lend less money and, thus, the rental rate R will rise. This will make production using robots relatively less profitable than using low-skilled labour. Hence, there will be a contraction in the range of automated varieties.

An increase in the rate of growth of labour-augmenting technology, a, will reduce the rate of growth of adjusted wage paid to low-skilled labour so low-skilled labour becomes relatively more competitive to robots. This implies that the range of varieties to be produced with robots will get smaller.

3.1.2 Transitional dynamics

To gain further insight into how the economy reaches its long-run equilibrium, let us consider the transitional dynamics to the interior BGP. In doing so, we focus on the evolution of innovation incentives which are linked to factor prices. Given the automation intensity \(m_t=I_t-(N_t-Z)\), the dynamics of this variable is given by \(\dot{m_t} = \dot{I_{t}} - \dot{N_{t}}= \mu _{I} \frac{H_{It}}{A_{It}} - \mu _{N} \frac{H_{Nt}}{A_{Nt}}\) which, in turn, depend on the comparison between \(\mu _{I} \frac{V_{It}}{A_{It}}\) and \(\mu _{N} \frac{V_{Nt}}{A_{Nt}}\). Along the BGP, the expected marginal benefits are equal so that \(\dot{m_t}=0\).

Now assume that there is a permanent unexpected increase in automation productivity parameterised by an increase in \(\mu _{I}\) (i.e., a positive automation shock). This shock increases the BGP automated range of varieties. The proposition below characterises the transitional dynamics of \(m_t\).

Proposition 4

Suppose that the economy is in an interior BGP at time \(t=0\). Also suppose that there is a positive shock that benefits automation (represented by an increase in \(\mu _{I}\)). Then the dynamic equilibrium path will converge in finite time (i.e., at \(t=T<\infty \)) to a new interior BGP. In this new BGP, the range of automated varieties will be higher than that in the initial BGP.

Indeed, an increase in \(\mu _{I}\) will trigger a wave of additional investment in automation relatively to that of new variety creation. As a result, there will be a continuous increase in \(m_t\). This is featured by \(\mu _{I} \frac{V_{It}}{A_{It}}>\mu _{N} \frac{V_{Nt}}{A_{Nt}} = W_{Ht}\) which then leads to \(\mu _{I} \frac{H_{It}}{A_{It}}>\mu _{N} \frac{H_{Nt}}{A_{Nt}}\) so that \(\dot{m_t}>0\). This means that innovation occurs at both automation and new variety creation but that of automation enjoys a faster pace. Over time, when the automated range expands, it reaches those of higher complexity so the pace will gradually decrease. In terms of cost-and-benefit analysis, because \(\omega _{LIt}\) decreases in \(m_t\), an increase in \(m_t\) will reduce the productivity-adjusted wage paid to low-skilled labour (while \(R=\rho +\theta a\) stays the same). This creates a cost advantage for low-skilled labour and, hence, discourages automation.

At the new BGP, the economy will have the same output growth rate (equal to a) but a bigger range of intermediate products being produced by machines alongside human capital. This is because factor prices play an important role as self-correcting market forces that push the economy towards balanced growth. Because \(\omega _{LIt} \ge R_t \ge \omega _{LNt}\) for \(\forall m_t \in (0;Z]\), the asymptotic stability of the equilibrium is always guaranteed.

The changes in automation efficiency and technology affect final output, effective income share of low-skilled labour (and, hence, that of robots), as well as wages paid to workers. Figure 1 shows the transitional dynamics of these interested variables corresponding to an increase in \(\mu _{I}\).Footnote 20 Specifically, the figure shows how the variables evolve over time during the transition (in solid lines) as compared to their dynamics under the case of no shock (in dashed lines). While final output and high-skilled wage are higher throughout and after the transition, the paths of effective income share of and wage rate paid to low-skilled workers are below those in the no-shock baseline. In all cases, the new BGP will have the same positive growth rate as that before the shock.

3.1.3 A numerical example

In this subsection, we report results of a simple numerical example. By this example, we show how individual parameter values can be used to solve the model and simulate the obtained BGP. Similar to Le and Le-Van (2018), we select parameters such that they closely match a group of industrialised countries such as Australia, Canada, France, the United Kingdom and the United States. In particular, we take \(\alpha = \frac{2}{3}\) and \(\beta = \frac{1}{2}\) so that \(\alpha \beta = \frac{1}{3}\) matching with the data on the group’s average capital income as share of GDP. Following Acemoglu et al. (2012), we choose \(\theta = 2\) to match with Nordhaus’s choice of intertemporal elasticity of substitution and \(\rho = 0.015\) which is in line with empirical estimates of the utility discount rate for developed countries as summarised in a survey by Zhuang et al. (2007). To make sure that our data correspond to an annual long run interest rate of 5.5%, we set \(a=0.02\) (as \(R=\rho + \theta a\)). In addition, we set \(\mu _{N}=1, Z=40\) and \(L=10,000\). For the purpose of comparison, we consider three different values \(\mu _{I} = 1, \mu _{I}= 1.5\) and \(\mu _{I} = 2\).

In Table 1, we report the effect of two permanent automation shocks on the effective income shares \(\varGamma _{L}, \varGamma _{K}, \varGamma _{H}\), the final output growth rate, g, and its level along the BGP, Y. In the first column, we consider the benchmark case in which automation efficiency, \(\mu _{I}\), takes the value of 1. In the second column, we consider a permanent positive shock that increases this automation efficiency by \(50\%\) so that \(\mu _{I} = 1.5\). The shock expands the range of intermediate products to be produced by industrial robots relative to low-skilled labour. This confirms the result obtained in Proposition 3 regarding the comparative static effect of a change in \(\mu _{I}\). Together with that expansionary effect, the shock has a strong distributional effect: it increases the effective income share of robots but reduces that of low-skilled labour. Although the effective income share of human capital stays unchanged, the aggregate income share of total labour declines. This result is in line with the downward trend in the share of labour in national income since 1970s that is observed in a large number of developed countries (see, for example, Karabarbounis and Neiman (2014); IMF (2017), and Acemoglu and Restrepo (2018b)). While this shock has no impact on final output growth rate, it increases the final output level in the long run. This is because the economy as a whole becomes more productive with this increase in the level of automation (recall that robots can only replace low-skilled workers in performing routine tasks when they are more productive than low-skilled workers). It also increases high-skilled wage rate but reduces low-skilled wage rate. In the third column, we conduct the same experiment by allowing a further 50% permanent increase in automation efficiency from the benchmark case (i.e., \(\mu _{I}=2\)). It can be seen that the distributional effect further reduces the effective income share of low-skilled labour but it further increases the effective income share of robots. Human capital is again unaffected by the shock. While final output still grows at the same exogenous rate of labour-augmenting technical change at 2%, its level is further improved by this additional shock. The gap between high-skilled wage rate and low-skilled wage rate is further widened.

The obtained results on the polarisation of the labour market can be explained on the following grounds. Because automation directly competes with low-skilled labour, other things equal, the automation shock harms low-skilled workers due to the displacement effect. This means that the effective income share and the wage rate of low-skilled workers will fall. Meanwhile, because human capital complements both robots and low-skilled workers, the automation shock will have no effect on its effective income share: the shock will only reallocate human capital between working with robots and working with low-skilled labour. Given that the automation shock increases in the income level of the whole economy and human capital cannot make a discrete jump, a constant effective income share of human capital implies a higher wage rate for high-skilled workers.

In short, positive automation shocks expand long-run output level but not its growth. They also enlarge the capital stock and benefit high-skilled workers but harm low-skilled workers. This means that while the race identifies high-skilled workers and robot owners as the winners, it points to low-skilled workers as the losers. The widening gap between the wage of high-skilled labour relative to that of low-skilled labour fits well with what has been happening in the US labour market since 1980 as described by Krusell et al. (2000) and in many other OECD countries as discussed by Angelini et al. (2020).

3.2 Endogenous labour-augmenting technical change

3.2.1 Balanced growth path

Now assume that labour-augmenting technological progress requires human capital investment.Footnote 21 To simplify notation, define \(B_{it} = A_{it}^{\frac{\alpha \beta }{1-\alpha }}\) and \(B_{t}=A_{t}^{\frac{\alpha \beta }{1-\alpha }} = \int _{I_{t}}^{N_{t}}B_{it}di\). Assume that at any point in time, a non-automated intermediate firm that hires one unit of human capital for researching purpose is successful in improving its labour productivity with a Poisson arrival rate \(\eta >0\). When an innovation is successful, the productivity level is improved as the following:

where \(\mu _{B}>0\) denotes the efficiency of this research activity and \(h_{Bit}\) is the amount of human capital employed for research. The appearance of \(B_{t}\) in this formula, which reflects the aggregate level of low-skilled labour productivity, is to capture any potential knowledge spillovers and \(\sigma \) denotes the degree of such a spillovers process. Aggregating across firms we get:

where \(H_{Bt}= \int _{I_{t}}^{N_{t}} h_{Bit}di\) is the amount of human capital used for conducting research leading to improvement of low-skilled labour productivity. It can be seen that due to symmetry, the amount of human capital employed for conducting research will be the same for every non-automated firm, i.e., \(h_{Bit}=\frac{H_{Bt}}{Z-m}, \forall i \in (I_t; N_t]\).

The market clearing condition for human capital will now read:

Along the BGP, the allocation of human capital to each sector will be a constant fraction of the total human capital stock. Also along the BGP, \(B_{t}\) grows at a constant rate \(g_{B}\). Thus, using Eq. 23, we work out that \(g_{B}=\frac{1}{1-\sigma }g_{H}\). This, together with Eq. 22, implies that all \(B_{it}\), for \(i\in (I_t; N_t]\), will grow at rate \(g_{B}\). By definition, for \(i\in (I_t; N_t]\), all \(A_{it}\) and \(A_{t}\) grow at rate \(a=\frac{1-\alpha }{\alpha \beta } g_{B} = \frac{1-\alpha }{\alpha \beta (1-\sigma )} g_{H}\). To simplify our calculation, we choose \(\sigma \) in a way that \(\frac{1-\alpha }{\alpha \beta (1-\sigma )} = 1\) or \(\sigma = \frac{\alpha \beta +\alpha - 1}{\alpha \beta }\). The convenience of this choice of parameters is that it makes \(a=g_{H}\) as in the previous sub-section so we do not have to re-derive all equations for \(\tilde{y_{t}}, R_{t}, W_{Ht}, W_{Lt}\) in their intensive forms. In the meantime, it does not affect our main results. The only difference is that \(g_{H}\) will now be endogenously determined within the model.

Again, we pay attention to a representative non-automated firm that lies in the borderline with those automated ones. This firm will employ human capital to improve its low-skilled labour productivity if the expected benefit outweighs the expected cost of that activity. The optimal level of human capital is determined by the following:

This formulation equates the marginal cost of human capital, \(W_{Ht}\), with its marginal benefit, \(\eta V_{Bt}\). Here, \(V_{Bt}\) is the value of upgrading low-skilled labour productivity that is given by the present discounted value of the incremented profit that would otherwise be generated using low-skilled labour before being replaced by robots:

This equation is obtained by using Eq. 22 and A35 before imposing the BGP conditions. It can be further simplified to yield:

This, together with Eq. 12 and 25, delivers:

where \(R=\rho +\theta g_H\). In addition, similar to the previous section, the two equations (20) and (21) still hold. As a result, we have three equations in three unknown variables \(m, g_H\) and \(\omega _{LI}\). Solving this system of equations will give us the BGP for the whole economic system. In particular, from Eq. 20 and 28, we obtain:

This result and that in Eq. 20 can be substituted into Eq. 21 to get an equation for m only:

where \(\frac{1}{R}= \frac{1-\theta }{\rho }+\frac{\theta }{\rho }.\frac{\mu _{I} \mu _{N}}{\eta \mu _{B}}. \left( \frac{2}{Z+m}\right) ^{\frac{\alpha \beta -1 + \alpha }{\alpha \beta }}.\frac{ (Z-m)^{\frac{1-\alpha }{\alpha \beta }}}{ \mu _{I}Z^{\frac{1-\alpha }{\alpha \beta }}+\mu _{N}m^{\frac{1-\alpha }{\alpha \beta }}}\). This shows that R is increasing in m. Regarding the existence of a solution to this equation, we state the following:

Lemma 2

There always exists a unique \(m^*\in (0,Z)\) that solves Eq. (30).

Proof

See Appendix.\(\square \)

Given that \(m^*\) is the key variable for determining other dimensions of the BGP, the result of Lemma 2 allows us to achieve further results which can be summarised in the proposition below:

Proposition 5

Suppose that Assumption 2(i) holds. Then there always exists a unique interior BGP in which the range of automated varieties is endogenously determined by the system. Along this BGP, final output, consumption, capital stock and labour-augmenting technology all grow at the rate of growth of human capital.

The essence of this proposition is to emphasize the existence of a unique interior BGP at which both robots and low-skilled workers find their own tasks in the production of varieties. This is equivalent to what was obtained previously in Proposition 1. Again, economic forces such as automation, variety creation and labour-augmenting technology are the factors that shape the uniqueness of this interior BGP. Equilibrium occurs when all of these forces are in balance. However, it should be noted that the key difference between the result obtained in this proposition and that in Proposition 1 lies in the feature that in this current setup, the dynamics of all activities are endogenously determined within the system rather than by an exogenous process as previously. In particular, output, consumption and low-skilled labour productivity will all grow at the rate of growth of human capital. This is because human capital is the key production factor that is employed in every activity of the economy, ranging from working in research labs (to boost up new technologies) to producing varieties and educating its own workforce.

Proposition 6

Other things equal, along the interior BGP, the range of automated varieties will be expanded further in the long run if there is an increase in automation efficiency. However, an increase in either the rate of time preference or the research efficiency of labour-augmenting technology does the opposite.

Proof

See Appendix.\(\square \)

The impact of a change in either automation efficiency, \(\mu _{I}\), or the rate of time preference, \(\rho \), on the range of automated varieties, m, can be explained through market mechanism in a similar way as in Proposition 3. As for the effect of the research efficiency of labour-augmenting technology, \(\mu _{B}\), on m, an increase in \(\mu _{B}\) will attract more human capital towards this line of research leaving less of this resource for other activities including research that targets at displacing low-skilled labour with robots. It also reduces the productivity-adjusted wage rate of low-skilled labour and, thus, render this production factor with an important cost advantage over its robotic counterparts. Being discouraged by this change, at the margin, intermediate firms will be less willing to make a transition to automating technology for their production. As a result, the range of automated products will contract.

Proposition 7

Along the BGP, the rate of growth of human capital is determined by market forces such as the rate of time preference, the range of available varieties and the productivity of alternative innovation types. While an improvement in the effectiveness of education and training has no effect on this growth rate, it strengthens research activities enhancing either variety expansion or automation.

Proof

See Appendix.\(\square \)

This result is interesting. Human capital, the key production factor that takes part in every economic activity, dictates its rate of change to all other important economic variables such as output, consumption and physical capital. However, this rate is not solely determined by human capital itself. Rather, it is determined by market forces, including those prescribing research activities and the range of available varieties (i.e., the economy’s supply side factors) and households’ preferences (i.e., the economy’s demand side factors), through the operation of the market system. Clearly, a change in research activities and the range of varieties will affect the demand for human capital. Meanwhile, a change in the rate of time preference will affect households’ decision on supplying human capital to the market. Notably, any improvement in the quality of education and training will not alter this growth rate but will reduce the amount of human capital needed for its own accumulation. Any extra resources saved from this process due to the improvement will be channelled to other activities. Because variety production and labour-augmenting technology each takes a constant proportion of human capital, research activities to further boost up variety creation and automation will proportionately absorb the increment.

In summary, obtained results differ significantly from those in Acemoglu and Restrepo (2018b) which assume no accumulation of human capital. In that paper, because human capital stock ("scientists") does not change, long-run growth depends on the allocation of human capital between automation and creation of new varieties (note that human capital is not employed for producing varieties in their paper). By introducing human capital accumulation, our model adds more dynamism to the system and, as a result, provides more explanation to factors affecting long-run growth. In particular, it is the rate of human capital accumulation, not its level as in Acemoglu and Restrepo (2018b), and factors influencing this rate of growth that will matter for long-run growth of the economy. Our result is, therefore, not subject to the scale effect which, as pointed out by Jones (1995), is refuted by empirical data. Any progress in education and training will be translated into either a higher rate of introducing a new variety or a higher rate of automation. Such an important effect is missing from Acemoglu and Restrepo (2018b).

3.2.2 Further on the numerical example

In this subsection, we undertake some further analysis on the numerical example to shed more light on our theoretical predictions. At the moment, our theoretical implications are ambiguous on the rate of growth of final output as well as on the effective income shares when there is a permanent shock, such as a permanent automation shock, to the system. This is because there may be indirect effects (for example, through changing R) that affects this variable besides the direct effect of the automation shock. In addition, it will be interesting to compare economic outcomes under the case of an endogenous labour-augmenting technology with those obtained under the case of an exogenous process. With this calibration, we aim to focus the implications of our theory on the issues under reasonable parameter values.

For the purpose of comparison, we continue to assume parameters to take their values as in described Section 3.1.3. To account for the modelling change in which labour-augmenting technological change is now specified as an endogenous process, we set \(\mu _{B}=50\) and \(\eta = 0.02\) so that the overall research efficiency of labour-augmenting technology is \(\eta \mu _{B} =1\). Although somewhat arbitrary, this is equal to \(\mu _{I}\) of automation and \(\mu _{N}\) of variety creation in the benchmark case making an equality among all lines of technology. Also, under this choice of parameter values, final output grows at 2% matching with the case of exogenous labour-augmenting technology. This allows us to make sensible comparison of economic outcomes under alternative assumptions regarding the labour-augmenting technology.

Similar to what were conducted before in Table 1, in Table 2, we explore changes in interested variables when there are permanent shocks to automation technology, first at 50% of the benchmark level (in the second column) and then a further 50% to the representative parameter, \(\mu _{I}\) (in the third column). Overall, obtained results on the impact of a permanent positive shock in automation technology on the range of automated products, final output level, effective income shares, and wages are largely similar to what were presented under the scenario of exogenous labour-augmenting technical change. In particular, each time, a positive permanent automation shock expands the range of intermediate products to be produced with robots and increases long-run output level. Hence, the result discussed in Proposition 6 regarding a change in \(\mu _{I}\) is confirmed here. In that process, it significantly reduces the effective income share of low-skilled labour but, at the same time, increases that of industrial robots. Although the effective income share of human capital stays unaffected, the aggregate income share for the total labour force will be lower. Unlike the case of exogenous labour-augmenting technology, long-run output growth is decreased after the shocks although its level is expanded. This means that a permanent automation shock now exerts both a level effect and a growth effect on the final consumption good. This can be explained on the ground that a positive automation shock will create more incentive for innovators to conduct research leading to a bigger range of automated varieties. This will expand the final output level. However, the automation shock also takes away resources that could be used to develop new varieties. If variety expansion generates a larger productivity gain than automation, the shock will result in a decrease in output growth. Another observation is that the magnitudes are larger for \(m, Y, \varGamma _{K}\) and \(W_H\) but smaller for \(g, \varGamma _{L}, W_L\) and R in the case of endogenous technology.

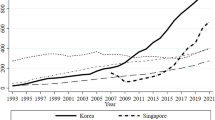

To better illustrate the forces behind these changes, Fig. 2 depicts the equilibrium paths of some interested variables for the case of a permanent increase in \(\mu _{I}\) from 1 to 1.5 (i.e., a 50% shock). It also compares the transitional paths of these variables under alternative assumptions on labour-augmenting technology. To that end, we express time paths under endogenous labour-augmenting technology as broken lines and compare them with those under exogenous labour-augmenting technology as solid lines. It can be seen that the time paths of final output and high-skilled wage under the endogenous technology case are above those under the exogenous technology case. However, with a higher growth rate, the latter may be able to catch up and even surpass the former in a sufficiently distant future. By contrast, the paths of low-skilled income share and low-skilled wage under endogenous technology are both lower than the paths under its exogenous counterpart. Interestingly, the gap between two low-skilled wages gets widened with time as the path under the exogenous case acquires a slightly higher growth rate.

Overall, an automation shock exerts a negative impact on low-skilled workers due to the ’race between man and machine’ (Acemoglu and Restrepo 2018b) but a positive impact on high-skilled workers due to the skill-capital complementarity (Krusell et al. 2000). In particular, an increment in the stock of robots increases the marginal product of high-skilled workers but decreases the marginal product of low-skilled workers. This result is in line with Graetz and Michaels (2018)’s finding that an increase in robot utilisation does not reduce total employment but reduces low-skilled workers’ share. Notably, the harmful impact on low-skilled workers is larger under the endogenous case than under the exogenous case. This may be due to a lower long-run output growth under the endogenous case. Given that this growth is mainly determined by the allocation of human capital between research enhancing automation and expanding varieties, an immediate policy implication would be to enhance education investment to spare more resources towards these two types of innovation. In that process, it is necessary for research on variety expansion to always get a lion’s share in the resource increment so that the benefit of variety expansion can offset the harmful impact of automation on low-skilled workers. In addition, it will be essential to improve productivity of the research line that enhances labour-augmenting technology because doing so will help deterring excessive automation. Such a policy action is the important feature that differentiates the endogenous version of the model from its exogenous counterpart presented previously.

4 Why introducing human capital is important

In our model presented in the previous section, low-skilled workers are displaced by robots in the production of some varieties and, therefore, relocated to the production of other new and more complex intermediate products. This process cannot happen without improvements in productivity of low-skilled labour through labour-augmenting technology. While Acemoglu and Restrepo (2018b) treats this technology either exogenously or as a learning-by-doing outcome, we posit that this technology evolves endogenously as a result of an intentional research lab investment using human capital. This is a more realistic assumption as there is a rich literature confirming that technological improvement is mostly due to purposeful R &D investment (Romer 1990; Grossman and Helpman 1991) in which human capital is one of the most important inputs. According to Goldin and Katz (2008), human capital is the key production factor that shapes our economy over the last century. All this necessitates the need of introducing human capital into our model as the key production factor that takes part in every activity of the economy including variety production. In Acemoglu and Restrepo (2018b), high-skilled labour is only used for R &D so they cannot divide the task space (routine versus non-routine) to match with the skill space (low-skilled versus high-skilled). In our paper, we are able to take account of the important role that an educated labour force can play in terms of creating, implementing and adopting technologies, thereby generating growth as emphasized by Nelson and Phelps (1966); Romer (1990); Benhabib and Spiegel (1994); Aghion and Howitt (1998), and more recently, Cinnirella and Streb (2017). It also helps capture the issue on division of labour and human capital investment discussed by Krusell et al. (2000) and Atack et al. (2019). As demonstrated in the previous section, the rate of growth of human capital is translated into that of all other important variables such as final output, consumption, and capital stock.

Another important departure of our model from the seminal work by Acemoglu and Restrepo (2018b) is the endogenous human capital accumulation. Technological change of different forms forces human capital to evolve over time so education and training takes place to ensure that the supply of human capital meets with its increasing demand. To some extent, our modelling assumption is in line with the discussion on capital-skill complementarity in Krusell et al. (2000) and the race between education and technology in Goldin and Katz (2008). Our results indicate that it is the rate of growth of human capital, not its level as in Acemoglu and Restrepo (2018b), that matters for the growth of the economy. In that respect, our results are not subject to the scale effect, an effect that is not supported by empirical data (Jones (1995)).

Introducing human capital and its endogenous accumulation not only helps us overcome the above-mentioned shortcoming of the existing literature on automation and growth but also allows us to conduct a critical assessment on economic impact of automation. Overall, our quantitative results imply that although automation leads to a decline in the income share and wage rate of low-skilled labour, it does not erode the income share of human capital and even enhances the wage rate of high-skilled workers. These theoretical predictions are in line with the empirical evidence presented by Valentini et al. (2023) on Euro area. In particular, they find that regions that invest more in R &D and have higher levels of human capital can enhance the complementarity between robots and the labour force, thereby turning the risk of automation into an increase in both income and employment. Our results also indicate the pathways for the income share of low-skilled labour to remain positive: (i) a sufficient rate of variety expansion so that no full automation occurs; and (ii) a sufficient rate of progress in labour-augmenting technology to improve productivity of low-skilled labour. Because these activities require human capital as the essential input, the key solution to the modern complex economic system is to take control of the rate of growth of human capital and its allocation. More specifically, making sufficient investment in education is the utmost important step to sustain long-run growth, maintain the balance between robots and low-skilled workers and allow the prosperity to be widely shared in the economy.

In the exogenous version of the model, long-run growth is determined by exogenous labour-augmenting technology. While this is inadequate, the endogenous version yields a more satisfactory answer to the questions on long-run growth and workers’ Income (i.e., output shares and wage rates) as interested variables are determined within the model. The result that other things equal, long-run growth is lower in the endogenous version is interesting. It raises an intriguing empirical question for us to think about: Do structural growth accounting exercises in the existing literature give automation too much credit? A critical assessment of our economy in order to provide a satisfactory answer to this question will be an interesting research avenue.

5 Conclusion

In this paper, we have considered a simple model of endogenous growth characterised by technological transition in which the evolution of technology, human capital and labour income (either in terms of wage rates or income shares) is consistent with observed pattern in the US and other advanced countries over the past several decades. Besides automation that takes place on the production of intermediate products, there are other lines of ongoing innovation that aim at either creating new product varieties to be used in the production of the final consumption good or improving low-skilled labour productivity. While the stock of automating capital is accumulated similarly as physical capital in the form of robots, it acts as a production factor that perfectly substitutes for low-skilled labour in performing routine tasks in the production process for varieties. Within that setting, we derived a balance growth path under alternative cases of labour-augmenting technology: exogenously determined versus endogenously determined within the model. We showed that in each case there exists a unique balanced growth path along which each of the production factors, robots and low-skilled labour, is employed to produce a fixed range of varieties alongside human capital. In other words, low-skilled labour still plays an important role in the production process and its employment opportunity depends greatly on the interaction of different technologies inside the economy. When labour-augmenting technology is exogenous, its rate of growth dictates that of output, consumption and wages. However, when this factor is endogenously determined within the model, it is the rate of growth of human capital that does the job. This rate of growth is, ultimately, determined by parameters characterising research activities and households’ preferences.

The stock-taking message here is that while automation may propose some threats to low-skilled labour, it does little harm to high-skilled labour. Only workers who work in tasks that can be easily done by industrial robots are under pressure. Those who perform in tasks of high human complexity will be relatively relaxed. Automation helps maintain long-run growth by forcing low-skilled labour to improve its productivity. Thinking in a positive way, industrial robots may serve as an ideal supplement for low-skilled labour in countries where this resource is relatively scarce. From economic policy perspectives, having sufficient investment in education and maintaining a fine balance for the allocation of high-skilled workers among different types of technological innovation are necessary for the economy to achieve its sustainable long-run growth. Under these conditions, low-skilled labour and routine tasks will get supported against the competition of robots and even achieve a reasonable balance with robots so that prosperity can be mutually shared.

There are several interesting theoretical and conceptual issues with which our framework can be further enriched. A new dimension might be to explore the possibility of excessive automation and whether robot taxation can help improve economic efficiency and social welfare. On the flip side, there could be a subsidy to innovation in variety expansion and labour productivity to provide some assistance to low-skilled workers in response to the harmful impact of automation. Moreover, it may be interesting to introduce the middle skill levelFootnote 22 to the skill set to further explore the heterogeneity in terms of impact on wages and employment dynamics.Footnote 23 These will open promising avenues for a fruitful research agenda in the future.

Data Availability

Data sharing is not applicable to this article as no datasets were generated or analysed during the current study.

Notes

In this paper, by robots or automation, we generally refer to AI or computer algorithms that can work or run automatically by themselves. These are primarily made up of physical capital. This capital is quite different from the traditional capital, as it has a very high degree of substitutability with low-skilled labour. However, to make it simple, we abstract from considering the traditional capital and assume that all physical capital is used to produce these robots.

According to Ong and Nee (2004), augmented reality technologies using interactive interfaces to increase workers’ ability to perceive or control objects can provide support to workers in production or integrated design tasks. They enhance workers’ productivity.

We can think of this line of technology as production techniques embedded in traditional physical capital in the form of machines or factory buildings that require high-skilled labour input to produce. As discussed above, because including both kinds of capital could make our model heavy and distract our attention from the other capital that is used in producing robots, we do not model the traditional capital here.

We use these two terms interchangeably throughout the paper.

In Appendix A, we consider a static version of this model. First, we analyse conditions under which either full automation (i.e., robots displace all low-skilled labour in performing routine tasks) or no automation (i.e., no robots are used) occurs. Second, we show the existence of a unique static equilibrium in which all factors of production (i.e., low-skilled workers, human capital, and robots) are employed. We find that, along this static equilibrium, variations in the range of varieties or capital–labour ratio affect the income share of low-skilled labour but not that of human capital.

Conducting our quantitative analysis on a simplified set of data is a needed simplification to help us better understand the impact of an automation shock on labour income (e.g., income shares and wage rates). While the result on wage polarisation (between high-skilled and low-skilled workers) is reached within this quantitative analysis, it is a sensible one given that the model yields important theoretical implications on skill premium, both along the balanced growth path and during the transitional dynamics.

There is another R &D-based growth literature that uses the Schumpeterian quality-ladder framework in which innovation is aimed at creating higher-quality products (Grossman and Helpman 1991; Aghion and Howitt 1992; Le 2011; Acemoglu et al. 2012; Le and Le-Van 2016, 2018). However, to keep the model more tractable, we do not consider this type of innovation here.

Actually, \(\alpha = \frac{\epsilon -1}{\epsilon }\) where \(\epsilon >1\) is the elasticity of substitution between inputs.

According to The Street (2010), lamplighter and pin setter are among jobs that have disappeared over the last decades. In the meantime, there will be prospective jobs created in the future, such as flight instructor or personal internet of things security repair person (Crimson Education 2018). In addition, jobs requiring labour can emerge from within firms using AI, for example, trainers to train AI system, explainers to communicate between AI systems and customers, or sustainers to maintain the performance of AI systems (Acemoglu and Restrepo 2018a).

Our task definition follows Autor et al. (2003) in which routine tasks are those that can be accomplished by explicit rules. They include a limited and well-defined set of cognitive and manual activities. Meanwhile, non-routine tasks are mostly not programmable and often involve problem-solving and complex communication activities.

With this assumption, we match the task set with the skill set: routine tasks are relatively low-skilled while non-routine tasks are relatively high-skilled. It is true that sometimes high-skilled workers may end up in performing tasks that are easily automated by machines while low-skilled workers may conduct sophisticated tasks. However, according to Chen (2020), in 2017, 75% of high-skilled individuals (with college education) worked in non-routine occupations as compared to roughly 36% of low-skilled ones (without college education). For simplicity, in this paper, we abstract from this possibility. We also do not consider the case of middle-skilled workers to avoid complicating the skills–tasks matching process and reducing the tractability of the model.

\(A_{it}\) can also be considered as the productivity of labour employed in that production line.

Assuming a growing low-skilled labour force does not affect the nature of our model results. Rather, it complicates our notations further. Therefore, we opt for a constant low-skilled labour force for simplicity.

While we focus on the dynamic equilibrium, we also derive results for a static equilibrium and include them in Appendix A.

Within a certain range of available varieties, there is a one-to-one mapping between I and m. However, we opt to use two different notations in which I refers to the index of variety while m refers to the range of varieties under automation. This distinction is important especially in the context of a dynamic equilibrium considered later on in which I (i.e., the index) varies with time while m (i.e., the range) is constant.

For more detailed derivation, see Appendix A.

To put it differently, if an existing monopolist decides to automate the production process of its variety, its decision will be made based on the discounted accrual of extra profit generated at each date.

In particular, it is drawn for the case of an increase in \(\mu _{I}\) from 1 to 1.5. Details on parameter choices for creating the graphs are discussed in the next subsection.

Examples are many. As a typical one, scientists and engineers are employed to create a new type of tractors that help improve productivity of farmers.

For instance, in a model of lobbying, Afonso et al. (2022) examine how automation affect middle-skill workers.

For example, the KLEMS databases published US National Statistical Institutes include a definition on middle skill level.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Acemoglu D, Restrepo P (2018a) Artificial intelligence, automation and work. NBER Working Paper N24196

Acemoglu D, Restrepo P (2018b) The race between man and machine: implications of technology for growth, factor shares and employment. Am Econ Rev 108(6):1488–1542

Acemoglu D, Restrepo P (2019) Automation and new tasks: how technology displaces and reinstates labor. J Econ Perspect 33(2):3–30

Afonso O, Lima P, Sequeira T (2022) The effects of automation and lobbying in wage inequality: a directed technical change model with routine and non-routine tasks. J Evol Econ 32:1467–1497

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press

Aghion P, Jones B, Jones C (2017) Artifical intelligence and economic growth. NBER Working Paper No. 23928

Agrawal A, Gans J, Goldfarb A (2019) Artificial intelligence: the ambiguous labor market impact of automating prediction. J Econ Perspect 33(2):31–50

Angelini E, Farina F, Valentini E (2020) Wage and employment by skill levels in technological evolution of south and east europe. J Evol Econ 30:1497–1514

Atack J, Margo R, Rhode P (2019) Automation of manufacturing in the late nineteenth century: the hand and machine labor study. J Econ Perspect 33(2):51–70

Autor D (2015) Why are there still so many jobs? The history and future of workplace automation. J Econ Perspect 29(3):3–30

Autor D, Levy F, Murnane R (2003) The skill content of recent technological change: an empirical exploration. Q J Econ 118(4):1279–1333

Autor D, Salomons A (2018) Is automation labor-displacing? Productivity growth, employment, and the labor share. Brook Pap Econ Act

Benhabib J, Spiegel M (1994) The role of human capital in economic development: evidence from agrregate cross-country data. J Monet Econ 34(2):143–174

Berg A, Buffie E, Zanna L (2018) Should we fear the robot revolution? (the correct answer is yes). J Monet Econ 97:117–148

Chen C (2020) Capital-skill complementarity. sectoral labor productivity, and structural transformation. J Econ Dyn Control 116:1–18

Cheng H, Jia R, Li D, Li H (2019) The rise of robots in China. J Econ Perspect 33(2):71–88

Cinnirella F, Streb J (2017) The role of human capital and innovation in economic development: evidence from post-Malthusian prussia. J Econ Growth 22:193–227

Cortes G, Jaimovich N, Siu H (2017) Disappearing routine jobs: Who, how, and why? J Monet Econ 91:69–87

Crimson Education (2018) Top 10 jobs in 2030: skills you need now to land the jobs of the future. https://www.crimsoneducation.org/au/blog/jobs-of-the-future

Dawid H, Neugart M (2023) Effects of technological change and automation on industry structure and (wage-)inequality: insights from a dynamic task-based model. J Evol Econ 33:35–63