Abstract

This paper provides an analytical review of the literature on the role of technology cycle time (TCT) in the catching-up process of latecomers at the firm, sectoral, and national levels. At the national level, latecomer economies follow a detour that consists of economic growth through specialization in short-TCT sectors during the catching-up phase, followed by a shift to long-TCT sectors in the post-catching-up phase. The paper then discusses the double-edged nature of TCT at the sectoral level, such that short TCT can either be a window of opportunity associated with the rapid obsolescence of existing technologies and thus low entry barriers, or another source of difficulty associated with the truncation of learning from existing technologies. Only latecomers with a certain absorptive capacity can benefit from short TCT as a window of opportunity. Finally, at the firm level, this paper discusses the issue of possible convergence in the behavior of catching-up firms towards those of mature firms in advanced economies. At all three levels, the keywords are detours and convergence. Given the barriers to entry in long-TCT sectors, latecomers pursue a strategy of detouring into short-TCT sectors. That is, instead of trying to emulate incumbents by entering long-TCT sectors, latecomers take the opposite route. Subsequently, as latecomers improve their capabilities over time, they shift their specialization from short to long TCT sectors, thereby achieving convergence in behavior and strategy at the firm, sectoral, and national levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The origins of the concept of “catch-up” can be traced back to Gerschenkron (1962) and Abramovitz (1986) who popularized the three keywords of “catching up,” “forging ahead,” and “falling behind.” Fagerberg and Godinho (2005: 514) define catch-up as a narrowing of a country’s gap in productivity and income in contrast to that of a leading country. Odagiri et al. (2010) explains catch-up as the process by which a late-developing country narrows its gap in income (“economic catch-up”) and technological capability (“technological catch-up”) vis-à-vis a leading country. Thereafter, neo-Schumpeterian economists provided a more elaborate theoretical skeleton to the empirical work on the catch-up phenomenon (Mazzoleni and Nelson 2007).Footnote 1 Nelson and Winter (1982) not only revived evolutionary economics with its explicit linkages to Schumpeter’s insight but also stimulated the research applying this insight into economic catch-up. A distinctive feature of the studies by neo-Schumpeterians is their emphasis on innovation and technological capabilities as the enabling factors of catch-up.

One of the key theoretical concepts in neo-Schumpeterian economics is the technological regime, which was first proposed by Nelson and Winter (1982) and is similar to the technological paradigm of Dosi (1982). The technological regime is a theoretical framework to interpret a variety of innovative processes that could be observed across technological sectors. Breschi et al. (2000) defined technological regimes as a particular combination of key dimensions and posited four fundamental factors: technological opportunity, appropriability of innovations, cumulativeness of technological advancements, and properties of the knowledge base. Researchers from the evolutionary tradition have explored the impact of technological regimes on technological change (Dosi 1982), market structure (Audretsch 1995; Cohen and Levin 1989), new-firm survival (Audretsch 1991), and patterns of innovation (Breschi et al. 2000; Malerba and Orsenigo 1996).

Recent studies have further examined the impact of technological regimes on the technological catch-up of latecomers (Landini and Malerba 2017; Lee and Lim 2001; Li et al. 2019; Park and Lee 2006). Park and Lee (2006) introduced additional elements of the technological regime, such as technology cycle time (TCT), uncertainty, knowledge accessibility, and initial knowledge stock, which are more relevant in the context of the catch-up by emerging economies. Lee (2013) further enriched the concept of technological regime in the context of catching up, focusing on the knowledge bases of not only sectors but also countries and firms in emerging economies. This three-dimensional extension of the technological regime is embedded in a larger theoretical framework of the national innovation system (NIS), which was proposed by Freeman (1988) in the 1980s and later enhanced by Lundvall (1992) and Nelson (1992). While NIS focuses on the efficiency of acquiring, creating, diffusing, and utilizing knowledge at the country level, “innovation system” can be defined and measured at the sectoral and firm levels.

In the three-dimensional analyses, the TCT plays a central role as key variable. TCT measures how fast technologies change or become obsolete over time (Jaffe and Trajtenberg 2002). On this basis, short TCT means that “creative destruction” (Schumpeter 1942: 73) occurs frequently. Then, both for incumbents and late entrants it becomes very crucial to respond well to technological changes because they act both as a creative force in the growth of firms and as a destructive forcing making the same firms vulnerable to competitors (Utterback 1994: xiv). In particular, short TCT technologies means that the knowledge base of existing technologies is more quickly destroyed or become obsolete, further suggesting a low-entry barrier for latecomers. Lee (2013) argues that qualified latecomer countries and firms can achieve comparative advantage by targeting and specializing in technological sectors with a short-cycle time because the dominance of incumbents is often disrupted by new innovations in short-TCT sectors; furthermore, the continuous and frequent emergence of new technologies can generate certain forms of growth opportunities. In other words, a sector with short TCT can satisfy the two viability criteria, namely, entry possibility and growth prospect. For example, information technology (IT) has a shorter cycle than pharmaceuticals.

The variable of TCT is also a key variable in the thesis of leapfrogging and windows of opportunity (Perez and Soete 1988; Landini et al. 2017) as well as the catch-up cycle framework (Lee and Malerba 2017). The arrival of new technologies can serve as a window of opportunity for latecomers for facing the sudden lowering of entry barriers, allowing them to pursue fast entry into newly emerging fields. Short-TCT sectors are exactly where a new window of opportunity is more likely to emerge with more frequency.

The volume of studies dealing with TCT at different levels (firms, sectors, and countries) is increasing. As shown by the reviewed literature in Sect. 2, recent developments can shed new insights into the roles and meaning of TCT in the context of catching up by latecomers. This paper presents an analytical survey of the related literature, with focus on the following four issues.

First, at the country level, this study focuses on the issue of whether a latecomer economy should keep specializing in short-TCT sectors or move eventually to long-TCT sectors so that its industrial structure may become similar to advanced economies and its income level may also converge to that of advanced economies. Lee and Lee (2021a) find that Korea and Taiwan have been moving towards long-TCT sectors since the 2000s, as well as China since the 2010s, and confirm the linkages from such transition to economic growth. They call this phenomenon a “detour path,” specializing in short TCT during the catching-up stage and then in long TCT at the post-catch-up stage.

Second, at the sectoral level, this study focuses on the double-edged nature of TCT. On the one hand, a short TCT (i.e., rapid knowledge obsolescence) tends to be a threat to incumbents and thus also represents an opportunity for latecomers (Park and Lee 2006; Suarez and Lanzolla 2007). On the other hand, some researchers have emphasized the possibility of short TCT interrupting latecomers’ learning and thus becomes an additional barrier to latecomers, especially since their learning of existing technologies is truncated or interrupted, and they will have to start learning new generations of technologies (Lall 2000). Accordingly, a key point is that whether short TCT would be a window of opportunity or a source of further difficulty for latecomers depends on the initial level of absorptive capacity (Cohen & Levinthal 1990) by latecomers, and, also, on dynamic capabilities (Teece et al. 1997) to respond to changing economic environment featured by new techno-economic paradigms or architectural innovations (Henderson & Clark 1990).

Third, at the firm level, the study deals with the issue of possible convergence in the behavior and strategies of a catching-up firm towards mature firms in the long term. By applying the same logic at the detour, from short to long TCT, at the country level as discussed above, we may reason that as a catching firm builds up, accumulates, and enhances its level of technological capabilities, it no longer has to seek a niche in the short-TCT area but may diversify into long-TCT businesses. Im and Lee (2021) have verified this hypothesis of convergence by comparing the behavior and innovation systems of Korean firms with those of US firms.

Fourth, the final question is how the variable of TCT interacts with other relevant factors in determining the outcome of Schumpeterian catch-up competition involving both incumbents and new entrants. Addressing this issue is important because we need to consider technologies "neither as given nor in isolation, but in terms of their necessary place within and linkages with other aspects of firms" (Utterback 1994: xvi), and probably of sectors and institutions of nations.

The remainder of the paper is organized as follows. Section 2 discusses the concept of TCT in the reviewed literature. Sections 3, 4, and 5 discuss the relationship between TCT and the catching up by latecomers at the firm, sector, and country levels, respectively. Section 6 discusses the role of other factors interacting with TCT to determine the outcome of competition for catch-up in the context of several industry cases. The final section provides a summary and the concluding remarks.

2 Concept of TCT and the literature

Diverse classes in patent classifications represent the varying nature of knowledge underpinning the innovative activities associated with the patents. Technological knowledge involves various degrees of specificity, tacitness, complexity, and obsolescence. An important attribute of knowledge is its tendency to become obsolete over time; this phenomenon presents the distinct feature of knowledge. Some types of knowledge become obsolete quickly while others are usable for a longer timeframe. TCT focuses on this aspect of knowledge, namely, speed of obsolescence of knowledge.

TCT can be measured with patent citation data, and its technical definition is the mean backward citation lag, which refers to how old patents each patent cites for its own innovation (Narin 1994; Jaffe and Trajtenberg 2002). For example, if a patent cites very recent patents registered in the last few years, its cycle time is short, as in the case of patents in the IT or mobile phone sectors. On the other hand, if a patent cites many old patents that were registered several decades ago, its cycle time would be long, with the example of patents in pharmaceuticals or machine tools. Reflecting this idea, a formula defining the TCT is given by

-

Cycle time of technology of patent

$$i=\frac{\sum_{\text{j=1}}^{{\text{NCITING}}_{\text{i}}}{\text{LAG}}_{\text{i}}}{{\text{NCITING}}_{\text{i}}},$$

where LAGj = time difference between the applied (or granted) year of citing patent i and the applied (or granted) year of cited patent j , and NCITINGi = total number of citations made by patent i.

Depending on the purpose of a particular research project, the year of registration (granted year) or application of patents can be used. More often, the applied year is utilized to reflect the earliest time a specific innovation is made.

TCT can be measured for a particular technology. For example, the average TCT of patents related to mobile phones is calculated to be 5.3 years, and that of personal computers is calculated to be 6.3 years; in comparison, some of the more recently emerged technologies are shown to have slightly longer TCTs, such as 3D printing (11.8 years) and IoT (6.6 years). To compare the relative length of TCT of different technologies, one can divide the absolute number of years by the average TCT years of all technologies. In this way, the normalized TCTs have values centered around one, with numbers less than one corresponding to short TCTs and numbers greater than one corresponding to long TCTs. For example, pharmaceuticals with a US PTO class number of 424 are calculated to have a normalized TCT of 1.02, while memory chips (with a US PTO class number of 711) are calculated to have a short TCT of 0.79.Footnote 2

At the firm level, TCT can be measured as the average TCT of all patents filed by a firm. To measure TCT of an industrial sector, we will need a concordance table that matches technological classes and industrial sectors.Footnote 3 Therefore, unless a specific dataset of patents in classes is transformed into an industrial sector-based dataset by some specific method, it is generally more precise to use the term “classes,” as patents are originally classified by patent authorities. However, the term “sector” is more commonly used than classes, and therefore, the term “technological sectors” is often used in place of (technological) classes. The terminology should be acceptable as long as the word “technological” is placed before “sectors” to distinguish them from industrial sectors. In this paper, the term “technological sector” is used in place of the more precise term “technological class.”

Defining and measuring the average TCT of a country is tricky because classifying a patent by nationality can be implemented in two ways: legal ownership (assignees) of patents or address of inventors where innovation activities have taken place. For instance, for a country with numerous foreign MNCs performing R&D activities, the patents invented by the MNC employees residing in that country can be classified as that country’s patents if we follow the location-based definition, namely, inventors’ address. Alternatively, we can classify a country’s innovation activities and patents according to the ownership of the patents. In such cases, the patent filed by the foreign MNC that hired the local inventors should not be counted as patents of the host country. The choice of either of the two methods is up to the researcher’s decision, and it generally considers the purpose of the research and the questions it needs to address.

The concept of TCT is highly useful for explaining the technological features of patents, firms, industries, and countries. If the cycle time of a patent is shorter than those of other patents, then this patent can be interpreted as being based on more recent technologies. Meanwhile, industry-level or sectoral-level TCT represents the speed of obsolescence of knowledge in the sector. This definition implies that in sectors with a shorter TCT (“short-cycle sectors”), older patents are not much utilized to invent new patents. By contrast, in sectors with a longer TCT (“long-cycle sectors”), older patents are useful in a longer period.

The research related to this concept of TCT is increasing. Here, we will discuss them in terms of three levels: firm, sector, and country. First, for the firm-level analyses using TCT as a variable, representative work includes the studies of Hirschey and Richardson (2001), Bierly and Chakrabarti (1996), and Lee (2013: Ch. 5). Incidentally, while all of them attempted to explain the relationship between the TCT and profitability of US firms, they obtained different results. Hirschey and Richardson (2001) and Bierly and Chakrabarti (1996) used firm-level data in the high-tech sector and found that firms with patents of shorter TCT, indicating higher level of technological capabilities, tended to enjoy higher profits. By contrast, Lee (2013: Ch. 5) found no significant difference in the profitability of US firms with long versus short TCT, which contrasts the high profitability among Korean firms with short TCT. Notably, the aforementioned studies used the TCT of firms and not the TCT of sectors in the regressions.

Second, the sectoral-level analyses that use TCT as a variable tend to focus on the potential entry-deterrent effect of long TCT of a sector. Park and Lee (2006) and Lee (2013: Ch. 4) conducted sectoral-level patent analyses and found emerging economies in Asia filing more patents in short-TCT sectors and thus specialize in such sectors. Albert (1998) studied the short TCT of the patents from Japan, Korea, and Taiwan, and observed the marked short cycle times in the automotive and IT sectors in Taiwan and the IT sector in Korea. Rosiello and Maleki (2021) examined whether short or long TCT could help in the catching-up of the sectors of oil/gas and PV/solar industries and subsequently found that the situations vary by sector depending on the initial level of the technological capabilities. Recently, Lee and Lee (2022) have explored the entry-barrier impact of sectoral-level TCT by performing regression analyses of a large number of US firms and found sectoral-level TCT to be a more robust and reliable measure of technological entry barrier of a sector compared with the R&D intensity of a sector and other traditional measures, such as advertising intensity or market structure measures, such as CR3 or CR5 (i.e., concentration ratio by the top three or five firms).

The double-edge nature of a sector featured by rapid technological change or short TCT was rarely studied until Park and Lee (2006) delved into this issue. In particular, the short TCT of a sector can serve as a window of opportunity for catch-up for latecomers who have accumulated a certain level of technological capabilities, but frequent changes in technology can also act as additional barriers against the catch-up due to the truncation of learning (Lall 1992, 2000) because frequent technological changes interfere with the learning and accumulation of knowledge by latecomers. This double-edge nature of short TCT is one of the emphases of the current study, and we refer to the findings of Chang et al. (2021) and other to discuss the issue in detail.

Studies dealing with TCT through country-level growth analysis are somewhat lacking. However, as the speed of knowledge obsolescence affects the stock of knowledge, it has important implications for economic growth. For instance, some studies pertaining to the endogenous growth models point out that the cumulative stock of knowledge may act as an entry barrier for late entrants because productivity is proportional to the cumulative stock of production or knowledge (Lucas 1988; Stokey 1988). The endogenous growth model utilized by Aghion and Howitt (1992) also focuses on the intertemporal implications of expectation of creative destruction by the frequent arrival of new technologies, which may affect the rates of return and even the prospect of future research. Thus, this situation may lead to discouragement of further research, as it may threaten to destroy the rents created by the current research. Petralia et al. (2017) analyzed the use of TCT as a proxy of entry barrier, noting that short-TCT sectors correspond to low barriers with respect to a country’s effort to aspire for technological development and diversification of product spaces.

Among the empirical literature, Hanson (2012) analyzed the international specialization between the North and South, distinguishing between high-income countries and China. He observed that China has recently specialized in the electronics sectors among many capital-intensive sectors. However, he failed to define these sectors systematically or theoretically; therefore, he could not connect a specialization with the prospect of attaining catch-up economic growth. Lee (2013) was the first scholar who conceptualized and provided evidence for this pattern of country-level specialization by using TCT as a variable. Specialization in short-cycle technology implies specialization in recent technologies and reliance on them, and consequently, exploring new opportunities in emerging technologies that rely less on existing technologies that are most likely already dominated by incumbent advanced countries. The advantage of short-cycle technologies contradicts the classical hypotheses of Vernon (1966) about the product life cycle, as they observed that latecomers tend to inherit old or mature products or industries. After all, inheriting mature technologies tends to correspond to low-margin (low-wage) activities that are also insufficient in sustaining the economic growth of the latecomer beyond the middle-income status. In the literature about country-level studies on TCT, a recent issue is that of the detour, specifically the changing specialization from short-TCT sectors during the catching-up stage to long-TCT sectors at the later or post-catch-up stage (Lee 2013). This long-term detour pattern of dynamic specialization is a key issue in the current paper, which will be treated in the next section.

3 Changing comparative advantages and NIS of nations

3.1 Detour from short-cycle technology-based sectors to long-cycle sectors

The comparative advantage framework considers a country's natural and physical endowments, including its labor force, as the basic criteria for specialization. Since many developing countries start out with an abundance of labor (Lewis 1954), they are advised to specialize in labor-intensive sectors. Consistent with the Heckscher–Ohlin trade theory and its variations (Sen 1957), the capital-to-labor ratio is a key variable in these criteria. However, the investment strategy proposed in this literature does not answer the question of what countries must do when increasingly scarce and expensive labor forces them to enter capital-intensive sectors during the middle-income stage. Given the different types of capital-intensive sectors, countries need guidance on which sector to enter first. However, the endowment-based theory of comparative advantage neither distinguishes between capital-intensive sectors nor suggests criteria for choosing among them.

The dynamic modification of static comparative advantage was proposed by Lin (2011, 2012) as the concept of latent comparative advantage, which states that a developing country can choose a sector that is new to the developing country but old to the forerunning countries or countries with a GDP per capita twice that of the developing country in question, and target mature or leftover industries from the forerunning countries. However, Korea not only inherited old sectors (i.e., steel and automobiles) from Japan, but also leapfrogged into emerging sectors (i.e., telecommunications equipment) and competed directly with the forerunning economies in these sectors (Lee 2013). Therefore, while this strategy may prove useful for lower-tier MICs (middle-income countries), the same cannot be said for upper-tier MICs that seek to upgrade their industrial structure to match that of emerging or near-frontier sectors.

Meanwhile, Hausmann et al. (2007) developed the concept of "product space" to argue that a country can achieve gradual sophistication (and diversification) in its trade structure by moving into neighboring spaces or capturing "low-hanging fruit". Hausmann et al. (2007) and Hidalgo et al. (2007) consider the proximity of product spaces as an important variable in determining the feasibility of diversification. However, their criterion does not reveal any information about the "directions" of diversification, while several spaces tend to be located at similar distances. The distance-based argument for diversification does not address the question of which sectors among similarly distant ones the latecomer economies should diversify into first. Moreover, while it says that latecomer countries must try to produce products developed by incumbents, it does not inform them how to compete with these incumbents in identical or similar sectors. It fails to propose an effective method for middle-income countries to reach the core structure with high entry barriers in terms of the required knowledge and technologies.Footnote 4

Given the weak capabilities of latecomers, they need to identify their niche in the international division of labor and participate in sectors in which they can achieve better growth prospects and survive by competing effectively with incumbents. In this case, “the possibility for entry/survival with some growth prospects” represents a viable criterion. Lee (2013) proposed that middle-income countries use TCT as a viable criterion for technological specialization, and states that latecomers should specialize short-TCT-based sectors. In short-TCT sectors, the dominance of incumbents is often disrupted by new innovations, and the continuous emergence of new technologies can generate opportunities. Low reliance on existing technologies represents both low barriers to entry and low profitability, which are associated with few collisions with the technologies of advanced countries, fewer royalty payments, first- and fast-mover advantages, and product differentiation (Lee 2013). In other words, a sector that is based on technologies with a short-cycle time satisfies the two criteria of viability: entry possibility and growth prospects. In short-CTC-based sectors, firms can leverage the opportunities resulting from the emergence of new technologies.

The advantage of specializing in short-cycle technologies is consistent with the leapfrogging concept, in which the emerging generations of technologies, e.g., digital technologies, allow catching-up countries to obtain a head start. When incumbents and latecomers compete under a new techno-economic paradigm, both of them begin from the same starting line, but incumbents are often locked in and tend to adhere to the existing technologies from which they derive their supremacy.

In contrast to the findings of Hausmann et al. (2007), who suggested that developing countries should seek to emulate rich countries as quickly as possible, the transition strategy of a developing country tend to involve entering sectors that are based on short-cycle technologies instead of those dominated by rich countries, such as long-cycle technologies. However, as countries reach technological maturity and achieve a somewhat high level of capabilities (e.g., the action of South Korea since the 2000s), they are driven to adopt long-cycle technologies, such as bio-medical or pharmaceutical industries, which is what Samsung has attempted to achieve recently.

3.2 Empirical evidence of the changing NIS: From short to long cycles

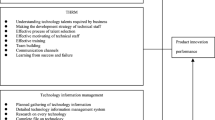

First, we briefly discuss the evidence supporting our main argument that latecomers can succeed in short-cycle sectors. This argument is based on the analyses of Korea, Taiwan, and China,Footnote 5 which have continuously entered their short-cycle sectors during their catching-up period or since the mid-1980s (e.g., Korea and Taiwan) or the mid-1990s (e.g., China). The international technological specialization may be examined by referring to Fig. 1.

Period average technology cycle time in selected economies and groups. Source: Upper panel: Fig. 1B in Lee and Lee (2021a, b); Lower panel: Adaptation of Fig. 4C in Lee et al. (2021). Using the raw data downloaded from the USPTO Patent Grant Red Book (Full Text, 1976~2019, http://patents.reedtech.com/pgrbft.php). Note: The absolute values of TCT are normalized by dividing by the world average so that the value of 1 may be the average of the cycle time. 1) Long cycle & Advanced: Canada, Germany, France, Italy, Switzerland, UK; 2) Short cycle & Catching-up: China, South Korea, and Taiwan; 3) Too long cycle & Trapped: Argentina, Brazil, Chile, Malaysia, Mexico, South Africa, and Thailand

Figure 1 shows an interesting pattern in that the average TCTs of Korea and Taiwan have steadily decreased since the mid-1980s until the end of 1990s when these economies had started to catch up with Japan and other high-income countries. Similarly, since the mid-1990s, China has shown a decreasing trend. Short-cycle sectors involve electronics, semiconductors, panel displays, or IT, whereas long-cycle sectors include machine tools, medicines, or pharmaceuticals. Meanwhile, Brazil, which represents middle-income countries that had been stuck in the middle-income trap, shows a very high TCT, even higher than that of Germany. Meanwhile, besides the use of country examples, the statistical clustering method can be utilized, such as the method of Lee et al. (2021) who classified 45 economies into four or five major NIS groups. For instance, the long-cycle and advanced group is led by Germany and joined by other European economies, whereas the short-cycle and catching-up group includes Korea, Taiwan, and China. Brazil belongs to the extremely long-cycle and trapped groups along with other middle-income countries.

The success of Korea, Taiwan, and China in catching up may be attributed to their specialization in short-cycle technologies, which served as a niche to avoid direct competition with advanced countries and allowed them to pursue technological independence. By using a country-panel analysis of growth equations, Lee (2013, Ch. 3) proved this hypothesis. They found a significant negative coefficient for the average cycle times for these East Asian economies compared with the positive coefficient for other groups, such as high-income or other middle-income countries. Specializing in short-cycle sectors is reasonable because they have higher growth potential owing to the constantly emerging new technologies and faster localization of knowledge creation mechanisms owing to less reliance on existing technologies dominated by advanced countries.

By contrast, a latecomer specializing in long-cycle technologies will face high entry barriers and fierce competition with advanced economies specializing in the aforementioned sectors. Thus, although a latecomer with long-cycle specialization can grow, its performance will be low or will not catch up with leading countries, as in the case of countries stuck in the middle-income trap (Lee et al. 2021).

The discussion presented above does not mean that successful catching-up economies should continue specializing in short-cycle sectors; they also have to eventually move to long-cycle technologies after completing the catching-up and maturation stages (Lee and Lee 2021a). Korea and Taiwan have increased their average TCTs since the 2000s, followed by their entry into the biomedical field, machine tools, and other materials, as shown in Fig. 1. In other words, long-cycle technologies are more desirable with high profitability associated with high entry barriers; thus, they should be a target at the later stages than in the earlier stages. Along this detour from short-TCT to long-TCT sectors, we can identify the turning point: the early 2000s for Korea and Taiwan and the early 2010s for China (Fig. 1).

The graph presented above is suggestive of the changing nature of NIS in Korea and Taiwan in the post-catch-up stage that began in the 2000s. These two economies are moving away from sectors based on short-cycle technologies and pursuing sectors based on long-cycle technologies. Thus, their NIS are approaching the levels of countries with advanced or mature NIS (bottom panel in Fig. 1). The recent regression analysis of Lee and Lee (2021a) has confirmed the contribution of long-TCT specialization since the 2000s to economic growth (Table 1A). For instance, the economic growth (per-capita income) of Korea is now positively associated with TCT (shown by the positive or non-negative coefficient of the post-2000 dummy), which contrasts the negative correlation observed in the mid-1980s and 1990s that has been reported in Table 1A and also in Lee (2013: Ch. 5). In summary, the “detour” hypothesis, which posits that a successful catching-up economy follows a technological detour of initially specializing in short-TCT sectors and later shifting long-TCT sectors has been confirmed (bottom panel in Fig. 1 and Table 1A).

3.3 A formal model: A two-sector and two-country model

As discussed above, more theoretical criteria are needed by middle-income countries to make sectoral choices prior to moving to the industrial structure of high-income countries, but they tend to face more competition and entry barriers into high-end sectors (Lin and Wang 2020; Lee 2013). Acemoglu et al. (2006) studied this issue and concluded that as an economy approaches the global technology frontier, a shift from adoption- or imitation-based strategy to an innovation-based strategy is required. While this finding is true in principle, a practical challenge is how to start an innovation for a sector initially facing uncertainty due to economic constraints, such as the technology gap (Cimoli et al. 2019). Furthermore, while topics on building technological capabilities and the role of industrial policy are frequently studied (Aistleitner et al. 2021; Cimoli et al. 2019; Landini and Malerba 2017; Dosi et al. 2021), the problem of economic growth in developing countries, especially middle-income levels, is not only related to building capabilities but also finding niches to use those capabilities; this point is a problem of sectoral specialization (Malerba and Lee 2021). In other words, even if a latecomer economy builds technological capabilities, growth will be derailed if these capabilities are applied in the wrong sector.

Han and Lee (2022) developed a formal model that builds on the Schumpeterian idea that technologies are heterogeneous across sectors (Nelson and Winter 1982). By modifying the Heckscher–Ohlin model (Ohlin 1968), Han and Lee (2022) consider two sectors with different capital depreciation rates (fast and slow rates) to represent different TCTs (short- and long-cycle sectors). The two types of economies are considered, namely an advanced economy (i.e., absence of capital endowment constraints) and an emerging economy (with capital endowment constraints) with limited capital stock (Ju et al. 2015).

The model is solved for a general equilibrium. First, in an autarky equilibrium, both economies have a comparative advantage (CA) in long-TCT sectors because long-cycle sectors with low depreciation rates are attractive to both economies regardless of capital stock given the low cost of replacing outdated technology. Second, in a trade equilibrium, the CA of emerging economies lies in producing short-TCT goods; by contrast, a capital-abundant economy (advanced economies) faces a higher opportunity cost for producing short-cycle sector goods (or vice versa).

Finally, a dynamic model is solved for the optimal dynamic path of capital accumulation in the two sectors. The optimality condition is defined in terms of the optimal capital stock ratio between the short- and long-cycle goods sector. On this basis, one can show that the initial CA in short-TCT sectors by an emerging economy is transitional, and it also needs to eventually specialize in long-TCT sectors. This finding is consistent with the actual pattern in East Asian economies, as discussed in the preceding subsection.

4 Double-edged nature of TCT at the sectoral level

4.1 Importance of initial level of absorptive capacity

The notion of technological regime defines the nature of technology according to a knowledge-based theory of production. Innovation is regarded as a problem-solving activity, drawing upon knowledge bases that are stored in routines (Nelson and Winter 1982). Technological regimes are important because they constrain the pattern of innovation from emerging in an industry. Another way of capturing sectoral heterogeneity is contrasting the Schumpeter Mark I-type parameters (sectors with small firms and high entry rates of new firms) and the Schumpeter Mark II type parameters (sectors with large firms and high industrial concentration) (Malerba and Orsenigo 1996).

Although the notion of technological regime has been used to explain the specific manner in which innovative activities of a technological sector are organized in many advanced economies (Breschi et al. 2000; Malerba and Orsenigo 1996), the implication of technological regimes for catching-up countries differs from those of advanced countries. For example, latecomer economies tend to encounter more challenges in conducting innovation when the technological regime is of high cumulativeness, given that they do not command high R&D intensity and a sound institutional basis for innovation. Lee and Lim (2001) applied the concept of the technological regimes in the context of catch-up and found that when the technological regime of an industry has higher cumulativeness and a more unpredictable technological trajectory, catch-up is more difficult, especially among large conglomerate-style firms.

The econometric study of Park and Lee (2006) is one of the first attempts to generalize the findings reported by many case studies about catching-up. They confirmed the hypothesis about TCT and catching-up (i.e., the shorter the cycle time of a technology, the higher the possibility of catch-up) by showing that Korea and Taiwan have filed more patents in short-TCT sectors, whereas the European incumbent have focused on long-TCT sectors. The fast catch-up in short-TCT sectors is also consistent with the observation of Amsden and Chu (2003) in which the catching-up firm’s task is to source high-tech inputs from overseas and create scarcities in other inputs, designs, or functions when a “new” mature product is still in demand.

Park and Lee (2006) also raised an interesting issue about the double-edge nature of the technological regime featured by short technical cycles, which is the key issue in the current paper. The short TCT may serve either as a window of opportunity for catch-up or an additional barrier against catch-up. The positive side of frequent changes in technologies is consistent with the leapfrogging argument that shifts the technological trajectory or the emergence of new technologies that often serve as a window of opportunity for latecomers (Perez and Soete 1988). However, leapfrogging strategies also involve risks, such as making the wrong choices among alternative technologies and standards and the absence of initial markets for first-movers (Lee et al. 2005). Mitigating these risks often requires help from the public research labs for joint research with private firms to reduce the technological uncertainty and ascertaining financial subsidies to cover for losses in the initial stage of entry.

In general, we may assume that the success of leapfrogging and knowing how to effectively solve the double-edged nature of short TCT depends both on the initial level of technological and other capabilities, such as absorptive capacity (Cohen & Levinthal 1990), which can be mobilized to deal with the uncertainty and risk. This final observation will be verified in the next sections as follows: first, by a case study of the telecommunication sector in four countries; second, by an empirical analysis of a large dataset involving many countries; and finally, by a formal simulation analysis.

4.2 “Common start and different ends” in the telecommunication sector in four countries

The double-edged nature of technological change can be understood by looking at contrasting cases of telecommunications industries in different countries, namely the successful ones in China and Korea versus the less successful ones in Brazil and India.Footnote 6 In these two sets of four country cases, a common feature is that all four countries had once indigenously developed fixed digital telephone switches in the 1980s. The subsequent divergence, particularly since the mid-1990s, can be attributed to the initial success of fixed-line switches and the fruitful transition to mobile telecommunications technology in Korea and China, while India and Brazil failed to make the transition to the mobile era. This divergence between countries can be explained by referring to the role of the degree of access to knowledge, industrial policy, and changes in techno-economic paradigms.

First, one of the reasons why all four latecomers were able to develop their respective digital switches in the 1980s has to do with the specific nature of the digital switch knowledge system, which manifested mature and stable trajectories. Access to knowledge was not difficult, whether it was in the form of licensing/JVs or by using the necessary knowledge available in the public domain. The latter variations, especially since the mid-1990s, can be explained by the strategies implemented by the respective actors and networks in the four countries. Critically, the initial successes in China and Korea were linked to building the absorptive capacity of private firms.

Second, in China and Korea, the government actively implemented coordination and protection policies, supported by strategic vision. In contrast, in India and Brazil, where the idea of market forces and market liberalization benefiting foreign actors is accepted, the active role of the state and the initial success of local firms were not sustained. As India and Brazil prioritized market liberalization, MNCs competed with and eventually displaced the local firms that had achieved the initial success.

Third, Korea and China took advantage of the technological discontinuities associated with the advent of wireless telecommunications as a window of opportunity, as their local players had accumulated absorptive capacity in fixed-line telecommunications due to asymmetric government support. In this way, Korea and China were able to adopt a path-creating or leapfrogging strategy, notably the commercialization of CDMA technology in Korea and the development of the 3G wireless standard (TD-SCDMA) in China. These scenarios contrast with the earlier strategy of “stage-skipping” in the development of digital switches in fixed-line telecommunications.

In sum, these contrasting cases imply that when latecomers fail to improve their own capabilities (absorptive capacity), the technological paradigm shift becomes another barrier to catching up, as in the cases of Brazil and India, and, in contrast, that paradigm (or generational) shifts can act as a window of opportunity, depending on the strategies and responses, including dynamic capabilities (Teece et al. 1997), of actors, including firms and government. In other words, the evolution of a sector can be seen as a co-evolution of both technological change and the changing levels of capabilities of the actors.

4.3 Empirical analysis of the double-edged nature of short TCT

The double-edged nature of short TCT can be tested by examining the differences between the more successful catching-up economies of Korea and Taiwan and those of the next-tier economies. This comparison can help determine whether the TCT variable has the same or different explanatory power as the determinants of catching-up in different groups of latecomer economies. This analytical approach was previously implemented by Lee (2013: Ch. 4), who constructed a regression model to analyze the technological catch-up phenomenon in relation to the notion of technological regimes. Technological catch-up is defined as a "faster increase in technological capability," measured relative to that of comparable groups. Technological capability is measured by a country's share of total patents in a given technological sector.

The main results of the regression analyses shown in Table 1B show that some (first-tier) catching-up economies achieve higher levels of technological capabilities in such classes, as featured by the short TCT, whereas other (second-tier) catching-up economies fail to act accordingly, as shown by the non-significant coefficients. This non-significance of this cycle variable for the second-tier countries is consistent with the reality of in these countries. This finding implies that frequent technological changes may serve as an additional barrier to catching-up. Second, another important finding is the opposite impact of the cycle-time variables on advanced and catching-up countries. While the first-tier catching-up economies achieve higher levels of technological capabilities in short-TCT classes, advanced countries perform significantly better in classes with a longer cycle time.

The difference between the first- and second-tier countries also explains the reversal of per-capita income levels between Asian and Latin American countries. Although Latin American countries owned more patents in the early 1980s compared with their Asian counterparts, they failed to file more patents continuously between the 1980s and 1990s, and their patents presented lower growth rates compared with those of Asian countries. The sources of the difference between East Asia and Latin America can be explained by a variety of factors, including historical and political factors. However, one of the most directly related variables is the amount of R&D expenses by these groups of countries. Another factor is the difference in enrolment between high schools and colleges and their training systems. In East Asia, a strong unit of well-trained engineers and a broad number of skillful and competent workforce are developed to a much greater degree compared with those in Brazil, which used to have highly trained and talented scientists and engineers, who eventually became isolated from the general economy and society.

4.4 A formal model with TCT and appropriability

Research has also been conducted on the role of TCT in technological leadership change (Bosworth 1978; Landini et al. 2017; Pakes and Schankerman 1984). However, the studies have produced conflicting predictions of the impact of TCT on technological leadership change because of its dual role in competitive dynamics between incumbents and latecomers. On the one hand, a short TCT (rapid knowledge obsolescence) tends to be a threat to incumbents, thus presenting an opportunity for latecomers (Park and Lee 2006; Suarez and Lanzolla 2007). Previous empirical studies showed the increased probability of technological leadership change by latecomers under short-TCT regimes (Niosi and Reid 2007; Petralia et al. 2017). On the other hand, short TCT may interrupt the latecomers’ learning, thus becoming an additional barrier to them (Lall 2000).

One of the efforts to reconcile the conflicting views and mixed empirical results is Chang et al. (2021), who developed a simulation model based on the Schumpeterian competition of Nelson and Winter (1982) in which probability of catch-up by latecomers is determined by interaction of several factors representing technological regimes, such as appropriability, cumulativeness, and TCT. The model systematically examines which effect (a window of opportunity or an additional barrier) of short TCT is stronger and how it dynamically shapes the latecomers’ optimal resource allocation between imitation versus innovation. They found an inverted U-shaped relationship between TCT and probability of technological leadership change, with a certain level of TCT depicting the highest probability of leadership change. Further simulations that consider the initial technology level (which may reflect the level of absorptive capacity) of latecomers in contrast to that of incumbents show that when the TCT is short and the disruption of technology is frequent, it makes more sense for latecomers to allocate more resources to imitation, especially when their initial technology level is low. As the initial technology level of latecomers increases from 20 to 60% of that of incumbents, the risk (failure probability) of innovation R&D becomes smaller. Consequently, latecomers may allocate more resources to innovation even under the short-TCT regime.

The simulation model also allows us to examine the impact of appropriability on the relative mix of imitation and innovation, and thus on the probability of catch-up. Appropriability has been defined as the ability of a firm to capture the value of innovations by protecting them from imitation by rivals (e.g., Breschi et al. 2000). High appropriability may increase the possibility for incumbents to monopolize their results while decreasing the possibility for other firms to benefit from these results through imitation (Levin and Reiss 1988; Levin et al. 1985). In the model, the next level of technological capability that the latecomer can achieve through imitation is assumed to be proportional to (1 - appropriability). Given this assumption, the results show that low appropriability leads a firm to devote more resources to imitation than to innovation, and it also tends to increase the probability of technological leadership change.

The above result should be considered together with the results of the empirical analyses, shown in Table 1B, which show that the latecomer firms tend to file more patents in high appropriability classes, where they feel they can better protect any benefits from innovations. Then, a summary interpretation of both the simulation and the empirical analyses is that while appropriability may reduce the possibility of imitation and thus the catch-up probability in a given sector, or other things being equal, latecomer firms tend to specialize in high appropriability sectors if they can choose among many classes in order to protect their innovation from being copied by others.

5 TCT at the firm level and its effect on firm performance

5.1 Firm-level innovation systems and Schumpeterian theory of the firms

While the literature on innovation systems tends to focus on the country or sector level, we can also analyze innovation systems at the firm level (Grandstrand 2000). This extension is consistent with the Schumpeterian theory of the firm (Winter 2006; Nelson 1991), which emphasizes the heterogeneity of firms and considers knowledge and imperfect learning as sources of inter-firm heterogeneity. Knowledge-related variables are indicators of the nature of the knowledge pool that each firm uses for its innovation and other activities. The nature of the knowledge base is thus related to the firm-level innovation system that underpins a firm's innovative activities.

Furthermore, we may investigate the aspects of knowledge that are regarded as markedly different between advanced and catching-up firms. Key variables include TCT, self-citation (intra-firm creation and diffusion of knowledge), technological diversification, and originality. These variables are used to investigate their relationship with firm behavior and performance. Among them, we are particularly interested in the TCT variable.

TCT

The firm-level analysis of Lee (2013: Ch. 5) found that catching-up firms (e.g., Korean enterprises) tend to specialize in short-cycle technologies, which is also positively associated with profitability. A good reason is that short TCT, on the average, means that firms rely less on the old stocks of knowledge of which the patent rights are owned and dominated by the incumbent. Accordingly, latecomers may avoid direct competition or IPR dispute with incumbents, tending to find niches that would avoid competition in the same markets. In other words, it makes more sense for latecomer firms to conduct innovation by relying on more recent technologies than on old technologies occupied by the incumbents. The regressions analysis found that short-TCT specialization has a significant positive effect on the performance of Korean firms in the 1990s but not on US firms. The advanced firms in the US find no need to seek niches in such a short TCT and their patent portfolios are more balanced.

The firm-level findings suggest an important interpretation and meaning of TCT at the firm level, which must be distinguished from its meaning at the sectoral level. As discussed in the preceding section, TCT at the sectoral level represents a degree of entry barrier, whereas TCT at the firm level can be interpreted as the firms’ reliance on new or old technologies for its innovation. Latecomer or new entrants tend to have shorter average TCTs than incumbents, which means that they tend to find a niche in short-TCT technologies.

Self-citations

The ratio of self-citation at the sectoral level is related to appropriability (Table 1B), namely, the capability to protect one’s innovations from being copied by others, indicating a monopolization of profits from the innovation (Trajtenberg et al. 1997). By contrast, self-citation at the firm level refers to the degree to which the innovation of a firm builds upon its accumulated knowledge pool. In the literature, the more advanced or older the firm, the higher its patent self-citation ratio. Thus, self-citation can be used as a measure of technological capabilities, as confirmed by the comparison between Huawei and Ericsson (Joo et al. 2016). Lee (2013) found that self-citation ratios are much higher in US firms compared with Korean firms, and they tended to have a significantly positive effect on firm performance (firm values) in the US; this is not the case in Korea, as companies had a very low ratio in the 1990s.

5.2 Transition from catching up to convergence of the firms

If we investigate the innovation systems of Korean firms since the 2000s, we find a trend of continuous catching-up and convergence, as presented by Im and Lee (2021). First, the average number of patents filed by each firm has shown a substantial increase since the 1990s, from less than 50 per firm in the early 1990s to more than 150 per firm in the 2000s and 2010. Second, the average ratio of self-citations, which represent the level of technological capabilities, has also notably increased about four times, from less than 2% in the early 1990s to approximately 8% by the mid-2010s. In fact, the level of 8% in the 2010s is somewhat close to the average level (12%) of US firms in the 1990s (Lee 2013: Ch. 5). Thus, this increasing number of patents per firm and the increasing trend of self-citations reflect the increasing levels of technological capabilities of Korean firms over time. Third, the average TCT of Korean firms has increased from 6 to 7 years in the early 1990s to nearly 12 years in the 2010s, which suggests that Korean firms have substantially reduced the degree of former specialization into short-TCT sectors.Footnote 7

The subsequent regression analyses by Im and Lee (2021) also showed that the two variables (self-citations and TCT) are the main drivers of change affecting the performance and behavior of Korean firms. Table 1C presents the regression results on the impact of TCT on firm profitability, and TCT was negative and significant in the 1990s, but not significant in the 2010s. In other words, the results for the 2010s have become similar to those of U.S. firms in the 1990s. One interpretation is that Korean firms have abandoned their earlier strategy of simply focusing on short TCT to carve out a niche and have instead opted for diversification in the 2010s. This finding is consistent with our hypothesis regarding Korean firms’ convergence with US firms. The regression results for the determinants of firm value measured by Tobin's Q are also interesting in that the self-citation ratio is positive and significant in the 2010s, but not in the 1990s or 2000s (Table 1C). The 2000s results are a continuation of the 1990s, while the 2010s results are consistent with the 1990s results for U.S. firms. These results indicate that Korean firms are converging with US firms in terms of the level of technological capabilities and their importance in firm value.

The overall scenario that emerges from the preceding part is a thesis of continuing convergence of Korean firms with US firms. With a significant increase in self-citation and TCT in Korean firms over time, the relationship between innovation variables and performance in Korea has now become similar to that in the US. In other words, we find some evidence of convergence. The trend of firm-level changes in Korea analyzed in this part is also consistent with the country-level pattern discussed in Sect. 3.

6 Schumpeterian competition for catch-up and the role of the diverse factors

The previous sections have discussed the role of TCT at the three levels of catching-up by latecomers. The focus on TCT does not mean that this single factor alone is sufficient to explain the complex dynamics of the catching-up process. Rather, TCT interacts with other factors, and the nature and mechanism of this interaction is the last remaining question. This section uses several short-TCT-related cases from different sectors, countries, and firms to show how TCT interacts with other factors to determine the outcomes of Schumpeterian catch-up competition. These analyses are useful because technologies should not be considered in isolation, but in terms of their linkages to other aspects of firms (Utterback 1994: xvi), and presumably of sectors and institutions of nations.Footnote 8

Other factors include the role of government regulation and industrial policy, techno-economic paradigm shifts versus the emergence of new generations of technologies that serve as windows of opportunity, the innovator's dilemma, and the latecomer’s absorptive capacity, as well as the exploitation of economies of scale. The case of the mobile phone industry in both the global and Chinese markets is also used to illustrate the fact that the catching-up framework can be applied to both the global and a country market, depending on the market and country characteristics.

6.1 Competition among mobile phone firms in global and Chinese markets

Technologies related to mobile phones tend to have very short cycle times, so it is not surprising that this sector has experienced frequent and successive changes of industry leaders (Giachetti 2013; Giachetti and Marchi 2017). The first leader was Motorola, while it was later dethroned by Nokia, which was also overthrown by Samsung and Apple. If we look at the Chinese domestic markets, Apple and Samsung have lost their market share to a number of newly emerging domestic firms, such as Huawei, Xiaomi, Oppo, Vivo, etc. These cases of firm competition in the mobile phone sector can be discussed in terms of Lee and Malerba’s (2017) catch-up cycle framework, which considers several stages of catching up, such as entry, gradual catch-up, forging ahead, and decline stages, and looks at the interaction of various firm-level factors with other dimensional factors.

The first factor is the techno-economic paradigmatic shifts versus discontinuities in a given paradigm, which are often used differently by incumbents and new entrants. In mobile phone technology, an important paradigmatic change was the transition from analog to digital mobile phones. The arrival of digital technology in the early 1990s implies a new window of opportunity for new entrants, while it resulted in the sudden redundancy of first-generation analog devices and the rise of second-generation services and devices, namely the GSM digital mobile technology launched in Europe in 1991. Faced with a situation akin to an innovator's dilemma or conservatism about whether or not to introduce innovations that are detrimental to the incumbent's current business (Christensen 1997; Utterback 1994: 223–226),Footnote 9 Motorola ignored the potential of digital technologies and continued to rely heavily on analog technology, believing that customers would prefer analog phones to digital phones (Giachetti 2013). In contrast, a new entrant, Nokia, committed to the emerging mobile standard earlier than its rivals, focused on base station development in the European GSM R&D alliance, and began building relationships with the newly licensed independent mobile operators, dethroning Motorola in 1998.

Then there was another transition from regular phones to smart phones, which can be seen not as a paradigm shift but as a generational shift within a given paradigm. The advancement in technology gave birth to a new category of phones: 'smart phones'. The entry of Apple's iOS and Google's Android OS in 2007 changed the face of the smartphone market. Unlike older mobile operating systems such as Nokia's Symbian, iOS and Android OS were specifically designed to support the touch interface that was gaining popularity with consumers. Faced with an incumbent trap situation, Nokia was reluctant to abandon its own Symbian to switch to Android, while Samsung quickly adopted it. Samsung dethroned Nokia in 2012. The smartphone can be considered an architectural innovation that changes the architecture of products without changing their components, and it can be a source of trouble for incumbents because it destroys the usefulness of their architectural knowledge (Henderson & Clark 1990).

The second factor influencing the catch-up cycles in the global mobile phone industry was the role of government regulation. The EU declared GSM as the exclusive standard in Europe, while the US took the position that market competition will determine the dominant standards and let three standards of analog, GSM, and CMDA compete freely. This exclusive standard policy of the EU was an important factor for Nokia to rise quickly in the market (Giachetti 2013; Giachetti and Marchi 2017).

The shift to 3G, or smartphones, also served as an impetus for the reemergence of the indigenous Chinese brands against the MNCs in the Chinese market, where targeting the low-end segmentation for economies of scale played a role.Footnote 10 The Chinese mobile phone industry has experienced a series of ups and downs since its catch-up process in the 1990s. In the early 1990s, all mobile phones sold in China were either imported or manufactured by multinational corporations (MNCs) such as Motorola, Sony Ericsson, and Nokia. By 2003, local brand manufacturers had taken over half of the domestic market. However, their dominant position did not last long. After 2003, Chinese indigenous firms began to lose market share to foreign vendors, such as Nokia and Samsung (Lee et al. 2016). Domestic vendors' share of the domestic market in the late 2000s, or in the 2G era, remained around a third or less, but they quickly regained their momentum afterwards or at the beginning of the 3G era with "smartphones". A strategy of leading domestic vendors, such as Huawei and Xiaomi, has been to target the low-end in the early or gradual stage of catching up, thereby increasing their scale and reducing costs, thus generating profits to be reinvested for continued emphasis on R&D for next generations of profits. This strategy of low-end for scale first and high-end later had worked in several industries in China, and thus can be considered as an important component of latecomers' catch-up strategies (Lee et al. 2016).

6.2 Competition in the semiconductor industry

The importance of the existence of a low-end market with some scale was also exemplified by the slow catch-up record in China's semiconductor memory chip sector, despite government efforts.Footnote 11 One reason for the slow catch-up is the fact that the market regime of memory chips is different from typical consumer markets, and is not segmented into low-end and high-end markets, but only one segment exists. Old and new generations of chips do not coexist in the market, as new chips quickly replace old ones with improved performance at similar prices. Such a feature is generally unfavorable to latecomers, as they cannot use low-end markets as leverage for late entry. This condition implies that latecomers should develop current and next-generation chips simultaneously, which is what Korean firms did in their catch-up or leapfrogging efforts in memory chips with Japanese firms (Lee and Lim 2001). The consortium of Korean firms and the government attempted to overcome the difficulties posed by specific market regimes and technologies in the memory chip sector by sharing knowledge and risks in the public–private joint R&D consortium.

Another critical factor for Korea to attempt leapfrogging was the availability of access to the external knowledge base and specific capital goods. The period when Korean firms, including Samsung, were considering production of 16-Kbyte D-RAM was the transition period in the global D-RAM industry from 16 K to 64 K. Samsung was able to borrow 64-Kbit D-RAM design technology from Microelectronic Technology, a small U.S.-based venture company, and manufacturing technology from Japan's Sharp. A few years after starting to produce D-RAM using borrowed manufacturing technology, Korean companies began to develop their own circuit design technology, first developing and producing 256-kilobit memory chips. In this process, the role of overseas R&D outposts in Silicon Valley and returning brains was crucial, and Samsung's 256-k DRAM chips from its Silicon Valley team proved superior to the Japanese counterparts (Kim 1997).

In contrast, it is now difficult for China to replicate a similar leapfrogging strategy, as access to foreign technology and equipment has become increasingly restricted. The number of suppliers of this semiconductor equipment and parts is very limited, or only one or two firms, and the market is thus an oligopoly or even close to a monopoly, while software is under the tight dominance of U.S. firms. For extreme ultraviolet (EUV) lithography machines, some of the most critical equipment, a Dutch company, ASML, is almost a monopoly.

The different stories of memory chip catch-up in China and Korea point to the importance of other complementary factors beyond the short CTC, and imply that short-cycle technologies offer latecomers a good chance of catching up only if they have already built up some absorptive capacity by starting early and investing in R&D with access to foreign knowledge bases and equipment. The role of industrial policy in coordinating public-sector support and sharing risk and knowledge was also critical.

6.3 MNC versus local firms in Shenzhen, China, and Penang, Malaysia

The role of different factors can also be appreciated by looking at the same short-TCT-based IT cluster in Shenzhen, China, and Penang, Malaysia. Both special economic zones share a commonality of FDI or MNC led growth in their early stages. However, an interesting difference is that Penang's economic growth has been much slower than that of Shenzhen, despite the fact that the former had a 10-year-earlier start in the 1970s, compared to Shenzhen with a later start from the 1980s.Footnote 12

One of the main reasons for the differences turns out to be the emergence of locally owned firms and their eventual dominance over MNCs in the case of Shenzhen, while Penang has continued to be dominated by MNCs, failing to generate locally owned firms of some size. For example, in the mid-2010s or 2015, the names of Huawei, ZET, Tencent, and BYD were on the list of the top-ten patent assignees in Shenzhen, whereas none of them were on the list in 2002.Footnote 13 Such a rise of local firms was not observed in Penang.

This difference, despite the same short-TCT-based specialization, has to do with the different policy lines of the local government. While Shenzhen has tried to nurture local firms by letting them learn from MNCs and helping them grow through various asymmetric supports, Penang has only focused on training and upgrading the local workforce so that MNCs can stay there and continue to hire locally available engineers.

6.4 Absorptive capacity and leapfrogging by Indian firms in IT services

If we go beyond East Asia and look for cases in other parts of Asia, the case of IT services in India must be an interesting case. This industry in India has been led by three giants, namely TCS, Wipro, and Infosys, which have competed well with firms from the West in the global market. The success of Indian IT services companies makes sense because IT services is also a short-TCT-based sector with frequent emergence of new business opportunities and a low entry barrier. Their growth has gone through the three stages consisting of body shopping (sending Indian company manpower to clients) in the 1970s, the offshoring model since the 1980s, and the global delivery model since the mid-1990s, which have coincided with successive upgrading of their capabilities, enabling the company to seize several windows of opportunity for leapfrogging.Footnote 14

The first window of opportunity for India came when a new business model emerged, such as offshoring business processes to India (Grossman and Rossi-Hansberg 2006). The second emerged when the government intervened by changing the policy towards foreign firms,Footnote 15 launching a campaign in 1988 with the slogan "Be an IT superpower by 2008", and finally liberalizing the market in 1991. This techno-economic paradigm shift can happen to other latecomer countries and firms. Therefore, additional factors specific to Indian firms are identified. First, we emphasize that India has English language skills with a zonal time difference of about 12 h, providing American firms with a 24-h working environment. More importantly, Indian firms have used these windows of opportunity to create their own unique business model in IT services, first reinventing the offshoring model and then inventing the global delivery model (GDM), which has become a global industry standard.

Among the three leading IT companies, Wipro exhibited the most typical example of leapfrogging and dynamic capability to respond to the ever-changing business environment. Wipro was founded as an agribusiness company that manufactured and sold vegetable oil products (Hamm 2007). However, as it entered the personal computer era, Wipro also got into the business of assembling and selling personal computers. Soon, the company realized that it was not competitive with foreign products and switched to PC maintenance and repair services. The Y2K panic, which can also be seen as a third window of opportunity, gave a decisive boost to Wipro's business, transforming it into a global IT services company listed on the New York Stock Exchange.

In sum, the case of Indian IT services firms can be interpreted in terms of the two stages of absorptive capacity (Zahra and George 2002); they have first built up "potential absorptive capacity" (acquisition and assimilation of externally generated knowledge) during the first two stages of simple body shopping and offshoring, and then moved on to "realized absorptive capacity" (successful application of such knowledge for transformation and exploitation) or even dynamic capabilities (Teece et al. 1997) to seize the windows of opportunity by creating their own global delivery model in the final stage.

6.5 Discussion

The cases of Schumpeterian competition discussed above are consistent with the main thesis of the catching-up cycle framework, which is that catching-up dynamics can be explained by the interaction of technological and market regimes with "the right responses" by actors, including firms and governments. However, the details of the dynamics differ. The cases suggest that technologies with short cycles provide a good opportunity for latecomers to catch up only if they have already accumulated some absorptive capacity by starting early and investing in R&D, used it to seize the opportunity of emerging technologies by making decisive investments to adopt and internalize the emerging technologies, and mobilized support from the public sector or government agencies to share financial and knowledge resources and risks. In a sense, successful latecomers "sensed and seized opportunities and created new competitiveness by reconfiguring their intangible and tangible assets" (Teece 2007).

While the term "right responses" is somewhat vague in the catch-up cycle framework, it can now be specified to include both absorptive capacity (Cohen & Levinthal 990) during the entry and gradual catch-up phases of catch cycles, and dynamic capabilities (Teece, et al. 1997; Teece 2007), rather than zero-order ordinary capabilities (Winter 2003), during the forging-ahead phase of catch-up cycles.

While absorptive capacity (AC) is defined as the ability of a firm to identify, evaluate, assimilate, and exploit knowledge from the environment, it refers specifically to the firm-level R&D efforts (Hammerschmidt 2009; Griffith et al. 2003) that are necessary for a latecomer to build its capabilities. The two-step approach of Zahra and George (2002) is useful here because it distinguishes between "potential" and "realized" AC. Given that realized AC overlaps with dynamic capabilities to a certain extent, it can be said that a latecomer firm is advised to first build potential AC and then move on to building realized AC or dynamic capabilities, so that it can seize the opportunity of new and emerging technologies and related market disruptions. In other words, finding the right response in a rapidly changing environment requires dynamic capabilities or "the ability to integrate, build, and reconfigure internal and external competencies" (Teece et al. 1997).

7 Summary and concluding remarks

TCT has emerged as one of the key variables linking technological regimes to the catching-up by latecomers. This study has provided an analytical review of the literature involving the three dimensions, namely, at the firm, sector, and country levels.

First, at the country level, this study discusses an emerging phenomenon in which a latecomer economy has undergone a path of detour, namely, specializing in short-TCT sectors during the catching-up stage and then shifting to long-TCT sectors at the later or post-catch-up stage. As a latecomer further accumulates capital, its comparative advantage may change from short- to long-TCT sectors. Second, at the sectoral level, this paper addresses the issue of the double-edged nature of TCT. On the one hand, short TCT can be either a window of opportunity, and on the other hand, it can be a further source of difficulty. Whether short TCT would be a window of opportunity or a source of further difficulty depends on absorptive capacity by latecomers. Third, at the firm level, this study deals with the issue of possible convergence in the behavior and strategies of a catching-up firm towards mature firms in the long term. It shows that as a catching-up firm builds up, accumulates, and enhances its level of technological capabilities, it no longer has to seek a niche in the short-TCT area but may diversify into long-TCT businesses.

Across the three levels discussed above, the overarching keywords are “detour” and “convergence.” Given the entry barriers against high-end long-TCT sectors, latecomers are advised to adopt the detour strategy of moving towards short-TCT sectors, which has an opposite or a different direction from the incumbent, and avoid emulating the incumbent forerunners in the long-TCT sectors. A premature emulation may lead to catch-up failure or middle-income trap. Then, as the level of capabilities of latecomers increase and accumulate over time, they may switch their specialization from short- to long-TCT sectors and activities, thereby realizing a convergence in terms of behavior and strategy at the firm, sector, and country levels. The findings of this study are also complementary to the idea of leapfrogging, which is to seize the window of opportunity of new technologies. The time that a window of opportunity opens up is exactly when an entry barrier becomes low, and short-TCT sectors are exactly where a new window of opportunity is more likely to emerge with more frequency. However, given the risk involved with leapfrogging, latecomers may pursue this strategy only after they have built up a certain level of absorptive capacity by learning from external knowledge and investing in their own R&D.

This paper has also addressed the issue of whether TCT alone is sufficient to explain the outcomes of catch-up competition. The diverse cases show that while the technologies with short TCT provide a good opportunity for latecomers to catch up, success is not guaranteed, as it often requires the right responses and the presence of other factors, such as the prudent role of government regulation and industrial policy and a certain level of absorptive capacity through timely investment in R&D, which are needed to seize a window of opportunity from emerging technologies. The right response is now specified to include both absorptive capacity (Cohen & Levinthal 1990) and dynamic capabilities (Teece, et al. 1997), so that latecomers can realize the potential of short-TCT-based technologies.

Finally, while this study has shown a viable path of catching-up (detour and leapfrogging) via short-TCT specialization, it does not exclude the possibility of alternatives, such as mixed specialization with both short- and long-TCT sectors. This possibility is shown by the case of India showing the combination of short-TCT for its IT services and long TCT for pharmaceuticals, as discussed by Lee et al. (2021). However, India’s strength in pharmaceuticals is more likely related to its very early start of coping with indigenous health problems. Another path is an approach called resource-based development, such as the cases of Malaysia and Chile (Lebdioui et al. 2021). This approach is also consistent with the idea of seeking a niche in low-entry barrier sectors by taking advantage of locally available resources.

Data availability

We did not analyze or generate any datasets because our work proceeds within a theoretical approach, doing a review of the literature.

Notes

Table 4.1 in Lee (2013: 85).

Another way of measuring the TCT of a sector is to take the average TCT of all patents filed by all firms belonging to a specific sector, as conducted in Lee and Lee (2022).

Instead, they merely argued that “countries can reach the core only by traversing ‘empirically infrequent’ (meaning, long) distances,” which is an extremely difficult task.

This comparative cases of four countries are the findings of Lee et al. (2012).

It may also reflect to a certain extent the increasing trend of TCT over time, regardless of the nationality and classes of patents (Lee and Lee 2021b

A need for addressing this issues is raised by a referee.

Utterback (1994: 223–226) observe that firms tend to become conservative and defensive as the market expands, exemplified by a phrase like,” when you have a good thing going, don’t change it.” Such mindset can be a reason for a firm to need dynamic capabilities.