Abstract

In developing countries, the evidence regarding the direct and indirect effects of FDI on economic and financial performance at the firm level is mixed. To contribute to this literature, we provide empirical evidence of direct and indirect effects of FDI on firm’s performance, using return on assets (ROA), gross revenues and gross revenues growth rate as performance measures. We examine the private formal enterprise sector in Ecuador from 2007 to 2018. Our identification strategy relies on the use of the Generalized Method of Moments (GMM) methodology for dynamic panel data which allows us to control for potential endogeneity, autocorrelation and heteroskedasticity issues. The results suggest that firms with inward FDI grow faster than their counterparts, and firms with higher amounts of FDI as a share of total revenues have on average higher levels of gross revenues. Moreover, we find negative horizontal wages and gross revenues spillover effects on gross revenues growth rates, but positive horizontal gross revenues spillover effects on ROA. There is also significant evidence of negative horizontal spillover effects in all economic sectors, whereas evidence for forward and backward spillovers is heterogeneous across them.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The inflow of international capital as FDI can have direct and indirect effects on firms of the host country (Girma et al. 2015). In the case of the former effect, Apostolov (2017) mentions that the firms that receive FDI experience changes on their productivity, profitability, innovation strategies, among others. Alternatively, the foreign inflows could cause spillovers (indirect effects on firms), such as, capital accumulation, knowledge transfers, and technology diffusion. Through capital accumulation, FDI encourages the adoption of new inputs and technologies in the production function of the recipient economy. Moreover, FDI can improve the existing stock of knowledge via labor training and skill acquisition (Chuang and Hsu 2004), and through the introduction of organizational arrangements (Blomström and Kokko 1998; De Mello 1997). Finally, FDI contributes to enhance technology diffusion in terms of physical capital and intangible assets (marketing, licensing agreements) (Borensztein et al. 1998; De Mello 1999). It is relevant to mention that the volume and type of FDI depends on the absorptive capacity of the host country (Borensztein et al. 1998; Alfaro et al. 2010; Damijan et al. 2013). For instance, countries that do not have enough stock of human capital to manage the technology transfers, do not obtain the highest returns of FDI, hence, cannot necessarily achieve higher growth rates.

There is not a consensus of whether FDI has positive, negative or null effects (direct and/or indirect) on firms’ outcomes and performance. In general, most studies focus on the macroeconomic effect of FDI or, in the case of microeconomic analysis, the approach is more oriented towards productivity and technology diffusion. Hence, we cover this gap and contribute to the existing empirical literature in four ways. First, we estimate the direct effect of FDI on performance, not using the common measure, which is the analysis of the Total Factor Productivity (TFP). Instead, we use Return on Assets (ROA) and gross revenues growth rate as measures for the performance and development of Ecuadorian firms. We analyze different measures of performance to get a robust and holistic evidence of the effect of FDI on profitability and economic development. By obtaining this evidence, we generate a relevant contribution on the focus FDI research should have, by determining whether the FDI should be studied on different performance measures. This study belongs to the group of studies that examines the impact of FDI on firm outcomes other than productivity. For example, Yang et al. (2017) analyze how firms’ FDI growth affect their ROA, and Reyes (2017) looks at the effect of FDI on the level of gross revenues. They find a positive effect of capital coming from abroad on firms’ performance.

Second, we analyze the horizontal, backward and forward spillovers. These FDI channels of spillovers have been scarcely addressed in the literature of international business, investments and firm performance, even though it is relevant, specially in developing countries where governments tend to promote FDI because of the benefits they could have on domestic firms (Gerschewski 2013). However, there are inconclusive findings of this effect (Görg and Greenaway 2004); hence, it is necessary to deepen the analysis. Third, we include two different measures of FDI to analyze not only the effect of the presence of FDI at the extensive margin (i.e. with a treatment indicator) but also at the intensive margin (i.e. level of FDI).

Finally, we study Ecuador, a small open and dollarized economy, contributing to the inconclusive evidence of cross country studies. It is relevant to develop single country studies, because studies by groups of countries tend to be biased and the results are not conclusive (Wooster and Diebel 2010; Demena and van Bergeijk 2017). Ecuador is an interesting case of study for several reasons. First, the country underwent several structural institutional changes during 2007-2018 (new constitution, state reform, development plans, tax reform, decentralization, etc.), higher oil and other commodities prices (commodities boom) (Aray and Pacheco-Delgado 2020; Armijos et al. 2018) and these changes might drive the attention of international investors to this country. Second, even though, Ecuador’s FDI inflows as a share of GDP are approximately 2.2 percentage points (p.p), which is below the average for Latin America (3.1%)Footnote 1, the country has experienced some periods of growth in capital inflows as a share of GDP (2008: + 3.5%, 2011: + 2.41% and 2018: + 1.14 %) during the period 2007-2018. However, compared to neighboring countries, such as Colombia (on average 4.0%) and Perú (on average 4.5%), Ecuador’s FDI inflows as a percentage of GDP are lower. In order to draw policy-relevant conclusions, it is necessary to determine whether FDI in this context had an effect on firm performance, even if it was not as large as in previous periods. Furthermore, authors such as Camacho and Bajaña (2020) found different results of the effect of FDI on economic growth when comparing those neighboring countries, which supports the importance of doing a single country analysis. Additionally, those authors and Salazar (2021) demonstrate that FDI has a positive effect on economic growth of Ecuador; hence, it would be relevant to analyze if a similar positive result is obtained when analyzing firms’ performance measured as return on assets (ROA) and gross revenues growth rate, which has not being studied before in Ecuador, for the knowledge of the authors. Third, there was a shift in the actors injecting capital into the country; for instance, prior 2007 the United States and Brazil were the primary sources of FDI inflows, whereas after 2007, Europe, China and Venezuela became important sources. These particularities make it interesting to understand whether inflows of FDI during this period had any impact on firm economic performance.

We use a panel dataset from the Superintendencia de Compañías, Valores y Seguros (SCVS) which contains information related to amounts of investments in the creation of enterprises and capital increases, as well as financial information from firms in the formal economy. We use information from the period 2007–2018 in order to calculate the direct and indirect effect of inward FDI. Moreover, we measure FDI in two ways: a dummy variable of FDI and the total FDI net inflows divided by production (measured by sales) (Alguacil et al. 2011; Herzer et al. 2008), and their lags. Our identification strategy lies in the use of the Generalized Method of Moments (GMM) methodology for dynamic panel data that allows us to control for potential endogeneity (reverse causality issues) not only of FDI, but also of all other explanatory variables (Alguacil et al. 2011). Additionally, we include many industry related covariates and some macroeconomic-institutional variables to control for firms’ characteristics and the economic context.

Our findings indicate low and mixed direct effects of inward FDI on firm performance, which may be explained by profit shifting behavior among multinationals and the presence of low FDI incentives in Ecuador during the period of analysis. In addition, we find evidence suggesting the presence of 1) negative horizontal wages and gross revenues spillovers effects on gross revenues growth but positive horizontal gross revenues spillover effects on ROA, 2) positive backward wages spillovers effects on gross revenues when the inward FDI occurs one period before the period of analysis, and 3) negative forward wages spillover effects on gross revenues in one period after the inward FDI was received. These findings suggest that inward FDI firms’ inputs are either more expensive or more advanced than those offered by domestic firms, resulting in negative forward spillovers since domestic businesses may not have enough absorptive capacity. In other words, as Lenaerts and Merlevede (2015) points out, large foreign investors “bring their own supply chain” and so do not generate spillovers along the supply chain. Furthermore, our findings imply that foreign enterprises acquire inputs from local enterprises, allowing them to increase sales in the next period. Given the high concentration of micro and small businesses, Ecuadorian enterprises appear to be less able to deal with MNEs’ “market stealing” effect, which is consistent with evidence of negative forward and horizontal spillovers.

The structure of this paper is as follows. Section 2 provides a brief literature review of the direct and indirect effects of the FDI inflows. Section 3 describes the overview of inward FDI in the Ecuadorian context. In Section 4, we explain the empirical strategy used to obtain the results that are exposed in Section 5. Finally, Section 6 describes the main conclusions and policy implications of the results.

2 The effects of foreign direct investment

One of the main controversies on international trade literature is whether FDI enhances economic growth or not. In the case of developing countries, Camacho and Bajaña (2020) find that FDI has a Granger causality effect on GDP for Ecuador and Peru, but not for Colombia. Hence, evidencing that for countries like Ecuador, the FDI has an influence on economic growth. A similar result is found by Olaya and Armijos (2017), who show that FDI has a short and long term relationship with the economic growth of the country. The overall picture of the empirical evidence on the FDI-growth relationship is offered by (Iamsiraroj and Ulubaṡoġlu 2015) who report that, of the 108 empirical studies surveyed, 43% show a positive and significant effect, 17% a negative and significant effect and 40% a statistically insignificant effect.

Besides the debate over the relationship between FDI and economic growth, it is also unclear how FDI affects local firm innovation (Jin et al. 2019), productivity spillovers (Rojec and Knell 2018), efficiency of domestic firms (Gorodnichenko et al. 2014), jobs creation (Javorcik 2014), wages (Görg and Greenaway 2004) and economic performance of firms in general (García et al. 2013).

According to Alfaro et al. (2004a), the positive or negative effects of inward FDI depend on the characteristics of the host country; the absorptive capacity of the host economy plays an important role (Damijan et al. 2013). For instance, the greater the technological gap between multinational affiliates and domestic firms, the less beneficial FDI is for the host country (Meyer 2004). It is also important to consider the market structure or competition within different industries (Hu and Jefferson 2002), the country’s cost of production, such as, wages and transportation (Chen and Ku 2000), cultural diversity barriers (Yang et al. 2017), local financial markets status, general infrastructure, political stability and institutional quality.

In the case of developing countries, the studies about the effect of FDI inflows, show mixed results.Footnote 2 Some authors find that there is a positive effect of FDI inflows on output (see, for example, Damijan et al. 2003), while others show that FDI impact negatively to the output generation (see, for example, Sinani and Meyer 2004).

2.1 FDI and firm’s performance

Many studies have found strong correlations between FDI and firm profitability. For example, (Chhibber and Majumdar 1999) suggest that this relationship has positive effects. This positive effect of FDI is typically carried out by foreign firms that outperform domestic firms. In this regard, (Kneller and Pisu 2004) argue that the performance of foreign firms in terms of employment, wages, and productivity is superior to that of domestic firms.Footnote 3 The authors also mention that foreign firms are more likely to export than other businesses, and they sell a larger share of total output abroad on average. As a result, they can transfer this knowledge to the companies in which they invest, which benefits them.

However, in some circumstances the effect of FDI on firms’ outcomes tends to be negative (García et al. 2013). According to authors such as (Fotopoulos and Louri 2004), foreign presence may have a negative impact on domestically owned firms in the short run if foreign firms with lower marginal costs than domestic competitors can divert demand away from them. Furthermore, (Aitken and Harrison 1999) contend that, in this competitive framework, domestic firms cut production and productivity falls in the short run because their fixed costs are spread over a smaller market. Additionally, some authors such as (Turnbull et al. 2016) find no effect at all.

In Table 8 we show a non-exhaustive review of the literature on the effects of FDI on firms performance variables, such as gross revenues, wages, ROA, ROE, employment and productivity. Regardless of the region studied or the methodology used, the overall effect is positive in the short and long run. In Ecuador, the evidence of the effect of FDI and firm economic performance is scarce. (Vera-Gilces et al. 2019) examines this relationship in Ecuadorian firms, particularly in the manufacturing sector, and find that firms that receive FDI outperform firms that do not receive FDI in terms of economic performance (TFP and size).

2.2 FDI spillovers

Positive spillovers are associated with FDI contributions to economic development, such as knowledge transfers to local firms within and across industries, technology diffusion, demonstration effects, and labor training, all of which are important factors in increasing productivity and competitiveness across firms (Demena and van Bergeijk 2017; Rojec and Knell 2018).Footnote 4 According to (Chuang and Hsu 2004), the presence of foreign ownership has a positive and significant effect on the productivity of domestic firms. Furthermore, trade with more advanced countries allows them to gain access to new technology and information, increasing productivity and allowing them to compete in international markets. In a similar vein, (Barge-Gil et al. 2019) find evidence of a positive productivity effect from multinationals on domestic firms operating in the same industry, and when the authors examine inter-industry linkages, they find evidence consistent with positive productivity spillovers from forward linkages (i.e. from multinational suppliers to local buyers) but negative productivity spillovers from backward linkages (i.e. from multinational buyers to local suppliers).

Negative (aggregated) outcomes, on the other hand, are related to the agglomeration versus competition effect. This is due to the fact that domestic firms can benefit from the positive agglomeration effect of foreign multinationals via channels such as knowledge spillovers, input sharing, and labor pooling. Nevertheless, they can also suffer from the negative competition effect, losing market share that goes towards more productive multinationals (Lu et al. 2017; Demena and van Bergeijk 2017).Footnote 5 In a short run imperfectly competitive market structure, domestic firm productivity may be reduced when gross revenues fall, causing fixed costs to be spread over fewer units; in the long run, increased competition induced by increased FDI in domestic industries may force inefficient domestic firms to exit and surviving firms to improve their performance (Hu and Jefferson 2002).

In this study, we look at both horizontal and vertical spillovers (divided in backward and forward). Horizontal spillovers happen between FDI recipients and other local firms in the same industry sector. In general, most of the studies identify four distinct channels through which these spillovers can occur: demonstration effects, labor turnover, competition effects, and export externalities (Meyer 2004; Buckley et al. 2002). We examine horizontal spillovers in particular, taking into account the demonstration effect (learning due to proximity) and competition effects, where local firms must become more efficient to remain competitive. In the case of horizontal spillovers in developing countries, the results are mixed. There is no strong evidence of positive externalities from firms receiving FDI to other firms in the same sector (Alfaro et al. 2004b). Vertical spillovers, which can be classified as backward or forward, occur between firms that receive FDI and their local suppliers and customers. Backward spillovers are caused by interactions between foreign affiliates and suppliers, whereas forward linkages are caused by contacts with local customers. The literature on vertical spillovers in developing countries is limited, although it is more conclusive than studies on horizontal spillovers. For instance, Kugler (2006) finds positive vertical spillovers, however they find less stronger evidence regarding horizontal spillovers. Furthermore, Iyer (2009) finds positive vertical spillovers, but also horizontal spillovers for the Indian case. These results are mixed in terms of the direction of the effects (negative or positive).

In Table 9 we show a non-exhaustive literature review of empirical research that analyzes FDI spillover effects on different countries.Footnote 6 Overall, the multiple results of FDI spillovers effects have been inconclusive, because of: (1) different ways of measurement used, (2) empirical methodologies employed, (3) heterogeneity of domestic and foreign firms (particularly related to the absorptive capacity and potential for spillovers), (3) difficulties distinguishing between unintentional and intentional knowledge diffusion, and (4) competition effects (Orlic et al. 2018). Also, the lack of evidence on FDI spillovers are both substantive and methodological. Substantive reasons suggest that there are no (or even negative) spillovers, and that the necessary preconditions for spillovers are often missing in host countries. Methodological reasons are related to databases being of insufficient quality or not detailed enough, and to inadequate econometric methods used (Rojec and Knell 2018).

3 Overview of FDI in Ecuador during 2007–2018

The FDI comes from non-Ecuadorian companies or individuals who invest in the formation of new businesses or the expansion of existing ones. According to Camino-Mogro et al. (2018b), the FDI that comes from the creation of companies is only 4.57% of the total FDI, whereas FDI that comes from capital increases of pre-existing firms is much larger (95.4% of the FDI). This means that almost all the FDI comes from capital increase of pre-existing firms, which is consistent with the businesses’ investment common strategy.

During the government of the period between 2007 and 2017 some Incentive Laws were established to attract FDI to preserve the dollar in the economy to maintain domestic liquidity and avoid problems of payment balance. Additionally, during the the first year of the government of the period 2017–2021, the Organic Law for Productive Promotion, Investment Attraction, Job Creation and Stability and Fiscal Equilibrium was established to boost the economy, promote investment and employment, as well as achieve a long-term fiscal sustainability.Footnote 7

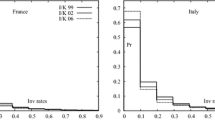

However, in both cases, the results of these laws were not as expected since their positive effect occurred only in the same year of implementation and after that the FDI decreased. According to the SCVS, the average of inward FDI of the last 12 years of all sectors in the country is only 614 million USD. In addition, Fig. 1 in Appendix shows that during 2007-2018, the FDI has three large falls on its growth; one in 2009, which could have happened because of the global financial crisis. Another decrease is between 2011 and 2012, which could be explained by the referendum of the year 2011 where there was established a new way of criminalization, which is defined as the non-affiliation of workers in relation to dependency to the Ecuadorian Social Security Institute. This is consistent with what Gross and Ryan (2008) explained about the effect of employment protection laws for regular and temporary employment in Japanese FDI to Europe in the late 1980s and 1990s, where they found that job protection does matter in the election of location of Japanese investors and has an adverse effect on the size of employment related to FDI. The other great decrease was in 2016, which could be explained because of the decrease of the price of oil and the earthquake on April of 2016. After these three decreases there are also three considerably large peaks, which show a relevant increase of FDI growth after a pronounced decrease.

Moreover, Fig. 1 in Appendix analyzes the variation of FDI, ROA, gross revenues and wages growth compared to each other and we evidence that there is a positive relationship between ROA and FDI growth, this is that FDI fluctuates similarly to the firms profitability, except in the first 4 years. Something remarkable in the Ecuadorian context is that this country is mainly engaged in mining and quarrying sector, which is constituted within the branch of natural resources. This branch includes the activities of agriculture, livestock, forestry and fishing, exploitation of mines and quarries, and electricity supply and water supply. As it is shown in Fig. 2 in Appendix, the natural resources sector and manufacturing sector are the ones that receive more FDI during all the period of analysis. In 2016, the mining and oil exploitation sector received more than 50% of the country’s FDI. Camino-Mogro et al. (2018b) found that after 2016, the participation of natural resources in FDI diminished with the fall of the price of oil, which positions the manufacturing sector as the one with more participation of FDI in 2017.Footnote 8

Furthermore, in the Ecuadorian economy, the group of large firms is composed for those who capture the largest amount of FDI (see Fig. 3 in Appendix), this is consistent with (Camino-Mogro et al. 2018b) and Vera-Gilces et al. (2019) that found that large size of the company allows the use of production scales, recruitment of qualified staff and continuous improvements in their processes, so that these companies become attractive to investors.Footnote 9 Finally, Fig. 4 in Appendix shows the participation of FDI by country of origin; in particular, in the three years showed in the figure, United States (U.S) is always on the top five countries that invest in Ecuador, but also we show that Panama and England are countries with important FDI participation. Berg (2000) argues that one of the advantages of dollarization, is that it lowers transaction costs with countries that have the same currency and assures stability, which might improve the levels of investment. However, we also show in each year of analysis a large participation of tax heavens such as: Panama, Bahamas, British Virgin Islands and Uruguay.

4 Design and empirical strategy

Our empirical strategy is justified by the existing theory on the effects of foreign ownership on productivity-enhancing investment in a firm. The theoretical rationale that motivates our empirical analysis is based on (Guadalupe et al. 2012) and (Girma et al. 2015). In this vein, foreign firms perform FDIs if the gains from doing so are larger than zero:

where \((V_{i}^{*F}- V_{i}^{*D})\) is the value created by the FDI, α are the bargaining weights of the foreign and domestic partners in the transaction and K is the fixed search cost of acquiring the domestic firm. In this model, the latent variable \(FDI_{it}^{*}\) determines the treatment that consists on receiving FDIit inflows; it is equal to 1 if \(FDI_{it}^{*}\) ≥ 0 and equal to 0 otherwise. We can express FDIit as a function of the initial productivity level of the company (ωi), year fixed effects (λt) and other firm time-varying controls (Xit)Footnote 10:

The performance outcome of the domestic firm that receives foreign capitals is determined by the following empirical model:

In this model the productivity-enhancing performance is a function of FDIit, firm time varying control variables, year fixed effects as well as firm fixed effects. The initial level of productivity that affects performance directly (not necessarily through the FDIit treatment) is captured by the firm fixed effect (γi). By including firm fixed effects, we control for time-invariant firm characteristics. Since firms evolve constantly, it is important to account for lagged firm characteristics which could drive selection into treatment and that can affect future performance related decisions. The extended model with lagged values of performance and FDI is described in Section 4.2.1.

The effect described above is the direct effect of FDI. However, the productivity-enhancing performance can be also affected by both the absorptive capacity to absorb spillovers from foreign firms and the number of foreign-owned firms in a given sector; the interaction of these two components captures the indirect or spillover effects (Girma 2005). On one side, there can be positive learning effects that are increasing on the number of foreign owned firms within a particular cluster. For instance, if we consider the process of workers reallocation from foreign owned firms to domestic ones, the greater the number of foreign-owned firms, the greater the likelihood of hiring a more highly trained worker, which will result in lower costs associated with implementing a new technology that affects performance. On the other side, there may be negative spillovers because of competition effects. For example, foreign firms may have lower marginal costs to produce due to a firm-specific advantage, allowing them to steal market share from domestic firms; this may force domestic firms to increase average production costs in response to a decline in demand, resulting in lower profitability. Furthermore, spillovers can occur within the same industry (horizontal spillovers) but they might also occur in a different industry (vertical spillovers); this depends on the level of backward and forward linkages that the firm may have with other firms in other industries.

4.1 Data

This study uses official administrative information provided by the Superintendencia de Compañías, Valores y Seguros (SCVS) and the Central Bank of Ecuador (BCE). We use an unbalanced panel data set at the firm level containing annual information from 2007 to 2018. There are 153,062 observations and 27,793 firms in the sample. The number of firms differs from the total population of firms because we debug the database. First, we eliminate firms that report values of zero on sales, assets, employees and wages, because this information is not consistent with the normal operation of the enterprises.Footnote 11 Second, we do not consider those firms that have a liquidity ratio lower than zero and/or have a value of investment lower than zero. Third, we keep firms that have at least three years of reported information on balance sheets. Fourth, we eliminate extreme values of ROA and equity.

We use three different sources to construct the database for this study: two from the SCVS and one from the BCE. The micro-level information was obtained from two data sets provided by the SCVS: 1) the financial statements, and 2) the investment data sheets. We also use 3) the database from the Central Bank of Ecuador (BCE) for our macro-level data. The databases from the SCVS have complete information of the firms’ characteristics, performance, and investment behaviour. The financial statements are composed by variables such as total assets, total equity, gross revenues, total income, exports, net profits, wages, among others. It also has some qualitative variables such as name and type of the firm, country, city, and name of the economic sector each firm belongs to (according to the classification of the International Standard Industrial Classification (ISIC) revision 4). The investment data sheets have information regarding the name of the shareholders, the country of origin of the investment, the type of investment (if it is foreign or domestic), the amount of capital allocation, and other characteristics of the investment. Finally, the BCE database has information about the macroeconomic context of the country. It includes variables such as inflation, GDP growth, among others.

Table 1 shows descriptive statistics of our sample by sector during the period 2007 – 2018. The services sector includes approximately seven service-related categories, with wholesale and retail trade being the largest. The service sector is composed by 18,607 firms, from which only 1.48 % receive FDI and 37.90 % of the total amount of investment of this sector corresponds to FDI during 2007-2018. Moreover, the manufacturing sector with 3,252 firms represents 13.38% of the observations in the sample. The 3.35% of these firms receive FDI during the period of analysis, whereas 48.61% of this sector’s total amount of investment corresponds to FDI. The natural resources sector is the third sector in order of participation of firms in the total sample (10.89%). Only 1.89% of the firms of this sector receive FDI and 45.82% of the investment comes from FDI during the period 2007-2018Footnote 12. Finally, the construction sector represents 9.53% of the sample (3,151 firms), and has the lowest amount of FDI during the period 2007-2018. Approximately, 0.73% of the firms in the sample receive FDI, and the foreign investment represents 17.47% of the total investment made by this sector. This fact is related with the contraction of the sector since 2014, possibly because of different regulations imposed such as the so-called “Real State Capital Gains Law” and “Inheritance Law”.

4.1.1 Variables description

The variables that we use for the analysis are described in detail in Appendix 11. The dependent variables are firm performance measures: ROA to analyze the profitability of the firm and the gross revenue growth to examine if the FDI has an effect on firms’ output. Given that the purpose of this study is to determine whether FDI is a potential tool for enhancing firm performance, the main variables of interest are FDI measured as an indicator variable equal to one if a firm i at time t receives FDI, and zero otherwise (extensive margin measure) and the amount of FDI as a share of total gross revenues (intensive margin measure). Furthermore, we use three FDI spillover measures as variables of interest that we explain in detail in Section 4.2.2. The control variables that we add are the following:

-

Micro-level variables. We include firms’ size because this variable is likely related with the performance of the firm. Moreover, we use the liquidity ratio as a control because it measures the company’s ability to convert assets into cash in the short-run and to pay debt obligations. A greater liquidity ratio could positively affect the performance of the firm. Additionally, we add the debt ratio, which measures the leverage of the firm. We include exports, as an indicator variable that captures whether the firm exports at time t or not, and is related with the evolution of international gross revenues and exposure of local firms. Moreover, we include the absorptive capacity (ABS) of the firm which is calculated following (Girma 2005) and (Lenaerts and Merlevede 2015), after the estimation of each firm Total Factor Productivity (TFP).

$$ ABS_{it} = \frac{Ln(TFP)_{i,t-1}}{Ln(TFP)^{*}_{j,t-1}} $$(4)The absorptive capacity is the ratio between the TFP (in logs) of the firm i during the previous period t − 1 and the maximum TFP value in sector j in period t − 1.Footnote 13

-

Macro-level variables. For the estimation of spillovers by economic sector, we use some macroeconomic variables that might affect directly the firm’s performance: GDP growth rate and inflation. These macroeconomic characteristics are representative indicators of the economic activity in the country. It is important to include these variables to analyze the FDI spillover effect.Footnote 14 The macroeconomic conditions play an important role on firms’ performance and FDI attraction (Herzer et al. 2008; Alguacil et al. 2011). For instance, a country with high inflation might increase its uncertainty level, hence lead to an unfavourable climate for firms.

-

Concentration: We include the Herfindahl-Hirschman Index (HHI) to control for the degree of concentration in an economic sector. We build this index considering 2 digits sectors from the ISIC Rev 4.0 categories. According to the U.S Department of Justice and the Federal Trade Commission 1997 the market concentration is a function of the number of firms and their market share within a sector. This indicator is computed by summing up the squared market shares by sector (in our case 2-digits sector code). The market concentration is divided by the Agency in three regions of analysis: unconcentrated when the HHI is below 1000, moderately concentrated when the HHI is between 1000 and 1800 and highly concentrated when the HHI is above 1800.

Table 2 shows some descriptive statistics of the micro-economic variables we use in our analysis. We calculate mean differences between the sub sample of firms that receive FDI and firms that do not, and test for its significance using a T-test. The results show that firms that do not receive FDI have on average a significant higher performance in terms of ROA than the ones that receive FDI. In contrast, firms with FDI have significantly higher gross revenues than the other firms. However, it is important to point out that this test does not consider the dynamics of this variable over time.

Furthermore, we find that firms that receive FDI have on average higher total wages from 2007 to 2018 than firms that do not. These results are consistent with the findings of (Conyon et al. 2003), who study the effect of foreign investment on the productivity and salaries in UK companies. They show that FDI firms pay employees 3.4% more than domestic firms. This difference is attributed to technology transfers and a good labor environment, which improves company’s performance and productivity levels.

Moreover, we find that firms with FDI show a significantly lower debt ratio than firms without FDI. This preliminary result gives some intuition about how firms with FDI prefer to finance a higher share of their assets via equity. In terms of participation in international markets, we find that firms that receive FDI have more participation: 35% of the enterprises with FDI export compared to 9% of the firms without FDI. Finally, the absorptive capacity (ABS) is higher for firms with inwards FDI compared to the firms that do not receive FDI.

4.2 Identification and Methodology

Before describing the econometric approach that we use, we evaluate the correlation among the variables that we include later in our model. Table 12 in Appendix, shows the correlation matrix between the variables included for the analysis of FDI and performances as well as for the analysis of horizontal and vertical spillovers.

Overall, the correlation between the independent variables is low. The highest correlation coefficient that we find occurs between inflation and GDP growth (0.48). This preliminary relationship found is consistent with the idea that countries with low initial levels of inflation (such as the Ecuadorian economy for being a dollarized economy) relate positively with growth rates. (Bullard and Keating 1995) find that increases in long run inflation have positive effect on growth when countries have sufficiently low inflation rates. In summary, the correlation between micro and macro economic variables is weak. This analysis is relevant to show that the variables we use in our empirical model, a priori, do not suffer from multicollinearity issues.

In the next subsection we detail the procedures used in the estimation of our main findings, which is divided into two parts: first, we study the relationship between FDI and firms’ performance (direct effects), having three different measures of performance (ROA, gross revenues and gross revenues growth rate) but also studying two different measures of FDI (and indicator of FDI treatment and FDI as a share of sales); second, we analyze whether there are FDI spillovers (indirect effects) in the whole economy and, in particular, within different economic sectors, during the period 2007-2018. For this, we analyze horizontal spillovers and two types of vertical spillovers: backwards and forwards spillovers.

4.2.1 FDI and firms’ performance

In order to evaluate if there is a direct FDI effect on firms’ performance, first, we conduct an empirical analysis regressing the FDI as an indicator variable (extensive margin) on three different measures of performance (ROA, gross revenues and gross revenues growth rate) controlling for firms’ characteristics such as: absorptive capacity (ABS), liquidity ratio, debt ratio and an indicator for exporting firms. We also control for market competition by introducing the Herfindahl-Hirschman Index (HHI). We include year fixed effects to control for possible macroeconomics effects, and economic sector and firm size indicator variables to control for possible microeconomic effects. The same regression is also estimated using the share of inward FDI from total sales (intensive margin) of firm i in year t and maintaining the same controls mentioned above. To carry out this analysis, we estimate the following general specification:

where Performance of firm i at time t is our dependant variable. FDI is our variable of interest. FDI as a treatment indicator takes the value of 1 if a firm i receive foreign direct investment in year t, and 0 otherwise. FDI at the intensive margin corresponds to net FDI inflows divided by gross revenues (Y ) of firm i at year t. Likewise, we include their lagged values in order to capture the dynamics of FDI over time. Micro is a set of covariates that accounts for financial and operational specific characteristics of firm i reported by year t: we include liquidity ratio, debt ratio, exports, firm size, and absorptive capacity (ABS). We also include year dummies, λt, in order to control for the unobserved heterogeneity over time (i.e: related to macroeconomic conditions), and the individual firm fixed effect, γi, which accounts for the unobserved heterogeneity among firms that is constant across the period of analysis, treating in some degree, possible endogeneity issues.

With the aim of estimating the effect of FDI on different performance measures, coping with some identification issues, such as, endogeneity, autocorrelation and heteroskedasticity, and also considering that our panel has relatively small “T” and large “N”, we employ the Difference and System Generalized Method of Moments (GMM) for dynamic panel data. This method was developed by (Holtz-Eakin et al. 1988), (Arellano and Bond 1991), (Arellano and Bover 1995), and (Blundell and Bond 1998).Footnote 15

We estimate Eq. 5, using the econometric procedure mentioned above, considering the past behavior of firms’ performance. In this sense, we include the first and second lags (in the case of gross revenues and gross revenues growth rate) of performance indicators in the set of independent variables. This methodology allows us to control for potential endogeneity issues not only related to the FDI variables,Footnote 16 but also from other explanatory endogenous variables such as the dummy of exports and ABS of the firm.

The endogeneity related to the FDI variable may arise in two cases. First, FDI allocation might occur, specially in firms with higher profitability levels, resulting in reverse causality; and second, local firms investment decisions in new assets are related to the firms’ output and profit levels, which subsequently might be affected by investment rates (Sinani and Meyer 2004). In order to mitigate this issue to some extent, we employ lagged values of the two FDI variables of interest as instruments and also incorporate them into our identification equation.

Furthermore, we overcome the autocorrelation issues present in the idiosyncratic error by using a dynamic panel data estimator and including time dummies, thereby ensuring autocorrelation within firms, but not between them. In our results, we apply the Arellano-Bond test for autocorrelation in order to test the validity of the moment conditions used in the system GMM; we also present the Hansen test for joint validity of the full instrument set.

It is important to point out, as (Roodman 2009) mentions, that one of the drawbacks of this type of econometric approaches is that they can become complicated to compute and can easily generate invalid estimates. However, we obtain robust estimators controlling for the number of instruments and taking into account the design and limitations of our identification.

From Eq. 5, α1 and α2 constitute our main coefficients of interest. They capture how the firms performance varies with inward FDI. Some evidence from developing countries suggest that these coefficients should be positive and significant in our case, given that Ecuador is a developing economy that lacks sufficient technology and innovative production methods. The FDI could help to solve this problem as it contributes with new technology, know-how and also helps to finance resources that improve the efficiency and production of domestic firms. In addition, foreign participation reduces the financial dependence of the local firms with the government. However, according to what we described in section 2, results are mixed, and we could find no significant effects or even negative coefficients. Positive coefficients would indicate that the inward FDI is beneficial for local firms; nevertheless, no significant coefficients would suggest that the FDI has no effect, and moreover, negative coefficients would imply that FDI is in fact harming on average firms’ performance.

4.2.2 FDI spillovers

In this subsection, we evaluate the indirect effect of FDI on performance, better known as spillover effects that inward FDI may cause on domestic firms. The objective of this variable is to capture the relevance that the firms that receive FDI have in a given sector in terms of boosting performance indicators of other firms. In this sense, we analyze two alternatives of spillovers: wages spillovers and gross revenues spillovers. Moreover, we evaluate different types of spillovers, which correspond to horizontal spillovers, backward spillovers and forward spillovers. In this line, horizontal spillovers are evaluated following (Sinani and Meyer 2004) and (Damijan et al. 2013):

where Horizontal in sector j at time t, is the ratio between: the sum of Pf, which can be either gross revenues or wages, for the firms that receive FDI, in sector j at each period t. Moreover, the denominator Pt is the sum of all the firm’s gross revenues or wages by sector j at each year t; hence, this sum is composed of gross revenues or wages from domestic and foreign firms. With the horizontal spillovers we capture the effect of inward FDI on the firms’ performance within the same industry.

However, horizontal spillovers are not the only ones that inward FDI can generate. Also, there are vertical spillovers that occur given the backward and forward linkages between firms of different industries. The linkages between domestic firms and foreign ownership enterprises that can act as buyers or suppliers may have a distinct effect on the average indicators of performance. The linkages between industries are approximated using the national components from the “Input-Output Supply and Use Tables” that the Central Bank of Ecuador offers annually.Footnote 17 We calculate the technical coefficients without considering the share of imports, that is, using only the national component of the matrix, which provides the national share of output that each industry supplies as input to another industry. Following the existing literature (see, for example: Girma et al. 2008; Lenaerts and Merlevede 2015) we construct the backward and forward spillovers as follows:

where in Eq. 7, δhjt represents the proportion of sector h output that is provided as an input for sector j. Whereas in Eq. 8, πkjt is the share of outcome of sector j that is supplied as an input for sector k. πkjt captures the downstream linkages across firms that have inward FDI in a certain economic sector, whereas δhjt captures the upstream linkages across firms.

In addition, we analyze the inward FDI spillover contribution on each firm’s performance indicator using the following baseline equation, estimated through the difference and system GMM method developed by (Blundell and Bond 1998):

Moreover, we include the variable Spillover, which is of three types (Horizontal, Backward and Forward), at period t and its lag at period t − 1, similarly to (Sinani and Meyer 2004). In this sense, we capture the lagged effect of FDI inflows on performance, and understand the differences in the timing of FDI inflows, accounting for possible autocorrelation issues.

We run a different regression for each Performance indicator and each alternative of spillovers: wage spillovers and gross revenues spillovers. We estimate Eq. 9 for all the sample of firms, including time fixed effects νt and microeconomic controls that include firm size and economic sector dummies, to evaluate if there exists on average a spillover effect in the whole economy.

Likewise, we estimate Eq. 9 for each economic sector j separately, in order to analyze the FDI spillover effect on performance within each economic activity. In this part, we did not include time fixed effects νt, so we could test the effect of FDI spillovers on performance by sector given that the Horizontal spillovers are generated by economic sector and vary only across time. However, instead of νt and in order to capture the effect of some macroeconomic conditions, we include GDP growth rate and inflation as controls.

From Eq. 9, λh and 𝜃k constitute our main coefficients of interest. They measure how a firm’s performance may vary when there is a spillover effect. We expect these coefficients to be positive and significant, in particular the lag of the spillover (𝜃k), given that when foreign firms bring knowledge and technology to the country, there is an effect of competition with domestic firms, forcing them to modernize their production processes and try to adopt new technologies and even improve them. A non-significant coefficient would indicate that the presence of FDI in an specific sector j does not have a strong positive or negative effects on domestic firm’s performance belonging to this sector. A negative coefficient, on the other hand, would show a harmful effect from the sector FDI spillover to the firms’ performance within the sector. This can happen when firms that receive FDI compete aggressively with firms that do not receive FDI which usually take longer to catch up in terms of market share, given that are, on average, unable to adopt foreign technology immediately.

5 Main findings

5.1 Direct effects of FDI on firms’ performance

In this section, we present the results regarding the direct effect of FDI on firm’s performance in Ecuador, using three different measures of performance: ROA, gross revenues and gross revenues growth rate. Table 3 summarizes the results for the total sample using Difference and System GMM two-step estimators with robust standard errors, by applying (Windmeijer 2005) correction. We also include time, size and sector dummies in order to control for intrinsic characteristics of the firm.

Columns (1), (3) and (5) show the direct effect of FDI as an indicator variable on firms’ performance. The Hansen test of validity of instruments and the auto correlation test are also reported in Table 3. We treat the first (and second lag in the case of gross revenues and gross revenues growth rate) lag of the performance variables and FDI as endogenous and use their lags as instruments. Moreover, we also treat ABS and exports status as endogenous. The inclusion of the performance variables lags in the identification aim to control for the dynamic component of the relation tested, given the short run persistence nature of this variable.

A priori by looking at the descriptive statistics of Table Eq. 2, we can observe that firms with FDI seem on average to have less ROA levels than firms that do not have FDI inflows in the same year. This idea is confirmed by the empirical results obtained in our estimations. When controlling for the dynamics of the performance variables and some endogeneity issues, we find that there is a statistical significant (at 5% level of significance) effect of FDI inflows when accounting for FDI in period t but not in period t − 1 in terms of ROA and gross revenues. On average, a firm that has inward FDI in period t has a ROA 3.6% lower than the ROA in the case of domestic firms in the same period of analysis. However, the effect on gross revenues is less stronger and more mixed given that we find a significant effect but only at 10% level of confidence. On average firms with inward FDI have 0.11% lower gross revenues in the same period of the investment, but have 0.10% higher gross revenues growth rate in the period after receiving the investment. This last result, suggests that firms that receive FDI do not necessarily show grater levels of sales in the short run but on average their growth rate is higher compared to domestic firms (at least at 10% level of confidence).

In Columns (2), (4) and (6) we examine whether the amount of inward FDI as a share of total income obtained in a given year (an intensive margin measure of FDI) has an effect on performance. In this sense, we find that in terms of ROA and gross revenues growth rate, there is no significant effect founded; nevertheless, when we observe Column (4) there is a slightly significant effect (at 10% level of confidence) in the generations of sales. In other words, an increase of 10% in the amount of FDI received by the firm as a share of total income, relates on average to an increase of 0.2% on its gross revenues in the same period of the investment.

Based on this evidence, we can deduce that there are mixed indications of a direct effect of FDI measure as discrete and continuous variable. On the one hand, we find a negative effect of inward FDI on ROA and gross revenues, but not significant effect on gross revenues growth at time t. However, there is significant positive effect on gross revenues growth (at 10% level of confidence) of inward FDI made at time t − 1. On the other hand, the FDI share variable is only statistically significant and positive on the effect of gross revenues. This could happen because firms that receive FDI do not have the sufficient absorptive capacity (ABS) to transform immediately the investments in better performance indicators; as we show in Table 3, ABS in firms with FDI is positive but not statistically significant when compared to firms without FDI.

5.2 FDI Spillover effect on performance

This subsection shows the results of the existence of spillover effects related to FDI inflows on average and by economic sectors. We focus our analysis on three types of spillovers: horizontal, forward and backward spillovers. Furthermore, we look at two alternatives of spillovers: wages spillovers and gross revenues spillovers.

Table 4 shows the average effect of FDI Spillovers on ROA, gross revenues and gross revenues growth rates controlling for economic sectors, time and firms’ size. In Columns (1) and (2) we analyze ROA as a performance measure and find no evidence of wages spillover effect but significant positive evidence (at 10% level of confidence) of horizontal gross revenues spillovers when we analyze the whole economy.

In Columns (3) and (4) of Table 4 we also analyze Gross Revenues as a performance measure and find evidence of wage positive forward spillovers in the economy as a whole, when studying the performance measure at the same period that the FDI was received. However, there are negative forward spillovers from inward FDI firms at the period t − 1, which suggest that on average the inputs offered by firms with inward FDI are either more expensive or too technological advanced for local firms (Smarzynska Javorcik 2004); this result is somehow mixed given that is significant at a 10% level of confidence and is in line with a not significant coefficient of the absorptive capacity in Column (3). Moreover, we find positive backwards spillovers when the inward FDI was obtained a period before the one of analysis. This suggests that foreign firms that have higher wages buy inputs to local firms, that on average can generate greater sales in the period after. The increase in demand of inputs by foreign owned firms, pushes local firms to improve their product quality, productivity and product diversity.

On the other side, when analyzing gross revenues spillovers, we only find evidence in the case of forward spillovers effects in one period after the inward FDI was received, suggesting that there is a negative forward spillover effect. In other words, inputs supply by firms with inward FDI a period before of the one analyzed might provide inputs that are too technological advance or more expensive to be consumed by local firms.

Additionally, we estimate the same regression dividing the sample by different economic sectors, controlling by sub sectors and firm size.Footnote 18 We find that there are wages spillover effects in the construction sector (see Table 5). In particular, within the construction sector there is evidence (at 10% level of confidence) of a negative horizontal wage spillover effect on average ROA and a positive wage forward spillover effect related to vertical linkages of the industry. In other words, on average, the ROA from construction firms is affected negatively by the increase of wages from firms with inward FDI in the same sector. However, increases on wages from FDI firms in other economic activities that supply inputs to the construction sector, disentangle a positive effect on local firms from the construction sector that buy those inputs; for instance, the forward spillovers are positive either because foreign suppliers (from different industries) provide cheaper inputs, or because the inputs provided by foreign suppliers to firms in the construction are of higher quality (Markusen and Venables 1999). This theory is relevant in our findings given that it suggests that for domestic firms in the construction sector it can be more attractive to buy inputs from firms in other industries that have received FDI in the same period, than from domestic companies.

Moreover, there is evidence of negative gross revenues horizontal spillovers in the construction sector, as well as positive gross revenues forward spillovers, which are slightly smaller in magnitude than in the case of wages spillovers. Likewise, in the service sector, there is a small but positive gross revenues forward spillover both, from spillovers that derived from investment in the same period of analysis, as well as, from the investment related period t − 1.

In Table 6, we analyze spillovers effects on gross revenues dividing the sample by economic activity. In this sense, we find significant evidence of negative effects on gross revenues generation from horizontal spillovers in the service sectors, both in terms of wages and gross revenues. This result implies that firms in the service sector are worst off when there are higher shares of sales (or wages) generated by firms with inward FDI at the sector level, which is related to the presence of a competition effect. There exists a further argument about the presence of negative spillover effects suggested by (Girma et al. 2008), attributed to asymmetries in bargaining powerFootnote 19.

Moreover, we find that the service sector has positive forward spillovers both in terms of wages and gross revenues; nevertheless, this effect is only significant for gross revenues. In other words, the more inputs the local service sector acquire from inward FDI firms in other sectors, the greatest advantage they can get in the sales generation process. This effect might be related to the fact that inward FDI firms can provide more efficient technologies to local firms helping them to develop their production processes.

Likewise, we find a negative backward gross revenues spillover effect (related to inward FDI in the period t − 1) in the service sector which suggests that even though the linkage of the service sector with other industries is high, firms with inward FDI in other industries might prefer to get inputs from abroad than from local firms in the service sector; this can occur given the higher cost of local inputs relative to inputs in neighbour countries or given the shortage of technology that local firms have in order to produce some inputs that inward FDI firms demand.

In the natural resources economic sector, we find spillovers (horizontal, forward and backward) effects specially related to inward FDI in period t − 1. In this sense, we find negative horizontal spillover effects, both from wages and gross revenues when the inward FDI was obtained in period t. However, we find positive gross revenues horizontal spillovers effects within the industry when analyzing the lag of the spillover, which is consistent with the idea that inward FDI in this sector might cause local firms from the same sector to adopt same technologies as firms with FDI, becoming more efficient in the sales generation process a period after the inward FDI was materialized.

There is also significant evidence about negative forward spillovers in the natural resources economic sector when analyzing gross revenues as a performance measure. In other words, on average, local firms do not benefit from acquiring inputs from firms with FDI capitals in other sectors. Indeed, they might be harmed given that foreign owned enterprises have greater bargaining power. It is worth noticing that even though local firms that belong to the natural resources sector seem to be harmed in the sales generation by buying to foreign suppliers (negative backward spillovers), this effect is smaller compared to the gains from supplying to foreign companies (positive backward spillovers effects). This last result refers to the idea that local firms in the natural resources sector might benefit from supplying inputs to foreign owned enterprises in the country, creating a greater potential for knowledge transfers (Havranek and Irsova 2011). Foreign owned enterprises in different sectors might prefer to acquire inputs from local firms in the natural resources sector, considering long distances between the foreign affiliates and its headquarters and considering that a country such as Ecuador has variety of products, for example in the agricultural sector (which is part of the natural resources sector) given its strategic location on the globe.

Finally, there is not enough accurate evidence to conclude about the existence of spillovers effects in the manufacturing sector, given that the dynamic specifications in columns (9) and (10) does not satisfy the auto correlation tests.

In Table 7, we study the effect of spillovers on gross revenues growth rate as a measure of performance for the whole sample and within each economic sectors. We find that overall, the results for the whole sample show a negative horizontal spillover on the average gross revenues growth rates of local firms, with similar coefficients for both alternatives of spillovers: 1) wages and 2) gross revenues of foreign owned firms. Moreover, this result is consistent with the negative horizontal spillover effect in the sector of natural resources, which suggests that local firms are worst off (in terms of growth rate) from the increase of wages by foreign owned firms within the same sector. This idea suggests that local firms are constrained in terms of growth when foreign owned firms pay higher salaries.

Also, there is evidence of positive backward spillovers both in terms of wages and gross revenues for local firms in the sector of natural resources. This result implies that local firms are better off from providing inputs to foreign owned enterprises, so they show higher growth rates if the supply of inputs to foreign firms increases, which might be due to the fact of adopting new technologies to satisfy the demand and requirements of these foreign buyers. This can be better appreciated in the agricultural sector, where a lot of foreign owned firms buy intermediate inputs from local producers in order to export final or intermediate products; for instance, quality standard requirements from foreign owned firms to local produces plays an important role for firms that export and pushes local firms to adopt better production practises.

Finally, the service sector does not show wages spillovers but it does show gross revenues spillovers. In particular, there are negative horizontal spillovers within the economic sector. Likewise, there are positive forward spillovers (from higher gross revenues of foreign owned firms) on local firms growth rates, suggesting that either local firms benefit from the higher quality of inputs provided by foreign firms in other sectors or this inputs are cheaper which allow them to allocate resources in other operative areas such as marketing strategies that can trigger growth.

Overall, we find heterogeneous indirect effects of inward FDI on firm performance. In terms of ROA, our results suggest that there is significant evidence of negative FDI horizontal wages spillovers and gross revenues spillovers in the construction sector; nevertheless, in this sector there are significantly positive forward wages and gross revenues spillovers effects. Moreover, there is also evidence of positive forward gross revenues spillovers in the service sector.

Furthermore, FDI backward wages spillover effect is only significantly negative in the service sector. When analyzing gross revenues as a performance measure, our evidence suggest a negative horizontal wages and gross revenues spillover effect in the service and natural resources economic sector. Also, in the manufacturing sector we find a negative horizontal gross revenues spillover effect. Likewise, forward wages and gross revenues spillover effect are found in the service sector, but a negative effect is found in the economic sector of natural resources. Backward spillover effects are found to be negative in the service and manufacturing sectors, but positive in the natural resources sector. Finally, when we analyze the FDI spillover effects on gross revenues growth, we find negative horizontal wages spillovers and gross revenues spillovers on growth in the services and natural resources sectors. While positive backward spillover effects are found in all sectors except for the manufacturing sector, the results for forward spillover effects are more diverse across different economic sectors.

6 Conclusions

We examine the direct and indirect effects of FDI on firm performance as measured by ROA, gross revenues, and gross revenue growth in Ecuadorian firms in the formal economy from 2007 to 2018. To begin, we estimate a dynamic panel data model to control for potential endogeneity issues in order to study the direct effects of FDI on firm performance. Our primary variable of interest is FDI, both at the intensive and extensive margins. In addition, to examine the FDI spillover effects (indirect effects), we estimate a dynamic panel data model. The variables of interest in this case are horizontal, backward, and forward spillovers generated by wages and gross revenues. We also study the FDI spillover effects within each economic sector in order to study heterogeneous effects across different economic activities.

We first show that in our sample, only 1.70 % of firms in the formal enterprise sector receive some FDI, and FDI accounts for 40.43 % of total investment registered.

Our main findings from the analysis of the direct effects of FDI on firm’s performance reveal that: 1) firms that have inward FDI in period t, have on average a ROA 3.6% lower than the ROA of domestic firms at the same period, 0.10% less gross revenues in the same period of the investment, but have 0.10% higher gross revenues growth rate than their counterparts, and, 2) an increase of 10% in the amount of FDI received by the firm as a share of total income, relates on average to an increase of 0.2% on its gross revenues in the same period of the investment. This may be an indication that firms that receive FDI lack the sufficient absorptive capacity to immediately transform the investments into better performance indicators. Furthermore, given that the majority of incoming capital inflows in Ecuador are from lower-tax countries such as Venezuela, Uruguay, the British Virgin Islands, and Panama, one possible explanation for the mixed relationship between FDI and firm performance could be profit shifting behavior. In fact, firms with inward FDI have higher gross revenue levels; however, the magnitude of this effect is small, suggesting a possible profit shifting behavior from MNCs. The more connections local businesses have with countries that have lower corporate tax rates, the more likely it is that they will use tax arbitrage mechanisms such as profit shifting (Beer et al. 2020).

In the case of the spillover analysis, our main conclusions are as follows: 1) there are negative horizontal wages and gross revenues spillovers effects on gross revenues growth but positive horizontal gross revenues spillovers effects on ROA, 2) there are positive backwards wages spillovers effects on gross revenues when inward FDI was obtained a period before the period of analysis, and 3) there is a negative forward wage spillover effect on gross revenues in one period after the period of analysis. These results suggest that the inputs offered by firms with inward FDI are either more expensive or too technologically advanced for local firms, which triggers negative forward spillovers because domestic firms could not have enough absorptive capacity. In other words, as Lenaerts and Merlevede (2015) mentions, large foreign investors “bring their own supply chain” and thus do not generate spillovers along the supply chain. Furthermore, our findings suggest that foreign firms purchase inputs from domestic firms, allowing them to increase their sales in the following period. Ecuadorian firms, on the other hand, appear to be less able to deal with the “market stealing” effect of MNEs, which is consistent with evidence of negative forward and horizontal spillovers, given the country’s high proportion of micro and small firms.

Our findings from spillover effects on various economic sectors are diverse. Negative horizontal spillover effects are found in all sectors, but the magnitude varies depending on the performance measure. According to our findings, backward spillovers have mostly a negative effect on the performance indicators of firms in various economic sectors. On each sector and firm performance measure, the results for forward spillover effects are more diverse. These heterogeneous FDI spillovers effects on economic activities imply various challenges in terms of public policy.

Consequently, several policy implications can be derived from these results. First, the government should provide support to domestic firms by a policy of tax incentives for small firms conditional on receiving FDI via capital increase, or via creation of new firms with a minimum amount of foreign capitals. Second, the government should focus incentives on FDI heterogeneously, distinguishing whether incentives are made for investments by reinvestment of foreign profits or if it is carried out mainly by new incoming FDI. Third, improving the investment framework through better macroeconomic and institutional conditions should be a prime guideline for policy (Alguacil et al. 2011). Fourth, policies aimed at increasing local learning capabilities and labor skills may be essential to increase the absorptive capacity of domestic firms (Sinani and Meyer 2004), which could reduce the technological transfer gaps between foreign and domestic firms but more importantly, firms could better absorb technology and increase the quality of their products and increase competition. Finally, the government should focus on specific industries where there are no spillover effects on ROA and gross revenues in order to spread the positive outcomes of some firms in the sector, but also on industries where there are backward spillovers because they can stimulate foreign firms to buy goods for domestic firms in order to promote competition, product quality, and increase local firm production.

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Notes

This average is obtained excluding high income countries (World Bank 2022).

For more information, refer to Table 1 of (Wooster and Diebel 2010).

(Griffith et al. 2004) argue that multinational firms are known to be more productive than domestic firms.

Findings of positive spillover effects are more likely to appear in studies with more recent data or analyses with higher degrees of freedom (Wooster and Diebel 2010).

Negative spillover effects are more commonly documented in estimations that use output share as a measure of foreign presence or use firm-level data rather than industry-level data (Wooster and Diebel 2010).

For more information on these laws see Table 10 in Appendix.

Additionally, in Fig. 2, one of the sectors with greatest weight is services but this is because it includes approximately 14 sectors. The group services includes activities such as wholesale and retail trade (one of the biggest ones), transport and storage, financial and insurance activities, administration and defense, among others. Each of the sectors separately represent much less than the manufacturing, natural resources and construction sector. It is important to mention that the construction sector also includes the real state services.

Firm size is defined in the Organic Code of Production, Trade and Investment of Ecuador: Microenterprises: Between 1 to 9 workers or gross revenue less than $100,000.0. Small firms: Between 10 to 49 workers or gross revenue between $100,001.0 and $1,000,000.0. Medium firms: Between 50 to 199 workers or gross revenue between $1,000,001.0 and $5,000.000.0. Large firms: More than 200 workers or revenue above $5,000,001.0. Always prevailing gross revenue over the number of workers.

For instance, Xit includes the following variables: microit, HHIit, the lagged performance and lagged FDIit decisions.

Ecuador is known as an oil producer country. Also, it is specialized in production of primary commodities, such as, bananas, flowers, shrimp, among others (Camino-Mogro et al. 2016). The TFP estimation was made following the (Levinsohn and Petrin 2003) methodology. See Appendix A for further details.

The maximum level of TFP for each sector was obtained considering the average between the 75th and 99th percentile of the TFP distribution for each year. This strategy is adopted to avoid the presence of outliers in the denominator.

Macroeconomic variables are needed when we run a regression for each economic sector because we cannot introduce time indicators since the horizontal spillovers vary only across time within each economic sector.

This method is programmed in a written STATA command (xtabond2) introduced by (Roodman 2009).

Only for the ROA indicator, the FDI share from sales is not treated as endogenous in the model.

Bargaining power is related to differences in size and international operations that firms with FDI inflows have, compared to domestic firms.

We do not control for selection bias by considering the expectation conditional on the survival probability, because we use an unbalanced panel data set and following (Levinsohn and Petrin 2003) we argue that this issue is not important in this kind of data.

References

Aitken B.J., Harrison A.E. (1999) Do domestic firms benefit from direct foreign investment? evidence from venezuela. Am Econ Rev 89(3):605–618

Alfaro L., Chanda A., Kalemli-Ozcan S., Sayek S. (2004a) FDI and economic growth: The role of local financial markets. J Int Econ 64 (1):89–112

Alfaro L., Chanda A., Kalemli-Ozcan S., Sayek S. (2010) Does foreign direct investment promote growth? exploring the role of financial markets on linkages. J Dev Econ 91(2):242–256

Alfaro L., Rodríguez-Clare A., Hanson G.H., Bravo-Ortega C. (2004b) Multinationals and linkages: an empirical investigation. Economia 4 (2):113–169

Alguacil M., Cuadros A., Orts V. (2011) Inward fdi and growth: The role of macroeconomic and institutional environment. J Policy Model 33(3):481–496

Apostolov M. (2017) The impact of FDI on the performance and entrepreneurship of domestic firms. J Int Entrepreneurship 15(4):390–415

Aray H., Pacheco-Delgado J. (2020) Public investment allocation across ecuadorian provinces. Socio Econ Plan Sci 100830:71

Arellano M., Bond S. (1991) Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M., Bover O. (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51

Armijos J.-P., Basani M., Bonifaz J.-L., Borensztein E., Maldonado P.C., Castellani F., Aguayo Y.C., Cueva S., Deza M. C., Díaz J.P. et al (2018) Reformas y desarrollo en el Ecuador contemporáneo. Inter-American Development Ban

Barge-Gil A., López A., Núñez-Sánchez R. (2019) Estimation of foreign mnes spillovers in spain. Appl Econ Lett 26(5):418–423

Beer S., De Mooij R., Liu L. (2020) International corporate tax avoidance: a review of the channels, magnitudes, and blind spots. J Econ Surv 34 (3):660–688

Berg A. (2000) The pros and cons of full dollarization. International Monetary Fund

Blomström M., Kokko A. (1998) Multinational corporations and spillovers. J Econ Surv 12(3):247–277

Blundell R., Bond S. (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Borensztein E., De Gregorio J., Lee J. -W. (1998) How does foreign direct investment affect economic growth? J Int Econ 45(1):115–135

Buckley P.J., Clegg J., Wang C. (2002) The impact of inward fdi on the performance of chinese manufacturing firms. J Int Bus Stud 33 (4):637–655

Bullard J., Keating J.W. (1995) The long-run relationship between inflation and output in postwar economies. J Monet Econ 36(3):477–496

Camacho F.R., Bajaña Y. S. (2020) Impact of foreign direct investment on economic growth: Comparative analysis in ecuador, Peru and Colombia 1996-2016. Int J Econ Financial Issues 10(4):247

Camino-Mogro S. (2021) Tfp determinants in the manufacturing sector: the case of ecuadorian firms. Appl Econ 30(89):92–113

Camino-Mogro S., Andrade-Diaz V., Pesantez-Villacis D. (2016) Posicionamiento y eficiencia del banano, cacao y flores del Ecuador en el mercado mundial/positioning and efficiency of bananas, cocoa and flowers in the global market. Ciencia Unemi 9(19):48–53

Camino-Mogro S., Armijos-Bravo G., Cornejo-Marcos G. (2018a) Productividad total de los factores en el sector manufacturero ecuatoriano: evidencia a nivel de empresas. Cuadernos de Econoía 41(117):241–261

Camino-Mogro S., Bermudez-Barrezueta N., Avilés P. (2018b) Análisis sectorial: Panorama de la inversión empresarial en el ecuador 2013-2017. X-pedientes Económicos 2(2):79–102

Chen T. J., Ku Y. H. (2000) The effect of foreign direct investment on firm growth: The case of Taiwan’s manufacturers. Jpn World Econ 12 (2):153–172

Chhibber P.K., Majumdar S.K. (1999) Foreign ownership and profitability: Property rights, control, and the performance of firms in indian industry. J Law Econ 42(1):209–238

Chuang Y. -C., Hsu P. -F. (2004) Fdi, trade, and spillover efficiency: evidence from china’s manufacturing sector. Appl Econ 36(10):1103–1115

Conyon M.J., Girma S., Thompson S., Wright P.W. (2003) The productivity and wage effects of foreign acquisition in the United Kingdom. J Ind Econ 50(1):85–102

Damijan J.P., Knell M., Majcen B., Rojec M. (2003) The role of fdi, r&d accumulation and trade in transferring technology to transition countries: evidence from firm panel data for eight transition countries. Econ Syst 27(2):189–204

Damijan J.P., Rojec M., Majcen B., Knell M. (2013) Impact of firm heterogeneity on direct and spillover effects of fdi: Micro-evidence from ten transition countries. J Comp Econ 41(3):895–922

De Loecker J., Goldberg P.K. (2014) Firm performance in a global market. Annual Review of Economics 6(1):201–227

De Mello L.R. (1999) Foreign direct investment-led growth: evidence from time series and panel data. Oxf Econ Pap 51(1):133–151

De Mello, Jr L.R. (1997) Foreign direct investment in developing countries and growth: a selective survey. J Dev Stud 34(1):1–34

Demena B.A., van Bergeijk P.A. (2017) A meta-analysis of fdi and productivity spillovers in developing countries. J Econ Surv 31(2):546–571

Department of Justice, U.S And Federal Trade Commission, U.S (1997) Horizontal Merger Guidelines. US Department of Justice

Du L., Harrison A., Jefferson G.H. (2012) Testing for horizontal and vertical foreign investment spillovers in China, 1998–2007. J Asian Econ 23(3):234–243