Abstract

This paper investigates the value creation process in policy-driven cluster initiatives that are important policy tools for implementing Smart specialisation strategies. It aims at studying the evolution of the Croatian Competitiveness Clusters (CCC) to understand the role of sectoral specificities in affecting value creation within cluster initiatives. In this context, it looks at what services cluster initiatives should deliver to meet the expectations of members and generate value and what modes of cluster management and governance are the most conducive to value creation across different industries. The analysis relies on a survey of 250 CCC members. The results show that members’ preferences for support to the business activities are associated with different levels of perceived value creation. High-value CCC members are interested in innovation, infrastructure development, market analysis and training, while low-value CCC members are interested in lobbying and networking. Regardless of the sector, CCC with a higher share of private, small, and high-growth firms are more likely to generate public value by pursuing long-term activities with the emphasis on innovation, knowledge transfer, infrastructure, and market development, as compared to CCC with a high share of declining firms that see CCC as a platform for lobbying and networking and as such generate more private value, failing to achieve their ultimate goal. A high level of value is also created if members reach a consensus on the vision and activities of the CCC and work together to share knowledge, information and learning processes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The development of clusters has become a standard regional policy approach to boost competitiveness, innovation, and growth (Fromhold-Eisebith and Eisebith 2005; De La Maza et al. 2012; Asheim et al. 2017), and clusters have spread worldwide in many forms in different countries (OECD 2000; Koszarek 2014; Aranguren Querejeta et al. 2014; Konstantynova and Lehmann 2017). Their diffusion has also been spurred by the recent resurgence of interest towards a proactive industrial policy that responds to market failures and take into consideration social and environmental challenges (Rodrik 2004; Aiginger and Rodrik 2020), relying upon the drivers of high-road strategy, such as innovation, education, the adoption of new technologies, and sustainability, and addressing the collaboration between the government and the private sector (Aiginger and Rodrik 2020). In the context of smart specialisation strategy, cluster policy aims at tackling information and coordination failures of actors within innovation systems (Anderson et al. 2004) and the related underinvestment leading to suboptimal levels in the variety of economic activities in an economy, supporting cooperative relationships between the government and economic agents (De La Maza et al. 2012; Aranguren Querejeta and Wilson 2013).

The literature has underlined that policy-driven cluster initiatives are different from spontaneous clusters in a cluster configuration, forms of cooperation, management and governance styles, performance, and value creation (Ferreira et al., 2012). Policy-driven cluster initiatives are usually more focused on public benefits and regional development. In contrast, spontaneous clusters support the needs of a specific group of businesses and intend to stimulate entrepreneurship (Fromhold-Eisebith and Eisebith 2005). The establishment of clusters by governments has been often justified by market failures associated with the provision of public goods (such as lack of skills, infrastructure, and R&D) and coordination failures (OECD 2000). Despite the growing interest in the topic, few empirical studies examine the process of value creation in cluster initiatives (Alberti and Belfanti 2019; 2021). Since clusters involve different actors and local stakeholders intending to transform regional economic systems and increase competitiveness, understanding their evolution and performance represents an important step towards evaluating EU regional policy (Asheim et al. 2017; Foray 2018; Lecluyse et al. 2019). In this respect, one of the most exciting avenues for research and policy debate refers to the analysis of cluster initiatives as a tool for implementing smart specialisation strategy (Aranguren Querejeta and Wilson 2013), which is a relatively new strategic approach to innovation-based regional growth in the EU.

Many studies have confirmed a positive effect of cluster membership on the capability of cluster members to innovate and grow (Baptista and Swann 1998; Aranguren Querejeta et al. 2014). This impact unfolds through linkages, networking and the incorporation of different public and private organisations that interact, cooperate, share knowledge, and jointly provide value, develop new products, technologies, and services (e.g., Adner and Kapoor 2010; Baptista and Swann 1998; Baptista and Swann 1999; Laur et al. 2012; Ingstrup and Damgaard 2013). However, cluster initiatives might also fail (Sölvell et al. 2003), which is often the case with policy-driven clusters (Nightingale and Coad 2020). Policy-driven clusters can be simply a means for cluster participants to obtain windfall profits by externalising some internal costs instead of tackling some key market failures, thereby increasing innovative activities beyond the existing levels (Nightingale and Coad 2020). The inability to explicitly address the market failures as a major goal of cluster initiatives leaves the space for rent-seeking activities if clusters are used for lobbying for protection that is beyond the provision of public goods (OECD 2000).

The generation of public and private values in the context of policy-driven cluster initiatives depends upon cluster actors, their individual characteristics, and facilitators that coordinate and promote the process of cluster evolution and the mechanisms of growth and development, which vary substantially across different industrial sectors (Su and Hung 2009; Huang et al. 2012; Ingstrup and Damgaard 2013; Hsieh et al. 2012; Alberti and Belfanti 2021). Different sectors require different policy actions and services and different management approaches and cluster governance, which impacts how value is generated and delivered in policy-driven clusters representing different sectors.

In this paper, we examine how cluster initiatives developed by the government might generate value for their members across different sectors while promoting cluster growth and development within the smart specialisation strategy domain. Following the assumption that cluster initiatives are collaborative organisations whose development crucially depends on business support, we operationalise the driving forces for cluster development and growth through the business services cluster initiatives should provide to meet members’ expectations. We consider the perceived performance of the CCC as an indicator of value creation. Furthermore, we investigate what modes of management and cluster governance are most conducive to value creation across different sectors. In doing so, we explore the interesting case of Competitiveness Clusters in Croatia (hereafter CCC), a unique type of pre-planned policy-driven cluster initiatives that play an important role in implementing Croatia’s smart specialisation strategy. CCC cover 13 different industries ranging from low-tech, traditional manufacturing sectors to advanced service sectors, and we believe that this constitutes a perfect setting to explore the different types of services members expect from clusters. We exploit data from an original survey of 250 CCC members.

Our paper contributes to the literature on value creation in policy-driven cluster initiatives in the following ways. First, we examine the value creation process from the members’ point of view across different types of industries. We determine whether and how CCC representing different industrial sectors might create value and discuss how private and public interests are aligned in value generation for cluster members. Our study extends the paper Anić et al. (2019) that looked at the most relevant objectives pursued by CCC and explored the differences related to the expected benefits members require from CCC. The existing contributions in the literature concerning the value creation for policy-driven clusters’ members have not considered sectoral specificities, even if it is well documented that different industries require different competencies and different types of support from cluster organisations (Andersson et al. 2004). There is evidence that the benefits from policy-driven cluster membership depend on the maturity of the industry, the process of technology diffusion, the links between firms and the university, the existence of networks among the different members and the role of venture capital (Braunerhjelm et al. 2000).

Second, we investigate and compare what modes of management and governance are most effective in delivering value to CCC members across different industries. The theory suggests that the way the cluster management interacts with members and the governance of clusters have some peculiar traits in policy-driven clusters compared to spontaneous clusters (e.g., Fromhold-Eisebith and Eisebith 2005; Ingstrup 2013; Jungwirth and Müller 2014). However, the literature on this issue is limited (Chiaroni and Chiesa 2006), especially concerning the competitiveness of cluster initiatives in implementing smart specialisation strategy. We also intend to discuss the variance of different management and governance modes considering sectoral specificities.

Our final contribution refers to the context of analysis, i.e., Croatia. Past research shows that cluster initiatives operate differently in diverse environments, which has a very different impact on clusters’ operational practices and performance (Ketels et al. 2006). Besides the macroeconomic environment, the industrial tradition and innovation system in each region produces differences in the growth of cluster initiatives in different sectors (Braunerhjelm et al. 2000). Croatia is a relatively new EU member state that has started the process of formal cluster development in 2013 and has even more recently adopted the smart specialisation strategy, therefore being still in the process of learning how to implement policy-driven clusters in practice. CCC have been promoted to enhance the competitiveness of different sectors. Still, their evolution and performance are very heterogeneous across industries, depending upon the alignment between the benefits required by the cluster members and the overall value provided by the clusters. In this context, our analysis intends to provide some policy recommendations on how to position CCC in value creation to be more attractive for their members and strengthen management and cluster governance in delivering value. The findings of our analysis might also help other new EU member states struggling with the cluster development process to gain new knowledge in this field.

The rest of the paper is organised as follows. Section 2 introduces the theoretical background, discussing the main characteristics and evolution of policy-driven cluster initiatives, the process of value creation, and the role of cluster management and governance. Section 3 outlines the program of competitiveness clusters in Croatia, while Sect. 4 illustrates the process of data collection and the methodology. Finally, Sects. 5 and 6 present and discuss the research results, while Sect. 7 provides conclusions and policy implications.

2 Policy-driven cluster initiatives: value creation, management, and governance

Clusters can be defined as a form of spatial concentration of firms and supporting institutions within an industry linked by commonalities and complementarities that are interconnected through patterns of cooperation and knowledge, information, and resource exchange (Baptista and Swann 1998; Baptista and Swann 1999; Martin and Sunley 2003; Andersson et al. 2004; Asheim et al. 2017). The literature recognises two types of clusters: spontaneous and policy-driven clusters (Chiaroni and Chiesa 2006; Su and Hung 2009). While spontaneous clusters emerge and grow in response to a spontaneous concentration of companies and their growth occurs without the direct commitment of public actors, policy-driven clusters are developed through a policy action that creates favourable conditions for cluster development to boost the competitiveness of a region/sector (Chiaroni and Chiesa 2006; Su and Hung 2009; Huang et al. 2012). One form of policy-driven clusters are cluster initiatives that the governments develop as “organised efforts to increase the growth and competitiveness of clusters within a region, involving firms, government and/or the research community” (Sölvell et al. 2003, p. 31). Within cluster initiatives, various types of firms and other actors with different roles, motives, and relationships cooperate and compete simultaneously concerning technologies and markets (Laur et al. 2012).

Policy-driven cluster initiatives are often built from the cluster mapping of existing cluster structures (OECD 2000; Konstantynova and Lehmann 2017). Their development involves the creation of formal cluster organisations (OECD 2000; Konstantynova and Lehmann 2017) representing legal entities that receive financial support from the public investor at the early stage of their development (Su and Hung 2009) and act as intermediary organisations which serve the needs of their members by providing services such as brokering, facilitating, promoting and other value-adding activities among actors (Laur et al. 2012). Cluster organisations support collaborations, networking, and learning processes within clusters (Chiaroni and Chiesa 2006).

Although the aims of policy-driven cluster initiatives are often broadly formulated to attract a variety of actors with differing interests, their main goal is enhancing innovation, productivity, and the competitiveness of the regions/sectors (Laur et al. 2012; Konstantynova and Lehmann 2017). In this sense, cluster initiatives generate both public/social value for the surrounding community and private value for the members (Laur et al. 2012). They apply a set of activities to reach their objectives and meet the needs of their members, such as business advice and consulting, financial and technological assistance, information exchange, facilitation of partnership and cooperation among the members, knowledge and technology transfer, facilitation of access to competencies and workers, but also educational and technical support and lobbying (Sölvell et al. 2003; Bennett et al. 2007; Laur et al. 2012).

Cluster initiatives are an important building block for implementing the smart specialisation strategies (Koschatzky et al. 2017; Saha et al. 2018), which many EU countries have implemented to qualify for EU structural funding (Koschatzky et al. 2017). The main idea behind this strategy is the specialisation into activities that can generate economic impact (Benner 2017) and the transformation of economic structures and regions through the development of new transformative activities and extra-regional capacities (Foray 2018). Within the smart specialisation concept, cluster initiatives should enhance growth, productivity, competitiveness, and regional development by creating unique entrepreneurship, knowledge-driven activities, and the interaction and cooperation of participants (Saha et al. 2018).

2.1 The process of value creation in policy-driven clusters

When discussing the success or failure of policy-driven cluster initiatives from an evolutionary perspective, one aspect appears to be poorly understood, i.e., the value creation process for cluster members. The literature recognises that the creation of value within clusters affects the decision of organisations to enter and stay in the cluster (Ellegaard et al. 2009; Hsieh et al. 2012), and therefore has an impact on the overall evolution of the clusters. Scholars have developed several conceptualisations of the process of value creation in strategic networks, alliances, and clusters (e.g., Amit and Zott 2001; Lavie 2007; Hsieh et al. 2012; Alberti and Belfanti 2019, 2021). In a business network, value creation is the result of the efforts of individual organisations that work independently or in close cooperation with other members (Ellegaard et al. 2009), while in alliances, value creation is seen as the collective processes that generate common benefits shared by all partners in an alliance (Lavie 2007). Bititci et al. (2004) suggest that all partners in collaborative organisations should benefit from collaboration by increasing internal value (i.e., wealth) to their shareholders and by delivering better external value to the customer (i.e., satisfaction). As far as the specific case of value creation in clusters is concerned, Hsieh et al. (2012) argue that in clusters, the net value is generated by cluster effects – i.e., economies of agglomeration and network effects - developing and managing the strategic networks. More recently, the attention has focused on the distinction between the private, business-related value of cluster participation and the public, societal-related value of cluster participation. Scholars have started to investigate the extent to which clusters can create shared value (Porter and Kramer 2011; Alberti and Belfanti 2019, 2021). For example, Alberti and Belfanti (2021) have examined the process of value creation in clusters by using the framework of shared value creation, according to which clusters can generate both business and social benefits. Cluster development is perceived as creating shared value both for the cluster community and society, beyond business benefits related to higher revenues, productivity, and innovation (Porter and Kramer 2011).

Concerning the process of value creation, the literature also distinguishes between value creation and value appropriation (Bowman and Ambrosini 2000; Mizik and Jacobson 2003; Lavie 2007). While value creation, as a collective process, generates common/public benefits from the activities performed by the alliance/cluster shared by all partners (Khanna et al. 1998), value appropriation includes competitive behaviour and the generation of private value from activities outside the alliance/cluster (Khanna et al. 1998). These two types of value require different cluster activities. On the one hand, public value creation relies on cooperative behaviour (Lavie 2007). It involves joint activities such as R&D, innovations, building technological capabilities, production, delivering products to the market (Mizik and Jacobson 2003), enhancing the firms’ ability to generate value that cannot be developed independently (Lavie 2007). To appropriate value, on the other hand, participants pursue self-interested objectives to defend their position in the market, increase the rent and extract the profit by the protection mechanisms, imposing barriers, or advertising (Mizik and Jacobson 2003; Lavie 2007). Interest groups might influence policies at lower costs through lobbying, which does not increase public welfare (Polk 2011). While enhancing value depends on the availability of network resources and the prominence of partners in the network, the value appropriation capacity is related to participants’ bargaining power (Lavie 2007). There is evidence that firms expect both types of value when entering the alliance, and there will be few actors who seek only public value or private value. If more opportunities exist outside than in the cluster, participants will have more incentives to extract private value (Khanna et al. 1998).

The analysis of the value creation process is particularly interesting in the context of policy-driven clusters, where the creation and delivery of specific services contribute to the enhancement of business performance (Alberti and Belfanti 2021). The literature also shows that cluster initiatives that emphasise the promotion of innovation and the diffusion of new technologies, providing technical training and thus focusing on public value creation, were more successful (Sölvell et al. 2003; Lindqvist et al. 2013). They contribute to competitiveness by generating trust and facilitating cooperation and knowledge sharing (Aragon et al. 2012; Aranguren Querejeta et al. 2014). On the other hand, several studies indicate that policy-driven clusters are not successful in Europe and the US, because they are often captured by the interests of cluster members and that only the long term, innovation-oriented and uncertain problem-solving processes lead to value creation (Nightingale and Coad 2020). Furthermore, a recent study shows that clusters in countries that rank low in political transformation (e.g., Serbia and Ukraine) emphasise more lobbying activities than clusters in countries that rank high in political transformation (e.g., Austria and Germany), which focus on activities that contribute to the increase of knowledge, the accumulation of competences and the cooperation (Konstantynova and Lehmann 2017).

In this paper, we examine how cluster initiatives initiated by the government might produce value in line with the expectations of cluster members and, as such, promote sectoral development. We also investigate whether policy-driven clusters in the Croatian environment are just a means of cluster participants to obtain windfall profits (e.g., by externalising some otherwise internal costs) or is value to cluster participants (and mostly firms) generated by tackling some key market failures, thereby elevating their innovative and investment activities beyond prior levels. Following the assumption that cluster initiatives are collaborative organisations whose development depends on business support, we follow Alberti and Belfanti (2021) and operationalise the sources of cluster development through the business services that should be provided to members while considering the perceived performance as value creation.

Since clusters often emerge in connection to a specific sector (Ketels et al. 2006), which strongly affects their development, we compare the process of value creation across cluster initiatives representing different sectors. Scholars have shown that clusters may cover various segments of the value chains, and therefore different industries may need specific competencies and financial resources (Andersson et al. 2004). Different industries face different levels of competition, are characterised by specific technological trajectories, and therefore require distinctive processes of knowledge and skill development and evolution (Andersson et al. 2004; Eisingerich et al. 2010). For example, in service-related clusters, marketing and communication services are more important than in high-tech, R&D-based manufacturing clusters, whereby the availability of superior technical knowledge and high-risk funding is more important (Andersson et al. 2004). This implies that clusters associated with different sectors might have different expectations from cluster membership and perceive the benefits generated from cluster organisations differently.

2.2 Cluster management and governance

A well-developed, high-quality cluster management is crucial to ensure the virtuous value-generating cycles within clusters (Schretlen et al. 2011; Hsieh et al. 2012; Laur et al. 2012). Cluster management includes the organisation and coordination of activities that are important for the functioning of the cluster in order to achieve defined objectives, such as providing members with information, expertise and skills, and consultancy on research and innovation activity, promoting cluster needs and lobbying, stimulating collaboration, networking, providing education and training (Schretlen et al. 2011; Lindqvist et al., 2013; Koszarek 2014). The complexity and heterogeneity of actors in cluster initiatives make the management even more complex. One of the key challenges of cluster management is to resolve the conflicting interests of members and translate them into united objectives and collective actions to produce enough value for members to participate in the cluster (Schretlen et al., 2011). Furthermore, good cluster governance is also required to create value in the cluster. It should ensure that the cluster is well-managed and include collective actions of the stakeholders, such as setting the vision and the strategy, approving action plans, evaluating the performance(Schretlen et al. 2011).

Past research also shows that cluster management and governance based on joint commitment, efforts, and collaboration leads to success, while the clusters driven only by cluster managers without a joint commitment of all actors are more likely to fail (Schretlen et al. 2011). In other words, management and governance based on collaboration are more likely to generate public benefits, while cluster initiatives driven by individual private interests are likely to underperform. According to Laur et al. (2012) the success of clusters crucially depends upon the consensus upon the vision. A shared vision and common objectives bind members to work together and create a collective identity, which in turn helps clusters operate well through cooperation, mutual learning, and technological synergies (Pinkse et al. 2018). Other features concerning management and governance of successful cluster initiatives are the availability of cluster resources, the cooperation inside and outside the cluster, and the development of a clear framework, structure, and action plan to achieve objectives (Sölvell et al. 2003; Schretlen et al. 2011).

The characteristics and evolution of the value creation process and the role of management and governance of cluster initiatives are particularly interesting in the case of new EU member States. Despite the diffusion of cluster initiatives across Europe, the success of these policy tools considering the implementation of smart specialisation strategies is often questioned (Boschma 2016; Anić et al. 2019). One important aspect concerns the sectoral variability of these initiatives. Therefore, the empirical analysis will investigate the management and governance practices most conducive to the achievement of value within different sectoral contexts to understand whether it is possible to identify sectoral patterns of value creation within policy-driven clusters.

3 The croatian competitiveness clusters

In Croatia, the development of cluster initiatives is an important part of economic policy, which promotes growth and competitiveness, while stimulating regional development, networking, and innovations. The Croatian clusters of competitiveness (CCC) were established in 2013 by the Croatian Ministry of Economy, crafts, and entrepreneurship as an important form of cluster development in the country. CCC were developed as non-profit organisations that “operate within sectors of strategic importance for the development of the country and link together private, scientific-research and public institutions (triple helix) in a formal structure to increase competitiveness and innovation in specific sectors of the country’s economy” (MINGO 2016). CCC were formed as a state initiative that took into consideration the most important sectors of potential growth, their structure, the major companies within those sectors, as well as public and scientific institutions that were called to join cluster organisations. CCC received public funding for their activities, such as sectoral analyses, strategic guidelines, sectoral mapping, and sectoral promotion. The main idea behind CCC is to promote the collaboration between stakeholders on strategic objectives, actions, and projects and in such way raise the competitiveness of sectors, promoting the efficient use of EU funds and programmes, the internationalisation and cross-sectoral networking and lobbying, as well as stimulating investments and innovations in the sector. CCC members can be private entities, business clusters, professional organisations, public institutions, scientific-research institutions, and regional or local government institutions. CCC members do not need to pay a membership fee.

CCC have a very important role in the implementation of the country’s smart specialisation strategy through which Croatia wants to overcome growth obstacles, enhance the competitiveness, innovation and, close the gap with more advanced EU countries, and attract EU structural funding (MINGO 2016). So far, the Croatian economic environment has been experienced quite a poor economic performance, relatively low investment in R&D, low innovation activity and patenting, and a low diffusion of new technologies and networking practices. The economy is dominated by traditional sectors, as is also shown by the composition of the country’s exports that are dominated by low value-added products. Institutional, regulatory and market conditions are implemented efficiently. One of the most important growth barriers is the lack of adequate linkages between research institutions and the business sector (Bečić and Švarc 2015; MINGO 2016).

In total 13 CCC referring to different sectors have been established that can be classified as follows (Ketels et al. 2006): (1) CCC covering basic, traditional manufacturing industries with future growth prospects (CCC for food processing, textile, leather and footwear, wood processing and maritime industries), (2) CCC including capital intensive manufacturing sectors (CCC for automotive, chemicals, plastics and rubber, electrical and manufacturing machinery and technology, defence, construction industries), and (3) CCC covering advanced high-tech services (CCC for creative and cultural industries, ICT, health, personalised medicine).

4 Data collection and methodology

Our analysis is based on original survey data containing the members’ perceptions towards the drivers of the development of CCC, the process of value creation in CCC, and the process of cluster management and governance (for more details on the survey and data collection procedure see Anić et al. 2019). In this study, we exploit a subjective assessment of the value creation process in CCC and collect cluster members’ opinions, preferences and expectations that can be used as a first insight on cluster performance and on cluster management, even if they do not allow to build an objective and unbiased indicator. The data come from 250 questionnaires. Table 1 presents the sample and the number of respondents by CCC, while Table 2 shows firms’ characteristics by sector.

The sample covers all 13 CCC. Most respondents are firms (52.4%), 17.6% are members from high education and research institutions, 16.8% are regional and local government institutions, 10% are professional organisations, and 3.2% are business clusters. As expected, the size of the companies is larger in CCC representing manufacturing industries than in CCC representing services. At the same time, growth is more pronounced in CCC related to advanced service industries (37% high-growth firms in services, as compared to 26% and 27% in manufacturing, and 22% of declining firms in services, as compared to 35% and 30% in manufacturing).

The questionnaire included questions about the drivers of cluster development, which identify priority objectives on which CCC should act to deliver value to their members, questions about the existing cluster management and governance processes, and questions about the perceived value creation (cluster performance). The questionnaire was designed following the existing literature, including the Global Cluster Initiative Survey (Sölvell et al. 2003; Lindqvist et al. 2013). Concerning the drivers of cluster development, we asked respondents to evaluate on a Likert scale (from 1 - totally unimportant to 7 extremely important) the importance of 26 objectives CCC should fulfil to generate value. These objectives represent priority areas on which cluster initiatives should act, and as such, can be considered as the drivers of CCC development in line with past research (Alberti and Belfanti 2019; Albahari et al. 2019). They include various areas of services ranging from the provision of infrastructure, networking services, innovation activities, the facilitation of diffusion of new technologies to the provision of business assistance, the promotion of technical and managerial training, and lobbying. The evidence shows that the most important priority areas for cluster members are those related to innovativeness, promotion, and diffusion of new technologies (84-88% of respondents), which indicates that members are aware of the importance of these objectives. The most important priority areas are lobbying for improving regulatory policy and infrastructure (about 83% of respondents), which suggests that members see their CCC as a mediator in the negotiation with the government. Although lower-ranked, other objectives are also important, indicating that members expect CCC to work on a broad spectrum of activities that combine public and private interests.

5 Value creation in CCC: empirical findings

5.1 Drivers of CCC development

The main scope of our analysis is to examine the mechanisms for value generation within CCC across different types of industries/sectors and to relate these mechanisms to different drivers of CCC development and different modes of cluster management and governance. The starting point of the analysis is the study by Anić et al. (2019) that identified six groups of CCC development drivers that result from a factor analysis performed on 26 CCC development drivers (see Table A1 in the Appendix for the details related to the factor analysis). These factors are lobbying, innovation, market analysis, infrastructure, networking, and training.

The first factor is Lobbying that accounts for 36% of the total variance and includes items related to lobbying the government or infrastructure, regulatory policy, subsidies and FDI incentives. Through lobbying in CCC, participants might try to interact with the government authorities to trigger policy actions, defend or improve their market position and in such a way boost the competitiveness (Sölvell et al. 2003; Meyer-Stamer and Harmes-Liedtke 2005).

The second factor - Innovation - is explained by a set of objectives related to the development and diffusion of product and process innovations, which also involve attracting new and innovative firms. The development of innovations is one of the most common reasons to set up the clusters and promote competitiveness globally (Asheim et al. 2017). Collective actions related to innovation are particularly interesting for SMEs with limited resources, as they can benefit from the knowledge spillovers occurring within clusters (Huang et al. 2012). This type of cluster support is associated with the promotion of a more intense R&D activity in different sectors and with the adoption of the “high-road strategy” as the only sustainable alternative for higher-cost countries (like Croatia) that cannot compete on low prices (Asheim et al. 2017). A high-road strategy refers to delivering higher value-added products sold based on their quality rather than price (Mayhew and Keep 2014). In promoting a high-road strategy, the clusters play an important role by focusing on developing and adopting innovations, high-quality skills, and standards, leading to higher wages and productivity growth (Ketels and Protsiv 2013).

The third factor - Market analysis - is explained by the items related to assembling market intelligence, analysing sectoral trends, and providing business assistance. CCC members attribute relevance to this factor because market analysis helps them identify business opportunities and threats as the basis for further actions. The delivery of this service requires the development of a cluster website, participant directories, and helpdesk services, which represent powerful communication tools between the cluster management organisation, the cluster members, and the outside world (Schretlen et al. 2011).

The need for infrastructure-related projects and incubator services is the fourth group of expected benefits for cluster members – Infrastructure. This factor is explained by four different objectives, i.e., the development of private infrastructure projects, the establishment of technical standards, the coordination of purchasing processes and the provision of incubator services. CCC members expect the cluster management to facilitate the links with existing incubators, the logistics, and the innovation/education centres. The services in this area might include providing space and its maintenance, consultancy, and activities related to promoting a strong connection between the members and venture capitalists (Ratinho and Henriques 2010).

Networking is the fifth group of services CCC need to provide and is explained by the activities related to fostering networks among people and firms. This set of actions allows firms to access legal, consulting, and financial support, as well as different skills and resources (Humphrey and Schmitz 1996). It also creates the basis for upgrading efforts and includes the development of institutional networks, the organisations of workshops and meetings on scientific and business issues, the management of newsletters and other communication tools, and the promotion of social/partnering events with local and international actors (Schretlen et al. 2011). Dense networks of SMEs in clusters can create economies of scale and scope (Meyer-Stamer and Harmes-Liedtke 2005), and therefore this service has been recognised to be a central aspect of most cluster initiatives across the world (Sölvell et al. 2003; Meyer-Stamer and Harmes-Liedtke 2005; Leclyuse et al. 2019). The process of networking and cooperation among cluster members can maximise the innovative potential of the group through the development of mutual learning (Albahari et al. 2019).

The final sixth group of CCC development drivers is related to technical and managerial training - Training. This type of support has emerged as a very important value-creating mechanism in other clusters worldwide (Sölvell et al. 2003; Albahari et al. 2019). Training services of cluster organisations includes the provision of seminars and workshops on business-related topics –e.g., venture capital and business development, regulation, and innovation. In some cases, cluster organisations cooperate with universities to develop specific training programs, while in other cases, they can employ the services of external consultants or training centres (Schretlen et al. 2011).

It is important to underline that while most of these cluster development drivers are important for the creation of public value in clusters, lobbying is driven to a large extent by private interests and may represent a way to appropriate private value (Khanna et al. 1998; Mizik and Jacobson 2003; Polk 2011; Ketels and Protsiv 2013).

The literature has often underlined that the drivers behind cluster development and the type of support required might vary across sectors (Ketels et al. 2006; Andersson et al. 2004; Eisingerich et al. 2010). In our study, we investigate whether there are specific patterns concerning the development drivers by CCC. Table 3 illustrates the mean values of factor scores of development drivers for each CCC.

Our results show that CCC from different sectors are interested in different types of business support and expect different benefits. Specifically, members from CCC representing basic and traditional manufacturing industries on average are more interested in lobbying, innovation, and infrastructure development. This is particularly true for the CCCs associated with the food processing, textile, leather, and footwear industries. Those sectors include, at the same time, more state-owned companies and declining firms that are typically more inclined towards lobbying activities. However, it is interesting to notice that on the one hand, members of clusters representing traditional sectors see lobbying instruments as a means to generate value, but on the other hand see clusters as an instrument to push for innovation and public infrastructural investments, which could be an indication that these cluster participants perceive a coordination failure (e.g., underinvestment in the infrastructure of use to all market participants) and expect their CCC to work in these areas. In this group, the CCC related to the wood processing sector is an outlier, as its members are less interested in lobbying and more in the provision of market analysis, training, and infrastructure development, which may be due to the strong presence of many (private) high-growth SMEs in this CCC.

The members of the CCC related to the capital-intensive manufacturing sectors mostly require support related to market analysis and infrastructure development, while they are not interested in lobbying. On average, capital intensive CCC have more private firms and fewer declining firms than CCC associated with traditional industries, which might explain their lower tendency towards lobbying and their higher inclination towards market-driven activities. If we look at the third group of CCC in advanced high-tech services, it can be noticed that members in this group are on average interested only in training and networking. As compared to the first two groups, these CCC have, on average more SMEs, more private and young firms, more high-growth firms, and fewer declining firms. In this group, the CCC related to personalised medicine stands out with particularly high values on the factors concerning infrastructure, innovation, and training. Creative and cultural industries seem to be an outlier in this group regarding a higher interest in lobbying, which can be explained by the characteristics of this industry depending on state support.

5.2 The process of value creation in CCC

The CCC development drivers are associated with members’ perception of the impact of CCC on the sectoral performance, i.e., with the process of value creation. We operationalise the concept of value creation through the perceived business performance. In the questionnaire, the respondents were asked to evaluate on a Likert scale (from 1 = disagree completely to 7 = agree completely) 12 statements related to the impact of CCC on sectoral development, including international competitiveness, the strengthening of the collaborations between firms across the global value chains, the development of the science-industry links and new technologies, enhancement of revenues, employment, and export growth in the sector.

The evaluation of the 12 performance items shows that the mean value of the evaluations of the performance items (2.7–3.9) signals poor levels of value creation in CCC as perceived by members. The most important outcomes of CCC concern the creation of industry-university links (38.8% of respondents agree with the statement of the positive impact of CCC), the attraction of new firms to the sector (26.1% of respondents agree with the statement of the positive effect of CCC) and the improvement of the international competitiveness of the sector (21.3% of respondents agree with the statement of the positive impact of CCC). On the contrary, the worst results pertain to the attraction of new firms to the region (average evaluation of 2.74), the attraction of FDI (average evaluation of 2.77), the employment increase (average evaluation of 2.93).

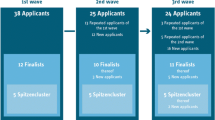

To investigate how members of CCC evaluate the process of value creation in different CCC, we performed a factor analysis on the previously mentioned performance items, which produced one factor - perceived valueFootnote 1 (Table A2 in the Appendix). Different CCC score differently regarding the perceived value, depending on the objectives of different members they have when joining the cluster initiatives. To understand the relationship between the cluster development drivers and the perceived value, we first classified CCC members into two groups, based on the average score of their members on the perceived value factor. High-value creation CCC have, on average, a positive factor loading of the perceived value factor among their members. In contrast, low-value creation CCC have, on average, a negative factor loading of the perceived value factor among their members. A positive evaluation of the value creation indicates that the members are satisfied with the benefits CCC generates, while a negative evaluation shows the members’ disappointment. Table 4 shows the distribution of CCC in the two groups of high-value creation and low-value creation and the relative importance of the development drivers for these two groups. The first group - high-value creation - consists mainly of the CCC representing capital-intensive manufacturing with two outliers: the CCC associated with the personalised medicine sector from the group of advanced high-tech services, and the CCC associated with the wood processing sector from traditional manufacturing. The second group - low-value creation - consist of CCC related to basic and traditional manufacturing and advanced high-tech services (Table 4).

What is interesting for the scope of our paper is that members of high- and low-value creation CCC significantly differ in their evaluation of the CCC development drivers. In particular, the members of high-value creation CCC are interested in the support related to infrastructure development, innovation, market analysis and training. At the same time, they do not consider lobbying as important. On the other hand, the members of the low-value creation CCC are interested in lobbying and networking. This might suggest that the mechanism of public value creation in clusters works much better for CCC, whose members are oriented towards innovation and market analysis. At the same time,it is not so efficient for CCC, whose members look for lobbying and networking.This finding is also in line with the firm composition of the two groups. Indeed, high-value creation CCC have more high-growth, market-oriented firms as compared to low-value creation CCC that have a higher share of declining, typically lobbying-oriented firms. We checked for the statistical significance of the differences in the factor and found that the differences between the two groups of CCC are significant for the lobbying and market analysis factors.

The results provide interesting insights into the effectiveness of cluster policy in the smart specialisation context. Indeed, such a policy mechanism aims at tackling information and coordination failures and the related underinvestment leading to suboptimal levels in the variety of economic activities in an economy. In this case, the value creation in the cluster leads to an alignment of public and private value and entails both economic and social benefits. Under such conditions, clusters may unlock value by improving the external context for companies while also enhancing their productivity (Porter and Kramer 2011). If, on the other hand, the cluster generates only private interests expressed through windfall profits by externalising costs (e.g., through the coordination of lobbying), then the policy-driven cluster generates private value but will probably fail to create a variety of economic activities which should be the primary policy goal. In Croatia, we observe that, on average, those cluster initiatives whose development is mainly driven by lobbying and networking objectives tend to generate less value than those cluster initiatives that are driven by priority areas related to innovation, infrastructure, and training, benefiting both companies and the sector as well. This second type of cluster can unlock value creation mechanisms through the investments in building knowledge and competencies, which lead to the improvement of the business environment (Porter and Kramer 2011), enabling the generation of public value opportunities that go beyond the single firm’s capacity, since they allow the access to a valuable set of skills, capabilities, and knowledge. (Bengtsson and Kock 1999).

5.3 Management and cluster governance

The value creation process in CCC requires a well-developed system of management and governance (Sölvell et al. 2003; Schretlen et al. 2011) that guarantees the efficient delivery of support services to the CCC members. For this reason, in this section, we investigate the modes of management and cluster governance across different CCC to detect the most relevant features of the high-value CCC, focusing on their sectoral composition. In the questionnaire, we asked respondents to identify their level of agreement on a set of 12 statements concerning CCC management and governance patterns (from 1- “completely disagree” - to 7 - “completely agree”).

The results show that having a consensus about the activities that the CCC should pursue is very important for 44.6% of the respondents. The orientation towards consensus requires developing a set of agreements related to expected outcomes and benefits and the obligations of cluster members (Schretlen et al. 2011). A set of shared values can provide a platform for developing trust, and the lack of consensus is often one of the causes of cluster failure (Ingstrup and Damgaard 2013). However, building consensus in the early phase of a cluster development may entail a tremendous effort (Sölvell et al. 2003). A clear cluster vision is also an important element of cluster management, as agreed by 45.8% of respondents. The vision refers to the outline of the long-term goals of the cluster and constitutes an important milestone for the cluster’s strategic planning (Schretlen et al. 2011).

With respect to the cluster management and governance perspective, it is also important that the objectives are quantifiable. The framework for cooperation is developed clearly and thoroughly, which is agreed upon by about 30% of respondents. The willingness to share information with other clusters represents a best practice in many countries (Sölvell et al. 2003). Past research indicates indeed that strong ties with the environment drive a positive cluster performance (Eisingerich et al. 2010). This process requires sharing knowledge and information between the clusters and the surrounding environment/society. Newsletters, communications on the website, seminars and workshops constitute effective means to diffusion of information (Schretlen et al. 2011). In our sample, 25.7–26.9% of respondents perceive that their CCC share their experiences with other actors, indicating that CCC make not many contacts and/or long-lasting relationships with other actors. One crucial issue in cluster governance is the definition of cluster leadership. Many successful clusters have at least one large firm functioning as an anchor company that supports cluster development by acting as a pole of attraction for other companies. Large firms can build a critical mass of experienced human capital, provide a large customer base, and develop relationships with suppliers (Andersson et al. 2004). In the case of a policy-driven cluster, the initiative comes from the government, and it is often part of a process where large organisations at different levels are engaged, and the local and regional government can be involved (Sölvell et al. 2003). According to the respondents, in the CCC, major companies dominate the process of cluster governance, while regional and local governance is less influential. Table 5 shows the average mean values of management and governance modes across high-value and low-value creation CCC.

The data show that compared to low-value creation CCC, on average, high-value creation CCC have received better evaluation scores on observed management and governance items related to the existence of a clearly formulated vision, the practice of the quantification of objectives, a consensus on activities, operational tasks, orientation towards cooperation and sharing the experience with other actors. The results, therefore, confirm that CCC with a better capability of generating value are more structured and organised. If CCC are managed and governed based on joint commitment, efforts and cooperation, these clusters will likely generate larger public value shared by all members and the sector. This requires a well-defined commitment to developing a framework of cooperation, a consensus on the vision, and cooperation with different stakeholders outside the clusters. On the other hand, CCC in which members do not cooperate and share knowledge and experience and reach consensus on vision, are likely to underperform, as private interests will dominate in the decision-making process. In this case, as discussed by the literature, the cluster might only serve as a means of externalising costs through the coordination of lobbying, and it fails to create a variety of economic activity, which should be the primary policy goal (OECD 2000; Nightingale and Coad 2020). In general, members of all CCC perceive that the available budget is not sufficient for the implementation of major projects, whereas high-value CCC evaluated the existing budget availability slightly more favourably than low-value CCC. Members of both groups of CCC also agree to a large extent that this process is dominated by major companies and that the regional and local governments are somewhat involved, but are less influential

6 Discussion

This paper examines how cluster initiatives initiated by the government within the smart specialisation strategy might generate value for their members across different sectors. The main idea behind the development of such cluster initiatives is to gather the most important business and research-oriented actors in the economy and use the clusters as a platform through which the synergies resulting from cooperative and joint efforts, actions, and projects will be developed, which in turn raises the regional and sectoral competitiveness (Laur et al. 2012; Konstantynova and Lehmann 2017). For cluster initiatives to fulfil their mission, they must meet the expectations of their members. In doing so, they need to provide the services that members ask for when joining them. If this is not the case, such cluster programs are doomed to fail. The existence of different members’ expectations in joining the clusters has been acknowledged in past research. Still, much less is known about what type of cluster support is required by different sectors, which is the focus of our paper.

Our analysis looks at the specific case of the 13 CCC in Croatia. It shows that members of clusters associated with different sectors have different requirements and competencies, and thus expect the clusters to deliver them a different set of services. The members of CCC representing basic and traditional manufacturing industries are on average more interested in lobbying and infrastructure development than members of CCC in other sectors. This sector has a higher share of large, state-owned, and declining firms, which are motivated to lobby to trigger policy actions. Traditional sectors also see the development of innovations as a key driver of future growth because they use simple technologies, employ low-to-medium skilled labour, and deliver low value-added products (Sölvell et al. 2003), and might require help from clusters to upgrade their business. The results also show that CCC representing capital-intensive manufacturing sectors are the most market-oriented and require from their clusters marketing services. These sectors consist of private, small, and domestic firms that have problems selling their products on the market, and as such, expect help from clusters in this field. These CCC also have a lower share of declining firms and members do not perceive that their CCC can realise their goals through lobbying using CCC platform. The members of CCC representing advanced high-tech services perceive on average that training is the most important service. This indicates that the members of CCC in these sectors are aware of the fast-technological changes in the market, which require upgrading skills and competencies. The second most important service for them is realising the benefits of mutual learning through networking with other actors. Companies in this group are small, private, and young and typically experience high growth.

Our findings suggest that the goal-orientation is associated with different levels of perceived value creation. In particular, the expected support related to infrastructure development, innovation, market analysis and training yields a better evaluation of the capability of the cluster to generate value. It produces greater public value for the community. As these activities rely on cooperative behaviour, involve joint efforts related to R&D, innovations, building technological capabilities, production, delivering products to the market, benefits are shared by all members and are important for generating public value (Khanna et al. 1998; Lavie 2007).

Our case further shows that, on average, in the group of successful cluster initiatives are those CCC that are aimed at public value generation by tackling some key market failures, thereby increasing members’ innovative capability, investment activities, and competencies beyond prior levels. In other words, when the goals are oriented towards the development of innovations, pursuing a high-road strategy with the aim of delivering higher value-added products and services, and of developing new knowledge and competencies, the CCC tend to produce a greater value (Ketels and Protsiv 2013; Mizik and Jacobson 2003). It is, however, also possible that CCC produces a higher value if it manages to align both public and private value by relying on both lobbying and public value generation activities with the emphasis on public value generation activities (e.g., Khanna et al. 1998). For example, members of CCC in wood processing and construction industries expect some public value generation activities (like innovation and infrastructure development) and attach importance also to lobbying that is, however, less important.

On the other hand, in the group of CCC that generated a lower value, we find CCC in which members see lobbying and networking activities as the most important, which might indicate that these participants perceive a coordination failure in the cluster initiatives. These activities are relevant as a means of appropriation of private value from the cluster membership but fail to contribute to the generation of public/shared value within the sectoral context. Moreover, there are also some CCC (e.g., chemical, plastic, and rubber CCC) in which members do not see that their cluster initiatives should develop through lobbying but still perceive networking as a very important factor, which is also an indication of a coordination failure. Although “networking” in our case is associated with low-value CCC, this activity which might include organising conferences, workshops, meetings, and other events can be in fact very useful for members, if efficiently carried out. Networking can indeed help firms learn about new business opportunities, build collaborations, and establish new relationships, which might result in new arrangements, new joint projects and increase the innovative potential of firms (Schretlen et al. 2011; Albahari et al. 2019).

Furthermore, our findings indicate that it is not the technological intensity of the sector that determines the specific goal orientation, but rather the characteristics of firms. In other words, in the group of low-value creation CCC, we have some high-tech CCC like ICT and medical CCC, and in the group of high-value CCC, we find some CCC from traditional industries like wood processing. What matters for determining goal orientation is the composition of firms in the sector and their position in the market. As such, high-value CCC have more high-growth firms (38% vs. 24%), fewer declining firms (27.2% vs. 29.8%), and more private firms (96.4% vs. 79.3%) than the group of low-value CCC. It is more likely that if a firm is small, private and experiences high growth, it expects cluster management to provide public value generation activities that help strengthen their capacities to compete more efficiently in the market in the long run, such as the support for innovation activities and infrastructure development. On the other hand, if a CCC consist of more declining and larger firms with an important share of state ownership, their members are likely to search for lobbying and coordination activities to defend or improve their current market position.

Our study confirms previous findings that most CCC do not pursue pure private or pure public value-seeking activities but encompass an alignment of both types of values (Mizik and Jacobson 2003). In contrast, if private benefits dominate over public ones, the alliance will fail to achieve its goals (Khanna et al. 1998). The inclination towards private value generation through lobbying is more emphasised when members perceive more opportunities to obtain unexpected earnings outside the cluster, such as lobbying towards the government (Mizik and Jacobson 2003; Konstantynova and Lehmann 2017). Contrary to the expectations, our results show that CCC representing high-tech industries are found in both groups, which indicates that high-tech firms also employ value appropriation strategy to defend their position in the market (Mizik and Jacobson 2003). Furthermore, firms’ behaviour is conditioned by their position in the market (Khanna et al. 1998). High-growth, small and private firms are more interested in the value creation process to create new advantages at a faster rate by innovations to improve their market position, rather than to defend it (Grant 1991; Mizik and Jacobson 2003). In stable technology markets, i.e., traditional sectors where technology is less important and potential earnings exist outside the cluster in the market, value appropriation will be more emphasised (Chandler 1994; Mizik and Jacobson 2003).

Finally, our study also indicates a few management and governance elements that drive the value generation process in CCC. On average, higher scores on the consensus upon the activities, a clearly formulated vision, the quantification of objectives, the openness of the cluster to information and best practice sharing with other actors are associated with a higher capability to generate value for the cluster members. This analysis is important, because more public value is created if members reach a consensus on the cluster vision and goals that bind them to work together through cooperation, sharing of information and mutual learning (e.g., Schretlen et al. 2011). On the other hand, the lack of consensus or share values makes the cluster just a tool to externalise costs and obtain windfall profits, without any opportunity of generating shared, public value together with creating private value.

7 Conclusions

This paper has investigated the process of value creation in the Croatian policy-driven cluster initiatives (CCC) to understand what are the factors that are most conducive to the generation of value and how this process is associated with specific management and governance practices. We have emphasized the sectoral differences across different cluster initiatives. Our analysis based on 13 CCC shows that there is a specific set of services that cluster initiatives should provide to their members to meet their expectations and create value. Our study shows that a pattern of desired activities conditions the success of CCC. Long-term objectives such as innovation, market analysis, infrastructure development, and training produce overall more value. CCC that pursue these services are more likely to achieve their main goals, tackling some market failures and increase the competitiveness of the sector/region. On the other hand, short-term oriented objectives such as lobbying and networking produce overall less value. It is likely that CCC pursuing these objectives will not achieve their main goal because they are captured by private interests.

Our findings further show that the composition of firms in CCC can explain CCC members’ goal orientation. CCC with a higher share of high-growth, private and small firms are more likely to require activities that enhance their capacity to improve market position beyond the current level of development, as compared to CCC with a higher share of declining and state-owned companies that emphasise lobbying and networking activities to improve or defend their current market position. Finally, our study indicates that a few management and governance elements drive the public value generation process in CCC, such as joint efforts, a shared vision, and cooperation among actors.

The findings have some important implications for cluster managers and policymakers. As the evaluation of management and governance of CCC are pretty low at the present stage of CCC development, meaning that CCC do not provide enough value to their members and/or to the sector, changes in the development path of CCC are needed. Our findings show that CCC should particularly focus on the efficient provision of those services, which produce the highest value for members in line with their expectations. Those services are related to innovation, infrastructure development, market analysis and training, which drive higher public value creation. Cluster managers need to create an environment in which members do not perceive cluster initiatives only as a short-term opportunity for lobbying but as a platform through which members can learn and enhance their competencies, skills, and market capabilities through cooperation, knowledge sharing and innovation development with other actors, in line with previous studies (e.g., Hamel et al. 1989; Khanna et al. 1998; Laur et al. 2012). Cluster managers should also recognise the differences across different sectoral cluster initiatives regarding the services required by cluster members. At the same time, CCC should excel in cluster management and governance and go beyond the management of cluster organisations (Schretlen et al. 2011). This means that it is important to motivate members to work together and align the private interest with the overall objectives of smart specialisation and development of the sector (Laur et al. 2012; Pinkse et al. 2018). It is also important that CCC have a sufficient budget for implementing important sectoral projects (Sölvell et al. 2003).

This study has some limitations. The study is based on a subjective assessment of the value creation process that has some weaknesses as compared to an objective, unbiased evaluation, which is based on observable and verifiable facts. Even though the indicator we use is not an objective indicator for evaluating cluster success and distinguishing high- and low-value clusters, it allows us to collect information about members’ expectations, which can provide some useful insights on cluster performance. A further limitation of our study is the early stage of development of the CCC program, which makes it difficult to assess the long-term cluster effects. Even though the case of Croatia is a very peculiar one, the generalisability of the results might be limited due to small sample restrictions. It should be also mentioned that besides sectoral differences, the value creation process in cluster initiatives can be also influenced by other factors, such as various interests of stakeholders, individual characteristics of firms and cluster managers, as well as by human resources, financing and infrastructure, and timing of cluster impulses, which can be examined in future studies. Future studies might also include input variables and extend the selection of management and governance items, also including short-term performance variables. Furthermore, cross-country comparisons can be made to see how the evolution of clusters and the benefits of these structures differ among new and more advanced EU countries. Lastly, the paper suffers from the smallness and the general characteristics (cross-section only) of the data set, making causal interpretations/analyses impossible.

Data availability statement

The dataset generated and analysed during the current study is not publicly available due to the fact that they constitute an excerpt of research in progress but is available from the corresponding author on reasonable request.

Notes

This factor accounts for the long-term performance indicators such as the increase in employment, revenues, and FDI, the promotion of export, and the upgrade of products and process (Anić et al. 2019).

References

Adner R, Kapoor R (2010) Value creation in innovation ecosystems: how the structure of technological interdependence affects firm performance in new technology generations. Strateg Manag J 31:306–333. https://doi.org/10.1002/smj.821

Aiginger K, Rodrik D (2020) Rebirth of Industrial Policy and an Agenda for the Twenty-First Century. J Ind Competition Trade 20:197–207

Albahari A, Klofsten M, Rubio-Romero JC (2019) Science and Technology Parks: a study of value creation for park tenants. J Technol Transf 44:1256–1272. https://doi.org/10.1007/s10961-018-9661-9

Alberti FG, Belfanti F (2019) Creating shared value and clusters. The case of an Italian cluster initiative in food waste prevention. Competitiveness review: An International Business Journal 29:39–60. doi:https://doi.org/10.1108/CR-01-2017-0008

Alberti FG, Belfanti F (2021) Do clusters create shared value? A social network analysis of the motor valley case. Competitiveness review: An International Business Journal 31:326–350. doi:https://doi.org/10.1108/CR-05-2020-0077

Andersson T, Serger SS, Sörvik J, Hansson EW (2004) The Cluster Policies White book. IKED, International Organisation for Knowledge Economy and Enterprise Development, Malmö

Amit R, Zott C (2001) Value Creation in E-Business. Strateg Manag J 22:493–520. doi: https://doi.org/10.1002/smj.187

Anić ID, Corrocher N, Morrison A, Aralica Z (2019) The development of competitiveness clusters in Croatia: a survey-based analysis. Eur Plan Stud 27(11):2227–2247. https://doi.org/10.1080/09654313.2019.1610726

Aranguren Querejeta MJ, de la Maza X, Parrilli MD, Vendrell-Herrero F, Wilson JR (2014) Nested Methodological Approaches for Cluster Policy Evaluation: An Application to the Basque Country. Reg Stud 48:1547–1562. https://doi.org/10.1080/00343404.2012.750423

Aranguren Querejeta MJ, Wilson JR (2013) What can experience with clusters teach us about fostering regional smart specialisation? Ekonomiaz 83:127–174

Asheim B, Isaksen A, Martin R, Trippl M (2017) The role of clusters and public policy in new regional economic path development. In: Fornahl D, Hassink R (eds) The Life Cycle of Clusters, A Policy Perspective. Edward Elgar Publishing, Cheltenham, pp 13–34

Baptista R, Swann P (1998) Do firms in clusters innovate more? Res Policy 27:525–540. https://doi.org/10.1016/S0048-7333(98)00065-1

Baptista R, Swann G (1999) A comparison of clustering dynamics in the US and UK computer industries. J Evol Econ 9:373–399. https://doi.org/10.1007/s001910050088

Bengtsson M, Kock S (1999) Cooperation and competition in relationships between competitors in business networks. J Bus Industrial Mark 14:178–194. https://doi.org/10.1108/08858629910272184

Benner M (2017) Smart specialization and cluster emergence: Elements of evolutionary regional policies, The Life Cycle of Clusters A Policy Perspective, Edited by Dirk Fornahl and Robert Hassink, 151–172

Bečić E, Švarc J (2015) Smart Specialisation in Croatia: Between the Cluster and Technological Specialisation. J Knowl Econ 6:270–295. doi:https://doi.org/10.1007/s13132-015-0238-7

Bititci US, Martinez V, Albores P, Parung J (2004) Creating and managing value in collaborative networks. Int J Phys Distribution Logistics Manage 34:251–268. https://doi.org/10.1108/09600030410533574

Boschma R (2016) Smart Specialisation and Regional Innovation Policy. Welsh Economic Review 24:17. https://doi.org/10.18573/j.2016.10050

Bowman C, Ambrosini V (2000) Value Creation Versus Value Capture: Towards a Coherent Definition of Value in Strategy. Br J Manag 11:1–15. https://doi.org/10.1111/1467-8551.00147

Braunerhjelm P, Carlsson B, Cetindamar D, Johansson D (2000) The old and the new the evolution of polymer and biomedical clusters in Ohio and Sweden. Journal of Evolutionary Economics 10:471–488. doi: https://doi.org/10.1007/s001910000053

Chandler AD (1994) The Competitive Performance of U.S. Industrial Enterprises since the Second World War. Bus Hist Rev 68:1–72. https://doi.org/10.2307/3117015

Chiaroni D, Chiesa V (2006) Forms of creation of industrial clusters in biotechnology. Technovation 26:1064–1076. doi:https://doi.org/10.1016/j.technovation.2005.09.015

Eisingerich AB, Bell SJ, Tracey P (2010) How can clusters sustain performance? The role of network strength, network openness, and environmental uncertainty. Res Policy 39:239–253. doi:https://doi.org/10.1016/j.respol.2009.12.007

De La Maza X, Vendrell-Herrero F, Wilson JR (2012) Where is the value of cluster associations for SMEs? Intangible Capital 8:472–496. doi: https://doi.org/10.3926/ic.346

Ellegaard C, Geersbro J, Medlin CJ (2009) Value Appropriation within a Business Network. Paper presented at 4th IMP Asia Conference, Kuala Lumpur, Malaysia. https://research.cbs.dk/en/publications/value-appropriation-within-a-business-network. Accessed 1 September 2020

Ferreira MP, Ribeiro Serra F, Kramer Costa B, Maccari EA, Couto HR (2012) Impact of the Types of Clusters on the Innovation Output and the Appropriation of Rents from Innovation. J Technol Manage Innov 7:70–80. https://doi.org/10.4067/S0718-27242012000400006

Foray D (2018) Smart specialisation strategies and industrial modernisation in European regions – theory and practice. Camb J Econ 42:1505–1520. https://doi.org/10.1093/cje/bey022

Fromhold-Eisebith M, Eisebith G (2005) How to institutionalize innovative clusters? Comparing explicit top-down and implicit bottom-up approaches. Res Policy 34:1250–1268. https://doi.org/10.1016/j.respol.2005.02.008

Grant R (1991) The Resource-Theory of Competitive Advantage: Implications for Strategy Formulation. Calif Manag Rev 33:114–135. doi:https://doi.org/10.1016/B978-0-7506-7088-3.50004-8

Hamel G, Doz YL, Prahalad CK (1989) Collaborate with Your Competitors – and Win. Harvard Business Review January-February: 133–139

Hsieh PF, Lee CS, Ho J (2012) Strategy and process of value creation and appropriation in service clusters. Technovation 32:430–439. https://doi.org/10.1016/j.technovation.2011.03.003

Huang KF, Yu CMJ, Seetoo DH (2012) Firm innovation in policy-driven parks and spontaneous clusters: the smaller firm the better? J Technol Transfer 37:715–731. https://doi.org/10.1007/s10961-012-9248-9

Humphrey J, Schmitz H (1996) The triple approach to local industrial policy. World Dev 24:1859–1877. https://doi.org/10.1016/S0305-750X(96)00083-6

Ingstrup MB, Damgaard T (2013) Cluster facilitation from a cluster life cycle perspective. Eur Plan Stud 21:556–574. https://doi.org/10.1080/09654313.2012.722953

Jungwirth C, Müller EF (2014) Comparing Top-Down and Bottom-Up Cluster Initiatives from a Principal-Agent Perspective: What We Can Learn for Designing Governance Regimes. Schmalenbach Bus Rev 66:357–381. https://doi.org/10.1007/BF03396911

Ketels C, Protsiv S (2013) Clusters and the New Growth Path for Europe. WWW for Europe Working Paper Series 14. WIFO, Vienna

Ketels C, Lindqvist G, Sölvell O (2006). Cluster initiatives in developing and transition economies. Center for Strategy and Competitiveness, Stockholm

Khanna T, Gulati R, Nohria N (1998) The dynamics of learning alliances: competition, cooperation, and relative scope. Strategic Management Journal 19: 193?210. https://doi.org/10.1002/(SICI)1097-0266(199803)19:3<193::AID-SMJ949>3.0.CO;2-C

Konstantynova A, Lehmann T (2017) Cluster Activities in Different Institutional Environments. Case Studies of ICT-Clusters from Austria, Germany, Ukraine and Serbia. Admistirative Sci 7:1–15

Koszarek M (2014) Supporting the development of clusters in Poland – dilemmas faced by public policy. Res Papers Wroclaw Univ Econ 365:103–112

Koschatzky K, Kroll H, Schnabl E, Stahlecker T (2017) Cluster policy adjustments in the context of smart specialization? Impressions from Germany, The Life Cycle of Clusters A Policy Perspective, Edited by Dirk Fornahl and Robert Hassink, 173–200

Laur I, Klofsten M, Bienkowska D (2012) Catching Regional Development Dreams: A Study of Cluster Initiatives as Intermediaries. Eur Plan Stud 20:1909–1921. https://doi.org/10.1080/09654313.2012.725161

Lavie D (2007) Alliance portfolios and firm performance: A study of value creation and appropriation in the U.S. software industry. Strateg Manag J 28:1187–1212. https://doi.org/10.1002/smj.637

Lecluyse L, Knockaert M, Spithoven A (2019) The contribution of science parks: a literature review and future research agenda. J Technol Transf 44:559–595. https://doi.org/10.1007/s10961-018-09712-x

Lindqvist G, Ketels C, Sölvell Ö (2013) The Cluster Initiative Greenbook 2.0. Ivory Tower Publishers, Stockholm

Martin R, Sunley P (2003) Deconstructing Clusters: Chaotic Concept or Policy Panacea? J Econ Geogr 3:5–35. https://doi.org/10.1093/jeg/3.1.5

Mayhew K, Keep E (2014) https://www.cipd.co.uk/Images/industrial-strategy-and-the-future-of-skills-policy_2014_tcm18-10247.pdf. Accessed 2 September 2020

MINGO - Ministry of Economy, entrepreneurship, and crafts (2016) Croatian Smart Specialisation Strategy 2016–2020. http://s3platform.jrc.ec.europa.eu/documents/20182/222782/strategy_EN.pdf/e0e7a3d7-a3b9-4240-a651-a3f6bfaaf10e Accessed 27 August, 2020

Mizik N, Jacobson R (2003) Trading off between Value Creation and Value Appropriation: The Financial Implications of Shifts in Strategic Emphasis. J Mark 67:63–76

Meyer-Stamer J, Harmes-Liedtke U (2005) How to Promote Clusters. Mesopartner Working Paper, 08, 1–38. Mesopartner Partnergesellschaft, Duisburg. https://www.mesopartner.com/fileadmin/media_center/Working_papers/mp-wp08_01.pdf. Accessed 10 July, 2020

Nightingale P, Coad A (2020) The myth of the science park economy. DEMOS. https://demos.co.uk/blog/the-myth-of-the-science-park-economy/

OECD (2000) Local partnership, clusters and SME globalisation, Workshop 2, Conference for Ministers responsible for SMEs and Industry Ministers Bologna, Italy, 14–15 June 2000