Abstract

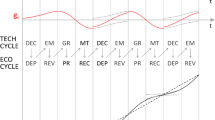

The purpose of this paper is to present a model of growth with endogenous fluctuations. The main feature of our model is that it throws light on the relationships between long waves and business cycles in the economy. The driving forces in the model work in this way: endogenous R&D investment creates new cumulative knowledge. When this knowledge reaches a threshold H*, radical innovations occur which generate productivity growth via the substitution of old capital with new capital. These disruptive events appear recurrently, generating long waves and revitalizing the growth process. Short-term cycles in the model come from the interactions between these innovation-driven transformations and certain prey-predator mechanisms that involve the labor market. We find that our model presents excellent properties: the model generates endogenous cyclical growth as a disequilibrium process; persistent and irregular short cycles appear interwoven with the long waves; and there is a strong significant interaction between both kinds of fluctuations.

Similar content being viewed by others

Notes

We may associate this leap with the emergence of a new capital-embodied critical technology. Helpman (1998) refers to these technologies as General Purpose Technologies (GPTs): steam power, electrification, the internal combustion engine and the computerization of the economy.

For Fig. 1 and for any simulation in this section, we will use Eq. 17 with the following initial values and parameters: λ 0 = 0.03; μ 0 = 0.3; β = 0.01; ρ = 6; γ = 5.4; θ = 0.3; δ = 0.04; h = 0.1; π = 0.2; v(0) = 0.91; u(0) = 0.46; k(0) = 100; η(0) = η − 1 = 0.3; a(0) = a − 1 = 1, ϕ = 0.51; H ∗ = 430. See Silverberg and Verspagen (1994) for similar values. Besides, Fig. 1b offers some similarities with the evidence provided by Harvei (2000) on Goodwin cycles in OECD countries.

References

Aghion P, Howitt P (1998) Endogenous growth theory. The MIT Press, Cambridge Mass

Blanchard OJ (1992) For a return to pragmatism. In: Belongia M, Garfinkel M (eds) The business cycle. Kluwer, Boston

Boldrin M (2009) La Teoria del Ciclo Economico: Una perspectiva personal. In: Martinez D (ed) Ensayos sobre Ciclos Economicos. Servicio de Estudios Cajasol, Sevilla, pp 9–52

Freeman C (ed) (1996) Long wave theory. Edward Elgar, Cheltenham

Freeman S, Hong D, Peled D (1999) Endogenous cycles and growth with indivisible technological developments. Rev Econ Dyn 2:403–432

Goodwin RM (1967) A growth cycle. In: Feinstein C (ed) Socialism, capitalism and economic growth. Cambridge University Press, Cambridge, pp 54–58

Harvei D (2000) Testing Goodwin: growth cycles in ten OECD countries. Camb J Econ 24:349–376

Helpman E (ed) (1998) General purpose technologies and economic growth. MIT Press, Cambridge Mass

Hirsch MW, Smale S (1974) Differential equations, dynamical systems, and linear algebra. Academic Press, New York

Jarne G, Sanchez-Choliz J, Fatas-Villafranca F (2007) S-shaped curves in economic growth. A theoretical contribution and an application. Evol Inst Ec Review 3(2):239–259

Lucas RE (1987) Models of business cycles. Blackwell, Oxford

Mandel E (1995) Long waves of capitalist development. Verso, London

Pasinetti LL (1981) Structural change and economic growth. A theoretical essay in the dynamics of the wealth of nations. Cambridge University Press, Cambridge

Romer D (2006) Advanced macroeconomics. McGraw-Hill, New York

Sanchez-Choliz J, Fatas-Villafranca F, Jarne G, Perez-Grasa I (2008) Endogenous cyclical growth with a sigmoidal diffusion of innovations. Econ Innov New Technol 17(3):241–268

Schumpeter JA (1939) Business cycles. A theoretical, historical and statistical analysis of the capitalist process, 2 vols. McGraw-Hill, New York

Silverberg G, Verspagen B (1994) Learning, innovation and economic growth: a long-run model of industrial dynamics. Ind Corp Change 3(1):199–223

Zarnowitz V (1992) Business cycles: theory, history, indicators and forecasting. University of Chicago Press, Chicago

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has benefited from financial support under projects PO17-2000 of the Government of Aragon and SEJ 2007-60960 of the Spanish Ministry of Education and Science. The authors would like to express their thanks to Gerald Silverberg and to the anonymous referees for their comments on earlier versions of this work.