Abstract

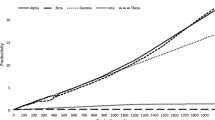

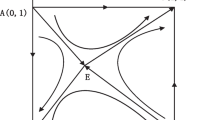

The aim of this paper is to highlight the effect of irreversibility in partner choice in inter-firm collaborations. In an environment where firms are binded by contractual constraints regarding the duration of partnerships, how does the tacitness and complexity influence the overall knowledge in the industry? Through an agent based simulation model, we compare the knowledge generation in irreversible and reversible systems in two regimes as tacit and codified. The emerging network structures are also analysed. The results reveal that, in tacit regimes irreversible systems generate more knowledge only when product complexity is at an intermediate level.

Similar content being viewed by others

Notes

In this paper, we adopt this definition of complexity.

See Ozman (2010) for a more general version of this model, which investigates the impact of knowledge base on network structure.

See Cowan et al. (2003) for this knowledge setting. Specifically, \(k_j^i =k_j^h\) means that agents i and h have exactly the same knowledge in type j. If \(k_j^i >k_j^h\) agent i knows everything that agent h knows in type j, and has some knowledge in addition.

If product n uses 90% of knowledge type j, then there is 0.9 probability that agent i produces good n. With 10% probability it produces one of the other goods, depending on their requirements of knowledge type j.

We assume an environment in which agents consider only the short term joint production amounts, and that they cannot predict the amount of learning that will take place in the long run because of uncertainty.

With regards to how knowledge overlap between firms influence alliances, a major finding in the literature is an inverted-u relationship between technological distance between firms and learning (Mowery 1998; Schoenmakers and Duysters 2006; Nooteboom et al. 2007). Moreover this distance diminishes as firms collaborate with each other (Mowery et al. 1998). Note that, in these models, the overlap between total knowledge endowments of firms are looked at. In our model, however, relative knowledge levels measure the extent to which one firm knows more than the other in a particular field, and not the overlap in their total knowledge vector (See footnote 2). Because there is more than one field of knowledge, two firms complement each other when one knows more than the other in one field, and vice versa. It is also important to note that the learning used here is the extent to which parties can make use of production, rather than direct transfer between firms. Because it is the knowledge of the high-knowledge firm which is used in production, the low-knowledge firm’s learning is limited, i.e. he cannot make full use of production in that knowledge category. Nevertheless, it can complement the other firm in a different knowledge category.

We take into account only bilateral link formation in a single period, but when sufficient time elapses, these bilateral links form a network.

Each of these matrices is an input to a single run (5 goods, 10 knowledge types).

Note that these results concern the overall learning in the economy, rather than the performance of individual firms. In other words, some firms maybe better-off by being more selective, but when all firms are taken into account overall knowledge generation is higher.

This is to say that firms can revert to other partners easily.

References

Ahuja G (2000) Collaboration networks, structural holes and innovation: a longitudinal study. Adm Sci Q 45(3):425–453

Anderson U, Forsgren M, Holm U (2002) The strategic impact of external networks: subsidiary performance and competence development in multinational corporation. Strateg Manage J 23:979–996

Argyres N, Bercovitz J, Mayer KJ (2007) Complementarity and evolution of contractual provisions: an empirical study of IT service contracts. Organ Sci 18(1):3–19

Argyres N, Liebeskind JP (1998) Contractual commitments, bargaining power, and governance inseparability. In: Academy of Management proceedings & membership directory, pp D1–D8

Arora A, Gambardella A (1990) Complementary and external linkages: the strategies of the large firms in biotechnology. J Ind Econ 38(3):361–79

Audretsch DB, Feldman MP (1996) Innovative clusters and the industry life-cycle. Rev Ind Organ 11:253–273

Baum J, McEvily B, Rowley T (2007) Better with age? Tie longevity and the performance implications of bridging and closure. Rotman School of Management Working Paper No 1032282. Available at SSRN: http://ssrn.com/abstract=1032282

Burt RS (1992) Structural holes: the structure of competition. Academic, New York

Colombo MG (2003) Alliance form: a test of the contractual and competence perspectives. Strateg Manage J 24:1209–1229

Cowan R, Jonard N (2001) Knowledge creation, knowledge diffusion and network structure. In: Kirman A, Zimmermann J-B (eds) Economies with heterogeneous interacting agents, Springer

Cowan R, Jonard N, Ozman M (2003) Knowledge dynamics in a network industry. Technol Forecast Soc Change 71(4):469–484

Crocker KJ, Masten SE (1988) Mitigating contractual hazards: unilateral options and contract length. RAND J Econ 19(3):327–343

Echols A, Tsai W (2005) Niche and performance: the moderating role of network embeddedness. Strateg Manage J 26:219–238

Frenken, K (2006) A fitness landscape approach to technological complexity, modularity and vertical disintegration. Struct Chang Econ Dyn 17:288–305

Goerzen A (2007) Alliance networks and firm performance: the impact of repeated partnerships. Strateg Manage J 28:487–509

Gulati R (2007) Managing network resources: alliances, affiliations and other relational assets. Oxford University Press, Oxford

Hagedoorn J (1993) Understanding the rationale of strategic technology partnering: inter-organizational modes of cooperation and sectoral differences. Strateg Manage J 14:371–85

Hemphill TA, Vonortas N (2003) Strategic research partnerships: a managerial perspective. Technol Anal Strateg Manag 15(2):255–271

Jones C, Hesterly WS, Borgatti SP (1997) A general theory of network governance: exchange conditions and social mechanisms. Acad Manage J 22:911–45

Joskow P (1987) Contract duration and relationship-specific investments: empirical evidence from coal markets. Am Econ Rev 77(1):168–85

Kauffman S (1993) The origins of order. Oxford University, New York

Kogut B (1989) The stability of joint ventures: reciprocity and competitive rivalry. J Ind Econ 38:183–198

Lerner J, Merges RP (1998) The control of technology alliances: an empirical analysis of the biotechnology industry. J Ind Econ 46:125–156

Mosakowski E (1997) Strategy making under causal ambiguity: conceptual issues and empirical evidence. Organ Sci 8(3):414–442

Mowery DC, Oxley JE, Silverman BS (1998) Technological overlap and interfirm cooperation: implications for the resource based view of the firm. Res Policy 27:507–23

Nooteboom B, Haverbeke W, Duysters G, Gilsing W, Oord A (2007) Optimal cognitive distance and absorptive capacity. Res Policy 36:1016–1034

Orsenigo L, Pammoli F, Riccaboni M, Bonaccorsi A, Turchetti G (1998) The evolution of knowledge and the dynamics of an industry network. Journal of Management and Governance 1:147–175

Oxley JE, Sampson RC (2004) The scope and governance of international R&D alliances. Strateg Manage J 25:723–749

Ozman M (2010) The knowledge base of products: implications for organizational structure. Organ Stud 31:1129–1154

Pangarkar N (2003) Determinants of alliance duration in uncertain environments: the case of the biotechnology sector. Long Range Plan 36:269–284

Pisano GP (1989) Using equity participation to support exchange: evidence from the biotechnology industry. J Law, Econ Organ 5(1):109

Poppo L, Zenger T (2002) Do formal contracts and relational governance function as substitutes or complements? Strateg Manage J 23(8):707

Powell WW (1990) Neither market nor hierarchy: network forms of organization. Res Organ Behav 12:295–336 (Reuer and Arino, 2007)

Powell WW, Koput KW, Smith-Doerr L (1996) Inter-organizational collaboration and the locus of innovation: networks of learning in biotechnology. Adm Sci Q 41:116–145

Reed R, DeFillippi RJ (1990) Causal ambiguity, barriers to imitation, and sustainable competitive advantage. Acad Manage Rev 15:88–102

Reuer J, Ariño A (2007) Strategic alliance contracts: dimensions and determinants of contractual complexity. Strateg Manage J 28:313–330

Reuer JJ, Zollo M, Singh H (2002) Post-Formation dynamics in strategic alliances. Strateg Manage J 23:135–151

Rosenkopf L, Tushman, ML (1998) The coevolution of community networks and technology: lessons from the flight simulation industry. Ind Corp Change 7:311–346

Rowley T, Behrens D, Krackhardt D (2000) Redundant governance structures: an analysis of structural ad relational embeddedness in the steel and semiconductor industries. Strateg Manage J 21:369–86

Santoro MD, McGill JP (2005) The effect of uncertainty and asset co-specialization on governance mode in biotechnology alliances. Strateg Manage J 26:1261–1269

Schoenmakers W, Duysters G (2006) Learning in strategic technology alliances. Technol Anal Strateg Manag 18(2):245–264

Simon HA (1969) The architecture of complexity, in the sciences of the artificial. MIT, Cambridge, pp 192–229

Simonin B (1999) Ambiguity and the process of knowledge transfer in strategic alliances. Strateg Manage J 20:595–623

Uzzi B (1997) Social structure and competition in interfirm networks: the paradox of embeddedness. Adm Sci Q 42(1):35–67

Uzzi B, Gillespie JJ (2002) Knowledge spillover in corporate financing networks: embeddedness and the firm’s debt performance. Strateg Manage J 23:595–618

Wang Q, von Tunzelmann N (2000) Complexity and the functions of the firm: breadth and depth. Res Policy 29:805–818

Wang L, Zajac EJ (2007) Alliance or acquisition? a dyadic perspective on interfirm resource combinations. Strateg Manage J 28(13):1291–1317

Williamson, OE (1975) Markets and hierarchies: analysis and antitrust implications. Free Press, New York

Zander U, Kogut B (1995) Knowledge and the speed of the transfer and imitation of organizational capabilities: an empirical test. Organ Sci 6(1):76–92

Author information

Authors and Affiliations

Corresponding author

Additional information

The work leading to this paper has been supported by the ANR Grant ANCORA (Analyse de la production de Connaissances par la Recherche Académique; ANR-06-APPR-003), in addition to NoE DIME (Dynamics of Institutions and Markets in Europe, EU 6th FP, grant N° 513396) and EU 7th FP, AEGIS (Contract No.225134). In addition, we would like to thank Robin Cowan and two anonymous referees for their comments. The usual disclaimers apply.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Llerena, P., Ozman, M. Networks, irreversibility and knowledge creation. J Evol Econ 23, 431–453 (2013). https://doi.org/10.1007/s00191-011-0231-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-011-0231-7