Abstract

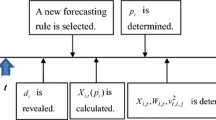

We revise Metzler’s well-known inventory model by developing a framework in which producers can either apply a simple but cheap extrapolative or a more sophisticated but expensive regressive forecasting rule to predict future sales. Producers are boundedly rational in the sense that they tend to select forecasting rules with a high evolutionary fitness. Using a mixture of analytical and numerical tools, we attempt to describe the characteristics of our model’s dynamical system. Our results suggest that the evolutionary competition between heterogeneous predictors may lead to irregular fluctuations in economic activity.

Similar content being viewed by others

Notes

Akerlof and Shiller (2009) convincingly argue that people’s expectations are subject to animal spirits and may thus have a destabilising impact on macroeconomic outcomes. Moreover, the relevance of inventory adjustments on the evolution of the business cycle is, amongst others, demonstrated in Blinder and Maccini (1991) or Ramey and West (1997).

See Evans and Honkapohja (2001) for a general survey on learning in macroeconomics.

In particular, Metzler (1941) discusses the effects of several simple linear expectation formation rules on the dynamics of the business cycle.

See, e.g. Lines (2007), who proves that no parameter combination satisfies the last condition as an equality while simultaneously satisfying the first three conditions.

For a comprehensive survey on the stability of linear difference equations, see, e.g. Gandolfo (2009).

In the next section it will become clear that these claims may not be generalised too much. For some parameter combinations stability may in fact crucially depend on the interplay between parameters c and f, i.e. the two parameters defining the expectational forces in our model.

As it turns out, in rare situations the inventory becomes negative for our initial parameter setting. This issue may be circumvented by either adding a fixed buffer or an inventory floor to Eq. 4. However, such a fixed buffer does not affect the model’s law of motion. For a more detailed description of a model with an inventory floor, see, e.g. Sushko et al. (2009).

For a complete mathematical treatment of the Chenciner bifurcation, see Kuznetsov (2004). Moreover, economic applications covering this kind of bifurcation are given by Gaunersdorfer et al. (2008), Lines and Westerhoff (2010), Neugart and Tuinstra (2003), Kind (1999), Agliari (2006) and Agliari et al. (2005).

In contrast, in the case of a pure subcritical Neimark–Sacker bifurcation, the fixed point becomes unstable and all trajectories simply diverge.

Please recall, that the other stability condition which may be violated is completely independent of parameter c.

References

Agliari A (2006) Homoclinic connections and subcritical Neimark bifurcation in a duopoly model with adaptively adjusted productions. Chaos, Solitons Fractals 29(3):739–755

Agliari A, Gardini L, Puu T (2005) Some global bifurcations related to the appearance of closed invariant curves. Math Comput Simul 68(3):201–219

Agliari A, Bischi G-I, Gardini L (2006) Some methods for the global analysis of closed invariant curves in two-dimensional maps. In: Puu T, Sushko I (eds) Business cycle dynamics: models and tools. Springer, pp 7–49

Akerlof G, Shiller R (2009) Animal spirits: how human psychology drives the economy and why it matters for global capitalism. Princeton University Press, Princeton

Alfarano S, Lux T, Wagner F (2005) Estimation of agent-based models: the case of an asymmetric herding model. Comput Econ 26(1):19–49

Anufriev M, Assenza T, Hommes CH, Massaro D (2008) Interest rate rules with heterogeneous expectations. CeNDEF Working Paper 08-08, University of Amsterdam

Berardi M (2007) Heterogeneity and misspecifications in learning. J Econ Dyn Control 31(10):3203–3227

Blinder AS, Maccini LJ (1991) Taking stock: a critical assessment of recent research on inventories. J Econ Perspect 5:73–96

Boswijk HP, Hommes CH, Manzan S (2007) Behavioral heterogeneity in stock prices. J Econ Dyn Control 31(6):1938–1970

Branch WA (2004) The theory of rationally heterogeneous expectations: evidence from survey data on inflation expectations. Econ J 114(497):592–621

Branch WA, McGough B (2009) A new Keynesian model with heterogeneous expectations. J Econ Dyn Control 33(5):1036–1051

Branch WA, McGough B (2010) Dynamic predictor selection in a new Keynesian model with heterogeneous expectations. Working Paper

Brock WA, Hommes CH (1997) A rational route to randomness. Econometrica 65(5):1059–1095

Brock WA, Hommes CH (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22(8–9):1235–1274

Brock WA, Dindo PDE, Hommes CH (2005) Adaptive rational equilibrium with forward looking agents. CeNDEF Working Paper 05-15, University of Amsterdam

Chiarella C, He X (2003) Dynamics of belief and learning under a l -processes—the heterogeneous case. J Econ Dyn Control 27:503–531

DeGrauwe P (2008) DSGE-modelling when agents are imperfectly informed. ECB Working Paper, European Central Bank

Dieci R, Foroni I, Gardini L, He X (2006) Market mood, adaptive beliefs and asset price dynamics. Chaos, Solitons Fractals 29(3):520–534

Diks C, van der Weide R (2005) Herding, a-synchronous updating and heterogeneity in memory in a CBS. J Econ Dyn Control 29(4):741–763

Evans G, Honkapohja S (2001) Learning and expectations in macroeconomics. Princeton University Press, Princeton

Franke R (1996) A Metzlerian model of inventory growth cycles. Struct Chang Econ Dyn 7(2):243–262

Franke R, Lux T (1993) Adaptive expectations and perfect foresight in a nonlinear Metzlerian model of the inventory cycle. Scand J Econ 95(3):355–363

Galor O (2007) Discrete dynamical systems. Springer, Berlin

Gandolfo G (2009) Economic dynamics, 4th edn. Springer, Berlin

Gaunersdorfer A, Hommes CH, Wagener FOO (2008) Bifurcation routes to volatility clustering under evolutionary learning. J Econ Behav Organ 67(1):27–47

Goldbaum D, Mizrach B (2008) Estimating the intensity of choice in a dynamic mutual fund allocation decision. J Econ Dyn Control 32(12):3866–3876

Heemeijer P, Hommes C, Sonnemans J, Tuinstra J (2009) Price stability and volatility in markets with positive and negative expectations feedback: an experimental investigation. J Econ Dyn Control 33(5):1052–1072

Hommes C, Huang H, Wang D (2005a) A robust rational route to randomness in a simple asset pricing model. J Econ Dyn Control 29(6):1043–1072

Hommes C, Sonnemans J, Tuinstra J, van de Velden H (2005b) Coordination of expectations in asset pricing experiments. Rev Financ Stud 18(3):955–980

Kahnemann D, Slovic P, Tversky A (1986) Judgment under uncertainty: heuristics and biases. Cambridge University Press, Cambridge

Kind C (1999) Remarks on the economic interpretation of Hopf bifurcations. Econ Lett 62(2):147–154

Kuznetsov YA (2004) Elements of applied bifurcation theory. Springer, New York

Lines M (2007) Practical tools for identifying dynamics in discrete systems. Working paper, Department of Statistics, University of Udine

Lines M, Westerhoff F (2006) Expectations and the multiplier-accelerator model. In: Puu T, Sushko I (eds) Business cycle dynamics: models and tools. Springer, pp 255–276

Lines M, Westerhoff F (2010) Inflation expectations and macroeconomic dynamics: the case of rational versus extrapolative expectations. J Econ Dyn Control 34(2):246–257

Manski CF, McFadden D (eds) (1981) Structural analysis of discrete data with econometric applications. MIT Press, Cambridge, Massachusetts

Marcet A, Nicolini JP (2003) Recurrent hyperinflations and learning. Am Econ Rev 93(5):1476–1498

Matsumoto A (1998) Non-linear structure of a Metzlerian inventory cycle model. J Econ Behav Organ 33(3–4):481–492

Metzler LA (1941) The nature and stability of inventory cycles. Rev Econ Stat 23(3):113–129

Neugart M, Tuinstra J (2003) Endogenous fluctuations in the demand for education. J Evol Econ 13(1):29–51

Ramey VA, West KD (1997) Inventories. NBER Working Paper Series 6315, National Bureau of Economic Research

Reitz S, Westerhoff F (2003) Nonlinearities and cyclical behavior: the role of chartists and fundamentalists. Stud Nonlinear Dyn Econom 7(4)

Simon HA (1955) A behavioral model of rational choice. Q J Econ 9:99–118

Smith V (1991) Papers in experimental economics. Cambridge University Press, Cambridge

Sushko I, Wegener M, Westerhoff F, Zaklan G (2009) Endogenous business cycle dynamics within the inventory model of Metzler: adding an inventory floor. Nonlinear Dyn Psychol Life Sci 13:223–233

Tuinstra J, Wagener F (2007) On learning equilibria. Econ Theory 30(3):493–513

Wegener M, Westerhoff F, Zaklan G (2009) A metzlerian business cycle model with nonlinear heterogeneous expectations. Econ Model 26:715–720

Westerhoff FH (2006) Business cycles, heuristic expectation formation, and contracyclical policies. J Public Econ Theory 8(5):821–838

Westerhoff F, Hohnisch M (2008) Business cycle synchronization in a simple Keynesian macro model with socially-transmitted economic sentiment and international sentiment spill-over. Struct Chang Econ Dyn 19:249–259

Acknowledgements

This paper was presented at the 6th International Conference on Nonlinear Economic Dynamics, Jönköping, Sweden, June 2009. We thank the participants, in particular Jan Tuinstra, for their very helpful and encouraging comments.

We also wish to thank two anonymous referees, whose remarks helped us to considerably improve our paper.

Author information

Authors and Affiliations

Corresponding author

Appendix: Aggregation of sales expectations

Appendix: Aggregation of sales expectations

In this appendix, we illustrate the conditions under which expected sales of consumption goods, U t , may be expressed as a weighted average of both types of expectations. For the sake of simplicity, we restrict our analysis to the simplest case in which producers have no memory at all and have no preference for simple linear heuristics, i.e. m = 0 and μ = 0. Given this, Eqs. 10 and 11 will reduce to

Moreover, we want to omit all cases of asynchronous updating. Hence, the fractions of agents using either the extrapolative or the regressive forecasting rule are respectively denoted by

and

Let us now suppose that there are N firms in the market. All firms shall be equal in size in the sense that each firm is able to sell the same amount of consumption goods. Nevertheless, each firm still forms its individual expectations about its future sales, which are now specified by

and

Accordingly, the individual performance of each predictor may be written as

and

The individual weighting function

may now be interpreted as the (individual) probability with which a particular firm chooses the extrapolative forecasting rule. Hence, expected future sales of a particular firm are determined by the following probability function

while overall expected sales are simply given by

If we furthermore suppose that all producers react equally sensitive to differences in the performance of both predictors, we are able to scale parameter g so that the intensity of choice of each producer is given by

With this simple transformation, it is now straightforward to see that our individual probability function given by Eq. 55 corresponds to Eq. 41. Thus, for a sufficiently large number of firms, approximately \(w_t^E N\) firms will choose the extrapolative predictor, while approximately \((1-w_t^E)N\) firms will select the regressive forecasting rule.

Accordingly, the aggregate of expected sales of consumption goods may properly be approximated by

Rights and permissions

About this article

Cite this article

Wegener, M., Westerhoff, F. Evolutionary competition between prediction rules and the emergence of business cycles within Metzler’s inventory model. J Evol Econ 22, 251–273 (2012). https://doi.org/10.1007/s00191-010-0215-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-010-0215-z