Abstract

This paper presents the effects of an R&D subsidy in a Schumpeterian general equilibrium model with rich industry dynamics. R&D subsidies raise the long-run growth rate, but they also raise the level of industry concentration. In the model firms compete for market share through process R&D endogenously determining the market structure within and across industries. Endogeneity of the market structure allows for analysis of changes in the moments of the firm size distribution in response to policy. R&D subsidies primarily benefit large incumbent firms who increase their innovation rates creating a greater technological barrier to entry. Concentration increases with fewer firms and a higher variance in the market shares. In general equilibrium, the greater distortions in the product market cause the wage rate to fall which leads to increased turnover rates. In addition, the analysis demonstrates that the model captures a large number of empirical regularities described in the industrial organization literature, but absent from most endogenous growth models. These features, such as entering firms are small relative to incumbents, the hazard rate of exit is negatively related to firm size, and large firms spend more on R&D than small firms play important roles in understanding the impact of R&D subsidies on the economy.

Similar content being viewed by others

Notes

See also Aghion et al. (2005) for empirical work on the implications of levelled versus unlevelled sectors.

The property that a firm’s decision only depends on its relative position is also a feature of Aghion et al. (2001). In that model, with quality differences between imperfect substitutes, what matters is the relative distance in terms of “quality steps” and not the absolute quality level.

Weintraub et al. (2007) study a partial equilibrium single industry model, also based on Ericson and Pakes (1995), of many firms. Weintraub et al. assume each firm ignores all short-term fluctuations apart from its own state. That is firms do not account for rivals’ states, but only consider the long-run average industry state in making decisions. The assumption here, merely restricts firms to view the industry’s position relative to the economy as stable over time. Firms do account for rivals’ states within their industry and this information shapes R&D strategy.

The assumption prevents firms from achieving cost reductions with near certainty while the price level of the investment good is falling. If this were not the case, with constantly falling prices on the investment good, P Y , (driven by constant reduction in the cost of producing intermediate goods), the cost of achieving the same probability for R&D success would continually fall. Firms would then increase the levels of investment and eventually be able to achieve reductions in their marginal costs with near certainty with essentially zero investment.

Levin et al. (1987) report from a survey that most firms rely on secrecy and lead time in using innovations. Patents are less effective means of guarding an innovation, though most firms are able to reproduce an innovation elsewhere within a short period of time.

In the Ericson and Pakes (1995) model there is a random shock which increases the marginal costs of all incumbent firms. The shock moves incumbents closer to the entry level for marginal costs. The result is that industries cannot grow through process innovation since costs fall with innovations, but increase with the shocks. The cost shocks create a small, finite bounded set of costs that occur in equilibrium. Therefore, solving for the value and policy functions requires only considering this finite set of costs. In the model of this paper, in contrast, constantly falling marginal costs allow the economy to grow and marginal costs can take on values in an infinite set. The “shock” is the spillover process which serves to keep entrants close to incumbents. Entrants’ costs are lowered as opposed to raising incumbents costs. The homogeneity of degree zero in the profit function allows for solving the model using only a small finite set of marginal costs. Policies and values are identical for proportional changes in the vector of marginal costs. Therefore, the dynamic problem can be solved on a small, finite subset of costs as in Ericson and Pakes.

Note that the spillover is industry, but not firm specific, indicating that any spillover lowers entrants’ marginal costs relative to all incumbents.

The liquidation value represents the opportunity cost of using a firm’s private stock of knowledge in an alternative industry. For simplicity, that cost is zero to avoid specifying a secondary market for innovations. The presence of such a market would add little to the analysis.

Note that the current period profit-maximizing quantity does not influence the future state. A firm’s output contributes nothing to future efficiency. Thus, the static product market decision is separable from the dynamic decisions over R&D, entry, and exit. The separability assumption is not necessary, but it does simplify the solution tremendously. For example, separability would not hold if there were learning-by-doing in production as argued in Arrow (1962). Careful redefinition of the state variables would allow for more complicated dynamic problems. However, those issues are not central to the immediate questions posed in this paper. See Benkard (2000) for dynamic learning-by-doing effects.

Wadell et al. (1966) report that the average time for construction of new manufacturing plants was about one year.

Peretto (1999) assumes entry at the average stock of knowledge to retain symmetry. In this model, if new firms entered at the average stock of knowledge, then the market share of new firms would be indistinguishable from incumbents and remain counterfactual.

Although I abstract from explicitly modeling the source of entrants’ innovations, the assumption is closer to reality than the treatment of entry in most endogenous growth models. In most models, entrepreneurs must engage in R&D for some period of time, before entering the product market. In this paper, no firm conducts R&D before establishing production facilities. Thus, while I do not capture labs devoted to research hoping for success, I do capture new firms that begin research programs specifically to enhance their production capabilities.

An alternative assumption would be to model the entry level as a stochastic variable. If the mean of the entry level is below the industry average, similar results follow. This assumption would add complexity without additional insights.

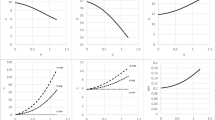

The value function of an individual firm is a complex multi-dimensional object which depends on a firm’s own stock of knowledge relative to both the public stock and the private stock of all its existing competitors. However, the basic shape is an increasing convex function which becomes concave, holding competitors’ private innovation stocks fixed.

Ericson and Pakes (1995) prove both ergodicity and existence for this class of models.

Note that the change from an integral to a summation occurs because each state covers a discrete range of industries. The expression in Eq. 1 is equivalent.

A more detailed technical appendix is available from the author upon request.

This value constitutes a renormalization of the aggregate expenditures.

Note that much of the endogenous growth literature characterizes the causation running from expected profits to R&D. The opposite direction, emphasized by Thompson (2001), also applies here. Firms with high profit levels seek to maintain or even increase their profits through continued R&D in order to defend their positions.

The simple OLS regression with R&D intensity as the left-hand side variable, produced coefficients of −0.001493 (−0.709 t-stat) and −0.000735 (−1.221 t-stat) on quantity and quantity squared. Given the size of the sample used, over 12,000 observations, lack of significance in the coefficients is rather surprising, but consistent with the notion of independence of R&D intensity and firm size.

The equilibria shown are steady-states and do not consider the transition path.

Labor is homogenous here and only has two functions, producing the intermediate goods and operating R&D firms. If labor were divided into skilled and unskilled labor, such that labor instead of goods were used in the R&D process, the wage rate of skilled labor would move in exactly the same manner as the relative price of the investment good. Thus, subsidies to R&D would increase the wage differential between the two types of labor, assuming the supply of each were fixed.

More specifically, first the solution runs 10,000 periods and finds the modal market structure. Then the program uses the mode as its initial value and runs for 1 to 100 million periods. The number of periods depends on the characteristics of the value function solution. In some cases the error around the implied rate of return is sufficiently small that 1 million runs accurately characterizes the ergodic distribution for a given level of tolerance about r. In other cases, more than 1 million are necessary for the same tolerance level. The tolerance level used is 5 basis points or 0.0005%.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Harris C, Howitt P, Vickers J (2001) Competition, imitation, and growth with step-by-step innovation. Rev Econ Stud 68(3):467–492

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2005) Competition and innovation: an inverted u relationship. Q J Econ 120(2):701–728

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Audretsch D (1995) Innovation and industry evolution. MIT, Cambridge

Bain J (1956) Barriers to new competition. Harvard University, Cambridge

Barro R, Sala-i-Martin X (1995) Economic growth. McGraw-Hill, New York

Benkard CL (2000) Learning and forgetting: the dynamics of aircraft production. Am Econ Rev 90(4):1034–1054

Caves R (1998) Industrial organization and new findings on the turnover and mobility of firms. J Econ Lit 36(2):1947–1982

Cohen W, Klepper S (1992) The anatomy of R&D intensity distributions. Am Econ Rev 82(4):773–799

Cohen W, Klepper S (1996) A reprise of size and R&D. Econ J 106:925–951

Dasgupta P, Stiglitz J (1980) Uncertainty, industrial structure, and the speed of R&D. Bell J Econ 11(1):1–28

Dunne T, Roberts M, Samuelson L (1988) Patterns of entry and exit in U.S. manufacturing. RAND J Econ 19:495–515

Ericson R, Pakes A (1995) Markov-perfect industry dynamics: a framework for empirical work. Rev Econ Stud 62:53–82

Fudenberg D, Tirole J (1991) Game theory. MIT, Cambridge

Geroski PA, Machin S, van Reenen J (1993) Innovation and firm profitability. RAND J Econ 24(2):198–211

Geroski PA (1995) What do we know about entry? Int J Ind Organ 13:421–440

Griliches Z (1998) R&D and productivity: the econometric evidence. University of Chicago Press, Chicago

Grossman G, Helpman E (1991) Innovation and growth in the global economy. MIT, Cambridge

Klette J, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112(5):986–1018

Laincz C (2005) Market structure and endogenous productivity: how do R&D subsidies affect market structure? J Econ Dyn Control 29(1–2):187–223

Laincz C, Rodrigues ASR (2007) The impact of cost-reducing R&D spillovers on the ergodic distribution of market structures. Working paper. http://econpapers.repec.org/paper/pcawpaper/

Levin R, Klevorick A, Nelson R, Winter S (1987) Appropriating the returns from industrial research and development. Brookings Pap Econ Act 1987(3):783–820 (Special Issue on Microeconomics)

Mansfield E (1985) How rapidly does new industrial technology leak out? J Ind Econ 34(2):217–223

Mansfield E, Schwartz M, Wagner S (1981) Imitation costs and patents: an empirical study. Econ J 91:907–918

Maskin E, Tirole J (1988) A theory of dynamic oligopoly, I: overview and quantity competition with large fixed costs. Econometrica 56:549–569

Nelson R, Winter S (1974) Neoclassical vs. evolutionary theories of economic growth: critique and prospectus. Econ J 84:886–905

Nickell S (1996) Competition and corporate performance. J Polit Econ 104(4):724–746

Pakes A, McGuire P (1994) Computing Markov-perfect Nash equilibria: numerical implications of a dynamic differentiated product model. RAND J Econ 25(4):555–589

Peretto P (1999) Cost reduction, entry, and the interdependence of market structure and economic growth. J Monet Econ 43(1):173–195

Romer P (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer P (1990) Endogenous technical change. J Polit Econ 98(5: Part 2):S71–S102

Schmalensee R (1989) Interindustry studies of structure and performance chapter 16. In: Schmalensee R, Willig R (eds) Handbook of industrial organization, vol 2. North-Holland, Amsterdam

Segerstrom P (2007) Intel economics. Int Econ Rev 48(1):247–280

Song M (2006) A dynamic analysis of cooperative research in the semiconductor industry. Working paper. http://outside.simon.rochester.edu/fac/MSONG/papers.html

Symeonidis G (1996) Innovation, firm size and market structure: Schumpeterian hypotheses and some new themes. OECD Working Papers, No. 161

Thompson P (2001) The microeconomic structure of R&D based models of economic growth. J Econ Growth 6(4):263–283

Wadell R, Ritz P, Norton J, Wood M (1966) Capacity expansion planning factors. National Planning Association, Washington, DC

Weintraub G, Benkard CL, Van Roy B (2007) Markov perfect industry dynamics with many firms. Working paper. http://www.stanford.edu/~lanierb/

Acknowledgements

I would like to thank Michelle Connolly, Greg Crawford, Kent Kimbrough, Stephen Klepper, Enrique Mendoza, Pietro Peretto, J. Barkley Rosser, Curtis Taylor, Peter Thompson, participants of seminars at the SET Workshop (Venice International University, July, 2002), Iowa State, Carnegie Mellon, SUNY-Albany, University of Central Florida, Miami, Drexel, University of Southern California, Columbia, and the Duke University Macroeconomics Seminar for their many helpful comments and suggestions. Any and all remaining errors, of course, are solely my responsibility.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendices

1.1 Appendix A: Computation of the general equilibrium

This section gives a brief description of the algorithms that solve for the general equilibrium. A more complete technical appendix is available from the author upon request. Appendix B describes the key alteration that allows for growth and continually falling marginal costs.

The state space for each industry is defined over a maximum number of firms \(\overline{N}\) and a maximum number of private innovations \(\overline{I}\). The demand parameters determine the maximum number of firms that would choose to operate simultaneously in a market. Since the profit margin declines with each additional firm while all firms face fixed costs, \(\overline{N}\) exists. The maximum number of innovations follows from the concavity of the value function as shown in the examples of Figs. 1 and 2. However, numerical methods locate the upper bound. The algorithm for the single industry specifies \(\overline{I}\) and computes the value and policy functions. Simulations then determine the distribution of private innovations. If a firm reaches \(\overline{I}\) and continues to invest a positive amount, \(\overline{I}\) must be increased.

For the general equilibrium, the algorithm searches over P Y until the aggregate rate of return from the demand side for investment matches the required rate of return for consumers. The steps entailed are as follows. First, taking a set of parameters as given, includifng the price level and wage rate, profits are computed. These solutions are stored in a separate file. Second, an adaptation of the algorithm used in Pakes and McGuire (1994) solves for the single industry value and policy functions. Third, simulations based on the output of step 2 determine the ergodic distribution of market structures.Footnote 27 Using the probability weights for each market structure, another routine calculates the rate of return to investment and labor demand. If the rate of return is higher than ρ, the algorithm increases P Y and otherwise it decreases. The algorithm stops when the rate of return is within a specified tolerance level for ρ. Once the equilibrium ergodic distribution is determined, other programs use this input to analyze it.

The wage rate also needs to vary to clear the labor market. In practice, a wage rate is chosen initially resulting in a labor supplied by the aggregate solution and that level is taken as the economy-wide labor supply in the initial equilibrium. Fixing the wage rate initially reduces by the number of steps in the computational process. In other words, instead of initially pinning down the labor supply and finding the market clearing wage rate, the wage rate is fixed and the associate labor supply derived for the initial equilibrium only. Because policy experiments meant to compare with the baseline need to have the same labor supply, any comparative analysis then fixes the labor supply and allows the wage to vary.

1.2 Appendix B: Constantly falling marginal costs

In the Ericson-Pakes framework, the relative efficiency levels, as opposed to innovations, map one-to-one into marginal costs. Because the efficiency levels are bounded on a finite set of positive integers, there can be no growth through process innovation. However, I seek to retain the limits on the state of the market structure through the boundedness of the efficiency levels while allowing for constantly declining marginal costs. To introduce this alteration, define the variable \(i_{mt}^{\ast }\) to represent the “frontier efficiency”level of the industry at time t. The evolution of the frontier is given by: \(i_{mt}^{\ast }=i_{mt-1}^{\ast }+1I_{mw^{\ast }}\) where \(I_{mw^{\ast }}\) is an indicator variable taking on the value of one whenever the current industry leader innovates. What this notion captures is the fact that the industry leader always has the lowest marginal cost, i.e. the highest efficiency. \(i_{mt}^{\ast }\) includes both public and private innovations and measures the most advanced efficiency level attained by the industry over time and it increases by one every time the current industry leader experiences success in process innovation, though the industry leader may change over time.

However, the issue remains that if marginal costs are continually falling, then marginal costs will be changing over time confronting firms with completely new problems in every period which would make the state space intractable. Thus, the property of homogeneity of degree zero of profits in the vector of marginal costs is crucial to the solution method. This result implies that the state space need only include one set of vectors of marginal costs as firm behavior will not depend on the absolute levels of the marginal costs, but only on their relative levels between firms.

Rights and permissions

About this article

Cite this article

Laincz, C.A. R&D subsidies in a model of growth with dynamic market structure. J Evol Econ 19, 643–673 (2009). https://doi.org/10.1007/s00191-008-0114-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-008-0114-8