Abstract

This study explores the interplay among different types of incentives (monetary incentives, non-monetary incentives, and benefits) and managerial performance. We collect data via a questionnaire and use qualitative comparative analysis (QCA) to analyze them. Using data from 614 managers, we identify multiple incentive packages that are consistently related to high managerial performance. Specifically, our analyses reveal that non-monetary incentives in the form of autonomy and development opportunities are as related to high performance in isolation as their combination with recognition. High performance can also be achieved with the combination of traditional tangible benefits with (1) social support benefits and recognition or with (2) monetary incentives. Finally, our findings suggest that monetary incentives, social benefits, and autonomy and development opportunities are more important for the success of CFOs than to non-CFOs. Conversely, tangible benefits are particularly relevant for the high performance of non-CFOs but not for CFOs. Our findings contribute to the incentives literature by showing successful incentive packages that companies are using in practice and how they relate to different theories such as agency theory, self-determination theory, and human capital theory.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Incentives play a fundamental role in motivating individuals to achieve organizational goals (Armstrong & Brown, 2019; Ashton, 1990; Bonner et al., 2000; Bonner & Sprinkle, 2002; Christ et al., 2016; Incentive Federation, 2021; Sprinkle, 2003). However, extant literature offers mixed evidence regarding the effectiveness of incentives as drivers of individual effort and performance (e.g., Awasthi & Pratt, 1990; Bonner & Sprinkle, 2002; Bonner et al., 2000; Cerasoli et al., 2014; Libby & Lipe, 1992). Traditionally, organizations and researchers have focused on monetary incentives as a means of rewarding managers and employees (e.g., Brown, 2012; Thibault-Landry et al., 2017). However, recent evidence suggests that other types of rewards—such as non-monetary incentives imbued with meaning, purpose, appreciation, and intention—can be as effective as money (Thibault-Landry et al., 2017). Therefore, it is not surprising that today’s organizations are seeking to redesign their compensation contracts (Brink & Rankin, 2013). Specifically, aside from providing different performance-based pay schemes according to organizational and individual characteristics (Armstrong & Brown, 2019; Swiss, 2005), companies may, for example, provide additional learning and development opportunities to high-performing employees (Brown, 2012; Thibault-Landry et al., 2017), vary the level of decision autonomy (Brown, 2012; Merchant & Van der Stede, 2012), introduce recognition practices (Brown, 2012; Hewett & Conway, 2016; Long & Shields, 2010), allow flexible work hours (Thibault-Landry et al., 2017), or grant fringe benefits (Merchant & Van der Stede, 2012; Milkovich et al., 2014).

Monetary incentives, non-monetary incentives and benefits are used in combination by many companies (e.g., Armstrong & Brown, 2019; Chiang & Birtch, 2006; Incentive Federation, 2021; Milkovich et al., 2014; SHRM, 2018; Stajkovic & Luthans, 1997), but little is known about how these incentives work together (Sittenthaler & Mohnen, 2020). Prior research, mainly experimental studies, has focused on some of these incentives (e.g., Kelly et al., 2017; Lourenço, 2016; Presslee et al., 2013; Stajkovic & Luthans, 2001) and uncovered complementarity and substitution effects. We contribute to this research by providing field-based empirical evidence regarding different combinations of a wide range of incentives (monetary incentives, non-monetary incentives—such as recognition, feedback, and autonomy and development opportunities—and benefits—such as social support benefits and traditional tangible benefits), i.e., incentive packages, which are related to high managerial performance.

Drawing on questionnaire data from a sample of 614 managers and using qualitative comparative analysis (QCA) to analyze them, we identify multiple incentive packages that consistently are related to high managerial performance. Specifically, our analyses reveal that non-monetary incentives in the form of autonomy and development opportunities are as related to high performance in isolation as their combination with recognition. High performance can also be achieved with the combination of traditional tangible benefits with i) social support benefits and recognition or with ii) monetary incentives. Finally, our findings suggest that monetary incentives, social benefits, and autonomy and development opportunities are more important for the success of CFOs than to non-CFOs. Conversely, tangible benefits are particularly relevant for the high performance of non-CFOs but not for CFOs.

We contribute to the literature in three important ways. First, we expand the extant incentives literature by analysing combinations of a broad set of incentives—monetary (weight of performance-based pay on total compensation), non-monetary (recognition, feedback, autonomy and development opportunities) and benefits (social support benefits and traditional tangible benefits) — that are related to high managerial performance in field settings. Prior literature has focused on the analysis of incentives in isolation or in a limited number of incentives (e.g., Lourenço, 2016; Stajkovic & Luthans, 2001) and, therefore, our study provides a more complete picture about the types of incentives that companies are effectively using. Second, our study contributes to several theories that aim at explaining the use of incentives by organizations. Specifically, regarding agency theory, our study suggests that monetary incentives are not sufficient per se to induce high performance and that they need to be complemented with traditional tangible benefits. This finding contradicts the traditional assumption of agency theory (e.g., Baiman, 1990; Eisenhardt, 1989; Jensen & Meckling, 1976) which postulates that monetary incentives provide the necessary motivation to achieve high performance. Our findings also add to the ongoing debate in the literature regarding the cost versus incentive view of benefits in compensation packages within the scope of the principal-agent model. In particular, extending Marino and Zábojník’s (2008) study, we show that benefits should not be viewed solely as a cost and a way of managers extracting rents from the company (a product of the conflict of interest between managers and shareholders) but rather as a motivator to increase performance. Our findings are also important to self-determination theory (Deci et al., 2017) as they provide evidence that the use of autonomy and development opportunities and recognition—despite in our study being awarded conditional on the performance achieved and, therefore, having an extrinsic nature—may be a solution for companies to promote in their managers the internalization of certain goals and behaviors and, hence, to increase their autonomous motivation and, subsequently, their performance. Our study also adds to human capital theory (Rosen, 1976) by demonstrating that CFOs and non-CFOs have incentive packages with different combinations of incentives which likely reflects their distinct capabilities and capacity to influence the design of compensation systems. Finally, to the best of our knowledge, we are the first to explore incentive packages and their association with managerial performance using QCA to identify effective incentive packages. The QCA method is referred as one of the most suitable techniques to examine complex relationships among multiple variables relative to a desired outcome (Boon et al., 2019; Ragin, 2008), which is not possible with other methods (e.g., cluster analysis). Therefore, we contribute to the literature by uncovering successful combinations of incentives used by companies to obtain high performance.

The paper proceeds as follows. Section 2 presents the theoretical background and research question, Sect. 3 the research method, Sect. 4 the results, Sect. 5 additional evidence, and Sect. 6 the discussion of results. Finally, Sect. 7 concludes.

2 Theoretical background and research question

Ever since the pioneering work of Taylor (1911) regarding individual motivation at the workplace, monetary incentives are considered the main stimulus to induce desired individual behavior. This type of incentive involves providing a monetary reward such as bonuses, commissions, pay increases, or other monetary compensation according to the performance achieved (De Cenzo et al., 1996).

However, with Herzberg’s (1966) and Deci’s (1975) studies, other types of rewards gained emphasis as alternative ways to encourage desired behaviors. One of these alternatives is non-monetary incentives. Non-monetary incentives do not involve a direct payment to the employee and are generally related to psychological and emotional fulfillment (Assaf, 1999). Organizations use a wide range of non-monetary incentives that can vary in their nature, goal, and form (e.g., Armstrong & Brown, 2019; Brun & Dugas, 2008; Frey, 2006, 2007; Incentive Federation, 2021; Nelson, 2012; Ventrice, 2009). Examples of non-monetary rewards include recognition (e.g., of the organization, of co-workers, of supervisor), feedback, and autonomy and development opportunities (e.g., participation in the decision-making process, assignment of additional responsibilities, training, allocation of increased autonomy, and geographic mobility).

Benefits are also an alternative form of compensating agents and are particularly valuable in managerial roles. Benefits are granted not by the performance level achieved but according to the agent’s role in the firm. Therefore, benefits can be seen as ex ante incentives, i.e., conceded before the agent performs a task. Benefits usually intend to improve the quality of the work and the personal lives of the employees (Milkovich et al., 2014) and, therefore, can be a useful form of attracting, motivating, and retaining qualified employees (e.g., McCaffrey, 1990). Although the traditional agency theory considers benefits as a misuse of firm resources for managers’ private benefit that destroy firm value (Jensen & Meckling, 1976), they are widely used by modern companies. More recent developments in agency theory consider the role of benefits as an incentive motivator (Marino & Zábojník, 2008). Benefits can provide some type of social support, such as health/life insurance, paid time off/long-term disability benefit pay, pension supplement, financial support for geographic mobility, educational assistance, housing benefit, and workplace flexibility. They can also assume the form of more traditional tangible benefits, such as mobile phone, vehicle, free parking, subsidized meals/eating facilities for employees, discounts on company products, parties/gifts for employees’ children, sports facilities, and travel, tours, and excursions.

Organizations offer monetary incentives, non-monetary incentives, and benefits to their employees and managers with the expectation that performance will increase. However, the evidence collected thus far provides mixed results. For example, although empirical studies document positive performance effects of monetary incentives (e.g., Banker et al., 2001; Bareket-Bojmel et al., 2017; Jenkins et al., 1998; Lazear, 2000; Lourenço, 2016; Presslee et al., 2013; Shearer, 2004), some authors advocate that monetary incentives lead to a crowding out effect of intrinsic motivation, which causes a decrease in performance (Frey, 1994; Frey & Jegen, 2001; Frey & Oberholzer-Gee, 1997). Similar contradictory evidence can be found for non-monetary incentives (e.g., Alvero et al., 2001; Balcazar et al., 1985; Deci & Ryan, 1985; Deci et al., 1981; Eisenberger & Cameron, 1996; Lourenço, 2016; Stajkovic & Luthans, 2003) and benefits (e.g., Grossman & Hart, 1980; Hart, 2001; Jensen, 1986; Jensen & Meckling, 1976; Muse & Wadsworth, 2012; Muse et al., 2008; Rajan & Wulf, 2006). An explanation for these contradictory findings possibly resides in the type and number of incentives considered in each study, which may not include all organizational rewards available. In fact, earlier research considers the possibility that the effect of one incentive may be reinforced or reduced by the presence of (an)other incentive(s) (e.g., Grabner & Moers, 2013; Milgrom & Roberts, 1995). Therefore, it is important to consider broad combinations of different incentives that are widely used by organizations and not each incentive in isolation or in limited combinations of incentives (e.g., Lourenço, 2016; Stajkovic & Luthans, 2001).

There are two related streams of research regarding the interplay between different types of incentives. One stream of research compares the effectiveness of different rewards relative to monetary incentives. For instance, a quasi-experiment in a company by Stajkovic and Luthans (2001) shows that monetary incentives are more effective than non-monetary incentives (i.e., recognition and feedback) in improving work performance. However, recent studies in other contexts provide opposite results. For instance, field experiments on prosocial behavior show that non-monetary incentives (i.e., recognition) lead to a greater performance when compared to monetary incentives (Ashraf et al., 2014; Handgraaf et al., 2013). These results have been replicated in (simulated) working environments, wherein researchers have shown that non-monetary incentives (e.g., in-kind gifts) are more effective in increasing employee’s performance than actual money because the former signals effort and time invested in the selection of the non-monetary gift by the employer, which is reciprocated with more effort from the employees (Kube et al., 2012). Other scholars suggest that being engaged in meaningful work can play a role in the performance effects of monetary and non-monetary incentives such as recognition (Kosfeld et al., 2017).Footnote 1 Conversely, a lab experiment by Sittenthaler and Mohnen (2020) shows no significant difference in individual performance in response to monetary, non-monetary (in the form of a prize), and mix incentives.

Another stream of research focuses on the examination of substitution or complementarity effects among different types of incentives. Similar to the previous stream, the main emphasis is on monetary incentives. Early studies from the organizational behavior literature that analyze the interaction between monetary incentives and feedback with regard to task performance fail to find such complementarity effect (e.g., Arkes et al., 1986; Chung & Vickery, 1976; Hogarth et al., 1991; Phillips & Lord, 1980; Weiner & Mander, 1978). Likewise, a managerial accounting field experiment in a retail services company by Lourenço (2016) also does not find either an interaction between performance feedback and monetary incentives or with recognition. Conversely, in a lab setting, Buchheit et al. (2012) find a complementarity effect between monetary incentives and feedback relative to peers when participants are engaged in a complex task. Even though not tested directly, this complementarity effect is also suggested in other lab experiments when different forms of compensation and feedback are manipulated (Christ et al., 2016; Hannan et al., 2008; Sprinkle, 2000; Tafkov, 2013). Similarly, when exploring the effect of a team-based incentive plan on labor productivity, product quality, and worker absenteeism, Román (2009) finds that complementing monetary incentives with other management control practices (such as performance feedback or punishment for deficient worker behavior) leads to better results.

Studies that focus on the complementarities between monetary incentives and some form of recognition also provide contradictory evidence. For example, a field experiment conducted with university students by Kvaløy et al. (2015) and an analytical study by Kvaløy and Schöttner (2015) show a complementarity effect of non-contingent verbal motivation (i.e., motivational talk) and monetary incentives on individual performance. Conversely, Lourenço (2016) provides evidence regarding a substitution effect between monetary incentives and recognition in a field experiment in a retail services company. The explanation for this substitution effect on individual performance is the different motivation mechanisms (tangible payoffs versus social esteem) that underlie each of these incentives. Meta-analyses regarding the use of monetary and non-monetary incentives (i.e., feedback and recognition) show that all rewards have positive effects on performance (Stajkovic & Luthans, 1997, 2003), but the use of these incentives in combination seems to produce stronger effects (Stajkovic & Luthans, 2003).

Overall, the literature provides contradictory evidence regarding the relationship between different types of incentives. Moreover, the same type of incentive used in different academic studies and by different real-word companies varies immensely. For instance, monetary incentives may be expressed as a flat rate, a piece rate, a variable ratio, a quota, or a tournament (e.g., Bonner et al., 2000).Footnote 2 The same applies to non-monetary incentives and benefits which can assume many different forms and have a different nature (e.g., Incentive Federation, 2021). Considering the purpose of this study and the wide range of incentives in each category that are used by companies, the development of specific hypotheses is too contrived. Therefore, we take an exploratory approach and analyse evidence from the field regarding how companies use different incentives and combine them into successful incentive packages. The notion of ‘incentive packages’ is consistent with studies that examine relationships among multiple elements, instead of individual elements in isolation (e.g., Einhorn et al., 2021; Fiss, 2011; Schneider et al., 2010). In the accounting literature, management control systems packages have been considered useful for a better understanding of the effectiveness of management control systems design (Chenhall, 2003; Friis et al., 2015; Grabner & Moers, 2013; Malmi & Brown, 2008; Merchant & Van der Stede, 2012). Furthermore, Malmi and Granlund (2009, p. 610) argue that an effect of a certain management control system element in isolation ‘is probably not the most puzzling issue’ but understanding the effects of certain combinations of the management control system elements ‘needs more attention’. Therefore, the analysis of incentive packages and their relationship with individual performance can provide a better understanding of incentive systems design. Our study in a real-world setting provides an opportunity to explore distinct types of incentives (monetary incentives, non-monetary incentives, and benefits) that may effectively be combined into incentive packages related to high performance. Thus, we formulate the following research question:

RQ. What types of incentives may be combined into incentive packages that are related to high individual performance?

3 Research method

3.1 Sample and data description

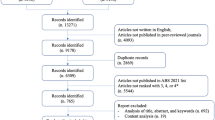

We collected data from two questionnaires targeted at managers of large, medium, and small enterprises in Portugal.Footnote 3 We focused our study on managers because they receive a wide range of incentives, which can be combined in different incentive packages. The first questionnaire collected data regarding organizational characteristics and the second regarding the manager.

From an initial sample of 35,459 firms, we successfully sent the first questionnaire to 23,439 firms.Footnote 4 From these requests, we received 4,496 usable responses. This corresponds to an overall response rate of 19.18%. Using this database, a team of research assistants contacted each of these firms via telephone to collect information about the name and e-mail addresses of the directors/managers. This information served to create a second database that was used to send the second questionnaire. Thus, from the initial sample of 4,496 firms we obtained 13,312 names with their related job roles and e-mail addresses (personal or organizational). From that list of names and e-mail addresses, we successfully sent 9,085 questionnaires.Footnote 5 We received 1,703 responses, which correspond to a usable response rate of 18.75%. However, because we have to restrict our sample to respondents who completed the questions about incentives and for whom performance can be compared to that of other managers in the company (our measure of performance), the number of usable observations was reduced to 905. Because some respondents belong to the same company, and in order to assure the independence of observations, we dropped multiple observations from the same firm.Footnote 6 Hence, the final sample consists of 614 observations.

To test for potential (non-) response bias we apply two procedures commonly used in the literature (e.g., Armstrong & Overton, 1977). First, we compare the size, location, and industry representation of the respondents to the non-respondents from the list of 9,085 e-mails sent successfully. An independent sample t-test regarding the firm size (measured by the number of employees) shows no difference between respondents (\(\overline{X }\)= 129.95) and non-respondents (\(\overline{X }\)= 108.00). A chi-square test shows that there are no statistically significant differences regarding location of the sample of respondents versus non-respondents. Nevertheless, a chi-square test regarding industry shows significant differences between the two groups (p < 0.01), which is a limitation of this study.Footnote 7

Second, we compare the responses of early and late respondents as late respondents are more similar to non-responders (Moore & Tarnai, 2002). We use the date of the received response to distinguish between early and late respondents. Overall, the results indicate that there are no statistically significant differences between the two groups for the variables examined in our model.

Given that all data used are obtained from a single source at a single point in time, we address the concern of common method bias by applying both procedural and statistical remedies (Podsakoff et al., 2003; Speklé & Widener, 2018). Ex ante, i) we employed simple wording and provided examples where appropriate to improve understanding and appropriateness for the sample frame; ii) we safeguarded the confidentiality of the respondents; iii) we used a distinct response scale for the variables of interest; and iv) we carefully and thoroughly pre-tested the questionnaire with practitioners (managers not in the sample) and academics (management accounting researchers) to ensure the instrument’s clarity, readability and length. Ex post, we apply Harman’s one-factor test to address common method variance concerns regarding the measures (Mossholder et al., 1998; Podsakoff & Organ, 1986). The factor solution yields ten factors with eigenvalues greater than 1. Together they account for 53.84% of the total variance. The first factor explains 13.20% of the total variance, which means that it does not account for the majority of the variance. In sum, the results of both procedures indicate that common method bias is unlikely to be a serious concern for this study.

Table 1 reports the descriptive statistics for the respondents and firm characteristics. The respondents are, on average, 43.90 years old and have 21.39 years of professional experience. Most occupy the position of chief financial officer (CFO) (41%). Table 1 also shows that respondents come mainly from the manufacturing and wholesale and retailing industries (36% and 27%, respectively). Sample firms have an average of 176 employees.

Panel A (B) in Table 2 shows the frequency, sorted by descending order, of each type of non-monetary incentives (benefits) offered by the organizations.

3.2 Construct measurement

To increase the overall quality of the survey instrument, we use, when possible, questions that have been validated in prior studies and follow Bedford and Speklé’s (2018a) recommendations.Footnote 8 Below, we present more details on the measurement of the variables obtained. Appendix presents the questions and items used to measure the main constructs.

3.2.1 Monetary incentives

We measure monetary incentives as the percentage of monetary incentives (MONINC) included in annual compensation. We ask respondents to indicate which would have been the weight of his/her variable compensation, i.e., dependent on the performance in his/her total annual compensation if he/she had fulfilled all the established objectives/targets (e.g., Abernethy et al., 2017). The response can be between 0 and 100%.

3.2.2 Non-monetary incentives

To measure non-monetary incentives, we ask respondents to choose from a list of non-monetary incentives those that are offered by their company and are indexed to their performance but that have no impact on their annual compensation. Following prior literature (e.g., Milkovich et al., 2014; Thibault-Landry et al., 2017), we create three categories of non-monetary incentives: i) recognition (RECOG), which includes recognition of the organization, recognition of co-workers, recognition of supervisor; ii) feedback (FBACK), which corresponds to the feedback provided; and iii) autonomy and development opportunities (AUT&DEV), which includes participation in the decision-making process, assignment of additional responsibilities, training, allocation of increased autonomy, and geographic mobility.Footnote 9 Each category of non-monetary incentives is a count variable resulting from the sum of the items marked by the respondents. It may vary from 0 (the respondent does not receive non-monetary incentives) to the maximum number of non-monetary incentives listed in each category. Thus, RECOG may vary from 0 to 3, FBACK from 0 to 1, and AUT&DEV from 0 to 5.

3.2.3 Benefits

To measure benefits (BENEF), we ask respondents to choose from a list of benefits that are available in their company. Due to the miscellaneous nature of the set of benefits available, we follow Luo et al.’s (2011) and Marino and Zábojník’s (2008) reasoning to create two categories. The first is social support benefits (S_BENEF), which includes health/life insurance, paid time off/long-term disability benefit pay, pension supplement, financial support for geographic mobility, educational assistance, housing benefit, and workplace flexibility. The second category corresponds to more traditional tangible benefits (T_BENEF), which includes mobile phone, vehicle, free parking, subsidized meals/eating facilities for employees, discounts on company products, parties/gifts for employees’ children, sports facilities, and travel, tours, and excursions. Each category of benefits is a count variable resulting from the sum of the items marked by the respondents. It may vary from 0 (the respondent does not receive benefits) to the maximum number of benefits listed in each category. S_BENEF may vary from 0 to 7 and T_BENEF from 0 to 8.

3.2.4 Managerial performance

To measure the individual performance of managers (PERF), we use a self-reported survey question developed by Mahoney et al. (1965), identified in the inventory of constructs in survey-based management accounting research by Bedford and Speklé (2018b), and recurrently used in prior accounting studies (e.g., Chalos & Poon, 2000; Chong & Chong, 2002; Hall, 2008; Marginson & Ogden, 2005; Otley & Pollanen, 2000; Parker & Kyj, 2006).Footnote 10 The original scale assesses managerial performance along eight dimensions that are related to planning, investigating, coordinating, evaluating, supervising, staffing, negotiating, and representing, and also include an overall assessment of performance. Hall (2008) reduces the scale to 7 items by excluding 2 items (negotiating and representing) because of low factor loadings and not belonging to a unidimensional managerial performance scale. With the intention to reduce the length of the questionnaire, we use this reduced form and ask respondents to indicate on a 7-point Likert scale (1 = well below average to 7 = well above average) the extent to which their performance was below or above average on each of the 7 remaining items. Exploratory factor analysis (EFA) using principal-component extraction supports unidimensionality for the construct, with all items loading greater than 0.76 on a single factor (Variance = 64.22%, Cronbach’s alpha = 0.91, composite reliability = 0.90).Footnote 11 Hence, we compute an average score of all items of this variable and use it for further analyses.

3.2.5 Descriptive statistics and correlations

Table 3 presents descriptive statistics and Table 4 shows bivariate correlations for the measurement instruments. The correlations among the variables provide first evidence on the relationship between different types of incentives and performance. We find a positive and statistically significant correlation between managerial performance and autonomy and development opportunities (r = 0.08; p < 0.1).

3.3 Calibration and data analysis

We employ set-theoretic method termed qualitative comparative analysis (QCA) by using STATA 15.Footnote 12 QCA identifies combinations of causal conditions (i.e., independent variables) that can lead to the outcomes of interest (dependent variables). QCA distinguishes from other exploratory approaches (e.g., cluster analysis) by allowing us to examine the combination contribution of different causal conditions on the outcome of interest (Fiss, 2007; Haynes, 2014). That is, instead of considering one causal condition alone, QCA detects multiple combinations of these causal conditions that may lead to a high level of the outcome (Ragin, 2008; Schneider & Wagemann, 2012). Moreover, this method determines combinations of causal conditions that are necessary (i.e., those that produce the outcome but by themselves may not be enough) and sufficient (i.e., those that always lead to the outcome) for high outcome levels (Ragin, 2008). Additionally, this approach includes statistics for coverage (similar to an R-squared value) and consistency (similar to a p-value), which are lacking in other exploratory methods such as cluster analyses (Bedford et al., 2016).

The first step in performing QCA corresponds to calibration of the construct measures. Calibration involves the specification of the degree of membership that a particular variable takes in a specific category. Variables can be calibrated to either crisp sets (i.e., the membership of a variable in the category is binary: 0 for non-membership and 1 for membership) or fuzzy sets (i.e., variables take varying degrees of memberships from 0 to 1) (Ragin, 2008).Footnote 13

To calibrate non-binary measures, we follow Ragin’s (2008) recommendation and employ a direct calibration method, which converts specified threshold variables to fuzzy set scores through a logistic function. This method presupposes the specification of the three threshold values that correspond to full membership (1), full non-membership (0), and a crossover point (0.5). The value of 0.5 indicates neither membership nor non-membership in the category (i.e., the point of maximum ambiguity) (Fiss, 2011; Woodside, 2013). When fuzzy set membership scores meet the crossover point (i.e., 0.5), this may cause difficulties in intersecting sets (Ragin, 2008). To avoid the problem of dropping these cases from the analysis, we add a constant of 0.001 to all calibrated values equal to 0.5 (Fiss, 2011).

We follow prior literature (e.g., Bedford et al., 2016; Einhorn et al., 2021; Erkens & Van der Stede, 2015; Fiss, 2011) to calibrate our variables of interest. Specifically, for monetary incentives (MONINC), two categories of benefits (S_BENEF and T_BENEF) and two categories of non-monetary incentives (RECOG and AUT&DEV)—which are continuous or count variables—we code managers as having few benefits/incentives if they have raw scores in the bottom 25th percentile (i.e., full non-membership) and as having many incentives/benefits if their raw scores are in the 75th percentile (i.e., full membership). We set the median as the crossover point.Footnote 14 Because FBACK is a binary variable, we code it as crisp set and use 0 for non-membership and 1 for membership. To calibrate managerial performance (PERF), which is a Likert scale, we also follow the abovementioned studies and use the endpoints of the scale for full non-membership and full membership, respectively, and scale midpoints for the crossover point.Footnote 15 Table 5 presents details of the calibration of the variables of interest.

The second step in performing QCA consists in the construction of the truth table (Ragin, 2008). The truth table represents all possible combinations of incentives for outcome variable (i.e., managerial performance). This truth table contains 16 rows that corresponds to \({2}^{k}\), where k is a number of causal conditions (i.e., incentives) in the analysis. In the next step, we refine the truth table (i.e., reduce the number of truth table rows) by applying the thresholds to: i) frequency and ii) consistency (Ragin, 2008). First, the frequency threshold sets the minimum number of cases required for a solution to be considered (Fiss, 2011). To avoid inferences from single observations, we use a frequency threshold of at least four observations (Maggetti & Levi-Faur, 2013).Footnote 16 This frequency threshold used is consistent with Ragin’s (2008) suggestion that the threshold adopted should capture at least 75–80 percent of the cases. Second, to guarantee reliable inferences from the truth table, the consistency threshold should be as close as possible to 1 (Greckhamer, 2011), with the minimum recommended threshold of 0.80 (e.g., Schneider & Wagemann, 2012).

4 Results of QCA

Prior to conducting our main tests, we perform necessity analysis to evaluate whether any of the causal conditions (incentives in our study) are necessary when the outcome occurs (high performance in our study) (Ragin, 2008). A causal condition is considered to be necessary if that condition is always present (or absent) when the outcome is present (or absent) (Schneider & Wagemann, 2012). In our study, as none of the incentives exceeds the consistency threshold of 0.90 suggested by prior literature for this type of analyses (Greckhamer et al., 2018; Schneider et al., 2010) there is no necessary condition for achieving high performance. This means that the absence of any incentive does not prevent the occurrence of high performance. Therefore, in what follows, we will focus on the analysis of the sufficient conditions, i.e., on the incentive packages that are consistently associated with high managerial performance.

Table 6 presents the results of the parsimonious solution.Footnote 17 Consistent with previous literature (Bedford et al., 2016; Fiss, 2011; Ragin & Fiss, 2008), solid circles, (⬤) refer to the presence of an incentive and circles with a cross ( ⊗) designate its absence. Blank spaces indicate redundant incentives as the outcome is unaffected by its presence or absence.

The measures for consistency and coverage are also reported. Coverage is similar to a R-square value, as it indicates the degree to which a particular incentive package explains the outcome. That is, the higher a package’s coverage, the more empirically relevant the incentive package is for reaching high managerial performance. Coverage encompasses two portions: raw and unique. Raw coverage indicates which share of the outcome is explained by an incentive package, and unique coverage indicates which share of the outcome is exclusively explained by an incentive package (i.e., without overlap with other packages). Consistency score is analogous to a p-value in regression analyses. In other words, the higher a consistency of the incentive package, the stronger the evidence for a package being related to high managerial performance (e.g., Bedford et al., 2016; Erkens & Van der Stede, 2015).

Overall, we find five incentive packages that explain high managerial performance. Each resulting package—which represents a simplified combination from the truth table rows—displays a consistency not lower than 0.94. The overall solution consistency is 0.94, indicating that the identified packages are strongly related to high managerial performance. Coverage is also in the acceptable range, with a total raw coverage of 0.44, which indicates that the combined solutions account for about 44% of membership in managerial performance. In sum, the results indicate that the presented solution is quite informative, because solution consistency is greater than 0.75 and solution coverage is greater than 0.25 (Ragin, 2008; Woodside, 2013). Moreover, the findings suggest that all packages are empirically relevant since unique coverage for all of them exceeds 0.0 (Ragin, 2006; Schneider et al., 2010).

Packages 1a and 1d suggest that the use of recognition is associated with high managerial performance, but only if the organization also provides other incentives. Package 1a illustrates high performance when recognition is combined with social support benefits and traditional tangible benefits, in the absence of monetary incentives and feedback. Package 1d represents a combination of recognition and autonomy and development opportunities in the absence of traditional tangible benefits and feedback. Packages 1b and 1c show a successful combination of monetary incentives and traditional tangible benefits in the absence of recognition and autonomy and development opportunities (package 1b) and of social support benefits (package 1c). Package 1e indicates that managers show high performance when they are provided solely with autonomy and development opportunities.

In sum, and answering our research question, we find multiple incentive packages that are consistently related to high managerial performance. Specifically, our analyses reveal that non-monetary incentives in the form of autonomy and development opportunities are as related to high performance in isolation as their combination with recognition. High performance can also be achieved with the combination of traditional tangible benefits with i) social support benefits and recognition or with ii) monetary incentives.

5 Additional evidence

Given the fact that CFO roles can be quite different from non-CFO positions (Caglio et al., 2018), we provide further evidence for samples of CFOs and non-CFOs. To perform the CFO analysis, we exclude 364 observations referring to non-CFOs, keeping 250 observations of CFOs. To perform the non-CFO analysis, we exclude 250 observations referring to CFOs and 144 observations referring to “Other managerial positions” (due to the heterogeneous nature of positions included in this classification). Therefore, we keep 283 observations of non-CFOs. Table 7 presents the descriptive statistics of monetary incentives, non-monetary incentives, and benefits for these subsamples.

Table 8 shows that the parsimonious solutions for both subsamples of CFOs and non-CFOs are informative (Ragin, 2008; Woodside, 2013) and all packages are empirically relevant (Ragin, 2006; Schneider et al., 2010).

The CFO results suggest that these professionals can achieve high performance with the combination of i) monetary incentives, social support benefits, and recognition; ii) social support benefits and autonomy and development opportunities, or iii) monetary incentives and autonomy and development opportunities.

The non-CFO results suggest that in isolation autonomy and development opportunities or traditional tangible benefits are as related to high performance as the combination of traditional tangible benefits with i) monetary incentives or ii) recognition.

Comparing the results of the CFO sample with the non-CFO sample, one can observe that monetary incentives, social benefits, and autonomy and development opportunities appear to be more important for the success of CFOs than to non-CFOs. Monetary incentives and autonomy and development opportunities are present in two packages out of three successful packages for CFOs but in only one package out of four for non-CFOs. Conversely, traditional tangible benefits seem to be important for non-CFOs but not for CFOs as these benefits are present in three out of four packages of the non-CFOs sample and they are not part of any successful package of the CFO sample.

6 Discussion of results

Earlier research considers the possibility that the effect of one incentive may be reinforced or reduced by the presence of (an)other incentive(s) (e.g., Grabner & Moers, 2013). Therefore, it is important to consider combinations of different incentives. This study adds to the ongoing management accounting debate regarding successful combinations of incentives, i.e., incentive packages related to high performance.

First, our study suggests that monetary incentives are not sufficient per se to obtain high managerial performance. This finding contradicts the traditional assumption of agency theory, which postulates that monetary incentives provide the necessary and sufficient motivation for agents to exert effort aligned with the interests of the principal (e.g., Baiman, 1990; Eisenhardt, 1989; Jensen & Meckling, 1976). Particularly, our results show that monetary incentives need to be complemented with traditional tangible benefits (e.g., mobile phone, vehicle, free parking). These findings reinforce Marino and Zábojník’s (2008) incentive view of benefits within the principal-agent model, which suggests that benefits should be considered as an important component of a complex incentive system as they can shield the manager from the risk of performance-based pay. Therefore, benefits should not be viewed solely as a cost and a way of managers extracting rents from the company (a product of the conflict of interest between managers and shareholders) but rather as a motivator to increase performance. In our setting, both traditional tangible benefits and social support benefits, combined with recognition, also lead to high performance which suggests that benefits can even replace monetary incentives as a motivator as long as they are combined with recognition. This is also aligned with Marino and Zábojník (2008)’s work suggesting that, in the scope of the principal-agent approach, firms can use benefits to reduce performance-based pay, i.e., monetary incentives. In this regard, the size of the firm may also be relevant in explaining the use of monetary incentives and traditional tangible benefits as large firms (compared to small firms) have more capacity to design and implement performance-based compensation and benefits, and, hence, to make greater use of this type of compensation (Lee, 2009). Untabulated results corroborated this argument as the size of the firms with packages that include monetary incentives is larger than that of firms with packages that do not include monetary incentives.Footnote 18

Second, our study shows the relevance of non-monetary incentives, such as autonomy and development opportunities, and recognition. Specifically, we find that the use of autonomy and development opportunities in isolation can lead to high managerial performance, as well as their combination with recognition. These findings contribute to self-determination theory (Deci et al., 2017) as they support the premise that extrinsic rewards that directly speak to autonomy and relatedness needs can elicit high performance without the expected motivation crowding out (e.g., Frey, 1994; Frey & Jegen, 2001; Frey & Oberholzer-Gee, 1997) of using traditional extrinsic rewards (e.g., money). Therefore, following this rationale, the use of autonomy and development opportunities and recognition—despite in our study being awarded conditional on the performance achieved and, therefore, having an extrinsic nature—may be a solution for companies to promote in their managers the internalization of certain goals and behaviors and, hence, to increase their autonomous motivation and, subsequently, their performance. Autonomy and development opportunities are especially relevant for managers who are building their career path and still looking for future promotions or new jobs. Consistent with this argument, we find that incentive packages that include autonomy and development opportunities (either alone or complemented with recognition) have younger and less experienced managers, while incentive packages that are based on monetary incentives and traditional tangible benefits have older and more experienced managers.Footnote 19 These results are consistent with Petroulas et al.’s (2010) study, which suggests that younger generations of employees look for rewards such as more interesting work assignments, while older generations of employees place greater value on money and outward signs of achievement.

It is also noteworthy that feedback is not included in any incentive package. Hence, we fail to find support for the suggested complementarity between feedback and monetary incentives (e.g., Buchheit et al., 2012; Christ et al., 2016; Hannan et al., 2008; Sprinkle, 2000; Tafkov, 2013). One explanation for this contradictory finding may be the type of feedback used in prior studies, which is typically relative performance information (e.g., Buchheit et al., 2012; Hannan et al., 2008; Tafkov, 2013). Conversely, in our study we only measure the presence or absence of feedback (single item) without specifying the types of feedback. This is a limitation of our study. Nevertheless, our results are in line with Lourenço’s (2016) study, which suggests independence (no interaction) between performance feedback (relative to a target and not peers) and monetary incentives or non-monetary incentives, in the form of recognition.

Finally, our findings suggest that monetary incentives, social benefits, and autonomy and development opportunities appear to be more important for the success of CFOs than to non-CFOs. Conversely, tangible benefits seem to be important for non-CFOs but not for CFOs. These results add to human capital theory (Rosen, 1976) and its extension to executive compensation by Caglio et al. (2018), which suggests that compensation should reflect unique managerial capabilities such as knowledge and expertise. In fact, the CFO is considered as an executive with unique knowledge and influence over financial decisions (Indjejikian & Matějka, 2009; Maas & Matějka, 2009). Thus, compared with non-CFO roles, CFOs may receive compensation packages with more monetary incentives, social benefits, and autonomy and development opportunities that reflect their unique managerial skills and differential expertise. These findings are also aligned with agency-type arguments suggesting that the CFO (in contrast to non-CFO) might exploit his/her differential financial knowledge to his/her personal advantage, for example, by making decisions that favor his/her own pay (Graham et al., 2005). In contrast, non-CFOs do not carry so much authority and power, which limits their influence over the design of compensation packages. Nevertheless, and because these managers still need to be motivated to exert greater effort and better perform their tasks, they receive traditional tangible benefits (e.g., mobile phone, vehicle, free parking) as a signal of their specific managerial role (Marino & Zábojník, 2008).

7 Conclusion

Drawing on questionnaire data from a sample of 614 managers and using QCA to analyze them, we find that there are multiple ways by which incentives may be combined into packages related to high managerial performance. Specifically, we find that the use of non-monetary incentives in the form of autonomy and development opportunities are as related to high performance in isolation as their use in combination with recognition. High performance can also be achieved with the combination of traditional tangible benefits with i) social support benefits and recognition, or with ii) monetary incentives. Finally, our findings suggest that monetary incentives, social benefits, and autonomy and development opportunities are more important for the success of CFOs than to non-CFOs. Conversely, tangible benefits are particularly relevant for the high performance of non-CFOs but not for CFOs.

Overall, our results somewhat contradict the assumption of agency theory, which postulates that monetary incentives provide the necessary and sufficient motivation for agents to exert effort aligned with the interests of the principal (e.g., Baiman, 1990; Eisenhardt, 1989; Jensen & Meckling, 1976). Our study suggests that monetary incentives per se are not sufficient to motivate managers to achieve a high performance. Conversely, providing managers with autonomy and development opportunities appears to be sufficient to obtain high managerial performance. Besides autonomy and development opportunities, our study also uncovers the role of recognition and benefits as drivers of performance in combination with other incentives. Therefore, our study sheds new light into compensation systems.

Our study has important implications for practice. First, owners and top-managers should be aware that there are multiple combinations of incentives (i.e., incentive packages) that are associated with high managerial performance. Second, our study shows that there is no need to base incentive systems solely on monetary incentives, which can imply a large cost to the companies. Instead, high performance can be achieved with the use of autonomy and development opportunities (solely or jointly with recognition) or with the combination of recognition and benefits.

The findings of our study should be interpreted in light of its limitations. First, and although we take several steps to ensure the reliability of the data (i.e., pre-test of instrument, construct, and content validity), our study shares common drawbacks of survey studies. One of them is a (non-) response bias in terms of industry. This limitation suggests that our findings should be generalized with caution to industries not well represented in our study. Second, we measure non-monetary incentives and benefits as binary choices regarding their use or not in the company. This option enabled us to reduce the extension of the questionnaire but does not capture the intensity of use of these different incentives that could be captured with a Likert Scale. Hence, we fail to capture the intensity of use of each specific incentive, but we are able to capture that intensity by the type/category of incentive—monetary incentives, recognition, autonomy and development opportunities, social support benefits, and traditional tangible benefits—as we consider the number of items in each category. Third, because we use broad categories of incentives (e.g., autonomy and development opportunities) and broad descriptions of each item (e.g., recognition from the supervisor), our study cannot provide specific insights regarding the detailed implementation of each incentive category and items. However, these broad descriptions enabled us to map the use of a large set of incentives in the field and to document successful incentive packages. Fourth, we measure feedback as a single item which does not reflect all the different types of feedback that companies may be using. Therefore, our results regarding feedback should be generalized with caution. Fifth, we did not measure the salary level as part of incentives’ packages. The salary level can be seen as an important component of a compensation package, but in the questionnaire, we avoided asking for euro amounts as this could deter participants from answering the questionnaire. Sixth, we did not capture the prior level of performance. Because the prior level of performance may influence the efficacy of certain incentives, e.g., feedback and recognition, our results regarding these incentives should be generalized with caution. Another limitation refers to the theoretic nature of QCA and, therefore, it should not be applied mechanically. Instead, all conclusions are drawn upon researchers’ subjective judgement. Thus, to mitigate this issue, we were as transparent as possible with regard to the choices made (Bedford & Sandelin, 2015). Additionally, this study does not incorporate the evolution of incentive practices and managerial performance over time. To gain a better understanding of the causality mechanisms between incentives and performance, future research can investigate the long-term dynamics of the relationship between these variables. Finally, although our study examines a wide range of incentive practices, modern organizations explore increasingly novel forms of incentives to reward managers. Thus, a useful extension of this study might be to examine the effect of other incentive practices on individual behaviors (e.g., the use of tangible incentives, corporate jets, computers, meditation hour, grooming stipend, collaborative culture). Moreover, future studies can also extend our research by including other managerial behaviors and attitudes as outcomes of the incentive systems (e.g., satisfaction, turnover, absenteeism, organizational commitment, job involvement). Finally, as the QCA approach employed in this study does not allow to directly draw conclusions regarding interdependencies among the different incentives, future research can extend our findings by directly testing complementarities and substitution effects among the different elements of the incentive packages. Despite the limitations and avenues for future research, we consider this study as a promising step forward in the literature regarding the use incentive packages and their relation to managerial performance.

Data availability

The datasets generated and analyzed during the current study are not publicly available due the fact that they constitute an excerpt of research in progress.

Notes

Ariely et al. (2008) consider meaningful work as a task that is recognized by others and/or has some point or purpose. Kosfeld et al. (2017)show that monetary incentives affect individual performance independently of the level of task meaningfulness (either low or high). In contrast, meaningfulness and non-monetary incentives interact negatively: recognition increases performance only if individuals perceive that their work has low meaning.

In the scope of this study, we use monetary incentives as the percentage of variable pay, i.e., pay contingent on performance, in the total annual compensation.

We obtain a list of companies from InformaDB, a firm specialized in corporate information. We excluded micro-enterprises (companies with less than 10 employees) because these companies are likely to have less developed incentive systems and are less likely to answer questionnaires.

The reasons for this smaller sample are the following: refusal to participate, organization no longer in operation, missing or invalid telephone contact, no telephone contact available via web search, incorrect e-mail address, full mailbox, insufficient capacity of the mailbox, and e-mail considered as spam.

The reasons for this smaller sample are similar to those described in the previous footnote.

We eliminate multiple answers from the same firm by using stratified random sampling procedure (using the firm identification as the stratifying criterion). This procedure assures that each observation from our final sample comes from different companies.

We believe that (non-) response bias regarding industry is not a major concern in our study due to two reasons. First, (non-) response bias may occur due to the small number of observations in certain categories (e.g., arts, entertainment, and recreation [1 observation], public administration and defense; compulsory social security [2 observations], and agriculture, forestry and fishing [3 observations]). Second, industry is not associated with the dependent variable (the F test of an ANOVA of industry on performance is not statistically significant).

In some cases, we make slight modifications with the aim to fit the measures to the present research context. In addition, we draft the full version of the questionnaire in English and after that translate it into the local language of the managers following the procedures used in intercultural research (e.g., Ady, 1994). First, we carefully translate the questionnaire from its original English version to the local language of the managers. Second, another researcher fluent in both languages review our translation. Third, another researcher performs a retranslation of the instrument. Finally, researchers compare the retranslation wording with the original wording and resolve differences between the two.

The aggregation of non-monetary incentives into the third category (AUT&DEV) is based on the idea that these non-monetary incentives aim to provide the manager with opportunities for advancement and continuous learning.

According to prior studies, self-reported measures of performance are valid and tend to be less biased than supervisor ratings (Dunk, 1993; Marginson & Ogden, 2005; Parker & Kyj, 2006). Moreover, self-reported subjective measures of subordinate performance are highly correlated with supervisors’ subjective ratings of subordinate performance, as well as with objective measures of subordinate performance (Furnham & Stringfield, 1994; Heneman, 1974).

STATA allows performing QCA by applying a new command called fuzzy, which uses the Quine–McCluskey algorithm to logically reduce the combinations of causal conditions (Longest & Vaisey, 2008).

Crisp set (csQCA) and fuzzy set (fsQCA) are two main variants of QCA. The former operates exclusively with binary variables, while the latter is more appropriate for variables measured as continuous values (Ragin, 2008).

As 25th percentile is equal to median for S_BENEFITS, we set full non-membership as 0.

The use of ordinal Likert scales to measure constructs already provides qualitative anchors (e.g., ‘strongly agree’, ‘somewhat agree’, ‘neither agree nor disagree’, ‘somewhat disagree’, and ‘strongly disagree’) that conceptually may provide the calibration thresholds of set memberships (Fiss, 2011).

Frequency threshold indicates the number of observations (i.e., managers) required to be considered valid empirical evidence. Thus, we retain packages (rows in the truth table) that have at least four observations.

The parsimonious solution is the recommended representation of the results because it presents a simplified view of the results by displaying only the core conditions with the strongest empirical support (Ragin, 2008).

An ANOVA comparing the size of the firms that include monetary incentives in their packages and those without monetary incentives is statistically significant (p < 0.05).

An ANOVA comparing incentive packages with and without autonomy and development opportunities reveals significant difference between these packages in terms of age (p < 0.01) and professional experience (p < 0.01).

References

Abernethy, M. A., Bouwens, J., & Kroos, P. (2017). Organization identity and earnings manipulation. Accounting, Organizations and Society, 58(1), 1–14.

Ady, J. C. (1994). Minimizing threats to the validity of cross-cultural organization research. In R. L. Wiseman & R. Shuter (Eds.), Communicating in multinational organizations (pp. 30–42). Sage Publications.

Alvero, A., Bucklin, B., & Austin, J. (2001). An objective review of the effectiveness and essential characteristics of performance feedback in organizational settings (1985–1998). Journal of Organizational Behavior Management, 21(1), 3–29.

Ariely, D., Kamenica, E., & Prelec, D. (2008). Man’s search for meaning: The case of legos. Journal of Economic Behavior & Organization, 67(3–4), 671–677.

Arkes, H. R., Dawes, R. M., & Christensen, C. (1986). Factors influencing the use of a decision rule in a probabilistic task. Organizational Behavior and Human Decision Processes, 37(1), 93–110.

Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14, 396–402.

Armstrong, M., & Brown, D. (2019). Armstrong’s handbook of reward management practice: Improving performance through reward (6th ed.). Kogan Page Publishers.

Ashraf, N., Bandiera, O., & Jack, K. (2014). No margin, no mission? A field experiment on incentives for public service delivery. Journal of Public Economics, 120(C), 1–17.

Ashton, R. H. (1990). Pressure and performance in accounting decision settings: Paradoxical effects of incentives, feedback, and justification. Journal of Accounting Research, 28(3), 148–180.

Assaf, A. (1999). Managerial behavior in contemporary organizations. Amman: Dar Zahran.

Awasthi, V., & Pratt, J. (1990). The effects of monetary incentives on effort and decision performance: The role of cognitive characteristics. The Accounting Review, 65(4), 797–811.

Baggaley, A. R. (1964). Intermediate correlational methods. John Wiley & Sons.

Baiman, S. (1990). Agency theory in managerial accounting: A second look. Accounting, Organizations and Society, 15(4), 341–371.

Balcazar, F., Hopkins, B., & Suarez, Y. (1985). A critical: Objective review of performance feedback. Journal of Organizational Behavior Management, 7(3–4), 65–89.

Banker, R. D., Lee, S. Y., Potter, G., & Srinivasan, D. (2001). An empirical analysis of continuing improvements following the implementation of a performance-based compensation plan. Journal of Accounting and Economics, 30(3), 315–350.

Bareket-Bojmel, L., Hochman, G., & Ariely, D. (2017). It’s (Not) All About the Jacksons: Testing Different Types of Short-Term Bonuses in the Field. Journal of Management, 43(2), 534–554.

Bedford, D. S., Malmi, T., & Sandelin, M. (2016). Management control effectiveness and strategy: An empirical analysis of packages and systems. Accounting, Organizations and Society, 51(C), 12–28.

Bedford, D. S., & Sandelin, M. (2015). Investigating management control configurations using qualitative comparative analysis: An overview and guidelines for application. Journal of Management Control, 26(1), 5–26.

Bedford, D. S., & Speklé, R. F. (2018a). Construct validity in survey-based management accounting and control research. Journal of Management Accounting Research, 30(2), 23–58.

Bedford, D. S., & Speklé, R. F. (2018b). Constructs in survey-based management accounting and control research: An inventory from 1996 to 2015. Journal of Management Accounting Research, 30(2), 269–322.

Bonner, S. E., Hastie, R., Sprinkle, G. B., & Young, S. M. (2000). A review of the effects of financial incentives on performance in laboratory tasks: Implications for management accounting. Journal of Management Accounting Research, 12(1), 19–64.

Bonner, S. E., & Sprinkle, G. B. (2002). The effects of monetary incentives on effort and task performance: Theories, evidence, and a framework for research. Accounting, Organizations and Society, 27(4–5), 303–345.

Boon, C., Den Hartog, D. N., & Lepak, D. P. (2019). A systematic review of human resource management systems and their measurement. Journal of Management, 45(6), 2498–2537.

Brink, A. G., & Rankin, F. W. (2013). The effects of risk preference and loss aversion on individual behavior under bonus, penalty, and combined contract frames. Behavioral Research in Accounting, 25(2), 145–170.

Brown, D. (2012). European rewards in an era of austerity: Shifting the balance from the past to the future. Compensation & Benefits Review, 44(3), 131–144.

Brun, J., & Dugas, N. (2008). An analysis of employee recognition, perspectives on human resources practices. International Journal of Human Resource Management, 19(4), 716–730.

Buchheit, S., Dalton, D., Downen, T., & Pippin, S. (2012). Outcome Feedback, incentives, and performance: Evidence from a relatively complex forecasting task. Behavioral Research in Accounting, 24(2), 1–20.

Caglio, A., Dossi, A., & Van der Stede, W. A. (2018). CFO role and CFO compensation: An empirical analysis of their implications. Journal of Accounting and Public Policy, 37(4), 265–281.

Cerasoli, C. P., Nicklin, J. M., & Ford, M. T. (2014). Intrinsic motivation and extrinsic incentives jointly predict performance: A 40-year meta-analysis. Psychological Bulletin, 140(4), 980–1008.

Chalos, P., & Poon, M. C. C. (2000). Participation and performance in capital budgeting teams. Behavioral Research in Accounting, 12, 199–229.

Chenhall, R. H. (2003). Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Accounting, Organizations and Society, 28(2/3), 127–168.

Chiang, F. F., & Birtch, T. A. (2006). An empirical examination of reward preferences within and across national settings. Management International Review, 46(5), 573–596.

Chong, V. K., & Chong, K. M. (2002). Budget goal commitment and informational effects of budget participation on performance: A structural equation modeling approach. Behavioral Research in Accounting, 14(1), 65–86.

Christ, M. H., Emett, S. A., Tayler, W. B., & Wood, D. A. (2016). Compensation or feedback: Motivating performance in multidimensional tasks. Accounting, Organizations and Society, 50(1), 27–40.

Chung, K. H., & Vickery, W. D. (1976). Relative effectiveness and joint effects of three selected reinforcements in a repetitive task situation. Organizational Behavior and Human Performance, 16(1), 114–142.

De Cenzo, D., Robbins, A., & Stephen, P. (1996). Human resource management. John Wiley & Sons Inc.

Deci, E. L. (1975). Intrinsic motivation. Plenum Press.

Deci, E. L., Betley, G., Kahle, J., Abrams, L., & Porac, J. (1981). When trying to win: Competition and intrinsic motivation. Personality and Social Psychology Bulletin, 7(1), 79–83.

Deci, E. L., Olafsen, A. H., & Ryan, R. M. (2017). Self-determination theory in work organizations: The state of a science. Annual Review of Organizational Psychology and Organizational Behavior, 4(1), 19–43.

Deci, E. L., & Ryan, R. M. (1985). Intrinsic motivation and self-determination in human behavior. Plenum Press.

Dunk, A. S. (1993). The effects of job-related tension on managerial accounting performance in participative budgetary settings. Accounting, Organizations and Society, 18(7), 575–585.

Einhorn, S., Heinicke, X., & Guenther, T. W. (2021). Management control packages in family businesses: A configurational approach. Journal of Business Economics, 91(4), 433–478.

Eisenberger, R., & Cameron, J. (1996). The detrimental effects of reward: Myth or reality? American Psychologist, 51(11), 1153–1166.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74.

Erkens, D. H., & Van der Stede, W. (2015). Strategy and control: Findings from a set-theoretical analysis of high-performance manufacturing firms. Working Paper, Marshall School of Business. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2296468.

Fiss, P. C. (2007). A set-theoretic approach to organizational configurations. Academy of Management Review, 32(4), 1180–1198.

Fiss, P. C. (2011). Building better causal theories: A fuzzy set approach to typologies in organization research. Academy of Management Journal, 54(2), 393–420.

Frey, B. S. (1994). How intrinsic motivation is crowded out and in. Rationality and Society, 6(3), 334–352.

Frey, B. S. (2006). Giving and receiving awards. Perspectives on Psychological Science, 1(4), 377–388.

Frey, B. S. (2007). Awards as compensation. European Management Review, 4(1), 6–14.

Frey, B. S., & Jegen, R. (2001). Motivation crowding out theory: A survey of empirical evidence. Journal of Economic Surveys, 15(5), 589–611.

Frey, B. S., & Oberholzer-Gee, F. (1997). The cost of price incentives: An empirical analysis of motivation crowding-out. American Economic Review, 87(4), 746–755.

Friis, I., Hansen, A., & Vámosi, T. (2015). On the effectiveness of incentive pay: Exploring complementarities and substitution between management control system elements in a manufacturing firm. European Accounting Review, 24(2), 241–276.

Furnham, A., & Stringfield, P. (1994). Congruence of self and subordinate ratings of managerial practices as a correlate of supervisor evaluation. Journal of Occupational and Organizational Psychology, 67(1), 57–67.

Grabner, I., & Moers, F. (2013). Management control as a system or a package? Conceptual and empirical issues. Accounting, Organizations and Society, 38(6), 407–419.

Graham, J. R., Harvey, C., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3–73.

Greckhamer, T. (2011). Cross-cultural differences in compensation level and inequality across occupations: A set-theoretic analysis. Organization Studies, 32(1), 85–115.

Greckhamer, T., Furnari, S., Fiss, P. C., & Aguilera, R. V. (2018). Studying configurations with qualitative comparative analysis: Best practices in strategy and organization research. Strategic Organization, 16(4), 482–495.

Grossman, S. J., & Hart, O. D. (1980). Takeover bids, the free-rider problem, and the theory of the corporation. The Bell Journal of Economics, 11(1), 42–64.

Hair, J., Black, W., Babin, B., & Anderson, R. (2014). Multivariate data analysis (7th ed.). Pearson Education Limited.

Hall, M. (2008). The effect of comprehensive performance measurement systems on role clarity, psychological empowerment and managerial performance. Accounting, Organizations and Society, 33(2–3), 141–163.

Handgraaf, M. J., Lidth, V., de Jeude, M., & Appelt, K. (2013). Public praise vs. private pay: Effects of rewards on energy conservation in the workplace. Ecological Economics, 86, 86–92.

Hannan, L., Krishnan, R., & Newman, A. (2008). The effects of disseminating relative performance feedback in tournament and individual performance compensation plans. The Accounting Review, 83(4), 893–913.

Hart, O. D. (2001). Financial contracting. Journal of Economic Literature, 39(4), 1079–1100.

Haynes, P. (2014). Combining the strengths of qualitative comparative analysis with cluster analysis for comparative public policy research: With reference to the policy of economic convergence in the Euro currency area. International Journal of Public Administration, 37(9), 581–590.

Heneman, H. (1974). Comparisons of self- and supervisor-rating of managerial performance. Journal of Applied Psychology, 59(5), 638–642.

Herzberg, F. (1966). Work and the nature of man. Staples Press.

Hewett, R., & Conway, N. (2016). The undermining effect revisited: The salience of everyday verbal rewards and self-determined motivation. Journal of Organizational Behavior, 37(3), 436–455.

Hogarth, R. M., Gibbs, B. J., McKenzie, C. R. M., & Marquis, M. A. (1991). Learning from feedback: Exactingness and incentives. Journal of Experimental Psychology: Learning, Memory and Cognition, 17(4), 734–752.

Incentive Federation. (2021). IFI Incentive Federation Inc. http://www.incentivefederation.org/ (accessed 29 November 2021).

Indjejikian, R., & Matĕjka, M. (2009). CFO fiduciary responsibilities and annual bonus incentives. Journal of Accounting Research, 47(4), 1061–1093.

Jenkins, G. D., Jr., Mitra, A., Gupta, N., & Shaw, J. D. (1998). Are financial incentives related to performance? A meta analytic review of empirical research. Journal of Applied Psychology, 83(5), 777–787.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323–329.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kelly, K., Presslee, A., & Webb, R. A. (2017). The effects of tangible rewards versus cash rewards in consecutive sales tournaments: A field experiment. The Accounting Review, 92(6), 165–185.

Kosfeld, M., Neckermann, S., & Yang, X. (2017). The effects of financial and recognition incentives across work contexts: The role of meaning. Economic Inquiry, 55(1), 237–247.

Kube, S., Maréchal, M., & Puppe, C. (2012). The currency of reciprocity—Gift-exchange in the workplace. The American Economic Review, 102(4), 1644–1662.

Kvaløy, O., Nieken, P., & Schöttner, A. (2015). Hidden benefits of reward: A field experiment on motivation and monetary incentives. European Economic Review, 76(C), 188–199.

Kvaløy, O., & Schöttner, A. (2015). Incentives to motivate. Journal of Economic Behavior and Organization, 116(C), 26–42.

Lazear, E. (2000). Performance pay and productivity. The American Economic Review, 90(5), 1346–1361.

Lee, J. (2009). Executive performance-based remuneration, performance change and board structures. The International Journal of Accounting, 44(2), 138–162.

Libby, R., & Lipe, M. G. (1992). Incentives, effort, and the cognitive processes involved in accounting-related judgments. Journal of Accounting Research, 30(2), 249–273.

Long, R. J., & Shields, J. L. (2010). From pay to praise? Non-cash employee recognition in Canadian and Australian firms. International Journal of Human Resource Management, 21(8), 1145–1172.

Longest, K., & Vaisey, S. (2008). Fuzzy: A program to performing qualitative comparative analysis (QCA) in Stata. The Stata Journal, 8(1), 79–104.

Lourenço, S. M. (2016). Monetary incentives, feedback, and recognition—complements or substitutes? Evidence from a field experiment in a retail services company. The Accounting Review, 91(1), 279–297.

Luo, W., Zhang, Y., & Zhu, N. (2011). Bank ownership and executive perquisites: New evidence from an emerging market. Journal of Corporate Finance, 17(2), 352–370.

Maas, V. S., & Matějka, M. (2009). Balancing the dual responsibilities of business unit controllers: Field and survey evidence. The Accounting Review, 84(4), 1233–1253.

Maggetti, M., & Levi-Faur, D. (2013). Dealing with errors in QCA. Political Research Quarterly, 66(1), 198–204.

Mahoney, T. A., Jerdee, T. H., & Carroll, S. J. (1965). The job(s) of management. Industrial Relations, 4(2), 97–110.

Malmi, T., & Brown, D. A. (2008). Management control systems as a package—Opportunities, challenges and research directions. Management Accounting Research, 19(4), 287–300.

Malmi, T., & Granlund, M. (2009). In search of management accounting theory. European Accounting Review, 18(3), 597–620.

Marginson, D., & Ogden, S. (2005). Coping with ambiguity through the budget: The positive effects of budgetary targets on managers’ budgeting behaviours. Accounting, Organizations and Society, 30(5), 435–456.

Marino, A. M., & Zábojník, J. (2008). Work-related perks, agency problems, and optimal incentive contracts. The RAND Journal of Economics, 39(2), 565–585.

McCaffrey, R. (1990). Organizational performance and the strategic allocation of indirect compensation. Human Resource Planning, 12(3), 229–238.

Merchant, K. A., & Van der Stede, W. A. (2012). Management control systems: Performance measurement, evaluation and incentives. Prentice Hall.

Milgrom, P., & Roberts, J. (1995). Complementarities and fit strategy, structure, and organizational change in manufacturing. Journal of Accounting and Economics, 19(2/3), 179–208.

Milkovich, G. T., Newman, J. M., & Gerhart, B. A. (2014). Compensation (10th ed.). Mcgraw Hill/Irwin.

Moore, D., & Tarnai, J. (2002). Evaluating nonresponse error in mail surveys. In R. M. Groves, D. A. Dillman, J. L. Eltinge, & R. J. A. Little (Eds.), Survey nonresponse (pp. 197–211). John Wiley & Sons.

Mossholder, N., Bennett, E., Kemery, R., & Wesolowski, M. A. (1998). Relationships between bases of power and work reactions: The mediational role of procedural justice. Journal of Management, 24(4), 533–552.

Muse, L. A., Harris, S., Giles, W. F., & Feild, H. S. (2008). Work-life benefits and positive organizational behavior: Is there a connection? Journal of Organizational Behavior, 29(2), 171–192.

Muse, L. A., & Wadsworth, L. L. (2012). An examination of traditional versus non-traditional benefits. Journal of Managerial Psychology, 27(2), 112–131.

Nelson, B. (2012). 1501 ways to reward employees. Workman Publishing.

Nunnally, J. C. (1978). Psychometric theory (2nd ed.). McGraw-Hill.

Otley, D., & Pollanen, R. M. (2000). Budgetary criteria in performance evaluation: A critical appraisal using new evidence. Accounting, Organizations and Society, 25(4–5), 483–496.

Parker, R. J., & Kyj, L. (2006). Vertical information sharing in the budgeting process. Accounting, Organizations and Society, 31(1), 27–45.

Petroulas, E., Brown, D., & Sundin, H. (2010). Generational characteristics and their impact on preference for management control systems. Australian Accounting Review, 20(3), 221–240.

Phillips, J. S., & Lord, R. G. (1980). Determinants of intrinsic motivation: Locus of control and competence information as components of Deci’s cognitive evaluation theory. Journal of Applied Psychology, 65(2), 211–218.

Podsakoff, P. M., MacKenzie, S. B., Lee, J., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: Problems and prospects. Journal of Management, 12(4), 531–544.

Presslee, A., Vance, T. W., & Webb, R. A. (2013). The effects of reward type on employee goal setting, goal commitment, and performance. The Accounting Review, 88(5), 1805–1831.

Ragin, C. C. (2006). Set relations in social research: Evaluating their consistency and courage. Political Analysis, 14(3), 291–310.

Ragin, C. C. (2008). Redesigning social inquiry: Fuzzy sets and beyond. University of Chicago Press.

Ragin, C. C., & Fiss, P. C. (2008). Net effects analysis versus configurational analysis: An empirical demonstration. In C. C. Ragin (Ed.), Redesigning social inquiry: Fuzzy sets and beyond (pp. 190–212). University of Chicago Press.

Rajan, R. G., & Wulf, J. (2006). Are perks purely managerial excess? Journal of Financial Economics, 79(1), 1–33.

Román, F. J. (2009). An analysis of changes to a team-based incentive plan and its effects on productivity, product quality, and absenteeism. Accounting, Organizations and Society, 34(5), 589–618.

Rosen, S. (1976). A theory of life earnings. Journal of political Economy, 84(4, Part 2), S45–S67.