Abstract

This study explores the relationship between contextual variables—strategy, perceived environmental uncertainty (PEU), and decentralization—and the use of non-financial performance measures (NFPM) for managerial compensation in small and medium enterprises (SMEs). Using questionnaire data from SMEs’ managers, we find that the use of NFPM is positively associated with PEU hostility and decentralization. Furthermore, our study shows that these results are mostly driven by CEO’s compensation (in comparison to non-CEOs compensation) and family firms (in comparison to non-family firms). Finally, our analyses reveal that the use of different types of NFPM (customer-oriented, employee-oriented and operations-oriented) is associated with distinct contextual variables. Particularly, customer-oriented NFPM are negatively related to PEU dynamism and positively related to decentralization, while operations-oriented NFPM are positively related to PEU hostility.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the last decades, a great number of studies ascertain an increase in the use of non-financial indicators for both performance evaluation and managerial compensation (Govindarajan & Gupta, 1985; Ittner et al., 1997; Kaplan & Norton, 1992; Merchant et al., 2011; Said et al., 2003; Simons, 1987). However, performance measures need to be chosen according to the context of the organization as they may have different effects (Euske et al., 1993), namely in terms of performance. In fact, the appropriate choice of performance measures is seen as a critical factor to effectively accomplish organizational strategic objectives (Burney et al., 2009).

Therefore, it is not surprising that several researchers claim for a deeper exploration of the impact of contingent variables on the design and use of performance measures (Franco-Santos et al., 2012; Ittner & Larcker, 2001). Performance measures are a key element of performance measurement systems (PMS), which have been widely investigated for large firms (e.g., Chenhall & Langfield-Smith, 1998; Ittner et al., 2003a, 2003b; Kaplan & Norton, 1992). Research regarding PMS in small and medium enterprises (SMEs) was sparse in the beginning of the century (e.g., Brem et al., 2008; Garengo et al., 2005; Hudson et al., 2001), but has increased substantially in the last decade (e.g., Ahmad & Zabri, 2015; Ates et al., 2013; Bititci et al., 2012; Heinicke, 2018; Pešalj et al., 2018; Rojas-Lema et al., 2020; Taylor & Taylor, 2014).

Performance measures are also an important issue for managerial compensation, which is intertwined with PMS. Nevertheless, relatively little empirical evidence exists on the determinants that affect the choice of performance measures in compensation contracts (Franco-Santos et al., 2012; Ittner & Larcker, 2001; Ittner et al., 1997). And even less evidence is known for SMEs (e.g., Speckbacher & Wentges, 2012).

This lack of evidence is even odder when the importance of SMEs to local economies is undeniable and there are significant differences between large and small companies (e.g., Garengo et al., 2005; Hudson et al., 2001; Pešalj et al., 2018). SMEs are crucial agents for the economy in every country (Wolff & Pett, 2006). There are about one million and a half SMEs in Europe, which assure approximately 35.9% of all jobs and deliver 34.3% of the gross value added in the European non-financial business sector (European Commission, 2021). Therefore, in this study, we focus on SMEs due to both the lack of research on managerial compensation in this type of companies and the importance of SMEs in the economy. Additionally, we focus on the use of non-financial performance measures (NFPM) due to the increasing importance of these measures for managerial compensation (e.g., Franco-Santos et al., 2012; Ittner et al., 2003a, 2003b). Hence, the research question addressed in this paper is: What are the contextual factors associated with the use of NFPM for managerial compensation in SMEs?

Using questionnaire data from 851 SMEs, this study investigates whether contextual factors such as strategy, perceived environmental uncertainty (PEU) and decentralization are associated with the use of NFPM for managerial compensation in SMEs. We find that the use of NFPM is positively associated with PEU hostility and decentralization.Footnote 1 These findings support the arguments that SMEs give more emphasis to NFPM in conditions of high external uncertainty and decentralization as these measures provide managers with more strategic information (e.g., Ittner & Larcker, 1998) from multiple organizational areas.

Further analyses suggest important differences in the use of NFPM between CEO’s and non-CEO’s, and between family and non-family firms. Specifically, when we restrict our sample to CEOs, we find that the use of NFPM is positively related to PEU hostility and decentralization and negatively related to PEU unpredictability. Conversely, when we restrict our sample to non-CEOs, we fail to find any significant relationship. Compared with the results for our full sample, these findings suggest that CEOs, who likely have higher managerial power than non-CEOs, may protect themselves from PEU unpredictability by reducing their exposure to NFPM.

When we consider in our sample only family firms, we find that the use of NFPM is positively related to PEU hostility and decentralization. These results are in accordance with those of the full sample. Conversely, for non-family firms the use of NFPM is only negatively associated with PEU dynamism. Although prior research suggests that family ownership is not related to the use of performance measures in SMEs (Speckbacher & Wentges, 2012), our results indicate that family (non-family) ownership may play a role when PEU hostility (dynamism) is high.

Additionally, our analyses reveal that the use of different types of NFPM is associated with distinct contextual variables. Specifically, customer-oriented NFPM are negatively related to PEU dynamism and positively related to decentralization. The first result may be explained by the fact that in highly dynamic environments firms need to go beyond existing customer-needs as these may become outdated in the future (Narver et al., 2004) and, hence, firms respond by reducing the use of customer-oriented NFPM. The second result is consistent with that of the main analysis. Our analyses also reveal that operations-oriented NFPM are positively related to PEU hostility. This result is consistent with that of our main model.

This study contributes to the management accounting and contingency literature in several ways. First, we extend the use of NFPM from PMSs research (e.g., Franco-Santos et al., 2012; Gibbs et al., 2009; Heinicke, 2018; Ittner et al., 1997) to managerial compensation. Second, our study focuses on SMEs which are “life blood of modern economies” (Ghobadian & Gallear, 1996, p. 83) and that are different from large companies (e.g., Garengo et al., 2005; Malagueño et al., 2018; Rojas-Lema et al., 2020). Third, we add to contingency research by adding novel empirical evidence on how managerial incentives vary according to the organizational context.

The paper proceeds as follows. Section 2 presents the theoretical background, as well as the hypotheses development. Section 3 presents the method and Sect. 4 the empirical results. Finally, Sect. 5 concludes.

2 Literature review and hypotheses development

2.1 Theoretical background

Agency theory postulates that the implementation of appropriate compensation systems motivates managers to act on behalf of the owner’s interests and, therefore, enhance firm’s outcomes (Holmstrom & Milgrom, 1991; Jensen & Meckling, 1976; Sprinkle, 2003). Incentives motivate employees through the performance measures that underlie the incentive plan, directing employees’ attention to the tasks that are measured (e.g., Bushman et al., 1996; Fisher, 1995; Moers, 2005). Furthermore, according to the informativeness principle, measures should be included in these incentive plans as long as they provide additional information about managerial actions desired by the owner (Banker & Datar, 1989; Feltham & Xie, 1994; Holmstrom, 1979; Ittner et al., 1997). In this context, NFPM appear as a complement to financial performance measures (FPM) that have been more commonly used in managerial incentive contracts. FPM are measures that provide performance information in monetary terms and that usually come from accounting or capital market data. Examples of these measures are net income, sales, earnings per share, return on investment, and economic value added. NFPM are measures that provide performance information in non-monetary terms, such as market share, customer satisfaction, innovation/new product development and employee turnover. NFPM provide incremental information about managerial actions that are not observable in FPM (Ittner et al., 1997; Kaplan & Norton, 1992; Said et al., 2003). Particularly, NFPM provide more strategic information (e.g., Ittner & Larcker, 1998), have a more long-term focus (e.g., Sedatole, 2003), are better aligned with organizational goals, and have greater capacity to adapt to market changes than FPM (Medori & Steeple, 2000).

The use of FPM and NFPM for managerial compensation in large companies has received much attention (e.g., Banker et al., 2000; Carlon et al., 2006; Ittner & Larcker, 1998; Ittner et al., 2003a, 2003b). However, evidence regarding the use of different types of performance measures for managerial compensation in SMEs is sparse (e.g., Said et al., 2003; Schiehll & Bellavance, 2009; Speckbacher & Wentges, 2012).

Prior research in SMEs is suggestive of a limited use of NFPM in PMS (e.g., Perera & Baker, 2007), which may also have an impact on the use of these measures for managerial compensation (e.g., Speckbacher & Wentges, 2012). In fact, prior studies identify the lack of financial and human resources (Pelham, 1999), lack of management expertise (Gray & Mabey, 2005), and lower benefits from economies of scale comparatively to large companies (Sels et al., 2006) as reasons that may preclude SMEs to implement performance evaluation and compensation practices.

Overall, prior literature recognizes that performance evaluation practices and the use of incentive compensation are crucial issues to enhance performance of SMEs (e.g., King-Kauanui et al., 2006). Nevertheless, and following a contingency approach, contextual factors are likely to be associated with differences in the use of NFPM for managerial compensation in SMEs. Contingency researchers argue, for example, that there is no management control system that can be used universally for all organizations with the same efficacy (Chenhall, 2003; Ferreira & Otley, 2009). Specifically, prior studies using a contingency approach suggest that the design and use of management control systems is related to contextual factors such as PEU, strategy, culture, organizational structure, size, technology, and ownership structure (Chenhall, 2005, 2007; Ferreira & Otley, 2009; Otley, 2016). Similar factors are identified for the adoption and use of PMSs (Franco-Santos et al., 2012; Ittner & Larcker, 2001). Limited contingency research in SMEs also reveals similar contextual factors related to management accounting and control practices (King et al., 2010; López & Hiebl, 2015; Vitale et al., 2020).

We extend this research by analyzing the use of NFPM for managerial compensation in SMEs according to three contextual variables that past research suggests being related to the use of performance measures for managerial compensation (e.g., Abernethy et al., 2004; Bouwens & van Lent, 2007; Ittner et al., 1997; Said et al., 2003)—strategy, external environment and decentralization.

2.2 Strategy and NFPM for managerial compensation in SMEs

Strategy, which can be defined as how a business chooses to compete within its particular industry (Langfield-Smith, 1997), is usually considered one of the most important contextual variables (Bedford et al., 2016; Chenhall, 2003). Although the literature presents a variety of taxonomies for strategy (Langfield-Smith, 1997)—differentiation and cost-leadership (Porter, 1980), prospector, defender and analyzer (Miles & Snow, 1978), build, hold and harvest (Govindarajan & Gupta, 1985) strategies—this study follows the typology developed by Porter (1980). This choice is based on the argument that this typology provides a narrower scope and a greater focus on the organization’s competitive position than the Miles and Snow’s (1978) typology (Langfield-Smith, 1997). Additionally, the Govindarajan and Gupta’s (1985) classification is based on the market share and short-term profit tradeoff, which ignores how organizations compete in the market and, hence, their priorities in terms of information needs which are relevant for this study.

The different taxonomies can be broadly conceptualized as a continuum between two different strategic orientations (e.g., Miles & Snow, 1978). Specifically and following Porter’s (1980) typology, when organizations follow a differentiation strategy they attempt to compete on the market with new products/services that are perceived by customers as unique in terms of product quality and flexibility and with a wide availability of product offerings, technology and customer service. When organizations follow a cost-leadership strategy they try to compete through low cost/price products, which requires an aggressive construction of efficient scale facilities, tight costs and overhead control, and cost minimization in areas such as R&D (Auzair & Langfield-Smith, 2005).

Extant research provides evidence that the choice of performance measures within PMS depends upon organizational strategy (Abernethy & Lillis, 1995; Chenhall, 2003; Fleming et al., 2009; Van der Stede et al., 2006). In general, NFPM appear to be linked to product differentiation, prospector and build types of strategies (e.g., Anderson & Lanen, 1999; Perera et al., 1997). Conversely, cost-leadership, defender and harvest types of strategies seem to be related to FPM (e.g., Chenhall & Morris, 1986; Chong & Chong, 1997; Langfield-Smith, 1997). Specifically, prior studies suggest a positive relation between the adoption of a cost-leadership strategy and financial information and, a positive association between a differentiation strategy and non-financial information (e.g., Simons, 1987; Van der Stede, 2000).

A similar relationship is observed for the use of performance measures for compensation purposes and strategy. For example, Ittner et al. (1997) and Said et al. (2003) show that an innovation-oriented (prospector) strategy adopted by firms is associated with the use and retention of non-financial measures for annual bonus and compensation purposes. Balsam et al. (2011) find that sales, as a performance measure of executive compensation, receive a greater weight in organizations which follow a cost-leadership strategy than in organizations with differentiation strategies.

Despite this consensus, the majority of this evidence comes from samples of large companies. The literature does not provide evidence regarding the use of NFPM per strategy type in SMEs. The literature only provides limited evidence regarding the use of management control systems, and in particular, performance management practices per strategy type in SMEs. For example, past research suggests that when SMEs’ experience liquidity constraints they tend to focus on cost control, leading to a greater focus on budgets and financial data (e.g., López & Hiebl, 2015; Reid & Smith, 2000). In fact, SMEs that follow a cost-leadership strategy, i.e., are primarily concerned with achieving a low-cost position relative to competitors and, therefore, pursue cost reductions (Porter, 1980), will focus on FPM that allow them to control costs. Conversely, firms following differentiation strategies—that require more outward focused and broad scope information (Simons, 1987)—are more likely to use NFPM that enable them to follow the external environment requirements and the critical success factors of product differentiation (Abernethy & Lillis, 1995). NFPM mirror the long-term focus (Sedatole, 2003) and innovation and creativity nature (Bisbe & Otley, 2004) of a differentiation strategy. These different priorities in terms of PMSs are likely to be translated into managerial compensation as the alignment of the managers’ interests with those of the company is critical for organizational success.

Therefore, we argue that SMEs following a cost-leadership strategy have less reliance on NFPM in managerial compensation due to the short-term focus and the necessity to restring managerial attention to cost-reduction practices. We also argue that NFPM in managerial compensation are more likely to be used in SMEs pursuing a differentiation strategy because these measures are more long-term, external-oriented, quality and innovation-related than FPM. Hence, our hypotheses are as follows:

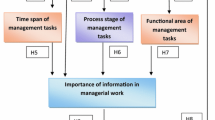

H1a: The use of NFPM for managerial compensation in SMEs is positively associated with a differentiation strategy.

H1b: The use of NFPM for managerial compensation in SMEs is negatively associated with a cost-leadership strategy.

2.3 Perceived environmental uncertainty and NFPM for managerial compensation in SME

Similar to strategy, PEU is one of the most common contextual variables studied in contingency research (e.g., Chenhall, 2003; Gordon & Miller, 1976; Hoque et al., 2001; Sohn et al., 2003). PEU can be defined as the manager’s perceptions about the predictability and stability of the organization’s external environment, such as the competitors’ actions in the market, economic and technological changes and customers’ preferences (Gordon & Narayanan, 1984).

Prior research suggests that organizations tend to use more externally focused, non-financial, and future-oriented management accounting information when environmental uncertainty is high (Chenhall & Morris, 1986; Chong & Chong, 1997; Gordon & Naryanan, 1984; Govindarajan & Gupta, 1985; Gul & Chia, 1994). For instance, Chenhall and Morris (1986) and Gul and Chia (1994) report that in situations of high PEU, organizations require specific management accounting information that is future-oriented and, hence, NFPM are more likely to be used. Similarly, Gordon and Naranyan (1984), and Govindarajan and Gupta (1985) find evidence that FPM receive greater emphasis when organizations operate in relative certain and low complexity environments.

SMEs literature suggests that environmental uncertainty is greater for SMEs than for large companies (Oakes & Lee, 1999). To reduce the perceived uncertainty and increase comfort levels in decision-making, (small) firms are likely to seek (additional) information when facing an uncertain environment (Liu et al., 2014). NFPM appear to be a good solution for this problem as they provide managers with strategic information about customers, internal processes, competitors and human capital which is difficult to capture with the sole use of financial measures (e.g., Amir & Lev, 1996; Feltham & Xie, 1994). Furthermore, in a context of high PEU, firms can use NFPM to better evaluate managerial performance since this type of measures is less likely to be affected by external factors and is more likely to be influenced by agents’ decisions (Hoque, 2005).

Hence, we argue that a higher level of external uncertainty in which SMEs operate requires a higher use of NFPM, which is likely to be translated into managerial compensation practices. Therefore, we hypothesize that SMEs make greater use of NFPM for managerial compensation when they operate in environments that are perceived as more uncertain. Hence, our hypothesis is the following:

H2: The use of NFPM for managerial compensation in SMEs is positively associated with PEU.

2.4 Decentralization and NFPM for managerial compensation in SMEs

Decentralization is the amount of decision-making authority that is delegated to lower-level managers by their supervisors (Govindarajan, 1988). Prior literature shows that decentralization is related to the adoption of management accounting system and its effect on managerial performance (e.g., Chia, 1995; Merchant, 1981). Organizational structure is especially important in SMEs because their operations are considered less professional and more ad hoc. Therefore, the level of centralization and how that structural component relates to the delegation of decision making is of particular interest to SMEs (Martin et al., 2016).

Research regarding the relationship between decentralization and the use of performance measures provides mixed evidence. One stream of research suggests that when decentralization increases, firms prefer to use aggregate FPM for compensation purposes (Abernethy et al., 2004; Bouwens & van Lent, 2007; Chenhall & Morris, 1986; Moers, 2006). Researchers attribute this result to the specific properties of FPM as they “represent the most aggregate performance measures because the full consequences of every action the agent takes ultimately flow through the financial statements” (Moers, 2006, p. 901). Hence, with high decentralization FPM are important to evaluate managerial performance. In contrast, NFPM are not able to express the full consequences of different decisions, but instead can provide information about a particular activity (Abernethy et al., 2004; Moers, 2006). NFPM are also noisier than FPM because they have relatively more subjectivity and less verifiability, and may be related to events that cannot be observed directly or that are not susceptible of being contracted (Banker et al., 2000; Ittner et al., 2003a, 2003b). However, the literature provides inconclusive results regarding the use of NFPM and decentralization as studies fail to find a negative significant relationship between the two variables.

Another stream of research suggests that decentralization, which is viewed as an adequate solution for dynamic environments, requires broad scope and non-financial information (e.g., Gordon & Miller, 1976; Waterhouse & Tiessen, 1978).Footnote 2 Due to SMEs’ organizational characteristics this argument is particularly relevant for this type of firms. For example, there is evidence that higher complexity in SMEs’ organizational structure is positively related to an increased usage of management accounting system (e.g., Becker et al., 2011). Complex organizational structures, which may refer to a higher number of interdependent departments or empowered employees, both of which relate to decentralization, demand more and more diverse information and thus more sophisticated management accounting system (López & Hiebl, 2015). Similarly, King et al. (2010) provide evidence that decentralized SMEs are more likely to use more advanced management accounting practices, as decentralized organizations delegate decision making to lower-level management and operational staff. Hence, the need for NFPM is higher in decentralized SMEs as these measures provide strategic information (e.g., Ittner & Larcker, 1998) from multiple organizational areas. This more intense use of NFPM is likely to be translated into managerial compensation so that managers provide the necessary effort in these multiple dimensions. As past research shows NFPM provide incremental information about managerial actions that are not observable in financial measures (Ittner et al., 1997; Kaplan & Norton, 1992; Said et al., 2003).

Despite the contradictory arguments and evidence, we follow the latter stream of research as SMEs with a higher degree of decentralization use more sophisticated management accounting systems and use more NFPM in their PMS than centralized SMEs. These measures will also be used for managerial compensation to align the interests of the manager with the objectives of this type of organization. Therefore, our hypothesis is the following:

H3: The use of NFPM for managerial compensation in SMEs is positively associated with decentralization.

3 Method

3.1 Sample selection

We collect data from two questionnaires targeted at SMEs managers in Portugal.Footnote 3 Portuguese SMEs represent 4.7% of businesses, contributing significantly to job creation and prosperity of the Portuguese economy. Specifically, SMEs account for 36.8% of employment and 42.8% of value added of Portugal’s “non-financial business economy”.Footnote 4 Both indicators are about 10 percentage points higher than the respective European Union average for SMEs (European Commission, 2021).

The first questionnaire collects data regarding organizational characteristics (for instance organizational strategy, PEU, decentralization, technology, family ownership, firm performance, size, region, and industry) and the second regarding the manager (for instance NFPM, age, tenure, position, ownership and individual performance).

The first questionnaire was successfully sent to 22,997 SMEs; 4192 useable responses were received. This corresponds to an overall response rate of 18.23%. Using this database, a team of research assistants contacted each of these firms via telephone to collect information about the name and e-mail addresses of the directors/managers. This information served to create a second database that was used to send the second questionnaire. Thus, from the initial sample of 4192 SMEs we obtained 11,748 names with their related job roles and e-mail addresses (personal or organizational). However, due to refusal of participation or error in the e-mailing process, the number of questionnaires successfully sent was 8038. We received 1463 valid responses. To ensure high degrees of “sample prototypicality” and “sample relevance” (Speklé & Widener, 2018), we restrict our sample to respondents who filled in the questions about monetary incentives and performance measures, which results in 1132 usable observations. This corresponds to a usable response rate of 14.08%. Because the total sample of 1132 responses may include more than one observation from the same firm, this may be a concern for tests that require independence of observations. Because we perform several tests that require the independence of observations, and to ensure that all tests are comparable by using the same sample, we randomly select one observation per firm and eliminate all additional observations from the same firm.Footnote 5 Hence, in this study we use a sample of 851 observations that includes only one observation per firm.

To test for potential (non-) response bias we apply two procedures commonly used in the literature (Armstrong & Overton, 1977). First, we compare the size, location and industry representation of these 851 companies to the 2097 companies of non-respondents from the list of e-mails sent successfully. A chi-square test shows that location categories do not differ between the respondents’ sample and the non-respondents’ sample. Conversely, a chi-square test regarding industry shows significant differences between the two groups (chi-square = 31.02; p < 0.01). Additionally, an independent sample t-test regarding firm size (measured as the number of employees) shows a difference between respondents (\(\overline{X }\)= 57.12) and non-respondents (\(\overline{X }\)= 32.67); this difference is statistically significant (p < 0.01 for a two-tailed t-test). These differences in samples by size and industry are limitations of this study.Footnote 6

Second, we compare the responses of early and late respondents as late respondents are more similar to non-participants (Armstrong & Overton, 1977). We use the date of the received response to distinguish between early and late respondents. Overall, the results indicate that there are no statistically significant differences between groups for the variables examined in our model.Footnote 7

Because our data comes from two different instruments (the dependent variable comes from the second questionnaire while the main independent variables come from the first questionnaire), collected in two different periods and likely answered by two different persons, common method bias is unlikely to be a concern in our study.Footnote 8 Nevertheless, we address this potential issue by applying both procedural and statistical remedies (Podsakoff et al., 2003; Speklé & Widener, 2018). Ex ante, (1) we employed a simple wording and provide examples where appropriate to improve understanding and appropriateness for the sample frame; (2) we safeguarded the confidentiality of the answers; (3) we used a distinct response scale for predictors variables as compared to the predicted variable; and (4) we carefully and thoroughly pre-tested the questionnaire with practitioners (SMEs managers not in the sample) and academics (management accounting researchers) to ensure instrument’s clarity, readability and length. Ex post, we apply Harman’s one-factor test to address common method variance concerns regarding the measures (Mossholder et al., 1998; Podsakoff & Organ, 1986). The factor solution yields eleven factors with eigenvalues greater than 1. Together they account for 61.22% of the total variance. The first factor explains 12.72% of the total variance, which means that it does not account for the majority of the variance. In sum, the results of both procedures indicate that common method bias is, again, unlikely to be a concern for this study.

Table 1 reports the descriptive statistics for the demographic variables and organizational characteristics. The respondents are, on average, 46 years old, have 16 years of tenure in the organization and hold 16% of the equity of the firm. Most occupy the position of chief executive officer (CEO) or chief financial officer (CFO) (40% and 24%, respectively). Table 1 also shows that respondents come mainly from the manufacturing and wholesale and retailing industries (33% and 30%, respectively). Sample firms have an average of 57 employees and, on average, about 57% of the firm’s equity is held by family members.

3.2 Variable measurement

To increase the overall quality of the survey instrument, we use, when possible, questions validated in prior studies and follow Bedford and Speklé’s (2018a) recommendations.Footnote 9 To assess both content and construct validity, we perform several empirical tests. For instance, we use exploratory factor analysis to examine the unidirectionality of the constructs and Cronbach’s alpha to examine their internal consistency (Nunnally, 1978). Moreover, we verify if each item shows a factor loading greater than 0.50 to support convergent validity and if discriminant validity is assured by the lack of significant cross-loadings between the items (Hair et al., 2014). In addition, we assess the discriminant validity of the constructs by exploring multi-trait matrix. Below, we present more details on the measurement of the variables. Appendix A presents the instruments used to measure the main constructs, while Table 2 reports the factor analyses used to construct the variables.

3.2.1 Non-financial performance measures

The dependent variable of this study is the relative weight placed on non-financial performance measures in the manager’s annual compensation (NFPM). We calculate the score for this variable by adding the weights of all NFPM from a list of performance measures (financial, non-financial customer-oriented, non-financial employee-oriented, and non-financial internal operations) and for which the weights had to sum 100%. Hence, the NFPM variable is comprised between 0 and 100%.

3.2.2 Strategy

We measure strategy through eleven items identified by Miller et al. (1992) and applied by Chenhall and Langfield-Smith (1998) and Chenhall (2005). This construct encompasses three strategic outcomes: flexibility, delivery/service and low cost-price. The first two outcomes are derived from a product differentiation strategy and the last one refers to a cost-leadership strategy. The instrument encompasses four questions for the flexibility outcome that capture flexibility and customization factors, five questions for the delivery/service outcome that involve delivery, service and quality outcomes, and two questions for the low cost and low production price. On a 7-point Likert scale ranging from 1 (low influence) to 7 (high influence), we ask respondents to indicate the extent to which each item influenced the management of the firm in the last three years.

The exploratory factor analysis, with oblique rotation reveals three interpretable factors consistent with Chenhall’s (2005) solution. The four items chosen ex ante to measure the flexibility outcome load on the first factor, which we label STGflex. Five questions chosen ex ante to measure the delivery/service outcome load on the second factor that we label STGserv. However, according to Hair et al. (2014), we exclude two items (STGserv2 and STGserv5) from further analyses due to low loadings (< 0.50). Two of the remaining items load on a third factor (STGcost), which has an internal consistency of 0.49. Although a low Cronbach’s alpha for the STGcost may indicate a possible measurement error, it may also be caused by the fact that the scale includes only two items. Assessing the Pearson correlation between the two questions may help to mitigate this issue (Kruis et al., 2016). The correlation suggests adequate measurement as it is reasonably strong (0.33; p < 0.01). Thus, although the Cronbach’s alpha is slightly below the recommended limits of acceptability, generally considered to be around 0.50–0.60 (Nunnally, 1978), we retain this factor keeping the Cronbach’s alpha in mind (King & Clarkson, 2015). Overall, the three factors together explain 72% of the total variance. The Cronbach’s alpha for flexibility outcome and delivery/service outcome is 0.74 and 0.78, respectively. To form the variables STGflex, STGserv and STGcost, we average the items with factor loadings greater than 0.50 for each scale.

3.2.3 Perceived environmental uncertainty

To measure PEU we use the questions from Gordon and Narayanan (1984) and King et al. (2010). Ten questions linked to a 7-point Likert scale ranging from 1 (low PEU) to 7 (high PEU) aim to capture the dynamic and unpredictable nature of the external environmental, as well as the intensity of competition. Exploratory factor analysis, with oblique rotation, reveals four factors with eigenvalues greater than 1, wherein PEUhos1 loads alone on one factor. However, in order to follow prior studies (Gordon & Narayanan, 1984; King et al., 2010), we force factor analysis to produce only three factors. Following the literature, we label these factors as “PEU dynamism” (PEUdyn), “PEU unpredictability” (PEUunp) and “PEU hostility” (PEUhos). Four questions related to the stability of the external environment load on PEUdyn, whereas two questions related to the predictability of the external environment load on PEUunp and four questions related to the competitiveness of the business environment on PEUhos. Due to low loading (< 0.50), we exclude the item PEUhos1 from further analyses (Hair et al., 2014). Overall, the constructs capture 58% of the explained variance. The Cronbach’s alphas for the three factors are 0.73, 0.56 and 0.66, respectively.

3.2.4 Decentralization

To measure decentralization (DECENT), we adapt six survey questions from Gordon and Narayanan (1984) and King et al. (2010). On a 7-point Likert scale ranging from 1 (no delegation) to 7 (total delegation), we ask respondents to indicate the extent to which decision-making authority is delegated for each of the six items. Factor analysis reveals only one factor with eigenvalue greater than 1, which explains 56% of the total variance. The factor loadings of the six items range from 0.61 to 0.82 and Cronbach’s alpha is 0.84. Based on these results, we average the six items to form the DECENT variable.

3.2.5 Control variables

Following the advice of other researchers (e.g., Huselid, 1995), due to the large size of the dataset, a conservative approach was used and we included several control variables.Footnote 10

Technology. Prior literature suggests that technology is important for the adoption and use of PMSs (e.g., Chenhall, 2007). We measure technology (TECH) using three questions based on Chenhall (2007). On a 7-point Likert-scale ranging from 1 (very low) to 7 (very high), we ask respondents about the extent to which technologies are characterized by standardized and automated processes (TECstd), high levels of task uncertainty (TECunc) and high levels of interdependence (TECdep). Untabulated factor analysis reveals two factors, the two items that load on factor 1 (TECstd and TECdep) have unreliable internal consistency of 0.44. When we restrict the extraction to only one factor, the Cronbach’s alpha remains unreliable (0.27). Thus, we use three variables for technology—TECstd, TECunc and TECdep.

Size. We control for firm size (SIZE), measured as the natural logarithm of employees, as literature provides evidence that the choice of performance measures depends on firm size (Ahmad & Zabri, 2016; Speckbacher & Wentges, 2012). We use the natural logarithm to mitigate high skewness and kurtosis.

Ownership and family ownership. We control for participant’s ownership (OWN) and family ownership (FAMOWN) as extant literature suggests ownership and family ownership being important contextual factors in PMSs design (e.g., Haas & Speckbacher, 2017; Speckbacher & Wentges, 2012, respectively). We measure ownership by asking respondents to indicate the percentage they hold in the company’s equity (that is ownership at individual level). To measure family ownership, we ask respondents to indicate the percentage of family ownership of the firm (which corresponds to the family ownership at the organizational level).

Age and tenure. Respondent’s age and tenure are self-reported measures in the questionnaire. We use the natural logarithm of each of these variables to mitigate high skewness and kurtosis.

Managerial position. Since the use of NFPM may vary with respondent’s position and because our sample has some heterogeneity related to the participants’ role in the company, we include dummy variables for each category presented in Table 1, remaining CFO as default.

Region. Given that some regions are more dynamic in terms of company creation and labor market (Martin, 1997), we control for region by using four dummy variables: REGION1 to REGION4, using REGION5 as default. This classification is based on regional classification within the country.

Industry. Since we use data from firms operating in different industries, we also control for industry effects by including dummy variables according to the Statistical Classification of Economic Activities in the European Community (NACE). Due to a small number of observations in some individual industry categories we grouped some of them. We create 6 categories and used one of them as the baseline.

Firm and managerial performance. Additionally, we control for firm performance and managerial performance because our measure of NFPM is ex post (that is, respondents state the percentage of NFPM attached to the annual compensation they have received) and, hence, the level of performance may influence their answers. Firm performance (FIRM_PERF) is a self-reported measure based on a previously validated scale (Roth & Jackson, 1995) and used in the accounting studies (Widener, 2007). On a 7-point Likert-scale ranging from 1 (very poor performance) to 7 (very good performance), we ask respondents to assess their organizational performance, taking into account their goals on four dimensions. Factor analysis reveals one factor explaining 74% of the variance, with item loadings above 0.84 and a Cronbach’s alpha of 0.87. Based on these results, we average the four items to form the FIRM_PERF variable.

To measure managerial performance (MNG_PERF) we use a self-reported measure developed by Mahoney et al. (1965) and recurrently used in accounting studies (e.g., Bedford & Speklé, 2018b). The original scale assesses managerial performance along eight dimensions related to planning, investigating, coordinating, evaluating, supervising, staffing, negotiating and representing, and also includes an overall assessment of performance. Hall (2008) reduces the scale to 7 items by excluding 2 items (negotiating and representing) because of low factor loadings and not belonging to a unidimensional managerial performance scale. We follow his procedure and ask respondents to indicate on a 7-point Likert scale (1 = well below average to 7 = well above average) the extent to which their performance was below average or above average on each of the 7 remaining items. Factor analysis reveals one factor explaining 66% of the variance, with item loadings above 0.72 and a Cronbach’s alpha of 0.91. Based on these results, we average the seven items to form the MNG_PERF variable.

4 Empirical results

4.1 Descriptive statistics and exploratory analyses

Table 3 presents descriptive evidence for our sample. Panel A presents the descriptive statistics for the main variables investigated in this study. The mean percentage of NFPM used for managerial compensation in our sample is 8.36%. The mean of the strategy variables ranges from 4.82 to 5.54, while the mean of PEU variables ranges from 3.80 to 4.55. Decentralization variable mean is 2.91. Panel A also reports the mean of the control variables managerial performance and firm performance, which are 4.93 and 4.39, respectively.

Additionally, Panel B provides information on the use of different types of NFPM in our sample. This panel shows that productivity and customer satisfaction are the most commonly used NFPM in managerial compensation in SMEs. The means of these measures are 2.51 and 1.36, respectively. When we restrict our sample to companies that use NFPM for managerial compensation (see the last column), these means rise to 18.11 and 10.79, respectively.

The correlations among the variables presented in Table 4 provide first evidence on the relationship between NFPM and other variables of interest. The table shows that the use of NFPM is positively and significantly correlated with STGflex (r = 0.07; p < 0.10), STGserv (r = 0.08; p < 0.05), PEUunc (r = 0.06; p < 0.10), PEUhos (r = 0.13; p < 0.01) and DECENT (r = 0.12; p < 0.01) as predicted. Moreover, age is negatively and significantly correlated to the use of NFPM (r = − 0.11; p < 0.01).

Table 5 provides a comparison between NFPM users (N = 195) and non-users (N = 656). The number of observations in each group suggests that a relatively small proportion of firms are using NFPM in the variable compensation of their managers. Panel A shows NFPM users are more likely to follow a flexibility strategy (t = 1.73; p < 0.10), face a high PEU hostility in their environment (t = 2.80; p < 0.01) and exhibit a higher level of decentralization (t = 2.86; p < 0.01) comparatively to NFPM non-users. These results are consistent with our predictions and correlation analysis. Panel A also shows that NFPM users have younger managers (t = 2.08; p < 0.05) than NFPM non-users. Additionally, Panel B shows significant differences between NFPM users and non-users for position (chi2 = 22.73; p < 0.01) and industry (chi2 = 13.19; p < 0.05). This result is in line with our expectations that the use of NFPM varies by managerial position and industry and supports our decision to have these variables as controls.

4.2 Main analysis

After these bivariate evidences that do not control for the joint effects of multiple independent variables, we test our hypotheses using a multivariate method—regression analysis. Specifically, we estimate the following model:

where i represents the participant (firm) and the variables are as defined in the previous section.

Our second specification is similar to the first with the addition of control variables related to the participant—age, tenure, position, ownership and managerial performance—and to the firm—firm size, family ownership, firm performance, technology, region and industry.

where i represents the participant (firm) and the variables are as defined in the previous section.

Both Eqs. (1) and (2) are estimated using a tobit regression with a lower bound (0) and an upper bound (100) for the dependent variable NFPM. This method allows for a full use of data available as both the users and non-users of NFPM are considered and it also accounts for the natural lower and upper bounds in the dependent variable, which is comprised between 0 and 100%.

Columns 1 and 2 of Table 6 show the results for Eqs. 1 and 2, respectively.Footnote 11 Due to missing data in some variables the number of observations used in each regression varies.

Column 1 of Table 6 shows non-significant relationships between the use of NFPM and differentiation (flexibility outcome or delivery/service outcome) and cost-leadership strategies and, thus, we do neither find support for H1a nor for H1b.

We find partial support for H2. Specifically, the results do not show significant relationships between NFPM and PEU dynamism and PEU unpredictability. However, we find a significant positive association between PEU hostility and the use of NFPM. These findings partially support our argument that greater external uncertainty in which SMEs operate requires higher reliance on NFPM as these measures may provide managers with more strategic information about customers, internal processes and competitors (e.g., Amir & Lev, 1996; Feltham & Xie, 1994). This greater emphasis in NFPM is translated into the performance measures used in managerial compensation.

Column 1 of Table 6 also shows that the use of NFPM is positively related to decentralization, which supports H3. This finding is consistent with the argument that decentralization—for being an appropriate response to dynamic environments in which SMEs operate—requires broad scope and non-financial information (e.g., Gordon & Miller, 1976; Waterhouse & Tiessen, 1978) which are then reflected into managerial compensation.

The results for Eq. 2 which includes control variables—presented in column 2 of Table 6—are similar to results for Eq. 1. Regarding the control variables, we find that the use of NFPM is negatively related to age and positively related to tenure, manager’s ownership and managerial performance. Industry is also an important predictor in the use of NFPM as the F-test for the joint significance of the industry dummies is highly significant. Because a F-test for the joint significance of all control variables is statistically significant (F = 1.61; p < 0.05), we include the control variables in our additional analysis and robustness tests, and, hence, consider Eq. (2) as the base model.

4.3 Additional evidence and robustness tests

Given the heterogeneity of our sample and also within the NFPM variable, we further examine our data using different subsamples and subsets of NFPM, and also conduct some robustness tests.

4.3.1 CEOs versus non-CEOs

Given that dummy variables for participant position used as controls may have not fully taken care of the heterogeneity of the sample, and the fact that CEO role is quite different from non-CEO positions, we control for the potential systematic differences between CEOs and non-CEOs by partitioning our sample. Columns 3 and 4 of Table 6 show the results for these subsamples. Results for the subsample of CEOs in column 3 of Table 6 are consistent with those for the base model (column 2), except for PEU unpredictability (which becomes significant but is contrary to H2). Specifically, we find a significant and negative relationship between the use of NFPM and the unpredictability of the environment. This result could be explained by the fact that CEOs have higher managerial power than non-CEOs and, hence, they can protect their compensation from the unpredictability of the environment. From prior literature it is known that greater CEO power over the board of directors is related to a lower use of NFPM in annual bonus contracts (Ittner et al., 1997; Schiehll & Bellavance, 2009).

Curiously, results for the subsample of non-CEOs in column 4 of Table 6 do not reveal any significant relationship between the use of NFPM and main variables.

4.3.2 Family and non-family firms

Despite the fact that we control for family ownership in our analysis, given the heterogeneity of our sample in this regard and the relevance of this variable for compensation schemes, we replicate our analysis partitioning our sample into family and non-family firms. Columns 5 and 6 of Table 6 present the results for these subsamples, respectively. The results for the subsample of family firms are consistent with those for the base model, while the subsample of non-family firms reveals only one significant and negative relationship between the use of NFPM and PEU dynamism (p < 0.10), which is contrary to H2. Although prior research suggests that family ownership is not related to the use of performance measures in SMEs (Speckbacher & Wentges, 2012), our results indicate that family (non-family) ownership may play a role when PEU hostility (dynamism) is high.

4.3.3 Types of NFPM

Following Van der Stede et al. (2006), we split NFPM into three categories: non-financial customer-oriented (3 items), non-financial employee-oriented (2 items), and non-financial operations-oriented (5 items). Next, we replicate the specification in Eq. (2) for each category. Table 7 shows the results of this analysis.

Column 1 of Table 7 shows that the use of customer-oriented NFPM is positively and significantly related to decentralization (which is consistent with results from the base model), and negatively and significantly related to PEU dynamism. The latter finding does not support H2, since we hypothesized a positive relationship between NFPM and PEU dynamism. Extant literature on customer orientation can help to explain this result. This research suggests that by focusing exclusively on existing consumer needs firms may fail to identify new value-adding opportunities (Narver et al., 2004), which is particularly relevant in dynamic market environments (Christensen & Bower, 1996). Particularly, Slater and Narver (1998, p. 1005) suggest that “being customer-led in a dynamic environment will rarely lead to a position of competitive advantage since it provides insufficient stimulus for the significant innovation that discontinuous change requires”. Hence, firms may respond to this risk by reducing the use of customer-oriented NFPM for managerial compensation in dynamic markets.

Column 2 of Table 7 does not reveal any significant relationship between the use of employee-oriented NFPM and main variables. Column 3 of Table 7 shows that operations-oriented NFPM are positively and significantly associated with PEU hostility, which is consistent with H2. These results are also in accordance with those of the base model.

4.3.4 Robustness tests

We perform several validity tests on our main specification (shown in column 2 of Table 6). We replicate the specification for Eq. (2) including the strategy variables used by Chenhall (2005), instead of those revealed by our factor analysis. The (untabulated) results of these analyses remain similar to those of the base model since the significance and the signs of all significant relations do not change. Next, we replicate our analyses for Eq. (2) including the original set of items to measure PEU used by Gordon and Narayanan (1984) and King et al. (2010), instead of those revealed by our factor analysis. Similar to the previous test, the (untabulated) results show that the signs of all significant relations do not change, and their significance is not affected.

Finally, the correlation analyses in Table 4 reveal a slightly high correlation between participant age and tenure (r = 0.53). Although, this value does not overcome the threshold of 0.90 suggested by Hair et al. (2014) and the VIF test did not suggest any problem of multicollinearity in our regressions, we decided to drop one of these variables. We opted for dropping tenure as the correlation coefficient between this variable and NFPM is not significant. The (untabulated) results after dropping tenure show similar results to our base model: the signs on all significant relations remain unchanged and their significance is not affected.

5 Conclusion

A considerable body of research has examined the use and adoption of PMSs using a contingency-based approach (e.g., Bititci et al., 2012; Ittner & Larcker, 2001; Said et al., 2003; Sohn et al., 2003). Nevertheless, only few studies investigate the relationship between the use of NFPM for managerial compensation and contextual factors (e.g., Franco-Santos et al., 2012; Ittner et al., 1997). Moreover, the use of NFPM for managerial compensation in SMEs has attracted only limited attention from researchers (e.g., Perera & Baker, 2007).

This study presents evidence regarding the relationships between three main contextual factors—strategy, PEU, and decentralization—and the use of NFPM for managerial compensation in SMEs. Based on a sample of 851 SMEs, we find that the use of NFPM is positively associated with PEU hostility and decentralization. These findings support the arguments that SMEs give more emphasis to NFPM in conditions of high external uncertainty and decentralization as these measures provide managers with more strategic information (e.g., Ittner & Larcker, 1998) from multiple organizational areas.

We also find that SMEs use more NFPM in the compensation of younger and more tenured managers and for those who hold a higher percentage of the company’s equity. These results suggest that managers’ demographic characteristics are also important when designing compensation packages.

Further analyses suggest important differences in the use of NFPM between CEO’s and non-CEO’s, and between family and non-family firms. Specifically, when we restrict our sample to CEOs, we find that the use of NFPM is positively related to PEU hostility and decentralization and negatively related to PEU unpredictability. Conversely, when we restrict our sample to non-CEOs, we fail to find any significant relationship. Compared with the results for our full sample, these findings suggest that CEOs, because they have higher managerial power than non-CEOs, may protect themselves from PEU unpredictability by reducing their exposure to NFPM.

When we consider in our sample only family firms we find that the use of NFPM is positively related to PEU hostility and decentralization. These results are in accordance with those of the full sample. Conversely, for non-family firms the use of NFPM is only negatively associated with PEU dynamism. Although prior research suggests that family ownership is not related to the use of performance measures in SMEs (Speckbacher & Wentges, 2012), our results indicate that family (non-family) ownership may play a role when PEU hostility (dynamism) is high.

Additionally, our analyses reveal that the use of different types of NFPM is associated with distinct contextual variables. Specifically, customer-oriented NFPM are negatively related to PEU dynamism and positively related to decentralization. The first result may be explained by the fact that in highly dynamic environments firms need to go beyond existing customer-needs as these may become outdated in the future (Narver et al., 2004) and, hence, firms respond by reducing the use of customer-oriented NFPM. The second result is consistent with that of the main analysis. Operations-oriented NFPM are positively related to PEU hostility. This result is also consistent with that of our main model.

Overall, while our study is in line with prior literature suggesting that the use of performance measures is related to the complexity of the firm and its environment rather than to size-related factors (e.g., Davila et al., 2009), we extend this finding to the use of NFPM for compensation purposes.

Based on the evidence provided by this study, managers designing compensation schemes in SMEs should be aware of their particular organizational characteristics and external contingencies. In particular, these decision-makers should pay attention to the environmental uncertainty to which their company is exposed and its level of decentralization. Moreover, decision makers should consider differences between CEOs and non-CEOs, family and non-family firms, and specific types of NFPM when designing compensation contracts.

We acknowledge that while significant results are presented, our study has some limitations that warrant discussion. First, there is (non-)response bias in terms of industry, firm size, and age. The bias regarding industry may occur due to the small number of observations in certain categories. The bias regarding size may be explained by the higher propensity of large organizations to participate in surveys, while small firms prefer to ignore them. Alternatively, smaller organizations may not have participated because these organizations do neither use sophisticated compensation systems nor performance measurement systems. Hence, our results may not generalize to very small firms. The bias regarding age (late respondents are older than early respondents) is also a concern because age is negatively related with NFPM. Hence, our results should be generalized with caution to older managers. Second, we do not consider how the use of NFPM in managerial compensation contracts and contextual factors evolve over time, which limits our ability to make causal claims regarding the relationships we document. Third, despite prior literature suggesting that performance evaluation practices and the use of incentive compensation are crucial issues to enhance SMEs’ performance, the use of NFPM for managerial compensation in our sample seems to be reduced, which limits our ability to find statistically significant relationships. Finally, we only examine three contextual variables which clearly do not explain all of the variance in the dependent variable.

This study provides several avenues for future research. By using longitudinal data, future studies may address causality which is not possible to identify in a cross-sectional study. Moreover, future research can analyze other contextual variables such as national culture or firm’s market position.

6 Appendix A: Survey items

Performance measures (from 0 to 100%)

Indicate for each of the performance measures below the percentage attached to your variable compensation.

Performance measure | % |

|---|---|

Financial | |

Net income | |

Sales | |

Sales growth | |

EBITDA—earnings before interest, taxes, depreciation, and amortization | |

Operating income | |

EVA—economic value added | |

Budget | |

Cash-flow | |

ROA—return on assets | |

ROI—return on investment | |

ROE—return on equity | |

Non-financial customer-oriented | |

Customer satisfaction | |

No. of customer complaints | |

Market share | |

Non-financial employee-oriented | |

Employee satisfaction | |

Rotation of personnel | |

Non-financial operations-oriented | |

Productivity | |

Quality of the product/service | |

Production volume | |

Innovation | |

Compliance with the processes | |

Other metrics | |

Strategy (1 = Low influence, 7 = High influence)

To what extent the following factors influence the management of the firm in the last three years?

Item | Label |

|---|---|

I. Flexibility | |

Customize products and services to customer needs | STGflex1 |

Make rapid volume and/or product/service mix changes | STGflex2 |

Make changes in design and introduce new products/services quickly | STGflex3 |

Provide unique product/service features | STGflex4 |

II. Delivery/service | |

Product/service availability | STGserv1 |

Provide effective after-sales service and support | STGserv2 |

Make dependable delivery promises | STGserv3 |

Provide fast deliveries | STGserv4 |

Provide high quality products/services | STGserv5 |

III. Low cost/price | |

Low price | STGcost1 |

Low production costs | STGcost2 |

Perceived environmental uncertainty

Dynamism (1 = Very stable/changing slowly, 7 = Very dynamic/changing rapidly)

How do you evaluate the firm’s external environment considering the following dimensions?

Item | Label |

|---|---|

Economic environment | PEUdyn1 |

Technological environment | PEUdyn2 |

Legal environment | PEUdyn3 |

Political environment | PEUdyn4 |

Unpredictability (1 = Very predictable, 7 = Very unpredictable)

Considering the last five years, how do you assess the level of the predictability of the following factors?

Item | Label |

|---|---|

The market activities of firm competitors | PEUunp1 |

The tastes and preferences of customers | PEUunp2 |

Hostility (1 = Insignificant, 7 = Extremely significant)

How intense is each of the following factors in the sector where the firm operates?

Item | Label |

|---|---|

Price competition | PEUhos1 |

Competition for the diversity of services and products marketed | PEUhos2 |

Competition for manpower | PEUhos3 |

Competition for access to suppliers | PEUhos4 |

Decentralization (1 = No delegation, 7 = Total delegation)

To what extent authority is delegated to operational/line managers and/or employees for each of the following decisions?

Item | Label |

|---|---|

Initiate ideas for new services | DECENT1 |

Hiring and firing of personnel | DECENT2 |

Selection of large investments | DECENT3 |

Budget allocations | DECENT4 |

Pricing decisions | DECENT5 |

Operation decisions | DECENT6 |

Family ownership (from 0 to 100%)

Indicate the percentage of the company’s equity held by family members.

Respondent’s ownership (from 0 to 100%)

What percentage do you hold in the company’s equity?

Technology (1 = Very low, 7 = Very high)

Indicate to what extent the firm’s technologies are characterized by:

Item | Label |

|---|---|

Automated and standardized processes | TECH1 |

High levels of task uncertainty | TECH2 |

High levels of interdependence in the processes | TECH3 |

Managerial performance (1 = Well below average, 7 = Well above average)

Indicate to what extent your performance, compared with other managers in your company in similar positions, was below or above the average in the following dimensions:

Item | Label |

|---|---|

Planning: determining goals, policies, and courses of action such as work scheduling, budgeting, and programming | MNG_PERF1 |

Investigating: collecting and preparing of information usually in the form of records, reports, and accounts (measuring output, record keeping, and job analysis) | MNG_PERF2 |

Coordinating: exchanging information with people in the organization other than my subordinates in order to relate and adjust procedures, policies and programs | MNG_PERF3 |

Evaluating: assessment and appraisal of proposals or of reported/ observed performance (e.g., employee appraisals, judging financial performance and product inspection) | MNG_PERF4 |

Supervising: directing, leading, and developing your subordinates | MNG_PERF5 |

Staffing: maintaining the work force of your responsibility area (e.g., selecting and promoting your subordinates) | MNG_PERF6 |

Overall, how do you rate your performance? | MNG_PERF7 |

Firm performance (1 = very poor performance, 4 = met goals, 7 = very good performance)

For each performance indicator, select the number that best indicates the degree of conformance to your organization’s goals:

Item | Label |

|---|---|

Overall organizational performance | FIRM_PERF1 |

Overall organizational profitability | FIRM_PERF2 |

Relative market share for primary products | FIRM_PERF3 |

Overall productivity of the delivery system | FIRM_PERF4 |

Change history

08 August 2022

A Correction to this paper has been published: https://doi.org/10.1007/s00187-022-00345-8

Notes

In our analyses, we operationalize PEU variable via three dimensions: dynamism, unpredictability and hostility. Dynamism refers to the instability of external factors over time (Duncan, 1972), unpredictability relates to the uncertainty of results, and hostility is related to the intensity of competition (Khandwalla, 1977).

Consistent with this argument, an empirical study in large companies by Gong and Ferreira (2014) shows that decentralization is positively related to the use of NFPM, but only for low performing firms, which was contrary to the predictions made by the authors of a negative association.

In our study, SME is defined based on the number of employees, which excludes micro-enterprises. Specifically, SMEs are those with 10–249 employees. This criterion is consistent with the European Commission definition (European Commission, 2005). We obtain a list of SMEs from a firm specialized in corporate information.

The “non-financial business economy” includes industry, construction, trade, and services, but not enterprises in agriculture, forestry and fisheries and the largely non-market service sectors such as education and health (European Commission, 2021).

We thank an anonymous reviewer for this suggestion.

We believe that (non-) response bias regarding industry is not a major concern in our study due to two reasons. First, (non-) response bias may occur due to the small number of observations in certain categories (e.g., agriculture, forestry and fishing [11 observations], real estate activities [11 observations], and human health and social work activities [1 observation]). Second, industry is not associated with the dependent variable (the F test of an ANOVA of industry on NFPM is not statistically significant).

We also compare organizational and demographic variables among early and late respondents and we do not find statistically significant differences, except for age. Early respondents have a mean age of 43 while late respondents a mean of 47 and the difference is statistically significant at 0.10 level.

We thank another anonymous reviewer for this suggestion.

In some cases, we make slight modifications with the aim to fit the measures to the present research context.

Besides the control variables described, we also controlled for organizational culture [see, for example, Heinicke et al. (2016) for measurement details]. Untabulated results show that this control variable is not statistically significant and its inclusion/exclusion in the model does not change the estimates of our explanatory variables. Thus, we decided to omit it from further analyses (Baerdemaeker and Bruggeman, 2015).

Variance Inflation Factor (VIF) indicate the lack of multicollinearity problems since the highest VIF value is 1.95, which is well below the suggested threshold of 10 (Hair et al., 2014).

References

Abernethy, M. A., & Lillis, A. (1995). The impact of manufacturing flexibility on management control system design. Accounting, Organizations and Society, 20(4), 241–258.

Abernethy, M. A., Bouwens, J., & van Lent, L. (2004). Determinants of control system design in divisionalized firms. The Accounting Review, 79(3), 545–570.

Ahmad, K., & Zabri, S. M. (2015). Factors explaining the use of management accounting practices in Malaysian medium-sized firms. Journal of Small Business and Enterprise Development, 22(4), 762–781.

Ahmad, K., Zabri, S. M. (2016). The application of non-financial performance measurement in Malaysian manufacturing firms. In 7th international economics and business management conference (IEBMC 2015). Procedia economics and finance (Vol. 35, pp. 476–484).

Amir, E., & Lev, B. (1996). Value-relevance of nonfinancial information: The wireless communications industry. Journal of Accounting and Economics, 22(1–3), 3–30.

Anderson, S., & Lanen, W. (1999). Economic transition, strategy and the evolution of management accounting practices: The case of India. Accounting, Organizations and Society, 24(5–6), 379–412.

Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14, 396–402.

Ates, A., Garengo, P., Cocca, P., & Bititci, U. (2013). The development of SME managerial practice for effective performance management. Journal of Small Business and Enterprise Development, 20(1), 28–54.

Auzair, S. M., & Langfield-Smith, K. (2005). The effect of service process type, business strategy and life cycle stage on bureaucratic MCS in service organizations. Management Accounting Research, 16(4), 399–421.

Baerdemaeker, J. D., & Bruggeman, W. (2015). The impact of participation in strategic planning on managers’ creation of budgetary slack: The mediating role of autonomous motivation and affective organisational commitment. Management Accounting Research, 29(1), 1–12.

Balsam, S., Fernando, G. D., & Tripathy, A. (2011). The impact of firm strategy on performance measures used in executive compensation. Journal of Business Research, 64(2), 187–193.

Banker, R. D., & Datar, S. M. (1989). Sensitivity, precision, and linear aggregation of signals for performance evaluation. Journal of Accounting Research, 27(1), 21–39.

Banker, R. D., Potter, G., & Srinivasan, D. (2000). An empirical investigation of an incentive plan that includes nonfinancial performance measures. The Accounting Review, 75(1), 65–92.

Becker, W., Ulrich, P., & Staffel, M. (2011). Management accounting and controlling in German SMEs: Do company size and family influence matter? International Journal of Entrepreneurial Venturing, 3(3), 281–300.

Bedford, D. S., & Speklé, R. F. (2018a). Construct validity in survey-based management accounting and control research. Journal of Management Accounting Research, 30(2), 23–58.

Bedford, D. S., & Speklé, R. F. (2018b). Constructs in survey-based management accounting and control research: An inventory from 1996 to 2015. Journal of Management Accounting Research, 30(2), 269–322.

Bedford, D. S., Malmi, T., & Sandelin, M. (2016). Management control effectiveness and strategy: An empirical analysis of packages and systems. Accounting, Organizations and Society, 51(C), 12–28.

Bisbe, J., & Otley, D. (2004). The effects of the interactive use of management control systems on product innovation. Accounting, Organizations and Society, 29(8), 709–737.

Bititci, U. S., Garengo, P., Dörfler, V., & Nudurupati, S. (2012). Performance measurement: Challenges for tomorrow. International Journal of Management Reviews, 14(3), 305–327.

Bouwens, J., & van Lent, L. (2007). Assessing the performance of business unit managers. Journal of Accounting Research, 45(4), 667–698.

Brem, A., Kreusel, N., & Neusser, C. (2008). Performance measurement in SME: Literature review and results from a German case study. International Journal of Globalisation and Small Business, 2(4), 411–427.

Burney, L. L., Henle, C. A., & Widener, S. K. (2009). A path model examining the relations among strategic performance measurement system characteristics, organizational justice, and extra- and in-role performance. Accounting, Organizations and Society, 34(3–4), 305–321.

Bushman, R. M., Indjejikian, R. J., & Smith, A. (1996). CEO compensation: The role of individual performance evaluation. Journal of Accounting and Economics, 21(2), 161–193.

Carlon, D. M., Downs, A. A., & Wert-Gray, S. (2006). Statistics as Fetishes: The case of financial performance measures and executive compensation. Organizational Research Methods, 9(4), 475–490.

Chenhall, R. H. (2003). Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Accounting, Organizations and Society, 28(2/3), 127–168.

Chenhall, R. H. (2005). Integrative strategic performance measurement systems, strategic alignment of manufacturing, learning and strategic outcomes: An exploratory study. Accounting, Organizations and Society, 30(5), 395–422.

Chenhall, R. H. (2007). Theorizing contingencies in management control systems research. In C. S. Chapman, A. G. Hopwood, & M. D. Shields (Eds.), Handbook of management accounting research (pp. 163–205). Elsevier.

Chenhall, R. H., & Morris, D. (1986). The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. The Accounting Review, 61(1), 16–35.

Chenhall, R. H., & Langfield-Smith, K. (1998). The relationship between strategic priorities, management techniques and management accounting: An empirical investigation using a systems approach. Accounting, Organizations and Society, 23(3), 243–264.

Chia, Y. (1995). Decentralization, management accounting system (MAS) information characteristics and their interaction effects on managerial performance: A Singapore study. Journal of Business Finance and Accounting, 22(6), 811–830.

Chong, V. K., & Chong, K. M. (1997). Strategic choices, environmental uncertainty and SBU performance: A note on the intervening role of management accounting systems. Accounting and Business Research, 27(4), 268–276.

Christensen, C., & Bower, J. (1996). Customer power, strategic investment, and the failure of leading firms. Strategic Management Journal, 17(3), 197–218.

Davila, A., Foster, G., & Li, M. (2009). Reasons for management control systems adoption: Insights from product development systems choice by early-stage entrepreneurial companies. Accounting, Organizations and Society, 34(3–4), 322–347.

Duncan, R. B. (1972). Characteristics of organizational environments and perceived environmental uncertainty. Administrative Science Quarterly, 17(3), 313–327.

European Commission. (2005). The new SME definition: User guide and model declaration. Enterprise and Industry Publications, 5–50.

(European Commission, 2021). SME country fact sheet’s background document: Portugal. https://ec.europa.eu/growth/smes/sme-strategy/performance-review_en. Accessed 09 October 2021

Euske, K., Lebas, M., & McNair, C. (1993). Performance management in an international setting. Management Accounting Research, 4(4), 275–299.

Feltham, G. A., & Xie, J. (1994). Performance-measure congruity and diversity in multitask principal-agent relations. The Accounting Review, 69(3), 429–453.

Ferreira, A., & Otley, D. (2009). The design and use of performance management systems: An extended framework for analysis. Management Accounting Research, 20(4), 263–282.

Fisher, J. G. (1995). Contingency-based research on management control systems: Categorization by level of complexity. Journal of Accounting Literature, 14, 24–53.

Fleming, D. M., Chow, C. W., & Chen, G. (2009). Strategy, performance measurement systems and performance: A study of Chinese firms. The International Journal of Accounting, 44(3), 256–278.

Franco-Santos, M., Lucianetti, L., & Bourne, M. (2012). Contemporary performance measurement systems: A review of their consequences and a framework for research. Management Accounting Research, 23(2), 79–119.

Garengo, P., Biazzo, S., & Bititci, U. S. (2005). Performance measurement systems in SMEs: A review for a research agenda. International Journal of Management Reviews, 7(1), 25–47.

Ghobadian, A., & Gallear, D. (1996). Total quality management in SMEs. Omega—International Journal of Management Science, 24(1), 83–106.

Gibbs, M., Merchant, K. A., Van der Stede, W. A., & Vargus, M. E. (2009). Performance measure properties and incentive system design. Industrial Relations: A Journal of Economy and Society, 48(2), 237–264.

Gong, M. Z., & Ferreira, A. (2014). Does consistency in management control systems design choices influence firm performance? An empirical analysis. Accounting and Business Research, 44(5), 497–522.

Gordon, L. A., & Miller, D. (1976). A contingency framework for the design of accounting information systems. Accounting, Organizations and Society, 1(1), 59–69.

Gordon, L., & Narayanan, V. (1984). Management accounting systems, perceived environmental uncertainty and organization structure: An empirical investigation. Accounting, Organizations and Society, 9(1), 33–47.

Govindarajan, V. (1988). A contingency approach to strategy implementation at the business-unit level: Integrating administrative mechanisms with strategy. Academy of Management Journal, 31(4), 828–853.

Govindarajan, V., & Gupta, A. K. (1985). Linking control-systems to business unit strategy—Impact on performance. Accounting, Organizations and Society, 10(1), 51–66.

Gray, C., & Mabey, C. (2005). Management Development. International Small Business Journal, 23(5), 467–485.

Gul, F., & Chia, Y. (1994). The effects of management accounting systems, perceived environmental uncertainty and decentralization on managerial performance: A test of threeway interaction. Accounting, Organizations and Society, 19(4–5), 413–426.

Haas, N., & Speckbacher, G. (2017). Everything under my control: CEO characteristics and the evaluation of middle manager performance in small and medium-sized firms. Schmalenbachs Business Review, 18(2), 109–128.

Hair, J., Jr., Black, W., Babin, B., & Anderson, R. (2014). Multivariate data analysis (7th ed.). Pearson Education Limited.

Hall, M. (2008). The effect of comprehensive performance measurement systems on role clarity, psychological empowerment and managerial performance. Accounting Organizations and Society, 33(2–3), 141–163.

Heinicke, A. (2018). Performance measurement systems in small and medium-sized enterprises and family firms: A systematic literature review. Journal of Management Control, 28(4), 457–502.

Heinicke, A., Guenther, T. W., & Widener, S. K. (2016). An examination of the relationship between the extent of a flexible culture and the levers of control system: The key role of beliefs control. Management Accounting Research, 33, 25–41.

Holmstrom, B. (1979). Moral hazard and observability. Bell Journal of Economics, 10(1), 74–91.

Holmstrom, B., & Milgrom, P. (1991). Multitask principal-agent analyses: Incentive contracts, asset ownership, and job design. Journal of Law, Economics and Organization, 7(special issue), 24–52.

Hoque, Z. (2005). Linking environmental uncertainty to non-financial performance measures and performance: A research note. British Accounting Review, 37(4), 471–481.