Abstract

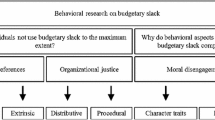

Budgetary slack is a heavily researched topic in the field of management accounting, but the heterogeneous nature of prior research blurs our understanding of this important topic. In this paper, we provide a structured overview of research on budgetary slack published in top-tier accounting and business ethics journals and reach the following conclusions: Participative budgeting can create or reduce budgetary slack. Less slack is created under truth-inducing pay schemes compared to slack-inducing schemes. Additionally, slack creation is affected by budget users’ risk attitudes and information asymmetry. Information asymmetry increases budgetary slack, but that effect is influenced by multiple factors, including budgetary participation and information systems. Fairness and reputation concerns decrease budgetary slack, but ethics concerns do not. Finally, the analysis revealed that social norms decrease slack and peer influence moderates the effect. We show that research in this field focuses mainly on psychological perspectives to analyse individuals’ budget-related behaviour. Experimental research was determined to be the most frequently used research method. An analysis of current experiments shows growing numbers of investigations of budgetary slack as a proxy of honesty in managerial reporting.

Similar content being viewed by others

Notes

Within these journals, we searched for “slack”, “budget slack”, “budgetary slack”, “honesty”, and “honest reporting”.

The sample was determined in June 2014 and updated in January 2018.

Analytical, archival, experimental, and survey-based studies are easily distinguishable. Field studies and archival research differ based on the manner in which archival work is a part of field studies. Framework-based studies differ from reviews based on the development of new perspectives, whereas review articles mainly serve to structure the previous literature (Hesford et al. 2007).

The articles are ordered alphabetically to offer a reference book setting for research methods and samples.

References

Abdel-Rahim, H. Y., & Stevens, D. E. (2018). Information system precision and honesty in managerial reporting: A re-examination of information asymmetry effects. Accounting, Organizations and Society, 64, 31–43.

Altenburger, M. (2017). The effect of injunctive social norms and dissent on budget reporting honesty. Journal of International Accounting Research, 16(2), 9–31.

Anderson, S. W., & Lillis, A. M. (2011). Corporate frugality: Theory, measurement and practice. Contemporary Accounting Research, 28(4), 1349–1387.

Antle, R., Bogetoft, P., & Stark, A. W. (1999). Selection from many investments with managerial private information. Contemporary Accounting Research, 16(3), 397–418.

Antle, R., Bogetoft, P., & Stark, A. W. (2001). Information systems, incentives and the timing of investments. Journal of Accounting and Public Poicy, 20(4–5), 267–294.

Antle, R., & Fellingham, J. (1995). Information rents and preferences among information systems in a model of resource allocation. Journal of Accounting Research, 33(1), 41–58.

Antle, R., & Fellingham, J. (1997). Models of capital investments with private information and incentives: A selective review. Journal of Business Finance & Accounting, 24(7–8), 887–908.

Argyris, C. (1952). The impact of budgets on people. New York: Controllership Foundation.

Arnold, M. C. (2015). The effect of superiors’ exogenous constraints on budget negotiations. The Accounting Review, 90(1), 31–57.

Arnold, M. C., & Artz, M. (2015). Target difficulty, target flexibility, and firm performance: Evidence from business units’ targets. Accounting, Organizations and Society, 40, 61–77.

Arnold, M. C., & Gillenkirch, R. M. (2015). Using negotiated budgets for planning and performance evaluation: an experimental study. Accounting, Organizations and Society, 43, 1–16.

Arnold, M. C., Ponick, E., & Schenk-Mathes, H. Y. (2008). Groves mechanism vs. profit sharing for corporate budgeting—an experimental analysis with preplay communication. European Accounting Review, 17(1), 37–63.

Arnold, M. C., & Schreiber, D. (2013). Audits, reputation, and repeated interaction in a capital budgeting setting. European Accounting Review, 22(1), 185–213.

Arya, A., & Glover, J. (1996). Verification of historical cost reports. The Accounting Review, 71(2), 255–269.

Arya, A., & Glover, J. C. (2013). On the upsides of aggregation. Journal of Management Accounting Research, 26(2), 151–166.

Arya, A., Glover, J., & Sivaramakrishnan, K. (1997). Commitment issues in budgeting. Journal of Accounting Research, 35(2), 273–278.

Arya, A., Glover, J., & Young, R. A. (1996). Capital budgeting in a multidivisional firm. Journal of Accounting, Auditing & Finance, 11(4), 519–533.

Baiman, S., & Demski, J. S. (1980). Economically optimal performance evaluation and control systems. Journal of Accounting Research, 18(Supplement), 184–220.

Baiman, S., & Evans, J. H. (1983). Pre-decision information and participative management control systems. Journal of Accounting Research, 21(2), 371–395.

Balakrishnan, R. (1990). The role of budgets and variances in repeated investment decisions. Contemporary Accounting Research, 7(1), 105–122.

Belkaoui, A. (1985). Slack budgeting, information distortion and self-esteem. Contemporary Accounting Research, 2(1), 111–123.

Birnberg, J. G. (2011). proposed framework for behavioral accounting research. Behavioral Research in Accounting, 23(1), 1–43.

Birnberg, J. G., & Ganguly, A. R. (2012). Is neuroaccounting waiting in the wings? An essay. Accounting, Organizations and Society, 37(1), 1–13.

Birnberg, J. G., Turopolec, L., & Young, S. M. (1983). The organizational context of accounting. Readings in Accounting for Management Conrol (pp. 107–131). Boston, MA: Springer.

Blay, A. D., Gooden, E. S., Mellon, M. J., & Stevens, D. E. (2016). The usefulness of social norm theory in empirical business ethics research: A review and suggestions for future research. Journal of Business Ethics. https://doi.org/10.1007/s10551-016-3286-4.

Bouwens, J., & Kroos, P. (2011). Target ratcheting and effort reduction. Journal of Accounting and Economics, 51(1–2), 171–185.

Briers, M., & Hirst, M. (1990). The role of budgetary information in performance evaluation. Accounting, Organizations and Society, 15(4), 373–398.

Brink, A. G., Coats, J. C., & Rankin, F. W. (2014). Deceptive superiors and budgetary reporting: An experimental investigation. Journal of Management Accounting Research, 29(3), 79–91.

Brink, W. D., Eaton, T. V., Grenier, J. H., & Reffett, A. (2017). Deterring unethical behavior in online labor markets. Journal of Business Ethics. https://doi.org/10.1007/s10551-017-3570-y.

Brown, J. L., Evans, J. H., & Moser, D. V. (2009). Agency theory and participative budgeting experiments. Journal of Management Accounting Research, 21(1), 317–345.

Brown, J. L., Fisher, J. G., Peffer, S. A., & Sprinkle, G. B. (2017). The effect of budget framing and budget-setting process on managerial reporting. Journal of Management Accounting Research, 29(1), 31–44.

Brown, J. L., Fisher, J. G., Sooy, M., & Sprinkle, G. B. (2014). The effect of rankings on honesty in budget reporting. Accounting, Organizations and Society, 39(4), 237–246.

Brownell, P., & McInnes, M. (1986). Budgetary participation, motivation, and managerial performance. The Accounting Review, 61(4), 587–600.

Brüggen, A., & Luft, J. (2011). Capital rationing, competition, and misrepresentation in budget forecasts. Accounting, Organizations and Society, 36(7), 399–411.

Brüggen, A., & Luft, J. L. (2016). Cost estimates, cost overruns, and project continuation decisions. The Accounting Review, 91(3), 793–810.

Brunner, M., & Ostermaier, A. (2017a). Sabotage in capital budgeting: The effects of control and honesty on investment decisions. European Accounting Review. https://doi.org/10.2139/ssrn.2888831.

Brunner, M., & Ostermaier, A. (2017b). Peer influence on managerial honesty: the role of transparency and expectations. Journal of Business Ethics. https://doi.org/10.1007/s10551-017-3459-9.

Cammann, C. (1976). Effects of the use of control systems. Accounting, Organizations and Society, 1(4), 301–313.

Cardinaels, E., & Jia, Y. (2016). How audits moderate the effects of incentives and peer behavior on misreporting. European Accounting Review, 25(1), 183–204.

Cardinaels, E., & Yin, H. (2015). Think Twice Before Going for Incentives: Social twice before going for incentives: Social norms and the principal’s decision on compensation contracts. Journal of Accounting Research, 53(5), 985–1015.

Chalos, P., & Cherian, J. (1995). An application of data envelopment analysis to public sector performance measurement and accountability. Journal of Accounting and Public Policy, 14(2), 143–160.

Chen, C. X., Rennekamp, K. M., & Zhou, F. H. (2015). The effects of forecast type and performance-based incentives on the quality of management forecasts. Accounting, Organizations and Society, 46, 8–18.

Chenhall, R. H. (2003). Management control systems design within its organizational context: findings from contingency-based research and directions for the future. Accounting, Organizations and Society, 28(2–3), 127–168.

Childs, J. (2012). Gender differences in lying. Economics Letters, 114(2), 147–149.

Chow, C. W., Cooper, J. C., & Haddad, K. (1991). The effects of pay schemes and ratchets on budgetary slack and performance: a multiperiod experiment. Accounting, Organizations and Society, 16(1), 47–60.

Chow, C. W., Cooper, J. C., & Waller, W. S. (1988). Participative budgeting: effects of a truth-inducing pay scheme and information asymmetry on slack and performance. The Accounting Review, 63(1), 111–122.

Chow, C. W., Hirst, M., & Shields, M. D. (1994). Motivating truthful subordinate reporting: an experimental investigation in a two-subordinate context. Contemporary Accounting Research, 10(2), 699–720.

Chow, C. W., Hwang, R. N. C., & Liao, W. (2000). Motivating truthful upward communication of private information: An experimental study of mechanisms from theory and practice. Abacus, 36(2), 160–179.

Christensen, J. (1982). The determination of performance standards and participation. Journal of Accounting Research, 20(2), 589–603.

Christie, R., & Geis, F. L. (1970). Studies in machiavellianism. New York: Academic Press.

Chung, J. O., & Hsu, S. H. (2017). The effect of cognitive moral development on honesty in managerial reporting. Journal of Business Ethics, 145(3), 563–575.

Church, B. K., Hannan, R. L., & Kuang, X. (2012). Shared interest and honesty in budget reporting. Accounting, Organizations and Society, 37(3), 155–167.

Church, B. K., Lynn Hannan, R., & Kuang, X. J. (2014). Information acquisition and opportunistic behavior in managerial reporting. Contemporary Accounting Research, 31(2), 398–419.

Clor-Proell, S. M., Kaplan, S. E., & Proell, C. A. (2015). The impact of budget goal difficulty and promotion availability on employee fraud. Journal of Business Ethics, 131(4), 773–790.

Collins, F. (1978). The interaction of budget characteristics and personality variables with budgetary response attitudes. The Accounting Review, 53(2), 324–335.

Collins, F., Almer, E. D., & Mendoza, R. I. (1999). Budget games and effort: Differences between the United States and Latin America. Journal of International Accounting, Auditing & Taxation, 8(2), 241–267.

Collins, F., Seiler, R. E., & Clancy, D. K. (1984). Budgetary attitudes: the effects of role senders, stress and performance evaluation. Accounting and Business Research, 14(54), 163–168.

Covaleski, M., Evans, J. H., III, Luft, J., & Shields, M. D. (2003). Budgeting research: three theoretical perspectives and criteria for selective integration. Journal of Management Accounting Research, 15(1), 3–49.

Covaleski, M., Evans, J. H., III, Luft, J., & Shields, M. D. (2007). Budgeting research: three theoretical perspectives and criteria for selective integration. In Chapman C, Hopwood AG, Shields MD (Eds.), Handbook of management accounting research 2 (pp. 587–624). Amsterdam: Elsevier.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. In J. B. Miner (Ed.), Organizational behavior 2: Essential theories of process and structure (pp. 60–77). Armonk, NY: M.E. Sharpe.

Davila, T., & Wouters, M. (2005). Managing budget emphasis through the explicit design of conditional budgetary slack. Accounting, Organizations and Society, 30(7–8), 587–608.

Davis, S., DeZoort, F. T., & Kopp, L. S. (2006). The effect of obedience pressure and perceived responsibility on management accountants’ creation of budgetary slack. Behavioral Research in Accounting, 18(1), 19–35.

De Baerdemaeker, J., & Bruggeman, W. (2015). The impact of participation in strategic planning on managers’ creation of budgetary slack: The mediating role of autonomous motivation and affective organisational commitment. Management Accounting Research, 29, 1–12.

Douglas, P. C., HassabElnaby, H., Norman, C. S., & Wier, B. (2007). An investigation of ethical position and budgeting systems: Egyptian managers in US and Egyptian firms. Journal of International Accounting, Auditing & Taxation, 16(1), 90–109.

Douglas, P. C., & Wier, B. (2000). Integrating ethical dimensions into a model of budgetary slack creation. Journal of Business Ethics, 28(3), 267–277.

Douglas, P. C., & Wier, B. (2005). Cultural and ethical effects in budgeting systems: A comparison of US and Chinese managers. Journal of Business Ethics, 60(2), 159–174.

Douthit, J. D., & Stevens, D. E. (2015). The robustness of honesty effects on budget proposals when the superior has rejection authority. The Accounting Review, 90(2), 467–493.

Dreber, A., & Johannesson, M. (2008). Gender differences in deception. Economics Letters, 99(1), 197–199.

Dunk, A. S. (1990). Budgetary participation, agreement on evaluation criteria and managerial performance: A research note. Accounting, Organizations and Society, 15(3), 171–178.

Dunk, A. S. (1993). The effect of budget emphasis and information asymmetry on the relation between budgetary participation and slack. The Accounting Review, 68(2), 400–410.

Dunk, A. S., & Nouri, H. (1998). Antecedents of budgetary slack: A literature review and synthesis. Journal of Accounting Literature, 17, 72–96.

Dunk, A. S., & Perera, H. (1997). The incidence of budgetary slack: a field study exploration. Accounting, Auditing & Accountability Journal, 10(5), 649–664.

Eskenazi, P. I., Hartmann, F. G., & Rietdijk, W. J. (2016). Why controllers compromise on their fiduciary duties: EEG evidence on the role of the human mirror neuron system. Accounting, Organizations and Society, 50, 41–50.

Evans, J. H., Hannan, R. L., Krishnan, R., & Moser, D. V. (2001). Honesty in managerial reporting. The Accounting Review, 76(4), 537–559.

Ewert, R., & Ernst, C. (1999). Target costing, co-ordination and strategic cost management. European Accounting Review, 8(1), 23–49.

Farlee, M. A. (1998). Welfare effects of timely reporting. Review of Accounting Studies, 3(3), 289–320.

Farlee, M. A., Fellingham, J. C., & Young, R. A. (1996). Properties of economic income in a private information setting. Contemporary Accounting Research, 13(2), 401–422.

Fauré, B., & Rouleau, L. (2011). The strategic competence of accountants and middle managers in budget making. Accounting, Organizations and Society, 36(3), 167–182.

Fisher, J. G., Frederickson, J. R., & Peffer, S. A. (2000). Budgeting: an experimental investigation of the effects of negotiation. The Accounting Review, 75(1), 93–114.

Fisher, J., Frederickson, J. R., & Peffer, S. A. (2002a). The effect of information asymmetry on negotiated budgets: An empirical investigation. Accounting, Organizations and Society, 27(1–2), 27–43.

Fisher, J. G., Maines, L. A., Peffer, S. A., & Sprinkle, G. B. (2002b). Using budgets for performance evaluation: effects of resource allocation and horizontal information asymmetry on budget proposals, budget slack, and performance. The Accounting Review, 77(4), 847–865.

Giroux, G., & Shields, D. (1993). Accounting controls and bureaucratic strategies in municipal government. Journal of Accounting and Public Policy, 12(3), 239–262.

Goretzki, L., Lukka, K., & Messner, M. (2017). Controllers’ use of informational tactics. Accounting and Business Research, 47(7), 1–27.

Groves, T., & Loeb, M. (1979). Incentives in a divisionalized firm. Management Science, 25(3), 221–230.

Guo, L., Libby, T., & Liu, X. K. (2017). The effects of vertical pay dispersion: experimental evidence in a budget setting. Contemporary Accounting Research, 34(1), 555–576.

Hall, M. (2016). Realising the richness of psychology theory in contingency-based management accounting research. Management Accounting Research, 31, 63–74.

Hannan, R., Rankin, F., & Towry, K. L. (2006). The effect of information systems on honesty in managerial reporting: A behavioral perspective. Contemporary Accounting Research, 23(4), 885–932.

Hannan, R. L., Rankin, F. W., & Towry, K. L. (2010). Flattening the organization: the effect of organizational reporting structure on budgeting effectiveness. Review of Accounting Studies, 15(3), 503–536.

Hartmann, F. G. (2000). The appropriateness of RAPM: toward the further development of theory. Accounting, Organizations and Society, 25(4–5), 451–482.

Hartmann, F. G., & Maas, V. S. (2010). Why business unit controllers create budget slack: Involvement in management, social pressure, and machiavellianism. Behavioral Research in Accounting, 22(2), 27–49.

Hartmann, F. G., & Moers, F. (1999). Testing contingency hypotheses in budgetary research: An evaluation of the use of moderated regression analysis. Accounting, Organizations and Society, 24(4), 291–315.

Heinle, M. S., Ross, N., & Saouma, R. E. (2014). A theory of participative budgeting. The Accounting Review, 89(3), 1025–1050.

Hesford, J. W., Lee, S.-H., Stede, W. A. V., & Young, S. M. (2007). Management accounting: A bibliographic study. Handbooks of management accounting research 1 (pp. 3–26). Amesterdam: Elsevier.

Hirst, M. K. (1983). Reliance on accounting performance measures, task uncertainty, and dysfunctional behavior: some extensions. Journal of Accounting Research, 21(2), 596–605.

Hobson, J. L., Mellon, M. J., & Stevens, D. E. (2011). Determinants of moral judgments regarding budgetary slack: An experimental examination of pay scheme and personal values. Behavioral Research in Accounting, 23(1), 87–107.

Huang, C. L., & Chen, M. L. (2009). Relationships among budgetary leadership behavior, managerial budgeting games, and budgetary attitutes: evidence from Taiwanese corporations. Journal of International Accounting, Auditing & Taxation, 18(1), 73–84.

Huddart, S. (2017). Discussion of “the effects of vertical pay dispersion: Experimental evidence in a budget setting”. Contemporary Accounting Research, 34(1), 577–581.

Hughes, M. A., & Kwon, S. Y. (1990). An integrative framework for theory construction and testing. Accounting, Organizations and Society, 15(3), 179–191.

Indjejikian, R. J., & Matejka, M. (2006). Organizational slack in decentralized firms: The role of business unit controllers. The Accounting Review, 81(4), 849–872.

Indjejikian, R. J., & Matĕjka, M. (2012). Accounting decentralization and performance evaluation of business unit managers. The Accounting Review, 87(1), 261–290.

Jackson, D. N. (1994). Jackson personality inventory—revised: Techical manual. Port Huron, MI: Sigma Assessment Systems.

Kamin, J. Y., & Ronen, J. (1978). The smoothing of income numbers: Some empirical evidence on systematic differences among management-controlled and owner-controlled firms. Accounting, Organizations and Society, 3(2), 141–157.

Kanodia, C. (1993). Participative budgets as coordination and motivational devices. Journal of Accounting Research, 31(2), 172–189.

Kihn, L. A. (2011). How do controllers and managers interpret budget targets? Journal of Accounting & Organizational Change, 7(3), 212–236.

Kilfoyle, E., & Richardson, A. J. (2011). Agency and structure in budgeting: Thesis, antithesis and synthesis. Critical Perspectives on Accounting, 22(2), 183–199.

Kim, D. C. (1992). Risk preferences in participative budgeting. The Accounting Review, 67(3), 303–318.

Kirby, A. J., Reichelstein, S., Sen, P. K., & Paik, T.-Y. (1991). Participation, slack, and budget-based performance evaluation. Journal of Accounting Research, 29(1), 109–128.

Kramer, S., & Hartmann, F. (2014). How top-down and bottom-up budgeting affect budget slack and performance through social and economic exchange. Abacus, 50(3), 314–340.

Kunz, J. (2017). Discussion of: The effect of injunctive social norms and dissent on budget reporting honesty. Journal of International Accounting Research, 16(2), 33–35.

Lal, M., Dunk, A. S., & Smith, G. D. (1996). The propensity of managers to create budgetary slack: a cross-national re-examination using random sampling. The International Journal of Accounting, 31(4), 483–496.

Lambert, R. A. (2001). Contracting theory and accounting. Journal of Accounting and Economics, 32(1–3), 3–87.

Lau, C. M., & Eggleton, I. R. C. (2003). The influence of information asymmetry and budget emphasis on the relationship between participation and slack. Accounting and Business Research, 33(2), 91–104.

Leone, A. J., & Rock, S. (2002). Empirical tests of budget ratcheting and its effect on managers’ discretionary accrual choices. Journal of Accounting and Economics, 33(1), 43–67.

Luft, J. (2016). Cooperation and competition among employees: Experimental evidence on the role of management control systems. Management Accounting Research, 31, 75–85.

Luft, J., & Shields, M. D. (2009). Psychology models of management accounting. Foundations and Trends in Accounting, 4(3–4), 199–345.

Lukka, K. (1982). Budgetary slack from the control perspective. Turku: Turku School of Economics.

Lukka, K. (1988). Budgetary biasing in organizations: Theoretical framework and empirical evidence. Accounting, Organizations and Society, 13(3), 281–301.

Lyne, S. R. (1988). The role of the budget in medium and large UK companies and the relationship with budget pressure and participation. Accounting and Business Research, 18(71), 195–212.

Lyne, S. R. (1992). Perceptions and attitudes of different user-groups to the role of the budget, budget pressure and budget participation. Accounting and Business Research, 22(88), 357–369.

Maas, V. S., & Matejka, M. (2009). Balancing the dual responsibilities of business unit controllers: field and survey evidence. The Accounting Review, 84(4), 1233–1253.

Maas, V. S., & Van Rinsum, M. (2013). How control system design influences performance misreporting. Journal of Accounting Research, 51(5), 1159–1186.

Magner, N., Welker, R. B., & Campbell, T. L. (1996). Testing a model of cognitive budgetary participation processes in a latent variable structural equations framework. Accounting and Business Research, 27(1), 41–50.

Matuszewski, L. J. (2010). Honesty in managerial reporting: is it affected by perceptions of horizontal equity? Journal of Management Accounting Research, 22(1), 233–250.

Mehafdi, M. (2000). The ethics of international transfer pricing. Journal of Business Ethics, 28(4), 365–381.

Merchant, K. A. (1985). Budgeting and the propensity to create budgetary slack. Accounting, Organizations and Society, 10(2), 201–210.

Merchant, K. A. (1998). Modern management control systems: Text and cases. The Robert S Kaplan series in management accounting. Upper Saddle River, NJ: Prentice Hall.

Merchant, K. A., & Manzoni, J. F. (1989). The achievability of budget targets in profit centers: A field study. The Accounting Review, 64(3), 539–558.

Mitchell, F. (1994). A commentary on the applications of activity-based costing. Management Accounting Research, 5(3–4), 261–277.

Mittendorf, B. (2006). Capital budgeting when managers value both honesty and perquisites. Journal of Management Accounting Research, 18(1), 77–95.

Newman, A. H. (2014). An investigation of how the informal communication of firm preferences influences managerial honesty. Accounting, Organizations and Society, 39(3), 195–207.

Nikias, A. D., Schwartz, S. T., Spires, E. E., Wollscheid, J. R., & Young, R. A. (2010). The effects of aggregation and timing on budgeting: an experiment. Behavioral Research in Accounting, 22(1), 67–83.

Nouri, H. (1994). Using organizational commitment and job involment to predict budgetary slack: A research note. Accounting, Organizations and Society, 19(3), 289–295.

Nouri, H., & Parker, R. J. (1996). The effect of organizational commitment on the relation between budgetary participation and budgetary slack. Behavioral Research in Accounting, 8, 74–90.

Nouri, H., & Parker, R. J. (1998). The relationship between budget participation and job performance: The roles of budget adequacy and organizational commitment. Accounting, Organizations and Society, 23(5–6), 467–483.

Onsi, M. (1973). Factor analysis of behavioral variables affecting budgetary slack. The Accounting Review, 48(3), 535–548.

Otley, D. T. (1978). Budget use and managerial performance. Journal of Accounting Research, 16(1), 122–149.

Otley, D. T. (1985). The accuracy of budgetary estimates: Some statistical evidence. Journal of Business Finance & Accounting, 12(3), 415–428.

Paik, T. Y. (1993). Participative budgeting with kinked linear payment schemes. Review of Quantitative Finance and Accounting, 3(2), 171–187.

Parker, R. J., & Kyj, L. (2006). Vertical information sharing in the budgeting process. Accounting, Organizations and Society, 31(1), 27–45.

Pope, P. F. (1984). Information asymmetries in participative budgeting: A bargaining approach. Journal of Business Finance & Accounting, 11(1), 41–59.

Ramadan, S. (1989). The rationale for cost allocation: A study of UK divisionalised companies. Accounting and Business Research, 20(77), 31–37.

Rankin, F. W., Schwartz, S. T., & Young, R. A. (2008). The effect of honesty and superior authority on budget proposals. The Accounting Review, 83(4), 1083–1099.

Reichelstein, S. (1992). Constructing incentive schemes for government contracts: an application of agency theory. The Accounting Review, 67(4), 712–731.

Rothenberg, N. R. (2009). The interaction among disclosures, competition, and an internal control problem. Management Accounting Research, 20(4), 225–238.

Salterio, S. E. (2015). Barriers to knowledge creation in management accounting research. Journal of Management Accounting Research, 27(1), 151–170.

Salterio, S. E., & Webb, A. (2006). The effect of information systems on honesty in managerial reporting: A behavioral perspective. Contemporary Accounting Research, 23(4), 919–932.

Schatzberg, J. W., & Stevens, D. E. (2008). Public and private forms of opportunism within the organization: A joint examination of budget and effort behavior. Journal of Management Accounting Research, 20(1), 59–81.

Schiff, M., & Lewin, A. Y. (1970). The impact of people on budgets. The Accounting Review, 45(2), 259–268.

Schreck, P. (2014). Honesty in managerial reporting: How competition affects the benefits and costs of lying. Critical Perspectives on Accounting, 27, 177–188.

Schwartz, S. T., Spires, E. E., Wallin, D. E., & Young, R. A. (2012). Aggregation in budgeting: An experiment. Journal of Management Accounting Research, 24(1), 177–199.

Shields, M. D. (1997). Research in management accounting by North Americans in the 1990s. Journal of Management Accounting Research, 9, 3–61.

Shields, M. D., Deng, F. J., & Kato, Y. (2000). The design and effects of control systems: Tests of direct-and indirect-effects models. Accounting, Organizations and Society, 25(2), 185–202.

Shields, J. F., & Shields, M. D. (1998). Antecedents of participative budgeting. Accounting, Organizations and Society, 23(1), 49–76.

Shields, M. D., & Young, S. M. (1993). Antecedents and consequences of participative budgeting: Evidence on the effects of asymmetrical information. Journal of Management Accounting Research, 5, 265–280.

Simons, R. (1988). Analysis of the organizational characteristics related to tight budget goals. Contemporary Accounting Research, 5(1), 267–283.

Sprinkle, G. B. (2003). Perspectives on experimental research in managerial accounting. Accounting, Organizations and Society, 28(2–3), 287–318.

Sprinkle, G. B., & Williamson, M. G. (2007). Experimental research in managerial accounting. In C. S. Chapman, A. G. Hopwood, & M. D. Shields (Eds.), Handbook of management accounting research 1 (pp. 415–444). Amsterdam: Elsevier.

Sridhar, S. S. (1994). Managerial reputation and internal reporting. The Accounting Review, 69(2), 343–363.

Stevens, D. E. (2002). The effects of reputation and ethics on budgetary slack. Journal of Management Accounting Research, 14(1), 153–171.

Thompson, V. A. (1961). Modern organization. New York: Knopf.

Tisdell, C. (1984). Slack and strain in efficient budgeting and resource allocation by organizations. Managerial and Decision Economics, 5(1), 54–57.

Todd, R., & Ramanathan, K. V. (1994). Perceived social needs, outcomes measurement, and budgetary responsiveness in a not-for-profit setting: Some empirical evidence. The Accounting Review, 69(1), 122–137.

Turner, M. J., & Guilding, C. (2012). Factors affecting biasing of capital budgeting cash flow forecasts: Evidence from the hotel industry. Accounting and Business Research, 42(5), 519–545.

Van der Stede, W. A. (1997). Strategy—control—performance: An empirical analysis in large, independent. Belgian firms. European Accounting Review, 6(4), 807–809.

Van der Stede, W. A. (2000). The relationship between two consequences of budgetary controls: Budgetary slack creation and managerial short-term orientation. Accounting, Organizations and Society, 25(6), 609–622.

Van der Stede, W. A. (2001a). Measuring ‘tight budgetary control’. Management Accounting Research, 12(1), 119–137.

Van der Stede, W. A. (2001b). The effect of corporate diversification and business unit strategy on the presence of slack in business unit budgets. Accounting, Auditing & Accountability Journal, 14(1), 30–52.

Vaysman, I. (1996). A model of cost-based transfer pricing. Review of Accounting Studies, 1(1), 73–108.

Verband der Hochschullehrer für Betriebswirtschaft e.V. (2015). VHB-JOURQUAL 3. Retrieved from http://vhbonline.org/vhb4you/jourqual/vhb-jourqual-3/. Accessed 8 Jan 2018.

Walker, K. B., & Johnson, E. N. (1999). The effects of a budget-based incentive compensation scheme on the budgeting behavior of managers and subordinates. Journal of Management Accounting Research, 11, 1–29.

Waller, W. S. (1988). Slack in participative budgeting: The joint effect of a truth-inducing pay scheme and risk preferences. Accounting, Organizations and Society, 13(1), 87–98.

Waller, W. S. (1994). Discussion of “trust and truthful subordinate reporting: an experimental investigation in a two-subordinate context”. Contemporary Accounting Research, 10(2), 721–734.

Waller, W. S., & Bishop, R. A. (1990). An experimental study of incentive pay schemes, communication, and intrafirm resource allocation. The Accounting Review, 65(4), 812–836.

Waterhouse, J. H., & Tiessen, P. (1978). A contingency framework for management accounting systems research. Accounting, Organizations and Society, 3(1), 65–76.

Webb, R. A. (2002). The impact of reputation and variance investigations on the creation of budget slack. Accounting, Organizations and Society, 27(4–5), 361–378.

Weitzman, M. L. (1976). The new soviet incentive model. The Bell Journal of Economics, 7(1), 251–257.

Wickramasinghe, D., & Hopper, T. (2005). A cultural political economy of management accounting controls: A case study of a textile Mill in a traditional Sinhalese village. Critical Perspectives on Accounting, 16(4), 473–503.

Williamson, O. E. (1970). Corporate control and business behavior: An inquiry into the effects of organization form on enterprise behavior. Prentice Hall international series in management. Englewood Cliffs, NJ: Prentice Hall.

Yeom, S., Balachandran, K. R., & Ronen, J. (1993). Piecewise linear incentive scheme and participative budgeting. Review of Quantitative Finance and Accounting, 3(2), 149–169.

Young, S. M. (1985). Participative budgeting: the effects of risk aversion and asymmetric information on budgetary slack. Journal of Accounting Research, 23(2), 829–842.

Young, S. M., Fisher, J., & Lindquist, T. M. (1993). The effects of intergroup competition and intragroup cooperation on slack and output in a manufacturing setting. The Accounting Review, 68(3), 466–481.

Zhang, Y. (2008). The effects of perceived fairness and communication on honesty and collusion in a multi-agent setting. The Accounting Review, 83(4), 1125–1146.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Illustration by variables

Variables | |||||

|---|---|---|---|---|---|

Paper | Dependent | Intervening | Moderator | Independent | Antecedent |

Onsi (1973) | Slack attitude | Several managerial behavioural variables (e.g. slack manipulation, slack detection) | |||

Cammann (1976) | Subordinate responses to uses of control systems | Subordinate participation and job difficulty | Superior use of control systems | ||

Collins (1978) | Budgetary response attitudes (positive, negative) | Attitudes towards budget characteristics | Personal flexibility, perceived budget characteristics (e.g. accuracy), demographic variables (e.g. age) | ||

Belkaoui (1985) | Budgetary slack creation | Self-esteem feedback | |||

Merchant (1985) | Propensity to create budgetary slack | Importance of meeting budget, participation, technology, ability to detect slack | |||

Young (1985) | Amount of budgetary slack, importance of being seen as a hard worker, degree of social pressure felt | Risk-aversion, private information | Budgetary participation | ||

Chow et al. (1988) | Budgetary slack, performance | Information asymmetry | Pay scheme (truth-inducing, slack-inducing) | ||

Simons (1988) | Firm performance | Budget goal tightness | Business strategy, internal organizational conditions | ||

Waller (1988) | Budgetary slack | Risk-neutrality, risk-aversion | Pay-scheme | ||

Dunk (1990) | Managerial performance | Agreement on evaluation criteria | Participative budgeting | ||

Waller and Bishop (1990) | Managers’ misrepresentation, resource consumption | Unit profit scheme, unit profit-plus-penalty scheme, Groves scheme | |||

Kim (1992) | Budget preferences (tight, safe) | Status relative to average performance, dispositional risk attitude | |||

Dunk (1993) | Budgetary slack | Budgetary participation, information asymmetry, budget emphasis | |||

Giroux and Shields (1993) | Level of governmental expenditures | Audit, budget, city manager and certificate of achievement, political competition, total debt | |||

Shields and Young (1993) | Firm-wide performance | Participative budgeting, budget-based incentives | Information asymmetry | ||

Young et al. (1993) | Budgetary slack, performance | Intragroup cooperation, intergroup competitive feedback | |||

Chow et al. (1994) | Subordinate misrepresentations | Pay scheme (profit sharing, single-subordinate truth-inducing scheme, Groves scheme) | |||

Nouri (1994) | Budgetary slack | Organizational commitment | Job involvement | ||

Todd and Ramanathan (1994) | Performance in the not-for-profit sector | Police operations; budgetary measures | |||

Lal et al. (1996) | Budgetary slack | Importance of meeting budget, participation, technology, ability to detect slack | |||

Magner et al. (1996) | Budget utility, job-relevant information | Budget quality | Budgetary participation | ||

Nouri and Parker (1996) | Budgetary slack | Organizational commitment | Budgetary participation | ||

Van der Stede (1997) | Corporate performance | Corporate diversification; internal control system | |||

Nouri and Parker (1998) | Job performance | Budget adequacy, organizational commitment | Budgetary participation | ||

Collins et al. (1999) | Budgetary effort | Budget game (devious, incremental, economic) | Locale (United States and Latin America) | ||

Walker and Johnson (1999) | Subordinates’ participatory budget estimates | Budget-based incentive compensation scheme | |||

Chow et al. (2000) | Subordinates’ misrepresentation | Groves scheme, Osband and Reichelstein scheme, non-mechanistic superior, linear profit sharing scheme | |||

Douglas and Wier (2000) | Budgetary slack | Information asymmetry, incentive to create budgetary slack, ethical position (relativism, idealism) | Budgetary participation | ||

Fisher et al. (2000) | Budgetary slack, subordinate performance | Budget setting: unilaterally, negotiation process (agreement, behaviour, structure) | |||

Shields et al. (2000) | Job performance | Standard tightness, Standard-based incentives, job-related stress | Participative standard setting | ||

Van der Stede (2000) | Managerial short-term orientation | Rigid budgetary control, budgetary slack | Business unit competitive strategy; past business unit performance | Business unit past performance and competitive strategy | |

Evans et al. (2001) | Managerial reporting honesty | Preferences for wealth and honesty: contract design | |||

Van der Stede (2001b) | Budgetary slack | Budgetary controls, associated incentives | Corporate diversification, business unit strategy | ||

Fisher et al. (2002a) | Budgetary slack, subordinate performance | Information asymmetry, justice and fairness considerations | Negotiation process | ||

Fisher et al. (2002b) | Subordinate’s initial budget proposals, slack, performance | Using budgets for performance evaluation and resource allocation, information asymmetry | |||

Leone and Rock (2002) | Managers’ discretionary accrual choices | Budget ratcheting | |||

Stevens (2002) | Budgetary slack | Reputation and ethical concerns | Level of information asymmetry | ||

Webb (2002) | Budgetary slack | Reputation concerns, variance investigation | |||

Lau and Eggleton (2003) | Propensity to create budgetary slack | Information asymmetry, budget emphasis | Budgetary participation | ||

Davila and Wouters (2005) | Budget emphasis | Budgetary slack | Demanding conditions | Alternative goals | |

Douglas and Wier (2005) | Budgetary slack | Budgetary participation, incentive to create slack, ethical ideology | |||

Davis et al. (2006) | Budgetary slack, perceived responsibility for budget recommendation | Obedience pressure to create slack | |||

Hannan et al. (2006) | Managerial honesty | Information system precision | Information system existence | ||

Indjejikian and Matêjka (2006) | Organizational slack | Information asymmetry between corporate headquarter and business unit manager; managerial accounting system | |||

Parker and Kyj (2006) | Job performance | Vertical information sharing, organizational commitment, role ambiguity | Budget participation; | ||

Douglas et al. (2007) | Budgetary slack, budgetary participation | National culture | Ethical position | ||

Arnold et al. (2008) | Misreporting | Groves mechanism, profit sharing | Communication | ||

Rankin et al. (2008) | Budgetary slack | Final budget authority (superior, subordinate), mode of budget communication (offer, factual assertion) | |||

Schatzberg and Stevens (2008) | Budgetary slack, effort | Rejection power, pair rotation, experience, concerns for fairness and ethics | |||

Zhang (2008) | Reporting honesty, whistleblowing | Perception regarding the fairness of the principal, communication among agents | Peer reporting system | ||

Huang and Chen (2009) | Attitudes towards the budgetary process | Budgeting games (devious, economic) | Leadership behaviour (contingent reward, contingent punishment) | ||

Maas and Matějka (2009) | Data misreporting, local decision-making support | Role conflict, role ambiguity | Emphasis on the functional responsibility of business unit controllers | ||

Hannan et al. (2010) | Budgetary slack, superior’s willingness to reject projects | Span of control | |||

Hartmann and Maas (2010) | Budgetary slack | Controller involvement in management, machiavellianism | Social pressure to create budgetary slack | ||

Matuszewski (2010) | Honesty in managerial reporting | Participant remuneration, horizontal equity of salary | |||

Nikias et al. (2010) | Budgetary slack | Aggregation and timing of budgetary reports | |||

Anderson and Lillis (2011) | Business strategy, budget culture, cost management practices | Corporate frugality | |||

Bouwens and Kroos (2011) | Effort reduction | Target ratcheting | |||

Brüggen and Luft (2011) | Misrepresentation of private information | Level of competition | |||

Hobson et al. (2011) | Moral judgments regarding budgetary slack | Pay scheme, personal values (e.g. traditional values) | |||

Church et al. (2012) | Honest reporting, budgetary slack | Awareness of misreporting, other employees’ preference for honesty | Shared interests | ||

Turner and Guilding (2012) | Biasing of capital budgeting cash flow forecasts | Locus of power between hotel owner and operator; emphasis attached to the payback investment appraisal method; adequacy of funds allocated to the furniture, fittings, and equipment account; challenge in accessing reserve account funds; remaining length of management contract; emphasis on financial versus non-financial factors in investment appraisal | |||

Arnold and Schreiber (2013) | Superior/subordinate payoff, slack creation | Reputational aspects, level of social content | Audits in a fixed/random matching setting | Subordinates’ past norm violations | |

Maas and van Rinsum (2013) | Reporting honesty | Control system design | Impact on peers | ||

Brink et al. (2014) | Budgetary slack | Final budget authority | Cost system information | ||

Brown et al. (2014) | Honest budgetary reporting | Ranking | |||

Church et al. (2014) | Opportunistic reporting | Honesty preference | Discretion in information acquisition | ||

Heinle et al. (2014) | Budgetary slack, firm performance | Top-down/bottom-up budget Paradigms; information asymmetry between principal and agent | |||

Kramer and Hartmann (2014) | Budgetary slack; managerial performance | Social/economic exchange with the company | Top-down versus bottom-up orientation | ||

Newman (2014) | Managerial reporting honesty | Tightness of informal cost targets (tight, moderate, loose) | |||

Schreck (2014) | Honesty in managerial reporting | Rivalry | Gender | Competition | |

Arnold (2015) | Negotiation agreement, subordinate effort, budget commitment | Exogenous constraints | Opportunity costs, financial pressure, budget imposition, favourable budgeting process perceptions | ||

Arnold and Artz (2015) | Firm performance | Target flexibility | Predominant use of targets for decision making | Target difficulty | |

Arnold and Gillenkirch (2015) | Superior’s task outcome | Budget negotiation | Performance evaluation, planning | ||

Cardinaels and Yin (2015) | Honest cost reporting | Social norms, trust | Incentive contract versus fixed-salary contract | ||

Chen et al. (2015) | Accuracy and optimism of forecasts | Performance-based incentives | Forecast type, | ||

Clor-Proell et al. (2015) | Employee fraud | Budget goal difficulty | Promotion availability | ||

De Baerdemaeker and Brugeman (2015) | Budgetary slack | Affective organisational commitment, autonomous budget motivation | Participative strategic planning | ||

Douthit and Stevens (2015) | Budgetary slack | Superior rejection authority | Honesty preferences in participative budgeting | ||

Brüggen and Luft (2016) | Cost underestimation | Changing versus continuing superiors | |||

Cardinaels and Jia (2016) | Honest reporting | Audits | Incentives, peer behaviour | ||

Eskenazi et al. (2016) | Ability to withstand pressure to misreport | Managers’ personal versus organizational interest | Neurobiological aspects | ||

Guo et al. (2017) | Misreporting | Vertical pay dispersion | |||

Abdel-Rahim and Stevens (2018) | Honesty in managerial reporting | Perceived information asymmetry | Information system accuracy | Information system precision | |

Altenburger (2017) | Budget reporting honesty | Dissent | Injunctive social norms | ||

Brink et al. (2017) | Reporting honesty | Codes of conduct, monitoring, penalties, Machiavellianism | |||

Brown et al. (2017) | Honest reporting | Participative budgeting, budget framing | |||

Brunner and Ostermaier (2017a) | Sabotage in capital budgeting | Distrust, intent to punish | Factual assertion | Intent to be honest, reciprocity | |

Brunner and Ostermaier (2017b) | Managerial honesty | Peer influence: | |||

Chung and Hsu (2017) | Firm profit | Honest reporting | Trust versus optimal hurdle contract | Cognitive moral development | |

Appendix 2

Current experiments illustrated by variables

Variables | ||||

|---|---|---|---|---|

Paper | Dependent | Intervening | Moderator | Independent |

Davis et al. (2006) | Budgetary slack: inflation of budget estimate; Perceived responsibility for budget recommendation: 100% allocation method | Obedience pressure resulting in no obedience, total obedience, zone of compromise | ||

Hannan et al. (2006) | Managerial honesty: The cost report made by the manager, the proportion of cost reports falling within the range of the information system signal | Information system precision: precise (0.25 lira range for actual cost), coarse (0.5 lira range for actual cost) | Information system existence | |

Arnold et al. (2008) | Misrepresentation | Groves mechanism, profit sharing | Communication | |

Rankin et al. (2008) | Budgetary slack: reported cost minus actual cost | Final budget authority (superior, subordinate), mode of budget communication (offer, factual assertion), | ||

Schatzberg and Stevens (2008) | Slack: Expected production less self-set budget divided by expected production; Low Effort: Time producers provided low effort | Rejection power (0 or 1), pair rotation (0 or 1), experience (0 or 1), fairness concerns (1–7), ethics concerns (1–7) | ||

Hannan et al. (2010) | Superior’s willingness to reject projects: cost threshold above which projects are rejected; Budgetary slack: mean reported cost | Span of control: low span (eight superiors, eight subordinates), high span (four superiors, 12 subordinates) | ||

Hartmann and Maas (2010) | Budgetary slack: likelihood for slack creation in the scenario | Controller involvement in management: high, low (embedded in the scenario); Machiavellianism: Mach IV scale (Christie and Geis 1970) | Social pressure to create budgetary slack: high, low (embedded in the scenario) | |

Matus-zewski (2010) | Honesty in managerial reporting: change in honesty; Differences between first and second half of the experiment in the portion of the payoff available (difference between maximum cost a participant could have reported and actual cost) that the participant did not claim | Pay of each participant: participant salary variable (no change, increased, decreased); Horizontal equity: salary changes (increased: inequitable to equitable; decreased: equitable to inequitable; no change: equitable) | ||

Nikias et al. (2010) | Creation of budgetary slack: proportion of slack retained = \( ({\text{budget}} - {\text{actual}}\;{\text{cost}})/50 - {\text{actual}}\;{\text{cost}} \) | Aggregation and timing of budgetary reports (for two projects): aggregate (subordinates observe each project’s cost and submit one budget), sequential (subordinates observe costs and submit individual budgets sequentially), delayed treatment (subordinates observe both costs before providing individual budgets) | ||

Brüggen and Luft (2011) | Misrepresentation of private signal: the agent’s revenue prediction minus his or her private signal of the most likely revenue; Misrepresentation of expected revenue: the agent’s revenue prediction minus the expected revenue conditional on his or her private signal; Actual misrepresentation as a percentage of possible misrepresentation | Level of competition generated by capital rationing: Principals could accept three, no more than two, or no more than one project | ||

Hobson et al. (2011) | Moral judgment regarding budgetary slack: 1 “strongly disagree” to 7 “strongly agree” in response to the question: “To have set the budget significantly below the forecast of productions would have been unethical” (Stevens 2002) | Pay scheme: slack inducing, truth-inducing; Personal values: traditional values, responsibility, empathy [measured by Jackson Personality Inventory-Revised questionnaire (Jackson 1994)] | ||

Church et al. (2012) | Honesty: \( 1 - [({\text{budgeted}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}})/ ( 6 0 0 0- {\text{actual}}\;{\text{cost)]}} \); Slack: \( {\text{budgeted}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}} \) | Awareness of misreporting: knowledge: whether the manager’s report and actual cost are known to the assistant; Other employees’ preference for honesty: 1 “The budget should not be inflated” to 11 “The budget should be inflated to the full extent” | Shared interests: no-sharing condition (division manager keeps the entire amount of slack), sharing condition (slack is split equally between division manager and assistant) | |

Maas and van Rinsum (2013) | Reporting honesty: Overstatement is calculated as report (number of correct answers) minus score (actual number of correct answers), Dishonesty is Overstatement/(100 − Score) | Control system design: Open/closed information policy | Impact on peers: Inclusion of a group performance-based element in the participants’ pay function relating to the average reported score of all other participants | |

Brink et al. (2014) | Budgetary slack \( ({\text{budgeted}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}}) \) | Final budget authority (superior, subordinate) | Cost system information (public and verifiable, private), | |

Brown et al. (2014) | Honest budgetary reporting \( [({\text{Budget}}\;{\text{request}} - {\text{Project}}\;{\text{cost}})/({\text{Revenue}} - {\text{Project}}\;{\text{cost}})] \) | Ranking: firm profit, own compensation, both firm profit and own compensation, randomly | ||

Church et al. (2014) | Opportunistic reporting \( [({\text{reported}}\;{\text{bonus}} - {\text{actual}}\;{\text{bonus}})/(25 - {\text{actual}}\;{\text{bonus}})] \) | Honesty preference: Low, moderate, high (according to opportunistic reporting) | Discretion in information acquisition (present/absent) | |

Newman (2014) | Managerial reporting honesty: honesty defined as \( 1 - [({\text{budgeted}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}})/(\$ 30 - {\text{actual}}\;{\text{cost}})] \) | Tightness of informal cost targets: moderate (near the mean of the cost range), loose (at the upper end of the cost range), tight (at the lower end of the cost range) | ||

Schreck (2014) | Honesty in managerial reporting: honesty defined as participants overstatements relative to the maximum potential overstatement | Rivalry (lower honesty preferences): Subjects do not compete for scarce resources but for their position in a ranking; Expected monetary benefits of lying | Gender: male, female | Competition (economic pressure to lie): no competition treatment (every project receives funding), economic pressure treatment (subjects compete for scarce financial resources), no rivalry |

Arnold (2015) | Negotiation agreement; subordinate effort: performance divided by capability; budget commitment | Exogenous constraints: superior opportunity cost/financial pressure | Opportunity cost: superior’s working time is (not) independent of the negotiation length; Financial pressure: superior’s payoff is (not) independent of subordinate’s and superior’s total performance; Budget imposition, favourable budgeting perceptions | |

Arnold and Gillenkirch (2015) | Superior’s task outcome (Potential subordinate bonus based on the subordinate’s estimated performance capability; Realized planning error) | Budget negotiation (subordinate’s initial budget proposal, estimate of his performance capability, performance; superior’s initial counteroffer) | Performance evaluation budget, planning budget (separate/single budget setting) | |

Cardinaels and Yin (2015) | Honest cost reporting \( [({\text{mean rep. costs}} - {\text{mean act. costs}})/(\hbox{max. rep. costs pos.}- {\text{mean act. costs}})] \) | Social norms and trust: (7-point Likert scale ranging from “fully disagree” to “fully agree”) | Incentive contract versus fixed-salary contract | |

Chen et al. (2015) | Accuracy of forecasts (difference between forecast and actual performance), optimism of forecast (excess of forecast over the actual performance) and performance (number of correct answers) | Performance-based incentive (present/absent) | Forecast type (disaggregated/aggregated) | |

Clor-Proell et al. (2015) | Employee fraud: distance between reported costs and actual costs | Budget goal difficulty: high/low cost goal | Promotion availability: not available, available after each round, available at the conclusion | |

Douthit and Stevens (2015) | Budgetary slack \( ({\text{reported}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}}) \) | Superior rejection authority (factual assertion, salary authority; knowledge about superior’s endowment) | Honesty (agreement with the statement ‘‘I wanted both parties to have even payoffs,’’ on a seven-point Likert scale) | |

Brüggen and Luft (2016) | Cost underestimation: (a) subordinate’s private cost signal minus his or her cost forecast; (b) expected value of costs given the private signal minus the subordinate’s cost forecast; (c) percent understatement measure: subordinate’s actual understatement divided by the maximum possible understatement | Changing versus continuing superiors | ||

Cardinaels and Jia (2016) | Honest reporting: (1 − (true cost-reported cost)/(true cost − 500)) × 100 | Audit: The audit team’s detection probability increases with the level of deviation from a truthful report | Peer honesty: Message that a high/low number of peer managers report a cost number that equals the true cost of the investment; Incentive: 10% or 50% of the divison’s reported profit | |

Eskenazi et al. (2016) | Ability to withstand pressure to misreport (Scale from 1 “very unlikely” to 7 “very likely” whether they would engage in the action proposed by the BU manager) | Managers’ personal versus organizational interest | Neurobiological aspects (decrease in power of mu waves in the emotional expressions condition relative to the abstract shapes condition) | |

Guo et al. (2017) | Misreporting: reported slack \( ({\text{reported}}\;{\text{cost}} - {\text{actual}}\;{\text{cost}}) \) | Vertical pay dispersion (high: $25/$10; low: $25/$25, $10/$10) | ||

Abdel-Rahim and Stevens (2018) | Honesty: \( 1 - [({\text{budgeted}}\;{\text{cost}} - {\text{actual cost}})/6] \) | Perceived information asymmetry: Inverse of response to the exit questionnaire item “If the corporate headquarters’ cost system had generated an estimate of the actual cost within a wider (narrower) range, I would have felt more (less) flexible to increase my earnings by reporting a higher cost (7-point Likert scale) | Information system accuracy: high (90/10%), low (70/30%) | Information system precision: equal to 1 if the system is precise and 0 if coarse |

Altenburger (2017) | Budget reporting honesty: (1 − (budgeted costs − actual costs)/(maximum possible report − actual costs)) | Dissent: Minority shows different preferences than the respective majority | Injunctive social norms: Participants see statements regarding honesty or opportunism of five anonymous colleagues | |

Brink et al. (2017) | Reporting honesty: participants’ self-reports of the number of identified pairs of numbers that sum to 10, unsolvable task | Codes of conduct: Code, no code; Monitoring: No monitoring, monitoring and penalty, monitoring but no penalty; Machiavellianism: High/low measured using the average of the 20-question MACH IV scale | ||

Brown et al. (2017) | Honest reporting: (budget report − cost of production) | Participative budgeting: Subordinate/superior sets the budget; Budget framing: Honest, fair, preferred | ||

Brunner and Ostermaier (2017a) | Sabotage in capital budgeting: number of times a manager sabotages the investment divided by the number of times he can sabotage it | Distrust: Managers were asked to what extent they agree that the hurdle contract signals distrust; intent to punish: Managers were asked to state the extent to which they agreed that they intended to punish owners for distrusting them | Factual assertion (yes/no) | Intent to be honest: Managers were asked to state the extent to which they agreed that they intended to be honest with owners; Reciprocity: owner can (cannot) chose the hurdle contract |

Brunner and Ostermaier (2017b) | Managerial honesty: (reported cost − actual cost)/(100 − actual cost) × 100 | Peer influence: transparency: Managers know each other’s cost and report (full), managers learn each other’s report but not cost (partial) | ||

Chung and Hsu (2017) | Firm profit | Honest reporting: 1-payoff claim/payoff available | Trust versus optimal hurdle contract | Cognitive moral development: defining issues test |

Rights and permissions

About this article

Cite this article

Daumoser, C., Hirsch, B. & Sohn, M. Honesty in budgeting: a review of morality and control aspects in the budgetary slack literature. J Manag Control 29, 115–159 (2018). https://doi.org/10.1007/s00187-018-0267-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00187-018-0267-z