Abstract

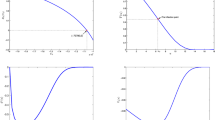

We consider an optimal robust investment and reinsurance problem for a general insurance company which holds shares of an insurance company and a reinsurance company. It is assumed that the decision-maker is ambiguity-averse and does not have perfect information in drift terms of the investment and insurance risks. To capture the ambiguity aversion in the objective function, the criterion of this paper is to minimize a robust value involving the probability of drawdown and a penalization of model uncertainty. By using the technique of stochastic control theory and solving the corresponding boundary-value problems, the closed-form expressions of the optimal strategies are derived explicitly, and a new verification theorem is proved to show that a non-increasing solution to the Hamilton–Jacobi–Bellman equation is indeed our value function. Moreover, we examine theoretically how the level of ambiguity aversion affects the value function and optimal drift distortion. In the end, some numerical examples are exhibited to illustrate the influence of the different investment patterns on our optimal results.

Similar content being viewed by others

Notes

\(a\wedge b\) denotes the \(\min \{a,b\}\) and \(a\vee b\) means the \(\max \{a,b\}\)

References

Anderson E, Hansen L, Sargent T (1999) Robustness detection and the price of risk. Working paper, University of Chicago. Available at:https://files.nyu.edu/ts43/public/research/.svn/text-base/ahs3.pdf.svn-base

Angoshtari B, Bayraktar E, Young VR (2016a) Optimal investment to minimize the probability of drawdown. Stochastics 88(6):946–958

Angoshtari B, Bayraktar E, Young VR (2016b) Minimizing the probability of lifetime drawdown under constant consumption. Insur Math Econom 69:210–223

Bai L, Cai J, Zhou M (2013) Optimal reinsurance policies for an insurer with a bivariate reserve risk process in a dynamic setting. Insur Math Econom 53(3):664–670

Bayraktar E, Zhang Y (2015) Minimizing the probability of lifetime ruin under ambiguity a version. SIAM J Control Optim 53(1):58–90

Borch K (1960) Reciprocal reinsurance treaties. Astin Bull 1:171–191

Borch K (1969) The optimal reinsurance treaties. Astin Bull 5:293–297

Browne S (1997) Survival and growth with a fixed liability: optimal portfolio in continuous time. Math Oper Res 22(2):468–493

Cai J, Fang Y, Li Z, Willmot GE (2013) Optimal reciprocal reinsurance treaties under the joint survival probability and the joint profitable probability. J Risk Insur 80:145–168

Chen L, Shen Y (2018) On a new paradigm of optimal reinsurance: a stochastic Stackelberg differential game between an insurer and a reinsurer. Astin Bull 48(2):905–960

Chen X, Landriault D, Li B, Li D (2015) On minimizing drawdown risks of lifetime investments. Insur Math Econom 65:46–54

Cvitanić J, Karatzas I (1995) On portfolio optimization under drawdown constrainsts. IMA Vol Math Appl 65:77–88

Elie R, Touzi N (2008) Optimal lifetime consumption and investment under a drawdown constrainst. Finance Stochast 12:299–330

Fang Y, Qu Z (2014) Optimal combination of quota-share and stop-loss reinsurance treaties under the joint survival probability. IMA J Manag Math 25(1):89–103

Grandell J (1991) Aspects of risk theory. Springer, New York

Grossman S, Zhou Z (1993) Optimal investment strategies for controlling drawdowns. Math Finance 3(3):241–276

Han X, Liang Z (2020) Optimal reinsurance and investment in danger-zone and safe-region. Opt Control Appl Methods 41(3):765–792

Han X, Liang Z, Yuen KC (2018) Optimal proportional reinsurance to minimize the probability of drawdown under thinning-dependence structure. Scand Actuar J 2018(10):863–889

Han X, Liang Z, Zhang C (2019) Optimal proportional reinsurance with common shock dependence to minimise the probability of drawdown. Ann Actuar Sci 13(2):268–294

Hipp C, Taksar M (2010) Optimal non-proportional reinsurance. Insur Math Econom 47(2):246–254

Huang C, Pages H (1992) Optimal consumption and portfolio policies with an infinite horizon: existence and convergence. Ann Appl Probab 2(1):36–64

Huang Y, Yang X, Zhou J (2017) Robust optimal investment and reinsurance problem for a general insurance company under Heston model. Math Methods Oper Res 85(2):305–326

Li D, Rong X, Zhao H (2015) Time-consistent reinsurance-investment strategy for an insurer and a reinsurer with mean-variance criterion under the CEV model. J Comput Appl Math 283:142–162

Li D, Rong X, Zhao H (2016) Optimal reinsurance and investment problem for an insurer and reinsurer with jump-diffusion risk process under the Heston model. Comput Appl Math 35:533–557

Liang Z, Bayraktar E (2014) Optimal reinsurance and investment with unobservable claim size and intensity. Insur Math Econom 55(1):156–166

Liang X, Young VR (2018) Minimizing the probability of ruin: optimal per-loss reinsurance. Insur Math Econom 82:181–190

Liang Z, Bi J, Yuen KC, Zhang C (2016) Optimal mean-variance reinsurance and investment in a jump-diffusion financial market with common shock dependence. Math Methods Oper Res 84(1):155–181

Stroock DW (1987) Lectures on stochastic analysis: diffusion theory. Cambridge University Press, Cambridge

Yi B, Viens F, Li Z, Zeng Y (2015) Robust optimal strategies for an insurer with reinsurance and investment under benchmark and mean-variance criteria. Scand Actuar J 2015(8):725–751

Yuan Y, Liang Z, Han X (2022) Robust reinsurance contract with asymmetric information in a stochastic Stackelberg differential game. Scand Actuar J 2022(4):328–355

Zeng Y, Li D, Gu A (2016) Robust equilibrium reinsurance-investment strategy for a mean-variance insurer in a model with jumps. Insur Math Econom 66:138–152

Zhao H, Weng C, Shen Y, Zeng Y (2017a) Time-consistent investment-reinsurance strategies towards joint interests of the insurer and the reinsurer under CEV models. Sci China Math 60(2):317–344

Zhou J, Yang X, Huang Y (2017b) Robust optimal investment and proportional reinsurance toward joint interests of the insurer and the reinsurer. Commun Stat Theory Methods 46(21):10733–10757

Funding

The authors would like to thank the associate editor and anonymous referees for their careful reading and helpful comments on an earlier version of this paper, which led to a considerable improvement of the presentation of the work. This research was supported by the National Natural Science Foundation of China (Grant No. 12071224), the Natural Science Foundation of the Jiangsu Higher Education Institutions of China (Grant No. 22KJB110021), and the Startup Foundation for Introducing Talent of NUIST (Grant No. 1521182201001).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A Auxiliary functions

The functions \(g_{1i}(x,m)\) and \(f_{1i}(y)~(i=1,2,3)\) are given by

and

The functions \(g_3(x,m)\) and \(f_3(y)\) are given by

Appendix B Proof of Lemma 3.1

Define the process \(H=\{H(t)\}_{t\ge 0}\) by \(H(t)=e^{-\delta \hat{X}(t)}\), in which \(\hat{X}(t)=\hat{X}^u(t)\). In the expression of H(t), \(\delta \) is a positive constant to be chosen later in the proof. By applying Itô’s formula to H(t), we obtain

in which

with

and

We wish to show that, for \(\delta \) large enough, \({\mathcal {K}}(t)\ge \frac{\alpha (\eta -\theta )\mu _3-rb}{2}>0\) for all \(0\le t\le \tau ^u_{\kappa b}\) with probability 1. First, notice, for \(x\le b\), we have \(\alpha (\eta -\theta ) \mu _3-rx\ge \alpha (\eta -\theta )\mu _3-rb\). Next, find \(\delta \) such that

or equivalently,

for all \(u\in {\mathcal {D}}\). Note that, for \(-{\mathcal {M}}(t)-\frac{\alpha (\eta -\theta )\mu _3-rb}{2}\le 0\), we can simply set \(\delta =0\) and the inequality (B.1) holds. For \(-{\mathcal {M}}(t)-\frac{\alpha (\eta -\theta )\mu _3-rb}{2}>0\), by condition (2.8), we deduce that

The inequality (B.1) holds for any \(\delta \ge \delta _0\); thus, set \(\delta =\delta _0>0\), and for this choice of \(\delta \), we have \({\mathcal {K}}(t)\ge \frac{\alpha (\eta -\theta )\mu _3-rb}{2}>0\) for all \(0\le t\le \tau ^u_{\kappa b}\) with probability 1.

Assume \(\hat{X}(0)=x\in (\kappa m,b)\); otherwise, \(\tau ^u_{\kappa b}=0\). Apply Itô’s formula to \(e^{-\delta \hat{X}(t)}\) to obtain

The integrands of the second and third integrals are bounded, so the integrals’ expectations equal zero; thus, if we take the \({\mathbb {Q}}\)-expectation of both sides, we get

Note that \(e^{-\delta b}\le e^{-\delta \hat{X}(\tau ^u_{\kappa b}\wedge t)}\le e^{-\delta \kappa m}\) for all \(t\ge 0\) with probability 1, so we have the following sequence of (in)equalities

By letting \(t\rightarrow \infty \) in the last expression, we deduce that \(\lim \limits _{t\rightarrow \infty }{\mathbb {Q}}_{x,m} (\tau ^u_{\kappa b}>t)=0\), or equivalently, \({\mathbb {Q}}_{x,m} (\tau ^u_{\kappa b}<\infty )=1\). \(\Box \)

Appendix C Proof of the verification theorem

Under the optimal measure \({\mathbb {Q}}^*\) (corresponding to \(\phi ^*\)) and an arbitrary strategy \(u=(\pi _1,\pi _2,q)\), the wealth process becomes

Applying Itô’s formula to W(x, m) and integrating from 0 to \(\tau ^u_{\kappa b}\wedge t\), we get

Taking \({\mathbb {Q}}^*\)-expectation on both sides, the equation can be simplified as

From conditions (vi) and (vii), we have

and the third integral is zero almost surely because \(dM^{u}(t)\) is non-zero only when \(M^{u}(t)=X^{u}(t)\). At the same time, \(W_m(m,m)=0\) is given by condition (iii). Here, we admit the fact that \(M^{u}(t)\) is a non-decreasing process; hence, the first variation process associated with it is finite almost surely and it comes to a conclusion that the cross variation of \(M^{u}(t)\) and \(\hat{X}^{u}(t)\) is zero almost surely. Then, we obtain

or equivalently,

Because \(\tau ^u_{\kappa b}<\infty \) with probability 1, it follows from the boundary conditions and inequality (C.1) that

Then, we have

Substituting the above equation into (C.1) and applying the Dominated Convergence Theorem, we obtain

Hence, the inequality

holds for any \(u\in {\mathcal {D}}\). Then

Under the optimal investment and reinsurance policy \(u^*\) and an arbitrary probability measure \({\mathbb {Q}}\in {\mathcal {Q}}\), the wealth process follows

Applying Itô’s formula to W(x, m) and integrating from 0 to \(\tau ^{u^*}_{\kappa b}\wedge t\), we obtain

Taking \({\mathbb {Q}}\)-expectation on both sides, the equation can be simplified as

From conditions (vi) and (vii), we have

Again, it follows that

or equivalently,

Passing \(t\rightarrow \infty \), we have

The inequality holds for all \({\mathbb {Q}}\in {\mathcal {Q}}\). So

From the above discussion, it yields that \(W(x,m)=V(x,m)\), which completes the proof of verification theorem. \(\square \)

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yuan, Y., Liang, Z. & Han, X. Minimizing the penalized probability of drawdown for a general insurance company under ambiguity aversion. Math Meth Oper Res 96, 259–290 (2022). https://doi.org/10.1007/s00186-022-00794-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-022-00794-w