Abstract

We propose a new optimal control model of product goodwill in a segmented market where the state variable behaviour is described by a partial differential equation of the Lotka–Sharp–McKendrick type. In order to maximize the sum of discounted profits over a finite time horizon, we control the marketing communication activities which influence the state equation and the boundary condition. Moreover, we introduce the mathematical representation of heterogeneous electronic word of mouth. Based on the semigroup approach, we prove the existence and uniqueness of optimal controls. Using a maximum principle, we describe a numerical algorithm to find the optimal solution. Finally, we examine several examples on the optimal goodwill model and discover two types of marketing strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper we investigate the mathematical model of the product goodwill. For the first time in this type of models, we consider segmentation with respect the consumer usage experience, moreover we propose the new way of creating goodwill among potential customers by taking into account electronic word of mouth (eWOM). We are interested in goodwill because it is one of the most important phenomena in the context of increasing competition in global markets. It refers to the difference between the price paid by the buyer for the company and the book value of the assets of that company. This value may be created by the positive experiences of its clients, and may be improved by investment in marketing instruments such as advertising or other promotional tools. Thus goodwill translates to an enhancement in the competitiveness of the company and to the acquisition of future earning power Cañibano et al. (2000). Many times it can be observed that a company making a loss is bought at a high price because of its well-known brands. Some real examples of this type of merger and acquisition may be found in Kapferer (2012), p. 18. Although many researchers have studied this phenomenon, there are still some gaps that prevent a full understanding of the nature of the dynamics of goodwill.

Modelling is one way to explore the properties of company goodwill. Nerlove and Arrow in 1962 took the first steps in modelling the concept of goodwill. They interpreted goodwill as the part of the demand for products that is created by current and past advertising efforts, see Nerlove and Arrow (1962), and assumed that the stock of goodwill depreciates over time at a constant rate and depends positively on the advertising effort. They described the dynamics of goodwill in a non-segmented market by an ordinary differential equation.

The model proposed by Nerlove and Arrow has been modified and analysed by many scientists, see eg. Fruchter et al. (2006) and Huang et al. (2012). Recently they have taken into account dynamic games, see Jørgensen and Zaccour (2014) and Lambertini (2014), or market segmentation (Buratto et al. 2006). In goodwill models with segmented market it is often assumed that the firm sells one product in infinitely many segments, indicated by the age of the customers a, and the demand in segment a and time t depends on the level G(t, a) of goodwill for this product. This assumption results in the representation of the goodwill dynamics by a first-order hyperbolic partial differential equation, see Grosset and Viscolani (2005) and Faggian and Grosset (2013). The same state equation but with a different interpretation is proposed by Barucci and Gozzi (1999). They consider also a goodwill model with market segmentation and describe a monopolistic firm selling infinitely many products with new goods continuously launched onto the market.

The model proposed in this paper has few important modifications which may improve the description and explanation of complex real-world phenomena. First, we consider a new way of market segmentation which is based on customer experience in using a product. The usage experience reflects a consumer’s perceptions, responses, attitudes, and emotions about using a particular product and has a strong influence over purchasing decisions. This observation is confirmed by the usage dominance theory described in Deighton et al. (1994). As far as we know, this type of market segmentation has not previously been included in goodwill models.

Moreover, since the empirical studies summarized by Bagwell (2007) indicate the existence of decreasing returns to marketing efforts, we include this observation in the new model and we assume a non-linear relationship between marketing communication efforts and goodwill. A similar assumption was used by Weber (2005) and by Mosca and Viscolani (2004) in a goodwill model expressed by an ordinary differential equation. In addition, we have expanded the existing models by allowing the depreciation of goodwill to be non-constant, but rather heterogeneous with respect to the usage experience of the product. The main difference between the existing models and that presented in this paper is the process of building the goodwill among consumers with no usage experience. We assume that goodwill on the part of new consumers depends on offensive marketing instruments, and on eWOM communication which can be amplified by defensive marketing efforts aimed at existing consumers. Consumers consider eWOM to be credible, reliable and relevant communication channel (Gruen et al. 2006). Word of mouth is taken into account in modelling the sales of many products (for example Monahan 1984), but so far, have not yet been taken into account in models describing the dynamics of goodwill involving firms operating in a segmented market. Our idea of using eWOM in modelling goodwill is based on the empirical evidence, see, for example, Bruce et al. (2012) and Agliari et al. (2010), in which the authors claim that consumer to consumer communication have a strong influence on the level of goodwill.

The goodwill control problem analysed in this paper is interpreted as an optimal double control problem. Dynamics of the state variable is described by a partial differential equation of Lotka–Sharp–McKendrick typeFootnote 1. Our aim is to choose marketing instruments that maximize the sum of the discounted profits in the finite time horizon. A general class of optimal control models with heterogeneous state variables which include age structured systems is introduced in Veliov (2008) and the existence and uniqueness of an optimal solution is proved. In our goodwill equation, the dependence on the controls is not Lipschitz continuous, hence the existence result from Veliov (2008) can not be applied directly. Following the semigroup approach, see Pazy (1983), Prato and Iannelli (1994) and Lasiecka and Triggiani (2000), the existence and uniqueness of the state equation is proven (see Theorem 4 in “Appendix 1”). The existence of a unique optimal solution is contained in “Appendix 2” (Theorem 1). Proposition 5 in “Appendix 1” shows that the semigroup-based generalised mild solution (see Definition 3) is the solution on the characteristic lines introduced in Feichtinger et al. (2003), Definition 1. Hence we are able to use the maximum principle from Feichtinger et al. (2003) to construct a numerical solution to the optimal control problem. Finally, using the new numerical algorithm we examine several examples on the optimal goodwill model and discover two types of marketing strategies: ‘supportive’ and ‘strengthening’.

The remainder of this paper is organized as follows. Section 2 presents the new model of product goodwill and discusses the economic background of the new idea of market segmentation based on usage experience. Moreover, a mathematical description of heterogeneous eWOM communication is introduced. Section 3 establishes the existence and uniqueness of an optimal solution to the goodwill model. Furthermore, in Sect. 3.1 the necessary optimality conditions are derived. Section 4 presents the results of simulations of the optimal goodwill model obtained by means of the numerical algorithm from Sect. 3.2.

2 Optimal goodwill control problem with eWOM recommendations

We shall consider a company in a market with a monopolistic structure divided into segments by the consumer usage experience \(e\in [0,1]\). More precisely, the variable e indicates the time spent using the product. The segment \(e=0\) includes consumers who have already purchased the product. The maximal usage experience is normalized to the value 1. This means that consumers in segment \(e=1\) will not use the product in the next periods. For example a service of mobile operators can be used by consumers for a whole lifetime starting from childhood, hence for these goods the unit of time can be greater than 70 years. On the other hand there are many products which are used only for a certain period of life, eg nappies, where the time unit is about 4 years.

In the previous models it is assumed that goodwill in created only by advertising efforts. In the paper Heiman et al. (2001) it is observed that goodwill is built not only through advertising efforts but also through other promotional mechanism such as sampling. This idea is also consistent with the Spremann model (1985), where the author considers two types of firm’s image: goodwill and reputation. The former is created from advertising whereas the later is built through price promotion. Both stocks of reputation and goodwill influence the product demand. According to the well known four C’s classification by Lauterborn (1990) the marketing communication is one of the business tools used to create a dialogue with the customers and it includes advertising, public relations, sales organisation and sales promotion. One of the basic objectives of marketing communication is to increase demand. Taking into account the above observations we extend the classical Nerlove-Arrow goodwill model and assume that goodwill is created by all kinds of current and past marketing communication efforts.

We assume that the company operates in finite horizon \(T>0\). Moreover, in each segment e and at each moment of time \(t\in [0,T]\) we consider the product goodwill G(t, e) defined as a part of demand which comes from current and past marketing communication activities. In order to formalize the concept of eWOM recommendation, we assume that G(t, e) is equal to the number of consumers who have been using the product for \(e\in [0,1]\) units of time and they continue buying the product at time \(t\ge 0\) as the effect of marketing communication. Since the product demand can be reasonably well approximated by the number of consumers, our definition of product goodwill reflects the Nerlove and Arrow (1962) seminal statement. There are many methods of measuring goodwill. For instance in Heiman et al. (2001) the authors define goodwill as the average likelihood of purchasing a product, which is a similar measure of the phenomenon to our proposition.

The company is able to stimulate different levels of product goodwill by marketing communication tools. The company instruments (control variables) u(t, e) and \(u_0(t)\) represent the intensiveness of defensive and offensive marketing efforts at time t directed to consumer segment e, and to new consumers, respectively. The offensive marketing \(u_0\) is identified with every marketing activity that attracts new consumers. Similar to Martín-Herrán et al. (2012) we define the defensive marketing strategy u as all marketing activities which are focused on retaining existing consumers and fostering brand loyalty. Both marketing strategies make a distinction between the consumers with different usage experience. This phenomenon is commonly used by service companies. For example mobile phone providers offer clients discounts depending on their usage experience. This information is transmitted by marketing communication channels such as direct advertising. In our model, we assume a linear and non-linear effect of marketing communication efforts on goodwill, which is reflected in the parameter \(\rho =1\) and \(\rho \in (0,1)\), respectively. Therefore, \(\lambda ^\rho u^\rho (t,e)\) and \(\lambda ^\rho u^\rho _0(t)\) positively influence the product goodwill G(t, e) in segment e and the level of product goodwill G(t, 0) of new consumers, respectively. Here \(\lambda ^\rho \) is the effectiveness of marketing channel. Furthermore, there is a natural depreciation rate of goodwill \(\delta (e)\ge 0\), different for each consumer segment e. This expresses a situation in which the depreciation rate depends on the time spent using the product, and it is natural for an experience product, see Nelson (1974). For this type of goods during the use of the product, consumers learn about its features and they may update their judgement about it. This results in changes in the depreciation rate of the goodwill. Therefore, the dynamics of the goodwill is governed by the following PDE:

The main novelty in the presented model of goodwill is in the construction of goodwill in the segment of new consumers. In each time t we assume that the value of goodwill in the segment of new consumers G(t, 0) is influenced by the positive eWOM recommendation and defensive and offensive marketing efforts. Given the distinct characteristic of Internet communication, eWOM is defined in Hennig-Thurau et al. (2004) as “any positive or negative statement made by potential, actual, or former customers about a product or company, which is made available to a multitude of people and institutions via the Internet”. A number of empirical studies have concluded that eWOM are a credible source of information, see Andreassen and Streukens (2009) and Gruen et al. (2006), in particular for consumers without any experience in using the product. Therefore consumer recommendations reduce the risk of purchase decisions and facilitate consumer choice, see Trusov et al. (2009).

For reasons of clarity, let N(t, e) represent consumers who at time t buy the good for the first time and their purchase propensity stems from the eWOM recommendations coming from segment e or from defensive marketing campaigns directed to segment e. We distinguish two disjoint groups \(N_1(t,e)\) and \(N_2(t,e)\) of new consumers such that \(N(t,e)=N_1(t,e)+N_2(t,e)\). The first group \(N_1(t,e)\) includes new consumers who want to buy the product influenced by eWOM recommendations given by consumers with usage experience e. The size of \(N_1(t,e)\) depends on the amount of existing consumers and the effectiveness of eWOM in segment e, thus it is equal to

Here R(e) reflects the share of consumers in segment e who assess positively the product attributes and are willing to effectively recommend it, thus R(e) is a measure of the effectiveness of consumer recommendations. Since eWOM recommendations are closely connected with the product quality, which is assumed to be constant in the decision making horizon, R(e) is time homogeneous. On the other hand, usually the quality of the product can only be recognised after some amount of time spent using the product, see Godes and Mayzlin (2004), therefore, R(e), is heterogeneous with respect to usage experience e.

Defensive marketing efforts u(t, e) influence not only the level of goodwill G(t, e) but also the strength of eWOM recommendations in segment e by reminding consumers of the reasons for a positive judgement of the product, and thus encouraging them to share their opinion about the product with potential consumers (Keller 2009). In conclusion, defensive marketing efforts u(t, e) act as a reinforcement of the effectiveness of eWOM recommendations in segment e. As a result, a new group of people \(N_2(t,e)\) buy the product, which can be calculated by

where \(\lambda ^\rho u^\rho (t,e)\) is the effectiveness of defensive marketing in consumer generation e at time t.

Finally, by (2)–(3) we obtain that the number of new consumers who buy the product at time t as a result of eWOM recommendations is equal to

The value of goodwill G(t, 0) in the segment of new consumers is also affected by offensive marketing instruments \(u_0(t)\) directed at consumers with no usage experience. Hence, adding the effect of eWOM and defensive and offensive marketing activities (cf. (4)), we obtain

From the above considerations the dynamics of goodwill is given by

where \(G_0(e)\ge 0\) is the initial stock of goodwill in segment e.

Remark 1

Equation (6) is known in the literature as the Lotka–Sharpe–McKendrick and it provides a framework for the mathematical modelling of many other real world phenomena. The most popular application of the equation is a description of age-structured population dynamics with a boundary condition describing the reproduction process of the population. Population dynamics with an appropriate goal functional is of interest for many biological issues, such as harvesting and birth control, see Chan and Zhu (1989), Prato and Iannelli (1994), Park et al. (1998), Anita (2000) and references therein.

The product goodwill can be only accumulated by marketing communication, see (6), therefore if we stop investing in marketing activities (\(u_0=u=0\)), then in each market segment the product goodwill G(t, e) should decrease to zero. Therefore, we assume that

Assumption 1

Let the function \(R:[0,1]\rightarrow [0,\infty )\) belongs to \(L^\infty (0,1)\) and let \(\delta :[0,1]\rightarrow [0,1]\) be a measurable function such that

We assume similarly as in Nerlove and Arrow (1962) that the demand function q is of the form

where p(t, e) is the price of the product for consumers in segment e, \(-\epsilon _p<-1\) is the price elasticity of demand, and \(\epsilon _g\) is the goodwill elasticity of demand. Let \(C(t,e)=C(q(t,e))\) be the total operating cost function at time t in segment e and the optimal price \(p^*(t,e)\) be the solution to the problem:

Then

where \(m=\frac{\epsilon _p}{\epsilon _p-1}\) is a monopolistic mark-up. We assume that \(C(q)=q^\alpha +c_f\), where \(c_f> 0\) is fixed cost, \(\alpha \ge 1\) is the elasticity of variable cost with respect to output. Thus, based on (8) and (10) the optimal price is given by

Observe that the optimal production \(q^*(t,e)\) which meets the demand in consumer segment e is given by

where \(K=\left( m\cdot \alpha \right) ^{\frac{-\epsilon _p}{1+\epsilon _p(\alpha -1)}}\).

We assume similarly to Grosset and Viscolani (2005) that the instantaneous costs of defensive and offensive marketing instruments are given by

respectively, where \(\frac{\beta }{2} > 0\) is the unit price of marketing activities. Therefore, from (10) to (13), it follows that the firm’s profit at time t from market segment e is

for a.e. \((t,e)\in [0,T]\times (0,1]\), where \(K_\varPi =K^{1-\frac{1}{\epsilon _p}}-K^\alpha \) and \(\gamma =\frac{\epsilon _g\alpha }{1+\epsilon _p(\alpha -1)}\). In the sequel, we assume that \(K_\varPi >0\). The firm wants to maximise the sum of discounted profits in the finite horizon T. Hence the goal functional for the firm takes the form

where G is a solution to (6), and \(r>0\) is the force of interest.

In conclusion the company faces the goodwill control problem of the form:

where for the maximal marketing communication efforts (possibly infinite) \(I\in (0,\infty ]\) we denote by

and

the sets of admissible controls.

Theorem 4 in “Appendix 1” shows that for each pair of admissible controls there exists a generalised mild solution to (6) (see Definition 3 from “Appendix 1”).

3 The optimal solution to the goodwill control problem

Definition 1

The triple \((G^*,u_0^*,u^*)\) is an optimal solution to the goodwill control problem (16) if \(G^*\) is a generalised mild solution (see Definition 3 in “Appendix 1”) to (6) with \((u_0^*,u^*)\in U_{0,ad}\times U_{ad}\) and

holds for any admissible controls \((u_0,u)\in U_{0,ad}\times U_{ad}\) and G satisfying (6).

Theorem 1

Assume that (7) holds and let \(G_0\in L^2(0,1)\) be an almost everywhere non-negative function. The optimal control problem (16) admits a unique solution.

The existence of an optimal solution to (16) is proven using the classical results for general extreme problems in a Hilbert space H. Details are presented in “Appendix 2”.

3.1 Necessary optimality conditions

In this section we assume that (7) hold and \(G_0\in L^{\infty }(0,1)\) is non-negative a.e. Then by Remark 7 in “Appendix 1” and Theorem 1 there exists an unique optimal solution \((G^*,u_0^*,u^*)\in L^{\infty }(0,T;L^{\infty }(0,1))\cap C(0,T;L^2(0,1))\times U_{0,ad}\times U_{ad}\) to the goodwill control problem (16). Furthermore, from Proposition 2 in Feichtinger et al. (2003) it follows that there exists a unique solution \(\xi :\left[ 0,T\right] \times \left[ 0,1\right] \rightarrow {\mathbb {R}}\) to the adjoint system:

We follow Feichtinger et al. (2003) in defining the Hamiltonian associated with boundary condition

for a.e. \(t\in [0,T]\) and every \(u_0\in [0,I]\), and the distributed Hamiltonian

for a.e. \((t,e)\in [0,T]\times [0,1]\) and every \(u\in [0,I]\).

Based on maximum principle introduced in Feichtinger et al. (2003) the optimal solution (16) satisfies

and

for a.e. \((t,e)\in [0,T]\times [0,1]\).

Summarizing the above considerations, the optimal triple \((G^*,u_0^*,u^*)\) is the solution of the following system

where \(u_0^*, u^*\) are given by (18) and (19).

3.2 Numerical algorithm

The system of equations (20) does not possess an explicit solution. Therefore, in order to analyse the properties of optimal trajectories, we describe an algorithm to solve (20) numerically. For this purpose we apply well-known approach in the numerical analysis of PDEs - so-called method of lines (MOL) (cf. Kamont 1999; Schiesser and Griffiths 2009). In the first step we use a finite difference approximation to discretize the space variable e on a selected space mesh. Thus, let \(\{ e_0=0,e_1,e_2,\ldots ,e_N=1\}\) be uniform grid of the consumers’ segments and \(\varDelta e=\varDelta e_i=e_i-e_{i-1}\) be the diameter of this division. In the segment \(e_i\) for \(i=0,1,\ldots ,N\) we set up the notation: \(G_i^*(t)=G^* (t,e_i)\), \(\xi _i (t)=\xi (t,e_i)\), \(R_i=R(e_i)\), \(\delta _i=\delta (e_i)\), \(u_i^*(t)=u^*(t,e_i )\).

Moreover, we apply the composite trapezoidal rule for the approximation of the definite integral (Gautschi 1997, p. 153)

where

and the explicit and the implicit Euler schemes as the approximations of derivativesFootnote 2:

Therefore, the system (20) is transformed to the system of 2N ordinary differential equations

where the controls \(u_0, u_i^*\) with \(i=1,\ldots ,N\) are of the forms

and

respectively. The system (21) is a non-linear boundary value problem (BVP) and it can be solved with the Matlab solver bvp5c.

The challenge with implementation of the Matlab solver bvp5c is providing an initial approximation to the solution i.e. guess function such that bvp5c solver leads to convergence, see Shampine et al. (2003). Therefore, we apply the iterative procedure for solving the system (21). At the beginning, we establish a very sparse mesh for space division and based on the polynomial interpolation with respect to the initial condition in (21) we obtain first guess function and then, using bvp5c procedure we find the initial solution to (21). Next, we increase the division of space and find a new guess function based on polynomial interpolation of the initial solution to (21) and using it we solve the system (21) again. This scheme is repeated until we obtain a sufficient degree of accuracy of the solutions, i.e. the next increase in number of spatial grid points causes no significant change in a solution.

The analysis of convergence of some numerical MOL schemes can be found in Verwer and Sanz-Serna (1984) and Kamont (1999), but the convergence of the solutions of (21) to the solution of PDEs (20) is still an open problem.

4 Illustrative examples of the goodwill model

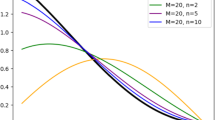

In this section, we verify the validity and practicability of the results from Sect. 3. Therefore, we find optimal defensive and offensive marketing strategies and the corresponding optimal trajectories of goodwill. In particular, we draw attention to the impact of different values of the goodwill elasticity of demand (\(\epsilon _g\)) and the parameter of the marketing response function (\(\rho \)) on the optimal solution and the level of the company profit. We consider an experience good. Hence the consumers learn about the attributes of the product after using it for some time, see Nelson (1974). Moreover, we assume that the product is low conformance quality and the longer consumers use it, the lower the proportion of them evaluate it positively. Therefore, we assume that the rate of eWOM recommendation R(e) is decreasing with respect to a segment e and it takes the form \(R(e)=0.48-0.12\sqrt{e}\). The assumption causes also that the depreciation rate of goodwill is increasing and it takes the form: \(\delta (e)=0.8-\frac{0.4}{1-\exp (-1)}\exp (-e)\). It reflects the fact that as time goes by, more and more consumers might become disappointed about the product’s functionality. Different values of the goodwill elasticity of demand \(\epsilon _g\) are related to the consumer response to marketing communication efforts. A low goodwill elasticity of demand may occur in a situation where the consumer has commitments which block the use of a substitute product. Therefore, despite the fact that marketing activities have convinced the consumer to use another product, the consumer is only able to purchase an additional part of the service. Thus, their contribution to demand is relatively small. A good example is that of mobile operators, where post-paid service requires the consumers to sign a contract. By contrast, pre-paid customers do not have any obligation to the mobile operator and may change firms at any time. Therefore, the goodwill elasticity of demand for this group of users is high. In addition, we examine how the non-linear shape of the marketing response function in the goodwill equation affects the optimal defensive and offensive marketing strategies, optimal goodwill path, and the firm’s profit. For these reasons, we analyse the linear \(\rho =1\) and concave-downward \(\rho =0.5\) responses of marketing instruments. Besides, we assume that the rate of interest r is equal to 2.8%, the length of the product life cycle \(T=1\), the unit advertising cost \(\beta =0.000001\), and the parameter \(K_\varPi =0.34\). The initial level of goodwill is \(G_0(e)=100\).

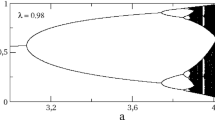

The results of the simulations are shown in Figs. 1, 2, 3 and 4. Each graphical presentation consist of the following three plots (from left to right): a contour plot of the optimal defensive marketing strategy, a contour plot of the optimal goodwill paths, a plot of the optimal offensive marketing strategy. We find two types of optimal marketing strategies: we will refer to them as ‘supportive’ and ‘strengthening’. The first maintains the level of goodwill at most at its initial level, while the latter causes a significant increase in the level of goodwill from its initial value. Different types of optimal marketing strategies are responsible for different shapes of the associated optimal goodwill paths. The optimal paths of product goodwill \(G^*\) for a strengthening strategy reaches a maximum value for segments of consumers with a little experience and these values spread over time to the segments of consumers with long experience (see Fig. 4). Whereas for the second type, the maximum value of \(G^*\) is achieved in all segments at the beginning of the product life cycle and then decreases, moreover, the rate of decline is the greatest among consumers with a little usage experience (see Figs. 1, 2, 3). Furthermore, the maximum values of optimal offensive marketing efforts are smaller by 25% for \(\rho =0.5\) and by 50% for \(\rho =1\) than the maximum values of optimal defensive efforts (cf. Table 1).

For the low value of goodwill elasticity of demand (\(\epsilon _g=0.2\)) we recognize that all optimal marketing strategies are supportive (see Figs. 1, 2). One may observe that the rate of decline of goodwill is lower for larger value of parameter \(\rho \). More precisely, at the end of the product life cycle the mean value of optimal goodwill path for model with \(\rho =0.5\) decreases by 70% of its initial value (cf. Table 1), whereas for \(\rho =1\) we observe 30% decline in the average level of product goodwill. Moreover, in each market segment e one may observe two shapes of optimal marketing strategies: for \(\rho = 0.5\) we have parabolic shape with a maximum (see Fig. 1) and for \(\rho =1\) we receive decreasing concave shape (see Fig. 2). Strictly speaking, a non-linear marketing response function in the goodwill model results that the maximum defensive marketing efforts occur much later. However, the maximum level of optimal strategies with a parabolic shape is more than three times smaller than for the strategy with a decreasing concave shape.

For the high value of goodwill elasticity of demand (\(\epsilon _g=1\)) we observe both supportive and strengthening marketing strategies (see Figs. 3, 4). The differences between linear and non-linear models for \(\epsilon _g=1\) are more striking. The strengthening policy occurs in the experiment for a linear marketing response function, \(\rho =1\) (see Fig. 4). It causes that the optimal goodwill path reaches level of 590, which is almost six times bigger than its initial value. Furthermore, the average goodwill at the end of the product life cycle increases four times. As for the model with supportive strategy (\(\rho =0.5\)) we observe a four-fold average decrease in goodwill at the end of the time horizon.

In the experiments presented on Figs. 3 and 4 the curves of optimal marketing communication efforts posses two shapes depending on the marketing response function. Supportive strategies, \(u^*\) and \(u_0^*\) have a concave decreasing shape in each market segment (see Fig. 3). Moreover, their maximum level is achieved at the beginning of the product life cycle and for consumers with little usage experience. For the linear model (see Fig. 4) marketing strategies change shape into a serpentine, piecewise linear. In comparison with the non-linear model the greatest values of strengthening defensive and offensive polices are nearly seven and six times larger, respectively (see Table 1).

Finally, we compare financial consequences of investments in defensive and offensive marketing communication efforts. They are presented in Table 1.

The ratio \(\frac{\varDelta J}{J_0}\) is a measure of the benefit from investments in marketing and is equal to the percentage change of the company profits caused by introducing the optimal marketing polices. Our experiments confirm that a low level of goodwill elasticity of demand causes a small percentage increase in the company profits \(\frac{\varDelta J}{J_0}\) for both values of parameter \(\rho \). In case of a high goodwill elasticity of demand the company benefit form marketing investments is higher compared to the previous experiments and for the linear marketing response function \(\frac{\varDelta J}{J_0}\) reaches 92%.

The above analysis highlights the importance of eWOM and the levels of goodwill elasticity of demand in creating an optimal defensive and offensive marketing campaign. Moreover, the non-linear effect of marketing communication efforts has a strong impact on optimal goodwill path in every market segment. Finally, conducted experiments have confirmed that the defensive and offensive marketing strategies have different magnitudes and it should be taken into account by managers.

Notes

Known also as the Von Foerster equation.

Note that instead of Euler’s discretization schema one may also use higher-order Runge-Kutta integration methods.

References

Agliari E, Burioni R, Cassi D, Neri FM (2010) Word-of-mouth and dynamical inhomogeneous markets: an efficiency measure and optimal sampling policies for the pre-launch stage. IMA J Appl Math 21(1):67–83

Anita S (2000) Analysis and control of age-dependent population dynamics. In: Lowen R (ed) Mathematical modelling: theory and applications, vol 11. Kluwer Academic Publishers, Dordrecht

Andreassen TW, Streukens S (2009) Service innovation and electronic word-of-mouth: is it worth listening to? Manag Serv Qual Int J 19(3):249–265

Bagwell K (2007) The economic analysis of advertising. Handb Ind Org 3:1701–1844

Bruce NI, Foutz NZ, Kolsarici C (2012) Dynamic effectiveness of advertising and word of mouth in sequential distribution of new products. J Mark Res 49(4):469–486

Barucci E, Gozzi F (1999) Optimal advertising with a continuum of goods. Ann Oper Res 88:15–29

Buratto A, Grosset L, Viscolani B (2006) Advertising a new product in a segmented market. Eur J Oper Res 175:1262–1267

Cañibano L, Garcia-Ayuso M, Sánchez MP (2000) The value relevance and managerial implications of intangibles: a literature review. J Account Lit 19:102–130

Chan WL, Zhu GB (1989) Optimal birth control of population dynamics. J Math Anal Appl 144(2):532–552

Deighton J, Henderson CM, Neslin SA (1994) The effects of advertising on brand switching and repeat purchasing. J Mark Res 31(1):28–43

Da Prato G, Iannelli M (1994) Boundary control problem for age-dependent equations. In: Clement PH, Lumer G (eds) Evolution equations, control theory, and biomathematics. Lecture notes in pure and applied mathematics, vol 155. Marcel Dekker AG, New york

Engel KJ, Nagel R (2000) One-parameter semigroups for linear evolution equations. In: Axler S, Gehring FW, Ribet KA (eds) Graduate texts in mathematics, vol 194. Springer, New York

Engel KJ, Nagel R (2006) A short course on operator semigroups. Springer, New York

Faggian S, Grosset L (2013) Optimal advertising strategies with age-structured goodwill. Math Method Oper Res 78(2):259–284

Fruchter GE, Jaffe ED, Nebenzahl ID (2006) Dynamic brand-image-based production location decisions. Automatica 42(8):1371–1380

Feichtinger G, Tragler G, Veliov VM (2003) Optimality conditions for age-structured control systems. J Math Anal Appl 288(1):47–68

Gautschi W (1997) Numerical analysis: an introduction. Birkhauser, Boston

Gripenberg G, Londen SO, Staffans OJ (1990) Volterra integral and functional equations. Cambridge University Press, Cambridge

Godes D, Mayzlin D (2004) Using online conversations to study word-of-mouth communication. Mark Sci 23(4):545–560

Gruen TW, Osmonbekov T, Czaplewski AJ (2006) eWOM: The impact of customer-to-customer online know-how exchange on customer value and loyalty. J Bus Res 59(4):449–456

Grosset L, Viscolani B (2005) Advertising for the introduction of an age-sensitive product. Optim Control Appl Methods 26:157–167

Huang J, Leng M, Liang L (2012) Recent developments in dynamic advertising research. Eur J Oper Res 220(3):591–609

Heiman A, McWilliams B, Shen Z, Zilberman D (2001) Learning and forgetting: modeling optimal product sampling over time. Manag Sci 47(4):532–546

Hennig-Thurau T, Gwinner KP, Walsh G, Gremler DD (2004) Electronic word-of-mouth via consumer-opinion platforms: what motivates consumers to articulate themselves on the internet? J Interact Mark 18(1):38–52

Jørgensen S, Zaccour G (2014) A survey of game-theoretic models of cooperative advertising. Eur J Oper Res 237(1):1–14

Kamont Z (1999) Hyperbolic functional differential inequalities and applications. In: Hazewinkel M (ed) Mathematics and its applications, vol 486. Springer, Dordrecht

Kapferer JN (2012) The new strategic brand management: advanced insights and strategic thinking. Kogan Page Publishers, London

Keller E, Fay B (2009) The role of advertising in word of mouth. J Advert Res 49(2):154

Kurdila AJ, Zabarankin M (2005) Convex functional analysis. In: Basar T (ed) Systems and control: foundations and applications. Birkhäuser, Basel

Lambertini L (2014) Coordinating static and dynamic supply chains with advertising through two-part tariffs. Automatica 50(2):565–569

Lasiecka I, Triggiani R (2000) Control theory for partial differential equations: continuous and approximation theories. Part II. In: Rota GC (ed) abstract hyperbolic-like systems over a finite time horizon. Cambridge University Press, Cambridge

Lauterborn B (1990) New marketing litany. Advert Age 61(41):26–26

Martín-Herrán G, McQuitty S, Sigué SP (2012) Offensive versus defensive marketing: what is the optimal spending allocation? Int J Res Mark 29(2):210–219

Monahan GE (1984) Technical note—a pure birth model of optimal advertising with word-of-mouth. Mark Sci 3(2):169–178

Mosca S, Viscolani B (2004) Optimal goodwill path to introduce a new product. J Optim Theory Appl 123(1):149–162

Nerlove M, Arrow JK (1962) Optimal advertising policy under dynamic conditions. Economica 29:129–142

Nelson Ph (1974) Advertising as information. J Polit Econ 82(4):729–754

Pazy A (1983) Semigroups of linear operators and applications to partial differential equations. In: Marsden JE, Sirovich LS (eds) Applied mathematical sciences, vol 44. Springer, New York

Park EJ, Iannelli M, Kim MY, Anita S (1998) Optimal harvesting for periodic age-dependent population dynamics. SIAM J Appl Math 58(5):1648–1666

Schiesser WE, Griffiths GW (2009) A compendium of partial differential equation models: method of lines analysis with Matlab. Cambridge University Press, Cambridge

Shampine LF, Gladwell I, Thompson S (2003) Solving ODEs with matlab. Cambridge University Press, Cambridge

Spremann K (1985) The signaling of quality by reputation. In: Feichtinger G (ed) Optimal control theory and economic analysis. North-Holland, Amsterdam

Trusov M, Bucklin RE, Pauwels K (2009) Effects of word-of-mouth versus traditional marketing: findings from an internet social networking site. J Mark 73(5):90–102

Veliov VM (2008) Optimal control of heterogeneous systems: basic theory. J Math Anal Appl 346(1):227–242

Verwer JG, Sanz-Serna JM (1984) Convergence of method of lines approximations to partial differential equations. Computing 33(3–4):297–313

Webb GF (1985) Theory of nonlinear age-dependent population dynamics. Marcel Dekker, New York

Weber TA (2005) Infinite-horizon optimal advertising in a market for durable goods. Optim Control Appl Methods 26(6):307–336

Acknowledgements

The authors wish to thank Gila Fruchter, Luca Lambertini, Władysław Milo, Yair Orbach, and two anonymous referees for their helpful and constructive comments that greatly contributed to improving the final version of the paper. The authors also gratefully acknowledge financial support from the National Science Centre in Poland. Decision No. DEC-2011/03/D/HS4/04269.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Existence and uniqueness of the solution to the goodwill equation

In order to prove existence and uniqueness of the solution to (6) we transform this equation into a PDE with homogeneous boundary conditions (26) and then use the semigroup approach to find a generalised mild solution.

Let

denote the term with controls from the boundary condition (5).

Remark 2

If \((u_0,u)\in U_{0, ad}\times U_{ad}\), then the function \(w:[0,T]\rightarrow [0,\infty )\) belongs to \(L^{\infty }(0,T)\).

Denote

the future value in time e of 1 unit of goodwill in segment of new consumers. Moreover, let

where

Theorem 2

Assume (7) holds and \(u\in U_{ad}\), \(u_0\in U_{0,ad}\) are positive-valued, differentiable functions such that \(\frac{\partial u}{\partial t}\) and \(\frac{d u_0}{dt}\) are continuous. Moreover, let \(\delta \) be a continuous function. Then, G is a classical solutionFootnote 3 to (6) if and only if Q, given by (24), belongs to \( C^1\left( [0,T]\times [0,1]\right) \) and satisfies the following equation

Proof

Let G be a classical solution to (6). Then, the assumptions on controls \(u, u_0\) guarantee that there exists continuous derivative \(w'\). By (24), (25) and (6) we obtain

for all \((t,e)\in [0,T]\times [0,1]\). Moreover, for all \(e\in [0,1]\) from (24) and (25) we have the initial condition

By (24), (25) and (5) we have the boundary condition

for all \(t\in [0,T]\). Similarly, one can prove the ”if” implication. \(\square \)

1.1 5.1 The goodwill equation as a homogeneous Cauchy problem in a Hilbert space

Since we want to consider non-smooth controls \(u,u_0\), we need to introduce a weaker concept of solution to (6). Let \(L^2(0,1)\) be the Lebesgue space of square integrable functions on (0, 1) and \(W^{1,p }(0,1)\), with \(p\ge 1\), be the Sobolev space of p-integrable functions with weak derivative in \(L^p(0,1)\). We rewrite (26) as an evolution equation in \(L^2(0,1)\). Define the linear unbounded operator on \(L^2(0,1)\) by

Then, under the assumption (7) the operator \(({\mathcal {A}},{\mathcal {D}}({\mathcal {A}}))\) generates strongly continuous semigroup of linear operators \((S(t))_{t\ge 0}\) on \(L^2(0,1)\), see Webb (1985); Prato and Iannelli (1994). The semigroup \(\left( S(t)\right) _{t\ge 0}\) is given by

where \(B_{\phi }\) is the solution of Volterra integral equation

with

and

Remark 3

By (7) the semigroup \((S(t))_{t\,\ge \,0}\) is uniformly exponentially stable [cf. Sect. 4.5 in Chapter VI in Engel and Nagel (2006)].

Proposition 3

Assume (7) holds. Then, for all \(\phi \in L^2(0,1)\):

-

1.

The equation (28) possesses the unique continuous solution \(B_{\phi }\) on \([0,\infty )\);

-

2.

The function \(B_{\phi }\) satisfies

$$\begin{aligned} \Vert B_{\phi }\Vert _{L^{\infty }(0,1)}\le \mu \Vert \phi \Vert _{L^{\infty }(0,1)}\Vert R\Vert _{L^{\infty }(0,1)}; \end{aligned}$$(29) -

3.

For D defined in (23), the function \(B_{D}\) satisfies

$$\begin{aligned} B_{D}(t)=\int _{t\wedge 1}^{1}R(s)D(s)ds+\int _0^{t\wedge 1}R(s)D(s)B_{D}(t-s)ds \end{aligned}$$and is differentiable on \([0,\infty )\). Moreover, \(B'_{D}\in L_{loc}^\infty (0,\infty )\) is the solution to

$$\begin{aligned} B'_{D}(t)=\left\{ \begin{array}{ll} -\frac{1}{\mu }R(t)D(t)+\int _0^t R(s)D(s)B'_{D}(t-s)ds &{} \text {for } t\in [0,1),\\ \int _0^{1}R(s)D(s)B'_{D}(t-s)ds &{}\text {for } t\ge 1 \end{array}\right. \end{aligned}$$(30)and hence for all \(t>0\) satisfies

$$\begin{aligned} \Vert B'_{D}\Vert _{L^\infty (0,t)}\le \Vert R\Vert _{L^\infty (0,1)}. \end{aligned}$$(31)

Proof

Let \(\phi \in L^2(0,1)\).

- Part 1.:

-

Note that \(F_\phi \in C([0, \infty ))\), thus the result follows from Theorem 3.5 in Chapter 2 in Gripenberg et al. (1990).

- Part 2.:

-

Since \(\frac{D(s)}{D(s-t)}=e^{-\int _{s-t}^s\delta (u)du}<1\) for all \(s\ge t\ge 0\), from (28) we obtain

$$\begin{aligned} \Vert B_{\phi }(\cdot )\Vert _{L^{\infty }(0,1)}\le \Vert \phi \Vert _{L^{\infty }(0,1)}\Vert R\Vert _{L^{\infty }(0,1)}+\int _0^{1}R(s)D(s)ds \Vert B_{\phi }\Vert _{L^{\infty }(0,1)}. \end{aligned}$$Hence and using the definition of \(\mu \) in (25) we get

$$\begin{aligned} \Vert B_{\phi }(\cdot )\Vert _{L^{\infty }(0,1)}\le \mu \Vert \phi \Vert _{L^{\infty }(0,1)}\Vert R\Vert _{L^{\infty }(0,1)}. \end{aligned}$$ - Part 3.:

-

Since \(F_D(t)=\int _{t\wedge 1}^{1}R(s)D(s)ds, t\ge 0\) is differentiable a.e on \([0,\infty )\) and \(F'\in L^\infty (0,\infty )\), \(B_D\) is differentiable a.e. on \([0,\infty )\) by Theorem 3.3 from Chapter 3 in Gripenberg et al. (1990). Moreover, the derivative \(B'_D\in L_{loc}^\infty (0,\infty )\) satisfies (30). Finally, note that (31) is a simple consequence of (30). \(\square \)

Observe that the Eq. (26) can be reformulated as a Cauchy problem in the Hilbert space \(L^2(0,1)\):

Based on Pazy (1983) we introduce the following definition.

Definition 2

A measurable function \(Q:[0,T]\rightarrow L^2(0,1)\) is called a mild solution to (32) if \(G_0\in L^{2}(0,1)\) and \(w\in W^{1,1}([0,T])\) and for any \(t\in [0,T]\) one has

Remark 4

Let the assumptions of Theorem 2 be satisfied. If Q is a classical solution to (26), then Q is a mild solution to (32) (cf. Engel and Nagel 2000; Pazy 1983).

Definition 3

A measurable function \(G:[0,T]\rightarrow L^2(0,1)\) is called a generalised mild solution to (6) if \(G_0\in L^{2}(0,1)\), \((u_0,u)\in L^2(0,T)\times L^2((0,T)\times (0,1))\) and for any \(t\in [0,T]\) one has

We write \(G=G(u,u_0;G_0)\) to denote that generalised mild solution to (6) depends on the controls u, \(u_0\) and the initial value \(G_0\).

Remark 5

If Q is a mild solution to (32), then \(G=Q+g\) is a generalised mild solution to (6).

Proof (Proof of Remark 5)

Indeed, from (33), (25) and (24) we get

We integrate by parts the last term to obtain

\(\square \)

From Remarks 4, 5 and Theorem 2 we obtain:

Remark 6

Under the assumptions of Theorem 2, if G is a classical solution to (6), then G is a generalised mild solution to (6).

Here and subsequently, z stands for

where w is given by (22).

Theorem 4

Let \(G_0\in L^2(0,1)\), \((u_0,u)\in L^2(0,T)\times L^2((0,T)\times (0,1))\) and (7) holds. Then,

-

1.

There exists a unique generalised mild solution \(G(u,u_0;G_0)\) to (6) i.e. \(z(t)\in {\mathcal {D}}({\mathcal {A}})\) for all \(t\in [0,T]\);

-

2.

\({\mathcal {A}}z\in C(0,T;L^2(0,1))\cap L^{\infty }(0,T; L^{\infty }(0,1))\).

Furthermore, if \((u_0^1,u^1)\in L^2(0,T)\times L^2((0,T)\times (0,1))\) and \(G=G(u,u_0;G_0)\) and \(G_1=G_1(u^1,u_0^1;G_0)\) are the generalised mild solution to (6), then there exist \(L_1,L_2>0\) such that

-

3.

$$\begin{aligned}&\sup _{t\in [0,T]} \Vert G(t)\Vert _{L^2(0,1)}\\&\quad \le L_1\left( \Vert G_0\Vert _{L^2(0,1)}+\Vert u\Vert ^\rho _{L^2((0,1)\times (0,T))}+\Vert u_0\Vert ^\rho _{L^2(0,T)}\right) ,\\&\sup _{t\in [0,T]} \Vert G(t)-G_1(t)\Vert _{L^2(0,1)}\\&\quad \le L_1 \left( \Vert u-u^1\Vert ^\rho _{L^2((0,1)\times (0,T))}+\Vert u_0-u^1_0\Vert ^\rho _{L^2(0,T)}\right) ; \end{aligned}$$

-

4.

If moreover \((u_0,u), (u^1_0,u^1)\in U_{0,ad} \times U_{ad} \) and \(G_0\in L^{\infty }(0,1)\), then we have

$$\begin{aligned}&\sup _{t\in [0,T]} \Vert G(t)\Vert _{L^{\infty }(0,1)}\\&\quad \le L_2 \left( \Vert G_0\Vert _{L^\infty (0,1)}+ \Vert u\Vert ^\rho _{L^{\infty }((0,1)\times (0,T))}+\Vert u_0\Vert ^\rho _{L^{\infty }(0,T)}\right) ,\\&\sup _{t\in [0,T]} \Vert G(t)-G_1(t)\Vert _{L^\infty (0,1)}\\&\quad \le L_2 \left( \Vert u-u^1\Vert ^\rho _{L^\infty ((0,1)\times (0,T))}+ \Vert u_0-u^1_0\Vert ^\rho _{L^\infty (0,T)}\right) . \end{aligned}$$\(\square \)

Proof

Let \(z^1(t)=\int _0^tS(t-s)D w^1(s)ds\) where \(w^1(t)=\int _0^1R(e)\lambda ^\rho (u^1(t,e))^\rho de+(\lambda u_0^1(t))^\rho \) for all \(t\ge 0\). By (Prato and Iannelli 1994, Theorem 2.2) we obtain that \(z(t), z^1(t)\in {\mathcal {D}}({\mathcal {A}})\) for all \(t\in [0,T]\), and \({\mathcal {A}}z(\cdot ),{\mathcal {A}}z^1(\cdot )\in C([0,T];L^2(0,1))\) and

where \(L_T=(\frac{1}{\mu }+\left\| R\right\| _{L^{\infty }(0,1)}\sqrt{T})\). Moreover, by Hölder’s continuity of \(x\mapsto x^\rho \) and the Hölder inequalities we have

Similarly, we have

where \(M(T)=\sup _{t\in [0,T]}\Vert S(t)\Vert _{{\mathcal {L}}(L^2(0,1))}<\infty \). Therefore, by (35)–(37) we obtain inequalities from part 3. of Theorem 4, where \(L_1=\max \left\{ M(T),\lambda ^\rho T^{1-\frac{\rho }{2}}M(T),\lambda ^\rho \mu L_T T^{\frac{1-\rho }{2}}(\Vert R\Vert _{L^\infty }\vee 1)\right\} \).

Now we prove parts 2. and 4. of Theorem 4. By the definition of semigroup \((S(t))_{t\ge 0}\) (cf. (27)) we can rewrite (34) as

for all \(a\in [0,1]\) and \(t\in [0,T]\). Differentiating (38) with respect to e we obtain

for all \(t\in [0,T]\). Hence

where the last inequality follows form the third part of Proposition 3. Since \(0<D(e)\le 1\) for every \(a\in [0, 1]\), by (29) we obtain

for all \(\phi \in L^{\infty }(0,1)\). Similarly, by (29) we have

Finally, form (40)–(42) we get

for all \(G_0\in L^{\infty }(0,1)\) and \(t\in [0,T]\), where

\(\square \)

1.2 5.2 The relationship between the generalised mild solution and the solution along the characteristic lines

In order to apply the maximum principle introduced by Feichtinger et al. (2003) we formulate the following proposition.

Proposition 5

If (7) holds, then the generalised mild solution to (6) satisfies the following formulae:

for all \(c\in (0,1]\) and all \(t\in [0,1-c]\), and

for all \(c\in [-T,0]\) and all \(t\in (-c,T]\), and

for all \(t\in [0,T]\).

Proof

Identity (45) follows directly by applying (27), (39) to the definition of the generalised mild solution. We prove (44), as the formula (43) can be proven similarly.

Observe that by (27) we obtain

and

for a.e. \(c\in [-T,0]\) and \(t\in (-c,T]\). Moreover, using (39) we have

As a result, by (46)–(48) the generalised mild solution of (6) takes the form

for a.e. \(c\in [-T,0]\) and for all \(t\in [-c,T]\). Hence for all \(c\in [-T,0]\) the mapping \(t\mapsto G(t,t+c)\) has an absolutely continuous version. Finally, for a.e. \(t\in [-c, T]\) the derivative \(t\mapsto G(t,t+c)\) is equal to

which proves (44). \(\square \)

Remark 7

By Theorem 4 and Proposition 5, if \(G_0\in L^{\infty }(0,1)\), and \((u,u_0)\in U_{0,ad}\times U_{ad}\) then the generalised mild solution \(G(u,u_0;G_0)\) of (6) is the solution of (6) along the characteristic lines as in Feichtinger et al. (2003). In particular \(G(u,u_0;G_0)\) belongs to \(L^{\infty }(0,T;L^{\infty }(0,1))\cap C(0,T;L^2(0,1))\).

Appendix 2: The existence and uniqueness of an optimal solution to the goodwill control problem

In this section we present the proof of Theorem 1. We apply the following classical results for general extreme problems in a Hilbert space H (see Theorem 6).

Let \(f:U\rightarrow {\mathbb {R}}\) be a functional defined on subset \(U\subset H\). Consider the optimization problem

Theorem 6

[Kurdila and Zabarankin (2005), Theorems 7.3.5, 7.3.7] If the functional \(f:U\rightarrow {\mathbb {R}}\) is lower semicontinuous, convex and coercive, and the set U is not empty, closed and convex, then there exist a solution \(u^*\in U\) to (50) i.e. \(f(u^*)=\inf _{h\in H} f(h)\).

Notice that if U is bounded, then in Theorem 6 the coercivity of f is superfluous. Moreover, if f is additionally strictly convex, then the solution \(u^*\in U\) is unique.

In the proof of Theorem 1 we need the following lemma.

Lemma 1

Let \(\mathcal {E}_1, \mathcal {E}_1^{\prime }, \mathcal {E}_2\) be Banach function spaces over a \(\sigma \)-finite measure space \((S,\varSigma ,\mu )\). Consider an operator \(F:\mathcal {E}_1 \times \mathcal {E}_1^{\prime } \rightarrow \mathcal {E}_2\) such that, \(\mu \)-almost everywhere,

and let \(f^*\) be a positive and strictly concave functional on \(\mathcal {E}_2\). Then, the composition \(f^*\circ F\) is strictly concave functional on \(\mathcal {E}_1\).

Proof

Let \(\alpha \in (0,1)\) and \(f_1,f_2\in \mathcal {E}_1\). Then, from the assumptions on \(f^*\) and by (51) it follows that

where in the last inequality we use strict concavity of \(f^*\). \(\square \)

Proof (Proof of Theorem 1)

Fix \(G_0\in L^2(0,1)\) such that \(G_{0}(e)\ge 0\) for a.e \(a\in (0,1)\). We can rewrite the problem (16) as (50) with \(H= L^2(0,T)\times L^2((0,T)\times (0,1))\) and the functional \(f(u_0,u)=-J(G,u_0,u)\) defined on \(U=U_{0,ad}\times U_{ad}\subset H\). The set of admissible controls U is obviously nonempty and convex. To prove closedness of U let \(\{(u_{0,n},u_n)\}_{n\ge 1}\) be a sequence of admissible controls converging in H-norm to \((u_0,u)\). We show that \(u_0\in U_{0,ad}\) and \(u\in U_{ad}\). Indeed, the sets \(A=\{t\in (0,T):u_0(t)<0\}\) \(B=\{t\in (0,T): u_0(t)-I>0\}\) are measurable and \(\int _Au_{0,n}(t)dt\ge 0\), \(\int _B(u_{0,n}(t)-I)dt\le 0\) for all \(n\ge 1\). Taking the limits in these two sequences of integrals we obtain \(\int _Au_{0}(t)dt\ge 0\) and \(\int _B(u_{0}(t)-I)dt\le 0\). Thus \(|A|=0\) and \(|B|=0\) and we conclude that \(0 \le u_{0}(t)\le I\) for a.e. \(t\in (0,T)\). Hence \(u_{0}\in U_{0,ad}\). The same argument can be used to prove that \(u\in U_{ad}\).

Moreover, since \(\rho ,\gamma \in (0,1]\) one can prove that J given by (15) is strictly concave. Indeed, first notice that J can be represented as follows

with

for all \((u_0,u)\in H\), where \(G(u_0,u;G_0)=G_1(u^\rho ;G_0)+G_2(u^\rho _0)\), \(G_1:L^2((0,1)\times (0,T))\rightarrow C([0,T];L^2(0,1))\) is given by

and \(G_2:L^2(0,T)\rightarrow C([0,T];L^2(0,1))\) satisfies

Since any norm in a Hilbert space is strictly convex, the mapping \(H\ni (u,v)\mapsto -\frac{\beta }{2}\int _0^1\int _0^Te^{-rt}(u^2(t,e)+v^2(t)-c_f)dtda\) is strictly concave. Hence it is enough to show that \(J_1:H\rightarrow {\mathbb {R}}\) is strictly concave. Notice that \(J_1\) is a composition of the Niemycki operator \((u_0,u)\mapsto ((u_0)^{\rho },(u)^{\rho })\) on H and the positive linear operators \(G_1\), \(G_2\) with the strictly concave functional

on \(C([0,T]; L^{2}(0, 1))\). Positivity of \(G_1\), \(G_2\) follows by assumption \(G_0\ge 0\) and by positivity of the Lotka-Sharp-McKendrick semigroup \((S(t))_{t\ge 0}\) (cf. Engel and Nagel 2000, Sect. 4 in Chapter IV). Hence by Lemma 1 \(J_1\) is strictly concave.

Furthermore, in the case of \(I=\infty \) we show that the functional f is coercive. For this purpose consider a sequence \(\{(u_{0,n},u_n)\}_{n\ge 1}\subset U_{0,ad}\times U_{ad}\) such that \(\Vert (u_{0,n},u_n\Vert _{L^2(0,T)\times L^2((0,T)\times (0,1))}\rightarrow \infty \), thus \(\Vert u_n\Vert _{L^2((0,T)\times (0,1))}\rightarrow \infty \) or \(\Vert u_{0,n}\Vert _{L^2(0,T)}\rightarrow \infty \). From Theorem 4 for each element of sequence \(\{(u_{0,n},u_n)\}_{n\ge 1}\) there exists the generalised mild solution \(G_n=G_n(u_{0,n},u_n;G_0)\) to (6). Therefore,

Thus, since \(\rho ,\gamma \in (0,1]\), \(|f(u_{0,n},u_n)|\rightarrow \infty \) as n tends to \(\infty \). Hence the functional f is coercive.

Since by Theorem 4 the generalised mild solution to (6) continuously depends on \((u_0,u)\in H\), it follows that the functional \(J:H\rightarrow {\mathbb {R}}\) is continuous.

Therefore, by Theorem 6 the goodwill control problem (16) admits a unique solution. \(\square \)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Górajski, M., Machowska, D. Optimal double control problem for a PDE model of goodwill dynamics. Math Meth Oper Res 85, 425–452 (2017). https://doi.org/10.1007/s00186-017-0577-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-017-0577-1