Abstract

This paper considers an auctioneer who has a non-monotonic utility function with a unique maximizer. The auctioneer is able to reject all bids over some amount by using rejection prices. We show that the optimal rejection price for such an auctioneer is lower than and equal to that maximizer in first-price and second-price sealed-bid auctions, respectively. Further, in each auction we characterize a necessary and sufficient condition that by using the optimal rejection price not only the auctioneer but also bidders can be better off, compared to a standard auction. Finally, we find that the auctioneer strictly prefers a first-price sealed-bid auction if he is risk-averse when his revenue is lower than the maximizer or if the distribution of revenues which are lower than the maximizer in a standard first-price sealed-bid auction is first-order stochastic dominant over the one in a standard second-price sealed-bid auction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In standard auction theory, it is assumed that an auctioneer’s utility monotonically increases with money. In this paper, contrary to the standard assumption, we consider an auctioneer with non-monotonic utility.

Here is a real-life example.Footnote 1 Nowadays, in land auctions many of China’s local governments set a highest selling price for each land and then the land auction will be ended if the bids go above it. The news reported that why the local governments introduced the mechanism was to control surging land costs that had been driving up home prices. This is because the local governments are concerned about the impacts of high home prices such as aggravating the real estate bubble, declining the fertility rate,Footnote 2 slashing people’s living standards and so on. Therefore, the local governments would like to keep the land price within a reasonable range.

Two features are important in this example. First, the auctioneer (the local governments in China) has a non-monotonic utility function with a unique maximizer (interior). This is because the land price imposes a negative externality which increases with money on his utility. Hence the utility of the auctioneer increases with money while the externality is small but decreases while it is large enough. Second, the auctioneer may refuse all bids over some amount (in this paper we call it a rejection price). Being afraid of the negative externality, the auctioneer would like to refuse the bid which is higher than the rejection price in order to maximize his expected utility.

In fact, such a kind of auctioneer is not uncommon in reality. In a large auction in which the worth of a good is large compared to the wealth of a bidder, the auctioneer may also have a non-monotonic utility function. This is because winners can declare bankruptcy if the good is worth less than expected. Therefore similar to the local governments in China, the auctioneer is also concerned about high hammer prices. For example, in the 1996 radio frequency spectrum auction in the U.S., the winning bids totaled 10.2 billion dollars, but the auctioneer raised only 400 million dollars in the next three years, since many of the winners declared bankruptcy.Footnote 3

The goal of this paper is to study how an auctioneer who has a non-monotonic utility function with a unique maximizer can use the rejection price to increase expected utility in a first-price sealed-bid auction (FPA) and a second-price sealed-bid auction (SPA). We also investigate whether using the rejection price can also increase bidders’ expected utilities or not. And we examine which auction does an auctioneer with non-monotonic utility prefer.

In our model, an auctioneer announces publicly a rejection price before a given FPA or SPA starts. Subsequently, n risk-neutral bidders bid for an object. At the end of bidding, the bids which do not exceed the rejection price are called effective bids. The bidder with the highest bid among the effective bids gets the object and pays the highest and second-highest one among the effective bids in the FPA and SPA, respectively.

For a given FPA or SPA with a rejection price in an environment with independently and identically distributed private values, we first show an equilibrium bidding behavior which is based on a natural equilibrium bidding behavior in a standard FPA or SPA.Footnote 4 In an SPA with a rejection price the optimal strategy for the bidder is bidding the lower one between his private value and the rejection price, since there is no incentive for a bidder to bid higher than his private value (suffer a loss) or the rejection price (be rejected). In an FPA with a rejection price, we find that in the equilibrium bidding strategy there exists a jump point below which bidders bid the same as the standard model and above which bidders bid the rejection price. Why does the jump point exist? If the equilibrium bidding strategy were continuous at that point, a bidder whose value is slightly lower than that point would improve his payoff by bidding the rejection price. This is because he could win bidders whose value is higher than that point. So the equilibrium bidding strategy should be discontinuous at that point.

Then we show the optimal rejection price for the auctioneer by assuming that the auctioneer believes that all bidders will follow the equilibrium bidding behavior if he announces a rejection price. In an SPA with a rejection price, the optimal rejection price is just the unique maximizer. In an FPA with a rejection price, the optimal rejection price could be the unique maximizer. But due to the discontinuous bidding strategy, with a lower rejection price bidders are more likely to bid it in an FPA than in an SPA, i.e., the auctioneer has much more probability of receiving the rejection price. Hence the optimal rejection price will be lower than the unique maximizer if a loss by receiving the lower rejection price can be negligible.

Note that no matter an FPA or an SPA becomes inefficient with a rejection price, since the object may not end up in the hands of the bidder who values it the most ex post if there are more than two bidders whose values are higher than the rejection price. Perhaps more surprisingly, not only the auctioneer but also bidders are better off under the optimal rejection price. This is the case if and only if the bidder with the maximum value is better off. Namely, the optimal rejection price results in a Pareto improvement.

Finally, we study the preferences of the auctioneer over the two auctions. In standard auction theory, Matthews (1979) and Waehrer et al. (1998) show that a risk-averse auctioneer strictly prefers an FPA to an SPA. Similarly, we prove that with the optimal rejection price the auctioneer also strictly prefers an FPA to an SPA if he is risk-averse when his revenue is lower than the maximizer or if the distribution of revenues which are lower than the maximizer in a standard FPA is first-order stochastic dominant over the one in a standard SPA. And we also find some cases where the auctioneer strictly prefers an SPA to an FPA.

Our paper is related to the literature on buy prices. In an auction with a buy price, a winner bidding the buy price pays it. In contrast, in the SPA with a rejection price, a winner bidding the rejection price pays the second-highest effective bid. Due to the difference, in an SPA with a buy price, a natural equilibrium candidate where each bidder bids the lower one between his private value and the buy price is not an equilibrium. In fact, the extant papers do not study buy prices in SPAs with continuously distributed types. Budish and Takeyama (2001) study a simple model with two bidders and two types, and find that a risk-neutral auctioneer gains by augmenting his auction with a buy price when bidders are risk-averse. And Inami (2011) extends these results to a model with n bidders where bidders’ types are discretely distributed. Hidvegi et al. (2006) study buy prices in English auctions with continuously distributed types. They find a unique equilibrium which depends on the information structure of the English auction. Mathews (2003) and Mathews and Katzman (2006) study temporary buy prices in auctions with continuously distributed types. They show that a risk-averse auctioneer can gain from augmenting his auction with a buy price and this option may result in a Pareto improvement compared to a standard auction.

Our paper is also related to the literature on bid caps (ceiling prices) which is basically the same as the rejection prices. Chowdhury (2008) analyzes a simple SPA with independent private values where the bidders may potentially collude. An optimal policy which includes both a reserve price and an efficient ceiling price prevents collusion. Gavious et al. (2002) consider bid caps in symmetric all-pay auctions and show that the auctioneer might benefit from a bid cap if bidders’ cost functions are convex and the number of bidders is sufficiently large. Sahuguet (2006) studies asymmetric all-pay auctions with private values and shows that capping the bids is profitable for an auctioneer.

Our paper is different in an important way from the literature mentioned above. To maximize an auctioneer’s expected utility, the most frequent studies for auctions with a buy price or a ceiling price focus on incentivizing bidders with different risk attitudes to bid aggressively. On the contrary, we focus our attention on an auctioneer whose utility is non-monotonic and has a unique maximizer to restrain risk-neutral bidders’ bids to maximize his expected utility. This is because high transaction price sometimes imposes a negative externality to the auctioneer’s utility, as we mentioned such as aggravating the real estate bubble and declining the fertility rate in land auctions.

Muto et al. (2020) study a “pro-buyer” auction designer who maximizes the weighted sum of the bidders’ and auctioneer’s expected payoffs where the weight for the auctioneer is lower.Footnote 5 And they show some optimal auctions have a bid cap, i.e., similarly to our paper the auction designer dislikes high bids in those auctions as well. Moreover, the auction designer’s objective function may also be non-monotonic.Footnote 6 In our paper, the auctioneer caps bids by employing a rejection price to maximize his expected utility, since he has a non-monotonic utility with a unique maximizer. And because in some cases all bidders can be better off with the optimal rejection price, the auctioneer can be “pro-buyer” as well.

From the bidders’ perspective, an auction with a rejection price is equivalent to the auction where all bidders are subject to a commonly known budget constraint that equals the rejection price. Hence our paper is also related to the literature on budget constraints. But none of them are similar to our paper. Laffont and Robert (1996) assume that all bidders have the same common budget constraint and derive the revenue maximizing auction.Footnote 7 Maskin (2000) examines the constrained efficiency in the same environment. Unlike them, the common budget constraint in our model, i.e., the rejection price is manipulated by the auctioneer. We find an optimal common budget constraint for an auctioneer with non-monotonic utility.

In an environment where budget constraints are private informationFootnote 8 and continuously distributed, Che and Gale (1998) derive the equilibrium for auctions with budget constraints and show that revenue equivalence no longer holds. Kotowski (2019) studies an FPA in which bidders’ valuations are interdependent and shows that in an equilibrium bidders may adopt discontinuous bidding strategies. Che and Gale (1998) compare the revenues to be realized by standard common value auctions. And Bobkova (2020) solves an FPA for two bidders with asymmetric budget distributions and common valuations. However, our model is not a special case in any of them since in our model neither bidders’ valuations are common nor the rejection price corresponds to private budget constraints.

The rest of this paper is organized as follows. In Sect. 2, we present the basic setting and assumptions. In Sect. 3, we study an FPA and an SPA with rejection prices. In Sect. 4, we compare the two auctions. In Sect. 5, we discuss a more general non-monotonic utility. Section 6 concludes.

2 Model

There is one indivisible object for sale, and n potential risk-neutral bidders are bidding for the object. Bidder \({i}\in {N=\{1,2,...,n\}}\) assigns a private value of \(v_i\) to the object and \(v_i\) is independently and identically distributed on some interval \([{\underline{v}},{\bar{v}}]\subset [0,\infty )\) according to an increasing distribution function \(F(\cdot )\). It is assumed that \(F(\cdot )\) admits a continuous density \(f(\cdot )=F'(\cdot )>0\) and has full support.

In this paper, we consider that the auctioneer has a non-monotonic utility function with a unique maximizer. We assume that \(u(\cdot )\) is strictly increasing on the interval \([0,v^*]\) and is strictly decreasing on the interval \((v^*,\infty )\), where \(v^*\in {({\underline{v}},{\bar{v}})}\) denotes the unique maximizer. For tractability, we assume that the utility function \(u(\cdot )\) is continuous on the interval \([0,\infty )\). Note that in the case \(v^*\le {\underline{v}}\), the auctioneer is willing to sell the object for \(v^*\) in the auction since his utility is strictly decreasing on \((v^*,\infty )\). And in the case \(v^*\ge {\bar{v}}\), the utility function is just the same as the standard assumption. Hence it is not interesting to study these two cases.

We provide an example of non-monotonic utility functions with a unique maximizer, using the example of the radio frequency spectrum auction. Let the probability that the winner declares bankruptcy is \(\alpha p/{\bar{v}}\) where \(p\in [{\underline{v}},{\bar{v}}]\) is the winner’s payment and \(\alpha \in (0,1]\). Then the auctioneer’s utility is \(p(1- \alpha p/{\bar{v}})\) which is a parabola opening downward. If we additionally assume \(\alpha \in (1/2,{\bar{v}}/2{\underline{v}})\), we have the unique maximizer \(p^*={\bar{v}}/2\alpha \in {({\underline{v}},{\bar{v}})}\).

Before a given kth-price sealed-bid auction starts, for \(k\in {\{\textrm{I,II}\}}\), the auctioneer can announce a rejection price \(R_k\in {({\underline{v}},{\bar{v}})}\). That is, the auctioneer rejects bids above \(R_k\). At the end of the auction, the bidder who gives the highest bid among the bids which are not rejected wins the object and pays the \(k{th}\)-highest one among the bids which are not rejected. We assume that if there is a tie the object goes to each winning bidder with equal probability, i.e., when l bids tie, each winning bidder gets the object with probability 1/l, for any \(l\in {N}\).

In a given kth-price sealed-bid auction with a rejection price \(R_k\), we let \(b_i\) denote bidder i’s bid for every \(i\in {N}\) and \(b=(b_1,b_2,...,b_n)\) denote the bid profile. Notice that we assume \({\underline{v}}\ge 0\), so that no bidder would bid a negative amount. So we can let \(b_i{\textbf {1}}_{\{b_i\le {R_k}\}}\) denote bidder i’s bid after screening by a rejection price \(R_k\), for every \(i\in {N}\) and \(k\in {\{\textrm{I,II}\}}\), where

Then bidder i can win the object only if \(R_{k}\ge b_i=\max \limits _{j}\{b_j{\textbf {1}}_{\{b_j\le R_k\}}\}\). And we let \(l(b_i)=|\{b_j|b_j=b_i,j=1,2,...,n\}|\) denote the number of bids which are equal to \(b_i\). For every \(i\in {N}\) and \(k\in {\{\textrm{I,II}\}}\), we let \(u_k(v_i,b)\) denote the utility of the bidder i with the bid profile b. More concretely,

in an FPA with a rejection price \(R_{\textrm{I}}\), and

in an SPA with a rejection price \(R_{\textrm{II}}\).

3 Analysis

In this section, we study an FPA and an SPA with rejections prices. In each auction, we study equilibrium bidding strategies and examine what effect such a rejection price has on the expected utilities of the auctioneer. And we investigate whether using the rejection price can also increase bidders’ expected utilities or not.

3.1 Equilibrium bidding strategies

First, we study equilibrium bidding strategies in an SPA with a rejection price \(R_{\textrm{II}}\). In this paper, we consider extending a natural equilibrium bidding strategy in a standard SPA to our model. Consider bidder \(i\in N\) with value \(v_i\). Note that the truth-telling is a weakly dominate strategy in a standard SPA. Hence when \(v_i\le R_{\textrm{II}}\), the truth-telling is a weakly dominate strategy for him, since he still has no incentive to bid higher or lower than his value.

When \(v_i>R_{\textrm{II}}\), there is no incentive for him to bid higher than \(R_{\textrm{II}}\), and if he bids the rejection price \(R_{\textrm{II}}\) his payoff is at least as high as bidding less than the rejection price at the end of the auction. Namely, bidding the rejection price is a weakly dominate strategy for him when \(v_i>R_{\textrm{II}}\). Then the bidding strategy in an SPA with a rejection price is that any bidder bids the lower one between his value and the rejection price.

Proposition 1

In an SPA with a rejection price \(R_{\textrm{II}}\), \(\beta _{\textrm{II}}(v_i)=\min {\{v_i,R_{\textrm{II}}\}}\) is an equilibrium bidding strategy.

Remark 1

As we mentioned in the introduction, our paper is related to the literature on buy prices, though none of them study a buy price in an SPA with continuously distributed values. Budish and Takeyama (2001) and Inami (2011) study models with discretely distributed types. With continuously distributed values, Hidvegi et al. (2006) study English auctions, and Mathews (2003) and Mathews and Katzman (2006) study temporary buy prices. If we replace the rejection price to a buy price in our model, the bidding strategies in Proposition 1 are not equilibria. This is because the expected utility of a bidder with value equals the buy price is 0 if he bids the buy price, but his expected utility must be positive if he bids slightly lower than the buy price. In fact, it is not easy to find and may be impossible to find pure equilibrium bidding strategies in an SPA with a buy price, where bidders’ values are continuously distributed. Hidvegi et al. (2006) find a unique pure equilibrium bidding strategy in an English auction with a buy price. But in the equilibrium whether a bidder bids the buy price or not depends on the current high bid, i.e., it cannot be extended in an SPA with a buy price.

Now, we study equilibrium bidding strategies in an FPA with a rejection price \(R_{\textrm{I}}\). As we mentioned in the introduction, from the bidders’ perspective a rejection price can be regarded as a common budget constraint that is equal to the rejection price. In an FPA with private budget constraints which are continuously distributed, Che and Gale (2000) propose sufficient conditions ensuring increasing and continuous equilibrium bidding strategies. Further, Kotowski (2019) shows that under some conditions there exist increasing but discontinuous equilibrium bidding strategies in the same environment. He also shows the existence of the discontinuous equilibrium bidding strategies with a numerical case in which private budget constraints are discretely distributed. Although in our model the rejection price does not correspond to private budget constraints, we show that, like (Kotowski 2019), there exist (weakly) increasing and discontinuous equilibrium bidding strategies.

Let \(\beta {(v)}\) denote the equilibrium bidding strategy by a bidder with value \(v\in {[{\underline{v}},{\bar{v}}]}\) in a standard FPA, i.e.,

Based on Proposition 1, we may conjecture an equilibrium bidding strategy such that some types of the bidders bid the rejection price and the other types of the bidders follow \(\beta {(v)}\). Therefore, for a given rejection price \(R_{\textrm{I}}\), there exists some value \(v_J\) that bidders whose values are higher than \(v_J\) bid the rejection price and the bidders whose value is lower than \(v_J\) follow \(\beta {(v)}\). And the bidder with value \(v_J\) must be indifferent between bidding the rejection price \(R_{\textrm{I}}\) and the standard bid \(\beta {(v_J)}\). The following lemma shows that in such an equilibrium bidding strategy, the value \(v_J\) uniquely exists if \(R_{\textrm{I}}\in ({\underline{v}},\beta {({\bar{v}})})\) and it is strictly increasing in \(R_{\textrm{I}}\).

Lemma 1

For any given \(R_{\textrm{I}}\in ({\underline{v}},\beta {({\bar{v}})})\), there uniquely exists \(v_J\in {({\underline{v}},{\bar{v}})}\) which satisfies

And \(\frac{dv_J}{dR_{\textrm{I}}}>0\) when \(R_{\textrm{I}}\in ({\underline{v}},\beta {({\bar{v}})})\).

Proof

See Appendix A.1. \(\square\)

Based on Lemma 1, we can prove the next proposition which states that in some cases the conjecture that for a given rejection price \(R_{\textrm{I}}\) the bidders whose values are higher than \(v_J\) bid the rejection price and the others follow \(\beta {(v)}\) is right.

Proposition 2

In an FPA with a rejection price \(R_{\textrm{I}}\),

(i) if \(R_{\textrm{I}}<\beta {({\bar{v}})}\),

is an equilibrium bidding strategy, where \(v_J\) is a jump point which satisfies that

(ii) if \(R_{\textrm{I}}\ge {\beta {({\bar{v}})}}\), for every \(v_i\in {[{\underline{v}},{\bar{v}}]}\)

is an equilibrium bidding strategy.

Proof

See Appendix A.2. \(\square\)

Proposition 2 implies that there exists a jump point in the equilibrium bidding strategy if the rejection price works (\(R_{\textrm{I}}<\beta {({\bar{v}})}\)), i.e., such a rejection price induces some bidders to bid higher than they bid in the standard model. One may imagine that the bidders might bid \({\hat{\beta }}_{\textrm{I}}{(v_i)}=\min {\{\beta {(v_i)},R_{\textrm{I}}\}}\) like the bidding strategy \(\beta _{\textrm{II}}{(v_i)}\). Due to Lemma 1 the interim expected utility of a bidder is discontinuous at \(v=\beta ^{-1}(R_{\textrm{I}})\) in this case. Hence a bidder whose value is lower than \(\beta ^{-1}{(R_{\textrm{I}})}\) and sufficiently closes to it can get a gain by bidding the rejection price, since \(R_{\textrm{I}}<\beta ^{-1}({R_{\textrm{I}})}\). Namely he prefers bidding the rejection price to bidding the bid in the standard model. Conversely, in the equilibrium, the interim expected utility of a bidder is continuous, since the equilibrium bidding strategy \(\beta _{\textrm{I}}{(v_i)}\) is discontinuous at the lowest value among all values with which a bidder bids the rejection price.

3.2 Optimal rejection prices

In this paper, we only focus on the equilibrium bidding strategies in Propositions 1 and 2. Now we examine what effect such a rejection price has on the expected utilities of the auctioneer in each auction.

In an SPA with a rejection price \(R_{\textrm{II}}\), the equilibrium bidding strategy \(\beta _{\textrm{II}}(v_i)=\min {\{v_i,R_{\textrm{II}}\}}\) is weakly increasing in \(v_i\). Let \(\nu\) be the second-highest value among \(v_1,v_2,...,v_n\). Then at the end of the auction, the auctioneer’s revenue is the second-highest bid \(\min \{\nu ,R_{\textrm{II}}\}\) which is bid by the bidder with value \(\nu\). If \(\nu \le v^*\), then \(u(\min \{\nu ,R_{\textrm{II}}\})\le u(\nu )= u(\min \{\nu ,v^*\})\), otherwise \(u(\min \{\nu ,R_{\textrm{II}}\})\le u(v^*)= u(\min \{\nu ,v^*\})\). Notice that \(\min \{\nu ,v^*\}\) is the second-highest bid when \(R_{\textrm{II}}=v^*\), i.e., it is ex-post rational for the auctioneer to use the rejection price \(R_{\textrm{II}}=v^*\). The following proposition also shows the uniqueness of the rejection price \(R_{\textrm{II}}=v^*\).

Proposition 3

(Truth-telling for auctioneer) In an SPA with a rejection price \(R_{\textrm{II}}\), the unique optimal rejection price is \(R_{\textrm{II}}^*=v^*\).

Proof

See Appendix A.3. \(\square\)

Remark 2

Proposition 3 holds even if \(u(\cdot )\) is discontinuous on the interval \([{\underline{v}},{\bar{v}}]\). This is because our proof in Proposition 3 does not rely on the continuity of \(u(\cdot )\).

In an FPA with a rejection price \(R_{\textrm{I}}\), we find that it is not profitable for an auctioneer to set a rejection price higher than the maximizer, if the maximizer is lower than the maximum equilibrium bid in a standard model. Let \(U_{\textrm{I}}(R_{\textrm{I}})\) denote the expected utility of the auctioneer in an FPA with a rejection price \(R_{\textrm{I}}\). And let \(v_J(R_{\textrm{I}})\) denote the jump point with a rejection price \(R_{\textrm{I}}\) by Lemma 1. For notational simplicity, we drop \(R_{\textrm{I}}\) in \(v_J(R_{\textrm{I}})\) when there is no ambiguity.

Proposition 4

In an FPA with a rejection price \(R_{\textrm{I}}\), if \(v^{*}<\beta {({\bar{v}})}\), the optimal rejection price \(R_{\textrm{I}}^{*}\) is unique and is in \(({\underline{v}},v^{*}]\). Moreover, if \(u(\cdot )\) is differentiable at \(v^*\), then the optimal rejection price \(R_{\textrm{I}}^{*}\) is in \(({\underline{v}},v^{*})\).

Proof

See Appendix A.4. \(\square\)

Remark 3

If \(v^*<\beta {({\bar{v}})}\) and \(u(\cdot )\) is linear on the interval \([{\underline{v}},v^*]\), the optimal rejection price in an FPA is \(R_{\textrm{I}}^{*}=v^*\). The reason is as follows. It suffices to show that \(R_{\textrm{I}}^{*}\ge v^*\) by the former statement of Proposition 4. By the definition of \(v_J(R_{\textrm{I}})\), we have

So by the linearity, the auctioneer’s expected utility with a rejection price \(R_{\textrm{I}}\) is

for any \(R_{\textrm{I}}\in [{\underline{v}},v^*]\). Therefore for any \(R_{\textrm{I}}\in ({\underline{v}},v^*)\),

And due to the continuity of \(U_{\textrm{I}}(R_{\textrm{I}})\), we have \(U_{\textrm{I}}(v^*)>U_{\textrm{I}}(R_{\textrm{I}})\) for any \(R_{\textrm{I}}\in [{\underline{v}},v^*)\). Hence \(R_{\textrm{I}}^{*}\ge v^*\).

Proposition 4 implies that the optimal rejection price is not higher than the maximizer. Before we give an explanation, let \(F_{\textrm{I}}(v;R_{\textrm{I}})\) denote the distribution function of the auctioneer’s revenue v in an FPA with a rejection price \(R_{\textrm{I}}\). It is easy to see that if \(R_{\textrm{I}}\in [{\underline{v}},\beta ({\bar{v}}))\),

and if \(R_{\textrm{I}}\in [\beta ({\bar{v}}),{\bar{v}}]\),

for any \(v\in [{\underline{v}},\beta ({\bar{v}})]\). For a rejection price \(R_{\textrm{I}}>v^*\), notice that \(F_{\textrm{I}}(v;v^*)=F_{\textrm{I}}(v;R_{\textrm{I}})\) for any \(v\in [{\underline{v}},\beta {(v_J(v^*}))\) and \(u(v^*)>u(v)\) for any \(v\in (v^*,{\bar{v}}]\). Therefore, the auctioneer will get a higher expected utility with the rejection price \(v^*\) than with the rejection price \(R_{\textrm{I}}\), i.e., the optimal rejection price \(R^*_{\textrm{I}}\) cannot be higher than \(v^*\).

For the case where \(u'(v^*)=0\), notice that the jump point is increasing in the rejection price, so that a rejection price which is lower than \(v^*\) makes bidders more likely to bid it, i.e., the auctioneer has a greater probability of receiving the rejection price. The increment of the probability brings a positive gain to the expected utility, but there is also a loss by receiving the lower rejection price. Because \(u'(v^*)=0\), if the lower rejection price is sufficiently close to \(v^*\), then the loss can be negligible and there is only a gain to the expected utility. Hence the optimal rejection price is lower than the maximizer in this case. By the intuition, if the maximizer is larger than \(\beta {({\bar{v}})}\) but sufficiently close to it, there also exists an optimal rejection price \(R_{\textrm{I}}^{*}\in {({\underline{v}},\beta {({\bar{v}})})}\).Footnote 9

3.3 Pareto improvement

Note that no matter an FPA or an SPA becomes inefficient with a rejection price, since the object may not end up in the hands of the bidder who values it the most ex post if there are more than two bidders whose values are higher than the rejection price. In fact, the efficiency which is defined in standard auction theory does not apply in our model.Footnote 10 In spite of this inefficiency, in each auction we find that all bidders’ interim expected utilities and the auctioneer’s expected utility can be improved with a rejection price, compared to its standard model. In this subsection, we show a necessary and sufficient condition which guarantees the improvement in each auction.

To state our results, we need to introduce some additional notations. We let \(u_k(v;R_k)\) denote the interim expected utility of a bidder with value \(v\in {[{\underline{v}},{\bar{v}}]}\) in \(k{th}\)-price sealed-bid auction with a rejection price \(R_k\), where \(k\in {\{\textrm{I,II}\}}\). In an SPA with a rejection price \(R_{\textrm{II}}\), with Proposition 1 we can calculate thatFootnote 11

It is easy to see that \(u_{\textrm{II}}(v;{\bar{v}})=\int _{{\underline{v}}}^{v}F^{n-1}(t)dt\) denotes the interim equilibrium expected utility by a bidder with value v in a standard SPA. Let \(\Delta _{\textrm{II}}(v)=u_{\textrm{II}}(v;R_{\textrm{II}})-u_{\textrm{II}}(v;{\bar{v}})\).

Proposition 5

Using a rejection price \(R_{\textrm{II}}\) makes a Pareto improvement for bidders to a standard SPA, i.e., the interim expected utilities of bidders with any values are improved and the interim expected utilities of bidders with at least one value are strictly improved if and only if \(u_{\textrm{II}}({\bar{v}};R_{\textrm{II}})\ge u_{\textrm{II}}({\bar{v}};{\bar{v}})\), namely

Proof

See Appendix A.5. \(\square\)

We proved Proposition 5 by considering \(\Delta _{\textrm{II}}(v)\) which is the difference between the interim expected utilities of a bidder with value v in a SPA with a rejection price and a standard SPA. When \(v\in [{\underline{v}},R_{\textrm{II}})\), \(\Delta _{\textrm{II}}(v)=0\), i.e., his interim expected utilities are the same in the two auctions. And we proved \(\Delta _{\textrm{II}}(v)\) is strictly concave on the interval \([R_{\textrm{II}},{\bar{v}}]\). Hence for a given rejection price if the interim expected utility of the bidder with value \({\bar{v}}\) can be improved, all bidders’ interim expected utilities can be improved.

Based on Propositions 3 and 5, we can show that using the optimal rejection price can result in a Pareto improvement, compared to a standard SPA. We omit the proof, since it is easy to see.

Proposition 6

Using the optimal rejection price \(R_{\textrm{II}}^*=v^*\) makes a Pareto improvement to a standard SPA, i.e., it makes a Pareto improvement for bidders and the expected utility of the auctioneer is improved if and only if

Corollary 1

Using the optimal rejection price \(R_{\textrm{II}}^*=v^*\) makes a Pareto improvement to a standard SPA if for any \(v\in [v^*,{\bar{v}}]\)

Proof

See Appendix A.6. \(\square\)

Corollary 1 implies that using the optimal rejection price \(v^*\) makes a Pareto improvement to a standard SPA if the distribution function \(F(\cdot )\) first-order stochastic dominates a distribution function which is the same as \(F(\cdot )\) on the interval \([{\underline{v}},v^*]\) and is uniform on the interval \([v^*,{\bar{v}}]\).

In an FPA with a rejection price, we also find results which are similar to the SPA with a rejection price. With Proposition 2, we can calculate that if \(R_{\textrm{I}}<\beta {({\bar{v}})}\),

It is easy to see that \(u_{\textrm{I}}(v;{\bar{v}})=\int _{{\underline{v}}}^{v}F^{n-1}(t)dt\) denotes the interim expected utility by a bidder with value v in a standard FPA. Let \(\Delta _{\textrm{I}}(v)=u_{\textrm{I}}(v;R_{\textrm{I}})-u_{\textrm{I}}(v;{\bar{v}})\).

Proposition 7

Using a rejection price \(R_{\textrm{I}}<\beta {({\bar{v}})}\) makes a Pareto improvement for bidders to a standard FPA if and only if \(u_{\textrm{I}}({\bar{v}};R_{\textrm{I}})\ge u_{\textrm{I}}({\bar{v}};{\bar{v}})\), namely

Proof

See Appendix A.7. \(\square\)

Similarly to Proposition 5, we proved Proposition 7 by showing that \(\Delta _{\textrm{I}}(v)=0\) on the interval \(v\in [{\underline{v}},v_J)\) and \(\Delta _{\textrm{I}}(v)\) is strictly concave on the interval \([v_J,{\bar{v}}]\), where \(\Delta _{\textrm{I}}(v)\) is the difference between the interim expected utilities of a bidder with value v in an FPA with a rejection price and a standard FPA.

Based on Propositions 4 and 7, we can also show that using the optimal rejection price can make a Pareto improvement to a standard FPA by the following proposition. We omit the proof, since it is easy to see.

Proposition 8

If \(v^*<\beta {({\bar{v}})}\), using the optimal rejection price makes a Pareto improvement to a standard FPA if and only if

where \(v_J^*=v_J(R_{\textrm{I}}^*)\).

Corollary 2

If \(v^*<\beta {({\bar{v}})}\), using the optimal rejection price makes a Pareto improvement to a standard FPA if for any \(v\in [v_J^*,{\bar{v}}]\)

where \(v_J^*=v_J(R_{\textrm{I}}^*)\).

Proof

See Appendix A.8. \(\square\)

Corollary 2 implies that using the optimal rejection price \(v_J^*\) makes a Pareto improvement to a standard FPA if the distribution function \(F(\cdot )\) first-order stochastic dominates a distribution function which is the same as \(F(\cdot )\) on the interval \([{\underline{v}},v_J^*]\) and is uniform on the interval \([v_J^*,{\bar{v}}]\).

4 Comparison

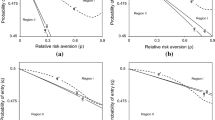

In this section, we investigate the preferences of an auctioneer with non-monotonic utility over the two auctions. We show not only the cases where with the optimal rejection price the auctioneer prefers an FPA to an SPA, but also the cases where with the optimal rejection price the auctioneer prefers an SPA to an FPA.

We first show the former cases. In standard auction theory, Matthews (1979) and Waehrer et al. (1998) show that a risk-averse auctioneer strictly prefers an FPA to an SPA under the standard equilibria. In our model, we draw a similar conclusion to theirs. Before we state that conclusion, we show their result by the following lemma.

Lemma 2

An auctioneer with a utility function \(w(\cdot )\) which is concave on the interval \([{\underline{v}},{\bar{v}}]\) prefers a standard FPA to a standard SPA, that is,

Moreover, the inequality becomes strict if \(w(\cdot )\) is not linear.

Proof

See Appendix A.9. \(\square\)

This lemma is intuitive. Consider the event that a bidder with value \(v\in [{\underline{v}},{\bar{v}}]\) wins the object in a standard \(k{th}\)-price sealed-bid auction, where \(k\in {\{\textrm{I},\textrm{II}\}}\). The bidder’s payment is \(\beta {(v)}\) in a standard FPA and due to the payment rule his payment is deterministic. His expected payment is also \(\beta {(v)}\) in a standard SPA, however it is the expectation of the second-highest bid that is random. So a risk-averse auctioneer will get a higher expected utility from this event in a standard FPA. And notice that this event happens with the same probability in both auctions, therefore the auctioneer prefers a standard FPA to a standard SPA. We apply the same intuition to our model. Let \(U_{\textrm{II}}(R_{\textrm{II}})\) denote the expected utility of the auctioneer in an SPA with a rejection price \(R_{\textrm{II}}\), and

Proposition 9

For a given rejection price \(R\le {v^*}\), if \(u(\cdot )\) is concave on the interval \([{\underline{v}},R]\), then an auctioneer strictly prefers an FPA to an SPA, that is, \(U_{\textrm{I}}(R)>U_{\textrm{II}}(R)\).

Proof

See Appendix A.10. \(\square\)

In an FPA with a rejection price \(R\in [{\underline{v}},{\bar{v}}]\), if bidders bid following the strategy \({\hat{\beta }}_{\textrm{I}}{(v)}=min{\{\beta (v),R\}}\), then the auctioneer’s expected utility is equal to \(\int _{{\underline{v}}}^{{\bar{v}}}{w(\beta (t);R)dF^{n}(t)}\). By applying Lemma 2 to two standard auctions with a concave but non-linear utility function w(v; R), we see that the expected utility is greater than the auctioneer’s equilibrium expected utility under the standard SPA, which is equal to \(U_{\textrm{II}}(R)\) in our setting. In fact, in an FPA, some bidders bid higher than they bid following \({\hat{\beta }}_{\textrm{I}}{(v)}=min{\{\beta (v),R\}}\). Since \(R\le {v^*}\) and \(u(\cdot )\) is strictly increasing on the interval \([{\underline{v}},v^*]\), the auctioneer will get a higher expected utility than that case. Hence the auctioneer prefers an FPA. Notice that in Proposition 9, R could be equal to \(v^*\) which is the optimal rejection price in an SPA, then the following proposition is straightforward.

Proposition 10

If \(u(\cdot )\) is concave on the interval \([{\underline{v}},v^*]\), then with the optimal rejection priceFootnote 12an auctioneer strictly prefers an FPA to an SPA, that is, \(\max \limits _{R\in {[{\underline{v}},{\bar{v}}]}}{U_{\textrm{I}}(R)}>U_{\textrm{II}}(v^*)\).

Proof

By Proposition 9, \(\max \limits _{R\in {[{\underline{v}},{\bar{v}}]}}{U_{\textrm{I}}(R)}\ge {U_{\textrm{I}}(v^*)}>U_{\textrm{II}}(v^*)\). \(\square\)

We reach the above conclusions based on the auctioneer’s risk-attitude. Next, we analyze the preferences of the auctioneer over the two auctions in a different way. From the auctioneer’s point of view, a kth-price sealed-bid auction with a rejection price can be regarded as a lottery since the revenue is random, where \(k\in {\{\textrm{I},\textrm{II}\}}\). Recall that we let \(F_{\textrm{I}}(v;R_{\textrm{I}})\) denote the distribution function of the auctioneer’s revenue v in an FPA with a rejection price \(R_{\textrm{I}}\).

Now we let \(F_{\textrm{II}}(v;R_{\textrm{II}})\) denote the distribution function of the auctioneer’s revenue v in an SPA with a rejection price \(R_{\textrm{II}}\). Then it is easy to see that for any rejection price \(R_{\textrm{II}}\in [{\underline{v}},{\bar{v}}]\),

The following proposition shows that for a given rejection price \(R\le {v^*}\), if \(F_{\textrm{I}}(v;R)\) is first-order stochastic dominant over \(F_{\textrm{II}}(v;R)\) on the range where the auctioneer’s revenue is lower than \(\beta (v_J(R))\), the auctioneer prefers an FPA to an SPA.

Proposition 11

For a given rejection price \(R<\beta ({\bar{v}})\), if \(R\le {v^*}\) and for any \(v\in {[{\underline{v}},\beta (v_J(R))]}\)Footnote 13

i.e., \(F_{\textrm{I}}(v;R)\) is first-order stochastic dominant over \(F_{\textrm{II}}(v;R)\), then an auctioneer strictly prefers an FPA to an SPA, that is, \(U_{\textrm{I}}(R)>U_{\textrm{II}}(R)\).

Proof

See Appendix A.11. \(\square\)

By Propositions 3 and 4, we have \(R_{\textrm{I}}^*\le v^*=R_{\textrm{II}}^*\) if \(v^*<\beta {({\bar{v}})}\). Then, the following proposition can be shown immediately.

Proposition 12

If \(v^*<\beta {({\bar{v}})}\) and for any \(v\in {[{\underline{v}},\beta (v_J(v^*))]}\)

i.e., \(F_{\textrm{I}}(v;v^*)\) is first-order stochastic dominant over \(F_{\textrm{II}}(v;v^*)\), then with the optimal rejection price an auctioneer strictly prefers an FPA to an SPA, that is, \(U_{\textrm{I}}(R_{\textrm{I}}^*)\ge U_{\textrm{II}}(v^*)\).

Proof

By Proposition 11, \(U_{\textrm{I}}(R_{\textrm{I}}^*)\ge U_{\textrm{I}}(v^*)>U_{\textrm{II}}(v^*)\). \(\square\)

The intuition of the conditions of Propositions 11 and 12 is that the auctioneer will be more likely to acquire a low revenue in an SPA than in an FPA. This is because even if the winner’s private value is high, the auctioneer may acquire a low revenue in an SPA.

The above four propositions show that the auctioneer strictly prefers an FPA. Nonetheless, we have a numerical example in which the auctioneer strictly prefers an SPA. Here is a numerical example in which \(v^*<\beta {({\bar{v}})}\). There are 2 bidders whose values are i.i.d. on [0, 1] according to a uniform distribution. Let the auctioneer’s utility be

Then it is easy to see that \(v^*=0.48<0.5=\beta {({\bar{v}})}\) and \(U_{\textrm{II}}(R_{\textrm{II}}^*)=U_{\textrm{II}}(v^*)>(1-v^*)^2u(v^*)=1.749488\). Now consider the auctioneer’s expected utility in an FPA with the optimal rejection price. By Lemma 1, \(v_J(R_{\textrm{I}})=\frac{R_{\textrm{I}}}{1-R_{\textrm{I}}}\) for any \(R_{\textrm{I}}\in [0,0.48]\). Then for any \(R_{\textrm{I}}\in [0,0.47]\), \(U_{\textrm{I}}(R_{\textrm{I}})<u(R_{\textrm{I}})\le u(0.47)=0.47<0.95<[1-(v_J{(v^*)})^2]u(v^*)<U_{\textrm{I}}(v^*)\). Hence \(R^*_{\textrm{I}}\in (0.47,0.48]\) by Proposition 4. And because \(\beta (v_J(v^*))=\frac{v^*}{2(1-v^*)}=\frac{6}{13}<0.47<v^*\), so

Therefore, \(U_{\textrm{I}}(R_{\textrm{I}}^*)<U_{\textrm{II}}(R_{\textrm{II}}^*)\).

5 Discussion

So far, we have assumed that the auctioneer’s utility function is strictly increasing below the unique maximizer and strictly decreasing above the unique maximizer. In this section, we consider a more general non-monotonic utility function that \(u(v^*)>u(v)\) for any \(v\in [0,v^*)\cup (v^*,\infty )\), where \(v^*\in ({\underline{v}},{\bar{v}})\). For tractability, we also assume that \(u(\cdot )\) is continuous on the interval \([0,\infty )\).

Notice that the equilibrium bidding strategies \(\beta _{\textrm{I}}(\cdot )\) and \(\beta _{\textrm{II}}(\cdot )\) are independent of the utility function \(u(\cdot )\), therefore, in this section, we focus on the optimal rejection prices in FPAs and SPAs. Before starting our discussion, we additionally assume that \(\max _{v\in [0,{\underline{v}}]}u(v)<\min _{v\in ({\underline{v}},v^*]}u(v)\) in order to exclude the case where the optimal rejection price is \(R^*_k\in [0,{\underline{v}}]\), with \(k\in {\{\textrm{I,II}\}}\).

At first, we consider an SPA with a rejection price. Recall that the function \(F_{\textrm{II}}(v;R_{\textrm{II}})\) denotes the distribution function of the auctioneer’s revenue v in an SPA with a rejection price \(R_{\textrm{II}}\). For a rejection price \(R_{\textrm{II}}>v^*\), notice that \(F_{\textrm{II}}(v;v^*)=F_{\textrm{II}}(v;R_{\textrm{II}})\) for any \(v\in [{\underline{v}},v^*)\) and \(u(v^*)>u(v)\) for any \(v\in [0,\infty )\). Therefore, the auctioneer will get a higher expected utility with the rejection price \(v^*\) than with the rejection price \(R_{\textrm{II}}\), i.e., the optimal rejection price \(R^*_{\textrm{II}}\) cannot be higher than \(v^*\). For a rejection price \(R_{\textrm{II}}<v^*\), notice that \(F_{\textrm{II}}(v;v^*)\) is first-order stochastic dominant over \(F_{\textrm{II}}(v;R_{\textrm{II}})\). So if \(u(\cdot )\) is weakly increasing on the interval \([{\underline{v}},v^*]\), then the auctioneer strictly prefers the rejection price \(v^*\). This is because \(u(\cdot )\) is not constant on the interval \([{\underline{v}},v^*]\) by the assumption that \(u(v^*)>u(v)\) for any \(v\in [0,v^*)\cup (v^*,\infty )\).

For an FPA with a rejection price, notice that the proof of Proposition 4 can be supported by the assumption that \(u(v^*)>u(v)\) for any \(v\in [0,v^*)\cup (v^*,\infty )\), i.e., we can prove the same results as Proposition 4. We omit the proof of the results, since it is easy to see.

Proposition 13

In an SPA with a rejection price \(R_{\textrm{II}}\), the optimal rejection price is \(R_{\textrm{II}}^{*}\in ({\underline{v}},v^{*}]\). Moreover, if \(u(\cdot )\) is weakly increasing on the interval \([{\underline{v}},v^*]\), then the optimal rejection price is \(R_{\textrm{II}}^{*}=v^*\). In an FPA with a rejection price \(R_{\textrm{I}}\), if \(v^{*}<\beta {({\bar{v}})}\), the optimal rejection price is \(R_{\textrm{I}}^{*}\in ({\underline{v}},v^{*}]\). Moreover, if \(u(\cdot )\) is differentiable at \(v^*\), then the optimal rejection price is \(R_{\textrm{I}}^{*}\in ({\underline{v}},v^{*})\).

We have shown that the auctioneer can be better off by rejecting bids which are higher than the unique maximizer. It seems that the auctioneer benefits from limiting the number of bidders, since it reduces the probability of getting high bids. However the auctioneer prefers using the optimal rejection price to limiting the number of bidders in a \(k{th}\)-price sealed-bid auction, where \(k\in {\{\textrm{I,II}\}}\). This is because in a \(k{th}\)-price sealed-bid auction, the auctioneer can be better off by using the optimal rejection price, i.e., with the same number of bidders the auctioneer prefers using the optimal rejection price to not using it. Moreover, with the optimal rejection price the auctioneer’s expected utility is increasing in the number of bidders, since increasing the number of bidders increases the probability of getting high bids which are not larger than the unique maximizer.

Intuitively, it is also rational for the auctioneer to use a posted price as well. This is because using a posted price can also “reject” high bids. However there are many cases where the auctioneer prefers selling an object in a \(k{th}\)-price sealed-bid auction with the optimal rejection price to selling it with any posted prices, where \(k\in {\{\textrm{I,II}\}}\).Footnote 14 Here is a numerical example. There are 3 bidders whose values are i.i.d. on [0, 1] according to a uniform distribution. Let the auctioneer’s utility be

By Proposition 10, we have \(\max \limits _{R\in {[{\underline{v}},{\bar{v}}]}}{U_{\textrm{I}}(R)}>U_{\textrm{II}}(v^*)=U_{\textrm{II}}(0.8)=0.616\). Now consider the auctioneer uses a posted price \(q\in [0,1]\). It is easy to see that the optimal posted price \(q^*\in [0,0.8]\), so his expected utility is at most \(1.25q^*(1-{q^*}^3)<0.6<0.616\).

6 Conclusion

We have studied an auctioneer whose utility is non-monotonic and has a unique maximizer. This kind of auctioneer is not uncommon in the real world, such as the local government in China. When such an auctioneer sells objects in an auction, he is willing to use a rejection price to maximize his utility.

First, we analyzed the equilibrium bidding strategy in an FPA and an SPA with rejection prices. In an SPA with a rejection price, the equilibrium bidding strategy is that any bidder bids the lower one between his value and the rejection price. In an FPA with a rejection price, we found that the rejection price works only if it is lower than the maximum equilibrium bid in a standard FPA. We focus attention on the case where it works and have shown that there exists a jump point in the equilibrium bidding strategy. In this case, the bid of a bidder whose value is lower than the jump point, is the same as the standard model, and the bidder whose value is higher than it bids the rejection price.

Then we analyzed the optimal rejection prices for the auctioneer in both auctions. In an SPA with a rejection price, the optimal rejection price equals the unique maximizer. In an FPA with a rejection price, the optimal rejection price is not higher than the maximizer if the maximizer is lower than the maximum equilibrium bid in a standard model. Moreover, if his utility function is smooth at the maximizer the optimal rejection price will be lower than the maximizer.

With a rejection price no matter an FPA or an SPA becomes inefficient. Perhaps more surprisingly, in both auctions we found that if the interim expected utility of the bidder with the maximum value can be improved by the rejection price, then all bidders’ interim expected utilities can be improved. Further, using the optimal rejection price makes a Pareto improvement to the standard model, if all bidders’ interim expected utilities can be improved.

Finally, we analyzed the auctioneer’s preferences over the two auctions. We found that the auctioneer strictly prefers an FPA to an SPA if the increasing part of his utility function is concave. The same conclusion can be reached if the distribution of revenues in an FPA is first-order stochastic dominant over it in an SPA. And we also found some cases where the auctioneer strictly prefers an SPA to an FPA.

The natural extension of this work is to consider a more realistic rejecting strategy where the auctioneer randomly rejects bids. One strategy that can be taken into account is that the auctioneer accepts the bids which are lower than some threshold and rejects the bids which are higher than the threshold with a positive probability, i.e. the auctioneer can use a mixed strategy. This may be relevant when the auctioneer cannot directly announce a rejection price, about which the bidders only have stochastic estimations. Note that, in this paper, we assume that bidders are able to bid higher than the rejection price, though get nothing. The rejection price becomes a pure rejecting strategy in a general framework. Another more realistic rejecting strategy is that the higher bid is more likely to be rejected, i.e. the rejecting probability is increasing in the bid. We leave the challenging work for future research.

Data availability statement

This research was supported by a grant from Hubei Business College (KY202112).

Notes

Yi and Yi (2008) investigate the effect of increasing housing prices on Hong Kong’s fertility rate.

Note that standard FPAs and SPAs can be regarded as FPAs or SPAs with infinite rejection prices, respectively.

For example, a social planner (auction designer) tends to choose pro-consumer policies for political reasons.

See Example 3 of Muto et al. (2020).

They show the optimal auction takes the form of an all-pay auction. Namely, the auctioneer’s expected revenue is maximized in an all-pay auction with a given rejection price. Nevertheless, it is difficult to analyze the all-pay auction in our model, since the auctioneer has a general non-monotonic utility function.

Burkett (2015) considers a situation in which each firm privately constrains the budget of its manager (bidder) to prevent the manager overpaying for auction items, since the manager simply receives some private payoff from managing the auction items. In our paper, the auctioneer manipulates the bidders’ common budget.

Here is a simple example. There are 2 bidders whose values are i.i.d. on [0, 1] according to a uniform distribution. Let the auctioneer’s utility be \(u(v)=1.01v-v^2\), then it is easy to see that \(v^*=0.505>0.5=\beta {({\bar{v}})}\) and the optimal rejection price is \(R_{\textrm{I}}^{*}\approx {0.455}<0.5\).

In standard auction theory, if the object ends up in the hands of the bidder who values it the most ex post, the welfare of a standard auction will be maximized. But in our model, if the auctioneer’s revenue is larger than \(v^*\), the welfare of our model may not be maximized since the auctioneer’s utility is decreasing in his revenue in this case.

The probability that a bidder with value \(v\in {[R_{\textrm{II}},{\bar{v}}]}\) wins the object is \(\frac{1-F^{n}(R_{\textrm{II}})}{n(1-F(R_{\textrm{II}}))}=\frac{1}{n}\sum _{i=1}^{n}{F^{n-i}(R_{\textrm{II}})}\).

In an FPA, if \(v^{*}\ge \beta {({\bar{v}})}\) the auctioneer’s expected utility may be maximized on the interval \([\beta {({\bar{v}})},{\bar{v}}]\), i.e., it may not be optimal for the auctioneer to use a rejection price. In this case, we regard any \(R\in {[\beta {({{\bar{v}}})},{{\bar{v}}}]}\) as his optimal rejection price.

These conditions can be satisfied if \(n=2\) and \(F(\cdot )\) is a uniform distribution function on [0, 1] and \(R\le 4/9\).

If we introduce a reserve price in our model, the auctioneer prefers our model to using a posted price. This is because selling an object in our model by setting the rejection price equals the reserve price is equivalent to selling it with a posted price.

See (Krishna 2010).

See the proof of Lemma 1.

References

Board S (2007) Bidding into the red: a model of post-auction bankruptcy. J Finance 62(6):2695–2723. https://doi.org/10.1111/j.1540-6261.2007.01290.x

Bobkova N (2020) Asymmetric budget constraints in a first-price auction. J Econ Theory 186:104–975. https://doi.org/10.1016/j.jet.2019.104975

Budish EB, Takeyama LN (2001) Buy prices in online auctions: irrationality on the internet? Econ Lett 72(3):325–333. https://doi.org/10.1016/S0165-1765(01)00438-4

Burkett J (2015) Endogenous budget constraints in auctions. J Econ Theory 158:1–20. https://doi.org/10.1016/j.jet.2015.03.010

Che YK, Gale I (1998) Standard auctions with financially constrained bidders. Rev Econ Stud 65(1):1–21. https://doi.org/10.1111/1467-937X.00033

Che YK, Gale I (2000) The optimal mechanism for selling to a budget-constrained buyer. J Econ Theory 92(2):198–233. https://doi.org/10.1006/jeth.1999.2639

Chowdhury PR (2008) Controlling collusion in auctions: the role of ceilings and reserve prices. Econ Lett 98(3):240–246. https://doi.org/10.1016/j.econlet.2007.04.033

Gavious A, Moldovanu B, Sela A (2002) Bid costs and endogenous bid caps. The RAND J Econ 33(4):709–722. https://doi.org/10.2307/3087482

Hidvegi Z, Wang W, Whinston AB (2006) Buy-price English auction. J Econ Theory 12(1):31–56. https://doi.org/10.1016/j.jet.2004.11.009

Inami Y (2011) The buy price in auctions with discrete type distributions. Math Soc Sci 61(1):1–11. https://doi.org/10.1016/j.mathsocsci.2010.09.002

Kotowski MH (2019) First-price auctions with budget constraints. HKS working Paper No. RWP19-021, https://doi.org/10.2139/ssrn.3403297

Krishna V (2010) Auction theory. Academic Press

Laffont JJ, Robert J (1996) Optimal auction with financially constrained buyers. Econ Lett 52(2):181–186. https://doi.org/10.1016/S0165-1765(96)00849-X

Maskin ES (2000) Auctions, development, and privatization: efficient auctions with liquidity-constrained buyers. Eur Econ Rev 44(4–6):667–681. https://doi.org/10.1016/S0014-2921(00)00057-X

Matthews S (1979) Risk aversion and the efficiency of first and second price auctions. 586 College of Commerce and Business Administration, University of Illinois at Urbana-Champaign, Berlin

Mathews T (2003) A risk averse seller in a continuous time auction with a buyout option. Brazil Electron J Econ 5(2):1–26, http://www.beje.decon.ufpe.br/v5n2/mathews.pdf. Accessed 20 Dec 2016

Mathews T, Katzman B (2006) The role of varying risk attitudes in an auction with a buyout option. Econ Theor 27(3):597–613. https://doi.org/10.1007/s00199-004-0571-8

Muto N, Shirata Y, Yamashita T (2020) Revenue-capped efficient auctions. J Eur Econ Assoc 18(3):1284–1320. https://doi.org/10.1093/jeea/jvz015

Sahuguet N (2006) Caps in asymmetric all-pay auctions with incomplete information. Econ Bull 3(9):1–8

Waehrer K, Harstad RM, Rothkopf MH (1998) Auction form preferences of risk-averse bid takers. The RAND J Econ 1:179–192, https://doi.org/10.2307/2555821, www.jstor.org/stable/2555821

Yi J, Yi X (2008) Increasing housing prices and secular fertility decline in Hong Kong. China Econ Q 3(009):961–982

Zheng CZ (2001) High bids and broke winners. J Econ Theory 100(1):129–171. https://doi.org/10.1006/jeth.2000.2715

Acknowledgements

I would like to thank Tadashi Sekiguchi, Ryuji Sano, Takeharu Sogo, Saori Chiba and all referees for their insightful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A.1 Proof of Lemma 1

For a given \(R_{\textrm{I}}\in ({\underline{v}},\beta {({\bar{v}})})\), let

where \(v\in ({\underline{v}},{\bar{v}})\). We show that H(v) has only one zero point. We take the derivative with respect to v,

Notice that \(\frac{1}{n}\sum _{i=1}^{n}F^{n-i}(v)>F^{n-1}(v)\) for any \(v\in ({\underline{v}},{\bar{v}})\), so \(H'(v)>0\) for any \(v\in [R_{\textrm{I}},{\bar{v}})\), i.e., H(v) is strictly increasing on the interval \([R_{\textrm{I}},{\bar{v}})\). Further, since \(\beta {(v)}<v\) for any \(v\in ({\underline{v}},{\bar{v}})\) and \(\beta {(v)}\) is strictly increasing in v,Footnote 15 we can get

and

So there uniquely exists \(v\in (R_{\textrm{I}},{\bar{v}})\) such that \(H(v)=0\). Notice that \(\beta {(v)}<v\) for any \(v\in ({\underline{v}},{\bar{v}})\), then \(H(v)<0\) for any \(v\in ({\underline{v}},R_{\textrm{I}}]\). Therefore, H(v) has only one zero point, i.e., \(v_J\in {({\underline{v}},{\bar{v}})}\) uniquely exists.

Now, we show that \(\frac{dv_J}{dR_{\textrm{I}}}>0\). Since

take the derivative of both sides with respect to \(R_{\textrm{I}}\), we can get

Due to \(v_J>R_{\textrm{I}}\) and \(\frac{1}{n}\sum _{i=1}^{n}F^{n-i}(v)>F^{n-1}(v)\), we can get \(\frac{dv_J}{dR_{\textrm{I}}}>0\).

1.2 A.2 Proof of Proposition 2

Obviously, if \(R_{\textrm{I}}\ge {\beta {({\bar{v}})}}\), the rejection price can not work and bidders bid following the standard model, i.e., \(\beta _{\textrm{I}}{(v_i)}=\beta {(v_i)}\). Thus, we only need to prove the case \(R_{\textrm{I}}<\beta {({\bar{v}})}\).

Suppose that all but bidder i follow the strategy given in the statement and let \(u_i(v_i,(b_i,(\beta _{\textrm{I}})_{-i}))\) denote bidder i’s interim expected utility when his bid is \(b_i\). Since \(\frac{1}{n}\sum _{i=1}^{n}F^{n-i}(v)>F^{n-1}(v)\) for any \(v\in ({\underline{v}},{\bar{v}})\) and the definition of \(v_J\), we have \(\beta {(v_J)}<R_{\textrm{I}}\), i.e., \(v_J\) is a jump point. Then the interim expected utility of bidder i can be computed:

Clearly, it is not optimal for bidder i to bid higher than \(R_{\textrm{I}}\) or lower than \({\underline{v}}\). On the one hand, if bidder i’s value is \(v_i<v_J\), note that the utility with \(b_i\le {\beta {(v_J)}}\) is the same as the standard model, so we have \(u_i\left( v_i,(\beta {(v_i)},(\beta _{\textrm{I}})_{-i})\right) \ge {u_i\left( v_i,(b_i,(\beta _{\textrm{I}})_{-i})\right) }\) for any \(b_i\le {\beta {(v_J)}}\). We also have, for any \(R_{\textrm{I}}>b_i>\beta {(v_J)}\),

and

Hence it is optimal for bidder i with value \(v_i<v_J\) to bid \(\beta {(v_i)}\).

On the other hand, if bidder i’s value is \(v_i\ge {v_J}\), for any \(R_{\textrm{I}}>b_i>\beta {(v_J)}\)

and for any \(b_i\le {\beta {(v_J)}}\)

Hence it is optimal for bidder i with value \(v_i\ge {v_J}\) to bid \(R_{\textrm{I}}\).

1.3 A.3 Proof of Proposition 3

Let \(\nu\) be the second-highest value among \(v_1,v_2,...,v_n\). Then the auctioneer’s revenue, i.e., the second-highest bid among \(\beta _{\textrm{II}}(v_1),\beta _{\textrm{II}}(v_2),...,\beta _{\textrm{II}}(v_n)\) is equal to \(\min \{\nu ,R_{\textrm{II}}\}\). By setting the rejection price \(R_{\textrm{II}}=v^*\), the auctioneer’s utility is \(u(\nu )\) if \(\nu <v^*\) and \(u(v^*)\) if \(\nu \ge v^*\).

Suppose, however, that the auctioneer sets the rejection price \(R_{\textrm{II}}<v^*\). If \(\nu \le R_{\textrm{II}}\), then his utility is still \(u(\nu )\). However, if \(\nu > R_{\textrm{II}}\) his utility is \(u(R_{\textrm{II}})<u(\min \{\nu ,v^*\})\), since \(u(\cdot )\) is strictly increasing on the interval \([0,v^*]\). Due to \(R_{\textrm{II}}<v^*<{\bar{v}}\), the probability that \(\nu >R_{\textrm{II}}\) is positive. Therefore, setting the rejection price less than \(v^*\) decreases his expected utility.

Suppose, on the contrary, he sets the rejection price \(R_{\textrm{II}}>v^*\). If \(\nu \le v^*\), then his utility is still \(u(\nu )\). However, if \(\nu > v^*\) then his utility is at most \(\max \{u(\nu ),u(R_{\textrm{II}})\}<u(v^*)\), since \(v^*\) is the unique maximizer. Due to \(v^*<{\bar{v}}\), the probability that \(\nu > v^*\) is positive. Therefore, setting the rejection price larger than \(v^*\) decreases his expected utility. Thus the unique optimal rejection price is \(R_{\textrm{II}}^*=v^*\).

1.4 A.4 Proof of Proposition 4

First, we show the former statement. The auctioneer’s expected utility with a rejection price \(R_{\textrm{I}}\) can be calculated as follows:

Due to Lemma 1, we have \(v_J(R_{\textrm{I}})>v_J(v^*)\), for any \(R_{\textrm{I}}\in {(v^*,\beta {({\bar{v}})}]}\). Note that \(u(v^*)>u(v)\) for any \(v\in (v^*,{\bar{v}}]\), so for any \(R_{\textrm{I}}\in {(v^*,\beta {({\bar{v}})}]}\)

For any \(R_{\textrm{I}}\in {(\beta {({\bar{v}})},{\bar{v}}]}\), it is easy to know that \(U_{\textrm{I}}(R_{\textrm{I}})=U_{\textrm{I}}(\beta {({\bar{v}})})<U_{\textrm{I}}(v^*)\). And since \(u(\cdot )\) is strictly increasing on the interval \([{\underline{v}},v^*]\), then \(U(v^*)>u({\underline{v}})=U({\underline{v}})\). Since \(U_{\textrm{I}}{(R_{\textrm{I}})}\) is continuous on the interval \([{\underline{v}},\beta ({\bar{v}})]\), therefore, there exists \(R_{\textrm{I}}^{*}\in {({\underline{v}},v^{*}]}\) such that \(U_{\textrm{I}}{(R_{\textrm{I}}^{*})}=\max \limits _{R_{\textrm{I}}\in {[{\underline{v}},{\bar{v}}]}}U_{\textrm{I}}{(R_{\textrm{I}})}\).

Now, we show the latter statement. Since \(u(\cdot )\) is differentiable at \(v^*\) and \(v^*\) is the maximizer, so we have \(u'(v^*)=0\) and \(U_{\textrm{I}}(\cdot )\) is also differentiable at \(v^*\). Lemma 1 implies \(\beta {(v_J{(v^{*})})}<v^*<v_J{(v^{*})}\) and \(\frac{dv_J{(v^*)}}{dR_{\textrm{I}}}>0\).Footnote 16 Then

This implies that there exists \(R_{\textrm{I}}\in {({\underline{v}},v^{*})}\) such that \(U_{\textrm{I}}{(R_{\textrm{I}})}>U_{\textrm{I}}{(v^*)}\). Further, by the former statement, there exists \(R_{\textrm{I}}^{*}\in {({\underline{v}},v^{*})}\) such that \(U_{\textrm{I}}{(R_{\textrm{I}}^{*})}=\max \limits _{R_{\textrm{I}}\in {[{\underline{v}},{\bar{v}}]}}U_{\textrm{I}}{(R_{\textrm{I}})}\).

1.5 A.5 Proof of Proposition 5

It suffices to show that \(\Delta _{\textrm{II}}(v)\ge {0}\) for any \(v\in [R_{\textrm{II}},{\bar{v}}]\) and \(\Delta _{\textrm{II}}(v)>0\) for some \(v\in [R_{\textrm{II}},{\bar{v}}]\) if and only if \(u_{\textrm{II}}({\bar{v}};R_{\textrm{II}})\ge u_{\textrm{II}}({\bar{v}};{\bar{v}})\). It is easy to see that

We take the derivative with respect to v, then for any \(v\in [R_{\textrm{II}},{\bar{v}}]\)

and

i.e., \(\Delta _{\textrm{II}}(v)\) is strictly concave on the interval \([R_{\textrm{II}},{\bar{v}}]\). Thus \(\Delta _{\textrm{II}}(v)>\min {\{\Delta _{\textrm{II}}(R_{\textrm{II}}),\Delta _{\textrm{II}}({\bar{v}})\}}\) for any \(v\in (R_{\textrm{II}},{\bar{v}})\). Notice that \(\Delta _{\textrm{II}}(R_{\textrm{II}})=0\), thus \(\Delta _{\textrm{II}}(v)>0\) for any \(v\in (R_{\textrm{II}},{\bar{v}})\) if and only if

1.6 A.6 Proof of Corollary 1

By Proposition 6, it suffices to show that \(u_{\textrm{II}}({\bar{v}};v^*)\ge u_{\textrm{II}}({\bar{v}};{\bar{v}})\). Notice that \(u_{\textrm{II}}(v;R_{\textrm{II}})\) can be written as

for any \(v\in [R_{\textrm{II}},{\bar{v}}]\). Then by the condition,

1.7 A.7 Proof of Proposition 7

It is easy to see

Then the proof is completed by replacing \(R_{\textrm{II}}\) by \(v_J\) in the proof of Proposition 5.

1.8 A.8 Proof of Corollary 2

Notice that if \(R_{\textrm{I}}<\beta ({\bar{v}})\), similarly to \(u_{\textrm{II}}({\bar{v}};R_{\textrm{II}})\), \(u_{\textrm{I}}({\bar{v}};R_{\textrm{I}})\) can be written as

for any \(v\in [v_J(R_{\textrm{I}}),{\bar{v}}]\). Then the proof is completed by replacing \(v^*\) by \(v_J^*\) in the proof of Corollary 1.

1.9 A.9 Proof of Lemma 2

Let \(\Delta (v)=n\int _{{\underline{v}}}^{v}{(F(v)-F(t))w(t)dF^{n-1}(t)}-\int _{{\underline{v}}}^{v}{w(\beta (t))dF^{n}(t)}\). Then taking the derivative with respect to v, we have

Since \(w(\cdot )\) is concave on the interval \([{\underline{v}},{\bar{v}}]\), by Jensen’s inequality, for any \(v\in [{\underline{v}},{\bar{v}}]\)

This implies that \(\Delta '(v)\le 0\) for any \(v\in [{\underline{v}},{\bar{v}}]\). Hence \(\Delta ({\bar{v}})\le \Delta ({\underline{v}})=0\), i.e.,

Moreover, if \(w(\cdot )\) is not linear, then

for some \(v'\in ({\underline{v}},{\bar{v}})\). This implies that \(\Delta '(v')<0\) for some \(v'\in ({\underline{v}},{\bar{v}})\). Hence \(\Delta ({\bar{v}})<\Delta ({\underline{v}})=0\), i.e.,

1.10 A.10 Proof of Proposition 9

Obviously, w(v; R) is concave but not linear on the interval \([{\underline{v}},{\bar{v}}]\) since \(u(\cdot )\) is strictly increasing on the interval \([{\underline{v}},R]\). Then we have

and if \(R\in [{\beta ({\bar{v}})},{\bar{v}}]\)

Notice that \(u(\cdot )\) is strictly increasing on the interval \([{\underline{v}},R]\) and \(R>\beta (v_J(R))\). Thus if \(R\in [{\underline{v}},{\beta ({\bar{v}})})\)

Therefore, by Lemma 2, we have for any \(R\le {v^*}\),

1.11 A.11 Proof of Proposition 11

Since \(R<\beta ({\bar{v}})\) and for any \(v\in {[{\underline{v}},\beta (v_J(R))]}\)

then we have

for any \(v\in [{\underline{v}},\beta (v_J(R))]\) and

for any \(v\in (\beta {(v_J(R))},R)\). Since \(u(\cdot )\) is strictly increasing on the interval \([{\underline{v}},R]\), then

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Shui, Z. Rejection prices and an auctioneer with non-monotonic utility. Int J Game Theory 52, 925–951 (2023). https://doi.org/10.1007/s00182-023-00845-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-023-00845-4