Abstract

We analyze price leadership in a Stackelberg game with incomplete information and imperfect commitment. Sequential play is induced by an information system, represented by a spy, that reports the price of one firm to its rival before the latter chooses its own price. However, the Stackelberg leader may secretly revise its price with some probability. Therefore, the spy’s message is only an imperfect signal. This gives rise to a complex signaling problem where both sender and receiver of messages have private information and the sender has a chance to take another action with some probability. We find partially separating and pooling equilibria that satisfy equilibrium refinements such as the intuitive criterion and support collusive outcomes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ever since Adam Smith’s famous adage about price fixing economists view collusive pricing as a perennial problem in posted price markets served by a small number of competitors.Footnote 1 On the other hand economists emphasize that secret price changes often limit and undermine its impact, which lead some to believe that price fixing cannot have a lasting effect (see, for example Stigler, 1964).

Although price fixing and secret price changes are intrinsically difficult to observe, several case studies are available. For example, Porter (1983) analyzes price fixing and secret price discounts in the American Rail Freight Cartel that prevailed, interrupted by sporadic price wars, prior to the passage of the Sherman Antitrust Act and Austin (2005) reviews prominent cases of price fixing, ranging from the American Tobacco Cartel to the more recently prosecuted price fixing by the auction houses Christie’s and Sotheby’s.

Price fixing takes different forms. The classical textbook case evaluated by Stigler (1964) and others is that of a cooperative agreement among firms. However, modern antitrust laws make such agreements illegal and thus not legally enforceable which poses a serious risk of policing and internal enforcement.Footnote 2

Another form of price fixing, which is considered in the present paper, occurs if one firm in a posted price oligopoly market acts as price leader and sets its price before competitors respond and set their own price. If goods are imperfect substitutes such price leadership tends to support higher prices because if the leader raises its price other firms follow suit and also set higher prices.

In the literature this kind of price fixing is commonly captured by the Bertrand-Stackelberg model with differentiated products. It raises several issues: Who is leader and follower and why? Who informs the follower of the leader’s choice of action? Absent an informer, the game falls back to a simultaneous moves game.Footnote 3 How strong is the leader’s power to commit, i.e., how likely is it that it can secretly revise the price? Is the equilibrium robust and survives if the spy’s observation is subject to small noise?

In a nutshell, the present paper addresses these issues in the framework of a simple duopoly model as follows: Sequential play is induced by an information system, represented by a spy, that reports the price of one firm to its rival before the latter sets its own price. The spied-at firm is leader and the firm served by the spy is follower. The leader is subject to imperfect commitment and is free to secretly revise its price with some probability. Firms also face incomplete information concerning each other’s unit cost.

Ideally, the leader would like the follower to believe that he never revises his price. However, this is not time-consistent. Because the leader revises its price with some probability, the follower cannot be sure that the price reported by the spy is actually the true price. This ambiguity gives rise to a non-standard signaling game where both sender and receiver of messages have private information, beliefs are multi-dimensional, and the sender of messages has a chance to take another action.

The assumed cost uncertainty assures that the sequential equilibrium is robust and not upset if the spy’s observation is subject to small noise.

This game yields some uncommon results: it admits no fully separating equilibrium and standard solution procedures yield partially separating equilibria that violate the intuitive criterion for some parameters and pooling equilibria that may satisfy it. However, with a slight modification of standard solution procedures we find partially separating equilibria that satisfy ideal continuity properties or are robust and satisfy the intuitive criterion. Similarly we find that pooling equilibria tend to violate the intuitive criterion.

Spying out rival firms’ prices or sales is abundant in competitive environments and takes a variety of forms.

Although spying is intrinsically a secret operation, evidence of spying surfaced on various occasions. For example, in high profile auctions investigators found out that the winner had illegally acquired the application documents of the rival bidder (see the examples reported in Lengwiler and Wolfstetter, 2010) or was allowed to revise his bid by a corrupt agent auctioneer. Andreyanov et al (2017) estimate that decisive bid leakage occurred in at least 10% of a large sample of 4.3 million procurements that took place in Russia between 2011 and 2016 (see also the follow-up study by Ivanov and Nesterov, 2020).

In posted price markets where price setting firms compete with firms that sell substitutes, various companies openly advertise their services to spy out rival companies’ pricing. In online markets companies like “Price2Spy”, “Sniffie”, and “Scraping Intelligence” offer intelligence about competitors’ pricing or inventory.

The spy is often a trusted insider who is driven by financial motives, or takes revenge for unfair treatment, or has been blackmailed into handing over sensitive information. A common scenario is that a gullible staff member is lured into passing over inconsequential information and, after having committed a minor offense, is blackmailed into leaking sensitive information. However, the spy is not necessarily a natural person. He may also be a “malware tool” that exploits vulnerabilities in computer software to transmit information prepared on a PC or submitted online. Modern information technology dramatically extended the possibilities of espionage and lowered its cost.

The techniques used by spies range from low-key activities such as searching through wastebaskets, known as “dumpster diving”, to gaining access to unattended PCs and laptops, planting sophisticated malware that is able to secretly switch on cameras or recording devices of computers and mobile phones (such as the infamous spyware of Israel’s NSO group).

Spying may also trigger counter-spying when the spy has been doubled.

Once the identity of a spy has been exposed, the spy may find himself faced with the agonizing choice between punishment or being “doubled”, and, after being doubled, serves the spied at party and transmits strategically distorted information.

Our analysis relates to various strands of the literature.

In a seminal contribution Bagwell (1995) questions the value of commitment in games of complete information. Essentially, his intervention indicates that a robust Stackelberg structure can only be sustained if the game has an equilibrium in mixed strategies where strategies prescribe a random move or, as in the present paper, the game is one of incomplete information where strategies are type dependent and predicting a player’s strategy does not predict its choice of action.Footnote 4

Price leadership and the role of secret price changes has also been analyzed in Green and Porter (1984) and Rotemberg and Saloner (1986). These contributions and the ensuing literature explore the effect of demand fluctuations on collusive pricing, interrupted by price wars. Unlike the present paper this literature assumes that the leader has no commitment power and their analysis employs supergame models where firms interact infinitely many times.

The present analysis also relates closely to the literature on signaling games and on equilibrium refinements geared to weed out the plethora of equilibria (see the reviews by Kreps and Sobel, 1994; Sobel, 2009). In that regard the present analysis raises new conceptual issues, due to its above mentioned non-standard features.

There is also a small theoretical literature on espionage in market games. While most contributions consider spying out rivals’ type, the present paper assumes spying out rivals’ actions. The two kinds of espionage are fundamentally different. Whereas spying out rivals’ type allows players to sharpen their prediction of rivals’ play, spying out rivals’ action also changes the order of moves.

Spying out rivals’ type is considered in several contributions. Wang (2020) considers a Cournot duopoly where one firm can spy out the rival’s unit cost which results in a noisy observation, Zhang (2015) analyzes spying out rivals’ types in two-player contests where types are represented by valuations for the given prize, and Kozlovskaya (2018) assumes that firms can learn about demand by conducting their own market research and by imperfectly spying out a rival firm’s market research.

Solan and Yariv (2004); Barrachina et al (2014, 2021) analyze the impact of spying on entry deterrence. Whereas in Solan and Yariv (2004) the entrant’s spy gathers noisy information about the incumbent’s decision to either fight or accommodate entry, in Barrachina et al (2014) the potential entrant receives information about the incumbent’s capacity which increases the likelihood of entry and thus has a positive effect on competition and welfare. Similarly, Barrachina et al (2021) consider an entry game in the spirit of Milgrom and Roberts (1982) assuming that the potential entrant has a spy who imperfectly observes the incumbent’s cost. Their main finding is that, depending upon the precision of the spy’s observation, the game admits pooling equilibria in which entry occurs with positive probability, unlike in the entry game without spying.

Altogether, in all these contributions, spying on a rival’s type tends to increase competition and benefit consumers which is in contrast to the present study of spying on rival’s actions, where spying tends to support tacit collusion that adversely affects consumers.

One limitation of the present analysis is that the role of the spy is given and the spy is not modeled as a player who pursues his own agenda. However, one could also view the spy as an unspecified party that imperfectly informs the Stackelberg follower about the leader’s choice of action.

The plan of the paper is as follows: Sect. 2 states the model and Sect. 3 briefly reviews two benchmark games: the game when the spy’s message is perfectly informative and the game when it is perfectly uninformative. Section 4 prepares the solution of the game with imperfect commitment. Sections 5–6 find two partially separating equilibria: one that satisfies a desirable continuity requirement but not always the intuitive criterion and one that satisfies the intuitive criterion but violates the continuity requirement. Section 7 considers pooling equilibria and shows that they tend to violate the intuitive criterion. In Sect. 8 we assess the extent to which spying induces price leadership and show that spying is a stable relationship that supports collusive outcomes. In Sect. 9 we close with a discussion. All proofs omitted from the main text are spelled out in the Appendix and in one case in a downloadable supplementary file.

2 Model

Consider a duopoly with firms 1 and 2 that engage in price competition with differentiated goods where prices, \(p_1, p_2\), are strategic complements. Each firm knows its own unit cost but not that of the other. Firm 2 has access to an information system, represented by a spy, who observes the unit price chosen by firm 1 and reports it to firm 2 before the latter sets its own price. This induces a Stackelberg game (where 1 is mnemonic for first- and 2 for second-mover).

However, firm 1 is able to secretly revise its price with some commonly known probability and, in that event, sets two prices, the price observed by the spy and the secretly revised price.Footnote 5

The presence of the spy is common knowledge but firm 2 does not know whether the price reported by the spy is the true price or just a decoy. Therefore the spy’s message is subject to ambiguity.

To keep the analysis tractable, we assume a binary model with unit costs \(X_i \in \left\{ 0, x_h\right\}\), \(x_h >0\), that are i.i.d. random variables, symmetric linear demand functions: \(Q_i(p_i,p_j):= 1- p_i+s p_j\), where products are imperfect substitutes, i.e., \(s \in (0,1)\). Firms are risk neutral and their payoff functions, defined on prices and the own unit cost, are: \(\pi _i(p_i,p_j,x_i):=(p_i-x_i) Q_i(p_i,p_j)\), \(i,j \in \left\{ 1,2\right\} , i \ne j\). Because prices are strategic complements reaction functions are increasing.

We refer to the firm 1 that is committed to stick to its quoted price and cannot revise it as type c (mnemonic for “committed”) and the firm 1 that can secretly revise its price as type n (mnemonic for “not committed”), and to firms with high cost, \(x_h\), as type h and with low cost, 0, as type \(\ell\) (mnemonic for “high” and “low”). Therefore, the type set of firm 1 is \(T_1=\left\{ { c\ell }, { ch},{ n\ell }, { nh}\right\}\) and that of firm 2 is \(T_2=\{\ell , h\}\).

The time-line of the model is as follows:

-

1.

Nature independently draws firms’ types, \((t_1, t_2) \in T_1 \times T_2\), and each firm privately observes its own type.

-

2.

Firm 1 sets its unit price, \(p_1\), which the spy reports to firm 2. That price is the true price if firm 1 is type c and a decoy if it is type n.

-

3.

Firm 2 sets its price \(p_2\) and firm 1 type n secretly revises its price and sets its true price, \(q_1\).

-

4.

Transactions take place at true prices, i.e., at \((p_1, p_2)\) if firm 1 is type c and \((q_1, p_2)\) if firm 1 is type n, and payoffs are realized.

It does not matter when firm 1 type n literally revises its price; what matters is that firm 2 and firm 1 type n choose their true prices “simultaneously”, i.e., without knowing each other’s play.

The prior probability that firm 1 is type n is \(\eta _0\). The prior probability of drawing the high cost, \(x_h\), is \(\mu _0 \in \left( 0,1\right)\); hence, \(\bar{x}:=E[X_1]=E[X_2]=\mu _0 x_h\). As a rule, random variables are denoted by capital and realizations by lowercase letters.

No firm is ever crowded out of the market which assumes that even the weakest firm with high unit cost must earn a nonnegative profit. This requiresFootnote 6:

3 Benchmark games

Here we briefly review two special cases that serve as benchmarks: the case when the spy’s message is completely uninformative (\(\eta _0=1\)), because firm 1 can revise its price with probability one, which is equivalent to the standard Bertrand game without spying (B), and the case when the spy’s message is perfectly informative (\(\eta _0=0\)), because firm 1 cannot revise its price, which is equivalent to the standard Stackelberg game (S).

Because the analysis of these two cases is relatively straightforward and covered in detail in an example in Fan, Jun, and Wolfstetter ((2022a), Sect. 4) we simply summarize the results without proof.

The Bayesian equilibrium strategies of the Bertrand game are:

Similarly, the perfect Bayesian equilibrium strategies of the Stackelberg game are:

Note that the Stackelberg leader price of the low cost firm 1, \(p_1^S(0)\), can, somewhat surprisingly, be smaller than the expected value of the Bertrand equilibrium price, \(p^*\):

Because “no-crowding-out” requires that \(x_h \le \check{x}\) and because \(\check{x}>\hat{x} \iff \mu _0 >\nicefrac {s^2}{(4-s^2)}\), it follows that \(p_1 ^{S}(0)<p^*\) can only occur if \(\mu _0> \nicefrac {s^2}{(4-s^2)}\).

Altogether, comparing game B, where spying plays no role, with game S, where spying is most effective, perfectly informative spying, \(\eta _0=0\), affects firms’ profits, consumer surplus, and welfare as follows:

Proposition 1

Perfectly informative spying benefits the spying firm 2, regardless of its cost, and reduces expected consumer surplus and welfare. The spied at firm 1 also benefits if its cost is high but is worse-off if its cost is low and the probability of meeting a high cost rival is sufficiently high.

The fact that the low cost firm 1 can be made worse-off by being spied at is in sharp contrast to the standard Bertrand-Stackelberg game under complete information where both leader and follower are better off than in the Bertrand game.Footnote 7

4 The game with imperfect commitment: Preliminaries

Now we take into account that firm 1 is subject to imperfect commitment and able to secretly revise its price with some probability and thus firm 2 is unsure whether the price reported by the spy is the true price. Naturally, firm 1 type n hides its type and mimics firm 1 type c with some probability so that the price reported by the spy is only an imperfect signal.

After observing the price reported by the spy, firm 2 updates its beliefs and chooses its own price, based on its prediction of the probability distribution of the true price of firm 1, and firm 1 type n chooses its true price, \(q_1\).

The posterior beliefs concerning the type of firm 1 and the cost of firm 1 are denoted by \((\eta (p_1), \mu (p_1))\), and if there is no risk of confusion simply by \((\eta ,\mu )\). If firm 1 is type c, its reported price is also its true price.

We consider pure strategy perfect Bayesian Nash equilibria: \(\left( p_1^c(x_1), p_1^n(x_1), q_1(p_1,x_1), p_2(p_1,x_2)\right)\), where, in the spirit of subgame perfection, for each given \(p_1\), the strategies \(\left( q_1(p_1,x_1), p_2(p_1,x_2)\right)\) must be a Bayesian Nash equilibrium, conditional on updated beliefs.

In principle there are three kinds of pure strategy equilibria: 1) fully revealing equilibria, where \(\left\{ p_1^c(0), p_1^c(x_h)\right\} \cap \left\{ p_1^n(0), p_1^n(x_h)\right\} = \emptyset\), 2) pooling equilibria, where \(p_1^c(0)=p_1^c(x_h)=p_1^n(0)=p_1^n(x_h)\), and 3) partially separating equilibria, where \(p_1^c(x_1) = p_1^n(x_1')\) for some but not all \((x_1,x_1') \in \left\{ 0, x_h\right\} \times \left\{ 0, x_h\right\}\).

In a fully revealing equilibrium beliefs are updated to \(\eta =0\) if \(p_1 \in \left\{ p_1^c(0), p_1^c(x_h)\right\}\) and to \(\eta =1\) if \(p_1 \in \left\{ p_1^n(0),p_1^n(x_h)\right\}\), which yields the payoffs of the corresponding benchmark games S and B.Footnote 8 If such an equilibrium would exist, firm 1 type \({ nh}\) would benefit from mimicking type \({ ch}\) and deviate to \(p_1=p_1^c(x_h)\) in lieu of \(p_1=p_1^n(x_h)\), by Proposition 1. Therefore, the game admits no fully revealing equilibrium. However, it has partially separating and pooling equilibria.

We now prepare the analysis by solving the subgames that are played after the spy has reported the price and by stating a basic property of partially separating equilibria, followed by a roadmap of our analysis.

4.1 Solution of the “subgames” played after the spy has reported the price

In a first step we solve the subgames that are played after the spy has reported \(p_1\) and beliefs have been updated from \(\left( \eta _0,\mu _0\right)\) to \(\left( \eta ,\mu \right)\). There, firm 2 sets its price in response to the spy’s message, and firm 1 type n secretly sets its price, \(q_1\). Firm 1 type c is not involved because its reported price is already its true price.

The Bayesian Nash equilibrium strategies of those subgames, \(\left( q_1(p_1,x_1), p_2(p_1,x_2)\right)\), must solve the following requirements, where expectations are based on updated beliefs:

and one finds:

Lemma 1

The equilibrium strategies \(\left( q_1(p_1,x_1), p_2(p_1,x_2)\right)\) areFootnote 9:

If \(\eta =1\) firm 1 can always revise its price, hence \(p_1\) is uninformative, and (7)–(8) yield the Bertrand equilibrium (2).Footnote 10

If \(\eta =0\) firm 1 cannot revise its price, hence (7) does not apply, and setting \(p_1=p_1^S(x_1)\) yields the Stackelberg equilibrium (3).

Based on these results we introduce the expected best reply functions of firm 2. From the perspective of firm 1, these functions summarize how firm 2 responds in expectation to \(p_1\):

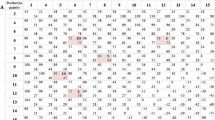

These functions are illustrated in Fig. 1.Footnote 11 They have a number of easily confirmed properties that are essential for our analysis:

(1) They are increasing in \(p_1\) for all \(\eta <1\) and continuously approach the expected best reply functions of the Stackelberg follower as \(\eta\) approaches zero; (2) they are independent of \(p_1\) (i.e., flat shaped) as \(\eta\) approaches one; (3) R has a fixed-point equal to the expected value of the Bertrand equilibrium price, \(p^*\), i.e., \(R(p^*, \eta )=p^*\), and hence R continuously approaches \(p^*\) as \(\eta\) approaches one; (4) as one varies \(\eta\) the \(\tilde{R}\) functions rotate around the common intersection point at \(\tilde{p}^*(\mu )\):

(5) \(\nicefrac {\partial R}{\partial \eta } \lesseqqgtr 0 \iff p_1 \gtreqqless p^*\).

Because the profit function \(\pi _1\) is linear in \(p_2\), we can simplify and write the expected profit of firm 1 type c as \(\pi _1\left( p_1,\tilde{R}(p_1, \eta , \mu ),x_1\right)\) and that of firm 1 type n as \(\pi _1\left( q_1(p_1,x_1),\tilde{R}(p_1,\eta ,\mu ),x_1\right)\).

4.2 A basic property of partially separating equilibria

A “natural” partially separating equilibrium is one where firm 1 type n always mimics firm 1 type \({ ch}\). Indeed:

Proposition 2

In a partially separating equilibrium firm 1 type n mimics firm 1 type \({ ch}\) and sets the price \(p_1^n=p_1^c(x_h)>p_1^c(0)\) regardless of its own cost; hence, the type of firm 1 is revealed only if firm 1 is type \({ c\ell }\).

The proof is in the Appendix.

We use these necessary conditions to construct partially separating equilibria.

4.3 Roadmap of the analysis

Ideally, an equilibrium should satisfy two requirements: (1) Continuity: It should continuously approach the solution of the Stackelberg game as \(\eta _0\) goes to zero, because it does not appear reasonable that the outcome in a game with a one in a million chance of facing firm 1 type n differs significantly from that in a game in which firm 1 is type c with probability 1. Similarly, it should continuously approach the solution of the Bertrand game as \(\eta _0\) goes to one. (2) Robustness: It should be robust with respect to reasonable variations of off-equilibrium beliefs and pass standard equilibrium refinements such as the well-known intuitive criterion.

We construct several equilibria that satisfy one of these ideal properties and for some parameter profiles both.

In Sect. 5 we find a partially separating equilibrium that satisfies the continuity requirement. We adapt the well-known intuitive criterion, IC, to the present framework and show that this equilibrium does not satisfy IC for all parameter values.

In Sect. 6.1 we introduce an auxiliary variation of the intuitive criterion, called IC-S, which is stronger than IC, and find partially separating equilibria that always satisfy IC-S and thus IC.

In Sect. 7 we consider pooling equilibria and show that pooling equilibria violate IC-S, yet satisfy IC for some parameter range and violate it for other parameter values.

5 A partially separating equilibrium that satisfies the continuity requirement

The following construction adapts the “two-step procedure” introduced by Cho and Sobel (1990) and Sobel (2009).

In a standard signaling game this procedure finds the unique strategically stable equilibrium. In the present context it finds a partially separating equilibrium for all possible parameter configurations.

Consider the belief system where \(\eta _1\) is the result of Bayesian updating conditional on the equilibrium strategies stated in Proposition 2Footnote 12:

If \(p_1=p_1^c(0)\), firm 1 is believed to be type \({ c\ell }\) and, in turn, firm 1 predicts that the expected response of firm 2 is equal to \(R(p_1^c(0), 0)\); whereas if \(p_1=p_1^c(x_h)\), firm 2 updates its belief to \(\eta _1\), and, in turn, firm 1 predicts that the expected response of firm 2 is equal to \(R(p_1^c(x_h), \eta _1)\).

Two-step procedure

- Step 1::

-

Set \(p_1^c(x_h) \in \arg \max _{p} \pi _1\left( p,R(p,\eta _1),x_h \right) .\)Footnote 13

- Step 2::

-

Set \(p_1^c(0) \in \arg \max _{p} \pi _1(p, R(p,0),0)\), subject to the constraints:

$$\begin{aligned} \pi _1(p,R(p,0),x_h)&\le \pi _1(p_1^c(x_h),R(p_1^c(x_h),\eta _1),x_h ) \end{aligned}$$(14)$$\begin{aligned} R(p,0)&\le R(p_1^c(x_h),\eta _1). \end{aligned}$$(15)Constraint (14) assures that firm 1 type \({ ch}\) cannot benefit by switching from \(p_1^c(x_h)\) to \(p_1^c(0)\); constraint (15) assures that firm 1 type n cannot benefit by switching from \(p_1^n=p_1^c(x_h)\) to \(p_1^n=p_1^c(0)\).

Solving Step 1 yieldsFootnote 14:

To solve Step 2, implicitly define \(p_A\) as the price p that satisfies constraint (14) with equality and \(p_B\) as the price that satisfies constraint (15) with equality:

If neither constraint binds, one has \(p_1^c(0)= p_1^S(0)\); therefore,

Proposition 3

(Equilibrium I)

The strategies \((p_1^c(0),p_1^c(x_h))\), together with \(p_1^n=p_1^c(x_h)\), the assumed belief systems, and the equilibrium strategies of the duopoly subgames, \(\left( q_1(p_1,x_1), p_2(p_1,x_2)\right)\), are a partially separating equilibrium. That equilibrium continuously approaches the solution of the Stackelberg game as \(\eta _0\) goes to zero and that of the Bertrand game as \(\eta _0\) goes to one.

The proof is easily explained with the help of Figs. 2a–d that cover all possible patterns of equilibrium prices.Footnote 15 There, \(I_1(x_h)\), \(I_1(0)\) denote the indifference curves of firms 1 type \({ ch}\) and \({ c\ell }\) and the lines with solid and dashed segments are the expected best replies of firm 2, \(R(p_1,\eta _1)\), \(R(p_1,0)\), and \(R(p_1,1) = p^*\). The solid segments of these lines display how the reported price induces the beliefs of firm 2 and thus its expected best replies.

Constraint (14) restricts firm 1 type \({ c\ell }\) to choose a point on the graph of \(R(p_1,0)\), up to the point where it intersects the indifference curve \(I_1(x_h)\). Constraint (15) restricts firm 1 type \({ c\ell }\) to choose a point on the graph of the \(R(p_1,0)\) line with \(p_1^c(0) \le R(p_1^c(x_h),\eta _1)\).

The assumed belief system is obviously consistent with equilibrium strategies and Bayes’s rule.

As a first case suppose \(x_h>\hat{x}\) which is equivalent to \(p_1^S(0)< p^*\) (see (4)), which is illustrated in Fig. 2a. In this case, constraints (14)–(15) cannot bind, and the equilibrium is the straightforward interior solution with \(p_1^c(0)=p_1^S(0)\). Based on the assumed belief system, as one moves \(p_1\) from 0 to \(p^*\), the expected best response of firm 2 moves along the graph of the \(R(p_1,0)\) function. As \(p_1\) is further increased up to \(p_1^c(x_h)\), that expected best response moves along the \(R(p_1,\eta _1)\) function, and as \(p_1\) is even further increased it jumps down to the \(R(p_1,1) = p^*\) function. Because firm 1 type n cares only about the expected best response of firm 2, this indicates clearly that it never pays for firm 1 type n to deviate from the asserted equilibrium and set a price \(p_1 \ne p_1^c(x_h)\). Given the stated belief system and the strategies of firm 1 type n, it is obvious that firms 1 type \({ c\ell }\) and \({ ch}\) have no incentive to deviate either.

Next, suppose \(x_h< \hat{x}\) which is equivalent to \(p_1^S(0)>p^*\). In this case the equilibrium is either an interior solution or a corner solution in which constraint (14) or constraint (15) binds.

Figure 2b displays the case when neither constraint binds, Fig. 2c the case when constraint (14) binds, and Fig. 2d the case when constraint (15) binds.

Based on the assumed belief system, in the cases displayed in Fig. 2b–d, as one increases \(p_1\) from 0 to \(p_1^c(0)\), the expected best response of firm 2 moves along the \(R(p_1,0)\) function. As \(p_1\) is further increased up to \(p_1^c(x_h)\), that expected best response jumps down to the \(R(p_1,\eta _1)\) function, and as \(p_1\) is even further increased it jumps down again to the \(R(p_1,1) = p^*\) function. This shows clearly that it never pays for firm 1 type n to deviate from the asserted equilibrium and set \(p_1 \ne p_1^c(x_h)\) (optimality for type \({ c\ell }\) and \({ ch}\) is obviously satisfied by construction).

In all cases, the equilibrium prices of firm 1 are increasing in \(\mu _0\) and decreasing in \(\eta\). More importantly, the equilibrium prices \(p_1^c(x_1)\) continuously approach the Stackelberg leader prices, \(p_1^S(x_1)\), as \(\eta _0\) goes to zero (because when \(\eta _0\) is sufficiently close to zero, both \(p_A\) and \(p_B\) are close to \(p_1^S(x_h)>p_1^S(0)\) and therefore \(p_1^c(0)\) is equal to \(p_1^S(0)\), the interior solution).

Altogether, the appealing feature of Equilibrium I is that it satisfies the continuity requirement. However, it does not always satisfy the well-known intuitive criterion introduced by Cho and Kreps (1987, p. 202).

5.1 Intuitive criterion (IC)

Adapted to the present context, the idea of that equilibrium refinement is that an out-of-equilibrium price should be viewed as a signal that firm 1 is type c if firm 1 type n cannot be better off no matter what belief, \((\eta ,\mu )\), firm 2 holds and no matter how it adjusts its price, whereas firm 1 type \({ c\ell }\) or \({ ch}\) will be better off if firm 2 believes that it is type c.

While the above equilibrium assumed a belief system where \(\eta\) responds to \(p_1\) whereas \(\mu\) remains the prior level, \(\mu = \mu _0\), unless \(p_1=p_1^c(0)\), applying the intuitive criterion requires that one allows for all possible beliefs and employs the best reply function \(\tilde{R}(p_1,\eta , \mu )\) in lieu of \(R(p_1, \eta )\).

According to the following formal statement, an equilibrium violates the intuitive criterion if there exists an out-of-equilibrium price, \(p_1'\), with the following properties:

1) setting \(p_1'\) would make firms 1 type \({ nh}\) and type \({ n\ell }\) worse-off, even if observing that price would induce firm 2 to update to beliefs that are most favorable for firm 1; whereas 2) firm 1 type \({ c\ell }\) or \({ ch}\) is made better-off by setting \(p_1'\) if observing that price triggers firm 2 to update to beliefs that are least favorable for firm 1.

Intuitive Criterion (IC)

For any out-of-equilibrium price, \(p_1'\), we say that the equilibrium violates the intuitive criterion if the following conditions are satisfiedFootnote 16:

where

denote the equilibrium expected payoffs of firm 1.

5.2 Why this equilibrium does not always satisfy IC

Equilibrium I satisfies the intuitive criterion for some parameter profiles, yet violates it for others.

Consider the example displayed in Fig. 2c, where the equilibrium is a boundary solution. Using this example, in Fig. 3a we add the collection of expected best replies of firm 2 that apply if one allows for all possible beliefs and accordingly employs the \(\tilde{R}(p_1,\eta ,\mu )\) function in lieu of \(R(p_1,\eta )\). This entire collection is represented by the shaded area in between the solid lines defined by \(\min \left\{ R(p_1,0),\tilde{R}(p_1,1,0)\right\}\) and \(\max \left\{ R(p_1,0),\tilde{R}(p_1,1,1)\right\}\); each point in this area is on the graph of one such \(\tilde{R}(p,\eta ,\mu )\) function.

Now consider an off-equilibrium price \(p_1' \in (p_1^c(0), p_B)\) and recall that firm 1 type n cares only about the induced expected best response (its indifference curves are horizontal lines, and its indifference curve that passes through the equilibrium point \((p_1^c(x_h),R(p_1^c(x_h),\eta _1))\) is denoted by the \(I^n\) line). If firm 2 observes \(p_1'\), it can be sure that this message cannot come from type n, because for all possible beliefs \((\eta ,\mu )\) and cost levels, firm 1 type n can only trigger a lower expected best response than \(R(p_1^c(x_h),\eta _1)\) and hence be worse-off. However, firm 1 type c is better off if it is recognized as type c, regardless of beliefs about its cost. Therefore, the equilibrium violates the intuitive criterion IC.

As a general property of all partially separating equilibria in which firm 1 type n mimics firm 1 type \({ ch}\) (not just the one constructed with the two-step procedure) one can show that:

Proposition 4

Every partially separating equilibrium with prices \((p_1^c(0),p_1^c(x_h))\) and \(p_1^n=p_1^c(x_h)\) satisfies the intuitive criterion IC if and only if:

where \(\tilde{p}^*\) is defined in (11) and \(p_A, p_B\) are defined in (17).

The proof is in the Appendix.

In the case of Equilibrium I one can simplify this condition to:

Corollary 1

Equilibrium I satisfies the intuitive criterion if and only if condition (21) holds.

The proof is in the Appendix.

Using this result, Fig. 3b illustrates the scope of violations of IC, assuming \((s,\mu _0)=(\nicefrac {4}{5}, \nicefrac {2}{5})\). In that case, the equilibrium violates condition (21) and hence IC for all parameters \((\eta _0, x_h)\) in the shaded area of Fig. 3b.

Evidently, Equilibrium I satisfies the intuitive criterion for a large range of parameters \((\eta _0,x_h)\); however, violation occurs for a significant range of parameters.

6 A partially separating equilibrium that always satisfies the intuitive criterion

We now construct a partially separating equilibrium that satisfies the intuitive criterion IC for all parameter configurations.

6.1 An auxiliary equilibrium refinement (IC-S)

To prepare the construction, we introduce an auxiliary equilibrium refinement to which we refer as IC-S. We show that IC-S implies IC and construct a partially separating equilibrium that satisfies IC-S and thus IC for all parameter configurations.

We emphasize that IC-S is an auxiliary construct; it only serves the purpose to facilitate the proof that the constructed equilibrium satisfies IC.

Intuitive Criterion IC-S For any out-of-equilibrium price, \(p_1'\), we say that the equilibrium violates IC-S if the following conditions are satisfied:

Evidently, IC-S differs from IC by restricting the beliefs about the cost of firm 1 to \(\mu (p_1)=\mu _0, \forall p_1 \ne p_1^c(0)\) in lieu of the most favorable \(\mu\) for firm 1 type n and the least favorable \(\mu\) for firm 1 type \({ ch}\) or \({ c\ell }\). Accordingly, it employs the \(R(p_1,\eta )\) function in lieu of \(\tilde{R}(p_1,\eta ,\mu )\) for all \(p_1 \ne p_1^c(0)\).

IC-S is a stronger requirement than IC:

Lemma 2

If an equilibrium satisfies IC-S it also satisfies IC.

Proof

We prove the equivalent statement: If an equilibrium violates IC, then it also violates IC-S.

For this purpose consider an equilibrium that violates IC, i.e., (19)–(20) apply. Because:

it follows that (23)–(24) apply as well.

\(\square\)

Again, we find a necessary and sufficient condition that applies to all partially separating equilibria in which firm 1 type n mimics firm 1 type \({ ch}\) :

Lemma 3

Every partially separating equilibrium with prices \((p_1^c(0),p_1^c(x_h))\) and \(p_1^n=p_1^c(x_h)\) satisfies IC-S if and only if:

The proof is in the Appendix.

6.2 Construction of equilibrium

To further prepare the construction, consider the pair of prices, \(\left( \underline{p}, \bar{p}\right)\), that makes both firm 1 type \({ ch}\) and type n indifferent between the price \(\bar{p}\) combined with the belief \((\eta _1, \mu )\) and the price \(\underline{p}\) combined with the belief \((\eta ,\mu )=(0,\mu )\), where \(\mu\) satisfies (13):

These prices have the unique solution:

Evidently, \(\bar{p}>\underline{p}\); moreover, \(\bar{p}\) is increasing and \(\underline{p}\) decreasing in \(\eta _1\), and as \(\eta _0\) (and thus \(\eta _1\)) approaches zero, these prices coincide at the level \(p_C=\nicefrac {(1+x_h+s(1+\bar{x})}{(4-s^2)}\), illustrated in Fig. 4b. Obviously, at \(p_1=p_C\) the marginal rate of substitution (slope of the indifference curve) of firm 1 type \({ ch}\) is equal to zero.

Using these prices we can restate the condition for IC-S stated in Lemma 3 as follows:

Lemma 4

Every partially separating equilibrium with prices \((p_1^c(0),p_1^c(x_h))\) and \(p_1^n=p_1^c(x_h)\) satisfies the intuitive criterion IC-S if and only if:

The proof is in the Appendix.

This suggests the following construction of an equilibrium that satisfies IC-S and thus also IC. In order to distinguish that equilibrium from Equilibrium I we denote its equilibrium prices by \(\hat{p}_1^c(x_1)\).

Alternative two-step procedure

- Step 1::

-

Set \(\hat{p}_1^c(x_h) \in \arg \max _{p} \pi _1(p,R(p,\eta _1),x_h) \,\, \text {s.t.} \,\, p \le \bar{p}\).

- Step 2::

-

Set \(\hat{p}_1^c(0)\) equal to the most profitable price given \(\eta =0\), subject to the constraints that firm 1 type n does not benefit from setting that price rather than \(\hat{p}^c_1(x_h)\):

$$\begin{aligned} \hat{p}_1^c(0) \in \arg \max _{p} \pi _1(p, \,&R(p,0),0) \,\, \text {s.t.} \,\,\, R(p,0) \le R(\hat{p}_1^c(x_h),\eta _1). \end{aligned}$$(31)

Proposition 5

(Equilibrium II)

The strategies \(\hat{p}_1^c(x_1), p_1^n=\hat{p}_1^c(x_h)\), together with the belief system (13), (12) (and the equilibrium strategies of the duopoly subgames) are a partially separating equilibrium. That equilibrium satisfies the intuitive criterion IC-S and thus IC, yet exhibits a discontinuity at \(\eta _0=0\).

The proof is easily explained with the help of Fig. 4.

The assumed belief system is consistent with equilibrium strategies and Bayes’s rule. The solution is either a boundary solution, illustrated in Fig. 4a, or an interior solution, illustrated in Fig. 4b (there \(I^n\) is an indifference curve of firm 1 type n).

Again, the solid parts of the expected reaction functions summarize how the reported price impacts the beliefs of firm 2 and thus its expected price. As \(p_1\) moves from 0 to \(\hat{p}_1^c(0)\), the expected best response of firm 2 moves along the \(R(p_1,0)\) function. As \(p_1\) is further increased that expected best response moves along the \(R(p_1,\eta _1)\) function until it reaches \(\hat{p}_1^c(x_h)\), and as \(p_1\) is further increased, the expected best reply jumps down to \(R(p_1,1) = p^*, \forall p_1\) (which can only be displayed in Fig. 4b because \(p^*\) is outside the displayed range of Fig. 4a).

This shows clearly that for firm 1 type n it never pays to deviate from the asserted equilibrium and set a price \(p_1 \ne \hat{p}_1^c(x_h)\). Optimality for type \({ c\ell }\) and \({ ch}\) is obviously satisfied and the necessary and sufficient conditions stated in Lemma 4 imply that this equilibrium satisfies IC-S and thus IC.

Because this equilibrium exhibits a discontinuity at \(\eta =0\), it violates the continuity requirement.

This discontinuity at \(\eta _0=0\) occurs for the following reasons, illustrated for the case of the interior solution in Fig. 4b: As \(\eta _0\) (and thus \(\eta _1\)) is reduced, \(\underline{p}\) increases and \(\bar{p}\) decreases until these two prices coincide as \(\eta _0\) approaches zero at \(p_C:=\lim _{\eta _0 \rightarrow 0} \hat{p}_1^c(x_h)\), where the indifference curve of firm 1 type \({ ch}\) has a minimum and its graph intersects the best response line \(R(p_1,0)\). Therefore, the Stackelberg leader price, \(p_1^S(x_h)\), that maximizes the payoff of firm 1 type \({ ch}\) on \(R(p_1,0)\), exceeds \(p_C\).

The intuitive criteria are important robustness tests. However, the discontinuity of Equilibrium II is disturbing. Therefore, the partially separating equilibrium that survives the intuitive criteria does not appear to be plausible if \(\eta _0\) is small.

Conversely, the partially separating Equilibrium I that fails the intuitive criterion for some range of parameters, converges to the Stackelberg equilibrium as \(\eta _0\) goes to zero, and to the Bertrand equilibrium as \(\eta _0\) goes to one.

This suggests that both Equilibria I and II have merit and one should perhaps select the equilibrium that satisfies the intuitive criterion if the prior probability \(\eta _0\) is sufficiently large and instead select the equilibrium that satisfies the continuity requirement if \(\eta _0\) is close to zero.

7 Pooling equilibria

The game also admits pooling equilibria where all types of firm 1 choose the same price. One can even find pooling equilibria that satisfy the intuitive criterion for some parameter values. An example is displayed in Fig. 5a.Footnote 17 There, the particular pooling equilibrium price, \(p_1^e=p_K\), is supported by the simple belief system \(\mu (p_1)= \mu _0, \forall p_1\), combined with \(\eta (p_1^e)=\eta _0\) and \(\eta (p_1)=1, \forall p_1 \ne p_1^e\). In fact, all prices between \(p_J\) and \(p_K\) are such pooling equilibria. They all satisfy the intuitive criterion IC because \((p_1,R(p_1,\eta _0))\) lies above the indifference curves \(I_1(0)\) and \(\hat{I}_1(x_h)\) and below the \(\tilde{R}(p_1,1,1)\) line.

Assuming \((s,\mu _0)=(\nicefrac {4}{5}, \nicefrac {1}{5})\), the shaded area in Fig. 5b displays all parameters \((\eta _0, x_h)\) for which there exist pooling equilibria that satisfy the intuitive criterion IC.

Interestingly, these results differ from standard signaling games, where the two-stage procedure typically selects an equilibrium that satisfies the intuitive criterion and pooling equilibria typically fail it.

However,

Proposition 6

All pooling equilibria violate the intuitive criterion IC-S.

The proof is in the Appendix.

In a sense, this restores the usual property that (partially) separating equilibria like Equilibrium II satisfy the intuitive criterion while all pooling equilibria violate it and suggests to exclude pooling equilibria.

8 Overall economic impact of spying under imperfect commitment

We conclude with an assessment of the overall impact of spying under imperfect commitment.

One may expect that imperfect commitment and the resulting ambiguity of the spy’s message essentially preserves but weakens the price leadership induced by spying in the standard Stackelberg setting. This conjecture confirms if one selects the partially separating equilibria obtained by the two-step procedures:

Proposition 7

Consider the partially separating equilibria I-II. The price leadership induced by the presence of the spy is weakened but does not vanish because:

The proof is in the Appendix.

The more important question is: Who benefits from spying and the ambiguity about the spy’s message and how do these benefits shape the relationship between spying and spied at firms?

The unambiguous answer is: Whereas spying under perfect commitment generally does not benefit both the spying and the spied at firms (see Proposition 1), the ability of the spied-at firm to secretly revise its price with some probability and the resulting ambiguity of the spy’s message give rise to a symbiotic relationship.

Proposition 8

The spying and the spied-at firm type n mutually benefit from spying, regardless of their unit cost. The same applies to firm 1 type \({ ch}\); however, firm 1 type \({ c\ell }\) may be adversely affected by spying for some parameter range.

The detailed proof is available in a downloadable supplement to the present paper Fan et al (2022b) which can also be obtained upon request from the authors.

The fact that firm 1 type \({ c\ell }\) may be adversely affected by spying suggests the question: Could that firm benefit from taking counter-measures and bypass the spy, for example by delaying its pricing decision or by firing the spy if his identity is known?

The answer is no. If firm 2 observes that a bypass occurred it infers that firm 1 must be type \({ c\ell }\), just like if no bypass occurred and the spy observed \(p_1=p_1^c(0)\). The only difference is that firm 1 type \({ c\ell }\) thus loses the benefit of being first-mover (while beliefs about firms’ types are unaffected). However, giving up the role as first-mover is not advantageous already because the first-mover could always set the same price it would set if it bypassed the spy (and generally do even better).

9 Discussion

The results of the present paper indicate that spying with the chance of secret price changes due to imperfect commitment induces collusive outcomes. This suggests that antitrust authorities should keep an eye on spying activities and perhaps probe them as potential antitrust violations.

The significance of this antitrust issue is underscored if one embeds the analysis in a repeated game context. Considering an infinitely repeated Bertrand game, Mouraviev and Rey (2011) show that once price leadership has been achieved, simple trigger strategies supports collusive pricing, essentially for all levels of the discount rate, whereas simultaneous pricing supports collusion only when the discount rate is sufficiently low.

Our analysis assumes that firms compete in a Bertrand market game where goods are imperfect substitutes. If goods are complements, both firms prefer the Bertrand game (see Amir, Grilo, and Jin, 2009) and therefore neither the spying nor the spied-at firm benefits from spying.

If Bertrand is replaced by Cournot competition it is well-known that, under complete information, the first-mover is better off than the second-mover who in turn is worse off than in the corresponding simultaneous moves game (see, for example,Gal-Or, 1985; Dowrick, 1986; Amir and Grilo, 1999). In that case it is only the spied at firm that benefits from the presence of a spy. However, in the presence of incomplete information, spying has the benefit of removing uncertainty about the rival’s cost. It remains to be seen whether this information benefit may outweigh the strategic disadvantage. Future work may also consider the case when goods are complements.

In our analysis the firm that engages a spy is given exogenously. This is appropriate insofar as an opportunity to use the service of a spy comes up more or less at random. However, in the framework of an asymmetric model one may think that one can also explain endogenously which firm is likely to be more proactive procuring the service of a spy. In a Cournot market game one can indeed show that the firm that has a significant cost advantage or whose cost is drawn from a more favorable distribution prefers to be the first-mover whereas the other firm prefers to be second-mover.Footnote 18 This suggests that in a Cournot market game the firm with the higher cost is more eager to procure the services of a spy while the firm with the cost advantage is content to be spied at. However, this does not also apply to Bertrand market games when goods are (imperfect) complements, where, as Albæk (1990) pointed out, firms always prefer to be second-movers, even if costs are drawn from different distributions.

Notes

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” Smith (1776 p. 117).

Until the 1930s collusion was actually legal in many countries. In the U.S. this changed with the passing of the Sherman Antitrust Act as early as 1890, whereas in Switzerland cartels remained legal as recently as 1959.

In principle, it could also be firm 1 itself that informs firms 2 about its scheduled price. However, there is a chance that it changes the price. This is all that matters. Also note that firms prefer to be second movers. Therefore, it is not likely that the firm itself will announce its price.

Maggi (1999) was the first who emphasized that incomplete information is essential for a robust value of commitment.

As an alternative interpretation, one could assume that the spy has been doubled and instructed to report strategically distorted information. However, this calls for an explicit analysis of the relationship between the spy, the firm he pretends to serve, and the firm he serves.

The Stackelberg equilibrium prices are obviously higher than the corresponding Bertrand equilibrium prices, and the equilibrium prices of the game with imperfect commitment are generally in between. Therefore, we require that, conditional on \(X_i=x_h\), the Bertrand equilibrium price is greater than or equal to \(x_h\), which yields the stated condition.

If one assumes general demand functions and continuously distributed, possibly correlated, unit costs, even the Stackelberg leader may be worse off (see Fan, Jun, and Wolfstette, (2022a)).

Note: It is clear that in a fully revealing equilibrium we would always have \(p_1^n(0)=p_1^n(x_h)\).

With \(\gamma _0: = 4+s(2+x_h(2 \mu _0 +s \eta \mu ))\), \(\gamma _1:= 2 s^2(1- \eta )\), \(\delta _0:=4+s\eta (2+x_h(2 \mu +\mu _0 s))\), \(\delta _1:= 4\,s(1- \eta )\).

Because in this case \(p_1\) is uninformative, prior beliefs are not updated and hence \(\mu =\mu _0\).

The plots are based on the the parameter values: \((s,\mu _0,\eta ,\mu ,x_h)=(\nicefrac {4}{5},\nicefrac {1}{5}, \nicefrac {2}{5},\nicefrac {4}{5}, \nicefrac {13}{10})\).

\(\mu (p_1)\) assumes that \(p_1\) does not inform about the cost of firm 1, unless \(p_1=p_1^c(0)\). More general belief systems will be considered when we check whether these equilibria satisfy the intuitive criterion.

To avoid misunderstanding, note that in the present context the “good” type is type \(\ell\) (with low cost) and the “bad” type is type h (with high cost).

\(\pi _1\left( p,R(p,\eta _1),x_h \right)\) is strictly concave in p; hence it has a unique maximizer.

These figures assume the following parameter profiles. Figure 2(a): \((s,\mu _0,\eta _0,x_h)=(\nicefrac {4}{5},\nicefrac {1}{2},\nicefrac {418}{625},\nicefrac {4}{5})\), Fig. 2(b): \((s,\mu _0,\eta _0,x_h)=(\nicefrac {4}{5},\nicefrac {2}{5},\nicefrac {1}{5},\nicefrac {3}{5})\), Fig. 2(c): \((s,\mu _0,\eta _0,x_h)=(\nicefrac {4}{5},\nicefrac {2}{5},\nicefrac {1}{5},\nicefrac {1}{5})\), Fig. 2(d): \((s,\mu _0,\eta _0,x_h)=(\nicefrac {4}{5},\nicefrac {1}{2},\nicefrac {418}{625}, \nicefrac {11}{20} )\).

We state (20) in full generality, ignoring the particular feature of the present model that the payoff of firm 1 type c is actually independent of the beliefs of firm 2 concerning its cost, \(\mu\).

The plots in Fig. 5a are based on the parameter profile \(\left( s,\mu _0,\eta _0,x_h\right) = \left( \nicefrac {4}{5}, \nicefrac {1}{5}, \nicefrac {1}{5}, \nicefrac {2}{5}\right)\).

By definition \(p^B(x_h)\) is the maximizer of \(\pi (p_1,R(p_1, 1), x_h)\).

There, \(x_A=\frac{2 s^2 (2+s)(1-\eta _1 )^2 }{2 s^2 (2+s)(1-s) (1-\eta _1 )^2 + (1-\mu _0) \left( 2 s^3(1-\eta _1 )^2 + \left( 4-s^2\right) ^2\eta _1 \right) }\) and

\(x_B=\frac{2\,s^2 (2+s)(2-\eta _1 ) (1-\eta _1 ) }{4 (1-\mu _0) \left( 4 \eta _1 - s^2\left( 2 -3 \eta _1 +2\eta _1 ^2\right) \right) +s^2 (2+s) (2-\eta _1 ) ((2-3 \eta _1 ) (2-s)-\mu _0 (2- (4-s)\eta _1 ))}\).

References

Albæk S (1990) Stackelberg leadership as a natural solution under cost uncertainty. J Ind Econ 38:335–347

Amir R, Grilo I (1999) Stackelberg versus Cournot equilibrium. Games Econ Behav 26:1–22

Amir R, Grilo I, Jin J (2009) Demand-induced endogenous price leadership. Int Game Theory Rev 1:219–240

Andreyanov P, Davidson A, Korovkin V (2017) Detecting auctioneer corruption: evidence from Russian procurement auctions. mimeo., UCLA

Austin A (2005) Adam Smith on the inevitability of price fixing. Case W Res Law Rev 55:501–523

Bagwell K (1995) Commitment and observability in games. Games Econ Behav 8:271–280

Barrachina A, Tauman Y, Urbano A (2014) Entry and espionage with noisy signals. Games Econ Behav 83:127–146

Barrachina A, Tauman Y, Urbano A (2021) Entry with two correlated signals: the case of industrial espionage and its positive competitive effects. Internat J Game Theory 50:241–278

Cho IK, Kreps D (1987) Signaling games and stable equilibria. Quart J Econ 102:179–221

Cho IK, Sobel J (1990) Strategic stability and uniqueness in signaling games. J Econ Theory 50:381–413

Dowrick S (1986) von Stackelberg and Cournot duopoly: choosing roles. RAND J Econ 17:251–260

Fan C, Jun B, Wolfstetter E (2022a) Spying in Bertrand markets under incomplete information: who benefits and is it stable? J Math Econ 102 (October): Article 102722

Fan C, Jun B, Wolfstetter E (2022b) Supplement to “Price leadership, spying, and secret price changes: a Stackelberg game with imperfect commitment”. Working paper, https://drive.google.com/file/d/1UPRuyri2Duygd4QQYIIwGCN2VPzrJ8cp/view

Gal-Or E (1985) First mover and second mover advantages. Int Econ Rev 26:649–653

Green EJ, Porter RH (1984) Noncooperative collusion under imperfect price information. Econometrica 52:87–100

Hamilton J, Slutsky S (1990) Endogenous timing in duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2:29–46

Ivanov D, Nesterov A (2020) Stealed-bid auctions: detecting bid leakage via semi-supervised learning. Working paper

Kozlovskaya M (2018) Industrial espionage in duopoly games. Discussion paper, SSRN

Kreps D, Sobel J (1994) Signalling. In: Aumann R, Hart S (eds) Handbook of game theory with economic applications, vol 2. North-Holland, Amsterdam, pp 849–867

Lengwiler Y, Wolfstetter E (2010) Auctions and corruption: an analysis of bid rigging by a corrupt auctioneer. J Econ Dyn Control 34:1872–1892

Maggi G (1999) The value of commitment with imperfect observability and private information. RAND J Econ 30:571–594

Milgrom P, Roberts J (1982) Limit pricing and entry under incomplete information: a general equilibrium analysis. Econometrica 50:443–459

Mouraviev I, Rey P (2011) Collusion and leadership. Int J Ind Org 29:705–717

Porter R (1983) A study of cartel stability: the joint executive committee, 1880–1886. Bell J Econ 14:301–314

Rotemberg J, Saloner G (1986) A supergame-theoretic model of price wars during booms. Am Econ Rev 76:390–407

Smith A (1776) The Wealth of Nations, (reprinted 1970) edn. Everyman’s Library, Dent & Sons, New York

Sobel J (2009) Signaling games. In: Myers R (ed) Encyclopedia of complexity and system science. Springer, New York, pp 8125–8139

Solan I, Yariv L (2004) Games with espionage. Games Econ Behav 47:172–199

Stigler GJ (1964) A theory of oligopoly. J Polit Econ 72:44–61

van Damme E, Hurkens S (1996) Commitment-robust equilibria and endogenous timing. Games Econ Behav 15:290–311

van Damme E, Hurkens S (2004) Endogenous price leadership. Games Econ Behav 47:404–420

Wang T (2020) Competitive intelligence and disclosure of cost information in duopoly. Rev Ind Org 57:665–699

Zhang H (2015) Three essays on the incentives for information acquisition and information sharing in competitive environments. PhD thesis, University of California Riverside

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank seminar participants at the Universidad de Los Andes (Buenos Aires) and the Academia Sinica (Taiwan), and anonymous referees for constructive comments and suggestions. Research support by the National Natural Science Foundation of China (Grant: 72171140), the Humanities and Social Sciences Research Foundation of the Ministry of Education of China (Grant: 19YJA790009), and Korea University (Grant: K1919021) is gratefully acknowledged. .

Appendix

Appendix

Here we spell out the proofs omitted from the main text.

Proof of Proposition 2

The proof of these necessary conditions builds up in several steps (Lemmas 5 to 8):

Lemma 5

Suppose a partially separating equilibrium exhibits \(p^n_1 \notin \left\{ p_1^c(0), p_1^c(x_h)\right\}\). Then, after observing \(p^n_1\) firms play the unique equilibrium strategies of the benchmark Bertrand game, \(\left( p^B(x_1),p^B(x_2)\right)\).

Proof

In that case, the on-the-equilibrium path beliefs must specify \(\eta (p^n_1)=1\), and the assertion follows from Lemma 1. \(\square\)

Lemma 6

Suppose a partially separating equilibrium exhibits \(p^n_1 \notin \left\{ p_1^c(0), p_1^c(x_h)\right\}\). Then \(p_1^c(x_h)> p^*\).

Proof

In that case the on-the-equilibrium path beliefs must specify \(\eta (p_1^c(x_h))=0\).

Suppose \(p_1^c(x_h)\le p^*\). Then \(R(p_1^c(x_h),0)\le R(p_1^c(x_h),1)=p^*\), because \(R(p_1, \eta )\) is increasing in \(\eta\) for all \(p_1 < p^*\).

If firm 1 type \({ ch}\) deviates from its equilibrium strategy and sets \(p_1=p^B(x_h)\) its payoff is equal to \(\pi _1^d( \eta ):= \pi _1(p^B(x_h), R(p^B(x_h), \eta ),x_h)\), which depends upon off-equilibrium-path beliefs \(\eta\). However, because \(R(p_1,\eta )\) is decreasing in \(\eta\) for all \(p_1 > p^*\), and \(p^B(x_h)\) is obviously greater than \(p^*\), that deviation payoff has a lower bound equal to \(\pi _1(p^B(x_h), R(p^B(x_h),1),x_h) = \pi _1(p^B(x_h), p^*, x_h)\), as illustrated in Fig. 6.Footnote 19 Therefore,

We conclude that this deviation is profitable, which is a contradiction. \(\square\)

Lemma 7

There is no partially separating equilibrium that exhibits \(p^n_1 \notin \left\{ p_1^c(0), p_1^c(x_h)\right\}\).

Proof

Suppose there is such an equilibrium. Then, the on-the-equilibrium path beliefs must specify \(\eta (p_1^c(x_h))=0\), \(\eta (p^n_1)=1\). Therefore, by Lemma 6 and the fact that \(R(p_1,0)\) is increasing in \(p_1\):

whereas, by Lemma 5, \(R(p^n_1,\eta (p^n_1))=R(p^n_1,1)=p^*\). Thus, firm 1 type n has an incentive to deviate from its equilibrium strategy and set a price equal to \(p_1^c(x_h)\), a contradiction. \(\square\)

Lemma 8

\(p_1^c(0) \ne p_1^c(x_h) \, \Rightarrow \, p_1^c(x_h) > p_1^c(0)\).

Proof

Let \(\bar{Q}:=Q(p_1^c(x_h), R(p_1^c(x_h),\eta ))\) and \(\underline{Q}:= Q(p_1^c(0), R(p_1^c(0),\eta '))\), where \(\eta , \eta '\) denote the updated beliefs after observing \(p_1^c(x_h)\), resp. \(p_1^c(0)\). Suppose, per absurdum, that \(p_1^c(x_h) \le p_1^c(0)\). Then, by definition of an equilibrium, one must have:

By the same reasoning:

This is a contradiction. \(\square\)

As a final step of the proof of Proposition 2, note that in the assumed partially separating equilibrium one must have \(p_1^c(0) \ne p_1^c(x_h)\) and therefore, by Lemma 8, \(p^c_1(x_h)>p_1^c(0)\). By Lemma 7\(p^n_1 \in \left\{ p_1^c(0),p_1^c(x_h)\right\}\). Suppose \(p^n_1 =p_1^c(0)\), then firm 1 type n can increase its profit by raising \(p^n_1\) to \(p_1^c(x_h)\), because \(R(p_1^c(x_h),0)>R(p_1^c(0), \eta )\) (see Fig. 1), and we conclude that \(p^n_1=p_1^c(x_h)\).

Proof of Proposition 4

Sufficiency: If \(p_B \le \tilde{p}^*(1)\) (condition (21)), then

Hence, \(\Pi _1^n(x_1) \le \max _{(\eta ,\mu )} \left( \max _p \pi _1 (p, \tilde{R}(p_1',\eta ,\mu ),x_1)\right)\). This contradicts condition (19). Therefore IC cannot be violated.

If condition (22) is satisfied, firm 1 type \({ ch}\) can be better off than in the equilibrium only if \(p_1>p_A \ge p_B\), and firm 1 type \({ c\ell }\) can be better off only if \(p_1> p_B\). At those prices,

Hence, IC cannot be violated either.

Necessity: Suppose both conditions are violated. Then \(p_B > \tilde{p}^*(1)\) and either (a) \(p_B>p_A\) or (b) there is \(p_1 < p_B\) such that \(\pi _1(p_1,R(p_1,0),0)>\pi _1(p_1^c(0),R(p_1^c(0),0),0)\). In case (a) there is \(p_1 \in (\max \{p_A,\tilde{p}^*(1)\},p_B)\) such that

IC is violated because at that price we have

and thus firm 1 type n is worse off than in equilibrium.

In case (b) it is clear that at \(p_1\) firm 1 type \({ c\ell }\) is better off than in equilibrium if \(\eta =0\), whereas firm 1 type n is worse off for all \((\eta ,\mu )\) because

Proof of Corollary 1

Sufficiency: follows from Proposition 4.

Necessity: For this equilibrium one can show that \(\tilde{p}^*(1)< p_B \Leftrightarrow x_h<x_A\), and \(p_A<p_B \Leftrightarrow x_h<x_B\), and \(x_A<x_B\).Footnote 20 Suppose condition (21) is violated. Then \(\tilde{p}^*(1)< p_B\), hence \(x_h<x_A<x_B\) and so \(p_A<p_B\). Thus condition (22) is also violated. Therefore, by Proposition 4, IC is violated.

Proof of Lemma 3

Sufficiency: If condition (25) is satisfied, firm 1 type \({ ch}\) can be better off than in the equilibrium only if \(p_1>p_A \ge p_B\), and firm 1 type \({ c\ell }\) can be better off only if \(p_1> p_B\). At those prices,

Hence, \(\Pi _1^n(x_1) \le \max _{\eta } \left( \max _p \pi _1 (p, R(p_1,\eta ),x_1)\right)\). This contradicts condition (23). Therefore IC cannot be violated.

Necessity: If condition (25) is violated, then either (a) \(p_A<p_B\) or (b) there is \(p_1 < p_B\) such that \(\pi _1(p_1,R(p_1,0),0)>\pi _1(p_1^c(0),R(p_1^c(0),0),0)\). In case (a) there is \(p_1 \in (p_A,p_B)\) such that

IC-S is violated because at that price we have

and thus firm 1 type n is worse off than in equilibrium.

In case (b) it is clear that at \(p_1\) firm 1 type \({ c\ell }\) is better off than in equilibrium if \(\eta =0\), whereas firm 1 type n is worse off for all \(\eta\) because

Proof of Lemma 4

By definition of \(p_A\) one has:

Using this together with the fact that \(\nicefrac {d \pi _1(p_1,R(p_1,0),x_h)}{dp_1} >0\) for all \(p_1 < p_1^S(x_h)\) we find that

Let p be a candidate equilibrium price, \(p_1^c(x_h)=p\). Then \(p_B\) is a linear function of p and \(\Delta\) is a quadratic function of p with positive coefficient in the quadratic term. \(\Delta =0\) has two roots, \(p^*\) and \(\bar{p}\). The derivative of \(\Delta\) is negative at \(p^*\) and positive at \(\bar{p}\). Therefore, \(p>\bar{p} \Leftrightarrow \Delta>0 \Leftrightarrow p_B>p_A\). Thus by Proposition 3 condition (30) is necessary and sufficient for IC-S.

Proof of Proposition 6

The proof is in three steps. 1) We show that if \(p_1^e\) is a pooling equilibrium price then \(p_1^e > p^*\).

Suppose \(p_1^e \le p^*\). Then,

where the first inequality follow from the fact that for \(p<p^*\) the most favorable belief for firm 1 is \(\eta =1\).

If firm 1 type \({ ch}\) deviates to \(p^B(x_h)\), then it can earn at least

Thus \(p_1^e\) cannot be a pooling equilibrium price.

2) Define \(p_B^e\) as the implicit solution of \(R(p_B^e,0)=R(p_1^e,\eta _0)\). We show that:

Solving the equation \(R(p_B^e,0)=R(p_1^e,\eta _0)\) for \(p_B^e\), one obtains

Using this, one finds

which is positive, because \(p_1^e > p^*\) by 1) and

(3) By the continuity of \(\pi _1\) and R and the monotonicity of \(R(p_1,0)\) there exists a \(p_1'<p_B^e\) such that

Therefore, firm 1 type \({ c\ell }\) is better off if it sets price \(p_1'\) and is recognized as type c whereas firm 1 type n would be worse off. Thus IC-S is violated.

Proof of Proposition 7

First, consider Equilibrium I.

The proof is in three steps: 1) Substituting \(p_1^n=p_1^c(x_h)\), (12)–(13), and (16) in (7) and comparing with (3), we find:

\(q_1(p_1^c(x_h),x_1)< p_1^S(x_1)\).

2) One has:

Combining (1) and (2) implies \(\eta _0 E\!\big [ q_1(p_1^c(x_h),X_1)\big ] + (1- \eta _0 ) E \!\big [p_1^c(X_1)\big ] < E\!\big [ p_1^S(X_1)\big ]\).

3) Similarly, one has:

Because \(p_A,p_B>p^*\) and \(p_1^c(0)=\min \left\{ p_1^S(0),p_A,p_B\right\}\), if \(p_1^S(0)\ge p^*\) one has

Whereas if \(p_1^S(0)<p^*\), \(E \!\big [p_1^c(X_1)\big ]=\mu _0 p_1^c(x_h)+(1-\mu _0)p_1^S(0)\) and

Thus, we have \(\eta _0 E\!\big [ q_1(p_1^c(x_h),X_1)\big ] + (1- \eta _0 ) E \!\big [p_1^c(X_1)\big ]>p^*\) also in this case.

Next consider Equilibrium II which satisfies the stronger IC-S equilibrium refinement. Note, there the equilibrium strategies of firm 1 type c are denoted by \(\hat{p}_1^c(x_1)\).

Because \(\hat{p}_1^c(x_h)=\min \left\{ p_1^c(x_h),\bar{p}\right\}\) and \(p^*< \bar{p}\), it follows that \(p^*<\hat{p}_1^c(x_h) < p_1^S(x_h)\). One can also show that \(p^B(x_1)<q_1(p_1^c(x_h),x_1)<p_1^S(x_1)\). Thus if \(p_1^S(0)\ge p^*\), then (32) is proved because \({\hat{p}}_1^{c(0)}=\min \left\{ p_1^{S(0)}, p_B\right\}\). If \(p_1^S(0)<p^*\), then one can show \(\mu _0 \bar{p}+(1-\mu _0)p_1^S(0)>p^*\), thus (32) follows as well.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fan, C., Jun, B.H. & Wolfstetter, E.G. Price leadership, spying, and secret price changes: a Stackelberg game with imperfect commitment. Int J Game Theory 52, 775–804 (2023). https://doi.org/10.1007/s00182-023-00840-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-023-00840-9