Abstract

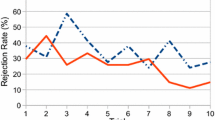

Experimental data for two types of bargaining games are used to study the role of strategic risk in the decision making process that takes place when subjects play a game only once. The bargaining games are the ultimatum game (UG) and the yes-or-no game (YNG). Strategic risk in a game stems from the effect on one player’s payoff of the behavior of other players. In the UG this risk is high, while it is nearly absent in the YNG. In studying the decision making process of subjects we use the time elapsed before a choice is made (response time) as a proxy for amount of thought or introspection. We find that response times are on average larger in the UG than in the YNG, indicating a positive correlation between strategic risk and introspection. In both games the behavior of subjects with large response times is more dispersed than that of subjects with small response times. In the UG larger response time is associated with less generous and thus riskier behavior, while it is associated with more generous behavior in the YNG.

Similar content being viewed by others

Notes

We use the word ‘proposal’ to refer to a division of the 100ECU, e.g., [90, 10], giving 90 to the proposer and 10 to the responder. The word ‘offer’ is used to refer to the responder’s share that is specified by the proposer’s proposal. In the example, the offer is of 10ECU.

In the YNG there is strategic risk since the responder may reject all offers. Thus, a proposal may yield the payoff prescribed by this proposal or it may yield a payoff of zero (risk). However, since this risk affects all proposals equally, it plays no role in the determination of the proposer’s optimal behavior.

We used neutral names, X (proposer) and Y (responder), for the two roles.

This way of implementing the classical sequential UG is called the strategy method (Selten 1967) because it implements the strategic representation of the game.

The measurement of response times (RT) has been used in psychology to study mental structures since the mid 19th century. It is the time elapsed between a visual or auditory stimulus and the response, choice, or decision that the stimulus calls for [see, e.g., Luce (1991), Jensen (2006)]. Experiments in psychology are typically simple in the number and type of choices they ask subjects to make and measurement is very precise (up to the millisecond). Our use of RT is very different. Since measurement is less precise, we limit our use of RT to comparisons across situations.

The total number of strategies available to responders in the UG is \(2^9\). Strategies for which a MAO exists—monotonic strategies—are only nine: one for each possible proposal by the proposer. It is reasonable and empirically justified to believe that responders will mainly use such monotonic strategies.

Proposals across games are statistically different after controlling for gender, origin, matching on gender and origin, and cross effects of these control variables. Given the nature of the dependent variable offer, we ran interval regressions of offer as a function of a game dummy variable and the control variables. The t statistic for game effect has a p value less than 0.001 regardless of the controls considered and controls are never significant. An interval regression is a maximum likelihood estimation where the likelihood of each data point is the density evaluated on an interval instead of at a point. Full regression reports in the supplementary online material.

The categorization is approximate whenever 25 % of the considered subset of the data is not an integer. An alternative categorization, used both in Rubinstein (2008) and Piovesan and Wengstrom (2009), is to split the data into four unequally-sized groups: the Very Fast 10 % with smallest values of \(\textit{RT}\), the Very Slow 10 % with largest values of \(\textit{RT}\) and two groups containing 40 % of the data each, of Fast and Slow subjects. Our qualitative results are maintained with this alternative categorization.

If the \(\textit{RT}\) categories of Rubinstein (2007) and Piovesan and Wengstrom (2009) are used, the behavioral difference between the Very Fast and the Very Slow is more accentuated than that between our Q1 and Q4. While the Very Slow proposers make every possible proposal, the Very Fast make only proposals [50, 50] and [60, 40].

All the comparisons of responder \(\textit{RT}\) across games go in the expected direction. Responder \(\textit{RT}\) in the UG is larger on average and more dispersed than responder \(\textit{RT}\) in the YNG. Responders in the UG also have larger response times, on average, than proposers.

Pearson’s \(\chi ^2\) test with p value \(=0.018\), regressions with or without control variables yield coefficients of Q3 and Q4 dummies that are significant at 1 %, while Q2 is never significantly different from Q1 (omitted, base).

When the UG is analyzed with a levels of reasoning model, whenever a proposer of level j proposes [50, 50], a responder of level \(j+1\) is indifferent between all values of MAO between 10 and 50. If we assume that a responder who is indifferent randomizes uniformly over all strategies, we get oscillation: proposers of odd level propose [50, 50], proposers of even level propose [90, 10]; responders of odd level set a MAO of 10, responders of even level randomize equally over all values of MAO. A cognitive hierarchies model, where players of level j best respond to a population containing players with all levels lower than j, predicts convergence to proposal [90, 10] by proposers of high level, and to a MAO of 10 by responders of high level.

References

Arad A, Rubinstein A (2012) Multi-dimensional iterative reasoning in action: the case of the colonel blotto game. J Econ Behav Organ 84(2):571–585

Avrahami J, Güth W, Hertwig R, Kareev Y, Otsubo H (2013) Learning (not) to yield: an experimental study of evolving ultimatum game behavior. J Soc Econ 47:47–54

Camerer C, Ho T-H, Chong J-K (2004) A cognitive hierarchy model of games. Q J Econ 119(3):861–898

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10:171–178

Fischbacher U, Hertwig R, Bruhin A (2013) How to model heterogeneity in costly punishment: insights from responders’ response times. J Behav Decis Mak 26(5):462–476

Gehrig T, Guth W, Levati V, Levinsky R, Ockenfels A, Uske T, Weiland T (2007) Buying a pig in a poke: an experimental study of unconditional veto power. J Econ Psychol 28:692–703

Greiner B (2004) An online recruitment system for economic experiments. In: Kremer K, Macho V (eds) Forschung und wissenschaftliches Rechnen 2003. GWDG Bericht 63. Ges. fur Wiss

Güth W, Kirchkamp O (2012) Will you accept without knowing what? The yes-no game in the newspaper and in the lab. Exp Econ 15:656–666

Güth W, Kocher M (2014) More than thirty years of ultimatum bargaining experiments: motives, variations, and a survey of the recent literature. J Econ Behav Organ 108:396–409

Hauk E, Nagel R (2001) Choice of partners in multiple two-person prisoner’s dilemma games. J Confl Resolut 45(6):770–793

Jensen A (2006) Clocking the mind: mental chronometry and individual differences. Elsevier, The Netherlands

Knoch Daria, Fehr Ernst (2007) Resisting the power of temptations. The right prefrontal cortex and self-control. Ann N Y Acad Sci 1104:123–134

Luce RD (1991) Response times: their role in inferring elementary mental organization. Oxford University Press, New York

Nagel R (1995) Unraveling in guessing games: an experimental study. Am Econ Rev 85(5):1313–1326

Piovesan M, Wengstrom E (2009) Fast or fair? A study of response times. Econ Lett 105:193–196

Rand D, Greene J, Nowak M (2012) Spontaneous giving and calculated greed. Nature 489:427–430

Rubinstein A (2007) Instinctive and cognitive reasoning: a study of response times. Econ J 117:1243–1259

Rubinstein A (2008) Comments on neuroeconomics. Econ Philos 24:485–494

Selten R (1967) Die strategiemethode zur erforschung des eingeschränkt rationalen verhaltens im rahmen eines oligopolexperiments. In: Sauermann H (ed) In Beiträge zur experimentellen Wirtschaftsforschung, vol I, pp 136–168. J.C. Mohr (Siebeck)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors gratefully acknowledge financial support from the Spanish Ministry of Science and Innovation (Grants ECO2012-30626, CSD2010-00034, and ECO2013-44879-R), the Government of Andalusia Project for Excellence in Research (Grant P12-SEJ-1436), Basque Government (research group IT-783-13), and the European Research Council (advanced Grant BRSCDP-TEA). We thank Praveen Kujal, Jaromir Kovarik, Ismael Rodríguez-Lara, and the audience at the 4th annual meeting of SEET in Tenerife for useful comments.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Brañas-Garza, P., Meloso, D. & Miller, L. Strategic risk and response time across games. Int J Game Theory 46, 511–523 (2017). https://doi.org/10.1007/s00182-016-0541-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-016-0541-y