Abstract

After Japan’s bubble economy collapsed in 1991, household values diversified, and, gradually, the budget shares on intangible services exceeded that on tangible goods, leading to a shift from demand for goods to services. In this study, we focus on the increased budget allocation to services in Japanese household expenditure and verify whether service-related items can be aggregated into a service group using Lewbel’s (Am Econ Rev 86(3):524–543, 1996) generalized composite commodity theorem (GCCT). We first accurately reclassify into all 51 items consisting of goods and services and verify whether these aggregations are justified. Next, we verify whether these 51 items can be sub-aggregated into goods or service groups. In testing the GCCT, we incorporate panel time-series analysis with cross-sectional dependence, unlike traditional GCCT tests with time-series data. We also conduct a nonparametric revealed preference test for weak separability as a benchmark against the GCCT test results. Our findings demonstrate that the utility function can be rationalized even when the data set is reclassified into 51 items, justifying the aggregation into service groups. This suggests that in the future, specifying the functional form of a service group can be developed into a traditional demand analysis, such as calculating estimates and elasticities.

Similar content being viewed by others

Data availability

The data that support the findings of this study are available from the author upon reasonable request.

Notes

A well-behaved utility function is a utility function that satisfies monotonicity, continuity, and concavity.

Other consumption expenditures originally included pocket money, social expenses, and remittances; however, because these price series do not exist in the data, they were removed from the list of medium classifications in this analysis.

The demand function is rational if it satisfies the adding-up condition, the homogeneity condition, the Slutsky symmetry, and the semi-negative definite condition.

The problem of cross-sectional dependence concerns the panel time-series properties of each variable, the presence or absence of which does not affect the independence between relative price and group index.

For example, assuming the AR(1) model, it can be expressed as \({X}_{jt}={\theta }_{j}{X}_{j,t-1}+{u}_{jt}, \mathrm{ for} t=1,\dots ,T;j=1,\dots 6\), where \({X}_{jt}\) is the observable variable such as relative prices and group indices. The error terms represent the correlation between age groups \(j\).

Defining \({X}_{jt}\) as the observed variable such as relative prices and group indices, Bai and Ng (2004) assume the following factor model: \({X}_{jt}={c}_{j}+{{\varvec{\uplambda}}}_{\mathbf{j}}^{\prime}{\mathbf{F}}_{\mathbf{t}}+{e}_{jt}\), \({\text{for}} t=1,\dots ,T; j=1,\dots 6\), where \({{\varvec{\uplambda}}}_{\mathbf{j}}^{\prime}{\mathbf{F}}_{\mathbf{t}}\) denotes the common factor term and \({e}_{jt}\) is the idiosyncratic factor term.

For the idiosyncratic factor, a unit root test is performed for each cross-sectional unit \(j\), and then, those test statistics are pooled together to perform the overall unit root test. For the common factor, a unit root test is performed by testing the number of I(1) variables included in the estimated factor \({\widehat{\mathbf{F}}}_{\mathbf{t}}\).

The exact null hypothesis is that the number of I(1) variables in the estimated factor \({\widehat{\mathbf{F}}}_{\mathbf{t}}\) is 1.

For example, if the food group is divided into goods and services, it is necessary to examine whether their aggregation is justified.

Weak separability is equivalent to two-stage budgeting allocation, which can be determined the optimal expenditure allocation within each subgroup.

These results are available upon request.

These classifications are not necessarily accurate. To classify them accurately, one would need to go back to the small or item classifications.

In addition, the Case 3 tests were not tested in the full same separable structure as the GCCT tests. For example, in the “Food” in Case 3 of Table 6, we test for two subgroups, a food group consisting of 12 items and a group consisting of the remaining 39 items. The same is applied to the remaining groups such as “Housing” and “Fuel, light, and water charges.” In this regard, also, the Case 3 results would be just a benchmark for the GCCT test.

References

Afrait SN (1967) The construction of a utility function from expenditure data. Int Econ Rev 8(1):67–77

Bai J, Ng S (2004) A PANIC attack on unit roots and cointegration. Econometrica 72(4):1127–1177

Breusch T, Pagan AR (1980) The Lagrange multiplier test and its application to model specifications in econometrics. Rev Econ Stud 47:239–253

Capps O, Love HA (2002) Econometric considerations in the Use of electronic scanner data to conduct consumer demand analysis. Am J Agr Econ 84(3):807–816

Cherchye L, Demuynck T, Rock BD, Hjertstrand P (2015) Revealed preference tests for weak separability: An integer programming approach. J Econom 186(1):129–141

Davis GC, Lin N, Shumway CR (2000) Aggregation without separability: tests of the United States and Mexican agricultural production data. Am J Agr Econ 82(1):214–230

Diewert WE, Parkan C (1985) Tests for the consistency of consumer data. J Econom 30(1–2):127–147

Fleissig AR, Whitney GA (2003) A new PC-based test for Varian’s weak separability conditions. J Bus Econ Stat 21(1):133–144

Fleissig AR, Whitney GA (2008) A nonparametric test of weak separability and consumer preferences. J Econom 147(2):275–281

Fleissig AR, Hall AR, Seater JJ (2000) GARP, separability, and the representative agent. Macroecon Dyn 4(3):324–342

Gengenbach C, Palm FC, Urbain J-P (2006) Cointegration testing in panels with common factors. Oxford Bull Econ Stat 68(1):683–719

Heng Y, House LA, Kim L (2018) The competition of beverage products in current market: a composite demand analysis. Agric Resour Econ Rev 47(1):118–131

Hjertstrand P, Swofford JL (2019) Revealed preference tests of indirect and homothetic weak separability of financial assets, consumption and leisure. J Financ Stab 42:108–114

Hjertstrand P, Swofford JL, Whitney GA (2016) Mixed integer programming revealed preference tests of utility maximization and weak separability of consumption, leisure, and money. J Money Credit Bank 48(7):1547–1561

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press

Lewbel A (1996) Aggregation without separability: a generalized composite commodity theorem. Am Econ Rev 86(3):524–543

Ministry of Internal Affairs and Communications (2021) 2021 White Paper on Information and Communications in Japan.

Moon HR, Perron B (2004) Testing for unit root in panels with dynamic factors. J Econom 122:81–126

Pedroni P (2004) Panel cointegration: asymptotic ad finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20:597–625

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Cambridge Working Papers in Economics 0435 3: 1–39.

Reed AJ, Levedahl JW, Hallahan C (2005) The generalized composite commodity theorem and food demand estimation. Am J Agric Econ 87(1):28–37

Schulz LL, Schroeder TC, Xia T (2012) Studying composite demand using scanner data: the case of ground beef in the US. Agric Econ 43:49–57

Straus J, Yigit T (2003) Shortfalls of panel unit root testing. Econ Lett 81(3):309–313

Swofford JL, Whitney GA (1987) Nonparametric tests of utility maximization and weak separability for consumption, leisure and money. Rev Econ Stat 69(3):458–464

Varian HR (1982) The nonparametric approach to demand analysis. Econometrica 50(4):945–973

Varian HR (1983) Non-parametric tests of consumer behaviour. Rev Econ Stud 50(1):99–110

Acknowledgements

This research was supported by research funds from Otemon Gakuin University.

Funding

This research was supported by research funds from Otemon Gakuin University.

Author information

Authors and Affiliations

Contributions

The author revised the manuscript, approved the manuscript to be published, and agreed to be accountable for all aspects of the work in ensuring that questions related to the accuracy of integrity of any part of the work are appropriately investigated and resolved.

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The generalized composite commodity theorem test for Case 3

In Appendix A, we examine whether the sub-aggregation of 51 reclassified items based on the ten major classifications is feasible. Following the original major classifications of Table 1, numbers 1–12 are classified as food; 13–15 as housing; 16–19 as fuel, light, and water charges; 20–25 as furniture and household utensils; 26–32 as clothing and footwear; 33–35 as medical care; 36–40 as transportation and communications; 41–42 as education; 43–49 as culture and recreation; and 50–51 as other expenditures. These classifications are used to verify whether the original aggregation based on the major classification is valid, even when goods and services are reclassified into 51 items. In addition, medium classifications based on the ten major classification groups are commonly used in realistic demand analyses. In Table

7, \({R}_{I}\) represents the \(I\)-th group index, and \({\rho}_{i}\) is the relative price of the \(i\)-th item in Table 1. The relative prices are divided by the prices of the above-mentioned ten major groups.

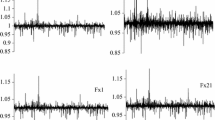

Table 7 shows that for most group indices and relative prices, the null hypothesis of no cross-sectional dependence between error terms is rejected at the 5% level, with only \({\rho}_{13}\) and \({\rho}_{15}\) determined as having no cross-sectional dependence. In general, because most variables are found to have cross-sectional dependence, we incorporate cross-sectional dependence into the panel unit root and cointegration tests. For \({\rho}_{13}\) and \({\rho}_{15}\), other tests, such as the Breusch and Pagan (1980) Lagrange multiplier (LM) and Pesaran (2004) scaled LM tests, result in the adoption of cross-sectional dependence. Therefore, we apply panel unit root and cointegration tests, which also account for the cross-sectional dependence on these variables.

The left-hand side of Table

8 presents the results of the Bai and Ng (2004) unit root test. First, for the group indices \({R}_{I}\), the null hypothesis for the panel unit root in the common factors is not rejected, except for \({R}_{7}\). In addition, the null hypothesis for the panel unit root in idiosyncratic factors is not rejected except for \({R}_{2}\) and \({R}_{6}\). Therefore, we conclude that all group indices are I(1) variables with panel unit roots in either common or idiosyncratic factors or both factors. Second, for relative prices \({\rho}_{i}\), the null hypothesis for the panel unit root is not rejected for all the common factors. In addition, the null hypothesis for the panel unit root is not rejected for idiosyncratic factors except for \({\rho}_{12},{\rho}_{21}\), \({\rho}_{45}\), and \({\rho}_{49}\). Therefore, we conclude that all relative prices are I(1) variables with panel unit roots in either common or idiosyncratic factors or both factors.

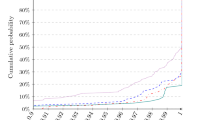

Based on these results, we conduct an individual cointegration test between each relative price \({\rho}_{i}\) and the group index \({R}_{I}\) to verify whether the GCCT is satisfied in each group. The right-hand side of Table 8 presents the results of the Gengenbach et al. (2006) cointegration test. Among the ten major groups, the applicability of GCCT is rejected in transportation and communications and culture and recreation groups. In the transportation and communications group, we failed to reject, even at the 10% level, the null hypothesis for no panel cointegration relationship between each relative price \({\rho}_{i}\) and group index \({R}_{I}\) for the common factor for public transportation (i.e., item 36). By contrast, for the idiosyncratic factor, we reject the null hypothesis for no panel cointegration between each relative price \({\rho}_{i}\) and group index \({R}_{I}\). Therefore, the cointegration relationship between the group index and the relative price for public transportation has not been established, and the GCCT is not satisfied. In the culture and recreation group, the null hypothesis for no panel cointegration relationship between each relative price \({\rho}_{i}\) and group index \({R}_{I}\) for the common factor is not rejected, even at the 10% level for recreational goods services (i.e., item 47). However, for the idiosyncratic factor, we reject the null hypothesis for no panel cointegration between each relative price \({\rho}_{i}\) and the group index \({R}_{I}\). Therefore, the cointegration relationship between the group index and the relative price of recreational goods services has not been established, and the GCCT is not satisfied. In the remaining groups, the null hypothesis for no panel cointegration between each relative price \({\rho}_{i}\) and group index \({R}_{I}\) for both common and idiosyncratic factors is rejected. In other words, the cointegration relationship between each relative price and the group index is established. The GCCT is satisfied in these groups, and aggregation is justified for each group. Thus, two out of ten groups had no cointegration relationship.

The first row of each group in Table 8 shows the results of the GCCT family-wise cointegration test. In this test, we employ Pedroni’s (2004) cointegration test based on Engel–Granger for both common and idiosyncratic factors. In Case 3, where 51 reclassified items are aggregated into ten groups, the null hypothesis for no cointegration relationship is rejected for both common and idiosyncratic factors. Although the individual GCCT tests failed to establish a cointegration relationship between the two groups, the family-wise GCCT test established a cointegration relationship. Thus, we conclude that the GCCT is satisfied. One would first suspect the possibility of a spurious relationship problem, where the results of the family-wise test suggest a false cointegration relationship, as a reason for the differences between these results. In addition, the two groups of transportation and communication and culture and recreation have seen their budget shares for services increasing in recent years, and it cannot be ruled out that their preferences may change. However, since this requires careful discussion, it would be treated as just one possibility. On the other hand, the GCCT test was performed with the null hypothesis of no panel cointegration; however, the GCCT may be satisfied if the null hypothesis for having a panel cointegration was tested.

Appendix B: Nonparametric weak separability test

The general method of constructing nonparametric revealed preference tests was first introduced by Afrait (1967) and developed by Varian (1982, 1983) and Diewert and Parkan (1985). Subsequently, Fleissig and Whitney (2003) proposed a methodology using linear programming. Furthermore, Hjertstrand et al. (2016) formulated a mixed-integer linear programming (MILP) problem for a new testing procedure for weak separability, as proposed by Cherchye et al. (2015). In this test, the dataset satisfies weak separability if there exists a feasible solution to the optimization problem (7)–(15). However, if there is no feasible solution to the problem, the dataset violates weak separability. We calculated in Python using the MIP package with solver CBC to solve the optimization problems.

We suppose the \(n\) goods and services at T time periods. Let \({\mathbf{x}}_{t}=\left({x}_{1t},{x}_{2t},\dots ,{x}_{nt}\right)\) denote the observed quantity vector at time \(t\in T\), and \({\mathbf{p}}_{t}=\left({r}_{1t},{r}_{2t},\dots ,{r}_{nt}\right)\) the corresponding price vector at time \(t\in T\). Next, we suppose the data set is split into two subgroups \({\mathbf{w}}_{t}=\left({x}_{1t},{x}_{2t},\dots ,{x}_{gt}\right)\) with prices \({\mathbf{z}}_{t}=\left({r}_{1t},{r}_{2t},\dots ,{r}_{gt}\right)\) and \({\mathbf{q}}_{t}=\left({x}_{g+1t},{x}_{g+2t},\dots ,{x}_{nt}\right)\) with prices \({\mathbf{v}}_{t}=\left({r}_{g+1t},{r}_{g+2t},\dots ,{r}_{nt}\right)\), defined a data set as D = \({\{{\mathbf{z}}_{\mathbf{t}}, {\mathbf{v}}_{\mathbf{t}};{\mathbf{w}}_{\mathbf{t}}, {\mathbf{q}}_{\mathbf{t}}\}}_{t\in T}\). The utility function \(U\left(\mathbf{x}\right)\) is weakly separable in the partition of two subgroups if it can be written as \(U\left(\mathbf{x}\right)=U\left(\mathbf{w},\mathbf{q}\right)=u\left(\mathbf{w},V\left(\mathbf{q}\right)\right)\) with a macro-function \(u\) and sub-utility function \(V\). The data set D can be rationalized by a weakly separable utility function, if there exist well-behaved utility functions \(u\) and \(V\), such that for all observations \(t\in T\).

Hjertstrand et al. (2016) and Hjertstrand and Swofford (2019) focused on some of the weak separability condition proposed by Varian (1983) and transformed it into the optimization problem. The conditions are as follows.

There exist numbers \({Q}_{t}\), \({u}_{t}\), and \({\phi }_{t}>0\) such that, for all \(s,t\in T\),

They also solved the following MILP problem to implement Varian (1983)’s weak separability conditions (4)–(6), for which a formal proof was provided by Cherchye et al. (2015).

where \({X}_{t,s}\) are binary (0–1) variables, \(\varepsilon \) is a small positive number, and \({A}_{t}\) is a large, fixed number. In this study, we set \(\varepsilon ={10}^{-6}\) and \({A}_{t}={{\varvec{z}}}_{t} {{\varvec{w}}}_{t}+3\). The objective function is set to zero because we are only interested in whether a feasible solution to the equalities exists. \(\mathbf{q}\) goods and services are weakly separable from the remaining goods and services if there exists a feasible solution to problems (7)–(15). On the other hand, if there is no feasible solution to the problem, dataset D violates weak separability.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ogura, M. Testing the aggregation of goods and services without separability using panel data. Empir Econ (2024). https://doi.org/10.1007/s00181-024-02590-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00181-024-02590-3

Keywords

- Generalized composite commodity theorem

- Cross-sectional dependence test

- Panel cointegration test

- Nonparametric weak separability test