Abstract

We explore how the type of global market entry affects wage premia, classifying firms into four categories: domestic only, domestic exporters, non-exporting multinationals, and exporting multinational enterprises. Using firm-level panel data for Bosnia and Herzegovina, Croatia, and Slovenia for the years 2007–2017 and a multivariate endogenous treatment model based on the approach of Wooldridge (J Econom 68(1):115–132, 1995), we find that the multinational wage premia are mainly driven by the export status of multinational firms. Specifically, domestic exporters and exporting multinationals pay on average higher wages than non-exporting firms, whereas non-exporting multinationals tend to pay lower wages than domestic-only firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between firms’ international activities and wage inequality has been in the limelight of attention for some time, as between-firm wage-setting differences may be conducive to the overall income inequality in an economy (e.g., see Helpman et al. 2017). Wage inequality may result from two alternative mechanisms: specialization forces and comparative advantage on the one hand, whereby workers in some sectors win while others lose in labor markets with some frictions; and premia paid to workers of firms that benefit from globalization relative to others that do not even within the same sector. The present paper contributes evidence to the latter line of thought.

Two important elements matter for globalization-related wage premia. First, they are fundamentally rooted in rent-sharing and are based on the larger size of revenues and profits of some firms relative to others (see Egger and Kreickemeier 2009). Second, they have been documented to exist for exporters (see Baumgarten 2013; Egger et al. 2013) and for multinational firms (see Egger and Kreickemeier 2013; Orefice et al. 2021), where the exporting (see Melitz 2003; Chaney 2008; Arkolakis 2010) and multinational-firm status (see Helpman et al. 2004) are endogenous and depend on a firm’s productivity. What is interesting in this regard is that most of the work—both the theoretical and even more so the empirical—focused on either exporting and associated wage premia or on multinational status and associated wage premia but not an interaction between these two. The latter is in the limelight of the present paper.

It should be noted that a sizable body of work considered a distinction between exporting and non-exporting multinationals (MNEs). Typically, MNEs where one or more affiliates engage in exports are associated with either a vertical MNE (see Helpman 1984; Markusen 2004) or an export-platform MNE type (see Helpman et al. 2004; Ekholm et al. 2007). Vertical MNEs exploit the comparative advantage of potential locations and organize a global value chain, where the final output is produced in a cost-minimizing way. Export-platform MNEs exploit location advantages of host countries to access foreign customers from there by the lowest-possible shipping costs, see Tintelnot (2016). These forms of MNEs differ from horizontal MNEs (Markusen 2004) which produce the same output throughout their affiliate network in order to minimize the distance and avoid the trade costs to serve their customer base. The respective literature suggests three insights. First, on average, the combined revenues and the combined employment across all affiliates render multinational enterprises (MNEs) larger than non-MNEs (see, for example, Criscuolo and Martin 2009). As long as coordinating several affiliates across countries is associated with fixed costs at the headquarters level, MNEs exhibit what is called multi-plant economies of scale (see Egger et al. 2018), which are associated with larger firm sizes of MNEs in comparison with other companies. Second, non-exporting MNE affiliates, which are usually associated with a horizontal firm structure, are on average smaller compared to non-MNE exporters (see Bandick and Görg 2010). The reason for the latter is that foreign affiliates of horizontal MNEs produce locally in the host country only for that market, whereas non-MNE exporters in the same country produce locally there for the world market. Third, vertical (or exporting) MNEs are on average larger than exporting non-MNEs (see Gumpert et al. 2020). The latter would not necessarily have to be the case, but it can be the result of technology transfer from the headquarters to its affiliates, whereby foreign affiliates could operate in a more efficient way than their local non-MNE exporter counterparts.

Recall that wage premia are anchored in firm size and profits. Yet, differences in firm size and profits are inherently connected to the organization of the firm and their participation in world markets (through exporting or not; and through MNE participation or not). This motivates the following questions. First, do the wage premia differ between exporting and non-exporting MNEs? Second, if the premia differ, do they do so with a pattern that relates to the type (and size) of the individual affiliates, and how do they compare with the premia paid by non-MNE exporters? The present paper is devoted to exactly those questions, using firm-level data for three southern European countries for which both the export status and the MNE status are known, and firm-level panel data are available.

In addressing the mentioned research questions, we categorize firms into four distinct states of global market participation. These states arise from the interplay between national and MNE integration strategies, as well as between domestic selling and exporting. The categories are as follows: Domestic firms exclusively serving their home market; domestic firms that also engage in exporting; MNE-affiliated firms focusing solely on domestic sales; and MNEs that participate in exporting. Specifically, we do so by considering that firms self-select according to their productivity into the mentioned four states, which means considering them to be endogenous in estimation. Building on the ideas of Wooldridge (1995) in treating self-selection in the context of a selection-on-unobservables framework, we specify a panel data endogenous treatment effects model with three treatment states relative to the control state of being a non-exporting domestic firm, focusing on the treatment effects of (switching into) these treatments on the average wages paid by the associated firms. Specifically, we do so by using firm-level panel data for three southeastern European countries—Bosnia and Herzegovina, Croatia, and Slovenia for the years 2007–2017—as we observe the national versus MNE as well as the exporting versus non-exporting status of firms and the average wages paid per worker for a sizable cross-section of firms there.

This paper contributes to the aforementioned literature in two ways: (i) it formulates a multiple-treatment design where selection into exporting-only, MNE-activity-only, and exporting-and-MNE-activity against the contrast of non-exporting domestic firms may generate a specific wage premium each; (ii) it casts this design in the context of a panel data model with multiple endogenous treatments which is inspired by the approach of Wooldridge (1995) that had been designed for sample-selection problems with panel data.

Using the mentioned firm-level panel data for Bosnia–Herzegovina, Croatia, and Slovenia, we find that wage premia are primarily generated by exporting—both by domestic firms and MNEs. This aligns with the argument of Setzler and Tintelnot (2021) that integration into multinational production networks drives MNE wage premia and not foreign ownership per se. In the data at hand, non-exporting MNEs even tend to undercut wages below those of domestic non-exporting firms. This is consistent with the observation that non-exporting MNEs are on average smaller and less productive than the other three considered firm types in the data.Footnote 1 Thus, not differentiating between exporting and non-exporting MNEs when estimating MNE wage premia may conceal an important degree of heterogeneity within the type of MNEs. To the extent that many economies aim at attracting MNEs and create a policy environment to achieve that, we would conclude that it matters for the benefits of an economy—especially, for the workforce—whether MNEs engage in larger-scale production facilities which may serve as export platforms or whether they just sell locally and eventually only operate as local sales platforms.

The remainder of the paper is structured as follows. Section 2 introduces the data used in this study. In Sect. 3, we describe the empirical approach and also present the results. Section 4 presents some robustness checks. Finally, Sect. 5 concludes with a brief summary.

2 Data

We use firm-level data of Bosnia and Herzegovina, Croatia, and Slovenia from Bureau van Dijk’s Orbis database. For these countries, Orbis provides a very good coverage. Specifically, this database does not only provide detailed balance-sheet information on companies at an annual frequency, but it also permits identifying firms which are part of an MNE (as the parent or a foreign affiliate) or not, and it reports on whether firms engage in exporting or not. Moreover, we believe that the included countries are especially well-suited for our analysis, as their institutional and historical background provides a great heterogeneity of reasons for MNEs to be active there: firms might use cheaper labor than in Western Europe to supply foreign markets (export platforms) or create subsidiaries to supply only the domestic market (especially for countries not being members of the European Union), see Ekholm et al. (2007) or Tintelnot (2016).

In total, our data include 203,605 firm-year observations for the years between 2007 and 2017. Among those, 26,084 firm-year observations pertain to MNEs (either exporting or non-exporting) and the rest to domestic firms. We define domestic firms as ones that are neither controlled by or have control over a foreign entity. To this end, we use a threshold of ownership of larger than 50% to define a company as an MNE. Table 1 provides some details on the composition of the sample regarding the four mentioned treatment states of interest.

According to Melitz (2003) and Helpman et al. (2004), the type of firm integration primarily depends on three sets of variables: productivity; fixed costs; and industry-specific profit margins.Footnote 2 We are relying on a combination of firm-level fixed effects and time-varying variables to control for the aforementioned factors. We use log domestic sales as a theory-consistent proxy for productivity. Note that in so-called new trade models as introduced by Eaton and Kortum (2002), Melitz (2003), Helpman et al. (2004), and Arkolakis (2010), the relative sales of companies in a given market reflect the relative productivity of the firms selling there, and all firms sell in the domestic market. Thus, only the domestic sales can reveal the relative productivity of domestic sellers and exporters (multinational or not). In this context, domestic sales are a truly exogenous measure of firm-level labor productivity, while for example, total sales per employee would be endogenous to the selection into exporting, non-exporting MNE, or exporting MNE types. We give a more formal intuition in “Appendix A.” We approximate fixed costs by a log-additive function involving two variables: log intangible assets and log tangible assets. Baltagi et al. (2019) show that firm-level exporting and foreign investment decisions are related to tangible and intangible assets. Specifically, higher tangible assets can be used as collateral to finance fixed costs of exporting (see Manova 2012). Similarly, Li et al. (2021) argue that a greater amount of intangible assets (internal knowledge) makes firms more attractive for foreign investors, but it raises the price of an acquisition (see Lev 2003). Thus, tangible and intangible assets can be clearly linked to fixed costs. Finally, industry-specific profit margins are picked up by firm-fixed effects, assuming that these are time-invariant. Table 2 summarizes the descriptive statistics for all variables used in the analysis. We summarize wages (annually per worker)—the log of which will be the outcome variable of interest below—at the top of the table.

Table 3 summarizes key observable variables for all considered firm types in the data. It demonstrates that exporting domestic firms and exporting MNEs are more similar to each other, and so are non-exporting domestic firms and non-exporting MNEs. Non-exporting MNEs have consistently the lowest average values for all variables, even when compared to domestic non-exporting firms.

3 Econometric approach and analysis

We build on the self-selection approach (into the sample) for panel data by Wooldridge (1995) and modify it to a setting with four mutually exclusive endogenous treatments as regressors of interest in a regression with log firm-level average wages per worker as the dependent variable. With an interest in the three firm-status-related wage premia (relative to non-exporting domestic firms), we classify firms as: exporting domestic firms (E), non-exporting MNE firms (M), exporting MNEs (ME), and the remainder reference category (non-exporting domestic firms).

Let us denote log wages of firm i in year t by \(y_{it}\). Moreover, denote the three indicator variables of mutually exclusive firm status types \(v\in \{E,M,ME\}\) by \(S^v_{it}\). Finally, denote the explanatory variables determining (the net profitability of) treatment v by \(Z^v_{it}\) and the explanatory variables of outcome apart from the treatment indicators by \(X_{it}\). In what follows, we will consider selection equations of the form

where \(\ell ^v_{it}\) is a latent variable, the net profitability of selecting treatment \(S^v_{it}\), \(\varepsilon ^v_{it}\) is a residual, \(Z^v_{it}\) are time-variant regressors, \(\overline{Z}^v_{ih}\) are period-h-specific averages of \(Z^v_{it}\) as in Wooldridge (1995), and \(\beta ^v_t\) and \(\chi _{ht}\) are conformable parameter vectors. Casting the choice problem in the context of a probability framework, we postulate that the probability \(P(\ell ^v_{it}>0)=P(S^v_{it}=1|Z^v_{it},\sum ^T_{h=1}\overline{Z}^v_{ih}\chi _{ht})\), with \(\sum _{\upsilon \in {0,E,M,ME}}=1\). The outcome equation assumes the form

where \(X_{it}\) are the time-variant control variables, \(X_{ih}\) are period-h-specific averages of \(X_{it}\) as in Wooldridge (1995), \(\alpha ^v\) are average treatment effect parameters of interest, \(\gamma \) and \(\pi _{h}\) are conformable second-stage parameter vectors on the control variables, and \(u_{it}\) is the second-stage residual.

By mutual exclusivity of the three treatment indicators and their endogeneity, the symmetric variance–covariance matrix of the residuals \(\zeta _{it}=(\varepsilon ^E_{it},\varepsilon ^{M}_{it},\varepsilon ^{ME}_{it},u_{it})^{\prime }\) for any time period t reads

We follow Wooldridge (1995) and estimate a probit model for each time period (year) separately. The outcome model will be informed by the first-stage through the inclusion of inverse Mills’ ratios for each one of the three treatment indicators \(S^v_{it}\) with \(v\in \{E,M,ME\}\). It will be useful to define the normal densities \(\phi ^v_{it}\) and cumulative normal densities \(\Phi ^v_{it}\) as

to formulate the inverse Mills’ ratios for the type-v-treated (\(\lambda ^v_{1,it}\)) and for all observations (\(\lambda ^v_{it}\)) regarding treatment type v as

respectively.

Using \(\hat{\lambda }^v_{it}\) to denote an estimate of \(\lambda ^v_{it}\), we will estimate the outcome equation

where \(\left( \sum _{v\in \{E,M,ME\}}\rho ^v_t\hat{\lambda }^v_{it}\right) \) serves as a control function to absorb the self-selection bias of \(\alpha ^vs^v_{it}\).Footnote 3

3.1 Selection-model estimates

We estimate probit models for \(P(S^v_{it}=1)\) for each treatment \(v\in \{M,E,ME\}\) and year \(t\in \{2007, \ldots ,2017\}\), separately. For brevity, we report on a version of this probit model, where we pool the parameters across all years, in Table 4 and relegate results for annual probit models to “Appendix B.” The latent variable underlying the probit models is determined as in Eq. (1).

As the standard theory on exporting and MNE status predicts (see Helpman et al. 2004), firm-level productivity (reflected in domestic sales) has a positive impact on choosing exporting as well as the MNE status. Tangible assets are positively related to the exporting status of firms, independent of their MNE status, while for non-exporting MNEs the impact is negative and statistically significant. The coefficients on log productivity with non-exporting MNEs and exporting domestic firms are not different from each other at customary statistical levels: a student’s t test does not reject the null hypothesis of the parameter being identical (the associated p value is 0.271). It appears that by distinguishing between non-exporting and exporting MNEs, the commonly assumed relationship between productivity (domestic sales) and firm status is changed.

Recall the comparison of the statistics regarding the observable across the firm types in Table 3, and note that they are broadly consistent with the results of the pooled probit model in Table 4. Specifically, the link between non-exporting MNE status and the productivity measure is much weaker than for other firms and similar to that with domestic non-exporting firms (the control group).Footnote 4

3.2 Second-stage outcome-regression estimates

Table 5 shows the results of two versions of the outcome equation based on Equation (7): Models (1) and (3) are standard (firm-)fixed-effects models, which exclude inverse Mills’ ratio terms, and Models (2) and (4) are the proposed three endogenous treatments fixed-effects models. The average treatment effects in Models (1) and (3) are apparently biased toward zero. We focus on the discussion of the parameters in Model (4), as Models (1) and (3) are rejected based on a joint F-test on the exclusion of the three inverse Mills’ ratios.

Before presenting the results regarding the treatment effects on the average wage outcome, let us add two remarks. First, one might generally wish to include regressors in the first-stage probit models which are excluded in the second-stage model. However, this is particularly the case for sample-selection models.Footnote 5 Second, we utilize block bootstrapping to calculate the standard errors in our second-stage regression analysis. The method involves re-sampling individual firms, along with all their observations across the years. This considers the correlation of firm characteristics over time. The block-bootstrapping approach provides a more accurate approximation of various distributions compared to traditional asymptotic approximations (see Kapetanios 2008 or Hall 2013).

According to Model (4) in Table 5, the average worker of exporting domestic firms and exporting MNEs enjoys a significant positive wage premium. Note that this premium is composed of two components: the differences in the composition of the workforce in exporting domestic and multinational firms relative to domestic non-exporters (we cannot measure this difference in the data); and the within-worker-and-task-type premium awarded by firms. After all, such companies are not only significantly larger, but they also have more elaborate organizational structures and more complex task compositions linked to their type (see Caliendo and Rossi-Hansberg 2012). Accordingly, workers in exporting MNEs have the highest average wages. On the other hand, the average worker and employee of a non-exporting MNE—which is comparatively small on average—earns less that the one of a domestic non-exporting firm. Our findings suggest that the wage premium of MNEs is determined mainly by the exporting status of the firm rather than the MNE status per se. This is consistent with Setzler and Tintelnot (2021) who find that the integration into multinational production networks (and hence implicitly exporting within the network) drives the MNE wage premium and foreign ownership on its own is not sufficient. The relationship between productivity and export status has been extensively documented in the literature, based on works by Melitz (2003) and Helpman et al. (2004). This relationship may also apply to MNEs within a country. Specifically, only the most productive MNEs may choose to export, while less productive MNEs may supply only to the local market, as discussed by Garetto et al. (2019). This would account for the wage differences observed between exporting and non-exporting MNEs. Furthermore, arguments by Caliendo and Rossi-Hansberg (2012) suggests that non-exporting MNEs likely have a flatter organizational structure than exporting and even purely domestic firms, with high-skilled management positions centralized at the headquarters. This could further contribute to the lower average wages observed in non-exporting MNEs. Additionally, there is a literature documenting the violation of governance and social standards by MNEs abroad. For example, Aaronson (2005) and Clerc (2021) highlight historical inefficiencies in MNEs’ due diligence regarding global supply chain operations concerning both foreign affiliates and arm’s length suppliers of MNEs. This suggests that some MNEs may use foreign affiliates to reduce production costs by undercutting standards that would apply elsewhere.

According to Table 5, the average premium estimated conditional on log firm productivity are considerably large. The results suggest that non-MNE exporters pay wages to the average worker that exceed the ones of domestic non-exporters by about \(100\exp (0.459)-100\approx 58\%\) on average. MNE exporters pay even higher average wages of \(100\exp (1.008)-100\approx 174\%\) beyond the ones of domestic non-exporters. Non-exporting MNEs pay an average wage which is \(100\exp (-0.283)-100\approx 61\%\) lower than the one of non-exporting domestic firms. These premia for exporters are larger than the ones reported in Egger et al. (2013) for France. However, the latter paper did not distinguish between the four treatment states considered here, and it relied on cross-sectional rather than fixed-effects panel regressions. We also would expect that the participation in global markets as exporters or parts of an MNE network permits paying higher wages in countries which find themselves in transition to the western European average than in France or other frontier countries in Europe. And for the quantitative interpretation, we should emphasize again that the premia are ones for average workers and employees in a company, and the profiles and tasks of the workforce would be expected to vary across the size distribution but also the considered types of firms.

4 Robustness checks

In this section, we discuss two robustness checks. First, we use a 25% foreign ownership threshold to classify MNEs instead of one of 50%. Second, we exclude wholesale firms from the data.

A 50% ownership threshold is commonly used in the literature to define subsidiaries (e.g., see Criscuolo and Martin 2009, Egger et al. 2020, or Langenmayr and Liu 2023). This definition ensures full control over the subsidiary, and, hence, the production strategy and wage setting can clearly be determined by an ownership of this extent. However, lower ownership shares might impact firm strategies and behavior. As a robustness check we replicated the estimations above using a 25% foreign ownership threshold to classify firms as MNEs. The results are qualitative and quantitative very similar to the 50% ownership threshold sample, as can be seen from the detailed results reported in “Appendix C.”

Another concern might be the inclusion of wholesale firms in our data. The focus of wholesale firms might be on low-value-added segments of the value chain. Accordingly, wages in these firms should be lower than on average. These firms would act as local distribution centers that only serve the local market. If this were the case primarily for non-exporting MNEs, the treatment effect would reflect the wholesale specialization effect rather than an average treatment effect of non-exporting MNEs. Table 6 shows the shares of wholesale firms by firm type. Interestingly, non-exporting MNEs do not represent an outlier in the data: exporting MNEs have a higher share, while non-exporting domestic firms have a lower share of wholesalers among their ranks.Footnote 6

While the sectoral composition of firm types is rather similar and the inclusion of Mundlak–Wooldridge means (firm-level fixed effects) imply that the treatment effects are identified only from the within-firm variation over time, we still provide regressions results excluding all wholesale firms in “Appendix D.” The results based on the second robustness check indicate the following. Indeed, non-exporting MNEs are less productive and smaller than other considered form types on average. However, they do not systematically differ in terms of their sector affiliation from other firm types. This may reflect that non-exporting MNEs focus on simpler tasks and less profitable segments of the value chain, and this may result in conditionally lower wage premia in comparison with exporting firms (non-MNEs and MNEs).

5 Conclusion

In this paper, we investigate the wage premia paid for average workers and employees across different types of companies which are differentiated in exporting versus non-exporting and domestic versus multinational types. We treat the selection into these treatment states as one based on unobservables in the tradition of Heckman (1979) and Wooldridge (1995)

To this end, we rely on firm-level data of Bosnia and Herzegovina, Croatia, and Slovenia from Bureau van Dijk’s Orbis database. In contrast to the existing literature, we differentiate between four types of firms: (i) firms that operate only domestically, i.e., are not multinational firms or exporters; (ii) firms that are exporting goods, but are not multinationals; (iii) firms that are multinationals, but are not exporting any goods, (iv) exporting multinationals. We use a Wooldridge (1995) multivariate endogenous treatment model to establish a causal relationship between firm status and (average) wages within the firm. Consistent with the theoretical literature on exporters and MNEs, we use domestic sales (productivity), fixed costs, and profit margins, to determine the endogenous treatment in our model.

We find that the average wage for workers in (exporting) multinational firms in these three countries is significant higher compared to firms that only operate domestically. However, this only holds for exporting multinationals, but not for non-exporting ones. The latter are much more similar to non-exporting domestic firms and they even pay less than domestic firms. Thus, when estimating the multinational wage premium lumping, exporting and non-exporting multinationals together will induce a downward bias.

Notes

For instance, such a pattern is consistent with sales platforms that only serve the headquarters and other affiliates in the MNE network upstream of the value chain. A highly differentiated organization of the value chain across the affiliates within an MNE’s network of firms permits focusing on production stages in some of its affiliates that do not rely on sophisticated skills of the workforce and do not require to pay said workforce any premia. Consistent with this notion, Bernard and Jensen (2007) report on low positive correlations between log wages and the binary network participation of foreign plants in MNE networks of US headquarters. That correlation is lower than the one with the export status of affiliates.

Also trade costs matter, but those are either highly correlated with fixed costs or largely time-invariant over short periods.

An alternative specification of the control function would be one, where \(\left( \sum _{v\in \{E,M,ME\}}\rho ^v_t\hat{\lambda }^v_{it}\right) \) is replaced by \(\left( \sum _{v\in \{E,M,ME\}}\sum _{v^{\prime }\in \{E,M,ME\}}\rho ^{vv^{\prime }}_tS^{v^{\prime }}\hat{\lambda }^v_{it}\right) \).

The reason is that in small-to-medium-sized samples, the inverse Mills’ ratio is close to being linear in the variables in \(X_{it}\), which would lead to collinearity between \(X_{it}\) and \(\hat{\lambda }^v_{it}\). However, this is less of a concern with larger data. Moreover, as noted by Vella (1998), the inverse Mills’ ratio is nonlinear by design with self-selection into treatment, which eliminates the requirement of outside regressors even in small to medium-sized samples.

In “Appendix D,” we show an even more detailed comparison of the sectoral distribution by firm type. From this comparison, it can be see that the four considered firm types are rather similar in terms of their sector affiliations.

References

Aaronson SA (2005) Minding our business: what the United States government has done and can do to ensure that U.S. multinationals act responsibly in foreign markets. J Bus Ethics 59(1):175–198

Arkolakis C (2010) Market penetration costs and the new consumers margin in international trade. J Political Econ 118(6):1151–1199

Baltagi BH, Egger PH, Kesina M (2019) Contagious exporting and foreign ownership: evidence from firms in Shanghai using a Bayesian spatial bivariate probit model. Reg Sci Urban Econ 76:125–146 (Spatial Econometrics: New Methods and Applications)

Bandick R, Görg H (2010) Foreign acquisition, plant survival, and employment growth. Can J Econ/Revue canadienne d’Economique 43(2):547–573

Baumgarten D (2013) Exporters and the rise in wage inequality: evidence from German linked employer–employee data. J Int Econ 90(1):201–217

Caliendo L, Rossi-Hansberg E (2012) The impact of trade on organization and productivity. Q J Econ 127(3):1393–1467

Chaney T (2008) Distorted gravity: the intensive and extensive margins of international trade. Am Econ Rev 98(4):1707–21

Clerc C (2021) The French ‘duty of vigilance’ law: lessons for an EU directive on due diligence in multinational supply chains. ETUI Policy Brief Eur Econ Employ Soc Policy 1:1–5

Criscuolo C, Martin R (2009) Multinational and U.S. productivity: evidence from Great Britian. Rev Econ Stat 91(2):263–281

Eaton J, Kortum S (2002) Technology, geography, and trade. Econometrica 70(5):1741–1779

Egger H, Kreickemeier U (2009) Firm heterogeneity and the labor market effects of trade liberalization. Int Econ Rev 50(1):187–216

Egger H, Kreickemeier U (2013) Why foreign ownership may be good for you. Int Econ Rev 54(2):693–716

Egger H, Egger P, Kreickemeier U (2013) Trade, wages, and profits. Eur Econ Rev 64:332–350

Egger P, Riezman R, Zoller-Rydzek B (2018) Multi-unit firms and their scope and location decision. mimeo

Egger PH, Strecker NM, Zoller-Rydzek B (2020) Estimating bargaining-related tax advantages of multinational firms. J Int Econ 122:103258

Ekholm K, Forslid R, Markusen JR (2007) Export-platform foreign direct investment. J Eur Econ Assoc 5(4):776–795

Garetto S, Oldenski L, Ramondo N (2019) Multinational expansion in time and space. Working Paper 25804, National Bureau of Economic Research

Gumpert A, Li H, Moxnes A, Ramondo N, Tintelnot F (2020) The life-cycle dynamics of exporters and multinational firms. J Int Econ 126:103343

Hall P (2013) The bootstrap and edgeworth expansion. Springer, Berlin

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47(1):153–161

Helpman E (1984) A simple theory of international trade with multinational corporations. J Political Econ 92(3):451–471

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus FDI with heterogeneous firms. Am Econ Rev 94(1):300–316

Helpman E, Itskhoki O, Muendler M-A, Redding SJ (2017) Trade and inequality: from theory to estimation. Rev Econ Stud 84(1 (298)):357–405

Kapetanios G (2008) A bootstrap procedure for panel data sets with many cross-sectional units. Econom J 11(2):377–395

Langenmayr D, Liu L (2023) Home or away? Profit shifting with territorial taxation. J Public Econ 217:104776

Lev B (2003) Remarks on the measurement, valuation, and reporting of intangible assets. Econ Policy Rev (Sep):17–22

Li G, Li J, Zheng Y, Egger PH (2021) Does property rights protection affect export quality? Evidence from a property law enactment. J Econ Behav Organ 183:811–832

Manova K (2012) Credit constraints, heterogeneous firms, and international trade. Rev Econ Stud 80(2):711–744

Markusen JR (2004) Multinational firms and the theory of international trade. The MIT Press, London

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Orefice G, Sly N, Toubal F (2021) Cross-border merger and acquisition activity and wage dynamics. ILR Rev 74(1):131–162

Setzler B, Tintelnot F (2021) The effects of foreign multinationals on workers and firms in the United States. Q J Econ 136(3):1943–1991

Tintelnot F (2016) Global production with export platforms. Q J Econ 132(1):157–209

Vella F (1998) Estimating models with sample selection bias: a survey. J Human Resour 33(1):127–169

Wooldridge JM (1995) Selection corrections for panel data models under conditional mean independence assumptions. J Econom 68(1):115–132

Funding

Open access funding provided by ZHAW Zurich University of Applied Sciences.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Productivity measure

In this section, we provide a general intuition for relying on domestic sales as a measure of firm-level productivity.

Let us use the following convention for an arbitrary constant-returns-to-scale (CRS) technology, where output \(q_v=q(\psi _v)\) of a firm v with total-factor productivity \(\psi _v\) is produced by a factor bundle \(F_v(q)\) per efficiency unit. In general, output in this case is \(q_v=\psi _vF_v\). For example, if output were produced with labor (\(L_v\)) only, then \(q_v=\psi _vL_v\). If output were produced by a Cobb–Douglas technology with capital (\(K_v\)) and labor (\(L_v\)) at labor-cost share \(\gamma \), we could write \(F_v=L^{\gamma }_vK^{1-\gamma }_v\), and \(q_v=\psi _v L^{\gamma }_vK^{1-\gamma }_v\). With profit-maximizing firms that charge a fixed markup of \(\mu \)—e.g., with \(\mu =0\) under perfect competition or with \(\mu >0\) under monopolistic competition, the two customary types in quantitative international economics—the optimal price of firm v per unit of output is \(p_v=\mu c \psi ^{-1}\), where c is the cost of the factor bundle (e.g., labor only or labor combined with capital, etc.) per efficiency unit, and \(\psi ^{-1}\) is the unit requirement of the factor bundle (the input coefficient which corresponds to inverse total-factor productivity). This is exactly the structure prevailing in the models of Eaton and Kortum (2002), Melitz (2003), Helpman et al. (2004), or Arkolakis (2010) to mention but a few. Denote the revenues in the domestic market (i.e., domestic sales) of any firm v by \(r^D_v\), and note that under the assumption of identical, unitary trade costs in the domestic market, firm v’s domestic revenues can be specified as \(r^D_v=p^{\eta }_vS\), where \(S>0\) is a shifter that is common to all firms in their domestic sales and \(\eta <0\) is commonly referred to as the trade elasticity (is related to the price elasticity of demand). The latter does not only imply that the relative domestic sales between firms v and \(v^{\prime }\) are \((r_v/r_{v^{\prime }})=(p_v/p_{v^{\prime }})^{\eta }\) and depend (inversely) on prices only, but with \((p_v/p_{v^{\prime }})^{\eta }=(\psi _v/\psi _{v^{\prime }})^{-\eta }\) they are even a function of productivity only (apart from the trade elasticity \(\eta \)). Hence, under assumptions that are customary in the quantitative literature of international trade, the relative domestic sales of firms are positively related to their relative productivity and, apart from the common demand elasticity, to nothing else. This is why the relative sales of the firms from one market are often used to infer their productivity in datasets, where such sales are available. (Note that the total sales or revenues per firm are not sufficient.) The strategy had been formally introduced by Arkolakis (2010), and a body of work followed it since.

Appendix B: Annual probit estimates

Tables 7, 8 and 9 present the parameters on the time-variant regressors in the probit models for being a non-MNE exporter only, a non-exporting MNE, and an exporting MNE. In contrast to the results in Table 4, the underlying probit model is estimated for each year separately, and we omit the time-fixed effects, which are annual constants in this case. Each column of a table gives the estimation results for a specific year in the data. For each indicator equal to unity, we compute the inverse Mills’ ratios \(\hat{\lambda }^v_{it}\) as introduced in the main text.

Appendix C: Robustness check with 25% ownership threshold

The following two regressions Tables 10 and 11 show the pooled first-stage probit model and the second stage regression when using a 25% foreign ownership threshold to classify MNEs. The results are very consistent with the regressions presented in Sect. 3. Thus, our findings are not driven by a very strict definition of MNEs status.

Appendix D: Robustness check excluding wholesale firms

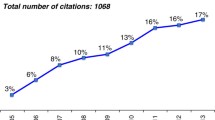

In this section, we conduct the same analysis as in the main text for a sub-sample of firms that excludes wholesalers and retailers. First, we present results regarding the distribution of firms across 2-digit NACE categories in Fig. 1. All firm types display rather similar distributions across all industries.

Tables 12 and 13 show the pooled first-stage probit results and the second-stage results exclusing wholesale firms. All results are very robust.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Egger, P.H., Gunes, P.K. & Zoller-Rydzek, B. Multinational and exporter wage premia: evidence from southeastern Europe and a panel multiple-treatments approach. Empir Econ 66, 2451–2470 (2024). https://doi.org/10.1007/s00181-023-02535-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02535-2