Abstract

Promoting legality and productivity is a central issue in modern economies. In this paper, we investigate the implications of a public policy that aims at achieving these goals through the adoption of the so-called legality rating (LR). The latter reduces corporate risk uncertainty by abating asymmetric information between companies that use good legal, fiscal and ethical practices and the credit system. We match companies whose legal and ethical practices have been certified by the Italian government—through the assignment of the LR—with a sample of unrated firms, and apply recent advances in nonparametric frontier analysis to assess the economic performance. We highlight a positive relationship between legality rating and firms’ production efficiency. Our findings also show that legality rating policy is an effective tool to enhance inter-regional technological catching-up of businesses.

Similar content being viewed by others

1 Introduction

The implementation of policies able to enhance legal and ethical activities is a matter of growing interest in modern societies. Government plays a key role in promoting the development of economic activities, especially when these are restricted by illegal practices and other forms of unfair competition. In particular, the capacity of the government to release firms’ official information on legal, fiscal and ethical status becomes relevant when companies interact with other stakeholders, such as consumers, investors and public institutions. The disclosure of such information can abate problems of adverse selection, free-riding and moral hazard (Steurer 2011), with important consequences in terms of higher markets stability and better economic environments. This, in turn, can both reduce the impact of criminal activities in the economy and promote firms’ legal, fiscal and ethical good practices, thus correcting market imperfections that, in the absence of information, may favour free-riding firms.

Embedded in this line of reasoning, we investigate in our paper whether a trade-off between legality, i.e. firms’ formal and substantial respect of legal standards, and the efficiency of firms exists. This research question is fundamental to a better understanding of firms’ strategic behaviour, since they may choose to adopt different degrees of compliance to either legal or ethical norms for a number of reasons. A first motivation may be merely that of increasing their profits through, for instance, tax evasion. A second reason may be driven by competition among firms. When some firms free-ride on the compliance with legal standards, the other companies face tougher competition and may either be pushed out of the market or be induced to adopt similar illegal strategies.

To address whether firms face a trade-off between legality and efficiency, we exploit a public policy that has introduced in Italy—starting from 2012—the so-called legality rating (LR). The aim of the reform is to certify the degree of attention paid by companies to the sound and responsible management of businesses. The LR is assigned to Italian firms that fulfil all the requirements established by law, and entails advantages and preferences in obtaining public funding and facilitation of access to bank credit, in terms of cost and speed of procedures.

In order to carry out our empirical analysis, we first select the full set of firms that received a legality score from the Italian government and match them with a sample of unrated companies with similar characteristics in terms of geographical area, sector and size; we adopt a propensity matching score approach and link each LR company to the “nearest neighbours” in terms of firms’ propensity scores. Then, following recent developments in nonparametric frontier literature (Cazals et al. 2002; Daraio and Simar 2005; Bădin et al. 2012; Mastromarco and Simar 2015), we apply a robust nonparametric two-step approach to investigate the transmission mechanism through which both the legality score, rated as a corporate risk indicator, and the long-term debt, used as a proxy for the firm ability to access credit, may affect firms’ performance. By using a matched sample of 3,636 firms with the LR and 10,258 firms without the LR over the period 2011–2017, we explore the channels under which the legality rating and the long-term debt foster productivity by disentangling the impact of these external factors on the production process and its components: impact on the attainable production set (input–output space) and on the distribution of efficiencies.

In particular, after the seminal papers by Aigner et al. (1977) and Meeusen and van den Broeck (1977), frontier methodology has been widely used in empirical studies aiming to estimate the economic efficiency of various economic systems (firms, industries, regions, etc.) and, moreover, to analyse the factors that may affect the production process, such as production factors (shape of the frontier), technological factors (shift of the frontier) or efficiency factors (distance from the frontier) (Kumbhakar and Lovell 2000; Bădin et al. 2012). There are two different approaches, one parametric and the other nonparametric, to estimate frontier models. The parametric approach suffers from misspecification problems when the data-generating process is unknown, as usual in the applied studies, and nonparametric methods often give the most reliable results. The reduced number of assumptions needed to specify the data generating process (DGP) is quite an attractive feature of the nonparametric approach. Hence, we prefer using a nonparametric approach since it does not require restrictive assumptions on the production function form and distributions of efficiency and stochastic errors.

Our results highlight that firms awarded with the LR exhibit a higher efficiency, especially in the manufacturing, construction and retail sectors. This is against the common wisdom that firms which free-ride attain better rewards because they reduce the costs of compliance with legal standards (Becchetti et al. 2017). Conversely, our findings support the idea that a positive relation between legality and efficiency exists for reasons associated with a reduction in financial, legal and tax risks that lead, in turn, to less negative shocks for sound companies. At the same time, firms with the LR gain a better reputation in the economic environment that helps them to establish more trustworthy relationships with both their investors and customers (Branco and Rodrigues 2006; Alwi et al. 2017; Wanner and Janiesch 2019). Furthermore, companies that guarantee higher standards of corporate social responsibility (CSR) may offer better working environments that, in turn, attract more skilled and productive workers.

We also show that the release of certified information through the LR facilitates companies in terms of accessing to the bank credit. Thanks to the larger long-term funding by the credit system, firms undertake greater productive investments that translate into a higher level of efficiency. This is also true for healthy but less efficient businesses. Indeed, the LR allows these companies not only to improve their productivity, but also to converge towards the same levels as the most efficient companies. These results are also important at inter-regional level. In fact, considering that less efficient firms are generally located in less productive areas and that the LR produces a convergence in terms of productivity between firms that obtain it, the release of the LR also generates a convergence of productivity at inter-regional level. In addition, the reduction of information asymmetries, and therefore, of the corporate risk perceived by the credit system, allows banks to identify the companies on which to convey long-term credit better. This makes it possible to reduce the territorial variability in the granting of credit and, therefore, to converge credit transactions also at the inter-regional level.

In fact, banks that usually calculate an “insolvency rating” concerning financial data only are offered—through the LR—further guarantees that reduce banking risk (Pizzi et al. 2020); in this sense, the LR can be seen as a tool for the financial stabilisation of the economic system. Furthermore, banks that do not grant credit to the companies with legality rating must account for their denial by sending a report to the central bank containing the reasons for the rejection. According to the Bank of Italy, there were 3,265 and 4,400 legally rated companies that requested and obtained financing from the banking system in 2016Footnote 1 and 2017,Footnote 2, respectively. The legality rating generated benefits for 34% of them in 2016 and 40% in 2017 in the form of better economic conditions in the granting of loans, shorter timing and lower costs of preliminary bank investigation.

The remainder of the paper proceeds as follows: Section 2 presents the Legality Rating introduced in Italy in 2012; Section 3 describes the methodology and Section 4 the data; Section 5 presents the empirical results; and Section 6 concludes.

2 Legality rating (LR)

In 2012, the Italian government introduced the LR as a new tool for companies, aimed at promoting and introducing principles of ethical and transparent behaviour in the business environment.Footnote 3 The LR is a “recognition”, measured in “stars”, indicative of the respect for the lawfulness of companies and, more generally, of the degree of attention paid to the sound and responsible management of their businesses. The assignment of the LR entails advantages and preferences in obtaining public funding and facilitation of access to bank credit, in terms of cost and speed of procedures. Indeed, banks that do not grant credit to a company having the LR are required to motivate the choice with a specific note to the Bank of Italy. Additionally, public administrations can adopt the LR as a reward criterion in the awarding of public contracts. Other benefits of the LR may lie in the competitive advantages arising from the increase in transparency and market visibility and the boost of reputation and reliability towards the business stakeholders (Caputo and Pizzi 2019).

Companies are granted the LR by the Autorità Garante della Concorrenza e del Mercato (AGCM), whose members are appointed by the presidents of Senate and Chamber of Deputies of the Italian Parliament and are independent from the government, if some minimum requirements are met, as follows:

• they have achieved a minimum turnover of € 2 M during the last fiscal year, reported in financial statements regularly approved by the corresponding company body and published according to the law for the single firm or the group it belongs to;

• they have been recorded in the official company register for at least the last two years;

• they have operational headquarters in Italy.

The rating varies in a range between a minimum of one star and a maximum of three stars, awarded by the Authority based on information held by the public administration offices. The base score can be increased by a “+” for each additional requirement that the company respects among the expected ones. The achievement of three “+” involves the attribution of an additional star, up to a maximum score of three stars. In order to obtain the minimum score of “one star”, the company’s owner and other people subject to the rating (e.g. directors and legal representatives) must not have been convicted of specific crimes, including tax and Mafia-type association crimes, or are not subject to related preventive and or precautionary measures.

In addition, in the two years preceding the rating assignment, the company must not have been convicted of serious antitrust violations or violations of the consumer code or failure to comply with the rules to protect health and safety of employees in the workplace or violations of salary, contributory, insurance and tax obligations towards its employees and collaborators. The fulfilment of these criteria contributes, among other things, to improve the working environment and, therefore, to attract a more talented and motivated workforce. This, in turn, has a positive effect on firms’ efficiency. Furthermore, the company must not have been a recipient of measures to ascertain the non-payment of taxes and fees and must not have been subject to revocation measures for public loans the company was obliged to return. The company also must not be a recipient of sanctions implying preclusion to the signing of contracts with the public administration or to participation in tendering or awarding of public contracts for works, services or supplies. Finally, the company must also make payments and financial transactions of an amount higher than a one-thousand-euro threshold, exclusively with traceable payment instruments.

In order to grant “two or three stars”, the law requires firms to comply with additional requirements. Specifically, among them, companies must: adopt processes to guarantee forms of Corporate Social Responsibility, ethical conduct and prevention and fight of corruption; be registered in one of the lists of suppliers, service providers and executors of works not subject to Mafia infiltration attempts; and have effective control procedures. The legality rating has a duration of two years from the issue and is renewable upon request. In the event of the loss of one of the basic requirements necessary to obtain a star, the Authority revokes the rating. If the requirements for which the company has obtained a higher rating are no longer met, the Antitrust reduces the number of stars. The Authority keeps the list of companies which the legality rating has been assigned to, suspended, or revoked (with the relevant starting date) updated on its website.

3 Methodology

We consider a production technology where the activity of the production units—firms in our case—is characterised by a set of inputs \(X \in {\mathbb {R}_+^p} \) used to produce a set of outputs \(Y \in {\mathbb {R}_+^q} \) and a generic vector of environmental variables \(Z \in {\mathbb {R}^d}\).Footnote 4

Following Cazals et al. (2002) and Daraio and Simar (2005), the unconditional production set, that is the set of technically feasible combinations of (x, y), is defined as:

This can be characterised by \(\Psi =\{(x,y) | H_{X,Y}(x, y) > 0\}\) where \(H_{XY}(x,y) = \text {Prob}(X \le x, Y \ge y)\). So \(\Psi \) is the support of the joint random variable (X, Y). The unconditional (marginal) output-oriented Farrell–Debreu technical efficiency of a production plan (x, y) is defined as

where \(S_{Y|X}(y|x)= Prob (Y \ge y | X \le x)\) is the nonstandard conditional survival function of Y given that \(X \le x\).

For conditional efficiency measure, we define the attainable set \(\Psi ^z_t \subset \mathbb {R}_+^{p+q}\) as the support of the conditional probability:

Accordingly, the conditional output-oriented technical efficiency of a production plan \((x,y)\in \Psi ^z\), facing conditions z, is defined in Daraio and Simar (2005) as

where \(S_{Y|X,Z}( y | x,z) = Prob(Y\ge y | X \le x, Z=z)\).

A nonparametric estimator of the conditional survival function \(S_{X|Y,Z}(x|y, z)\) could be obtained by using standard smoothing methods where a bandwidth h has to be determined for each component of Z. The choice of appropriate bandwidth selection is the focus of studies of Bădin et al. (2012), Daraio and Simar (2005), Daraio and Simar (2007). They are determined by the estimation of conditional distributions \(S_{Y|X,Z}(y| x,z)\), conditioned on \(X \le x \) and a particular value of \(Z=z\), and adapting standard tools from Hall et al. (2004) and Li and Racine (2007).

Nonparametric estimators of the attainable sets can be obtained by plugging nonparametric estimators of the survivor functions into the definitions above. Only the variables (z) require smoothing and appropriate bandwidths, since we have

where the function K is a kernel with compact support (for technical details see Bădin et al. 2010).Footnote 5

Plugging the \(\hat{S}_{Y|X,Z}(y|x,z)\) (that is the empirical version of \(S_{X|Y,Z}\)) into (2) provides the very flexible FDH (Free Disposal Hull) estimator of \(\Psi \) and allows to estimate conditional efficiency scores \(\hat{\lambda }(x, y|z)\). Optimal bandwidths can be selected by either least-squares cross-validation (LSCV) or maximum likelihood cross-validation (MLCV), both of which are asymptotically equivalent (see, for example, Li and Racine 2007). In this paper, we use LSCV to find optimal values for \(h_z\) (Bădin et al. 2010).Footnote 6

In applied studies, the application of these nonparametric techniques may be problematic due to the presence of outliers or extreme data points in real data samples, which fully determine the estimated frontier and the measurement of inefficiencies. Estimated frontier and the measurement of inefficiencies are totally unrealistic. This can be avoided by using partial order frontier with extreme orders. Approaches have been proposed in the frontier literature ( Cazals et al. (2002) and Daouia and Simar (2007)) not only to keep all the observations in the sample but also to replace the frontier of the empirical distribution by (conditional) quantiles or by the expectation of the minimum (or maximum) of a subsample of the data.

Daouia and Simar (2007) introduce the order-\(\alpha \) quantile efficiency measures to obtain more robust efficiency scores, counteracting the effects of outliers and extreme observations. They are defined for any \( \alpha \in (0,1)\) as follows (for the unconditional and conditional cases, respectively):

Hence, we are not characterising the full support of Y under the conditioning but under a less extreme quantile (unless \(\alpha = 1\)). These partial measures, using more robust techniques, accommodate possibly extreme observations, providing the same information as the full frontier estimates (for example, with \(\alpha =0.99\)). For \(\alpha = 0.50\), the order-\(\alpha \) frontier is not looking at optimal behaviour but rather at the median behaviour of firms.

3.1 The impact of environmental variables on the production process

The effects of conditioning variables on the boundary and on the distribution of the inefficiencies can be identified using the approach developed by Bădin et al. (2012).

The effect on the boundary can be detected by assessing the ratios between conditional and unconditional efficiency measures, relative to the robust partial frontier of the conditional and the unconditional attainable sets with \(\alpha =0.99\):

Examining the potential differences between the boundaries of the attainable sets and assessing the above ratio, we can just establish whether the environmental variables affect the technology: if it is increasing, it indicates a positive effect. We may also look, as suggested in Bădin et al. (2012), to the order-\(\alpha \) counterparts by choosing more central quantiles, such as the median, to investigate the effect of Z on the distribution of inefficiencies and hence on the impact of the external variables on the catching-up towards the most efficient firms (technological frontier). The ratios to be analysed are the same, but \(\alpha =0.5\) in this case.

Potential shifting effect already observed for full frontier (the first case) may be enhanced or reduced if the effect is different with the ratios computed for smaller \(\alpha \) (second case). As, for the full ratios, a tendency of the ratios to increase with conditioning variables indicates a favourable effect of these variables on the distribution of the efficiency. The conditional distribution is more concentrated to its upper boundary when the conditioning variables increase (Mastromarco and Simar 2015). Hence, these external variables help on the catching-up towards the most efficient firms. The opposite in the case of an unfavourable effect. If this effect is similar to that shown with the ratios with full frontier, we can conclude that we have a shift of the frontier while keeping the same distribution of the efficiencies when the conditioning variables change; if the effect with the medians is more important than for the full frontier, this indicates that in addition to a shift of the frontier we have also an effect on the distribution of the efficiencies.

Since the order-\(\alpha \) efficiency scores are not bounded by 1, the ratios are also not bounded by 1. The order-\(\alpha \) efficiency scores are equal to 1 if and only if the unit (x,y) is on the \(\alpha \)-frontier, greater than 1 if they are below and smaller than 1 if they are above (Mastromarco and Simar 2015, 2018).

In practice, we use nonparametric estimators of the efficiency scores, and we explore the effects of Z, that in our case are long-term debt and legality rating, by looking at the behaviour of \(\hat{R}_{O,\alpha }(x, y|z)\) as a function of Z.

4 Data description

Our sample consists of the full set of 3,636 firms with the legality rating (LR firms hereafter) available on the website of the Autorità Garante della Concorrenza e del Mercato (AGCM).Footnote 7 AGCM shows the continuously updated list of firms with the LR assigned, revoked or suspended, on its website. We include firms with the LR assigned over the period 2015–2017 and which financial data are available on the AIDA databaseFootnote 8 in our sample. Indeed, for these firms, we extract all economic data needed to define the input and output variables used in the FDH analysis over the period 2011–2017 from AIDA.

Moreover, since LR firms only represent a small percentage of the universe of companies headquartered in Italy and might have different characteristics compared to unrated companies in our sample, we select the control group by using a propensity score matching approach. In particular, we match rated and unrated firmsFootnote 9 by running a probit in which the dependent variable, taking the value 1 if the firm obtains the LR and 0 otherwise, is regressed on fiscal year dummies, three-digit NACEFootnote 10 industry code dummies, regional dummies,Footnote 11 and firm size proxied by total sales revenue. As stated by Caliendo and Kopeinig (2008) and Heckman et al. (1997) only variables that influence simultaneously the participation decision to get the legality rating and the outcome variable, i.e. the efficiency score, should be included. It should also be clear that only variables that are unaffected by participation (or the anticipation of it) should be included in the model. Moreover, as highlighted by Bryson et al. (2002) over-parameterised models should be avoided since (1) including extraneous variables (for instance, further balance sheet items) in the participation model exacerbate the support problem and (2) the inclusion of non-significant variables can increase their variance. This is the reason why we decided to include, i.e. size, fiscal year dummies, geographic areas and sectors as potential dimensions treated and control firms might differ from each other that affect, in turn, the probability of getting the LR and the efficiency level.

Moreover, we match the sample of LR firms with a comparable sample of unrated firms, linking each company to its 3 “nearest neighbours” in terms of firms’ propensity scores.Footnote 12 This procedure, on the one hand, reduces considerably the sample size, but on the other hand, leads to the closest similarity in the predicted probabilities between the two groups of firms.Footnote 13 Table A1 reports the standardised differences, as proposed by Yang and Dalton (2012), between rated and unrated firms for regional and sector dummies and for the size of the companies. As suggested by Austin (2009), an absolute standardised difference of 0.10 or more indicates that covariates are imbalanced between groups. Instead, our results show a perfect balance in terms of firms’ characteristics between the two groups.

Therefore, in addition to 3,636 firms with the LR,Footnote 14 our full sample includes 10,258 firms without the LR observed over the period 2011–2017.Footnote 15 Hence, LR firms represent 26.2% of companies in our sample. For a graphical inspection, Fig. 12 shows the median level of rating (from 1 to 5) by province, whereas Fig. 13 shows the numerical geographical distribution of rated and unrated firms; what emerges is that the treated and the control sample are well-balanced at the territorial level.Footnote 16

We have further grouped firms with the LR according to the sector in which they operate. Following the NACE classification, we call the manufacturing cluster (1,536 firms) C, retail (537 firms) G and construction (835 firms) F. Besides the homogeneous clusters C, G and F, we included a heterogeneous cluster named MIX, which contains all the remaining sectors (728 firms). Specifically, MIX includes sectors with few firms with the LR that are not worth studying separately. Furthermore, MIX includes those companies with the LR that belong to sectors that are very different from the manufacturing, retail and construction sectors such as, for instance, agriculture, education, public administration, information and communication, services and fishing. The control sample is also split into 3,991 firms for manufacturing, 1,604 firms for retail, 2,261 for construction and 2,402 firms for MIX.

Table 1 shows the summary statistics for the variables used in the empirical exercise, split by sector, for each group of companies (rated and unrated firms). The variables used as proxies of inputs are tangible fixed assets and the number of employees. We adopted added value as a proxy of output and long-term debt and legality rating as environmental variables, i.e. exogenous factors that can affect the production process. All the variables built using data coming from the financial statements have been normalised by the number of employees.

5 Results

The LR allows companies to signal in a credible way to both the credit system and other economic agents their low level of risk deriving from full compliance with the rules of good fiscal, legal and ethical conduct. Therefore, being a risk indicator, the LR reduces the uncertainty about corporate risk as it eliminates the asymmetric information among the companies and the economic agents with which they interact.

This section compares the productivity of companies whose risk has been disclosed by the certification of the LR with that of the control sample for which this information is unknown in the economic environment where companies operate. The results will highlight the relationship between the reduction of risk uncertainty and firms productivity and the resilience of less efficient firms once their risk has been disclosed. We present the results by studying the impact of both long-term debt and legality rating on efficiency. Then, we will place emphasis on substantial policy implications at macro-regional level. We will also bring to the fore the credit system’s ability to grant credit to firms that effectively have lower business risk.

5.1 The impact of long-term debt on efficiency

In this subsection, we study the relationship between firms’ ability to access credit, as proxied by the long-term debt and their level of efficiency. In other words, we are interested in evaluating whether the long-term debt, all else being equal, is a fundamental driver of the productivity of companies and whether it explains any divergence in the efficiency scores between rated and unrated companies.

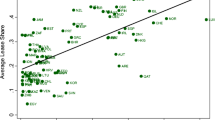

Figures 1, 2, 3, and 4 show the effects that long-term debt has on efficiency for the following sectors: retail (G), construction (F), manufacturing (C) and the mixed sector (MIX). The figures show the ratios of partial frontiers with \(\alpha =0.99\) in panels (a) and \(\alpha =0.50\) in panels (b) to evaluate the impact: i) on the boundary of technological frontier (shifts of the production frontier) and ii) on efficiency distribution (the catching-up effect towards the technological frontier). In all figures, both panels (a) and (b) denote firms’ long-term debt on the horizontal axes and the ratio (see Eq. 3) between the conditional and the unconditional efficiency scores on the vertical axes. The darker dots represent the unrated firms, and the light coloured dots are the firms with the rating. When there is no effect, the dots are concentrated around the line where the ratio is equal to one.Footnote 17

Figure 1a indicates a clear U-shaped effect between long-term debt and the ratio in the retail sector (G). This shape shows that in order to achieve an increase in technology, the retail sector needs a high level of debt. As for the catching-up effect, captured in Fig. 1b, the positive impact of debt on the productivity of median-efficient companies is clear only against a high level of debt.

The comparison between Fig. 1a and b reveals that firms on the frontier behave differently than those on the median of the efficiency distribution for low levels of indebtedness. On the other hand, their behaviour tends to converge for higher levels of indebtedness. Furthermore, debt is a more important factor for businesses that are below the efficient frontier. Indeed, for medium–high level of debt, there is an evident effect of a convergence process towards the technological frontier. The negative effect of low debt levels in Fig. 1a may denote that firms use low levels of debt for liquidity reasons rather than for productive investments. Finally, Fig. 1a and b clearly shows that relatively higher levels of investments are needed for achieving higher production efficiency.

Figure 2a exhibits a weak U-shaped effect between long-term debt and the ratio (see Eq. 3) in the construction sector (F). As regards firms below the efficiency frontier, Fig. 2b exhibits a positive relationship between the ratio and long-term debt for high levels of indebtedness, while there is no effect for small levels of indebtedness. Such an effect is particularly evident for unrated firms below the efficient frontier.

In the manufacturing sector (C), long-term debt has an effect only for high levels of indebtedness, where this effect is markedly positive, as shown in Fig. 3a. Similarly, Fig. 3b evidences that there is a positive effect of debt in making firms more efficient only at high levels of debt. We also note that for rated firms the effect is similar to unrated firms but with higher dispersion.

As far as the mixed sector (MIX) is concerned, the result displayed in Fig. 4a is ambiguous, given the mixed nature of the sample. Instead, Fig. 4b clearly highlights that indebtedness is a more important factor for companies that are below the efficient frontier. In fact, there is an evident effect of a convergence process towards the technological frontier.

In conclusion, we discover a positive relationship between long-term debt and productivity for sufficiently high levels of debt for both rated and unrated firms. This means that productivity gains require sufficiently high investments to materialise. However, the way the long-term debt shapes the productivity of firms diverges between rated and unrated firms below the efficiency frontier. In particular, rated companies are able to achieve higher levels of productivity than unrated companies for high levels of investments, which are driven by long-term debt. Thus, the median rated firms catch up in the matter of efficiency and put themselves on a par with the most efficient firms.Footnote 18

5.2 The impact of Legality Rating on efficiency

Provided the positive relationship between long-term debt and efficiency, it is interesting to understand whether rated companies become much more efficient than the counterparts after obtaining the legality rating, i.e. once the low level of risk characterising their business is disclosed.

Figure 5 provides an answer. The figure reports the average conditional efficiency on the vertical axis and the before (2011–2014)/after (2015–2017) period on the horizontal axis for both rated and unrated companies in each sector. To correctly interpret the graph, recall that the LR was introduced in 2012 and that it took a couple of years before fully implementation by the government. Therefore, it is evident that the companies in the period before they obtain the LR exhibit a level of efficiency similar to those in the control group. However, the productivity of rated firms clearly increases and diverges from that of unrated firms after achieving the rating. Therefore, the reduction of uncertainty about corporate risk through the attribution of the legality rating is very effective in promoting both legality and the productivity of healthy companies.

In what follows, we consider seven different levels of legality scores that firms can achieve and investigate whether a higher rating has a greater impact on firms’ efficiency. Each level of legality score represents a different degree of reduction in uncertainty about corporate risks; that is, companies with higher legality scores have a lower degree of uncertainty.

Figures 6, 7, 8, and 9 show the effects that the legality rating scores have on technology and efficiency in the four sectors under consideration. Precisely, each figure shows the ratios of partial frontiers with \(\alpha =0.99\) in panel (a) (effect on technology) and \(\alpha =0.50\) in panel (b) (effect on efficiency). In all panels, the graphs display firms’ legality rating scores on the horizontal axes and the ratio between the conditional and the unconditional efficiency score, presented in Eq. 3, on the vertical axes. The darker dots represent unrated firms, i.e. those with a rating score equal to “zero”, while the light coloured dots are the firms with the rating, grouped by legality scores. When there is no significant effect, the dots are concentrated around the line where the ratio is equal to one.Footnote 19

As regards both retail (G) and mixed (MIX) sectors, the effect is clearly nonlinear, as shown in Figs. 6a and 9a, respectively. For the firms on the frontier, the lowest rating scores show a slightly negative effect that becomes positive as the rating increases. Construction (F), displayed in Fig. 7a, manifests a constantly positive effect as the rating increases, starting from a rating score equal to 5. The positive effect of the rating score in the construction sector may also be due to the advantages that the law assigns to companies with the ratings in public tenders, while, for manufacturing (C), the effect visible in Fig. 8a is ambiguous. Overall, as highlighted in Figs. 6b, 7b, 8b, and 9b, the effect is clearly nonlinear for all sectors which confirms that the choice of nonparametric methodology is appropriate.

For the sake of completeness, we summarise the results of the analysis so far conducted in Figs. 23–26, highlighting the multi-dimension of Z, i.e. the joint effect of long-term debt and legality rating on the ratios for all the aforementioned sectors for \(\alpha =0.99\) (panel a) and \(\alpha =0.50\) (panel b).

As regards the sector G, F and C, it is clearly evident in Figs. 23a, 24a and 25a a nonlinear but intertwined impact of long-term debt and legality rating on the efficiency ratios. Overall, the productivity is larger for firms that register a high value in terms of both legality rating and long-term debt. We also observe a similar pattern for firms below the efficiency frontier (panel (b) of Figs. 23, 24 and 25). As far as the mixed sector (MIX) is concerned, the results displayed in Fig. 26a and 26b are again inconclusive, given the mixed nature of the sample.

Our findings highlight, on the one hand, the effectiveness of the policy (legality rating) in allowing firms to access the banking system, leading to an increase in their level of productivity, and, on the other hand, that companies which achieved the legality rating are able to reach higher levels of productivity than the rest of companies for high levels of investments, proxied by long-term debt.

5.3 Policy implications at regional level

The policy tool under investigation applies uniformly to all firms. However, the impact of such policy may be different across regions. Here, we are interested in understanding whether the economic effects are greater in the most productive regions rather than in the less productive ones. This will allow us to evaluate if the reduction of uncertainty about the business risk can be associated with divergence rather than convergence in the inter-regional productivity of healthy companies. Another aspect that we will investigate concerns an assessment of the ability of banks to grant credit to healthy companies and whether any differences have marked territorial connotations. In order to do that, we differentiate the effects of the legality rating at the macro-regional level.

5.3.1 Inter-regional convergence

First of all, we want to understand if a lower uncertainty about the risk of companies can be associated with convergence or divergence in productivity at inter-regional level. Figure 10 replicates Fig. 5 by distinguishing the efficiency effects among the North, Centre and South macro-regions, where the North is the most productive part of the country and the South the notoriously least productive one. In fact, according to Fig. 10, firms located in the North and Centre of Italy have the highest productivity before rating (see the period 2011–2014), while southern firms the lowest. Furthermore, as in Fig. 5, Fig. 10 exhibits the average efficiency scores considering all sectors together. Specifically, the figure shows a greater improvement in southern firms’ efficiency after taking the rating. Since the average efficiency score in the poorest regions increases much faster than in the other macro-regions, the legality rating seems to be a powerful policy tool to enhance productivity and drive the technological catching-up among regions. Thus, the reduction of corporate risk uncertainty benefits companies located in less productive regions to a greater extent. Clearly, the legality rating can be associated with inter-regional convergence of productivity levels among healthy firms. These results are also confirmed when we implement a difference-in-mean test on the average conditional efficiency scores between rated and unrated companies by year and geographical area (see Table A2). The difference in the level of efficiency between the two groups of firms becomes significant only after rated firms are assigned the LR and in particular in the last two years (2016–2017), regardless of the area where firms are located. Nevertheless, the magnitude of this difference seems to be larger in the South, suggesting that rated firms converge to the level of efficiency of those located in the most productive areas of the country.

5.3.2 An assessment of the ability of banks to grant credit to healthy companies

Furthermore, it is interesting to check the role of firms’ investments, as proxied by firms’ access to credit, in the inter-regional convergence of firms’ productivity. Figure 11Footnote 20 describes the average long-term debt of unrated and rated firms by macro-region during the period 2011–2017. Clearly, at the beginning of the investigation period, when no firms were awarded the legality score, sound firms had the same access to credit than companies in the control group in all the geographical areas of the country. In fact, Table A2 shows that the difference in the level of long-term debt between rated and unrated companies is negative in the Centre–North and positive in the South, but not statistically significant at any conventional levels, apart from the year 2013. Figure 11 and Table A2 also highlight what happens after firms have been awarded the legality rating. Undoubtedly, long-term debt increases after obtaining a rating score in all macro-regions. Therefore, since the capacity to borrow increases with the rating, Fig. 11 confirms that long-term debt allows firms to make investments that increase the productivity of their businesses. After obtaining the legality rating, rated companies located in the South show a greater access to credit than companies in the North and Centre. Therefore, the legality rating can be associated with convergence towards similar investment dimensions at the macro-regional level.

The analysis of Figure 11 allows us to conclude that the reduction of uncertainty on the business risk seems to play a role in the inter-regional convergence of the productivity of healthy firms as it guarantees greater access to credit for firms located in less productive regions.

6 Concluding remarks

Is there any trade-off between business productivity and legal, ethical and social good practices? The economic literature shows a lack of analysis of how to clearly disentangle the relationship between legality and firms’ productivity. This paper uncovers such a relationship by studying the economic effects of a government policy introduced in Italy that, through the releasing of information about the legal status of firms, proves to be able to enhance the growth of economic activities in environments that comply with the highest legal and ethical standards.

One of the main advantages for companies to obtain the legality rating by the central government is to signal their low-risk business conduct in order to gain easier access to bank credit. Given this motivation, we first investigate, ceteris paribus, the impact of access to credit, proxied by the long-term debt, on firms’ efficiency. The results show a positive effect on the efficiency scores of both rated and unrated companies, suggesting how the access to credit is an important factor shaping the productivity of firms in our sample. Nevertheless, the positive effect on the efficiency scores of firms with the legality rating is significantly higher, which proves the effectiveness of the policy tool used by the government.

Furthermore, we investigate whether a relation between the magnitude of the legality score, as a measure of corporate risk, and firms’ efficiency exists. In order to do that, we consider that a higher magnitude of the efficiency rating score is associated with higher compliance with legal, fiscal and ethical requirements. We find evidence of a direct relation between the magnitude of the legality rating and efficiency for high scores, especially in the construction sector, which suggests that efficiency and legality are complements rather than substitutes.

Another important issue considered in our paper concerns the consequences of releasing the legality rating at regional level. It is, in fact, interesting to know the effects of the policy in macro-regional contexts characterised by different levels of wealth and productivity. Our results show that the legality rating is more effective in regions where the efficiency levels of firms are notoriously below the average. In fact, the legality rating can be associated with lower inter-regional inequality, in terms of firms’ productivity levels, thanks to a greater access to long-term credit above all in favour of firms located in less productive regions.

Finally, the analysis highlights the existence of significant differences in the behaviour of the credit system both at regional and national level. The legality rating allows banks to better identify sound companies to which funds are to be allocated, reducing in turn the banking risk and, more generally, the systemic risk. The implementation of policy tools capable of reducing the uncertainty of the credit system regarding the risk of companies allows healthy companies to increase investments and productivity. At the same time, less productive firms can make up for the production gap. This explains why there is a positive relationship between lower uncertainty about business risk and inter-regional convergence in the productivity of healthy firms.

Notes

See Law 24 marzo 2012, n. 27 and AGCM resolution November 14, 2012, n. 24075.

In what follows, we do not take into account the panel structure of our dataset because it is heavily unbalanced, and hence, we do not model the dynamics following the approach of Mastromarco and Simar (2015). We have an estimate of the time conditional efficiency for a small sample of our dataset and our findings are confirmed (results not reported and available upon request).

As our external variables Z are both continuous “\(z^{c}\)=Long-Term Debt” and ordered discrete “\(z^{o}\)=Legality Rating”, i.e. \(z^{o}=\{0,1,...7\}\), we use a standard multivariate product kernel \(K_{h_z}(z,z_j)=\frac{1}{h_c}l^{c}(z^{c}_{j}-z^{c})l^{o}(z^{c}_{j},z^{c},h^{o})\). For the ordered discrete variable, we employ Li and Racine (2007) discrete kernel function that also takes into account the ordering of the categories \(l^{o}(z^{o}_{j},z^{o},h^{o})=h^{{o} {|z^{o}_{j}-z^{o}|}}\). However, Li and Racine (2007) at page 145 of chapter 4 of their book state: “Of course, if an ordered discrete variable assumes a large number of different values, one might simply treat it as if it were a continuous variable. In practice this may well lead to estimation results similar to those arising were one to treat the variable as an ordered discrete variable”. Given that our ordered discrete variable assumes seven different values, we might treat it as continuous.

Li and Racine (2007) explain that the main problem with likelihood cross-validation is that it may lead to inconsistent results for fat tailed distributions. For standard distributions (thin tailed), the likelihood cross-validation method works well. In section 1.3.3 of their book, they compare the performance of likelihood cross-validation and least-squares cross-validation to select bandwidth and they conclude that the resulting density estimates are identical (see pages 19–27 of Li and Racine 2007).

AIDA is owned by Italian Bureau Van Dijk and includes financial statements and other relevant details of 1 million Italian companies, with up to ten years of history.

We use psmatch2 command in Stata proposed by Leuven and Sianesi (2003).

NACE is the industry standard classification system within the European Union.

Italy is administratively divided into 20 regions.

Nearest neighbour matching is the most common form of matching used ( Thoemmes and Kim (2011); Zakrison et al. (2018)) and requires the specification of a distance measure to define which control unit is closest to each treated unit. The default and most common distance is the propensity score difference, which is the difference between the propensity scores of each treated and control unit ( Stuart (2010)).

Further, the histogram of the estimated propensity scores (not reported and available upon request) shows a notable overlap. This reassures us that for each unit in the treatment, there is a matched firm in the control with a similar value in terms of size, sector and regions. Similar results are found when we use the one-to-one matching or when we switch from the nearest-neighbour to the Mahalanobis distance matching (findings available upon request). However, the decision of implementing k-NN (with k equal to 3) lies on the trade-off between sample size (our sample is larger than that coming from the implementation of the one-to-one approach and Mahalanobis distance, but smaller compared to the sample size we get when the nearest-neighbour matching with k higher than 3 is used) and the “perfect” balance between treatment and control group in terms of the variables used in the probit model ( Austin (2009))—not always found for some covariates when the aforementioned different matching procedures are adopted.

Note that 12 companies were rated in 2015, 1,029 companies in 2016, and 2,144 in 2017. We also included 451 companies that were rated in the first month of 2018.

It is noteworthy that unrated firms in the control group are likely to fulfil all the minimum requirements needed to obtain the LR, but not the legality standards.

The map is for all sectors. The same picture can be drawn for each sector.

In Figs. 14–17 in Appendix of the paper, we present the ratios of partial frontiers with \(\alpha =0.95\) in panels (a) and \(\alpha =0.90\) in panels (b) for the retail (G), construction (F), manufacturing (C) and the mixed sector (MIX). The results are very similar to those presented in the main body of the paper.

In Figs. 19–22 in Appendix of the paper, we present the ratios of partial frontiers with \(\alpha =0.95\) in panels (a) and \(\alpha =0.90\) in panels (b) for the retail (G), construction (F), manufacturing (C) and the mixed sector (MIX). Again, our findings are not affected by the level of \(\alpha \).

Note that this figure was built with the same criteria as Fig. 5.

References

Aigner D, Lovell CK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econom 6(1):21–37

Alwi SFS, Ali SM, Nguyen B (2017) The importance of ethics in branding: mediating effects of ethical branding on company reputation and brand loyalty. Bus Ethics Q 27(3):393–422

Austin PC (2009) Balance diagnostics for comparing the distribution of baseline covariates between treatment groups in propensity-score matched samples. Stat Med 28(25):3083–3107

Bădin L, Daraio C, Simar Léopold (2010) Optimal bandwidth selection for conditional efficiency measures: a data-driven approach. Eur J Oper Res 201(2):633–640

Bădin L, Daraio C, Simar Léopold (2012) How to measure the impact of environmental factors in a nonparametric production model. Eur J Oper Res 223(3):818–833

Becchetti L, Corrado L, Fiaschetti M (2017) The regional heterogeneity of wellbeing ‘expenditure’ preferences: evidence from a simulated allocation choice on the BES indicators. J Econ Geogr 17(4):857–891

Branco MC, Rodrigues LL (2006) Corporate social responsibility and resource-based perspectives. J Bus Ethics 69(2):111–132

Bryson A, Dorsett R, Purdon S (2002). The use of propensity score matching in the evaluation of active labour market policies. Department for Work and Pensions working paper

Caliendo M, Kopeinig S (2008) Some practical guidance for the implementation of propensity score matching. J Econ Surv 22(1):31–72

Caputo F, Pizzi S (2019) Ethical firms and web reporting: empirical evidence about the voluntary adoption of the Italian “legality rating’’. Int J Bus Manag 14(1):36–45

Cazals C, Florens J-P, Simar L (2002) Nonparametric frontier estimation: a robust approach. J Econom 106(1):1–25

Daouia A, Simar L (2007) Nonparametric efficiency analysis: a multivariate conditional quantile approach. J Econom 140(2):375–400

Daraio C, Simar L (2005) Introducing environmental variables in nonparametric frontier models: a probabilistic approach. J Prod Anal 24(1):93–121

Daraio C, Simar L (2007) Advanced robust and nonparametric methods in efficiency analysis. Springer, New York

Hall P, Racine J, Li Q (2004) Cross-validation and the estimation of conditional probability densities. J Am Stat Assoc 99(468):1015–1026

Heckman JJ, Ichimura H, Todd PE (1997) Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. Rev Econ Stud 64(4):605–654

Kumbhakar S, Lovell C (2000) Stochastic frontier analysis. Cambridge University Press, Cambridge

Leuven E, Sianesi B (2003). Psmatch2: Stata module to perform full mahalanobis and propensity score matching, common support graphing, and covariate imbalance testing, version 3.0. 0. URL http://ideas.repec.org/c/boc/bocode/s432001.html

Li Q, Racine JS (2007) Nonparametric econometrics: theory and practice. Princeton University Press, Princeton

Mastromarco C, Simar L (2015) Effect of fdi and time on catching up: new insights from a conditional nonparametric frontier analysis. J Appl Econom 30(5):826–847

Mastromarco C, Simar L (2018) Globalization and productivity: a robust nonparametric world frontier analysis. Econ Model 69:134–149

Meeusen W, van den Broeck J (1977) Efficiency estimation from Cobb–Douglas production functions with composed error. Int Econ Rev 18(2):435–444

Pizzi S, Caputo F, Venturelli A (2020) Does it pay to be an honest entrepreneur? Addressing the relationship between sustainable development and bankruptcy risk. Corp Soc Responsib Environ Manag 27(3):1478–1486

Steurer R (2011) Soft instruments, few networks: How ‘new governance’ materializes in public policies on corporate social responsibility across Europe. Environ Policy Gov 21(4):270–290

Stuart EA (2010) Matching methods for causal inference: a review and a look forward. Stat Sci 25(1):1–21

Thoemmes FJ, Kim ES (2011) A systematic review of propensity score methods in the social sciences. Multivar Behav Res 46(1):90–118

Wanner J, Janiesch C (2019) Big data analytics in sustainability reports: an analysis based on the perceived credibility of corporate published information. Bus Res 12(1):143–173

Yang D, Dalton JE (2012) A unified approach to measuring the effect size between two groups using SAS. In: SAS Global Forum, vol 335, pp 1–6

Zakrison T, Austin P, McCredie V (2018) A systematic review of propensity score methods in the acute care surgery literature: avoiding the pitfalls and proposing a set of reporting guidelines. Eur J Trauma Emerg Surg 44:385–395

Funding

Open access funding provided by Università della Calabria within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised due to first author’s name correction.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

DeBenedetto, M.A., Giuranno, M.G., Mastromarco, C. et al. Legality rating and corporate efficiency: evidence from a conditional nonparametric frontier analysis. Empir Econ 66, 2137–2168 (2024). https://doi.org/10.1007/s00181-023-02511-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02511-w