Abstract

This paper employs a quantile vector autoregressive approach to compare the extent of connectedness between macroeconomic uncertainty and U.S. real activity in normal and extreme economic and financial conditions. Based on a database ranging from January 1960 to February 2023 and using the methodology of Jurado et al. (Am Econ Rev 105(3):1177–1216, 2015), we derive, first, eight real and financial uncertainty measures based on 134 macroeconomic indicators. Second, we examine the quantile connectedness among the eight estimated macroeconomic uncertainties and real activity. The results indicate that real activity is strongly (weakly) influenced by the extremely high (low) values of the real and financial uncertainty estimates, indicating asymmetric spillover effects of US macroeconomic uncertainties on real economic activity. Among the real and financial uncertainty estimates, the real output uncertainty blocks are the most important transmitters of shocks to real activity under looser economic and financial conditions. However, under tighter economic and financial conditions, higher output and income and stock market uncertainty blocks are the major spillover transmitters of shocks to real activity. Finally, connectedness between macroeconomic uncertainties and real activity exhibits the highest level during the recent COVID-19 pandemic outbreak at various quantiles.

Similar content being viewed by others

Notes

Data are retrieved from the http://research.stlouisfed.org/econ/mccracken/sel/. The database contains 128 macroeconomic indicators, we add the 6 monthly survey of purchasing managers in the manufacturing and service sectors provided by the Institute for Supply Management (ISM). We retrieve the 6 ISM manufacturing indices from the subscribed Global Economic Indicators database on Quandl (ECD | Global Economic Indicators | Nasdaq Data Link).

‘‘To ensure that the latent uncertainty factor is positive, the method of principal components is applied to the logarithm of the individual uncertainty estimates and then rescaled’’ Jurado et al. (2015).

We use the free MATLAB code provided by Serena Ng (sn2294—Code and data (google.com). After four lags selected in the FAVAR model and the suitable transformations used to transform the raw data into stationary one, the remaining sample period span from 1960:7 to 2023:2.

For each macroeconomic uncertainty plot include the uncertainty estimate along with the NBER dates, and a horizontal line corresponding to 1.65 standard deviation from the long-term average. High uncertainty is identified as macro uncertainty exceeding the 1.65 line.

4We use the R Connectedness Package provided by David Gabauer. Redirecting (google.com).

We thank an anonyms reviewer to suggest us this sensitivity analysis. The real macroeconomic uncertainty estimates include the four output uncertainties (output and income, labour market, housing, and consumption, orders and inventories) and prices uncertainty, whereas financial uncertainty measures include the three remaining uncertainties: money and credit uncertainty, interest and exchange rates uncertainty, and stock market uncertainty.

References

Ando T, Greenwood-Nimmo M, Shin Y (2022) Quantile connectedness: modeling tail behavior in the topology of financial networks. Manag Sci 68(4):2401–2431

Azqueta-Gavaldón A (2017) Developing news-based economic policy uncertainty index with unsupervised machine learning. Econ Lett 158:47–50

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Baker SR, Bloom N, Davis SJ, Kost KJ (2019) Policy news and stock market volatility (No. w25720). National Bureau of Economic Research

Balcilar M, Gupta R, Pierdzioch C (2016) Does uncertainty move the gold price? New evidence from a nonparametric causality-in-quantiles test. Resour Policy 49:74–80

Bekaert G, Hoerova M, Duca ML (2013) Risk, uncertainty and monetary policy. J Monet Econ 60(7):771–788

Bekaert G, Engstrom EC, Xu NR (2022) The time variation in risk appetite and uncertainty. Manag Sci 68(6):3975–4004

Berger D, Dew-Becker I, Giglio S (2020) Uncertainty shocks as second-moment news shocks. Rev Econ Stud 87(1):40–76

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bordo MD, Duca JV (2021) An overview of the Fed’s new credit policy tools and their cushioning effect on the COVID-19 recession. J Gov Econ 3:100013

Bouri E, Saeed T, Vo XV, Roubaud D (2021) Quantile connectedness in the cryptocurrency market. J Int Financ Markets Inst Money 71:101302

Caggiano G, Castelnuovo E, Groshenny N (2014) Uncertainty shocks and unemployment dynamics in US recessions. J Monet Econ 67:78–92

Caggiano G, Castelnuovo E, Pellegrino G (2017) Estimating the real effects of uncertainty shocks at the zero lower bound. Eur Econ Rev 100:257–272

Cesa-Bianchi A, Pesaran MH, Rebucci A (2020) Uncertainty and economic activity: a multicountry perspective. Rev Financ Stud 33(8):3393–3445

Chen J, Liang Z, Ding Q, Liu Z (2022) Quantile connectedness between energy, metal, and carbon markets. Intern Rev Financ Analys 83:102282

Dai L, Sheng X (2021) The impact of uncertainty on state-level housing markets of the United States: the role of social cohesion. Sustainability 13(6):3065

David A, Veronesi P (2022) A survey of alternative measures of macroeconomic uncertainty: which measures forecast real variables and explain fluctuations in asset volatilities better? Annu Rev Financ Econ 14

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 23:57–66

Diebold FX, Yılmaz K (2015) Financial and macroeconomic connectedness: a network approach to measurement and monitoring. Oxford University Press, Oxford

Elliott G, Rothenberg TJ, Stock JH (1992) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836

Foerster A (2014) The asymmetric effects of uncertainty. Econ Rev 99:5–26

Gupta R, Ma J, Risse M, Wohar ME (2018) Common business cycles and volatilities in US states and MSAs: the role of economic uncertainty. J Macroecon 57:317–337

Jin X, Chen Z, Yang X (2019) Economic policy uncertainty and stock price crash risk. Acc Finance 58(5):1291–1318

Jones PM, Enders W (2016) The asymmetric effects of uncertainty on macroeconomic activity. Macroecon Dyn 20(5):1219–1246

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105(3):1177–1216

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econom 74(1):119–147

Londono JM, Ma S, Wilson BA (2021) The global transmission of real economic uncertainty. International Finance Discussion Paper (1317)

Ludvigson SC, Ma S, Ng S (2021) Uncertainty and business cycles: exogenous impulse or endogenous response? Am Econ J Macroecon 13(4):369–410

Manela A, Moreira A (2017) News implied volatility and disaster concerns. J Financ Econ 123(1):137–162

McCracken MW, Ng S (2016) FRED-MD: a monthly database for macroeconomic research. J Bus Econ Stat 34(4):574–589

Nguyen Thanh B, Strobel J, Lee G (2020) A new measure of real estate uncertainty shocks. Real Estate Econ 48(3):744–771

Orlik A, Veldkamp L (2014) Understanding uncertainty shocks and the role of black swans (No. w20445). National bureau of economic research

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29

Rossi B, Sekhposyan T (2015) Macroeconomic uncertainty indices based on nowcast and forecast error distributions. Am Econ Rev 105(5):650–655

Saxegaard ECA, Davis SJ, Ito A, Miake N (2022) Policy uncertainty in Japan. J Jpn Int Econ 64:101192

Schaal E (2017) Uncertainty and unemployment. Econometrica 85(6):1675–1721

Schüler YS (2014) Asymmetric effects of uncertainty over the business cycle: a quantile structural vector autoregressive approach

Scotti C (2016) Surprise and uncertainty indexes: real-time aggregation of real-activity macro-surprises. J Monet Econ 82:1–19

Taylor JB (2013) The effectiveness of central bank independence vs. policy rules. Bus Econ 48(3):155–162

Uluceviz E, Yilmaz K (2020) Real-financial connectedness in the Swiss economy. Swiss J Econ Stat 156(1):1–20

Uluceviz E, Yilmaz K (2021) Measuring real-financial connectedness in the US economy. N Am J Econ Finance 58:101554

Funding

Funding was provided by Imam Mohammed Ibn Saud Islamic University (Grant No. RG-21-10-01).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Figs. 13, 14, 15, 16, 17 and 18.

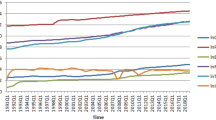

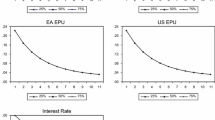

Robustness checks: selection of real macroeconomic uncertainty (RMU) versus IPI (12-month average of the monthly industrial production growth), and financial uncertainty (FU) versus IPI. MU versus IPI is the total connectedness index (TCI) of the system including the seven real and the financial uncertainty measures, and the IPI. RMU versus IPI is the TCI of the system including the five real macroeconomic uncertainty measures (output and income, labor market, housing, consumption, orders and inventories, prices) and the IPI. FU versus IPI is the TCI of the system including the financial uncertainty measures (money and credits, interest and exchange rates, and stock market) and the IPI. All TCIs are estimated at extreme lower (\(\tau =0.10\)) and upper (\(\tau =0.90\)) quantiles

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ben Haddad, H., Mezghani, I., Medhioub, I. et al. Spillover effects of disaggregated macroeconomic uncertainties on U.S. real activity: evidence from the quantile vector autoregressive connectedness approach. Empir Econ 66, 829–858 (2024). https://doi.org/10.1007/s00181-023-02474-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02474-y