Abstract

Since the beginning of the twenty-first century, several pandemics, including SARS and COVID-19, have spread faster and on a broader scale. Not only do they harm people’s health, but they can also cause significant damage to the global economy within a short period of time. This study uses the infectious disease EMV tracker index to investigate the impact of pandemics on the volatility spillover effects of global stock markets. Spillover index model estimation is conducted using the time-varying parameter vector autoregressive approach, and the maximum spanning tree and threshold filtering techniques are combined to construct the dynamic network of volatility spillovers. The conclusion from the dynamic network is that when a pandemic occurs, the total volatility spillover effect increases sharply. In particular, the total volatility spillover effect historically peaked during the COVID-19 pandemic. Moreover, when pandemics occur, the density of the volatility spillover network increases, while the diameter of the network decreases. This indicates that global financial markets are increasingly interconnected, speeding up the transmission of volatility information. The empirical results further reveal that volatility spillovers among international markets have a significant positive correlation with the severity of a pandemic. The study’s findings are expected to help investors and policymakers understand volatility spillovers during pandemics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ever since 2000, six public health emergencies of international concern (hereinafter referred to as PHEIC) have occurred, including the H1N1 pandemic in 2009 and the COVID-19 pandemic that broke out at the end of 2019. Such pandemics not only inflicted severe loss of lives but also greatly affected the global economy. As Mensi et al. (2017) pointed out, the global financial system is becoming increasingly complex, and the intertwined structure of financial markets has led to the spread of risks throughout the financial system. Events such as terrorism, financial crises, or pandemics lead to huge spreads of shocks between stock markets (Arin et al. 2008; Ben Rejeb and Arfaoui 2016; Khan et al. 2020).

Compared with other extreme events, a pandemic may take a long time before it can inflict damage on the economy; however, it can still cause rapid and intense stock market fluctuations (Yang et al. 2020a, b). For example, the announcement of the first confirmed case of COVID-19 in Saudi Arabia had a significant negative effect on the Saudi stock market (Sayed and Eledum 2021). The day after the COVID-19 pandemic was declared a PHEIC, the US stock market plummeted by 10%. Furthermore, its spread to Europe also caused the European stock markets to drop in unprecedented proportions (Capelle-Blancard and Desroziers 2020). Stock markets worldwide had different reactions to various stages of the COVID-19 pandemic. In particular, Ashraf (2021) found that stock markets responded negatively to growth in confirmed cases. From the outbreak phase to the pandemic itself, the US market had a significantly negative reaction to COVID-19 (Ramelli and Wagner 2020), and volatility in developed stock markets continued to rise (Ali et al. 2020).

Meanwhile, different pandemics may have varying impacts. For instance, Nippani and Washer (2004) concluded that SARS had no negative impact on the affected countries’ stock markets, with the exception of China and Vietnam. Macciocchi et al. (2016) showed that ZIKV shocks do not seem to have a relevant and persistent effect on stock returns. Funck and Gutierrez (2018) found that only some industries were significantly impacted by both positive and negative Ebola news days. Valle-Cruz et al. (2021) concluded that the COVID-19 pandemic’s duration and impact on economies and stock markets were much greater than those of H1N1.

Given the severe impact of pandemics on stock markets, there is an urgent need to study how they affect the volatility spillovers of international stock markets. Chen et al. (2018) confirmed that a pandemic may weaken the long-term relationship between the country at the center of such a pandemic and other stock markets. Okorie and Lin (2021) found a fractal contagion effect of the COVID-19 pandemic on stock markets. Although these studies confirmed that pandemics lead to the spread of risks across markets, they are unable to offer explanations for the varying impacts of different pandemics. Therefore, this study aims to improve our understanding of the impacts of pandemics on the volatility spillovers of international stock markets. In particular, it uses the spillover index, network, and regression models to analyze the dynamic volatility spillover effects among stock markets.

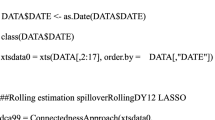

The spillover index method proposed by Diebold and Yilmaz (2012, 2014) under the framework of the vector autoregression (VAR) model based on variance decomposition can describe the influence brought about by the internal information transmission of a system. However, the Diebold–Yilmaz (DY) model is based on a sliding time window; thus, different window choices will have varying degrees of impact on the analysis results. Fortunately, Antonakakis et al. (2020) and Liu and Gong (2020) used a combination of the time-varying parameter vector autoregressive model (TVP-VAR) and the DY method (hereinafter referred to as the “TVP-DY model”), which solved the problem of data loss caused by sliding windows and improved the accuracy of the evaluation. Therefore, the current paper uses the TVP-DY method of Antonakakis et al. (2020) and Liu and Gong (2020) to obtain the time-varying dynamic volatility spillover index. Then, the method of complex networks is applied to study volatility spillovers among different stock markets during pandemics, which is considered to be an effective tool for analyzing the spillover correlation of volatility in various markets (Barigozzi and Hallin 2017; Egger and Zhu 2021; Hasse 2022). In addition, the minimum spanning tree (MST) and threshold methods are combined to reduce noise and retain as much useful information as possible. Meanwhile, to study the varying impacts that different pandemics may bring, we used the Infectious Disease EMV tracker index (EMVID) constructed by Baker et al. (2020) to quantify the severity and duration of a pandemic. Their data, collected since January 1985, include all seven severe pandemic events recorded in recent years, such as SARS and COVID-19.

Our study makes three contributions to the literature compared with previous studies. First, the empirical analysis indicated that volatility spillovers among international markets have a significantly positive correlation with the severity of a pandemic, wherein the more severe it is, the faster the transmission of volatility information. Indeed, previous studies have looked closely at the financial contagion of a specific pandemic and have not compared dynamic volatility spillovers across several pandemics. Second, this study uses the EMVID established by Baker et al. (2020) to quantify pandemic outbreaks, which can not only reflect their severity but also their durations. This is also the first time the EMVID has been used to measure the impact of pandemics on risk spillovers among global stock markets. The TVP-DY method is also used to construct the dynamic volatility spillover network to investigate volatility spillovers among different markets, thus avoiding the problem of information loss caused by sliding windows. Finally, we combined the MST and threshold dual-filtering techniques for the first time, which can better reduce noise and retain the effective information of a temporal network.

The remainder of the paper is organized as follows: the second section presents the literature review, the third section introduces the methods, the fourth section provides our empirical findings, and the fifth section summarizes the research.

2 Review of the literature

Our research is highly relevant to volatility spillovers across markets. Previous studies have confirmed that volatility in a single market spills over into other markets (Bekaert and Campbell 1997, 1995; Gamba-Santamaria et al. 2019; McIver and Kang 2020; Prasad et al. 2018; Syriopoulos et al. 2015; Wongswan 2006). Furthermore, there are higher levels of risk spillovers, especially when extreme events occur. For example, during the 1987 US stock market crash, the level of dependence of major global stock markets increased (Pindyck and Rotemberg 1993). Similarly, the East Asian and Latin American stock markets’ dependence levels increased significantly during the crisis (Rodriguez 2007). Ji et al. (2018) have demonstrated that extreme events have an impact on the intensity of information transmission in stock markets. Liu et al. (2020) found that the stock indexes of major countries and regions affected by the COVID-19 pandemic were negative affected. At the same time, scholars have analyzed the reasons for the different impacts of extreme events. For instance, Cho et al. (2015) found that the larger the economic size of a country, the wider the scope and the longer the duration of the impact. Ben Rejeb and Arfaoui (2016) confirmed that during various crises, the spread of volatility is closely related to the degree of geographic proximity.

To explore the heterogeneity of extreme events, scholars have begun to use some tracking indicators to measure the severity and duration of extreme events. For example, Arin et al. (2008) used the terrorism index to measure the risk of terrorist attacks and further analyzed stock markets’ returns and volatility changes. Beirne et al. (2013) used the Chicago Board Options exchange volatility index (VIX) to identify stock volatility and risk spillovers caused by shocks. Dakhlaoui and Aloui (2016) concluded that the uncertainty of US economic policy has a volatility spillover effect on the stock returns of BRICS countries in the short term and that a time-varying correlation exists between them in the long term. Caldara and Iacoviello (2018) constructed a geopolitical risk index (GPR index) to measure the occurrence of wars, terrorist attacks, and other events between countries or regions. The EMVID tracker developed by Baker et al. (2020) is typically used to analyze the impacts of infectious diseases on stock markets. For example, Bai et al. (2021) used this index to confirm the impact of infectious disease pandemics on the volatility of single markets.

In the study of volatility spillovers, especially those caused by extreme events, research methods are constantly updated. For example, the DCC GARCH model (Engle 2002) can model multivariate conditional volatility and the flexibility of its time-varying correlation. Many scholars have applied this model to analyze the dynamic relationship between economic indicators and to explore the internal mechanisms of economic fluctuations (Aslanidis et al. 2010; Dimitriou et al. 2013; Ehrmann et al. 2011; Filis et al. 2011). However, it is unable to reveal the volatility spillover direction and time-varying characteristics among markets. To describe the dynamics of volatility spillovers, Diebold and Yilmaz (2012, 2014) proposed the spillover index method, which is based on the variance decomposition structure of the VAR model. It can not only measure the overall spillover intensity between markets, but also subdivide the directional spillover intensity and that between specific markets, intuitively reflecting the relationship between such variables. However, the DY method also has shortcomings. Based on the sliding time window, different window selections may affect the accuracy of the analysis results to a certain extent. To compensate for the deficiency of the DY method, Antonakakis et al. (2020) and Liu and Gong (2020) proposed a new method that calculates the time-varying volatility spillover indexes based on the time-varying parameter VAR model with stochastic volatility. Using this method can obtain clearer and more stable time-varying patterns of volatility spillovers.

Furthermore, the emerging network analysis methods proposed in recent years have provided new tools for the study of cross-market volatility spillovers. Information asymmetry, clustering, and small-world property provide additional indications of profound similarities between complex and financial networks (Kyrtsou et al. 2019). Related to these, Allen and Gale (2000) developed a financial risk propagation network model, while Acemoglu et al. (2016), Cabrales et al. (2017), Kumar et al. (2020), and Elliott et al. (2021) applied network methods to analyze financial risk contagions and volatility spillovers in the global market.

In view of the continuing serious impact of the COVID-19 pandemic, this paper aims to study whether pandemics can affect the volatility spillovers of stock markets. Unlike previous studies, we focused on whether the severity of extreme events causes differences in volatility spillover effects. We adopted the EMVID indicator to quantify the duration and severity of pandemics and then used the empirical method to analyze the impacts of pandemics on volatility spillovers. At the same time, to avoid defects in the original DY model, the TVP-DY model is used to estimate the parameters of the spillover index model. Finally, the combined MST–threshold dual-filtering technique is used to filter the temporal network. The specific method construction process is shown in the next section.

3 Methods

3.1 TVP-DY model

To reveal the volatility spillover effects between stock markets, we used the TVP-DY model proposed by Antonakakis et al. (2020) and Liu and Gong (2020). According to Antonakakis et al. (2020) and Mandaci et al. (2020), we built a TVP-VAR model as follows:

where object set \({Y}_{t}\) and noise term \({\varepsilon }_{t}\) are all \(N\times 1\) vectors; \({\beta }_{t}\) depends on \({\beta }_{t-1}\) and have a \(Np\times Np\) variance–covariance matrix; \({v}_{t}\) is a \({N}^{2}p\times 1\) vector; \({S}_{t}\) and \({R}_{t}\) are the \(N\times N\) and \({N}^{2}p\times {N}^{2}p\) matrices, respectively; and p is the optimal lag length of the TVP-VAR model measured by AIC and SC. The detailed model setting and derivation process can be seen in Antonakakis et al. (2020). Meanwhile, we can obtain the generalized forecast error variance decompositions as follows:

where \(\Sigma\) represents the covariance matrix of \({\varepsilon }_{t}\), \({\sigma }_{jj}^{-1}\) is the standard error of \({\varepsilon }_{t}\), and \({e}_{j}\) represents a vector with the j-th unit value 1. Thus, the variance decomposition matrix \({D}_{ij}\left(h\right)\) reflects the spillover effect from markets j to i, which is expressed as follows:

To analyze the spillover effect, we standardized the total spillover effect of each row as 1, after which we defined the standard of \({d}_{ij}\left(h\right)\) as \({l}_{ij}\left(h\right)\) with the detailed format shown in Eq. (6):

Then, the total connectedness (or spillover) index (TCI) is given by:

We can calculate the net pairwise directional connectedness (NPDC) as follows:

3.2 Dual-filter temporal network

In this section, we construct a new fully connected directed temporal network (\({G}_{t}\)(\({V}_{t}, {E}_{t}\))) with different stock indexes as nodes and NPDC as edges. In particular, \({G}_{t}\) represents the t-th day’s spillover network, \({V}_{t}\) represents the set of nodes, and \({E}_{t}\) is the set of edges. The temporal network not only reflects the risk spillover relationship between different stock markets on day \(t\) but also the daily changes of these spillover relationships.

Due to the noise in the fully connected network, we must deal with the noise reduction of the network. Related to this, the minimum spanning tree (MST) and threshold techniques are two popular approaches to removing redundant edges. The MST method can ensure network connectivity, although it typically deletes some useful information. Meanwhile, the threshold method can retain most of the information in the network but is unable to ensure that the network is connected. Given the pros and cons of both methods, we improved the new temporal network by using a combination of the MST–threshold dual-filtering methods.

First, we filtered the fully connected temporal network with the MST algorithm proposed by Prim (1957) so that we could obtain an MST network \({G}_{t}^{1}({V}_{t}, {E}_{t})\). Then, we filtered the fully connected temporal network using the threshold method. We defined the threshold by the average of all the NPDC based on the TVP-DY model and then deleted the edges under the threshold value. In this step, we obtained another filter network \({G}_{t}^{2}({V}_{t}, {E}_{t})\). Finally, we selected all edges in \({G}_{t}^{1}({V}_{t}, {E}_{t})\) and \({G}_{t}^{2}({V}_{t}, {E}_{t})\) to obtain the dual-filtering directed network \({G}_{t}^{3}({V}_{t}, {E}_{t})\).

3.3 Measures of the dual-filter temporal network

The whole system index, such as network density, network diameter, and single market index (e.g., degree, closeness, eigenvector, and betweenness centrality), are analyzed in our paper. As these indicators are common in complex networks and would be explained in detail in the analysis later, in this section, we only present the formula and basic explanation for the day \(t\) network \({G}_{t}^{3}({V}_{t}, {E}_{t})\).

-

(1)

Network density (\(N\_Den\))

$$N_{{{\text{Den}}}} = \frac{M}{{N\left( {N - 1} \right)}}$$(9)

where M represents the respective numbers of edges and nodes.

-

(B)

Network diameter (\(N\_\mathrm{Dia}\))

$$N_{{{\text{Dia}}}} = \max \left\{ {{\text{d}}_{m,n} } \right\}$$(10)where \({d}_{m,n}\) represents the distance between node \(m\) and node \(n\).

-

(C)

Degree centrality (\(\mathrm{NC}\))

$${\text{NC}}\left( i \right) = \frac{1}{{N\left( {N - 1} \right)}}\mathop \sum \limits_{j = 1}^{n} a_{i,j}$$(11)where \(\mathrm{NC}(i)\) represents the degree centrality of node \(i\), and \({a}_{i,j}\)=1 if the node \(j\) is connected to \(i\) or node \(i\) is connected to \(j\). Then, we obtain the following formula:

$${\text{NC}}\_{\text{in}}\left( i \right) = \frac{1}{{N\left( {N - 1} \right)}}\mathop \sum \limits_{{\text{j = 1}}}^{n} b_{i,j}$$(12)where \(\mathrm{NC}\_in(i)\) represents the in-degree centrality of node \(i\), and \({b}_{i,j}=1\) if the node \(j\) is connected to \(i\).

$${\text{NC}}\_{\text{out}}\left( i \right) = \frac{1}{{N\left( {N - 1} \right)}}\mathop \sum \limits_{{\text{j = 1}}}^{n} c_{i,j}$$(13)where \(\mathrm{NC}\_in(i)\) represents the out-degree centrality of node \(i\), and \({c}_{i,j}=1\) if node \(i\) is connected to \(j\).

-

(D)

Closeness centrality

$${\text{CC}}\left( i \right) = \frac{N - 1}{{\mathop \sum \nolimits_{{\begin{array}{*{20}c} {\text{j = 1}} \\ {j \ne i} \\ \end{array} }}^{N} {\text{d}}_{{{\text{ij}}}} }}$$(14)where \(\mathrm{CC}\left(i\right)\) represents the closeness centrality of node \(i\) and \({d}_{ij}\) represents the distance between nodes \(i\) and \(j\).

-

(E)

Eigenvector centrality

$${\text{EC}}\left( i \right) = \frac{1}{\lambda }\mathop \sum \limits_{{\text{j = 1}}}^{n} a_{{{\text{ij}}}} x_{j}$$(15)

Eigenvector centrality means that the importance of a node depends not only on the number of its neighbors (i.e., the degree of the node), but also on the importance of each neighbor node. In Eq. (15), \(\lambda\) is a constant; \({a}_{ij}\) is the adjacency matrix of node \({x}_{i}\), where \({a}_{ij}=1\) when node j is the neighbor of node \(i\); and \({x}_{j}\) represents the importance measure of node \(j\).

-

(F)

Betweenness centrality

$${\text{BC}}\left( i \right) = \frac{2}{{\left( {N - 1} \right)\left( {N - 2} \right)}}\mathop \sum \limits_{1 \le j < l \le N} \frac{{n_{jl} \left( i \right)}}{{n_{jl} }}$$(16)

where \(\mathrm{BC}(i)\) represents the betweenness centrality of node \(i\), \({n}_{jl}\) is the number of the shortest path between node \(j\) and node \(l\), and \({n}_{\mathrm{jl}}(i)\) is the number of the shortest path between node \(j\) and node \(l\) when the shortest path passes node \(i\).

3.4 Impact of pandemics on stock markets

In this study, we also aim to explore the impact of EMVID on the global stock markets. Specifically, we investigated its influence on the risk spillover effect and structures of spillover networks using OLS regression as follows:

where \({\varepsilon }_{t}\) is the noise term; \({Controls}_{t}\) are the control variables in this paper, namely, VIX, term spread, and stock uncertainty; \({y}_{t}\) represents the dependent variables, which are categorized into overall indicators (e.g., total spillover index, network density, and network diameter) and individual indicators (e.g., net spillover effect of each country). The overall indicators reflect the impacts of the EMVID on all stock markets, while the individual indicators reflect the impact of the EMVID on single stock markets.

4 Empirical results

4.1 Data

Our sample includes the daily data of the stock return indices of 12 markets. Referring to the research of Ji et al. (2018), Belaid et al. (2021), and Zhang et al. (2021), we chose the representative developed markets in the USA, the UK, France, Germany, Japan, South Korea, and Hong Kong. In addition, we chose BRICS countries to represent the emerging markets, including China, India, Russia, Brazil, and South Africa. Due to the availability of data, our sample period is from August 1, 2002 to September 29, 2020; we deleted the missing data of the trading day index due to different holidays.Footnote 1 Finally, we obtained 3390 observations of daily data, which were collected from the WIND database. The specific selected indices are shown in Table 1.

4.2 Total spillover and net spillover effects

Figure 1 presents the results of the total volatility spillover effect in the global market. The total spillover effect is time-varying, and when extreme events occur, it tends to rise sharply. For instance, the total spillover effect showed a rising trend in both the 2008 financial crisis and the 2009 European debt crisis. The results support the findings of BenSaida and Litimi (2021). Unlike previous studies, we found a significant increase in total spillovers during the pandemic. Such an increase in 2003 coincided with the emergence of SARS. On February 1, 2016, the World Health Organization (WHO) declared the ZIKV pandemic a PHEIC. During this period, the total spillover effect increased sharply. The COVID-19 outbreak at the end of 2019 affected not only people’s health but also financial markets worldwide, and such an impact rapidly spread across international stock markets. On January 30, 2020, COVID-19 was officially declared a PHEIC, and the total spillover effect reached its highest point in history. To explain the particular impact of pandemics, many scholars have pointed to panic as a reason for the overall negative impact of public health events on stock markets (Donadelli et al. 2017; Ichev and Marinč 2018; Yan 2020).

The net spillover effects of developed and emerging markets are shown in Figs. 2 and 3, respectively. Developed markets are net risk transmitters over the sample period, while emerging markets serve as net risk receivers. The US stock market is identified as the main net transmitter of volatility spillover, followed by the European stock markets. Net spillovers fluctuate substantially when extreme events occur, especially those originating from extreme events. As shown in Fig. 2, in 2009, the H1N1 pandemic broke out in the USA on a large scale. This event, characterized by a relatively high net spillover effect, spread to 214 countries and regions, causing nearly 200,000 deaths. In the UK, the net volatility spillover effects from 2016 to 2020 kept decreasing until it was transformed into a risk receiver. This may be attributed to the four-year Brexit turmoil period that began in 2016. Furthermore, after the 2008 financial crisis and the 2009 European debt crisis, the net volatility spillover effect indexes in Germany and France fell. As both countries are EU members, the same Brexit turmoil period led them to share risks, turning them into risk receivers as well. While South Korea, Japan, and Hong Kong are developed financial markets, most of the time, they behave like emerging markets. In particular, during the MERS epidemic in South Korea in the second half of 2015, its net spillover index was positive. The performances of emerging markets can be seen in Fig. 3, which shows that they are mostly receivers of volatility spillover risks. However, Fig. 3 also reveals that after the outbreak of the COVID-19 pandemic, China’s absolute value became smaller, even though its net spillover index was negative. This indicates that during the COVID-19 pandemic, financial risks in the Chinese market spread to other markets. In general, the source of extreme events is more likely to be the source of volatility spillovers, but those caused by developed markets tend to be larger and longer lasting. However, the impact of a PHEIC is different. Moreover, the extent and magnitude of the impact are related to the severity of a pandemic, not to the size of the economy where the outbreak originated.

4.3 Characteristics of the dynamic network

4.3.1 Network basic index

-

(1)

Network density

Figure 4 shows the network density of the global stock market. As can be seen, the change trends of network density and the total spillover effect are consistent. In the absence of extreme events, the fluctuation of network density is small. However, in the second half of 2003, the network density suddenly showed a significant drop, which may be due to the outbreak of SARS in China. Chen et al. (2018) suggested that the SARS pandemic has indeed weakened the integration of Asian stock markets. Next, the 2008 financial crisis, the 2009 European debt crisis, and the H1N1 pandemic successively appeared, and during these crises, the correlation between markets became stronger. However, after the crisis, network density continued to decline, consistent with the findings of BenSaida et al. (2018).

From mid-2012 to mid-2017, network density experienced steady fluctuations and steadily declined. This may be attributed to countries being in the process of recovery after the crises and not being highly correlated with other markets. From the second half of 2017 to February 2018, network density rose rapidly, and during this period, global stocks were largely in a bull market. The global stock markets are increasingly interconnected because a decade after the 2008 financial crisis, central banks around the world continue to run supportive monetary policies, thus improving the global economy.

However, from early 2018 to early 2020, the network density gradually decreased, which can be attributed to the Trump administration’s announcement regarding a series of antidumping tariffs against China in February 2018. In response, the Chinese government also implemented a series of countermeasures. Since then, the world economy has entered a period of great uncertainty, and cross-market correlations have weakened accordingly.

From the beginning of February 2020, the density of the network rose rapidly, reached a peak, and then dropped rapidly. This can be attributed to the WHO officially recognizing the COVID-19 pandemic as a PHEIC on January 31, 2020, which spread panic around the world. Since then, many countries have not had enough production capacity to meet the demands of international trade, and the economic links among countries have weakened. Hence, network density has continued to decline.

-

(B)

Network diameter

According to Chaintreau et al. (2007), the diameter of a network is an upper bound on the number of intermediate hops needed to find at least one path between any two nodes. In other words, the network diameter value should be smaller when a network is more closely connected. As shown in Fig. 4, the results for network diameter and network density are consistent. For example, before 2004, global financial markets were not highly correlated, so the value of the network diameter was large. After 2004, with the continuous strengthening of global financial connections, the value of the network diameter kept dropping, indicating increasingly rapid volatility information transmission between any two nodes. Among these, the value of some special nodes is consistent with the real situation. For example, in 2003, 2009, and early 2020, the network diameter values were at the bottom of the peak due to the SARS, H1N1, and COVID-19 pandemic outbreaks, which quickly spread risks across stock markets worldwide.

Figure 5 shows the in-degree and out-degree of the spillover volatility dynamic network in developed markets. The greater the in-degree of the node, the greater the risk reception of the stock market, while the greater the out-degree of the node, the greater the intensity of risk contagion in the stock market. During the entire sample period, the USA has always served as a financial risk transmitter. In particular, when the H1N1 pandemic broke out in the USA in 2009, it caused a significantly negative impact on the global market. Similarly, before the European debt crisis in 2009, Germany, France, and the UK were also net transmitters of financial risks. However, after the European debt crisis, the European stock market suffered a huge negative impact, and the ability of financial institutions to resist risks declined. In the dynamic volatility spillover network, they gradually played the role of risk receivers. Unlike traditional developed markets, Japan, South Korea, and Hong Kong have always been risk receivers in the global stock network. This may be due to the fact that the Asian markets experienced the Asian financial crisis that started in 1997. This crisis has had a long-lasting impact and these Asian stock markets have not yet recovered to their pre-crisis level.

As shown in Fig. 6, BRICS markets mainly acted as receivers of risk transmission in the network. However, with the continuous development of BRICS countries, the contagious power of their financial risks has also increased. In particular, when special events occur, the financial risks of these emerging markets will spill over to other markets on a large scale. This may be because these emerging countries occupy an important position in the raw material processing trade, and once they stop producing, the world economy will stagnate. For example, at the end of 2019, when COVID-19 first broke out in Wuhan, China, the country immediately suspended production to fight the pandemic. China’s stock market in the first half of 2020 became sluggish, and this downturn quickly affected the stock markets of other countries. This example serves as a reminder of the serious consequences of a pandemic on stock markets.

4.3.2 Degree centrality

Figures 7 and 8 present the dynamic results of the in- and out-degree centralities of the developed and emerging markets in the dynamic network, respectively. Degree centrality measures the importance of a node in the network, in which the greater its value, the higher the position of this market in the stock risk network. With the higher centrality of the out-degree, the market is in an important position for risk transmission, and it can quickly spread the risk to other markets. Furthermore, the higher the in-degree centrality, the greater risks the country is likely to receive. As shown in Figs. 7 and 8, the out-degree centrality of the USA far exceeds that of other countries. This means that the USA occupies the most important position in the stock volatility spillover dynamic network, and its stock market fluctuations can easily affect other markets. In addition, the out-degree centrality values of other developed markets are also higher, indicating that these markets have a greater influence on the entire volatility spillover network and can cause volatility in stock spillovers to other markets. In emerging markets, the value of the out-degree centrality is always small and only increases when extreme events occur in such markets.

Figure 8 reveals the changing status of BRICS markets in the volatility spillover network, thus proving the time-varying relationship of volatility spillovers. As can be seen, South Africa and Brazil have similar results. This can be attributed to the fact that Brazil and South Africa are both resource-rich countries with relatively similar industrial structures. Meanwhile, from the results of China’s degree centrality, it can be seen that starting in 2016, the country’s influence on the volatility spillover network has been increasing. This is because since the 2008 and 2012 financial crises, China’s GDP growth rate has become the fastest in the world, and its impact on the global economy has continued to increase. Before 2012, India’s degree centrality was close to 0, indicating that its stock market had little influence on the world market during this period. Russia’s results showed that after 2014, the results were close to zero. The likely reason is that Europe imposed economic sanctions on Russia during this period.

4.3.3 Closeness centrality

Figures 9 and 10 depict the dynamic process of closeness centrality. Closeness centrality measures whether a node is at the center of the network, in which the higher the value of closeness centrality, the more likely it is that the node is in the center of the network. Figure 9 shows that the value of closeness centrality in the USA is close to 1, indicating that it has always occupied a dominant position in the network. The values in other developed markets are also relatively high, with an average value of around 0.5. However, in Fig. 10, it can be seen that most BRICS markets have low values of closeness centrality. For example, the average values for China, India, and Russia are close to 0. This indicates the low financial status of emerging markets.

4.3.4 Betweenness centrality

Betweenness centrality reflects the role of a node in the process of risk transmission in the volatility spillover network, in which the greater the value of betweenness centrality, the more important the role of a node in risk transmission. Figures 11 and 12 clearly show the low betweenness centrality values of the developed and BRICS markets, respectively. This may be because the contagion of stock market risks is very direct and does not go through an excessively lengthy transmission path. However, comparing Figs. 11 and 12, we can see that developed markets are likely to play a higher intermediary role in the volatility spillover network. This also shows that developed markets are able to transfer risks well when they are affected by other markets, and that the emerging markets can only serve as risk receivers.

4.3.5 Eigenvector centrality

The value of eigenvector centrality represents the condition that if the importance of the neighboring nodes of a certain node is very high, then the latter’s importance also increases accordingly. In other words, with the increase in the volatility spillover intensity of other stock markets, which have a direct volatility spillover relationship with a certain stock market, the spillover intensity of that stock market also increases. By comparing Figs. 13 and 14, we find that the value of the eigenvector centrality of BRICS markets is high while that of developed markets is low. This is consistent with our previous findings that developed markets play a central role in the volatility spillover network, because they are the starting points of the impact. Therefore, their eigenvector centrality scores are low. The volatility spillover risks of BRICS markets are usually secondary, and they are not the starting points of volatility spillovers. However, due to their close association with other countries with high volatility spillovers, their volatility spillover risks are likely to increase accordingly.

4.4 The impact of the pandemic on the volatility spillover network

The volatility spillover indicators and network characteristic variables in this article were derived from the volatility spillover network we constructed. EMVID, an indicator used to indicate the pandemic, was originally proposed by Baker et al. (2020), who built a newspaper-based infectious disease stock market volatility tracker. Since January 1985, this tracker has collected and updated data on a daily basis. The EMVID tracks the various infectious disease-related terms that appear in newspapers, such as “epidemic,” “pandemic,” and “coronavirus”. Figures 15 and 16 present daily data regarding EMVID.

Given that the value of EMVID during the COVID-19 pandemic is particularly high, we show its value before December 2019 in Fig. 15. The dots on the graph indicate the time points of the six PHEIC declared by the WHO. When SARS first broke out, the WHO did not have the level of PHEIC, so we marked SARS on April 16, 2003. On this day, the WHO confirmed that SARS was a pandemic caused by the coronavirus. Within the data period, there were seven relatively serious pandemics. It can be seen that before and after these pandemics were marked as PHEIC, the values of EMVID were relatively high. Therefore, it is appropriate to use EMVID to measure the severity and duration of pandemics.

In addition, Baker et al. (2020) selected some other terms related to stock market volatility, which were scaled to match the VIX index. However, this may cause the pandemic indicator not to be a pure indicator. To solve this problem, we chose VIX as a control variable. With reference to Yang et al. (2020a, b), we controlled for the possible impact of interest rates and economic uncertainty. The definitions and sources of specific variables are shown in Table 2.

The descriptive statistics for all variables are shown in Tables 3 and 4. Table 4 shows that the mean net spillover effect of the US stock market is the highest for the sample, while the lowest effect is obtained from the Chinese stock market. Furthermore, the mean net spillover effects of traditional developed markets, such as the UK, France, and Germany, are all positive. With the exception of Brazil, most emerging markets have negative mean net spillover effects. Finally, according to the results in Tables 3 and 4, all the data we used passed the ADF and PP tests, thus ensuring the validity of our empirical results.

In Table 5, we present the regression results of the impacts of pandemics on the total spillover effect and stock volatility spillover network characteristics. The results reveal that EMVID has a significant impact on network indicators. In terms of total volatility spillover effects, it can be seen from Columns 2–4 that the regression coefficient of pandemics to the total volatility spillover is significantly positive at the level of 1%, indicating that when a pandemic occurs, systemic risks spread rapidly around the world. For the network density of the volatility spillover network, Columns 5–7 show that the regression coefficient of pandemics is significantly positive at the level of 1%, indicating that when a pandemic breaks out, the connections of global stock markets are enhanced and all markets become closely linked, thus speeding up the volatility information transmission across global markets. Finally, according to the results in Columns 8–10, pandemics have a significant impact on the network diameter of the volatility spillover network, and the impact direction is negative. This indicates that, in the case of a pandemic outbreak, the connection paths among different markets become shorter, and the volatility information and financial risk can spread more quickly. All these results suggest that volatility information transmission and financial risk contagions are closely linked to pandemics.

Previous studies have demonstrated that the volatility spillovers caused by financial and debt crises are related to the country where a crisis occurs, in which the larger the economic size of these countries, the more serious the impact will be. In our study, we find that the volatility spillover from a pandemic outbreak is more likely to be related to the severity of the outbreak itself than to the country where it occurred. As for the reasons why pandemics affect financial volatility spillover, the indicators we choose also reflect some internal mechanisms. The EMVID (Baker et al. 2020) includes news data collected from newspapers, which may catch investors’ attention, affect their sentiments, and cause them to act irrationally. As Huberman and Regev (2001) pointed out, negative emotions and fears caused by pandemics are no less serious than those caused by war and terrorism.

The results in Table 6 indicate the impact of pandemics on the net spillover effect of a single market. In particular, it shows that pandemics have a significantly negative impact on the net spillover effects of Hong Kong, Japan, and Germany, which are markets serving as risk receivers when pandemics occur. This may be because the risk structure of Hong Kong and other markets is close to that of the Chinese mainland market, and an obvious risk resonance phenomenon is likely to occur in the event of external shocks (Yang and Zhou 2017). For other developed markets and all BRICS markets, pandemics are likely to have a significantly positive impact on their net spillover effect, as these markets serve as risk transmitters when pandemics occur.

5 Conclusion

Understanding the characteristics of pandemic-induced volatility spillover networks is critical for risk management and dynamic hedging. In this study, we adopt the TVP-DY method and the combined MST–threshold technique to construct the “directed and connected” dynamic volatility spillover networks of developed and emerging markets. We selected sample periods from August 1, 2001, to September 29, 2020, which included multiple pandemics, such as SARS and COVID-19. We also used the EMVID index to investigate the impacts of pandemics on the volatility spillover network.

From the dynamic volatility spillover network, we detected the time-varying nature of the spillovers between developed and emerging markets. When pandemics occur, the total volatility spillover effects tend to increase sharply, the density of the volatility spillover network increases, and the diameter of the network becomes smaller. These results indicate that pandemics speed up the volatility information transmission of global stock markets. Furthermore, the COVID-19 pandemic that broke out at the end of 2019 has led to a historical peak in the total volatility spillover effect. For some time afterward, such an effect remained at a high level. The dramatic impact of the pandemic is partly due to panic, which is then sustained by a shrinking workforce, reduced investments, and import and export restrictions. As expected, most developed markets have taken a dominant position in risk transmission, while emerging markets take on the role of risk receivers. However, it is worth mentioning that the net receiver strength of emerging markets has declined over time, suggesting that their importance as total transmitters of volatility in global equity markets has increased.

The empirical results further indicate that pandemics have a significant positive impact on the total spillover effects and the density of the volatility spillover network. Meanwhile, they have a significant negative effect on the diameter of the volatility spillover network. This means that during a pandemic outbreak, the correlation between different stock markets tends to increase, leading to the rapid transmission of volatility information and the spread of financial risk between different markets. In this case, the risk spreads faster if a pandemic becomes more serious. For investors, market participants, and policymakers, considering the emergence of volatility spillovers due to pandemics is important in managing risks and portfolio diversifications.

Notes

Addressing the problem of asynchronous trading in global stock markets, Callot, Kock, and Medeiros (2017) found that the results are robust to variations in the data-cleaning procedure, as only very few observations are censored.

References

Acemoglu D, Malekian A, Ozdaglar A (2016) Network security and contagion. J Econ Theory 166:536–585

Ali M, Nafis A, Syed ARR (2020) Coronavirus (COVID-19)—an epidemic or pandemic for financial markets. J Behav Exp Financ 27:100341

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13(4):84

Arin K, Davide Ciferri P, Spagnolo N (2008) The price of terror: the effects of terrorism on stock market returns and volatility. Econ Lett Spagn 101(3):164–167

Ashraf BN (2021) Stock markets’ reaction to Covid-19: Moderating role of national culture. Financ Res Lett 41:101857

Aslanidis N, Osborn DR, Sensier M (2010) Co-movements between US and UK stock prices: the role of time-varying conditional correlations. Int J Financ Econ 15(4):366–380

Bai L, Wei Y, Wei G, Li X, Zhang S (2021) Infectious disease pandemic and permanent volatility of international stock markets: a long-term perspective. Financ Res Lett 40:101709

Baker SR, Bloom N, Davis SJ, Kost KJ, Sammon MC, Viratyosin T (2020) The unprecedented stock market impact of COVID-19. Natl Bur Econ Res. https://doi.org/10.3386/w26945

Barigozzi M, Hallin M (2017) Generalized dynamic factor models and volatilities: estimation and forecasting. J Econom 201(2):307–321

Beirne J, Guglielmo MC, Schulze-Ghattas M, Spagnolo N (2013) Volatility spillovers and contagion from mature to emerging stock markets. Rev Int Econ 21(5):1060–1075

Bekaert G, Campbell RH (1995) Time-varying world market integration. J Financ 50(2):403–444

Bekaert G, Campbell RH (1997) Emerging equity market volatility. J Financ Econ 43(1):29–77

Belaid F, Amar AB, Goutte S, Guesmi K (2021) Emerging and advanced economies markets behaviour during the COVID-19 crisis era. Int J Financ Econ. https://doi.org/10.1002/ijfe.2494

Ben Rejeb A, Arfaoui M (2016) Financial market interdependencies: a quantile regression analysis of volatility spillover. Res Int Bus Financ 36:140–157

BenSaida A, Litimi H (2021) Financial contagion across G10 stock markets: a study during major crises. Int J Financ Econ 26(3):4798–4821

BenSaida A, Litimi H, Abdallah O (2018) Volatility spillover shifts in global financial markets. Econ Model 73:343–353

Cabrales A, Gottardi P, Vega-Redondo F (2017) Risk sharing and contagion in networks. Rev Financ Stud 30(9):3086–3127

Caldara D, Iacoviello M (2018) Measuring geopolitical risk. FRB International Finance Discussion Papers (1222)

Callot Laurent AF, Kock AB, Medeiros MC (2017) Modeling and forecasting large realized covariance matrices and portfolio choice. J Appl Econom 32(1):140–158

Capelle-Blancard G, Desroziers A (2020) The stock market is not the economy? Insights from the COVID-19 crisis. CEPR Covid Econ

Chaintreau A, Mtibaa A, Massoulie L, Diot C (2007) The diameter of opportunistic mobile networks. Paper presented at the Proceedings of the 2007 ACM CoNEXT Conference

Chen M-P, Lee C-C, Lin Y-H, Chen W-Y (2018) Did the SARS epidemic weaken the integration of Asian stock markets? Evidence from smooth time-varying cointegration analysis. Econ Res-Ekonomska Istrazivanja 31(1):908–926

Cho SJ, Hyde S, Nguyen N (2015) Time-varying regional and global integration and contagion: evidence from style portfolios. Int Rev Financ Anal 42:109–131

Dakhlaoui I, Aloui C (2016) The interactive relationship between the US economic policy uncertainty and BRIC stock markets. Int Econ 146:141–157

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econom 182(1):119–134

Dimitriou D, Kenourgios D, Simos T (2013) Global financial crisis and emerging stock market contagion: a multivariate FIAPARCH-DCC approach. Int Rev Financ Anal 30:46–56

Donadelli M, Kizys R, Riedel M (2017) Dangerous infectious diseases: bad news for Main Street, good news for Wall Street? J Financ Mark 35:84–103

Egger PH, Zhu J (2021) Dynamic network and own effects on abnormal returns: evidence from China’s stock market. Empir Econ 60(1):487–512

Ehrmann M, Fratzscher M, Rigobon R (2011) Stocks, bonds, money markets and exchange rates: measuring international financial transmission. J Appl Economet 26(6):948–974

Elliott M, Georg C-P, Hazell J (2021) Systemic risk shifting in financial networks. J Econ Theory 191:105157

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20(3):339–350

Filis G, Degiannakis S, Floros C (2011) Dynamic correlation between stock market and oil prices: the case of oil-importing and oil-exporting countries. Int Rev Financ Anal 20(3):152–164

Funck M, Gutierrez JA (2018). Has Ebola infected the market: a contagious reaction to a (media) health care crisis? J Bus Strateg

Gamba-Santamaria S, Gomez-Gonzalez JE, Hurtado-Guarin JL, Melo-Velandia LF (2019) Volatility spillovers among global stock markets: measuring total and directional effects. Empir Econ 56(5):1581–1599

Hasse J-B (2022) Systemic risk: a network approach. Empir Econ 63(1):313–344

Huberman G, Regev T (2001) Contagious speculation and a cure for cancer: a nonevent that made stock prices soar. J Financ 56(1):387–396

Ichev R, Marinč M (2018) Stock prices and geographic proximity of information: evidence from the Ebola outbreak. Int Rev Financ Anal 56:153–166

Ji Q, Bouri E, Roubaud D (2018) Dynamic network of implied volatility transmission among US equities, strategic commodities, and BRICS equities. Int Rev Financ Anal 57:1–12

Khan K, Zhao H, Zhang H, Yang H, Shah MH, Jahanger A (2020) The impact of COVID-19 pandemic on stock markets: an empirical analysis of world major stock indices. J Asian Financ, Econ, Bus 7(7):463–474

Kumar S, Bansal A, Chakrabarti AS (2020) Ripples on financial networks. Eur J Financ 28(13–15):1302–1323

Kyrtsou C, Kugiumtzis D, Papana A (2019) Further insights on the relationship between SP500, VIX and volume: a new asymmetric causality test. Eur J Financ 25(15):1402–1419

Liu TY, Gong X (2020) Analyzing time-varying volatility spillovers between the crude oil markets using a new method. Energy Econ 87:104711

Liu HY, Manzoor A, Wang CY, Zhang L, Manzoor M (2020) The COVID-19 outbreak and affected countries stock markets response. Int J Environ Res Public Health 17(8):2800

Macciocchi D, Lanini S, Vairo F, Zumla A, Figueiredo LTM, Lauria FN, Strada G, Brouqui P, Puro V, Krishna S (2016) Short-term economic impact of the Zika virus outbreak. New Microbiol 39(4):287–289

Mandaci PE, Cagli EC, Taskin D (2020) Dynamic connectedness and portfolio strategies: energy and metal markets. Resour Policy 68:101778

McIver RP, Kang SH (2020) Financial crises and the dynamics of the spillovers between the U.S. and BRICS stock markets. Res Int Bus Financ 54:101276

Mensi W, Hammoudeh S, Al-Jarrah IMW, Sensoy A, Kang SH (2017) Dynamic risk spillovers between gold, oil prices and conventional, sustainability and Islamic equity aggregates and sectors with portfolio implications. Energy Economics 67:454–475

Nippani S, Washer KM (2004) SARS: a non-event for affected countries’ stock markets? Appl Financ Econ 14(15):1105–1110

Okorie DI, Lin B (2021) Stock markets and the COVID-19 fractal contagion effects. Financ Res Lett 38:101640

Pindyck RS, Rotemberg JJ (1993) The comovement of stock prices. Q J Econ 108(4):1073–1104

Prasad N, Grant A, Kim S-J (2018) Time varying volatility indices and their determinants: evidence from developed and emerging stock markets. Int Rev Financ Anal 60:115–126

Prim RC (1957) Shortest connection networks and some generalizations. Bell Syst Tech J 36(6):1389–1401

Ramelli S, Wagner AF (2020) Feverish stock price reactions to COVID-19. Rev Corp Financ Stud 9(3):622–655

Rodriguez JC (2007) Measuring financial contagion: a copula approach. J Empir Financ 14(3):401–423

Sayed OA, Eledum H (2021) The short-run response of Saudi Arabia stock market to the outbreak of COVID-19 pandemic: an event-study methodology. Int J Financ Econ. https://doi.org/10.1002/ijfe.2539

Syriopoulos T, Makram B, Boubaker A (2015) Stock market volatility spillovers and portfolio hedging: BRICS and the financial crisis. Int Rev Financ Anal 39:7–18

Valle-Cruz D, Fernandez-Cortez V, López-Chau A, Sandoval-Almazán R (2021) Does twitter affect stock market decisions? Financial sentiment analysis during pandemics: a comparative study of the H1n1 and the Covid-19 periods. Cognit Comput: pp 1–16.

Wongswan J (2006) Transmission of information across international equity markets. Rev Financ Stud 19(4):1157–1189

Yan C (2020). COVID-19 outbreak and stock prices: Evidence from China. Available at SSRN 3574374.

Yang Z, Zhou Y (2017) Quantitative easing and volatility spillovers across countries and asset classes. Manag Sci 63(2):333–354

Yang Y, Peng F, Wang R, Yang M, Guan K, Jiang T, Xu G, Sun J, Chang C (2020a) The deadly coronaviruses: The 2003 SARS pandemic and the 2020 novel coronavirus epidemic in China. J Autoimmun 109:102434

Yang Z, Zhou Y, Cheng X (2020b) Systemic risk in global volatility spillover networks: evidence from option-implied volatility indices. J Futur Mark 40(3):392–409

Zhang H, Chen J, Shao L (2021) Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. Int Rev Financ Anal 77:101828

Acknowledgements

We are grateful to the editor and the anonymous referees for their helpful comments and suggestions.

Funding

The authors wish to express their gratitude for the support provided by the National Social Science Fund of China (Grant No. 22&ZD098), the National Natural Science Foundation of China (Grant No. 71974208), the National Social Science Fund of China (Grant No. 21&ZD103), and the Graduate Students Explore Innovative Projects of Central South University (Grant No. 2022ZZTS0343). The authors also appreciate the helpful advice of the editor of this journal and the anonymous reviewers.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lan, T., Shao, L., Zhang, H. et al. The impact of pandemic on dynamic volatility spillover network of international stock markets. Empir Econ 65, 2115–2144 (2023). https://doi.org/10.1007/s00181-023-02422-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02422-w