Abstract

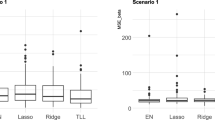

This paper studies the variable selection problem in threshold model with a covariate-dependent threshold, in which the threshold is modeled by a function of candidate variables that affect the separation of regimes. To simultaneously select explanatory variables and the variables that affect the threshold, we develop a variable selection procedure via mixed integer optimization in the \(l_0\)-penalization framework. Monte Carlo simulations are conducted to assess the performance of the suggested variable selection procedure, and the simulation results indicate that the variable selection procedure works well in finite samples. The empirical usefulness of the proposed approach is illustrated with an application to the famous growth–debt nexus.

Similar content being viewed by others

Notes

A natural choice of \(({\underline{p}}, {\overline{p}})\) is \((0, 2 p_x+p_z)\). When \(2 p_x+p_z\) is very large, we can choose a small \({\overline{p}}\) to speed up computations in practice.

We thank an anonymous referee to raise this point to us.

It is worth noting that Hidalgo et al. (2019) find that the US data would be better fitted with a multiple threshold model, and conclude that the low threshold they find (17.2%) is not necessarily invalidating the Reinhart-Rogoff hypothesis. We thank an anonymous referee to raise this point to us.

A further investigate on the post-selection inference in the framework is worthwhile, but it will not be pursued in this paper. We intend to study this in the future. As the selected model (omitting debt in the first regime) does not nest the classical threshold model, we include debt in the first regime in conducting inference in the paper.

We thank the anonymous referees to raise this point to us.

We thank an anonymous referee to raise this point to us.

References

Bertsimas D, King A, Mazumder R (2016) Best subset selection via a modern optimization lens. Ann Stat 44(2):813–850

Buhlmann PL, van de Geer S (2011) Statistics for high-dimensional data: methods, theory and applications. Springer, New York

Callot L, Caner M, Kock AB, Riquelme JA (2017) Sharp threshold detection based on sup-norm error rates in high-dimensional models. J Bus Econ Stat 35(2):250–264

Chen H (2015) Robust estimation and inference for threshold models with integrated regressors. Econom Theory 31(4):778–810

Dueker MJ, Psaradakis Z, Sola M (2013) State-dependent threshold smooth transition autoregressive models. Oxf Bull Econ Stat 75(6):835–854

Gomez-Puig M, Sosvilla-Rivero S (2017) Heterogeneity in the debt-growth nexus: evidence from EMU countries. Int Rev Econ Finance 51:470–486

Hansen BE (2000) Sample splitting and threshold estimation. Econometrica 68(3):575–603

Hansen BE (2017) Regression kink with an unknown threshold. J Bus Econ Stat 35(2):228–240

Hidalgo J, Lee J, Seo MH (2019) Robust inference for threshold regression models. J Econom 210(2):291–309

Lee S, Seo MH, Shin Y (2016) The lasso for high dimensional regression with a possible change point. J R Stat Soc Ser B 78(1):193–210

Lee S, Liao Y, Seo MH, Shin Y (2021) Factor-driven two-regime regression. Ann Stat 49(3):1656–1678

Reinhart CM, Rogoff KS (2010) Growth in a time of debt. Am Econ Rev 100:573–78

Wang H, Li B, Leng C (2009) Shrinkage tuning parameter selection with a diverging number of parameters. J R Stat Soc Ser B 71(3):671–683

Yang L, Su J-J (2018) Debt and growth: is there a constant tipping point? J Int Money Finance 87:133–143

Yang L (2019) Regression discontinuity designs with state-dependent unknown discontinuity points: estimation and testing. Stud Nonlinear Dyn Econom 23(2):1–18

Yang L (2020) State-dependent biases and the quality of China’s preliminary GDP announcements. Empir Econ 2020(59):2663–2687

Yang L (2021) Time-varying threshold cointegration with an application to the Fisher hypothesis. Stud Nonlinear Dyn Econom, forthcoming

Yang L, Zhang C, Lee C, Chen I-P (2021) Panel kink threshold regression model with a covariate-dependent threshold. Econom J 24(3):462–481

Yoon G (2012) War and peace: explosive U.S. public debt, 1791–2009. Econ Lett 115(1):1–3

Yu P, Fan X (2021) Threshold regression with a threshold boundary. J Bus Econ Stat 39(4):1–59

Zhu Y, Chen H, Lin M (2019) Threshold models with time-varying threshold values and their application in estimating regime-sensitive Taylor rules. Stud Nonlinear Dyn Econom 23(5):1–17

Acknowledgements

The author acknowledges the financial support from the National Natural Science Foundation of China (Grant No. 72273059). The author thanks anonymous referees and the editor for very valuable comments and suggestions on previous versions of the paper. Remaining errors are my own.

Funding

This study is supported by the National Natural Science Foundation of China (Grant No. 72273059).

Author information

Authors and Affiliations

Contributions

The author has accepted responsibility for the entire content of this submitted manuscript and approved submission.

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflicts of interest regarding this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yang, L. Variable selection in threshold model with a covariate-dependent threshold. Empir Econ 65, 189–202 (2023). https://doi.org/10.1007/s00181-022-02340-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02340-3

Keywords

- Variable selection

- Threshold model

- Covariate-dependent threshold

- Monte Carlo simulations

- Growth–debt nexus