Abstract

Financial risk is spread and amplified through the interconnectedness among financial institutions. We apply a time-varying parameter vector autoregression model to analyze the dynamic spillover effects in the Chinese financial system. We find that the 2017 house price control policies have significantly increased the risk of China’s financial system. Before 2017, with the prosperity of the real estate market, the interconnectedness of the Chinese financial system continued to decline, while after 2017, with the slowdown of house price growth and the downturn of the real estate market, the interconnectedness turned to increase. For different sectors, the trends and the magnitudes of the spillover effects are diverse, and any sector can contribute to systemic risk in a dynamic way. Finally, we rank 20 systemically important financial institutions according to two centrality measures. The stable institution ranking provides less noisy information for regulators to formulate a policy and intervene in the market effectively.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The interconnectedness among financial institutions features key aspects of systemic risk (Diebold and Yılmaz 2014).Footnote 1 Financial institutions play a key role in macroeconomic and monetary policy transmission; hence, understanding their interconnectedness is essential for monetary and macro prudential policies (Rampini et al. 2020). Therefore, the analysis of systemic risk needs to start from the perspective of network (Barigozzi and Brownlees 2019; Barigozzi and Hallin 2017; Giudici et al. 2020; Hautsch et al. 2015; Yang and Zhou 2013). After the 2008 financial crisis, regulators began to realize that they should not only focus on the risk of a single financial institution, but should also focus on the risk of the entire financial system. Preventing systemic financial risk has become an important task for national and other relevant regulatory authorities.

Systemic risk is often regarded as “hard to define but you know it when you see it,” it refers to “many market participants suffer losses at the same time and spread to the whole system” (Benoit et al. 2017). Billio et al. (2012) believe that systemic risk refers to a series of events that threaten the stability of the financial system or public confidence in it. Giglio et al. (2016) propose a systemic risk index which can predict tail risks to economic growth. To maintain macroeconomic stability, we need to identify the systemic risk and driving factors in the financial system, and at the same time, we should not ignore the impact of the financial cycle on the financial crisis and strengthen macro prudential supervision (Arnold et al. 2012).

The most popular measures of risk, the value at risk (VaR) and the expected shortfall (ES), focus on the risk of an single institution in isolation. However, a single institution’s risk measure does not necessarily reflect systemic risk. Adrian and Brunnermeier (2016) propose an influential systemic risk measure, “CoVaR,” which uses quantile regression to estimate the lower tail quantile of market returns conditional on the tail return of a given institution. In addition, White et al. (2015) use multiple quantile regression method to measure tail dependence. Diebold and Yilmaz (2009) use variance decomposition to measure volatility spillover effect. For high-frequency stock data, Pelger (2020) uses principal component analysis, which was applied to local volatility and jump covariance matrix to estimate systematic factors. Another statistical method for measuring the correlation between financial institutions is the Granger causality test (Billio et al. 2012; Hong et al. 2009), but it can only determine the direction of interconnectedness, not the size.

The interconnectedness among financial institutions may change drastically over time, and thus, the volatility spillover is time varying. Adams et al. (2014) and Adams et al. (2015) use a state-dependent sensitivity VaR model to study the spillover effects among four US financial sectors, i.e., commercial banks, investment banks, hedge funds, and insurance companies. Geraci and Gnabo (2018) propose a time-varying parameter vector autoregression model (TVP-VAR) to estimate the dynamic network of financial spillover effects. They find a gradual decrease in interconnectedness after the Long-Term Capital Management crisis and the 2008 financial crisis. Chan et al. (2020) develop a factor-like structure to estimate high-dimensional time-varying parameter structural vector autoregressive model (TVP-SVAR).

The interconnectedness is also viewed as the driving factor of systemic importance (Drehmann and Tarashev 2013). Nucera et al. (2016) propose a principal component approach for systemic risk ranking. Acharya et al. (2017) estimate the systemic expected shortfall (SES) by integrating the leverage level (Nakajima and Omori 2012) and expected equity loss (Kupiec and Guntay 2016). Brownlees and Engle (2017) propose a similar measure called SRISK, which also computes the conditional capital shortfall, but using a different estimation approach. In addition, Nijskens and Wagner (2011) find that banks have a greater impact on systemic risk. Bernal et al. (2014) use \(\Delta CoVaR\) to measure systemic risk and find banks contribute more to systemic risk, compared with insurance industry. The insurance industry is mainly the risk taker, which shows little impact on the increase in financial system vulnerability, and the risk in insurance industry is not the cause of macroeconomic recession, which lags behind the macroeconomic recession (Bierth et al. 2015). Differently, Jourde (2022) shows that the interconnectedness of the insurance industry with financial and non-financial companies has increased over the last decades for 16 developed countries. Some of our empirical results also suggest that after 2017 the outgoing connections from insurers to both brokers and real estates show an increasing trend.

The proposed approaches above are widely applied in analyzing interconnectedness for developed markets. In this paper, we explore the spillover effects in the Chinese financial market. China has become the second largest economy in the world. In the past decade, China’s financial system has also developed rapidly, playing an important role in promoting China’s economic expansion. According to data released by the People’s Bank of China, the total assets of financial institutions reached 381.95 trillion yuan at the end of 2021.Footnote 2 According to the Financial Stability Board, there are 4 of China’s commercial banks and 1 insurance company among the G-SIBsFootnote 3 and the G-SIIs.Footnote 4 It implies that China faces great regulatory challenges to prevent domestic financial risks from infecting the global market. Since 2017, in response to the surging price bubble in the real estate market, regulators have implemented the most stringent house price control policies in history. These policies include raising mortgage interest rates, restricting loans, restricting price, restricting the purchase of real estate, restricting the sale of real estate, adjusting land supply, and putting property taxes on the legislative agenda. These policies were targeted at containing the surge in house prices and regulating housing speculation. The starting point of these regulations is to maintain the stability of the real estate market, so as to curb the further expansion of the gap between the rich and the poor. However, the implementation of these policies brought unintended consequences in the financial system. It requires us to measure the systemic risk and identify the risk contribution of institutions from the macroprudential perspective.

Several papers have studied the connectedness/spillover in the Chinese financial system based on various approaches, such as the Granger causality connectedness (Gong et al. 2019), CoVaR (Wang et al. 2018a), and variance decompositions (Wang et al. 2021, 2018b). In this paper, we choose the TVP-VAR framework as in Geraci and Gnabo (2018), which allows us to construct a continuously evolving spillover network, with connections changing gradually through time. Geraci and Gnabo (2018) show that importance rankings based on the TVP-VAR model are more stable than rankings based on other methods. Stable ranking is very useful for regulators to formulate a policy.

More importantly, we contribute to the literature by including real estate sector into financial system. The existing literature basically considers three sectors: banks, broker–dealers, and insurers. While the real estate sector is not part of the traditional financial services industry, it has strong capital attributes. As stated above, the house price control policies can bring risks to the Chinese financial system by hitting the real estate market. Our empirical results show that before 2017, with the prosperity of the real estate market, the interconnectedness of the Chinese financial system continued to decline. However, after the house price control policies, with the slowdown of house price growth and the downturn of the real estate market, the interconnectedness turned to increase. The market-based interconnectedness measure suggests that systemic risk in the Chinese financial system has increased since 2017.

In addition to the overall interconnectedness, we further analyze the interconnectedness at sectoral level and at institution level. We find the trends and the magnitudes of the spillover effects for different sectors are diverse, and any sector can contribute to systemic risk significantly. Then, we measure interconnectedness at the individual level among 20 systemically important financial institutions. The analyses at the institution level provide the importance rankings for financial institutions. Although connection strength is declining, Ping An insurance is still the most important risk taker (top 2) and the most important risk spreader.

The paper is structured as follows. Section 2 introduces the TVP-VAR framework for modeling interconnectedness. Section 3 describes the data. Section 4 measures interconnectedness at the sectoral level. Section 5 measures interconnectedness at the individual institution level. Section 6 takes a robust test using an alternative measure. Section 7 draws the conclusions.

2 The model

To characterize interconnectedness among financial institutions, we estimate a time-varying VAR model following Geraci and Gnabo (2018):

where \(R_{t} \equiv \left[ r_{1 t}, \ldots , r_{N t}\right] ^{\prime }\) is the vector of N stock returns, \(B_{t}\) is an \(N\times N\) time-varying coefficient matrix, and \(\Omega _{t}\) is an \(N\times N\) time-varying covariance matrix. We do not consider contemporaneous dependence because we focus on the spillover effect, which is directional and intertemporal dependence. Although contemporaneous dependence is also part of interconnectedness, it is not helpful to understand the spread of risks or fluctuations. Since the serial correlations decay with the lag order, the interconnectedness can be mostly characterized by the one lag model. We stack the matrix \(B_t\) in \(\theta _t\) so that Eq. (1) can be viewed as the measurement equation of a state space model. The absolute value of \(B_t^{ji}\) represents the strength of spillover effect from i to j at time t, defined as the time-varying marginal effect of the risk from a given institution to another institution (Hautsch et al. 2015). According to the setting of many macroeconomic literature (e.g., Cogley and Sargent (2005), Primiceri (2005), and Marco and Primiceri (2015)), we let coefficients evolve according to a driftless random walk. Thus, the state equation of the model is as follows:

where we assume that \(e_t\) and \(u_{\theta t}\) are independent.

The covariance matrix \(\Omega _t\) captures heteroscedastic volatility and time-varying correlation among errors, which reflects the contemporaneous spillovers among financial institutions. It can be decomposed as \(\Omega _t=A_t^{-1}\Sigma _t\Sigma _tA_t^{'-1}\), where \(A_t\) is a lower triangular matrix where the diagonal elements equal to one, and \(\Sigma _{t}={\text {diag}}\left( \sigma _{1 t}, \ldots , \sigma _{N t}\right) \). Thereby, the errors can be written as \(e_{t}=A_{t}^{-1} \Sigma _{t} \varepsilon _{t}\). We stack the lower triangular elements of \(A_t\) as \(a_{t}=\left( a_{1 t}, \ldots , a_{q t}\right) ^{\prime }\) and define \(h_{t}=\left( h_{1 t}, \ldots , h_{N t}\right) \) where \(h_{it}=\log \sigma _{it}^2\). These time-varying parameters follow the random walk process:

Then, the vector of errors \([\varepsilon _t, u_{\theta t}, u_{at}, u_{ht}]\) is jointly normal with mean 0 and variance–covariance matrix defined as:

with \(\Sigma _a\) and \(\Sigma _h\) being diagonal.

The model is estimated by standard Bayesian methods as described in Nakajima (2011). It implements the Markov Chain Monte Carlo (MCMC) algorithm to generate sample from the posterior distribution of the TVP-VAR models.

3 Data

We collect the weekly closing prices of four sectoral indexes and 20 systemically important financial institutions listed in the Chinese stock market. The four sectoral indexes are SWS Banking II Index (801192), SWS Broker II Index (801193), SWS Insurance II Index (801194), and SWS Real Estate Development II Index (801181). The first three are typical financial industry indexes, and the real estate sector has close debt relationships with banks. The time series cover from July 2010 to December 2021.Footnote 5 We do not use daily frequency since the daily price is updated much frequently with large amount of noise. We calculate the weekly stock returns for company i at week t as \(r_{it}=\log P_{it}-\log P_{i,t-1}\), where \(P_{it}\) is the stock price of company i at the end of week t.

Next we proceed to analyze the interconnectedness for the Chinese financial system at two levels. First, we measure interconnectedness at the sectoral level. Then, we measure interconnectedness at the individual level among 20 systemically important financial institutions.

4 Interconnectedness at the sectoral level

In this section, we study the interconnectedness among four different sectors: banks, broker–dealers, insurers, and real estate companies, using a 4-variable TVP-VAR model with 1 lag. In order to measure the spillover effect among sectors, we introduce the time-varying network density, which reflects the average strength of a dependence at every period. It is given by

where \(i, j \in \{\text {banks, brokers, insurers, real~estate}\}\) and \(B_t^{(ji)}\) is the cross coefficient between i and j at period t estimated by the TVP-VAR model with \(N=4\). Here we use absolute beta because we are concerned with the average dependent strength. Both positive and negative spillovers represent interconnectedness. If we took the original beta, the positive and negative dependencies cancel each other out when calculating the average density across different pairs of stocks/sectors.

Figure 1 displays the evolution of overall density for the Chinese financial system. The value of the overall density locates between 0.0646 and 0.0701; and the curve shows a downward trend first and then upward. Before 2017, the overall density continued to decline. Geraci and Gnabo (2018) find a similar decline in the US economy after the 2008 financial crisis. However, the overall density has turned to increase since April 2017. We attribute this to the most stringent house price control policies implemented by the regulatory authorities since 2017. These policies strained the capital flow of real estate companies. For example, the sale restriction policy affects the return of funds and the price limit policy reduces the profits of real estate companies. Meanwhile, the loan restriction policy reduces the bank’s profits. In addition, if a property loan defaults, banks will also take a hit. These policies reduce the growth rate of the economy, which in turn affects the performance of broker-dealers and insurance companies. Therefore, systemic risk starts to rise across the financial sectors. The COVID-19 has little effect on the upward trend in systemic risk. This is because the Chinese government has been very successful in controlling the epidemic. With the release of domestic systemically important banks (D-SIBs) and the strengthening of supervision over financial institutions, the upward trend of systemic risk was contained by the end of 2021.

To illustrate that the evolution of interconnectedness is indeed affected by the house price control policies, we show the price index and volume index of listed houses in Fig. 2. We can see that the growth of house price index slowed down significantly after 2018. More significantly, the house listing volume presents an opposite trend to the interconnectedness of China’s financial system. In other words, the interconnectedness presents a V-shaped evolution pattern, while the volume of listed houses presents a corresponding inverted V-shaped pattern.Footnote 6

To further analyze the spillover effect among sectors, we study the time-varying cross-coefficients of the TVP-VAR model. Figure 3 gives the time-varying cross-coefficient (the value of \(B_t^{(ji)}\) where \(i\ne j\)), which represents directed spillover effect from sector i (the ith column of Fig. 3) to sector j (the jth row of Fig. 3). The sign of \(B_t^{(ji)}\) indicates whether the spillover effect is positive or negative.

We first analyze the interconnectedness between banks and other sectors. We find that the outgoing connections from banks to both brokers and real estates are first rising and then falling, while the connections to insurers are becoming smaller. Meanwhile, the incoming connections from other sectors to banks show some degree of symmetry with the outgoing case, but not quite. For example, the spillover impact of banks on brokers is obviously greater than that of brokers on banks, although their trends are consistent. It is worth noting that the spillover values are negative from insurers to banks, so the dependency trend is likewise decline as that from banks to insurers. For brokers, the evolutionary patterns of outgoing and incoming connections are quite similar with those for banks.

For insurers, the spillover effects are asymmetric, that is, the connection value from insurers to other sectors is negative, while the connection from other sectors to insurers is positive. This may be due to the unique industry attributes of insurers. Compared with other financial institutions, insurers essentially short risks, just like option sellers. Therefore, as counterparties of other investors, insurers often have negative spillovers with other financial sectors. The (absolute) outgoing connections to banks show a downward trend, which is consistent with incoming connections from banks. This may reflect the competitive relationship between insurance and banking. However, after 2017, the (absolute) outgoing connections from insurers to both brokers and real estates show an increasing trend. It reflects that the house price control policies intensify the connections among different sectors. This is consistent with the empirical results for the developed countries (Jourde 2022).

For real estates, the outgoing connections to brokers show a upward trend, but a downward trend to insurers. The outgoing connections to banks are more complicated; namely, the curve shows an upward trend first and then decline between 2014 and 2016 and finally rise again. The real estate is a typical capital-intensive industry. Its development depends on credit support from banks. When housing prices rise too quickly as in 2014–2016 and exceed the purchasing power of residents, housing supply exceeds demand. As a result, a large amount of real estate inventory is stored. The intensified backlog funds of real estates will cause an increase in the non-performing loan ratio of commercial banks, which has a negative impact on the development of commercial banks. Therefore, the performances of real estates and banking industry may emerge some separation and cause the connection decline in that period. After 2017, the house price control policies intensify the spillovers from real estates to banks.

5 Interconnectedness at financial institution level

In this section, we analyze the interconnectedness among individual financial institutions. We select 20 systemically important financial institutions in China, including all 4 G-SIBs and 1 G-SII released by the Financial Stability Board (FSB) and other 15 head institutions.Footnote 7 The sample consists of 7 banks, 5 brokers, 3 insurers, and 5 real estates, as the following: Bank of China, China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, China Minsheng Bank, China Merchants Bank, China CITIC Bank, CITIC Securities, Haitong Securities, GF Securities, Huatai Securities, China Merchants Securities, Ping An Insurance, China Pacific Insurance, China Life Insurance, Vanke, Poly Group, Gemdale Group, Shimao Group, and GM Real Estate.

The study conducts a pairwise analysis similar to that of Billio et al. (2012) and Geraci and Gnabo (2018). That is, we estimate a bivariate TVP-VAR for each pair of financial institutions.

5.1 Financial institution centrality

In order to compare the importance of each institution in the dynamic financial network, we introduce two measures: incoming centrality (ICC) and outgoing centrality (OGC), according to the definition of weighted degree in complex network. The absolute value of \(B_{t}^{(i j)}\) (\(B_{t}^{(j i)}\)) is viewed as the in-degree (out-degree) weight for financial institute i. Thus, ICC measures the average extent influenced by other financial institutions and OGC measures the average propagation to other financial institutions. These two measures are given as follows:

where \(i, j \in \{1, 2, \dots , 20\}\) and N = 20 and \(B_t^{(ij)}\) represents the cross coefficient from j to i estimated by the bivariate TVP-VAR model.

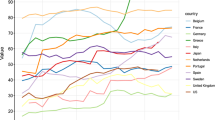

Figures 4 and 5 represent the time-varying ICC and OGC for 20 systemically important financial institutions, respectively. Figure 4 shows that Ping An Insurance is the most connected financial institution with the highest level of ICC at the beginning of sample period. Ping An Insurance is the unique Chinese insurance company listed in the global systemically important insurers (G-SIIs). However, the ICC level of Ping An Insurance decreases year by year from 0.085 to 0.058, showing that spillover from other institutions to Ping An Insurance is declining, and Ping An Insurance is becoming more robust. At the end of sample period, the ICC level of China Merchants Securities exceeds that of Ping An Insurance. For real estates, we find that almost all real estate companies present V-shaped ICC, as the overall density in Fig. 1. On the whole, the trends of ICC level for different financial institutions are diverse.

Figure 5 shows that OGC trends are more homogeneous among financial institutions compared with the ICC trends. Specifically, all 5 brokers experience a decline in OGC during this sample period. All insurers and real estates show a pattern of first falling and then rising. However, the trends of OGC for banks are not consistent, that is, increasing for Bank of China, Agricultural Bank of China, China CITIC Bank, and China Minsheng Banking, but decreasing for China Merchants Bank.

5.2 Stability of centrality rankings

According to the ICC and OGC, we can rank the 20 systemically important financial institutions at every time point. However, if the rankings of institutions are highly volatile, it is difficult for regulators to supervise these institutions and adjust supervision policies in time. Therefore, the stability of ranking is important to implement an effective supervision. In order to assess the stability of interconnectedness ranking, we refer to two stability indicators proposed by Geraci and Gnabo (2018). The quadratic stability indicators are defined as:

where \(Z_{i,t}^{\textrm{IN}}\) represents the ranking of institution i at time t according to the ICC and \(Z_{i,t}^{\textrm{OUT}}\) represents the ranking of institution i at time t according to the OGC. Similarly, the absolute stability indicators are defined as:

In order to compare the ranking stability of ICC and OGC estimated by the TVP-VAR model, we also compute these stability indicators for several additional rankings, such as MES (Marginal Expected Shortfall), leverage ratio, and SES (Systemic Expected Shortfall) proposed by Acharya et al. (2017). The MES refers to the expected equity loss of each institution in the financial crisis, defined as the average return of its equity when the market returns appear in the 5% worst days:

The quasi-leverage ratio is defined as:

SES measures the conditional capital shortfall of a financial institution when a systemic crisis has already happened. It is based on a structural assumption that requires observing a realization of systemic crisis. For instance, the 2008 financial crisis is a typical systemic crash. We can use the returns of each firm from July 2008 to June 2009 to estimate MES and use the balance sheet data at June 2009 to estimate the LVG. Correspondingly, we use the cumulative equity return from July 2009 to June 2010 as the proxy of SES for each firm. Then, we run a cross-sectional regression for SES on MES and LVG:

After having the triplet (a, b, c), the predicted SES that firm i poses at a future time \(t+1\) is calculated as:

Bisias et al. (2012) give a detailed review on systemic risk measures, including MES, SES, and Leverage described above. We notice that an alternative measure, called SRISK (Brownlees and Engle 2017), estimates the conditional capital shortfall the same as SES, but using a different method.

Table 1 reports the absolute and quadratic stability indicators for centrality rankings computed by the TVP-VAR model (Panel A), as well as by SES, MES and leverage ratio (Panel B). The columns headed “% Invariance” denote the proportion that the ranking of financial institutions remains unchanged in adjacent time periods.

From Panel A, the quadratic stability value for the ICC and OGC measured by TVP-VAR is 2.51 and 2.37, and the absolute stability value is 0.99 and 0.93, respectively. We can see that the ranking of risk propagator is more stable than that of risk receiver. The average percentages of institutions that maintain the same ranking in adjacent time periods are 84.58% and 86.04%. We can conclude that the ranking of most institutions in the adjacent time periods remains unchanged.

From Panel B, the quadratic and absolute stability indicators measured by MES are the highest, while the lowest calculated by leverage. The leverage is computed based on the book value of assets reported in the firm’s balance sheet, which is updated less frequently. Therefore, the ranking measured by leverage is more stable. In contrast, MES is calculated by the firm and the market’s stock return and therefore has the lowest stability. SES is the weighted average of MES and leverage ratio, so its stability lies in between. The average percentages of institutions maintaining the same position in adjacent time periods are 25.65\(\%\), 5.65\(\%\), and 47.61\(\%\), respectively. Only a few proportion of institutions remain unchanged under MES method, while more than half of institutions under SES and leverage ratio change the rank. Compared with Panel A and Panel B, we show that the TVP-VAR model provides much more stable institution ranking than other methods.

To illustrate the ranking stability by the TVP-VAR model intuitively, Table 2 lists the top 5 institutions, in terms of incoming and outgoing centrality at 3 time points, i.e., the end of Jun 2012, the end of Jun 2018, and the end of Jun 2021. We can find that the rankings are fairly stable at different time points for both ICC and OGC. For ICC, Ping An Insurance and China Merchants Securities are always the top 2. CITIC Securities and China Life Insurance always list in top 5, although their rankings changes slightly. Similarly, for OGC, Ping An Insurance, Bank of China, Haitong Securities, China Vanke, and CITIC Securities never rank out of top 5. Moreover, Ping An Insurance always ranks the top 1. Interestingly, the top 5 include head institutions of all 4 financial sectors, indicating that any sector can contribute to systemic risk significantly.

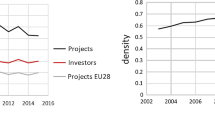

6 Alternative measure

In order to demonstrate the robustness of the interconnectedness measure, we estimate the total interconnectedness using the variance decomposition method proposed by Diebold and Yılmaz (2014). We select 2 different rolling window widths to estimate, i.e., 50 weeks and 130 weeks (see Fig. 6). We also see that before the implementation of the house price control policies, the interconnectedness continued to decline, while after that, the interconnectedness turned to increase, especially for the longer rolling window case (130 weeks). This evolutionary pattern is similar with that in Fig. 1, but with higher volatility.

Total interconnectedness estimated by the variance decomposition method proposed by Diebold and Yılmaz (2014). The rolling estimation window widths are 50 weeks (left) and 130 weeks (right), respectively. The predictive horizon for the underlying variance decomposition is 5 weeks

7 Conclusion

In this paper, we apply a time-varying parameter vector autoregression model to analyze the spillover effects in the Chinese financial system. We compute the time-varying sectoral density and institution centrality, respectively. To do this, we collect the weekly closing prices of four sectoral indexes and 20 systemically important financial institutions from 2010 to 2021. Since we allow stochastic volatility in the model, we take a Bayesian approach using the Markov Chain Monte Carlo sampling algorithm for an efficient estimation.

We calculate an overall network density for the Chinese financial system, which reflects the average strength of dependence among four sectors at every time point. We find that the trend of overall density is highly related with the house price control policies since 2017. Before 2017, with the prosperity of the real estate market, the interconnectedness of the Chinese financial system continued to decline. However, after the house price control policies, with the slowdown of house price growth and the downturn of the real estate market, the interconnectedness turned to increase. This implies that the 2017 house price control policies have significantly increased the risk of China’s financial system. For different sectors, the trends and the magnitudes of the spillover effects are diverse, and any sector can contribute to systemic risk in a dynamic way.

At the financial institution level, we estimate two importance measures proposed by Geraci and Gnabo (2018): incoming centrality and outgoing centrality. These centrality measures are time varying and asymmetric between incoming and outgoing connections. According to these measures, we rank the 20 systemically important financial institutions at every time point. As the unique Chinese insurance company among G-SIIs, Ping An insurance is still the most important risk taker (top 2) and the most important risk spreader, although its connection strength is declining. We also confirm that the rankings are fairly stable at different time points for the Chinese financial system, as in Geraci and Gnabo (2018) for the American financial system. The stable institution ranking provides less noisy information for regulators to formulate a policy and intervene in the market effectively.

Notes

We focus on the spillover effect among financial institutions, which is directional and intertemporal dependence. Therefore, we use “interconnectedness” instead of “connectedness”.

We start the analysis in 2010 because some systemically important financial institutions were listed in 2010. For example, the Agricultural Bank of China was listed on the Shanghai Stock Exchange on July 15, 2010.

Note that we can’t simply say that the interconnectedness measures are procyclical or countercyclical. Before 2017, the house price index surged, while the overall interconnectedness showed a downward trend. After 2017, although both the house price index and the interconnectedness have been rising, the growth of house price index slowed down significantly.

We select stocks based on 2 criteria. First, its listing date is no later than that of the Agricultural Bank of China. Second, in addition to 4 G-SIBs and 1 G-SII, we select other institutions based on its industry reputation.

References

Acharya V, Pedersen L, Philippon T, Richardson M (2017) Measuring systemic risk. Rev Financ Stud 30(1):4–27. https://doi.org/10.1093/rfs/hhw088

Adams Z, Füss R, Gropp R (2014) Spillover effects among financial institutions: a state-dependent sensitivity Value-at-Risk approach. J Financ Quant Anal 49(3):575–598. https://doi.org/10.1017/S0022109014000325

Adams Z, Füss R, Schindler F (2015) The sources of risk spillovers among U.S. REITs: financial characteristics and regional proximity. Real Estate Econ 43(1):67–100. https://doi.org/10.1111/1540-6229.12060

Adrian T, Brunnermeier MK (2016) CoVaR. Am Econ Rev 106(7):1705–1741. https://doi.org/10.1257/aer.20120555

Arnold B, Borio C, Ellis L, Moshirian F (2012) Systemic risk, macroprudential policy frameworks, monitoring financial systems and the evolution of capital adequacy. J Bank Financ 36(12):3125–3132. https://doi.org/10.1016/j.jbankfin.2012.07.023

Barigozzi M, Brownlees C (2019) NETS: network estimation for time series. J Appl Economet 34(3):347–364. https://doi.org/10.1002/jae.2676

Barigozzi M, Hallin M (2017) A network analysis of the volatility of high dimensional financial series. J R Stat Soc C 66(3):581–605. https://doi.org/10.1111/rssc.12177

Benoit S, Colliard J, Hurlin C, Perignon C (2017) Where the risks lie: a survey on systemic risk. Rev Finance 21(1):109–152. https://doi.org/10.1093/rof/rfw026

Bernal O, Gnabo J, Guilmin G (2014) Assessing the contribution of banks, insurance and other financial services to systemic risk. J Bank Financ 47:270–287. https://doi.org/10.1016/j.jbankfin.2014.05.030

Bierth C, Irresberger F, Weiss G (2015) Systemic risk of insurers around the globe. J Bank Financ 55:232–245. https://doi.org/10.1016/j.jbankfin.2015.02.014

Billio M, Getmansky M, Lo A, Pelizzon L (2012) Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J Financ Econ 104(3):535–559. https://doi.org/10.1016/j.jfineco.2011.12.010

Bisias D, Flood M, Lo A, Valavanis S (2012) A survey of systemic risk analytics. Annu Rev Financ Econ 4:255–296. https://doi.org/10.1146/annurev-financial-110311-101754

Brownlees C, Engle R (2017) SRISK: a conditional capital shortfall measure of systemic risk. Rev Financ Stud 30(1):48–79. https://doi.org/10.1093/rfs/hhw060

Chan JCC, Eisenstat E, Strachan RW (2020) Reducing the state space dimension in a large TVP-VAR. J Econom 218(1):105–118. https://doi.org/10.1016/j.jeconom.2019.11.006

Cogley T, Sargent T (2005) Drifts and volatilities: monetary policies and outcomes in the post WWII US. Rev Econ Dyn 8(2):262–302. https://doi.org/10.1016/j.red.2004.10.009

Diebold F, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ J 119(534):158–171. https://doi.org/10.1111/j.1468-0297.2008.02208.x

Diebold F, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econom 182:119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Drehmann M, Tarashev N (2013) Measuring the systemic importance of interconnected banks. J Financ Intermed 22(4):586–607. https://doi.org/10.1016/j.jfi.2013.08.001

Geraci MV, Gnabo J-Y (2018) Measuring interconnectedness between financial institutions with Bayesian time-varying vector autoregressions. J Financ Quant Anal 53(3):1371–1390. https://doi.org/10.1017/S0022109018000108

Giglio S, Kelly B, Pruitt S (2016) Systemic risk and the macroeconomy: an empirical evaluation. J Financ Econ 119(3):457–471. https://doi.org/10.1016/j.jfineco.2016.01.010

Giudici P, Sarlin P, Spelta A (2020) The interconnected nature of financial systems: direct and common exposures. J Bank Financ 112:105149. https://doi.org/10.1016/j.jbankfin.2017.05.010

Gong X-L, Liu X-H, Xiong X, Zhang W (2019) Financial systemic risk measurement based on causal network connectedness analysis. Int Rev Econ Financ 64:290–307. https://doi.org/10.1016/j.iref.2019.07.004

Hautsch N, Schaumburg J, Schienle M (2015) Financial network systemic risk contributions. Rev Financ 19(2):685–738. https://doi.org/10.1093/rof/rfu010

Hong Y, Liu Y, Wang S (2009) Granger causality in risk and detection of extreme risk spillover between financial markets. J Econom 150(2):271–287. https://doi.org/10.1016/j.jeconom.2008.12.013

Jourde T (2022) The rising interconnectedness of the insurance sector. J Risk Insur 89(2):397–425. https://doi.org/10.1111/jori.12373

Kupiec P, Guntay L (2016) Testing for systemic risk using stock returns. J Financ Serv Res 49(2–3):203–227. https://doi.org/10.1007/s10693-016-0254-1

Marco D, Primiceri G (2015) Time varying structural vector autoregressions and monetary policy: a corrigendum. Rev Econ Stud 82(4):1342–1345. https://doi.org/10.1093/restud/rdv024

Nakajima J (2011) Time-varying parameter VAR model with stochastic volatility: an overview of methodology and empirical applications. Monet Econ Stud 29:107–142

Nakajima J, Omori Y (2012) Stochastic volatility model with leverage and asymmetrically heavy-tailed error using GH skew Student’s t-distribution. Comput Stat Data Anal 56(11):3690–3704. https://doi.org/10.1016/j.csda.2010.07.012

Nijskens R, Wagner W (2011) Credit risk transfer activities and systemic risk: how banks became less risky individually but posed greater risks to the financial system at the same time. J Bank Financ 35(6):1391–1398. https://doi.org/10.1016/j.jbankfin.2010.10.001

Nucera F, Schwaab B, Koopman S, Lucas A (2016) The information in systemic risk rankings. J Empir Financ 38:461–475. https://doi.org/10.1016/j.jempfin.2016.01.002

Pelger M (2020) Understanding systematic risk: a high-frequency approach. J Financ 75(4):2179–2220. https://doi.org/10.1111/jofi.12898

Primiceri G (2005) Time varying structural vector autoregressions and monetary policy. Rev Econ Stud 72(3):821–852. https://doi.org/10.1111/j.1467-937X.2005.00353.x

Rampini A, Viswanathan S, Vuillemey G (2020) Risk management in financial institutions. J Financ 75(2):591–637. https://doi.org/10.1111/jofi.12868

Wang G-J, Jiang Z-Q, Lin M, Xie C, Stanley HE (2018a) Interconnectedness and systemic risk of China’s financial institutions. Emerg Mark Rev 35:1–18. https://doi.org/10.1016/j.ememar.2017.12.001

Wang G-J, Xie C, Zhao L, Jiang Z-Q (2018b) Volatility connectedness in the Chinese banking system: do state-owned commercial banks contribute more? J Int Financ Mark Inst Money 57:205–230. https://doi.org/10.1016/j.inthn.2018.07.008

Wang G-J, Chen Y-Y, Si H-B, Xie C, Chevallier J (2021) Multilayer information spillover networks analysis of China’s financial institutions based on variance decompositions. Int Rev Econ Financ 73:325–347

White H, Kim T, Manganelli S (2015) VAR for VaR: measuring tail dependence using multivariate regression quantiles. J Econom 187(1):169–188. https://doi.org/10.1016/j.jeconom.2015.02.004

Yang J, Zhou Y (2013) Credit risk spillovers among financial institutions around the global credit crisis: firm-level evidence. Manag Sci 59(10):2343–2359. https://doi.org/10.1287/mnsc.2013.1706

Acknowledgements

We are grateful to the editor Bertrand Candelon and an anonymous referee for their constructive comments and helpful suggestions. We thank participants at the 5th International Workshop on “Financial Market and Nonlinear Dynamics” organized in Paris in June 2021. We acknowledge financial support from the National Natural Science Foundation of China (U1811462 and 71971081) and the Fundamental Research Funds for the Central Universities.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Xu, HC., Jawadi, F., Zhou, J. et al. Quantifying interconnectedness and centrality ranking among financial institutions with TVP-VAR framework. Empir Econ 65, 93–110 (2023). https://doi.org/10.1007/s00181-022-02338-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02338-x