Abstract

Using comprehensive data of 4893 interactions from the popular television show Shark Tank, we test whether gender match with entrepreneurs correlates with investors’ likelihood to extend funding offers. We find female investors are 35% more likely to engage with female (rather than male) entrepreneurs, while less systematic gender preferences emerge for male investors. Heterogeneity analyses suggest this result remains exclusive to non-male-dominated product categories, lending support to the industry representation hypothesis. We also find it is exclusive to ventures with lower asking valuations. Estimates are robust to the inclusion of a comprehensive set of control variables (such as asking valuation, investor-, and season-fixed effects) and a range of alternative specifications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Substantial gender inequities in various economic outcomes persist in our societies and receive much scholarly attention, such as the gender wage gap or the glass ceiling phenomenon (Bertrand 2011; Blau and Kahn 2017). However, an area in which we know less about potential gender differentials relates to two-way interactions between entrepreneurs and potential investors (Garrett 2020; Recalde and Vesterlund 2020). The corresponding industry is so male-dominated that 90% of US-based venture capital firms do not feature any women on their investment team (Brush et al. 2018). Despite comprising 40% of entrepreneurs, women receive only 3% of venture capital funding (Brush et al. 2018; Clark 2019; Balachandra 2020)—a tiny segment in an industry worth US$100b yearly. Additionally, while 34% of ventures seeking angel investment were women-led startups in 2020, these companies only received 19% of the funding of this type (Corkran et al. 2021). Why is that? Sometimes labeled the ‘second glass ceiling’ (Bosse and Taylor III 2012), this disparity is important to understand in its own right, not least because further gender differences—e.g., related to wages, hiring decisions, and promotions—may well be related to these substantial gender gaps in securing funding.

Most related empirical research focuses on horizontal gender differences (e.g., those between employees), rather than vertical interactions between agents of the same or opposite gender, such as those between entrepreneurs and potential investors. Even those studies that do explore both sides of negotiations usually focus on the labor market and rarely on investment decisions (see Recalde and Vesterlund 2020, for a summary of that literature). This is likely because a researcher needs to observe comprehensive and objective data from both sides of the negotiation table—something that is not easily measurable in real life. For example, we rarely observe unsuccessful interactions between entrepreneurs and investors. Hernandez-Arenaz and Iriberri (2018) summarize that “[e]xisting studies based on field data do not study gender interaction effects, either because the gender of the person in one role is not known or because there is not enough variation.” As a consequence, studies are usually confined to the laboratory, where researchers can cleanly design, isolate, and measure participants’ decisions. Caveats of such explorations relate to external validity concerns and the difficulty to credibly mimic the substantial stakes reflective of real-life situations in which entrepreneurs and potential investors usually negotiate over six-, seven-, or eight-figure sums.Footnote 1 Few existing field studies, such as Hernandez-Arenaz and Iriberri (2018), are able to elevate stakes to a few hundred US$ or Euros but still remain far from reaching representative sums. Overall, the confidential nature of entrepreneur–investor negotiations, combined with the substantial, difficult-to-replicate stakes in such interactions, complicate our understanding of whether and, if so, how gender combinations may be able to explain funding success—and thereby the associated large gender gaps in entrepreneurial funding.

In the following pages, we present findings from studying 4893 entrepreneur–investor interactions in Shark Tank, a popular US television show in which entrepreneurs pitch their product to five potential investors (Sharks) to obtain funding. Our study spans 246 episodes over 11 seasons and features two main advantages: (i) Stakes are sizeable, with entrepreneurs seeking an average of US$303,370 in funding in exchange for an average 15% of their respective company; and (ii) we observe decisions from a comprehensive set of five potential investors for each presented pitch.Footnote 2 Thus, we not only capture successful but also unsuccessful pitches, alleviating selection issues when considering the scarce real-life data on observed funding decisions.

Of course, this setting is not without disadvantages. First, although Sharks are not informed beforehand about the upcoming entrepreneurs or products, social desirability bias may inform their actions. For example, investors holding a particular gender bias may try to conceal such characteristics in front of millions of TV viewers. As stakes are substantial, however, it is difficult to believe an investor would systematically make costly and consequential decisions that are inconsistent with their true preferences. Second, the show’s producers may select particular types of entrepreneurs (perhaps those who are more interesting for a TV audience), i.e., the composition of entrepreneurs featured on Shark Tank may not reflect the real-life universe of entrepreneurs. This caveat, however, is shared by most laboratory-based studies, as it is difficult to precisely mimic the population of interest. Third, the 27 Sharks (19 male, 8 female; see Table 6 for a full list) may not necessarily be representative of the average potential investor. For instance, some Sharks are well-known celebrities, such as Mark Cuban (890 observations), Alex Rodriguez (16), Charles Barkley (8), or Maria Sharapova (4). Our estimations employ Shark-fixed effects to alleviate such concerns. 28% of entrepreneur–investor interactions in Shark Tank involve female investors, which is comparable to the angel investment market (Sohl 2021) despite the relative rarity of female investors in general venture capital (Brush et al. 2018). Nevertheless, all interpretations of our results should keep these attributes in mind.

Our estimations reveal two main insights. First, male Sharks do not differentiate between female and male entrepreneurs when deciding to make an offer. This result emerges in univariate settings and when accounting for our comprehensive set of potential confounders, including product category, the ask value of the respective entrepreneurs, season-fixed effects, and Shark-fixed effects. We only see a marginal preference of male Sharks for male (rather than female) entrepreneurs in funding proposals that feature valuations just below the median value in our sample (which corresponds to US$1.44m). However, our second and probably most important finding reveals gender match matters systematically for the average female entrepreneur, as their probability to receive an offer from a female Shark is approximately 9.7 percentage points (or 35%) higher than the average male entrepreneur’s. This result is robust in statistical and quantitative terms to (i) accounting for all observable, potentially confounding factors, (ii) applying alternative empirical specifications, and (iii) allowing for potential peer effects (i.e., the behavior of other Sharks). Finally, this relationship between female entrepreneurs and female investors is particularly prevalent in product valuations below the median ask valuation (US$1.44m) and in product categories in which female entrepreneurs are less under-represented, such as those categorized as related to beauty, health, children, or fashion.

The paper mainly contributes to the scientific inquiry pertaining to whether and, if so, how gender interactions matter in explaining consequential gender gaps in real life. Since it remains difficult to cleanly measure both sides of interactions in wage- and funding-related decisions, we hope our analysis of Shark Tank can complement existing laboratory studies (e.g., see Kanze et al.’s, 2020 experimental work).Footnote 3 Our findings indicate that female entrepreneurs may increase their chances of success when seeking funding from a female investor. Put differently, if society wanted to facilitate the access to funding for female entrepreneurs, then female investors could be one part of the solution. Importantly, we highlight that we cannot consistently and comprehensively measure entrepreneurs’ success rates, so we remain silent on broad efficiency considerations of such a proposal. Of course, external validity considerations also have to be taken into account.

2 Theoretical and empirical background

2.1 Gender interactions versus gender differences

Most research to understand business decisions and outcomes focuses on gender differences (Stuhlmacher and Walters 1999; Babcock et al. 2003; Bowles et al. 2007; Tinsley et al. 2009; Leibbrandt and List 2015; Mazei et al. 2015; Säve-Söderbergh 2019; Andersen et al. 2020), rather than interactions (see Recalde and Vesterlund 2020, for a summary of the research on gender differences in negotiations, mostly related to wages). For example, a vast literature studies gender wage gaps among employees—but we know less about the characteristics (such as gender) of the bargaining partner, i.e., the employer’s manager responsible for negotiating these wages. This is typically because that side of the bargaining table remains unobservable (e.g., see Hernandez-Arenaz and Iriberri 2018).

However, the gender of the negotiation partner can matter when exploring outcomes, such as wages, promotions, or funding decisions. For instance, homophily along gender lines would suggest that a shared gender between bargaining parties may affect behavior.Footnote 4 Put simply, a (fe)male employer or investor may find it easier to relate to a (fe)male employee or entrepreneur, either consciously or subconsciously, which could affect outcomes. Conversely, mixed-gender negotiations can increase the salience of gender roles and their associated behaviors, increasing congruity or incongruity with the necessary negotiation behaviors and impacting outcomes (Stuhlmacher and Linnabery 2013). The limited empirical evidence produces results that are consistent with that hypothesis (e.g., see Eriksson and Sandberg 2012, Dittrich et al. 2014, or Hernandez-Arenaz and Iriberri 2018), although evidence from real life remains scarce.

Similarly, gender discrimination may express itself in a person’s judgement and bargaining behavior related to employees, customers, or entrepreneurs of the opposite gender (e.g., see Castillo et al. 2013). If one side held stereotypical beliefs about the general capability of women or men to differentially perform in the respective role, then bargaining behavior and outcomes would differ systematically by gender. Thus, everything else equal, it may matter whether a female or male entrepreneur pitches their concept to a female or male investor.

2.2 Gender and venture financing

Gender differentials in securing venture financing are particularly pronounced. In the US, only 3% of all project funding is allocated to female entrepreneurs, even though 40% of all entrepreneurs are female (Brush et al. 2018; Balachandra 2020; Clark 2019). Of course, these basic differences are not evidence of discrimination per se, since a number of other factors beyond gender can influence the probability to get funded. In fact, it has been suggested that entrepreneur gender does not impact performance using appropriate measures (e.g., see Robb and Watson 2012, Lins and Lutz 2016, or Hebert 2020).

Additionally, while the picture for early-stage investment, otherwise known as angel investment, is somewhat kinder, it still paints a picture of an uphill battle for female entrepreneurs. Data from the Center for Venture Research suggests 33.6% of ventures seeking angel investment capital in 2020 were owned by women, and the percentage of these ventures that received capital was 28.1% (Sohl 2021). This is slightly lower than the overall rate of investment by angels (30.8%), which suggests a gap still exists between men and women in the reception of early-stage funding, which matches reporting that female-led businesses received only 19% of total angel investment funding (Corkran et al. 2021). Nevertheless, as early-stage funding is essential for quickly growing a business (Becker-Blease and Sohl 2007; Alsos and Ljunggren 2017), this disparity presents a significant hurdle for female entrepreneurs.

One hypothesis to explain these disparities draws on role congruity theory. If characteristics typically associated with successful entrepreneurship are in apparent conflict with the female gender role and more aligned with male gender roles, role congruity theory posits that differences in outcomes along gender lines would occur. Investors may prefer investing in male entrepreneurs as this role congruity would lead to the belief that male entrepreneurs enjoy greater probabilities of success. For example, entrepreneurship is often characterized as a masculine endeavor (Ahl 2006; Gupta et al. 2009), and some investors may view the ideal entrepreneur as male (Thébaud 2015; Malmström et al. 2017; Balachandra et al. 2019). Other studies indicate that gender bias is more pronounced in the absence of other qualifying factors which would reduce role incongruity, such as lacking a technical degree or prior connections to venture capital (Tinkler et al. 2015).

One avenue of research focuses on the entrepreneurs’ side—a narrative sometimes labeled as ‘fix-the-women’ (Recalde and Vesterlund 2020). For instance, Roper and Scott (2009) show female entrepreneurs perceive greater barriers to accessing finance, which may discourage them from seeking funding. Both Eddleston and Powell (2008) and Guzman and Kacperczyk (2019) suggest the difference may be due to differing levels of business growth orientation. Eddleston and Powell (2008) in particular show female business owners value employee relationships and social contributions over economic growth in their business, which can affect funding potential and outcomes.

Other lines of research consider the investor (or employer) side, sometimes labeled as a ‘fix-the-institution’ narrative (see Recalde and Vesterlund 2020), to seek explanations for the stark gender gap in funding. For example, Kanze et al. (2018) explore interactions between investors and entrepreneurs at pitch competitions to find female entrepreneurs are often asked prevention-focused questions (concerned with the return of capital), while male entrepreneurs receive promotion-focused questions (concerned with the growth of the venture; also see Becker-Blease and Sohl 2007, and Gupta and Turban 2012). This distinction has been shown to affect funding (Brockner et al. 2004; Lanaj et al. 2012) and could explain biases against female entrepreneurs.

A consistent theme that appears in these analyses is the industry representation hypothesis. As the venture capital space is heavily male-dominated (Greenberg and Mollick 2017; Balachandra 2020), this theory posits that by increasing the number of women making investment decisions in venture capital firms, female entrepreneurs will have better access to funding. While some studies suggest this mechanism as a policy intervention (Greene et al. 2001; Balachandra 2020), other research remains skeptical (Kanze et al. 2018). However, this literature is rarely able to examine both sides of the interaction due to lacking transparency and as such typically focuses on the gender of entrepreneurs. The scarce two-sided literature sometimes considers homophily, exploring shared characteristics between investor and entrepreneur, although often not as the main focus (Becker-Blease and Sohl 2007; Boulton et al. 2019). Overall, few studies examine gender interaction effects in their entirety in the venture capital space from the investor’s perspective (Harrison and Mason 2007; Boulton et al. 2019; Balachandra 2020).

3 Shark Tank

3.1 Background and format

Shark Tank is a US reality TV program that debuted in 2009 and recently completed its 11th season on the ABC network. The show is a derivation of Dragon’s Den, popular in the UK and Canada, which itself derives from the original Japanese format called Tigers of Money. The show focuses on entrepreneurship and venture capital, presenting “the drama of pitch meetings and the interactions between entrepreneurs and tycoons” (Lewis 2009).

A typical Shark Tank episode includes four pitches that are presented and fully concluded subsequently. Before the show, the five independent investors, known as Sharks, do not know which products or even which type of products would be presented. Over time, the show has maintained a cast of six regular Sharks with business backgrounds in a variety of product categories. These are (by number of appearances; also see Table 6 for a full list): Kevin O’Leary, notable for the US$4.2b software company The Learning Company; Mark Cuban, co-founder of online media and streaming website Broadcast.com and owner of the Dallas Mavericks basketball team; Robert Herjavec, founder of internet security company The Herjavec Group; Lori Greiner, serial entrepreneur best known for her role on the home shopping channel QVC; Daymond John, founder of the clothing brand FUBU; and Barbara Corcoran, best known for her US$5 billion real estate business in New York (ABC 2020). The show also frequently uses guests who are either successful entrepreneurs or famous individuals with investment backgrounds (e.g., Maria Sharapova or Charles Barkley). Nevertheless, each episode features five Sharks overall.

A typical pitch proceeds as follows:

-

1.

An entrepreneur or a team of entrepreneurs enters the ‘tank’ to face the Sharks and pitch their product, hoping to receive an investment.Footnote 5 The entrepreneurs introduce themselves and their product, stating the amount of cash they are requesting and the percentage stake in their company they are offering in return. This request is important as the entrepreneur must be able to convince the investors to invest the amount of cash they ask for at minimum, or they cannot receive a deal, according to the show’s rules (Burnett 2009).

-

2.

After the pitch is concluded, the Sharks are invited to ask questions to inform their investment decision. There is no pre-set sequence or speaking order, so any Shark can speak at any point.

-

3.

At this stage, a Shark would either (i) state they are out’ (i.e., are not interested in pursuing this product) or (ii) make a counteroffer. Sometimes, several Sharks would (openly) communicate with each other to potentially form alliances in making an offer.

-

4.

Open discussion and negotiations between the Sharks and the entrepreneurs take place. Several outcomes are possible: (i) Entrepreneurs leave without a deal, either because no Shark made an offer or there was no agreement; (ii) entrepreneurs agree to a deal with one Shark; (iii) entrepreneurs agree to a deal with multiple Sharks who present a joint offer.

-

5.

The next entrepreneur or team of entrepreneurs enters the ‘tank’ to face the Sharks, and we again begin at step #1 above.

Our point of research concerns step #2 above: Whether a Shark makes an offer to the entrepreneurs or not. In further regressions, we also consider whether an agreement is eventually made (step #3 above), but results are consistent with our main estimates from predicting the likelihood to make an offer.

To illustrate the process with an example, consider the case of Rebecca Rescate and her product CitiKitty, a toilet training seat for pet cats (see Fig. 4). In episode 23 of season 2 (May 2011), Rescate asked for US$100k, offering 15% of her venture in return. She then pitched her product and fielded questions from the investors (including a line of questioning about potential liability concerns of toilet-training cats). At the end of the pitch, Kevin O’Leary, Robert Herjavec, and Daymond John announced they are ‘out’. We code these three observations as the entrepreneur not receiving an offer. Kevin Harrington offers the requested $100k for 40% of the company, while Barbara Corcoran offers the exact deal Rescate requested—both these observations are coded as the entrepreneur receiving an offer. Eventually, Rescate agreed to a deal with Harrington, receiving $100k for 20% of her business.Footnote 6 (Today, Rescate has earned millions from CitiKitty; see CitiKitty 2020, and Wells 2020.)

3.2 Game shows and empirical research

Data from game shows has been used to study a range of behavioral patterns, often complementing insights from laboratory studies. The advantages usually come from higher, more realistic stakes (van den Assem et al. 2012), intense pressure (which often better reflects the respective real-life situation), and large samples. Early studies to better understand risk-taking and decision-making under uncertainty have used data from Card Sharks (Gertner 1993), Jeopardy! (Metrick 1995; Lindquist and Säve-Söderbergh 2011; Säve-Söderbergh and Sjögren Lindquist 2017; Jetter and Walker 2017, 2018, 2020a, b), the Weakest Link (Levitt 2004; Antonovics et al. 2005), Deal or No Deal (Post et al. 2008; De Roos and Sarafidis 2010), and Cash Cab (Kelley and Lemke 2013, 2015). Previous research has also examined the Shark Tank format. Maxwell et al. (2011) utilizes the Canadian version of the show, Dragon’s Den, to draw conclusions about early-stage investing.

Notably, Boulton et al. (2019) study Shark Tank, featuring 175 (vs. our 246) episodes from eight seasons (as opposed to our 11 seasons). Boulton et al. (2019) consider gender as one element of a group of shared characteristics, concluding that “personal characteristics are associated with the outcomes of negotiations between angel investors and entrepreneurs.” While their analysis does not incorporate Shark-fixed effects, they do collect and account for additional information pertaining to shared regional origin and race between entrepreneurs and Sharks. Our paper extends, focuses, and quantifies this aspect of Boulton et al. (2019), as we consider gender interactions exclusively and in greater depth, e.g., considering heterogeneity by asking valuation and product category, as well as pursuing a range of robustness checks. We also extend the analysis of gender as a shared characteristic to the show’s male investors and entrepreneurs.

Beyond Boulton et al. (2019), as far as we are aware, only Hernandez-Arenaz and Iriberri (2018) exclusively explore gender interactions in bargaining with game show data, finding that female participants in Spain are more likely to make reduced requests in bargaining, but only from men. These results suggest interaction effects are relevant when studying negotiation settings in general. The corresponding stakes are slightly greater than 400 Euros, which is larger than in most laboratory settings but remains substantially lower than those of most entrepreneurs seeking investment in their products.

3.3 Advantages and disadvantages of Shark Tank data

The downsides of game show settings often relate to potential audience effects or social desirability biases, whereby show participants may act differently because they know they are being observed by an audience (van den Assem et al. 2012). Further, selection issues remain a concern as a game show participant may not necessarily be representative of the respective group in society. In our case, entrepreneurs applying for Shark Tank may not feature the same characteristics as the average US entrepreneur. For example, given that the public nature of the show means it serves not only as an opportunity to receive investment but also an advertisement to potential customers, many of the products that feature on the show are business-to-consumer retail products, a sector which makes up only 8% of those seeking angel funding across the US in 2020 (Sohl 2021). In addition, out of those who do apply, show organizers likely select what they believe are the most interesting products and entrepreneurs to be on TV.Footnote 7

The corresponding advantages of studying Shark Tank, in addition to high monetary stakes that are likely to elicit actions consistent with both sides’ preferences, also concern personal aspects. Entrepreneurs negotiate over the fate of their own businesses, which often significantly determines economic returns for them and their families. From the Shark side, the invested money comes from their own funds rather than a pool of money the show allocates. Experimental research has shown that behavioral differences arise between money that has been earned – such as the funds and business equity Shark Tank deals with – and money that has been endowed (Hoffman et al. 1994; Cherry et al. 2002; Reinstein and Riener 2012; Danková and Servátka 2015).Footnote 8 The fact that the bargaining process is more personal than an experimental setting or a different game show setting, where the money is provided to the bargaining parties, allows for the possibility of real losses on behalf of both bargaining parties and avoids potential ‘house money’ or ‘windfall’ effects that may arise in situations where bargaining occurs with money endowed by a third party.

Another benefit of Shark Tank data comes from the flexible show format. Laboratory studies typically use fixed negotiation pies and structured bargaining frameworks (see Dittrich et al. 2014, where participants only communicate via a predetermined written form). Hernandez-Arenaz and Iriberri’s (2018) field study is freer from a behavioral perspective but still uses a fixed pie negotiation framework. The only condition imposed on the Shark Tank bargaining framework is that entrepreneurs must, at minimum, receive the amount of cash they request at the beginning. There are no restrictions on the equity amount that can be exchanged. For example, in one pitch from season 9, the clothing company Birddogs offered just 1.5% equity. Conversely, two entrepreneurs in season 10, pitching their product The Moki Door Step, sold 100% of their business for US$3m.

In sum, Shark Tank allows us to study true investment decisions in a transparent way, being able to observe the actions of both entrepreneurs and potential investors.

4 Data and empirical strategy

4.1 Data

By watching every episode, we construct a unique dataset spanning the entirety of the Shark Tank series from inception in 2009, including 977 pitches from 246 episodes.Footnote 9 This results in 4893 individual Shark–entrepreneur interactions over 11 seasons. Of the 977 pitches, 522 saw a single entrepreneur present their product, 421 featured a team of two entrepreneurs, while 33 presented a team of three and one pitch included four entrepreneurs.

The key variables of our analysis are the genders of both the Sharks and the entrepreneur teams. Table 1 reports summary statistics, while Table 7 documents summary statistics by Shark gender. Table 1 shows that a Shark made an offer in 28% of all Shark–entrepreneur interactions, approximately in-line with data from the Center for Venture Research (Sohl 2021). Similarly, 28% of all interactions featured female Sharks. This compares positively to the general venture capital market, where approximately 10% of venture capital investors are female (Clark 2019), but is again similar to the angel investment market, where 29.5% of US angel investors were female in 2020 (Sohl 2021). Entrepreneurial teams on Shark Tank are twice as likely to include males than females. Overall, 243 (588) of the 977 pitches involved no male (female) entrepreneurs, while the remaining 146 pitches saw mixed-gender teams. In half of all Shark–entrepreneur interactions, gender of the Shark fully matches the gender makeup of the entrepreneur(s), i.e., either the Shark is male and all corresponding entrepreneurs are male or the Shark is female and all corresponding entrepreneurs are female. Results are not affected by how we code mixed-gender teams (see Sect. 5.2).

To capture potential confounders as well as possible, we employ data on the asking valuation of the entrepreneurs (cash requested divided by the stake offered) and product categories (available from AllSharkTankProducts.com). These data are consistently available and objectively assessable for all pitches.Footnote 10 Our estimations account for the natural logarithm of the asking valuation as a potential predictor of the likelihood to make an offer. Products are categorized in up to two of the 14 categories, and over three quarters of all pitches are categorized as Home, garden, and tools (20%), Food and drink (17%), Fashion (16%), Kids, toys, and baby (14%), or Beauty and health (13%). Table 8 provides an overview of numbers in each category, as well as category combinations.

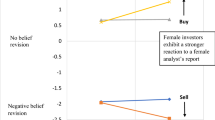

Figure 1 visualizes the likelihood of the Shark making an offer, distinguishing between the four possible gender combinations. The male-Shark-male-entrepreneur combination resulted in an offer in 29.9% of all cases—an average that is not quite statistically different from the male-female combination at conventional levels (27.4%; p-value of t-test for difference: 0.116). However, we observe a statistically significant difference for female Sharks who are 8.6 percentage points more likely to make an offer to female, rather than male, entrepreneurs (33.4% vs. 24.9%; p-value of t-test for difference: 0.002). Importantly, these basic comparisons of means do not account for potential confounders yet, such as product category, asking valuation, or unobservable differences across Sharks.

4.2 Empirical strategy

Our main specifications employ a basic OLS regression framework to predict whether Shark i presents an offer to the entrepreneur or the team of entrepreneurs j. We employ a linear regression format to facilitate the interpretation of magnitudes, but all results are virtually identical in statistical terms when considering logit specifications (see Sect. 5.2).Footnote 11 Formally, our main regression becomes

where \(\big (\textrm{Gender}{\,}\textrm{match}\big )_{ij}\) constitutes a binary indicator for whether the entire entrepreneurial team shares the same gender as Shark i. Results are consistent if we code that variable as one if at least one member of the entrepreneurial team features the same gender as the Shark (see Table 3). \(\beta \) represents our coefficient of interest: If gender played no role in Sharks’ actions, we should derive a coefficient that is statistically and quantitatively indistinguishable from zero.

\(\mathbf {X_{ij}}\) constitutes a vector of various observable control variables that could independently influence the Shark’s likelihood to present an offer. First, \(\mathbf {X_{ij}}\) accounts for binary indicators for each of the fourteen product categories. These category-fixed effects ensure \(\beta \) remains free of associations between particular product types and the likelihood to receive an offer. In other words, \(\beta \) is free of cross-category variation, and we only compare, fashion products to fashion products, for example. Section 5.3 delineates along those dimensions with category-specific specifications, exploring whether \(\beta \) differs when we focus on subsamples of particular product categories.

Second, \(\mathbf {X_{ij}}\) incorporates two binary indicators measuring (i) the presence of multiple female investors and (ii) whether the entrepreneurs present as a team. The former variable addresses potential selection whereby the show may attempt to match (fe)male entrepreneurs with (fe)male investors.Footnote 12 It also controls for the possibility that teams of entirely one gender may send stronger signals regarding venture leadership. The latter variable ensures \(\beta \) is not driven by any effects stemming from the size of the entrepreneurial team.Footnote 13

Third, we account for variables measuring (i) the percentage of the business offered and (ii) the natural logarithm of both the requested cash value and the asking valuation (calculated as dividing the requested cash value by the asking share). Accounting for the entrepreneurs’ asking valuation and its respective components ensures the stakes and their individual effect on a Shark’s likelihood to make an offer are filtered out. For example, if female entrepreneurs were more likely to request lower dollar amounts or offer smaller company shares than male entrepreneurs in the same product category, and female Sharks were more comfortable funding lower-stakes ventures than male Sharks, we may incorrectly attribute such dynamics to \(\beta \). Further, asking valuation also serves as a(n albeit subjective) proxy of product quality and market potential.

Finally, \(\mathbf {X_{ij}}\) includes season-fixed effects that account for the global investment climate in the year of filming and minor format changes in the show. For example, in season 5, Shark Tank removed a fee in the form of equity or royalties paid to the show’s production company simply for appearing on the show (Yakowicz 2013). Further, gender-specific aspects and considerations of Sharks, entrepreneurs, or Shark–entrepreneur matchings may have changed over time, and we want to ensure such overarching time trends are not affecting our derivation of \(\beta \).

Next, \(\lambda _{i}\) incorporates Shark-fixed effects to ensure \(\beta \) is not driven by unobservable cross-Shark variation that could independently affect their likelihood to produce an offer. For instance, an individual Shark’s beliefs, preferences, and gender perceptions may otherwise bias the derivation of \(\beta \). Concerning the error term, we calculate standard errors clustered at the Shark level but also present robust standard errors.

After estimating equation (1) for the full sample, we independently study subsamples of male and female Sharks, as well as other relevant subsamples and interaction effects. Overall, while we cannot eliminate the possibility of unobservable factors affecting \(\beta \), even after the inclusion of these covariates, we suggest it would be difficult for such dynamics to fully account for our derived \(\beta \)s. Nevertheless, any interpretation of our derived estimates should of course keep that possibility in mind.

5 Empirical results

5.1 Main findings

Table 2 documents our main results. Columns (1) and (2) consider the full sample of all Sharks, columns (3) and (4) turn to male Sharks, and columns (5) and (6) focus on female Sharks. For each sample, we first present results from a basic univariate estimation, followed by estimates derived from including the full set of covariates introduced in equation (1). Column (7) re-estimates column (2) but introduces a binary variable for investor gender and an interaction term between the gender match variable and the binary indicator for female Sharks. Standard errors clustered at the Shark level appear in parentheses below the estimates, while robust standard errors are denoted in brackets.

Estimations on the full sample imply some preference for entrepreneurs of the same gender. In the univariate estimation, gender match is indicated to raise the likelihood of the Shark making an offer by four percentage points or approximately 14%. The inclusion of our control variables increases that magnitude to 4.7 percentage points. The derived coefficient is statistically significant at the five (and one) percent level when employing clustered (robust) standard errors. Interestingly, higher asking valuations, potentially serving as a proxy of product quality, are positively correlated with the average Shark’s probability to propose an offer, although this is not statistically significant at conventional levels.

However, once we turn to the gender-specific subsamples of Sharks, substantial heterogeneity emerges. In fact, male Sharks are not more likely to engage with male entrepreneurs—a result that remains statistically and quantitatively indistinguishable from zero with an estimated coefficient of 0.012 once all covariates are accounted for.

Turning to the female subsample yields different conclusions. Without considering potential confounders, female Sharks are 8.6 percentage points more likely to present an offer to female entrepreneurs. This magnitude increases to 9.7 percentage points when acknowledging the independent effects of product category, season, ask characteristics, and Shark-fixed effects. Not only is that result meaningful in statistical terms (p-value of 0.008 for clustered standard errors) but also in terms of magnitude, implying an increase by over 35% of a female Shark’s average likelihood to present an offer.

The interaction variable generated in Column (7) delivers consistent results, showing the gender match between female entrepreneurs and female investors is associated with an increased likelihood of an offer being extended by 9.7 percentage points. However, this structure allows us to confirm a slightly modified conclusion: while Column (6) tells us female investors are more likely to extend offers to female entrepreneurs, Column (7) suggests female entrepreneurs are more likely to receive offers from female Sharks.

This finding corroborates the scarce existing literature. It partly confirms Boulton et al.’s (2019) broader conclusions regarding homophily among investors; however, our results specify these insights, suggesting this factor to be exclusive to female (not male) investors. It also matches the finding of research summarized in Balachandra (2020) that suggests female investors are more likely to invite women to the pitch stage, as well as the finding in Harrison and Mason (2007) that female investors are more likely to assist female entrepreneurs. This finding also provides large-sample evidence for the industry representation hypothesis regarding closing the gender gap in venture capital funding, supported by Greene et al. (2001) and Balachandra (2020), for example.

5.2 Robustness checks

Table 3 displays results from several robustness checks and alternative specifications. Columns (1)–(4) focus on male Sharks, while columns (5)–(10) explore female Sharks’ behavior. In columns (1) and (5), we predict the likelihood of a deal eventually being reached, rather than simply the likelihood of the Shark making an offer. For example, it is possible that female Sharks are more likely to make an initial offer to female entrepreneurs, but perhaps these are so low that a deal is eventually unlikely to materialize. Here again, we derive a statistically and quantitatively significant coefficient for female Sharks. In terms of magnitude, female Sharks are 9.3 percentage points more likely to complete a deal with female entrepreneurs than male entrepreneurs, equivalent to a difference of as much as 52%.

Interestingly, we do now also find a statistically significant relationship for male Sharks. Male Sharks are 1.3 percentage points more likely to complete a deal with male entrepreneurs than female entrepreneurs (a difference of approximately 10%), despite no apparent preference in gender when extending offers. Interpretations of these coefficients should be made cautiously, however; given a deal requires agreement from both sides of the negotiation, it is not clear whose preferences (if any) are represented in this coefficient. However, these estimates indicate that the gender match coefficients in Table 2 are unlikely to be a result of unusually low offers.

This is further confirmed in alternative estimations, where we explore whether the implied valuation of a female Shark’s offer differs statistically when facing female entrepreneurs. We find that is not the case, as indicated by Fig. 2. We also conduct balance tests to explore potential gender interaction effects for the likelihood to be offered a non-standard deal by a Shark (e.g., being offered a loan or an agreement with a royalty structure); however, we find no heterogeneity there (see Fig. 5).

In columns (2) and (6), we employ a logit estimation to better capture the binary nature of the dependent variable. In columns (3) and (7), we alternatively include mixed-gender teams into the gender match category, i.e., any entrepreneurial team that features at least one member of the Shark’s gender is coded as a gender match. In columns (4) and (8), we incorporate a binary variable for whether another competing offer is made to the respective entrepreneurs. Finally, columns (9) and (10) exclude the two female Sharks who appeared in the most episodes to ensure our results are not driven by a single investor. In all corresponding estimations, we derive results that are consistent with those from Table 2.

5.3 Product categories

Although the full results from Table 2 control for category-fixed effects, thereby isolating within-category variation only (i.e., removing cross-category variation) in the likelihood to make an offer, it is possible that our main finding is specific to some categories. Figure 3 shows that the share of female entrepreneurs differs substantially across categories. For example, when it comes to Kids, toys, and babies, 54% of all entrepreneurs on Shark Tank are female. On the other end, only 8% of all entrepreneurs featuring products related to the automotive industry are female.

To explore potential heterogeneity along product categories, Table 4 first documents results from individually studying the five most common product categories. Columns (6) and (7) independently focus on those five non-male dominated categories that feature a higher share of female entrepreneurs than the average (see Fig. 3) and then on the remaining, male-dominated categories. Panel A considers male Sharks, while Panel B is dedicated to female Sharks.

For male Sharks, we find gender is a statistically positive predictor of offer likelihood in the food product category. For female Sharks, we particularly identify effects in the Kids, toys, and baby and Beauty and health categories. We also derive a positive coefficient for Fashion products that barely misses statistical significance at conventional levels (p-value of 0.129). Interestingly, these constitute some of the categories that are most often presented by female entrepreneurs (see Fig. 2). This is further highlighted by the results from the final columns, where we distinguish between what we label the non-male-dominated and the male-dominated categories in terms of the average gender distribution of entrepreneurs. We find clear evidence, both in statistical and quantitative terms, that female entrepreneurs are more successful than male entrepreneurs in seeking funding offers for products that are more often represented by female business leaders. However, that is not the case for products that are typically presented by male entrepreneurs. Thus, our main result is driven by product categories in which female entrepreneurs are more common, at least on Shark Tank.

This finding corroborates recent research (Kanze et al. 2020) and lends credence to the use of role congruity theory when analyzing gender differences in venture capital and angel investment. While we have previously identified incongruity between female gender roles and perceptions of entrepreneurship, role congruity theory would suggest any impact of this would be minimized when female investors pitch products that align more closely with female gender roles, as the perceived mismatch is reduced. This improved match may indicate expertise in the eyes of investors (Kanze et al. 2020), which could affect offer outcomes across categories. This suggestion is supported by the negotiation literature such as Bear (2011), showing aversion to negotiation which is gender-incongruent.

5.4 Asking valuation

Our final set of estimations turns to potential heterogeneity along asking valuations. Table 5 delineates pitches by their asking valuation, as it is possible that gender bias in Sharks’ investment behavior is more readily expressed in, for example, lower-valued products. Put simply, it might be easier for female Sharks to ‘support’ female entrepreneurs if the associated cost is lower.

In column (1), we include an interaction term between the entrepreneurs’ asking value and the binary gender match indicator. If asking valuation did not play any role in offer decisions, we should not derive a statistically meaningful estimate here. Interestingly, we now derive some weak statistical evidence for gender matches to matter for male Sharks as well, at least at the low end of the asking value distribution (column 1 of Panel A). To properly explore potential nonlinearities along these lines, columns (2)–(5) consider subsamples of the respective asking valuations, beginning with the first quartile of the overall sample and ending with the fourth quartile. Indeed, for pitches between the 25th and 50th percentile in terms of asking valuation, male Sharks are more likely to select male entrepreneurs. However, no statistically meaningful relationship between gender match and the likelihood to make an offer emerges in the remaining segments.

For female Sharks, as documented in Panel B, a gender match matters for pitches that rank below the median in terms of asking valuation, which corresponds to approximately US$1.44m. Put differently, as investment value rises, entrepreneur gender ceases to matter—but female entrepreneurs appear particularly successful in obtaining offers from female Sharks if asking valuations are moderate. An alternate version of this analysis is included as “Appendix Table 9”, using the amount of cash requested rather than asking valuation as the measure of cost of investment. In that case, we no longer find any statistically significant relationship between gender match and likelihood of offer for male Sharks in any quartile. For female Sharks, we now also find the third quartile shows a meaningful relationship between a gender match and the likelihood of offer. However, we now see the associated coefficient for the first quartile (0.119) is notably larger than those for the second and third quartile (0.086 and 0.091 respectively), meaning the general takeaway remains the same: gender appears to matter more for female Sharks when the cost of investment is lower.

6 Conclusions

This paper introduces a large and comprehensive database of 4893 investor–entrepreneur interactions on the popular US game show Shark Tank. In reality, researchers rarely observe objective information on the behavior of entrepreneurs and potential investors—an artefact that substantially complicates our understanding of the sizeable gender gap in angel investment funding. Shark Tank offers just that: A transparent database which contains both successful and unsuccessful interactions between entrepreneurs who are seeking funding for their business and potential investors.

We focus on the descriptive power of gender interactions for the likelihood of an entrepreneur receiving an offer from the respective Shark. Our estimations produce evidence that is consistent with homophily, i.e., a female entrepreneur (relative to a male entrepreneur) is significantly more likely to obtain an offer from a female investor. This result is driven by (i) product categories in which female entrepreneurs are represented more frequently and (ii) products that are valued at less than the median US$1.44m. We also find some evidence to suggest male Sharks are more likely to reach an agreement with male entrepreneurs, though this result remains less robust.

These findings are in line with the scarce literature on gender interactions in investment decisions that largely derives from experimental studies, and carries potential consequences for our understanding of both negotiations and probabilities to secure funding offers. Our findings are consistent with the industry representation hypothesis, indicating that increasing the number of women in decision-making positions in venture capital firms might improve access to funds for female entrepreneurs, thereby reducing the gender disparity in angel investment funding. This might be especially the case for products in which the field of entrepreneurs is less male-dominated, such as Kids, toys, and babies, Beauty and health, and Fashion. Importantly, these findings indicate that female investors may have a positive bias towards female entrepreneurs, rather than male investors exhibiting a negative bias towards female entrepreneurs. Naturally, we advise caution in extrapolating our findings but hope to contribute towards a better understanding of the large gender gap in entrepreneurs’ success to secure investment funding.

Notes

For example, Antonovics et al. (2009) conclude that insights derived from laboratory and field studies in general are only comparable when stakes are high.

The nature of Shark Tank also allows for a better approximation of flexible real-life bargaining scenarios, owing to the free negotiation framework which allows for greater creativity in reaching mutually beneficial outcomes, compared to laboratory-based studies that often feature relatively rigid decision steps.

More specifically, we collect and analyze data for 246 episodes of all 11 seasons of Shark Tank to date, which constitutes approximately 40% more data points than Boulton et al. (2019) who study the general predictors of entrepreneurs’ requested valuations, offer likelihoods, and acceptance likelihoods across 175 episodes of the first eight seasons of Shark Tank. To be clear, we do not employ Boulton et al.’s (2019) data but hand-collect our entire database (see Sect. 4.1).

More generally, individual characteristics (such as gender, race, age, or geographical background) and their degree of similarity between bargaining partners may affect behavior and be able to influence negotiation outcomes (McPherson et al. 2001). For example, Hegde and Tumlinson (2014) find that “U.S. venture capitalists (VCs) are more likely to select start-ups with coethnic executives for investment.”

The Sharks are seated next to each other, all facing the entrepreneur(s).

This may seem an odd decision on the part of Rescate, but this example illustrates why we restrict our main analysis to investors extending offers; Sharks feature difficult-to-quantify value beyond money. A particular Shark’s business history and relationships may impact an entrepreneur’s decision to take a deal, such as Harrington’s TV platform that informed Rescate’s decision.

Shark Tank receives over 40,000 applicants per season, of which approximately 100 make it to air on TV (John 2014).

It should be noted that some studies have failed to replicate such an effect, such as Demiral and Mollerstrom (2020).

Initially, these were 991 pitches, but we omit 14 of them because of irregularities in pitch type or mixed-gender teams that do not fit a 0% (i.e., all-male), 50% (e.g., one female and one male), or 100% (all-female) gender composition.

We also considered including sales data at the time of the pitch, but these data are sometimes not reported by entrepreneurs or stated in different formats (e.g., over different time horizons or geographical areas), which would introduce selection issues.

Predicted values from linear regressions all range between zero and one in our estimations, i.e., there is no concern about predicting unrealistic probabilities to make an offer below zero or above one.

A binary is used here as only sixteen observations exist outside an investment panel construction of 4-1 or 3-2 (M-F), so these are collapsed into the main binary.

39% of pitches involving only men are by teams, while only 32% of pitches by only women are by teams.

References

ABC (2020) Shark Tank - Cast. Characters and Stars, Web page

Ahl H (2006) Why research on women entrepreneurs needs new directions. Entrep. Theory Pract. 30(5):595–621

Alsos GA, Ljunggren E (2017) The role of gender in entrepreneur-investor relationships: a signaling theory approach. Entrep Theory Pract 41(4):567–590

Amazon (2020) Citikitty cat toilet training kit. Website

Andersen S, Marx J, Nielsen KM, Vesterlund L (2020) Gender differences in negotiation: evidence from real estate transactions. Technical report, National Bureau of Economic Research

Antonovics K, Arcidiacono P, Walsh R (2005) Games and discrimination lessons from the Weakest Link. J Hum Resour 40(4):918–947

Antonovics K, Arcidiacono P, Walsh R (2009) The effects of gender interactions in the lab and in the field. Rev Econ Stat 91(1):152–162

Babcock L, Laschever S, Gelfand M, Small D (2003) Nice girls don’t ask. Harvard Bus Rev 81(10):14–16

Balachandra L (2020) How gender biases drive venture capital decision-making: exploring the gender funding gap. Gender Manag 35(3):261–273

Balachandra L, Briggs T, Eddleston K, Brush C (2019) Don’t pitch like a girl!: how gender stereotypes influence investor decisions. Entrep Theory Pract 43(1):116–137

Bear J (2011) “Passing the buck’’: incongruence between gender role and topic leads to avoidance of negotiation. Negot Conflict Manag Res 4(1):47–72

Becker-Blease JR, Sohl JE (2007) Do women-owned businesses have equal access to angel capital? J Bus Ventur 22(4):503–521

Bertrand M (2011) New perspectives on gender. In: Handbook of labor economics. Elsevier, vol 4, pp 1543–1590

Blau FD, Kahn LM (2017) The gender wage gap: extent, trends and explanations. J Econ Lit 55(3):789–865

Bosse DA, Taylor PL III (2012) The second glass ceiling impedes women entrepreneurs. J Appl Manag Entrep 17(1):52

Boulton TJ, Shohfi TD, Zhu P (2019) Angels or sharks? The role of personal characteristics in angel investment decisions. J Small Bus Manag 57(4):1280–1303

Bowles HR, Babcock L, Lai L (2007) Social incentives for gender differences in the propensity to initiate negotiations: sometimes it does hurt to ask. Organ Behav Hum Decis Process 103(1):84–103

Brockner J, Higgins ET, Low MB (2004) Regulatory focus theory and the entrepreneurial process. J Bus Ventur 19(2):203–220

Brush C, Greene P, Balachandra L, Davis A (2018) The gender gap in venture capital- progress, problems, and perspectives. Venture Capital 20(2):115–136

Burnett M (2009) Shark tank - episode 101

Castillo M, Petrie R, Torero M, Vesterlund L (2013) Gender differences in bargaining outcomes: a field experiment on discrimination. J Public Econ 99:35–48

Cherry TL, Frykblom P, Shogren JF (2002) Hardnose the dictator. Am Econ Rev 92(4):1218–1221

CitiKitty (2020) Citikitty cat toilet training kit with extra training insert - citikitty inc. Web page

Clark K (2019) US VC Investment in female founders hits all-time high. Web page

Corkran JA, McCarthy L, Wallace P (2021) Does Robinhood deserve the same amount of capital as all women-led businesses combined?

Danková K, Servátka M (2015) The house money effect and negative reciprocity. J Econ Psychol 48:60–71

De Roos N, Sarafidis Y (2010) Decision making under risk in Deal or No Deal. J Appl Econom 25(6):987–1027

Demiral EE, Mollerstrom J (2020) The entitlement effect in the ultimatum game-does it even exist? J Econ Behav Organ 175:341–352

Dittrich M, Knabe A, Leipold K (2014) Gender differences in experimental wage negotiations. Econ Inquiry 52(2):862–873

Eddleston KA, Powell GN (2008) The role of gender identity in explaining sex differences in business owners’ career satisfier preferences. Journal of Business Venturing 23(2):244–256

Eriksson KH, Sandberg A (2012) Gender differences in initiation of negotiation: Does the gender of the negotiation counterpart matter? Negot J 28(4):407–428

Garrett B (2020) There’s Still A \$189 Billion Gender gap in startup funding—but efforts to move the needle are stronger than ever. Online article

Gertner R (1993) Game shows and economic behavior: risk-taking on “Card Sharks’’. Q J Econ 108(2):507–521

Greenberg J, Mollick E (2017) Activist choice homophily and the crowdfunding of female founders. Adm Sci Q 62(2):341–374

Greene PG, Brush CG, Hart MM, Saparito P (2001) Patterns of venture capital funding: Is gender a factor? Venture Capital 3(1):63–83

Gupta VK, Turban DB (2012) Evaluation of new business ideas: Do gender stereotypes play a role? J Manag Issues, 24(2):140–156,121. Copyright - Copyright Pittsburg State University, Department of Economics Summer 2012; Document feature - Tables; ; Last updated - 2013-02-28; CODEN - JMAIE9; SubjectsTermNotLitGenreText - United States–US

Gupta VK, Turban DB, Wasti SA, Sikdar A (2009) The role of gender stereotypes in perceptions of entrepreneurs and intentions to become an entrepreneur. Entrep Theory Pract 33(2):397–417

Guzman J, Kacperczyk AO (2019) Gender gap in entrepreneurship. Res Policy 48(7):1666–1680

Harrison RT, Mason CM (2007) Does gender matter? Women business angels and the supply of entrepreneurial finance. Entrep Theory Pract 31(3):445–472

Hebert C (2020) Gender stereotypes and entrepreneur financing. In: 10th Miami behavioral finance conference

Hegde D, Tumlinson J (2014) Does social proximity enhance business partnerships? Theory and evidence from ethnicity’s role in US venture capital. Manag Sci 60(9):2355–2380

Hernandez-Arenaz I, Iriberri N (2018) Women ask for less (only from men): evidence from bargaining in the field. J Econ Behav Organ 152:192–214

Hoffman E, McCabe K, Shachat K, Smith V (1994) Preferences, property rights, and anonymity in bargaining games. Games Econ Behav 7(3):346–380

Jetter M, Walker JK (2017) Anchoring in financial decision-making: Evidence from Jeopardy! J Econ Behav Organ 141:164–176

Jetter M, Walker JK (2018) The gender of opponents: Explaining gender differences in performance and risk-taking? Eur Econ Rev 109:238–256

Jetter M, Walker JK (2020) At what age does the anchoring heuristic emerge? Evidence from Jeopardy! J Econ Behav Organ 179:757–766

Jetter M, Walker JK (2020b) Gender differences in performance and risk-taking among children, teenagers, and college students: Evidence from Jeopardy!. BE J Econ Anal Policy 20(2)

John D (2014) Behind the scenes of Shark Tank as a startup. Web blog

Kanze D, Conley MA, Okimoto TG, Phillips DJ, Merluzzi J (2020) Evidence that investors penalize female founders for lack of industry fit. Sci Adv 6(48):eabd7664

Kanze D, Huang L, Conley MA, Higgins ET (2018) We ask men to win and women not to lose: closing the gender gap in startup funding. Acad Manag J 61(2):586–614

Kelley MR, Lemke RJ (2013) Decision-making under uncertainty in the Cash Cab. Appl Cogn Psychol 27(4):542–551

Kelley MR, Lemke RJ (2015) Gender differences when subjective probabilities affect risky decisions: an analysis from the television game show Cash Cab. Theory Decis 78(1):153–170

Lanaj K, Chang C-H, Johnson RE et al (2012) Regulatory focus and work-related outcomes: a review and meta-analysis. Psychol Bull 138(5):998

Leibbrandt A, List JA (2015) Do women avoid salary negotiations? Evidence from a large-scale natural field experiment. Manag Sci 61(9):2016–2024

Levitt SD (2004) Testing theories of discrimination: evidence from Weakest Link. J Law Econ 47(2):431–452

Lewis H (2009) ABC To Humiliate Entrepreneurs On National TV. Web article

Lindquist GS, Säve-Söderbergh J (2011) “Girls will be girls’’, especially among boys: risk-taking in the “daily double’’ on Jeopardy. Econ Lett 112(2):158–160

Lins E, Lutz E (2016) Bridging the gender funding gap: Do female entrepreneurs have equal access to venture capital? Int J Entrep Small Bus 27(2–3):347–365

Malmström M, Johansson J, Wincent J (2017) Gender stereotypes and venture support decisions: how governmental venture capitalists socially construct entrepreneurs’ potential. Entrep Theory Pract 41(5):833–860

Maxwell AL, Jeffrey SA, Lévesque M (2011) Business angel early stage decision making. J Bus Ventur 26(2):212–225

Mazei J, Hüffmeier J, Freund PA, Stuhlmacher AF, Bilke L, Guido H (2015) A meta-analysis on gender differences in negotiation outcomes and their moderators. Psychol Bull 141(1):85–104

McPherson M, Smith-Lovin L, Cook JM (2001) Birds of a feather: homophily in social networks. Annu Rev Sociol 27(1):415–444

Metrick A (1995) A natural experiment in “Jeopardy!’’. Am Econ Rev 85(1):240–53

OECD (2020). OECD iLibrary – Consumer Prices. OECD website

Post T, Van den Assem MJ, Baltussen G, Thaler RH (2008) Deal or no deal? Decision making under risk in a large-payoff game show. Am Econ Rev 98(1):38–71

Recalde M, Vesterlund L (2020) Gender differences in negotiation and policy for improvement. Technical report, National Bureau of Economic Research

Reinstein D, Riener G (2012) Decomposing desert and tangibility effects in a charitable giving experiment. Exp Econ 15(1):229–240

Robb AM, Watson J (2012) Gender differences in firm performance: evidence from new ventures in the United States. J Bus Ventur 27(5):544–558

Roper S, Scott JM (2009) Perceived financial barriers and the start-up decision: an econometric analysis of gender differences using GEM data. Int Small Bus J 27(2):149–171

Säve-Söderbergh J (2019) Gender gaps in salary negotiations: salary requests and starting salaries in the field. J Econ Behav Organ 161:35–51

Säve-Söderbergh J, Sjögren Lindquist G (2017) Children do not behave like adults: gender gaps in performance and risk taking in a random social context in the high-stakes game shows Jeopardy and Junior Jeopardy. Econ J 127(603):1665–1692

Sohl J (2021) The Angel Market in 2020: Return of the Seed and Start-Up Stage Market for Angels. Technical report, Center for Venture Research

Stuhlmacher AF, Linnabery E (2013) Handbook of research on negotiation, chapter Gender and negotiation: a social role analysis, pages 221–248. Edward Elgar, London, UK

Stuhlmacher AF, Walters AE (1999) Gender differences in negotiation outcome: a meta-analysis. Pers Psychol 52(3):653–677

Thébaud S (2015) Status beliefs and the spirit of capitalism: accounting for gender biases in entrepreneurship and innovation. Soc Forces 94(1):61–86

Tinkler JE, Bunker Whittington K, Ku MC, Davies AR (2015) Gender and venture capital decision-making: the effects of technical background and social capital on entrepreneurial evaluations. Soc Sci Res 51:1–16

Tinsley CH, Cheldelin SI, Schneider AK, Amanatullah ET (2009) Women at the bargaining table: pitfalls and prospects. Negot J 25(2):233–248

van den Assem MJ, van Dolder D, Thaler RH (2012) Spilt or steal? Cooperative behaviour when the stake are large. Manag Sci 58(1):2–20

Wells J (2020) How this 39-year-old became a millionaire with an invention that potty-trains cats. Web page

Yakowicz W (2013) Mark Cuban made Shark Tank change its contracts. Web article

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval

We report no conflict of interest, and all remaining errors are our own.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Missing Open Access funding information has been added in the Funding Note.

We are grateful to Martijn van den Assem and Tushar Bharati, as well as participants of the Honors Findings Presentation Seminar at the University of Western Australia for fruitful discussion and comments. We are also greatly indebted to two anonymous referees, the Associate Editor, and the Editor (Robert M. Kunst) for their constructive comments on an earlier version.

A Appendix

A Appendix

See Tables 6, 7, 8 and 9, Figs. 4 and 5.

The Citikitty product presented in episode 23 of season 2 by Rebecca Rescate. The top graph shows the product, while the bottom graph illustrates the process (from Amazon 2020)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Jetter, M., Stockley, K. Gender match and negotiation: evidence from angel investment on Shark Tank. Empir Econ 64, 1947–1977 (2023). https://doi.org/10.1007/s00181-022-02305-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02305-6

Keywords

- Gender interaction effects

- Gender differences

- Angel investment

- Venture capital financing

- Field data

- High stakes bargaining