Abstract

They do. Partly. We identify credit supply shocks via sign restrictions in a Bayesian VAR and separate them into positive and negative. Using local projections, we find that positive credit supply shocks leave notably different prints in private debt, mortgage debt, and debt-to-GDP, as opposed to negative credit supply shocks. This pattern is caused by the response of household mortgage debt. Furthermore, we find evidence that positive credit supply shocks are the driving force behind boom-bust cycles. Yet, developments behind the boom-bust cycle cannot explain the strong and persistent response in debt; but house prices tend to. However, if we abstract from potential asymmetries, we get rather mild results, which underestimate the true effects of credit supply shocks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The financial crisis and the subsequent Great Recession made sternly clear that credit markets can take a leading role for economic activity. As such, there is a renewed interest in the nexus between credit supply shocks and economic activity.

One common finding in the literature is that an unexpected contraction in credit conditions has adverse effects. For example, Gambetti and Musso (2017) estimate a time-varying vector autoregressive model (VAR) model with drifting parameters and stochastic volatility for the US, the UK, and the euro area for 1980 to 2011. They find significant effects of credit supply shocks which increase over time. Their results also imply that the effects of credit market distortions are stronger during recessions. In another seminal paper, Gilchrist and Zakrajšek (2012) show that lower credit spreads improve the costs of debt finance, which increases spending and production and, in turn, increases asset prices and thus stimulates economic activity through the financial accelerator mechanism (for further recent contributions, see Jordà et al. 2013; Mumtaz et al. 2018; Mian et al. 2017; Gertler and Gilchrist 2018; among others). However, these analyses have in common that they examine symmetric responses to distortions in credit supply, i.e. the impact of a positive shock is identical to the impact of a negative shock in absolute terms.

The contribution of this paper is to examine asymmetries (and potentially nonlinearities) in the propagation of credit supply shocks. The objective here is to provide new evidence on the transmission of credit supply shocks by relying on a simple, yet flexible framework. We follow Tenreyro and Thwaites (2016), who investigate asymmetric effects of monetary policy shocks on key macroeconomic variables via local projections. The advantages of local projections over vector autoregression (VAR) models are well documented (JordÀ 2005). Above all, it is not necessary to impose dynamic restrictions as is done in VAR models. Moreover, local projections allow us to parsimoniously test for asymmetric effects. We do so by splitting an identified credit supply shock à la Gambetti and Musso (2017) into its positive and negative parts which are then planted into a set of seemingly unrelated equations. This allows us to directly evaluate the effect of a credit supply shock for different adjacent horizons.Footnote 1 Our set of variables includes key variables for the US on the overall debt cycle of households, but also various variables describing real activity as well as the demand and supply side of the economy ranging from the early 1970s until late 2018.

Overall, our results clearly point to asymmetric effects concerning the different debt measures considered in this paper. More specifically, we find that the response of overall household indebtedness to an unexpected increase in credit supply is substantially stronger in absolute terms than in the opposite case of an unexpected decrease. That is, we find that an expansionary shock of one standard deviation leads to a significant increase of household indebtedness by about 1.5 percent after roughly three years. However, a negative shock of the same size leads to a decrease of household indebtedness which is significant only for the first year and also significantly different from the response following a credit supply easing. Importantly, this result is shown to clearly be driven by the responsiveness of households’ mortgages. Also, we find key macro headline variables (prices, production, short-term interest rate) as well as some key variables determining the demand and supply side of the economy to respond asymmetrically. Overall, following an expansionary shock of credit supply, our results clearly point to the well-established boom-bust cycle. In the opposite case we do not observe such a pattern.

While our framework allows us to flexibly uncover asymmetric responses following shocks, tracking the exact mechanisms that drive our results is beyond the scope of this model and, thus, of this paper.

Nevertheless, a large body of literature points at amplifications and asymmetries in the propagation of sudden (financial) distortions as, for example, (i) occasionally binding borrowing constraints, (ii) market imperfections (in terms of asymmetric information), or (iii) the role of asymmetric central bank behavior.

Regarding occasionally binding constraints, suppose an unexpected easing of credit conditions. In this case, both, firms and households that previously were excluded from the credit market are now able to borrow. The resulting increase in demand will in turn stimulate the economy. Following an unexpected deterioration in credit conditions, in contrast, the credit constraint could eventually become binding for both, households and firms. In this case, firms and households alike could either (i) no longer being able to rely on financial intermediaries to borrow externally or (ii) not being able to borrow the amount demanded.Footnote 2

Another important mechanism relies on the role of asymmetric information. In general, the external finance premium is the premium that banks charge due to asymmetric information regarding a project to be financed. As such, the balance sheet or net worth is of particular importance for the financing decision. Fluctuations in the net worth could thus increase the effect of shocks hitting the economy. Consider again a negative credit supply shock which reduces the availability of credit in the economy. In this case, the role of the balance sheet with respect to the credit conditions of firms will become more important than before. A positive credit supply shock, in contrast, increases the availability of credit. A firm with a given balance sheet may therefore find it easier to borrow money, but disproportionately more difficult to borrow money in the case of a negative shock.

Finally, the central bank may play an important role in the transmission of credit supply shocks. Central banks monitor the lending behavior to firms and households very closely. Eventually, the central bank has asymmetric preferences when it comes to stabilizing shocks stemming from the credit market. For example, it is possible that the central bank reacts stronger during boom phases than during bust phases. Also, the central bank eventually reacts different when overall credit conditions are loose already. Finally, the reaction of the central bank may also depend on the zero lower bound. For example, if the key interest rate is close to zero, the central bank has less scope to counter inflationary pressures and may have to resort to unconventional monetary policy measures. These effects on the systematic component of monetary policy can all contribute to making the transmission of credit supply shocks nonlinear or asymmetric.Footnote 3

Overall, our paper fits well into a relatively new strand of literature which investigates nonlinearities and asymmetries in the transmission of credit supply shocks. The first paper to mention is of Colombo and Paccagnini (2020), who estimate a smooth transition VAR (STVAR) and investigate the role played by credit supply shocks across the business cycle. They find that contractionary credit supply shocks trigger asymmetric and negative effects. However, the paper that fits closest is Barnichon et al. (2019), who estimate a vector moving-average (VMA) with functional approximations of impulse responses. They find that the effects of financial shocks on the economy depend on their sign and size. That is, their results imply that the mild and short-lived effects of financial market disruptions typically found in SVAR models can be explained by asymmetric effects. However, we do not solely focus on key macro variables, but also investigate whether asymmetric effects can be found in credit volumes as well as different measures of both, aggregate supply and aggregate demand. Finally, investigating asymmetries helps not only to get a better understanding of the consequences of credit supply shocks but rather is crucial for policymaking. This is because the events leading to and following the latest financial crisis raised the question whether monetary policy should take credit developments into account when making policy decisions. For this reason, it is not surprising that many economists propose that the central bank should eventually lean against the credit cycle. If this is the case, it is crucial for policy design to know whether credit shocks propagate symmetric or asymmetric before adjusting the short-term nominal interest rate.

The remainder of this paper is organized as follows. Section 2 explains the methodology. Section 3 contains our main results. In Sect. 4, we conduct a battery of robustness checks. Section 5 concludes.

2 Methodology

Before we show our results, we introduce our methodological approach in this section. First, we describe the derivation of our credit supply shock. We then explain our econometric methodology to uncover asymmetries in the transmission of these shocks. Finally, we set out our approach to statistical inference.

2.1 Deriving the credit supply shock

In order to derive a credit supply shock, we use an auxiliary structural VAR model identified by means of sign restrictions for the US. Let \(\textbf{y}_t\) be an \(n\times 1\) vector including real GDP, consumer prices, loan volumes, a composite lending rate, and a reference short-term (shadow) interest rate. The SVAR reads

where \(\varvec{\varepsilon }_t\) is an \(n\times 1\) vector of structural shocks, \(\textbf{A}_j\) is an \(n\times n\) matrix of structural parameters for \(0 < j \le J\) lags with \(\textbf{A}_0\) invertible and \(\textbf{c}\) is a \(1\times n\) vector of parameters.

The SVAR model in (1) can be rewritten as

where \(\textbf{A}_+'=[\textbf{A}_1', \ldots ,\textbf{A}_J', \textbf{c}']\) and \(\textbf{x}_t'=[\textbf{y}_{t-1}', \ldots ,\textbf{y}_{t-J}', 1]\) for \(1\leqslant t \leqslant T\). Hence, we estimate the reduced-form VAR

where \(\textbf{B}=\textbf{A}_+\textbf{A}_0^{-1}\), \(\textbf{u}_t'=\varvec{\varepsilon }_t\textbf{A}_0^{-1}\), and \(\textbf{E}[\textbf{u}_t\textbf{u}_t']=(\textbf{A}_0\textbf{A}_0')^{-1}\).

Since the structural parameters are not identified, we need to impose some restrictions. We therefore rely on the identification strategy of, among others, Gambetti and Musso (2017) who draw inference concerning the response of (log) real GDP, (log) consumer prices, (log) loan volumes, a composite lending rate, and a reference short-term interest rate to four structural shocks: (i) aggregate supply, (ii) aggregate demand, (iii) monetary policy, and (iv) credit supply.Footnote 4 The latter is of main interest for our further analysis.

Table 1 summarizes the identification restrictions. The identification of an aggregate supply shock, an aggregate demand shock and a monetary policy shock is quite standard, we therefore will not discuss it here.Footnote 5

The identification of the expansionary credit supply shock, on the other hand, deserves further discussion. As pointed out by, inter alia, Christiano et al. (2010) and Gambetti and Musso (2017), a credit supply shock can be associated with various events, such as unexpected changes in bank capital availability for loans due to changes in regulatory capital ratio requirements or unanticipated changes in the degree of competition in the banking sector. The identification we use can be thought of as (i) shocks to the bank funding technology or bank reserve demand, as in Cúrdia and Woodford (2010), as well as (ii) shocks to bank’s capital quality and bank’s net worth, as in Gertler and Karadi (2011). An expansionary credit supply shock consequently leads to an increase in real GDP and prices. This notion is in line with the identification scheme of all model-specific credit supply shocks in the models of Cúrdia and Woodford (2010) and Gertler and Karadi (2011) as well as some specific credit supply shocks in Gerali et al. (2010) and Christiano et al. (2010).

An exogenous increase in loan supply (credit supply) is also assumed to lead to a contemporaneous drop in the lending rate as well as an increase in the short-term interest rate, which is under the control of the central bank. An exogenous expansion of the supply of loans to the private sector via a decrease in the lending rate has expansionary effects as the lower costs of external funds enable to expand consumption while firms can expand their investments.Footnote 6 The central bank counteracts the resulting price pressure by increasing the short-term interest rate.

Finally, note that while it is common practice to derive shocks from an auxiliary SVAR model, our hybrid VAR-LP approach is internally inconsistent. This is because in the SVAR model, structural shocks are identified under the assumption that the data generating process is linear and symmetric, as pointed out by Barnichon et al. (2019).Footnote 7 Of course, one might consider deriving the structural shock in a state-dependent local projections model as well. However, this approach has two limitations: first, also within an LP approach along the lines of Plagborg-Møller and Wolf (2021), we need to proceed in two steps, where, in the first step, a linear local projections model is fitted to the observed data to extract a credit supply shock. In a second step, this shock is then used in another local projections model to uncover possible asymmetries in the transmission of credit supply shocks. The reason is that within both, an LP framework as well as a VAR framework, it is not possible to separately identify positive and negative credit supply shocks a priori without knowing the shock in advance. The second point is more of a technical nature. Structural identification in a local projection approach works very similarly to a VAR approach, whereby the variance-covariance matrix is derived from the \(h=1\) projection residuals for the identification. The (only) crucial difference, as pointed out by Plagborg-Møller and Wolf (2021), is that within a local projections framework, the reduced-form impulse responses come directly from the direct projections rather than from iterative forecasts as in a VAR model. Importantly, as pointed out by Plagborg-Møller and Wolf (2021), the projection residuals from a local projections approach equal these Wold innovations. As a result, the variance-covariance matrix \(\varvec{\Sigma }\) as obtained within a local projections framework contains the same information as obtained from a VAR framework. Hence, if and only if we restrict the responses of the endogenous variables on impact only, as is done in this paper, then we get the same set of structural shocks in the local projections framework as in the VAR framework. Since we are not interested in the impulse responses from the first stage but only in the identified credit supply shock for the second stage, it makes no difference to us whether we identify our shock in a VAR framework or a local projections framework.

Nevertheless, we use an alternative measure of a credit supply shock obtained from a proxy SVAR in the robustness section.

2.2 Econometric setup

In order to uncover the asymmetric effects of structural shocks, we follow Tenreyro and Thwaites (2016) and rely on local projections, as proposed by JordÀ (2005). The local projection method provides a flexible framework and is easy to implement. Moreover, it is well documented that local projections have several advantages over VAR models. Above all, local projections are more robust to possible misspecifications, at least under a finite lag structure. Moreover, they allow us to parsimoniously model asymmetric effects and, in effect, saves degrees of freedom relative to a multivariate approach. That is, even though we lose observations from adjusting for leads and lags, we ultimately save degrees of freedom because our set of control variables on the right-hand side is relatively sparse as we do not need to describe the dynamics of the endogenous variables conditional on the shock.

Local projections base on the idea to directly regress the dependent variable at different horizons \(t+h\) for \(h=0,1, \ldots ,H\), conditional on an information set \(\Omega _t\) that consists of a set of control variables. In the linear case, the regression equation reads

where \(y_{t+h}\) is the variable of interest at horizon \(t+h\), \(\textbf{x}_t\) is a vector of control variables, and \(shock_t\) is the identified structural shock.Footnote 8 The coefficient \(\beta _h\) measures the average response of the dependent variable to the shock that hits the economy at time t. Thus, one constructs the impulse responses as a sequence of the \(\beta _h\)’s estimated in a series of separate regressions for each horizon.

Note that (4) is easily adapted to estimate a model that allows for nonlinear effects. More precisely, we want to test whether positive shocks have the same impact as negative shocks. This can be done by regressing

While the information sets in (4) and (5) do not differ, the coefficients \(\beta _h^{+}\) and \(\beta _h^{-}\) do now allow us to test for sign-dependent impulse responses. In particular, the response of \(y_{t+h}\) on a shock in t is now given by

It is important to stress that a perfectly symmetric transmission of credit supply shocks would imply that \(\beta _h^{+}=\beta _h^{-}\). That is, exogenous expansions and contractions of credit supply would have the same effects in absolute terms. Contrary to this, we would point to asymmetric effects when the divergence between \(\beta _h^{+}\) and \(\beta _h^{-}\) is significantly different from zero.

Our vector \(\textbf{x}_t\) contains control variables that are supposed to have an effect on the endogenous variable \(y_t\). We therefore include \(p = 2\) lagged values of the short-term federal funds rate, the consumer price index, and real GDP, where consumer prices and real GDP are in logs and multiplied by 100. Finally, \(\textbf{x}_t\) also includes \(q = 3\) lags of the dependent variable.Footnote 9

2.3 Inference

Regressing the dependent variable at different horizons on the same set of control variables will likely result in autocorrelated residuals. In order to calculate standard errors that account for the possibility of serially correlated residuals within and across equations, we follow Ramey and Zubairy (2018) and Tenreyro and Thwaites (2016) and estimate seemingly unrelated equations as proposed by Driscoll and Kraay (1998). To be more precise, we estimate the parameters of interest of each equation separately and, in a second step, average the moment conditions across horizons \(h=0, \ldots ,H\) when deriving Newey-West standard errors. In effect, the Driscoll–Kraay standard errors account for autocorrelation across both, time t and horizons h. We follow standard practice (see JordÀ 2005) and set the maximum autocorrelation lag for the Newey-West procedure \(L=h+1\).

3 Results

In this section, we present the baseline results of our paper. In the baseline setting, the idea is to uncover possible asymmetries in the responses of the economy to a credit supply shock. Hence, the baseline regression focuses on the asymmetric effects of positive and negative shocks on the economy. The sample size covers data from 1975Q3 to 2018Q4, consisting of 174 observations. After adjusting for leads and lags, the effective sample size starts in 1976Q2 and ends in 2013Q4 and, hence, consists of 151 observations.

3.1 Baseline results

Do credit supply shocks have asymmetric effects? Before we answer this question, it is important to bear in mind that throughout the paper, we present impulse response coefficients rather than impulse responses.Footnote 10 So, for example, a positive value of \(\beta _h^-\) indicates that after a negative shock (i.e., an unexpected credit curtailment), the effect, i.e. impulse response, is negative. In other words, there is a uniflow response to the shock.

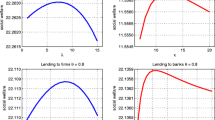

This being said, Figs. 1, 2, 3, 4 read as follows: The rows correspond to the dependent variables that are affected by the credit supply shocks. The first column depicts the impulse response coefficients \(\beta _{h}^+\) (red-solid lines) following a positive credit supply shock. In contrast, the second column depicts the impulse response coefficients \(\beta _{h}^-\) (red-solid lines) describing the response following a negative credit supply shock to the particular dependent variable, both accompanied by their respective 90 percent confidence bands. For further comparison, dashed lines represent the impulse response coefficients from the linear model (Eq. 4), i.e. \(\beta _h\).

The third column shows \(t-\)statistics testing the null hypothesis \(H_0:(\beta _h^+-\beta _h^-)=0\) for adjacent horizons \(h=0, \ldots ,H\), where the shaded area covers the \(t-\)critical values for a 90 percent confidence interval, i.e. \(\pm 1.645\). If the \(t-\) statistics (red-solid) lies outside the shaded-area, we reject the null that the difference in the response of the endogenous variable is not distinguishable from zero in favor of the alternative hypothesis that they are significantly different from zero at the 90 percent confidence level and thus, indicate non-negligible asymmetric effects.

Response of credit volumes to credit supply shocks. Notes: The first column shows the impulse response coefficients (red-solid) \(\beta _h^+\) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock, the second column shows the impulse response coefficients (red-solid) \(\beta _h^-\) for a negative (one standard deviation) credit supply shock. In both cases, the dark (pale) red-shaded area corresponds to the 68 (90) percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The rows show, from top to bottom, the responses of overall debt volume (in percent), the volume of consumer credit (in percent), mortgage credit volume (in percent), and the share of debt-to-GDP (in percentage points)

Figure 1 shows the impulse response coefficients corresponding to different debt volumes, namely overall household debt, consumer credit, mortgages, as well as the response of debt-to-GDP for each horizon h (x-axis) after a shock hits the economy in t. Given a positive credit supply shock, overall debt steadily and significantly increases by 1.5 percent. This effect is highly persistent as it holds for more than 20 quarters. The volume of consumer credit increases significantly, reaching a peak of 0.9 percent after ten periods before it wears out. The effect of a credit supply shock on consumer credit is more short-lived than overall debt. The response of mortgages shows where the sluggish behavior of overall debt stems from: mortgages respond very similar to a positive credit supply shock as does overall debt in both, magnitude and duration.Footnote 11 The positive effect proceeds over more than 20 quarters with a peak response of 1.5 percent. Debt-to-GDP shows a picture similar to both, the response of overall debt and mortgage debt. The positive response, which peaks at 0.025 percent, becomes significant after five periods and remains thereafter, shows evidence that debt is more sensitive to a credit supply shock than real GDP.

Turning to the responses to a negative shock, recall that a positive response coefficient indicates a concurrent reaction such that, e.g., concerning overall debt, a detrimental credit supply shock leads to a decrease in overall debt for two quarters. In the medium-term, i.e., after roughly ten quarters, the negative shock goes into reverse and leads to an increase of debt, though not significant, as the confidence bands of the response coefficients comprise zero. This is true for all debt categories, as well as the debt-to-GDP ratio. Above all, it stands out that the responses are in all cases other than the response of consumer credit, less pronounced than in the case of a positive credit supply shock. By the same token, when not accounted for asymmetries, one gets misleadingly rather mild responses to credit supply shocks.Footnote 12

Furthermore, the responses in all cases are more sticky than in the case given a positive shock. Even though the response of the overall indebtedness, mortgage debt, and the debt-to-GDP ratio is slightly significantly different from zero, the concurrent effect is short-lived, at most, and tends to increase debt in the medium-term, with response coefficients significantly different from zero at the 90 percent confidence level.

Most importantly, in all cases except consumer credit, the responses to a positive (negative) shock reside well above (below) their symmetric counterparts, indicating that there are non-negligible asymmetric effects.

The third column of Fig. 1 underpins this visual impression. The \(t-\)statistics for overall debt, mortgage debt, and the debt-to-GDP ratio show that we reject the null whereupon private debt equally responds to positive and negative shocks. Solely for consumer credit, we do not reject the null hypothesis based on our \(t-\)statistics and conclude that, following an exogenous shock to credit supply, consumer credit responds similarly in absolute terms.

Three insights from this first exercise need to be highlighted: first, in the linear model, the responses are driven by the positive component of the shock, thus, suppressing a debt-increasing effect of adverse shocks in the medium-run, as seen in the second column of Fig. 1.Footnote 13 Second, the differences in the responses between the linear and nonlinear models are most pronounced for overall debt, mortgage debt, and debt-to-GDP; measures that are central to the debate whether central banks should actively lean against the credit cycle in their policymaking.Footnote 14 Third, not accounting for asymmetries leads to misleadingly attenuated responses of the aforementioned debt measures.

Credit supply shocks and headline variables. Notes: The first column shows the impulse response coefficients \(\beta _h^+\) (red-solid) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock, the second column shows the impulse response coefficients \(\beta _h^-\) (red-solid) for a negative (one standard deviation) credit supply shock. In both cases, the dark (pale) red-shaded area corresponds to the 68 (90) percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 90 percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The first row shows the response of real GDP (in percent), the second row the response of consumer prices (in percent), and the third row shows the response of the effective federal funds rate (amended by the Wu-Xia shadow rate) in percentage points

Turning to the effects on key macro variables, the first column of Fig. 2 reports the results for real GDP and consumer prices (both in logs) as well as for the short-term (shadow) interest rate. Following a positive credit supply shock, real GDP increases immediately by about 0.25 percent, peaking at 0.5 percent after four quarters and steadily reverts afterward. This effect is significant for about seven periods. What stands out is that the effect of the shock does not wear out but instead leads to a subsequent decline in real GDP. After 16 quarters, there is a significant drop in output of 0.5 percent. This is in line with the well-established notion that credit supply expansions lead to subsequent episodes of economic downturn, as in, e.g., Schularick and Taylor (2012) or Mian et al. (2017).

The economic upturn caused by additional availability of credit leads to an increase (though not significant) in consumer prices by up to 0.2 percent which starts to decline after 10 quarters. As real GDP subsequently decreases, so do prices, leading to deflationary pressure after 18 quarters which is significantly different from zero. In light of the responses of debt-to-GDP both, the responses of real GDP and prices add up to Fisher’s debt-deflation hypothesis whereupon an economic slowdown increases the real burden of debt, which in turn puts downward pressure on aggregate demand, slowing down economic activity even further.

As the monetary authority responds to output and prices in the conduct of its policies, it follows the boom-bust pattern. First, it increases its short-term interest rate in response to the increase in those indicators. The peak response is an increase of one percentage point after four quarters. As the economic downturn comes into action, interest rates respond with a substantial decrease.

The effects following an unexpected credit crunch are not very different to those from the linear model. A negative credit supply shock leads to a significant decrease in output and prices, and as such, interest rates decrease to counteract the economic downturn. Here, after four years, prices hint to patterns of asymmetry, mounting to a stronger deflationary pressure in the presence of negative shocks. This also explains the asymmetric effects of real debt variables in the mid-run, because the strong response of prices following a negative shock seem to dampen the overall response of real debt following an unexpected negative credit supply shock.

Summing up, our results point to symmetric effects in the short-run, as the t-statistics fluctuate within, rather than outside of its critical values for the first four years or so. Thereafter, however, we find that all three key variables respond asymmetrically. More precisely, in all three cases, the response following a positive credit supply shock is stronger in absolute values than in the case of a negative credit supply shock. Furthermore, it is worth noting that our results suggest that in the presence of a negative shock, prices exhibit stronger deflationary pressure, which are underestimated in a linear model.

3.2 Digging deeper

There are different channels through which a credit supply deterioration can transmit into the (real) economy. An expansion in credit supply, therewith decrease in lending rates, could, for example, boost the supply side of the economy through additional (funds for and realizations of) investments due to decreasing credit costs, as argued by inter alia Gilchrist and Zakrajšek (2012), which in turn would lead to an increase in employment. Aggregate demand, on the other hand, can be stimulated by means of credit expansion by enabling households to increase consumption as their balance sheets improve, as noted by i.a. Mian and Sufi (2014) and Gertler and Gilchrist (2018). For this reason, we search for traces of asymmetry in the responses of some surrogates for both, aggregate supply and aggregate demand to credit supply deteriorations.

Beginning with the supply side, Fig. 3 shows how external financing, measured via the credit spread provided by Gilchrist and Zakrajšek (2012), the total non-farm payroll employment, investments, and real credits to non-financial corporations respond.

Credit supply shocks and the supply side. Notes: The first column shows the impulse response coefficients \(\beta _h^+\) (red-solid) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock, the second column shows the impulse response coefficients \(\beta _h^-\) (red-solid) for a negative (one standard deviation) credit supply shock. In both cases, the dark (pale) red-shaded area corresponds to the 68 (9)0 percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The first row shows the response of the Gilchrist and Zakrajšek (2012) spread (in percentage points), the second depicts the response of total non-farm payrolls (in percent), the third shows the response of real investments (in percent), and the last row shows the response of real credits to non-financial corporations (in percent)

As the top panel shows, we find that, following a negative credit supply shock, the response of the external finance premium is different from zero only on impact and indistinguishable from zero afterwards. This is contrary to the response following a positive credit supply shock. Here, we see no significant response on impact and the subsequent three years. Afterwards, however, the finance premium increases, which coincides with the responses to the bust pattern we observe for our macroeconomic variables.Footnote 15

In the case of employment, total non-farm payrolls clearly exhibits the boom-bust pattern. If a positive credit supply shock hits the economy, employment significantly increases on impact by 0.05 percent and increases up to 0.2 percent before it reverts and becomes significantly negative after almost four years. In the case of a negative credit supply shock, total non-farm payrolls co-move by 0.1 percent for 12 periods, which translates into an decrease in payrolls. Both results are mostly indistinguishable, except, as before, at the long-end of our analysis, and a result of the changes in economic activity given the respective shocks.

Investment responds very similarly to both, positive and negative credit supply shocks, as does real GDP. After a significant and somewhat persistent increase on impact, peaking at 1.5 percent, the response mean-reverts and becomes significantly negative by 1.5 percent after 11 quarters. As before, we observe asymmetric effects after 16 quarters, i.e. at the farther end of our projection. Also here, we find that the response of a positive credit supply shock is stronger in absolute value than in the case of a negative credit supply shock, as indicated by the significantly negative t-statistic in the respective panel.

Taken together, the responses of the external finance premium, non-farm payrolls, as well as real investments represent the well established boom-bust cycle caused by a credit supply deterioration.

Finally, real credits to non-financial corporations exhibit a significant and persistent increase in response to a positive credit supply shock. The peak median response, which amounts to 3.4 percent, is observed after 13 quarters, before the response reverses. The timing also matches the responses of overall debt and mortgage debt, which comes at no surprise, as these variables follow the same cycle. The same is true in the case of a negative credit supply shock: the initial decrease in real credits wears out after roughly two years and tends to increase thereafter. As in the case of the other credit variables, the responses show significant asymmetries.

Mian et al. (2017) stress that the boom-bust cycles of the past four decades were primarily driven by household debt operating through the household demand channel. For example, the combination of rising house prices (and thus improvement in the household’s balance sheet) and declining lending rates (i) led to an increase in residential investments and (ii) enabled additional consumption of both, domestic and foreign goods and services.Footnote 16 Hence, we take a look at the responses of house prices, real residential investments, and real household expenditures, which are depicted in Fig. 4.

Credit supply shocks and the demand side. Notes: The first column shows the impulse response coefficients \(\beta _h^+\) (red-solid) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock, the second column shows the impulse response coefficients \(\beta _h^-\) (red-solid) for a negative (one standard deviation) credit supply shock. In both cases, the dark (pale) red-shaded area corresponds to the 68 (90) percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The first row shows the response of house prices (real Shiller index, in percent).The second row depicts real residential investments (in percent). The last row shows the response of real personal expenditures (in percent)

The first row shows that the response of house prices (real Shiller Index) resembles remarkably well the response of mortgage debt. Positive credit supply shocks lead to a persistent and also significant increase in house prices. While negative shocks lead to quite similar opposite effects, we find clear patterns of asymmetry as the t-statistics are very close at or above the critical values from quarter 4 onwards. This is because, at the back-end, house prices (i) remain on a relatively high level after a positive shock and (ii) tend to exhibit mean-reverting behavior after a negative shock, which in turn increases the difference between the \(\beta \) coefficients. Furthermore, the linear response is mitigated by the response to a negative shock, underestimating the stark effect of positive credit supply shocks on house price inflation.

The response of residential investment is similar to the response of total investments. This can be explained by higher demand for housing due to an improvement in the household’s balance sheets. The response of residential investment peaks at one percent after one year before it mean-reverts, exhibiting the boom-bust pattern. After 20 quarters, residential investments significantly decrease by approximately two percent. Concerning a negative credit supply shock, the same story applies as in the case of total investments.

It stands out that for both shocks, consumption expenditures follow the response of consumer credit and real GDP very closely. Given a positive credit supply shock, expenditures increase initially and show mean-reverting behavior that eventually results in a significant decrease. That is, beneficial credit conditions improve the household’s balance sheets (e.g. through higher asset prices such as housing) such that they increase borrowing (especially consumer credit) with which they expand consumption. In the case of a contractionary credit supply shock, expenditures decrease significantly by 0.2 percent and tend to remain declining in the long-run.

To summarize, three things stand out: First, the responses of consumer credit, real GDP, the interest rate, non-farm payrolls, total and residential investment, as well as personal expenditures to a positive credit supply shock all contribute to the notion that credit supply expansions lead to a vicious boom-bust cycle.

Second, the response of credits to non-financial corporations, house prices, and mortgage debt is highly persistent and does not follow the boom-bust pattern. One explanation could be the following: Positive credit supply shocks increase funding possibilities for corporations as well as house prices and, thus, stimulate economic activity, which in turn leads to an increase in demand for (new or the expansion of existing) mortgage loans. As the economy, however, transits into the bust-phase, monetary policy steps into place, decreasing interest rates. This decrease, in turn, leads to an increase in asset prices, such as house prices. Thus, while the economy shows the boom-bust pattern, house prices do not. For example, a closer look at the responses of house prices and real GDP reveals that the pace of change in house prices decreases after 6 to 10 quarters; the period where the boom goes bust.

Last, asymmetries appear in the back-end of the responses and are primarily driven by the positive portion of the shock.Footnote 17 In turn, this implies that not accounting for asymmetries leads to underestimated effects of credit supply shocks in the medium to long-run.Footnote 18

4 Sensitivity analysis

So far, our results indicate that the transmission of credit supply shocks is asymmetric. This section seeks to underpin our results via a battery of robustness checks, including an alternative choice of credit supply shock as well as several alternative model specifications.

4.1 Credit supply shocks from a proxy SVAR

Our results in Sect. 3 rely on the identification strategy following Gambetti and Musso (2017) through sign restrictions. Since the identified credit supply shock comes from a different model and enters our local projection framework exogenously, we crosscheck our results using an alternative credit supply shock. Using a Monte Carlo experiment, Mumtaz et al. (2018) provide detailed evidence that the performance of various structural vector autoregression models seeking to identify credit supply shocks varies substantially.Footnote 19 Using data for the US, they find that the Gambetti and Musso (2017) identification performs well in replicating DSGE model-implied impulse response functions. Several other authors use alternative proxies for credit supply, including Gilchrist and Zakrajšek (2012), Bassett et al. (2014), and Lown and Morgan (2006), and use it as an endogenous variable in an otherwise standard VAR, where a shock to the proxy is interpreted as a credit supply shock. However, Mumtaz et al. (2018) show that proxy variables in a recursive SVAR do not perform well due to a large attenuation bias increasing in the variance of the measurement error. They also show that the measurement error has little effect on the performance of proxy VARs because the proxy of credit supply does not enter the model directly. We, therefore, extend the sample of Mumtaz et al. (2018) and estimate a proxy SVAR model where the excess bond premium of Gilchrist and Zakrajšek (2012) is considered as an instrument rather than an additional endogenous variable.Footnote 20

The correlation of the estimated credit supply shock from our proxy SVAR and our credit supply shock identified as in Sect. 2 is 0.59. Both series show the same pattern most of the time and the dynamics during periods of financial turmoil as in 2008 overlap almost perfectly.Footnote 21

Figures 11, 12, 13, 14 in the appendix show that in most cases, the qualitative directions of the impulse responses do not change. Also, the difference between the coefficients \(\beta _h^+\) and \(\beta _h^-\) looks very much like in our benchmark case. However, while the \(t-\)statistics for the macro variables still point to asymmetric effects, uncertainty in the impulse response coefficients of debt volumes after a positive shock is remarkably higher than after negative shocks, resulting in t-statistics that are not statistically different from zero. Overall, we conclude that our results still point to asymmetric effects in most cases when we use a credit supply shock from a proxy SVAR instead of a shock identified by means of sign restrictions.

4.2 A note on the role of estimation uncertainty surrounding the shock

So far, our impulse response coefficients are the mean responses to the median of a series of identified shocks, that satisfy the imposed restrictions. Consequently, estimation uncertainty surrounding the shock is not taken into account. Our set of \(B=10000\) draws for the credit supply shock from the VAR nevertheless allows us to test how representative our shock is. For each series \(shock_t^{(1)}, \ldots ,shock_t^{(10000)}\), we therefore estimate our baseline model and report the uncertainty across all draws. Note that the potential disadvantage of the median is that the median in t and \(t+1\) can come from different draws (and thus different models, see Fry and Pagan 2011 on this). By using the entire time series for each draw, we avoid this inconsistency. Figure 5 reports the baseline point estimates (red-solid) with the 68 percent and 90 percent confidence bands (red-shaded areas) as well as the median over all point estimates (black-solid) and 90 percent (black-dashed) confidence intervals across all 10000 draws. It stands out that our median shock seems to be very representative of the population, as the median across all 10000 estimates is very close to our baseline impulse responses.

Impulse responses across all draws of the credit supply shock. Notes: Point estimates (red-sold) with the 68 and 90 percent confidence bands (red-shaded areas) from the baseline model as well as the median over all point estimates (black-solid) and 90 percent (black-dashed) confidence bands across 10000 draws

4.3 Is monetary policy a potential cause for asymmetric effects

As mentioned in the introduction, it is quite conceivable that monetary policy decisions can be a cause of asymmetric responses, if, for example, monetary policy systematically responds differently to expansionary shocks than to contractionary shocks. To examine the role of monetary policy in the transmission of credit supply shocks in our setup, we re-estimate the VAR model based on the assumption, that the policy rate does not react to contemporaneous and past movements of the composite lending rate and credit volumes by means of block exogeneity. In this scenario, the policy rate only reacts to movements in those variables via feedback from the remaining variables of the model, but not directly to movements of those variables.

In a second step, we repeat our baseline estimation

where \(y_{t+h}\) is the variable of interest at horizon \(t+h\), \(\textbf{x}_t\) is a vector of control variables, and \(shock_t^{cf}\) is the credit supply shock of this counterfactual exercise.

Figure 6 compares the credit supply shock from our baseline setup with the shock we obtain in this exercise. Here, the red-solid line reports the mean of the baseline specification with the corresponding 90 percent confidence bands (shaded area), respectively. In contrast, the black-solid line corresponds to the median shock of the counterfactual scenario. As can be seen, the two shocks mostly overlap.

Figure 7 reports the corresponding impulse response coefficients for this exercise together with the original impulse response coefficients for a subset our endogenous variables, in order to conserve space.Footnote 22 The red-solid line corresponds to the baseline impulse response coefficients, whereas the black-solid line corresponds to the impulse response coefficients obtained from the counterfactual experiment credit supply shock.

Baseline IRFs versus counterfactual IRFs. Notes: Impulse response coefficients for the baseline (red-solid) and counterfactual (black-solid) credit supply shocks. Dark (pale) red-shaded areas are the 68 (90) percent confidence intervals of the responses to the baseline shock, relying on Driscoll–Kraay standard errors. The last column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. Here, the dark (pale) red-shaded areas cover the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). All responses are expressed in percent

Note that we only report the baseline specification’s 68 percent and 90 percent confidence bands.

In all cases, there is virtually no difference in the responses to the shocks, as the impulse response coefficients are basically alike. In other words, our findings suggests that the central bank’s systematic response to credit volumes and lending conditions has no important role for the transmission of credit supply shocks and is thus not a driving force for the asymmetric effects we find in our results.

What are the policy implications for monetary policy? The results of the counterfactual analysis by no means imply that monetary policy does not influence the transmission of the credit supply shock at all. This is because the restriction within the counterfactual experiment merely restricts the central bank’s systematic response to credit volumes and the composite lending rate. However, a credit supply shock also affects other variables, including real GDP and prices, i.e., variables to which the central bank reacts. Consequently, monetary policy acts in the background, but is not in the position to directly influence the course of events. In other words, leaning against the credit cycle would not meet the desired objectives. Hence, from a policy point of view, it is necessary to asymmetrically respond to unexpected disruptions in the credit market by means of macroprudential activity. One conceivable measure would be to implement buffers whose amount is aligned with the sign or size of the credit shock–similar to the counter-cyclical capital buffers, which are determined by the business cycle. However, we would like to leave a more thorough analysis of this to further research.

4.4 The effects of the overall business cycle and credit conditions

One explanation for our observed asymmetries could be that the distribution of our identified credit supply shocks itself is asymmetric, depending on either the overall business cycle or credit conditions. First, we devote ourselves to the effects of the overall business cycle.

One could argue that positive credit supply shocks occur mainly during periods of expansion, while adverse credit supply shocks could predominantly occur during recessions. If this was the case, we probably would have to account for this state dependence in our regression analysis. In order to test for this possibility, we compare the distribution of shocks during different phases of the business cycle. To do so, we follow the procedure of Tenreyro and Thwaites (2016), which amounts to estimating state-depending probability distributions via a smoothly increasing logistic function \(F(z_t)\) as a weighting function of the kernel, where \(z_t\) is an indicator of the state of the economy. To do so, we take the annualized quarterly growth rate of real GDP. Since this series is very volatile, we smooth out short-term volatility by filtering the series using a seven-quarter moving average. Subsequently, we calculate the logistic function over time. We follow Teräsvirta and Granger (1993) and employ a function of the form

where \(\mu \) is used to control the proportion of the sample the economy spends in either state (boom or recession), and \(\sigma _z\) is the sample standard deviation of the state variable \(z_t\). The parameter \(\kappa \) controls how abruptly the economy switches from one state to the other following movements of the state variable. That is, higher values of \(\kappa \) mean that rather small movements of the state variable are needed to induce a switch from one regime to the other. We follow Auerbach and Gorodnichenko (2012) and Tenreyro and Thwaites (2016) and choose a value of \(\kappa =3\), indicating an intermediate degree of intensity of the regime-switching. We calibrate \(\mu \) such that we spend 11.3% of the time in recessions. According to the NBER recession indicators, this corresponds to the share of periods we spend in recessions within our sample.

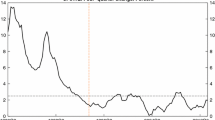

With the logistic function at hand, we estimate both, a probability density function (PDF) and cumulative density function (CDF) using our logistic function \(F(z_t)\) and \(1-F(z_t)\), respectively, for weighting our (Normal Gaussian) kernel function in order to get state-dependent distributions of our credit supply shock. The resulting state-depending PDFs and CDFs are shown in Fig. 8. The bottom panel shows the weighting function \(F(z_t)\) (black-solid line), where the red-shaded areas highlight NBER recessions. As expected, we observe drops in our function \(F(z_t)\) during recessions. This happens with a short delay since we use a moving average.

Estimated state-dependent PDFs and CDFs. Notes: Estimated probability density functions (top panel), cumulative density functions (middle panel) and transition function \(F(z_t)\) (bottom panel) over time. The green lines show the estimated distributions of credit supply shocks during booms, and the red lines show the estimated distributions during recessions using \(F(z_t)\) and \(1-F(z_t)\) for weighting our kernel function. The black-dotted lines correspond to the average distributions of credit supply shocks using a normally distributed kernel. In the bottom panel, the red-shaded areas highlight NBER recession dates

Turning to the estimated probability distribution functions, the average PDF of our credit supply shock appears to be normally distributed, which is not surprising because our shock is distributed as \(shock_t\sim \mathcal {N}(0,I)\) by construction within our VAR. The distribution during booms almost perfectly overlaps the average distribution. The estimated PDF during recessions is also clearly centered around zero. Not surprisingly, we observe that large (negative) shocks occur mainly during recession. This is also visible in the estimated CDF, where the probability of getting a shock of minus one standard deviation or less (in absolute terms) in size is slightly higher during recessions. Nevertheless, the overall picture clearly points to common central tendencies of the distributions across the business cycle. We therefore conclude that the distribution of shocks does not depend on the business cycle.

However, it is possible that positive credit supply shocks primarily occur when financial conditions are looser than average, whereas negative credit supply shock may predominantly occur when financial conditions are tighter than average. If we find this to be true, this would imply that we possibly would have to take different states of financial conditions into account and therefore have to adjust our regression. We, therefore, take the NFCI Credit subindex and repeat our exercise in order to investigate whether the distribution of our credit supply shock systematically depends on financial credit conditions.Footnote 23

Estimated state-dependent PDFs and CDFs | \(z_t:\) Financial Conditions Credit Subindex. Notes: Estimated probability density functions (top panel), cumulative density functions (middle panel) and transition function \(F(z_t)\) (bottom panel) over time. The green lines show the estimated distributions of credit supply shocks during booms. The red lines show the estimated distributions during recessions using \(F(z_t)\) and \(1-F(z_t)\) for weighting our kernel function. The black-dotted lines correspond to the average distributions of credit supply shocks using a normally distributed kernel. In the bottom panel, the shaded areas highlight the NBER recession dates

Starting with the dynamics of \(F(z_t)\) at the bottom panel of Fig. 9, it turns out that whenever we are in a recession as indicated by the red-shaded area, credit conditions are above average, i.e. tighter on average. The estimated probability density functions at the top panel show that small shocks in absolute values are slightly more likely when credit conditions are below average, i.e., when credit conditions are relatively loose (red line), whereas larger shocks in absolute terms seem to be somehow more common during periods of credit tightening (green line). However, both estimated state-dependent distributions are clearly centered around zero and not much different from the estimated average probability distribution. This finding is mirror-imaged in the middle panel, where the cumulative probability distributions do not differ notably. We conclude that, similar to the previous exercise, the distributions of credit supply shocks both, when credit conditions are above and below average, follow common central tendencies.

4.5 Altering specifications

In order to further stress test our results, we make changes to the sample size as well as take a closer look at the role of lags and trends in order to ensure that these factors do not distort our results.

First, we take a look at the role of the Great Recession. Throughout the paper, we estimate our model over an effective period from 1975Q3 to 2013Q3. The asymmetric effects we found so far could possibly be a relic of the Great Recession. We test for this possibility and estimate our model, excluding NBER recession dates that mark the Great Recession. The blue-dashed line in Figs. 15, 16, 17, 18 in the appendix show the results of this exercise. In short, the results are generally similar to our baseline such that we conclude that our findings are not driven by the Great Recession.

The next exercise is to investigate the effects of lags and trends. In our baseline setting, we do not include a log-linear trend into our regression equation in order to keep the regression equation consistent across our endogenous variables.Footnote 24 This subsection examines whether adding a trend changes our main results. We do so by estimating

where \(\delta \) denotes the effect of a log-linear time trend t, while the remainder is similar to our baseline regression (5). The results do not change, as can be seen form the course of the black-dotted line in Figs. 15, 16, 17, 18.

As explained in Sect. 2, the choice of lags for both, the endogenous variable as well as the set of control variables other than the endogenous variables, relies on the Bayesian Schwartz Information Criterion. We, therefore, test whether the results change if our lag lengths are chosen according to the more restrictive Akaike Information Criterion (AIC) given by

The AIC suggests \(p=4\) lags of the endogenous variable and \(q=3\) lags for the remaining variables, as opposed to the benchmark case where two lags of the endogenous variable have been used. Overall, we find that the choice of lags does not change our results remarkably, as the respective impulse responses (black-dashed line) are very similar to our baseline results (red-solid), as Figs. 15, 16, 17, 18 show. Furthermore, the \(t-\)statistics as well show the same pattern as in Sect. 3.

5 Conclusion

The Great Recession has renewed the interest in the nexus between credit cycles and economic activity. One important finding is that credit developments can lead to vicious boom-bust cycles. That is, what starts with a stimulation of economic activity eventually results in economic downturn (e.g. Schularick and Taylor 2012; Jordà et al. 2013). Another finding is that the boom-bust phases observed in the past four decades goes back to credit supply expansions (e.g. Mian et al. 2018; Justiniano et al. 2019). However, the research so far is limited to symmetric effects of credit supply developments. As pointed out by Barnichon et al. (2019), this may lead to somewhat counterintuitively lenient results. One reason is that originally differently operating shocks will eventually level out in a symmetric setup. This, as well as the theoretical literature that shows asymmetries (and nonlinearities) in the response to financial shocks, raises the question, whether credit supply shocks cause asymmetric effects.

They do. Especially overall private debt, mortgage debt, debt-to-GDP, and house prices exhibit asymmetries in the response to credit supply shocks. In this respect, positive credit supply shocks tend to have stronger and more prolonged effects.

Furthermore, our results underpin the narrative of the boom-bust cycle in the presence of financial distortions which, again, is more pronounced in the presence of positive credit supply shocks. After an initial increase in economic activity (output, prices, investments, expenditures, and consumer credit) that lasts for five to ten quarters, the economy transits into a bust phase with a notable slowdown in economic activity. In contrast, negative credit supply shocks cause notably stronger deflationary pressure.

Looking at some surrogates of aggregate demand and aggregate supply, the boom-bust narrative is further confirmed, yet it does not explain the highly asymmetric and persistent response of overall debt, mortgage debt, and debt-to-GDP. However, even though this paper does not aim at tracing down the specific causes of asymmetries, we find that house prices, and thus the household-driven demand channel (e.g. Mian and Sufi 2018) are key for the persistence in the response of mortgage debt and debt-to-GDP to credit supply shocks.

Lastly, if we abstract from asymmetries, we get relatively mild responses for debt and prices in the presence of credit supply shocks, such that the true effects tend to be underestimated.

However, we do not trace down the causes of asymmetries, which may be rooted in a variate of reasons: occasionally binding borrowing constraints, asymmetric information due to market imperfections, or behavioral biases, to name a few. We leave further going down the rabbit hole for future research.

Change history

14 November 2022

The original online version of this article was revised due to Funding note update.

Notes

Such a credit supply shock can be associated with various events, such as unexpected changes in bank capital availability for loans due to changes in regulatory capital ratio requirements or unanticipated changes in the degree of competition in the banking sector. More precisely, an exogenous drop in credit supply is assumed to lead to an increase in the lending rate, which ultimately leads to a drop in economic activity and deflationary pressure.

In this respect, as pointed out by SedlÁČek and Sterk (2017) and emphasized by Barnichon et al. (2019), episodes of high financial stress can prevent high-potential firms to emerge. More precisely, SedlÁČek and Sterk (2017) show that cohorts of large firms tend to be born during periods of booming consumer demand, i.e., when it is easy for firms to acquire new customers. Phases of booming consumer demand, in turn, may depend on credit conditions.

As will be shown in the robustness section, we find that the central bank’s systematic response to credit volumes and lending conditions has no important role in the transmission of credit supply shocks and is thus not a driving force for the asymmetric effects we find in our paper.

In order to estimate (3), we rely on Bayesian techniques using a Minnesota prior. Inference is based on 20000 draws, where the first 10000 draws are discarded, as samples that have been generated in early iteration steps are likely to be not representative for the true posterior distribution. Data is compiled as in Gambetti and Musso (2017) (see supplementary material therein) and extended until 2018Q4.

For a comprehensive description, see Gambetti and Musso (2017).

We take a closer look at this transmission channel in section (III).

They directly estimate a vector moving-average model to derive financial shocks and rely on functional approximations of impulse responses (FAIR). However, their robustness checks imply that a hybrid VAR-LP approach (as ours) and the internally-consistent approach using FAIR yield very similar results.

More precisely, \(\textbf{x}_t\) summarizes p lagged values of a vector of control variables, \(controls_t\), and q lagged values of the dependent variable. Hence, we get \(\varvec{\gamma }_h\textbf{x}_t\equiv \varvec{\gamma }_h^{controls}\sum _{j=1}^pcontrols_{t-j}+\varvec{\gamma }_h^y \sum _{k=1}^ qy_{t-k}\).

The choice of p and q is based on the Schwartz Bayesian Information Criterion given by \(-2\ln (\widehat{L}) + k\ln (n)\), where k is the number of parameters, \((\widehat{L})\) is the maximized value of the likelihood function, and n is the effective sample size after adjusting for leads and lags. We tried different combinations of p and q ranging from 1 to 4 lags each. For each combination of p and q, we follow the strategy of Tenreyro and Thwaites (2016) and sum up the resulting information criteria over both, the horizon h and over all different dependent variables. Finally, the minimum value of this operation results in the optimal lag length of \(p=2\) and \(q=3\).

In order to get impulse responses, one simply needs to flip the impulse response coefficients.

This comes at no surprise as the share of mortgage credit to the overall indebtedness amounts to over 90 percent in the mid-2000’s which further explains the results.

A finding in line with Barnichon et al. (2019) statement regarding financial shocks.

For example, the response coefficient for mortgage debt given an expansionary credit supply shock is three times higher than the equivalent response coefficient from the linear model.

As financing conditions can play a crucial rule for economic fluctuations (see, for example, Adrian et al. 2010 or Bruno and Shin 2015), we have also looked at the subcomponents of the Chicago Fed National Financial Conditions Index (NFCI), which comprise a wide range of indicators concerning volatility and funding risk, credit conditions, as well as debt and equity measures. In short, the impulse responses of the subindexes are remarkably similar to the impulse responses of the GZ spread, which is why we refrain from presenting them in the paper. Of course the results are available upon request.

For further impressions, see the evolution of real mortgage rates depicted in Fig. 10 in the appendix.

At the back-end, the t-statistics are either (i) overwhelmingly negative, as in the case of consumer prices, non-farm payrolls, as well as total and residential investments or (ii) significantly negative, as consumer prices, non-farm payrolls, investment-to-GDP, and expenditures, which indicates stronger responses to positive than negative shocks.

Another observation, that an anonymous referee thankfully brought to our attention, is that we observe a boom-bust pattern in the impulse responses of economic variables, on the one hand, but no such pattern in the responses of the debt variables, on the other hand. One potential reason is the difference in the underlying cycles. As far as credit and debt variables are concerned, these variables are rather sluggish compared to classical economic variables and are merely linked to the credit cycle. There is much evidence that the letter is twice as long as the business cycle (see, for instance, Alpanda and Zubairy 2019). This could explain why, for some variables, we do not yet observe a change in the sign of the response over our 20-quarter horizon.

The authors consider three different DSGE models featuring credit supply in order to construct artificial data, namely the DSGE model by Gertler and Karadi (2011), the estimated DSGE model from Christiano et al. (2014) and, finally, the model by Cúrdia and Woodford (2010). In a nutshell, Mumtaz et al. (2018) use these DSGE models as the true data generating processes and consider various competing SVAR models with different identification strategies in order to shed light on their replication performance of the true impulse responses following the model-implied credit supply shocks.

The reliability statistic proposed by Mertens and Ravn (2014), as the squared correlation between the proxy and the credit supply shock, is 0.16 in our case and notably higher as in Mumtaz et al. (2018), thus indicating higher reliability as a strong instrument. Most strikingly, however, is that all impulse responses within our proxy SVAR show the expected sign. This is interesting from the standpoint that in our proxy SVAR, the identification is far less restrictive than in our baseline model from Sect. 2.

The impulse responses for the remaining variables are available on request.

We repeat this exercise for different state variables, namely, the output gap and the adjusted Chicago Fed National Financial Conditions Index. The resulting estimated probability density functions as well as the estimated cumulative density functions can be found in appendix (B), Figs. 19 and 20, respectively.

Note that our effective sample size runs from 1975Q3 to 2013Q4. For some variables under consideration during this time span, it can be seen with the naked eye that adding a linear time trend would probably deliver misleading results.

References

Adrian T, Moench E, Shin HS (2010) Macro risk premium and intermediary balance sheet quantities. IMF Econ Rev 58(1):179–207

Alpanda S, Zubairy S (2019) Household debt overhang and transmission of monetary policy. J Money Credit Bank 51(5):1265–1307

Auerbach AJ, Gorodnichenko Y (2012) Measuring the output responses to fiscal policy. Am Econ J Econ Pol 4(2):1–27

Barnichon R, Matthes C, Ziegenbein A (2019) Are the effects of financial market disruptions big or small? Discussion paper, Technical Report

Bassett WF, Chosak MB, Driscoll JC, Zakrajšek E (2014) Changes in bank lending standards and the macroeconomy. J Monet Econ 62:23–40

Bruno V, Shin HS (2015) Capital flows and the risk-taking channel of monetary policy. J Monet Econ 71:119–132

Christiano L, Motto R, Rostagno M (2010) Financial factors in economic eluctuations. In: ECB Working Paper, No. 1192

Christiano LJ, Motto R, Rostagno M (2014) Risk shocks. Am Econ Rev 104(1):27–65

Colombo V, Paccagnini A (2020) Does the credit supply shock have asymmetric effects on macroeconomic variables? Econ Lett 5:108958

Cúrdia V, Woodford M (2010) Credit spreads and monetary policy. J Money Credit Bank 42:3–35

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Fry R, Pagan A (2011) Sign restrictions in structural vector autoregressions: a critical review. J Econ Lit 49(4):938–60

Gambetti L, Musso A (2017) Loan supply shocks and the business cycle. J Appl Economet 32(4):764–782

Gerali A, Neri S, Sessa L, Signoretti F (2010) Credit and banking in a DSGE model of the Euro Area. J Money Credit Bank 42:107–141

Gertler M, Gilchrist S (2018) What happened: financial factors in the great recession. J Econ Perspect 32(3):3–30

Gertler M, Karadi P (2011) A model of unconventional monetary policy. J Monet Econ 58(1):17–34

Gilchrist S, Zakrajšek E (2012) Credit spreads and business cycle fluctuations. Am Econ Rev 102(4):1692–1720

Jordà Ò, Schularick M, Taylor A (2013) When credit bites back. J Money Credit Bank 45(s2):3–28

JordÀ Ò (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Justiniano A, Primiceri GE, Tambalotti A (2019) Credit supply and the housing boom. J Polit Econ 127(3):1317–1350

Lambertini L, Mendicino C, Punzi MT (2013) Leaning against boom-bust cycles in credit and housing prices. J Econ Dyn Control 37(8):1500–1522

Lown C, Morgan D (2006) The credit cycle and the business cycle: new findings using the loan officer opinion survey. J Money Credit Bank 38(6):1575–1597

Mertens K, Ravn M (2014) A reconciliation of SVAR and narrative estimates of tax multipliers. J Monet Econ 68:S1–S19

Mian A, Sufi A (2014) What explains the 2007–2009 drop in employment? Econometrica 82(6):2197–2223

Mian A, Sufi A (2018) Finance and business cycles: the credit-driven household demand channel. J Econ Perspect 32(3):31–58

Mian A, Sufi A, Verner E (2017) Household debt and business cycles worldwide*. Q J Econ 132(4):1755–1817

Mian A, Sufi A, Verner E (2018) How does credit supply expansion affect the real economy? The productive capacity and household demand channels. Product Capacit Household Demand Channels 2:558

Mumtaz H, Pinter G, Theodoridis K (2018) What do vars tell us about the impact of a credit supply shock? Int Econ Rev 59(2):625–646

Plagborg-Møller M, Wolf CK (2021) Local projections and VARs estimate the same impulse responses. Econometrica 89(2):955–980

Ramey VA, Zubairy S (2018) Government spending multipliers in good times and in bad: evidence from US historical data. J Polit Econ 126(2):850–901

Schularick M, Taylor A (2012) Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. Am Econ Rev 102(2):1029–61

SedlÁČek P, Sterk V (2017) The growth potential of startups over the business cycle. Am Econ Rev 107(10):3182–3210

Svensson LE (2017) Cost-benefit analysis of leaning against the wind. J Monet Econ 90:193–213

Tenreyro S, Thwaites G (2016) Pushing on a string: US monetary policy is less powerful in recessions. Am Econ J Macroecon 8(4):43–74

Teräsvirta T, Granger C (1993) Modelling nonlinear economic relationships. Oxford University Press, Oxford

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank an anonymous referee and Peter Tillmann for very helpful comments and suggestions. Vanessa Thelen, Katrin Luise Gärtner and Karsten Kucharczyk provided insightful comments. We also thank Egon Zakrajšek and Luca Gambetti for providing their data. We thank the Fritz Thyssen Stiftung for financial support (Grant no. 10.16.2.004WW).

Appendix

Appendix

See Figs. 10, 11, 12, 13, 14, 15, 16, 17 and 18.

Real mortgage rates over time. Notes: Real mortgage rate from 1990Q1 to 2019Q3 as the difference between the 30-year fixed mortgage rate and different measures of inflation expectations: GDP deflator-based one year-ahead inflation rate forecast (light grey-dotted), CPI-based one year-ahead inflation rate forecast (dark grey-dotted) and CPI-based 10 years-ahead inflation rate forecast (black-solid). The 30-year fixed mortgage rate is taken from the FRED, and the SPF forecasts are taken from the Philadelphia Fed

Impulse response of credit volumes to alternative credit supply shock. Notes: The first column shows the impulse response coefficients (red-solid) \(\beta _h^+\) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock from the proxy SVAR, the second column shows the impulse response coefficients (red-solid) \(\beta _h^-\) for a negative (one standard deviation) credit supply shock from the proxy SVAR. In both cases, the dark (pale) red-shaded area corresponds to the 68 (90) percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The first row shows the response of overall debt volume (in percent), the second row the response of consumer credit volume (in percent), the third row the response of mortgage credit volume (in percent) and the fourth row shows the response of the share of debt-to-GDP (in percentage points)

Impulse responses of headline variables to alternative credit supply shock. Notes: The first column shows the impulse response coefficients (red-solid) \(\beta _h^+\) for \(h=0, \ldots ,H\) for a positive (one standard deviation) credit supply shock from the proxy SVAR, the second column shows the impulse response coefficients (red-solid) \(\beta _h^-\) for a negative (one standard deviation) credit supply shock from the proxy SVAR. In both cases, the dark (pale) red-shaded area corresponds to the 68 (90) percent confidence interval, relying on Driscoll–Kraay standard errors. The red-dotted lines in the first two columns show the impulse response coefficients \(\beta _h\) from a linear model without testing for asymmetric effects. The third column shows the \(t-\)statistics testing the null that \(H_0:(\beta _h^+-\beta _h^-)=0\) for each horizon h using the Driscoll–Kraay method. The dark (pale) red-shaded area covers the \(t-\)critical values for a 68 (90) percent confidence interval, i.e. \(\pm 0.995\) (\(\pm 1.645\)). The first row shows the response of real GDP (in percent), the second row the response of consumer prices (in percent) and the third row shows the response of the effective federal funds rate (amended by the Wu-Xia shadow rate) in percentage points