Abstract

This paper compares multipliers of different categories of US federal government spending, and in doing so provides a new insight as to why fiscal multipliers may differ across countries and time. We identify exogenous federal government spending shocks at the state level for defense and non-defense spending. Using a projection-based approach, we estimate the cumulative multiplier due to shocks in either of these spending categories. Our results indicate that defense spending yields lower multipliers than non-defense spending. Thus, focusing only on defense spending may result in underestimating the multiplier for government spending.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A central question in macroeconomics is whether the government can effectively stimulate the economy by increasing spending or decreasing taxes. The effectiveness of a short-run spending stimulus can be assessed by estimating the fiscal multiplier, i.e., the additional income generated per unit of additional government spending. However, the existing estimates of the fiscal multiplier vary substantially across studies. These differences are not only due to the empirical approaches used. Economic factors, such as the state of the business cycle, the exchange rate regime, and the openness of a country, also affect the size of the multiplier (Ramey 2019). In this paper, we focus on another factor that may contribute to differences in fiscal multipliers, namely the category (or function) of government spending that dominates a fiscal policy stimulus. Our investigation of the role of government spending categories starts with a simple comparison: defense spending versus non-defense spending. Indeed, defense spending has been often used in the fiscal policy literature due to its acyclical property, allowing researchers to characterize defense spending shocks as events exogenous to the business cycle (Ramey 2019). However, the way defense spending impacts the local economy may be quite indirect, and depends on the reaction from a few defense contractors. Instead, non-defense spending, which includes social transfers, education, health, or infrastructure, is more aligned with the typical counter-cyclical stimulus tool. The mechanisms by which defense and non-defense spending affect the local economy may differ, and we hypothesize that their economic impact might also depend on the category of spending. From a policy perspective, it is important to know whether there is a difference in the effectiveness across government spending categories in order to effectively use specific counter-cyclical policy measures to dampen economic slowdowns.

Previous studies have estimated fiscal multipliers for defense and for non-defense spending, either at the national level using time series data, or at the sub-national level using panel data.Footnote 1 Regarding defense spending, there are both estimates at the aggregate (Ramey and Zubairy 2018) and the state levels (Nakamura and Steinsson 2014; Dupor and Guerrero 2017). Similarly, there are studies investigating the effects of non-defense spending at the aggregate (Alesina et al. 2018) and the state levels (Leduc and Wilson 2013; Clemens and Miran 2012; Shoag 2016). Comparing the fiscal multipliers in these different studies points at higher multipliers for non-defense spending at the state level. However, such a gap may also be driven by other differences between the papers. Indeed, no study has attempted to directly compare the multipliers across government spending categories in a unified methodological framework, relying on the same identification method. This is because the identification method often relies on a specific spending grant or event, while a comparison requires to devise a method which (i) could be applicable in a similar way to defense and non-defense spending and (ii) allows for causal inference in order to quantify fiscal multipliers.

In this paper we contribute to the literature by systematically comparing fiscal multipliers of different government spending categories. To this aim we identify exogenous federal government spending shocks at the state level for defense and non-defense spending. We isolate the exogenous part of federal spending allocated to states by removing the common component of spending across states and the endogenous state-level component. This identification strategy, to recover state-level spending shocks for different categories, exploits the cross-sectional variation in federal spending. Specifically, we use the fact that part of federal spending to states is allocated independently of the state-level economic conditions. Our estimated shocks, for both defense and non-defense spending, predict federal spending at the state level more accurately than many existing instruments, which typically relate only to a small (exogenous) component of state-level spending.

Investigating the dynamic effects of the estimated spending shocks, we find that defense spending yields lower income multipliers than non-defense spending.Footnote 2 This is in line with previous findings on non-defense spending (state) multipliers (Leduc and Wilson 2013; Clemens and Miran 2012; Shoag 2016). We conclude that by focusing only on defense spending, one may underestimate the government spending multiplier.

The outline of this paper is as follows. Section 2 presents the structure of fiscal spending in the USA, which will be used for our empirical strategy. Section 3 places our research question and approach in the related literature. Section 4 explains the method and data that we use to estimate fiscal multipliers for defense and non-defense spending. Section 5 discusses the baseline results, robustness checks, and extensions. We also test the effect of accounting for spillovers across states and study a further disaggregation of the non-defense spending category. Finally, Sect. 6 concludes the paper.

2 The structure of government spending in the USA

In a fiscal union or federally organized state, multiple levels of government are engaged in fiscal policy. Typically, there exists a common structure of fiscal flows between the federal government and state governments. These fiscal flows include transfer payments that aim to achieve short-run economic stabilization of a state, or promote long-run convergence between states. Therefore, both the federal and state-level governments are involved in most spending categories. The US federal government is often not actively involved in the implementation of a specific policy, but it finances the policies implemented by lower-level governments through transfers. An exception is defense spending, which usually only takes place at the federal level.

The structure of fiscal flows in the case of the USA is summarized in the non-hierarchical overview in Fig. 1. We distinguish three different fiscal channels. Channel A is the direct federal spending channel, where the federal government interacts with the state-level economy without cooperation with the state government. Instead, in channel B the federal government interacts with the state economy only indirectly, via the state government. Finally, in channel C the state government directly interacts with the state economy, without any involvement of the federal government.

Total government spending affecting the local economy is the sum of channels A, B, and C. Our aim is then to evaluate how different categories of such spending affect the local economy, by estimating the corresponding local fiscal multipliers. To do so, we therefore need to break down total spending by category. Those categories can be related, for example, to government functions (education, health, infrastructure, and defense) or types of spending (consumption, investment, interest payments). Although the latter could make more sense from an economic perspective, only the former disaggregation is allowed given the way the data is constructed. Indeed, education spending could affect the development of human capital, but would be expected to have a rather long-term effect on income, while infrastructure spending, such as a new bridge or highway, may increase the productivity of firms in the area in the short run. To better complement large parts of the literature we focus in this paper on defense versus non-defense spending (c.f. Barro and Redlick 2011). We classify all non-military spending automatically as non-defense spending.

The categories of spending are linked to the structure of fiscal flows too. Indeed, we know that only the federal government is involved in defense spending. The state economy is therefore only affected by defense spending through channel A. On the other hand, non-defense spending does not belong to a specific channel, although channels B and C dominate.Footnote 3 Hence, we have to take into account the specific structure of US federal and state-level fiscal flows when analyzing the effect of defense versus non-defense spending on state economies. The disadvantage of using the specific structure of government spending is that we cannot disentangle the effect of different spending channels versus different categories. However, we believe that there is no reason to assume that the channel plays an important role in the local effects of spending. Instead, if we find differences in the estimated multipliers, then these are more likely driven by the different spending categories. In this study, we limit ourselves to federally financed spending at the state level (channels A and B) because it is easier to identify the exogenous spending component for these channels (see our identification strategy).

3 Local fiscal multipliers in the related literature

The aim of this paper is to estimate and compare the fiscal multipliers of state-level defense versus non-defense spending in the US context. In this section, we first outline crucial empirical challenges when estimating local multipliers and how they have been tackled in the related literature. We then highlight how we complement these approaches. Our method is further discussed in detail in Sect. 4.

3.1 Estimating local fiscal multipliers: objectives and challenges

The estimated fiscal multiplier based on state-level or sub-national data is often labeled as the ‘local fiscal multiplier’. Nakamura and Steinsson (2014) argue that such local fiscal multiplier should be interpreted as an ‘open economy relative multiplier’ because federal states can be considered as open economies that form a currency union. Therefore, the local fiscal multiplier is different from the closed economy aggregate multiplier that can be estimated with time series data (Blanchard and Perotti 2002; Barro and Redlick 2011; Ramey 2011; Ramey and Zubairy 2018). Furthermore, positive spillovers and general equilibrium effects (i.e., across states) may contribute to a difference between the local and the aggregate multipliers (Auerbach et al. 2019; Dupor and Guerrero 2017).

Estimating the local fiscal multiplier for different categories of government spending in a fiscal union is difficult because local and federal government spending shocks are partially endogenous to the state-level business cycle for two reasons. First, government spending by the state government is partially endogenous to the state-level business cycle because the state government relies on its own revenues to finance spending. In times of economic slack, revenues decrease and therefore the state has to decrease spending, especially because state governments often face balanced budget requirements (Conti-Brown and Skeel 2012). Second, many federal spending programs intend to provide economic support to states. Hence, the federal government spending stimulus to a state is also endogenous to the state-level business cycle. If we fail to take this into account, then the multiplier estimates are biased upward.

3.2 Estimating local fiscal multipliers: possible solutions

To solve the problems highlighted above, it is common to instrument state or federal spending with variables that are uncorrelated to the state-level business cycle. Following Chodorow-Reich (2019), we can decompose state-level spending for a specific category into three components: a common component across states, an endogenous state-level component, and an exogenous (random) state-level component. The typical approach in the related literature is to find a variable that proxies the exogenous state-level component to instrument the endogenous state-level component. The common component can be controlled for using time fixed effects. Previous works can be further separated into those studying defense spending socks and those focusing on non-defense spending shocks. As we detail in what follows, the instrument chosen is often specific to the chosen spending category and therefore cannot be used to compare fiscal multipliers across categories (i.e., defense versus non-defense spending).

The papers that study defense spending focus on the effect of direct federal government spending on state-level income, according to channel A (see also Fig. 1). Nakamura and Steinsson (2014), Dupor and Guerrero (2017) and Auerbach et al. (2019) construct an instrument to exploit the heterogeneity in the response of local defense contracts to national variation in defense spending. The identifying assumption is that the federal government does not increase national defense spending to give a disproportional economic stimulus because a particular state is doing economically poorly compared to other states. These studies use the approach by Bartik (1991) to instrument military spending per state with the change in national defense spending, scaled by the average level of military spending in that state to its output in previous years. Nakamura and Steinsson (2014) estimate a local fiscal multiplier of 1.5 for a two-year horizon, but Dupor and Guerrero (2017) show that the multiplier is probably lower, depending on the estimation period. Finally, Auerbach et al. (2019) construct a defense contract dataset at the city level for different industries. They confirm the multiplier found by Nakamura and Steinsson (2014) once they sum over positive within-city and rest-of-state spillover effects. Next to these studies, Biolsi (2015) and Hausman (2016) use historical policy examples from the 1930s to illustrate the effect of direct federal spending at the local level without estimating multipliers.

On the other hand, papers that study non-defense spending use specific instruments that relate to spending from the local government, either indirectly funded by the federal state or by states’ own resources, which correspond to our channels B and C respectively (see Fig. 1).Footnote 4 In the first case, the federal government provides state governments with grants to carry out a particular spending program. The effectiveness of an indirect federal fiscal shock depends on how the shock is transmitted by state governments and whether the grants crowd out spending by state governments. To avoid this, the federal government attaches conditions to grants. In total, 77% of such granted amount involves either matching or maintenance-of-effort requirements in the USA (FFIS 2016). Matching requirements mandate a state government to use its own revenues to match the amount granted by the federal government, while maintenance-of-effort requirements ensure that state governments do not cut spending in the program tied to the grant when it receives federal funds. As a result, empirical studies have found that federal grants do not crowd out state spending, which is the so-called flypaper effect (Gamkar and Oates 1996; Nesbit and Kreft 2009).Footnote 5

Many studies that use indirect federal spending focus on exogenous drivers of the grants to state governments, such as specific rules in grant mechanisms (Chodorow-Reich et al. 2012; Wilson 2012; Fishback and Kachanovskaya 2015; Suárez Serrato and Wingender 2016; Chodorow-Reich 2019). These rules are used to instrument grants from the federal to the state government. Alternatively, Leduc and Wilson (2013) do not use an IV-setup. Instead, they use the difference between the expected amount of grants and the actual amount received to estimate the indirect federal government spending shock. All fiscal multiplier estimates for this spending channel range between 1.4 and 2.0.Footnote 6

Finally, there are papers that use internally financed state government (non-defense) spending (channel C in Fig. 1).Footnote 7 In this case, state governments finance the spending with state taxation, deficits, or other funds, such as rainy-day funds, pension funds, or lottery funds. Clemens and Miran (2012) analyze deficit-financed spending by state governments. They use differences in states’ balanced-budget requirements and estimate a multiplier of 0.3. Shoag (2016) analyzes an external shock to state government spending by exploiting windfalls in state pension funds and estimates a multiplier close to 2.0.

The specific instruments used in previous studies do not allow for a comparison across government spending categories. In the next section we describe our method, which, similar to previous studies, removes the endogenous component of state-level spending, but does so in a unified methodological framework which is valid for defense as well as non-defense spending. Note however that the impacts of defense and non-defense spending shocks are still estimated separately.

4 Empirical approach

In this section, we discuss the methodology we use to estimate fiscal multipliers for different spending categories. We present the methodology to estimate state-specific federal government spending shocks. We include the shocks in a dynamic panel data model to estimate impulse responses and construct cumulative multipliers.

4.1 Data

We use state-level panel data for 50 US states from 1963 to 2014. In the next paragraphs, we discuss the main variables that we use.

4.1.1 Income

The main dependent variable is personal income at the state level, available in the Regional Economic Accounts from the US Bureau of Economic Analysis (BEA). Personal income sums income of all residents, including income received from other states.Footnote 8 We convert these data in real per capita terms, using the population estimates and deflators from Dupor and Guerrero (2017). In line with Shoag (2016), we use personal income instead of output, due to limitations in data availability.Footnote 9 In addition, income follows fluctuations of output closely.

4.1.2 Defense spending

In the case of defense spending, there is no involvement from the state government (only channel A). In order to estimate the effect of defense spending, we use data on direct federal spending on defense contracts from Dupor and Guerrero (2017).Footnote 10 The database was constructed using annual reports on defense contracts.Footnote 11 The amounts are aggregated to estimate military procurement actions per state. We use the variable in real per capita terms. It captures the total real amount spent on defense procurement by the federal government in a state and year.

There are two possible concerns when using this variable. First, it is possible that contractors rely on subcontractors in other states. However, Nakamura and Steinsson (2014) have shown that controlling for subcontracting does not change their results. Second, the actual work related to the defense contract could take place in a different year than the announcement (i.e., the signing) of the contract. This time inconsistency could create biased estimates of the effect that government spending has on income. Dupor and Guerrero (2017) have shown that their results are robust to this problem.

4.1.3 Non-defense spending

To estimate the effect of non-defense spending, we use data on intergovernmental transfers from the federal government to the state government (channel B1)Footnote 12 and state government spending (channel B2)Footnote 13. Both variables are available in the Annual Survey of State and Local Government Finances from the US Census Bureau. The series are transformed in real per capita terms. By focusing on intergovernmental transfers, (indirect) federal non-defense spending can be captured in the most complete sense. Instead, in the related literature, studies often focus on specific grants, such as American Recovery and Reinvestment Act (ARRA) grants (Chodorow-Reich 2019) or the Federal-Aid Highway Program (Leduc and Wilson 2013). The variable intergovernmental transfers consist of all categorical and block grants awarded both on a competitive or formula basis.Footnote 14 These grants are an important source of revenue for state governments.Footnote 15

A possible concern is that although intergovernmental transfers measure revenue for state governments, these are not one-to-one linked with state government spending.Footnote 16 The funds from the federal government could crowd out other parts of the state government budget, such as own-revenue financed spending (channel C). However, 77% of the total grant amount from the federal government to state government contain either matching or maintenance-of-effort requirements (FFIS 2016). Hence, it is unlikely that grants crowd out state spending significantly.

In addition, there is a close link between intergovernmental grants and state spending. Indeed, when evaluating the impact of intergovernmental transfers on state spending below (see the next subsection, Step 2), the F-test indicates strong explanatory power.

4.2 Econometric model

Our main goal is to compare fiscal multipliers for defense spending and non-defense spending. To do this, we need to estimate the dynamic responses of both income and the government spending categories to a shock in one of these spending categories. We propose to use a dynamic approach, which can take directly into account the underlying structure of the government spending categories to extract the exogenous component of state-level federal government spending. Instead of relying on instruments, we can remove the common and the endogenous state-level component in the estimation steps. In appendix A, we discuss why using the static IV approach from Nakamura and Steinsson (2014) is not preferable: The constructed instruments are very weak, in particular at longer horizons.

Specifically, the shocks are based on forecast errors for the federal government spending categories at the state level, denoted as \(x_{i,t}\), i.e., defense contracts or intergovernmental transfers. By using state-level shocks of federal spending (channels A and B), we avoid the endogeneity problems associated with federal spending at the state level. Since the spending decisions are made on the federal level, we identify ‘external shocks’ from the federal government for every state. Formally, the shocks \(s_{i,t}\) are defined as the one-step ahead forecast error, i.e., the difference between the realized value and the forecast:

where \({\mathbb {E}}[x_{i,t+1}|{\mathcal {I}}_t]\) is the one-step ahead forecast, using the available information at the state level. The shocks are unforecastable with the available information set of economic agents \({\mathcal {I}}_{i,t}\). This information set can be used to extract the exogenous component of \(x_{i,t}\) if it contains information on aggregate government spending to remove the common component, and confounding business cycle variables to remove the endogenous state-level component.

The analysis consists of three steps. First, we obtain government spending shocks for each state from the one-step ahead out-of-sample forecast error of federal government spending at state level for each considered spending category. Second, we use local projections to estimate impulse responses for income and each government spending category considered. Third, we construct the cumulative multiplier over an eight-year horizon.

4.2.1 Step 1: estimating the shocks

We start by estimating the shocks for the different government spending categories: defense contracts and intergovernmental transfers for non-defense spending. Ideally, we would have used official forecasts for these variables that are available to the government. This is the approach of Clemens and Miran (2012) and Leduc and Wilson (2013). However, there are no official state-level forecasts available for the variables that we use. Therefore, we estimate state-level forecasts with a panel data model using a rolling forecast of 10 years to obtain an out-of-sample, one-step ahead forecast.

To obtain the forecast, we use a panel regression for every category of government spending separately, including state fixed effects. We do not include year fixed effects in this regression because the model is used for out-of-sample forecasting, and it should therefore not be optimized for in-sample fit.Footnote 17 However, we add independent variables that control for the national business cycle and aggregate shocks. The panel data fixed effects model that we use can be written down as follows:

where \(x_{i,t}\) is either defense contracts for defense spending or intergovernmental transfers for non-defense spending. We include state fixed effects \(\alpha _i\) and two lags of the dependent variable (i.e., \(L = 2\)). The set of control variables in the vector \(V_{i,t}\) includes state personal income, state government spending, state government tax revenue, federal government spending, the oil price, and the real interest rate. All variables but the real interest rate have been converted in logs and are expressed in real per capita terms. Prior to estimation, we de-trend the variables using a state-specific linear trend.Footnote 18

Using the out-of-sample prediction of defense (resp. non-defense) spending at time t in state i (\({\widehat{x}}_{i,t}\)), we define the prediction error as

We interpret \({\hat{s}}_{i,t}\) as the government spending shock at time t in state i for defense and non-defense spending, respectively.Footnote 19 Note that the above approach to estimate government spending shocks shares important similarities with the identification strategy in Blanchard and Perotti (2002): We assume that economic conditions (at the state level) have no contemporaneous impact on (exogenous) state-level spending. We formulate the local projection regressions below such that a change in exogenous state-level spending may have instantaneous effects on state-level income/output. Even though we do not estimate the defense and non-defense shocks jointly and do not impose orthogonality between the shocks, the correlation between the shocks is small once we control for year fixed effects.

4.2.2 Step 2: estimating the impulse responses

The (estimated) shocks from the first step (\({\hat{s}}_{i,t}\)) allow us to estimate the effect of federal government spending on the state-level income. We use the local projection method by Jordà (2005) to obtain impulse response functions tracing the dynamic local effect of the shocks without modeling explicitly the dynamic interaction between the variables. Note that this does not allow for dynamic interaction between states and therefore we cannot investigate general equilibrium effects as in, for example, Auerbach et al. (2019). In Sect. 5.2, we investigate whether the shocks also have cross-sectional spillovers.

We are interested in estimating the effect of the defense contracts shock on defense contracts and the non-defense (intergovernmental transfers) shock on state government spending.Footnote 20 To that aim we estimated the following regression:

For horizon \(h\), the government spending variable \(g_{i,t}\) (either defense or non-defense spending) is regressed on both (estimated) shocks of defense spending, \({\hat{s}}_{i,t}^{D}\), and non-defense spending \({\hat{s}}_{i,t}^{ND}\). This is done to rule out potential omitted variable bias. For the same reason, all local projection regressions include two lags of both, defense and non-defense spending as regressors. The vector of controls, \(W_{i,t}\), contains state-level personal income, the state-level unemployment rateFootnote 21 and the state government deficit ratioFootnote 22. Following our identification assumption that state-level economic conditions have no contemporaneous effects on (exogenous) state-level government spending, we only include lagged realizations of the variables in \(W_{i,t}\). We set \(L = 2\). Finally, state and year fixed effects (\(\zeta _{i,h}\) and \(\phi _{t,h}\)) are included. The latter removes the common component across states.Footnote 23

The local projection regression in Eq. 4 is separately estimated for each spending category and each horizon \(h=0,1,2,\ldots ,8\). When the dependent variable is defense contracts, the estimate of \(\omega _h^{D}\) is the estimated impulse response of defense spending at horizon \(h\) to a defense spending shock. Similarly, when the dependent variable is state government spending, the estimate of \(\omega _h^{ND}\) is the estimated impulse response of state government spending at horizon \(h\) to a non-defense spending shock. These coefficients should be interpreted as the percentage change in defense contracts or state spending as a result of one percent increase in either defense contracts or intergovernmental transfers. Alternatively, the significance of the estimated coefficients can be interpreted as a measure of how well the shock explains the variation in the government spending variable at different horizons, which is comparable to a first stage (weak instrument) F-test in IV. As expected, when we perform a marginal F-test on \({\hat{\omega }}_h^{D}\) (resp. \({\hat{\omega }}_h^{ND}\)), we obtain F-statistics of 114 and 101 at h = 1 for defense contracts and intergovernmental transfers, respectively, which are well above the common rule-of-thumb critical value of 10 to reject the null hypothesis of a weak instrument.Footnote 24 By construction, the explanatory power should be high at short horizons, since the shocks contain the unexplained variation in federal spending one step-ahead. In fact, the F-statistics for the shocks gradually decrease and drop below the value of 10 after 4 years for defense contracts and after 6 years for intergovernmental transfers.

The position of the impulse response function depends on the scaling (or normalization) of the shocks. We scaled the shocks such that the integral of the estimated impulse response function of government spending, i.e., the sum of the coefficients, equals one. The motivation is that we require total defense and non-defense spending (i.e., state government spending) to equal each other over the horizon that we analyze.

We proceed similarly when estimating the response of income. We estimate the following panel regression for state-level income \(y_{i,t}\), including state and year fixed effects (\(\eta _{i,h}\) and \(\theta _{t,h}\)). As above we set \(L=2\). The vector of controls, \(W_{i,t}\), contains state government spending, state-level defense spending, the state-level unemployment rate, and the state government deficit ratio. Our identification assumption allows for contemporaneous effects of the variables included in \(W_{i,t}\) on state-level income. Thus, contemporaneous controls are included as well.Footnote 25

where this time \(\hat{\rho _h}^{D}\) and \(\hat{\rho _h}^{ND}\) correspond to the estimated responses of income to a defense and non-defense spending shock at horizon h, respectively.

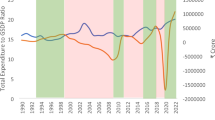

Impulse response functions and bootstrapped 90% confidence intervals, using a state-specific linear trend and state and time fixed effects. The top two panels show the effect of a non-defense shock on state income and on state spending. The bottom two panels show the effect of a defense shock on state income and on defense contracts

Confidence intervals are constructed using a nonparametric bootstrap approach. We implement the moving block-bootstrap proposed in Gonçalves (2011) or Gonçalves and Kaffo (2015), to re-sample both the regressant and the regressors (including the estimated shock) in the local projection regressions (4) and (5). This allows us to take (estimation) uncertainty about the shock into account when constructing inference. Furthermore, the chosen bootstrap approach is particularly suited in our case (using macro panel data) due to its robustness to serial and cross-sectional dependence.

4.2.3 Step 3: constructing cumulative multipliers

The final step consists in assessing the overall effect of one unit of government spending on the outcome variable personal income. We define the cumulative multiplier as the ratio of the sum of responses of personal income over \(h=0,1,2,\ldots ,H\) and the sum of responses of government spending over the same horizonFootnote 26 scaled by the sample income-spending average:

Note that the coefficient \(\omega _h\) (effect on the government spending variable) is scaled such that it sums up to one after \(H\) periods. As a consequence, the cumulative multiplier at horizon \(H\) is equal to the normalized sum of the point estimates \(\rho _h\), i.e., the effect of shock i on income.

5 Results

Next we present and discuss our results. First, we use the approach described in Sect. 4, and then, we test their robustness to changes in some of our assumptions. Finally, we analyze potential spillover effects across states.

5.1 Baseline results

In this section we report the results of the analysis following the approach discussed in Sect. 4. Figure 2 shows the estimated impulse responses, and 90% confidence intervals in shaded areas, for a shock in non-defense spending (first row) and defense spending (second row), referring to Eqs. 4 and 5 . The figure shows both the response of income (left column) and of the government spending variable, i.e., state spending or defense contracts (right column).

The plots in the right column show that both shocks have a strong initial positive effect on the spending variable. Over time, this effect slowly decreases. The response for defense contracts shows a stronger initial effect, whereas the response for state spending appears to be more persistent. This is possibly due to the fact that non-defense spending programs are more long-term oriented and therefore a one time shock in non-defense spending has a longer lasting effect on spending. Instead, defense spending is more volatile and a one-time increase in spending does not have a persistent effect on defense spending at the state level.

The figure, furthermore, shows the response of income to a defense or to a non-defense shock (left column). The response of income to a non-defense shock remains positive up to the 8-year horizon, but is only significant in years 2 and 6. For defense spending, coefficients are also all positive but only turn significant after the third year. Indeed, the defense shock has a small positive effect on income, which accumulates over time.

Figure 3 shows estimates of the cumulative multiplier and the 90% bootstrapped confidence intervals as shaded areas, referring to Eq. 6. We find that the multiplier for a non-defense shock starts at 0.5 and continues increasing until 1.1 after 8 years. The multiplier for a defense shock starts around zero on impact and increases toward 0.6 after 8 years.

From year 2 onward, we find a significant difference between the two multipliers. The cumulative multiplier for a non-defense shock is significantly higher than for a defense shock.

5.1.1 Discussion

The lower local fiscal multiplier for defense spending compared to non-defense spending is in line with the existing literature. Several studies confirmed that local fiscal multipliers are higher for non-defense spending (Clemens and Miran 2012; Leduc and Wilson 2013; Shoag 2016) than for defense spending (Nakamura and Steinsson 2014; Dupor and Guerrero 2017).Footnote 27

We will discuss three channels that could explain why defense spending results in lower fiscal multipliers. First, firms play an important role in the transmission mechanism of fiscal policy. The characteristics of the firms that receive contracts determine how the economy is affected by defense spending. For example, the connectivity and competition levels of the firm within the industry affect the positive and negative spillovers of such a firm-specific shock. More specifically, when an industry is concentrated around a few large firms, then firm-specific shocks can affect the whole industry.Footnote 28 Nakamura and Steinsson (2014) indicate that there are limited positive spillovers from defense contractors to other firms. In contrast, non-defense spending affects a broader set of firms and, hence, may create stronger positive spillover effects within the state-level economy.Footnote 29

Second, the effectiveness of government spending relies on how news about a policy change is received. Clemens and Miran (2012) claim that military build-ups increase future tax expectations more than increases in non-defense spending. The strong ‘Ricardian’ response of consumers could explain why the multiplier for defense spending is lower. If consumers are aware that non-defense spending stimulates productivity and labor supply more than defense spending (Barro and Redlick 2011; Clemens and Miran 2012), they might believe that an increase in defense spending does not stimulate future income enough to finance government borrowings for military build-ups.

Third, it is likely that defense spending has a different effect on the supply-side of the economy. When firms in a state receive more defense contracts, this attracts production factors (capital, labor, etc.) from other industries. Since the reallocation of production factors is costly (Ramey and Shapiro 1998), this limits the positive effect of an increase in defense contracts on state-level income. Meanwhile, non-defense spending raises household demand for products and services across a wider variation of industries. Since the demand is less concentrated in a specific industry, the re-allocation effect is likely less pronounced.

5.1.2 Robustness checks

We investigate the robustness of our results in several ways.

First, we control for political party dominance in states, by using political party dummies (i.e., Republican or Democrat). When a state is dominated by one political party, it may be easier to gain influence at the federal level, especially if that party also controls the federal administration. In that case, the federal government might be willing to spend more in a state that is in need for federal spending. Not controlling for this might create upward bias in the multipliers. We use data on the political dominance of the Democratic Party versus the Republican Party in the state senate, state house, and governorship. We updated the data by Klarner (2013) for the last 4 years using the State Partisan Composition tables from NCSL.Footnote 30 Including variables on the political party dominance (of the Democratic party) has no effect on the multiplier (see appendix C).

Second, we investigate whether using fiscal years vs. calendar years has an impact on our results. The government spending variables are reported in fiscal years (July 1–June 30), whereas the economic variables income and unemployment are reported in calendar years (January 1–December 31). Using calendar years instead of fiscal years may create an upward bias if one does not control for business cycles. The estimation results in appendix C confirm this hypothesis: We find slightly lower multipliers when we match all economic variables to fiscal years.

Finally, we check whether the responses to non-defense spending shocks are affected by using an alternative definition of state spending. Instead of the data from the US Census Bureau, we use the data on federally financed state spending from the National Association of State Budget Officers (NASBO). These data correspond exactly to channel B2 in Fig. 1. The estimation results for the sample 1991–2014 are very similar when using the NASBO and Census data (see appendix C), although the multiplier is slightly lower when the NASBO data are used.

To conclude, the results seem to be robust to alternative specifications. Although the exact multiplier estimates can slightly differ across specifications, our main finding that defense spending results in a lower multiplier is robust.

5.2 Spillovers across states

So far, we have analyzed the effects of shocks to defense and non-defense spending to the states itself. However, it is possible that a shock to one state also affects other states. We therefore estimate the cross-state spillover effect in state \(i\) from other states by weighting the shocks from all other states using the bilateral Commodity Flow Survey 2012 data on total shipments between states \(i\) and \(j\).Footnote 31 The weights \(w_{i,j}\) from state \(j\) to state \(i\) are constructed such that they sum up to 1 for every state \(i\). The ‘partner shock’ \({\hat{p}}_{i,t}\) (in either defense or non-defense spendingFootnote 32) can be written down as follows:

We cannot just analyze the spillover effect of a shock in state \(j\) on income in state \(i\) because it is likely that the shocks (in a specific spending category) are correlated between states \(i\) and \(j\). To make sure that we can interpret the effect of the partner shock as the cross-state spillover effect, we remove the effect of the own shock by regressing state-by-state the estimate \({\hat{p}}_{i,t}\) on the own shock \({\hat{s}}_{i,t}\) and using the residual from this regression, which we denote as \({\tilde{p}}_{i,t}\). Afterward, we include both filtered defense and non-defense (partner) shocks, \({\tilde{p}}_{i,t}\) and \({\hat{s}}_{i,t}\), in the local projection regressions as before to estimate impulse responses.

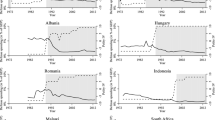

Impulse responses and bootstrapped 90% confidence intervals for a partner shock, using a state-specific linear trend and state and year fixed effects. The top two panels show the effect of a non-defense shock on income (left) and on state spending (right). The bottom two panels show the effect of a defense shock on income (left) and on defense contracts (right)

The results are shown in Fig. 4. The two figures on the left show the response of income to the partner shock. We find that non-defense spending clearly results in significant positive spillover effects all throughout the 8-year horizon. However, for defense spending, we find a significant negative impact from year 2 onward. These results show that beyond the spillover effects within a state that are found in Auerbach et al. (2019), there are also significant cross-state spillover effects. This could indicate that for non-defense spending the positive demand effects outweigh negative supply effects. However, the opposite holds for defense contracts. An increase in production by contractors in other states seems to increase competition for production factors in state \(i\), which cancels out the positive demand effect.

The two right-hand side figures show the effect of a partner shock on state spending and defense contractors. On the one hand, we find that state spending increases after one year. Since state government spending is largely pro-cyclical, it increases when there is an increase in income due to the partner shock. On the other hand, we mostly do not see a significant effect on defense contracts in state \(i\) when other states experience an increase in defense contracts, which is in line with our intuition. (It is only slightly significant and positive in years 2, 3, and 7.)

6 Conclusion

In this paper we estimate local fiscal multipliers for different categories (or types) of government spending in the USA. We focus in particular on the difference between defense and non-defense spending.

Using a dynamic approach, we isolate the part of federal defense or non-defense spending allocated to state governments that is exogenous to the state-specific economic conditions. We estimate this exogenous component of federal spending at the state level by removing the common component of spending across states, and the endogenous state-level spending component. The estimated shocks are included in a dynamic model, which avoids the weak instrument problem in instrumental variables (IV) analysis. We use US data on state-level defense contracts and federal intergovernmental transfers to state governments to estimate (state-level) shocks to federal defense and non-defense spending and their implied (local) multipliers.

We find that non-defense spending multipliers are higher than those for defense spending. This finding is robust across different model specifications, controls, constructions of the measure we use to estimate the shocks, and other factors. Moreover, beyond the within-state spillover effects found by Auerbach et al. (2019), we find significant cross-state spillover, as well particularly strong for non-defense spending.

Our point is not that the federal state should substitute defense spending with more effective non-defense spending, since defense spending does not directly aim at stimulating the economy in the short to medium run. However, our findings may imply that multipliers estimated based on defense expenditures understate the effectiveness of other types of spending policies. Policymakers should therefore be more confident in using these tools to stimulate the economy, at least at the local level. Yet, this paper only scratches at the surface and a deeper understanding of how different types of spending affect the economy is crucial for more effective policy design.

Notes

An advantage of panel data analysis is that estimation is feasible even if the time dimension is relatively short. Moreover, with time fixed effects, it is easier to control for business cycle dynamics. It is also possible to take a multi-country approach for the cross-sectional analysis (Ilzetzki et al. 2013).

The income variable only includes household income, and not firm income, due to limitations in data availability, which limits to some extent the possibilities to interpret the results in a broad economic context.

In the USA, the federal government spending consists mainly out of defense spending and social transfers, but transfers are generally ignored when studying the effects of spending policy.

Suárez Serrato and Wingender (2016) do not clearly distinguish between direct and indirect spending.

Except Fishback and Kachanovskaya (2015), but this study uses data from the Great Depression.

Adelino et al. (2017) analyze the effect of municipal spending.

The variable comprises wages, proprietors’ income, dividends, interests, rents, and government benefits.

There is a break in 1997 because the BEA shifted industry classification from SIC to NAICS.

It is the updated version of the work from Nakamura and Steinsson (2014).

The included contracts are manufacturing (processing and assembling), construction, and service contracts (transportation and communication) from the US Department of Defense (DoD).

We will use the terms intergovernmental grants or transfers interchangeably.

Technically, this means that when we compare defense and non-defense spending, we use two different spending channels. This is unavoidable due to the specific structure of US government spending.

Formula grants are awarded to predetermined recipients (according to eligibility criteria), and their amount is decided by a fixed rule linked to the recipient’s characteristics (i.e., the ‘formula’). Instead, competitive grants are awarded after an application process and selected by a committee. Ninety-four percentage of the amount of grants is formula based (FFIS 2018).

The FFIS (2018) notes that states finance 30% of their spending with intergovernmental transfers.

In our setup, we calculate the multiplier of non-defense spending using the amount spent by the state government. Hence, even if there is not a one-to-one link, our results are not biased.

Furthermore, we include time fixed effects in the second step anyway to remove common cycles.

The precision of the forecast can be assessed with goodness-of-fit indicators. Root mean square forecast errors are reported in Appendix B, see Table 3. In particular, we find that adding additionally a quadratic trend worsens the out-of-sample forecast performance.

Strictly speaking, our approach does not allow to disentangle the direct or indirect channel and category of government spending, i.e., defense or non-defense spending.

State government spending also includes spending that is financed with non-federal funds (channel C). As a robustness check, we use only federally financed state spending (channel B2). See the robustness test entitled ‘NASBO vs. Census data’ and discussed in Section 5, ‘Robustness tests’.

The source of the unemployment rate is the Bureau of Labor Statistics (BLS), Local Area Unemployment Statistics (LAUS). These data are available from 1976 until 2014.

Since many states have balanced-budget requirements, state governments budgets are highly pro-cyclical. We calculate the deficit ratio using US Census Bureau data on state expenditures and revenues.

By using year fixed effects, we assume that states react homogeneously to common shocks. It is difficult to control for all aggregate business cycle dynamics and common shocks without time fixed effects. Not including time fixed effects may create upward bias in the response of income.

The marginal F-test is separately performed for each horizon on the coefficient for the shock in Eq. 4, using 1790 and 1791 degrees of freedom, respectively.

This finding has also been confirmed on the aggregate level by Ellahie and Ricco (2017).

Since government contractors are concentrated in few states, this creates a downward bias in the effect of defense spending. However, the results are robust to excluding the ten states with the lowest fraction of defense contracts over state-level income.

Alternatively, Dupor and Guerrero (2017) identified for every state the main trading partner state from the Commodity Flow Survey 2007 data to estimate the spillover effect.

We skip the superscript D and ND for \({\hat{p}}_{i,t}\) and \({\hat{s}}_{i,t}\), indicating either a defense or non-defense (partner) shocks, to avoid clutter.

The results do not change qualitatively if we use the one-year growth rate instead of the two-year growth rate when constructing the variables.

This is an exclusion test for removing only the instrument in the first stage regression, while keeping the other control variables.

We do not use the critical values from Stock and Yogo (2005) because they assume i.i.d. standard errors.

References

Acemoglu D, Carvalho V, Ozdaglar A, Tahbaz-Salehi A (2012) The network origins of aggregate fluctuations. Econometrica 80(5):1977–2016

Adelino M, Cunha I, Ferreira M (2017) The economic effects of public financing: evidence from municipal bond ratings. Rev Financ Stud 20(9):3223–3268

Alesina A, Favero C, Giavazzi F (2018) What do we know about the effects of austerity? Working Paper. Harvard University

Auerbach A, Gorodnichenko J, Murphy D (2019) Local fiscal multipliers and fiscal spillovers in the United States. NBER Working Paper 25457

Barro R, Redlick C (2011) Macroeconomic effects from government purchases and taxes. Quart J Econ 126:51–102

Bartik T (1991) Who benefits from state and local economic development policies? W.E. Upjohn Institute for Employment Research, Michigan

Biolsi C (2015) Local effects of a military spending shock: evidence from shipbuilding in the 1930s, Working Paper. University of Houston

Blanchard O, Perotti R (2002) An empirical characterization of the dynamic effects of changes in government spending and taxes on output. Quart J Econ 117(4):1329–1368

Chodorow-Reich G (2019) Geographic cross-sectional fiscal spending multipliers, what have we learned? Am Econ J Econ Pol 11(2):1–34

Chodorow-Reich G, Feiveson L, Liscow Z, Woolston W (2012) Does state fiscal relief during recessions increase employment? Am Econ J Econ Pol 4(3):118–145

Clemens J, Miran S (2012) Fiscal policy multipliers on subnational government spending. Am Econ J Econ Pol 4(2):46–68

Conti-Brown P, Skeel D (2012) When states go broke: the origins, context, and solutions for the American states in fiscal crisis. Cambridge University Press, Cambridge

Dupor B, Guerrero R (2017) Local and aggregate fiscal policy multipliers. J Monet Econ 92:16–30

Ellahie A, Ricco G (2017) Government purchases reloaded: informational insufficiency and heterogeneity in fiscal VARs. J Monet Econ 90:13–27

FFIS (2016) Summary of state matching and MOE requirements, Special Analysis 16–03. Federal Funds Information for States, Washington DC

FFIS (2018): Grants 101: an introduction to federal grants for state and local governments, primer update, federal funds information for states, Washington DC

Fishback P, Kachanovskaya V (2015) The multiplier for federal spending in the states during the great depression. J Econ Hist 75(1):125–162

Gabaix X (2011) The granular origins of aggregate fluctuations. Econometrica 79(3):733–772

Gamkar S, Oates W (1996) Asymmetries in the responses ot increases and decreases in intergovernmental grants: some empirical findings. Natl Tax J 49(4):501–512

Gonçalves S (2011) The moving blocks bootstrap for panel linear regression models with individual fixed effects. Economet Theor 27(5):1048–1082

Gonçalves S, Kaffo M (2015) Bootstrap inference for linear dynamic panel data models with individual fixed effects. J Econom 186:407–426

Gordon N (2004) Do federal grants boost school spending? Evidence from Title I. J Public Econ 88:1771–1792

Hausman J (2016) Fiscal policy and economic recovery: the case of the 1936 veterans? Bonus. Am Econ Rev 106(4):1100–1143

Ilzetzki E, Mendoza E, Végh C (2013) How big (small?) are fiscal multipliers? J Monet Econ 60(2):239–254

Jordà O (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Klarner C (2013) State partisan balance data, 1937–2011, Harvard University

Knight B (2002) Endogenous federal grants and crowd-out of state-government spending: theory and evidence from the federal highway aid program. Am Econ Rev 92(1):71–92

Leduc S, Wilson D (2013) Roads to prosperity or bridges to nowhere? Theory and evidence on the impact of public infrastructure investment. NBER Macroecon Ann 2012:89–142

Mountford A, Uhlig H (2009) What are the effects of fiscal policy shocks? J Appl Economet 24(6):960–992

Nakamura E, Steinsson J (2014) Fiscal stimulus in a monetary union: evidence from US regions. Am Econ Rev 104(3):753–792

Nesbit T, Kreft S (2009) Federal grants, earmarked revenues, and budget crowd-out: state highway funding. Public Budg Finance 29(2):94–110

Ramey V (2011) Identifying government spending shocks: it’s all in the timing. Q J Econ 126(1):1–50

Ramey V (2019) Ten years after the financial crisis: What have we learned from the renaissance in fiscal research? J Econ Perspect 33(2):89–114

Ramey V (2020) Comment on “What Do We Learn From Cross-Regional Empirical Estimates in Macroeconomics”, in NBER Macroeconomics Annual 2020, vol 35. National Bureau of Economic Research Inc, NBER Chapters, pp 232–241

Ramey V, Shapiro M (1998) Costly capital reallocation and the effects of government spending. Carn-Roch Conf Ser Public Policy 48:145–194

Ramey V, Zubairy S (2018) Government spending multipliers in good times and in bad: evidence from US historical data. J Polit Econ 126(2):850–901

Shoag D (2016) The Impact of Government Spending Shocks: Evidence on the Multiplier from State Pension Plan Returns, Working paper. Harvard University

Stock J, Yogo M (2005) Testing for weak instruments in linear IV regression. Identification and inference for econometric models: essays in honor of Thomas Rothenberg. Cambridge University Press, Cambridge, pp 80–108

Suárez Serrato J, Wingender P (2016) Estimating Local fiscal multipliers. NBER Working Paper No. 22425

Wilson D (2012) Fiscal spending jobs multipliers: evidence from the 2009 American recovery and reinvestment act. Am Econ J Econ Pol 4(3):251–282

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

All authors declare that they have no conflict of interest.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A Static approach

In the static approach, we follow the two-stage least squares (2SLS) setup from Nakamura and Steinsson (2014)Footnote 33 to estimate the effect of defense and non-defense spending on state-level income. This approach relies on the Bartik (1991) approach to construct instruments to capture the exogenous component of a government spending category. The procedure therefore uses only information from the federal level and state-specific characteristics from previous years. The identifying assumption behind the construction of the instruments is that fluctuations of the national level of government spending are exogenous to state-specific business cycles. We investigate whether there is a difference in the two-year static multiplier of defense versus non-defense spending. The instruments \(z_{i,t}\) are created separately by interacting the national one-period growth of a specific category of aggregate spending \(x_{t}\) with a state-specific scaling factor:

The scaling factor is the lagged share of the state in the total national amount for that type of spending \(s^{x}_{i,t}\), divided by the share in national personal income \( s^y_{i,t}\). Both shares are computed using the average of the previous year and the year before.

We estimate the first and second stage and compute the standard errors that are asymptotically robust to heteroskedasticity and autocorrelation. In the first-stage regression, government spending \(g_{i,t}\), i.e., either defense spending or state-government spending (for non-defense spending), is instrumented using the instrument \(z_{i,t}\), and state and year fixed effects (\(\mu _i\) and \(\nu _t\)):

We use the instrumented value in the second stage to estimate the effect on the two-year growth rate of income. The second-stage regression can be written down as follows:

where \(y_{i,t}\) is personal income and the third term on the right-hand side is the instrumented value from the first stage of either defense contracts or state government spending for non-defense spending. This regression also includes state and year fixed effects (\(\alpha _i\) and \( \gamma _t\)). We can compute directly the short-horizon two-year multiplier through the coefficient \(\beta \).Footnote 34

Table 1 shows the estimated multipliers from the second stage regression. We estimate a 2-year multiplier around 1.2 for defense spending with an F-statistic of 7.24.Footnote 35 This result is close to the estimate from Nakamura and Steinsson (2014), even though we use a longer period for estimation. For non-defense spending we estimate a 2-year multiplier of 1.4 with an F-statistic of 8.53. However, the large standard errors prevent us from claiming that there is a significant difference between the estimated multipliers.

Our finding, that the above defense spending multiplier is much larger than we have estimated using our (dynamic) local projection approach is consistent with the observations in Ramey (2020). Investigating the approach in Nakamura and Steinsson (2014), she finds that using annual instead of biennial data and addressing the serial correlation in the instrument by estimating a dynamic model leads to substantially smaller multiplier estimates.

The first-stage F-statistics indicate that both instruments suffer from the weak instrument problem because both F-statistics are below 10, which is the common rule-of-thumb critical value to reject the null hypothesis of a weak instrument.Footnote 36 The low relevance of the instruments indicates that they do not capture the main fluctuations in spending. The underlying reason is probably that federal spending at the state level is largely driven by aggregate dynamics. However, since the Bartik (1991) approach uses mainly aggregate information to construct the instrument, the relevance of the instrument decreases once we take into account state and year fixed effects to control for aggregate dynamics.

Furthermore, the results are sensitive to the choice of the horizon for the dependent variable. To illustrate this, consider Table 2, which shows the second stage coefficients and the first stage F-statistics for longer horizons, where we shift the dependent variable one period ahead for each horizon. We would expect to see a peak in the F-statistic at a short horizon and then a gradual decrease in the statistic. However, for both instruments this is not the case. The estimated second-stage coefficients are very erratic.

To conclude, the results indicate that the multiplier for non-defense spending is higher than for defense spending, although the large standard errors prevent us from concluding that there is a significant difference between the multipliers. However, we do not think that the static approach produces reliable measures of the fiscal multipliers since the instruments are weak and the estimation result is very sensitive to the chosen horizon.

Appendix B Forecasting model for the dynamic approach

We construct a forecast for the federal spending variables defense contracts and (the categories of) intergovernmental transfers for non-defense spending. This forecast is based on a 10-year rolling-window panel regression with fixed effects using two lags of the following variables: personal income, state-government spending, state-government tax revenue, federal-government spending, the oil price, and the real interest rate. Based on this regression, we compute a one-step ahead out-of-sample forecast \({\hat{X}}_{i,t} \). The out-of-sample forecast precision of the model can be evaluated using the root mean squared forecast error (RMSFE).

We calculate the mean over the cross-sectional as well as time series dimension. Below we compare forecast errors for different trend specifications, using a linear and quadratic trend polynomial. In Table 3, we compare these to the naive forecasts, where we use last year’s value as a forecast.

The results in the table show that including a quadratic trend does not improve the forecast quality. The model performs better in forecasting IGT than defense contracts and, in particular, education and Medicaid grants. However, for some spending categories, the naive forecast performs even better. Especially for total IGT, Highways and Medicaid, the RMSE naive forecast is lower.

Appendix C Robustness checks

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van Gemert, T., Lieb, L. & Treibich, T. Local fiscal multipliers of different government spending categories. Empir Econ 63, 2551–2575 (2022). https://doi.org/10.1007/s00181-022-02217-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02217-5