Abstract

In this paper, we estimate price-response functions for a ski resort using a conjoint framework. The analysis is based on survey data from 350 skiers at a large ski resort in the inland region of Norway. The results suggest that the waiting time at the main lifts (crowdedness) and the proportion of slopes open affect the optimal (profit-maximizing) price the ski resort should charge for a one-day ski pass. The results of this study support previous findings from the literature using alternative methodological approaches and can be used directly by ski resort managers when developing new pricing schemes for their ski resort.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The utility that alpine skiers experience when visiting a ski resort is affected by congestion on both the ski lifts and the slopes (Fonner and Berrens 2014; Haugom and Malasevska 2019; Walsh et al. 1983). The general relationship is that the greater the congestion, the lower will be the experienced utility from a visit to a given ski resort. If ski resorts aim at having satisfied customers who will return to the ski resort in the future, they mainly have two options to reduce congestion, namely reducing peak demand or expanding capacity.

Reducing peak demand can most efficiently be achieved through dynamic pricing. A prime example of this is the electricity industry, where peak load prices can reach thousands of dollars for a single megawatt hour to avoid congestion. In the electricity industry, the system will collapse if there is congestion (Weron 2006). At a ski resort, the consequence is not one of total collapse, but longer waiting lines. This means that skiers spend less time on the activity they have purchased. Hence, to balance the experienced utility with the quantification of utility (i.e., money), the ski resort could adjust ticket prices accordingly. The practice of dynamically adjusting ticket prices to “form demand” has been used in the airline and hospitality industries for decades, but only recently have ski resorts started to adopt the same practice (Malasevska 2017).

A general expansion of the overall skiing capacity is obviously a long-term, strategic decision. In contrast, adjusting the number of slopes that are open on a given day can be a short-term, operational decision, although it can also be related to factors that are outside the control of ski resort managers, such as weather conditions or climatic circumstances. No matter the underlying reasons, reduced capacity will directly affect the utility the alpine skiers experience as they cannot take full advantage of all the slopes at the resort.

A well-known issue from the literature on ski resorts is the demand fluctuation and strong dependence on weather conditions that may lead to high peak periods with crowded slopes and/or long waiting lines at the ski lifts (e.g. Holmgren and McCracken 2014; Malasevska et al. 2017a; Malasevska and Haugom 2018a). Additionally, a ski resort may face reduced carrying capacity and/or season length because of insufficient snow cover (e.g. Falk and Hagsten 2016). If skiers encounter increasing numbers of other skiers on the slopes or in the lines at ski lifts, or reduced capacity in terms of the number of slopes open, their satisfaction from skiing is reduced (e.g. Matzler et al. 2007). Accordingly, a ski resort may face a change in a skier’s willingness to pay (WTP) for a ski-lift ticket.Footnote 1

Using an econometric approach, Mulligan and Llinares (2003) examined the effects (for the ski resort and skiers) of using faster lifts to reduce waiting lines. One early example of research on ski-lift ticket pricing and congestion is Barro and Romer (1987).Footnote 2 They pointed out that skiers purchase a ski-lift ticket based on an expected utility that depends on the number of lift rides per day. They argued that WTP for skiing is higher among avid skiers with a strong preference for more ski rides per day and among those with a greater distaste for congestion.

Walsh et al. (1983) estimated skiers’ marginal WTP for a reduction in lift queues and on-slope congestion at three Colorado ski areas. They found that both slope congestion and congestion in the ski-lift lines reduce skiers’ satisfaction and result in a decline in the WTP for lift tickets. Falk (2008) investigated congestion effects in a hedonic price analysis of Austrian ski resorts and reported findings that confirmed these results.

However, crowding is not always negative. Fonner and Berrens (2014) found that alpine skiers and snowboarders prefer some level of crowding and showed a nonlinear relationship between a ski-lift ticket price and the level of crowdedness. While skiers desire a moderate level of crowdedness to enjoy the skiing in a social manner, at some point crowdedness leads to congestion and has a negative impact on the experience offered to skiers.

Malasevska et al. (2017b) examined the relationship between ski-lift ticket price and quantity demanded under scenarios in which proportions of the ski slopes are closed. These findings suggest that the WTP for a ski-lift ticket in such conditions is substantially reduced.

Several studies in the economics literature have used conjoint analysis. Riganti and Nijkamp (2008) looked at the congestion challenge and optimal prices at popular tourist areas in Amsterdam. Yoo and Ohta (1995) presented a framework for optimal pricing in product planning for new multiattribute products. Harrison et al. (2005) analysed three data sets within agriculture: one on preferences for new food products, one on preferences for ostrich meat products, and another on preferences for crawfish sausage products. Banfi et al. (2008) used a choice design to evaluate the WTP for energy-saving measures in Switzerland’s residential sector. Dütschke and Paetz (2013) analysed consumer preferences for dynamic electricity pricing in Germany. Haugom and Malasevska (2019) analysed the relative importance of various ski resort- and weather-related characteristics when going alpine skiing. They find that apart from the price level, temperature, share of slopes open (available capacity), and queue (waiting time in the main lifts) are considered the most important attributes when alpine skiers go skiing. The link between weather and optimal prices has been examined in previous research using other data and methodologies (see Malasevska et al. 2017), but not the link between available capacity/waiting time and pricing. In this paper, we analyse these relationships using a conjoint framework and the same data set as used in Haugom and Malasevska (2019). This analysis allows us to address the following questions.

-

How are the reservation prices for a one-day ski pass affected by waiting times at the main lifts of a ski resort?

-

What is the optimal price for a one-day ski pass for various waiting times?

-

How are the reservation prices affected by capacity changes of a ski resort?

-

What is the optimal price for a one-day ski pass for various capacity levels (because of, for example, lack of snow)?

This study makes three contributions. First, to our knowledge, this is the first study that estimates skiers’ reservation prices for ski-lift tickets based on a conjoint framework. Previous studies have used more direct approaches for these estimations. Our results can therefore be used to verify the general findings of similar studies. Second, the hedonic price analysis by Falk (2008) does not measure the skiers’ preferences, but rather examines the factors that drive variation in prices across many ski resorts, which are already set. Hence, based on this framework, it is not possible to estimate individual consumers’ reservation prices or price optimization under various scenarios. Third, in contrast to Walsh et al. (1983), we do not assume linear relationships between lift-line waiting time or slope congestion and the aggregate WTP. Instead, our analyses use skiers’ preference ratings among several alternatives to “back out” the reservation price distribution. This approach means that we can find any (linear or nonlinear) shape of the optimal prices across lift-line waiting time and/or capacity levels.

2 Theoretical framework

We focus on crowdedness/waiting time at the main lifts and the proportion of slopes open/capacity of a ski resort. How should these possible congestions influence the ski resort’s pricing strategy? We use consumer utility theory (Pindyck and Rubinfeld 2009) as a theoretical framework to analyse these kinds of scenarios. Figure 1 shows the consumption choices that will be made by the ski resort customers for two different scenarios: (1) “a normal winter day” and (2) “a not optimal day for skiing”, which in this study refers to crowdedness or reduced capacity. A customer maximizes utility by choosing combinations of services and/or products at which the budget line is tangent to an indifference curve.

Customers’ consumption choices between expenditure on ski day passes and expenditure on other leisure activities. The upper panel a and b illustrates the choices for “a normal winter day”, while the middle c and d and lower panels e and f illustrate the choices for “a not optimal day for skiing”. a, c and e illustrate the cases that maximize utility; b, d and f give the corresponding price-response function for a particular ski resort for a given scenario; e and f illustrate the cases that maximize utility for various prices (not only one) of a ski day pass and show the corresponding price-response function

We assume that a share of the destination customers’ income (e.g. 20%) is being spent on leisure activities. We also assume that this share of the total income is spent on either skiing day passes at a particular ski resort or on another leisure activity (or a mix of other activities). We start with the scenario “a normal winter day” (Fig. 1a and b). The fixed income share is R, the fixed price of other leisure activities is \( P_{2}^{1} \), and the actual price of a skiing day pass is \( P_{1}^{3} \). This starting point gives the budget line from \( R/P_{1}^{3} \) to \( R/P_{2}^{1} \), as representing all possible combinations of skiing day passes and other leisure activities that the current budget allows. We assume the destination customer’s choice is at point A where they buy \( X_{2}^{2} \) units of other leisure activities and \( X_{1}^{2} \) units of day passes. Point A is where the budget line is tangent to the indifference curve \( I \). In Fig. 1b, we observe the point E, with \( X_{1}^{2} \) units of skiing day passes at price \( P_{1}^{3} \). Based on point E in Fig. 1b, the shape on the drawn curve in that figure is in this case just assumed. The curve shows the quantity demanded of a consumer or a group of consumers as a function of the price offered to that consumer or group and is named the price-response function (Phillips 2005).

As an example, let us assume that we are going from “a normal winter day” with a waiting time at the main lifts of 1 min to “a not optimal day for skiing” with a waiting time of 10 min. It is then reasonable to assume reduced utility from skiing, compared with other leisure activities. In Fig. 1c, we account for this by reducing (compared with the case of “a normal winter day”) the price of other leisure activities from \( P_{2}^{1} \) to \( P_{2}^{2} \) and obtain another budget line, one that is more favourable for other leisure activities relative to skiing. Point D is then where the budget line is tangent to the indifference curve \( I_{1} \), and we get point H in Fig. 1d, with \( X_{1}^{1} \) units of skiing day passes at price \( P_{1}^{3} \). Because we go from “a normal winter day” to “a not optimal day for skiing”, we observe a shift to the left in the price-response function, and for a fixed price \( \left( {P_{1}^{3} } \right) \), the quantity demanded for skiing day passes will decrease (Fig. 1a and b, from \( X_{1}^{2} \) to \( X_{1}^{1} \)).

Note, for example, that it is not obvious that price \( P_{1}^{3} \) and quantity \( X_{1}^{1} \) of skiing day passes are optimal for this scenario of a waiting time of 10 min at the main lifts. To use this framework to analyse optimal prices, we need to estimate (not just assume) the shape of the price-response function for each of the scenarios empirically. The lower panel of Fig. 1 illustrates how to empirically deal with “a not optimal day for skiing” with the scenario of a waiting time of 10 min at the main lifts.

As a starting point, in the lower panel of Fig. 1, we assume the destination customer’s choice is at point D, which we call the reference point, or base case, where they buy \( X_{2}^{4} \) units of other leisure activities and \( X_{1}^{1} \) units of day passes (Fig. 1e). In Fig. 1f, we observe that the reference point/base case is point H, with \( X_{1}^{1} \) units of day passes at price \( P_{1}^{3} \). Because of crowdedness, given the same price \( \left( {P_{1}^{3} } \right) \) and compared with “a normal winter day”, the number of purchased day passes has decreased from \( X_{1}^{2} \) to \( X_{1}^{1} \) (Fig. 1a and e).

As a natural reaction to the crowdedness and reduced skiing experience, fewer skiers will visit the destination and then the prices will be pushed down. We now assume, because of the long waiting time at the main lifts, that the destination reduces the price for day passes to \( P_{1}^{2} \), which is lower than \( P_{1}^{3} \), and that \( R \) and \( P_{2}^{2} \) are constant. Decreasing the day-pass price results in a new budget line from \( R/P_{1}^{2} \) to \( R/P_{2}^{2} \) in Fig. 1e. For a given scenario at the discounted price \( P_{1}^{2} \), we assume the destination customer’s choice combination is C, implying a shift from indifference curve \( I_{1} \) to \( I_{2} \). In Fig. 1f, the price \( P_{1}^{2} \) induces a ski-pass demand of \( X_{1}^{3} \) units and point G corresponds to point C in Fig. 1e; that is, we see a movement along the price-response function from point H to point G.

Finally, when decreasing the day-pass price to \( P_{1}^{1} \) for a given scenario, the general effect is the same as when the price was increased from \( P_{1}^{3} \) to \( P_{1}^{2} \). Because of the price reduction, the budget line rotates outwards, and destination customers achieve a higher level of utility associated with the indifference curve \( I_{3} \) by selecting point B, with \( X_{1}^{4} \) units of skiing day passes. Point F in Fig. 1f shows the price of \( P_{1}^{1} \) and the quantity of ski passes demanded of \( X_{1}^{4} \) units. The price–quantity curve drawn through points F, G and H in Fig. 1f represents the “empirical” price-response function for destination customers for a scenario of a waiting time of 10 min at the main lifts.

When we know the shape of the price-response function, we use that information in a final step to find the price that gives the highest revenue for the ski destination for each scenario in this study. The same theoretical framework can be used to explain how price-response functions are formed in other scenarios, such as various weather conditions (see Malasevska et al. 2017b).

3 Methods

3.1 Conjoint analysis technique

Different WTP methods have been used to estimate price-response functions (Breidert et al. 2006; Miller et al. 2011). Breidert et al. (2006) noted the following data collection methods: market data, experiments, direct surveys and indirect surveys. In this study, we use indirect surveys, more specifically conjoint analysis to estimate price-response functions for each scenario. Conjoint analysis is frequently used in pricing studies (for reviews, see, e.g., Breidert et al. 2006; Rao 2014). In the case of alpine skiing activities, only a few conjoint analysis studies have examined the relative importance of different attributes of a ski resort (see, e.g., Carmichael 1996; Siomkos et al. 2006; Unbehaun et al. 2008; Won et al. 2008; Won and Hwang 2009). However, to our knowledge, no conjoint studies have examined the pricing decisions for alpine skiing activities.

In conjoint analysis, there are various alternative approaches for eliciting preferences for a set of hypothetical choice alternatives from respondents. Previous studies have used a ratings-based method (choice alternatives are rated), ranked-based method (choice alternatives are ranked), and choice-based method (respondents make a specific choice among a set of choice alternatives) (Boyle et al. 2001; Rao 2014). In this study, the ratings-based method is used, partly because we obtained metric data, that is, the ratings of the various alternative scenarios.Footnote 3

Different procedures are available for estimating the ratings-based conjoint model. It is possible to recode the rating data to either ranked- or choice-based data and use appropriate estimation methods for these formats (e.g. tobit, ordered probit, rank-ordered logit, fractional regression) (see, e.g., Boyle et al. 2001). In this study, we use the rating data directly in linear regression estimation for several reasons. First, to account for heterogeneity, we estimated individual-level models, which is easiest to do with linear regression (highest degrees of freedom). Second, earlier studies have checked the robustness of the results using different response formats and estimation methods. Harrison et al. (2005) show that the estimated underlying utility scale results, based on a cardinal assumption (as we do when using the rating data as continuous), compared with an ordinal assumption (recode the rating format to an ordered scale), do not significantly differ. This supports the use of linear regression, or alternatively the fractional regression model by Papke and Wooldridge (1996), which accounts for the bounded nature of the dependent variable. This boundedness is particularly important to account for in the presence of excess zero values as it then would lead to an overdispersion problem.Footnote 4 In our study, 5.7% of the respondents had indicated zero ratings on a majority of the profile scenarios and there is a potential overdispersion problem in these few estimations (20 out of 350). The fractional regression model could have accounted for this, but it did not converge when doing the estimations at the individual level. However, linear regression was also the method/approach used by Kohli and Mahajan (1991), who we follow closely in our study.

The linear regression model can be specified as (Malhotra and Briks 2007):

where \( U_{i} \) is a vector of skiers’ preference ratings for individual \( i \), \( X_{i} \) is a matrix of dummy variables for the attribute levels for individual \( i \), \( \beta_{i} \) is a vector of estimated coefficients for individual \( i \), and \( e_{i} \) is a vector of error terms. The estimated coefficients of the OLS regression can then be related to the part worths for individual \( i \). Given the dummy variable coding, each dummy variable coefficient represents the difference in the average ratings for that level of the attribute, relative to the average rating for the base level.

3.2 Estimating the price-response function with conjoint analysis

To derive the part-worth utility for price, or the WTP for the given scenario, which is the cornerstone of the price-response function, we follow Kohli and Mahajan (1991). They let price be included as an attribute in Eq. (1) and modelled as a continuous linear variable in the multiattribute preference function. Denote the predicted \( U_{it \sim p} \) as the multiattribute utility of profile \( t \), which is the utility contribution where the price is not included in \( U_{it \sim p} \). Furthermore, let the predicted \( U_{i}^{*} \) denote the estimated utility for a status quo profile (this is in our case a given profile, e.g. a profile with a given waiting time at the main lifts, price, and day of the week). Hence, we can define

where \( U_{{i}} \left( p \right) \) is the calculated contribution of price \( p \) to individual \( i \)’s utility of profile \( t \). If we rewrite Eq. (1) as \( U_{i} = \beta_{0i} + \beta_{1i} X_{1} + \beta_{2i} X_{2} + \cdots + \beta_{pi} p + e_{i} \), where \( p \) is the price variable (which includes different discrete price levels), and \( U_{i \sim p} = \beta_{0i} + \beta_{1i} X_{1} + \beta_{2i} X_{2} + \cdots + e_{i} \), and \( U_{i \sim p} + U_{i} \left( p \right) = \beta_{0i} + \beta_{1i} X_{1} + \beta_{2i} X_{2} + \cdots + \beta_{pi} p + e_{i} \), then we obtain \( U_{{i}} \left( p \right) = \beta_{pi} p \). Inserting this last relation into Eq. (2) and solving it with respect to price for a given profile \( t \) gives

Kohli and Mahajan (1991) further assumed that the price estimates are drawn from a normal distribution,Footnote 5 and \( p_{ti} \) estimated for each consumer \( i \) reflects the WTP for profile \( t \) over the status quo profile. A normal distribution is defined over the range \( \left[ { - \infty ,\infty } \right] \), while conjoint multiattribute utility functions are estimated only over a restricted positive range \( \left[ {p_{\text{min} } ,p_{\text{max} } } \right] \). Let \( U_{i} \left( {p_{\text{min} } } \right) = \beta_{pi} p_{\text{min} } \) and \( U_{i} \left( {p_{\text{max} } } \right) = \beta_{pi} p_{\text{max} } \). Estimates are then less than the range \( \left[ {p_{\text{min} } ,p_{\text{max} } } \right] \) when \( U_{i \sim p} + U_{i} \left( {p_{\text{min} } } \right) < U_{i}^{*} \) and higher when \( U_{i \sim p} + U_{i} \left( {p_{\text{max} } } \right) > U_{i}^{*} \). By counting, we can find the fraction \( q_{1t} \left( {q_{2t} } \right) \) of respondents whose WTP/reservation prices are below \( p_{\text{min} } \) (above \( p_{\text{max} } \)) for profile \( t \). From the estimates of the vector in the range \( \left[ {p_{\text{min} } ,p_{\text{max} } } \right] \), we can calculate for each profile \( t \) the mean \( \bar{p}_{t} \) and variance \( \sigma_{t}^{2} \).

It would be wrong to use \( \bar{p}_{t} \) and \( \sigma_{t}^{2} \) as inputs in the normal distribution of WTP/reservation prices for profile \( t \) because this will not fully cover the range \( \left[ { - \infty ,\infty } \right] \). That is, it will be a truncated normal distribution. To estimate the full or nontruncated normal distribution, we follow Kohli and Mahajan (1991) and Rao (2014) by definingFootnote 6

and

where \( R = \left( {f\left( {z_{t,\text{min} } } \right) - f\left( {z_{t,\text{max} } } \right)} \right)/\left( {F\left( {z_{t,\text{max} } } \right) - F\left( {z_{t,\text{min} } } \right)} \right) \) and \( C = 1+\left( {z_{t,\text{min} } }{f\left( {z_{t,\text{min} } }\right) - {z_{t,\text{max} } }f\left({z_{t,\text{max} } } \right)} \right)/\left( {F\left( {z_{t,\text{max} } } \right) - F\left( {z_{t,\text{min} } } \right)} \right) -{R^2}, \, F\left( {z_{t,\text{min} } }\right)=q_{1t}\), \( F\left( {z_{t,\text{max} } } \right) = q_{2t} \), \( f\left( {z_{t,\text{min} } } \right) = 1/\sqrt {2\pi } e^{{\left( { - z_{t,\text{min} }^{2} /2} \right)}} \), \( f\left( {z_{t,\text{max} } } \right) = 1/\sqrt {2\pi } e^{{\left( { - z_{t,\text{max} }^{2} /2} \right)}} \), and the corresponding \( z_{t,\text{min} } \) and \( z_{t,\text{max} } \) can be determined from standard normal tables.

Once the values \( \hat{\mu }_{t} \) and \( \hat{\sigma }_{t} \) are estimated, we put them into an inverse cumulative normal distribution specification \( N\left( {\hat{\mu }_{t} ,\hat{\sigma }_{t} } \right) \), and then produce the price-response function, denoted \( d\left( {p_{t} } \right) \) for profile t.

3.3 The price optimization problem

The overall objective for the alpine skiing destination is to maximize the total contribution, where the total contribution margin (cm) is given by

where \( c_{t} \) is the incremental cost, which in this study is the increase in total cost associated with one additional customer at the particular alpine skiing destination. Here, this is the cost related to the size of the workforce (at the ticket office and ski lifts) and energy consumption of the ski lifts. Both of these cost elements may depend to a certain extent on the number of visitors at the ski resort. However, based on our own calculations and following Phillips (2005), we assume that the incremental cost is zero per additional customer. Assuming that \( c_{t} = 0 \) simplifies the maximization of total contribution to maximize revenue \( R\, {\text{for profile }}t \):

This problem can be solved using any optimization software. Intuitively, the optimal price can be found by searching/calculating the ski pass price in Fig. 1b, d and f that gives the largest area below the price-response function for a given profile \( t \).

4 Questionnaire and data

The data used in this study are from the survey carried out by Haugom and Malasevska (2019). A detailed description of the questionnaire and data is provided in their article. We therefore limit the presentation of the pretesting, research design, sample, and descriptive statistics to what is needed to understand the subsequent analysis. Interested readers should confront Haugom and Malasevska (2019).

Table 1 lists the attributes and attribute levels included in this survey. To overcome the complexity problem while retaining the opportunity to include a rich set of attributes, we selected a combination of two approaches. First, instead of using a full factorial design, which would induce 16,200 \( \left( {5 \times 6 \times 3 \times 3 \times 3 \times 2 \times 2 \times 5} \right) \). possible profiles, we chose to use a fractional factorial design. A set of nine main profiles was constructed to constitute the estimation stimuli setor all respondents. The nine profiles focused on (1) waiting times (1, 5, and 10 min), (2) day of the week (weekend and weekdays), and (3) price (NOK 250, 350, 450, 550, and 650). The total number of possible profiles when including these attributes is 30 (3 × 2 × 5). However, many of the combinations from the full design make little sense (e.g. profiles with very high prices with long waiting times on weekdays). Feedback from respondents of the pretest enabled us to construct the final nine profiles, and these are presented in the upper and lower panels of Fig. 2.

The second approach used to handle the large number of profiles stemming from the remaining attributes in Table 1 is what Rao (2014) referred to as incomplete block design. Here, the basic idea is to develop a set of profiles and then divide them into subsets and administer them to each subject in a subgroup of people (Rao 2014, pp. 52–54). In total, we created ten versions of the questionnaire, where weather, time period, or slope characteristics (Q8 and Q9) differed slightly, but where the nine main profiles remained identical. Table 2 presents the features of the key questions (Q8 and Q9) for all ten questionnaires. Figure 2 illustrates two versions of the tables presented to the respondents. The difference between these two versions is the weather on the skiing day. In the upper panel, we see that it is a day with snowfall, 0 °C and no wind. In the lower panel, we have a day with nice sunny weather, − 5 °C and no wind. The data collection was carried out in such a way that the replications for each of the ten versions of the questionnaire were the same. This way of collecting the data allows us to create a data set where the relative importance of many attributes can be analysed without overwhelming all respondents with questions about all the attribute levels.

4.1 Sample and descriptive statistics

The sample consists of active skiers at one major ski resort in the inland region of Norway.Footnote 7 Table 3 provides detailed information about the main features of the ski resort. The data collection was performed by four undergraduate students during March and April 2018. The students collected the data at the ski resort on different weekdays and weekends and during the Easter holiday. A total of 400 forms were either partly or fully completed. The total number of obtained ratings (Q8 and Q9) was 6,490. As each respondent was asked to perform 18 ratings, the average number of ratings performed by each respondent is 16.23, or 90%. A total of 350 of the 400 respondents completed all 18 ratings, which corresponds to 87.5%. For the conjoint analysis, a sample size of 150 is required to ensure reliability (Orme 2010). Thus, the sample size of the current study meets the minimum requirement to ensure reliable results.

Descriptive statistics of the sample are presented in Haugom and Malsevska (2019), and interested readers can confront that study for the details of the sample characteristics.

4.2 Variable specification

As the dependent variable in Eq. (1), we used the individual respondent’s rating on each profile (see Fig. 2). As explanatory variables (\( X_{i} \) is a matrix) in Eq. (1), we used waiting time at the main lifts, day of the week, vacation, weather conditions, temperature, wind and the proportion of slopes open as dummy variables, and price as a continuous variable.

The results from the estimations (of Eqs. (1) and (2)) were then used to estimate WTP and price-response functions for 1) the three profiles of waiting time at the main lifts and 2) the three profiles of proportion of slopes open, for midweek and weekend, respectively. All other explanatory variables were then control variables (in Eqs. (1) and (2)) in the estimation of the WTP and price-response functions. As the status quo profile, for prediction of \( U_{i}^{*} \) in Eqs. (2) and (3), we used the profile with weekend, a waiting time of 10 min, and the price of a day pass at NOK 350.Footnote 8

5 Results

5.1 Optimal prices for waiting times at the main lifts

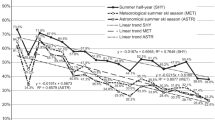

The estimated price-response functions for various waiting times at the main lifts and day of the week are illustrated in Fig. 3. The price-response function for the weekend is to the right of that for weekdays. This means that the WTP is higher for skiing at the weekends compared with weekdays. This is consistent with the findings of Malasevska and Haugom (2018b) and Malasevska et al. (2017b), who report significantly higher optimal prices at the weekends compared with weekdays.

Moreover, we observe a shift to the right with decreasing waiting times at the main lifts. For weekends (right panels), the mean reservation price for waiting times of 10 min is NOK 359, for 5 min, it is NOK 434, and for 1 min, it is NOK 449. For weekdays, the mean reservation price for waiting times of 10 min is NOK 301, for 5 min, it is NOK 397, and for 1 min, it is NOK 415. Note also that the price-response function becomes steeper with increased waiting time. This means that the variation in WTP across the respondents decreases with an increase in waiting time. This finding is in line with Haugom and Malasevska (2019) who show that waiting time in the main lifts is an important attribute when visiting a ski resort. They also find that the reduction in the utility skiers experience when queue time goes from five to 10 min is bigger compared to the reduction in utility when going from one to five minutes waiting time.

Figure 4 shows the calculated optimal prices for various waiting times at the main lifts. On weekends, with a waiting time of 1 min, the optimal price for a day pass is NOK 422, with 5 min, it drops to NOK 407 and further to NOK 338 with 10 min. For weekdays, the calculated optimal prices are lower (Fig. 4). A ski resort can use this information in several ways. For example, if they know the waiting time at the main lifts at the ski resort, they can use these estimated prices directly in their pricing strategy. An alternative application is to use these estimates as guides for adjustment of the day-pass price. Say the price for a day pass on a given weekend is NOK 407; at this price, the ski resort observes a waiting time at the main lifts of 5 min. The ski resort wants satisfied visitors who return to the destination frequently; as a result, the resort aims to reduce the waiting time to 1 min. A good price for the day pass is then NOK 422. This is a simplification for expository purposes, and the pricing tactics need to be thoroughly evaluated as part of an overall pricing strategy.

5.2 Optimal prices at reduced capacity

The estimated price-response functions for various proportions of slopes open and weekdays are presented in Fig. 5. Similar to the findings for various waiting times at the main lifts, the price-response functions for the weekend are to the right of those for weekdays. Furthermore, the functions shift to the right with increases in the proportion of slopes open. However, this shift is small when the proportion of slopes open changes from 50% to 75%. For weekends (right panel), the mean reservation price for 50% of the slopes open is NOK 348; for 75%, it is NOK 354, that is, an increase (at the mean) of just NOK 6. For an increase (on weekends) in the proportion of slopes open from 75% to 100%, the mean reservation price increases by NOK 60 to NOK 411. A similar pattern exists for the price-response functions for the proportion of slopes open for weekdays.

Figure 6 shows the calculated optimal prices of day passes for various proportions of slopes open. As expected, the calculated optimal prices increase with increasing proportions of slopes open. On weekends, with 50% of the slopes open, the optimal price for a day pass is NOK 326, with 75% of the slopes open, the optimal price is the same, but with 100% of the slopes open, the optimal price increases to NOK 385. For weekdays, the calculated optimal prices are in general lower.

6 Conclusion and implications

The main purpose of this study was to estimate reservation prices and to calculate optimal prices for a one-day ski pass under various waiting times and capacity scenarios. We used the standard theory of consumer behaviour and a conjoint analysis in the empirical work. To our knowledge, the conjoint framework has not been used previously for this purpose within the alpine skiing industry. A general finding is that the price sensitivity differs between weekdays and weekends. Specifically, the optimal (profit-maximizing) price is lower on weekdays than on weekends, thereby supporting the findings of previous studies using other methodologies.

We also documented the effect of ski-lift waiting times and reduced capacity on both the price-response functions and the subsequent optimal price calculations for each scenario. The results clearly show that skiers’ reservation price distribution is directly affected by both waiting time and the available capacity of a given skiing day. Increased waiting times reduce reservation prices, and the effect is stronger when waiting times increase from 5 to 10 min, compared with from 1 to 5 min. The effect of reduced capacity, as measured by the proportion of slopes open for skiing, is strongest when going from 100% (full capacity) to 75%. Reducing capacity beyond this does not have an impact on our estimations.

The main findings in this study can be used directly by ski resort managers when developing new pricing schemes for one-day ski passes. To avoid lengthy waiting lines at the main lifts, some sort of peak-load pricing could be implemented. This approach assumes that the ski resort has a good forecasting model of future demand because a prerequisite for such a pricing scheme to be accepted by consumers is that it is transparent and announced before the actual visit to the resort. Furthermore, using this approach also assumes that the current use of ski resort facilities is optimized and that long waiting lines at the main lifts reflect high demand and not other factors. However, long waiting lines could also occur because of poorly designed ski slopes and lifts, as well as an inefficient use of ski-lift capacity.

Another possible approach to making skiers indifferent is to introduce some sort of reimbursement after visiting the ski resort if the waiting times exceeded some predefined levels. In this case, skiers would have to wait in lift lines, but are then compensated for this (reduced skiing) after the visit. From an operational perspective, although the latter is potentially more difficult to implement in practice, the technology needed to implement this is available today (see www.skioo.com).

The results for the various capacity levels (in terms of proportion of slopes open on a given skiing day) can also be directly used by ski resort managers. When capacity is reduced (e.g. because of a lack of snow cover), the one-day ski pass price should be reduced to reflect the utility skiers experience.

The main point is that skiers are not indifferent to longer ski-lift waiting lines and reduced capacity. Avoiding a large discrepancy between the utility skiers experience and the quantification of this utility (i.e. money) is important to make consumers satisfied in both the short and long run. Reducing this discrepancy can be achieved efficiently through a more dynamic approach to pricing for ski-lift prices.

Notes

Congestion and waiting lines are also often seen in other areas within the tourism industry; for example, Riganti and Nijkamp (2008) analysed the willingness to wait at popular tourist areas in Amsterdam.

Choice-based conjoint models have some advantages over the ratings-based method regarding the simulation of choices that are made in the actual marketplace, the valuation of brand-based attributes, and the assessment of competitive effects of choice. However, even though this method can also be used to assess price sensitivity, the design of such a study is far more complex. The estimation procedure for directly extracting the price-response function can be performed with the ratings-based method with standard estimation methods, which is important to practitioners. Additionally, the number of attributes in the design can be higher in ratings-based methods than in choice-based methods (see Rao 2014). As a skiing day consists of a large number of attributes and general characteristics, we chose to use the ratings-based conjoint method in this study. However, in ongoing research, we have developed questionnaires using choice-based methods and we intend to compare the estimation results from the two approaches in future work.

We thank an anonymous referee for pointing out this potential overdispersion problem.

Because of the competitiveness of the Norwegian alpine skiing industry, the ski resort has requested to remain anonymous.

The choice of the status quo level in this model is somewhat ad hoc and that is a weakness. The estimated results are sensitive to the status quo profile, and different skiers might differ in their utility from the scenarios. This challenge is discussed in, e.g., Breidert et al. (2006).

References

Banfi S, Farsi M, Filippini M, Jakob M (2008) Willingness to pay for energy-saving measures in residential buildings. Energy Econ 30(2):503–516

Barro RJ, Romer PM (1987) Ski-lift pricing, with applications to labor and other markets. Am Econ Rev 77(5):875–890

Boyle KJ, Holmes TP, Teisl MF, Roe B (2001) A comparison of conjoint analysis response formats. Am J Agr Econ 83(2):441–454

Breidert C, Hahsler M, Reutterer T (2006) A review of methods for measuring willingness-to-pay. Innov Mark 2(4):8–32

Carmichael BA (1996) Conjoint analysis of downhill skiers used to improve data collection for market segmentation. J Travel Tourism Mark 5(3):187–206

Dütschke E, Paetz A-G (2013) Dynamic electricity pricing—which programs do consumers prefer? Energy Policy 59:226–234

Falk M (2008) A hedonic price model for ski lift tickets. Tour Manag 29(6):1172–1184

Falk M, Hagsten E (2016) Importance of early snowfall for Swedish ski resorts: evidence based on monthly data. Tour Manag 53:61–73

Fonner RC, Berrens RP (2014) A hedonic pricing model of lift tickets for US alpine ski areas: examining the influence of crowding. Tour Econ 20(6):1215–1233

Harrison RW, Gillespie J, Fields D (2005) Analysis of cardinal and ordinal assumptions in conjoint analysis. Agric Resource Econ Rev 34(2):238–252

Haugom E, Malasevska I (2019) The relative importance of ski resort- and weather-related characteristics when going alpine skiing. Cogent Soc Sci 5(1):1–16

Holmgren MA, McCracken VA (2014) What affects demand for “the greatest snow on earth?”. J Hospitality Mark Manag 23(1):1–20

Hoshino T (2013) Estimation of the preference heterogeneity within stated choice data using semiparametric varying-coefficient methods. Empir Econ 45:1129

Johnson NL, Kotz S (1970) Continuous univariate distributions—1 and 2. Houghton-Mifflin, Boston

Kohli R, Mahajan V (1991) A reservation-price model for optimal pricing of multiattribute products in conjoint analysis. J Mark Res 28(3):347–354

Malasevska I (2017) Innovative pricing approaches in the alpine skiing industry (PhD thesis). Inland Norway University of applied sciences, Norway. Flisa Trykkeri A/S, Flisa

Malasevska I, Haugom E (2018a) Alpine skiing demand patterns. Scandin J Hospitality Tour 3:1–14

Malasevska I, Haugom E (2018b) Optimal prices for alpine ski passes. Tour Manag 64:291–302

Malasevska I, Haugom E, Lien G (2017a) Modelling and forecasting alpine skier visits. Tourism Economics 23(3):669–679

Malasevska I, Haugom E, Lien G (2017b) Optimal weather discounts for alpine ski passes. J Outdoor Recreat Tour 20:19–30

Malhotra NK, Briks DF (2007) Marketing research: an applied approach, 3rd edn. Pearson Education Limited, Essex

Matzler K, Füller J, Faullant R (2007) Customer satisfaction and loyalty to Alpine ski resorts: the moderating effect of lifestyle, spending and customers’ skiing skills. Int J Tour Res 9(6):409–421

Miller KM, Hofstetter R, Krohmer H, Zhang ZJ (2011) How should consumers’ willingness to pay be measured? An empirical comparison of state-of-the-art approaches. J Mark Res 48(1):172–184

Mulligan JG, Llinares E (2003) Market segmentation and the diffusion of quality-enhancing innovations: the case of downhill skiing. Rev Econ Stat 85(3):493–501

Orme BK (2010) Getting started with conjoint analysis: strategies for product design and pricing research, 2nd edn. Research Publishers LLC., Madison

Papke L, Wooldridge J (1996) Econometric methods for fractional response variables with an application to 401(k) plan participation rates. J Appl Econ 11(6):619–632

Phillips R (2005) Pricing and revenue optimization. Stanford University Press, Stanford

Pindyck RS, Rubinfeld DL (2009) Microeconomics, 7th edn. Pearson Prentice Hall, New Jersey

Rao VR (2014) Applied conjoint analysis. Springer, New York

Riganti P, Nijkamp P (2008) Congestion in popular tourist areas: a multi-attribute experimental choice analysis of willingness-to-wait in Amsterdam. Tourism Economics 14(1):25–44

Siomkos G, Vasiliadis C, Lathiras P (2006) Measuring customer preferences in the winter sports market: the case of Greece. J Target Meas Anal Mark 14(2):129–140

Unbehaun W, Pröbstl U, Haider W (2008) Trends in winter sport tourism: challenges for the future. Tour Rev 63(1):36–47

Walsh RG, Miller NP, Gilliam LO (1983) Congestion and willingness to pay for expansion of skiing capacity. Land Econ 59(2):195–210

Weron R (2006) Modeling and forecasting electricity loads and prices: a statistical approach. Wiley, Chichester

Whitehead JC, Lew DK (2019) Estimating recreation benefits through joint estimation of revealed and stated preference discrete choice data. Empirical Economics. https://doi.org/10.1007/s00181-019-01646-z

Won D, Hwang S (2009) Factors influencing the college skiers and snowboarders’ choice of a ski destination in Korea: a conjoint study. Manag Leisure 14(1):17–27

Won D, Bang H, Shonk D (2008) Relative importance of factors involved in choosing a regional ski destination: influence of consumption situation and recreation specialization. J Sport Tour 13(4):249–271

Yoo D-I, Ohta H (1995) Optimal pricing and product-planning for new multiattribute products based on conjoint analysis. Int J Prod Econ 38(2–3):245–253

Acknowledgements

Open Access funding provided by Inland Norway University of Applied Sciences.

Funding

This study was funded by Regionalt Forskningsfond Innlandet (RFF), Grant number 285141.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors have declared that they have no conflict of interest.

Ethical approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Declaration of Helsinki and its later amendments or comparable ethical standards.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Haugom, E., Malasevska, I. & Lien, G. Optimal pricing of alpine ski passes in the case of crowdedness and reduced skiing capacity. Empir Econ 61, 469–487 (2021). https://doi.org/10.1007/s00181-020-01872-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01872-w