Abstract

This paper examines the relationship between external financing constraints and the intensive margin of exports for manufacturing firms in India. We use a sample of nearly 3200 firms over the period: 2000–2015 and construct a multivariate index proposed by Musso and Schiavo (J Evol Econ 18(2):135–149, 2008) to estimate the degree of external financing constraints. We find that an increase in the degree of external financing constraints faced is associated with lower firm-level exports and this result holds even after accounting for endogeneity issues. We next examine whether business group-affiliated firms are less dependent on external finance to support their overseas sales. We find that financing constraints are a significant binding factor even for firms with access to internal capital markets. Moreover, we find that firm size matters, as a decline in the financial health of small- and medium-sized firms is associated with a significantly larger decline in their export levels. Finally, we find some evidence of industry-level heterogeneity, as financing constraints lead to a more pronounced decline in the exports of firms in industries with greater dependence on external finance.

Similar content being viewed by others

Notes

India’s manufactured exports contributed 2% to world manufacturing exports in 2014 (UNCTAD statistics).

Prior to 1991, the cash reserve ratio was 25% and the statutory liquidity ratio was 40%, and these ratios currently stand at 4% and 19.5%, respectively (as of December, 2019).

The SEBI is the apex regulatory authority governing capital markets in India and was formed in 1992.

The priority sector guidelines do not lay down preferential rates of interest for loans under this category. https://www.rbi.org.in/scripts/FAQView.aspx?Id=87.

Refer to the table in “Appendix 1” for variable definitions.

See “Appendix 1” for variable definitions. The variables that constitute this index are chosen based on their performance in prior studies and their expected role in influencing the firm’s ability to raise external finance (Musso and Schiavo (2008)).

Each variable is defined such that an increase in the value represents an improvement in that financial metric of the firm. Sectoral averages are used to account for industry-specific differences in the variables.

Our results are also robust to other ways of combining the scores from the seven variables.

Refer to “Appendix 1” for all variable definitions. We follow Levinsohn and Petrin (2003) to estimate firm-specific productivity for each two-digit industry uniquely.

We refrain from defining export sales (the dependent variable) in terms of annual (percentage) growth as this can introduce autocorrelation in the error terms.

A firm is recognized as a continuous exporter if it has exported in all periods (observed in the sample). Firms which exported only in some of the (reported) years are classified as occasional exporters, and firms which did not export in any year (over the sample period) are classified as non-exporters.

This segmentation is based on the industry-specific median of the multivariate FC index (Score A) at the 3-digit industry-level classification.

One possible explanation for this could be that firms may reduce investments in productivity-enhancing activities after becoming exporters, which can happen even if they face borrowing constraints.

These can include a range of activities such as investment in better technology, import of capital goods or research and development-related expenses, all of which have implications for product quality and subsequently for the future demand for the products exported.

We use the CMIE Prowess database’s group classification for identifying the group affiliation for all firms in our sample. This approach follows existing studies on Indian business groups, including Khanna and Palepu (2000), Bertrand et al. (2002) and Gopalan et al. (2007), among others. The Prowess classification is appropriate for our empirical analysis as it is based on a continuous monitoring all corporate announcements as well as a qualitative interpretation of group-specific behavior of all affiliated firms. In our sample, 38% of all exporting firms are affiliated to an Indian or foreign-owned business group [Table 2 (Summary Statistics)].

Our empirical approach is not designed (or intended) to test for the existence of internal capital markets. However, prior studies by Gopalan et al. (2007) and Manos et al. (2007) provide strong evidence in support of the existence of internal capital markets among Indian business groups and our findings build on these well-established results.

Gopalan et al. (2007) find limited evidence of tunneling among Indian affiliated firms, in which intra-group flows are used to divert resources away from group firms with low insider holding and toward firms with high insider holding. This leads the authors to conclude that there is no evidence of intra-group loans being used by Indian firms to finance investment activities or to divert cash.

The World Bank report (2014) on financial inclusion documents that SMEs usually face greater shortages of formal credit, especially in low- and middle-income countries. Based on the World Bank Enterprise Survey, they find that nearly 44% of SMEs are involuntarily denied loans in low-income countries, whereas a comparatively smaller share of the large firms (25%) experience this issue.

Numbers are based on the Fourth Census of MSMEs conducted between 2006 and 2009.

The corresponding GMM estimates are reported in Table 2.1 (Appendix 2 in Electronic Supplementary Material).

The classification of industries based on our sample is similar (but not identical) to the classification listed in Rajan and Zingales (1998). We obtain qualitatively similar results following the original classification, which are not reported for brevity.

GMM estimates are reported in Table 2.2 (Appendix 2 in Electronic Supplementary Material).

We obtain similar results using industry-specific capital intensity (as an alternative measure of external financial dependence). These results are not reported for brevity.

We obtain qualitatively similar results using the GMM estimator, which are not reported for brevity.

See Levinsohn and Petrin (2003) for more information on the methodology.

We use the “levpet” command in Stata to obtain these estimates.

We use the total wage bill to represent labor as most firms over the sample period do not report information on the number of employees.

References

Ahluwalia MS (2002) Economic reforms in India since 1991: Has gradualism worked? J Econ Perspect 16(3):67–88

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Bas M, Berthou A (2012) The decision to import capital goods in India: firms’ financial factors matter. World Bank Econ Rev 26(3):486–513

Beck T, Demirguc-Kunt A, Levine R (2005) SMEs, growth, and poverty: cross-country evidence. J Econ Growth 10(3):199–229

Bellone F, Musso P, Nesta L, Schiavo S (2010) Financial constraints and firm export behaviour. World Econ 33(3):347–373

Berman N, Héricourt J (2010) Financial factors and the margins of trade: evidence from cross-country firm-level data. J Develop Econom 93(2):206–217

Bertrand M, Mehta P, Mullainathan S (2002) Ferreting out tunneling: an application to Indian business groups. Q J Econ 117(1):121–148

Chaney T (2016) Liquidity constrained exporters. J Econ Dyn Control 72:141–154

Eichengreen B, Gupta P, Kumar R (eds) (2010) Emerging giants: China and India in the world economy. OUP, Oxford

Ghosh S (2006) Did financial liberalization ease financing constraints? Evidence from Indian firm-level data. Emerg Markets Rev 7(2):176–190

Gopalan R, Nanda V, Seru A (2007) Affiliated firms and financial support: evidence from Indian business groups. J Financ Econ 86(3):759–795

Greenaway D, Guariglia A, Kneller R (2007) Financial factors and exporting decisions. J Int Econ 73(2):377–395

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints? Q J Econ 112:169–215

Khanna T, Palepu K (2000) Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. J Finance 55(2):867–891

Lensink R, Van der Molen R, Gangopadhyay S (2003) Business groups, financing constraints and investment: the case of India. J Dev Stud 40(2):93–119

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341

Manos R, Murinde V, Green CJ (2007) Leverage and business groups: evidence from Indian firms. J Econ Bus 59(5):443–465

Manova K (2013) Credit constraints, heterogeneous firms, and international trade. Rev Econ Stud 80(2):711–744

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Minetti R, Zhu SC (2011) Credit constraints and firm export: microeconomic evidence from Italy. J Int Econ 83(2):109–125

Musso P, Schiavo S (2008) The impact of financial constraints on firm survival and growth. J Evol Econ 18(2):135–149

Muûls M (2015) Exporters, importers and credit constraints. J Int Econ 95(2):333–343

Nagaraj P (2014) Financial constraints and export participation in India. Int Econ 140:19–35

Oliveira B, Fortunato A (2006) Firm growth and liquidity constraints: a dynamic analysis. Small Bus Econ 27(2–3):139–156

Rajan RG, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88:559–586

Stein JC (2003) Agency, information and corporate investment. In: Constantinides GM, Harris M, Stulz RM (eds) Handbook of the economics of finance, vol 1. Elsevier, Amsterdam, pp 111–165

Whited TM, Wu G (2006) Financial constraints risk. Rev Financ Stud 19(2):531–559

Reports

Ministry of Commerce and Industry (Department of Commerce) Report, Boosting India’s Manufactured Exports, Working Group Report (2011)

The Global Financial Development Report: Financial Inclusion (2014), World Bank Report

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix 1

Appendix 1

-

a.

Definitions

Control variables | |

|---|---|

Firm size | Log (assets) |

Productivity | LOG (TFP) (based on the Levinsohn–Petrin method described below) |

Capital intensity | Fixed capital/total assets |

Business group affiliation | A binary variable equal to 1 if firm belongs to an Indian or foreign-owned business group and 0 otherwise |

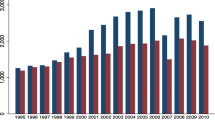

Demand | LOG (total industry exports) (proxy for external demand conditions, defined at the 2-digit NIC level) |

Measures of financing constraints | |

Musso and Schiavo (2008) Index | |

Firm size | Log (assets) |

Profitability | Return of assets (net income/total assets) |

Liquidity | Current assets/current liabilities |

Cash flow | Cash flow from operations |

Solvency | (Profit after tax + depreciation)/(short-term liabilities + long-term liabilities) |

Trade credit | Trade credit/total assets |

Repaying ability (represents the coverage ratio) | Cash flow from operations/debt |

Other measures of financing constraints | |

Liquidity | (Current assets-short-term debt)/total assets |

Leverage | Short-term debt/current assets |

-

b.

Measuring firm-level productivity (Levinsohn–Petrin method)

Following Levinsohn and Petrin (2003), the firm-specific, time-varying estimates of TFP are obtained by estimating the following production function:

where yit denotes firm revenue, kit denotes capital or fixed assets, wit represents the number of employees and nit denotes expenditure on intermediate inputs. The unexplained variation in output (yit) comprises of the unobserved efficiency term (μit) and the error component (εit). Estimating Eq. (3) above by Ordinary Least Squares (OLS) can be problematic as firms are likely to choose their factor inputs each period contingent on their contemporaneous productivity levels (which are unobservable to the econometrician). This may give rise to biased coefficient estimates of the production function and consequently biased estimates of firm productivity. Levinsohn and Petrin (2003) account for this possibility and propose the use of intermediate inputs to correct the simultaneity problem.Footnote 26 Their method (referred to as the LP method, henceforth) comprises of a semi-parametric approach to obtain consistent estimates of β, following which, TFP is obtained using the following equation:

We follow the LP method to obtain consistent estimates of firm-specific productivity by estimating Eq. (4) for each industry at the two-digit NIC level.Footnote 27 We use annual sales as our measure of firm revenue, fixed assets as a measure of capital [(kit), total wage bill as a proxy for labor (wit) and raw material expenses as a measure of intermediate inputs (nit)]. All variables used are in real terms and enter the regression equation in natural logarithm.Footnote 28

Rights and permissions

About this article

Cite this article

Mukherjee, S., Chanda, R. Financing constraints and exports: Evidence from manufacturing firms in India. Empir Econ 61, 309–337 (2021). https://doi.org/10.1007/s00181-020-01865-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01865-9

Keywords

- Financial constraints

- Intensive margin of exports

- Firm size

- Firm heterogeneity

- Endogeneity

- External financial dependence